Chinese Mainland

HKTDC Research | 6 Aug 2015

Post-Soviet States Jostle For Role in One Belt One Road Initiative

Following an initially cool reception, many former USSR republics have been lured by the sheer size of China's investment in the OBOR project, with a number of them now keen to capitalise on the wider initiative in line with their own domestic interests, according to Alexander Gabuev, Chair of the Russia in Asia-Pacific Program at the Carnegie Moscow Center.

When Xi Jinping, the Chinese President, made his now famous speech in Astana [the capital of Kazakhstan] in September 2013, announcing the launch of the Silk Road Economic Belt, few post-Soviet leaders took notice. The language of the speech was too vague and the content of Xi's proposals too imprecise to create any meaningful response. As the project matured, however, more attention was paid in all 15 capitals of the former USSR republics.

Questions were raised, though, both about China's internal motivation and about the future routes. Chinese officials' general responses to direct requests and the frequently changing maps of the future routes (published by Xinhua, China's state-owned news agency) didn't offer much in the way of transparency with regard to the initiative.

At the March 2015 Boao Forum, the Chinese National Development and Reform Commission finally presented a blueprint of the One Belt One Road (OBOR) initiative, together with a declaration of its guiding principles. This, coupled with the establishment of the US$40 billion Silk Road Fund, saw the initiative taken much more seriously by officials and business communities across the post-Soviet space.

The reaction of each individual state, though, was largely determined by three factors – the size and structure of their economy, their membership of supranational communities, such as the EU or the EEU (Eurasian Economic Union – Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia), and the level of expertise inside their respective governments and business communities.

The EEU Link

When it was first mooted, Russia's reaction to the OBOR was mixed. Following the initial 2013 announcement, the Kremlin was reluctant to engage in any meaningful negotiation as to how Xi's initiative would coexist with the EEU, the pet project of Vladimir Putin, Russia's President. A number of people in Moscow, concerned over Russia's fading status as a regional superpower in Central Asia, regarded OBOR as an intrusion into Russia's sphere of influence. They, therefore, argued that the Kremlin should pressure the Central Asian states into not participating in the Chinese project. This kind of reaction was one of the major concerns among Beijing's Russia-watching community.

Chinese officials were clearly relieved when Igor Shuvalov, Russia's First Deputy Prime Minister, announced at the Boao Forum that the EEU was ready to cooperate with the OBOR project. He then personally undertook to negotiate a framework document with Chinese leaders on Putin's behalf.

On 8th May this year, during an official visit to Moscow, Xi and Putin signed a joint statement formally linking OBOR with EEU. The document pledged to create a "joint economic space" in Eurasia. China has officially recognised the EEU and has indicated its willingness to deal with this body rather than talk directly to individual member-states. Similarly, the Eurasian Economic Commission, the supranational body of the EEU, has now been mandated to start negotiations on a trade and investment agreement with China. The question of a free trade agreement with China – a sensitive problem for both Russia and Central Asian states given their high levels of protectionism – was declared a distant goal and effectively postponed to a later date.

For the Russian leadership, the agreement came as the result of painful internal discussions. In the end, the Kremlin concluded that the benefits of coordinating the EEU alongside the Chinese initiative outweighed the risks. It is now understood that it is inevitable that China will become the major investor in Central Asia and the major market for the region's vast natural resources.

The only way Russia can maintain its influence, then, is to recalibrate its role in the region to accommodate its own ambitions and Beijing's quest for raw materials, as well as the region's appetite for Chinese money. What the Kremlin is hoping for is a division of labour between Moscow and Beijing in Central Asia. In this grand scheme, China will be the major driver for economic development, while Moscow will remain the dominant hard security provider in the region through its Collective Security Treaty Organization.

The biggest problem now is the actual linking process. Moscow still sees it as a bureaucratic project and has created a team of officials, led by the Ministry of Foreign Affairs (MFA), to write the rules. The reality, though, will be more complicated as China has no masterplan for prioritising land-based routes to Europe and possibly wants to build them all simultaneously – partly in order to secure more projects for its stagnating domestic infrastructure industry. What the terms of the Chinese financial loans will be and how much Russian companies will be involved remains to be seen.

The first project, which both have sought to position as a consequence of linking the EEU and OBOR, is the construction of a high-speed rail between Moscow and Kazan. The Russian Railways initiated the project back in 2012, hoping for government money and a German contractor. In the wake of the Ukrainian crisis, the Railways changed tact and agreed a loan-for-contract scheme with the Chinese.

Another issue for Russia is its concerns that that land-routes through Central Asia and the European part of Russia will undermine the chances of the Trans-Siberian Railway becoming the major land link between the markets of Europe and Asia. As a result, Moscow will be pushing Beijing to include the Trans-Siberian Railway and the northern Baikal-Amur Railway as part of the OBOR project. At the same time it will looking for pledges to improve the infrastructure and regulatory issues regarding the ports of the Russian Far East. Vladivostok, for instance, was declared a free port this year by President Putin. Moscow hopes that Chinese investment, coupled with efforts to facilitate the required transit procedures, will strengthen Russia's position as a bridge between the East and West.

Belarus is also hoping to secure its own role in the project by emphasising (together with Russia) the strengths of the Customs Union, under which a cargo coming from China will need to cross just two customs borders (China/Kazakhstan and then Belarus/Poland) to get into the EU. Previously, Ukraine had some hopes of participating in OBOR, with former President Victor Yanukovich seeking to include Crimean ports in the scheme. Following Russia's annexation of the peninsula and the military conflict in the east of the country, however, Ukraine is now unlikely to be included.

The Stans and the Baltic States

Overall, the Central Asian states – the five "Stans" – may be most affected by the OBOR initiative. Kazakhstan will play an important role as three of the planned Silk Road routes are passing through the country. The Northern Route will be going through northern Kazakhstan, crossing into Russia, then proceeding to the EU either via Belarus or through the Baltic ports.

The Central Route, meanwhile, is intended to cross the Caspian Sea through the ports of Aktau and Baku and then continue to Turkey through Azerbaijan and Georgia. The Southern Route will go through Turkmenistan and then on to Iran. Astana was quick to realize the potential of OBOR and presented its own national infrastructure development plans ("Nur Zhol") as a part of the initiative that needs to be financed. Kazakh officials and entrepreneurs, however, do have a number of private concerns, particularly that China's dominance in all contracts will leave no place for local companies, as well as Russia's likely anxiety about its status and the role of the EEU.

Many of the other Stans have less to offer the OBOR and are, consequently, unable to lobby Beijing for participation in their domestic projects. There are two countries, in particular, which are unlikely to benefit from the OBOR initiative – Tajikistan, due to its worsening security situation, and Uzbekistan, due to the growing isolationism favored by its President, Islam Karimov. Among the Baltic States, OBOR has been most welcome in Latvia – a country that is the principal transit destination in the region, largely thanks to its combination of developed seaports and well-managed railways.

Above and beyond that, a number of problems exist outside of Russia' sphere of influence. A number of big players inside the EU, including both Germany and the Brussels-based European Parliament, haven't decided on their policy and regulatory standing with regard to OBOR-sponsored projects within the EU. The other concern is the EU's worsening relationship with Russia, which may lead to Moscow lobbying for the Baltic States to be bypassed by the OBOR initiative.

Alexander Gabuev is Senior Associate and Chair of the Russia in

Asia-Pacific Program at the Carnegie Moscow Center

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 6 Aug 2015

Sri Lanka: A Key Node on the 21st Century Maritime Silk Road

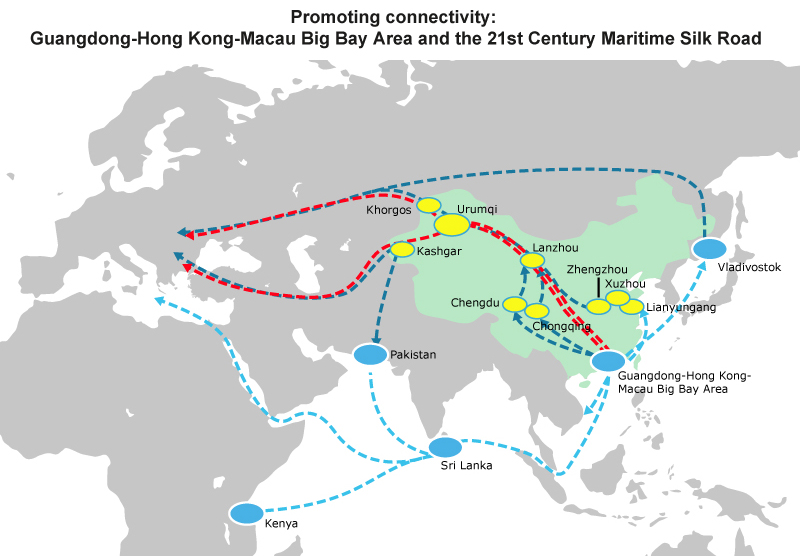

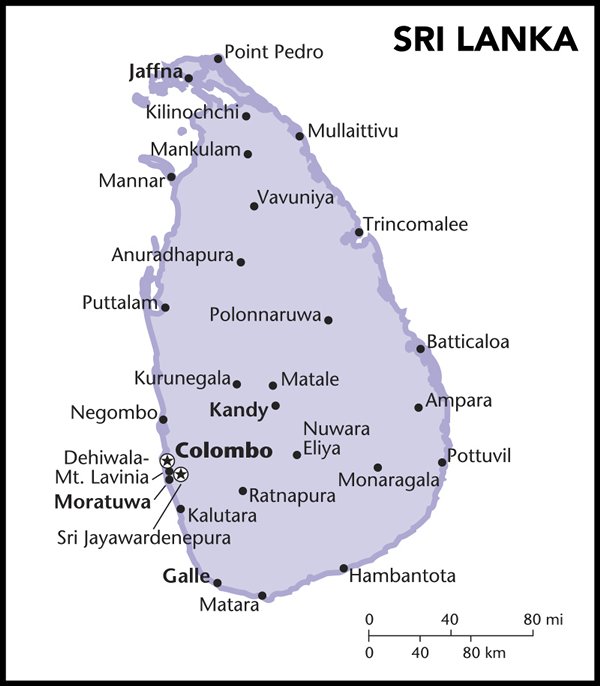

According to Vision and Actions on Jointly Building the Silk Road Economic Belt and the 21st Century Maritime Silk Road, a key strategy document produced by the Chinese government, the “maritime silk road” will consist of two routes, one of which will run from China's coastal ports to Europe via the South China Sea and Indian Ocean. As the key Eurasian shipping route, the Indian Ocean plays a major role in facilitating China’s overseas trade and the transportation of fuel and raw materials. Sri Lanka, an island country in the Indian Ocean, is seen as one of the vital nodes along the maritime Silk Road. In line with this, the Chinese province of Guangdong will ally with Sri Lanka to build the proposed sea-rail multi-modal transportation corridor as part of its participation in the “One Belt, One Road” initiative and the plan of developing the Guangdong-Hong Kong-Macau Big Bay Area into an international logistics hub as part of the Silk Road Economic Belt.

Sri Lanka’s Logistics Strengths

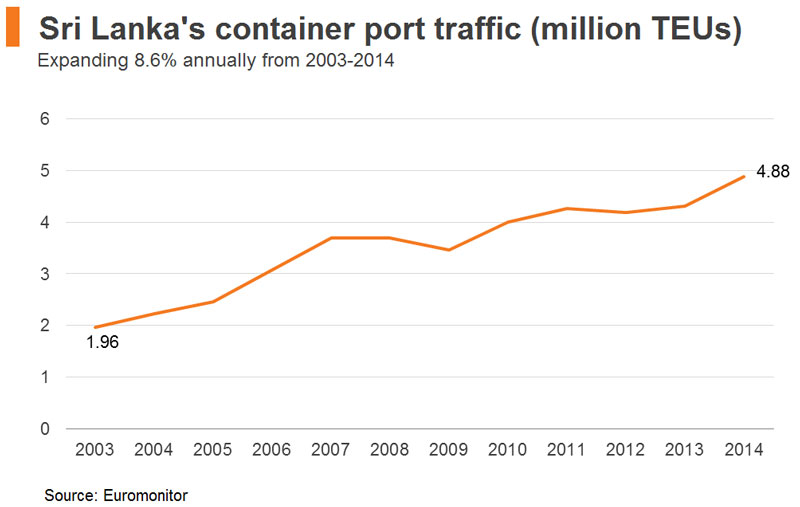

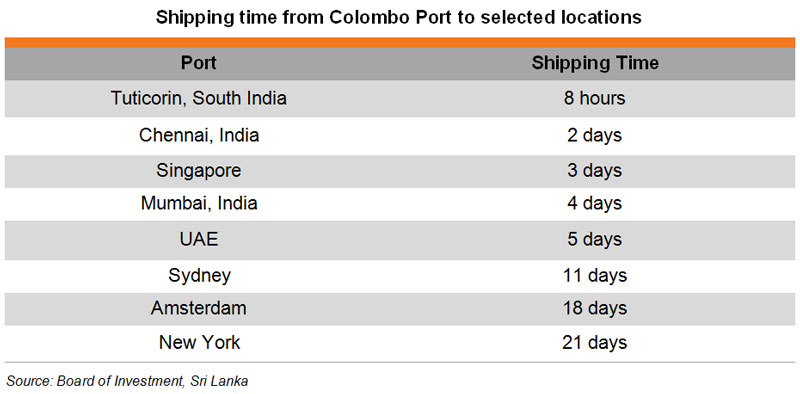

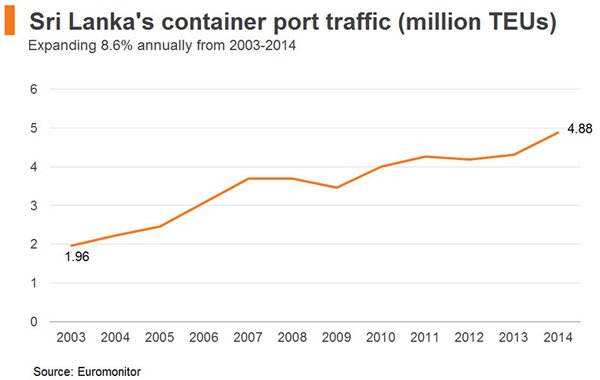

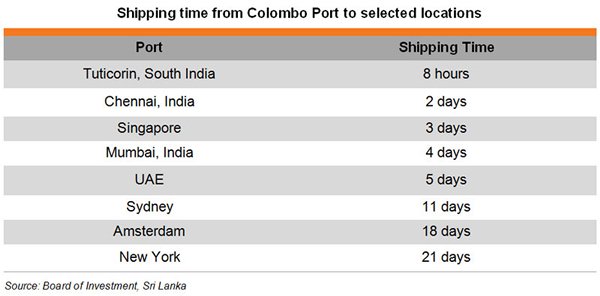

Situated in the Indian Ocean, along some of the world’s busiest shipping routes and close to India, Sri Lanka has a distinct locational advantage, which should see it develop into a key shipping centre and logistics hub in South Asia (See Sri Lanka: An Emerging Logistics Hub in South Asia). Despite being a small economy, with a total trade amounting to about US$31 billion in 2014 (only 4% of India’s US$778 billion), Sri Lanka is an important transhipment hub in the region. It is a site where many shipping companies consolidate and deconsolidate cargo for transhipping to other destinations. In 2014, the Port of Colombo reported a growth of 12.3% in container traffic to 4.88 million TEUs, of which transhipment cargo accounted for 75% of total container throughput.

World Shipping Council statistics show that the Port of Colombo – Sri Lanka’s major container port on the west coast – was the busiest port in South Asia in 2013, handling 4.31 million TEUs. This puts it ahead of India’s largest container port, Jawaharlal Nehru (4.12 million TEUs in 2013).

Port of Colombo

Amid the growing demand for international logistics services, Sri Lanka has launched the Colombo Port Expansion Project (CPEP). Prior to the project, there were three terminals in the Port of Colombo: Jaya Container Terminal, Unity Container Terminal and South Asia Gateway Terminal, with seven main container berths and four feeder berths.

Following the completion of the CPEP, three more terminals will be available. The first of these, the South Container Terminal (developed by Colombo International Container Terminals Limited, a joint venture (JV) between China Merchants Holdings (International) Co Ltd and SLPA) has already commenced operations. This is the first terminal in South Asia that can accommodate a mega-sized vessel. The SLPA-owned East Container Terminal (ECT) will come into operation in late 2015, while the West Container Terminal is still at the planning stage. It is expected that the container handling capacity of Port of Colombo could be increased from slightly more than 4 million TEUs to 12 million TEUs per year, making it one of the world’s largest container ports.

Hambantota Port

In order to further expand the country’s logistics sector, the Sri Lankan government is developing a new port and economic zone in Hambantota, a southern coastal district. Significantly, the designated contractor for the whole project is a JV between China Harbour Engineering Co and Sinohydro Corporation Ltd.

Phase one of the projects has already been completed, delivering a port capable of berthing four vessels and a bunkering terminal that started operation in 2014. The current plan will see the second phase of the port’s development add a container terminal with seven berths, while a dockyard will be added in third phase. It is expected that the construction of phase two will be completed by the end of 2015. While a vast proportion of the project is still under construction, the Hambantota port has already made good progress, handling a total of 388 ships in 2014 - more than double its 2013 throughput.

Although Sri Lanka does not manufacture automobiles, Hambantota is now becoming a transshipment hub for finished vehicles. Given its desirable location, augmented by its deep-water port, carmakers from Japan, Korea and India are increasingly using Hambantota as a nexus for transshipping vehicles built in India, Thailand, Japan and China to markets in Africa, the Middle East, Europe and the Americas. According to SLPA, the port handled 254 Ro-Ro vessels (i.e. ships carrying vehicles) in 2014, an 85% increase on the previous year. The total number of motor vehicles handled approached 190,000 in 2014, compared to about 65,000 in 2013. Aside from vehicles, the Hambantota port is also set to become a transshipment hub for a range of other merchandise, similar to the Port of Colombo. In particular, it is looking to service goods manufactured in OEM plants in other Asian production bases.

Foreign Participation

Despite heavy public and private investment in infrastructure – long considered an essential ”tangible factor” for a logistics hub - Sri Lanka is encountering challenges in terms of “intangible factors”, including access to a sufficient number of qualified professionals and international participants in the field. Not surprisingly, the country’s logistics and transport industry still lags behind a number of the region’s other leading hubs, including Hong Kong, Singapore and Dubai.

Sri Lanka was ranked 89th out of 160 countries in the World Bank’s 2014 Logistics Performance Indicator (LPI). Notably, Sri Lanka scored 2.91 on competence and quality of logistics services, compared to India’s 3.03, UAE’s 3.5, Hong Kong’s 3.81 and Singapore’s 3.97. This indicates a need for Sri Lanka to improve the quality of its logistics services, as well as a requirement for greater investment in “hardware” - ports, roads and railways.

The participation of foreign logistics service suppliers, many of whom could bring in the level of services that meet international standards, is important for the future development of Sri Lanka’s logistics industry. Currently, the permitted foreign shareholding of a shipping agency in Sri Lanka can be up to 40%, while requests for a larger share has to be approved by the Board of Investment (BOI) on a case-by-case basis.

Apart from its locational benefits, Sri Lanka has other advantages likely to appeal to foreign logistics companies. Unlike a number of other developing nations, Sri Lanka seldom experiences port congestion or large-scale industrial unrest. In addition, the relevant costs involved in undertaking international trade in Sri Lanka are cheaper than when carrying out comparable activities among its regional peers. According to the World Bank’s Doing Business Report 2015, the per-container cost for exporting and importing to and from Sri Lanka are, respectively, US$560 and US$690 – much lower than the South Asian average (US$1,923 and US$2,118) and in Mumbai (US$1,120 and US$1,250).

During a HKTDC Research field trip to a Hong Kong-based shipping and logistics services provider operating in Sri Lanka in early 2015, it was pointed out that an increasing number of liner and barge transport companies are moving to the country. This is gradually helping Sri Lanka achieve the economies of scale required to succeed in the logistics industry. APL Logistics, one of the world’s largest logistics companies, for example, has announced it will set up a regional consolidation hub for South Asia in Sri Lanka this year. Its company statement said that the logistics service provider will operate container freight stations, warehouses and other logistics-related businesses in the country. In a similar vein, Hong Kong logistics services suppliers who are considering expanding their business further afield can work with their Sri Lankan counterparts to access the opportunities in South Asia.

Useful Contacts

| Sri Lanka Ports Authority (SLPA) | Tel: (+94 11) 2421201 Fax: (+94 11) 2440651 Email: webmaster@slpa.lk Website: www.slpa.lk |

| The Chartered Institute of Logistics and Transport | Tel: (+94 11) 5657357 Fax: (+94 11) 2698494 Email: admin@ciltsl.com Website: www.ciltsl.com |

| Sri Lanka Logistics & Freight Forwarders’ Association | Tel: (+94 11) 4943031 Fax: (+94 11) 2507577 Email: secretary.general@slffa.com Website: www.slffa.com |

| Ceylon Association of Ships’ Agents (CASA) | Tel: (+94 11) 2696227 Fax: (+94 11) 2698648 Email: info@casa.lk Website: www.casa.lk |

| Shipper's Academy Colombo | Tel: (+94 11) 3560844 Fax: (+94 11) 2874065 Email: enquiries@shippersacademy.lk Website: www.shippersacademy.lk |

| Sri Lanka Shippers’ Council | Tel: (+94 11) 2392840 Fax: (+94 11) 2449352 Email: slsc@chamber.lk Website: www.shipperscouncil.lk |

| Content provided by |  |

Editor's picks

Trending articles

13 Aug 2015

The Silk Road Economic Belt and the 21st Century Maritime Silk Road

By Fung Business Intelligence Centre

While the Belt provides ample opportunities for sourcing resources and commodities from the West and Central Asia, the emerging South and Southeast Asian countries along the Road are potentially vast consumer markets. It was estimated that countries along the Belt and Road would create an “economic cooperation area” that jointly account for 64.2%, 37.3% and 31.4% of the world’s population, GDP and household consumption respectively. The report also pointed out that in implementing the “One Belt One Road” initiative, business opportunities would be seen in sectors such as infrastructure construction, finance, trade and logistics, distribution and retail.

Please visit the Fung Business Intelligence Centre website for the full report.

Editor's picks

Trending articles

HKTDC Research | 20 Aug 2015

Turkey's Business Leaders and Academics Welcome Belt and Road Plan

Despite concerns over the continuing trade imbalance between Turkey and China, the Turkish business community has given a cautious welcome to the Chinese blueprint for streamlining 21st century trade and boosting market access.

Turkey is one of the key stopping-off points along the Belt, and Road Initiative, China's ambitious plan to upgrade the world's trading routes and streamline access to many of the key global markets. The foundations for Turkey's involvement in the scheme were laid as long ago as 2010, with the signing of The Framework Agreement on Further Expanding and Deepening Bilateral Trade and Economic Co-operation Between Turkey and China.

This agreement was designed to facilitate the development of high value building and infrastructure projects for public utilities, telecommunications companies, railways, energy companies, airports, ports and Turkey's highways network. It was also geared to boosting Sino-Turkish trade, then worth around US$28 billion a year, to 50 billion by 2015 and 100 billion by 2020.

With the Belt and Road Initiative seen as the logical progression of this earlier undertaking, a number of Turkish businessmen and academics have cautiously welcomed China's plans. There are, however, several reservations and concerns on the part of the Turkish contingent.

Professor Selçuk Çolakoğlu

Professor of International Relations at Yildirim Beyazit University in Ankara and an advisor for the Center for Strategic Research, under the jurisdiction of Turkey's Ministry of Foreign Affairs.

Since the collapse of the Soviet Union, there have been a number of Silk Road-type projects. In the main, they have suffered from a lack of political will and a shortage of genuine financial support.

The Belt and Road initiative, however, seems to carry with it a presidential eagerness, while also being backed by sizable financial resources. To date, though, the two countries do not appear to have fully realised the potential of the 2010 agreement.

Back then, there was talk, for example, of a high-speed rail project. This has yet to materialise. When the 2010 agreement was signed, expectations were very high. Progress, however, has been slow.

In terms of bilateral trade, there is now something of a problem – a trade deficit highly in favour of China. As a result, Turkey wants to see some balancing factors. In particular, it wants to see more Chinese foreign development investment in Turkey. It wants to see China sponsoring some big projects.

There is enormous potential for this. An improved transport infrastructure would open up markets for Turkish businesses in Central Asia, Pakistan, Afghanistan and China itself, benefitting both countries. There is a need to see more concrete projects, however. If Chinese investment is secured, Turkey will clearly be a key transportation hub.

J Melvin Cottrell

An Istanbul-based business consultant and former Vice-chairman of the British Chamber of Commerce of Turkey with a 35-year history of working in the country.

Rebuilding the Silk Road is a catchy idea. It will appeal to Turks, many of whom take pride in the fact that their language can be spoken all the way to the Chinese border.

There will, however, be difficulties in fully implementing the strategy. China clearly has to keep its businesses happy by finding and developing new markets, but this is a very long road and the Chinese may find there are ways of accessing the Middle Eastern markets that are quicker and more practical.

Dr Altay Atli

Lecturer at Boğazici University and an expert in Sino-Turkish trade relations.

We need to look beyond the trade deficit with China and we need to address the many misconceptions about Chinese products. There is a general feeling in Turkey that goods from China are of a low quality and can be dangerous. Chinese manufacturing techniques, however, are changing fast.

Turkey is reliant on imported technology and China can clearly provide much of that. The entire world, for example, now uses Chinese railroad technology. If some of the proposed transportation projects come to fruition, this will also help Turkey once again fulfil its historical role as the link between Europe and Asia.

One temporary obstacle is that the Chinese and Turkish governments are at odds over China's treatment of the Uyghurs [a primarily Moslem grouping living in China's Xinjiang Uyghur Autonomous Region]. The two parties, however, are in constructive dialogue and my feeling is that the issue will soon be resolved and we can move on. After all, one of the chief beneficiaries of the Belt and Road will be the Uyghur region.

Make no mistake the Chinese very much want this initiative to succeed. China's growth is not only slowing down, its whole business model is changing and is in transition. As a result, it needs to improve the development of its Western regions.

For Turkey, improved transport links will boost its production of oil and gas. They will also prove a boon to those sectors – notably tourism and education where the trade imbalance is overwhelmingly in Turkey's favour. Closer links between the two countries will only enhance these valuable business opportunities.

This year, Turkey is chair of the G20 and next year it is China's turn. I hope and expect that their respective roles will only bring the two countries ever closer together.

Sayhin Saylik

General Manager of Kirpart, an automotive parts company with operations in China.

Of course the Belt and Road concept is a good idea and it should also work. It will not be easy, however, and it will take more time than people think before it is running efficiently.

When it is realised, in some form, I believe this will definitely add to the prosperity of both Turkey and China. Turkey's cultural and historical connection with the Silk Road and its role as the intersection of Europe and Asia place it in an extremely important position within the programme.

Over the last few years, politicians from both countries have underlined the flourishing economic and trade ties between Turkey and China. These have also been highlighted by a number of new projects, notably the establishment of the Silk Road Economic Belt, which will provide for the facilitation of investment and trade along the route.

China and Turkey already have extensive co-operation in a number of areas, such as high-speed rail, electricity generation, aerospace and satellites. Turkey has also become an important overseas engineering, procurement and construction market for Chinese enterprises. The establishment of the Silk Road Economic Belt will further broaden the scope of co-operation between the two countries when it comes to developing infrastructure projects.

Regardless of the Belt and Road, however, the trade deficit between Turkey and China has to be addressed. Apart from that, I have no real concerns about the programme. I believe this will create new areas for co-operation, bring more investment into Turkey and expedite the development of a number of other sectors, notably tourism. This is an opportunity for Turkey to narrow some of the current trade deficit.

As bilateral trade increases among the Silk Road countries, co-operation in a number of major areas – roads, railways, banking, tourism, manufacturing, investment, logistics, energy and tourism – will certainly flourish. As a result, Turkey's business leaders all seem optimistic about the programme and I have yet to hear any negative views being expressed.

If all of the countries concerned work closely together, making the upmost effort to generate mutual benefits, the initiative will be a success. If, however, every country puts its own interests first, the project will surely fail.

Murat Kolbaşi

President of Arzum, Turkey's leading small electrical appliances company, and an executive board member of DEİK, a body set up in 1986 to explore inward and outward investment opportunities as well as looking to increase Turkish exports.

The relations between Turkey and China goes far back and there is our shared history along the legendary Silk Road. In terms of the Belt and Road Initiative, our trade deficit with China does not pose any real obstacle to its success. On the contrary, Turkish culture was originally exported to China along the Silk Road. I believe that the trade deficit will be affected positively by the project.

It will increase our levels of exports to China, particularly with regard to such cultural items as Turkish coffee, Turkish delight, and Turkish bagels. It will also provide a boost to Turkish tourism and to our food exports. I think greater co-operation with China will also provide opportunities for the export of our TV programming, something that will further help spread our culture.

The conclusion of free trade agreements with other countries along the Silk Road is seen as highly desirable by the Turkish business community. The overall initiative has been received positively by the country's commercial leaders.

George Dearsley, Special Correspondent, Istanbul

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 27 Aug 2015

Infrastructure Projects Mount as Africa Readies for Belt and Road

East Africa clearly plays a key role in China's Belt and Road Initiative, with its clear endgame of accessing new markets and additional natural resources, but many nations across the continent are now asking what exactly is in it for them…

In 1896, the British colonial government began construction of a narrow-gauge railway line from the Kenyan port city of Mombasa to Nairobi. Back then, it took three decades to extend the line to Uganda. The initiative, however, did establish a transport corridor, allowing the landlocked British protectorate's natural resources to be shipped out for the good of the Empire.

Today, the railway builders are back. This time, though, it is China's economic integration strategy in East Africa that is behind the construction of a new rapid rail link between Mombasa and Nairobi. The new line, due to reach the Kenyan capital by 2018, will eventually extend to Uganda, Rwanda, Burundi and South Sudan. This is where China's Maritime Silk Road ends and where its trade connectivity with the East African region begins.

The Maritime Silk Road, part of the mainland government's Belt and Road Initiative, will change the way China engages with its trading partners in East Africa – particularly Kenya and Tanzania and, to a lesser extent, Uganda and the Horn. Africa, in general, is a growing consumer market for Chinese products and, at the same time, a prime source of essential mineral commodities.

Developing closer trade ties with Africa, via the Belt and Road, underpinned by investment in new regional infrastructure, is clearly a priority for China. It forms a key part of its broader international drive to restore momentum to its slowing economic cycle, primarily by deriving greater efficiency from its trade links.

Tellingly, a number of China's current infrastructure projects are focussed on East Africa. There are also clear indications that China is prioritising infrastructure investments in the region. In terms of enlightened self-interest, this will provide it with more efficient trade connectivity in the region and allow it to take advantage of Africa's improving economic conditions.

In addition to the East Africa Railway, China is also financing a number of essential port developments, including a US$10 billion deepwater harbour in Bagamoyo on the eastern coast of Tanzania. With many African ports already approaching capacity, China sees port upgrades across the continent as a critical part of its strategy of cementing further trade agreements and opening up trade lanes.

Although the funding sources for specific projects are not always clear, China is financing many of these facilities through a small number of institutions – the Asian Infrastructure Investment Bank, the Silk Road Fund and, specific to Africa, the Forum on China-Africa Co-operation (FOCAC) and the China-Africa Development Fund (CAD Fund). At times, projects are funded from a combination of sources and it's unclear as to the extent to which any such agreements are bilateral or continental in nature.

A number of analysts and scholars believe, however, that there is a direct connection between China's maritime trade strategy and its military plans for the region. It has been widely reported, for example, that China is considering setting up a naval base in Djibouti – already home to the only US naval base in Africa. It is also believed to have plans for Walvis Bay in Namibia.

Assessing the likelihood of this covert agenda, Yu-Shan Wu, a researcher with the South African Institute of International Affairs, said: "Understandably, as Chinese economic engagement expands in Africa, it will inevitably intersect with security issues. The question is whether China's presence could create areas for co-operation on peace and security issues in Africa, or whether it will be perceived as competition. At present, it is too soon to tell."

As its economy slows, China may also be looking to Africa as a cheaper manufacturing base for its more labour-intensive industries. In 2012, the Chinese-owned Huajian Shoes opened a factory in Ethiopia, a country keen to boost its level of industrialisation and attract foreign investment in manufacturing. The project is now often cited as a case study of China's interest in offshoring elements of its production to Africa. Over recent years, there has been a notable increase in the number of funding sources for Chinese businesses looking to expand abroad. In Huajian's case, it was the CAD Fund that backed its Ethiopian venture.

The successful implementation of Chinese offshore manufacturing projects would very much depend on the development path adopted by the African countries concerned. It would be influenced, for example, by whether individual nations were looking to move away from a resource-intensive growth model to more of a manufacturing-based economy. Certain African countries, it could be argued, need the necessary environment and investment that China is willing to provide in order to facilitate such industrialisation. The long-term impact of all these projects, however, will need to be assessed by all of the participants.

It is clear that East Africa is a key part of China's ambitious integration strategy and its bid to engage its Belt and Road trading partners. What is less clear, however, is the particular emphasis that China will place on Africa in the long term or the degree to which its economic drive in Kenya and the region will be of benefit to the wider continent.

Seeing it as a two-way process, Yu-Shan Wu said: "Regional integration is a priority for Africa, and China seems to be addressing those concerns. It is up to individual African countries, however, to determine just what they want from China's engagement. There could, for example, be potential for collaboration between Africa's own regional initiatives – such as the North-South Corridor, an integrated continental transport programme – and the Belt and Road Initiative."

It could, indeed, be argued that while China knows what it wants from Africa, Africa doesn't know what it wants from China. Addressing a conference in Cape Town earlier this year, Nkosazana Dlamini-Zuma, Chair of the African Union, however, left delegates in no doubt as to her stance on the benefits of China's greater economic integration with Africa, saying: "China is putting its relationships with Africa at a different level."

Speaking at the same event, Dlamini-Zuma, a pan-Africanist with a hugely ambitious vision of an economically integrated, connected continent, clearly welcomed China's greater participation. She said: "African states are benefiting from their partnership with Chinese companies in a number of areas, including transport infrastructure integration, energy, broadband technology, and healthcare and disease control."

This kind of ambitious Sino-African co-operation has also been reflected in an agreement between the African Union and China, signed earlier this year. This aims to connect Africa's capital cities through a vast network of road, rail and air transport routes – all of which are to be built by China. The deal has been hailed as the "most substantive project the African Union has ever signed with a partner".

Professor Lin Jiang, Chair of the Department of Public Finance and Taxation at Hong Kong's Lingnan University, believes that both parties can benefit from China's activities in Africa. He said: "The African component of the Belt and Road Initiative offers a new type of opportunity. This is not just open to Chinese private enterprises, but also those African countries that are able to collaborate when it comes to infrastructure development and manufacturing."

China's greater economic integration with Africa, though, is not without its challenges. Many of the countries in the region are among the poorest in the world, raising the question as to whether China will ever be able to make a return on its investment.

Nonetheless, if China's policy solely succeeds in developing infrastructure in the region, it will still make a clear impact. A number of these initiatives – notably the East Africa Railway, which will see high-speed freight trains replacing a 120-year-old colonial railway line and massively reducing the cost of regional transport logistics – will undoubtedly help to support economic growth and trade. For China, and Africa, it could well be a strategic win-win outcome.

Mark Ronan, Special Correspondent, Cape Town

| Content provided by |  |

Editor's picks

Trending articles

Fung Business Intelligence | 2 Sep 2015

Asia Sourcing South and West Asia Sep 2015

BANGLADESH

GARMENT EXPORTS TO US REBOUND IN 1H15

Bangladesh’s apparel exports to the US bounced back in the first half of the year, as the political situation began to stabilize and safety compliance in factories was showing pr ogress, drawing US buyers back to the country.

In the first six months of this year, Bangladesh’s garment exports to the US rose 9.5% yoy to US$2.68 billion, according to the Office of Textiles and Apparel (OTEXA) under the US Department of Commerce. In 2014, Bangladesh’s garment exports to the US fell 2.2% yoy.

Although the country’s garment exports to the US registered a significant rebound, the growth is still lower than those of other regional contenders. In the same period, garment exports to the US from Vietnam, India and Sri Lanka grew 15.4% yoy, 10.0% yoy and 16.5% yoy, respectively. At the same time, FOB prices of Bangladeshi garments did not increase in line with the rising production cost (particularly due to wage hike and rising electricity prices), raising concerns over the industry’s long-term development.

CLUSTER RELOCATION DELAY POSES RISKS TO LEATHER SECTOR

In the fiscal year 2014-15 (1 July 2014 – 30 June 2015), Bangladesh exported US$1.13 billion worth of leather and leather goods, making the leather sector the second largest contributor to national exports after the garment sector. Key export categories in the sector include leather shoes, travel bags, wallets, belts and finished leather.

For decades, pollution from Dhaka’s tanneries has poured into the Buriganga River, wiping out aquatic life and forcing the city to rely heavily on groundwater for washing and drinking. In response, the country’s high court has ordered tanneries in the city’s Hazaribagh subdivision, which process over 90% of the country’s leather, to relocate to the outskirts of the city at the Savar subdivision, where there will be a modern industrial campus with a central effluent treatment plant (CETP).

On 19 August, the government decided to extend the relocation again from December this year to possibly July 2016, as the installation of the CETP is delayed. The deadline was originally set at June this year. If the relocation cannot be carried out swiftly, polluting activities in Hazaribagh may once again come under scrutiny by environmental groups.

BGMEA PROMISES TO EM PLOY PEOPLE WITH AUTISM

In a unique event on 20 August spearheaded by Saima Wazed Hossain Putul, US-licensed school psychologist and chairperson of the National Committee on Autism and Neurodevelopment Disorders, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) announced that the garment industry is going to recruit people with autism in a move to create job opportunities for them.

Workers with autism are focused and enjoy repetitive tasks that other workers tend to dislike. They follow routine strictly and are suitable for tasks such as quality control, numbering, placing stickers, collar pressing, button matching, poly packing and cleaning. They can also work as security guard and liftman.

During the event, Putul stressed on the need to create a model for employing people with autism. Autistic children’s training must be started at a very early stage to identify their area of interest, as they will work only on what interest them, and those interests have to be matched with manufacturers’ needs.

To view the full article, please go to page top to download the PDF version.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 8 Sep 2015

Hong Kong Services for Mainland’s Outbound Investment (5): High-end Logistics Services Help Bolster International Business Expansion

As Chinese investment rapidly turns outwards, many mainland enterprises are seeking expansion by leveraging their overseas investments in conjunction with domestic and foreign supply chains to develop high value-added business. Such moves have generated a keen demand for high-end logistics services. Hong Kong, as a trade and logistics hub in Asia Pacific, is highly experienced in international logistics management. In an increasingly demanding market, local players can provide mainland investors with one-stop logistics services by making use of the latest generation of information technology in areas such as high quality cold chain logistics services and their extensive international logistics networks.

Meeting Demand for Integrated Services

Samuel Lau, Executive Director of Kerry Logistics (Hong Kong) Ltd, told HKTDC Research: “The demand of mainland enterprises for high-end logistics services is growing, particularly for integrated services. Logistics services ranging from production transport to sea-air intermodal transportation, warehouse management, customs clearance, inspection and quarantine, buyer data processing, and bank collateral / insurance are all in great demand.

“While mainland enterprises have a sound domestic network, the majority of mainland service suppliers and third-party logistics enterprises only provide basic services, such as cargo transport, loading and unloading, and local delivery. These, however, can barely meet the market demand for high-end international logistics services.”

Headquartered in Hong Kong, Kerry Logistics has a global logistics distribution network comprising more than 550 offices and 20,000 employees that provide integrated logistics, international freight forwarding services, and supply chain solutions. Clients include well-known international brands in various industries, such as trendy fashion and premium goods, electronics, food and beverages, fast-moving consumer goods, industrial and materials technology, automobiles and pharmaceuticals. The group has offices in key cities in China which, backed by its mainland networks and company resources, supply a full range of logistics services to mainland and foreign-invested enterprises.

Lau said: “As the number of middle-class-and-above consumers continues to increase on the mainland, consumer demand for upmarket live, fresh and imported food will stay strong. This has stimulated demand among distributors and importers for cold chain logistics services to deliver such food products. Meanwhile, medicines and certain electronic parts and components also require cold chain logistics for storage and delivery in a low-temperature environment.

“As mainland enterprises further invest overseas and strengthen their sourcing of high-end products – and as they set up production lines in foreign countries – they have consolidated connections between China and the world in terms of consumer goods and the high-tech products supply chain. As a result, demand for high-end cold chain logistics services keeps surging. No matter whether they are exported from or imported into the mainland, these goods must be kept in a strictly specified low-temperature environment at every stage of the delivery process to assure quality and reduce the chances of damage and deterioration.”

Apart from supplying advanced cold chain logistics services, Lau said that Hong Kong logistics providers use advanced monitoring and Internet of Things (IoT) technology to supervise the whole transportation process. Stringent inspection and testing services are also in place to check goods when they arrive at the cold storage to ensure that the refrigerated goods have not spoiled or been contaminated during the journey. “This, coupled with effective one-stop, value-added services including information and warehouse management, and customs clearance, can satisfy the demand of high-end clients for logistics services.”

Capturing the Belt and Road Opportunities in ASEAN Market

China is currently embracing the Belt and Road development strategy. The Belt refers to the economic belt along the Silk Road, and the Road refers to the 21st Century Maritime Silk Road. As ASEAN’s economy becomes increasingly buoyant, Lau noted that the “go global” strategy of mainland enterprises is embracing investment in manufactories in the ASEAN market. In turn, demand from ASEAN and mainland enterprises operating there for logistics and transportation services is bound to rise rapidly. To effectively serve ASEAN and mainland clients, Kerry Logistics, as a pioneer service provider in cross-border transportation in ASEAN, has launched Kerry Asia Road Transport (KART). This overland cross-border transport network links ASEAN countries and China, and supplies high-efficiency long-haul overland transport and door-to-door delivery services.[1]

Lau said: “As China’s economy grows, in future the one-sided situation of foreign firms coming to invest in the China market will come to an end. Rather, mainland enterprises will quicken their pace of “going out” to foreign markets to invest and “bringing in” foreign resources. In the course of this “going out” and “bringing in” strategy, they can make use of Hong Kong’s highly efficient logistics services to link up mainland and foreign supply chains. They can also take advantage of Hong Kong’s trade and logistics networks in the Asia-Pacific region to support their investment activities in ASEAN and other Asian markets in preparation for business opportunities resulting from the mainland’s Belt and Road Initiative.”

[1] KART’s operation headquarters is located in Bangkok, Thailand. Its service network covers seven logistics centres which operate seven routes linking ASEAN and the Chinese mainland, offering cross-border transportation services. Visit Kerry Logistics website for further details.

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 9 Sep 2015

Singapore Bids to Play Pivotal ASEAN Role in Belt and Road Initiative

While welcoming the Belt and Road Initiative, Singaporean business leaders, academics and politicians have emphasised the need for 'co-creation' in order to ensure that all participating countries fully commit to China's economic masterplan.

The potential impact of the Belt and Road Initiative on Southeast Asia needs to be viewed through the prism of China's robust relationship with Singapore, as well as its diplomatic ties to the ASEAN bloc, according to many in the region. The complexity of these relationships means that China is obliged to take a distinctly à la carte approach to dealing with the ASEAN nations. In some cases, it would be best to deal with certain countries directly, while others might be best accessed via Singapore, with a number of the remainder more appropriately tackled as a constituent part of ASEAN.

Dr Zhao Hong, a Visiting Senior Fellow with Singapore's Institute of Southeast Asian Studies, has clear views as to the value of the Belt and Road. He says: "China is coming to terms with the 'new normal' of slower, but better quality, growth and this marks a shift in strategic thinking towards engaging neighbouring countries.

"For Southeast Asia, the initiative provides an attractive platform for mutually beneficial economic development in various fields, notably infrastructure and industrial production. It also fits in with ASEAN's Masterplan on Connectivity and the vision of the Indonesian President, Joko Widodo, with regard to enhancing his country's maritime capability."

The fact that Xi Jinping, the Chinese President, chose to launch the Belt and Road Initiative in Indonesia in October 2013 is seen as an indication of the importance that China attaches to its ASEAN partners. Just over a year later, in November 2014, Indonesia announced a US$6 billion plan to develop its port infrastructure across the archipelago.

Xuhua Huang, a Singapore-based Partner with King & Wood Mallesons, a global law firm, sees the initiative as being the key driver of growth for Southeast Asia. He says: "By capitalising on this initiative, Southeast Asia will become one of the primary destinations for those Chinese enterprises seeking to expand globally. Undeniably, China's recent deal with Thailand on the construction of the Thai section of the Singapore-Kunming rail link brings this dream one step closer to fruition. This sees ASEAN members – with Singapore at the centre – inextricably moving closer to forging an impressive pan-Asian trade sphere. Singapore's next step, as one of the region's leaders in infrastructure and logistics, will be to aid neighbouring countries and fellow trading partners in developing their own resources."

With Singapore the most economically advanced country in the Southeast Asian region, Huang sees it as likely to take a lead role in bringing the Belt and Road Initiative to fruition. This was borne out by a March 2015 survey by Grand View, a Chinese think-tank, which ranked Singapore as the country with the highest investment value out of the 64 nations included on China's proposed programme.

Expanding on Singapore's likely role, Huang said: "The country's key industries have already drawn the attention of many Chinese businesses looking to invest in the region. In fact, a significant number of mainland enterprises have already successfully integrated their regional resources and achieved internationalisation through investing via Singapore. It is no surprise that Singapore has established itself as the second leading offshore hub for Rmb trading.

"We also expect to see Singapore's status become more prominent as a shipping and aviation hub for Southeast Asia. There is also likely to be an increase in trade and personnel exchange across the region. This will come as an inevitable consequence of the construction and development of a variety of infrastructure projects, such as ports and airports.

"At the same time, we anticipate that Singapore's central role in Southeast Asia's financial, trade and logistics services will expand significantly. These enhancements will be driven by the Initiative, but complemented by Singapore's established investment and financial services markets, its strong legal system, sound infrastructure and experience in financial systems, as well as by its political and social stability."

At the government level, many are also optimistic as to Singapore's likely role in the Belt and Road. Josephine Teo, Singapore's Minister of State for Transportation, says: "Given the scale of the Initiative – in particular, the maritime component that potentially spans 65 countries across three continents – there is much to be gained by approaching the Belt and Road as a process of co-creation. This will allow participating countries to see themselves as being capable of influencing the outcome, while retaining a sense of ownership over the pace and texture of any collaboration. If this can be achieved, the Initiative will usher in a new era of co-operation that will benefit all concerned."

The Minister also saw opportunities not just for Singapore, but also for Singapore's role within ASEAN. Highlighting this, she said: "Countries along the maritime belt will inevitably benefit from participating in the co-creation of this Initiative. Given Singapore's roots as a regional trading hub, it should adopt a more active role in a number of key areas related to connectivity, namely transport, finance and trade.

"Businesses can also operate out of Singapore to tap growth opportunities in the larger ASEAN and broader Asian region. It is important to remember, that the Initiative is not just ASEAN-related. The Belt and Road also extends to Asia, West Asia, and Eurasia – and we must not forget that. Those who have already set up businesses in China or elsewhere in the region will be able to expand further with every new flow developed under the Belt and Road programme."

Teo's words came in July this year as part of her address to the first Singapore Regional Business Forum, an event organised by the Singapore Business Federation (SBF). The forum saw 400 delegates from 18 countries discuss the implications, opportunities and challenges represented by the Belt and Road Initiative.

Assessing the prospects for the programme, Teo Siong Seng, Chairman of SBF, said: "The Belt and Road is an important initiative in terms of collaboration and sustainable development, specifically with regard to maritime infrastructure, shipping and trade, finance, tourism, hospitality and culture. Its success will inevitably result in huge economic, social and political benefits for Asia.

"As part of this, Singapore will leverage its role as a major financial, transportation, logistics and maritime hub in order to facilitate trade and investment in this fast-growing region."

While the vision is still taking shape, Teo believes that managing the multilateral ties and existing agreements will be critical for its success, especially bearing in mind its multinational scope. He said: "It all has to be achieved through mutual understanding. While the project has been initiated by the Chinese, we have to look at it as being owned by the people all along the route, ensuring that the flow can be truly smooth."

One note of caution, however, comes from Professor David Lee of the Singapore Management University. He said: "It is not possible for China and a number of ASEAN countries to dispel all reservations and co-operate merely on the basis of economic gains. Trusted by both sides, Singapore could act as a platform for China to enter the ASEAN market.

"Furthermore, Singapore could adopt a strategy in line with its Smart Nation policy, which has seen it committed to setting up infrastructure to boost internet finance and inclusive investment. This is seen as not only likely improve the quality of life in the more underdeveloped ASEAN regions, but also as a boost for Singapore's leading role in the bloc."

While it is only logical that Singapore will play a key role in the maritime components of the Belt and Road Initiative, the country sees itself as having a wider remit. In line with this, Singapore has long been investing in building ties with China – most notably with the Shaanxi province, a focal point for the new economic initiative and a region where Singapore has a 25-year trading history.

In April this year, marking this quarter-century milestone, the Shaanxi provincial government and the Commercial Bank of China organised a commemorative forum for industry and government leaders. As part of the event, five Singaporean companies and five Chinese private and government entities signed agreements aimed at furthering their collaborative efforts, with a particular focus on finance, logistics, technology and tourism.

Ronald Hee, Special Correspondent, Singapore

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 14 Sep 2015

Africa Welcomes Belt and Road but Still Cynical of Mainland Motives

While many of the aims of China's Belt and Road Initiative are seen as broadly aligning with a number of projects already underway across much of Africa – notably Kenya's Vision 2030 – some need convincing of the mainland's true agenda.

Broadly speaking, China's Belt and Road Initiative could be seen as largely in line with Africa's own plans for economic growth. Infrastructure improvements, resource development, trade integration and improved funding structures have all been identified as priorities across the continent.

At the same time, improved access to Africa's lucrative market is very much a priority for the Chinese government. Chinese investment in Africa has risen sharply over the last 15 years. Overall, Africa has been seen as one of the few areas experiencing robust economic growth, with the continent seen as the new frontier for Chinese business since the early 2000s.

Back in 2014, Li Keqiang, the Chinese Premier, visited Kenya, Ethiopia, Nigeria and Angola. His mission was to pledge further Chinese investment to the continent, particularly with regard to infrastructure development. He also confirmed a US$2 billion boost for the China-Africa Development Fund, an initiative established to invest in Sino-African joint ventures.

During the course of his visit, Li predicted that Sino-African trade would double to $400 billion by 2020. In Kenya, he pledged support for a number of the flagship projects outlined as part of Kenya's Vision 2030 development plan. He also encouraged Chinese financial institutions and businesses to invest in Kenya, while promising to ensure Kenyan products enjoyed enhanced access to the Chinese market.

Overall, the Belt and Road Initiative is potentially hugely significant for many of Africa's economies. For many years, China's growth has been resource-intensive, heavily dependent on – and favourable to – Africa's extractive industries. China's economic development, though, is now seen as having entered a new phase.

Africa, the world's fastest-growing continent, has a combined population of one billion, with its constituent countries now emerging as potentially significant consumer markets for Chinese goods and services in the own right. For this trade to materialise, however, significant upgrades are required in the transport infrastructure of many of the target nations.

In terms of priorities, much of China's activity is currently focussed on the infrastructure and logistics challenges in East Africa, the region seen as the gateway for Chinese economic and political interests. In Kenya, China is playing a key role in the construction of the East Africa Railway. Initially, this will provide a fast freight transport link between the Indian Ocean port of Mombasa and Nairobi, the country's capital. Ultimately, the link will also extend to neighbouring Uganda, Rwanda, Burundi and South Sudan. China is also investing in upgrades to several African ports on both the east and west of the continent. This is in a bid to increase port capacity, while accelerating the interconnection and regional integration of East Africa.

According to a report published by the Forum on China-Africa Co-operation (FOCAC), Africa needs to spend $95 billion a year on new roads, railways, electricity and ports, but lacks dependable local funding sources for such initiatives. As part of the solution to this investment shortfall, the report also highlighted the importance of China's funding for Africa's power infrastructure, tourism and telecommunication sectors.

China's economic integration with Africa is also likely to take the form of offshore manufacturing, an inevitable consequence of China's bid to rebalance its economy. Rising cost pressures in China's domestic manufacturing industries are seen as likely to lead to production being relocated to Africa, as well as to other low-cost regions. Already, a number of Chinese companies are manufacturing textiles and certain FMCGs in Africa.

Sino-African economic relations may well come to be defined by this new model, as Africa needs to remedy the shortfall in its domestic manufacturing resources. Despite this perceived requirement, a number of analysts and policymakers are uneasy over China's growing economic neo-colonial position in Africa and its clearly self-interested agenda. Ultimately, China still has a lot of work to do if it is going to convince many in Africa of the mutual benefits of the Belt and Road Initiative.

Already the process of educating Africa as to the likely benefits has begun, with Hong Kong playing a key role as an emissary of mainland interests. Speaking in South Africa last month, Perry Fung, the Hong Kong Trade Development's Regional Director for the Middle East and Africa, referred to China's slowing economic growth and recent financial market volatility as "the new normal".

Fung, however, contrasted the mainland situation with Hong Kong's ability to maintain a firm hand on the financial rudder as the Chinese markets nosedived. Its global perception as a reliable, established financial and services centre may well see Hong Kong established as the financing platform for many of the countries embraced by the Belt and Road Initiative.

As part of the mainland initiative involves increased Chinese outward direct investment for the emerging markets, Fung was quick to suggest this would be mainly channelled via Hong Kong. He said: "Currently, 57% of the mainland's outbound investment goes to or via Hong Kong.

"Hong Kong serves as a key hub for funnelling China's overseas investment, so the city's service providers can help China seize the Belt and Road opportunities. Hong Kong is the largest offshore capital-raising hub for Chinese finance and has a pivotal role to play in financing the private enterprises involved in the strategy."

At the moment, despite Fung's evangelical zeal, the jury is out. While some see China's Belt and Road Initiative as likely to reinvigorate Africa and boost innovation the region, others believe only Africa can solve Africa's problems, remaining highly sceptical as to China's true motives.

Either way, it is evident that both Africa and China are at a crucial stage in the development of their economies. The Belt and Road strategy clearly demonstrates that China knows where its best interests lie. The challenge remains to convince many in Africa that the strategy also aligns with their own long-term goals.

Mark Ronan, Special Correspondent, Cape Town

| Content provided by |  |

Editor's picks

Trending articles

HKTDC Research | 29 Sep 2015

Hong Kong Services for Mainland’s Outbound Investment (7): Effective Tax Planning a Prerequisite for “Going Out”

China has gradually become a net capital exporter with its outbound direct investments recently surpassing foreign investment into the country. Jane Hui, a Hong Kong accountant specialised in corporate mergers and acquisitions (M&As), restructuring and tax planning, reckons that the mainland enterprises involved in such activities will need effective professional services support, notably tax planning. This will help them achieve efficient use of investment capital, as well as long-term, sustainable development goals for their outbound capital investments. With China’s Belt and Road Initiative set to facilitate this “going out” activity, this will further stimulate professional services demand and provide tremendous business opportunities for Hong Kong players.

Diversified Investments Sustained by Professional Services Support

Hui is a partner of Ernst & Young[1] accounting firm. She told HKTDC Research, “China’s private enterprises are continuously growing in strength, being an increasingly important source of the country’s overseas investments. Early stage investments had previously focussed on energy and mineral resources. Now, the focus has changed, with greater emphasis on technology, real estate, financial services, agriculture, the medical sector, etc. This has broadened China’s outbound investment portfolio, while eliciting demand for a wide range of professional services in order to support the increasingly frequent and complicated global aspirations of the enterprises.”

Hui pointed out that many mainland enterprises are focussed on their capital costs when “going out”. Although the importance of investment risk control is starting to be recognised, many enterprises are not yet aware as to how international tax arrangements can impact their overseas investments. This is despite the fact that taxes may directly affect their capital use efficiency and unnecessarily raise the cost burden of the whole investment project.

She said, “Every stage of an overseas M&A project requires an assessment of all the relevant tax factors and their impact. In the early ‘strategic analysis’ stage, a transaction structure, taking into account the tax factors, should be in place in order to properly evaluate the initial value of the potential investment target. Then, at the ‘transaction strategy confirmation stage’, a deeper insight into the investment target’s local tax environment, along with any bilateral tax agreements with China or other regions could ensure any transaction structure maximising the potential tax benefits. Such an approach could also simplify a number of related components, such as taxes and any stamp duty payable on immovable property transactions. At the final ‘transaction realisation’ stage, assessing the tax costs of different financing formats in line with other financial due diligence procedures will help establish comprehensive financial and tax structures for the whole investment project.”

Effecting Tax Planning

Hui further noted that using unnecessarily complicated transactions or company structures to undertake overseas investments would not automatically reduce tax burdens. She said: “Complicated structures may affect not only the investment’s future operational costs and efficiency, but may also create barriers for the investors’ future asset transactions or investment exits.”

With regard to tax burdens, Hui said different countries or regions have different “anti-tax evasion” regulations. If an outbound investment project proved non-compliant with the requirements, the corporate income it generates would still fall under the respective tax net.

China’s income tax laws and related implementation rules, for instance, stipulate that a mainland-funded enterprise established offshore may or may not be required to pay income tax on the mainland, subject to the consideration of a series of relevant factors. These include: the location of ordinary residence of the company directors and senior management; their daily decision-making procedure with regard to operational, financial and human resources matters; as well as the prime assets, accounting and shareholders meeting records storage locations. Company structure alone would not take into account all of these considerations.[2]

Hui believes that in terms of addressing the business environments of different countries, Hong Kong can provide not only tax, accounting, legal and other professional services, but also render considerable support for the many “going out” needs of mainland enterprises. In addition, Hong Kong’s professional services providers are well versed in the tax and regulatory environments of the mainland and overseas markets.

Moreover, Hong Kong has decades of experience in offshore asset management, plus a highly efficient business operation environment and free flow of information, making it well placed to support mainland investors when it comes to effective tax planning and the avoidance of unnecessary tax burdens.

Looking ahead, mainland enterprises are set to “go global” with outbound investments, by capitalising on the Belt and Road Initiative of the central government. This will undoubtedly heighten demand for all kinds of professional services, and present far more business opportunities for Hong Kong’s professional service providers.

[1] Ernst & Young is one of the world’s largest professional services organisations. It has been providing Greater China with professional services for four decades and currently has a 14,000-strong workforce. Apart from its Hong Kong office, Ernst & Young also runs an extensive office network in China. It was among the first group of international professional services organisations to be granted permission to operate businesses in China.

[2] Please refer to China’s Enterprise Income Tax Law and related implementation rules for the mainland’s “anti-tax evasion” regulations.

| Content provided by |  |