Chinese Mainland

29 Sep 2016

New Trade Opportunities with Vietnam

By CGCC Vision

Hong Kong’s total exports to Vietnam grew 21% annually, and Vietnam was Hong Kong’s fifth largest export market in the first seven months of 2015. It is evident that trade relations between Hong Kong and Vietnam are increasingly close. In fact, Vietnam also has close relations with China, France and the US. Therefore, many Western countries are optimistic about the emerging market of Vietnam.

Currently, Vietnam is a part of the China-ASEAN Free Trade Area, and it has signed agreements on avoidance of double taxation with more than 60 countries and regions, including Mainland China and Hong Kong. Doan Duy Khuong, Vice-Chairman of Vietnam Chamber of Commerce and Industry (VCCI), pointed out that as the private sector is bound to become the main driving force of Vietnam’s economy in the future, ASEAN can create an open and level playing field for this sector.

Going global for investment opportunities

With the formal establishment of the ASEAN Economic Community (AEC) in late 2015, trade is expected to be more frequent and economic development will be more rapid in ASEAN. Hence, now is a good time to invest in Vietnam. Doan believes that in the future as trade, investment, economic and technical collaborations surge, agreements will mainly focus on these areas, which will also help resolve trade disputes. Under the current ASEAN Framework Agreement, it is hoped that there will be a broader and deeper involvement.

Challenges present opportunities

Doan expects Vietnam to face very intense competition in the region. He believes that at this stage, the Vietnamese Government should accelerate the reform of its business environment and strengthen institutional transparency. Moreover, other policies that will help enhance competitiveness, such as those for attracting foreign direct investment and infrastructure development, should be implemented concurrently. Overall, Doan believes that on the strength of its political, economic and resource advantages, Vietnam is one of Asia’s most attractive investment regions.

This article was firstly published in the magazine CGCC Vision February 2016 issue. Please click to read the full article.

Editor's picks

Trending articles

4 Oct 2016

Potential Macroeconomic Implications of the Trans-Pacific Partnership

By the World Bank

Over the last quarter century, trade flows of goods and services have increased rapidly. The value of world trade has more than quintupled, from $8.7 trillion in 1990, to more than $46 trillion in 2014. The relative importance of trade has increased too, from 39 percent of world GDP in 1990, to 60 percent in 2014. That said, global trade growth has slowed to about 4 percent per year since the crisis from about 7 percent, on average, during 1990-07. This slowdown in world trade reflects weak global investment growth, maturing global supply chains, and slowing momentum in trade liberalization….

This analysis discussed the features of new-generation free-trade agreements and TPP, specifically, and traced out potential macroeconomic implications for member and non -member countries. As a new-generation, deep and comprehensive trade agreement, TPP addresses a wide range of complex trade policy issues that go beyond the scope of traditional trade agreements. The agreement will reduce tariffs and restrictiveness of non-tariff measures as well as harmonize a range of regulations to encourage the integration of supply chains and cross-border investment.

TPP could be an important complement to other policies to lift medium-term growth:

- By shifting resources towards the most productive firms and sectors and expanding export markets, TPP has the potential to lift overall GDP of member countries by 1.1 percent by 2030. The impact could be considerably more in countries facing currently elevated barriers to trade (as much as 10 percent in Vietnam and 8 percent in Malaysia). In countries that export labor-intensive products, incomes of low-income and low-skilled households could expand strongly.

- To the extent that the TPP produces positive spillover benefits for other countries, detrimental effects on non-member countries may be limited. Such positive spillovers could arise from harmonized regulatory regimes in TPP export markets.

- TPP could also lift member countries’ trade by 11 percent by 2030. This would be an important counterweight to the trade slowdown underway since 2011. At current 2011-14 trends, member countries’ trade would fall 25 percent below pre-crisis trend by 2030.

- Policy reforms are needed to enhance the benefits of TPP—like other RTAs—in developing countries. Governments in several member countries see the liberalization required by the TPP as a driver for difficult policy changes. However, implementation of MRTAs, including the TPP, requires institutional capacity not available to some developing countries (Michalopoulos 1999; Hoekman et al. 2003). As the TPP is implemented over time, emphasis on the following issues would be important to mitigate unfavorable effects on developing countries:

- Capacity building. Capacity building and technical assistance for developing country members are an important building block of the TPP.

- Liberal rules of origin. TPP members and nonmembers will benefit if rules of origin mandating higher-cost inputs from TPP members are implemented in a permissive rather than restrictive manner.

- Liberalize labor- and resource-intensive industries. Low- and middle-income economies often have a comparative advantage in labor-and natural-resource intensive industries. By cutting tariffs for labor-intensive garments, the TPP thus benefits countries like Vietnam.

- Multilateral framework. Bringing MRTAs into a global framework would broaden the gains to a wider set of countries and reduce detrimental diversion effects for non-members. Implementation of the “living agreement” clause that keeps TPP membership open is particularly important.

Against the background of slowing trade growth, rising non-tariff impediments to trade, and insufficient progress in global negotiations, the TPP represents an important milestone. The TPP stands out among FTAs for its size, diversity and rulemaking. Its ultimate implications, however, remain unclear. Much will depend on whether the TPP is quickly adopted and effectively implemented, and whether it triggers productive reforms in developing and developed countries. Broader systemic effects, in turn, will require expanding such reforms to global trade, whether through TPP enlargement, competitive effects on other trade agreements, or new global rules.

Please click to read full report.

Editor's picks

Trending articles

7 Oct 2016

One Belt One Road and the Implications for China-EU Relations

By ThinkChina, University of Copenhagen

In this policy brief, Professor François Godement, Director of ECFR’s Asia & China Programme, discusses the background and future of the Chinese Government’s One Belt One Road initiative. Godement concludes, among other things, that Europe’s overemphasis on internal competition stands in the way of the coordinated effort that could leverage China’s aims.

The Policy Brief:

- Argues that China’s recent initiatives to boost overseas investment, e.g. AIIB and the National Development Bank, are not game-changing developments for the international financial architecture, but present strong competition for pre-existing international funders, and a potential investment over-supply in Asia.

- Asserts that China does not want to emphasize the geopolitical aims of OBOR, even though these were often cited in the first phase of the initiative.

- States that European policy towards China is intrinsically weak – whether in terms of collective bargaining and leverage, or on principled stands.

- Contends that China retains a massive current account surplus, and a fear of re-evaluation of the yuan.

Please click to read full report.

Editor's picks

Trending articles

Western China: The Route to Success along the Belt and Road

China’s 13th Five-Year Plan (2016-2020) emphasises optimising the spatial development, accelerating development of the western region, and balancing regional development. Since the central government implemented the Go West policy, economic development of the western region has been making good progress, with the economic level of some areas gradually moving close to that of the coastal region. Worth noting in particular is the Chengdu-Chongqing district formed by Chengdu, the capital of Sichuan province, and the nearby Chongqing municipality. This has developed into a commercial and financial centre as well as a transport hub of China’s western region. It is also developing into the bridgehead for the western region in establishing economic co-operation with the outside world under the Belt and Road Initiative.

The western region’s abundant supply of land, labour and technology talent, as well as lower production costs than the coastal region, attracted the attention of many companies some years ago. As a result, a number of domestic and foreign enterprises have relocated part of their production activities to places such as Sichuan and Chongqing, which have higher degrees of industrialisation. Many of these production activities involve high-tech and high value-added industries. As such, this shift has not only turned the region into a base for production relocation from the coastal region, but has also helped places such as Sichuan and Chongqing to evolve into modern manufacturing centres of the western region.

Owing to these changes, the whole industry chain in the western region is moving towards maturity while production, business and commercial activities are expanding, directly stimulating demand for all kinds of industrial and production materials as well as related business services. This in turn can bring about extra market opportunities for Hong Kong’s upstream materials suppliers and service providers. Moreover, companies in the western region are actively seeking to “go out” to make investments abroad. They hope to establish sales channels in overseas markets and to acquire technologies and other resources in order to increase their competitiveness and further expand the domestic and overseas businesses.

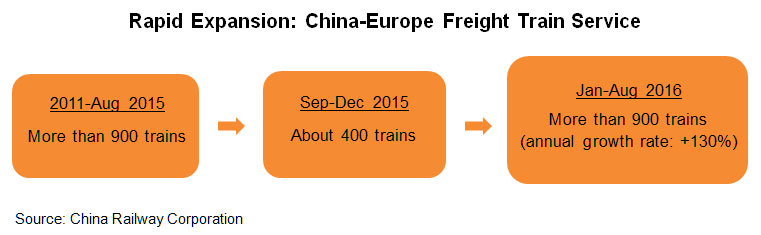

The western region has always been an important gateway through which China connects with countries in Central Asia, South Asia and West Asia. In recent years, cities such as Chengdu and Chongqing have quickened their pace in launching China-Europe freight-train services. They have also strengthened external multimodal transport services by air, sea and land and enhanced external transport and logistics links in order to further promote economic growth. Under the government’s efforts to implement the Going Out and Belt and Road development strategies, enterprises in Sichuan, Chongqing and other parts of the western region are expected to seek more foreign investment and trade opportunities. In doing so, their demand for various types of support services will be strong.

Hong Kong has long served as a foreign business and trade centre for the Chinese mainland. It is also the preferred service platform for mainland enterprises that are “going out” to make investments overseas. Hong Kong has rich experience in serving mainland enterprises, providing them with services related to supply chain, production and international trade. It also offers a full range of professional services such as financial, legal and risk management to mainland enterprises that are “going out”. As enterprises in the western region accelerate their pace of “going out” and “bringing in”, and the mainland authorities continue to unfold the Belt and Road development strategy, Hong Kong companies in related fields stand to benefit from the resulting opportunities.

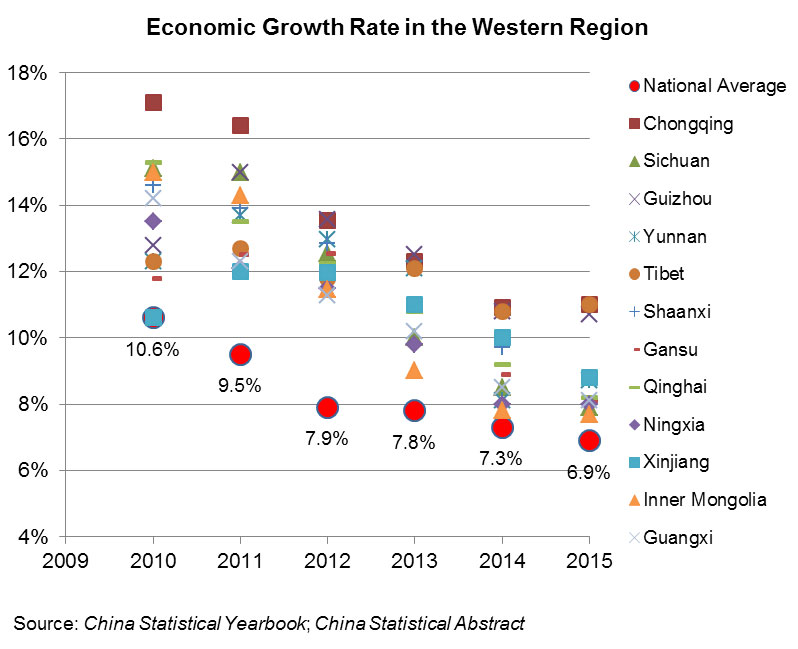

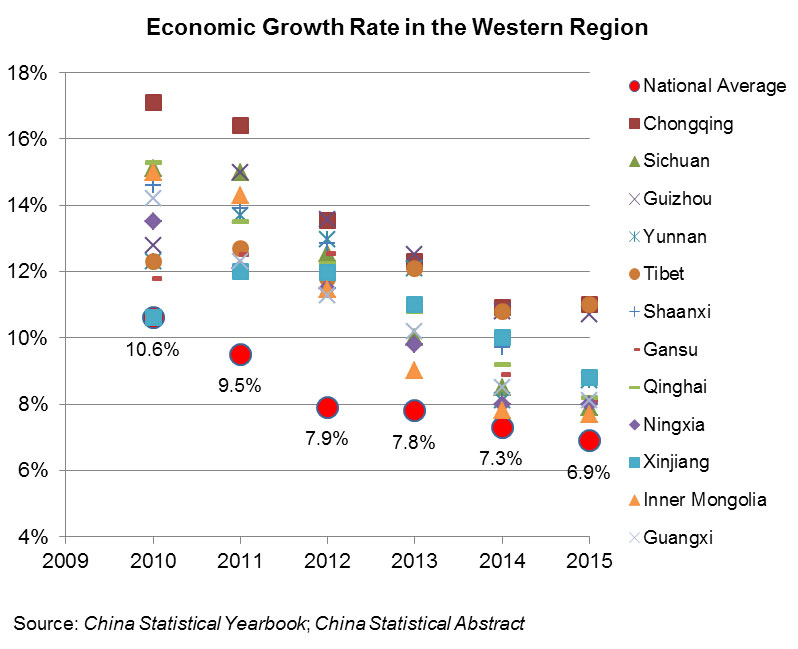

Westward Shift of Economic Development

In recent years, China’s economy has faced a number of challenges like lacklustre export markets and rising labour and land costs. This has inevitably constrained the development of many coastal provinces, which have strong economic clout but rely heavily on foreign trade. By comparison, the western region’s economy has been growing steadily, at a rate surpassing the national average. Blessed with abundant land and labour supply as well as lower operating costs, the western region is gradually attracting the attention of companies operating in the coastal region, as well as foreign firms. Thanks to the continuous development of industries in the western region and the constant inflow of foreign investment in recent years, provinces and cities in the region, such as Sichuan and Chongqing, have become new bright spots in China’s economic development.

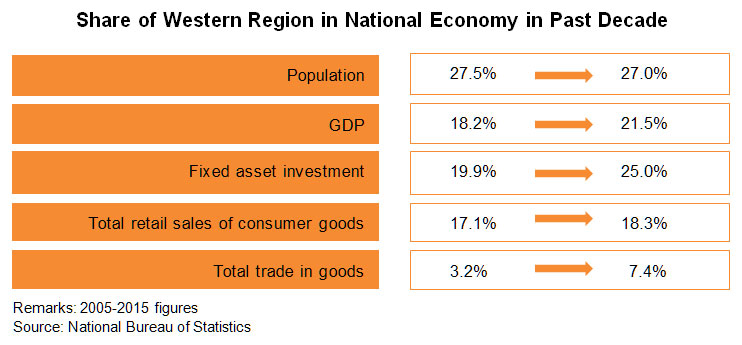

Meanwhile, the Chinese government is actively aligning the pace of development in the coastal and inland regions. In particular, under the Go West policy[1], continuous efforts have been made to strengthen connectivity between the eastern and western regions in terms of construction of infrastructural facilities such as transport and communications. A range of preferential policies has also been introduced to encourage industrial development in the western region[2]. Under the 13th Five-Year Plan unveiled by the government in early 2016, emphasis is given to promoting development of the western region under the Go West strategy, including optimising urban development planning in the context of regional development, advancing regional transport integration, and improving regional environmental planning[3].

Moreover, in January 2016 the State Council issued its Several Opinions on Promoting the Innovative Development of Processing Trade, proposing that action will be taken to further optimise the regional distribution of industry and gradually co-ordinate development of the eastern, central and western regions, including giving support to inland and border regions to serve as industrial relocation bases as well as advancing co-ordinated regional development.

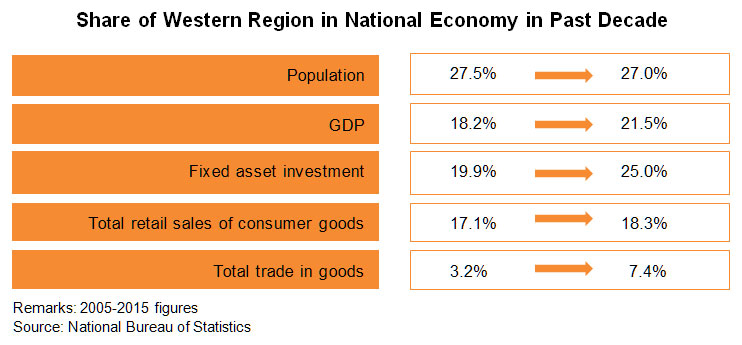

In May 2016, the State Council issued its Several Opinions on Promoting Stabilisation and Recovery of Foreign Trade, which stresses that efforts will be made to integrate fiscal and financial policies in support of relocating processing trade to the central and western regions. Steps will also be taken to implement the policy of lowering social insurance premium rates, encourage financial institutions to give financial assistance to processing trade relocation projects, and extend the “one-window” policy[4], which aims to enhance customs clearance facilitation in international trade, from the coastal region to central and western regions with the right conditions. With the government’s efforts, coupled with such advantages as land and labour supply, the western region has been rapidly developing in recent years and currently makes up a significant share of China’s overall economy.

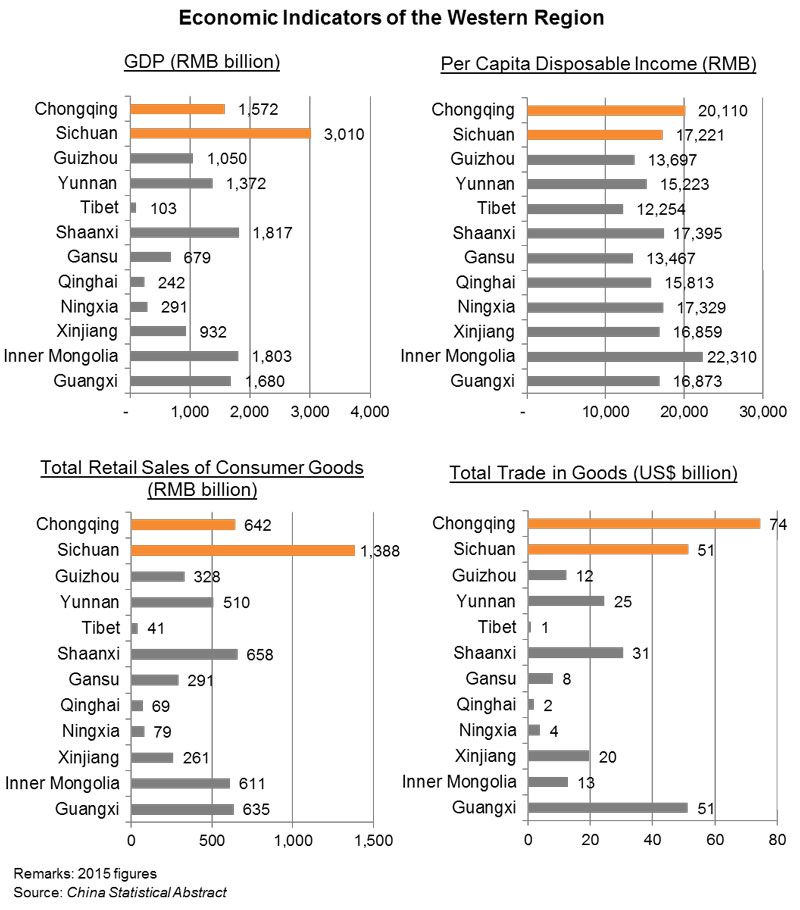

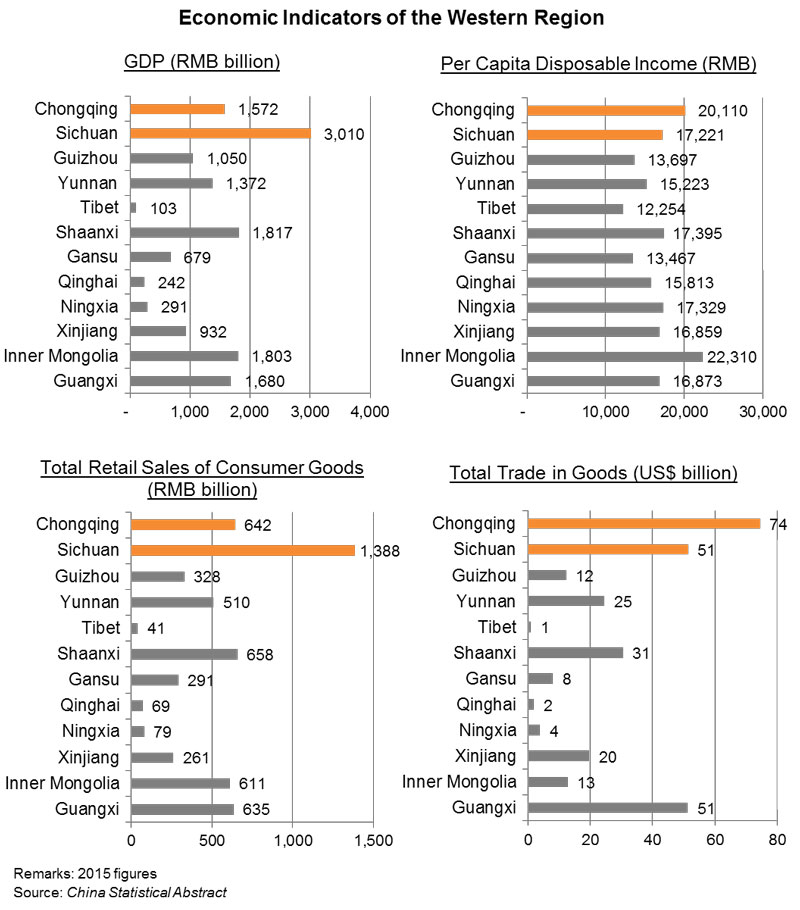

Sichuan and Chongqing: Economic Hubs in the Western Region

Sichuan’s economy is the largest among the 12 provinces and municipalities in the western region. The Sichuan-Chongqing region, comprising Sichuan province and its neighbouring Chongqing municipality, has become the western region’s largest economic and trade centre. While the income and spending power of Sichuan and Chongqing residents have been rising rapidly in recent years, commercial and infrastructural facilities there have also continually improved, quickly catching up with the development pace of coastal cities. At the same time, conscientious efforts by the local authorities to attract business and investment, as well as the continual inflow of investment funds from other parts of China and foreign countries, have also directly stimulated local industrial and commercial activities.

Not only has the western region been an important gateway connecting China with countries to the south and west, but it has also been a hub for commerce, trade, external logistics and transport. Taking advantage of the country’s “going out” and Belt and Road development strategies, companies in Sichuan and Chongqing are actively exploring opportunities arising from foreign investment and trade. As the Sichuan-Chongqing region is gradually developing into the bridgehead of China’s western region in establishing foreign economic and trade co-operation, its growth potential should not be underestimated.

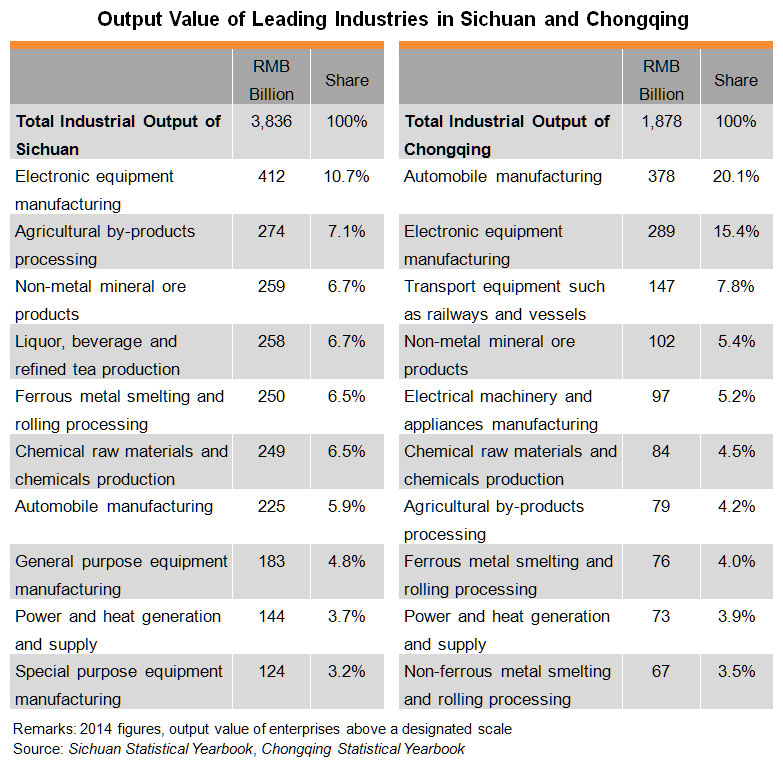

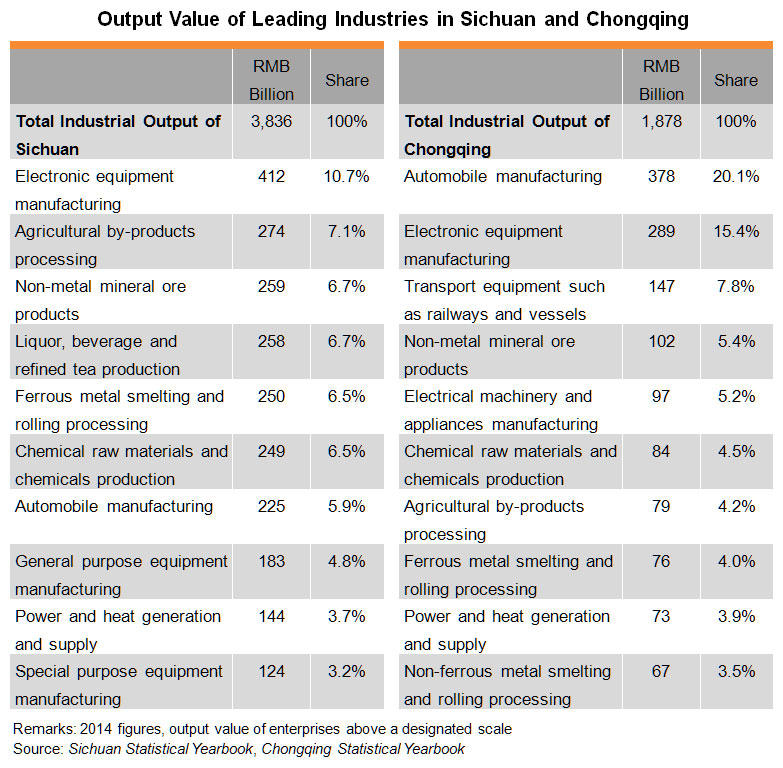

Currently, Sichuan province and Chongqing municipality together form the most highly industrialised area in China’s western region. In Sichuan, heavy industries such as coal, energy and metallurgy are the leading sectors, accounting for 67% of total industrial output in 2014[5]. Chongqing is one of the oldest industrial bases in China, focusing on automobiles, defence, iron and steel. In 2014, heavy industry accounted for 74% of the municipality’s total industrial output[6].

The Sichuan-Chongqing region has also been devoting a lot of effort to diversifying its industries. A large number of strong local enterprises have emerged which have helped to propel the development of the local economy. These range from enterprises in light industries such as food, Chinese medicine, liquor and silk processing, to high-tech industries including micro-electronics, computers, mobile phones, communications equipment and other electronic products, electrical appliances, and machinery. At the same time, positive steps are being taken to develop industries such as building materials, wood processing, natural gas, power, and chemical fibres. The output of some of these industries is among the highest in quantity terms in the western region.

Sichuan province has the largest industry cluster in the western region. Among the top 100 enterprises in the province are Sichuan Changhong Electric Co Ltd (electronic products), New Hope Group (food / dairy products / fast-moving consumer goods), Sichuan Yibin Wuliangye Group Co Ltd (liquor), Panzhihua Iron & Steel (Group) Co Ltd (mineral ore resources), and Tongwei Group Co Ltd (agricultural products / new energy / chemicals / pet food).

On the other hand, Chongqing municipality is also gradually evolving from an old industrial region to an important modern manufacturing base and a regional economic centre. The top 100 enterprises in Chongqing include Chongqing Changan Automobile Co Ltd, Chongqing Lifan Industry (Group) Co Ltd (automobile / motorcycle), Chongqing Chemical and Pharmaceutical Holding (Group) Co (chemicals / pharmaceuticals), Chongqing Energy Investment Group (energy investment / development / construction), Chongqing Machinery and Electronic Holding (Group) Co Ltd (electrical and mechanical equipment), and Chongqing Light Industry & Textile Holding Group Co (light industry / textile / building materials / property development). Among the well-known Sichuan and Chongqing enterprises, many are state-owned groups.

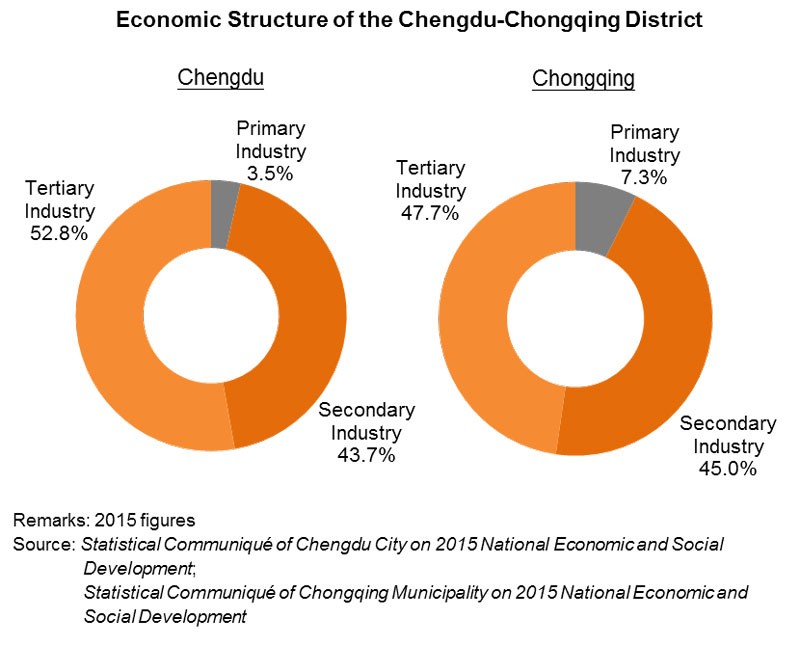

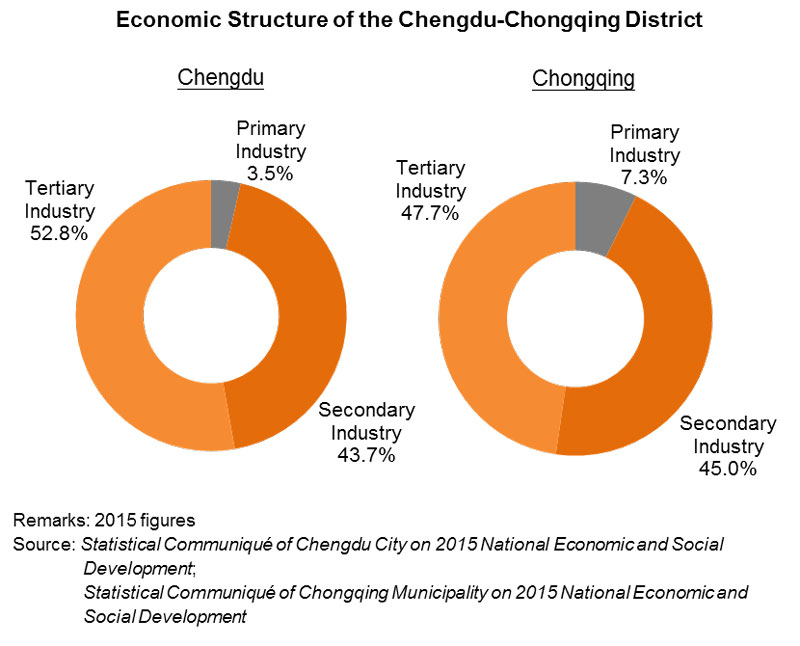

Formed by Chengdu city and Chongqing municipality, the Chengdu-Chongqing district is not only the focus of development and opening-up in the western region, but is also a regional commercial and financial centre, a transportation and communications hub, and a technology centre of the southwestern region. In 2015, Chengdu’s GDP reached RMB1,080.1 billion, with real growth of 7.9%. In particular, tertiary industry – led by services such as commodity circulation, transport, post and communications, finance and insurance, real estate, technology services, and tourism – is developing rapidly, accounting for 52.8% of the city’s GDP in 2015 and surpassing the share of secondary industry (43.7%). Chongqing is also gradually developing modern services to support its economic growth, including the rapidly expanding transport and logistics sectors. In 2015, tertiary industry accounted for 47.7% of Chongqing’s economy, surpassing the share of secondary industry (45%).

Foreign Firms Tapping Sichuan and Chongqing Opportunities

Increasingly, domestic enterprises from coastal regions, as well as multinationals, are setting up operations in the western region in a bid to leverage the various advantages there to meet their business needs. In addition to the availability of land and natural resources, these outside enterprises are lured by the more abundant supply of labour and the pool of technology talent in western China. By establishing a presence in the western region, they hope to further tap the potential of the mainland market and also develop their export businesses. In recent years, in the wake of constant investment inflows from outside enterprises, industries in Sichuan and Chongqing have been gradually moving towards high value-added and high-tech areas.

Chengdu, in addition to being a popular city for investments in central and western China for foreign companies, is also favoured by foreign-invested enterprises as a location for the headquarters of their businesses in the region. As of March 2016, among Fortune Global 500 companies, 271 corporations, including Intel, IBM, GE, Microsoft, Cisco, Siemens, Bayer and Volkswagen[7], have established a presence in Chengdu. These companies are involved in scores of industries including semiconductors, electronic information, automobiles, aviation manufacturing, new materials, finance, insurance, retailing and logistics. In fact, Chengdu is first among all cities in central and western China in terms of the number of Global 500 companies with a presence, the total investment amount and the diversity of industries invested.

Meanwhile, a considerable number of technology firms, including some electronics and automobile-related multinationals, have chosen to set up and establish factories in Chongqing. These include HP, Inventec, Tech-Front (of Quanta Group), Hongfujin (of Foxconn), Pegatron (of Pegatron / ASUSTeK Group) and Acer, helping to create the world’s largest computer-industry cluster in the municipality. Chongqing also boasts one of the biggest complete-car/motorcycle industries in the Chinese mainland, including such Sino-foreign joint ventures as Changan Ford, SGMW and Beijing Hyundai. It has also attracted foreign firms such as Honeywell, which has set up an automobile materials factory there.

As industry chains become increasingly developed, industrial and production activities in western China are expanding and diversifying into industries of more sophisticated technologies. This has triggered not only a rapid increase in demand for an extensive array of industrial materials, but also a strong demand for various types of support services, including product design and technology solutions, brand and market promotion services, as well as business services including international logistics. This has provided considerable market opportunities to Hong Kong’s upstream industrial-materials suppliers and services providers.

(For more information, please see Western China’s High-Tech Potential Woos the Multinationals)

Boosting Logistics Services to Connect Mainland and Overseas Markets

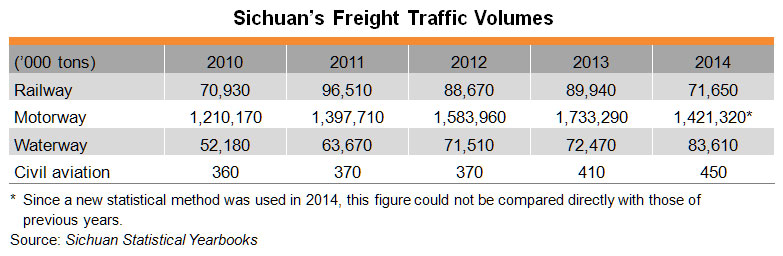

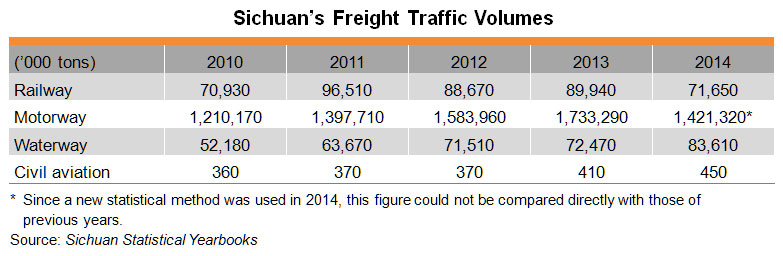

The expansion of production and economic activities in Sichuan and Chongqing has also directly driven demand for all kinds of logistics services from companies operating there. Indeed, the freight volumes of Sichuan and Chongqing have been constantly increasing in recent years. As a result, the respective local governments are now upgrading local and regional transportation networks in order to set up efficient logistics systems to further link local industries with supply chains in the coastal regions. It will also strengthen passenger and cargo transportation services, helping to better facilitate access to external markets.

During a recent visit to the Chengdu-Chongqing district, HKTDC Research was told by some local manufacturers and companies relocated from elsewhere that currently, overland freight services to and from the Pearl River Delta (PRD) and other coastal regions are very convenient. For example, from Chengdu, it takes only about two days to reach the PRD. If the starting point is in Chongqing, there is a further option of using waterway transportation to move goods from the upper Yangtze to the Yangtze River Delta (YRD) region. The growing demand for freight services from local manufacturers has been met by logistics services suppliers increasing efficiency, and by offering multimodal transportation services involving motorway, railway, waterway and air transportation.

Minsheng Logistics Co Ltd of Chongqing, which mainly handles products such as electronics, automobiles and fast-moving consumer goods, told HKTDC Research that it was offering customers in the Sichuan-Chongqing region regular container liner services and could help them to export their goods directly via Shanghai or other ports. Its customers could also choose to ship goods to and from the PRD via motorways or railways – the journey would take about 53 hours via the Chongqing-Shenzhen Railway.

(For more information on the logistics sector, please see Relocating to Chengdu and Chongqing: The Implications for the High-tech Sector).

Meanwhile, local governments are actively building new road networks. Major projects in Chengdu include the scheduled completion by 2020 of an expressway network consisting of three ring roads and 13 spoke roads; an inter-provincial expressway system allowing vehicles to reach Guiyang, Kunming, Xi’an and Wuhan in eight hours; and another to the Beijing-Tianjin-Hebei, PRD and YRD regions with journey times within 20 hours. Chengdu is also building an additional airport, Tianfu International Airport, in order to meet the increasing demands of the international air-cargo services. It is expected to be in service by 2020.

In fact, Chengdu is already a key air logistics hub in western China. The existing Shuangliu International Airport ranks first among airports in central and western China in terms of passenger numbers, cargo throughput and the number of international flight routes. In 2015, the airport recorded a passenger throughput of 42.24 million (an annual growth rate of 12%) and a cargo/mail throughput of 557,000 tons (annual growth of 1.6%)[8]. It connected to 194 cities through 252 international and domestic routes, of which 85 were international (or regional)[9]. Chengdu’s second airport is expected to further boost air-freight logistics services in Sichuan and even across the whole of western China.

To help businesses further expand into Europe and to tap inland market opportunities along the Belt and Road routes in Asia and Europe, both Chengdu and Chongqing have recently strengthened the China-Europe freight-train services. Furthermore, China is planning to step up communication with ASEAN member states in a bid to access transportation routes in countries such as Vietnam, Myanmar and Laos via the highway and railway networks in southwest China, and also to promote bilateral import-export trade.

(For more information on the China-Europe freight-train services, please see China-Europe Express Trains: On Track to Access Belt and Road Businesses).

Against such a backdrop, Hong Kong’s logistics services companies can enhance their advantages by strengthening their logistics and transportation networks linking western China and Hong Kong. One example is how the Chongqing branch of Kerry EAS Logistics Limited (Kerry EAS), which has its origin in Hong Kong, is using its logistics park facilities in Chengdu and Chongqing to serve businesses in Sichuan, Chongqing and peripheral areas. Most of its customer demands are currently for overland logistics transportation services between western China and eastern and southern China, and the goods carried include car parts, pharmaceuticals, electronics, and products related to e-commerce/cross-border e-commerce.

A Kerry EAS representative told HKTDC Research that as business opportunities emerged under the Belt and Road Initiative, and as China’s economic and trade relations with Southeast Asian countries got ever closer, Kerry Group was using its transportation and logistics networks in southwest China and ASEAN countries to provide customers with one-stop services and comprehensive logistics solutions to help them tap Belt and Road opportunities. In doing so, Kerry was taking advantage of the overland logistics routes that lead from the Chengdu-Chongqing district to the ASEAN markets via Yunnan province and other places, as well as its warehousing, logistics and customs clearance facilities in ASEAN countries.

Enterprises in Western China “Going Out” to Tap “Belt and Road” Opportunities

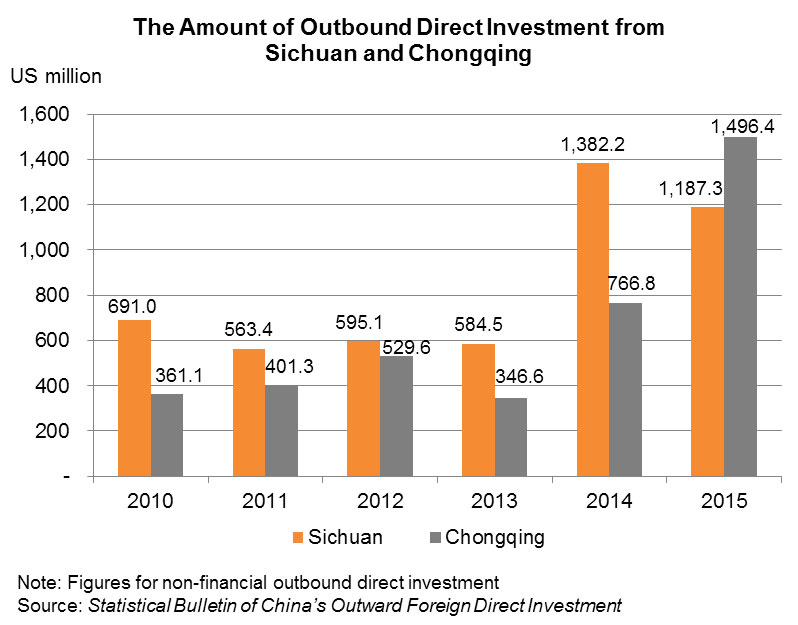

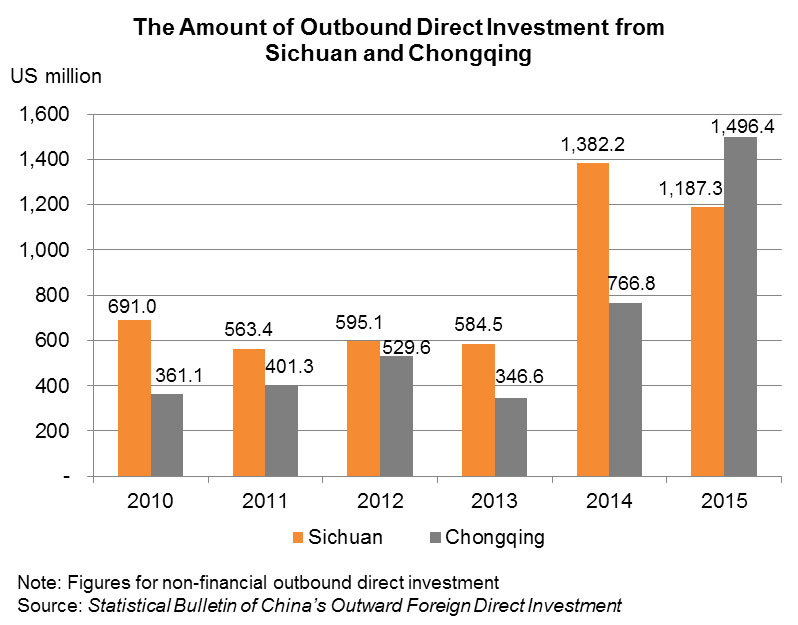

While capital inflows to western China are growing at an accelerated pace in order to tap local economic and market potential, enterprises from western China are also stepping up efforts to “go out” and seek various resources to raise competitiveness while developing overseas markets further. During 2010-2015, outbound direct investment (ODI) from Sichuan increased about 72%, while that from Chongqing rose more than 300%. The main destinations for Sichuan’s outbound investments are Hong Kong, the United States and Australia, while Chongqing’s investments go mostly to Hong Kong, Pakistan and Malaysia[10]. As well as “going out” to expand their sales networks, enterprises from Sichuan and Chongqing also go overseas to look for resources to support their business development on the mainland.

One example is New Hope Dairy Holdings Co Ltd, a well-known mainland Chinese dairy enterprise headquartered in Chengdu. During a 2016 HKTDC-led visit to the company by a Hong Kong design and market promotion industry delegation, a New Hope Dairy representative explained that it was always on the lookout for sources of fresh milk in western China and elsewhere in the country. To establish itself as the “No. 1 fresh-milk brand in China”, the company imports premium milk from Europe and, at the same time, develops a number of innovative technologies to ensure the freshness of its products and compliance with stringent quality requirements. In 2015, New Hope Dairy was active in “going out” to set up an Australian joint venture with its overseas partners to invest in upstream and downstream sectors of Australia’s milk-supply chain so that Australia’s superior resources can be used to support the company’s business development on the mainland.

A recent survey conducted by the HKTDC revealed that, to address the challenges resulting from the slowing down of the market and other changes in the business environment, enterprises in western China are actively seeking professional services from outside, such as brand design and promotion strategies; marketing; product design and development; finance; and law, in order to help their transformation and upgrading. Furthermore, most enterprises surveyed indicated that they would consider further “going out” to tap business opportunities in countries along the Belt and Road routes, ASEAN countries in particular. Other than trying to sell more industrial and light-industrial products to Belt and Road markets, these enterprises also wanted to go to countries along the Belt and Road routes to carry out investment activities, including sourcing and setting up production plants.

(For detailed findings of the HKTDC survey, please see China's “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities.)

In the course of “going out”, most of the enterprises surveyed indicated that they would like to go to Hong Kong to seek professional services and to look for business partners. In fact, Hong Kong is the preferred services platform for enterprises in western China as well as the coastal regions when they seek to “go out”. As western China enterprises step up their pace of “going out” – in particular, those operating in economically more developed places such as Chengdu and Chongqing that are actively expanding their overseas businesses – an unending stream of opportunities will emerge for Hong Kong’s services providers.

(For more “going out” examples of enterprises from Chengdu and Chongqing, please see Western China: Access Belt and Road Markets via Hong Kong).

[1] In November 1999, the Central Committee of the Communist Party of China and State Council convened a central economic work conference confirming implementation of the Go West strategy. In January 2000 the State Council Western Region Development Steering Group convened a meeting fully unfolding work of the Go West strategy. Since then, the Go West strategy has been included in the medium- to long-term plans for national economic and social development to become one of the important strategies of China in building a moderately prosperous society, implementing modernisation, and co-ordinating regional economic development.

[2] Examples include: enterprise income tax at the reduced rate of 15% for companies meeting requirements set out in policies related to the Go West strategy.

[3] For more details on the 13th Five-Year Plan, please see Opportunities Arising from China’s 13th Five-Year Plan: An Overview

[4] Under the “one-window” policy, parties participating in international trade and transport may submit standardised information and documentations via a single platform in order to comply with relevant laws, regulations and administration requirements. Companies only have to submit once to the supervisory trade department the relevant information and documentations, which are processed by a unified platform. Under integrated cross-region customs clearance, companies that have handled customs clearance procedures in one location are not required to make customs declaration again in other locations. This policy can help companies save customs clearance time, costs and relevant storage fees.

[5] Source: Sichuan Statistical Yearbook

[6] Source: Chongqing Statistical Yearbook

[7] Source: Chengdu Investment Promotion Commission

[8] Source: Shuangliu International Airport, Chengdu

[9] As of March 2016. Source: Chengdu Investment Promotion Commission

[10] Sources: Sichuan Provincial Department of Commerce; Chongqing Foreign Trade and Economic Relations Commission

| Content provided by |

|

Editor's picks

Trending articles

14 Oct 2016

The Trans-Pacific Partnership (TPP): Key Provisions and Issues for Congress

By US Congressional Research Service

The Trans-Pacific Partnership (TPP) is a proposed free trade agreement (FTA) among 12 Asia-Pacific countries, with both economic and strategic significance for the United States. The proposed agreement is perhaps the most ambitious FTA undertaken by the United States in terms of its size, the breadth and depth of its commitments, its potential evolution, and its geo-political significance. Signed on February 4, 2016, after several years of negotiations, if implemented, TPP would be the largest FTA in which the United States participates, and would eliminate trade barriers and establish new trade rules and disciplines on a range of issues among TPP partners not found in previous U.S. FTAs or the World Trade Organization (WTO). In addition, the TPP is designed to better integrate the United States into the growing Asia-Pacific region and has become the economic centerpiece of the Administration’s “rebalance” to the region. Congress would need to enact implementing legislation for the agreement to enter into force for the United States. Such legislation would be considered under Trade Promotion Authority (TPA) procedures, unless Congress determines the Administration has not met TPA requirements.

TPP Members

Currently, the TPP includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States, and Vietnam, which together comprise 40% of the world’s GDP. TPP is envisioned as a “living agreement,” potentially addressing new issues and open to future members, including as a possible vehicle to advance a wider Asia-Pacific free trade area. The United States currently has FTAs with six TPP partner countries. Japan is the largest economy and trading partner without an existing U.S. FTA. Malaysia and Vietnam also stand out among TPP countries without existing U.S. FTAs, given the rapid growth in U.S. trade with the two nations over the past three decades and their generally higher level of trade restrictions.

Potential Outcomes of TPP

The TPP would provide several principal trade liberalization and rules-based outcomes for the United States. These include the following:

- lower tariff and nontariff barriers on U.S. goods through eventual elimination of all tariffs on industrial products and most tariffs and quotas on agricultural products;

- greater service sector liberalization with enhanced disciplines, such as nondiscriminatory and minimum standard of treatment, along with certain exceptions;

- additional intellectual property rights protections in patent, copyrights, trademarks, and trade secrets; first specific data protection provisions for biologic drugs and new criminal penalties for cyber-theft of trade secrets;

- investment protections that guarantee nondiscriminatory treatment, minimum standard of treatment and other provisions to protect foreign investment, balanced by provisions to protect a state’s right to regulate in the public interest;

- enforceable provisions designed to provide minimum standards of labor and environmental protection in TPP countries;

- commitments, without an enforcement mechanism, to avoid currency manipulation, provide transparency and reporting concerning monetary policy, and engage in regulatory dialogue among TPP parties;

- digital trade commitments to promote the free flow of data and to prevent data localization, except for data localization in financial services, alongside commitments on privacy and exceptions for legitimate public policy purposes;

- enhanced regulatory transparency and due process provisions in standards-setting; and

- the most expansive disciplines on state-owned enterprises ever in a U.S. FTA or the WTO, albeit with exceptions, to advance fair competition with private firms based on commercial considerations.

The U.S. International Trade Commission (USITC) has estimated that the TPP would bring modest overall benefits to the U.S. economy once implemented, slightly increasing both output (0.15%) and employment (0.07%) above a baseline scenario without the agreement. According to the USITC study, most agriculture and services sectors would see expansions, while some manufacturing and natural resources sectors would be expected to contract relative to baseline projections as resources shifted within the U.S. economy.

TPP Debate

Views on the likely effects of the agreement vary. Proponents argue that the TPP is in the national interest and has the potential to boost economic growth and jobs through expanded trade and investment opportunities in what many see as the world’s most economically vibrant region. Opponents of TPP voice concerns over possible job loss and competition in import-sensitive industries. Other concerns include how a TPP agreement might limit the government’s ability to regulate in areas such as health, food safety, and the environment. The Obama Administration and others have argued that the strategic value of a TPP agreement parallels its economic value, while others argue that past trade pacts have had a limited impact on broad foreign policy dynamics. In analyzing the agreement and its implementing legislation, Congress may consider the agreement from several of these perspectives, as well as how the TPP promotes progress on U.S. trade negotiating objectives.

Please click to read full report.

Editor's picks

Trending articles

Western China’s High-Tech Potential Woos the Multinationals

Foreign capital has been flowing into China in recent years to tap the potential of its western region. Domestic enterprises in the coastal regions are also casting a covetous eye on the pool of tech talent and ample land and labour supply in the western region in order to tackle rising production costs and other challenges. Great efforts made by cities in the western region to improve their infrastructure, expand their transport networks and upgrade their overall distribution and logistics capabilities have turned this region not only into the target destination for industrial transfer from the coastal areas, but also the preferred destination for foreign companies looking to expand their overseas markets and Chinese companies seeking to further open up domestic sales.

Chengdu in Sichuan province, along with its neighbouring Chongqing municipality, is home to the largest industrial cluster in the western region, and is also the region’s logistics centre and transport hub. The Chengdu-Chongqing district attracts the most capital from companies operating in coastal regions, as well as from foreign firms. Much of this investment is funnelled into high-tech industries, such as those involving semiconductors, computers, communications equipment and automobiles. This has helped to turn Sichuan province and Chongqing municipality from old industrial bases into China’s leading modern manufacturing hubs.

Industries and production activities in the western region are diversifying and embracing higher technology as local industry chains gradually come of age. This not only leads to a sharp increase in demand for a wide range of industrial materials but also spurs demand for various types of supporting services. Business services including product design and technology solutions, brand and market promotion and international logistics should generate good market opportunities for Hong Kong’s upstream suppliers of industrial materials and services.

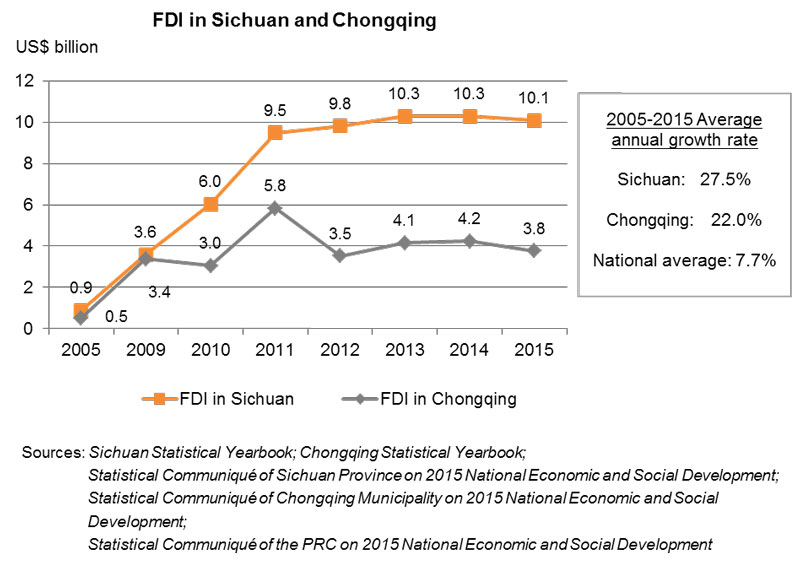

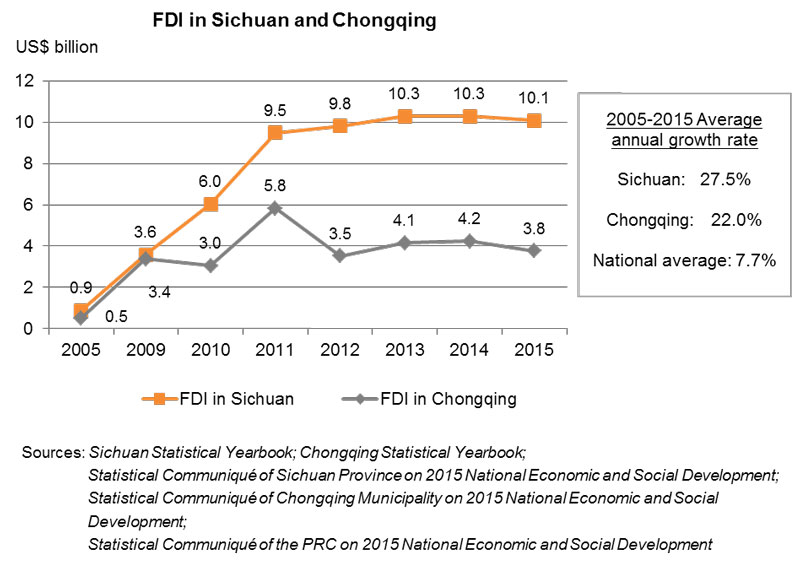

Rapid Growth of Foreign Investment in the Western Region

According to the Ministry of Commerce figures, China’s actual use of foreign capital between January and August 2016 showed an annual growth rate of 4.5% (reaching US$85.9 billion), with the western region showing a higher annual growth rate of 31%. In fact, foreign investment in the western region has been growing in tandem with the development of the regional economy. Between 2005 and 2015, foreign direct investment (FDI) in Sichuan and Chongqing increased by more than 10 and 7 folds respectively, representing an average annual growth rate of 27.5% and 22%, respectively, both exceeding the national average of 7.7%.

Sichuan leads the central and western regions in FDI utilisation and in attracting domestic enterprises from other provinces. For example, 271 Fortune 500 companies – including 202 overseas and 69 domestic enterprises – had established a presence in Chengdu up to March 2016.[1] This shows that like overseas companies, domestic enterprises from other provinces also hope to make the best of the advantages that these regions have to offer in order to expand their businesses.

In 2015, Sichuan’s actual use of FDI reached US$10.07 billion, while investment by domestic enterprises from other provinces totalled RMB911.6 billion (about US$145 billion) during the same period, representing year-on-year growth of 3.6%.[2] Investment went to wide-ranging industries, including those involved with electronic information, equipment manufacturing, food and beverages, oil, gas and chemicals, energy and electricity, and automobile manufacturing. This suggests that foreign companies and domestic enterprises from other provinces see great potential in Sichuan’s development.

The situation is similar in Chongqing. Its use of foreign investment totalled US$10.77 billion in 2015, including US$3.77 billion in FDI. It also attracted RMB853 billion (about US$135 billion) from other provinces in the year, representing an annual growth rate of 17.7%.[3] In terms of industry sector, outside investment mostly finds its way to electronic equipment and automobile-related industries, as well as to Chongqing’s financial, logistics and service sectors. In particular, more than half of the output value generated by foreign-invested enterprises in Chongqing is from the manufacturing of communications equipment, computers and other electronic equipment. In addition, about 30% of the output value of foreign-invested enterprises comes from the manufacturing of automobiles and auto parts.[4] The investment of domestic enterprises from other provinces is more diversified. Overall, outside investment in Chongqing mainly goes to high-tech industries.

Tech Giants Move into Sichuan and Chongqing

It is noteworthy that as leading investors in Sichuan and Chongqing in recent years, multinational companies and domestic enterprises are capitalising on the region’s advantages to satisfy their needs for global business expansion. In the electronics sector, for instance, large numbers of electronics engineers have been trained in the western region. Chengdu and Chongqing, in particular, have an ample supply of tech talent and personnel in the electronics field. The western region also has a well-developed defence industry, with Chengdu and Chongqing as leading centres. Given that the Chinese government is stepping up its efforts to convert defence technologies to civilian use, Chengdu, Chongqing and their surrounding areas have become focal points for highly qualified personnel in the electronics and other technology sectors.

Technology Resources of Chengdu and Chongqing

Chengdu

- Technology personnel number about 3.89 million (of which 1.85 million are professional technical personnel, ranking first in the western region)

- 53 tertiary institutions, including Sichuan University, University of Electronic Science and Technology of China, and Southwest Jiaotong University

- 67 national-level collaborative innovation centres, key laboratories, engineering technology research centres and other types of research and development platforms

Chongqing

- More than 890,000 technology personnel

- 67 tertiary institutions, including Chongqing University, Chongqing University of Technology and Chongqing University of Posts and Telecommunications

- More than 1,000 research institutions

Source: Chengdu Investment Promotion Commission; Chongqing Municipal People’s Government

Chengdu and Chongqing boast the largest clusters of electronic industries in the western region. For example, the Chengdu High-Tech Industrial Development Zone is home to more than 200 high-tech companies, including Intel and Texas Instruments, and has formed a relatively complete system of integrated circuit industries. Figures released by the development zone suggest that one out of every two notebook computers in the world has its CPU packaged and tested in Chengdu. For upstream parts and components, there are advanced TFT-LCD production lines, LCD glass substrate and other new display projects in the development zone. BOE Technology, a mainland-based group, is investing to build a Gen 6 LTPS/AMOLED production facility in Chengdu.

After relocating part of its production line from Shanghai to the western region a few years ago, Intel now air freights the chips produced in its factories in the United States, Israel, Dalian and elsewhere to Chengdu for packaging and testing. They are then shipped by air to various parts of China or exported to markets around the world, some via Hong Kong. This makes Chengdu one of the main packaging and testing centres for Intel chips produced around the world. Intel is currently upgrading its Chengdu facility, and plans to transfer some of the extended production lines in Israel to Chengdu.[5]

Texas Instruments is also upgrading and expanding the capacity of its packaging and testing facility in the development zone. Foxconn also has production plants for tablet computers, smartphones and relevant parts and components in Chengdu, and started to produce notebook computers for Apple in the city in mid-2016.[6]

Apart from Chengdu, Sichuan province has another cluster of manufacturers of electronic goods. These include local companies such as Changhong (colour TVs) and Chengdu Guoteng Communications (telecoms/data equipment), together with a supply chain capable of supporting their production activities. Domestic enterprises from other provinces, such as TCL and Lenovo, and foreign companies like Dell, have also invested in Chengdu to produce HDTV, computers and other information-technology products. These, together with the high-tech companies mentioned above, are contributing to the gradual improvement of Chengdu’s – and even Sichuan’s – overall supply chain.

As for Chongqing, the China Silian Instrument Group (electrical equipment, semiconductors and LED products) and CISDI Engineering (energy saving, environmental protection and information-technology equipment) have all made significant headway in the electronics sector and have joined the ranks of China’s top 100 electronics enterprises. Overseas high-tech companies are also actively investing in Chongqing. In particular, HP has increased the capacity of its production plant in Chongqing, and the computers and other information products produced there supply the booming domestic and global markets. Taiwanese manufacturers of information-technology equipment such as Acer, Quanta, Inventec and Foxconn are also setting up plants in Chongqing. These are directly responsible for the surge in Chongqing’s output of computers and other electronic products in recent years.

In fact, due to the policy support given by the municipal government for electronics manufacturing, information technology and other industries, Chongqing’s high-tech industries have been expanding for some years. For example, the Chongqing Liangjiang New Area was established in mid-2010 as a national-level development zone, with a status similar to that of Shanghai’s Pudong New Area and Tianjin’s Binhai New Area. With electronics as one of its target industries, Liangjiang offers preferential land policy, subsidy, credit support and other incentives to investors. Another example is the Chongqing Xiyong Micro-Electronics Industrial Park, which is actively wooing investors from sectors including information technology, integrated circuits and software. Liangjiang and Xiyong have bonded facilities to attract export-oriented production activities.

Against these backdrops, Chengdu and Chongqing have developed into important bases for the electronics industry, and their achievements are clearly evident. The following are some of the latest figures provided by the Chengdu High-Tech Industrial Development Zone, in mid-2016:

- The chips of 50% of all notebook computers produced globally are packaged and tested in Chengdu

- Two-thirds of iPads produced around the world are manufactured in Chengdu

- 40% of notebook computers produced globally are manufactured in the Chengdu- Chongqing district

Sichuan and Chongqing as Gateways to Domestic and Overseas Markets

As well as being technology centres, Sichuan and Chongqing are the transport hubs of western China, accessible to cargo transport and logistics networks. Under the “Go West” strategy, they have in recent years substantially upgraded their infrastructure, expanded their road and water-transport networks and improved their overall logistics distribution capacity with the central and coastal areas. Chengdu and Chongqing have also strengthened their air and rail links with other countries, including the China-Europe express freight-train services between Chengdu and Lodz in Poland and between Chongqing and Duisburg in Germany. This has completely changed the old impression that the western region is not in a good position to engage in production activities relating to international trade.

[Note: For more details about the China-Europe express freight-train services, please see: China-Europe Trains: The Express Route for Belt and Road Businesses]

Sichuan’s population of some 81 million people used to be the main source of migrant workers in China’s coastal areas. However, as the cost of living rises in the coastal areas and employment opportunities increase in the western region, many migrant workers are heading home to look for jobs. Chongqing, with a population of about 30 million, has ample labour supply as well. In view of these factors, growing numbers of domestic companies and foreign-invested enterprises operating in the coastal areas are relocating their production facilities to Sichuan and Chongqing, in part to keep their workers engaged while expanding their production capacity.

The governments of Sichuan and Chongqing are also actively looking for companies wishing to shift their businesses inland from the coastal areas where operating costs are high, and are wooing investors of more high-tech industries to set up production plants in this region. Combined with the fact that many multinational and domestic high-tech and electronic enterprises have already moved into this region in recent years, this has stimulated demand for all types of producer goods and prompted some upstream materials suppliers to follow their clients and invest in Sichuan and Chongqing in order to tap the growing market for industrial materials.

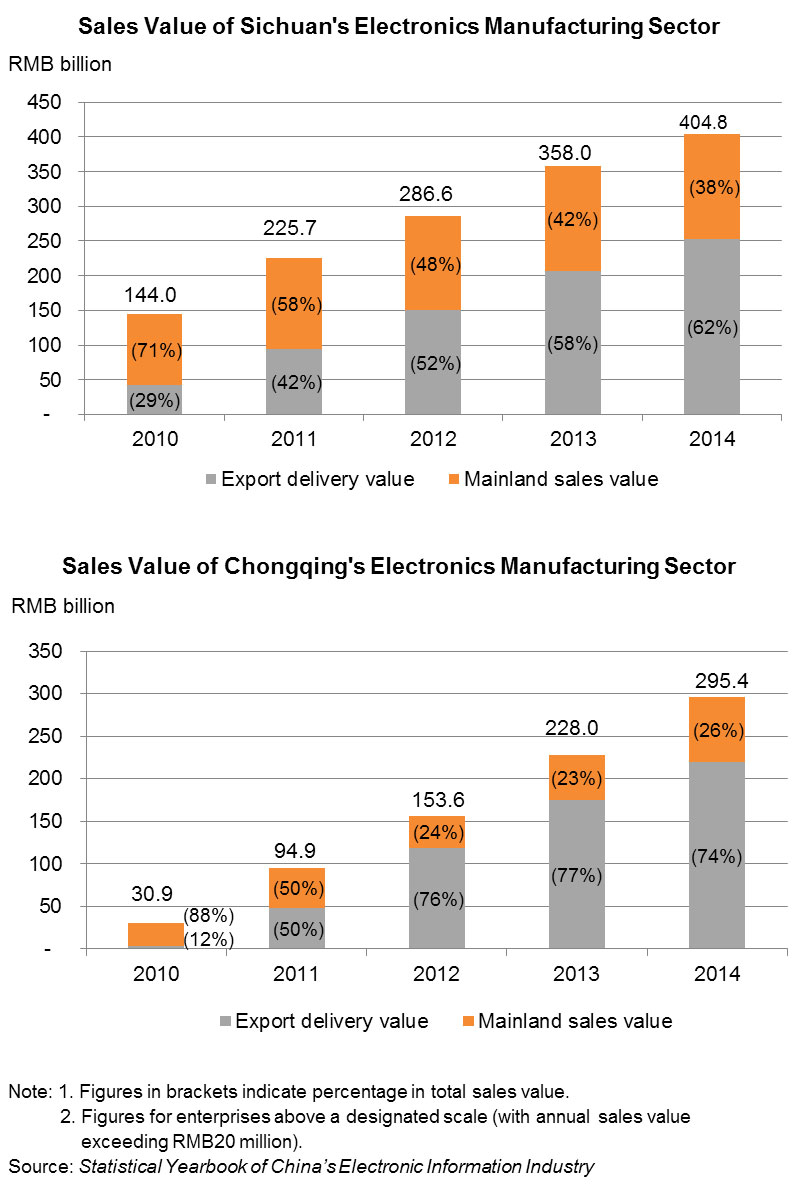

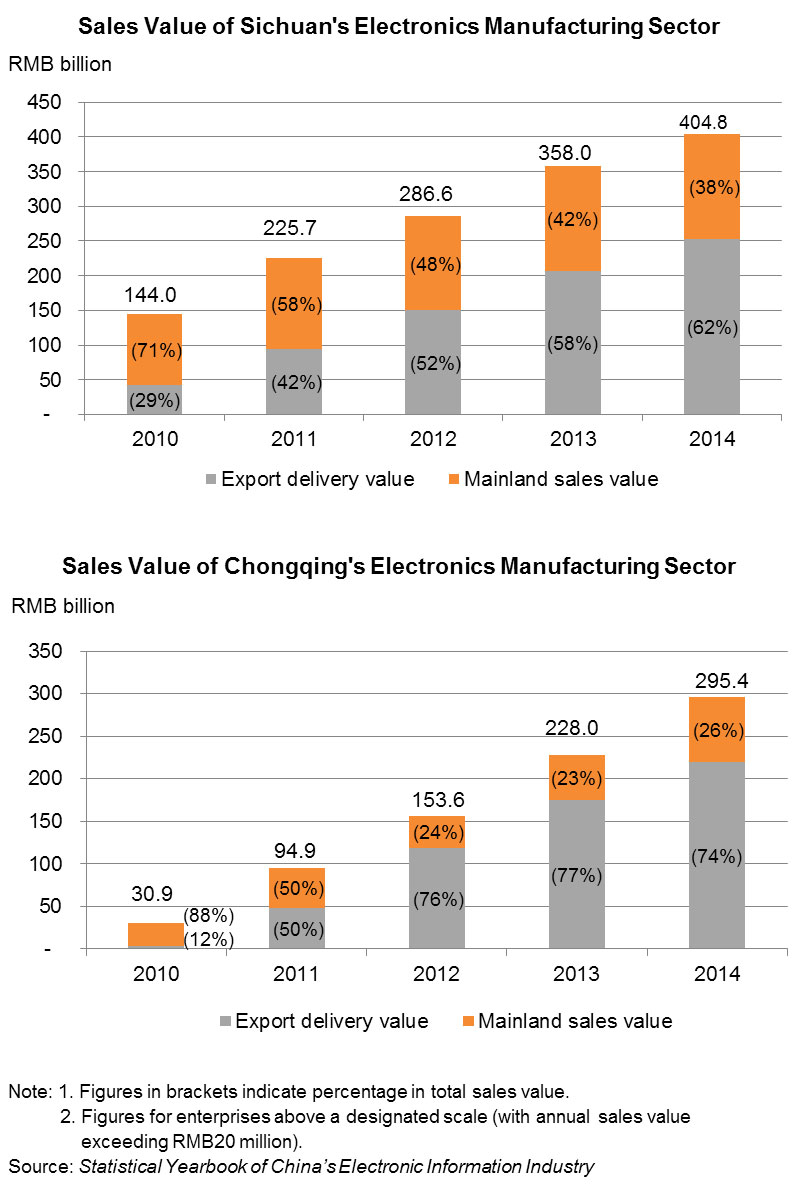

These developments have not only turned the western region into a destination for coastal enterprises to transfer some of their more high-tech production, but also made the region an ideal place for foreign and domestic enterprises to expand their businesses and further open up overseas markets and domestic sales. With the continuous flow of investment from outside, the sales value of the Sichuan and Chongqing electronics industry soared to RMB404.8 billion and RMB295.4 billion, respectively, between 2010 and 2014, representing an average annual growth rate of about 30% and 76%, respectively.

The industries in Sichuan and Chongqing have also evolved from having a majority of domestic sales to being export-driven. Exports by the electronics industries in Sichuan and Chongqing in 2014 accounted for 62% and 74%, respectively, of the total sales value, and their total export delivery value ranked fourth and sixth, respectively, among all provinces and municipalities in China. The main export items include computers, integrated circuits and telecommunications products. On the other hand, although the domestic sales ratios of the electronic industries of these two places have been on the decline, the actual sales values have been increasing, although the growth rate is trailing behind that of exports. This shows that more and more domestic companies and foreign-invested enterprises are using Sichuan’s and Chongqing’s leading-edge in technology, labour supply and other resources to expand domestic and overseas markets.

Implications for Hong Kong Businesses

An increase in investment by outside enterprises reflects the growing attention directed towards the western region. Sichuan and Chongqing have a wealth of technology talent and an ample supply of labour. The region’s rich market potential is favourable for the development of manufacturing clusters of electronics and other more high-tech industries. At present, not only multinational companies but also big mainland and Taiwan companies are investing in Sichuan and Chongqing. Upstream suppliers have also followed in their clients’ footsteps to this region in order to tap the growing market for industrial supplies. The efforts made by the local governments to lure more businesses from the coastal areas where operating costs are high will further stimulate demand for various types of production materials. This will generate opportunities for Hong Kong suppliers of upstream materials.

On the other hand, Sichuan and Chongqing are aiming for a higher technological level and are heading in a more service-oriented direction in their industrial development. Their governments welcome modern services in addition to manufacturing in the hope of achieving diversification. Electronics manufacturing has been extended to cover areas such as communications systems for transportation and rail transport, global positioning systems and logistics management. Greater importance is attached to the research, development and the application of new-energy vehicles to help boost the Sichuan-Chongqing region’s automobile sector. Local enterprises also hope to strengthen co-operation with technology and service sectors in other regions to increase their competitiveness and open up more domestic and overseas markets. Apart from opening the doors for Hong Kong technology companies to enter the western China market, these developments will also generate good opportunities for Hong Kong service providers, such as those providing business services in product design and technology solutions, brand and market promotion, and even international logistics.

With their maturing industry chains and more efficient logistics distribution systems, Sichuan and Chongqing offer an additional option to Hong Kong companies that are considering moving their coastal production facilities and expanding their production capacity inland. Moreover, the supply chain links between Sichuan and Chongqing and the coastal areas are getting closer. As their downstream clients are increasingly being tempted to invest in the western region, Hong Kong’s upstream suppliers may need to consider how they can move inland with their clients or find other ways to give them support.

[Note: For more details on the direction of industrial development of Sichuan and Chongqing and the current situation of industrial relocation, please see Relocating to Chengdu and Chongqing: The Implications for the High-tech Sector]

[1] Source: Chengdu Investment Promotion Commission

[2] Source: Statistical Communiqué of Sichuan Province on 2015 National Economic and Social Development

[3] Source: Statistical Communiqué of Chongqing Municipality on 2015 National Economic and Social Development

[4] Source: Chongqing Statistical Yearbook

[5] Source: Chengdu High-Tech Industrial Development Zone

[6] Source: Chengdu High-Tech Industrial Development Zone

| Content provided by |

|

Editor's picks

Trending articles

Relocating to Chengdu and Chongqing: The Implications for the High-tech Sector

China’s western region has an abundant supply of labour and land. With constant flows of foreign investment into Chengdu and Chongqing, the region’s industry chain is moving towards maturity while efficiency of the local logistics and transportation sectors has been enhanced. This has helped to turn the Chengdu-Chongqing region into an ideal base for industrial relocation from the coastal areas. However, as the local economy and industry continues to develop, the Chengdu-Chongqing region is becoming more cautious with land planning and is shifting from merely placing emphasis on the amount of investment projects to developing high-tech and high value-added industries.

Hong Kong companies wishing to expand and take advantage of what the western region has to offer should bear in mind the impact of higher logistics costs on their export businesses, and consider ways of connecting the supply chain in the coastal areas with the western region in the course of their production. They should also note that space for industrial relocation to the western region could diminish over time. Production activities in the Chengdu-Chongqing region, especially in light of the rapid growth of the electronics and other high-tech industries, will directly stimulate demand for a wide range of industrial materials, which could bring about considerable market opportunities for Hong Kong’s upstream materials suppliers.

Lower Production Costs Offset Logistics Charges

In recent years, the continual flow of foreign investment into Chengdu, the capital of Sichuan province, and the nearby Chongqing municipality has propelled the rapid development of the local supply chain. Technology giants such as Intel and HP have set up production plants in the region, while other foreign companies including Quanta, Inventec and Foxconn of Taiwan have established R&D and production bases there that are engaging in the production and export of information-technology products. The presence of these foreign players, together with mainland enterprises such as TCL and Lenovo, has greatly increased the spectrum of the existing local industry cluster and turned the Chengdu-Chongqing region into the largest modern manufacturing centre in China’s western region.

It is worth noting that the ongoing expansion of production activities in the Chengdu-Chongqing region has attracted many upstream materials manufacturers and supporting industries. Many have invested in the region in order to support their clients’ production activities and to help develop the industrial market in the western region. Moreover, Sichuan and Chongqing are both leading automobile production bases in China with a complete auto-parts supply system. Following the continual growth of other industries, the industry chain in Chengdu and Chongqing is becoming increasingly mature and the two cities have developed into ideal industrial relocation bases for companies from the coastal areas.

One example is Chongqing Huike Jinyang Technology Co Ltd, headquartered in Shenzhen. The company, which owns the well-known mainland computer brand HKC, relocated part of its production activities to Chongqing from Shenzhen some years ago, establishing a presence in the Chongqing Hong Kong Industrial Park. Chongqing Huike employs more than 1,000 staff in Chongqing, producing LCD display panels, computer monitors and TV sets, as well as conducting R&D and product design activities. About 70% of its products are sold in the mainland market, with the remainder exported to overseas markets like Europe, the United States and Asia.

A Chongqing Huike representative told HKTDC Research that its products made in Chongqing were mainly delivered overland to Shenzhen, where they were gathered with products manufactured in other regions and distributed to the mainland market for sale or exported via ports in the coastal city. A small portion of the products is transported from Chongqing to Shanghai for direct export to foreign clients. Chongqing Huike also acquires some of the materials from Shenzhen to support its daily production activities. As such, the company has to bear higher logistics costs.

(Photograph provided by Hong Kong Industrial Park in Chongqing.)

According to Chongqing Huike, local and out-of-the-city logistics service suppliers have strengthened their external logistics services in the Chengdu-Chongqing region in recent years and have opened new water and land transportation routes. Consequently, local logistics charges are dropping while transportation efficiency is improving. At the same time, bolstered by foreign investment, the supply of industrial materials in Chongqing has been increasing. In light of this, Chongqing Huike has strengthened its local purchasing activities, such as buying various kinds of metal parts, plastics and optical items from upstream enterprises in Chengdu and Chongqing. By so doing, the company manages to rely less on supplies from Shenzhen as well as save transportation and logistics costs. Yet, Chongqing Huike still has to rely on Shenzhen to supply key parts and components as well as certain precision moulds and devices in order to sustain effective production.

The abundant supply of labour and technical personnel in Chongqing, however, means lower production costs, which helps to offset higher logistics costs considerably. These advantages, coupled with government subsidies on logistics charges and tax concessions offered by the Go West strategy, have persuaded Chongqing Huike to shift part of its production activities to Chongqing from Shenzhen where costs are higher. Meanwhile, the company has also invested in advanced manufacturing and automation facilities, including building a Gen 8.5 LCD production line in the Chongqing Hong Kong Industrial Park. The aim is to pursue transformation, upgrading and development of the higher-tech business, apart from resolving problems like labour shortages and production-cost hikes encountered in coastal region.

Focusing on High-tech and High Value-added Industries

It is worth noting that as the pace of industrial development accelerates, Chongqing is also eager to attract investment projects involving higher technology. For instance, apart from offering preferential tax and land policies, the Chongqing Hong Kong Industrial Park has set up a special industrial development fund aimed at encouraging and supporting industries that adhere to the local development policies. These industries – in addition to the textile and garment trades, which have been given priority for development – mainly include new strategic industries such as laptops, communications, environmental protection equipment, pharmaceuticals, and new materials. This shows that Chongqing, as an industrial relocation base, is gradually shifting from attracting labour-intensive industries to focusing on those of higher value-added business and higher technology.

|

Hong Kong Industrial Park in Chongqing The Hong Kong Industrial Park located in Chongqing’s Ba’nan district was launched in 2013 with a planned area of 10 sq kilometres in Phase 1. The park mainly caters to the development of digital/electronic products, optical products, hardware, electrical machinery, as well as value-added processing industries like jewellery, watches and clocks, toys and garments. Currently, nine projects have entered the park with an investment amounting to RMB38.2 billion. These projects include new strategic industries such as LCD panels, smart devices, and biomedicine. In addition to Chongqing Huike, other enterprises that have established a foothold in the park include Hong Kong registered companies Blue Moon Group, Hengan Group and Bai Ya Group[1]. Furthermore, all industrial investment projects adhering to the park’s special investment policies are entitled to preferential tax and land policies[2], including:

|

But Chongqing also has plans to serve as a base for the relocation of light industries. For example, in the Chongqing Maliu Riverside Development Zone, apart from development of the pharmaceutical and logistics industries, a light-industry functional area covering three sq kilometres has been set up primarily for the development of such industries as light textiles, garments and cosmetics. In tenant recruitment, emphasis is placed on attracting a cluster of companies engaged in design and branding in the hope of establishing a national-level textile and garment design centre in the zone for building brands. In particular, brands and large and medium-sized enterprises, as well as creative garment design enterprises, are encouraged to move in. In other words, apart from attracting the light-textile industry, the development zone also hopes to attract investment projects of higher value-added.

As for Chengdu, the local government is determined to develop the city into an advanced manufacturing industry base in the western region, with a focus on high technology and high value-added industries such as electronic information, equipment manufacturing, agricultural products processing, modern Chinese medicine, aviation and aerospace, bio-engineering, and modern services. Indeed, after years of attracting businesses and investments, Chengdu is now home to many foreign and domestic enterprises with financial clout, and has also developed into a regional commercial, trade and financial centre, a transportation and communications hub, and a technology centre of the southwestern region[3].

As industrial development in the city moves towards maturity, the Chengdu government has become more cautious with land planning in order to prevent land shortage. For instance, the Chengdu High-Tech Industrial Development Zone formed by the South Park and the West Park not only attaches importance to developing high-tech and new and strategic industries, but also advances the development of the financial and commercial services sectors. Such efforts aim to strengthen support for production industries and promote the development of the zone as well as Chengdu’s overall economy.

In view of the fact that the West Park, which was developed earlier, is reaching saturation, the Chengdu High-Tech Industrial Development Zone is currently shifting its focus to developing the South Park. While efforts are being made to develop the next generation information-technology industry, bio-industry and service industry, steps are also being taken to set up related facilities and platforms such as incubators and entrepreneurship centres with a view to turning South Park into an international innovative industrial development centre.

Overall, the Chengdu High-Tech Industrial Development Zone hopes to attract more investment from companies with technological and innovative capabilities. As for industries that are more traditional, have lower technology content and do not meet the development needs of the zone, even though they may wish to relocate to the zone for development, they are likely to have less room for growth.

|

Chengdu High-Tech Industrial Development Zone The Chengdu High-Tech Industrial Development Zone, one of the first batches of national-level high-tech industrial development zones established upon the approval of the State Council in 1991, ranks third out of 146 such zones across the country. It is also the first national independent innovation demonstration zone in the western region, and contains an innovation and entrepreneurship park jointly run by China and South Korea. The planned area of the entire zone, comprising the South Park and the West Park, is 130 sq kilometres. Currently, 99 of the world’s Fortune 500 companies (including Intel, Dell, IBM and Microsoft) and R&D centres of more than 60 well-known foreign and domestic companies have established a presence there. The Zone is now focusing the development of the following “7+2” industries: √ Next generation information network |

Similar cases can be found in other areas in Chengdu, such as the private-run industrial parks in Chengdu Jiaolong Port. Since their launch in 2000, the port’s two parks, Qingyang Park and Shuangliu Park, have attracted more than 1,200 companies, with annual sales revenue amounting to RMB30 billion. A modern industrial system[4] with the service industry and the advanced manufacturing industry as the mainstays has been built. A representative of the Shuangliu Park told HKTDC Research that the current main development direction of Jiaolong Port was innovative economy. The park is gradually moving towards maturity, and in its efforts to attract industry players and investments, land saving and environment-friendliness are major considerations, with emphasis placed on attracting investment projects involving modern manufacturing, logistics, innovation, R&D and design. At the same time, steps are being taken to encourage companies operating in Chengdu Jiaolong Port to pursue transformation and upgrading in a bid to enhance the value-added of economic activities in the area.

Opportunities Arising from Industrial Relocation

The western region’s lower labour, land and other production costs, together with its increasingly mature supply chain system, have gradually turned it into an ideal location for companies in coastal areas to relocate their production activities. As economic and industrial development in the western region continues, the more mature Chengdu-Chongqing region is also shifting from focusing only on the number of investment projects to developing high-tech and high value-added industries. Therefore, it can be expected that available land for industrial relocation by coastal enterprises to the western region will gradually reduce. In view of this, Hong Kong companies wishing to capitalise on the potential of the western region may consider accelerating their pace of investment and business expansion. To upstream suppliers in Hong Kong, the rapid expansion of production activities in the Chengdu-Chongqing region has created demand for a wide range of industrial materials, parts and components, which can in turn unleash considerable market opportunities.

[1] Source: Hong Kong Industrial Park in Chongqing

[2] These concessions are available provided that the projects adhere to special industrial investment policies. For details, please make enquiries with the Chongqing Hong Kong Industrial Park.

[3] For more details on Chengdu city, please see Western China: The Route to Success along the Belt and Road

[4] Source: Chengdu Jiaolong Port Management Committee

| Content provided by |

|

Editor's picks

Trending articles

28 Oct 2016

Japan, China and the Trans-Pacific Partnership (TPP) as a Strategic Tool of Choice

RCAPS Working Paper Series

By Benny TEH Cheng Guan, School of Social Sciences, Universiti Sains Malaysia, Penang, Malaysia

Abstract

This paper discusses the role of the Trans-Pacific Partnership (TPP) agreement as a strategic tool for Japan in pursuing its national and regional interests. While it is undeniable that the economic benefits to be accrued from the agreement in terms of boosting Japan’s economic growth are important and well argued, Tokyo’s motivation to engage the TPP is driven more by its geopolitical and strategic calculations. The former serves middle to long term ambition while the latter takes on short to middle term goals. Centering on the latter, the paper discusses three major motivations:

- the use of the TPP to exert innovation and drive change at home in maintaining its strategic competitiveness;

- the perceived importance of the TPP as a rule setter for regional economic cooperation; and

- the significance of the TPP in balancing Beijing’s strategic influence in the region. China’s move to fortify its relations with neighboring countries through its own initiatives in an unending tussle with the US could see the formation of two opposing trade blocs in the Asia Pacific region. Japan can play a significant role in bridging the gap and contribute to the possibility of convergence.

Please click to read full report.

Editor's picks

Trending articles

China-Europe Express Trains: On Track to Access Belt and Road Businesses

Since the launch of the China-Europe Railway Express (CR Express) linking China with Europe by fast-track cargo rail, freight volume has increased substantially, particularly in the past year. The CR Express is of increasing interest to companies wanting to transport Chinese products to Europe while tapping markets along the Belt and Road routes, including manufacturers in western China and companies in the coastal region looking for an alternative to sea freight. Some companies even take advantage of these freight trains’ speed and customs clearance facilitation to bring imports into the booming domestic market.

As the CR Express service is expected to continue to improve, Hong Kong manufacturers and traders could consider using rail as an adjunct to sea transport in order to develop inland market opportunities along the Belt and Road routes in both Asia and Europe. Logistics providers could also strengthen co-operation with railway logistics companies to connect with logistics networks in Hong Kong, so as to further strengthen their niche in international transport and logistics in sea and air transport.

(Photograph provided by Yuxinou (Chongqing) Logistics Co Ltd.)

(Photograph provided by Yuxinou (Chongqing) Logistics Co Ltd.)

Fast Expansion of Services to Cover the Whole Country

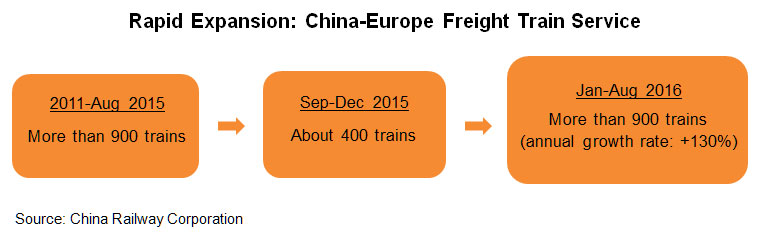

China’s Europe-bound freight-train service (now formally named the CR Express) was launched in March 2011, with the first train setting off from Chongqing to Duisburg, Germany. As of August 2016, more than 2,100 trains[1] had been dispatched via the Yuxinou (Chongqing-Xinjiang-Europe) International Railway. Currently, the CR Express provides regular rail services to at least 16 Chinese cities, including Chongqing, Chengdu, Zhengzhou, Wuhan and Suzhou, calling at more than 12 cities in eight European countries[2]. Of particular interest is the fact that CR Express services have grown rapidly in the past year, with increasing numbers of mainland companies relying on rail to transport goods to Europe.

The CR Express provides not only direct railway transport to Europe from China, but also a one-stop service in cargo inspection, quarantine and customs clearance thanks to the support of relevant government authorities. Notably, the technical specifications of the railway system and rail tracks are different between China, countries in Central Asia and Europe. Trains need to change from one rail track system to the others when crossing the China-Russia border, entering Central Asia (countries such as Kazakhstan), and arriving in Eastern Europe and Western Europe. However, such technical issues have been resolved thanks to the concerted efforts of the railway and shipping companies concerned. Today, most logistics operators are capable of monitoring the cargo during the whole process and provide the consignor with clearance on arrival at the railway terminus, warehousing and transshipment to the desired destination.

|