Chinese Mainland

4 Nov 2016

China Go Abroad (4th Issue) - Key connectivity improvements along the Belt and Road in telecommunications & aviation sectors

Albert Ng, Chairman, China Managing Partner, Greater China, EY:

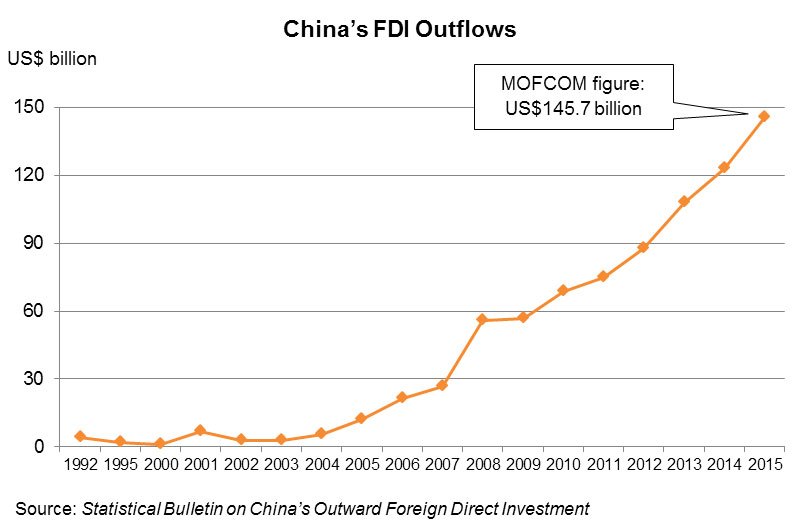

“China’s outward FDI reached USD99 billion in the first half of 2016, an over 50% increase compared with the corresponding period of 2015. It reflected the increasing Chinese interests in internationalization due to the country’s economic transformation and the changes in global markets. However, the desire for expansion poses a critical test on the overseas investment and operating abilities of Chinese enterprises. “Going out” is not the ultimate goal, rather, the key is how far you can go and how successful you become. EY expects China’s outward FDI in 2016 is likely to exceed USD170 billion for the whole year, reaching another historical record high. In the coming years, the tide of China’s overseas investment will continue to rise and maintain a double-digit growth rate. The challenges for Chinese enterprises are to improve their strategic decision-making and operating capabilities, seize the opportunities and generate new drivers for growth in order to survive ‒ and thrive ‒ in the international markets.”

Loletta Chow, Global COIN Leader, EY:

“Stepping into 2016, Chinese enterprises are performing remarkably well in the global investment market: as a net capital exporter, China's outward investment has exceeded the inward investment. The underlying high growth is the fresh and energetic momentum released by the Chinese outbound investment. A decelerated return growth rate for domestic investment and expectation of renminbi devaluation are the key concerns for capital and funds to look for better alternative opportunities. On the other hand, Chinese enterprises need to accelerate their internationalization process to enhance their competitiveness. In addition, with the implementation of encouraging national strategies such as “One Belt, One Road”, China’s outbound investment is expected to continue to grow in the future.

“The manufacturing industry has experienced a remarkable growth in China’s outbound investments. It indicates that the policies to promote the sector’s “going out” and strengthen international capacity cooperation have been successful. Technology-rich assets are the most sought-after currently as Chinese companies move up along the value chain. Thus, European and American countries with advanced technologies, stable economies, and healthy investment environments continue to be the most popular investment destinations.

“This year, 2016, is also witnessing China’s continued implementation of the “One Belt, One Road” initiative. Spanning more than 60 countries cross Europe, Asia and Africa, the initiative is fueling this round of outbound investment. In our last China Go Abroad report6, we focused on the rising high-end manufacturing power in China - the “going out” of high-speed rail and nuclear power. In this issue, we will turn to another two important sectors which also play an important role in the “One Belt, One road” strategy - the telecommunications and aviation sectors. From the “Information Silk Road” to the “Aerial Silk Road”, both large state-owned and private enterprises are actively developing their investment blueprints. And we expect to see substantial and robust development of the related investments driven by the “One Belt, One Road” initiative in mid-to-long term. However, careful due diligence and risk assessments will become the key for enterprises in their efforts to succeed due to the unique ‒ and often high risk ‒ investment environments along the Belt and Road.

“Outbound investment requires significant funding and needs to consider many sophisticated factors. A good financing structure will increase the success rate of investment. In the regional analysis of this issue, we will focus on Hong Kong and explore its important role in developing the “One Belt, One Road”. Because of its advantages in policy, talent and international experience, Hong Kong can serve as a strong platform from which Chinese enterprises are able to “go out” more smoothly. Relating to this, the EY Overseas Investment Growth Navigator has been developed to help Chinese enterprises to understand their possible financing difficulties and solutions, and we will look at a tax planning case study showing the importance of thorough investment and financing planning.

“For those involved in this new wave of outbound investment, enterprises should not just blindly follow existing trends. Instead, they should foster their own international market perspective and undertake long-term strategic planning. We look forward to seeing Chinese enterprises embrace the world with a better market understanding and show the world a new image of the mature Chinese corporation.”

Please click to read full report.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Editor's picks

Trending articles

Western China: Access Belt and Road Markets via Hong Kong

Western China’s thriving economy not only encourages the inflow of foreign investment aiming to tap the local market, but also spurs companies in the region to step up their efforts in “going out” to look for resources to boost their competitiveness and further develop overseas markets.

A survey conducted recently by HKTDC Research shows that as a service platform, Hong Kong is the first choice for these companies “going out” to tap business opportunities in markets along the Belt and Road routes. In fact, companies in western China are very keen to seek professional services support from Hong Kong in brand design and marketing strategy, sales, product development and design, financial and legal matters in order to control the risk of investing overseas, and to establish effective sales channels there. With enterprises stepping up their efforts in “going out” – especially those in economically more developed cities such as Chengdu and Chongqing – to actively expand their overseas operations, an endless supply of market opportunities are being created for service providers in Hong Kong.

(Note: For more information on the service needs of enterprises in western China to invest overseas, please see: China’s “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities)

Chengdu Sets Sights on Overseas Project Contracting

For example, Chengdu-based Sichuan Huaxi Group Co Ltd, after 60 years of development, is now one of biggest construction groups in western China, indeed the whole country. Engaged in project contracting on the mainland and overseas, real-estate development, building materials, financing and leasing, it has operations in more than 30 administrative regions throughout China, and more than 20 other countries and territories, including parts of Africa, South Asia and Southeast Asia. Huaxi Group has participated in offshore projects including hospitals and resorts in Kenya, hotels in Egypt, a sports stadium in Fiji, airport facilities in Zambia and Laos, urban facilities in Angola, as well as some of Hong Kong’s infrastructural development projects, such as the Tsing Ma Bridge.

As for overseas development, Huaxi Group told HKTDC Research that it had a market research team that collected information on overseas markets, which it also monitors through its Hong Kong network, particularly to collect information on laws and regulations as well as the business culture of the less developed countries along Belt and Road routes. This could help the group to effectively manage and control investment risk and reduce barriers to overseas markets.

It is understood that Huaxi Group’s overseas business is largely settled in foreign currencies, which require it to reduce exchange-rate risk using financial instruments. Also, given the many overseas investment opportunities, the group is keen to find cost-effective ways to raise funds through financing in Hong Kong, in addition to mainland financing, in order to promote overseas business development. The group has extensive experience in project contracting, and is very competitive in terms of cost control. In some technical areas, such as water treatment, it also recognises the strength of Hong Kong’s engineering service providers. The group aims to strengthen co-operation with Hong Kong companies in the areas of finance and technology to develop overseas-market opportunities in joint efforts by “going out”.

Chongqing Group “Going Out” to Foster Business Development

Besides, Chongqing Foreign Trade Group Co Ltd is now one of Chongqing’s key enterprises engaging in “going out" business. In recent years, the company has vigorously implemented the so-called “Boat Outward” strategy (i.e., strengthening its international business). It has made great efforts to optimise its business structure and speed up its transformation and upgrading. As a result, it has formed a business structure integrating the development of four business segments – namely, international trade, international engineering, modern finance, and cross-country investment.

Today, Chongqing Foreign Trade Group is a top-100 Chinese multinational company and a top-500 service company, having 16 subsidiaries and employing more than 30,000 people worldwide. It has four regional headquarters in Central and South America, Central and Eastern Europe, Southeast Asia, and Africa, and has set up offices in 39 countries and territories.

During the 13th Five-year Plan period (2016-2020), the company will focus on creating a modern service and cross-country investment platform in order to foster the further development of its four business segments. It aims to strengthen its “business platform”, “business channel” and “business integration" capabilities.

In making overseas investments and management of international operations, the company pays special attention to the use of various financial instruments in Hong Kong for project financing and reducing the cost of capital. In view of Hong Kong’s rich international information resources, the company has set up a branch office in the city to help manage its international business operations, especially the collection of market information in order to facilitate overseas mergers and acquisitions, and international trade business.

Looking ahead, Chongqing Foreign Trade Group will further strengthen overseas investment, including in countries along the Belt and Road routes like Southeast Asia and Africa. The company is keen to seek more of Hong Kong’s professional services, such as taxation, investment and financing consulting, in order to effectively reduce investment costs and managing overseas investment risk.

| Content provided by |

|

Editor's picks

Trending articles

China Takes Global Number Two Outward FDI Slot: Hong Kong Remains the Preferred Service Platform

While the pace of global economic growth is slackening, Chinese enterprises are actively making outward foreign direct investments (FDI) and expanding their businesses overseas. Together with the country’s efforts in advancing the Belt and Road Initiative, and strengthening various forms of economic co-operation with business partners in countries along the Belt and Road routes, this has contributed to the continued growth of China’s outbound FDI. China is now one of the world’s leading sources of FDI, its outflows in 2015 ranking second globally only to the US. During the same period, China’s outward FDI exceeded its inbound FDI, making the country one of the world’s net capital exporters.

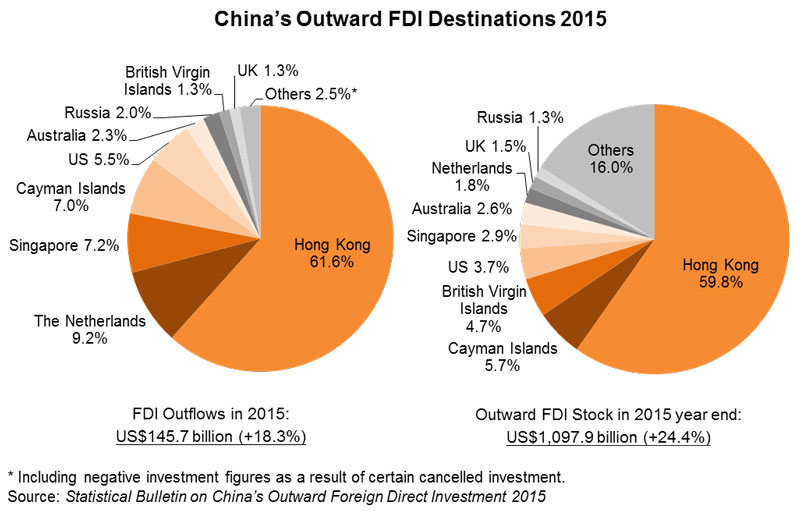

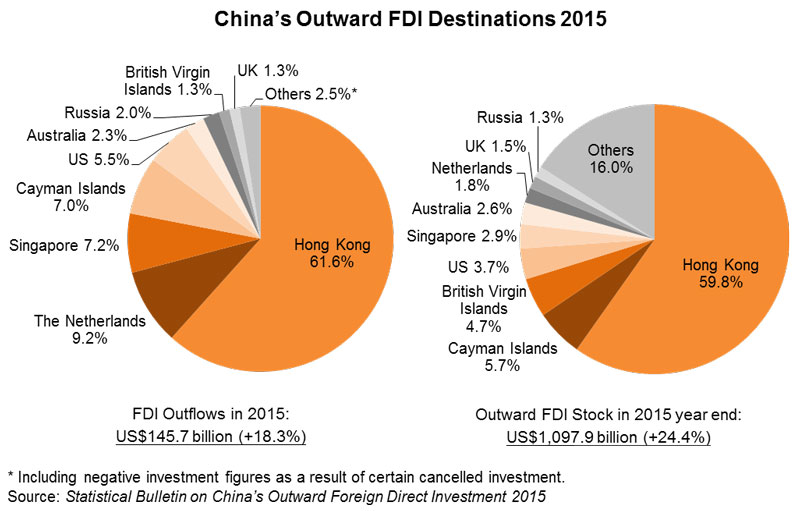

In recent years, the Chinese government has substantially relaxed the relevant administrative measures for overseas investments, whereby enterprises may now make outward FDI according to their own development plans. Currently, about 60% of the mainland’s outbound investment flows to Hong Kong, and it is believed that most of this is subsequently channelled overseas through Hong Kong’s service platform for different kinds of investment activities.

Hong Kong has always been the preferred service platform for mainland enterprises looking to invest abroad, helping industry players in the coastal areas and inland regions to handle matters involving investment and trade in foreign markets. Hong Kong is also the preferred location for mainland enterprises seeking professional services to capture opportunities arising from the Belt and Road Initiative. Its full range of professional services covers such areas as finance, legal service, tax, risk assessment of sustainable operations, and international testing and certification. As the mainland accelerates its pace of “going out” and advances the Belt and Road development strategy, its outward FDI activities will continue to expand, providing more business opportunities for professional service suppliers in Hong Kong.

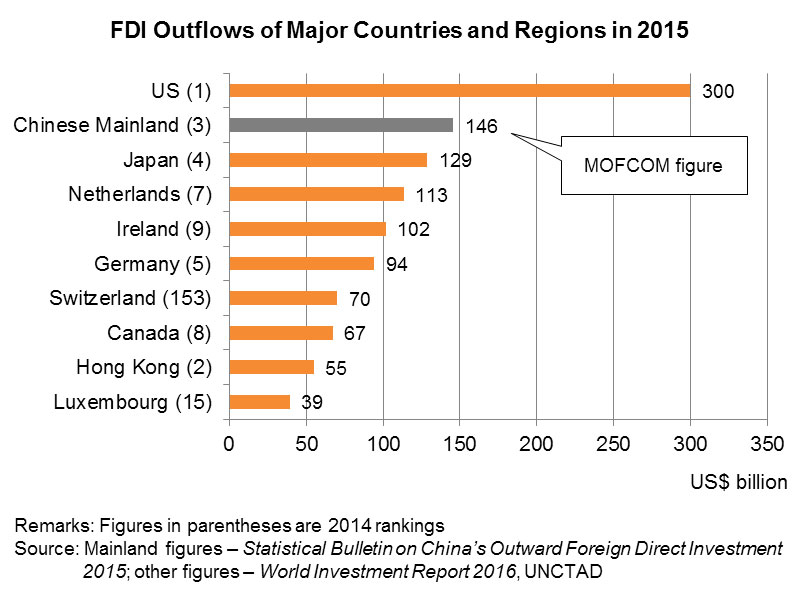

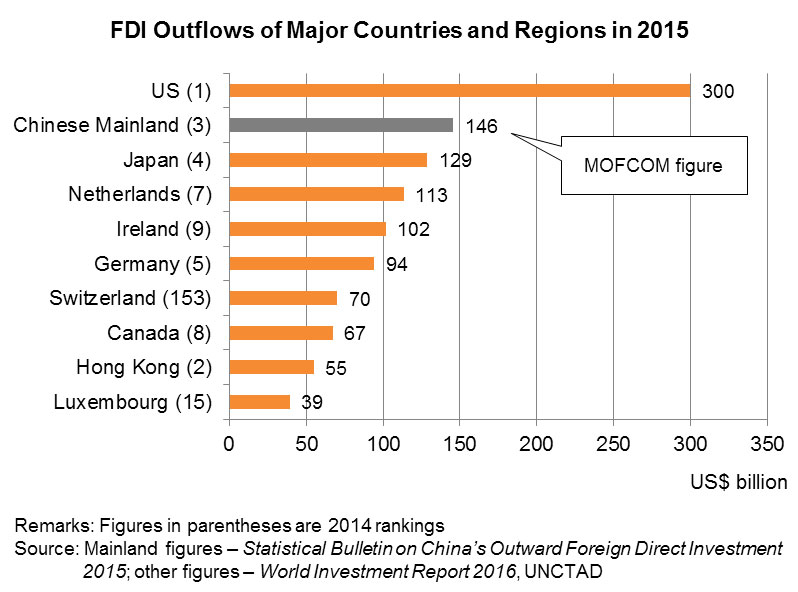

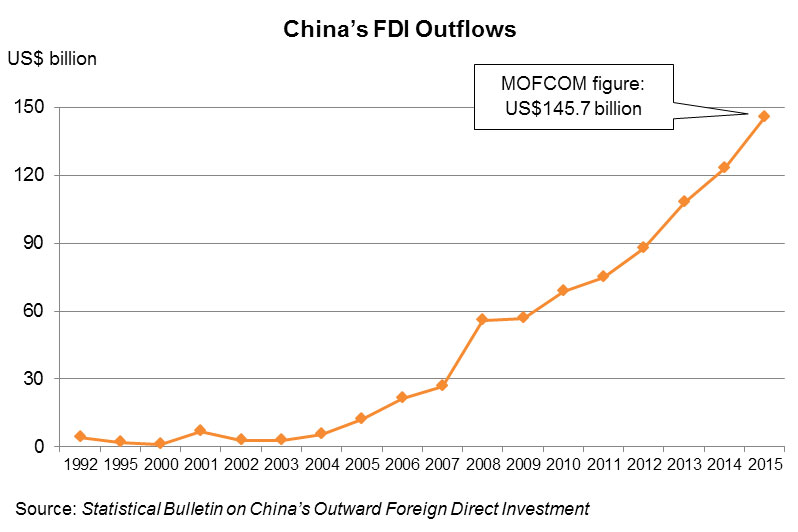

World’s Second-Largest FDI Source

According to figures released in September 2016 by the Ministry of Commerce, China’s outward FDI flows in 2015 reached US$145.7 billion (up 18.3% year on year), for the first time ranking as the world’s second-largest source of FDI. Its investment amount, second only to the US (US$300 billion) but higher than third placed Japan (US$128.7 billion), accounted for 9.9% of the global total of FDI outflows in the same period.

Meanwhile, in 2015, China’s outward FDI also exceeded the amount of its utilised foreign direct investment (US$135.6 billion), making the country a net capital exporter. It is worth noting that in this two-way capital flow involving the inflow of foreign investment into the mainland and outflow of Chinese investment abroad, Hong Kong serves as an important platform.

In particular, where outbound investment is concerned, China has substantially relaxed the relevant administrative measures for offshore investments in recent years, including, since May 2014, the introduction of the record-filing system for general outward FDI projects valued at less than US$1 billion. The National Development and Reform Commission (NDRC) further announced at the end of 2014 that the authority of approving[1] general outward FDI projects valued at and more than US$1 billion (not involving sensitive countries, regions or industries) was to be revoked. Since then, apart from outward FDI projects involving sensitive countries, regions or industries, all general outward FDI projects in China no longer require approval and are only subject to record-filing management.

Consequently, Chinese enterprises may now expand their businesses overseas and make outbound investments in countries of their choice according to their own development strategy. In spite of this, many enterprises still choose Hong Kong as their main conduit for outward investment. In 2015, the mainland’s FDI flows to Hong Kong reached US$89.8 billion (up 27% year on year), accounting for 62% of the country’s total outward FDI and reinforcing Hong Kong’s position as the leading destination of mainland outbound investments. In terms of cumulative outward investment as of the end of 2015, the stock of FDI outflows from the mainland to Hong Kong stood at US$656.9 billion, accounting for 60% of the total outward FDI stock at that time.

Blessed with such advantages as free flow of capital, wealth of global communications resources, world-class professional services and a sound legal system, Hong Kong has attracted large numbers of mainland enterprises to “go out” and invest overseas via its business platform.

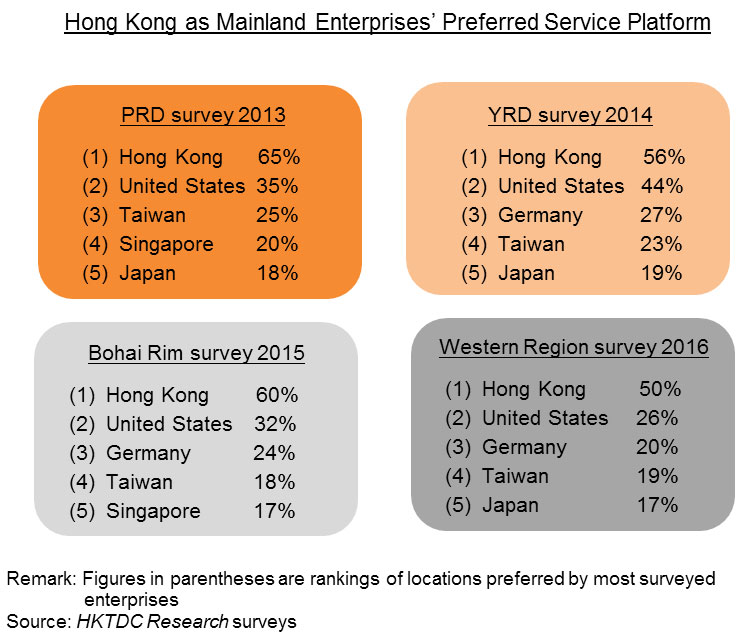

Macro factors aside, according to four questionnaire surveys conducted by HKTDC Research in different regions of the mainland between 2013 and 2016, the majority of surveyed mainland enterprises pointed out that they were interested in making use of the “going out” strategy to “bring in” the advantages of foreign business partners, while further tapping both the mainland and overseas markets. These enterprises also indicated that they needed all kinds of professional services, including brand design and promotion, marketing strategies, product development, and design services, in order to support their ventures of “going out” to expand businesses overseas.

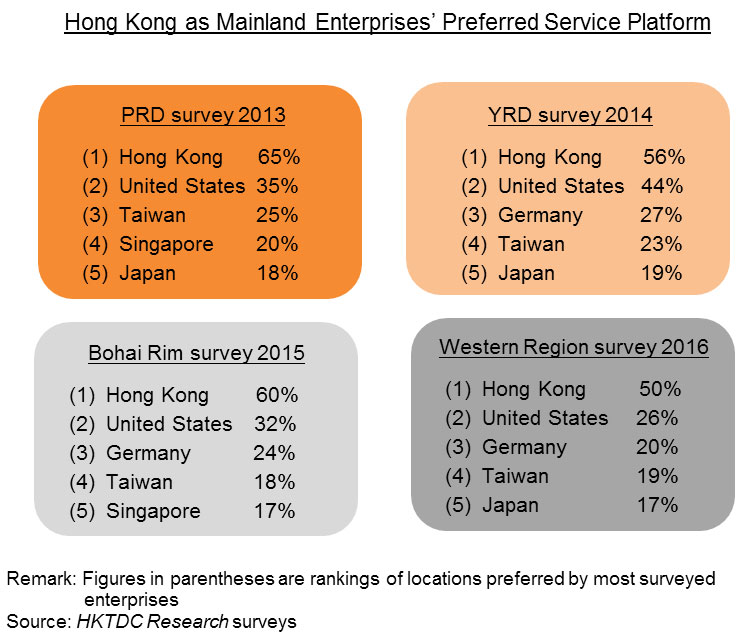

The majority of the surveyed enterprises remarked that they were most interested in seeking professional services support and co-operation partners in Hong Kong, with 65% of the enterprises in the Pearl River Delta (PRD), 56% in the Yangtze River Delta (YRD), 60% in the Bohai Rim and 50% in the western region saying so. In other words, no matter whether these enterprises are located in the coastal areas or the western region, Hong Kong is their preferred service platform in “going out” to make investment abroad.

[Remarks: For findings of the surveys conducted by HKTDC Research in the PRD, YRD, Bohai Rim and western region, please see the following reports – Guangdong: Hong Kong Service Opportunities Amid China’s “Going Out” Strategy (December 2013); Jiangsu/YRD: Hong Kong Service Opportunities Amid China's "Going Out" Initiative (September 2014); China’s “Going Out” Initiatives: Professional Services Demand in Bohai (September 2015); and China's “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities (July 2016).]

Belt and Road Initiative Adds Growth Momentum to Outward Investment

Meanwhile, China’s great efforts in advancing its Belt and Road development strategy[2] and encouraging more enterprises to conduct various kinds of trade and investment activities in countries along the Belt and Road routes have also contributed to the rapid growth of China’s outward FDI.

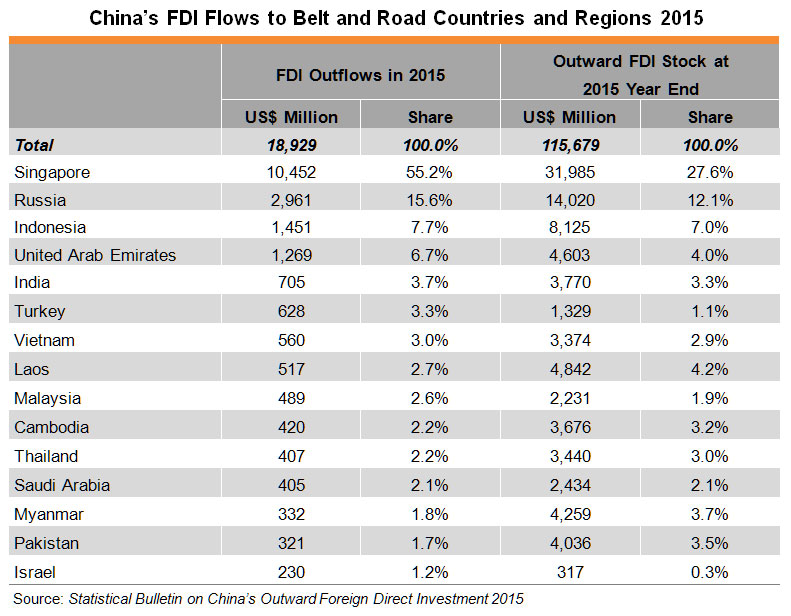

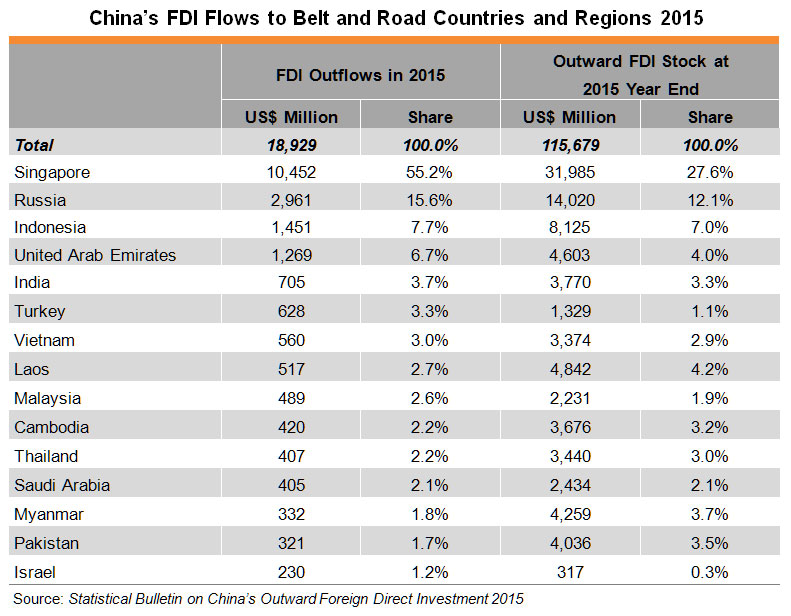

In fact, China’s FDI outflows to Belt and Road countries rocketed to US$18.9 billion in 2015 from about US$400 million in 2004, with average annual growth between 2004 and 2015 amounting to some 43%, higher than the 35% average annual growth of China’s total FDI outflows during the same period. In 2015, China’s investment in the Belt and Road countries and regions rose 38.6% year-on-year, more than twice the 18.3% annual growth rate of its total outward FDI for the same period. Moreover, the share of China’s outward FDI flows to the Belt and Road locations in its total outward FDI also climbed to 13% in 2015 from about 7% in 2004. In 2015, China’s investment in the Belt and Road Initiative mainly flowed to Singapore, Russia, Indonesia, the United Arab Emirates and India.

Strong Demand for Hong Kong Services

As mainland enterprises “go out” further to invest offshore and develop overseas business and expand foreign markets along the Belt and Road routes while seeking foreign technologies, brands, production materials and other resources to enhance their competitiveness, it can be expected that China’s outward FDI, including outflows to countries along the Belt and Road routes, will further increase in the years to come.

Hong Kong, as the preferred service platform for mainland enterprises “going out” to invest offshore, has many ways to help mainland enterprises make direct investment and expand overseas business in developed countries including the US and those in Europe. Hong Kong also serves as the ideal service platform outside the mainland for most Chinese enterprises seeking support to tap opportunities arising from the Belt and Road Initiative.

Findings of the questionnaire survey conducted by HKTDC Research in south China in 2016 show that among the many locations outside the mainland, Hong Kong is where the largest number of surveyed companies (50%) wish to seek support in developing their Belt and Road businesses. Such support includes various market-promotion services in Belt and Road markets as well as professional services related to investments in these markets, such as legal, accounting and consultancy services.

(Remarks: For findings on the questionnaire survey conducted by HKTDC Research in south China, please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China)

For many years, Hong Kong service suppliers have been assisting large numbers of mainland enterprises in handling matters related to their investment and trade activities in Hong Kong and overseas markets. Hong Kong offers many advantages in supporting mainland enterprises to invest overseas, including the free flow of capital, wealth of global communications resources, and a full range of world-class professional services, covering such areas as finance, legal service, tax, risk assessment of sustainable operations, and international testing and certification. Hence, Hong Kong is the preferred service platform for mainland enterprises “going out” to make offshore investment. As the mainland further relaxes the administrative measures for outward investment, encourages enterprises to “go out” to invest overseas, and advances the Belt and Road development strategy, more business opportunities are set to emerge for service suppliers in Hong Kong.

[1] NDRC Order No.20: Decision of the National Development and Reform Commission on Amending Relevant Articles in the Administrative Measures for the Approval and Record Filing of Outward Investment Projects and Administrative Measures for the Approval and Record Filing of Foreign Investment Projects (27 December 2014)

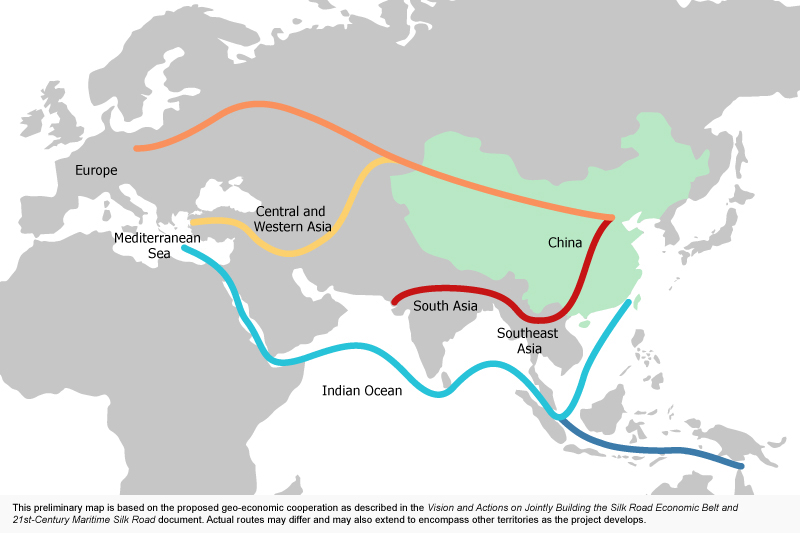

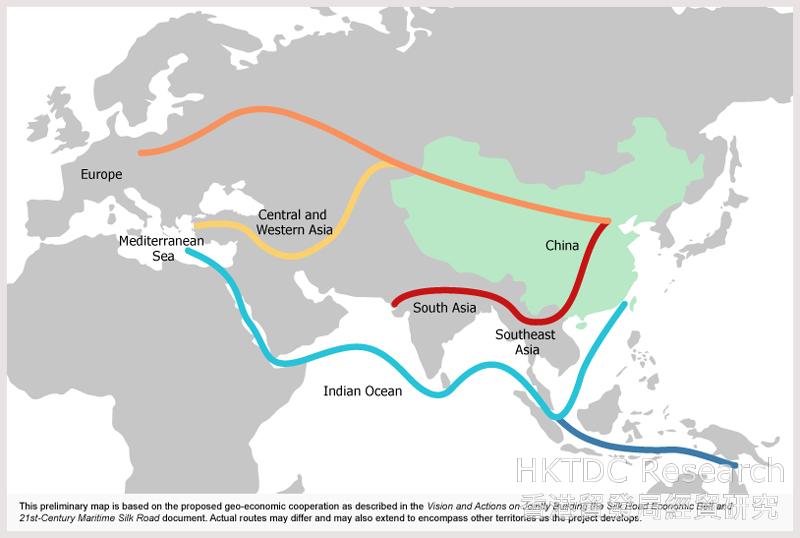

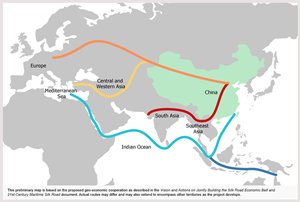

[2] China is advancing the Belt and Road (i.e., the Silk Road Economic Belt and 21st Century Maritime Silk Road) development strategy. In March 2015, China issued a document titled “Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st Century Maritime Silk Road”, proposing to accelerate the building of the Belt and Road in a move to better co-ordinate economic policies of countries along the route, promote the orderly and free movement of economic factors, and advance efficient resources distribution and in-depth market integration in creating an open, inclusive, balanced and mutually-beneficial regional economic co-operation framework.

| Content provided by |

|

Editor's picks

Trending articles

22 Nov 2016

China’s Belt and Road initiative: can Europe expect trade gains?

By Alicia Garcia Herrero and Jianwei Xu

Abstract

The Belt and Road initiative, recently embarked on by China, aims to improve cross-border infrastructure in order to reduce transportation costs across a massive geographical area between China and Europe. We estimate how much trade might be created among Belt and Road countries as a consequence of the reduction in transportation costs (both railway and maritime) and find that European Union countries, especially landlocked countries, should benefit considerably. This is also true for eastern Europe and Central Asia and, to a lesser extent, south-east Asia. In contrast, if China were to seek to establish a free trade area within the Belt and Road region, EU member states would benefit less, while Asia would benefit more. Xi Jinping’s current vision for the Belt and Road, centred on improving transport infrastructure, is very good news for Europe as far as trade creation is concerned.

Introduction

The Belt and Road project is undoubtedly the most important international project that China has embarked on in the last few decades. It aims to stimulate economic development over a vast area covering sub-regions in Asia, Europe and Africa. Although there has been no official announcement about what countries are covered by the Belt and Road initiative, some official sources point to the involvement of at least 63 countries, including 18 European countries. Particularly relevant for Europe is that the Road ends where the European Union (EU) starts. Most importantly, this massive bloc between the EU and China accounts for 64 percent of the world’s population and 30 percent of global GDP.

One of the Belt and Road’s key objectives is to ease bottlenecks for cross-border trade, in particular through transport infrastructure. This should reduce the cost of transportation, thus stimulating trade between China and these countries. The same effect should be expected for the other end of the road – the EU – because cheaper transportation should also foster its trade with other Belt and Road countries, as well as with China. This paper measures empirically whether the reduction in transportation costs – shipping or railway costs – will have a positive impact on trade flows for Belt and Road countries and, most importantly, for EU countries.

In addition to estimating the size of the trade gains stemming from a reduction in transportation costs, we explore the possibility that the Belt and Road may eventually go beyond its current objectives towards the creation of a free trade area. To that end, we establish a scenario in which China embarks on a free trade agreement (FTA) with the 63 countries of the Belt and Road initiative. This exercise is particularly relevant at the current juncture because the Trans-Pacific Partnership (TPP), a free trade agreement between a number of Pacific economies and the US, is about to be created. China has so far been excluded from the TPP. In other words, we aim to identify empirically what kind of trade gains countries could expect from a reduction of transportation costs and to compare them with potential trade gains from reductions in tariffs stemming from a potential FTA. While our analysis estimates gains/losses for a large number of countries, our focus is EU member states. Our results indicate that the reduction in transportation costs from the Belt and Road initiative should benefit the vast majority of EU countries, especially landlocked countries. In comparison, if China reached a deal for the establishment of an FTA with the countries of the Belt and Road initiative, the benefits would be concentrated among Asian and non-western European countries. EU countries’ trade, in turn, would be harmed although in a relatively limited way. The reason for this is substitution of EU trade with countries within the Belt and Road as their intra-regional trade tariffs are dismantled. In a nutshell, this paper points to the benefits for the EU of Xi Jinping’s current vision for the Belt and Road initiative, which focuses on improving transport infrastructure rather than on a establishing a free trade area within the Belt and Road region.

Please click to read full report.

Editor's picks

Trending articles

24 Nov 2016

Strategic Perspectives on the One Belt, One Road and ASEAN: Achievements, Challenges, Opportunities and Future Direction

By Dr. Sok Siphana

China and ASEAN are looking to achieve a two-way investment goal of USD150 billion by 2020. Both sides are now working toward upgrading the ASEAN-China FTA in order to spur additional trade growth. They are intensifying the negotiation process of the Regional Comprehensive Economic Partnership (RCEP) in the hopes of concluding it this year, all the while working in parallel to complete the ASEAN-Hong Kong FTA.

ASEAN and China have encouraged greater participation of the private sector to increase business, tourism, and cultural exchanges. Concretely, the China-ASEAN Expo in Nanning, the China-South Asia Expo in Kunming, the ASEAN-China Centre in Beijing, the China-ASEAN Business Summits, the ASEAN Economic Ministers’ Roadshow (just to name the main ones), have drawn great interest from both business communities to promote their products and to develop commercial partnerships. Taken as a whole, these regular activities play an important role in strengthening trade and investment ties by accelerating economic exchanges between ASEAN and China.

It is interesting to note that 2016 marks the 25th Anniversary of ASEAN-China Dialogue Relations. Both sides have coordinated their efforts to boost their economic, trade and investment cooperation as well as enhancing connectivity, particularly in infrastructure development and transport.

Socio-cultural Area

In the socio-cultural area, ASEAN and China have promoted cooperation in social, cultural, education, tourism and people-to-people contacts, including exchanges between youth, academics, media organisations and non-governmental organisations, with the aim of enhancing mutual understanding and awareness among the peoples. Moreover, they have collaborated to coordinate their responses against global and regional challenges such as natural disaster management responses through the exchange of information, early warning, and experience sharing on disaster rescue and relief.

In sum, the ASEAN-China strategic partnership is most dynamic and comprehensive when it comes to the overall external relations of ASEAN with their development partners.

Please click to read full report.

Editor's picks

Trending articles

29 Nov 2016

What consequences would a post-Brexit China-UK trade deal have for the EU?

By Alicia Garcia Herrero and Jianwei Xu

Executive summary

Brexit means that the United Kingdom could be able to run its own trade policy, which opens the door for the potential negotiation of a free trade agreement between the UK and China. We ask three questions about this important issue for the UK-EU economic relationship. If a China-UK FTA was signed, could Chinese exporters break into the EU market through the UK, making a possible China-EU FTA relatively superfluous? Would a China-EU FTA help UK exporters to gain a competitive advantage in China relative to EU exporters? Will UK producers benefit by importing cheaper Chinese intermediate goods?

Our analysis indicates that a UK-China FTA will be neither easy nor clearly advantageous for the UK. First, it will be difficult for the UK to reach an agreement with China without first establishing a new post-Brexit partnership with the EU. Negotiating tariffs with other WTO members will be a pre-condition if the UK exits the EU customs union, and this process will require time and effort. Second, even if the UK reaches an agreement with China, the UK cannot serve as a back door for Chinese products to enter the EU, because the EU is very likely use rules of origin to close any such loopholes. In addition, entering the EU via the UK will entail an additional transportation cost for Chinese goods that will, at least partly, offset any tariff savings, making use of such a loophole less worthwhile. Third, the UK and the other EU economies differ in most of their exports to China, so there would be very limited substitution between them.

It therefore seems that establishing a new trade relationship with the EU would be a more urgent task for the UK in the post-Brexit world, rather than an FTA with China. Under such circumstances, the UK might need to postpone its trade negotiations with other economies outside of EU, including China. This goes beyond the current discussion of the illegality of the UK starting to negotiate trade deals before it leaves the EU. The issue is whether it makes economic sense for the UK to do so, and the answer is no. In fact, the more the UK reaches an independent favourable trade agreement with China after Brexit, the harder it will be for the UK to strike a good deal with EU. In the meantime, it is also urgent for the UK to negotiate with the main WTO members on tariffs, because outside the EU, the UK might not participate in the EU schedule of concessions. The best strategy for the UK would be to negotiate with the other WTO members with the EU-based tariffs as a starting point, to avoid negotiating over terms separately and also to maintain a close relationship with the EU.

Please click to read full report.

Editor's picks

Trending articles

Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

China has now risen to become the world’s second largest source of outward foreign direct investment (FDI). Further, its investment outflow has already exceeded foreign capital inflow, making it a net capital exporter[1]. This rapid growth in outbound direct investment could be attributed to the country’s current drive to implement the Belt and Road Initiative. This encourages increasing numbers of enterprises to engage in trade and investment activities with countries along the Belt and Road routes.

Right at the forefront of China’s trade and economic co-operation relations with foreign countries is the South China region comprising Guangdong, Guangxi and several other provinces. This region also adjoins several ASEAN countries that lie along the Belt and Road routes.

In mid-2016, HKTDC Research conducted a questionnaire survey in the South China region to gauge the enthusiasm of mainland enterprises for 'going out' to explore Belt and Road opportunities and to assess their need for professional services.

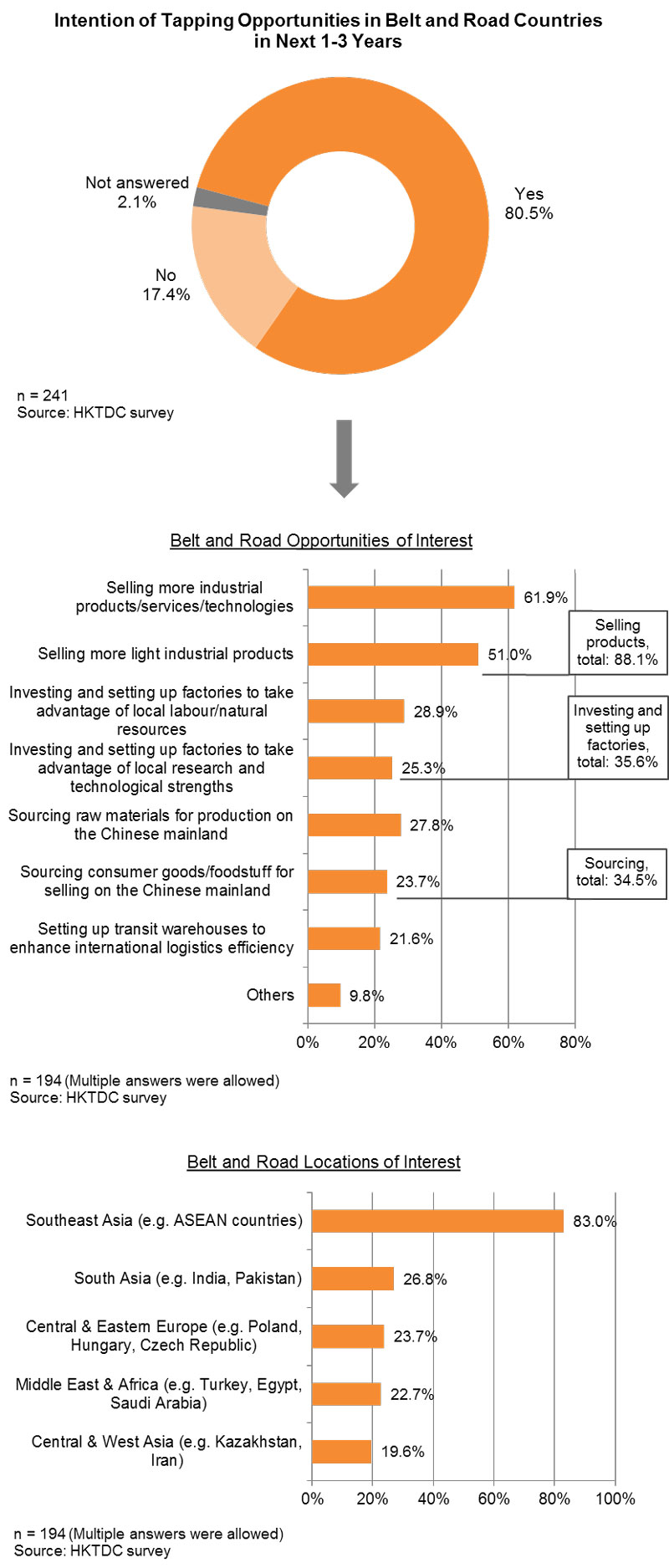

The survey results indicate that, for many mainland enterprises (50%), Hong Kong is the preferred location for seeking professional services outside of the mainland in making use of Belt and Road business opportunities. Most of the enterprises surveyed said they would like to sell more products to Belt and Road markets (88%). Some expressed an interest in going to Belt and Road countries to set up manufacturing facilities (36%) or to source various types of consumer goods / foodstuff or raw materials (35%). In addition, the majority of respondents (83%) expressed a desire to explore related business opportunities in Southeast Asia, including ASEAN countries.

Hong Kong is not only the preferred platform for mainland enterprises in 'going out' to invest overseas, but it is also the main site for them to seek professional services to support their efforts in capturing these new trade opportunities. As China continues to promote the Belt and Road initiative, it is expected that mainland enterprises’ demand for related services will increase further. This will therefore attract a continuous stream of business opportunities to Hong Kong’s services suppliers.

[For more information on China’s outbound investment and on Hong Kong as the preferred platform for mainland enterprises in 'going out' to invest overseas, please see: China Takes Global Number Two Outward FDI Slot: Hong Kong Remains the Preferred Service Platform].

Rapid Growth of China’s Direct Investment in Belt and Road Countries

Figures released by the Ministry of Commerce in September 2016 reveal that China’s direct investment in Belt and Road related countries has been growing rapidly over recent years. It reached a total of US$18.9 billion in 2015, equivalent to a year-on-year growth of 38.6%. That was double the rate of growth of China’s total FDI (18.3%) during the same period. To put this into perspective, China’s investments in Belt and Road related countries were worth around US$400 million in 2004. However, during 2004-2015 China's direct investments in these countries rose by more than 45 times, averaging a growth of approximately 43% annually. Over the same period, the share of these investments in China’s total FDI also climbed from 7% in 2004 to 13% in 2015.

At present, China is advancing its Belt and Road development strategy vigorously, encouraging its enterprises to carry out trade and investment activities in related countries and regions. As such, the initiative has become an important factor in driving the 'going out' of Chinese enterprises to invest overseas.

Hong Kong has consistently remained the preferred services platform for the 'going out' of mainland enterprises[2]. It can therefore be expected that the development of the Belt and Road initiative will further spur on demand for various Hong Kong support services from mainland enterprises.

HKTDC Research held a questionnaire survey on related Guangdong enterprises in the second and third quarters of 2016. This was conducted with the assistance of the Department of Commerce of Guangdong Province, the Bureau of Commerce of Dongguan City, the World Dongguan Entrepreneurs Federation, the Bureau of Commerce of Huizhou City, the Huizhou Association of Enterprises with Foreign Investment and the Bureau of Commerce of Jiangmen City. The same questionnaire survey was carried out on mainland enterprises on site attending the 13th China-ASEAN Expo, held in Nanning, Guangxi in September 2016.

A total of 296 completed questionnaires were collected across the Guangdong and Guangxi surveys. Of these, 241 of the respondents were mainland enterprises, comprising traders, manufacturers and services suppliers. More than 80% of these enterprises were based in Guangdong and Guangxi. The rest were mainly industry representatives from coastal regions. What follows is a summary of the views expressed by these 241 enterprises about 'going out' to develop Belt and Road opportunities.

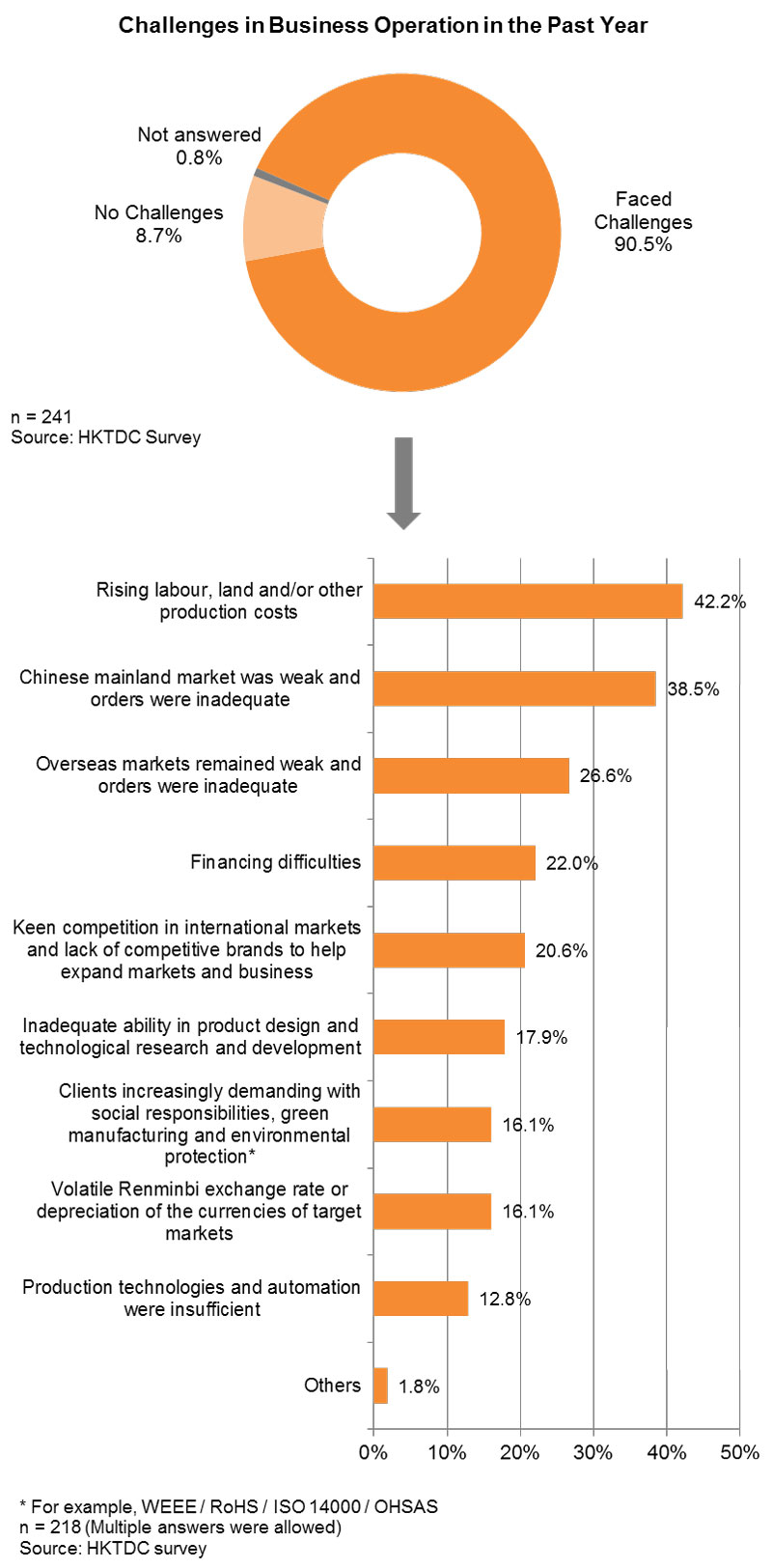

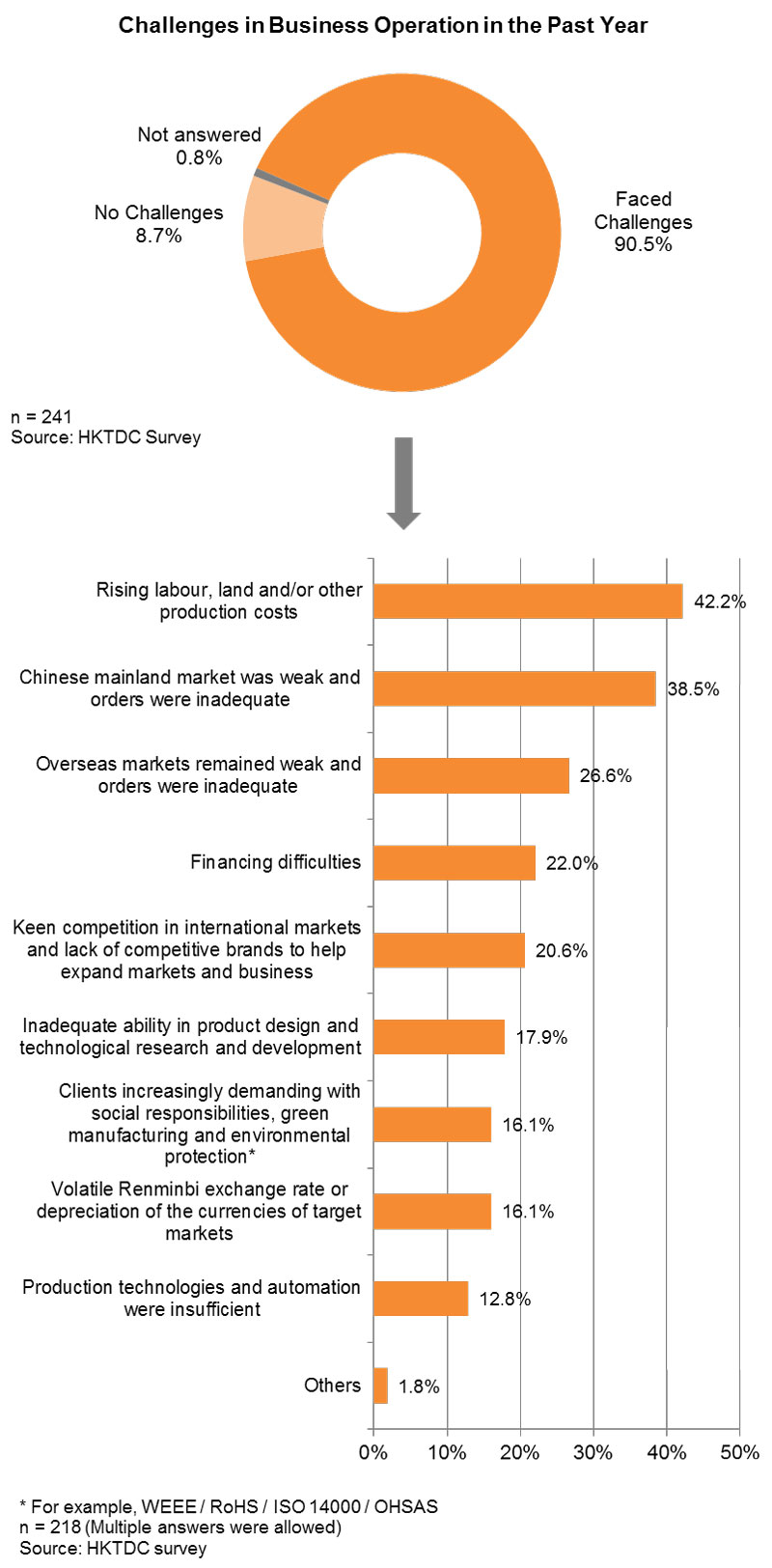

Challenges in Business Operation

More than 90% of the respondents said that their business operations had faced a variety of challenges over the past year. A number of them said that their foremost concern was rising labour, land and/or other production costs (42%). Others were affected by the weak mainland market and inadequate orders (39%), weak overseas markets and inadequate orders (27%), or difficulties in financing (22%).

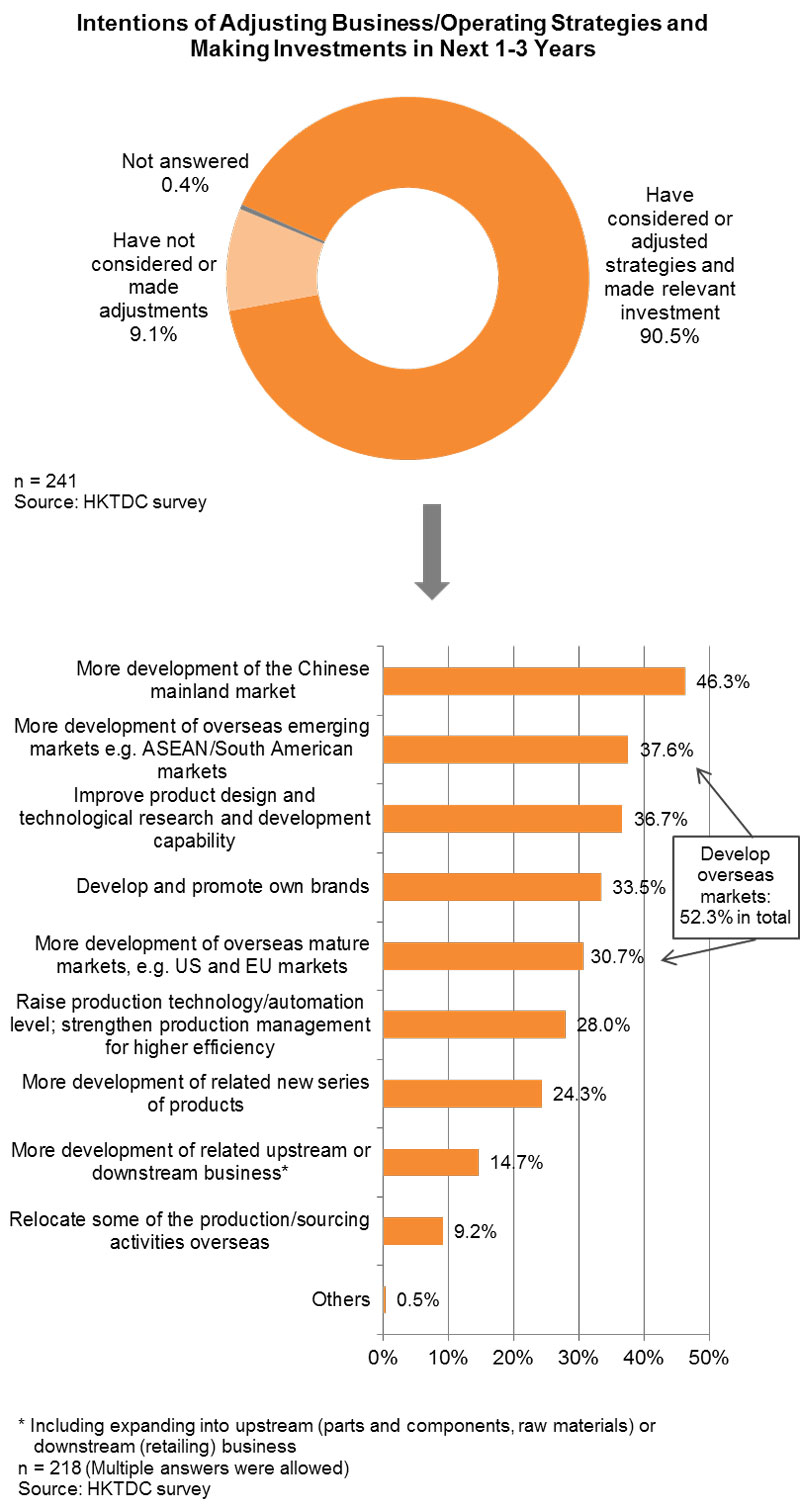

Intensify Efforts to Expand into Overseas Markets

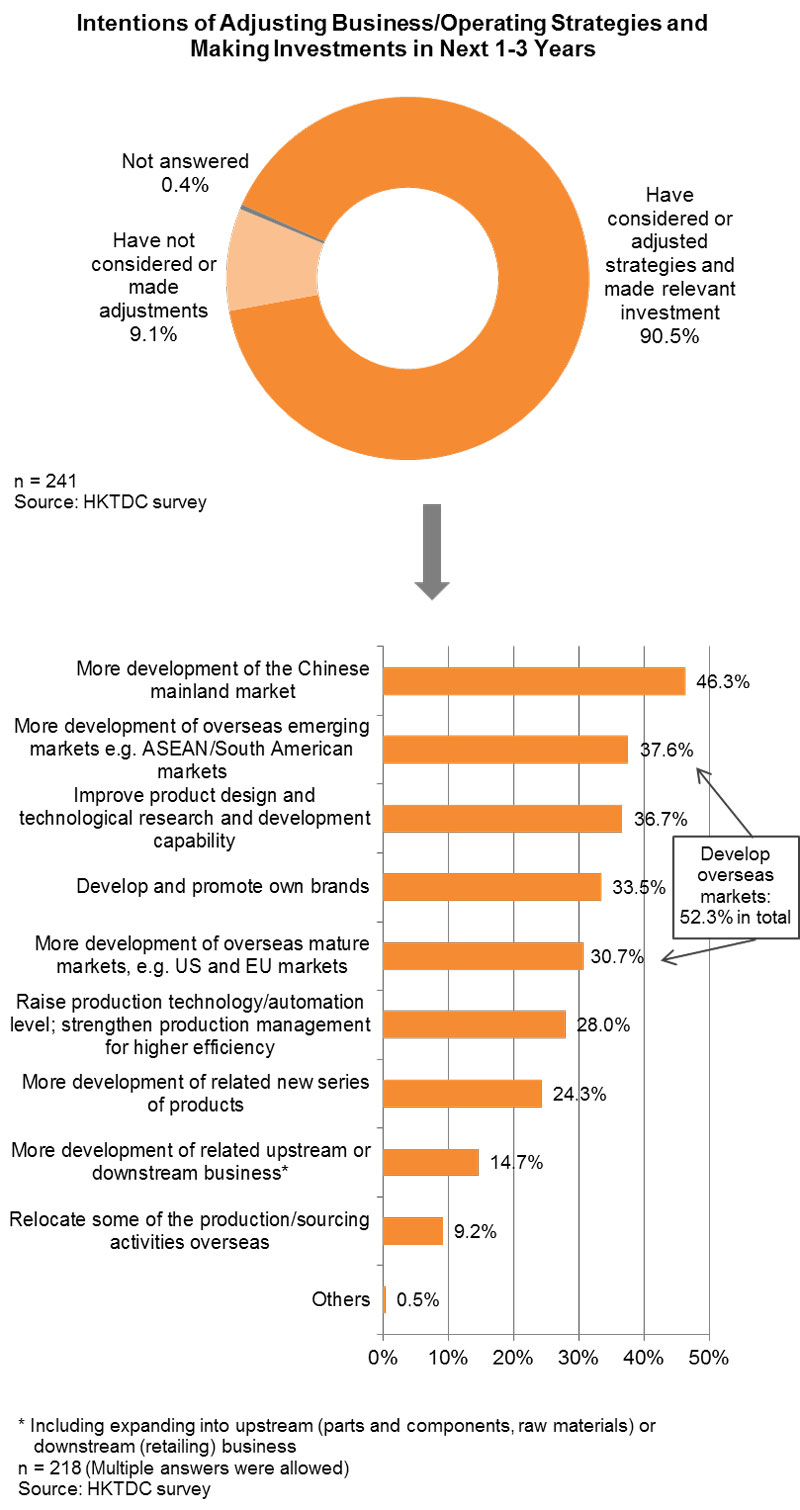

In a period of fierce market competition when challenges were many and varied, more than 90% of the enterprises polled said that they had already begun adjusting their business and operating strategies and made relevant investments, or else that they would consider doing so over the next 1-3 years. A total of 46% of the respondents said that they would like to further develop the domestic market. 52% said that they would intensify efforts in developing overseas markets. Of these, 38% and 31% respectively said that they would focus on developing emerging markets and mature markets overseas.

37% of respondents declared that they would strengthen their product design and technological R&D capability, while 33% said they would develop or strengthen their own-brand business.

Belt and Road Opportunities: Focusing on Southeast Asian Markets

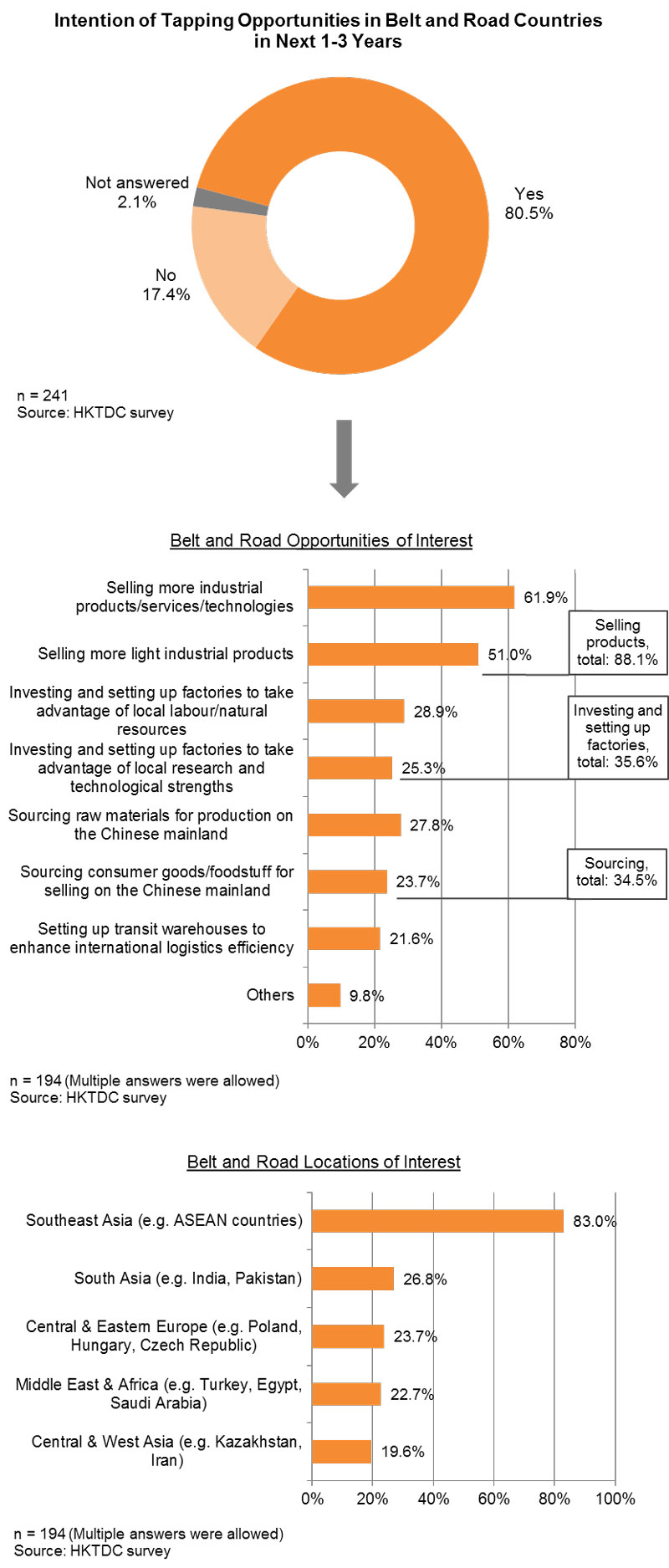

As China continues to promote the Belt and Road development strategy, 80% of the enterprises suggested they would consider tapping business opportunities in Belt and Road countries within the next 1-3 years. Conversely, 17% of the enterprises questioned said they wouldn't consider such a development.

Among those enterprises that would consider tapping Belt and Road opportunities, most said they wanted to sell more industrial products (62%) and / or light industrial products (51%) to these markets. Together, these enterprises accounted for 88% of the enterprises surveyed. Fewer respondents said they would consider investing and setting up factories in Belt and Road countries (36%). Fewer still are considering going there to source various consumer goods / foodstuffs for sale in the mainland or raw materials for use in production in the mainland (35%). Just 22% of the enterprises indicated that they intend to establish transit warehouses in Belt and Road countries as a means of boosting international logistics efficiency.

Among enterprises that would consider tapping Belt and Road opportunities, a great majority (83%) would focus on Southeast Asian countries, including those in the ASEAN. By way of comparison, far fewer enterprises selected regions such as South Asia (27%), Central and Eastern Europe (24%), the Middle East and Africa (23%), and Central and West Asia (20%).

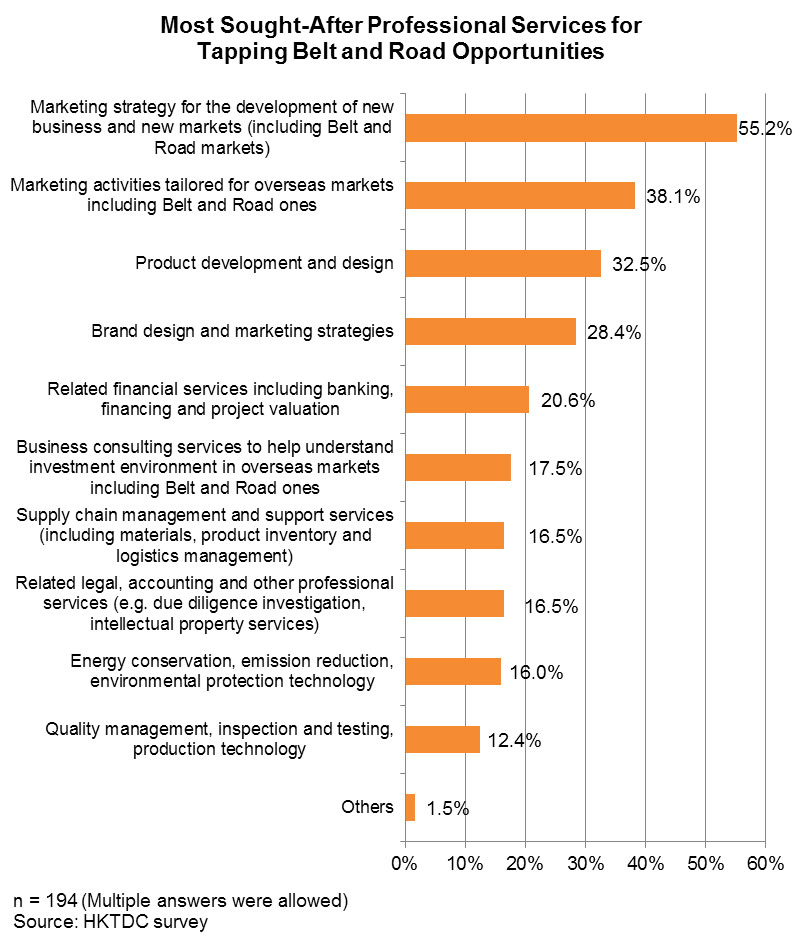

Need to Seek Services Support

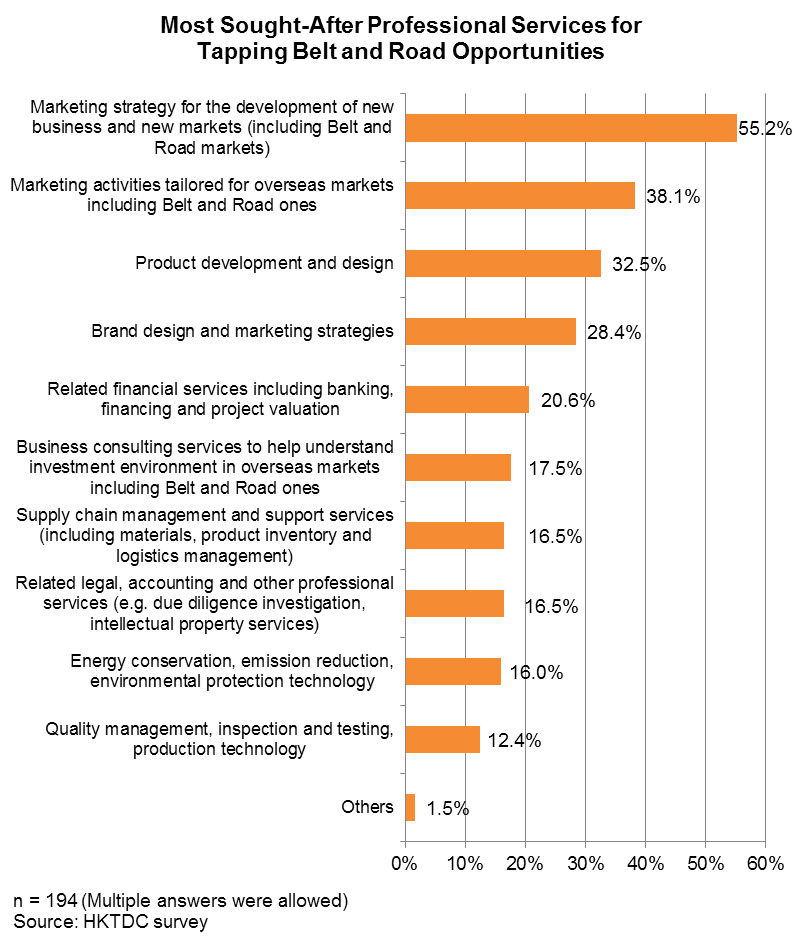

Of those enterprises looking to tap into Belt and Road opportunities, 55% said they would require services in sales and marketing strategies to help them develop new businesses and new markets. 38% said they would like to become involved in marketing activities tailored for Belt and Road and other overseas markets. 32% of the enterprises replied that they would like to seek services in product development and design. Another 28% aim to engage services in brand design and marketing strategies to help them reach out to these new markets.

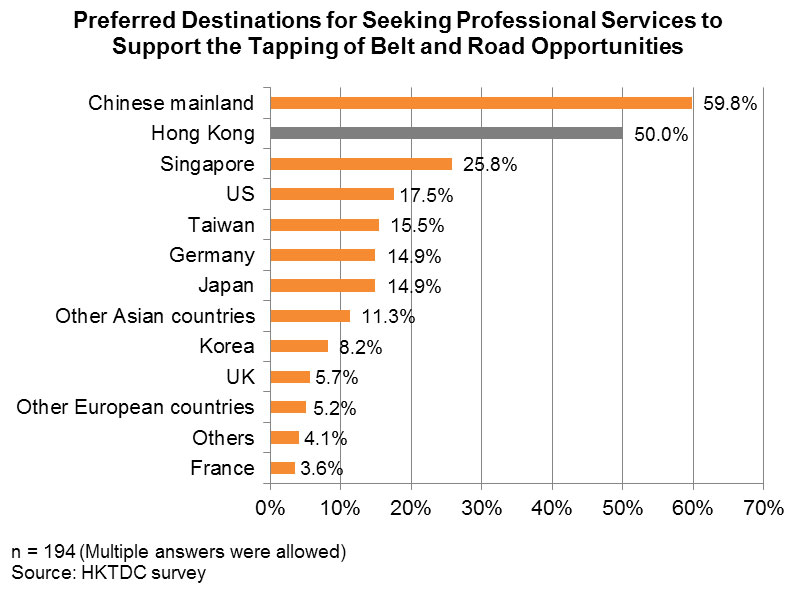

Hong Kong as Preferred Destination for Seeking Services Outside of the Mainland

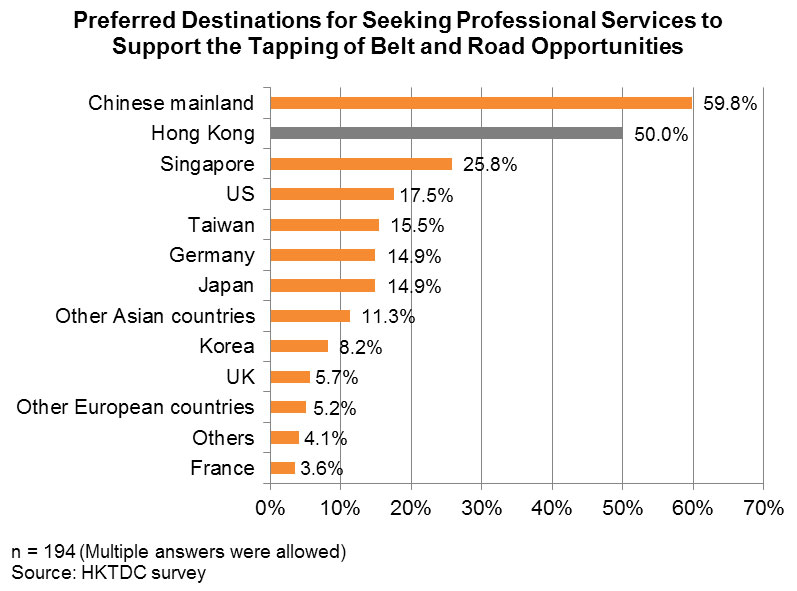

In order to locate these aforementioned professional services, 60% of respondents looking to tap Belt and Road trade opportunities said they would first source these support services locally. However, a significant number said they would seek various professional services outside of the mainland. Hong Kong was the most preferred destination for most enterprises, accounting for half (50%) of all respondents who would like to tap into the Belt and Road markets. Other destinations highlighted as of interest here included Singapore (26%), the US (18%), Taiwan (16%) and Germany (15%).

HKTDC Research would like to acknowledge the help extended by the Department of Commerce of Guangdong Province, the Bureau of Commerce of Dongguan City, the World Dongguan Entrepreneurs Federation, the Bureau of Commerce of Huizhou City, the Huizhou Association of Enterprises with Foreign Investment and the Bureau of Commerce of Jiangmen City in conducting the surveys and company visits.

[1] 2015 figures. Source: Statistical Bulletin of China’s Outward Foreign Direct Investment 2015.

[2] For more on Hong Kong’s status as a preferred services platform for the “going out” of mainland enterprises, please see: Guangdong: Hong Kong Service Opportunities Amid China’s “Going Out” Strategy, Jiangsu/YRD: Hong Kong Service Opportunities Amid China's "Going Out" Initiative, China’s “Going Out” Initiatives: Professional Services Demand in Bohai and China’s “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities.

| Content provided by |

|

Editor's picks

Trending articles

6 Dec 2016

"One Belt, One Road": China's Great Leap Outward

European Council on Foreign Relations

Introduction

China has created an action plan for its Silk Road concept in the form of the “One Belt, One Road” (OBOR) initiative. It is grandiose, potentially involving an area that covers 55 percent of world GNP, 70 percent of global population, and 75 percent of known energy reserves. China’s financial commitments to the project seem huge: some multilateral and bilateral pledges may overlap, but it is still likely we are looking at up to $300 billion in infrastructure financing from China in the coming years – not counting the leveraging effect on private investors and lenders, and the impact of peer competition. Japan, for example, has just announced a $110 billion infrastructure fund for Asia, and the Asian Development Bank is hurriedly revising its disbursement rules to increase its lending capacity. This does not even include the grand bargain being discussed with Russia on overland transport, energy, and cyber-connectivity.

However, concrete details are scarce, especially at the bilateral level, where potential partners seem to supply more information than can be found in published Chinese sources. Implementation may span a very long time period – as much as 35 years, according to some of our sources, reaching completion in time for the 100th anniversary of the People’s Republic of China in 2049.

This is also a geopolitical and diplomatic offensive; Xi Jinping talked first of a “community of destiny” among Asians, and our sources offer reassurance that China is seeking to “supplement” the existing international order rather than to revise it. But money also talks, and a strategy largely based on loans and aid is building China’s financial power, in addition to the trade power it already possesses.

The world’s great expectations further increase the audience for what the Chinese sometimes describe as the country’s “second opening”, after the 1979 model which led to China’s rapid growth over three decades. For example, there is much discussion of the success beyond all expectations of the China-founded Asian Infrastructure Investment Bank (AIIB). Intense debate is being carried out about the Silk Roads in countries that have reason to worry about some of their implications.

China also risks overreaching itself, and there is much uncertainty about the process. Our Chinese sources keep returning to some caveats: this is a concept based on giving, in terms of finances and in terms of leadership. China faces the possibility of losing money or stirring up opposition. The competition among potential Chinese actors – now including everybody up to China’s maritime coast – could provoke a “blind development” very much along the lines of events in China’s past. It could also happen that the aggregated projects shift some of China’s main trends of recent decades. Emphasising the westward continental overture represents a return to the late 1950s, when Mao rebalanced growth away from the coast with massive investments inland. The project also extends abroad the western development policy of the past decade. Is this a viable strategy, considering the obvious integration of coastal China in the global economy? Can geopolitical action trump economic interdependence, or will it drag down China’s overall competitiveness?

Much of China’s logic on the project is based on geopolitics and on the export of its huge infrastructure-building capacities. But even within China, these sectors are leading loss-makers. Geographical and geopolitical conditions differ widely outside China, especially along the continental routes. There is a debate about whether it is wise to pour such huge amounts into low-return projects and high-risk countries. Will this turn out to be a repeat of old mistakes, with overreliance on public financing and state-owned enterprises? Can China leverage private firms and investment in its grandiose plans? The answers are as yet unclear.

For the time being, however, no partner can ignore China’s throwweight and its track record in building massive infrastructure. Europe itself is also setting up a €315 billion infrastructure investment plan that is contingent on market financing. How it will manage to leverage China’s capital export drive for European growth is another interesting question – and perhaps a more important issue than that of a European minority stake in the AIIB.

Please click to read full report.

Editor's picks

Trending articles

Belt and Road Investment: Views and Service Demand of Dongguan Enterprises in Guangdong

At a recent seminar held by HKTDC Research in Dongguan city, Guangdong, it emerged that many local enterprises are actively seeking opportunities arising from the Belt and Road Initiative. Though different enterprises adopt a variety of business modes when 'going out', the majority of them said that they are not familiar with the investment environment of the Belt and Road markets where direct investment is concerned. This includes matters relating to the political, cultural, and legal climates in Southeast Asia and Africa. Inevitably, this has made it difficult for businesses to assess the risk of making outward foreign direct investment in these territories. In light of this, those businesses are in dire need of support from professional services.

Dongguan investors also highlighted a number of practical matters around this issue. Amongst them were compliance with the policies of investment destinations regarding importing foreign labour; the requirements for environmental protection; and customs clearance of industrial material imports, as well as regulations governing import tariffs and export tax rebate. Some manufacturers are keen to further develop their export markets along the Belt and Road routes. However, they have major hurdles to face, such as insufficient information about the local markets and a lack of reliable distribution channels in some of the Belt and Road countries. Another key problem is the scarcity of available data relating to product standards, safety specifications and certification requirements.

As a result, many Dongguan-based companies wish to make use of the professional services in Hong Kong. By doing so, they hope to solve these practical problems, assess the feasibility of their business ventures and seek advice on investment and marketing. The Hong Kong platform would also enable them to raise funds for their offshore dealings, alleviate the pressure exerted upon their cash flow, and control the credit risks related to Belt and Road trading.

Dongguan Enterprises Expand International Business along the Belt and Road

Dubbed the 'world’s factory', the Pearl River Delta (PRD) region is one of the leading production bases of China. Dongguan city is a key production base within the PRD. It enjoyed a head start in terms of development. In 2015, the industrial value-added of Dongguan reached RMB271.1 billion, accounting for 11% of PRD’s total[1]. As an economically developed city, Dongguan can boast five pillar industries, namely electronic information, machine building, textile and garment production, food and beverage processing and papermaking. Thanks to the continuous inflow of foreign investment into its high-tech industrial sector, the city has also established a complete supply chain for the production of computers and other electronic products. Well-known foreign high-tech companies which have established production plants in Dongguan include Samsung, Hitachi, Sony and Philips.

Several Dongguan enterprises are actively exploring business opportunities which have arisen from the central government’s Belt and Road development initiative. Statistics show that from 2004 to mid-2016, the number of enterprises in Dongguan 'going out' to invest offshore totalled 376. Their cumulative investment amount reached about US$1.12 billion. Together, these enterprises have set up 46 overseas offices. The main areas in which they are investing encompasses wholesale and retail, manufacturing, leasing and commercial services, as well as real estate. Key outward investment destinations for this include Hong Kong, the US, Europe and Africa[2].

China has become the world’s second largest source of outward foreign direct investment[3]. It is making constant efforts to bolster investment in and economic co-operation with countries along the Belt and Road. As a result, foreign economic activities in the south China region have continued to rise.

In mid-2016, HKTDC Research conducted questionnaire surveys throughout selected locations in Guangdong and Guangxi. The intention was to investigate the level of interest amongst mainland enterprises in 'going out' to explore business opportunities arising from the Belt and Road initiative, as well as their demand for the relevant support services[4]. In addition, the aforementioned seminar for Dongguan enterprises was held around the same time, as a means of canvassing the opinions of local manufacturers and traders. Key points from the findings are as follows:

-

Exploring direct investment opportunities

There are over 8,000 manufacturing enterprises in Dongguan, most of which are engaged in processing activities. Only very few produce for their own brands. In the process of 'going out', many Dongguan enterprises are exploring the feasibility of making outward direct investment in the Belt and Road countries. In doing so, they hope to utilise external resources to optimise their entire production system.

A number of light industrial products manufacturers have already set up production plants in African countries such as Egypt and Ethiopia. Some of the market players engaged in creating new materials and high-tech industries plan to invest in capital-intensive production projects in ASEAN countries, including Vietnam, Thailand and Malaysia. There, these companies aim to take advantage of the labour supply, raw materials and other resources in the Belt and Road countries to expand their production activities. There's also the prospect of tapping the local consumer goods and industrial materials markets.

Different companies may adopt different business models in 'going out', but the problems faced by the majority of them remain the same. For instance, they do not have enough data about the political, cultural and legal environments of the relatively underdeveloped investment destinations which lie along the Belt and Road routes. This makes it difficult for them to assess the potential risks of their investments. Moreover, they are not staffed by personnel with the appropriate global vision and management experience to plan and manage their offshore investment projects. As such, before they venture out to make outbound investments, these businesses need to seek support from professional services in the outside world.

-

Practical issues of concern to investors

In terms of labour, although wage levels in certain Belt and Road countries remain low, investing in these countries may not be cost-effective when factors such as productivity are taken into account. Besides, when making outbound direct investment by setting up factories, investors need to be well informed of the support provided by local technicians and technical workers, the structure of the entire supply chain, and the efficiency of local transportation and logistics. They are also obliged to comply with labour and environmental protection requirements of their investment destinations, as well as industrial policies. As such, they should conduct due diligence studies to obtain reliable information for assessing the feasibility of their investment projects prior to making any commitment.

Availability of the correct technical and production management staff is a must when highly efficient production processes and quality control must be guaranteed. This is particularly true for large-scale production activities and fully automated production lines. Some manufacturers looking to invest in the Belt and Road countries indicate that, in addition to drawing from their investment destinations' own labour force, they also post mainland technical and management staff there in order to support local production activities. Hence, before making any investment decisions, they first need a good understanding of the local investment policies governing these areas. This might include the criteria and requirements regarding the import of foreign labour, other laws and regulations relating to foreign labour, the stance of local labour unions towards the import of foreign workers, and local living standards for foreigners.

-

Obtaining market intelligence

Some of the companies who wish to tap into markets in Belt and Road countries stated that they not only lack local market intelligence, such as consumers’ spending power, market size and product demand. They also have limited knowledge of the specifications stipulated by the importing countries on imported products, including technical requirements such as hygiene, electrical and safety specifications. In addition, they have only limited access to effective channels of information about obtaining the requisite product certifications.

Of those companies interested in selling industrial materials to the Belt and Road markets in support of their export processing activities there, some said that certain countries and regions still have no arrangements in place for processing bonded imported materials. As such, companies importing such materials into these countries and regions have to pay tariffs. However, when exporting the processed products, they are not eligible for tax rebates. This has discouraged investors from developing the industrial market in these countries and regions. It has also slowed the pace of their investments in setting up production factories there. As such, they are in dire need of the relevant information to help them select suitable export markets from amongst the different Belt and Road countries and regions.

-

Capitalising on the Hong Kong service platform

To tackle these problems, the majority of enterprises in Dongguan said they intend to use the appropriate support services in Hong Kong. They hope to obtain the relevant market intelligence, as well as to take advantage of Hong Kong's investment consultancy and risk assessment services. This would enable them to plan their outward investment projects and control various possible political and market risks. There are other advantages in dealing with Hong Kong, too. At present, financial and related services which deal with foreign exchange fluctuations, tax planning, and export market insurance are not readily available in the mainland. To overcome this, Dongguan enterprises prefer to handle their outward investments via Hong Kong.

Many Dongguan-based businesses also plan to take advantage of Hong Kong’s financial market in order to raise low-cost capital for their 'going out' ventures. Some of the companies interested in investing in the Belt and Road markets pointed out that, as well as raising funds for their offshore projects, they also need to make provisions for cash flow required after these investment projects have been implemented. In particular, they need to transport production materials from the mainland to countries where there is no support for effective industry chains. This will enable them to support their production activities and deliver processed products to their clients prior to payment being collected. This in turn would lengthen the time of the production process, goods delivery and funds recovery, and consequently these companies require the necessary financial services in order to bridge the gap in cash flow.

There are also exporters who expressed concerns about collecting payment. They pointed out that currently they have no access to credit information about their Belt and Road clients. As these clients may request a longer payment period, the credit risk is higher. At the same time, longer payment periods also exert greater pressure upon their cash flow. Therefore, they hope to seek services such as export credit insurance as well as trade financing via Hong Kong, in order to lower their risks.

HKTDC Research wishes to express its appreciation to the Department of Commerce of Guangdong Province, the Bureau of Commerce of Dongguan City, and World Dongguan Entrepreneurs Federation for their assistance in conducting research studies and company visits.

[1] Only industrial enterprises with an annual sales turnover of RMB20 million and above are included. Source: Guangdong Bureau of Statistics

[2] Source: Bureau of Commerce of Dongguan City

[3] 2015 figures. Source: Statistical Bulletin of China’s Outward Foreign Direct Investment 2015

[4] For details of the surveys, please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China

| Content provided by |

|

Editor's picks

Trending articles

13 Dec 2016

Bridging global infrastructure gaps

By Jonathan Woetzel, Nicklas Garemo, Jan Mischke, Martin Hjerpe, and Robert Palter - McKinsey

In Brief

Briding Global Infrastructure Gaps

Today the world invests some $2.5 trillion a year in the transportation, power, water, and telecom systems on which businesses and populations depend. Yet this amount continues to fall short of the world’s everexpanding needs, which results in lower economic growth and deprives citizens of essential services. Building on MGI’s 2013 report Infrastructure productivity: How to save $1 trillion a year, this research updates our estimates of the world’s infrastructure needs and projected investment shortfalls. It also offers refined recommendations for bridging those gaps. Among our findings:

- From 2016 through 2030, the world needs to invest about 3.8 percent of GDP, or an average of $3.3 trillion a year, in economic infrastructure just to support expected rates of growth. Emerging economies account for some 60 percent of that need. But if the current trajectory of underinvestment continues, the world will fall short by roughly 11 percent, or $350 billion a year. The size of the gap triples if we consider the additional investment required to meet the new UN Sustainable Development Goals.

- Infrastructure investment has actually declined as a share of GDP in 11 of the G20 economies since the global financial crisis, despite glaring gaps and years of debate about the importance of shoring up foundational systems. Cutbacks have occurred in the European Union, the United States, Russia, and Mexico. By contrast, Canada, Turkey, and South Africa increased investment.

- There is substantial scope to increase public infrastructure investment. Governments can increase funding streams by raising user charges, capturing property value, or selling existing assets and recycling the proceeds for new infrastructure. In addition, public accounting standards could be brought in line with corporate accounting so infrastructure assets are depreciated over their life cycle rather than adding to deficits during construction. This change could reduce pro-cyclical public investment behavior.

- Corporate finance makes up about three-quarters of private finance. Unleashing investment in privatized sectors requires regulatory certainty and the ability to charge prices that produce an acceptable riskadjusted return as well as enablers such as spectrum or land access, permits, and approvals.

- Public-private partnerships have assumed a greater role in infrastructure, although there is continued controversy about whether they deliver higher efficiency and lower costs. Either way, they will continue to be an important source of financing in the future. But since they account for only about 5 to 10 percent of total investment, they are unlikely to provide the silver bullet that will solve the funding gap. Public and corporate investment remain much larger issues.

- Institutional investors and banks have $120 trillion in assets that could partially support infrastructure projects. Some 87 percent of these funds originate from advanced economies, while the largest needs are in middle-income economies. Matching these investors with projects requires solid crossborder investment principles. Impediments that restrict the flow of financing, from regulatory rulings on investment in infrastructure assets to the absence of an efficient market, have to be addressed. The most important step, however, is improving the pipeline of bankable projects.

- Beyond ramping up finance, there is even bigger potential in making infrastructure spending more effective. Accelerating productivity growth in the construction industry, which has flatlined for decades, can play a large role in this effort. Additionally, as our 2013 research showed, improving project selection, delivery, and management of existing assets could translate into 40 percent savings. Since our original report was published, we have completed a detailed diagnostic measuring the efficiency of infrastructure systems in 12 countries. Even the most advanced economies have significant room to learn from each other and to build stronger capabilities and learning institutions with strong oversight. A rigorous assessment that benchmarks each aspect of infrastructure development against global best practices can identify the areas where a well-targeted transformation could yield substantial results.

Please click to read full report.