Chinese Mainland

Industrial Co-operation under the Belt and Road Initiative

In line with the Belt and Road Initiative (BRI), trade co-operation between Malaysia and China has been strengthened by the countries jointly establishing two industrial parks – one in Kuantan in Malaysia, the other in Qinzhou in the Chinese region of Guangxi. Under the context of ‘Two Countries, Twin Parks’ [1], these industrial parks are intended to enhance the regional supply chain management and optimise the flow of trade and investment which runs between Malaysia and China.

One of the chief aims of the BRI is to encourage countries along the BRI to improve investment and the ease of trade facilitation. To this end, the BRI attempts to improve the capability of customs clearances and the coordination of cross-border supervision.

Malaysia is an important gateway for trade along the 21st Century Maritime Silk Road. At present, China and Malaysia are in the process of forming a cooperative ‘port alliance’, which seeks to fast-track trade flows by raising customs efficiency. It has been reported that, in addition to their contribution to trade cooperation, the new industrial parks could also serve as a testing ground for joint customs clearances between the two countries. Such a development might contribute to the advancement of the strategic direction of regional trade facilitation under the BRI.

The Malaysia-China Kuantan Industrial Park (MCKIP) is the first industrial park in Malaysia jointly developed by Malaysia and China, as well as the first to be accorded ‘National Park’ status. Its sister park in Guangxi, China is the Malaysia Qinzhou Industrial Park (CMQIP). Together, the two parks have been identified by both governments as an ‘Iconic Project for Bilateral Investment Co-operation’, which will drive the development of industrial clusters in both countries.

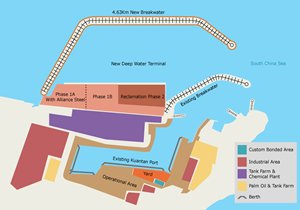

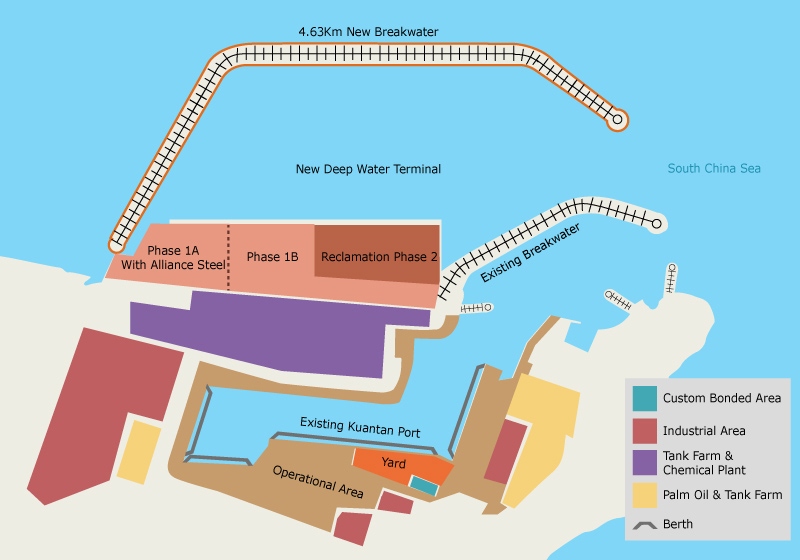

Kuantan Port will be an important gateway for logistics services for MCKIP, which is located just 10 kilometres away. At present, Kuantan Port mainly handles bulk cargoes for nearby industrial areas. In order to meet increased demand in the future, Kuantan Port is currently expanding its bulk cargo terminal. It is developing a new deep-water terminal (NDWT) which aims to become a container port for trans-shipment cargoes.

In June 2016, Kuantan Port received approval from The Ministry of Finance in Malaysia to establish a Free Zone port, so that it can provide value-added services for trans-shipment cargoes. Kuantan Port will act as the catalyst for MCKIP, with the synergy between the port and the industrial park forming a dynamic platform for investors expanding their business in the ASEAN region.

MCKIP: A Government-to-government Collaboration

Source: Kuantan Port Consortium

In 2008, the Malaysian government established the East Coast Economic Region Development Council (ECERDC) in order to develop and stimulate growth on the east coast of Peninsular Malaysia. It is a statutory body designed to spearhead the socio-economic development of the East Coast Economic Region (ECER) [2]. The five key economic sectors here are manufacturing, oil, gas and petrochemicals, tourism, agriculture and human capital development. The launch of MCKIP in 2013 has been one of the key milestones for the ECER.

By collaborating with Malaysia on the development of MCKIP, China can further enhance the flow of its trade and investment with Malaysia. At the same time, MCKIP provides a ‘going out’ platform where Chinese companies can expand their production capacities along the Belt and Road countries, in order to get closer to their final markets, in particular within the ASEAN.

MCKIP is a bilateral Malaysia-China government-to-government collaboration. MCKIP Sdn. Bhd. (MCKIPSB) is a 51:49 joint venture between a Malaysian consortium and a Chinese consortium. IJM Land holds a 40% equity interest in the Malaysian consortium; together, Kuantan Pahang Holding Sdn. Bhd. and Sime Darby Property hold 30% and the Pahang State Government holds the remaining 30%. The 49% stake of the Chinese consortium is held between the state-owned conglomerate Guangxi Beibu Gulf International Port Group (with a 95% equity interest) and Qinzhou Investment Company (the remaining 5% interest).

Positioning of MCKIP

MCKIP targets heavy industry and high-end/high technology industry. These include energy saving and environment friendly technologies, alternative and renewable energy, high-end equipment manufacturing and the manufacture of advanced materials. There are three distinct phases within the industrial park, namely MCKIP 1 (which consists of 1,200 acres of land), MCKIP 2 (1,000 acres) and MCKIP 3 (800 acres).

The construction of MCKIP 2 and MCKIP 3 should take place concurrently. While MCKIP 2 is designated for high-end and high technology industry development, MCKIP 3 is designated for multi-purpose development (including light industry, commercial property, residential areas and tourism parks). The entire MCKIP building project is expected to be completed in 2020. Since MCKIP 3 is intended for an assortment of different business opportunities, it is believed that it will attract foreign investment from a wide variety of countries for various purposes.

MCKIP 1 is designated for high technology industries and heavy industries. The first investor to be established there is Alliance Steel (M) Sdn. Bhd. [3] (Alliance Steel), which has been granted approval to invest RM5.6 billion in its facility in 2016. Its production site, which will cover 710 acres of land, is currently under construction. The steel mill is expected to be operation by the end of 2017. Once it is in full service, Alliance Steel expects to generate more than 3,500 job opportunities.

|

Alliance Steel (M) Sdn. Bhd. It’s estimated that the annual local demand for steel in Malaysia is over 10 million tonnes. However, the existing production facilities of some local steel mills are lagging behind in terms of productivity and technology innovation. Bringing in a new investor in the form of MCKIP will enhance the productivity and quality of steel production in Malaysia. Inspired by the Belt and Road Initiative, there are many infrastructure and construction developments now in progress along the 21st Century Maritime Silk Road. With its current production facilities in Guangxi, Alliance Steel is expanding its production facilities in MCKIP in order to meet the rising demand for steel in the ASEAN and international markets. Alliance Steel aims to upgrade levels of production technology and increase the degree of production automation in Malaysia’s new production sites. Its integrated modern steel mill will apply China’s most technologically advanced manufacturing process to produce the best quality high carbon steel rods, wires and H-shaped steel. Within its enclosed integrated steel mill, conveyor belts will be used to ensure the smooth flow of material and thereby streamline the operation. All waste water will be recycled and reused in the production process in order to minimise the impact on the environment. According to Alliance Steel, it will source raw materials from Malaysia as much as possible. Yet, some raw materials may still need to be imported. Maritime transport from China’s Qinzhou Port (in Guangxi) to Malaysia’s Kuantan Port takes just three days. In the early stages of its new operation, Alliance Steel may recruit some technicians from China before training up local talent in Malaysia. Alliance Steel is also co-operating with Malaysia’s institutions to establish a training programmes for local people, in order to enhance their metallurgy operation techniques. In this way, it will further strengthen the social and economic ties between two countries. |

Besides Alliance Steel, many China-based companies are planning to expand their production bases to MCKIP in order to extend their supply chain coverage within the region. For example, Guangxi Zhongli Enterprise Group Co. Ltd. will invest RM2 billion for the development of manufacturing of clay porcelain and ceramic in MCKIP 1. Meanwhile, ZKenergy (Yiyang) New Resources Science and Technology Co. Ltd. will invest RM200 million for the development of an engineering and production-based centre that will produce renewable energy for MCKIP’s own consumption. This will help MCKIP to position itself as a leading ‘green’ environmental-friendly industrial park.

In addition to the aforementioned projects in MCKIP, other investment projects led by China and Malaysia companies are already in the pipeline. The new investors include China’s Guangxi Investment Group Co. Ltd., which will invest RM580 million on an aluminum component manufacturing facility. Another is Malaysia’s LJ Hightech Material Sdn. Bhd., which will invest RM1 billion in a high-technology production-based plant to produce concrete panels and activated rubber powder for the construction industry. The construction works for these projects in MCKIP are expected to begin in the first quarter of 2017. Once completed, they will create more than 3,000 job opportunities.

Investment Environment in MCKIP

MCKIP not only welcomes investors from China and Malaysia, but also from ASEAN region and beyond. In addition to the current ECER incentives package [4], the Ministry of International Trade and Industry (MITI), together with the ECERDC, has offered special incentives packages for investors in MCKIP (subject to Terms and Conditions). Below are some highlights of the fiscal incentives in MCKIP:

-

Fifteen years of 100% corporate tax exemption from the year of statutory incomes derived, or 100% Investment Tax Allowance on qualifying capital expenditure incurred for five years.

-

15% of income tax rate for qualified knowledge workers [5] in MCKIP until 31 December 2020.

-

Import duty and sales tax exemption for raw materials, parts and components, plants and machinery and equipment.

-

Stamp duty exemption on transfer or lease of land or building used for development.

-

Investors can apply for Unit Kerjasama Awam-Swasta (UKAS) facilitation fund up to 10% of project cost or RM 200 million (whichever is lower), to finance the development of basic infrastructure.

Apart from fiscal incentives, MCKIP also offers other competitive incentives [6] and support in order to encourage both local and overseas investment. These include competitive land prices, flexibility in the employment of expatriates and the facilitation of human capital development. At present, MCKIP is still at the early stages of development. By implementing incentives and measures such as these, MCKIP aims to attract a range of investors from various industry sectors.

Synergistic Development of Kuantan Port

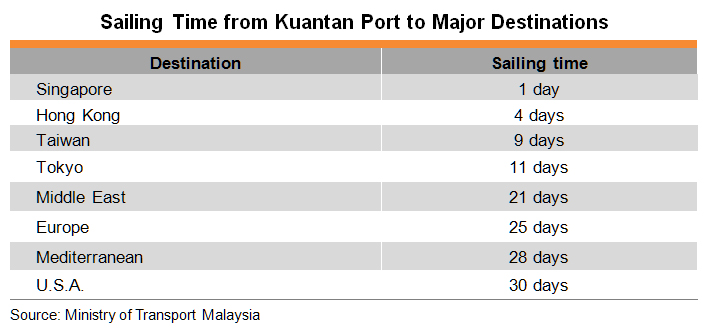

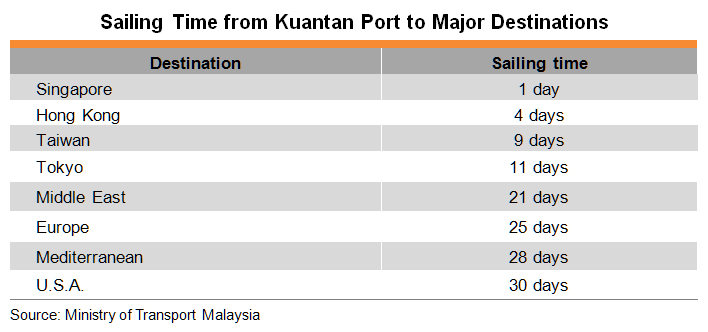

Located just 10 kilometres away from MCKIP, Kuantan Port currently handles mainly break bulk cargoes (such as steel pipes, sawn timber and plywood), dry bulk cargoes (such as iron ore, coal and fertilisers), liquid bulk cargoes (such as palm oil, vegetable oil, mineral oil and petrochemical products) and container cargoes. Kuantan Port is an all-weather port with 11.2 meter draft and the capacity to handle vessels up to 40,000 DWT (Dead Weight Tonnage). There are 22 berths at Kuantan Port with bulk cargoes accounting for 95% of throughput. At present, container business is relatively small and mainly handles automotive components for Pekan Automotive Industrial Park.

Kuantan Port is operated by Kuantan Port Consortium Sdn. Bhd. (KPC) [7]. It can offer well-developed port facilities and services, and a strong network of global shipping connections. As such, the port is set to be a catalyst for the development of the industrial and manufacturing activities in MCKIP, as well as those in Kuantan Port Industrial Area [8] and Gebeng Industrial Estate [9].

At present, major shipping lines which operate at Kuantan Port include Evergreen Marine Corporation Ltd, Jardine Shipping Services, Malaysia International Shipping Corporation Bhd. and Pacific International Lines.

Source: Kuantan Port Consortium

As it stands, Kuantan Port provides port services for the nearby high-end and high technology industries and heavy industries, such as those based at the Kuantan Port Industrial Area, Gebeng Industrial Estate and Pekan Automotive Industrial Park. In order to meet the extra port service demand now being created by MCKIP, Kuantan Port is currently under expansion. There will be three phases in the port expansion. Phases 1A and 1B will cover the import and export of bulk cargoes. In Phase 2, a new deep water terminal will be developed, which will be able to handle up to 200,000 DWT or 18,000 TEUs container vessels.

Construction of Phase A1 is now underway and is expected to be completed by the end of 2017. Phase 1A will be able to handle ships up to 150,000 DWT. The expected completion time of Phase 1A is in line with the completion time of Alliance Steel production sites at MCKIP 1. This will enable Alliance Steel to import raw materials from overseas markets and then export its final products to the international markets via Kuantan Port. The construction of Phase 1B is also underway and it should commence operation in late 2018. Both Phase 1A and Phase 1B will target the handling of bulk cargoes. Presently, a new 4.7 kilometres breakwater is under construction, which will create a sheltered harbor. This sheltered basin will allow for berths to operate safely and efficiently throughout the year, even during the monsoon season.

Strategic Partnerships along the New Silk Road

In terms of their potential growth, Kuantan Port and MCKIP go hand in hand. Although Kuantan Port currently handles mainly bulk cargoes, the Phase 2 development is intended to be a container port, in order to handle the import and export of light industry cargoes for MCKIP 3. The new deep-water terminal will become a major trans-shipment hub on the east coast of Malaysia. By the time of completion, it is estimated that Kuantan Port will be able to handle 52 million freight weight tonnes of bulk and container cargoes.

In light of China’s 21st Century Maritime Silk Road development, Kuantan Port will become a key trading gateway. China and Malaysia are forming a ‘port alliance’ to fast-track trade by reducing customs bottlenecks at both ends. Under the port alliance, 10 Chinese ports (including Dalian, Shanghai, Ningbo, Qinzhou, Guangzhou, Fuzhou, Xiamen, Shenzhen, Hainan and Taicang) will collaborate with six Malaysian ports (including Port Klang, Malacca, Penang, Johor, Kuantan and Bintulu). The final details are still being worked out, but the development is geared towards improved trade facilitation and integration within the region. It has been reported that the strategic imperative is to set up joint customs clearance facilities between ports of China and Malaysia, in order to reduce the overall time and cost of moving goods across the borders.

Kuantan Port to Perform Re-distribution Function

In June 2016, Kuantan Port received approval from The Ministry of Finance in Malaysia to establish a free zone port [10]. This will strengthen Kuantan Port’s plans to develop into a trans-shipment hub. A Free Zone is defined as a place outside Malaysia where there is no required payment of customs duty, excise duty, sales tax or service tax. According to KPC, the Free Zone in Kuantan Port may cater for commercial activities including trans-shipment, trading, regional distribution, inspection/sampling and related value-added services (such as repackaging, relabelling and break bulking).

By way of example, international distributors who have established their own sales network in the region can consolidate their products destined for Malaysia and other ASEAN and south Asian countries. They can then save costs by shipping them, in the first instance, to Kuantan Port free zone warehouse in the form of FCL (full container load). There, the importer may arrange re-packing or re-labeling for their products before redistributing the products in LCL (less than a container load) to their final market destinations in the region.

Evolving Business Potentials

Most of the current investments in MCKIP come from China-based companies, mainly involving heavy industry and high-end/high technology industry. In fact, MCKIP not only targets investors from China and Malaysia, but also other ASEAN countries and beyond. In particular, with the upcoming development in MCKIP 3 as a multi-purpose zone, new business opportunities may arise in areas such as commercial property development, residential management and hotel management.

MCKIP is the engine for new growth at Kuantan Port. Expecting a sharp increase in demand for bulk cargo services driven by the high-end/high technology industries and heavy industries establishing themselves in MCKIP 1 and MCKIP 2, Kuantan Port’s expansion plans are under way. With the port set to evolve into a trans-shipment hub for the ASEAN, it will become a free zone in order to provide value-added services for the container cargoes. Many investment opportunities exist in the construction of port facilities and other value-added logistics services.

Together, MCKIP and Kuantan Port are being developed into an industrial hub and an integrated logistics centre in Malaysia. These developments have created a new trade platform for companies which are interested in exploring the range of business opportunities in the ASEAN along the 21st Century Maritime Silk Road.

[1] In ‘Two Countries, Twin Parks’, ‘Two Countries’ represents Malaysia and China; ‘Twin Parks’ represents Malaysia-China Kuantan Industrial Park (MCKIP) and China-Malaysia Qinzhou Industrial Park (CMQIP).

[2] The ECER covers Kelantan, Terengganu, Pahang and the district of Mersing in Johor. It occupies an area of 66,000 square kilometres or 51% of the total area of Peninsular Malaysia.

[3] Alliance Steel (M) Sdn. Bhd. is a state owned joint-stock enterprise by Guangxi Beibu Gulf Port International Group Co. Ltd. and Guangxi Sheng Long Metallurgical Co. Ltd.

[4] For details, please refer to ECER investment opportunities.

[5] A non-resident is subject to income tax in Malaysia for his income which only comes from Malaysian sources, at a uniform rate of 28% unless he works less than 61 days in the year or his country of residence has concluded a double taxation agreement with Malaysia.

[6] For details, please refer to Malaysia-China Kuantan Industrial Park.

[7] Kuantan Port Consortium Sdn. Bhd. (KPC) is jointly owned by IJM Corporation Berhad and Beibu Gulf Holding (Hong Kong) Co. Ltd. on a 60:40 equity holdings with the Government of Malaysia having a special rights share.

[8] Kuantan Port Industrial Area is located within the vicinity of the port.

[9] Gebeng Industrial Estate is a world-class petrochemical zone covering 8,600 hectares.

[10] Source: Kuantan Port Consortium Sdn. Bhd.

Editor's picks

Trending articles

By Dr. Christine R. Guluzian, Visiting Research Fellow in Defense and Foreign Policy Studies, Cato Institute

Beijing is espousing a new “economic diplomacy” model to assist in spurring long-term, sustainable domestic economic growth. In addition, China’s New Silk Road initiative is offering its partners job creation opportunities, FDI, infrastructure building, and bolstered commercial exchange. The end goal, according to China, is to establish a “win-win” scenario for all partners involved.

Yet, this ambitious multinational project comes with serious obstacles: unstable political regimes within host countries; subpar international business practice standards, including non-transparency and corruption; and the potential for Chinese state involvement to politicize commercial relations via SOEs. These could all thwart positive trade relations and investment environments. Such challenges could be mitigated if private- and public-sector participants take precautionary steps, such as exercising due diligence on projects and partners, establishing clear contractual or treaty terms on dispute and arbitration mechanisms, and insisting on the application of international best-practice standards. As for host countries, the New Silk Road initiative could incentivize governments to implement free market principles within their own economies in order to better attract FDI. This must include removing or reducing tariffs, simplifying tax codes, limiting bureaucracy, providing for the protection of private property, and strengthening the rule of law.

The New Silk Road is an imperfect project in its formative stages. It is a large-scale initiative projected to span several countries and continents and is backed by the world’s second largest economy: if proven successful, it would be too large a project to ignore or to “contain.” The United States should approach the New Silk Road initiative cautiously yet constructively and as a potentially positive opportunity for cultivating mutually beneficial trade and relationship-building ties with China and New Silk Road participant states.

Please click to read the full report.

Editor's picks

Trending articles

First Chinese state visit to New Zealand for 11 years sees MoU signed on mutual BRI development, while imminent upgrade to existing Free Trade Agreement and streamlined customs and visa arrangements announced as priorities.

New Zealand is now the first developed western nation to sign up as a partner in China's ambitious Belt and Road Initiative (BRI). The joint commitment of the two countries to support the project was marked by a Memorandum of Understanding (MoU) signed by Bill English, the New Zealand Prime Minister, and Li Keqiang, the Chinese Premier.

The MoU was one of 13 agreements signed between the two countries during Li's state visit to New Zealand at the end of March. Among the other areas targetted for discussion were the streamlining of customs clearance procedures, educational exchanges, fishery quotas and food exports.

Speaking after the signing of the MoU, Li pledged his commitment to exploring the possibility of greater co-operation between the two countries in terms of both infrastructure development and increased trade. One of the first signs of this enhanced relationship will be an increased level of imports of New Zealand beef and lamb to the mainland, while China in turn will expand its range of vegetable exports to its upgraded trading partner.

Welcoming both developments, Li said: "We are expanding our imports of New Zealand beef and lamb in order to give Chinese consumers a greater choice of high-quality produce. At the same time, we welcome the opportunity to export more onions to New Zealand."

Among the subjects discussed by the two leaders were a number of issues related to regional stability and free trade, while several other cultural and business matters were also on the agenda. In particular, the two confirmed plans for negotiations on an upgrade to the existing China-New Zealand Free Trade Agreement, which duly began at the end of April.

The current agreement has been in place for nine years and is said to have considerably boosted bilateral trade between the two parties. In particular, it has led to New Zealand supplying 50% of China's imported dairy products. In the new round of negotiations, several food-safety issues are said to be high on the agenda.

Addressing the importance of the current round of negotiations, Li said: "With protectionism and anti-trade liberalisation sentiments on the rise around the world, it is incumbent upon us to send a clear message, backed up by positive actions, when it comes to safeguarding free trade and the process of economic globalisation. In line with this, the planned upgrade of the China-New Zealand Free Trade Agreement is crucial for both countries, as well as the wider region and the international community as a whole."

In line with this enhanced co-operation between the two countries, New Zealand has also announced plans to issue five-year multi-entry visas to properly qualified Chinese applicants. These new visas will entitle holders to stay in New Zealand for up to one month at a time.

Li's visit to the country marked the first official visit to New Zealand by a Chinese Premier for 11 years.

Dianne Zou, Sydney Office

Editor's picks

Trending articles

By James Villafuerte (ADB), Erwin Corong (Purdue University) and Juzhong Zhuang (ADB)

Executive Summary *

In the aftermath of the global financial crisis, two important trends emerged. First, the growth of global trade decelerated below output growth. Second, the People’s Republic of China (PRC) growth moderated on account of cyclical and structural factors. Faced with this twin and inter-related challenges, PRC unveiled a set of domestic and external reforms. Domestically, it has identified hundreds of reforms to address wasteful investment, increase consumption and innovation, and lift productivity growth. Externally, it unveiled the Silk Road Economic Belt and the 21st Century Maritime Silk Road—referred to here as One Belt, One Road (OBOR)—which is meant to strengthen infrastructure on the westward land route through Central Asia and Europe, and the southern maritime route through Southeast Asia, on to South Asia, Africa and Europe. OBOR could help PRC: (i) foster a trade revival; (ii) address overcapacity issues; and (iii) develop the less connected provinces in PRC. For countries in the OBOR route, OBOR gives them access to PRC’s overseas direct investment, helps them invest and upgrade their infrastructure. OBOR also strengthens regional integration in the region. The OBOR initiative is a large initiative covering more than 60 countries with a combined population of about 3.2 billion (around 45% of the world’s population) and a combined gross domestic product (GDP) of $13 trillion.

The economic and infrastructure developments in countries along the OBOR route are mixed. At present, there are: (i) 9 low-income economies; (ii) 16 lower-middle-income economies; 14 upper-middle-income economies; and 7 high-income economies along OBOR. Thus, alleviating poverty remains a major challenge for countries in the OBOR route. There is also a great diversity among countries in OBOR in terms of physical measure such as land area, population density, road density, paved road, and rail density. Many countries along the OBOR route have poorly developed transport infrastructure networks, relative to their population density. The proportion of paved roads to total roads is also relatively low and there is fairly limited rail access or movement for some of these economies. These gaps in transport infrastructure hamper trade and investment flows to the OBOR region.

Using the GTAP model, its version 9A database, and comparative static simulations, this study confirms that the OBOR initiative has non-trivial effects on Asia.1 For instance, improving the transport network and trade facilitation in countries along the OBOR route could raise the GDP growth in Central, West and South Asia ranging from 0.1 to 0.7 percentage points. It could also contribute to an increase in welfare from about $6 billion to about $100 billion. The total exports of countries in the OBOR could also increase by about $5 billion to $135 billion. More importantly, the distribution of benefits arising from OBOR is not equal—with some countries benefitting more than others. Certainly, PRC would gain a lot from the OBOR initiatives, but some countries such as Mongolia or Pakistan; and sub-regions such as Central Asia and Southeast Asia stand to gain significant benefit as well. However, many factors and challenges could hamper the realization of these potential benefits including the diversity of characteristics and institutional development of countries in the OBOR route. Mismatches in policy framework, legal and regulatory rules, and credit and payment standards could hamper effective cooperation and coordination.

* This is a draft version.

Please click to read the full report.

Editor's picks

Trending articles

Under the terms of the Belt and Road Initiative (BRI), the 60 or so countries that fall within its geographical remit are expected to benefit from both an enhanced investment environment and streamlined trade arrangements. In practical terms, this will manifest itself in a number of jointly-developed Free Trade Zones, an expansion of existing trade activities and moves to nurture both the trade in services and cross-border e-commerce. Overall, the BRI programme is expected to set a new high water mark in terms of cross-border business activities, with an accompanying rise in the number of international commercial disputes.

Typically, these cross-border trade disputes revolve around such issues as breach of contract, quality control problems, deferrals and difficulties related to customs procedures. Under established practices, such disputes are settled via expensive and time-consuming litigation, often across a number of different jurisdictions.

Ying Chi Lit Daniel [1] is a General Mediator who has spent the last two years offering on site arbitration services at the Canton Fair, China’s largest trade event. Two years ago, the fair – more formerly known as the China Import and Export Fair – was chosen as the pilot zone for the trial of a new initiative, one designed to settle cross-border trade conflicts between Chinese companies and their overseas counterparts through an internationally-accepted mediation framework.

Under the terms of this initiative, mediation is the first step for all of the parties concerned. Should this prove successful, the two sides then sign a settlement agreement before applying to a mainland arbitration court to endorse the arrangement. Once this step has been completed, the agreement is considered binding on all the relevant parties under the terms of the New York Convention, an agreement covering the recognition and enforcement of foreign arbitral awards recognised by some 65 countries. Combining aspects of both mediation and arbitration, this legally-binding model has proved highly effective in terms of resolving trade disputes. As such, it is seen as a fast, effective and low-cost platform for resolving cross-border disputes between the mainland and its overseas trading partners.

According to Ying, this globally-accepted model of facilitative mediation is very different to the form of advisory mediation favoured on the mainland. The international model focuses more on enabling all parties concerned to make their own decisions and evaluate their own situations, constantly facilitating communication between the various sides, while promoting an understanding of each other’s needs and perspectives. The mediator then guides the parties with regard to discussing, creating and expanding upon feasible solutions, while gradually addressing any difficulties.

Once a settlement has been reached, the mediator then assists in drafting and formalising the final agreement. Overall, the mediation process is based on the principles of voluntariness, neutrality and confidentiality and looks to both resolve the immediate conflict while fostering a long-term relationship between the parties.

According to Ying, many of the overseas businessmen who engaged the services of the Canton Fair arbitration centre were delighted to learn they were dealing with a Hong Kong-based mediator, believing this offered a very trustworthy route for the resolution of any trade-related issues. Overall, Hong Kong service providers are seen as having had greater exposure to the international business environment, a clear asset when dealing with such situations.

As the BRI programme and the mainland’s going-out initiatives continue to roll out, the demand for cross-border dispute resolutions will inevitably rise. Addressing this issue, Rimsky Yuen, Hong Kong’s Secretary for Justice, reassured the Legislative Council’s Panel on the Administration of Justice and Legal Services back in 2016 that every effort will be made to actively promote Hong Kong’s legal and dispute resolution services. It is hoped that this will encourage mainland businesses and those based in countries within the scope of the BRI to use the services of the relevant Hong Kong professionals whenever the need arises.

Yuen also committed Hong Kong’s mediation bodies to establishing a wide-ranging dialogue with their mainland counterparts in order to enhance the effectiveness of all concerned.

Overall, Ying believes the extensive experience of Hong Kong’s international facilitative mediation service providers is the perfect complement to China's arbitration-based cross-border commercial dispute resolution services and mechanisms. He also hoped that an increasing number of companies operating in markets along the proposed BRI routes would opt to use the mediation plus arbitration model when it came to resolving commercial disputes, believing this will help China and Chinese companies as they participate more fully in the global business arena.

[1] Daniel Ying is a Director of the Hong Kong Mediation Centre, Chairman of its Disciplinary Committee, a mediation expert in Hong Kong and Chinese commercial matters, a cross-border mediation instructor and an examiner. He has dealt with a variety of conflicts, including: a number of business disputes in both China and Hong Kong, corporate mergers, acquisitions, reform programmes, investment and financial disputes, partner conflict, debt collection and account handling problems.

Editor's picks

Trending articles

Hong Kong-based Design Icon views the SAR as a regional centre for intellectual property protection as it develops its branded photographic design solution. Director Billy Liu says the company aims to establish Hong Kong as an outstanding location on the global design map, while Director Mike Jerome sees the Belt and Road Initiative bringing a new client base to Hong Kong.

Speakers:

Billy Liu, Design Consultant and Director, Design Icon

Mike Jerome, Design Consultant and Director, Design Icon

Related Link:

Hong Kong Trade Development Council

http://www.hktdc.com/

The Shenzhen and Shanghai Stock Connect schemes accommodate the demand for multi-faceted investment opportunities on the Chinese mainland and in Hong Kong, fitting Belt and Road priorities such as Rmb internationalization, says MF Jebsen’s Clifford Wong. He believes the Initiative encourages increased business activities: good for MF Jebsen’s travel industry operations, for example.

Speaker:

Clifford Wong, Deputy Group Managing Director, MF Jebsen International Ltd

Related Link:

Hong Kong Trade Development Council

http://www.hktdc.com/

15 Mar 2009

Preparing for China’s Urban Billion

By McKinsey Global Institute

The McKinsey Global Institute (MGI) launched a major initiative two years ago to study the evolution of urbanization of China and to derive insights into how this process will develop. More than 20 consultants and experts have explored the global economic and social implications of the unprecedented expansion of China's cities and how national and local policy makers can shape China's urban development to 2025 and beyond. Preparing for China's Urban Billion describes the findings of our research and is available to download for free at our website www.mckinsey.com/mgi.

The views presented in this two-volume work are based on long-term macroeconomic trends in China. While the recent downturn in the global economy is bound to impact China in the short term, we believe the long-term fundamentals on which we have based our study are likely to hold out.

Please click to view the full report.

Editor's picks

Trending articles

15 Jun 2012

Urban World: Cities and the Rise of Consuming Class

By McKinsey Global Institute

The urbanization of the world continues apace and is one bright spot in an otherwise challenging global economic environment. The shift in economic balance toward the East and South is happening with unprecedented speed and scale. We are quite simply witnessing the biggest economic transformation the world has ever seen as the populations of cities in emerging markets expand and enjoy rising incomes - producing a game-changing new wave of consumers with considerable spending power. Meeting demand from these new consumers will necessitate an investment boom in buildings and infrastructure that will account for the lion's share of global investment in the years to 2025. It is important that cities make the investment they need in an efficient and productive way to ensure healthy returns and lock in high levels of resource productivity for decades to come...

Please click to view the full report.

Editor's picks

Trending articles

15 Jan 2013

Infrastructure Productivity: How to Save $1 Trillion a Year

By McKinsey Global Institute

Across the world, inadequate or poorly performing infrastructure presents major economic and social challenges that governments and businesses need to address. Without the necessary infrastructure—from transport systems to electricity grids and water pipelines—economies cannot meet their full growth potential and economic and human development suffers. Yet the imperative to invest more in infrastructure comes at a time when many governments are highly indebted and face competing calls on their scarce resources.

The size of the infrastructure gap and concerns about how to find the money to fill it are the linchpins of current debate on this issue. But this focus overshadows what we believe to be an equally compelling imperative—to improve the planning, delivery, and operation of infrastructure to get more, higher-quality capacity for less money, and to boost infrastructure productivity. Infrastructure productivity: How to save $1 trillion a year, a new report from the McKinsey Global Institute (MGI) and the McKinsey Infrastructure Practice, is the first in a series of planned reports on infrastructure. Our research raised several questions that we have not addressed in detail in this report and that we aim to address in future. These questions include the national balance sheet and financing of infrastructure, the challenges and opportunities faced by private-sector players, how to address the capability gap, the role of new technologies, and green infrastructure…

Please click to view the full report.

434 Views

434 Views