Chinese Mainland

Connecting the World Through “Belt & Road”

By China-United States Focus (He Yafei, former Vice Minister, State Council Office of Overseas Chinese Affairs)

China’s One Belt, One Road (OBOR) initiative has been gaining attention since its proposal by President Xi Jinping in 2013, along with the recent Asia Infrastructure Investment Bank and the Silk Road Fund.

OBOR has been proposed as an innovative method of co-operation in global governance in the face of a worsening economic climate and simmering geopolitical problems worldwide. This solution follows eight years of slow recovery since the financial crisis of 2008, which arguably witnessed the failure of “neo-liberalism” and its infamous economic reform recipe enacted by the “Washington Consensus.” China’s economic growth might give the world its only hope, with an annual GDP increase of 7% that contributes over 30% to global economic growth.

The dire prospects for global development and the re-emergence of geopolitical troubles in the Middle East, Ukraine and elsewhere are pressing for elusive answers. What should we do to promote global peace and common development in the age of fast-paced globalization? Given the reality of the world today, what is so innovative and trailblazing about OBOR? Can it really offer a way out of the quagmire in which the world finds itself? I will try to illustrate my points as follows.

First, founded in the idea of building a new network of global partnerships, OBOR provides a fresh way of thinking about regional and global co-operation, by including both bilateral and multilateral co-operation in political, economic, cultural and other fields. It emphasizes the adaptability of development strategies in China and other participating nations, in order to produce benefits that are shared by all in an economic “win-win” outcome.

In a nutshell, OBOR envisions the creation of multiple economic corridors encompassing more than 60 countries in East Asia, Southeast Asia, Central Asia, South Asia, West Asia, North Africa and East Africa, linking the most dynamic East Asia Economic Zone with the advanced European Economic Zone. If we visualize OBOR, it is an economic partnership map with multiple interconnected rings. President Xi describes OBOR as a “chorus”, not a soloist singing. OBOR transcends different Free Trade Agreements (FTAs), including the newly concluded TPP, in both scale and content. It envisions regional integration beyond pure economic union, forming a political community founded on common interest in an attempt to forge, as much as possible, a common cultural identity.

Second, OBOR looks to build “five connectivities” with a view of creating a community of nations with a common destiny. These “five connectivities” include policy consultation, infrastructure connectivity, free trade, free circulation of local currencies, and people-to-people connectivity. In sum, these connectivities denote the “big trends” in economic globalization and socialization, the information revolution, and shared economic growth.

Policy consultation is placed first in the OBOR plan, because its success depends on the participants’ adoption of parallel development strategies and policies. Regular policy consultations align participants’ economic growth strategies, macro-economic policies, and major growth plans. The importance of infrastructure connectivity is easily understood, since OBOR’s economic growth and regional economic integration depends on the sophistication and connectivity of both “hard and soft” infrastructures.

Free trade is necessary for OBOR in that Asia as a whole needs to upgrade its place in global production and value chains, with a freer and more integrated production network that embraces individual countries’ advantages. Free trade should also come into play with regional production capacity realignment, i.e., moving excessive production capacity to countries that are in need to build up their own economic frameworks. The end result will be a more open regionwide economic system.

Free circulation of local currencies will be integral to the new economic structure OBOR creates. The Asia Infrastructure Investment Bank (AIIB) and the Silk Road Fund have shown the way to global financial system reforms and offer a new avenue of infrastructure investment funding. According to the Asia Development Bank, from 2010 to 2020 there was an $800 billion gap in Asia Infrastructure funding. Mackenzie Consultancy estimates that over the next two decades the global need for infrastructure funding will amount to a staggering $57 trillion. Intraregional free trade and infrastructure funding will enable a more efficient use and circulation of currency in the involved countries, thus reducing or avoiding the risks associated with a complete dependency on a U.S. dollar-centered financial system for project funding.

People-to-people connections result from more frequent exchanges at all levels and create a common cultural identity and affinity that will go a long way in providing a solid social foundation for building OBOR. People will only accept and engage with OBOR when they get to know other ethnic groups better.

Third, OBOR is not only a great opportunity for China to further her opening-up and reform, it also provides a large, multi-layered platform all countries along OBOR can use to reap greater economic and social benefits by opening up to one another. It is clear that China will be one of the major economic engines in the first half of the 21st century, with projected outward investments of $500 billion and over 500 million outbound tourists in the next five years. “Made-in-China,” Chinese capital, China’s market, and Chinese consumers will be hallmarks in the new round of worldwide economic growth.

Fourth, OBOR will be the cushion for China and the United States, as rising and incumbent powers seek to avoid falling into the proverbial “Thucydides Trap”: The Belt and Road initiative will help both nations in a profound manner to have an appropriate strategic assessment of each other’s intentions, by showing China can create solid co-operation in a strategically significant region. OBOR is also useful, as it involves both countries in policy consultation and economic collaboration, shaping the future of our bilateral relations.

I am happy to note that after the historic visit to the U.S. by President Xi, President Obama’s administration has reversed its position on OBOR and the related AIIB, adopting a more open and welcoming attitude. This year, as we celebrate the 70th anniversary of the founding of the United Nations, all nations big and small are reminded that it is necessary to improve the current global governance system. I am convinced that with joint efforts and determination, OBOR will prove its worth to China and its participants, including the United States, as a new path to mutual trust and a better future in global governance.

Please click to read the full article on the website of China-United States Focus.

Editor's picks

Trending articles

China’s ‘Belt and Road’ Initiative: Opportunities for Investment in Africa Infrastructure

By Tom Luckock (Norton Rose Fulbright)

China's ‘Belt and Road’ initiative – the flagship foreign policy of President Xi Jinping – has the potential to open a raft of new development opportunities for African infrastructure, mining and power projects. The extent to which the initiative covers Africa is still a little unclear but it appears to cover North Africa and parts of East Africa at the very least, with Kenya acting as the gateway to the initiative’s links to Africa through its modern ‘Maritime Silk Road’.

Although the practical application of the initiative is still developing, to date we are seeing greater focus by Chinese SOEs on countries subject to the initiative, shorter and easier outbound approvals and easier credit approvals within Chinese banks. Chinese SOEs have been preparing business plans for investment in the Belt and Road projects and countries, as well as demonstrating progress against those plans internally. Chinese companies will insert long explanations on links to the Belt and Road in all of their approval applications. One immediately obvious consequence is the number of previously shelved projects being dusted off and started again as part of The Belt and Road Initiative.

The key opportunity for non-Chinese sponsors is to tap Chinese capital for The Belt and Road projects in North and East Africa. One way is by working with a Chinese EPC contractor to bring in Chinese banks and Sinosure cover.

There are a number of issues to think about when tapping Chinese funding, including the following:

The Chinese EPC contractor is the key route to the banks

It is important to remember that the contractor, not the borrower/sponsor, is the bank’s customer. That means using the contractor to obtain good financing terms and overcome negotiation obstacles.

Establish finance support up-front

Contractors frequently promise finance on attractive terms, but the key is to understand the substance to that support as early as possible. Many projects stall when credit approval falls through late in the day.

To the extent possible key finance terms should be agreed up-front

Negotiate key points, such as pricing, parent support, and change of control, up front when the contractor is competing hard for the project. This is not always easy to achieve but on some occasions sponsors have stapled a finance term sheet to the back of terms agreed with the contractor.

China Inc. and information flow

The sponsor will be surrounded by Chinese kit, EPC, debt and export credit cover. Information flows freely within China Inc. but does not flow so freely across to a foreign sponsor. It’s important to be aware of this.

Maintain competitive tension as long as possible

Chinese negotiations can drag and sometimes an EPC contractor will pull out because of unexplained outbound or state owned asset approvals difficulties, or because of credit approvals issues. Maintaining competitive tension as long as possible avoids the downside if this occurs and also keeps the pressure on the Chinese contractor.

Keep documents and structures simple

As far as possible, use structures that have been approved and negotiated before, as these can typically be negotiated and approved much more quickly. New structures are possible, particularly for strategically important projects, but the contractor, as the bank’s customer, will need to assist to push these through.

Partnering with foreign sponsors is a key aspect of The Belt and Road initiative. This is an important aspect to being sensitive to host country concerns, diversifying risk for China and also an important element to China's SOE reforms which aim to see China's SOEs partnering with the private sector. It also should in theory reduce some of the moral hazard concerns that SOEs with strong policy support may build projects that don't need to be built.

This article was first published by Norton Rose Fulbright and is reprinted here with their full permission.

Please click here for the original article.

Editor's picks

Trending articles

Tapping Chinese Belt and Road Capital for Power Projects: Ten Things to Know

By Norton Rose Fulbright

China’s Belt & Road Initiative (B&R) could see up to USD1.5 trillion invested in the 60 countries that comprise the B&R. This will make China the largest funder of power in the region. The sweet spot for Chinese banks, contractors and equipment suppliers, is difficult jurisdictions like those that make up the B&R – in these countries Chinese pricing of kit and debt is competitive, funds are deployed relatively quickly and importantly, Chinese capital comes with a partial fix for host country political risk. For any investor in emerging power markets, Chinese capital cannot be ignored. In this outline we look at how to tap it ……

This article was first published by Norton Rose Fulbright and is reprinted here with their full permission.

Please click here for the full article and related information (in Chinese).

Editor's picks

Trending articles

China’s New Silk Route - The Long and Winding Road

By PwC’s Growth Markets Centre

February 2016: Over the past year China has increasingly made headlines in global news, creating a constant stream of articles, background reports and opinion pieces. Many of the events covered are having an impact well beyond the country and its own economy. Some of the main events that have dominated global news recently have included the ongoing slowdown of the Chinese economy, culminating in the slowest annual growth in 25 years, several severe stock market crashes, official recognition by the IMF of the Renminbi as a reserve currency and a significant devaluation while it slowly moves towards a more market-determined exchange rate, as well as many other government interventions and policy easing. In the midst of all these developments, it may be challenging to keep an eye on China’s long-term goals, ambitions and initiatives, most notably, the massive efforts China’s leadership is putting into its ‘going global’ strategy. These efforts are shaped more and more by the so-called ‘Belt and Road’ (B&R) initiative, an initiative that is gaining wider recognition and momentum in public opinion in China, but not necessarily yet outside the country…..

Please click here for the full article.

Editor's picks

Trending articles

Latvia: A Ready Business Platform in the Baltics

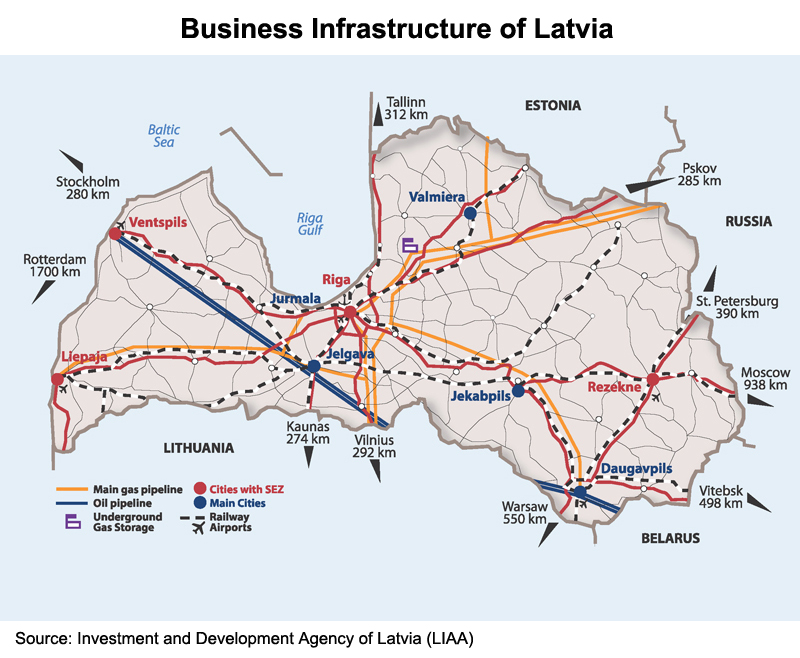

Sandwiched between Lithuania and Estonia, Latvia provides a strategic location in the Baltics for business operations targeting developed economies of the EU as well as the emerging markets to its east. On top of a well-developed rail, road and pipeline infrastructure, Latvia is privileged to also have the busiest airport among the three Baltic States. On the financial front, the mushrooming of Latvian banks in Hong Kong and the ongoing talks regarding a Latvia-Hong Kong comprehensive double taxation agreement (CDTA) further illustrate how Latvia is keen to develop itself into a business platform in the Baltics for Hong Kong and Asian traders and investors. Meanwhile, in tandem with closer economic ties, Hong Kong, with its heightened role as a “super-connector” under the Belt and Road Initiative (BRI), can be a vital hub and springboard for Latvian entrepreneurs such as green tech companies. Latvia can also be a cost-effective and convenient location for high-tech, high-value manufacturing.

Latvia as a Regional Transit Point

Situated on the EU’s eastern border with Russia and Belarus, two million-strong Latvia is one of the main transit points for both north-south and east-west trade flows. It connects not only the EU with the CIS countries and Asia, but also markets further afield such as the Americas. Accounting for 8% of GDP and more than 8% of employment in 2014, the transit and storage sector remains one of the country’s strongest. It is estimated that nearly 90% of the turnover in Latvian ports, more than 80% of Latvia’s rail cargo and a large proportion of its oil and oil products transported via trunk pipeline systems are in transit. Such a pivotal role gives Latvia the region’s busiest airport and several of its leading seaports.

Contributing almost 3% of GDP and supporting 2% of jobs in Latvia, Riga International Airport (RIX) is the regional air hub in the Baltics for both cargo and passengers, connecting to 69 destinations in winter and 89 destinations in summer. With traffic bigger than that of Lithuania and Estonia combined, RIX welcomed a record number of 5,162,675 passengers in 2015, exceeding the 5.1 million passengers registered in 2011. Popular destinations included London, Moscow, Frankfurt, Oslo and Helsinki.

Based at RIX, Latvia’s national airline airBaltic offers easy connections from Riga to over 60 destinations spanning the European Union, Scandinavia, Russia, CIS and the Middle East. Last year, airBaltic opened 14 new routes for the Baltic region – the largest expansion since completing restructuring and achieving profitability in 2013. In addition to a new highlight in Reykjavik, Iceland and the enhancement of the existing network around the Baltic Sea in 2016, direct flights between Riga and Chengdu, China are also in the pipeline, in accordance with the Memorandum of Understanding (MOU) for transport cooperation signed between Latvia and Chengdu municipality in September 2015.

Having a keen eye on Asia for a suitable strategic partner for the national airline, the Latvian government has been in talks with a variety of aircraft manufacturing firms in China, and with two South Korean airlines – Korean Air (KE) and Asiana Airlines (OZ) – over possible cooperation. This accords with the shared development goals of governments in Asia and Latvia in terms of increasing global connectivity.

To this end, Latvia has been paying special attention to its integration with the Trans-European transport network through the development of short sea shipping (such as roll-on/roll-off or “ro-ro” shipping) across the Baltic Sea and multimodal transport infrastructure such as railways and logistics and distribution parks.

Thanks to the former Soviet Union railway-gauge standards, which have been in operation in Latvia for many decades, the country is readily connectible to Asia-Europe rail trade arteries coming to and from Japan and Southeast Asia through the Russian Far East. Such a role will strengthen as the Second Eurasian Land Bridge takes shape and new railway routes better complement existing services. To this end, the growing multimodal freight logistics options between Europe and China facilitated by Kazakhstan Railways and the ongoing “Rail Baltica” project to improve railway connections [1] between Central and Northern Europe, and Germany, give supply chain professionals all the more reason to consider Latvia.

Forming part of the first pan-European transport corridor connecting Finland and the Baltic states to Poland and Western Europe, the Via Baltica (route E67) is the most important transport corridor traversing Latvia in a north-south direction. Given that maintenance funds are collected from excise tax on fuel and vehicle registration fees, all roads, including the Via Baltica, are public and toll-free in Latvia. Along with the financial support from the EU for road improvement, this gives logistics companies another attractive component in their multimodal transport operations.

According to Kreiss International Frigo Transportation, one of the biggest fleet operators in the Scandinavian and Baltic region, Latvia’s logistics cluster is ready to partner with Hong Kong and Asian logistics players to welcome the growing cargo flows expected from the BRI. Running a fleet of more than 1,200 trucks and more than 1 million full truck loads in 2014, Kreiss has extensive experience of bringing in goods from such far-flung markets as Portugal, Spain, Morocco and North Africa and delivering to Scandinavia, Russia and Central and Western Asia.

Furthermore, while Latvian trucks cannot drive directly into China, many Latvian forwarding companies have set up branches, affiliated companies or distribution centres in Russia and Kazakhstan to handle cargo coming from the Far East. In the case of Kreiss, some 1,000 trucks can be quickly deployed to connect goods from the Sino-Kazakh border if demand arises. As an authorised cargo transport company for non-military NATO cargo in Afghanistan and a regular freight forwarder for telecommunications equipment heading from Scandinavia to Iran, Kreiss is optimistic about the unblocking of Asia-Europe trade relations brought by the BRI.

Last but not least, the three major ice-free ports – namely Ventspils, Riga (handling mainly coal, forestry products and containerised cargo) and Liepaja (coal, forestry products and metals) – are an important component of Latvia’s multimodal transport infrastructure. Ventspils offers the shortest ferry trip to Sweden in the Baltics (approximately 60km from Stockholm) and ready connection to one of the longest European road routes – the two-track E22, which runs from the UK to Russia and other CIS countries. It also boasts a transshipment hub not only for commodity exports from Russia and CIS countries, such as coal, oil, chemicals, minerals, grains and fertilisers, but also general cargo and regular ro-ro to and from Scandinavia (Nynäshamn, Sweden) and Central Europe (Travemünde, Germany).

As one of the four special economic zones [2] in Latvia, Ventspils enjoys favourable incentive schemes for new business such as 80% relief on direct taxes (corporate income tax and real estate tax) and significant discounts on VAT and excise tax. It has aroused the interests of a number of Chinese investors to assess the possibilities of setting up a logistics and distribution centre there for better supply chain management and timelier support/after-sales services to both buyers (EU companies buying from China) and suppliers (Chinese companies selling to the EU).

The free-zone status is also attractive to non-EU manufacturers – including those from Asia, Russia and CIS countries – looking to set up plants for local production or assembly. This means they can enjoy “Made in the EU” status and are therefore exempt not only from import tariffs but also anti-dumping and countervailing controversies or even trade sanctions such as those in place between the EU and Russia.

Latvia as a Financial Partner

Despite its small domestic market, Latvia has a diverse economy. With limited natural resources, however, it relies heavily on the services sector. Aside from logistics, finance and green technology are among the bright spots for Hong Kong companies looking for opportunities in the Baltic country.

In the wake of the economic crisis of 2008, Latvia has implemented several pro-business reforms, with a focus on developing itself into an investment destination, including adopting the euro as its currency on 1 January 2014. These measures, together with the 16+1 formula [3] promoting regional co-operation between Central and Eastern Europe and China and the ongoing negotiation of a CDTA with Hong Kong, is set to make business and trade co-operation between Hong Kong and Latvia flourish.

Taking advantage of this growing momentum, several Latvian banks – ABLV and Expobank – have established formal representation in Hong Kong. Their operations in the SAR remain largely related to their Russian and CIS clients’ payments to and from China. However Expobank has chosen Hong Kong for its debut in Asia and is applying for a banking licence to prepare for broader business coverage, including international clients such as traders who need banking services in the Baltics, the CIS and Russia.

Source: ABLV and Expobank

Nowadays, with EU and US banks becoming generally more risk-averse towards Russian clients, Latvia, with 38% of residents claiming Russian as their mother tongue, can provide partners for Hong Kong banks and financial institutions to conduct due diligence investigations such as know your customer (KYC) and anti-money laundering (AML) requirements on Russian and CIS clients.

On the other hand, Latvian companies are small in size and capital. It is estimated that even the top-10 Latvian companies do not have enough capital to list in Hong Kong. With a typical project size of around €5-25 million (HK$43-213 million) Latvia is therefore not very attractive to state-controlled Chinese investors who are looking for big projects such as container terminals, distribution centres, and electronics and F&B (food and beverage) processing facilities. To attract smart money and angel funding, Latvian companies, despite their small size, need to make themselves visible to prospective investors. In this regard, Hong Kong can be an ideal platform for Latvian project owners to look for cooperation opportunities with Asian investors hunting for investment projects of different sizes.

Latvia as a Green Tech Supplier

Recognised as one of the greenest countries in the world, Latvia is active in promoting green technology in everything from recycling technologies to smart grid technologies. Getliņi EKO was created in 1997 to run the largest waste treatment project in the Baltic States – the Getliņi waste landfill (which has been in operation since the beginning of the 1970s) – and turn it into a modern waste management site that generates electricity by collecting methane gas from the decomposing garbage in the landfill. The company has been developing new technologies capable of being deployed elsewhere.

Handling half of the country’s rubbish by accepting solid municipal waste from private and corporate clients every day within the Riga waste management area from 7am till 10pm, Getliņi EKO Ltd is focused on achieving three inter-related goals in the waste management process – reducing air pollution from methane gas, preventing ground water pollution and modernising the Getliņi landfill.

As the first company in Latvia to introduce full utilisation of methane gas from the landfill for production of electricity via internal combustion engines, Getliņi EKO has transformed the Getliņi landfill from being a rat-infested health hazard – once an obstacle to Latvia’s EU membership. Now, more than 450 tonnes of yellow tomatoes are grown with the heat generated from the cooling of the energy generators, with the facility now acting as a model of good practice in waste management for EU policymakers to promote. Following the opening of a recycling factory near the landfill site in October 2015, Getliņi EKO has a new, 10-year goal of reusing up to 90% of the waste deposited in the Getliņi ecological landfill every year and better, earlier sorting of recyclable materials.

With solid waste management becoming an increasing challenge for governments in developing countries amid fast-paced urbanisation, Latvia’s experience offers an example to follow. Indeed, Getliņi EKO is ready to export its business model and provide consultancy services covering everything from the establishment of landfills and the installation of energy generation and ground water purification devices to design, securing financing and ultimately construction and operation.

In all likelihood, Latvia’s green solutions can suit the needs of many BRI countries where solid waste management (including sewage treatment) and heating for agricultural and even industrial purposes are common headaches. In terms of facilitating technology transfer and the development of new applications in new scenarios, especially the Chinese mainland, Hong Kong offers a ready platform for facilitators such as Latvian banks (which have representation in Hong Kong) to approach prospective clients from China and other parts of Asia.

Latvia as a Production Base

Despite the dominance of services, Latvia, given its competitive land and labour costs and tariff-free access to the 500 million-plus consumers living in the EU, can be a cost-effective and convenient location for high-tech, high-value manufacturing. An extension of the Tongyu Group’s facilities in Guangdong, Tongyu Communication is the company’s first manufacturing project overseas, in Riga. There it has built an assembly plant making quality microwave antenna products using key components imported from the group’s factory in Guangdong since 2014.

Fully compliant with EU standards, the assembly plant in Riga enables the company to provide European clients with Ex Works Riga (EU) invoicing and extended technical design and R&D services from its headquarters in Guangdong. Technical and logistics support have also become far easier to provide, not just in the EU market, but also to Russia, the CIS and other nearby markets.

Given the rising production costs in the Chinese mainland and the enhanced connectivity promoted under the BRI, more and more manufacturers (including those run by Hong Kong entrepreneurs) on the mainland will likely consider the feasibility of relocating their value-added production closer to final markets such as the EU. This will also help them to stay competitive in terms of response time and after-sale services.

Latvia, thanks to its cost advantages to investors, as well as its competitive tax rates (including incentives for R&D and state credit guarantee to foreign investors), can be considered an attractive option in the EU for firms considering relocating parts of their manufacturing.

[1] This project would serve as the first step in Latvia’s transition to European railway-gauge standards.

[2] There are four special economic zones in Latvia, namely Ventspils, Riga, Liepaja and Rezekne.

[3] In 2011, China revived its cooperation with a group of 16 Central and Eastern European (CEE) countries: Estonia, Latvia, Lithuania, Poland, the Czech Republic, Slovakia, Hungary, Romania, Bulgaria, Slovenia, Croatia, Serbia, Bosnia and Herzegovina, Montenegro, Albania and Macedonia. In 2012, the first meeting at a heads of government level was held in Warsaw, marking the official launch of the “16+1” formula.

| Content provided by |

|

Editor's picks

Trending articles

Seizing the Opportunities Brought About by “One Belt and One Road” and Seeking New Directions for Hong Kong’s Economy (1)

By Martin Liao (Legislative Council Member, Commercial (Second) Functional Constituency)

This year is the year when China starts to build the “One Belt and One Road”, and the steady progress of this strategic initiative is an important part of the “13th Five-Year Plan” that the country is currently focusing on formulating. The HKSAR Government should provide leadership and support to various industries to promptly capture the opportunities arising from the “One Belt and One Road” and seek a new direction for Hong Kong economy’s as a whole.

Provide leadership to industries to promptly capture opportunities

China has started discussions with the countries and regions along the Silk Road Economic Belt and the 21st-century Maritime Silk Road on building a new framework for regional economic co-operation and constantly enriching the contents and approaches of co-operation under the initiative. Hong Kong indeed needs to participate as soon as possible in order to benefit from it. Therefore, following my request for the Chief Executive to obtain information at the government level on the latest developments of the “One Belt and One Road” for Hong Kong’s business community earlier this year, at the beginning of the current legislative year recently, I put forward a motion at the Legislative Council, urging the HKSAR Government to provide leadership and support to the various industries to promptly capture the opportunities arising from the “One Belt and One Road” and seek a new direction for Hong Kong’s economy as a whole.

The motion was eagerly deliberated and adopted by the Legco members. It is evident that despite the diverse political views within the Legislative Council, the vast majority of Legco members agree with the need to capitalize on the “One Belt and One Road” to seek a new direction for Hong Kong’s economy. In fact, because Hong Kong has been slow in economic restructuring over the years, some of its inherent advantages have gradually faded. Coupled this with the external economic uncertainties, Hong Kong is indeed facing both external and internal problems. As the “One Belt and One Road” spans across Asia, Europe and Africa, it will be the world’s longest economic corridor and largest economic engine. With an overall economic value estimated to be as high as HK$163 trillion, its development potential is quite amazing.

China’s “Vision and Actions” on building the “One Belt and One Road” have given rise to a very broad space for industrial development, including transportation, port infrastructure and e-commerce, among which are many industrial areas where Hong Kong has advantages. The problem is that, specifically, where should Hong Kong’s industries start?

Dare to look beyond

The Chief Executive has said that he will first study and then select the industries suitable for participating in the “One Belt and One Road”. I very much agree with this. However, more importantly, I believe that we should set our vision higher and farther, not only to find current opportunities, but more so be bold enough to seek a new direction for Hong Kong’s sustainable economic development over the next five decades or even longer.

First, the industries where Hong Kong traditionally has advantages can capitalize on the “One Belt and One Road” platform to expand into new markets, as well as to upgrade and restructure. For example, in the financial sector, as one of the three major global financial centres, Hong Kong not only has the world’s largest offshore RMB business, but also boasts the largest pool of RMB funds outside of China. In addition, it has a sound financial system, professional financial division of labour, highly transparent and diverse financial products, as well as an excellent financial regulatory system and discipline. It also offers first-class asset management services, bringing together a group of the world’s top financial talents. With these advantages, Hong Kong is fully capable of becoming the premier multichannel financing centre for companies in the countries along the “One Belt and One Road”. According to estimates, just infrastructure construction alone, the “One Belt and One Road” has an investment scale of US$1.04 trillion and transnational investment of about US$52.4 billion. Hong Kong is well-positioned to become a treasury centre of the “Asia Infrastructure Investment Bank” to provide financing for construction projects in the countries along the “One Belt and One Road”.

Strengthening of RMB business hub

In order to meet the huge demand for funds due to the “One Belt and One Road”, China has set up the “Silk Road Fund” and the “Asia Infrastructure Investment Bank”, which also brings huge financing opportunities for Hong Kong, helping to develop its bond market and improve its financial strength. In addition, with the increase in economic and trade exchanges among the countries along the “One Belt and One Road”, the RMB will be used more frequently and financing needs will be more substantial. Plus, with financial reform and opening up, China is striving to build a RMB-dominated regional monetary system in Asia and expand the channels for the RMB to flow back. This is positive for the development of Hong Kong’s RMB market and will strengthen its role as an offshore RMB business hub. The Financial Services Development Council of Hong Kong pointed out that if the RMB is included as a reserve currency, an estimated RMB500 billion to RMB 600 billion will flow out from China, and Hong Kong will be able to play a greater role in RMB capital projects and going global, taking the opportunity to develop into a financial market offering a full range of products and services. Besides, the “One Belt and One Road” spans across many Islamic countries, which could significantly improve the Islamic bond market that has been developing well in Hong Kong in recent years. The development of wealth management, fund management and privately offered funds in Hong Kong will also benefit with the “One Belt and One Road” boosting interoperability among Asian financial markets.

The shipping industry, where Hong Kong still has advantages for the time being, is also likely to scale new heights. As an international shipping hub, a goods distribution centre and a place where logistics enterprises gather, Hong Kong has a world-class international airport and port transportation management facilities, with flight and shipping routes spanning across the globe. Its efficiency in custom clearance for cargo is second to none. Hong Kong can help the regions along the “One Belt and One Road” to replicate inland port cities, and drawing from its experience in rapid custom clearance, it can also help the countries establish cooperation networks to promote cooperation in areas such as joint supervision, data exchange and mutual law enforcement assistance.

Professional support centre for “One Belt and One Road”

Commerce and professional services, which are also Hong Kong’s pillar industries, are likely to improve and form a Professional Support Centre for the “One Belt and One Road” projects. Last year, China surpassed Japan for the first time to become Asia’s largest foreign investor. Hong Kong has always been a platform for Chinese enterprises under the “One Belt and One Road” initiative. According to the Ministry of Commerce, as of end of 2013, the Mainland had made foreign investments of as much as US$370 billion through Hong Kong, accounting for about 57% of its total investment. However, Chinese enterprises are actually still at the initial stage of “going global”, and the “One Belt and One Road” is bound to drive more Mainland enterprises to “go global” and increase their overseas investment and M&A activities. Hence, they will have increasingly stronger demand for Hong Kong’s professional services. Hong Kong is Asia’s leading centre for professional services, and it brings together highend service personnel and professional services. Coupled these with its wealth of international experience, in-depth industry knowledge, rigorous professional conduct and enormous business contact network, Hong Kong can naturally provide the necessary legal, arbitration, mediation, accounting, risk assessment, management and consulting services for the “One Belt and One Road” projects.

This article is firstly published in the magazine CGCC Vision 2015 December issue. Please click here to view the full article.

(Remark: This is a free translation. For the exact meaning of the article, please refer to the Chinese version.)

Editor's picks

Trending articles

Seizing the Opportunities Brought About by “One Belt and One Road” and Seeking New Directions for Hong Kong’s Economy (2)

By Martin Liao (Legislative Council Member, Commercial (Second) Functional Constituency)

The traditional Key Industries in Hong Kong, including the Finance Services, Trading and Marine Services Industry, as I have mentioned in my previous article in this series, surely can benefit a lot from the economic activities arising from the vision of “One Belt and One Road”. For the emerging economic sectors, they can find new directions for development from it as well.

Seize the opportunity to realize the potential of e-commerce

E-commerce is one of the emerging economic sectors that has great potential. It is reported that the scale of the global e-commerce market is expected to reach US$2.3 trillion in 2018, of which the Asia-Pacific region would account for 38% of the market share. And the “One Belt and One Road” is bound to generate more multilateral trade to further “expand the economic pie”. Hong Kong should accelerate the marriage of e-commerce and our traditional advantageous industries to capture these opportunities. The HKSAR Government has already named financial technologies as a new direction for the future development of Hong Kong’s financial industry, and is committed to further enhancing the operational efficiency of the industry and pioneering new development models for new technologies such as payment and settlement systems, big data analysis, cloud computing, information and risk management, and network security. Should the Steering Group on Financial Technologies succeed in its promotion of Hong Kong as a Fintech (financial technologies) hub, a new era of e-commerce would surely come with it. By then, Hong Kong with its advantages in freedom of information technology, convergence of talents, well-established legal system and intellectual property rights (IPR) protections, is absolutely well-positioned to be a Fintech hub for the countries and places along “One Belt and One Road”.

Another emerging economic sector is innovative technologies, which is quite a hot topic in Hong Kong these days. Although the innovative technologies industry in Hong Kong , for various reasons, has failed to play a major role over the years, it has high potential for development as many world-class researchers has been attracted to come and do their researches here. This year, a research team from the City University of Hong Kong, which has developed a specific biological technology for detecting toxins, was awarded the Grand Prix at the Geneva International Exhibition of Inventions. The “One Belt and One Road” is sure to provide a broad platform for Hong Kong’s innovative technology talents to maximize their potential. In this regard, the government too should take advantage of the chance and capitalize on Hong Kong’s well-established legal system and IPR protections to promote intellectual property (IP) trading and smooth its way to become an international IP trading hub.

Well-positioned to be an IP trading hub

“One Belt and One Road” not only can bring new development opportunities to Hong Kong’s creative industries, it can also bring new aspirations to our cultural and creative industries through the cultural exchanges with the various countries and regions far and near lying on the relevant economic corridors. As a matter of fact, creative industries have served as an economic engine for many countries and enhanced their economic strength. By comparison, creative industries in Hong Kong have lagged behind with the percentage share of value added in GDP stood at about 5% at 2013. But according to past records, Hong Kong’s entertainment industry was once dominant in the Southeast Asia market, and the influence of its kung fu movies reached as far as Europe and America, an indication that Hong Kong’s unique culture has full export potential. The HKSAR Government should help to create a favorable environment for Hong Kong’s creative industries to take off again, like assisting the industries to understand the cultures and traditions of the “One Belt and One Road” regions and facilitating various exchanges activities, thereby opening up the market and enhancing Hong Kong’s soft power at the same time.

The fore-mentioned are just a few examples of the numerous opportunities arising from the “One Belt and One Road” vision that I manage to cite in the limited length of this article. Actually it requires the joint efforts of the Government, business community and public to search out all the valuable new economic directions that “One Belt One Road” could render us. The Chief Executive has said that the leading industries of Hong Kong would not be the only ones that can “go global”. I believe our society is expecting the HKSAR Government, after the “13th Five-Year Plan” finalized officially, to keep the public informed of the specifics of the opportunities “One Belt and One Road” can bring to the various sectors in Hong Kong and what support schemes will be provided by the government.

The Government is expected to take the lead

As a matter of fact, if we are to seize all the opportunities arise from the “One Belt and One Road” vision, efforts on the part of the business sector alone is not adequate. Also this is not an efficient way for allocation of resources for society as a whole. In conclusion, the Government needs to play its part in creating a favourable environment in the background, actively participating in negotiating multilateral agreements to facilitate trade and safeguard investment, increasing the number of Asian Economic and Trade Offices, channeling resources and talents to “One Belt and One Road”- related key areas, and effectively helping the business community to capture opportunities. In addition, the Chief Executive has mentioned that he would ponder setting up a dedicated agency to support our country’s “One Belt and One Road” development, and would coordinate with various business associations and professional bodies to participate in the “One Belt and One Road”. These are very good ideas. I hope they can be put into execution soon enough so that the HKSAR Government can start assuming a leadership role and joining hands with the business community to translate the “One Belt and One Road” opportunities into substantive economic benefits.

This article is firstly published in the magazine CGCC Vision 2016 January issue. Please click here to view the full article.

(Remark: This is a free translation. For the exact meaning of the article, please refer to the Chinese version.)

Editor's picks

Trending articles

China-Kazakhstan Border Co-operation in Xinjiang

Xinjiang plans to become a regional transport hub under China’s Belt and Road Initiative. This mainly involves building three transport routes across the autonomous region. The middle route runs across the Central China Plain to Xinjiang through the second Eurasian land bridge and extends to Central Asia and Europe through two ports, one of which is Khorgas.

Located in the Ili Kazakh Autonomous Prefecture of Xinjiang, Khorgas borders Kazakhstan and is 90 km from Yining, 670 km from Urumqi and 378 km from the Kazakh city of Almaty. It is China's closest port to Kazakhstan and Central Asia and the largest highway port in western China. Cargo passing through Khorgas accounted for half of Xinjiang's import/export volume in 2014. The Khorgas Railway has also started operation since December 2012.

In September 2011, the State Council issued Several Opinions on Supporting the Building of the Kashgar and Khorgas Economic Development Zones, which clearly spelled out the relevant supporting policies and established Khorgas' special position in the opening up of Xinjiang, and indeed China, to the outside world. Khorgas was officially established as a city in September 2014 and combines the characteristics of a border area, a customs checkpoint, a commercial city and an international city. It is positioned as a gateway for international trade "linking the east and the west" and a bridgehead for opening up to the west.

A Logistics Hub for Trade with Central Asia

Khorgas, the westernmost port of China, is an important trading port between China and Kazakhstan as well as a node for the opening up of Xinjiang and China as a whole to the Silk Road Economic Belt and other countries and regions. An increase in Chinese exports to Central Asia in the past few years has attracted many logistics service suppliers to set up business in Khorgas. Apart from local firms, there are also logistics companies from other provinces. These serve not just local enterprises in Ili and Xinjiang but also provide transportation, customs clearance and other logistical support to traders and manufacturers outside the northwestern region in their exports to Central Asia. According to reports, the number of companies providing foreign-related warehousing and logistics services in this city has increased from 13 in 2013 to 49 at present. The number of international freight forwarding agents has also increased to 100.

The head of a Khorgas-based warehousing and logistics company told HKTDC Research his business offers a one-stop service in close collaboration with other logistics companies, including customs clearance for Chinese exports and imports from Kazakhstan. Goods from mainland cities are first stored in customs-supervised warehouses and reloaded onto trucks from Kazakhstan after completing customs and quarantine declaration formalities for export as Chinese trucks are only permitted to go 6km beyond the customs checkpoint. Generally speaking it only takes about one day to complete customs clearance on the Chinese side. The goods will be under customs supervision until customs clearance in Almaty, on the Kazakhstan side.

The price of products exported to Central Asia has increased due to improvements in their quality over the past few years, he observed. For example, some exported shoes have an ex-factory price of RMB400 but may retail at over RMB1,000 a pair. Some fur coats from places such as Hebei and Shandong, meanwhile, have a unit price of over RMB6,000. Hong Kong companies interested in venturing into Central Asia may consider using the logistics services available at Khorgas to solve logistics and customs clearance problems when exporting goods to these markets.

The International Border Cooperation Centre: A Frontline for ‘Opening Up’

The China-Kazakhstan Khorgas International Border Cooperation Centre (hereafter referred to as the Centre) is the main focus for implementing the development strategy of building an international trade corridor connecting east and west. As a bridgehead for “opening up” to the west, the Centre – a cross-border economic and trade zone and investment cooperation centre – is a joint project undertaken by China and Kazakhstan. Its aim is to promote economic development in the border areas and reinforce China's economic and trade ties with Central Asian countries such as Kazakhstan.

Located in an area straddling the China-Kazakhstan border, the Centre has a total area of 5.28 km2 and is managed in a closed way. The Chinese section has an area of 3.43 km2, while the Kazakh section has an area of 1.85 km2. It is mainly for trade negotiations, exhibition and sales of products, warehousing and transportation. It has hotels and commercial and financial facilities and hosts all types of economic and trade fairs. With trade liberalisation, goods, people and vehicles may move freely across the border here. General trade, border trade, tourist shopping and other forms of trade exist side by side. Goods entering the Centre are considered as exports, and tax rules for general trade apply to goods entering the Chinese section. Travellers entering the Chinese section of the Centre may bring in duty-free items worth up to RMB8,000 per person per day. The Centre may be viewed as a pilot transnational closed free trade zone.

Since the opening of the Centre in April 2012, a number of duty-free shops selling imported goods such as cosmetics, wine from Georgia, chocolate from Kazakhstan, and other goods, have started operations in the Chinese section. Most shoppers are from the mainland. According to Khorgas’ customs statistics, 3.66 million tourists visited the Centre in 2015, up 120% year on year. Commercial projects in the Kazakh section are now under way and are expected to bring Chinese consumers more European products upon completion.

Apart from duty-free shops, a number of business centres have also been completed and opened. They include the Yiwu International Trade City, which is similar to the small commodity cities in Yiwu, Zhejiang province. This business centre is home to many wholesalers and retailers of goods from all parts of the country. It mainly targets Central Asian markets, particularly traders from Kazakhstan, with light industrial goods made in China.

Besides allowing the Centre to function as a free trade area, the State Council also gave the green light to the building of a support zone for the Chinese section 1km south of the Centre. This provides as industrial base for supporting the Centre's development. Its main functions include export processing, bonded logistics, warehousing and transportation. The two are run on the “front shop, back factory” model. Goods entering the support zone from outside are bonded and must be declared to Chinese customs according to general import rules when they leave the zone. Goods entering the zone from other parts of the mainland are treated as exports and are eligible for tax refunds. Transactions between enterprises within the zone are exempt from VAT and consumption tax. The support zone has a planned area of 9.73 km2 and has started operating after passing an acceptance test in September 2015.

The Centre and its support zone effectively upgrade Khorgas’ trading functions, including foreign trade, product display and sales, warehousing, transportation, tourism and other commercial services. They also provide a key trading centre for China, offering processing, manufacturing, regional sourcing, and transit and transport, for companies to target Central Asian markets. By promoting the export of Chinese goods to Central Asia and the import of goods from Central Asia and even Europe, they merit the attentions of Hong Kong companies interested in tapping business opportunities in Central Asia.

| Content provided by |

|

Editor's picks

Trending articles

The Epoch-making “One Belt and One Road” Strategy

By CGCC Vision

As a China’s long term strategy to facilitate all-round economic andsocial development, “One Belt and One Road” is time-defining.

Tse Kwok-leung, Head of Policy and Economic Research of the Bank of China (HK), pointed out that China is making deployment preparation in different aspects to drive the “One Belt and One Road” strategy. These include perfecting infrastructures, establishing regional trade and logistics bases as well as offshore economic and trade co-operation parks, and raising funds for development.

Infrastructures as first priority

China is building various infrastructure projects along the route of “One Belt and One Road”, with high-speed rails as one of the foci. China is planning three highspeed rail links that go through Europe and Asia to connect China with Europe, Middle Asia and Southeast Asia. The third Euroasia Transcontinental Bridge is also under conceptualization. This would traverse through more than 20 countries in Eurasia to form a new regional economic development axis.

At the same time, China has started co-operation with countries such as Indonesia, Cambodia, Myanmar, Sri Lanka and Greece on port establishment and operation. On the other hand, the A, B and C lines of the Central Asia–China gas pipeline have already commenced production. These, together with the completion of line D, will form the Central Asia-China gas pipeline network to become a major economic belt of China and five Central Asian countries.

Co-establishing economic and trade co-operation parks

In addition to collaborating with core cities along the route of “One Belt and One Road” to establish trade and logistics hubs, China is also building economic and trade co-operation parks (i.e. industrial parks) overseas. Data from the Ministry of Commerce reveals that China has established 118 economic and trade co-operation zones or economic development areas in 50 countries. Amongst them, 77 are located in 23 countries along “One Belt and One Road”.

In 2014, the volume of trade between China and countries along “One Belt and One Road” amounted to USD$1.12 trillion, which represents 26% of total external trade. With an estimated average annual increase of 10%, the volume of trade between China and countries along “One Belt and One Road” is expected to reach USD$2 trillion by 2020.

Hong Kong to ride on the bandwagon

The country has also defined the positions of different provinces in its planning for “One Belt and One Road”. For example, Xinjiang has been defined as a “core area along the economic belt of the Silk Road”; Fujian, on the other hand, is the “core area of the 21st Century Maritime Silk Road”. Guangdong Province, sitting right next to Hong Kong, is to become the centre of commodity exhibition, sales and merchandizing for countries and regions along the 21st Century Maritime Silk Road.

As such, Hong Kong should seize the opportunity of “One Belt and One Road” and ride on the bandwagon to exert the power of its competitive edges. According to Tse, the funding requirement for the infrastructures of “One Belt and One Road” is expected to be in the range of USD$5-8 trillion. Multilateral financial institutes also need to raise large amount of development funds. Hong Kong can put its best advantage as a financing centre and take up an active role as a major offshore RMB market.

The building of “One Belt and One Road” involves different sectors. Hong Kong can play a part in sectors such as parts and components production; and commerce, trade and logistics. It can also offer talents from different professional services such as project management, law and arbitration and other intermediary services.

However, Tse reminded readers that the planning of “One Belt and One Road” does have a number of challenges. For example, it involves complicated multilateral international co-operation systems; the economic and legal standards of some of the countries along the route are comparatively backwards; there are also differences in culture and religions, etc. In addition, most high-speed rails and expressways consist of parts that are inside and outside the countries involved, meaning there would be dovetailing problems in the projects. These are all new challenges for participating countries and enterprises alike.

This article is firstly published in the magazine CGCC Vision 2015 December issue. Please click here to view the full article.

(Remark: This is the English translation version. For the exact meaning of this article, please refer to the Chinese version.)

Editor's picks

Trending articles

“China’s One Belt One Road Initiative”: Analysis from an Indian Perspective

By Geethanjali Nataraj and Richa Sekhani

The One Belt One Road initiative is the centrepiece of China’s foreign policy and domestic economic strategy. It aims to rejuvenate ancient trade routes–Silk Routes–which will open up markets within and beyond the region. India has so far been suspicious of the strategic implications of this initiative. If India sheds its inhibitions and participates actively in its implementation, it stands to gain substantially in terms of trade.

Introduction

The growth of China has been remarkable since it undertook reforms in 1978 and China is currently the second largest economy in the world even having overtaken Japan. In order to sustain this development, the concept of the Silk Road was proposed. The renewed initiative of the Belt and the Road is proposed to cope up with the profound changes and challenges that emerge in the course of development. The grandiose idea is rooted in history with the new Silk Road economic belt and the 21st century Maritime Silk Road (MSR) which earlier linked the major civilizations in Asia, Europe and Africa for years.

According to the official document titled “Vision and Actions on Jointly Building Silk Road Economic Belt and 21st Century Maritime Silk Road”, the project aims to create an open, inclusive and balanced regional economic co-operation with common ideology that benefits all the countries involved in the initiative. The vision reflects the demand from relevant countries for releasing infrastructure bottlenecks and improving connectivity with large markets in Asia and Europe as well as the need for China’s own development and security.

To achieve its objective, a new “Silk Road Economic Belt” will link China to Europe that cuts through mountainous regions in Central Asia and the “Maritime Silk Road” that links China’s port facilities with the African Coast and then pushes up through the Suez Canal into the Mediterranean Sea (Minnick2015). The MSR will extend from the Quanzhou province in China, heading south to Malacca Strait, from Kuala lampur it will head to Kolkata, crossing the northern Indian Ocean to Nairobi, Kenya.

Therefore it offers a tremendous opportunity to connect resource and commodity rich west and Central Asia to emerging South and South East Asian countries along the Road which has a huge potential consumer market. To facilitate this development, China has set up a US $40 billion Silk Road Fund.

1. Driving factors behind the OBOR initiative

Much of China’s logic on the project is based on geopolitics and on the export of its huge infrastructure-building capacities and therefore Chinese President Xi Jingping has made the program a centerpiece of both his foreign policy and domestic economic strategy. The project is comprehensive and multi-faceted and seeks to establish China not only as an Asia-Pacific but also as a global power.

Since decades, China’s opening up policy has favored development of East China and Coastal areas while West China and Inland areas limited by their geographical location, resources and development foundation have remained relatively less developed. The OBOR strategy contributes to the establishment of “one body two wings” of the new pattern of comprehensive opening up (Hucheng2014). Through this initiative China hopes to develop and modernize its landlocked and underdeveloped southern and western provinces, to enable them access the markets of south East Asia and west Asia thus shaping China’s regional periphery by exercising economic, cultural and political influence.

Further, the Chinese leadership is facing difficulties to manage the transition to a “new normal” of slower and more sustainable economic growth because of the property market challenges, overcapacity in the industries, debt burden and financial risks hovering over the Chinese economy. Infact, excess capacity in Chinese factories is a serious problem. It is expected that by promoting investments in course of implementation of OBOR Projects, new opportunities and markets would be created for Chinese firms which would have a multiplier impact on production of goods and services domestically, thereby creating more jobs and higher incomes for the Chinese populace. Given its huge foreign exchange reserves, totaling about $4 trillion, China is in need of avenues to invest so as to earn a reasonable return on the same.

Among all the driving factors, the strategic rationale for initiating the OBOR is of utmost importance. The project clearly reflects the deepening of Chinese interests in strategically important regions to its west, for instance, Persian Gulf. Many of the spectators are of the view that this new initiative by China is a response to the much –hyped “pivot to Asia” by United States (Leverett2015). According to few experts, the launch of this project, if handled proficiently will act as a non-military catalyst that will accelerate the relative decline of U.S. power over the Persian Gulf and will ensure more balanced distribution of geopolitical influence in this region which is seen to be vital strategically.

Financial integration is another important underpinning driving the implementation of OBOR. This project will help the internationalization of Yuan and encourage Chinese companies to issue Yuan bond to fund projects for the OBOR initiative. As more and more trade will get channelized through the route, the demand for Chinese currency will increase that will further help increase its weightage in the IMF and Special Drawing Rights. Also with most of the projects (in initial phases at least) to be financed by Chinese financial institutions like China Investment Corporation, China Development Bank etc., and China dominated institutions like Asia Infrastructure Investment Bank and BRICS New Development Bank, it is being commented by many observers that this would help China in faster internationalization of her currency, the Renminbi. Thus it quite apparent that China has a grand vision in promoting OBOR; a vision which will seek for a greater role for China (both political and economic) in the international community.

2. Economic Coverage of the BRI.

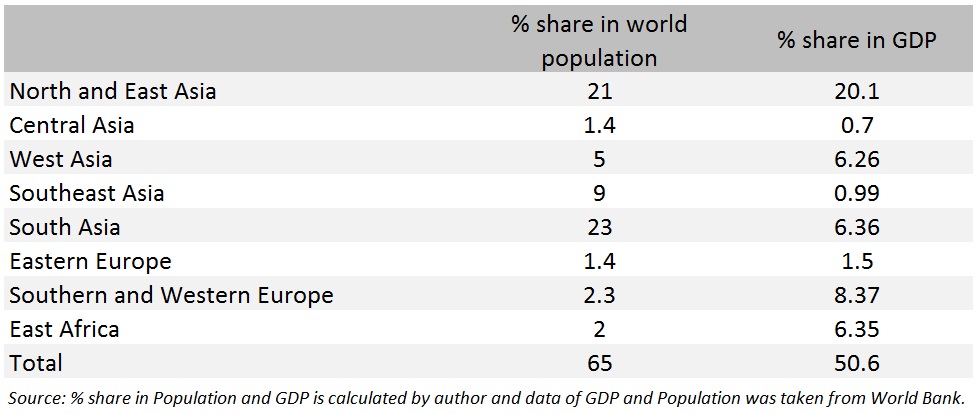

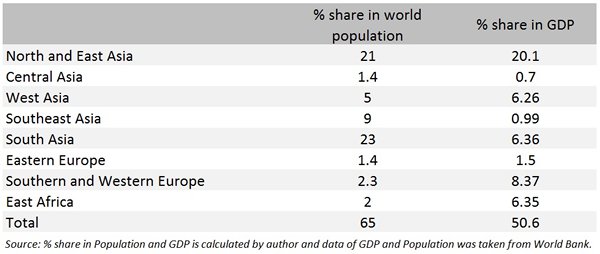

Economic and Trade co-operation is the foundation of the construction of OBOR. The Chinese officials use three keywords to define the new project: ‘Connection’, ‘Inheritance’ and ‘Record’ as the project is an important component of ‘Chinese Dream’ which extends both in space and time. With 58 countries involved along the “One Belt and One Road”, it accounts for the economic aggregation of $US 21 trillion, with share in the global trade 29 per cent[i]. Unlike the traditional Silk Road which ensured exchange of goods and technology, the New Silk Road also plans to link the policies, infrastructure, trade, finance and people. Table 1 below presents the regions covered along the route along with their percentage shares in world population and world GDP.

Table 1: List of Regions along the OBOR and their % share in world Population and GDP.

3. Implications of the OBOR on China and Member Countries.

One Belt One Road provides a platform to expand trade volumes between China and the member countries. Presently, trade between China and other partner countries along the roads boasts of a solid foundation. For most of the countries involved in the project, China is their largest trade partner, largest export market and the main source of investment. Trade and FDI, over the past 10 years between China and other countries have had an annual average growth of 19 per cent and 46 per cent respectively. According to Fidelity Worldwide Investment Report (2015), China’s trade value with the OBOR countries reached almost RMB7 trillion in 2014 accounting for 25% of total foreign trade value, while the combined weightage of trade with the US, Eurozone and Japan was around 34%.

Considering that China has maintained strong trade and economic co-operation with the countries involved in the project, this new initiative will further give boost to economic co-operation which will ensure regional integration. According to Chinese President, the annual trade with the countries involved in the project would surpass $2.5 trillion in a decade.

Chinese agriculture and mining are the two key industries which are expected to benefit as the route will encourage mineral exploration. OBOR initiative will also help China to identify new growth drivers for imports and exports and hence diversify China’s trading profile leading to trade creation. Through the OBOR, China is planning to encourage competitive industries to reap the advantage of high-end technology and increase overseas investment. This will further assist in exploration of resources which will improve China’s supply of energy resources. Under this new initiative China plans to build both hard and soft infrastructure from Indo- Pacific to Africa to improve the relations at both economic and political front.

China however has to be critical while formulating its plan. The route is in three directions- east, west and south and hence needs to be clearly differentiated.

The benefits of the project however is not just limited to China alone but also gives tremendous opportunities to its members to boost and revitalize trade with other countries and seeks for new markets and strengthen their accessibility. With connectivity improving, the OBOR covered countries are more likely to gain more share among Chinese trading partners. Being the final destination of the New Silk Road, Europe is also an important region for China from an economic viewpoint. Through better connectivity, OBOR may promote the reconciliation of EU and Russia and will also provide Europe, a platform to balance its transatlantic relationship. There will be a greater chance for Europe to co-operate with the markets of West Africa, the Indian Ocean and Central Asia

OBOR will also connect resource and commodity rich west and Central Asia to emerging South and South East Asian countries along the Road which has a huge potential consumer market. Southeast Asia though rich in resources suffers from infrastructure deficit and low level of industrial development. The project has potential to address this gap and hence promote the development in the region. For countries like Cambodia and Laos the OBOR project could be a game changer. Further, the large scale investment needed to build OBOR might encourage Chinese steelmakers to build more capacity in Southeast Asia, West Asia and African countries by setting up integrated steel mills with nearby iron-ore mines. China cement industries will also see a long term benefit as the demand from ASEAN and Central Asian countries will increase because of infrastructure development. This could also encourage overseas expansion of Chinese cement industries in these regions. Additionally, the freight movement by road will increase through multi-modal connectivity. Overall the countries are expected to gain as OBOR will encourage demand, burgeoning of new industries and creation of trade.

India and “One Belt One Road (BRI)”: Implications

According to various experts from different countries from east coast of Africa to Northeast Asia, India’s role in BRI has been acknowledged and seen essential. Indian Ocean is vital for pursuing the economic and strategic interests of China. However, unlike most of the ASEAN and South Asian countries who have welcomed the idea of BRI, India has not. For India, the proposal to build BRI is vague and does not give surety as to how serious Beijing is about opening up trade and cultural exchanges along the Himalayan barrier. The project has several implications for India.

4.1 Impact on Security

India, in order to balance China’s North-South connectivity to South- East Asia, has been promoting East- West Connectivity through Myanmar, Thailand and Vietnam. India however is concerned about the Bangladesh- China- India- Myanmar (BCIM) Economic Corridor which links Yunnan with North- east part of India.

Through the OBOR, China is countering the strategies of India and is promoting its greater presence in the North-Eastern region of India, part of which China claims as its own territory. These along with China’s plan to supply eight type 039 A submarines to Pakistan have made India anxious of China’s policy of ‘balanced’ South Asia. With China’s aid to Pakistan and launch of BRI, such submarines will be more than doubled. India, on the other hand only has 13 aging conventional subs which could result in India- China arms race and geopolitical rivalry in the India ocean region.

Further, the China- Pakistan Economic Corridor (CPEC) which is a part of the BRI passes through Pakistan Occupied Kashmir. According to the document released at the Bao Forum Conference in March 2015, the creation of maritime facilities with China’s aid will have an obligation for the host country to serve Chinese interests including strategic interests (Rajan 2014) .This is worrisome for India as Chinese will eventually increase their military presence in Indian Ocean and will reshape the economic arrangement in the regions. Further, the railway route planed under BRICS expected to link Pakistan and China via Pakistan occupied Kashmir will be of strategic importance in the event of conflicts with India and will facilitate China to supply missiles and spare parts to Pakistan. This might have serious consequences on India’s power to negotiate with China on the territory of Ladakh and further cause tensions at border.

4.2 Impact on Trade

The Silk Road Economic Corridor initiative is similar to that of BCIM and the CPEC Corridor. India has direct and indirect presence in all the three economic corridors. BCIM gives India greater presence in the region as it is the formal member. India pursues its soft power in the Silk Road Economic Corridor that outvie the economic and political development. The CPEC would link to the larger India market in order to reach its full economic potential. This corridor will open up the flow of trade between India and Pakistan which presently has to be routed through third-countries instead of receiving them directly. Further, India does not enjoy much leverage to guide ocean trade markets despite having proximity to sea and strong navy. Through OBOR project India will get access to more business in an environment which will promote business friendly reforms.

Although, China is the largest trade partner with most of the countries involved in BRI projects, India’s also is significant trading partner especially with African, South Asian and South East Asian countries. India will have economic implication once the BRI project is launched. The port development in Myanmar, Bangladesh, Sri Lanka, Maldives and Pakistan which is incorporated in the BRI project have the potential to change the bilateral equation of India further to its disadvantage (Sibal 2014) as it favors China’s trade flows through the Indian Ocean. This also will lead to trade diversion of Indian goods and services. China and India export some of the similar set of goods to the countries like Thailand, Myanmar, Cambodia in South East Asia region, Sri Lanka, Pakistan and Nepal in South Asia, few countries in Western Europe and Central Asia.Once the BRI is built the countries might divert their trade from India to China because of the easier accessibility to Chinese goods and currency exchange.

4.3 Why India should join?

China has a tradition of using the “Cheque book” policy against India. And under maritime silk route (MSR)China is developing ports in Bangladesh, Sri Lanka and Pakistan and is trying to enlarge its sphere of influence using its economic might in the Bay of Bengal, Arabian Sea, thus MSR is nothing but an economic disguise to the “string of pearl” theory. China is investing huge amount of monies in India’s immediate neighbors and these south-east Asian countries tend to use the “China card” against India that is try to play with the India-China mistrust in order to further their development and economic agenda. With more south East Asian nations coming under China’s sphere of influence would result in a serious setback to India’s traditional concept of the subcontinent as its privileged sphere.

Further, the project, though an informal channel at present, offers an alternative against the US –led Trans- Pacific Partnership (TPP) in the Asia- Pacific and Transatlantic Trade and Investment Partnership between the European Union and United States. These Mega Free Trade agreements through their policies and rules of global trade particularly where multilateral level consensus is more necessary will make it difficult for the government to regulate the market and will have economic implications on India’s trade.

Moreover, India and China are members of the BRICS Bank which aims to offer financial support for infrastructure projects and sustainable development. By refusing to be the member of BRI, India’s infrastructure needs may get neglected. This may further interfere with the economic co-operation among the BRICS countries and may cause conflicts.

Once the issue relating to strategic and economic implications is judiciously analyzed, India could benefit from being the BRI partner. Most importantly, from a strategic perspective, India’s involvement in OBOR will help the country, better implement and integrate its “spice route” and the “Mausam project”. Beside tangible benefit of physical connectivity, the integration of these projects will also invigorate a climate of mutual trust, stability and prosperity between the member countries. Additionally, India could also expedite the progress on the Chahbahar port on the Iranian coast which will give India access to Afghanistan and Central Asia. This would enable India to be a major player in the overland Silk Route.

India’s participation in OBOR will give a new start and a new bright spot in India- China co-operation as it will foster policy coordination, increase trade and investment and ensure people to people connect and most importantly integrate the financial system. For India MSR could prove to be a boon and help enhance its regional and bilateral co-operation. India does not have the same economic might as China has, but investing in neighboring littoral countries will help in reducing china’s sphere of influence to some extent.

5. Challenges

The huge grandiose plan of OBOR has been painted as everything from a response to home-grown economic problems to a masterful reshaping of the regional economy. However the complete realization of the project as estimated will take about 35 year which will mark the 100thanniversary of the foundation of People’s Republic of China in 2049. Though the project has met with skepticism from its neighbors, it has huge potential across regions.

However the plan is yet to finalise its strategic vision. The success of the project depends on addressing both internal and external challenges being faced by the Chinese economy.

Chinese are expecting quick results. As the project involves large scale infrastructure development, the plan needs to be given at least ten year time frame for success which means that expectation should be revised. Since China is planning continuous investment in infrastructure in the countries that are less developed and unstable, there is a potential for a debt crisis and limited returns. Moreover China presently is grappling with its own economic issues and slowdown can also have implication on its OBOR strategy. Therefore serious planning would be essential.

China has allocated $ 40 billion to its Silk Road Fund and established $100 billion AIIB. According to few analysts, the actual fund needed for the plan might exceed three or four time the amount allocated. The additional requirement will have to be met either by issuance of special bond and low-cost finance by the China Development Bank. China has to be vigilant of the financial challenges or else the ambitious project could end up as expensive boondoggles.

OBOR has also received criticism and skepticism from many member countries, particularly ASEAN. They see this project as an attempt by China to dominate its neighboring region and therefore are facing coordination problems. Further regional and territorial disputes of China can interfere with the project. Additionally, Chinese failure in considering regional politics and non-interference policy can expose the project to political risks from both local opposition and competing regional power. China’s OBOR dream can also get affected because of the presence of underdeveloped and immature market along the route. Terrorism can further add to the risk. The potential of conflicts and geopolitical tension with the United and the unbalanced trade relations between China and Russia can further act as a hurdle. India may also challenge OBOR as the initiative is seen more of a threat to the country rather than opportunity.

Therefore, it’s the adequate planning and coordination between the member countries that will be required for successful implementation of the OBOR initiative.

6. Conclusion