Chinese Mainland

By Arif Rafiq, President, Vizier Consulting LLC; non-resident fellow, Middle East Institute

Nearly three years have passed since the China-Pakistan Economic Corridor (CPEC) was formally launched. Several projects have come online, and a critical mass of electric power and infrastructure projects will be operational within the next 12 to 18 months. Now, more than halfway through the first of CPEC’s three five-year phases, is an opportune moment to assess how Beijing and Islamabad have fared so far in pushing forward the massive, fifteen-year connectivity project, valued at upwards of $62 billion…

What to Watch Out for in 2018

Gwadar Momentum Grows

Over the past year, Gwadar Port has averaged about one shipment per month—mainly inbound shipments of construction material. But there are indications that economic activity may pick up. The first phase of the Gwadar Free Zone launched at the end of January. The port operator, China Overseas Ports Holding Company (COPHC), is constructing an additional berth within the year to increase handling capacity and a COPHC subsidiary signed an MOU with Pakistan State Oil to develop an “oil city.” These developments suggest that China may begin using Gwadar for transshipment within the next few years. A clear sign of this will be if COSCO adds Gwadar to one of its regional shipping lines.

Basic, but resolvable, infrastructural deficiencies continue to hold Gwadar back. Gwadar presently has a water deficit of four million gallons a day (MGD). A five-MGD desalination plant for the city has been planned since the earliest CPEC discussions, but Beijing appears disinclined to provide a grant for the project. Pakistan has built water storage dams to service the Gwadar area, but there has been little to no rainfall in recent years. COPHC established a smaller 0.25-MGD desalination plant, and a cheaper option may be to repair an older two-MGD desalination plant. But as the city develops and hundreds of millions of dollars are poured in for commercial purposes, the absence of clean drinking water sends a dispiriting message to locals.

Gwadar’s electricity is currently sourced from nearby Iran. A 300MW coal power plant could be built on a fast-track basis within the next one to two years, but given the desire to build Gwadar as a tourism and natural gas hub, a natural gas-fueled plant may be a better fit.

Impact of Macroeconomic Stress and Poor Planning

The impending surge of CPEC projects coming online will lay bare the quality of economic planning by Pakistan’s Planning Commission, the chief coordinating body on CPEC. The initial indications are not encouraging. The co-produced CPEC Long-Term Plan is a vague, aspirational document that reflects little consultation with Pakistan’s business community and falls short in explaining how CPEC will benefit business. The Planning Commission’s CPEC “Center of Excellence” has functioned mainly as a publicity department, failing to produce serious policy-relevant research. Finally, the Planning Commission’s chief economist has made astounding estimates about the toll revenue that Pakistan will earn through CPEC.

The rise in Pakistan’s current account deficit has been propelled in part by machinery imports due to CPEC. Pakistan has had to float $3.5 billion in Eurobonds over the past few months to shore up its foreign exchange reserves. An IMF bailout may be on the horizon and could put future CPEC projects, including critical railway upgrades, at risk of postponement. In the end, the present pain may be short-term before long run gains. The economy on the whole is forecast to grow around 6 percent into 2020. But Pakistan’s economic planners have failed to demonstrate how exactly they will get over the present fiscal hump. Part of the solution may require some concessions from Beijing in the latest round of the Sino-Pak FTA talks to remove hurdles for Pakistani exports to China.

Multilateralization of CPEC

A host of countries have expressed interest in “joining” CPEC, and non-Chinese foreign investment in CPEC or CPEC-related projects is likely to rise as the initial wave of electric power and infrastructure projects come online. Presently, Qatari and Saudi investors are co-sponsoring two separate CPEC electric power projects, while a British company is co-sponsoring one of the lignite mining and mine mouth power plant projects in Thar. The Saudis, who recently agreed to finance part of the Turkmenistan-Afghanistan-Pakistan-India gas pipeline and blocked a Korean steel investment in Chabahar, appear keen on using geo-economics as a means to counter Iranian influence in Central and South Asia. This could translate into a more pronounced Saudi role in CPEC, leveraging the project not just to exploit opportunities in the Pakistani and Chinese markets, but also to steer regional connectivity away from Iran.

Please click to read full report.

Editor's picks

Trending articles

Five years on from the launch of the Belt and Road Initiative, China's economic masterplan, the first of a two-part report considers how Turkey, one of the programme's key partners, is coming to terms with the developmental realities.

For centuries Turkey has been seen as a link between East and West, a vital crossroads for cultural and economic exchange. More recently, it has come to be seen as one of China's key partners as it rolls out the Belt and Road Initiative (BRI), its ambitious international infrastructure development and trade facilitation programme.

Inevitably, given the size and scope of the programme, the BRI has inspired evangelical zeal among some of its proponents across the world, while others have been more reticent and, on occasion, wholly critical. For its part, Turkey has seen both points of view widely aired as business leaders, academics and political figures seek to come to terms with the huge impact the initiative is set to have on this 80-million strong country.

Setting the scene for the debate that has divided many of his countrymen, Salih Işik Bora, an International Trade Analyst with the Ankara-based Center for Eurasian Studies, said: "Today, 16% of the European Union's $1,720 billion imports come from China, making it Europe's largest trading partner. Along this trading route – historically known as the Silk Road – are many of the world's major economies. Unlike the practice of classic times, however, 96% of these products now reach Europe by sea, largely because of the poor land infrastructure found in much of Eurasia.

"As one of its key objectives, the BRI seeks to remedy this and, indeed, has already had some success in doing so. The volume of rail freight between China and Europe, for instance, has increased from 57,000 tonnes in 2013 to 311,000 in 2016.

"At least in this regard, the BRI has been positively received across Eurasia, with many countries along the route having made large contributions to the Asian Infrastructure Investment Bank, the project's key financial conduit. On top of that, a number of European nations, including France, Germany and the United Kingdom, as well as those further afield, such as India, Russia, Iran and Saudi Arabia, have also contributed."

Turkish Support

By and large, the BRI has attracted considerable support in Turkey, with the government embracing it as hugely complementary to its own infrastructure development programme. Acknowledging this close alignment between the political leaders in both countries, Şahin Saylik, the General Manager of Kırpart, an automotive-parts company based in Bursa, one of the largest cities in Northern Turkey, said: "With firm support from both the Chinese and Turkish governments, the success of the BRI is all but assured, especially as Recep Erdoğan, our President, has publicly committed to it.

"For our part, we were previously focused on our own Middle Corridor initiative, a development that was expected to benefit from some US$8 billion of investment. In order to ensure that this can be integrated into the BRI, the Turkish government has already contributed $40 billion in development funding.

"In terms of BRI-related projects already under way, there is the Marmaray Rail Network, the Ormangazi Bridge, a third Istanbul airport and a railway link between Edirne and Baku. More recently, it has also been proposed that a third bridge be built across the Bosporus [a strategic waterway marking the boundary between Europe and Asia] as a way of optimising the trade flow."

Infrastructure Improvements

While the improvements to Turkey's transport infrastructure are clearly apparent and widely welcomed, redeveloping the country's overland transport links is still seen as something of a challenge. The sheer scale of the work that needs to be done, however, has been seen as representing a real opportunity for Turkish businesses.

Emphasising the depths of the country's own redevelopment resources, Turgut Kerem Tuncel, a Senior Analyst with the Center for Eurasian Studies, said: "Turkish companies have long been partners and project leaders within the construction sector, having completed a wide variety of projects in many of the former Soviet countries, the Gulf and North Africa. With their significant experience in large and mid-scale cross-border business projects, many Turkish businesses are keen to participate in the BRI development programme.

"To date, there has already been some co-operation, most notably with regard to the construction of the Baku-Tiflis-Kars Railroad (BTK), which went into operation in October 2017. At the time, it was claimed that it finally provided an overland link between China and London. This, however, was something of an exaggeration.

"If Turkey is ever truly to become a bridge between the Pacific and the Atlantic, its rail network and its supporting infrastructure will need a massive upgrade. At present, there is not even a mainline rail connection between the two sides of the Bosporus."

Maritime Transport

Some, however, remain sceptical that Turkey will ever be able to fully capitalise on the potential of its overland transport routes. Expressing the sentiments of many, Professor Selçuk Çolakoğlu, Director of the Ankara-based Turkish Center for Asia Pacific Studies, said: "A number of China-led initiatives, such as the BRI and the China-Pakistan Economic Corridor (CPEC), have sought to revive the overland routes as an alternative to the maritime corridors.

"At present, it's hard to be sure whether the land routes will ever provide a viable alternative to the maritime routes that already link Europe and Asia. What is clear, though, is that China wants to reduce its current over-dependence on sea freight."

While some question the practicality of rebooting the land transit facilities, some go further still, openly wondering just how closely aligned China and Turkey's long-term objectives really are. Expressing his own scepticism, Çolakoğlu says: "It is still not entirely clear how the Middle Corridor will be integrated into the BRI. Initially, China was proposing to use the Southern (Iranian) Corridor as its primary conduit to Europe, while wholly bypassing the Turkish Middle Corridor. These initial fears were allayed, however, in light of China's commitment to investing in the development of the Edirne-Kars High-speed Railway Link, a key component of the corridor.

"Perhaps more worryingly, at present, Turkey has been excluded from the BRI's proposed maritime routes. As it stands, China sees the northeast Greek port of Piraeus as its preferred hub for accessing Europe.

"Overall then, while there are reasons to be optimistic about Sino-Turkish BRI co-operation, some concrete agreements need to be in place before it can genuinely be considered a success story. Despite that, let's say I remain cautiously optimistic."

Economic Gains

Such concerns aside, many in Turkey are bullish about the economic opportunities likely to emerge from the BRI. Clearly convinced as to the benefits on offer, Bora said: "Given Turkey's central geographical positioning within this proposed trading network, it may well emerge as one of the big winners. Based on current projections, the BRI should account for per annum GDP growth of at least 0.22% in the case of the Turkish economy.

"These gains, however, may not be evenly distributed. While, at present, western Turkey accounts for the largest proportion of the country's international trade, the BRI could act to rejuvenate the currently neglected eastern region. This would see such cities as Sivas and Erzurum once again becoming significant trading hubs, bringing much needed stability and redevelopment to the wider region."

For Çolakoğlu, the benefits are somewhat more prosaic, with the Professor saying: "Fundamentally, Turkey believes that the BRI will foster closer bilateral relations with China, with new railway lines carrying significant quantities of passengers and freight in both directions."

Some, though, remain concerned that, while the BRI will open up international trade, the key beneficiary will be China, with other countries – including Turkey – likely to see their trade deficit with their mighty eastern neighbour only set to widen. Kırpart's Saylik, however, is philosophical about any such eventuality, saying: "As long as Turkey is politically astute, it has no need to worry about the BRI. The trade deficit with China is a separate issue and one that that will need to be addressed regardless of the BRI.

"In general, though, I believe the BRI will have a positive impact on Turkey's bid to close its overall trade deficit, although maybe not so much when it comes to China in particular."

George Dearsley, Special Correspondent, Ankara

For further analysis of Turkey's likely role within the BRI, see part two of this report: "Turkey Set for Eastward Pivot as Potential BRI Benefits Beckons", 4 September 2018.

Editor's picks

Trending articles

With Beijing-Manila ties at their most cordial, the Belt and Road Initiative is helping cement the countries' partnership.

As with many of the most successful Belt and Road Initiative (BRI) infrastructure-redevelopment projects, many of China's investments in the Philippines advance the programme's overall objectives while also meeting key local needs. A prime example of this is the mainland's huge contribution to tackling the water-management issues that have long confounded Manila, the Philippines' capital.

Already deemed a priority by Rodrigo Duterte, the Philippines President, and a key component of his massive Build, Build! infrastructure initiative, China agreed to underwrite the costs of two of the related projects late last year. This saw the Beijing-led Asian Infrastructure Investment Bank (AIIB) and the World Bank each sign off on loans of US$207.63 million for the Metro Manila Flood Management Project, with the balance of US$84.74 million being met by the Philippines government. At the same time, China also agreed to provide the US$234.92 million required to initiate the New Centennial Water Source-Kaliwa Dam project (NCWSP).

In terms of water management, Metro Manila suffers from two seemingly contradictory problems, having both too much and, on occasion, too little. This sees the city regularly subjected to serious flooding, often with tragic consequences for many of its residents, while it also struggles to meet the growing demand for safe drinking water occasioned by the region's ever-expanding population. It is hoped that the two China-backed projects will help to alleviate both of these problems.

In terms of the first, the Metro Manila Flood Management Project, this will entail a substantial upgrade to 36 of the region's pumping stations, while an additional 20 will be constructed from scratch. It will also involve a major overhaul of much of the supporting infrastructure along the region's primary waterways.

In total, work on the project will extend across a 29 sq km site. Once completed, it is expected to eliminate the danger of flooding for some 210,000 local households, benefitting about 970,000 people in all.

The first phase of the project, which will see five existing pumping stations substantially upgraded, is expected to get under way this year. At present, details of the required engineering work are being finalised, with procurement work set to be completed by the end of June. Construction proper will then begin in the autumn, with a scheduled end date early in 2020.

The project overall is aiming for a May 2024 completion date. From a local angle, construction will be overseen by the Manila Development Authority, with the National Housing Authority and the Social Housing Finance Corp also playing supervisory roles.

In the case of the NCWSP dam, it is hoped that this will bring an end to the capital's water shortages. To this end, the project will see the construction of a low dam with a discharge capacity of 600 million litres per day and a 27.7-kilometre raw water conveyance tunnel with a capacity of 2.4 million litres per day.

At present, the Philippine authorities are considering bids from three mainland construction companies, one of which, under the terms of the loan, will be appointed as the principal contractor on the project. The three shortlisted contenders are China Engineering, Power China and a joint bid from Guangdong Foreign Construction and Guangdong Yuantian Engineering. Once due diligence has been completed, the winning bid will be announced by the Metropolitan Waterworks and Sewerage System, the Philippine government body with oversight on the project.

Scheduled to be completed in 2023, there is considerable pressure to ensure this particular project is not subject to any delays. This is largely down to the fact that the Angat dam, the source of 93% of the capital's water supply, will be unable to meet the growing demands of the city's population within eight years. Should the NCWSP encounter any major obstacles, Manila's taps running dry could become a very real possibility.

While the benefits to the Philippines represented by these two projects are clearly apparent, the upside for China is less immediately tangible. The new partnership between the two countries, however, has helped patch up a relationship that has more than occasionally been a little fraught. It has also succeeded in reducing the long-simmering tensions over the South China Sea, with the two countries now working more towards jointly administering and exploiting this particular stretch of the Pacific Ocean, rather than competing for ownership.

The thawing of relations has also already substantially improved bilateral trade, while the boost to the Philippine economy expected to result from the many China-backed infrastructure projects will doubtless provide a ready consumer market for an increased level of mainland exports. At the same time, this new co-operation is also expected to give China access to improved maritime trade via a number of the Philippines' hub ports.

Marilyn Balcita, Special Correspondent, Manila

Editor's picks

Trending articles

By Nancy L.S. LEUNG, Visiting researcher, Asian Cultures Research Institute, TOYO University

I. Introduction

‘The Silk Road Economic Belt and the 21st-Century Maritime Silk Road’, simply named as ‘the Belt and Road’ or ‘Belt and Road Initiative’ is introduced by Chinese president Xi Jinping in September 2013. The ‘Belt and Road Initiative’ immediately attracts great attention in economic circle and political circle as the initiative is cultural, economic and political. Furthermore, it does not only influence to participating counties, but also to non-participation counties. It is believed that since 2013, scholars from different academic disciplines start to study ‘Belt and Road Initiative’. This paper aims to study how ‘Belt and Road Initiative’ is being discussed in academia, especially in Japanese, Chinese and English academic articles. In other words, it is to examine and compare the research trend of ‘Belt and Road Initiative’. The reasons why this paper focuses on Japanese, Chinese and English academic articles are first, Japanese academia has a long history in studying China, Japanese academia can give an East Asia perspective towards ‘Belt and Road Initiative’. Second, since ‘Belt and Road Initiative’ is introduced by Chinese government, it is necessary to examine how Chinese academia discusses ‘Belt and Road Initiative’. Third, English is the most frequently used languages in academic publish and authors are from all over the world, therefore, English academic articles can provide a wider and objective perspective towards ‘Belt and Road Initiative’. In sum, this paper first analyzes the characteristics of academic articles in each language, and then compares the research trend on ‘the Belt and Road’.

II. Background of ‘the Belt and Road’

On 7th September 2013, Chinese president Xi Jinping announced the idea of ‘the Silk Road Economic Belt’ during his visit in Kazakhstan. Nearly a month later, on 3rd October 2013, Xi announced the idea of ‘the 21st-Century Maritime Silk Road’ during his visit in Indonesia. The idea of ‘the Silk Road Economic Belt’ and ‘the 21st-Century Maritime Silk Road’ comes from ancient Silk Road. However, this new Silk Road is not built by merchants or traders, rather it is a strategy introduced by Chinese government. In other words, it is Chinese government orientated. According to the official homepage of ‘the Belt and Road’, the principles of ‘the Belt and Road’ are open for cooperation, harmonious and inclusive, market-oriented and mutual benefit (State Information Center of People's Republic of China). Although the idea of ‘the Belt and Road’ is introduced in 2013, the actual practice starts after the establishment of Asian Infrastructure Investment Bank (AIIB), which means after December 2015. It is because infrastructure construction in developing countries is one of the main themes of the initiative and AIIB provides funding to those developing countries and relevant projects. Beside infrastructure development, policy coordination, trade, financial integration, cultural exchanges are also the themes of the initiative. Until 2017, there are 70 countries cooperating with China under the initiative. Most of the countries are developing countries in Central Asia and East Europe.

III. Research Method

This study is a comparative literature review on Japanese, Chinese and English academic articles published between 2013 and July 2017. Academic articles are collected through search engines in various academic journals databases by entering keywords, ‘Silk Road Economic Belt’, ‘21st Century Maritime Silk Road’, ‘One Belt One Road’, ‘Belt and Road Initiative’ and ‘New Silk Road’, etc. in Japanese, Chinese and English separately. Japanese articles are collected from CiNii, a Japanese scholarly and academic information navigator. Chinese articles are collected from China National Knowledge Infrastructure (CNKI), a Chinese national academic database. English articles are collected from JSTOR, SAGE Journals, ProQuest, Elsevier, Taylor & Francis Groups, academic journals database providers. Articles which are analyzed in this study are those published by July 2017 and whole article is accessible through the library of TOYO University. However, some articles which are printed in academic journals are excluded. They are articles which are less than 5 pages in Japanese or Chinese, printed in single column and less than 3 pages in English. Within 3 languages, the Chinese academic articles vary dramatically in quality. After screening, this study selected 99 articles from 5330 found articles. For English academic articles, this study only can access 114 articles from 122 founded articles. Thus, this study is done base on 13 Japanese articles, 99 Chinese articles and 114 English articles.

IV. Characteristics and research trend in Japanese academic articles

This study has collected 13 Japanese articles from CiNii. All 13 articles are published between 2015 and July 2017. Although the initiative of ‘the Belt and Road’ is introduced in 2013, there is no Japanese academic article discuss or analyze ‘the Silk Road Economic Belt’, ‘the 21st-Century Maritime Silk Road’ or ‘Belt and Road Initiative’ in 2013 or 2014. However, there is an increasing trend in studying ‘Belt and Road Initiative’ because 3 articles are published in 2016 and 6 articles are published in 2017 within 7 months.

Although all articles are written in Japanese and are published by Japanese academic institutes, not all authors are Japanese and attach to Japanese academic institute. According to the name and title of the authors, it is possible to identify the background of the authors. Among 13 articles, 7 articles are written by Japanese and 6 are written by Chinese. Within the articles that are written by Japanese authors, 3 articles are written by the same person. And for the articles written by Chinese authors, 3 articles are submitted by authors who are not attached to Japanese institute (2 is from mainland China, and 1 is from Taiwan). This implies that studies on ‘Belt and Road Initiative’ are limited in Japan. This situation also implies that Chinese scholars have interest to publish academic articles in Japanese academic institutions or to encourage, to promote ‘the Belt and Road’ studies in Japanese academia.

Besides the background of the authors, from the publisher of the articles, it is clear that ‘Belt and Road Initiative’ is not a common research topic in Japanese academia. Among the 13 articles, 9 articles are published by private research institutes, 3 are published by research institute attaches to university and 1 is published by academic society. The articles that are published by private research institutes, 4 are published by ‘The Economic Research Institute for Northeast Asia’, another 4 are published by ‘The Japan Research Institute, Limited’, and 1 is published by ‘Institute for International Trade and Investment’. These private research institutions are economic research institutes; therefore, ‘Belt and Road Initiative’ is one of their research interests.

Based on the discipline of the academic journals and the content of the articles, 13 articles are basically from 6 disciplines. They are Area Studies (1 article), Development Economics (1 article), Regional economics (1 article), Risk and Crisis Management (1 article), International Economics (6 articles) and International Relations (2 articles). In other words, most of the articles are from the discipline of Economics.

The main characteristics of the content are first, mentioning AIIB; second, are in questioning stand. Within 13 articles, 8 articles have mentioned AIIB. AIIB is a multilateral development bank that provides loans for infrastructure building; it has an important position in turning ‘Belt and Road Initiative’ into practice. Although most articles mentioned AIIB, their objects are different. For example, discussing the trade relation between China and its neighboring countries under ‘the Belt and Road’, examining the economic influence of ‘the Belt and Road’, analyzing AIIB, questioning the effectiveness of ‘the Belt and Road’, etc.

In sum, Japanese academic articles related to ‘Belt and Road Initiative’ are limited and mainly focus on economic aspects. In November 2017, Japanese Prime Minister Shinzo Abe agreed with Chinese president Xi to develop Japan-China business during a meeting in Vietnam (The Mainchi, 2017). This action implies Japanese government has a will to encourage Japanese firms to cooperate in ‘the Belt and Road’. The involvement of Japan in China’s ‘the Belt and Road’ will increase the demand on ‘Belt and Road Initiative’ research. ‘Belt and Road Initiative’ is not just an economic or political strategy, it also includes cultural exchanges. However, cultural exchanges between Japan and China start from 1972 and have a deep foundation. Therefore, in the coming years, research related to ‘Belt and Road Initiative’ will still focus on economic aspects in Japanese academia.

V. Characteristics and research trend in Chinese academic articles

When searching ‘Yidai-yilu’ (the Belt and Road) in China National Knowledge Infrastructure (CNKI), 5330 relevant academic articles are published by July 2017. However, these 5330 articles are varying in quality. In order to analyze the characteristics and research trend in Chinese academic articles, 99 articles are well selected for this study after strict screening.

The collected 99 articles are published between 2014 and July 2017. From the distribution of the 99 articles by its published year, it seems that the number of articles has increased sharply in 2015, dropped suddenly in 2016 and increased again in 2017. However, this cannot reflect the reality as these 99 articles are well selected. In order to provide an accurate trend, all the found articles (5330 articles) are also included in figure 3. From the distribution of 5330 articles, it shows an increasing trend of academic publish from 2014. Although the collected data stops in July 2017, by the end of July 2017 there are already 1851 articles published which is 86% of those published in 2016 (2142 articles).

Based on the discipline of the academic journals and the content of the articles, 99 academic articles are from 22 disciplines. They are Policy Studies (16 articles), International Relations (16 articles), International Trade (10 articles), Economic geography (7 articles), Asian Studies (6 articles), International Economics (5 articles), International Laws (5 articles), Educational sociology (5 articles), Social Research (5 articles), Crisis Management (4 articles), Public Policies (3 articles), Monetary Economics (2 articles), Geopolitics (2 articles), Environmental Economics (2 articles), Accounting(2 articles), Architecture (2 articles), Logistics (2 articles),Civil Laws (1 article), Transportation engineering (1 article), Management (1 article), Tourism Geography (1 article), and Environmental Science (1 article). The largest share of the selected Chinese academic articles is from the discipline of Policy Studies (16%) and International Relations (16%). In other words, 32% of the selected articles are from the discipline of Political Sciences.

All the well selected articles use the term ‘Yidai-Yilu’ (the Belt and Road) in the title of the article and all are published by research institutes in University. Although this study clarifies the 99 articles into 22 disciplines, the content of the articles are in great variation. For example, analyzing how ‘Belt and Road Initiative’ can improve the development and economic situation of China and related countries, discussing how importance is ‘Belt and Road Initiative’ to China, providing suggestions to different issues faced by ‘Belt and Road Initiative’, etc. Since the practice of ‘the Belt and Road’ starts after the establishment of AIIB, most of the articles are basically explaining the idea or concept of the ‘Belt and Road Initiative’, rather than analyze or examine the subject. Almost all articles emphasize ‘Belt and Road Initiative’ is a win-win game (games without losers, it is one of the principles of the ‘Belt and Road Initiative’) and how it is beneficial to the partner countries. Additionally, most articles try to link the subject internationally, but most of them end up with China-centered conclusions. Therefore, the main characteristic of Chinese academic articles is positive attitude towards the ‘Belt and Road Initiative’.

On the whole, the selected Chinese academic articles primarily from the discipline of political sciences. This suggests that Chinese academia mainly focuses the ‘Belt and Road Initiative’ in political perspective rather than economic direction. Since selected articles generally analyze or discuss ‘Belt and Road Initiative’ in a positive way, it can conclude that the selected articles are subjective. One of the reasons is ‘the Belt and Road’ is a national strategy that Chinese scholars spontaneously support the initiative. Therefore, it is predictable that academic articles published in Chinese in relation to ‘Belt and Road Initiative’ continue to be positive. Considering ‘Belt and Road Initiative’ concurrently serves as a foreign policy (including both political and cultural factors) and an economic policy, the research trend of ‘the Belt and Road’ in Chinese academia will mainly remain in economic perspective; at the same time, the demand from cultural perspective is increasing.

VI. Characteristics and research trend in English academic articles

This study has collected 122 English academic articles related to ‘the Belt and Road’, which are published between 2014 and July 2017, unfortunately, this study only can access 114 articles. All these articles are from peer-reviewed journals. Most of these English academic articles are published in 2016. However, there is an increasing trend of publishing English academic articles related to ‘the Belt and Road’ since 2015. By July 2017, 40 academic articles are published, which is 80% of 2016. This suggests that at the end of 2017, the number of English academic articles related to ‘the Belt and Road’ will be much more.

Considering English is the most common language used in academic publishing, authors of these 114 articles are from all over the world. Although it is difficult to identity the nationality of the authors by surnames, titles or the location of their attached institutes, despite the author is a co-author or a single author, by referring to the surname 53.5% of the articles are contributed by authors who have Chinese surname. This suggests over half of the articles are contributed by authors who have Chinese background. And this also reflects scholars who have Chinese background are interested to study ‘the Belt and Road’.

Depend on the journal’s discipline and article’s content, this study has classified the collect 114 articles into 8 disciplines. They are Agricultural Science (4 articles), Area Studies (11 articles), Earth Sciences (6 articles), Economics (36 articles), Geography (7 articles), Law (1 article), Sociology (2 articles) and Political Sciences (47 articles). Among 114 articles, the largest share is Political Sciences (41%), following by Economics (32%) and Area Studies (10%). This shows most English academic articles analyze ‘Belt and Road Initiative’ from the perspective of political or economic.

If organize the articles into a more detailed disciplines, 18 sub-disciplines can be identified. They are Agricultural Economics, Asian Studies, Cultural Studies, Development Economics, Economic Geography, Energy Economics, Environmental Science, Financial Economics, Geopolitics, International Economics, International Law, International Relations, Policy Studies, Political Economy, Resource Economics, Social Geography, Transport Economics and Transportation Engineering. Within the 18 sub-disciplines, the discipline of International Relations has the largest share (22%), following by Policy Studies (15%) and Asian Studies (10%). It may related to ‘Belt and Road Initiative’ is both an economic and political strategy and the theme of the initiative is to improve cooperation between countries.

The content of the 114 articles are great in variation. Although China does not show a definite stance to exclude U.S. from ‘the Belt and Road’, 7 articles in the field of International Relations focus China-U.S. relations under the practice of ‘Belt and Road Initiative’. These articles assume ‘Belt and Road Initiative’ can empower China and affect the position of U.S. as the World political or economic leader. In other words, some International Relations scholars believe ‘Belt and Road Initiative’ could increase China’s international political power and China’s responsibility in global governance. Besides articles from International Relations, articles from Asian Studies, Policy Studies and Political Economy also analyze how ‘Belt and Road Initiative’ affect China’s position in the world. Since, ‘Belt and Road Initiative’ is not just a foreign strategy or a political strategy, there are certain articles discuss the economic effect of ‘the Belt and Road’. Yet, ‘the Belt and Road’ starts its practice after the establishment of AIIB, recognized outcomes are still limited. Therefore, it is still difficult to assess the economic effects; as a result, most arguments are remaining in prediction.

Besides the discipline and content, wording representing ‘the Belt and Road’ or ‘Belt and Road Initiative’ are rich in diversity. Although official English translations are posted in the official homepage ‘Belt and Road Portal’ (hosted by the Central government of China), most English articles present ‘the Belt and Road’ or ‘Belt and Road Initiative’ differently. For the official names, ‘the Belt and Road’ and ‘Belt and Road Initiative’ are announced in mid-2017. Before that, ‘One Belt One Road’ or ‘OBOR’ are the official names of the initiative. Additionally, ‘the Silk Road Economic Belt’ and ‘the 21th-Century Maritime Silk Road’ are the official name of the land project and maritime project respectively. Among the 114 articles published between 2013 and July 2017, ‘the belt and Road’ are mostly represented by ‘One Belt One Road’ 1 (75 times), following by ‘Silk Road Economic Belt’ (74 times) and ‘21st-Century Maritime Silk Road’(47 times). This shows although some articles only focus on analyzing ‘the Silk Road Economic Belt’ or ‘the 21st-Century Maritime Silk Road’, most authors mention the land project and maritime project together.

All in all, English academic articles mainly discuss ‘Belt and Road Initiative’ from political or economic aspects. However, cultural exchange is considered as an important part of cooperation. Therefore, it is expected to have more studies on culture exchange between China and Central Asia or Middle East countries in the near future. Especially, the Chinese government set up a study abroad or study in China policy to attract oversea students to study in China, at the same time, to send Chinese students to study in ‘the Belt and Road’ participating countries in 2106. Nonetheless, studies from economic and political perspectives will remain as the major area in studying ‘the Belt and Road’.

VII. Comparative Studies on Japanese, Chinese and English academic articles

‘The Belt and Road’ is a cultural, economic and political initiative which across Eurasia continent and its related oceans. The impact of this initiative is still unpredictable as it is not only related to 71 participating counties (by the end of 2017), but also to their neighboring countries or traditional trade partners. After comparing the characteristics and content of Japanese, Chinese and English academic articles, this study concludes as the following.

First, this study finds research trend on ‘Belt and Road Initiative’ in Japanese, Chinese and English are slightly different. Japanese and Chinese articles mainly focus in economy, but English articles focus more in politic.

Second, the quantity of academic articles published in Japanese, Chinese and English between 2013 and July 2017 is in a huge gap. Although this study has some regulations in selecting academic articles, only 13 articles can be found in Japanese. Comparing to the Chinese (5330 articles without screening) and English (122 articles, including those author cannot access), publication of Japanese academic article related to ‘the Belt and Road’ is far behind. Figure 9 shows the number of selected articles by their published languages and published period. In other words, it suggests that ‘the Belt and Road’ is still not a popular research topic in Japanese academia but a hot topic in Chinese academia and has attracted certain attention in the global.

Third, the quality of academic articles written in Japanese, Chinese and English are varied. Academic articles that are written in Japanese are mostly discussing the ‘Belt and Road Initiative’ from economic aspects. On the other hand, academic articles that are written in Chinese are mostly explaining the idea or concept of ‘Belt and Road Initiative’. More evaluations, examinations, analysis are found in English academic articles. All in all, quantitative and qualitative researches on ‘Belt and Road Initiative’ are limited in all 3 languages. This is because the initiative has just started; it is difficult to produce qualitative research in a short period.

Forth, the variety of discipline is different. Among the 3 languages, academic articles written in Chinese have the highest variety in discipline. Japanese articles are typically from Economic. Cultural, Environmental, and Transport related disciplines can only be found in Chinese and English articles. This result may relate to the attitude of Japanese government towards ‘Belt and Road Initiative’, as Japanese government does not show intention to join ‘Belt and Road Initiative’ until December 2017. Still, economic and political influences from ‘the Belt and Road’ not only occur in participating counties, Japan is affected indirectly from its trade partners who have joined ‘the Belt and Road’. This can explain why Japanese academic articles mainly focus on economic aspects.

Fifth, wide variation in wording representing ‘the Belt and Road’ is found only in English academic articles. Since Japanese language uses Chinese characters and is influenced by Chinese language during ancient period, wording representing ‘the Belt and Road’ in Japanese articles is the same as those in Chinese articles. For English articles, even Chinese government has announced official English translation of ‘the Belt and Road’ and ‘Belt and Road Initiative’, most English articles use different wordings, such as ‘One Road One Belt’, ‘Belt and Road Strategy’, ‘New Silk Road’, ‘Maritime Silk Road’ to represent the initiative. This suggests authors of English articles pay not much attention to the official wordings.

Sixth, the attitude towards ‘the Belt and Road’ in 3 languages are different. Japanese articles basically in question stance and Chinese articles typically positive and China-centered. However, English articles do not show a united attitude. This may because authors of English articles are from all around the world and the influence of ‘the Belt and Road’ to their research interests and areas are different. Therefore, it can say that English academic articles can provide a more objective perspective than Japanese and Chinese academic articles.

Seventh, the present of authors who have Chinese background in Japanese and English academic publish is conspicuous. Among 13 Japanese articles, 6 articles are written by Chinese scholars who are from mainland China and Taiwan. Within 114 English articles, 61 articles are written or co-authors with authors who have Chinese background. This shows that almost half of the Japanese and English articles are contributed by authors who have Chinese background. This implies that scholars who have Chinese background consider ‘the Belt and Road’ is an interesting topic for research or Chinese scholars are more willing to promote research on ‘the Belt and Road’ in different academia.

VIII. Conclusion

To conclude, the recent research trend on ‘Belt and Road Initiative’ by July 2017 in Japanese, Chinese and English academic articles is centered on Economic and Political perspectives. It is believes that this result is closely related to the idea of ‘the Belt and Road’ as it emphasizes on cooperation, trade and infrastructure development. The limitation of this study is the number of academic article published between 2013 and July 2017 varies largely in 3 languages, especially the number of Japanese articles is not comparable to Chinese and English. By comparing academic articles published in Japanese, Chinese and English, it is clear that ‘the Belt and Road’ is not yet a hot topic in Japanese academia and only attract certain attention in global academia by July 2017. Since cooperation, trade, infrastructure development projects related to ‘Belt and Road Initiative’ start in 2015, the influence of ‘the Belt and Road’ will appear gradually in different fields, such as environment science and area studies. This study believes that ‘Belt and Road Initiative’ will attract more attention in different disciplines and academia in the near future.

This article was first published by Asian Cultures Research Institute TOYO University.

Editor's picks

Trending articles

By Christopher Len, Senior Research Fellow in the Energy Studies Institute, National University of Singapore

Executive Summary

This essay examines how the 21st Century Maritime Silk Road under China’s Belt and Road Initiative (BRI) relates to Beijing’s quest for energy security and draws implications for Japan, India, South Korea, and the U.S.

Main Argument

A common theme for the four major Asian economies of China, Japan, India, and South Korea is their heavy reliance on maritime transport for access to natural resources, which is expected to grow in the future. China, with its traditional emphasis on self-reliance, has sought to diversify its energy import sources and transit routes and protect its own rights and interests overseas. From the perspective of energy security, China’s development of access to port facilities for the People’s Liberation Army (PLA) Navy and alternative overland transit pipelines through its littoral neighbors will be the defining features of the Maritime Silk Road. However, Chinese actions have raised concerns among U.S. and Asian stakeholders about the future balance of power in the region and the development of a Sinocentric order.

Policy Implications

- China’s traditional emphasis on self-reliance provided the imperative for its energy diversification strategy and the development of the PLA Navy’s blue water capabilities. These activities are in turn driving new cooperative and competitive dynamics in the Indian Ocean region.

- China’s narratives about the benefits of BRI and the protection of rights and interests overseas are increasingly converging into a single broader narrative about China’s preparedness to contribute to common security in the areas covered by BRI. A likely result of this converged narrative is the increase in diplomatic activities by the PLA Navy under the auspices of BRI.

- The PLA Navy requires access to friendly ports across the Indian Ocean, and China is also looking for alternative overland transit routes to connect its overseas oil and gas shipments. Achieving these goals will require China to co-opt smaller littoral states into the Maritime Silk Road agenda.

- If the U.S., India, and Japan can forge a substantive strategic partnership, their accommodation of China as a rising maritime power will be less likely. Paradoxically, efforts to counterbalance or impede China’s plans will further ingrain the country’s sense of energy insecurity and reinforce its determination to enhance its maritime capabilities and develop alternative transit routes for its energy imports.

Please click to read the full report.

Editor's picks

Trending articles

In tapping opportunities arising from the Belt and Road Initiative, Chinese enterprises are not confining themselves to investing in major infrastructure projects. In fact, quite a number of them have established distribution channels in Belt and Road markets to sell different kinds of products. Others have chosen to set up manufacturing plants or source raw materials in Belt and Road countries for the Chinese mainland market.

All told, the types of businesses involved are increasingly diversified. In order to boost overall operational performance and foster sustained development of their overseas business, many of these enterprises need a great deal of service support to link up mainland production systems with their overseas business operations. In addition to utilising networks in Shanghai, Hong Kong and elsewhere to improve international logistics efficiency, they also have to strengthen information and capital flow management.

Maitrox, a supply chain service company headquartered in Shanghai, pointed out in an interview [1] that, although many mainland enterprises have high-tech production capabilities and the quality of their products is comparable to that of leading international brands, they need related service support in supply-chain management in “going out” and in developing Belt and Road markets. For example, in selling their own-label products in overseas markets, many enterprises are making considerable gross profits if reckoned only on a sales basis. But, if they want to develop their brand business and maintain brand loyalty and the support of overseas consumers, they would have to provide consumers with efficient after-sales and repair services, either through distributors or directly in the respective local markets. This may involve high fees and costs that might eat into the profits of the business concerned and, if not handled properly, might even affect the image of their brands in overseas markets.

Mainland enterprises are venturing into various overseas markets and Belt and Road related regions to set up comprehensive supply-chain management networks. The coverage spans across Asia, including Southeast Asia and India, Africa and even as far afield as Europe, and North and South America. According to Maitrox, many companies would like to use third-party services to raise the efficiency of such business processes as production, sales and after-sales services, and also to minimise the operation costs of expanding into international markets.

To be able to achieve these objectives, however, the service providers concerned need to have sophisticated IT, such as state-of-the-art big data analytics, before they can offer suitable solutions in designing and setting up networks in procurement, production, inventory, sales and after-sales services. They also need to utilise related financial services to help enterprises plan the income and expenses of each aspect of their business. In addition to improving cash flow in the entire business process and lowering funding costs, they also have to help solve problems in international payments and exchange risks.

Maitrox is currently providing comprehensive supply-chain services to mainland brands and other customers. This includes planning consultation and execution covering the entire production, sales and after-sales processes. For example, Maitrox provides its mobile phone business customers with after-sales supply-chain services to help set up overseas markets service networks. Such networks offer phone replacement, on-site repair, spare parts management, premium-grade repair and testing.

For customers with smaller overseas operations, Maitrox will help organise mail-in repair services by using logistics to send products requiring repairs back to the mainland, such as factories in Shanghai and Shenzhen bonded zones. In these factories, chip-level repairs, replacement and refurbishment will be carried out, before the mobiles are sent back to the overseas consumers expeditiously.

For this, in addition to running a number of repair centres and smart warehouses around the world, Maitrox has also set up a global repairing hub in Hong Kong. This way, with the support of advanced IT management systems, it can make use of Hong Kong’s international logistics network to transfer products, parts, components and spare parts for global distribution. Backed by its supply chains in Shanghai and elsewhere on the mainland, as well as Hong Kong’s financial services, Maitrox can provide customers with cost-effective global supply-chain management services.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Maitrox Smart Supply Chain was interviewed jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce in Q1 2018.

Editor's picks

Trending articles

Russian Post records its busiest ever month, a testament to the level of China-Russian cross-border e-commerce.

Russian Post handled 38 million international parcels in March this year, an all-time record for the state-owned mail carrier. This surge in deliveries is at least partly down to the success that two relatively new China-serviced e-commerce platforms – Joom and Pandao – have had in penetrating the Russian market.

The March record easily exceeds the highest level of throughput previously recorded by the carrier. During the immediately pre-Christmas period, traditionally the busiest few months for postal services the world over, Russian Post had previously hit a high of 30 million packages in a month, well short of its March total.

Tellingly, of the 93.7 million parcels handled by the service in the first three months of 2018 – a 35% increase over the same period last year – only some 900,000 were outbound from Russia. This is, again, a clear indication that cross-border e-commerce deliveries largely account for the carrier's package-handling spike.

The contribution of Joom and Pandao to these record figures should not be underestimated. While AliExpress, the Hangzhou-based e-commerce giant that has been active in Russia since 2015, operates its own logistics service, the two newcomers have been almost wholly-reliant on Russian Post for almost all of their deliveries.

Again, unlike AliExpress, both Joom and Pandao are ostensibly Russian businesses, even though the vast majority of their vendors are China-based. In the case of Pandao, it was launched by Mail.ru, Russia's longest-established internet business, in September last year.

Following an intense period of promotion, its user base grew from just 400,000 in November last year to 5.5 million in the March of this year. It now claims to process 370,000 orders a day, a development some see as down to the promotional clout of Mail.ru, which is second in online popularity only to Yandex.ru among Russian consumers.

With the two new players only adding to the flood of e-commerce purchases transiting from China to Russia, with AliExpress and JD.com taking the lead here, a number of new delivery routes have opened up over recent years. These include overland pick-up points in Heilongjiang and Jilin, which are serviced by a growing fleet of Russian trucks, as well as the Xinjiang and Kazakhstan dry-ports, both of which boast state-of-the-art trans-shipment capabilities and ready access to the customs facilities of the Eurasian Economic Union (EEU), the five-nation trading block that counts both Russia and Kazakhstan as members.

For Hong Kong businesses looking to break into the Russian market via e-commerce, however, the national carrier remains the preeminent choice. As well as offering access to other EEU member states, it also provides a cash-on-delivery service via its Post Bank network, a facility that has proved hugely popular among Russia's less technically-adept online shoppers. In another plus, Post Bank also has the facility to process Union Pay transactions in both roubles and RMB.

As an alternative to Russian Post, Kazakhstan Post – better known as KazPost – has some potential. At present, however, it lacks its own consolidation centre in Asia, a shortcoming that puts up its costs while slowing down its delivery time. It is, however, believed to be in negotiations to remedy this by establishing just such a facility in one of China's coastal cities. With KazPost's ambitions likely to be fuelled by the growing significance of the Belt and Road Initiative, it could be worth keeping an eye on the carrier as a possible future partner.

Leonid Orlov, Moscow Consultant

Editor's picks

Trending articles

By Nancy, L.S. LEUNG, Visiting researcher, Asian Cultures Research Institute, TOYO University

Background of ‘Belt and Road Initiative’

The idea of ‘Silk Road Economic Belt’ is first introduced by Chinese president Xi Jinping in September 2013, during his visit in Kazakhstan. In October 2013, Xi announces the idea of ‘21st-Century Maritime Silk Road’ during his visit in Indonesia. In February 2014 the ideas of ‘Silk Road Economic Belt’ and ‘21st-Century Maritime Silk Road’ are officially named as ‘One Belt One Road’, and ‘One Belt One Road Initiative’. However, in the middle of 2017, the official names change to ‘the Belt and Road’ and ‘Belt and Road Initiative’ respectively.

Research Trend of ‘Belt and Road Initiative’

1. Research Method

Academic articles are collected by using search engines in academic journals database providers such as JSTOR, SAGE Journals, ProQuest, Elsevier, Taylor & Francis Groups. Due to time limitation, this study only includes those academic articles which are published by July 2017 and are accessible through the library of TOYO University (whole article can be access). However, articles published in academic journals which are printed in single column and less than 3 pages are not included. Besides, introductory essay, working papers are not included in this study.

2. Number of Academic articles and Publication period

This study has collected 122 ‘Belt and Road Initiative’ related academic articles which were published by July 2017 and 114 articles are accessible through the library of TOYO University. Since the idea of ‘the Silk Road Economic Belt’ is first introduced in September 2013 and most of the ‘Belt and Road Initiative’ projects starts after the establishment of AIIB (December 2015), academic articles analyzing or discussing ‘Belt and Road Initiative’ are very limited in 2013 (1 article) and 2014 (1 article is published between 2014 and 2015), but increase sharply from 2015. In 2016, the number of academic articles is a double to 2015. By July 2017, there are 40 academic articles related to ‘Belt and Road Initiative’. The sharp increase implies that ‘Belt and Road Initiative’ attracts certain attention in English academia.

3. Academic Discipline

Base on the journal’s discipline and article’s content, this study has classified the collected 114 articles into 8 academic disciplines. They are Agricultural Sciences, Area Studies, Earth Sciences, Economics, Geography, Law, Sociology and Political Sciences. Among 114 articles, the largest share is Political Sciences (41%), following by Economics (32%) and Area Studies (10%). ‘Belt and Road Initiative’ is seen as an economic policy towards China, to solve internal economic issues such as excess production capacity and to develop the western part of China. At the same time, ‘Belt and Road Initiative’ is also seen as a foreign police, for example, to increase China’s leadership in global governance and its political influence towards developing countries.

Viewing from a more detailed sub-discipline level, 18 sub-disciplines are classified. They are Agricultural Economics, Asian Studies, Cultural Studies, Development Economics, Economic Geography, Energy Economics, Environmental Science, Financial Economics, Geopolitics, International Economics, International Law, International Relations, Policy Studies, Political Economy, Resource Economics, Social Geography, Transport Economics and Transportation Engineering. Within the 18 sub-discipline, International Relations has the largest share (25 articles, 22%), following by Policy Studies (17 articles, 15%) and Asian Studies (11 articles, 10%). Since ‘Belt and Road Initiative’ aims to increase cooperation in infrastructure, security and economic development between China and participating countries, it is not surprise to find most of the articles focus on the relations between China and partner counties, China and its neighboring countries, China and United States (US) or China and European Union (EU).

4. Wording

The official name ‘the Belt and Road’ or preferred translation ‘Belt and Road Initiative’ are announced in 2017. Before that, ‘One Belt One Road’ or ‘One Belt One Road Initiative’ are used. ‘Belt and Road Initiative’ is representing 2 projects, ‘the Silk Road Economic Belt’ (land project) and ‘the 21st-Century Maritime Silk Road’ (maritime project), therefore, ‘Silk Road Economic Belt’ and ‘21st Century Maritime Silk Road’ were commonly used to represent the initiative. Although 2 projects are commonly used to represent the initiative, it is rare to name the initiative as ‘Silk Road Economic Belt & 21st Century Maritime Silk Road’. Besides that, some articles focus on land route only mentioned ‘Silk Road Economic Belt’ and articles focus on maritime route only mentioned ‘21st Century Maritime Silk Road’. Until 2016, ‘Silk Road Economic Belt’ is being used more frequently than ‘One Belt One Road’. Between 2015 and 2016, ‘New Silk Road’ is commonly used to represent the initiative apart from ‘Silk Road Economic Belt’ and ‘One Belt One Road’.

The wording represent ‘Belt and Road Initiative’ is rich in variations. Moreover, different wordings are used to represent ‘Belt and Road Initiative’ in an article, e.g. ‘One Belt One Road’, ‘One Belt One Road Initiative’ and OBOR are commonly used together. Among the past and present official names representing the initiative, ‘Silk Road Economic Belt’ (18%), ‘21st Century Maritime Silk Road’ (11%)and ‘One Belt One Road’ (10%) are frequently used. However, the way it is presented in the articles is depended on the authors. For example, adding the word ‘and’, comma (,) or hyphen (-) between ‘One Belt One Road’ such as ‘One Belt and One Road’, ‘One Belt, One Road’, ‘One-Belt-One-Road’, ‘One Belt-One Road’, are commonly found. Since the idea of ‘Belt and Road Initiative’ is generated from the ancient Silk Road, ‘Silk Road’, ‘New Silk Road’, ‘Modern Silk Road’, ‘New Silk Route’, ‘New Maritime Silk Road’, ‘Maritime Silk Route’, ‘Two Silk Roads’ and ‘Chinese Silk Road’ are commonly used to represent the initiative too. Besides, short forms, such as ‘One Belt One Road’ as ‘OBOR’, ‘Belt and Road’ as ‘B&R’, ‘Silk Road Economic Belt’ as ‘SREB’, ‘21st Century Maritime Silk Road’ as ‘21st CMSR’ or ‘MSR’, ‘New Silk Road’ as ‘NSR’ and ‘Belt Road Initiative’ as ‘BRI’ are also commonly used. Furthermore, others expressions such as Chinese pronunciation ‘yidai yilu’ (pinyin) , an inversed expression ‘One Road, One Belt’, ‘Eurasian Silk Roads Initiative’, are also found to represent ‘Belt and Road Initiative’ in some articles. Apart from ‘Belt and Road’, the word ‘Initiative’ is commonly replaced by similar wordings such as ‘strategy’, ‘project’, ‘vision’, ‘concept’, ‘program’, ‘policy’, ‘framework’, ‘agenda’, ‘plan’ and ‘proposal’.

5. Summary and future directions

Among 114 academic articles related to ‘Belt and Road Initiative’, 25 articles (22%) are in the discipline of International Relations. Within the 25 articles, 7 articles are discussing the power relation between China and US. Although geographically ‘Belt and Road Initiative’ has not much relation towards US, ‘Belt and Road Initiative’ has both direct and indirect economic and political influences to US. First, most of the articles discuss ‘Belt and Road Initiative’ will empower China and affect the position of US as the world leader. Second, ‘Belt and Road Initiative’ will affect US’s political and economic interests in Southeast Asia, Central Asia, Middle East and EU. Third, ‘Belt and Road Initiative’ will affect the relations between US and ‘Belt and Road Initiative’ participating countries. Other articles in International Relations discipline examine the relation between China and other counties, such as South Korea, India, Pakistan, Afghanistan, EU, etc. in terms of trade, development and political influence. However, not all 25 articles in International Relations discuss the relationship between China and other countries under ‘Belt and Road Initiative’, 7 articles mention ‘Belt and Road Initiative’ once or twice only. This implies that in the field of International Relations, ‘Belt and Road Initiative’ is seen as an influencing policy, but since the outcomes of ‘Belt and Road Initiative’ are still limited for analyze, it is difficult to examine the influence of ‘Belt and Road Initiative’ at the moment.

Apart from International Relations, in the discipline of Asian Studies, Policy Studies and Political Economy, how ‘Belt and Road Initiative’ will influence China’s position in world and trade relations between China and other countries are also discussed. In the discipline of Economics, most articles explore how ‘Belt and Road Initiative’ is beneficial to China and participating countries and how it can help to develop less developed regions/areas. In sum, most of the articles evaluate the concepts or background of ‘Belt and Road Initiative’, both quantitative and qualitative studies are limited. Furthermore, most discussions are remained in assumption or prediction level. This is because the practice of ‘Belt and Road Initiative’ started in late 2015, most of the infrastructure projects, trade projects are still under constructions or discussion.

In the coming years, when more ‘Belt and Road Initiative’ related projects are completed, it is expected that the number of quantitative and qualitative studies related to ‘Belt and Road Initiative’ will increase. Considering cooperation is one of the main concepts in ‘Belt and Road Initiative’, mainstream research is expected to remain in the discipline of International relations. At the same time, studies from economics perspective will increase because infrastructure development is directly related to economy.

This article was first published by Asian Cultures Research Institute TOYO University.

Editor's picks

Trending articles

The Yangtze River Delta (YRD) is one of the major economic engines of China, as well as the biggest source of China’s outward direct investment (ODI). Enterprises in this region are making haste to open and develop markets along the Belt and Road routes in the hope of further boosting their business growth.

An important focus of these enterprises is to more effectively connect the YRD with the industry chains of other mainland regions and international markets through its gradually maturing network of transportation with the outside world. This includes sea and air transport as well as the China-Europe Railway Express line (or CR Express), which has seen rapid development lately, in order to better tap into new markets along the Belt and Road routes and other overseas markets.

CR Express Attracts Much Interest

Many companies have already established distribution channels in Belt and Road markets to sell their products. Their business is wide-ranging and needs the support of transportation networks in the YRD, South China and even Hong Kong in order to improve international logistics efficiency, while connecting their production system on the mainland with overseas business operations (For further details, see Devising “Belt and Road” Supply Chain Management System). Companies in the YRD are actively making use of the sea and air transportation and logistics networks in the region to connect with overseas markets, and more and more companies are beginning to pay attention to the transport of goods by train as an alternative.

Compared with sea and air transport, the freight volume of rail transport is relatively small. In 2016, rail transport only accounted for about 2% of the total freight volume of Jiangsu and Zhejiang and less than 1% of Shanghai’s [1]. Following the accelerated development of CR Express services, however, the service frequency of freight trains running between China and Europe has seen rapid growth in recent years.

Rail links have been extended from inland provinces in the western region to the YRD and other coastal cities. Many logistics service suppliers have come to see the potential of rail transport, and some of them have started to make active use of freight trains to ship goods sourced from coastal and western regions to Europe. A foreign-invested logistics company in the YRD even expressed the hope of leveraging the CR Express to further develop rail freight transport between Japan and Europe through the Chinese mainland. (For further details, see Planning for CR Express Connectivity to “Belt and Road” Logistics Network.)

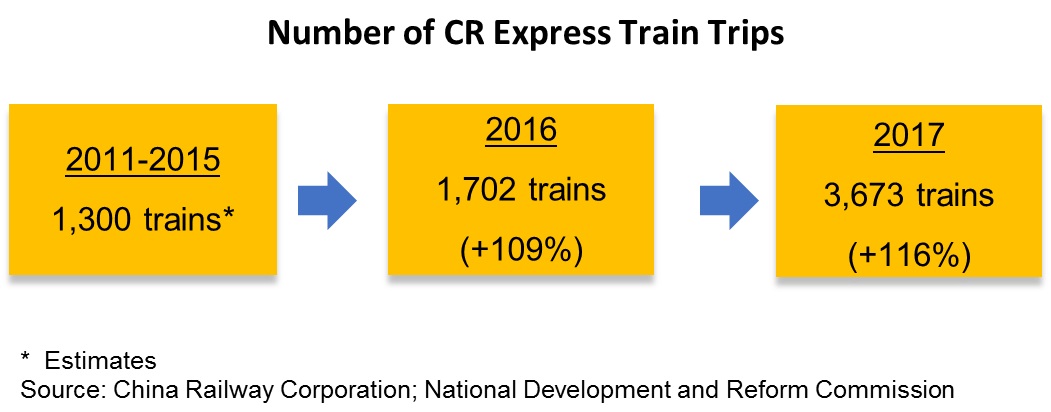

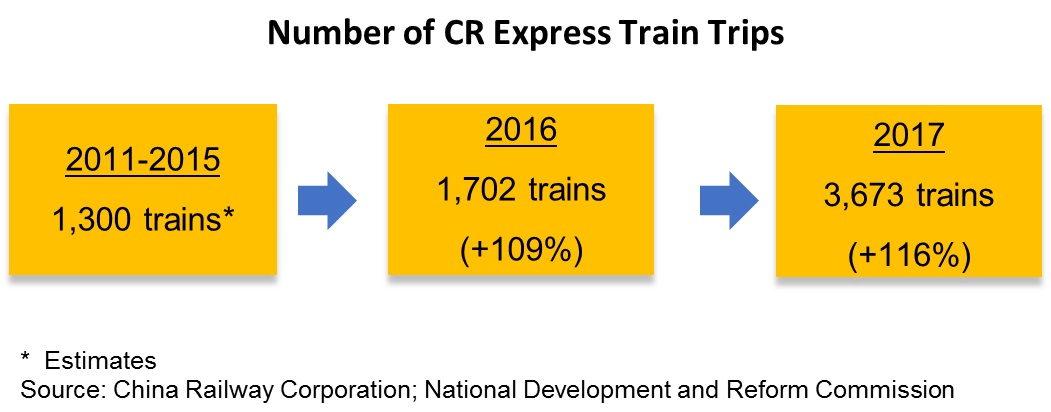

Since the first CR Express train set off from Chongqing to Duisburg (or Yuxinou, the Chongqing-Xinjiang-Europe International Railway) in Germany in 2011, about 6,600 trains had been dispatched up to the end of 2017. [2] In particular, the frequency of such train service has increased significantly in 2017, exceeding the total trips made during the six years between 2011 and 2016. This reflects the fact that mainland companies are relying more and more on trains to deliver goods to Europe.

The service was mainly used to ship Chinese goods to Europe in the early days, but the situation is gradually changing as more companies use rail links to import goods from Europe. In 2017, the number of inbound trains amounted to over half of that of outbound trains [3], putting trade between China and Europe by rail on the path of two-way development.

CR Express Provides an Alternative for Freight Transport

The National Development and Reform Commission announced the Development Plan for CR Express (2016-2020) in October 2016 with the aim of forming a convenient and efficient CR Express service system with steady transport volume by 2020. At the time of the announcement the CR Express had operated a total of 1,881 trips, with 16 departure cities in China and 12 destination cities abroad. [4]

According to the National Development and Reform Commission, departure cities in China had increased to 38 by the end of 2017, and the service had expanded to 36 cities in 13 countries across Europe in just a year. The range of outbound goods has gradually expanded from information technology products in the early days, like mobile phones and computers, to clothing, footwear and headwear, automobiles and auto parts, grain, wine, coffee beans, timber, furniture, chemicals, machinery and equipment.

Development Plan for CR Express (2016-2020) Aim: Increase frequency of freight train service to around 5,000 annually by 2020, with marked increase in freight volume on inbound trains. Western corridor: - Crossing the border at Alataw Pass (Khorgos) in Xinjiang, passing through Kazakhstan to connect to the Siberian Railway in Russia, crossing Belarus, Poland and Germany, and finally reaching other European countries. - Crossing the border at Khorgos (Alataw Pass) and finally reaching Europe after passing through Kazakhstan, Turkmenistan, Iran and Turkey, or passing through Kazakhstan and crossing the Caspian Sea into Azerbaijan, Georgia and Bulgaria, finally reaching Europe. - Connecting to the planned China-Kyrgyzstan-Uzbekistan Railway via the Torugart Pass (Irkeshtam), finally reaching Europe after crossing Kyrgyzstan, Uzbekistan, Turkmenistan, Iran and Turkey. Central corridor: - Crossing the border at Erenhot in Inner Mongolia to connect to the Siberian Railway after passing through Mongolia, finally reaching Europe. Eastern corridor: - Crossing the border at Manzhouli in Inner Mongolia (Suifenhe in Heilongjiang) and reaching Europe after connecting to the Siberian Railway in Russia. Departure/destination cities in China: - Chongqing, Zhengzhou, Chengdu, Wuhan, Suzhou, Yiwu, Shenyang, Changsha, Lanzhou, Beijing, Tianjin, Lianyungang, Yingkou, Qingdao, Urumqi, Xi’an, Hefei, Jinan and Dongguan. |

Besides Chengdu, Chongqing and other cities in western China, increasingly goods originating from production bases along the coastal region are exported through CR Express. For example, after the opening of the CR Express service between Yiwu in Zhejiang and the Spanish capital of Madrid in November 2014, small commodities from Yiwu were continually shipped to the European market via rail transport. On the other hand, goods imported from Europe on inbound trains are also becoming more diversified and cover a much wider range, including food and beverages like wine and olive oil, raw materials such as timber and pulp, and even electrical equipment, solar film, electronic components and machinery.

CR Express has also extended its service to South China. This includes the launch of the service from Shilong of Dongguan to Duisburg of Germany in April 2016 and another service from Guangzhou to Kaluga of Russia in August 2016. Clothing, footwear, computer accessories and electronic equipment produced in the Pearl River Delta (PRD) region can now be shipped by using standard 40-foot containers carried on CR Express. These developments help bring the YRD, PRD and other coastal regions closer to the European markets and suppliers.

It is worth noting that thanks to government support, CR Express can provide one-stop service in inspection, quarantine, customs declaration, customs clearance and other areas. Although trains bound for Russia, Central Asia (such as Kazakhstan) and even Eastern and Western Europe have to change tracks due to gauge differences, the technical problems have been resolved through the arrangement of railway and transportation companies. The logistic companies responsible for shipping the goods will also monitor the complete shipping process, provide the consignors with customs clearance service, and make sure that the goods are delivered to the required warehouses after reaching the respective railway terminals. These services contribute to the development of CR Express.In April 2017, a collaboration agreement was signed by railway departments of seven countries involved in the operation of CR Express, including China, Belarus, Germany, Kazakhstan, Mongolia, Poland and Russia. A broad consensus was reached on rail connectivity, optimisation of transportation organisations, perfection of service safeguards, improvement of customs clearance efficiency, and other issues. CR Express can expect steady growth in future thanks to cross-border collaboration.

The recent rapid expansion and increasing frequency of Europe-bound rail services, and the significantly shorter lead time of 10-12 days for the fastest routes, means rail has gradually become a viable alternative to sea and air transport for export and import businesses. Generally, these freight trains can transport cargo to their European destinations three times faster than shipping by sea for one-fifth of the cost of transport by air. While rail freight is still more costly than sea freight [5], CR Express can work as an adjunct to sea and air transport and attract more and more companies to use rail services to expand China-Europe trade.

These developments will effectively enhance the transport links between China and countries in Asia and Europe and strengthen the capabilities of related logistics providers of cargo transportation and distribution. Under such circumstances, companies not just in the western regions but also along the coast may need to consider the feasibility of the further rail transport use to enhance their flexibility in expanding into Eurasian markets. Furthermore, logistics operators can also strengthen partnerships and co-operation with the relevant railways, helping to connect them to logistics and transport networks in the YRD, South China and even Hong Kong and so enhance their advantage in the international transportation and integrated logistics business.

Note: For details of the company interviews conducted jointly by HKTDC Research and the Shanghai Municipal Commission of Commerce, please refer to other articles in the research series on Shanghai-Hong Kong Co-operation in Capturing Belt and Road Opportunities.

[1] Source: Jiangsu Statistical Yearbook, Zhejiang Statistical Yearbook, Shanghai Statistical Yearbook.

[2] Estimates.

[3] Source: China Railway Corporation.

[4] June 2016 figures.

[5] Source: National Development and Reform Commission.

Editor's picks

Trending articles

By Kaho Yu, Associate with the Geopolitics of Energy Project in the Belfer Center for Science and International Affairs, Harvard Kennedy School

Executive Summary

This essay examines the factors, mechanisms, and implications of energy cooperation under China’s Belt and Road Initiative (BRI) and analyzes how the initiative could reshape the current international energy order.

Main Argument

Unprecedented in size and scope, BRI promises approximately a trillion dollars in investments to resource-rich regions in Asia, Europe, and Africa. With its theme of interconnectivity, the implementation of the initiative is expected to prioritize infrastructure projects. Transnational energy cooperation, especially the massive development of energy infrastructure and improved market access, will be an important way for China to achieve its ambitious goals. Although BRI will facilitate energy cooperation, it would be wrong to assume that energy security is China’s primary aim; instead, energy cooperation is an important way of achieving the initiative’s higher-level objectives. BRI foresees a more multilateral engagement strategy from China, one that enables both domestic development and external influence and that eventually may have the potential to modify the current international energy order.

Policy Implications

- The U.S. should establish mechanisms to monitor and assess the progress of energy infrastructure projects. The U.S. should not assume that all energy projects in BRI are purely commercial or political but instead should analyze them on a case-by-case basis.

- The U.S. should address areas where its businesses could benefit from BRI. Poor coordination in BRI has resulted in false expectations in the recipient countries, leaving room for the U.S. to carve out a role for itself in the initiative. The U.S. could offer “soft” support in infrastructure construction and should consider joining the Asian Infrastructure Investment Bank and exercising leadership in existing institutions, such as the Asian Development Bank and the World Bank, to coordinate on projects.

- China has attempted to strengthen its maritime defense and logistics capacity by investing in ports along the BRI corridors. The U.S. should trace China’s new sea routes and port investments and find ways to cooperate with China’s navy in international partnerships and joint maritime operations.

- With BRI, China may eventually determine the rules for energy trade and investment in Eurasia. The U.S. should maintain flexibility in adapting the existing international order to accommodate new energy powers.

Please click to read the full report.