Chinese Mainland

HKTDC Research | 27 Nov 2015

Vietnamese Businesses Offer Cautious Welcome to Belt and Road

Although some concerns remain over territorial disputes with China, many Vietnamese companies remain upbeat over the country's prospects as part of the Belt and Road initiative, while infrastructure work is already underway.

Vietnam is considered a key part of the maritime component of China's ambitious Belt and Road Initiative. In particular, there has been a focus on Northern Vietnam's Haiphong Port, with plans afoot to complete a major upgrade to its facilities by the end of 2017.

Overall, Haiphong is a key nexus point along two of the proposed trade corridors. The first is along a route connecting Nam Ninh, Lang Son, Hanoi and Haiphong, while a second connects Kunming, Lao Cai, Hanoi and Haiphong. These proposals would see Vietnam playing an enhanced role in the transportation of goods produced in China, while also opening up the local consumer market to more external suppliers. It is also believed that the improved links will also help develop Vietnam's own industrial base.

With Vietnam ideally placed as a transportation hub for a number of other countries along the Mekong River – including Cambodia, Laos, Thailand and Myanmar – the country would play an important logistics role with regard to serving the ASEAN bloc. The only real barrier to such a development is seen as the lingering territorial disagreements between China and Vietnam, particularly with regard to the South China Sea.

Addressing the need to resolve such issues, Xi Jinping, the Chinese President, has gone on record saying: "We must strictly adhere to the important agreements that the leaders of the two countries have achieved. Together, we can handle and control any disagreement over the situation, and maintain peace, and stability on the East Coast."

Mutual benefit

Should any such issues be resolved or even merely set aside, many in both China and Vietnam would welcome the closer economic and logistics ties outlined as part of the Belt and Road proposal. One such advocate is Eric Fang, Director of the Shunfang Company, a Chinese fabric trading company based in Shanghai.

Outlining the possible benefits, Fang said: "Vietnam is one of our major buyers. The fact that Vietnam has agreed to be a part of the Silk Road project is great news for us. We have been working with Vietnamese companies for many years and, up until now, the process of shipping goods by sea has been lengthy, while also requiring the completion of a substantial amount of paperwork. In the future, if we could use rail transportation, there would be a considerable saving in terms of both time and costs."

While the benefits for those Chinese exporters seeking markets for their excess capacity is clear, some have been less certain about the upside for Vietnam. Despite this, the mood of the Vietnamese business community seems to be largely upbeat about the prospects of the initiative, believing it is likely to enhance its own trading prospects in the long-term.

Addressing this issue David Wong, Director of the Wintec Company, a specialist PU foam manufacturer based in Vietnam's Long An province, said: "I expect Vietnam will participate in the Belt and Road project and that, in future, relationships between the two countries will be less complicated. It can only lead to a much improved situation and not only in terms of international trade.

"I believe it will create the ideal conditions to develop and extend our business domestically. It will also benefit other Vietnamese enterprises and the Vietnamese economy in general."

Wong's optimism was echoed by Tran Lam, a Senior Sales Representative of the Au Viet Moc Trading Import Export Company, a wooden furniture manufacturing company based in Hi Chi Minh City. Emphasising the importance of overseas investment, Lam said: "In my opinion, when foreign companies invest in Vietnam, there will inevitably be more job opportunities for the people here. That means the unemployment rate will drop and the overall quality of life will improve. That has to be a good thing."

Highlighting the importance of settling any outstanding territorial matters, Nguyen Van Hoang, Deputy Director of Vietnam Textile and Garment Corporation, said: "In terms of our businesses, if the relationship between Vietnam and China improves, it can only be a good thing. Many of last year's problems relating to the South China Sea had a hugely negative impact on our business. With sales frozen for months, there was nothing for our workers to do. Despite this, we still had to pay our staff in order to retain them."

Power to the People

Overall, the Belt and Road project is seen as offering a number of clear opportunities for the Vietnamese economy. While most obviously offering Vietnam the chance to attract a higher level of investment from overseas companies, especially those based in China, the project will also support the development of the country's infrastructure, particularly in terms of utility and logistics facilities development.

A prime example of this is the work that has already been completed on the hydroelectric power generation plant in Binh Thuan on Vietnam's south central coast. Around 95% of the project's total capital cost of US$1.75 billion came from Chinese venture investors – the Southern China Power Grid Company and Chinese International Power Company, with the remaining 5% being covered by the Vietnam Coal and Mining Group (Vinacomin).

The same consortium is also behind the development of the Vinh Tan thermal power plant in Binh Thuan. With a total capacity of 1,200MW, the initial phase of the project will come on line before the end of 2018, with the second phase scheduled for completion some six months later.

Pham Tuong Vi, Special Correspondent, Ho Chi Minh City

| Content provided by |  |

Editor's picks

Trending articles

1 Dec 2015

Belt and Road Initiative: Myanmar and China’s One Belt One Road Strategy

Presented by Thomas Chan, China Business Centre, The Hong Kong Polytechnic University on 26 Nov 2015

This is a presentation for a seminar on Myanmar – Its Future and Its Role in China’s Maritime Silk Road Strategy.

Please click to download the presentation file.

Editor's picks

Trending articles

Fujian to Explore 21st Century Maritime Silk Road Opportunities

China's Belt and Road Initiative specifically states that Fujian is to become the core area of the "21st Century Maritime Silk Road". One of the goals of the Fujian Free Trade Zone (FJFTZ) [1] is to expand exchanges and cooperation with countries and regions along this Maritime Silk Road route, both in depth and breadth.

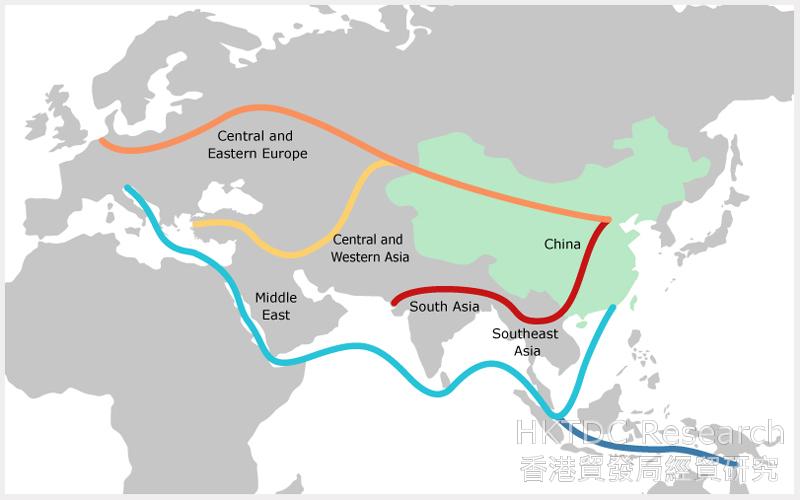

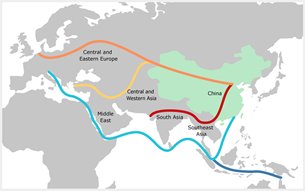

In fact, Fujian was not only the main starting point of the ancient maritime Silk Road, but is an important province in China for international trade and co-operation today. The province is also home to ports forming China’s Southeast International Shipping Centre. As such, Fujian is striving to cement closer ties with the ASEAN countries, the Middle East and countries along the coast of the Indian Ocean in the hope of further expanding investment and trade in these regions.

The keen demand for relevant support services will provide ideal opportunities for companies intending to tap the Belt and Road initiative.

Fujian - Core Area of 21st Century Maritime Silk Road

Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st Century Maritime Silk Road [2], issued by the Chinese government called for efforts to accelerate the building of the Belt and Road. It makes clear that China will support Fujian province in becoming a core area of the 21st Century Maritime Silk Road and strengthen port construction in coastal cities, such as Fuzhou, Xiamen and Quanzhou in Fujian and in other provinces. Fujian is to become the main force in the Belt and Road initiative, particularly the building of the 21st Century Maritime Silk Road, and leverage the unique role of overseas Chinese and the Hong Kong and Macau Special Administrative Regions in advancing the Belt and Road development strategy.

|

Origin of Maritime Silk Road The Maritime Silk Road can be traced back to the Han and Tang Dynasties. As people in ancient China moved over time from the Central Plains to the coastal areas and developed trade ties with foreign countries, trade via ports like Fuzhou, Quanzhou in Fujian and other coastal provinces became increasingly busy. Together with ports like Guangzhou, Jiaozhou and Yangzhou, maritime trade routes to Southeast Asia, South Asia and even the Middle East, Africa and Europe were reached. This was how the ancient maritime silk road gradually took shape.

|

In line with Vision and Actions, Fujian issued an implementation plan in November 2015 in order to develop the province as the core area of 21st Century Maritime Silk Road [3]. On the other hand, the FJFTZ made it a goal to tap the Maritime Silk Road opportunities, including the development of the Majiang sub-zone of the Fuzhou Economic and Technological Development Zone [4] inside the FTZ into an important platform for trade and for the exhibition and exchange of cultural and creative products and other commodities. The FJFTZ will explore innovative modes of cooperation and broaden cooperation with countries and regions along the Maritime Silk Road in such areas as investment, trade, shipping, infrastructure, technology, and cross-border trade settlement in Renminbi.

[For more information about the FJFTZ, see Tapping the Cross-Strait and Maritime Silk Road Opportunities of Fujian Free Trade Zone]

Fujian is an important province for China's economic cooperation with foreign countries. Its trade, investment and industries have seen sustained growth in recent years. It has a mature manufacturing sector including textile, garments and accessories (with industrial added value accounting for 10.1% of GDP in 2014), leather goods and shoe-making (9.1%), non-metal mineral products (7.6%) and computer, telecommunications and electronic equipment manufacturing (6.9%). Its service industry is also gradually maturing. In terms of industrial added value in 2014, its real estate and financial sectors had an 11.4% and 15.2% share of the province's services industry respectively [5]. A robust economy makes Fujian an important hub for promoting cooperation between China and countries along the Maritime Silk Road.

What merits attention is that while implementing the Haixi (or Western Taiwan Straits) Economic Zone development strategy and exploiting its favourable geographical location to promote cross-Straits economic development, Fujian also makes full use of its open policy and port facilities to strengthen foreign trade and investment with other regions. The port of Xiamen, home to the China Southeast International Shipping Centre, is the key port for vessels heading to Taiwan and other overseas countries. As the world's 17th largest container port, it handled 200 million tons of cargoes in 2014, with container throughput reaching 8.57 million TEUs. Cargo handling is expected to soar to 300 million tons by 2018, with container throughput reaching 12 million TEUs. Meanwhile, the port of Fuzhou has also joined the ranks of "100-million-ton class port" and become one of China's hub ports. Its Jiangyin port area with 250,000-ton class berths now ranks among the world's top 100 container ports.[6]

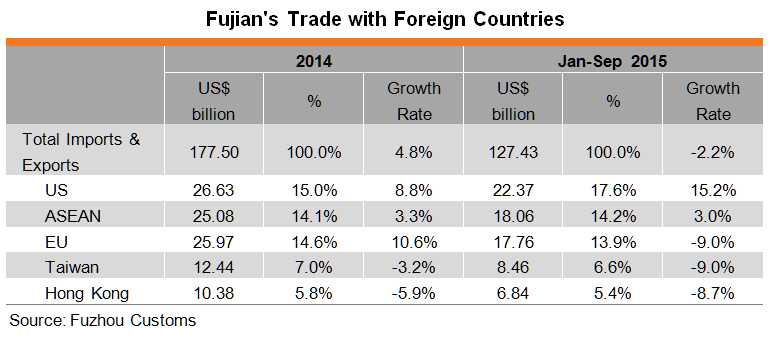

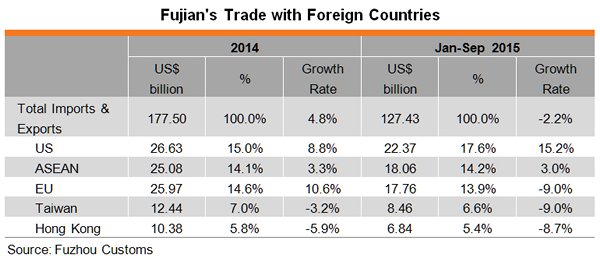

Fujian has frequent trade exchanges with Southeast Asia, South Asia, the Middle East and other regions. In particular, the ASEAN member states along the Maritime Silk Road have become Fujian's second largest trading partner after the US. Fujian-ASEAN bilateral trade amounted to US$18.1 billion in January-September 2015. On the other hand, ASEAN is Fujian's fourth key source of foreign direct investment (FDI) besides being the second main destination of outbound direct investment for Fujian province and Fujian enterprises.[7]

Fujian is also an important hometown of overseas Chinese. The Fujian provincial government estimates that there are currently over 12 million overseas Chinese of Fujian origin living in various parts of the world. Of this number, 80% are living in Southeast Asia. Among the 20 million-plus overseas Chinese living in the ASEAN countries, nearly 10 million came from Fujian. Fujian also has considerable social connections with countries further away. For example, about 50,000 Arabs are currently living in Quanzhou. Under the Belt and Road initiative, these trade, economic and social connections become favourable factors for the Fujian province, and hence the FJFTZ to further develop economic and trade ties with countries along the Maritime Silk Road.

Advancing Business along the Maritime Silk Road

Fujian is planning all kinds of business activities and projects under the Belt and Road development strategy. It hopes to further connect with countries along the Belt and Road and become an important pivot for economic cooperation among the Maritime Silk Road countries. While promoting bilateral trade and investment with ASEAN countries, the province is also actively opening up new markets in South Asia, West Asia, the eastern coast of Africa and other countries along the coast of the Indian Ocean and beyond. The specific measures include:

Strengthening cooperation with ASEAN countries in the construction and management of facilities such as ports, logistics parks and cargo distribution centres.

Accelerating the construction of China’s Southeast International Shipping Centre in Xiamen, including the construction of key port areas as well as the construction of an international container trunk line hub port and a regional cruise liner home port.

Making deployments for airport construction, accelerating the airport expansion projects and development of airport economic parks in Xiamen and Fuzhou, and increasing international routes serving countries in Southeast Asia, South Asia and other regions.

Promoting the construction of a cross-border optical fibre telecommunications network and cross-border e-commerce and logistics information platforms for trade with ASEAN countries, perfecting the customs clearance mechanism, and promoting information connectivity, customs clearance of goods and facilitation of people-to-people exchanges in regions along the Maritime Silk Road.

Making positive use of the investment facilitation and liberalisation measures offered by the FJFTZ to strengthen exchanges and cooperation with countries along the Maritime Silk Road.

Broadening two-way investment channels, guiding foreign investment into Fujian's leading industries, new and high-tech industries, modern services and energy-saving and environmental protection industries, supporting qualified domestic enterprises to build economic and trade cooperation areas and bases for trade logistics, production and processing of raw materials and production of traditional leading products abroad, and promoting two-way investment.

Promoting development of the China-ASEAN Marine Product Exchange.

The port of Mawei in Fuzhou is a major distribution centre for fish caught by Chinese ocean-going vessels, as well as an important port for the import and export of marine products. Over 300,000 tons of fish caught by ocean-going vessels cleared customs at Mawei each year, with annual turnover exceeding Rmb30 billion. The China-ASEAN Marine Product Exchange at Mawei has China's one and only dedicated fishing wharf with direct access to a marine products market, in addition to a robust cold-chain logistics system. Its platform for "online transaction, offline delivery and cross-border settlement" of bulk spot marine products can provide the China-ASEAN marine economy industry chain with unified standards for the orderly and traceable transactions of marine products and promote the development of the fishing industry in both China and the ASEAN.

Accelerating the construction and utilisation of the Fujian Commodity City outlets in Krasnodar (in Russia), Poland and other countries, and guiding enterprises in "going out".

- Actively take part in the UN Maritime-Continental Silk Road Cities Alliance to promote trade and investment among Silk Road cities.[8]

New Opportunities for Fujian-Hong Kong Cooperation

Fujian needs all kinds of professional services in trying to strengthen trade ties with countries along the Maritime Silk Road and promote outbound investment by enterprises in these countries. This will be a perfect chance for Hong Kong companies intending to tap opportunities arising from the Belt and Road initiative. In fact, Hong Kong is not just Fujian's major trading partner but is also its largest source of FDI, as well as a key destination for its outward FDI.

The flow of foreign investment from Hong Kong to Fujian amounted to US$4.52 billion in 2014, accounting for 63.5% of utilised FDI in the province. Investment mainly went to the manufacturing, wholesaling and retailing, and real estate sectors in cities like Xiamen, Quanzhou and Fuzhou. In the same year, Fujian's direct investment in Hong Kong reached US$1.23 billion, accounting for 44.4% of the outbound direct investment from the province.[9] Besides investing in the Hong Kong market, most of these funds are using Hong Kong as a springboard to invest in other regions overseas.

During a business promotion highlighting Fujian-Hong Kong cooperation held in Hong Kong in June 2015, the Fujian provincial government indicated its hope to make greater use of Hong Kong's advantages in developing the FJFTZ and promoting the building of Fujian as a core area of the 21st Century Maritime Silk Road.[10] In fact, Hong Kong is not just a regional commercial and trading centre but can provide extensive professional services in such areas as finance, logistics and law to enterprises in Fujian and in countries along the Maritime Silk Road and beyond with its leading edge in the services industry. Also, as the first port of call for professional services for mainland enterprises, Hong Kong can effectively promote their "going out" efforts and help them make the best of opportunities arising from the Belt and Road initiative. Fujian enterprises resolving to step up their development of trade and investment with countries along the Maritime Silk Road provide a perfect chance for Hong Kong companies intending to tap opportunities arising from Belt and Road initiative.

[Note: For more details concerning Hong Kong's support for mainland enterprises in their outbound investment, see Outbound Investment of Chinese Enterprises: Hong Kong the First Port of Call for Professional Services.]

[1] The Fujian FTZ in this report refers to the China (Fujian) Pilot Free Trade Zone.

[2] This document was jointly issued by the National Development and Reform Commission, Ministry of Foreign Affairs and Ministry of Commerce in March 2015.

[3] For details, please see HKTDC’s Business-Alert China article: “Fujian Announces Core Area Construction Plan for 21st Century Maritime Silk Road” (25 November 2015)

[4] The Majiang sub-zone is part of the Fuzhou Sub-zone of the Fujian FTZ and includes the 0.6 km2 Fuzhou Free Trade Zone.

[5] Source: Fujian Statistical Yearbook 2015

[6] Source: Xiamen Port Authority and Fuzhou City Bureau of Commerce

[7] Source: Fujian Provincial People's Government

[8] The UN Maritime-Continental Silk Road Cities Alliance is a joint initiative by the UN Office for South-South Cooperation (UNOSSC), UN Development Programme (UNDP), UN Industrial Development Organisation (UNIDO), UN Educational, Scientific and Cultural Organisation (UNESCO), UN World Tourism Organisation (UNWTO) and China International Center for Economic and Technical Exchanges. It aims to facilitate the coordination of policies, building of partnerships, formulation of initiatives and access to finance, leading to intensified trade, investment and exchange among participating cities.

[9] Source: Fujian Statistical Yearbook 2015; Hong Kong and Macau Section of the Department of Commerce of Fujian Province

[10] For more information on the "Presentation on Fujian-Hong Kong Cooperation", see article in Chinese published on the website of the Department of Commerce of Fujian Province on 5 June 2015: .

| Content provided by |

|

Editor's picks

Trending articles

HKTDC Research | 4 Dec 2015

China’s 13th Five-Year Plan: Likely Aims and Implications

At the fifth plenary session of the 18th Central Committee of the Communist Party of China, held on 29 October 2015, the Suggestions of the Central Committee of the Communist Party of China on the 13th Five-Year Plan for National Economic and Social Development (Suggestions) were passed. It was later stated at a State Council Executive Meeting that the 13th Five-Year Plan (2016-2020) will be formulated according to the Suggestions [1].

President Xi Jinping and Premier Li Keqiang also remarked that the core goals of the 13th Five-Year Plan are to build a “moderately well-off society” and to overcome such challenges as the “medium-income trap”. While efforts will be made to optimise the economic structure, improve the environment, and enhance the quality and benefit of development, steps will be taken to achieve economic growth. Specific goals include: [2]

-

Maintaining economic growth at a medium to high speed, with average annual growth over 6.5%

-

Raising per-capita GDP to US$12,000 (up from around US$7,600 in 2014)

-

Accelerating industrial upgrade and propelling the economy to develop at medium to high level

-

Balancing urban and rural development and ecological construction

-

Strengthening social fairness and justice and balanced development

Where Hong Kong is concerned, the Suggestions mention that efforts will be made to deepen the joint development of the mainland and Hong Kong (as well as Macau and Taiwan), including giving support to Hong Kong to strengthen its position as an international financial, shipping and trading centre; participate in China’s two-way opening-up and Belt and Road Initiative; consolidate its position as a global hub for offshore renminbi business; and deepen Guangdong-Hong Kong-Macau cooperation.

From the Suggestions and the statements made by the leaders, it can be gathered that the 13th Five-Year Plan to be launched next year is likely to cover the following development directions, which can bring about new opportunities for Hong Kong players.

Encourage Innovation and Enhance Quality of Economic Development

According to the Suggestions, the 13th Five-Year Plan will place emphasis on advancing mass entrepreneurship, encouraging technological innovation, and promoting the development of new industries, in a bid to inject new vigour into the economy. It will focus on developing high technology and high value-added industries, while strengthening supporting infrastructure, revamping related financial systems, and improving the business environment to promote further growth of related industries. The target industries and development sectors will include:

-

Developing emerging industries

This includes developing such emerging industries as energy saving and environmental protection, biotechnology, information technology, smart manufacturing, high-end equipment, and new energy, as well as giving support to traditional industries to undergo upgrade.

-

Bolstering infrastructure construction and encouraging innovation

This includes building high-speed and safe next-generation information infrastructure, as well as quickening the pace of implementing the “Internet +” action plans, developing IoT (Internet of Things) and big data technology and application, and formulating plans to develop the next generation of Internet and related technology.

-

Encouraging corporate innovation

Efforts will be made to encourage R&D, strengthen technology integration capability, and import technology from abroad, targeting advanced technologies including next-generation information communication, new energy, new materials, aviation and space, biomedicine, and smart manufacturing. Action will also be taken to improve tax concession policies for corporate R&D expenses, and expand preferential treatment for accelerated depreciation of fixed assets to encourage enterprises to replace their equipment and apply new technology.

-

Steps will be taken to encourage mainland industries to develop from “Made in China” to “Created in China”, and to achieve the task of industrial upgrade moving “from big to strong”. This includes raising the level of product technology, technical equipment, energy efficiency and environmental protection across the board, as well as liberalising market access for modern services in a bid to promote development of the specialised high-value producer service industry, and assist the manufacturing industry in increasing value-added.

-

Developing new systems

Action will be taken to simplify the industry and commerce administration systems, accelerate the pace of financial system reform, raise the efficiency of the financial sector in serving the real economy, and further develop the capital market in a bid to lower the financing costs of medium, small and micro enterprises.

Based on the above development directions, it can be expected that implementation of the 13th Five-Year Plan will boost the mainland’s demand for various types of new and high technology. However, in certain high-tech industries such as IoT applications and development of the next-generation Internet, as China is currently still short of total and standard solutions and lacks user experience in certain areas, related R&D and technology application is somewhat constrained. Hong Kong’s technical personnel, who are well-versed in advanced foreign technology and excel in using technologies developed by international standards/frameworks to provide technological and management system solutions, can assist in the commercialisation of related projects in the mainland and meet the technological demands listed in the 13th Five-Year Plan.

Meanwhile, the mainland hopes to make use of innovation to facilitate industrial upgrades. For instance, the policy paper “Made in China 2025” stated that enterprises will be encouraged to strengthen their product design capability and brand building so that more enterprises will shift from OEM to ODM, as well as develop their own branded business. This should provide opportunities for Hong Kong’s design and branding service suppliers. A recent survey conducted by the Hong Kong Trade Development Council found that mainland enterprises wish to obtain service support from Hong Kong or foreign countries in the following areas: (i) product development and design; (ii) brand design and promotional strategy; and (iii) marketing strategy. [3]

Hong Kong, as an international financial centre in the region, can provide mainland enterprises with the necessary loan and financing services, such as providing cost-effective capital for relevant technology and industrial projects, helping mainland enterprises to lower financial cost. Also, as Hong Kong is one of the largest venture capital management centres in Asia, a large number of top-notch international fund managers wishing to grasp business opportunities in China have already established a foothold in Hong Kong, which can offer more financing channels for mainland enterprises. It can be expected that during the 13th Five-Year Plan period the mainland will further open up its financial services market, this should bring about more opportunities for Hong Kong financial service suppliers to enter the mainland market.

Balanced Regional Development

The Suggestions also stress that during the 13th Five-Year Plan period efforts will be made to strengthen the balanced development of various regions, including placing equal emphasis on urban and rural development, as well as synchronising the pace of development of the more developed eastern coastal region with that of the central and western regions. The emphasis of the plan is expected to include:

-

Advancing coordinated regional development

This includes deepening the Go West initiative and promoting development of the central region. Emphasis will be placed on encouraging the coordinated development of certain regions, such as advancing the coordinated development of the Beijing-Tianjin-Hebei region and the Yangtze River Economic Belt. Regional development will be achieved by way of optimising urban development planning, encouraging regional transportation integration, and improving regional environmental planning.

-

Advancing new urbanisation construction

Steps will be taken to advance a people-centred new urbanisation plan; enhance the level of urban planning, construction and management; deepen household registration system reform; and assist rural migrants capable of working steadily in urban areas in obtaining urban resident status.

The importance attached by the Suggestions to the strategy of balanced development of the eastern and western regions and urban and rural areas aims to tackle problems brought about by disparities in regional development in the past and by the rapid pace of urbanisation of some localities. These problems include:

-

Insufficient transport facilities, environmental resources and supporting municipal facilities in certain city clusters

-

The polarised development of the urban and rural areas has quickened the pace of people flow into cities, increasing the pressure on urban development

-

As the pressure on the transportation and communication systems continues to grow, the efficiency of logistics services is in dire need of improvement

-

Water and air pollution problems are increasingly serious, creating a strong demand for environmental services, such as energy saving and emission reduction

The rate of urbanisation in the mainland rose rapidly from 36% in 2000 to 55% in 2014. The pace is particularly fast in more developed regions, for instance, the urbanisation rate in some of the YRD provinces exceeds 65%, which has created the problems mentioned above. [4] In view of this, the 13th Five-Year Plan is likely to take a further step in making “new” urbanisation a development direction, devoting great efforts to enriching the content of urban and rural development and making the enhancement of urban quality a development objective, instead of simply seeking urban construction or expanding the boundary of cities.

Against this backdrop, the 13th Five-Year Plan will not only bring about the upgraded development of coastal cities, but will also stimulate the construction and economic activities of urban and rural areas in the central and western regions, as well as the old industrial regions in the northeast. For instance, where building new city clusters is concerned, efforts will be made to strengthen the construction of daily-life supporting facilities in the relevant urban and rural areas, and to upgrade infrastructure, such as cross-regional intercity and trans-regional transport systems.

Hong Kong is not only an international financial centre, but also an important commercial services platform in the Asia-Pacific region. With a pool of local and foreign infrastructure construction service suppliers in extensive fields, Hong Kong has rich experience in different modes of urban development and management. Meanwhile, in the mainland, as the scope of urban construction continues to expand, infrastructure enterprises with comprehensive service abilities are needed to satisfy market demand for infrastructure and overall planning services. Also, as mainlanders’ income level continues to rise, they are becoming more demanding where the quality of urbanisation is concerned. Hence, when government departments in charge of planning and developers set out to advance urbanisation, priority is given to development quality over speed and quantity. This will create opportunities for qualified service suppliers wishing to tap the China market.

On the other hand, regional development and urbanisation are bound to change the urban landscape rapidly in different regions. The emergence of new commercial districts will prompt the distribution and retail sector to shift toward modern business modes, as well as bolster development of the consumer market in small coastal cities and in the central and western regions. However, Hong Kong companies wishing to enter these “emerging markets” must assess local purchasing power, pay attention to the consumption pattern of different cities, and avoid intense price competition from online businesses.

Moreover, under the 13th Five-Year Plan, the mainland may quicken its pace of building smart city clusters and apply next-generation information technology to raise the efficiency of city management. This should directly boost the demand for the application of IoT technology in a number of areas, such as transport, environmental monitoring and municipal management, generating opportunities for relevant service suppliers to enter the market.

As development of the transport logistics network in the mainland becomes increasingly mature, it will promote the further development of logistics services and e-commerce. For instance, as the mainland’s demand for cold chain logistics is rising rapidly, it is in urgent need of importing advanced cold chain solutions in order to raise overall operation efficiency and quality. Moreover, while domestic online shopping is growing in leaps and bounds in the mainland, cross-border e-commerce and related logistics services have yet to develop. In comparison, Hong Kong not only has rich experience in cold chain logistics management but also a sound e-commerce and logistics platform. Hong Kong is therefore well positioned to capture additional opportunities created by the 13th Five-Year Plan.

Sustainability is Main Development Strategy

Both the Suggestions and the leadership have stressed on many occasions that, while efforts will be made to advance social and economic construction, action will also be taken to accelerate the building of a resource-efficient, eco-friendly society and strengthen environmental protection in order to ensure sustainable social and economic development. In fact, the extensive growth mode of China’s economic development in the past has caused serious environmental pollution, with the resulting economic cost and social problems arousing great concern from both the government and the general public. Against this background, it can be expected that the 13th Five-Year Plan will include the following development plans:

-

Strengthening environmental protection measures

Action will be taken to implement the green city development plan, strengthen clean production management, encourage enterprises to upgrade and revamp their technical equipment, develop green finance to help enterprises strengthen environmental management and green operation, and encourage society to pursue green consumption.

-

Tightening pollution control

This includes optimising the industrial structure of the developed Beijing-Tianjin-Hebei, YRD and PRD regions and encouraging these regions to move towards high-end production and low pollution. In key ecological functional zones, the negative list will apply to industrial market access; greater efforts will be made to contain air, water and soil pollution; regulatory requirements for industrial pollution sources to meet emission standards will be fully implemented; urban domestic sewage and refuse treatment will be fully advanced; and enforcement of relevant laws will be strengthened.

-

Developing environmental protection and related industries

This includes expediting energy technology innovation; encouraging the development of the new energy industry, such as wind, solar, bio, water and geothermal energy; strengthening smart power grid construction; continuing to promote the development of the new energy car industry; popularising green construction; and boosting development of the waste recycling system and industry.

During the 13th Five-Year Plan period, the mainland will further strengthen energy saving, emission reduction and environmental protection policies. In particular, the new Environmental Protection Law, which came into effect on 1 January 2015, aims to tackle environmental pollution issues, including authorising environmental protection departments to close down facilities which have caused serious environmental pollution and to order units emitting excessive pollutants to limit or cease production; as well as impose heavier penalties and punishment on non-compliance. [5]

The demand of mainland enterprises and relevant units for environmental protection services such as energy saving and pollution prevention and containment is bound to rise rapidly. These enterprises, while facing more stringent legal requirements, are also encouraged by government policies, such as green finance measures. As such, they will take greater initiative to seek environmental protection services in order to meet requirements for energy saving, emission reduction and emission standards. In view of this, the 13th Five-Year Plan should provide environmental protection service and technology companies possessing the right technology and expertise with extensive room for market expansion.

Hong Kong’s environmental protection companies and technical personnel have accumulated rich experience in specialised project management throughout the years. As such, they possess advantages in providing one-stop services and excel in combining advanced environmental protection technology in foreign countries with low cost parts and components in the mainland. With the support of various financial services in Hong Kong, they can also provide mainland clients with project financing services, such as performance contracting for energy and water efficiency, hence they are well-positioned to make a foray into the mainland environmental protection market. This, coupled with Hong Kong’s favourable business environment, has made Hong Kong companies ideal cooperation partners for foreign environmental protection technology players interested in undertaking technology transfer and licensing in the mainland.

It is worth noting that Hong Kong companies wishing to capitalise on the environmental protection opportunities in the mainland have to obtain a qualification licence issued by the relevant department of the mainland government. For instance, if they wish to provide environmental protection system engineering design services or environmental protection facilities operation services, they may need to obtain a qualification licence from the national or local environmental protection department. However, CEPA [6] has introduced a lot of liberalisation measures facilitating Hong Kong companies’ provision of environmental protection services in the mainland (including establishing wholly-owned enterprises in the mainland to provide such services as sewage and waste treatment) and to apply for qualifications to operate environmental pollution control facilities. Furthermore, as Hong Kong has signed an agreement on the liberalisation of trade in services with the mainland, Hong Kong service suppliers entering the mainland environmental protection market are entitled to national treatment. This has given Hong Kong companies the advantage of entering the mainland environmental protection market earlier than their foreign counterparts. [7]

New Horizon in Opening Up

In recent years China has significantly liberalised administrative measures on outbound investment to encourage enterprises to “go out” and invest overseas in a move to establish sales networks in foreign markets and at the same time “bring in” the advantages of foreign partners, in order to enhance competitiveness and seek transformation and upgrade. Meanwhile, China is proactively encouraging free trade zones in Shanghai, Guangdong, Tianjin and Fujian to open up, as well as advancing the Belt and Road initiative in the hope of capitalising on the comparative advantages of the PRD, YRD and Bohai Rim in order to strengthen economic ties with countries along the route. Against this backdrop, the Suggestions point out that the 13th Five-Year Plan should strengthen the following liberalisation measures and development directions:

-

Strengthening two-way opening up

Steps will be taken to strengthen the construction of ports and infrastructure facilities in inland border areas, build cross-border multimodal transport corridors, and bolster the development of border economic cooperation zones and cross-border economic cooperation zones. Efforts will be made to expedite the optimisation and upgrade of foreign trade, further develop trade in services, implement positive import policies, and further open up the market to the rest of the world.

-

New opening-up measures

Action will be taken to encourage enterprises to expand outbound investment and promote “going out” with their equipment, technology and services so that Chinese industries can integrate further with global industry and logistics chains. Meanwhile, efforts will be devoted to encouraging the development of new trade modes, such as cross-border e-commerce, and advancing the construction of free trade zones and related opening-up measures. Besides, steps will be taken to further open up the service sector to the outside world, especially expanding the two-way opening-up of the financial sector, orderly realising convertibility of the RMB under the capital account and paving the way for internationalisation of the RMB.

-

Advancing the Belt and Road initiative

This includes improving bilateral and multilateral cooperation mechanisms, encouraging enterprises to invest in countries and regions along the route, advancing infrastructure connectivity, and strengthening energy cooperation in a bid to jointly build an offshore industry cluster and establish a local industry system. At the same time, cooperation in such areas as education, technology, culture and environmental protection will be unfolded. Detailed measures include enhancing cooperation with international financial institutions; participating in the establishment of the Asian Infrastructure Investment Bank and New Development Bank BRICS; giving full play to the Silk Road Fund; and attracting international funds to jointly build a diversified financial cooperation platform.

The 13th Five-Year Plan enhances foreign trade and economic cooperation and introduces positive import policies, and the mainland encourages Guangdong and Hong Kong to jointly expand the international market and strengthen trade ties with economies along the Maritime Silk Road. These efforts should help to consolidate Hong Kong’s position as a trade and shipping hub in the Asia-Pacific region.

The deepening of the opening-up policies in Guangdong and other free trade zones under the 13th Five-Year Plan, and the deepening of liberalisation of trade in services between Guangdong and Hong Kong under the CEPA framework, will further increase the room for Hong Kong companies to enter the Guangdong and the entire mainland market.

Where further financial sector opening up is concerned, in recent years many Hong Kong companies have proactively taken advantage of the mainland’s liberalising financial policies and CEPA concessions to gradually participate in the mainland financial market, set up networks and accumulate practical operation experience. Today, Hong Kong is a leading RMB offshore trading centre and has developed cross-boundary RMB lending business via Qianhai. All these factors will give Hong Kong financial players the first-mover advantage during the 13th Five-Year Plan period when the mainland further liberalises related policies.

Moreover, China’s Belt and Road initiative will further encourage mainland enterprises to invest in countries along the route. Hong Kong has always been acting as the bridgehead for the mainland’s foreign trade and economic cooperation activities, and is also the mainland’s preferred service platform for making offshore investments. In the past, Hong Kong has handled trade and investment business in overseas markets for a lot of mainland enterprises, providing a full range of professional services, such as financial, legal, taxation, sustainable operation risk assessment, and international certification and inspection services. With the 13th Five-Year Plan strengthening the “going out” strategy and advancing the Belt and Road initiative, it can be expected that more opportunities will be made available to Hong Kong service suppliers.

Raise Level of Social Development

The Suggestions also mention that efforts will be made to strengthen public services, enhance the quality of education, and guarantee people’s basic livelihood in order that the country will evolve into a moderately well-off society. Therefore, it can be expected that where social development is concerned, the 13th Five-Year Plan will cover the following directions for reform and development:

-

Promoting balanced growth of the population

The two-child policy will be fully implemented, proactive action will be taken to tackle the problem of ageing population, and the elderly care service market will be fully liberalised.

-

Reforming the social security system

This includes improving the employee pension insurance system, broadening social insurance fund investment channels, strengthening risk management, and raising investment return rate. Action will be taken to improve the sustainable development of the medical insurance system and deepen medical and health system reform, including introducing separation of consultation from medication, and establishing a basic medical and health system and modern hospital management system covering both urban and rural areas.

-

Tightening food safety

Steps will be taken to advance a stringent and highly efficient food safety management system.

In a bid to promote balanced growth of the population, the two-child policy will be fully implemented during the 13th Five-Year Plan period. This represents a step to be taken to further improve the country’s population control policy after introducing the policy of allowing single-child parents to have two children in November 2013. According to the estimates of the National Health and Family Planning Commission, the new second child generation will mainly concentrate in urban areas, accounting for 76% of all newly born second children. It is projected that by the year 2030 China’s total population will reach 1.45 billion. And by 2050, the population of the labour force aged 15-59 will increase by about 30 million, this will help alleviate the problem of population ageing and contribute to population structure optimisation.

In the short term, introduction of the two-child policy can directly stimulate the demand for maternity, baby and infant products and services, such as food, health food, daily use articles, as well as mother and child health service and child care service. In the long run, it will boost the demand for housing, education and medical care. As mainland parents are attaching more and more importance to product quality and safety, as well as the level of professional services, such as education and medical care, Hong Kong companies can capture the opportunities arising from this new development.

Moreover, the 13th Five-Year Plan’s aim to accelerate the pace of old-age insurance and medical insurance system reform is bound to stimulate the growth of the insurance market. Currently, as China liberalises its financial and services markets, financial and insurance industry players stand to benefit from the emerging market opportunities.

As China’s population gradually ages and the pace of life quickens in tandem with rapid urbanisation, the health care expenses of mainlanders continue to rise, particularly the case with middle-class or above citizens. Coupled with the proposal put forward in the 13th Five-Year Plan for medical system reform and market liberalisation, this will generate opportunities for Hong Kong service suppliers in related fields.

Hong Kong medical service suppliers, by combining health, medical and leisure services and taking advantage of the policy offered by the mainland allowing Hong Kong players to set up wholly-owned hospitals and traditional Chinese medicine hospitals in the mainland on a pilot basis starting from mid-2014, can tap the mainland’s high-end health and medical services market. Apart from capitalising on Hong Kong’s financial services to offer strategic recommendations on financing arrangements for these health and medical projects, Hong Kong companies can also make use of next-generation IoT technology and their experience in providing sustainable medical care service to Hong Kong’s diversified community in the form of private institution to offer custom-made management solutions to mainland projects.

The 13th Five-Year Plan also devotes great efforts to food safety. It can be expected that the mainland government will strengthen food safety system management as well as food certification, supervision and random check measures in a move to protect public health. At the same time, in order to boost consumer confidence, many food production enterprises have joined voluntary food certification schemes, including food safety and green and organic certification.

These developments will directly bolster market demand for food testing, inspection and certification services. Under CEPA, Hong Kong companies are granted concession to enter the mainland testing and inspection service market, this includes allowing Hong Kong testing and inspection organisations offering certification services to expand their business scope to cover food products and voluntary food certification in Guangdong province on a pilot basis. This can help Hong Kong industry players to capture opportunities arising from the 13th Five-Year Plan.

[1] For more details, please see: http://www.gov.cn/guowuyuan/2015-10/31/content_2957504.htm (31 October 2015); http://www.gov.cn/guowuyuan/2015-11/05/content_5004881.htm (4 November 2015)

[2] For more details, please see: http://news.xinhuanet.com/ttgg/2015-11/03/c_1117029621.htm (3 November 2015); http://www.gov.cn/guowuyuan/2015-11/10/content_5006876.htm (10 November 2015)

[3] For details, please see HKTDC research report: Outbound Investment of Chinese Enterprises: Hong Kong the First Port of Call for Professional Services

[4] Source: China Statistical Yearbook

[5] For more details, please see HKTDC research article: Green Opportunities in the Yangtze River Delta amid China’s Urbanisation Drive

[6] CEPA here refers to the Mainland and Hong Kong Closer Economic Partnership Arrangement and its supplementary agreements.

[7] For more details about CEPA, please see HKTDC industry profile: Environmental Protection Industry in Hong Kong

| Content provided by |  |

Editor's picks

Trending articles

What China's New Economic Diplomacy Means for Business

By the Economist Intelligence Unit

China has grown to be a significant force in global trade over its 36 years of reform, but for most of that time it has not assumed a strong leadership role in trade governance, opting instead to integrate into existing systems. With the launch of the One Belt, One Road (OBOR) initiative in 2013, and the creation of new multilateral financial institutions led and largely capitalised by China, the country may have turned a corner in its international economic policy.

Does this mark the beginning of the end of China’s engagement with the existing institutions of trade and investment governance? If China is pursuing a new paradigm of international trade liberalisation, what does that entail? This report looks at what China’s new economic diplomacy means for regional and global trade liberalisation, and for business.

Please click here for the full report.

Editor's picks

Trending articles

Hong Kong and Singapore: Not a Zero-sum Game

Statistics show that Hong Kong and Singapore complement each other regarding Asia’s electronics supply chain and capital needs. On the other hand, many regional companies have a presence in both economies, reflecting the existence of synergies. The two economies also have complementary roles in the China-led Belt and Road Initiative (BRI).

Nodes Connecting China and Southeast Asia

Among ASEAN countries, Singapore is Hong Kong’s biggest trading partner, with total merchandise trade amounting to HK$300 billion in 2014. Major trade items are electronic parts and components. Most of Singapore’s merchandise re-exports, which accounted for 47% of its total exports in 2014, went to other ASEAN countries (33% of the total), Hong Kong (15%) and China (13%).

Despite the complete implementation in 2010 of the China-ASEAN Free Trade Area, where tariffs between China and ASEAN countries were removed, Singapore’s re-exports to Hong Kong increased by 9% a year in 2009-2014, compared with 5% growth in all markets. Reflected in Hong Kong’s statistics, most of these re-exports were destined for China (84%) in 2014. Re-exports back to Singapore, accounting for 8% of the total, posted particularly strong growth of 31% a year during the five-year period.

Concerning investments, Singapore is Hong Kong’s top source (with cumulated stock of HK$225.9 billion in 2013) and destination of FDI (HK$80.2 billion) within ASEAN countries. In fact, one-fifth of Singapore’s FDI abroad was destined for other ASEAN countries in 2013. Even though FDI from Hong Kong accounted for just 4% of the total, it quickly expanded at 24% a year during 2008-2013, compared with 11% growth of all sources. Singapore’s outward FDI to Hong Kong also increased much faster, at 16% a year during 2008-2013, than China (14%) and all destinations (11%).

Location Choice of Headquarters and Other Business Functions

According to the Asia-Pacific Headquarters Study 2011, which surveyed 67 senior representatives of multinational companies operating in the Asia-Pacific region, the most important criteria for selecting the location of regional headquarters is “proximity of clients/markets”. Other top criteria include a favourable legal and regulatory environment, a stable and favourable political environment, and a favourable business and tax environment.

The survey results echo what we found from the trade concerning the comparison of Hong Kong and Singapore as headquarters. Businesses in Singapore did not see a significant difference in the two economies in terms of the business environment. Therefore, proximity to clients/markets is the most important, if not decisive, factor in making a choice. For businesses with a Southeast Asia focus, Singapore is the natural choice of headquarters. However, Hong Kong is still highly relevant. For instance, some Singaporean companies set up their Hong Kong offices to handle trade documents, manage financial transactions with their China counterparts, and perform staff training, etc. Many affirm the roles of Hong Kong as a sourcing platform, a fundraising platform, a trendsetter in Asia and a springboard to China. Others indicate that Hong Kong is an important market per se. The rise of Asia is not a zero-sum game for Hong Kong and Singapore. Rather, both economies are set to benefit from the strong trade flows and more business activities within the region.

Hong Kong and Singapore’s Complementary Roles in BRI

Singapore is expected to play a number of key roles for the China-proposed Belt and Road Initiative, specifically with regard to maritime infrastructure, shipping and trade, logistics, finance, legal and tourism. First, as one of the countries along the maritime belt – as well as a regional trade, shipping and aviation hub for Southeast Asia – Singapore will be a key node of the new, proposed transportation network. In addition, its knowledge and expertise in international shipping and transportation can provide other ASEAN countries with consultancy services in the process of upgrading their ports and logistics networks.

Second, with its established investment and financial-services markets, strong legal system, and political and social stability, Singapore has been the hub for raising capital to facilitate investment within ASEAN countries. While Hong Kong is expected to be the primary financial platform for funding the infrastructure projects under the Belt and Road Initiative, Singapore offers a good complement – for example, by providing due diligence, contract enforcement and other financial advisory services, leveraging its strong knowledge and experience with other ASEAN markets.

Third, both Hong Kong and Singapore follow the English common-law system. The two economies offer perfect complementarity in holding bilateral meetings, contract negotiation and dispute resolution between China and ASEAN countries.

An integrated tourism market along the land and maritime routes is also part of the Belt and Road Initiative. Hong Kong and Singapore, both international cities in the region, can join in facilitating tourist travel by developing tourism routes and strengthening cooperation in the marketing and promotion of tourism products.

| Content provided by |

|

Editor's picks

Trending articles

China’s Silk Road Initiative Needs Adept Moves in Investment and Politics

By Patrick Low

Patrick Low writes on the need to avoid certain pitfalls as China seeks to push ahead with its One Belt, One Road Initiative.

Please click here to view the article.

Editor's picks

Trending articles

Can the AIIB be a Shot in the Arm for Sustainable Growth in Asia?

By Pamela Mar

Pamela Mar says China's new infrastructure bank could underwrite Asia's efforts to build a sustainable future.

Please click here to view the article.

Editor's picks

Trending articles

The AIIB and Global Governance

By Andrew Sheng and Xiao Geng

Andrew Sheng and Xiao Geng write on the influence China's AIIB could have on areas beyond infrastructure-building.

Please click here to view the article summary.

Editor's picks

Trending articles

Five Reasons for Renminbi Internationalization

By Andrew Sheng

Andrew Sheng says the world needs a strong Chinese currency as much as the Chinese themselves.

Please click here to view the article.