Chinese Mainland

21 Jun 2016

How Washington Should Respond to the “Road and Belt”

By Zhao Minghao (He is a research fellow at the Charhar Institute and an adjunct fellow at the Chongyang Institute for Financial Studies at Renmin University of China. He is also a member of the China National Committee of the Council for Security Cooperation in the Asia Pacific.)

Major American think tanks are beginning to take the “Road and Belt” initiatives seriously. Recently the Center for Strategic and International Studies cosponsored a symposium on the “Road and Belt” with the Chongyang Institute for Financial Studies of Renmin University of China. The CSIS has also launched its own “Reconnecting Asia Research Initiative”. Scholars with the Brookings Institution, Center for American Progress and National Bureau of Asian Research have also started corresponding research projects.

US “overreaction” to Chinese proposals has created obstacles to development of China-US relations over the past few years. In fact, Washington could have responded in more appropriate and smarter ways. The US government took great pains to dissuade European allies from joining the Asian Infrastructure Investment Bank headquartered in Beijing, on the grounds that the institution can’t meet the “highest global standards” in management and lending. Yet Britain, Germany and France chose to become AIIB founding members despite US opposition.

Financial Times chief commentator Martin Wolf, who had worked with the World Bank, said what the US was truly worried about was that China-initiated mechanisms may undermine American influence on the global economy, and Britain’s decision to join the AIIB was a significant blow to the US. Wolf was straightforward in pointing out that rise of the Chinese economy is both desirable and unavoidable, the world needs fresh mechanisms, and will not stop its progress just because the US refuses to participate. (Martin Wolf, “A Rebuff of China’s AIIB Is Folly”, Financial Times, March 24, 2015)

On April 13, AIIB president Jin Liqun and World Bank president Jim Yong Kim signed their institutions’ first framework agreement on joint fundraising. The agreement will allow the two parties to jointly fund development programs, meaning that the two international institutions have taken an important step forward in meeting the world’s tremendous demands for infrastructure. Before that, the AIIB had agreed with the US-and-Japan-dominated Asian Development Bank, European Bank for Reconstruction and Development, and the British Department for International Development on fundraising for development projects. The AIIB is expected to approve about $1.2 billion in fundraising programs, including support for road construction in Pakistan and Central Asia.

For Beijing, the AIIB is a test rather than a so-called triumph against the US. This is the first time for the Chinese to attempt to provide public goods in the field of international development, indicating Beijing is actively embracing multilateralism in global governance. Chinese leaders have sufficient motivation to support the AIIB to develop in a manner in conformity with the principle of “lean, clean, green”. The AIIB is expected to demonstrate higher efficiency, zero tolerance to corruption, and commitment to sustainable development. In particular, the AIIB hopes its staff would be a third of the World Bank’s when its registered capital equals that of the latter.

Fundraising needs for infrastructure investments will reach $10 trillion in the next decade. There will be no competition between the AIIB and other multilateral development institutions, such as the World Bank and Asian Development Bank. Instead, there is broad room for them to cooperate. Jin has stated on multiple occasions that American companies would not be excluded from the AIIB’s scope of business. American lawyer Natalie Lichtenstein, who had worked for the World Bank for nearly 30 years, has been hired by the AIIB as an adviser. The AIIB has its eyes on talents’ qualifications and capabilities, not which country’s passport he or she holds.

Beijing has also been open to Washington regarding the “Road and Belt”. During his visit to the US in September 2015, Chinese President Xi Jinping stated in explicit terms that the US is welcome to participate in the initiative.

In order to promote Afghan economic development and economic integration in Central and South Asia, the US put forward the “New Silk Road” program in 2011. By 2014, the program had been further focused on four main fields, namely developing regional energy markets, promoting trade and transportation, upgrading customs and border control, enhancing business and personnel exchanges. This is very similar to the goals of the China-proposed “Silk Road Economic Belt”, so it should be possible to dovetail the two programs.

In fact, China and the US have already been collaborating on Afghan affairs in the past few years. Now they need to take one bolder step forward. They can jointly support construction of such infrastructure facilities as power grid, upgrade of border facilities, and negotiations on border trade agreements. China and the US can also cooperate under such frameworks as the Central Asia Regional Economic Cooperation Program. In June 2015, Richard Hoagland, a senior official with the US Department of State, talked with officials with China’s National Development and Reform Commission on how to make the “New Silk Road” and “Silk Road Economic Belt” mutually complementary.

Beijing does not expect the Obama administration to enthusiastically support the “Road and Belt”, but it does hope that the American side can be serious about the tremendous potential for the two countries to formulate a global development partnership. The “Road and Belt” has offered a window of opportunities. The US should not overreact to every Chinese proposals. They are not in a zero-sum game. As veteran China expert Harry Harding said, “a more successful and confident United States would regard the rise of China with greater equanimity”. In the realm of international development, Washington doesn’t need to panic, it should instead be confident and take a different attitude – let China succeed.

Please click here to view the full article on the website of China-United States Focus.

Editor's picks

Trending articles

Nordic Opportunities: CleanTech Models

Highly regarded as one of the greenest domains on Earth, the Nordic region is a best- practice case for how national or regional commitment to a green economy can earn a global environmental reputation. Greater environmental focus on traditional industries such as fisheries and forestry, coupled with developments in efficiency and improvements in sectors such as renewable energy, smart cities with sustainable water and waste management, smart buildings and green transportation, has made the Nordics an excellent partner in the development and deployment of fast-growing CleanTech businesses.

Nordics as a green domain

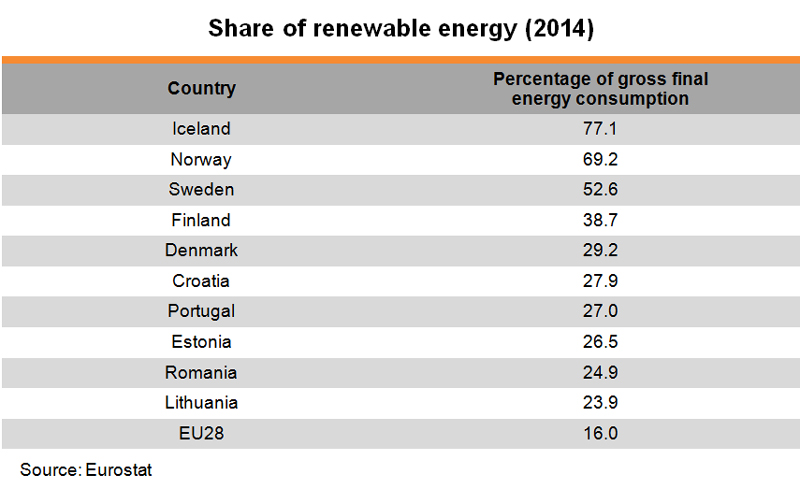

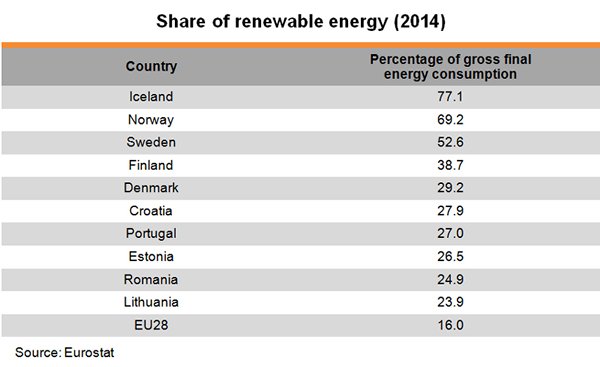

The Nordic region [1] leads Europe in the use of renewable energy. According to the latest available statistics, in 2014 renewables made up 77.1%, 69.2%, 52.6%, 38.7% and 29.2% of gross final energy consumption in Iceland, Norway, Sweden, Finland and Denmark, respectively, compared to the EU average of 16%. Major sources of renewables in the Nordic region include wind, waves, tidal, solar, geothermic, hydroelectric, biomass and biofuels.

With four out of the five Nordic countries – Iceland, Norway, Sweden and Finland – meeting their 2020 renewable-energy obligations by 2014 (each country has a separate target in terms of percentage of gross final energy consumption), and committed to the belief that others can follow suit, the region is keen to promote its renewable-energy technologies and applications to the world’s major energy consumers.

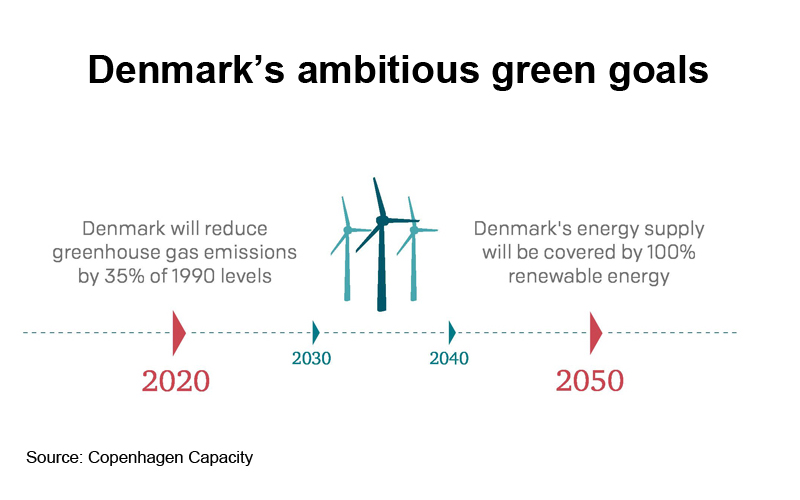

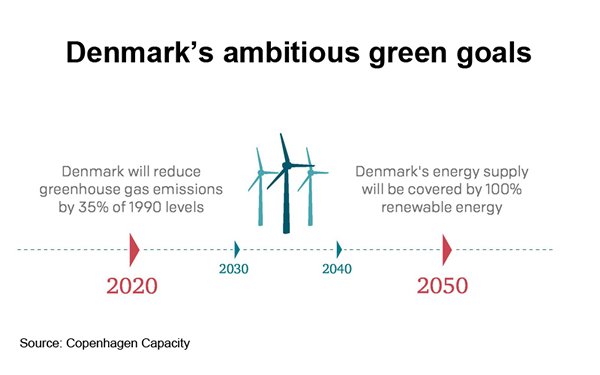

Although Denmark is still slightly behind its 2020 renewable-energy obligations (0.8% behind a target of 30%), it has committed to an ambitious goal to develop its capital and largest city, Copenhagen, into the world’s first carbon-neutral city by 2025, and to weaning the country off fossil fuels in favour of 100% renewables by 2050. Already able to meet its domestic electricity demand by wind power, Denmark exports power to its neighbours such as Germany, Norway and Sweden.

Ready to make inroads into Asia

As forerunners in green energy, many Nordic CleanTech companies have shown interest in securing partners and market opportunities to cash in on Asia’s growing demand for renewables, while Asian countries are pushing the development of renewable-energy options such as biomass, solar and wind power to reduce their reliance on fossil fuels.

While renewable-energy resources may vary from country to country, China, the world’s largest energy consumer since overtaking the US in 2010, presents a tremendous opportunity for Nordic CleanTech companies. Given China’s large agricultural sector and rich hydro resources, companies specialising in biomass power generation, hydro-power turbines and equipment, flood-control systems, and urban planning are likely to be in high demand in the country where urbanisation is seen as key to fast-tracking economic growth and improving living conditions as rural to urban migration continues.

Opportunities for FDI and research collaboration

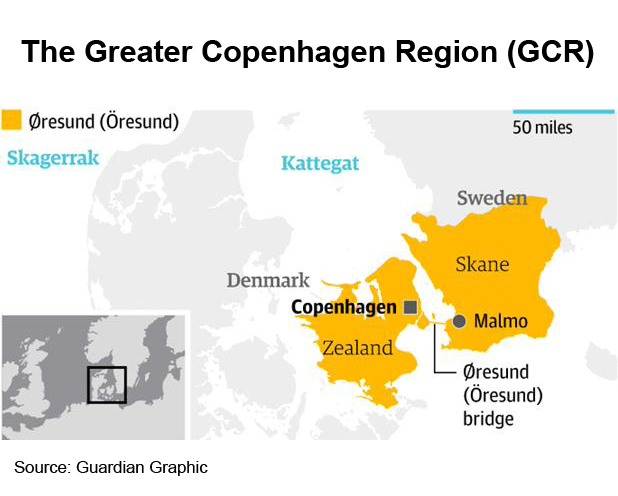

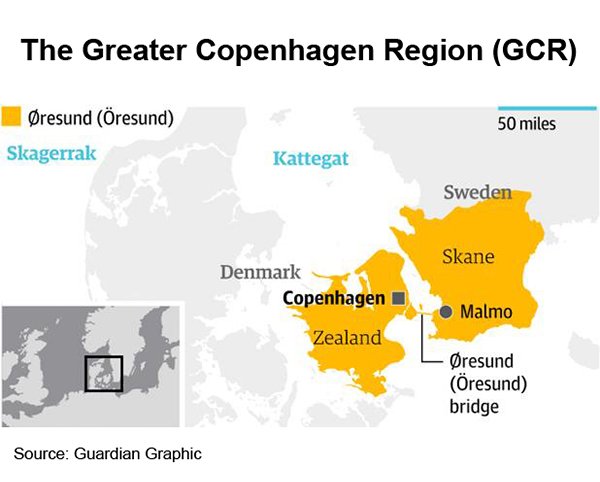

Home to nearly 4 million inhabitants and the Nordic region’s largest recruitment base for highly-skilled employees, the Greater Copenhagen Region (GCR), a metropolitan area spanning Eastern Denmark and Skåne in Southern Sweden, offers the best foreign direct investment (FDI) strategy among Europe’s mid-sized regions (between 1.5 and 4 million inhabitants) in fDi Intelligence’s European Cities and Regions of the Future rankings 2016/17.

With close links to Continental Europe, the Nordics and the Baltics, the GCR provides not only ready access to a market of more than 100 million consumers, but also to a cluster of high-level companies with strong competencies in renewable energy, waste and water management, recycling and upcycling solutions that make the GCR a frontrunner for green investments and innovation.

Boasting an ambitious goal to become a leading international hub for investment and knowledge capable of competing with the most successful metropolises in Europe by 2020, the GCR offers international investors world-class research facilities and a creative business environment for a number of attractive high-growth technology sectors.

For instance, through a unique collaboration between companies, universities and municipalities, Malmö Cleantech City, since 2010, has created a green network and promoted CleanTech entrepreneurship in Malmö. Aiming to become climate neutral by 2020 and 100% powered by renewables by 2030, Malmö, Sweden’s southernmost and third-largest city (after Stockholm and Gothenburg) has been successfully transformed from a polluted shipbuilding centre into a CleanTech hub boasting a high concentration of CleanTech players.

Thanks also to the city’s proximity to MAX IV, the next-generation synchrotron radiation facility, and the European Spallation Source (ESS), a state-of-the-art super-microscope generating new science and innovations for a sustainable society, Malmö is becoming a hotspot for leading life sciences and materials research. The industry cross-over between life sciences, CleanTech and smart-city solutions has already resulted in a number of projects and products including sensors on waste bins, smart grids, street lighting using LED, battery coating with nanoparticles for solar-energy generation and closed-loop recycled water showers.

Exportable experience for China’s urbanisation programme

It is estimated that about 70% of China’s population, or about one billion people, will be living in cities by 2030, as more than 100 million people migrate from the countryside. To cope with the high demand for efficient urban planning, smart-city development has become a key national policy and, in turn, a highly sought-after technology on the mainland.

To ensure a sustainable yet holistic urban-planning approach, substantial government involvement is usually a prerequisite. This is especially true when old solutions for energy, water, sewage and waste must somehow be retrofitted and new, stricter environmental requirements call for completely new solutions. This, however, could create problems for private engagement and future marketability of the various projects.

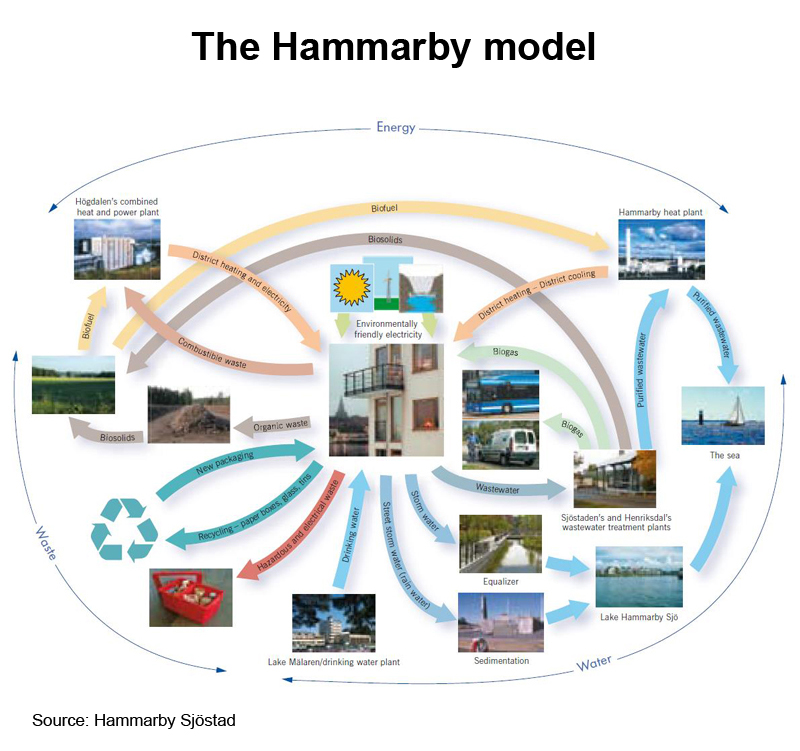

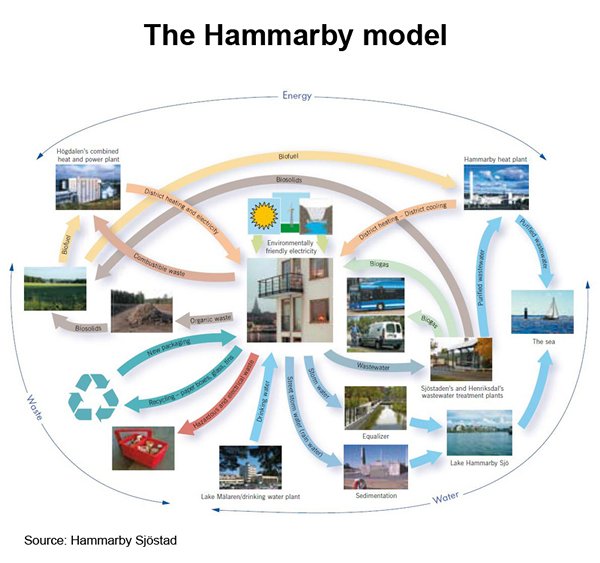

To this end, Stockholm – the first European Green Capital [2] – has a long historical track record of integrated urban management with ongoing credible green credentials and ambitious future plans. For instance, as the first eco-city district in Stockholm, Hammarby Sjöstad – as a symbol for the future of the Swedish capital – is one of the finest international role models of sustainable urban development.

The initial idea was born in 1990 as part of Stockholm’s bid to host the 2004 Summer Olympic Games. When the bid failed, the city authorities decided to use the project as a pilot for environmentally friendly urban development in order to meet strong demand for sustainable housing.

The development, expected to be completed in 2018, involves a mixture of private and public construction partners, which are designing and building individual housing units to accommodate 25,000 people in more than 11,000 apartments. It aims to achieving a 50% reduction in the overall environmental impact (waste, water and energy consumption) compared with a typical district built in the early 1990s.

The green solutions being invented and applied in Hammarby Sjöstad are based on a closed eco-cycle, known as the Hammarby model, in which waste, water and energy consumption are minimised and recycling and upcycling are used whenever possible.

In addition to installing solar cells and solar panels on several façades and roofs, treated sewage and combustible waste produced by the residents will be used as fuels in the production of the district’s heating, cooling, electrical power and biogas. Biodegrades, such as food waste and sewage sludge, will be used in the production of biogas for city buses and about 1,000 gas stoves.

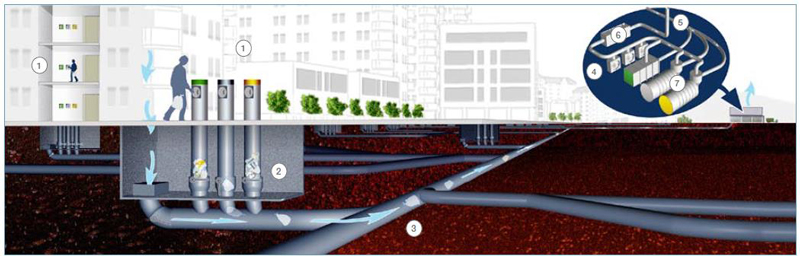

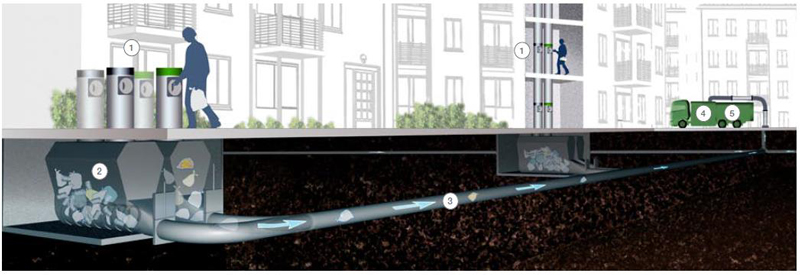

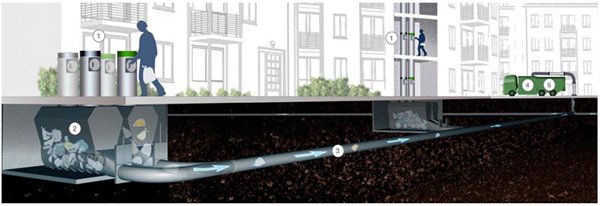

In a bid to free up space and reduce heavy traffic, Hammarby Sjöstad has adopted an automated waste-disposal system, with different refuse chutes, block-based recycling rooms and area-based waste-collection points being installed to help residents segregate and handle their waste at source.

In the district, household refuse and organic food waste are collected at special waste inlets or disposal chutes located in courtyards, entrance halls and refuse rooms. Envac’s underground pipeline system transports the waste at up to 70 kilometers per hour through vacuum pipes to designated collection stations or suction vehicles. Other recyclables including packaging materials such as glass, cardboard and metals, are collected in conventional bins placed in a separate recycling room in the building.

Source: Envac

Source: Envac

The district’s eco-friendly adaptation has resulted in substantial investments in transport. One ambitious goal is for most of the residents’ journeys to be made by cycling, walking or public transport, such as the Tvärbanan light railway that runs through the centre of the district and regular bus and ferry services that connect to the inner city of Stockholm. Other green-transport ideas such as car pools (ride-sharing services) and the use of electric vehicles are also being introduced or encouraged in the district to help minimise the environmental transport burden.

Riding on the success of the Hammarby Sjöstad, the Stockholm City Council has since 2010 embarked on another world-class eco-city project – the Stockholm Royal Seaport. Situated in a former industrial and port area close to the city centre, the new smart city, when fully developed by about 2030, will be fossil-fuel free and have even higher environmental requirements than Hammarby Sjöstad.

Both Hammarby Sjöstad and Stockholm Royal Seaport have shown not only Sweden’s determination in developing, marketing and implementing new energy and environmental solutions, but also the capability of creating sustainable and holistic city-planning systems using innovative environmental technologies and solutions that could be exported to, and applied in, many other parts of the world.

How can Hong Kong fit in?

The pressing needs to develop and adopt renewable energy and energy-saving technologies are providing numerous opportunities to further promote and strengthen tripartite cooperation between Hong Kong, the Chinese mainland and the Nordic countries.

Indeed, not only Nordic countries are marketing their CleanTech know-how to Hong Kong and the Chinese mainland. More and more Chinese companies are either cooperating with Nordic technology companies to carry out research and development (R&D) activities in CleanTech fields or are participating directly in CleanTech projects in the Nordic region, demonstrating their eagerness to explore the international market.

One recent example of such CleanTech investment includes a plan announced in February this year to invest €1 billion to build a new wood-based bio-refinery in Kemi, Finland by the Wuhan-based Sunshine Kaidi New Energy Group, which currently operates about 30 biomass plants in China and Vietnam. If its proceeds, it would be the biggest Chinese investment in Finland.

Already a conduit of China’s outbound direct investment, Hong Kong can also serve as a centre to help Nordic companies source, screen and manage CleanTech investment from China, in addition to providing relevant professional services to facilitate investment. Hong Kong companies can also represent or help Nordic CleanTech companies in finding partners in Hong Kong, the Chinese mainland and other parts of Asia, connect them with relevant authorities and investors, and facilitate commercialisation, transfer and licensing of relevant research results and innovations.

As companies from both the Chinese mainland and Nordic countries show increasing interest in sharing expertise and cooperating on R&D activities, Hong Kong companies should enhance their promotional efforts in the Nordic region to showcase the value they can add to this process.

In fact, Hong Kong is no stranger to Nordic CleanTech companies, many of which have either had experience with projects or have had business representation in the city. For instance, Envac, a leading Swedish CleanTech company and the inventor and major supplier of automated vacuum refuse-collection systems (the ones used in Hammarby Sjöstad), operates a wholly owned subsidiary in Hong Kong to provide technical support to its projects across the border. The company has also carried out various projects in the city for the Hong Kong government, the Hong Kong Housing Authority, the Science and Technology Park, HSBC, Hong Kong International Airport, and Adventist Hospital.

The success of these Nordic CleanTech companies has strengthened Hong Kong’s role in showcasing how innovative environmental technology from leading Nordic countries can be applied to a small, crowded city. Hong Kong can also become a role model to other Asian cities in terms of the integration of economic growth with environmental awareness and increasingly tough green standards.

Last but not least, as a crucial step towards activating private capital in the battle against global climate change, Nordic governments and financial institutions including Swedish corporate bank SEB – the underwriter of the world’s first green bonds issued by the World Bank in 2008 – have long been a driving force behind the global green bond market.

Green bonds were identified during the COP21 Paris conference last year as a promising source of green financing for cities, regions and governments around the world, and closer cooperation between Nordic and Hong Kong financial institutions can contribute to the goal of providing US$100 billion annually by 2020 to support climate action in developing countries.

For example, following the issuance of China’s first corporate green bond by Xinjiang-based Goldwind in Hong Kong and the publication of the world’s first official green bond guidelines – Green Bond Guidelines and the Green Bond Endorsed Project Catalogue – by the People’s Bank of China and the Green Finance Committee of the China Society of Finance and Banking on 22 December 2015, green bonds have quickly become a valuable item in the toolkit of Chinese CleanTech enterprises.

Furthermore, to lay a strong foundation for a green, robust and resilient economy over the next two decades, China would need a minimum annual investment of US$350 billion (about RMB 2.3 trillion) over the lifetime of the 13th Five-Year Plan (2016-2020) to address its environmental problems, 85% of which would have to come from the private sector, particularly the debt market.

It is widely believed that the new green bond rules will not only change the landscape of the global green bond market, which is currently dominated by players from Europe and the US, but that China’s big and growing demand for green financing will also provide a considerable advantage in developing and marketing Hong Kong’s status and strengths as an international financial centre.

[1] The Nordic region mainly consists of Demark, Finland, Iceland, Norway and Sweden. In this research report, Iceland is not covered given its small market size, while Norway is skipped due to its relatively narrow industrial base.

[2] The first European Green Capital was awarded in 2010 and seven cities – Stockholm (Sweden), Vitoria-Gasteiz (Spain), Nantes (France), Copenhagen (Denmark), Bristol (the UK), Ljubljana (Slovenia) and Essen (Germany) – have been awarded the title so far.

| Content provided by |

|

Editor's picks

Trending articles

24 Jun 2016

Anticipating the World’s Third-Largest Trade Axis

By Zhang Monan (Researcher at the China Center for International Economic Exchanges)

The Belt and Road Initiative was proposed against the background of deep global economic and trade restructuring. Regional economic integration continues to deepen, world trade and investment pattern is undergoing profound changes and countries around the world are at a crucial stage of development transition. The world needs further stimulating development potential and needs a cooperative development momentum.

The global trade system is undergoing its biggest restructuring since The Uruguay Round in 1994 and since 2008. In terms of today’s world economic and trade pattern, two trade centers with strong regional features exist in the world market: one is the Atlantic trade center and the other is the Pacific trade center. The world third-largest trade center is expected to form based on China’s One Belt One Road Initiative within the next decade.

Since the 21st century, the most prominent feature of the world economic development is that most developing countries and the emerging economies including Asia, Latin America and Africa have a strong integration on the whole. In recent years, the regional economic growth was particularly noticeable in countries along the One Belt One Road, mainly consisting of the developing countries. The One Belt One Road region covers about 4.6 billion population (exceeding the world population 60%) and its total GDP reaches $20 trillion (about one-third of the total world GDP). From 1990 to 2013, the average annual growth of the total GDP in the One Belt One Road region arrived at 5.1%, two times the world economic growth over the same period. During the slow world economic growth period from 2010 to 2013, the average annual growth of the total GDP in the One Belt One Road region was 4.7%, higher than the world average annual growth of 2.4%. During this period, the One Belt One Road region’s contribution to the world economic growth hit 41.2%.

Besides, according to the World Bank data, during the period between 2010 and 2013 after the world financial crisis, the average annual growth of the One Belt One Road region’s foreign trade and the net foreign capital inflow reached 13.9% and 6.2% respectively, 4.6% and 3.4% higher than the world average annual level. The One Belt One Road region is forming the third-largest trade center in the world stretching from Asia to Europe, after the Atlantic trade center and the Pacific trade center.

Of course, the economic development of the One Belt One Road countries also faces great challenges and growth weakness, which is precisely the driving force behind a new round of cooperation. In fact, the infrastructure of the One Belt One Road region still falls behinds its economic growth and is bellow the international standard both in quality and quantity. The backward infrastructure of both hardware and software has become the biggest barrier to the intraregional economic and trade cooperation. For example, the new Eurasian Railway runs through many countries along different railway gauges and it takes time and efforts to change the gauges. Port cooperation mechanisms among these countries have not formed yet, hampering transport and creating a high logistics cost. The port facilities of some countries are backward, increasing the difficulty of the circulation of goods and services.

There is a huge gap in infrastructure investment. Asia Development Bank predicts that within the next 10 years, Asia infrastructure investment will need $8.22 trillion, i.e. $820 billion more infrastructure capital every year. However, in 2013, only three big economies of China, Japan and South Korea had about $8 trillion total GDP in Asia, so the infrastructure investment gap was large enough. According to the World Bank statistics, the capital formation of the lower-and-middle-income countries only accounts for about one-fourth of the GDP and the capital invested in infrastructure was only about 20%, around $400 billion. So a huge gap exists in financing.

The ratio of intra-regional trade is relatively low. Compared with EU, NAFTA and ASEAN which have made substantial progress in regional integration, the intra-regional trade among the Belt and Road related countries has a lower ratio in the total foreign trade. The cooperation of the regional countries is still in the early stage. But the future cooperation prospect foretells a huge development potential. One Belt One Road cooperation framework can be seen as a new Trade Coordination Strategy. Since the rapid development of economic globalization at the beginning of this century and especially since the global financial crisis, the world economic pattern has turned from the Center-External one-way system to a two-way system and coordinative trade growth. This will surely bring new adjustments of the trade growth mode, such as integration and interaction of trade and direct investment and the industrial shift, transition from inter-industry trade to intra-industry trade, readjustment of trade structure and trade terms, promotion of the coordinative development of trade and investment through institutional arrangements.

At present, the global intermediate goods trade plays a decisive role in the global trade growth. Since 1995, the proportion of the global intermediate product export in the total global export has been increasing by more than 50%, reaching its highest proportion (69.32%) in 2013. I suggest building a “global value chain partnership” to encourage more countries to integrate into the global value chain network system.

In fact, the One Belt One Road Vision and Action Plan announced by the Chinese government points out that the facilitation degree of investment and trade has further increased and a high standard network of free trade areas has basically formed.” The action plan demands that One Belt One Road should be based on a creative trade mode, including the expansion of cross-border e-commerce and service trade. The action plan also includes aims such as “accelerate the investment facilitation, eliminate investment barrier, reinforce the bilateral investment protection agreement”, green trade and global value chain trade.

The One Belt One Road cooperative framework can speed up implementing “digital trade agreement”. Through new policies like the lowest customs threshold, intermediary responsibility, privacy, intellectual property rights, consumer protection, electronic signature and settlement of issues, the framework can promote interconnection and inter-flow in information, trade and industry so as to bring a new boom via the new round of trade globalization.

Please click to read the full article on the website of China-United States Focus.

Editor's picks

Trending articles

28 Jun 2016

China’s One Belt One Road Initiative on Tax and Customs

By Spiegeler Attorneys-at-Law

In September and October 2013, the Chinese President Xi Jinping had brought up two strategic initiatives which are jointly known as the “One Belt One Road” Initiative (OBOR), respectively the New Silk Road Economic Road (SREB) and the 21st Century Maritime Silk Road (MSR). These two projects are considered a re-establishment of the historical trade route between China and Europe across the Middle East. This is a trade and investment oriented Initiative aiming at integrity and connectivity in Eurasia.

In respect with tax and taxation, the State Administration of Taxation (SAT) announced a package of ten measures in April 2015 for serving the implementation of the OBOR Initiative. This package is also known as the “policy paper on implementing the OBOR Initiative” through enhancing taxation services and management. Thorough execution and interpretation of taxation agreements are on the top of this agenda. Eliminating mismatches between regional law enforcement and tax disputes are priorities as well.

Taxation information centers assorted by nationalities were firstly promoted in July 2015 on provincial levels for pilot functional testing. Besides, the tax information website for OBOR initiative was introduced to build a comprehensive taxation guidance database covering all the OBOR countries. A hotline for questions on taxation was set up. this is however mainly targeting Chinese enterprises planning to expand overseas via the OBOR platform...

Please click to read the full article.

Editor's picks

Trending articles

28 Jun 2016

China's New Economic Silk Road: The Great Eurasian Game & The String of Pearls

By Chris Devonshire Ellis, founding partner, Dezan Shira & Associates

An issue when composing a book such as this, covering such a large geographical area, is the definition of what Asia actually is. This becomes especially pertinent when dealing with Asian subcategories like “Eurasia” and “Central Asia”. What do these really mean? Indeed, what is “Russia”?

Asia is defined by Miriam-Webster as “A continent of the eastern hemisphere north of the equator forming a single landmass with Europe” and further revealed to possess “numerous large offshore islands including Cyprus, Sri Lanka, Malay Archipelago, Taiwan, the Japanese chain, & Sakhalin area”.

Which taken literally would mean that the southern islands of the Maldives, being south of the equator, are not part of Asia. Neither are Indonesia and Singapore. Meanwhile, Australia, a continent in its own right and almost exclusively “south of the equator”, has also declared itself part of Asia. Existing definitions, which we have grown used to, are therefore in need of some adjustment.

Central Asia is equally tricky. Most people would identify it as a collection of Muslim states, lying directly south of Russia, and previously part of the Soviet bloc. However, this doesn’t really work. Mongolia is for example Buddhist, as many of the currently Muslim territories once were, while its capital, Ulaan Baatar, is as close to Anchorage in the United States as it is to Moscow.

Even Eurasia can be difficult. The majority of people would imagine this area to extend roughly to the boundaries of the further reaches of the Mongolian Empire at its height – including all of China, and as far west to Hungary in Eastern Europe. “The Steppes” is an expression often used to describe Eurasia. Miriam-Webster again: Eurasia is “The landmass of Asia & Europe - chiefly used to refer to the two continents as one continent”.

Russia meanwhile acknowledges its unique geographic position by maintaining the Double-Headed Eagle as its national symbol. One head faces west, the other east. Although its capital city is in the European part, 75 percent of Russian territory lies in Asia. When thinking of Asia, images of steamy jungles and elephants tend to come to mind, yet the region has a long coastline above the Arctic Circle, previously home to the elephant’s distant cousin, the mammoth. As global warming increases, we may become more familiar with the concept of Arctic lands being Asian.

The reason these definitions are changing is largely due to the rise of China, a re-think of its role in the world and its revision of domestic and foreign policy. As China spreads its influence beyond its own borders, those of us from white European stock should be reminded that the term “Caucasian” typically used to describe us in terms of race includes the word “Asian”.

For the purposes of this book however, and in accordance with Miriam-Webster’s definition of “Eurasia”, this analysis views the subject as including all of Asia - meaning from Arctic Siberia, south to countries such as Sri Lanka and Indonesia, and West to India, Pakistan and Iran. It also includes Europe because, as we will see, China’s Silk Road Economic Belt will impact upon all.

Please click to read the full article.

Editor's picks

Trending articles

South Africa Seeks Hong Kong Partners for BRI Halaal Food Distribution

With South Africa looking to take a lead in the halaal food sector, Asia is a key target for its export-orientated businesses, especially as they set out to capitalise on the numerous opportunities now being opened up by the Belt and Road Initiative.

With the Belt and Road Initiative (BRI) set to transform access to markets across Asia, this is opening up new potential partnerships with African companies looking to target the continent's consumers. In particular, a number of South African halaal food producers have high hopes that Hong Kong could prove the ideal gateway for boosting their exports across the region.

By 2030, it is estimated that the global Muslim population will be some 2.2 billion in number, representing around a quarter of the world's consumers. Inevitably, this substantial demographic shift will result in an ever-increasing demand for halaal products.

Given that the global halaal food industry is estimated to be worth US$2.3 trillion, the business opportunity represented by serving the sector is clearly huge. South Africa is one of the many countries hoping to capitalise on this rapidly expanding market.

Despite its relatively small Muslim population, South Africa is one of the world leaders in producing and – importantly – certifying halaal products. The country's exporters see Asia as one of the fastest-growing markets for halaal goods – and with good reason. By 2030, it is thought that Asia will be home to 80% of the world's Muslim population.

Ebi Lockhat, a spokesman for the South African National Halaal Authority, the country's leading halaal certifying body, said: "South Africa has long had a significant number of domestic producers of halaal food. Now, though, those manufacturers are starting to become active internationally. This has seen many of them attend trade events across the Muslim world, while looking to establish a firm presence in the international markets."

South Africa's halaal production system is subject to high certification standards, ensuring its compliance with the requirements of discerning Muslim consumers. Eating solely properly-certified food is mandatory for practising Muslims, with such proof of compliance providing an assurance that all such foodstuffs have been produced in line with the requirements of Islamic law.

In line with this, plans are now in place to further enhance South Africa's position within the sector. A clear indication of this is the government-backed launch of a one billion rand (US$67 million) halaal food-processing industrial park. This new facility will ramp up South Africa's halaal food export capacity, hopefully doubling its share of the global market. At present, a feasibility study is being conducted in the Cape Town area in order to determine the optimum location for the proposed park.

When completed, the park will comprise a cluster of halaal manufacturing and service firms. South Africa's Western Cape provincial government also hopes to attract a globally recognised halaal certifying body to operate out of the site.

For the provincial government, growing the halaal industry is now one of its key focusses as it looks to boost growth and create new jobs in the region. Announcing the planned development of the facility, Alan Winde, the Western Cape Minister of Economic Opportunities, said: "This industry is growing at an estimated annual rate of 20%. It is one of the fastest-growing consumer segments in the world. This is why we are now looking for significant growth in the size of the province's halaal industry.

"Certification is also hugely important. In addition to developing a guide as to the current certification standards, we will work with the appropriate certification bodies in order to try and establish a single standard, one that is in line with global market demands."

The new park is being planned in collaboration with the Malaysian government, which has itself identified a shortfall in the provision of halaal food for the world's growing Muslim population. In 2015, Winde led a delegation to Malaysia in a bid to strengthen its trade links with the Western Cape region.

As a consequence, the Western Cape Fine Food Initiative, another partner in the proposed park, and the Malaysian Industry Government Group for High Technology signed a long-term co-operation agreement. It is hoped that this will foster an enduring partnership between the two countries' halaal industries.

Back in the 1970s, Malaysia was the first country to set certification standards for halaal food production. Today, these are still viewed as the global benchmark. Malaysia is also at the very heart of the Asian halaal market. It is hoped that this new agreement will see South Africa's halaal producers benefitting hugely from Malaysia's experience and reputation within the sector.

Asian/African Partnerships

China is also now looking to increase its share of the global halaal food market. This move has been partly spurred by the country's adoption of the far-reaching Belt and Road Initiative. Significantly, many of the countries along the proposed BRI routes have substantial Muslim populations.

As a consequence, China is keen to match its export offer with the needs of its Muslim neighbours along the BRI routes. In terms of halaal food, though, Chinese companies currently export less than 1% of the global total, but hope to substantially expand their share of the sector.

Despite such aspirations, though, many suppliers in China will be hampered by the poor reputation of the country's domestic food industry. This, then, leaves a clear opportunity for producers of properly-regulated and certified halaal food to work with distributors in the region.

As a key player in the BRI, Hong Kong is ideally positioned to adopt a primary role in the processing and distribution of such produce, with South Africa keen to be its supply partner. As something of an incentive, with the Rand now set to fall to an all-time low, importers can buy South African products for around 33% less than they were paying a year ago.

Addressing the issue of Asian/African partnerships in the sector, Nazeem Sterras, Chief Executive of the Western Cape Fine Food Initiative, said: "Countries such as Malaysia, Singapore and China are critical markets for halaal produce. ASEAN, in particular, presents a huge opportunity for distributors, while the overall Asian halaal market is estimated to be worth around $410 billion annually. I believe that Hong Kong can play a significant role in bringing halaal brands to these key consumer markets."

Mark Ronan, Special Correspondent, Cape Town

| Content provided by |

|

Editor's picks

Trending articles

Nordic Opportunities: Design and Innovation Solutions

Famous for its well-designed balance of minimalism, functionality and eco-friendliness, Nordic designs are increasingly regarded as a winning formula for sustainable business growth. Hong Kong, given its close proximity to the production hub of southern China, has become a natural gathering point for Nordic companies, primarily serving their European clients with manufacturing across the border. Meanwhile, more and more entrepreneurial Nordic start-ups have seen Hong Kong as a good springboard to commercialise their innovative business ideas.

As a beacon of design and innovation

Despite high income levels, Nordic people are very practical consumers. They have little interest in showing off, with purchase decisions usually focussed on more sophisticated concerns, such as design and innovation with respect to the use of materials, quality, functionality and environmental friendliness.

This, together with the high regard for private and family lives and relatively high labour costs in the Nordic region, strangles the development of labour-intensive industries there. By contrast, “mind-intensive” industries, such as R&D, innovation and design represent the major business focus in the Nordic region.

Given the relatively small domestic market size, the region’s specialisation in mind-intensive activities has bred a number of well-known enterprises offering innovative designs and solutions worldwide. In fact, Hong Kong consumers are not unfamiliar with innovative Nordic designs and technologies.

Just to name a few, IKEA furniture, H&M clothing, Marimekko fashion, Fiskars tools and housewares, Volvo autos, Scania trucks, Danish designer chairs and furnishings, Angry Birds mobile apps and the free internet telephony Skype, are famous examples of Nordic designs and innovation.

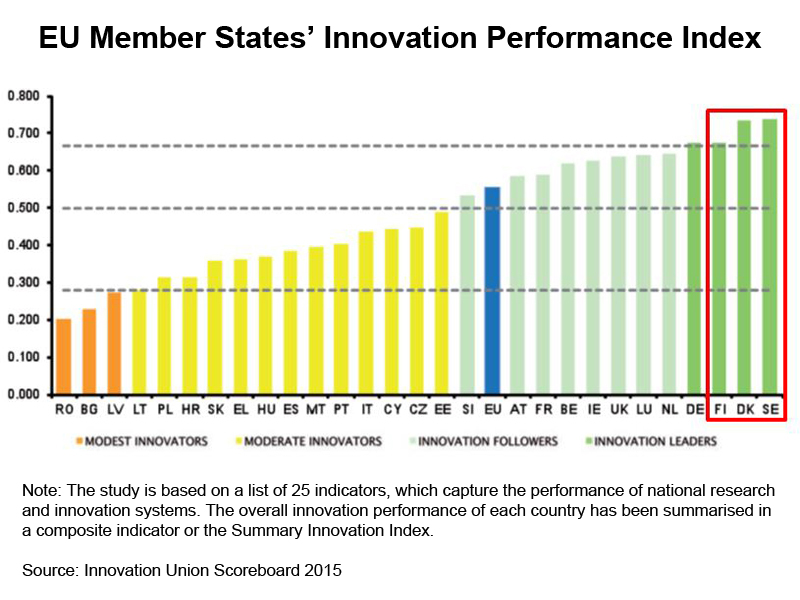

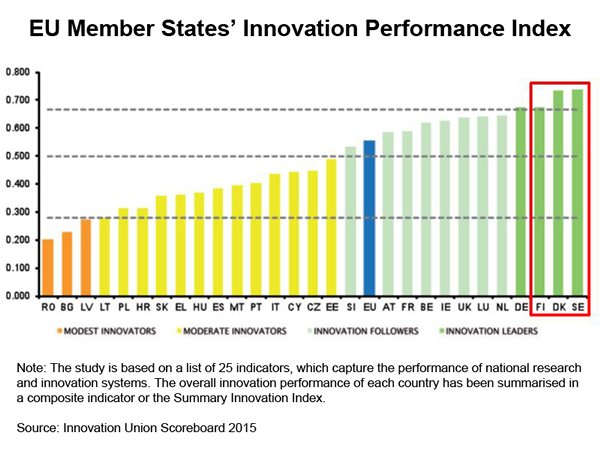

Nordic countries such as Sweden, Denmark and Finland have increasingly been seen as a beacon of design and innovation. Thanks to their sound national research and innovation systems, they lead Europe in innovation performance, from research and innovation inputs, through business innovation activities, to innovation outputs and economic effects.

Featuring modern style with minimum frills, and with a deep-rooted love of nature, the creativity of Nordic designers and innovative companies has been greatly sought-after. Their signature style’s balance of simplicity, minimalism, functionality and eco-friendliness has become a winning formula for sustainable business growth.

The marriage of innovation with entrepreneurship

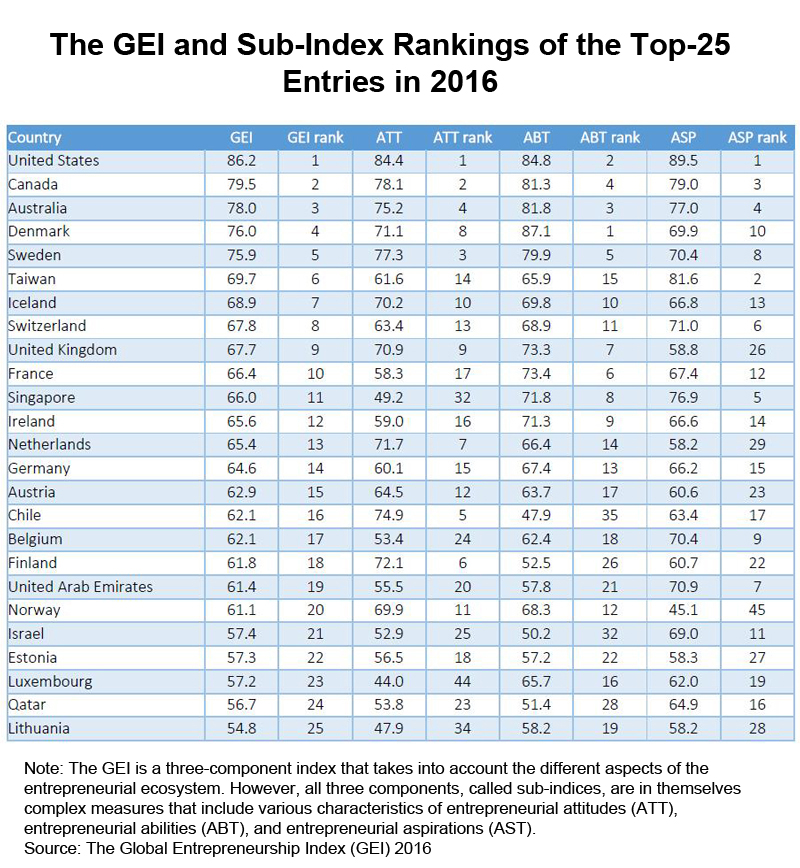

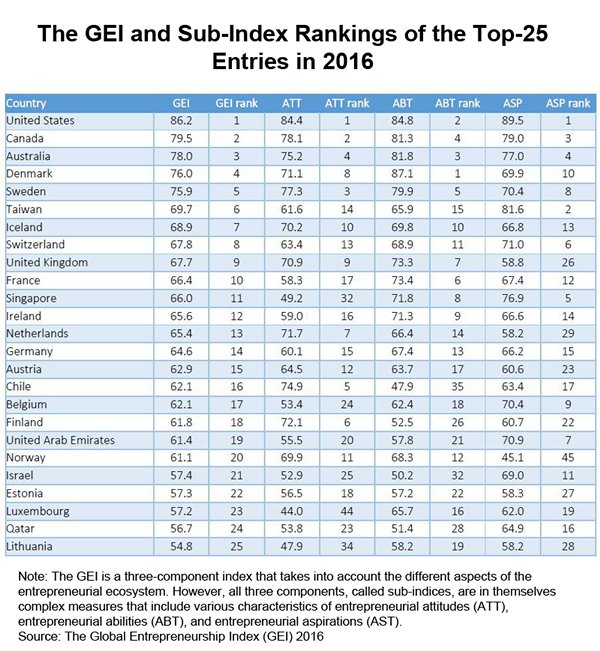

Scoring high on international benchmarks for entrepreneurship, the Nordic region is becoming a hotbed of entrepreneurship. For example, The Global Entrepreneurship Index (GEI) 2016, ranked Denmark and Sweden the fourth and fifth most entrepreneurial countries in the world out of 132 entries, surpassed only by the US, Canada and Australia.

With the promotion of innovation and entrepreneurship being integrated at every educational level in most, if not all of the Nordic countries, many fresh graduates have chosen to start their own businesses with innovative business ideas fomented throughout their school life.

With the aim of better serving their clients, primarily European companies with manufacturing activities in the Chinese mainland, many Nordic design companies – both well established and new start-ups – have opened studios in Hong Kong. This has been aided by the city’s extensive business network, unparalleled connectivity with the business ecosystems in the Pearl River Delta, robust legal and IP protection regime, as well as the world-class ICT infrastructure and professionals.

Packaging design, prototyping and production management in the Pearl River Delta form the core part of their businesses in Hong Kong supported by services including as industrial design, mechanical design, graphical art and patent application. Given the reputation and aesthetic appeal of Nordic design, the rapid growth of Nordic design studios has also drawn the attention of other international companies with production across the border. Collaboration and crossovers between Nordic design studios and the local business community and academia have become more commonplace.

Growing businesses via Hong Kong

Currently serving a range of globally recognised brands from both the EU and US, C’monde Studios, a Swedish industrial design studio based in Hong Kong, is taking advantage of the city’s close proximity to the production hub of southern China. The award-winning company is aiming to increase concept feasibility, implementation speed and supervision for a consistent design quality throughout the manufacturing process through its Hong Kong presence.

Having a strong track record in brand and design management from Europe, Hong Kong and Southeast Asia, the founder of C’monde Studios believes that companies selling in developed, saturated markets such as Hong Kong have big demand for unique offers and creativity to add value to profit margins in the new era of industrialisation.

In view of the shift of “industrial design” to “service design”, a more holistic approach in the design process is required to bring success to any company or industry at the beginning of a ‘Fourth Industrial Revolution’, a new era that builds and extends the impact of digitisation in new and unanticipated ways. The urgent need to increase the “ease of interaction” in order to enhance customer engagement across ages and social classes requires increasingly inputs from designers than engineers.

This, together with the fast expanding pool of increasingly financially-capable consumers with higher expectations for design, will keep opening new windows for Nordic design companies, which are well-known for their practical engineering yet chic design.

To this end, as well as providing prompt support to their Western clients, such as routine factory inspection visits to ensure consistency and compliance with design specifications, C’monde Studios has also completed several projects with local clients. One example is Octopus Card Ltd, to improve the card legibility on selected Kowloon Motor Bus (KMB) buses by increasing the font size and intensifying the display contrast to better cater for passengers with reduced eyesight.

C’monde Studios is also developing its own earphone brand, after years of experience designing earphones for design-driven audio accessory brands, such as New York-based me.u and fashion brands like Swedish street wear label, WeSC (We Are the Superlative Conspiracy). Production for the self-developed earphones is in Shenzhen, with the prime market being the US, as well as entertainment retailing companies in Asia.

Source: C’monde Studios

Source: C’monde Studios

Another good example of Nordic design studios growing their business in Hong Kong is Boris Design Studio, founded in 2009 by two Swedish designers – one of them is a master graduate of the Hong Kong Polytechnic University School of Design. Boris Design Studio has developed a distinctive style of work, blending design, sustainability and technology. It is built on the three pillars of product and packaging design, identity and digital design (strategy behind a product/service via interactive interfaces including branding, interface design, user-experience design) and design trend research (e.g. research on material use and its marriage with production technology).

The Studio has shown its capability for using creative tools and design thinking to push product development forward and to visualise complex and abstract future applications across a number of disciplines. Mobile phones were made easier to use for the elderly and vision impaired with easy-to-recognise buttons, built-in noise-blocking devices and simplified systems or apps. Lampshades were made more space efficient by an elegant folding mechanism, while corporate communications were made more effective, for clients such as Kerry Logistics, in its brochures and annual reports.

Following the success of the Hong Kong office, including winning various awards, such as Hong Kong Lighting Design Competition by the Hong Kong Trade Development Council and the Design for Asia Awards (DFA) by the Hong Kong Design Centre (HKDC), Boris Design Studio has opened an office in Stockholm, where the founders have their roots. With offices in both Hong Kong and Stockholm, the company can make good use of the 6-hour time difference between the two cities to get design work and project implementation moving around the clock.

In its more recent endeavours, Boris Design Studio has collaborated with other design centres and laboratories from San Francisco and Stockholm to visualise what form a potential catalogue for IKEA – the world-renowned Swedish furniture retailer – might take in 2030, when the Internet of Things (IoT) might take over. Although it is only a design fiction and not an official view from IKEA, it is a testimonial to Boris Design Studio’s capability to turn innovative ideas into a trump card to future business success.

Hong Kong, playing to its strengths as a service economy and a fast-growing start-up hub, is proven as an enabler linking ideas, capital, talents, production facilities and markets. Looking ahead, the newly established Innovation and Technology Bureau (ITB) and the Academy of Sciences of Hong Kong, as well as the opening of the Hong Kong office of the Finnish Funding Agency for Innovation, Tekes, on 24 May 2016, for example, will further make Hong Kong a magnet for entrepreneurial, innovative and design-driven Nordic companies.

| Content provided by |

|

Editor's picks

Trending articles

4 Jul 2016

China-Britain Belt and Road Case Studies Report 2016

China-Britain Business Council

The Belt and Road initiative was launched by President Xi Jinping in 2013, with the aim of improving and creating new trading routes, links and business opportunities between China and the rest of the world. Consisting of two main elements, the Belt and Road routes cover over 60 countries across Asia, Europe, the Middle East and Africa.

The ‘Belt’ refers to The Silk Road Economic Belt, which aims to enhance and develop land routes by:

- Building a “Eurasian land bridge” – a logistics chain from China’s east coast all the way to Rotterdam/ Western Europe; and

- Developing a number of economic corridors connecting China with Mongolia and Russia, central Asia and South-East Asia.

The ‘Road’ refers to the 21st Century Maritime Silk Road - a sea route rather than a road (a reference to the old maritime Silk Road) which runs west from China’s east coast to Europe through the South China Sea and the Indian Ocean. The six economic corridors of the Belt and Road are shown on page 16.

The main aims of the Belt and Road initiative include:

- Developing prosperity for underdeveloped parts of China, particularly in the west of the country.

- Developing new opportunities for China to partner and co-operate with various countries along the Belt and Road routes, many of which are developing countries.

- Increased integration, connectivity and economic development along these routes.

It is estimated that the Belt and Road countries account for two-thirds of the world’s population, but only account for one third of the world’s GDP. Infrastructure is key to the economic development of countries along these routes.

Chinese enterprises, already experienced in building China’s modern and ever expanding network of roads, railways, airports and power generation facilities, and supported in their efforts by new financial institutions such as the Silk Road Fund and Asia Infrastructure Investment Bank, stand ready to take advantage of these opportunities.

Entering into unfamiliar, challenging and often risky business and geographical environments is a scenario which plays well to the expertise of UK firms. As this case study report demonstrates, powerful partnerships between British and Chinese companies, playing to their unique strengths, are already shining, tangible examples of cooperation along the Belt and Road.

In this report, you will be able to review 21 case studies, which together demonstrate the farsightedness of Chinese and UK firms, as well as the benefits of working together. HSBC, along with two Chinese banks, has provided debt facilities for a power plant in Bangladesh with the design, consultancy, engineering and construction expertise supplied by major Chinese enterprises; while oil and gas firm BP is providing services and expertise to its long-term partners CNPC and CNOOC on projects in Iraq and Indonesia respectively. UK firm Linklaters has provided legal services to Chinese banks involved in financing a coal mine and associated power station in Pakistan; and KPMG is providing advisory services to a Chinese bank looking to finance projects in Nigeria. Such projects are underlined with pioneering agreements, such as that signed between London Metal Exchange and a number of Chinese institutions in order to establish financial and physical links along the Belt and Road. Finally, Chinese enterprises are also leveraging technologies, know-how and talent accumulated here in the UK to address market opportunities in third countries. The UK connection, as springboard to international business, is providing a win-win for both China and the UK.

As is evident in this report, from Asia to the Middle East, from Africa to Eastern Europe, and in countries across the Belt and Road, UK firms are already cooperating with Chinese firms and helping to turn the Belt and Road vision into reality. By highlighting these cases, it is our intention at CBBC to encourage many more Chinese and UK businesses to follow in their footsteps.

Please click here for the full report.

Editor's picks

Trending articles

7 Jul 2016

One Belt One Road – The Role of Hong Kong

By Houmin Yan (College of Business, City University of Hong Kong)

As a China development policy initiative One Belt One Road is achieving a high profile, and it is no surprise that throughout the region people are pitching to be part of it. The Hong Kong SAR is no exception and in a recent address, Chief Executive CY Leung identified a number of roles for the SAR. Hong Kong, he said, is ideally positioned to be the "super-connector" between the Mainland and the rest of the world. As China's major international financial centre, and one of the world's financial capitals, Hong Kong has the experience, the expertise and the connections to play a role as a major fundraising hub.

Hong Kong is well equipped: The HKSAR is an offshore Renminbi hub, with the world's largest Renminbi liquidity pool, home to the world's busiest air cargo airport, and the world's fourth-busiest container port. Some 20% of the Mainland's international trade is already handled by the SAR. So, according to Leung, its role as a logistics hub will only be enhanced once the OBOR maritime road is in full flow.

Hong Kong is also a rich source of top professionals in a wide range of services, such as accounting, law, construction, engineering and business management. Major financial players such as the Asian Infrastructure Investment Bank, and the US$40 billion Silk Road Fund will be supported by Hong Kong's expertise in international financing and asset management. And the very scope of the OBOR initiative means that innovative financial vehicles will also play a significant role in realising the dream...

Please click here for the full article.

Editor's picks

Trending articles

"Going Out" to Capture Belt and Road Opportunities (Expert Opinion 1): Key to Risk Management

China has investments all over Europe, the Americas and Asia, covering a wide spectrum, including information and communications, biotechnology, energy, automotive, real estate, finance and business services. Chinese enterprises are also increasingly aware that they need to use professional services to deal with different investment risks and ensure that their projects meet the legal requirements in the countries concerned.

However, as China gradually extends its outbound investment to countries along the Belt and Road routes, enterprises "going out" may face higher investment risks because the legal environment leaves something to be desired in some of these countries. Strong professional support is clearly imperative.

Hong Kong legal practitioners are not only familiar with the legal and investment environment in advanced countries but can make use of their extensive international connections to make effective risk assessments for enterprises investing in countries along the Belt and Road. The advice they give on the feasibility of the investment projects should help ensure the sustainable development of the projects.

Understanding the Legal Environment of the Investment Destinations

Many mainland investors have actively sought information on laws and regulations in foreign countries and tried to gauge their impact before "going out" and when drawing up investment plans.

In an HKTDC Research interview, Betty Tam, Partner of the Hong Kong law firm Mayer Brown JSM said: "China's investment in North America is a case in point. Many mainland companies have invested in high-tech industries in North America in recent years and companies like Lenovo, Baidu and the Chinese consortium - Uphill Investment, have carried out mergers and acquisitions (M&A) in the US.

“A typical mainland company would consider a mix of factors when choosing M&A target industries and companies as the basis for assessing the risk and feasibility of the project. These factors include whether the core technology and intellectual property rights of the target company are really what it wants, whether the imported technology can be applied or used to open up the local market, and how to integrate the business after takeover to achieve the purpose of mutual complementarity. Mainland companies must also find out about the preferential investment policies of these countries and whether there are access requirements or other restrictions.

“With these preconditions, mainland companies must seek the help of professionals with proficiency in specific fields of knowledge to carry out due diligence investigations or recommend concrete investment proposals prior to investment and design a transaction structure that suits the legal requirements and restrictive provisions of the place of investment."

As an example, Tam pointed out that certain foreign investment in the US must comply with the provisions of the Foreign Investment and National Security Act. The foreign bidder and US target must both submit information about the proposed deal to the US government through the Committee on Foreign Investment in the US (CFIUS).

Key industries that need to be reviewed by CFIUS include national defence, energy, infrastructure, manufacturing, science and technology, telecommunications, and transportation. If the proposed investment does not conform to these provisions, CFIUS has the right to recommend that the US President block, restructure or even unwind the deal. For example, if the proposed investment involves high-tech areas in the US, a mainland company must formulate strategies in the light of US technology export controls:

US Export Administration Act

Restricts the disclosure and transfer of sensitive technology and technical data to other countries.

Submissions to CFIUS on M&A must indicate whether the target company has exported any commodities under licence.

Even if M&A is not involved, such as granting a non-exclusive licence for thin-film solar technology to a Chinese company, some form of export licence may still be required. Moreover, the US administration currently bans the export to China of any technology relating to supercomputers.

Strategies

Investment in and acquisition of technology and technical data in the US may be seen by the US government as export and therefore need the approval of the US government. Therefore, mainland companies must familiarise themselves with the relevant laws and regulations before contemplating investment and starting due diligence investigations.

When conducting due diligence investigations, it is necessary to investigate and analyse whether the business of the target company is subject to export controls.

Risk Management of Belt and Road Investment Projects

On the other hand, Chinese companies have actively ventured to places like Asia and the Middle East in recent years in the hope of capturing opportunities for relocating production capacity, expanding trade, exploiting resources and purchasing raw materials under China’s Belt and Road initiative.

Tam pointed out in particular that unlike advanced countries in Europe and America, some countries along the Belt and Road are not foreign investment hotspots. Some of them do not have a legal system that is in line with international standards. They lack the necessary legal framework for foreign investment and the government departments concerned may not have any experience in managing foreign investment.

This not only affects the approval of foreign investment projects and the negotiation process but, worse still, may impose restrictions on the investment or demand the reopening of negotiations after investment was materialised when inconsistencies with local conditions are found or if some industries or sectors are affected. This may catch investors off guard and directly affect the sustainability of the investment project.

Tam reminded mainland companies investing in countries along the Belt and Road that they must watch out for additional risks when facing similar institutional problems. They must familiarise themselves with the actual investment climate besides carrying out due diligence investigations on the local laws and regulations as in Europe and America when planning investment in the Belt and Road regions.

When necessary, they must also present relevant government departments in the target country with investment proposals that are in line with international standards and to their partners. In doing so, both sides can have a full appraisal of the whole project in the early stage of planning and fully take into consideration all the relevant clauses so as to negotiate a win-win investment plan and avoid unnecessary future disputes.

For this reason, mainland investors must have international investment experience and local knowledge, or make use of relevant professional services, and formulate strategies suitable for investment in the Belt and Road regions in order to be able to effectively control risks.

Tam said: "Hong Kong legal practitioners know the investment and legal environment of advanced countries well and have service teams with rich international experience who can help mainland companies comply with the requirements of countries in Europe and America for foreign investors. Through their extensive international networks, they can act as team leaders of international projects and lead the professionals of different countries.

“They also have access to experts with local experience who can help conduct due diligence investigations for Belt and Road investment projects and offer customised strategic proposals and feasibility reports that suit the actual situations of different places of investment. Hong Kong's service platform boasts a mix of advantages, such as free movement of funds and a simple and low-rate tax system.

“Together with Hong Kong's efficient business environment, this platform can facilitate investors in setting up companies for special purpose, restructuring their M&A transaction structure for future holding, transfer or alienation of equity or asset in the target company, and help carry out financing and handle cross-border tax arrangements for the projects concerned. It can provide mainland investors with one-stop professional services and assist them in making outbound investment and capturing opportunities arising from the Belt and Road initiative."

| Content provided by |

|