Chinese Mainland

Nordic Opportunities: Healthcare Services

Population ageing and rising public health care spending are increasingly becoming issues of concern throughout the world, forcing governments into reforming public healthcare services. Sharing comparable standards of healthcare services and similar tax-based healthcare systems, the Nordic region and Hong Kong can be good partners in many areas, including preventive, curative and elderly care services as well as in revolutionary health-tech and the growing need to re-structure health service delivery. Moreover, building on its solid foundation in medical research and education, Hong Kong can be a research and development partner with Nordic countries in cutting-edge medicine.

Competitiveness and challenges of the Nordic model

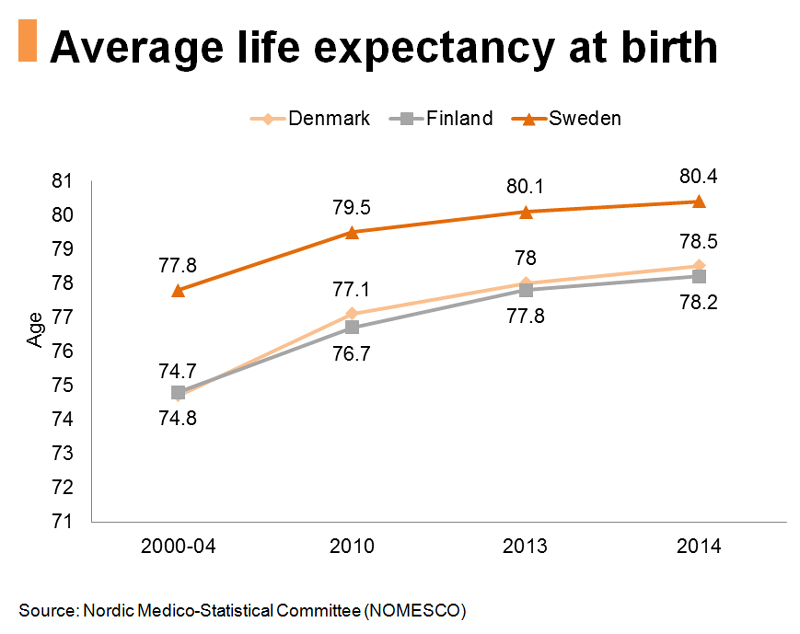

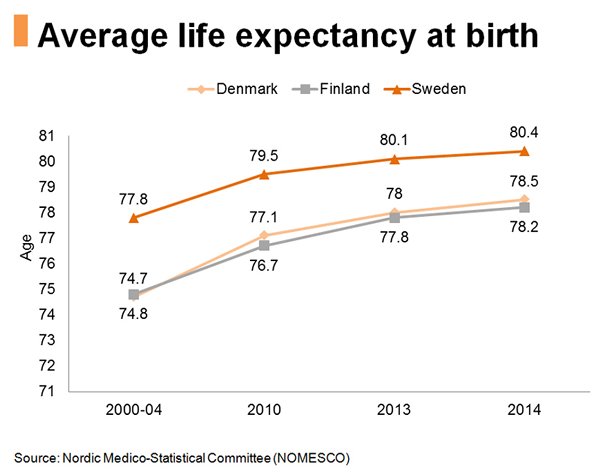

With an average life expectancy at birth of about 80 years and an infant mortality rate among the lowest in the world, the Nordic region leads in many healthcare practices and is renowned for its universalism, human touch and service-oriented approach. Financed almost completely by taxation (e.g. national, regional and local taxes), which is relatively high compared to other European economies (maximum individual income tax rate can be more than 60%) or through statutory health insurance schemes, nearly all hospitals are publicly owned and managed.

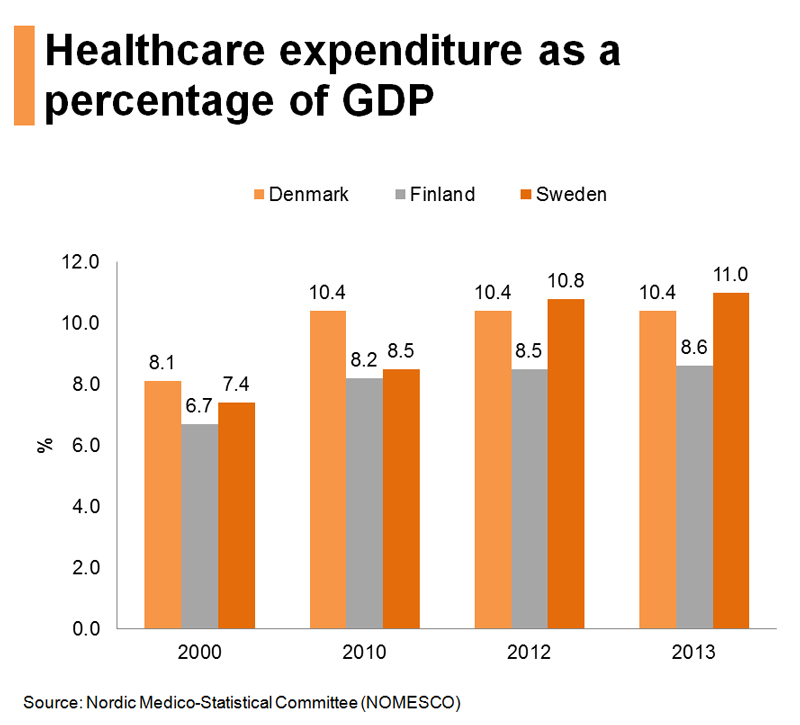

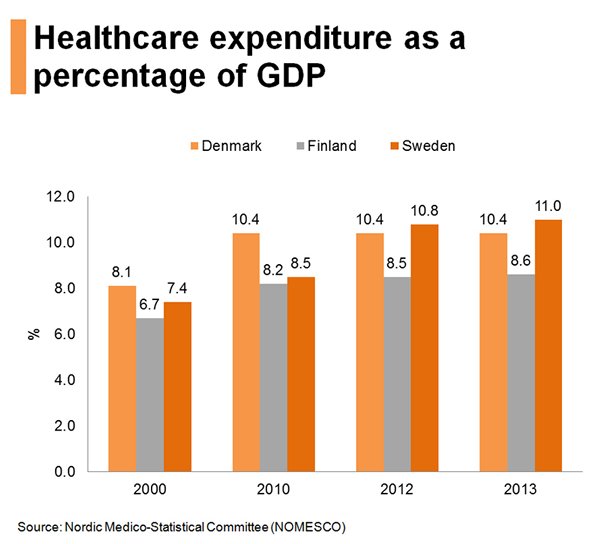

Nordic residents are given free access to most health services, while patients are required to pay for pharmaceuticals and some special treatment up to limit. As a result, government expenditure on healthcare services has been rising in the Nordics, especially in Sweden.

All the Nordic countries have established systems of primary healthcare in which every patient, except for emergency, needs to go through general medical practitioner services before being admitted to a hospital or referred for specialist treatment (usually offered outside hospitals). This drives patients through the hospital system more quickly to cut waiting times, while reducing unnecessary hospital stay and serves to relieve the ever-increasing state and municipal budgetary pressures. Systems of preventive care, such as preventive occupational health services and preventive services for mothers and infants have also been widely applied.

e-Health delivery

As a world-leading region for innovation and technology, Nordic countries are also forerunners in e-Health, which promotes electronic communication between patients and the healthcare system. Nordic countries in general have a very good infrastructure that can facilitate the provision of e-Health services even in the rural areas, thanks to their highly developed information and communications technology infrastructure, high smartphone penetration and e‐mature population.

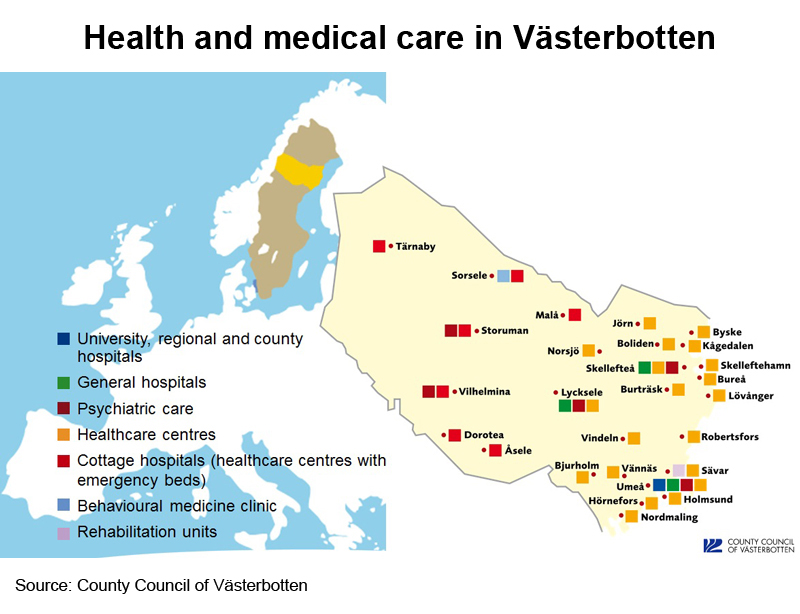

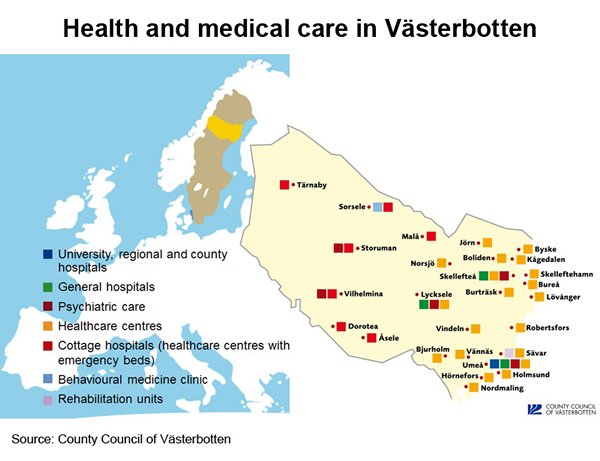

Take the county of Västerbotten in the north of Sweden as an example. e-Health services are well established in the county, which has a separate Accelerator Control Network (ACNET) that provides all the different healthcare-related institutions with fast access to medical records and high-speed transfer of images and videos between different users. This saves both the doctors’ and the patients’ time and travel costs and at the same time provide its residents with a higher quality care at reduced cost.

Among the e-Health services provided by the Västerbotten County Council are home monitoring of physiological parameters, such as electrocardiogram (ECG), lung functions, oxygen saturation and readings of pulse and blood pressure with portable health monitoring equipment; remote speech therapy for patients who suffer from speech, reading and language disorders; and hospital-to-hospital tele-medical consultation services via electronic stethoscopes for child patients with functional heart murmurs.

Source: County Council of Västerbotten

Västerbotten’s pilot public-private healthcare cooperation model

Open to working with local and global partners, Nordic countries are constantly looking for new systems or models to meet their new healthcare challenges. Characterised by its fast-acting leadership, the Västerbotten County Council has been keen on engaging global healthcare players to take part in its bold vision to have the best health and the soundest population in the world by 2020.

Unlike conventional public-private cooperation projects where private companies usually participate only as service providers, Västerbotten is seeking to engage private sector players as partners or co-owners of the project. As a ground-breaking cooperation model featuring a public-private partnership in the healthcare sector in the Nordics, two private partners, namely Philips (healthcare equipment) and Roche (diagnostics and pharmaceuticals) are running pilot projects in Västerbotten to understand how the public and private sector can work together to develop a long-term, self-financed investment framework for healthcare services.

Under the partnership, the two private companies will provide Västerbotten County Council with consultancy services for new, tailor-made solutions, equipment and technology required to revamp the existing healthcare system with an aim of reducing the County’s overall cost of healthcare (which accounts approximately for 80% of its budget) by reducing stays in hospitals and visits to clinics, improving care experiences and reducing staff sick leave, while getting paid through a reimbursement scheme.

Meanwhile, the Västerbotten County Council will provide the two private partners with a real-world environment, including a number of operating hospitals and primary care units, to test their new solutions and services which are capable of application elsewhere. For instance, various tests and studies have been carried out in an existing hospital in Umeå, the capital of the County, for a pilot project of a new psychiatric clinic with physical environment enhancement.

Hong Kong as a test partner and promoter of new healthcare models

Although the healthcare system in Hong Kong runs on a more dual-track basis than the Nordics, encompassing the public and the private sectors, the city offers equitable access to healthcare services at highly subsidised rates. Hong Kong faces similar compounding challenges of ageing population, rising expectations and escalating medical costs. There is therefore vast room for cooperation between Hong Kong and the Nordic countries in public healthcare services delivery, e-Health application and other innovative medical solutions.

In order to address the sustainability problems within the public sector, both Hong Kong and the Nordic countries have been striving to enhance public-private partnerships (PPPs) and shorten waiting times, among a whole plethora of other promises. To this end, Hong Kong can make reference to some pioneering PPPs in the Nordics (e.g. the Västerbotten County Council) and see how different private healthcare players, such as medical equipment suppliers and pharmaceuticals/diagnostics companies, can be engaged in the revamp of the public healthcare system. How these exportable cooperation experiences can be further adjusted and applied to different socio-demographic environments elsewhere can also be explored.

Given the healthcare policy reforms and the enormous growth in purchasing power, Chinese consumers’ demand for higher-quality healthcare has been ever increasing. The growing health awareness together with the increasing affordability calls for more and better medical services. To tap the vast opportunities of the burgeoning healthcare market in the Chinese mainland, Nordic companies can establish businesses in Hong Kong and work with Hong Kong hospitals and clinics to leverage on the liberalisation measures under CEPA, while taking advantage of the city’s long-standing ties with manufacturers and distributors in the Chinese mainland.

In the run-up to any modern health care reform, medical technology companies are focusing more than ever on products that deliver cheaper, faster, more efficient patient care. For instance, China’s 13th Five-Year Plan calls for the development of robots for surgery, medical imaging technology, wearable devices and equipment for traditional Chinese medicine. Yet these innovative medical advances constantly increase prices and burden government funds with regular upgrades and renewals.

While there is no simple way to solve this problem, the academic and business communities in Hong Kong and the Nordics can forge closer collaboration in medical research and development. This can better facilitate the commercialisation, transfer and licensing of research results and home-grown healthcare innovations to give Hong Kong’s consumers and public sector a wider choice of competitive options.

Hong Kong as an R&D partner in cutting-edge medicine

Built on a solid foundation in medical research and education, Hong Kong’s medical cluster is no stranger to Nordic healthcare players, not to mention the renewed popularity created by the opening of the first overseas research centre of the prestigious Swedish medical university, the Karolinska Institutet, in February 2015. This new research centre not only enables Hong Kong’s leading team of medical experts and their foreign counterparts to collaborate on cutting-edge areas of research on the frontiers of medicine, such as the search for a Parkinson’s disease cure with stem cell technology, but also lays a foundation for other dynamic Hong Kong-Nordic cooperation in fields of healthcare, such as HealthTech.

Hong Kong, as a financial centre and an entrepreneurial city, is keen on developing a thriving start-up ecosystem to promote innovation and technology. Leveraging the AIA Accelerator, Asia’s first HealthTech Accelerator programme, innovation accelerators such as Nest [1] have been more active in providing seed capital and expertise to HealthTech startups in Hong Kong.

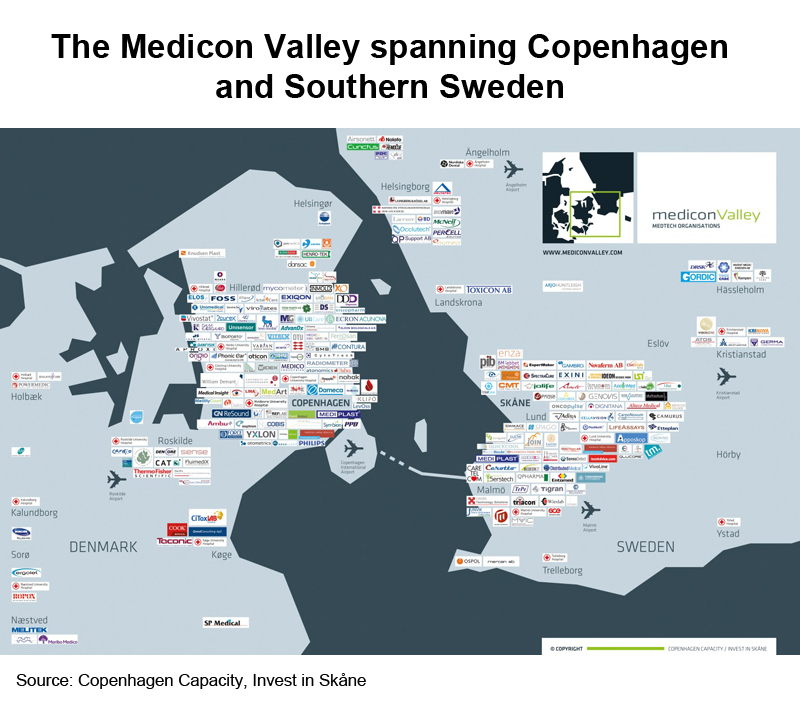

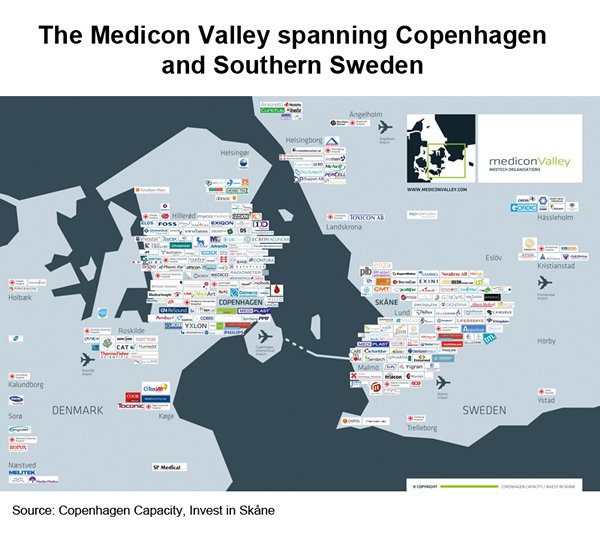

Also, Nordic life science clusters such as HealthBIO in Finland and Medicon Valley, jointly branded by Copenhagen Capacity [2] and Swedish counterpart Invest in Skåne in 1997 with the aim of becoming the most attractive ‘bio-region’ in Europe, are actively looking for investment and partnership opportunities from Hong Kong and Asian healthcare equipment manufacturers and HealthTech developers.

By working closely with Nordic healthcare start-ups and helping them find partners and clients from the Chinese mainland, Hong Kong can be an ideal enabler of Sino/Asian-Nordic HealthTech application and collaboration. Meanwhile, Hong Kong can be an disinterested risk controller, assisting Nordic HealthTech companies in screening prospective investors from the Chinese mainland and other parts of Asia.

[1] Nest is a leading full-service innovation accelerator platform in Hong Kong. Providing seed capital and expertise to entrepreneurs, it empowers startups throughout Asia with a wide range of services

[2] Copenhagen Capacity is the official organisation for investment promotion and economic development in the Greater Copenhagen Region.

| Content provided by |

|

Editor's picks

Trending articles

12 Jul 2016

The Broadband Silk Road

By CITY BUSINESS Magazine (College of Business, City University of Hong Kong)

After a century of marginalisation, Central Asia transit routes are once again taking centre stage. City Business Magazine editor Eric Collins investigates the nature of the historical Silk Road, and asks why China is unveiling a new version for the 21st century.

Sinuously the Silk Road flows from ancient times down to the present. From China through the Taklamakan Desert to Samarkand at its centre, through the grassland steppe of Central Asia to the shores of the Mediterranean, it helped pioneer globalisation. Romantically we imagine spices, silks, perfumes and precious stones wending their way by camel between China and Europe. But what was the nature of this Road? Who and what travelled along it and in what direction? Was it just confined to goods? Or did ideas make the journey as well? How Broadband was this historical Silk Road? And how does it relate to its latter-day successor, the recent China development policy initiative, One Belt One Road (OBOR)?

Please click here for the full article.

Editor's picks

Trending articles

Nordic Opportunities: FinTech Developments

With deep roots in information and communications technology (ICT) innovation and application, Nordic countries lead in many financial innovations, such as e-banking, e-invoicing, digital wallets, mobile money and ‘cryptocurrencies’. Attracting a total investment of US$390 million in the 15 months ending March 2016, the Nordic financial technology, or ‘FinTech’, industry has been fast developing into the region’s most popular investment.

Accounting for a lion’s share of FinTech start-up investments in the Nordics, Sweden is the third largest FinTech hub in Europe, trailing only the UK and Germany, while Finland is a global leader in electronic invoicing and Denmark is on track to become the world’s first cashless nation.

Fundamentals for FinTech success

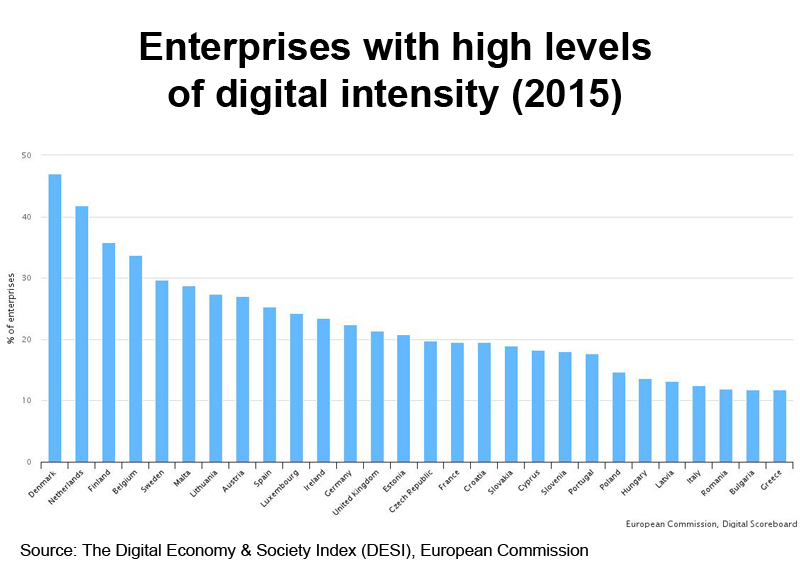

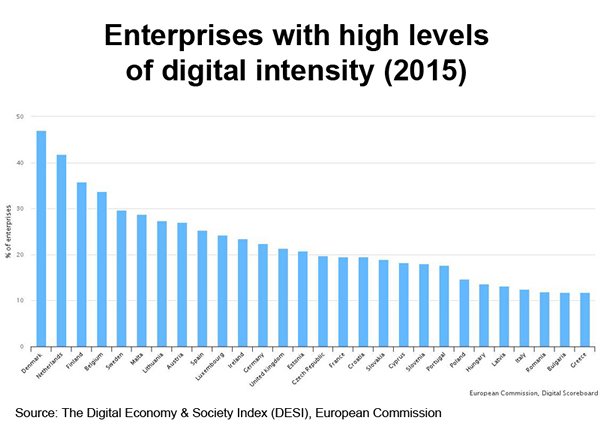

From the first 3rd Generation (3G) mobile phone licences (March 1999, Finland) to the success of mobile phone giants such as Nokia (Finland) and Ericsson (Sweden) and the EU’s highest corporate digital intensity (Denmark), Nordic countries are often described as perennial e-readiness leaders, jockeying for position and carrying out cutting-edge research and development in next-generation mobile telecommunications standards, such as 5G.

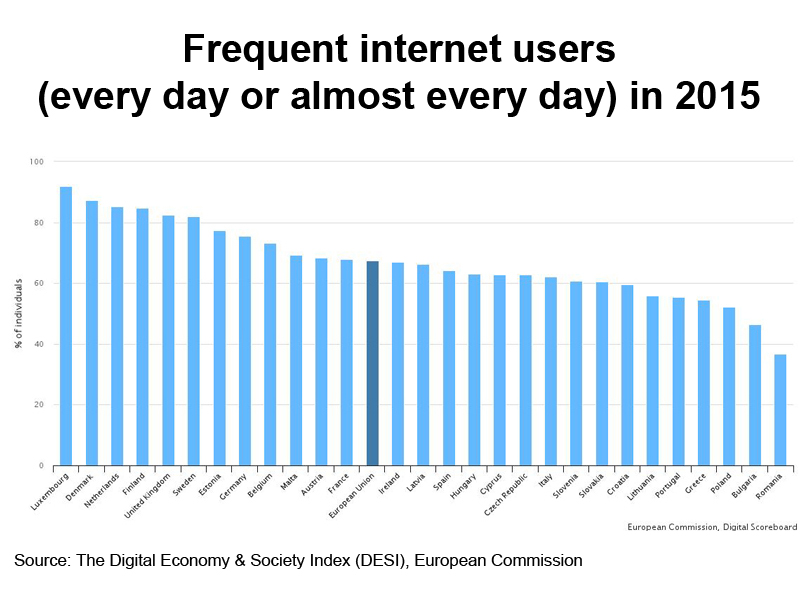

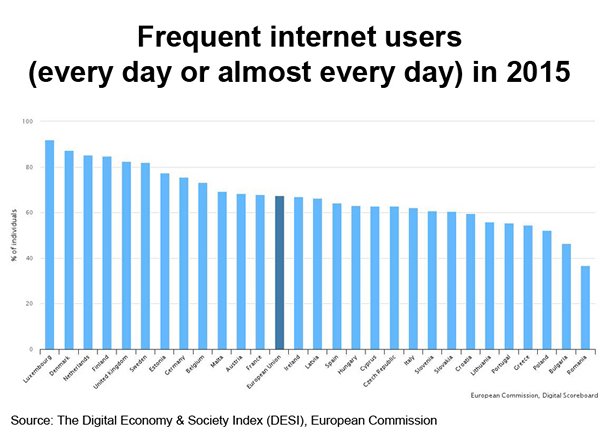

Boasting such advanced digital economies, Nordic countries like Denmark, Finland and Sweden have all the fundamentals to fast-track FinTech development. Riding on the solid ICT infrastructure, Nordic people have become adept, frequent internet users and early adopters of e-services, making them ready targets for FinTech developers.

Close to becoming a cash-free economy (e.g. bills and coins represent only 2% of Sweden’s economy, compared with 8% in the US and 10% in the Eurozone, while Denmark has a stated goal of “eradicating cash” by 2030), most Nordic countries see remarkable acceptance of not only online service orders and electronic payments, but cryptocurrencies (digital money or e-money) such as Bitcoin.

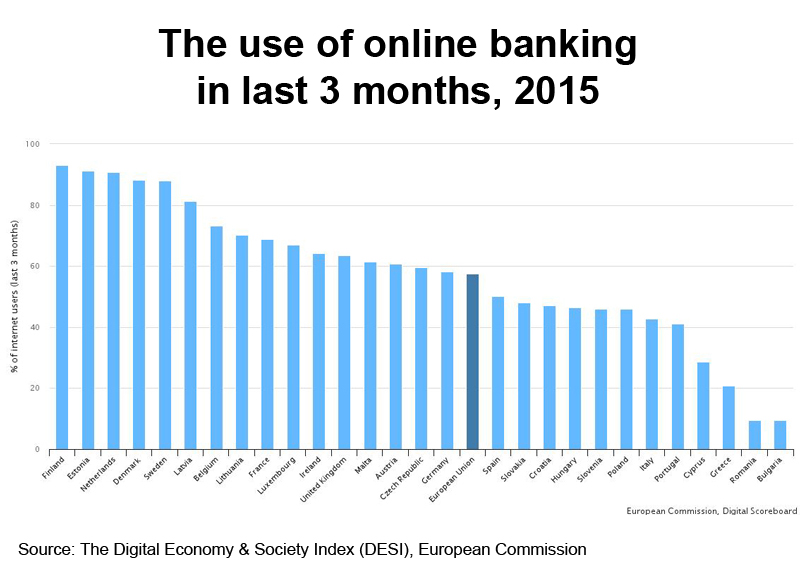

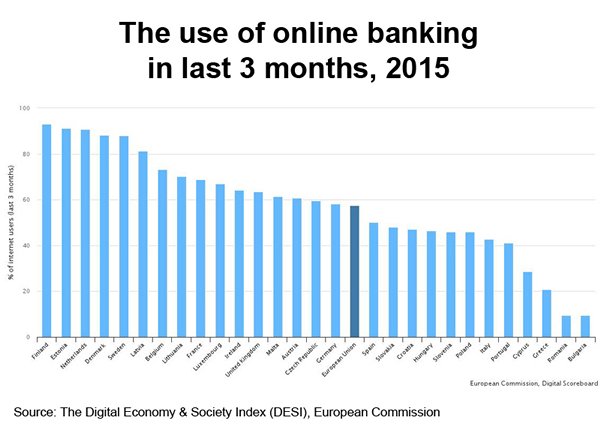

Thanks to promotion of electronic public services by Nordic governments and sound regulatory frameworks in the region’s banking and finance sector, most Nordic consumers are not only highly receptive in making online purchases such as holiday accommodation, travel plans and event tickets, but also readily use banking and managing savings, insurance and other financial plans such as crowd-funding over the Internet.

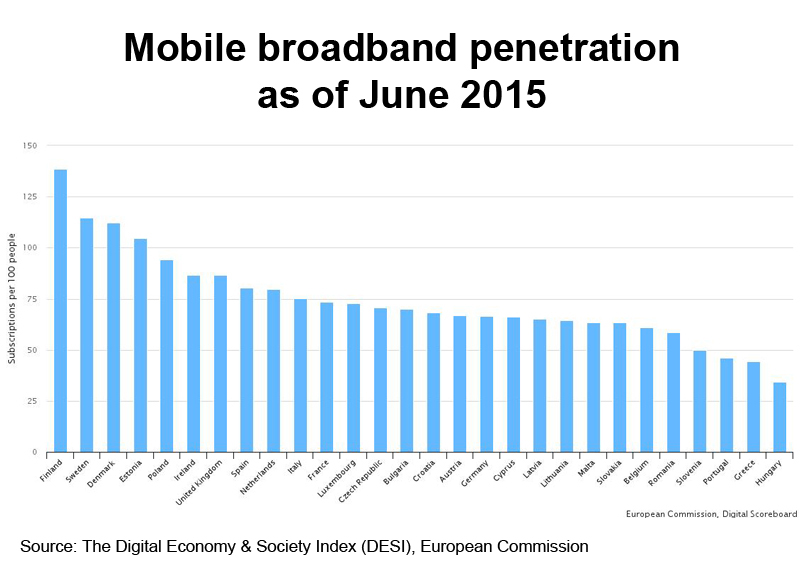

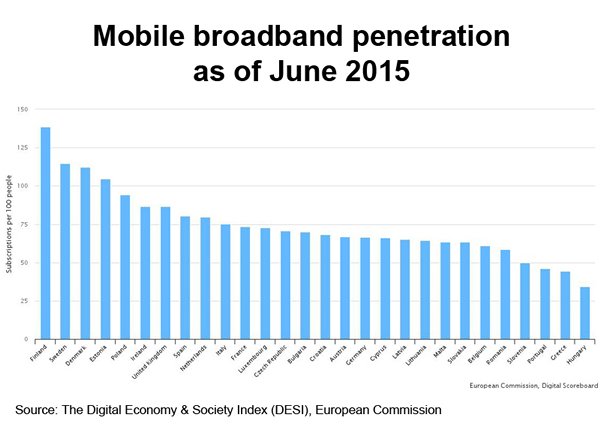

Complementing the trend is the region’s high mobile broadband penetration. Having the highest number of active mobile broadband SIM cards per 100 people in the EU, Nordic countries are fast following the trend of accessing the internet via smartphones. This, in turn, makes e-banking, e-insurance, e-securities and other FinTech applications more commonplace and readily accessible to their target audience.

Aside from the individual level, Nordic enterprises are also frontrunners in driving the digital revolution by unlocking the power of new, visionary concepts such as the Internet of Things (IoT) and Big Data. Electronic supply chain management, e-invoicing, enterprise resource planning (ERP) or customer relationship management (CRM) software, social media and web sales are commonplace among Nordic companies, providing FinTech developers a ready clientele to promote their innovative offers and a steady stream of fund for both start-ups and scale-ups.

A vibrant FinTech scene

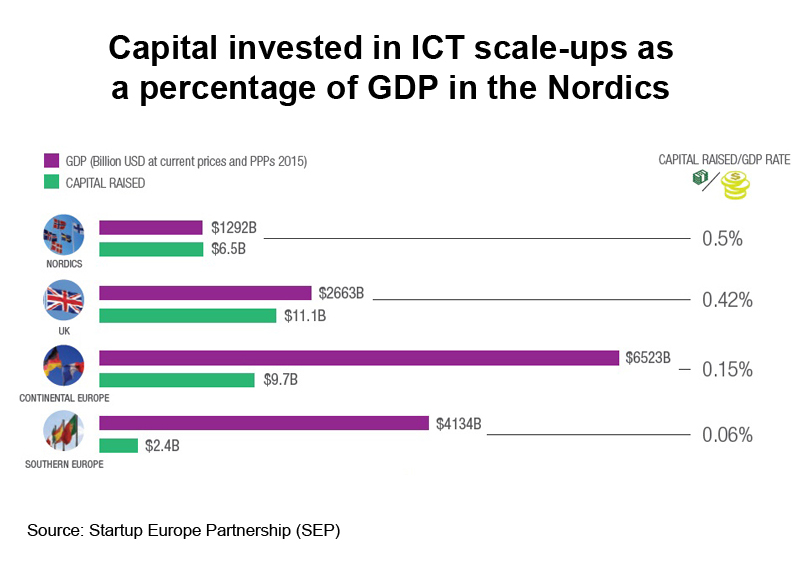

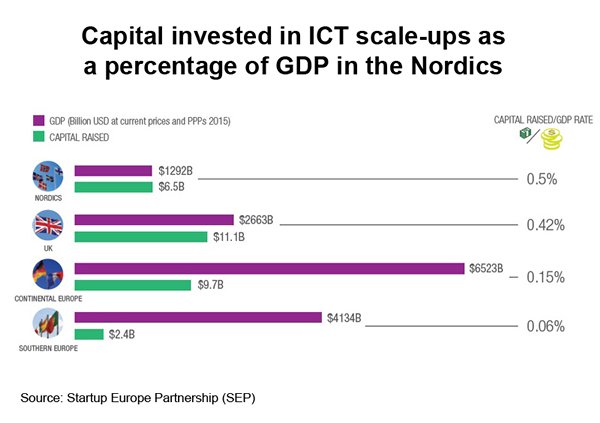

Established by the European Commission in January 2014, Startup Europe Partnership (SEP), a pan-European platform dedicated to transforming start-ups into scale-ups, describes the Nordics as a vital and productive start-up ecosystem for ICT players. Apparently, that the Nordics have injected more of their GDP into ICT scale-ups than other parts of Europe, creating a favourable scene for FinTech development.

According to data from The Nordic Web, a resource on venture capital for the Nordic start-up scene, 51 FinTech investments of US$390 million were tracked in the Nordics in the 15 months ending March 2016, making the emerging financial service sector the most attractive investment segment in the region for the first time.

Out of those 51 investments, 32 were made in Sweden, eight in Finland, five in Denmark and four in Norway, while nearly one in 10 investments in the Nordics is currently made in the field of FinTech. Such an encouraging investment landscape has not only made Sweden the third-largest FinTech hub in Europe, after UK and Germany, but highly conducive to FinTech research and development in the Nordic region as a whole. This, coupled with the strongly export-oriented Nordic economies, makes Nordic countries an unequalled partner for both greenfield and brownfield FinTech projects.

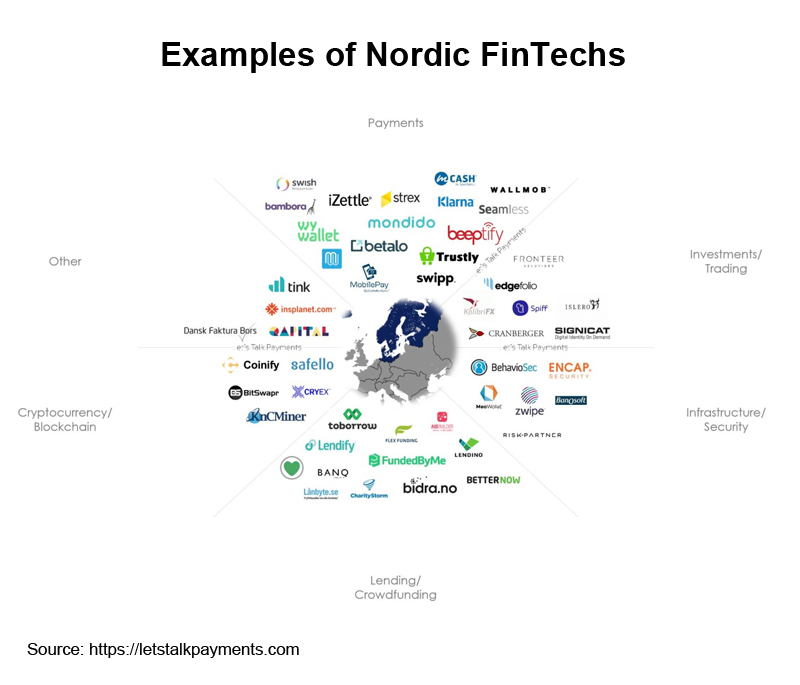

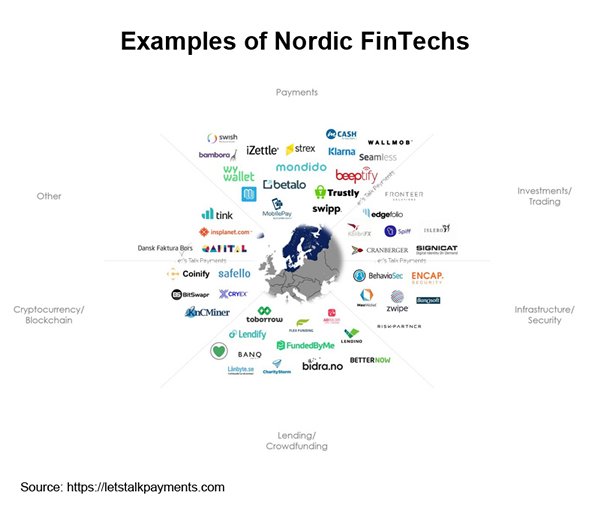

While the majority of Nordic FinTech investments are still in their infancy with investment mostly in the US$1-3 million range, first fruits of Nordic’s FinTech success include Sweden’s iZettle (mobile payment solutions), Klarna (payment solutions to e-stores) and FundedByMe (crowd-funding), Denmark’s Coinify (Bitcoin services) and Holvi (company banking solutions) and Finland’s Zervant (e-invoicing solutions). Given their small home market, most of these fast-growing Nordic FinTech companies have expanded overseas to find markets as well as in search of investment to further scaling up, creating a good environment for Hong Kong-Nordic collaboration.

A way forward for Hong Kong-Nordic FinTech collaboration

With respect to the Nordic’s vibrant FinTech scene, although Hong Kong is yet to evolve into the most attractive destination for greenfield FinTech projects, it can serve as a risk manager, assisting Nordic FinTech companies in screening prospective investors from the Chinese mainland and other parts of Asia. This is particularly useful when Nordic companies encounter problems with potential Chinese mainland investors, and when it comes to advising on such highly sought-after resources as government incentives and incubation schemes, accelerators, angels and venture capitalists, which are commonplace in Hong Kong but less so in Europe.

Sharing many similarities with the Nordics with respect to ICT, Hong Kong, as a free, well-connected and competitive economy with robust ICT infrastructure, is a leading digital economy, consistently achieving top rankings in e-readiness and internet access capabilities. The city’s broadband networks cover nearly all commercial and residential buildings in the territory, with household (84.0% as of Feb 2016) and mobile penetration rates (229% as of Feb 2016) ranking among the highest in the world.

The success of the FinTech industry in London over Silicon Valley and New York highlights the importance of proximity to a healthy financial centre, alongside a rich pool of talent and strong government/regulatory support. Similar patterns have also been observed in the Nordic FinTech field, with Sweden dominating the scene. Hong Kong, positioned as a major international financial centre and the premier capital formation centre for the Chinese mainland, therefore possesses all the ingredients for a FinTech hub.

As a long-time enabler for overseas services providers to develop products that are not just made for domestic market demand, but potentially transferable between geographies in Asia, the local knowledge of Hong Kong financial companies is a valuable resource for Nordic FinTech companies in the process of localising their technology to cater to the peculiar needs of the burgeoning Asian market as well as other Belt and Road economies which are striving for better physical as well as virtual connectivity.

The growing middle class in the Chinese mainland plus the Chinese government’s drive, under the 13th Five-Year Plan, towards the development of high-speed and safe next-generation ICT infrastructure, as well as quickening the pace of implementing the “Internet +” action plans and developing IoT and big data technology and applications, is set to create a wealth of opportunities for FinTech companies.

Given also the unprecedented pace of e-commerce adoption and the dire need for lucrative investment opportunities and diversified financial products among cash-rich Chinese enterprises and individuals, the demand for convenient, reliable FinTech solutions, such as crowd-funding or alternative banking platforms will see a hefty increase as people’s receptiveness to financial innovation grows and mobile broadband penetration is expected to reach 85% by 2020 from 57% in 2015.

By representing Nordic FinTech start-ups and helping them find partners in Hong Kong and the Chinese mainland, connecting them with relevant financial sector regulators and guiding them through setting up procedures such as business registration, incentive application and contract signing (e.g., the inclusion of the arbitration clauses stipulated by the home-grown Hong Kong International Arbitration Centre), Hong Kong’s financial services companies can be ideal facilitators of Sino-Nordic FinTech projects.

| Content provided by |

|

Editor's picks

Trending articles

Myanmar Rising: The Mandalay Opportunity

Myanmar, a medium-size ASEAN country by population with a good supply of young workers, has gained increasing attention as one of the alternative production bases in Southeast Asia. Driven by an increase in investment, the International Monetary Fund (IMF) recently projected that Myanmar would achieve 8.6% GDP growth in 2016, leading other fast-growing neighbouring countries such as Cambodia (7%), Laos (7.4%), Vietnam (6.3%) and Bangladesh (6.6%).

In a recent field trip to Myanmar, just prior to the formation of a new Myanmar government in April 2016, HKTDC Research set out to assess the suitability of the country for factory relocation. While all eyes are fixated on Yangon, the country’s economic centre and largest city, we also visited Mandalay, its second-most populous city, to gain an informed understanding of the business and investment environment there.

Investors Seeking Opportunities Beyond Yangon

While Yangon is still the primary focus of foreign direct investment (FDI), overseas investors are increasingly paying attention to other locations, in particular the core regional cities such as Mandalay – another growth pole of the country identified under Myanmar’s National Comprehensive Development Plan 2010-2030.

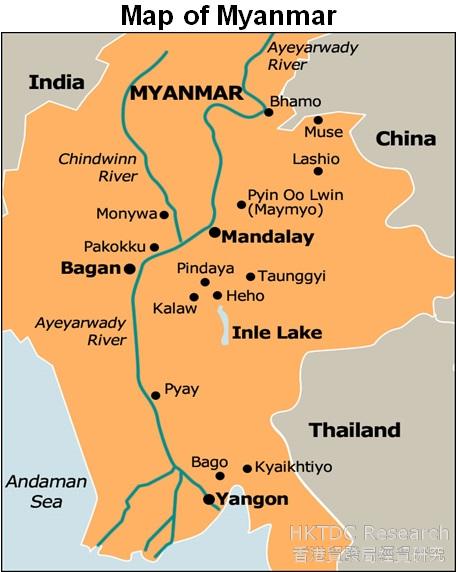

Mandalay, the capital of Mandalay Region, is a main economic centre in central and northern Myanmar. In the fiscal year ending March 2015, Mandalay Region contributed 11.4% to the country’s GDP, trailing Yangon Region’s 22% and Sagaing Region’s 11.6%.

In Mandalay, as in Yangon, government departments and private companies invariably expressed optimism over the future economic and business prospects of the country, despite a slowdown in economic growth[1] linked to the general election held in November 2015, which had been widely expected before the poll and turned out to be temporary. Business investment in Myanmar, in the infrastructure sector in particular, has gradually regained momentum in the wake of the smooth political transition in April 2016, sending a signal to investors that Myanmar remains committed to the on-going economic and political reform agenda.

Centrally Located Mandalay Currently a Trade Hub in Myanmar

Mandalay is a thriving trade hub thanks to its central geographical location in Myanmar, with a major highway from the border with China running through the region and onwards to Yangon. Along this route, which serves as one of the country’s primary trade arteries, agricultural products as well as jade and gemstones are exported to nearby countries, while manufacturing imports, mostly from China, are transported to Myanmar.

Situated on the east bank of Ayeyarwady River, Myanmar’s most important commercial waterway that flows through the country from north to south, Mandalay is also well connected with other major cities including Yangon and Bagan via an intricate network of canals transporting passengers and cargos using small vessels, and making it a key distribution centre for local markets.

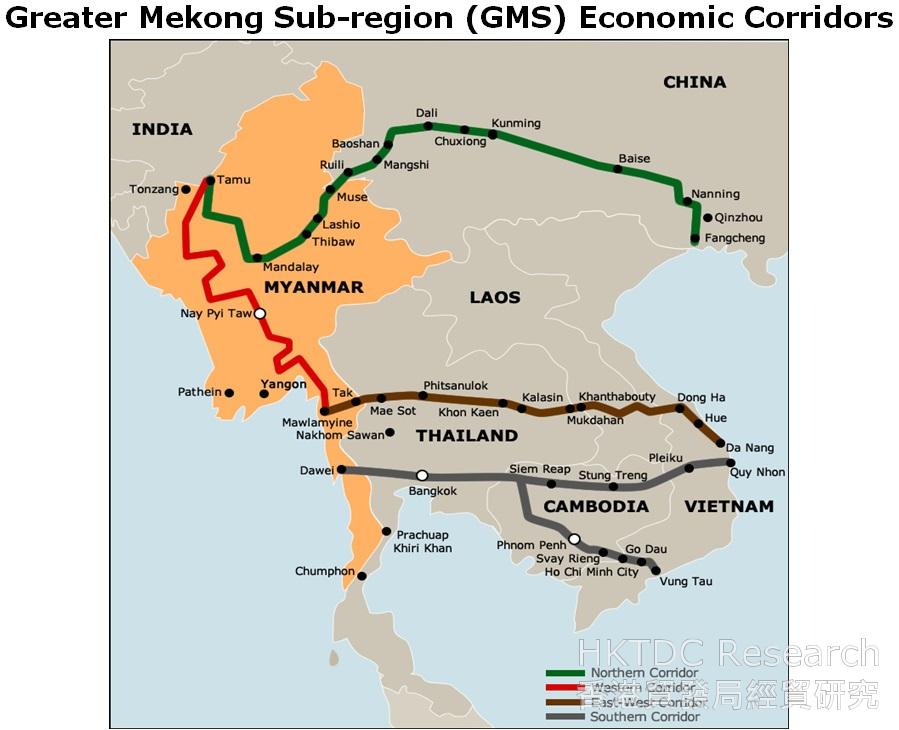

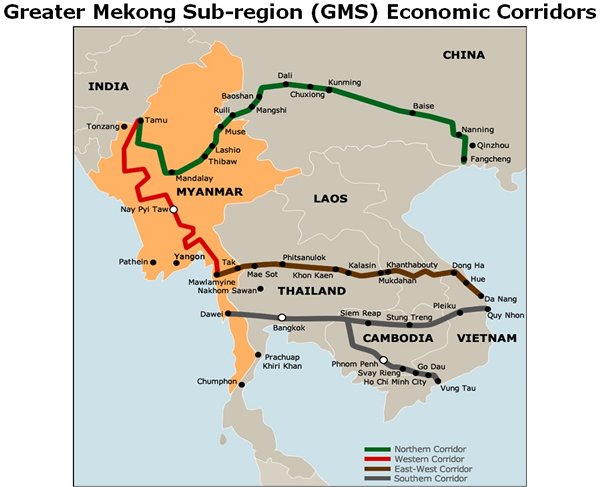

To boost its trade and logistics hub prospects, Mandalay has set its sight on further industrialisation and enhancement of its economic agglomeration along four main Greater Mekong Sub-region (GMS) Economic Corridors (the Northern Corridor, the Western Corridor, the East-West Corridor and the Southern Corridor, detailed below), which provide external connections between Myanmar and ASEAN countries on the Indochina Peninsula including Thailand, Laos, Cambodia and Vietnam, as well as internal connections within the country.

Mandalay Opportunities Arising from the BCIM Economic Corridor

Apart from collaborating with other ASEAN peers along the GMS economic corridors, Myanmar designates a major role to Mandalay in the development of the Bangladesh-China-India-Myanmar (BCIM) economic corridor, a route proposed under China’s Belt and Road Initiative (BRI) that links India’s Kolkata with China’s Kunming (K2K), with Myanmar’s Mandalay and Bangladesh’s Dhaka among the key points along the K2K highway. To this end, Mandalay is set to benefit from the improvement of infrastructure and industrial zones creation along the BCIM economic corridor.

Currently, most of the infrastructure and logistics companies in Mandalay focus on the domestic market and face a challenge in providing services that meet international standards. Construction of the BCIM economic corridor, which will comprise not just roads and power lines, but also industrial cities along the way, will create ample opportunities for overseas service providers with technical and expert knowledge in areas such as infrastructure construction and project management to enter the Myanmar market. In due course, this will facilitate knowledge sharing and technological transfer through partnerships between local and international companies, and will help to enhance the overall trading and logistics capability of Mandalay in the longer term.

Opportunities in Light Manufacturing, Agro and Food Processing

In terms of industrial production, most of the manufacturers in Mandalay Region are involved in agro/food processing, machinery and the production of a limited range of consumer goods. Apart from showing the potential to further develop its trading and logistics sector, opportunities also exist for companies to engage in light manufacturing in Mandalay, where land is cheaper than in Yangon.

According to a recent survey report[2] released by the Myanmar Investment Commission (MIC), the investment climate in Mandalay is promising with 56% of the survey respondents rating the business prospects of their industries in Mandalay as good for the coming three years, citing growing market demand, better infrastructure and improved government services.

While highlighting the region’s potential, the MIC survey recognises that Mandalay faces institutional and infrastructure limitations that may hinder its further development. To enhance Mandalay’s competitiveness, especially in the medium term, the MIC report suggests certain courses of action, such as upgrading the existing dilapidated transport infrastructure and increasing the availability of electricity supply and usable land.

On the heels of notable efforts made under reforms initiated by former President Thein Sein, the new NLD government under President Htin Kyaw is also committed to further liberalising Myanmar in order to attract foreign investment. However, it will take some time for Mandalay to gradually build up its economic capacity. Until then, investors seeking to take advantage of the array of opportunities presented have to carefully weigh up the benefits and challenges associated with an early entry into Mandalay.

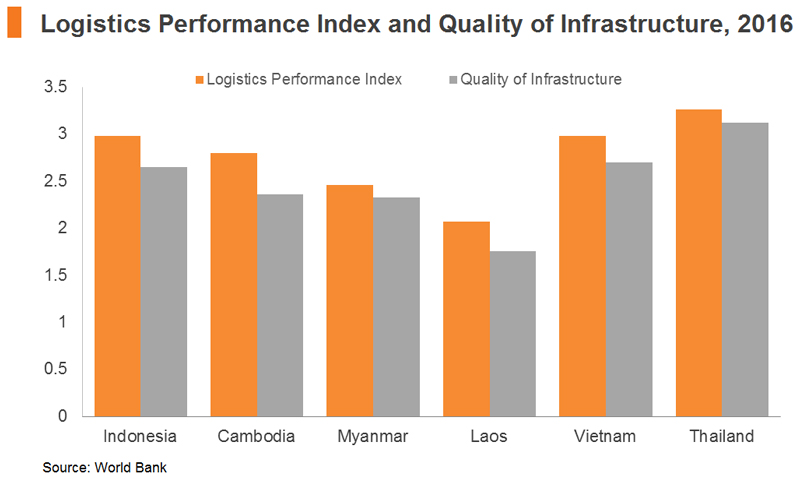

Infrastructure Capacity Building

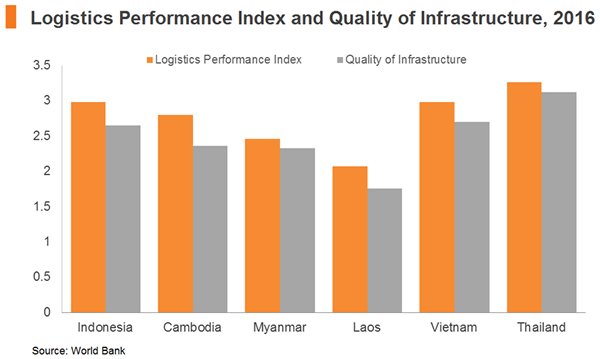

Mandalay’s favourable geographical location provides it with a unique opportunity to develop itself into a key regional transport hub. However, the country’s transport infrastructure on the whole requires a significant upgrade. In the 2016 World Bank’s Logistics Performance Index (LPI), Myanmar ranked number 113 out of 160 countries, trailing the other ASEAN countries. In terms of the quality of infrastructure, one of the LPI components relates to trade- and transport-related infrastructure (e.g. ports, rail, and information technology): Myanmar was ranked 105th.

In HKTDC Research’s recent trip to Myanmar, nearly all of the private-sector interviewees whom we met pointed to the country’s poor transport infrastructure, notably bad roads and insufficient port facilities, as a main obstacle to doing business. Upon our inspection of the road and transportation conditions in the two cities, Yangon is evidently better than Mandalay, where there appears to be proportionally fewer paved roads, numerous unpaved ones and even dirt trails, causing dust to hamper views during a typical dry and windy day.

While HKTDC Research found that new roads are being built in Mandalay, along with some newly completely routes such as those leading to the new airport, road infrastructure generally appears to be outdated with a pressing need to be upgraded, something urgently required in order to improve the efficiency of the country’s logistics links.

In the 2014-2015 financial year, FDI inflow to Myanmar was more than US$8 billion (MIC approved basis), with Yangon Region accounting for 47% of the FDI total. In comparison, Mandalay Region received just over 8% of the overall FDI. Admittedly, most foreign investors remain focused on Yangon and its nearby areas for the time being, where infrastructure is relatively more advanced, in part reflecting their concern about Mandalay’s transport infrastructure and other shortfalls.

That said, Mandalay authorities also recognise the need to modernise its underdeveloped transport network in order to keep pace with the country’s rapid development. A number of projects are now in process, which hopefully will enhance Mandalay’s overall environment for doing businesses in the longer term.

As the authorities roll out more new projects, many business opportunities will arise for foreign investors in the infrastructure and logistics sectors. The following section highlights some of the latest developments in Mandalay, giving potential investors a better picture of the region’s future prospects.

Transport Infrastructure – Road

As a growing economy, Myanmar has experienced a surge in demand for roads, with the total number of registered motor vehicles rising beyond five millions in 2014 from less than one million in 2004. However, only 40% of Myanmar’s road network is paved and at least 60% of its highways need maintenance, according to the ADB’s Asian Development Outlook 2016.

To improve land connectivity and to foster national and regional integration, major highways in Myanmar are being extended or upgraded. For example, the Mandalay-Muse Highway is the main route for border trade through Myanmar’s Shan State to China. An increase in border-trade activities between the two countries since 2012 has led to regular traffic jams and frequent road accidents, given an estimate of about 1,500 trucks using this road every day.

To relieve traffic congestion and increase safety, it was announced in early 2016 that the existing two-lane highway will be updated to a four-lane asphalt road with a US$300 million investment by the Oriental Highway Company, a former subsidiary of Asia World Group that is managing the highway under a Build-Operation-Transfer (BOT) agreement with the government. Two 16-kilometre sections of the Yangon-Mandalay Highway will also be upgraded along with the repair of roads and bridges within the Mandalay Region as part of a 100-day project launched by the local Road Transportation Administration Department (RTAD).

Transport Infrastructure – Railway

Myanmar has an extensive rail network, with about 6,000 kilometres of tracks connecting the country’s main cities. The Yangon-Mandalay route is one of the busiest in Myanmar and many commodities imported from China are transported to freight stations in Mandalay and forwarded to Yangon by rail. Like the country’s road system, the railway is severely under invested. As a result, a train from Yangon to Mandalay could take up to 16 hours to complete this 622-kilometre journey.

To reinvigorate the aged railway, a US$2.2 billion project is scheduled to commence in 2017, upgrading the railway under a three-phase programme and shortening the total travel time to eight hours upon completion in 2025. A tender for private companies to work on this railway upgrade project is expected by the end of 2016.

Transport Infrastructure – Port

Anticipating container-port traffic to build up over time, a new river port called the Semeikhon Port (SMP), located along the Ayeyarwady River about 70 kilometres from the city of Mandalay, is being built by the Mandalay Myotha Industrial Development Public Co. (MMID), the same company responsible for the nearby 4,400-hectare Myotha Industrial Park project, which is also under development.

The SMP, covering 152-hectares with a quay length of 1.5 kilometres, will be developed in phases. The first phase is designed with a floating berth, barges and cranes that allow the loading of cargo regardless of the differences in water levels in the wet and dry seasons. It is reported that the port will have the capacity to handle an estimated 200,000 tonnes of general cargo, containers and roll-on-roll-off (Ro-Ro) cargo once phase one is completed. As of March 2016, basic port infrastructure had been completed, according to MMID.

Transport Infrastructure – Air

In terms of air transport, Mandalay Region has two airports, including Mandalay International Airport (MIA), one of the only three international airports in the country alongside Yangon and Naypyidaw, the capital of Myanmar. At present, there are many international airlines and domestic airlines operating in Mandalay. Myanmar National Airlines, the national flag carrier, has the most extensive route network within the country. It has operated direct flights from Yangon to Hong Kong since December 2015, but has yet to provide a direct service to Hong Kong from Mandalay.

To meet the increased demand brought about by the accelerated business activities, the MIA will carry out a US$13.5 million upgrade plan, capitalising on the city’s existing road and river transport networks to facilitate trade links. This project aims to raise the airport’s annual passenger-handling capacity to 15 million from its current three million, while boosting its cargo-handling capacity in three phases, from 4,000 tonnes in Phase 1 to 12,000 tonnes in Phase 3. In addition to international contracting of construction, there will also be opportunities for Hong Kong companies with experience in airport management to benefit from the expansion project.

Electricity Supply

Apart from transport infrastructure, a lack of access to reliable electricity is considered to be another major shortcoming to investing in Mandalay. While the situation has improved compared to two or three years ago, as pointed out by many businessmen and government officials interviewed by HKTDC Research, it is worth noting that about 30% of some 4,780 villages in Mandalay Region are still not connected to the public electricity grid, according to the Mandalay Electricity Supply Corporation.

In an effort to boost electricity supply, an agreement was signed in 2015 by Singapore-listed Sembcorp Industries and the Myanmar government to build a 225-megawatt gas-fired power plant in Mandalay. The plant, with a total investment of US$300 million, is expected to be operational by 2018.

To reduce the country’s dependence on hydropower, the Myanmar government signed a US$480 million deal with United States-based ACO Investment Group in 2014 to construct two solar plants in Mandalay Region. All these developments will be conducive to creating a more stable electricity supply for Mandalay Region.

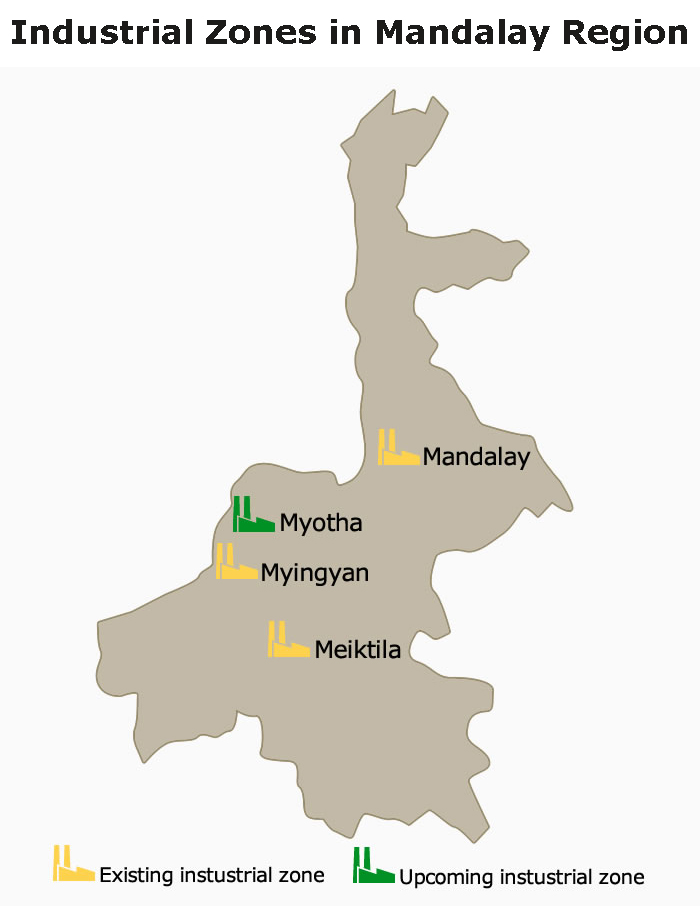

Land Supply – Industrial Zones in Mandalay

Apart from taking into account infrastructure development, the ease of finding a location to establish production plants will also be crucial for manufacturers considering investing in Mandalay, along with the availability of labour. As the country’s second-most populous city, the land locked Mandalay is centrally located and able to attract workers from the surrounding provinces, thus ensuring a good supply of workers over the short-to-medium term.

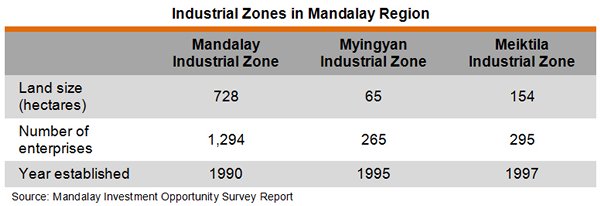

While land cost is generally lower compared to the country’s largest commercial centre Yangon, there are only a limited number of industrial zones available in Mandalay. At present, Mandalay Region has three industrial zones, namely the Mandalay Industrial Zone, Myingyan Industrial Zone and Meiktila Industrial Zone.

The Mandalay Industrial Zone, located in the city of Mandalay, was reported to have more than 1,200 factories in operation at the end of 2015, with its focus on production of consumer and household goods, agricultural and machinery. The zone also handles some export-oriented products from certain wood-based industries, with major markets including France, Italy, Japan, China and Thailand.

Most of the factories located in the Mandalay Industrial Zone are locally owned or run as joint ventures with companies from Southeast Asia, such as Singapore or Thailand. According to the Mandalay Industrial Zone Management Committee, plans to upgrade the zone include improving basic infrastructure as well as human resources development in order to attract FDI.

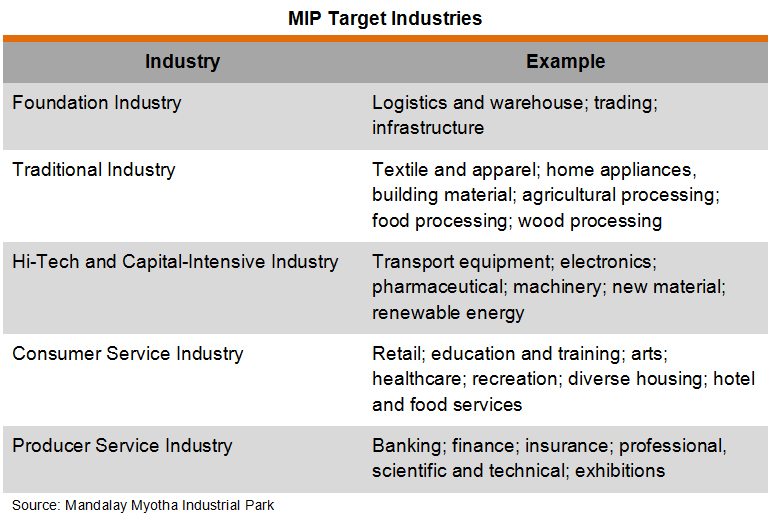

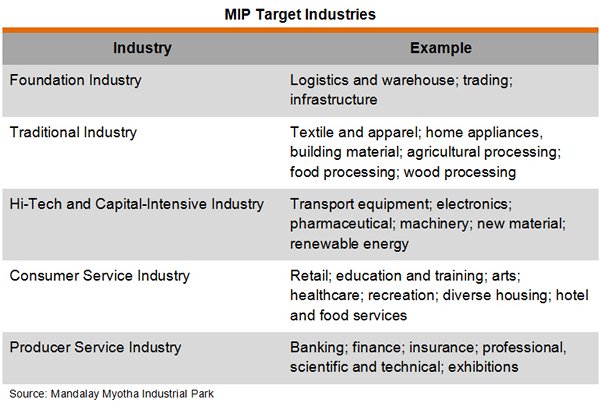

In addition to the three existing industrial zones, the Mandalay Myotha Industrial Park (MIP), located about 58 kilometres from the city of Mandalay and 45 kilometres from Mandalay International Airport, is also being developed under a joint venture between the Mandalay city government and the MMID.

According to the MMID, this new industrial park will be developed in three phases: Phase 1 during 2013-2017, Phase 2 during 2017-2022 and Phase 3 during 2022-2025. The park will include areas for industrial development, warehouse and logistics development, residential development, road transportation development, and the development of commercial facilities, with five target industry group being highlighted, as shown below. The MIP is expected to create a new industrial and logistic hub in upper Myanmar, enhancing the overall competitiveness of Mandalay in the future.

Summary

As Myanmar regains economic vigour, Mandalay is expected to thrive as the economic hub in the central and northern parts of the country under the new Myanmar government led by President Htin Kyaw, creating trading, light manufacturing and logistics opportunities. Meanwhile, an upgrade of the poor infrastructure is badly needed, with the government taking practical measures to tackle the problem with private-sector participation, thus creating opportunities for related services companies. Hong Kong investors seeking to go beyond Yangon to tap into the Mandalay opportunities, however, should carefully weigh up the benefits and the challenges in making an early entry there.

[1] According to the IMF, Myanmar’s real GDP growth slowed to 7.0% in 2015, from 8.7% in 2014.

[2] Myanmar Investment Commission : Mandalay Investment Opportunity Survey Report, October 2015

| Content provided by |

|

Editor's picks

Trending articles

15 Jul 2016

Opportunities for Scotland in One Belt One Road

By Thompson Chau, The Asia Scotland Institute

In March 2015, China issued a document entitled “Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road”, outlining the blueprint of the One Belt One Road Initiative (OBOR). The initiative not only represents a national and coordinated push to expand China’s influence abroad, but is also coupled with a domestic investment drive, involving almost every Chinese province. China’s ambassadors to countries situated from Africa to Southeast Asia are already securing assurances of collaboration on OBOR. Similarly, Chinese provinces have begun to invest in infrastructural projects and construct logistics centres in anticipation of growing trade and interaction with OBOR countries. Described as “the most significant and far-reaching initiative that China has ever put forward”, OBOR will increase the demand for Scotland’s leading export industries, professional services and universities among the regions involved. Along the five routes (shown in Figure 1), five OBOR goals were proposed: policy coordination; facilities connectivity; unimpeded trade; financial integration; and people to people bonds. While Chinese institutions and SOEs (state-owned enterprises) are expected to take the lead, these five areas of connectivity will offer organisations and individuals in Scotland a whole new spectrum of opportunities to play a role in shaping the economic development and integration across the three continents. OBOR is not a solo performance by China. It is a symphony orchestra in which the Scottish bagpipe is surely going to have its part...

Please click here for the full article.

Editor's picks

Trending articles

“Going Out” to Capture Belt and Road Opportunities (Expert Opinion 2): Managing Brand Value

China is currently the second largest economy and one of the biggest consumer markets in the world. However, in the face of such challenges as faltering global economic growth as well as slower pace of domestic sale and export, many Chinese enterprises are actively pursuing transformation and upgrading as well as developing brand business in the hope of increasing the value-added of their products or services, enhancing competitiveness, and exploring more new markets.

Yet, an expert in branding reminded these companies that they must map out a comprehensive long-term brand strategy, complemented with appropriate market positioning before they can build sustainable brand business. Hong Kong brand designers, who have accumulated rich experience in serving multinational companies, can provide mainland enterprises with one-stop services to develop both the domestic and foreign markets.

Sustainable Brand Strategy

Charles Ng, founding Chairman of the Hong Kong Brands Association and Chief Brand Consultant of Maxi Communications Ltd, told HKTDC Research that mainland manufacturers today are well aware of brand value and are also willing to invest in developing creative new products and new services. However, the resource inputs of many companies in building and promoting brands are insufficient, and some of them have even been distracted by fads and trends, diverting from the original course of business development.

Moreover, many companies lack long-term development strategy, yet hope to develop national and even international brands by using regional brand development methods. But with insufficient resource inputs, it is difficult for them to achieve the expected effects of transformation and upgrading.

Citing an example, Ng said: “At one stage when the economy underwent rapid growth, luxury consumer trends dominated the mainland market. This had attracted many catering and consumer goods companies to jump on the bandwagon and change their marketing strategy overnight in pursuit of short-term profit before clearly considering their business development.

“After the fads had receded, these companies were at a loss and some even quickly changed their market positioning, disrupting the sustainability of their promotion and marketing activities. This inevitably sent out confusing signals to consumers and the market, directly undermining their brand and corporate image.

“An all-round strategy is of prime importance to the development of brand business. For instance, in recent years online shopping has been gaining increasing popularity in the mainland, which has made it impossible for companies to ignore exploring online business opportunities. But companies positioned in the higher end of the market must consider how to balance the development of online and offline business in order to avoid giving people the impression of trading down, which may damage their overall brand image. And in search of short-term profit, these companies may also overlook the need for all-round development.”

Managing Overall Brand Value

Ng also cautioned against a one-size-fits-all approach to branding internationally. He said: “As for ‘going out’ to develop overseas markets, although the purchasing power of some of the Belt and Road markets is different to that of developed countries, mainland enterprises still have to avoid competing on price only along the Belt and Road routes at the expense of their overall sales and brand development strategy. This may impact their business development in other markets under the current trend of globalisation and free flow of information.

“Using an inappropriate strategy to develop individual markets is sure to affect the overall corporate image and brand value of the enterprise and may do more harm than good.”

Ng believes that markets with long-term development potential abound in the Belt and Road countries. Taking this and the limited number of emerging markets into account, mainland enterprises should consider identifying the right Belt and Road markets first before other competitors come on the scene, so that they can make use of effective promotion and marketing strategies ahead of others to tap the potential of local markets.

Many mainland enterprises are actively “going out” to search for services supporting brand design and promotion strategy in the hope of enhancing their brand business, as well as developing both the mainland and overseas markets. Ng pointed out that Hong Kong brand designers, who are well-versed in international market trends, familiar with Chinese culture and consumer habits, and experienced in serving multinational companies, can effectively help mainland enterprises in “going out”.

By filling the gap in mainland enterprises’ understanding of foreign cultures and business practices, they can assist clients in developing brand business in both the mainland and foreign markets. Ng added: “In addition to brand design, Hong Kong has a wide range of related service industries, such as marketing, product design, corporate management and training, which can give timely support to Hong Kong designers providing mainland enterprises with one-stop services. This is one of Hong Kong’s advantages.”

| Content provided by |

|

Editor's picks

Trending articles

Infrastructure Financing: Belt and Road Strategy and Hong Kong’s Role

By Norman Chan (Chief Executive, Hong Kong Monetary Authority)

2016 is proving a busy year for the HKMA. Having recently set up the Fintech Facilitation Office, we are now gearing up for the establishment of the Infrastructure Financing Facilitation Office (IFFO). Let me briefly explain the rationale for setting up the IFFO.

In his Budget Speech this year, the Financial Secretary asked the HKMA to set up the IFFO to provide a platform for pooling the efforts of investors, banks and the financial sector to facilitate investment in infrastructure projects in the countries along the Belt and Road (B&R) routes.

Broadly speaking, the B&R covers more than 60 countries with a population of 4.5 billion, accounting for about 60% of the world’s population. However, the combined gross domestic product (GDP) of these countries, amounting to US$23 trillion, accounts for just about 30% of the world’s total GDP. The per capita GDP of these countries ranges between US$600 and US$90,000, suggesting a great disparity in the stages of economic development among the B&R countries. Infrastructure in many emerging economies in the B&R region is lagging behind, constraining their economic and social development. Nevertheless, this also means that there is enormous potential for infrastructure development in these countries, which is the focus of the B&R strategy.

According to the estimates of the Asian Development Bank, funding needs for infrastructure development in emerging economies in Asia alone would be around US$8 trillion (or HK$62 trillion) over the 2010-2020 period. This huge funding gap represents immense opportunities for infrastructure financing.

On the other hand, there is no lack of investors interested in infrastructure investment or financing. Despite a generally longer investment cycle, infrastructure projects can offer relatively stable cash flows and investment returns. That’s why sovereign wealth funds, insurance funds and institutional investors have shown a growing interest in infrastructure investment in recent years.

While there are substantial funding needs for infrastructure projects in B&R countries, infrastructure investment and projects in the B&R region have been limited so far. This is where the IFFO can come into play. By establishing the IFFO, the HKMA aims to provide a platform to bring together key stakeholders, including fund providers (for example, private equity funds, sovereign wealth funds, banks, etc), project developers (such as corporations capable of developing and operating large-scale infrastructure) and the B&R countries. Through information exchange and experience sharing among the key stakeholders, we hope to facilitate more investments in infrastructure projects in the B&R region, thereby boosting their economic development. This will underscore Hong Kong's role as a leading business and financial centre in Asia, a role in which Hong Kong has long excelled.

The HKMA has already contacted a number of international financial organisations on the establishment of the IFFO, and received support from the International Finance Corporation under the World Bank, the Asian Infrastructure Investment Bank, the Asian Development Bank, the Silk Road Fund, etc. We are also inviting other public and private organisations interested in the B&R initiative to join the IFFO platform. We are making good progress so far and I hope the IFFO can be formally inaugurated this summer. By then, we will announce IFFO’s membership list and its specific work plans.

Please click here for the original article.

Editor's picks

Trending articles

Tackling Cynicism in SE Asia Remains a Priority for BRI Development

Concerns over China's geopolitical intentions remain a challenge for Belt and Road projects in Southeast Asia.

The Belt and Road Initiative (BRI) has not moved quite as quickly in Southeast Asia as it has in South or Central Asia. This is partly down to ongoing tensions in the South China Sea, which have raised concerns among some countries in the region as to China's geopolitical intentions.

At present, the 10-member Association of Southeast Asian Nations (ASEAN) is caught between these concerns and a desire to enhance its already strong trade relations with China. Overall, there is a recognition that the region would benefit from BRI-driven investment, with the Asian Development Bank maintaining US$1 trillion needs to be spent on infrastructure development by 2020 just to maintain current growth levels.

Xue Li is the Director of International Strategy at the Beijing-based Chinese Academy of Social Sciences' Institute of World Economics and Politics. Outlining the challenge facing the BRI, he said: "We haven't done enough to attract countries in Southeast Asia. On the contrary, their level of fear and worry toward China seems to be rising."

For Southeast Asia, the Singapore-Kumming Rail Link is something of a test case. This high-speed link will run through Laos, Thailand, and Malaysia, before terminating in Singapore, a total distance of more than 3,000km. To date, though, not everything is going the way China might have preferred.

In Laos, construction has been delayed. It is also likely that all of the work will have to be paid for by China, as Laos cannot afford the $7 billion required. In Thailand, meanwhile, negotiations have broken down. The Thais now want to build only part of the line – short of the border with Laos – and finance it themselves without Chinese involvement.

As to which company will build the Singapore-Malaysia stretch, that will be decided next year, with Chinese – as well as Japanese – firms emerging as the current frontrunners. Across the board, though, there is unhappiness at what is considered excessive demands and unfavorable financing conditions on the part of the Chinese. Back in 2014, Myanmar pulled out of the project, citing local concerns over the likely impact of the project.

A similar situation has now arisen in Indonesia. The $5.1 billion Jakarta-Bandung High-speed Railway Project, seen as an early success for the BRI, may now require significantly more funding. Indonesia is also unhappy at what it terms 'incursions' into its waters by Chinese fishing boats. It is, however, trying to downplay their significance as a 'maritime resource dispute' in a bid not to deter Chinese investment in the country. The Philippines is, by comparison, less conciliatory, largely because China is not one of its key trading partners. At present, the Philippines and Vietnam are the ASEAN nations most cynical with regards the ultimate intentions behind the BRI.

Singapore, a country with no direct stake in the South China Sea, remains strongly committed to the Initiative. In March this year, Chan Chun Sing, Minister in Prime Minister's Office, emphasised the importance of BRI as a means of improving links with China and its near neighbours.

He said: "The BRI represents a tremendous opportunity for businesses in Singapore – as well as in the wider Southeast Asian region – to work more closely with China. The more integrated China is with the region and the rest of the world, the greater the stake it will have in the success of the region. The more we are able to work together, the more it will bode well for the region and the global economy."

In line with this, this year has seen a number of Memorandums of Understanding (MOUs) signed between China and Singapore. Back in April, one such undertaking was signed between International Enterprise Singapore (IES) and the state-owned China Construction Bank. Under the terms of the memorandum, $30 billion is now available to companies from both countries involved with BRI projects. At present, the two organisations are in discussion with some 30 companies with regards to developments in the infrastructure and telecommunications sectors.

In June, an additional MOU was signed between IES and the Industrial and Commercial Bank of China. This has seen a further $90 billion earmarked to support Singapore companies engaged in BRI-related projects.

Ronald Hee, Special Correspondent, Singapore

| Content provided by |

|

Editor's picks

Trending articles

20 Jul 2016

Hong Kong Expertise ‘Can Put OBOR on Road to Success’

Source: SCMP Education Post

There is little doubt that China’s “One belt, one road” (OBOR) initiative to boost economic ties with countries along the old trading routes between Asia and Europe will have a significant impact in the years ahead.

But with ideas still forming, and concrete plans yet to materialise, what may in fact happen remains largely a matter of speculation, interpretation and educated guesswork.

“At this point, it is still a conceptual framework,” says professor Kalok Chan, dean of the Chinese University of Hong Kong (CUHK) Business School. “But the intention behind it is clear: to promote collaboration among countries in Asia. That means we will see a lot of infrastructure built, more trade-related and logistics services, and there will also be the funding side to think of, in order to support these other developments.”

Just within the 10-nation ASEAN grouping, there is a clear need for investment to upgrade transportation and port infrastructure. And if that gets the green light, it should almost automatically create wider opportunities for cities like Hong Kong with their expertise in fundraising, engineering and other professional services.

“Any such direct stimulus can boost economic co-operation, with the chance for both public and private sectors to get involved,” Chan says. “Hong Kong in particular, can act as a hub providing legal, financial, consulting and technical support for projects in Asia and beyond.”

For example, even though the Beijing-led AIIB (Asian Infrastructure Investment Bank) is likely to take the lead in raising funds, there is every reason to think Hong Kong can also make a substantial contribution. As a recognised offshore centre for trading renminbi (RMB) and issuing RMB-denominated bonds, the city has a head start in putting together certain types of syndicated loan, and should look to stretch that advantage.

With that in mind, CUHK Business School is already taking steps to tweak the content of MBA and EMBA programmes to increase general student awareness of OBOR and its longer-term implications.

“We are not only confining ourselves to what is delivered in the classroom,” Chan says. “A lot of the time now, we have to take students out of the classroom, and of Hong Kong, so they can really see the developments elsewhere.”

The template has been set with trips for MBA and EMBA students to Silicon Valley and cities in Britain, Sweden and Germany.

Now, besides Singapore and South Korea, future visits to less economically developed countries in south and west Asia are also very much on the agenda.

“In terms of course content and programme delivery, we have to consider student demand and what we think is really needed,” Chan says. “That means paying due attention to topics like big data, CSR [corporate social responsibility], innovation and entrepreneurship. Higher education has to be in touch with the latest trends, and do what’s necessary to give students the right kind of exposure, especially when forces like globalisation and technology are continuing to change so much, so quickly.”

In one specific example, the growth of online education has made it possible to disseminate knowledge over an internet platform. This is proving its worth as a way to supplement the more traditional style of face-to-face classroom teaching, and to reach more people, who do not necessarily have to be CUHK students.

“This is an important trend, but it is just one aspect of improving our business programmes and course delivery,” Chan says. “We are also continuing our efforts to recruit top scholars in terms of research and teaching, to help us create knowledge and disseminate it effectively.”

As part of the plan to encourage greater diversity and internationalisation, there are going to be more student exchanges and opportunities to work overseas. And there is also an ongoing scheme to increase collaboration with other universities, as well as with other schools within CUHK, notably those specialising in medicine, engineering, law and social sciences.

“These days, even if they are in the business world, students really need to have much a broader interdisciplinary knowledge,” Chan says. “That is something we hope to build through more collaboration, and which we want to reflect in our curriculum, both for undergraduates and for our MBA and EMBA students.”

Please click here for the full article.

Editor's picks

Trending articles

“Going Out” to Capture Belt and Road Opportunities (Expert Opinion 3): Hong Kong as a Fashion Capital

Chinese enterprises are attaching increasing importance to enhancing their product design capability in order to further expand in both the mainland and foreign markets. Recent HKTDC surveys show that mainland enterprises have strong demand for Hong Kong’s design services through which they hope to strengthen competitiveness and achieve transformation and upgrading.

According to Tony Lau of the Hong Kong Designers Association, the consumers demand for various consumer products and services is on the rise, both in the mainland as well as emerging markets. While their purchasing power still lags behind that of consumers in developed countries, they have their own requirements where product design and service quality are concerned. This is an important point not to be overlooked by industry players wishing to develop these markets.

Requirements of Belt and Road Consumers

At an interview with the HKTDC Research, Tony Lau[1] said: “Many mainland enterprises hope to make use of excess production capacity to develop emerging markets in order to make up for the flat domestic sales and exports to mature markets brought about by global economic downturn. However, while the product grade demanded by some emerging markets may not be on a par with mature markets, the majority of consumers still wish to buy value-for-money quality products in order to raise their living standard.

(Photograph provided by NowHere® Design Ltd.)

(Photograph provided by NowHere® Design Ltd.)

“In view of this, when mainland enterprises develop Belt and Road markets, they must take into consideration whether the product design and quality are reasonable and should also provide the appropriate sales service locally. If they only want to sell excess inventory, it would be difficult for them to truly tap the local markets.”

Lau pointed out that in both mature and emerging markets, consumers not only seek quality and functions, but also hope to buy trendy, fashionable products. He said: “Unlike mature consumers in developed countries, consumers in the mainland and certain Belt and Road markets may not be able to completely master product trends. For this reason, products with hardly any design elements may still sell well due to price or other factors.

“But when new competitors join the fray and try to suit the purchasing power of consumers, cut-throat competition will ensue and industry players selling poorly designed products may find it hard to sustain business development. Hence, mainland enterprises must enhance their product design and quality before they can effectively maintain consumer support for the product and the company.”

Feeling the Pulse of Fashionable Lifestyle Trends

“There are quite a lot of designers with fashion sense in the mainland and Asian countries, yet they lack the soil for growing trendy lifestyles. Actually, Hong Kong is not only an international city where Eastern and Western cultures meet, it is also a fashion capital of Asia. Middle-class consumers in the mainland and Southeast Asia in particular view Hong Kong as Asia’s lifestyle trendsetter.

“When well-known foreign brands enter the mainland market, most of them would use Hong Kong as a springboard. Consumers in the region and other Belt and Road markets would frequently refer to Hong Kong’s lifestyle trends and practices in order to master the fashion trends in Asian and Western countries.”

According to Lau, Hong Kong can provide mainland enterprises with professional designer services in such areas as product design, style, sales and marketing. This not only helps mainland products to catch up with international fashion trends, but also to meet international market standards, such as environmental requirements, recyclability of materials, minimising material waste and pollution in production process, as well as causing no harm to human health.

(Photograph provided by NowHere® Design Ltd.)

(Photograph provided by NowHere® Design Ltd.)

Hong Kong can also assist mainland enterprises in conveying the message that they meet the internationally recognised code of Corporate Social Responsibility (CSR), and build a positive image for their product and company in the local market.

Tony Lau is chairman of the Hong Kong Designers Association Global Design Awards (GDA) (2015-2016) Judging Panel. The Hong Kong Designers Association, with over 700 designer members, first organised the GDA in 1975. For many years, the GDA has not only honoured global design excellence, but has also become one of the most established multi-disciplinary design competitions in the Asia-Pacific region and helps to enhance Hong Kong’s status as a key creative centre.

[1] Tony Lau is founder and creative director of NowHere® Design Ltd, which is a Hong Kong design company mainly engaged in architectural and interior design and branding design.

| Content provided by |

|