Chinese Mainland

27 May 2016

Going Out - The Global Dream of a Manufacturing Power

By Ernst & Young

2015 was special for Chinese investors. Due to the unrest in the global market, China’s economic growth rate has been slowing. China’s economy grew by 6.9% in 2015, the lowest in the last five years. However, China’s outward FDI grew by 13.3% in 2015, hitting a historical high of USD 139.5 billion. Over the past five years, China’s average annual economic growth has been 7.4%, but its outward FDI CAGR reached as high as 16.9%. Ernst & Young predicts China’s growing outbound investment would become the kErnst & Young driver of future domestic economic growth and acceleration of the globalization. In 2016, the global economic recovery remains uncertain. However, China’s outbound investment was strong in the first quarter of 2016. One of the announced key deals was ChemChina’s acquisition of the Swiss giant Syngenta for more than USD 43 billion, the biggest-ever overseas acquisition by a Chinese enterprise. Ernst & Young expects the imperative need to upgrade, transform and improve Chinese enterprises’ international competitiveness is propelling them to “Go Global”…

With national strategies being carried forward, Chinese enterprises are being presented with new opportunities to expand overseas. However, risks always exist. The economic and geopolitical risks in the target countries and fierce competition in the global market will bring uncertainties to overseas investment. To realize the dream of a global manufacturing power, Chinese enterprises need wisdom and courage, on their way to the globe.

Please click here for the full report.

Other related reports:

Riding the Silk Road: China Sees Outbound Investment Boom

Navigating the Belt and Road: Financial Sector Paves The Way for Infrastructure

Editor's picks

Trending articles

Germany: Duisburg – a New Logistics Alternative for Eurasian Trade

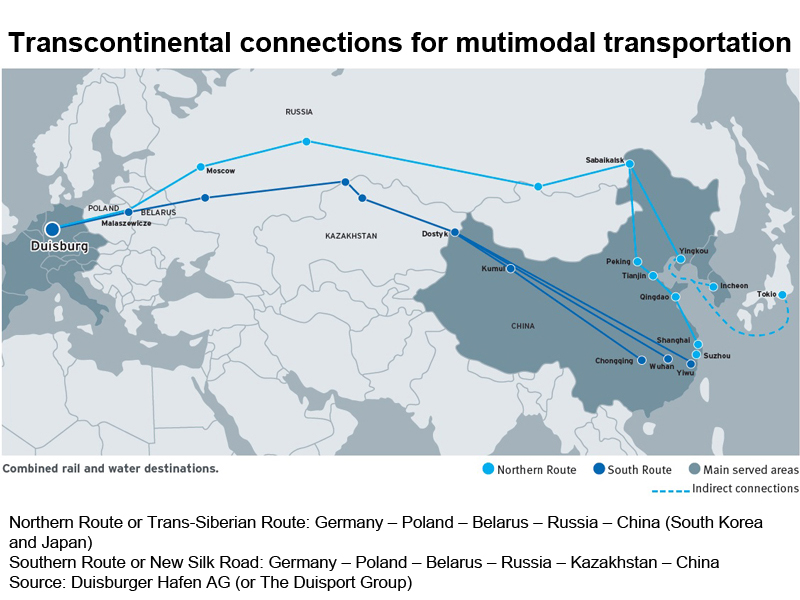

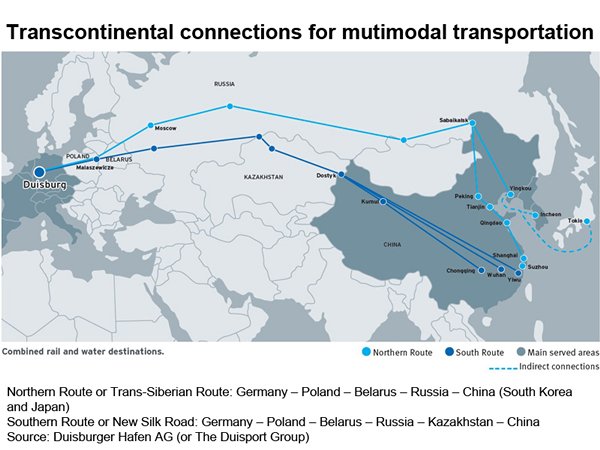

The German city of Duisburg, the world’s largest inland container port, has become a logistics hotspot for Eurasian traders and logistic players thanks to its location. Being at the west end of the Yuxinou Railway, Duisburg links the southwestern Chinese city of Chongqing to Europe.

The continuing expansion of transcontinental connections to other Chinese cities such as Shanghai, Beijing, Wuhan and Yiwu has further enhanced the city’s role in the expected surge in cargo traffic after various Belt and Road Initiative (BRI) strategies and processes are put into place.

A new option for Eurasian trade

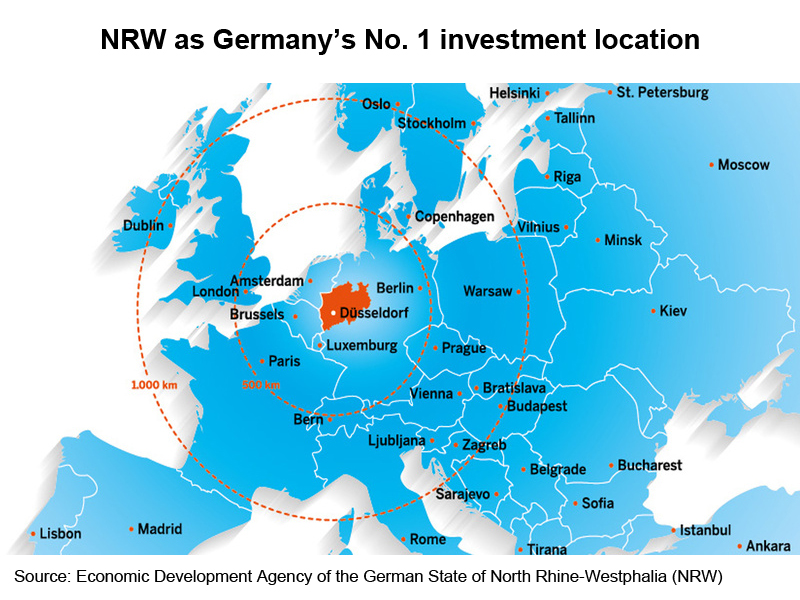

Located in North Rhine-Westphalia (NRW), the most populous and economically important industrial region of Germany’s 16 federal states, Duisburg’s port is near the well-connected Düsseldorf Airport, the largest in the NRW.

The NRW is the most popular destination for foreign companies investing in Germany, responsible for 30% of the country’s total foreign direct investment. It offers not only Europe’s largest consumer market with more than 30 million consumers spending €600 billion between them, but also access to 300,000 companies within a radius of 150 kilometres and a highly developed infrastructure.

The seamless connection to Europe’s No.1 railway junction (more than 360 train connections per week to in excess of 80 destinations – 20,000 journeys annually) and Europe’s most important waterway (the Rhine carries a similar number of ships each year), plus a transport hub for five international motorways or autobahns (A2, A3, A40, A57, A59), it has proven highly conducive to NRW’s international trade and logistics development.

The favourable location plus the state’s extensive network of transcontinental rail, road and short sea shipping options and a high concentration of industries including machinery manufacturing, chemical, petroleum refining, automobile manufacturing and electronics, has made NRW a magnet for some 18,000 international companies such as 3M, BP, Ericsson, Ford, LG Electronics, QVC, Toyota, Vodafone and Chinese enterprises such as Sany (construction machinery) and Huawei (ICT).

Recently, NRW has been named the top “European Region Overall” in fDi Magazine’s latest ranking of “European Cities and Regions of the Future 2016/17”, ahead of Île-de-France, Southeast England and Baden-Württemberg, Germany. Given such a vibrant industrial and investment landscape, NRW is itself a leading sourcing hub in Germany, currently accounting for more than 16% of all Germany-origin exports and over 22% of the country’s total imports.

With the new arrival of 81 Chinese enterprises in 2015, nearly 900 Chinese companies including a number of leading Chinese companies in the growth industries such as solar energy and lighting technology, have chosen to settle in NRW. Thanks to the convenient water and land transportation as well as a high concentration of complementing industries, more than two-thirds of these Chinese enterprises are involved in the trade and sale of products from mechanical engineering and industrial plant sectors, household appliances, ICT, the automotive industry to the healthcare industry and metallurgy, followed by services (15%) such as business consultancies or advertising agencies and manufacturing or research and development activities (around 50 companies).

Another stimulus underpinning the growth between Sino-NRW trade and investment is related to the enhanced rail connection between Duisburg and China. Covering a broad swathe of the Eurasian region, the first direct freight train between Chongqing and Duisburg (Yuxinou Railway) in the summer of 2011 via the so-called New Silk Road or the Eurasia land bridge, has showed strong commitment between the two sides to develop NRW into a crucial industrial and logistics hub for Eurasian trade.

Being a competitive alternative to the existing Eurasian sea-lanes, the 11,000-km Yuxinou Railway has made it possible to ship goods from China by rail to continental Europe in only 11-20 days, compared to 30-45 days by seaborne transport. More frequent direct freight trains via the Eurasia land bridge to a multitude of destinations in China including Wuhan (Hanxinou Railway), Chengdu (Rongxinou Railway) Chongqing (Yuxinou Railway) and Zhengzhou (Zhengxinou Railway) have made railway a more convenient and flexible option for Europe-bound cargo.

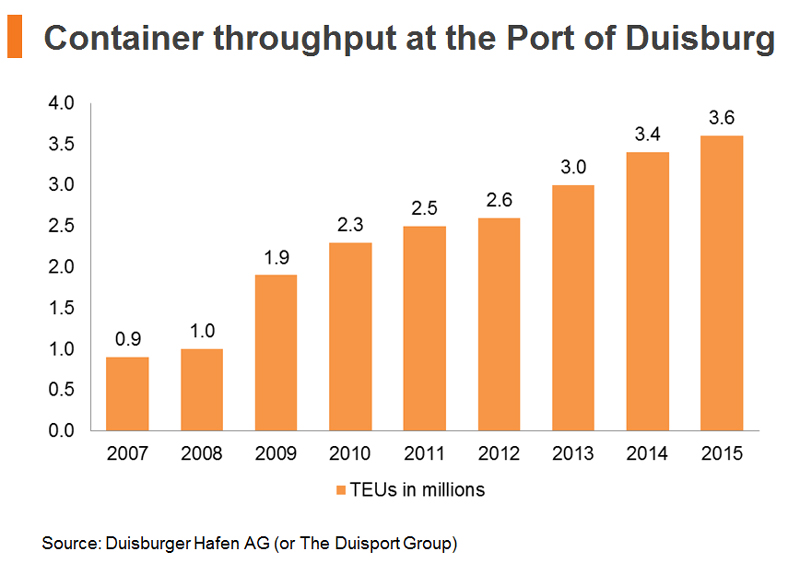

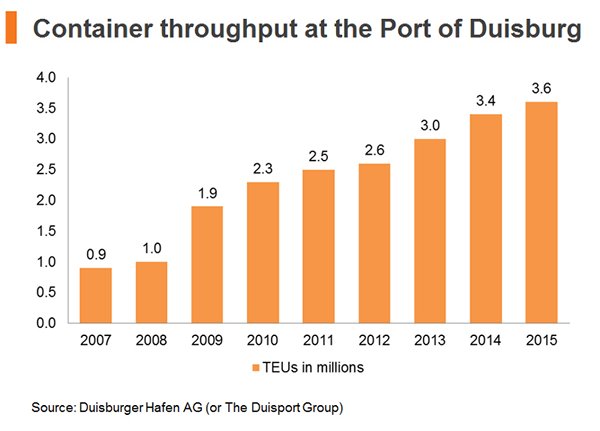

As such an important logistics location in Europe, Duisburg also plays a special role under the BRI, thanks largely to its host of Europe’s leading consolidation hub of containerised cargo. With a total of nine container terminals and 2 million square meters of covered storage space, Duisburg registered another all-time record of 3.6 million Twenty-Foot Equivalent Units (TEUs) (6% year-on-year growth) of containers in 2015, after seeing a 13% expansion to 3.4 million TEUs a year earlier, despite a stagnating logistics market in Europe.

Also of note is the expansion of the cargo traffic passing through Duisburg. The enhanced rail connection has bolstered traders’ interest in not only using rail transport between Asia and Europe, but also using it for a more diversified selection of products. According to Duisburger Hafen AG (or The Duisport Group), the management company and operator of the Port of Duisburg, traders in both Europe and Asia are becoming more open to the new logistics option.

The majority of Duisburg-bound cargo from China is IT, or ICT-related, products including telecoms equipment and associated parts and components, while going the other way most shipments are automobiles, auto parts and machinery. Twice as fast as going by sea and a lot cheaper than air, an increasing number of traders have started to send consumer goods like German food and beverages, infant formulas and other luxury items from Duisburg to China by rail.

As Chinese companies show greater interest in investing and/or developing logistics firms and industrial parks abroad as well as being able to take advantage of ports in countries like Belarus, Kazakhstan and Lithuania along the Belt and Road, Duisburg, thanks to its central location in Europe, will continue to appeal not only to Chinese traders but also other manufacturers and investors as the BRI develops in the coming years.

A new model of investment to combine logistics with manufacturing

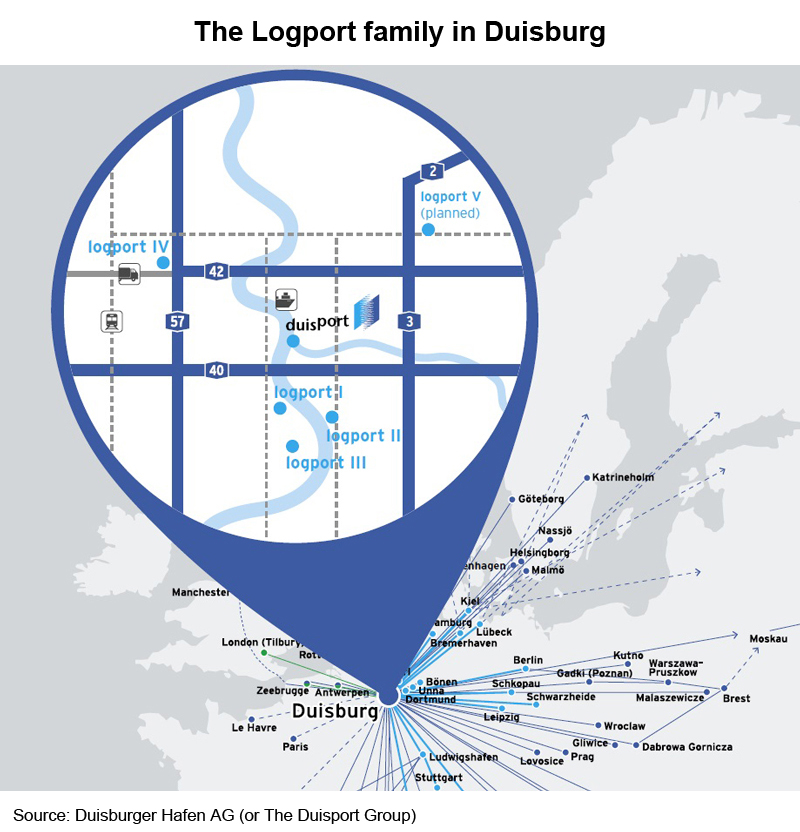

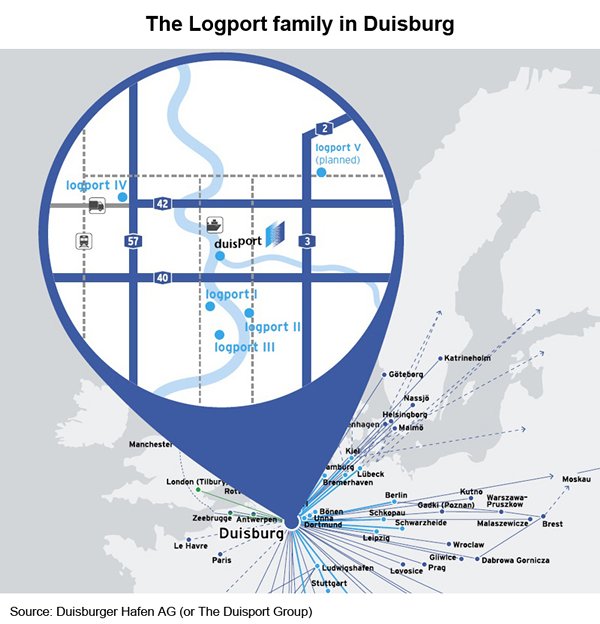

In addition to the strategic advantages of logistics and regional distribution in Europe, Duisburg offers new investment by combining logistics operations with manufacturing. Since 1998, under the Logport brand, the Duisport Group has begun the development and marketing of the 2,650,000 square meters former Krupp smelting works (Logport I) in Duisburg on the left bank of the Rhine.

By converting the disused and badly polluted industrial areas (a former steel plant, inoperative since 1994) in the Ruhr – Germany’s leading industrial centre – into a modern logistics centre for high-quality cargo and international service providers, Logport I is home to around 50 companies including such market leaders as Kühne + Nagel, DB Schenker, DHL and NYK/Yusen Logistics and European distribution centres for companies like Danone Waters, Hewlett Packard, Johnson & Johnson and Siemens.

Source: Duisburger Hafen AG (or The Duisport Group)

Source: Duisburger Hafen AG (or The Duisport Group)

In developing areas around the port of Duisburg such as Logport II, III, IV and V (planned), more international companies are investing in new facilities there. For instance, the world’s largest CKD logistics centre of Audi AG has been operating in Logport II since August 2013, while Nanjing High Accurate Drive Equipment Manufacturing Group (NGC [1]), a global player in the transmission and drive technology industry, just became the first Chinese company to settle its European headquarters in the Port of Duisburg in March 2015, followed by a 1,000 square meters factory.

Many German and international companies have shown their interest in putting their European head offices or distribution centres in or near Duisburg to allow their continental customers not only more direct access to sales and distribution, but also manufacturing and other services related to design, procurement, inspection, maintenance and after-sale support. Many believe the proximity to importers and distributors in Europe and ready inventory supplies and product know-how made possible by their presence in Duisburg allows them to deal with their European counterparts and respond more rapidly to market ups and downs.

This new model of investment (a combination of logistics and manufacturing activities) available in Duisburg is expected to draw more attention from Chinese enterprises, which are looking for new operating bases to expand their production and distribution in Europe under China's “Going Out” policy and the umbrella of the BRI, which aims to promote regional economic cooperation.

Taking advantage of Hong Kong’s role as a “superconnector” ready to deliver game-changing solutions for the 60plus countries along the Belt and Road, the formal launch of Cathay Pacific Airways’ direct passenger flights between Hong Kong and Düsseldorf since September 2015 has allowed easier business exchanges in tandem with the growing transcontinental economic ties between Europe and Asia.

Complementing this new air route are Hong Kong-based Hutchison Port Holdings’ DeCeTe Duisburger Container Terminal in Duisburg, which is well connected by rail and barge with such deep-sea terminals as Rotterdam (the Netherlands), Antwerp (Belgium), Tilbury (UK) and Goole (UK) and Orient Overseas Container Line’s office in Düsseldorf, which is ready to connect Hong Kong traders with Germany and other parts of Europe.

Air and sea transport aside, the opening of the international development office of KTZ Express (a wholly owned subsidiary of Kazakhstan Railways) in Hong Kong in June 2014 to promote multimodal freight logistics between Europe and China via Kazakhstan has made Hong Kong relevant to the promotion, operation and integration of the new rail alternatives – Yuxinou Railway and other international freight rail routes such as the ones linking Wuhan to Mělník and Pardubice in the Czech Republic, Chengdu to Lodz in Poland and Zhengzhou to Hamburg in Germany – for Eurasian trade in global supply chain management.

[1] Founded in 1969, NGC was listed on the Hong Kong stock exchange in 2007 under the name “China Transmission”.

| Content provided by |

|

Editor's picks

Trending articles

30 May 2016

Strengths and Challenges of China’s “One belt, One road” Initiative

Written by Irina Ionela Pop, Centre for Geopolitics & Security in Realism Studies (CGSRS)

China’s “One Belt, One Road” (OBOR) initiative, formally presented on 28 March 2015, is not just another “new Silk Road project”. Rather it is a consistent and ambitious Eurasian strategy of an emergent power. The OBOR initiative is based on existing and planned linkages from various regions of China towards the outside world. Supported by large financial contributions, it seems to be better articulated than other similar projects. Therefore, this paper aims to present the strengths and implementation challenges of China’s OBOR initiative. We took into account several levels on analysis: national, regional and international. In this sense, we focused on domestic constraints, tensions in China's neighbourhood, and great power rivalries. Finally, we tried to offer several suggestions regarding the improvement of China’s initiative. The suggestions concern the initiative’s planning and implementation, the means to improve its bilateral relations with neighbours and great powers, in order to be perceived as a responsible power on the international arena.

Please click here for the full report.

Editor's picks

Trending articles

2 Jun 2016

President Xi Jinping's “Belt and Road” Initiative - A Practical Assessment of the Chinese Communist Party’s Roadmap for China’s Global Resurgence

Written by Christopher K. Johnson, Senior Adviser and Freeman Chair in China Studies, CSIS

In the fall of 2013, Chinese President Xi Jinping put forward the strategic framework of building the “Silk Road Economic Belt” and a counterpart “21st Century Maritime Silk Road”, collectively referred to in abbreviated form in Chinese parlance as the “One Belt, One Road” (OBOR) initiative. …

As such, the new U.S. administration that takes office in January 2017 would be well served in thinking about new approaches to interact with and manage a process that, if President Xi gets his way, will be a force to be reckoned with for the next decade and beyond.

This report was firstly published by CSIS in March 2016.

Please click here for the full report.

Editor's picks

Trending articles

6 Jun 2016

One Belt, One Road, One Singapore – Analysis

By Eurasia Review

In 2015, Singapore exported US$61.3 million worth of goods and services to Central Asia, while importing US$6.1 million, representing 0.015 percent of Singapore’s total exports and 0.002 percent of total imports; and 0.07 percent of Central Asia’s total exports and 0.009 percent of total imports. While Singapore is a global trading and investment powerhouse, business experience and exposure in Central Asia has never been strong. In 2014, only 32 enterprises in Uzbekistan operated with Singaporean capital, and Singapore contributed only US$50 million of direct investment to Kazakhstan over the last ten years in contrast to US$604 billion of total foreign direct investment in 2014 alone. Central Asia is not directly connected to Singapore, and land routes to ports in the region are scant. However, as the One Road-One Belt Initiative links Central Asia to China’s eastern seaboard, Gwadar port and even the impending sanction-free Iran; inter-regional trade is awash with new connections and opportunities.

Please click here for the full article.

Editor's picks

Trending articles

Germany: Frankfurt – an ODI Hub for China

The German city of Frankfurt is the biggest financial services centre in continental Europe. Situated on the banks of the River Main, the city is styling itself as “Mainhattan”, given the presence of a large number of financial industry heavyweights, including the European Central Bank (ECB) and the German Central Bank (Deutsche Bundesbank), which are both headquartered there. This most international of German cities, it is also becoming a focus for the development of the pioneering financial technology (FinTech) industry. Thanks also to Frankfurt’s highly efficient multimodal (sea-air-road/rail) transport system and the city’s emergence as Europe’s first renminbi payment hub, many Chinese companies have taken advantage of its ready access to the European consumer and capital markets, making it a natural outbound direct investment (ODI) hub for Chinese companies interested in conducting business in the European Union (EU).

Frankfurt as a financial centre in continental Europe

Frankfurt has long been Germany’s financial capital and, more recently, continental Europe’s biggest financial services hub. The city is not only home to the German and European central banks but also to major pillars of the European system of financial market supervision, such as the European Systemic Risk Board (ESRB), the European Insurance and Occupational Pensions Authority (EIOPA), and the European Banking Federation. Germany’s largest banks – Deutsche Bank and Commerzbank – are based there, as is the German Stock Exchange Group, Deutsche Börse AG – the operator of the Frankfurt Stock Exchange (Börse Frankfurt), which generates about 90% of the country’s total stock market turnover. China's five largest banks – Bank of China, Industrial and Commercial Bank of China, China Construction Bank, Bank of Communications, and Agricultural Bank of China, also have a significant presence there.

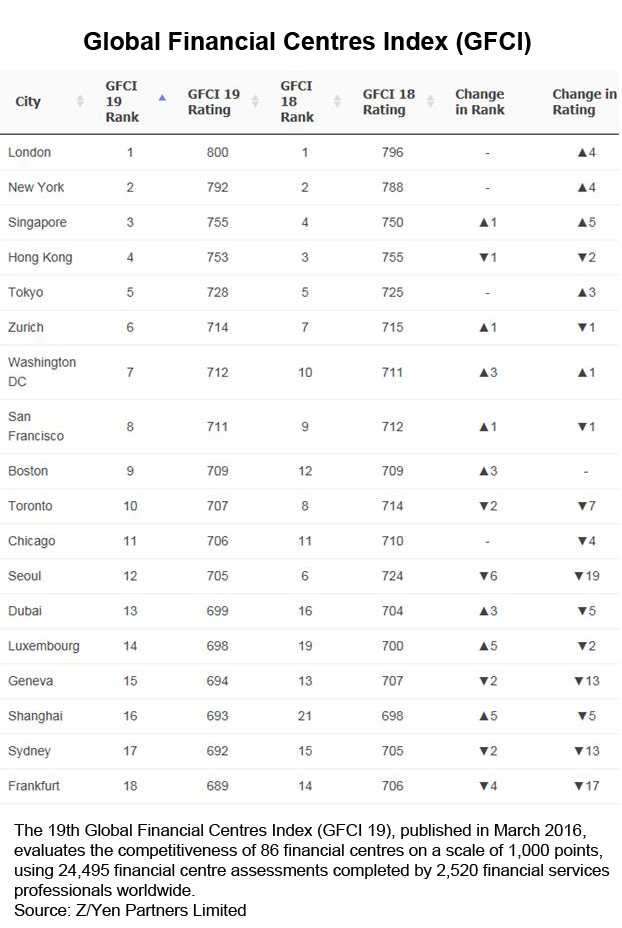

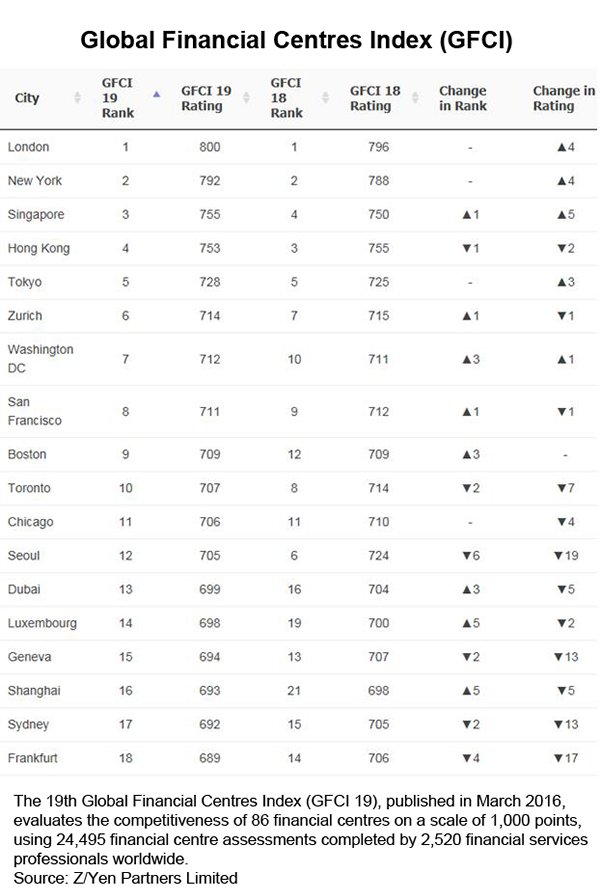

A proposed merger between Deutsche Börse AG and the London Stock Exchange (LSE) would make LSE-Deutsche Börse the world’s biggest stock exchange operator by revenue and the second-largest by market value, trailing only the Chicago Mercantile Exchange (CME) Group. The new company would be jointly headquartered in Frankfurt and London. The merger would also reinforce and enhance Frankfurt’s standing as a financial centre, following a decade in which its competitiveness has been in decline. Tracked by the Global Financial Centres Index (GFCI), Frankfurt was ranked sixth in terms of competitiveness – behind only London (first) and Zurich (fifth) in Europe – when the index was first published in 2007, but 18th – behind London (first), Zurich (sixth), Luxembourg (14th) and Geneva (15th) in Europe – in 2016.

Frankfurt as a darling to Chinese investors

Another unrivalled advantage Frankfurt has as a financial centre is the close link between the financial sector and the real economy. As one of Germany’s advanced manufacturing bases, 9% of all German products are made in the Frankfurt Rhine-Main (FRM) region, which also hosts one of the largest state-of-the-art insulin manufacturing plants in the world, operated by Sanofi.

The region’s all-rounded multimodal connectivity includes Europe’s busiest cargo airport, which handled more than two million tonnes of cargo last year, eight inland cargo ports providing access to important waterways, and the Frankfurter Kreuz – the most heavily used road interchange in the centre of the European highway system. Furthermore, the purchasing power of Frankfurt’s inhabitants, which is 15% above the national average, engenders a strong customer base for Chinese manufacturers and has helped to make Frankfurt a darling for many export-oriented foreign companies.

Since 2005, when the German-Chinese bilateral investment protection agreement came into force, Chinese investment in Germany has risen steadily, from €235 million to €1.2 billion in 2013. Nowadays, some 900 Chinese companies are active in Germany, focusing on sectors such as mechanical engineering, electronics, consumer goods and information and communication technology (ICT).

Frankfurt is the largest city in the German federal state of Hesse. The state is the biggest recipient of Chinese investment, accounting for 60% of the country’s total, and boasts a lively Chinese business community consisting of about 600 companies, including China Telecom, Huawei Technologies, ZTE, TP-Link, KONKA, Midea, Haier, Qube Hotel, Yunda, Hongfa, Kingfa, Air China, China Eastern Airlines & Shanghai Airlines, China Southern Airlines, Sinopec and many SMEs.

To help facilitate the growth in Chinese interests in the region and to support their needs regarding trade and investment in continental Europe, Frankfurt has become the first renminbi (RMB) offshore clearing hub on the continent. Since November 2014, it has been possible to clear and settle payments denominated in RMB directly with the Chinese mainland, Hong Kong and other offshore RMB centres via the Frankfurt branch of the Bank of China (BOC), the clearing bank chosen by the People’s Bank of China (PBoC). As an integral part of the PBoC’s long-term strategy of RMB internationalisation, the strengthening of the RMB offshore market can give international and Chinese mainland traders and investors a more viable option of paying their counterparts in RMB in an efficient and convenient way with lower transaction costs.

With respect to the desire to gain access to the German and European capital markets, more than 30 Chinese companies, including China Specialty Glass AG (specialty glass manufacturing), Ming Le Sports AG (sportswear manufacturing), Ultrasonic AG (footwear manufacturing), United Power Technology AG (engine-driven power equipment manufacturing), Youbisheng Green Paper AG (environment-friendly linenboard manufacturing) and Zhongde Waste Technology (energy from waste technology) have so far listed on the Frankfurt Stock Exchange (Börse Frankfurt).

Last year, 24 companies listed on the Frankfurt Stock Exchange, raising a total of €7 billion (US$7.8 billion). Also in 2015, the Chinese rating agency Dagong Global Credit moved its European headquarters to Frankfurt from Milan after seeing an urgent need for an innovative credit rating system to support the evolving investment trends such as initial public offerings (IPOs) and mergers and acquisitions (M&As) by companies ranging from state-owned enterprises to small, private Chinese entities.

Frankfurt as a FinTech promoter

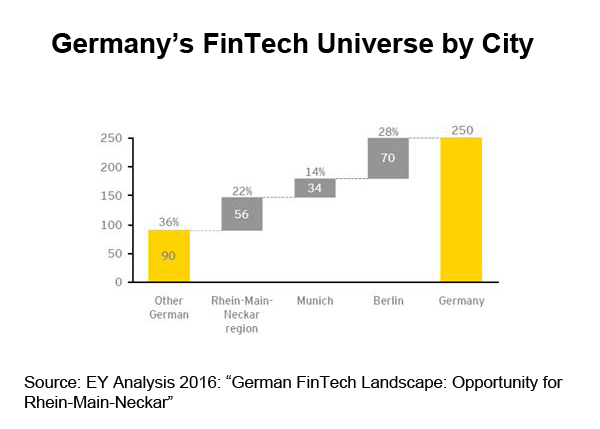

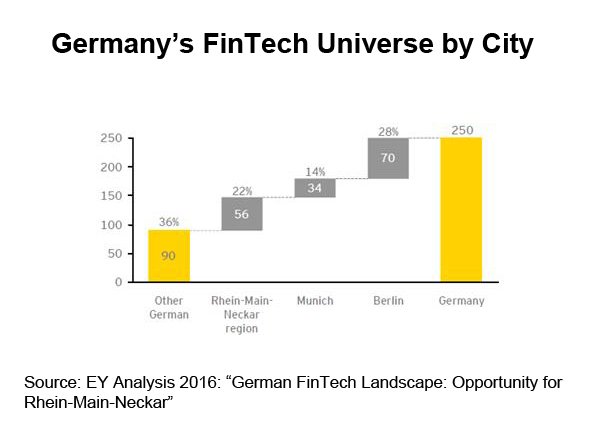

To stay competitive and ahead of the dynamic financial industry development, Frankfurt – riding on its proximity to institutional support and a vibrant industrial base – has been quick to respond to the increasingly popular trend for FinTech start-ups and investment. Home to 56 out of 250 German FinTech start-ups in 2015 (a 22% increase from 46 in 2014), the greater Frankfurt area – or the Rhein-Main-Neckar region – is the second most important FinTech hub in Germany, behind Berlin.

Frankfurt was generally not known in the past for its innovation, especially when compared to other German cities such as Berlin. But the state and federal governments have been lobbying for a fair share of the latest FinTech developments to stay and grow in Frankfurt.

As a step to bolster the FinTech scene, Frankfurt Main Finance – the marketing organisation of the Frankfurt financial centre – has set up Dialogforum FinTech, in which 44 interested parties exchange ideas and coordinate their activities in fields such as services for FinTech start-ups, financing, marketing, regulation, international partnerships, research and academics, networking and the establishment of a strong FinTech hub in Frankfurt.

Following Deutsche Börse’s €65-million takeover of 360T AG, a foreign exchange trading platform, in 2015, it has provided fully equipped premises in Frankfurt and on-site support from its Venture Network to help FinTech start-ups develop their business concepts and companies. In addition to such indispensable infrastructure, Deutsche Börse’s new initiative offers young FinTech companies an attractive environment in which to stay close to established financial institutions and market regulators. This is expected to strengthen Frankfurt’s unique role in promoting and expanding knowledge about risk management and regulations such as compliance management under Europe’s big but disintegrated regulatory financial environment, making the city a ready laboratory for many types of FinTechs, especially RegulationTechs.

How Hong Kong can play a role?

Possessing definite advantages and extensive experience in helping Chinese mainland enterprises make overseas investments, Hong Kong can play a pivotal role in the expected surge in Sino-European trade and China’s ODI to Europe under various development visions, including China’s Belt and Road Initiative (BRI) and Germany’s Industrie 4.0, which aims to integrate advanced network and information technology with its industrial production system to further enhance the country’s industrial efficiency.

With about 60% of Chinese outbound direct investment being directed to, or channelled through, Hong Kong, the city, as a regional financial centre in Asia, will continue to be the bridgehead for mainland Chinese enterprises exploring “going out” in innovative ways by investing in greenfield schemes and joint investment projects such as smart cities/factories embedded with digital processes using the Internet of Things (IoT) and Big Data, or conducting M&As. Hong Kong is ideally placed to help German enterprises and technology owners look for investment partners from Asia.

On the back of Hong Kong’s robust protection of intellectual property rights (IPRs) and full range of professional services, the city is an ideal platform to facilitate technology transfer to mainland China from Germany. With respect to the “new” environmental protection and urbanisation development directions stipulated in China’s 13th Five-Year Plan, for instance, Hong Kong’s environmental protection and urban planning and management companies can be ready cooperation partners for related Chinese players who are interested in undertaking technology investment in Germany in order to gain access to advanced German technology and expertise.

Investment opportunities linked to the Belt and Road Initiative include cooperation in logistics along and beyond the Eurasian landbridge, maritime finance (to which KfW Development Bank and Deutche Bank are leading the way in Germany) and infrastructure bidding, management and financing – highly sought-after in Germany by private insurance companies looking for more lucrative investment opportunities in the low interest rate environment across the eurozone.

With respect to the vibrant FinTech development in Germany, although Hong Kong is yet to evolve into the most attractive destination for greenfield FinTech projects, it can serve as a risk manager, assisting German FinTech companies in screening prospective investors from the Chinese mainland and other parts of Asia. This is particularly useful when German companies encounter problems with their potential mainland Chinese investors, and when it comes to advising on such highly sought-after resources as government incentives and incubation schemes, accelerators, angels and venture capitalists, which are commonplace in Hong Kong [1] but less so in Europe.

By representing German start-ups and helping them find partners in Hong Kong and the Chinese mainland, connecting them with relevant financial sector regulators and guiding them through setting up procedures such as office rental, incentive application and contract signing (e.g., the inclusion of the arbitration clauses stipulated by the home-grown Hong Kong International Arbitration Centre), Hong Kong’s financial services companies can be ideal facilitators of Sino-German FinTech collaboration.

[1] Startmeup.hk is a one-stop portal to the start-up community in Hong Kong, listing the latest start-up events and various resources including government incentive and incubation schemes, accelerators, angels and venture capitalists.

| Content provided by |

|

Editor's picks

Trending articles

8 Jun 2016

“Two Sessions” Lifting the Curtains of “13th Five-year” Plan

By CGCC Vision

Spring is not only the best time to make a year’s planning, it is also when the “Two Sessions” were held. The development of China raises concerns worldwide. The annual sessions are now an important window for the world to get a glimpse into China. This year, they also symbolize the beginning of the “13th Five-year” Plan. Taking a good look into its contents could help Hong Kong companies gain an early advantage.

Dou Shuhua: consensus favorable to the construction of a moderately prosperous society

Deputy Secretary-General of the NPC Standing Committee Dou Shuhua praises the recently concluded sessions highly, citing that they have made good preparation for the work of 2016, which would help bring the wisdom and strength of the people together.

Outstanding accomplishments achieved

Dou pointed out two main influences that the sessions have on the country and the public. First of all, they established common objectives for the country and promote democratic ideas. Secondly, they are the window to China’s image and help foreign countries gain a comprehensive understanding about China.

First Charity Law demonstrates significance

Dou also talked about the Charity Law, which he considered an important law to drive the development of the charity sector in China. It connects the country’s charitable and poverty alleviation work, and goes deep into helping the poor through charitable efforts. Considering the actual needs of China and benchmarking global experiences, the Charity Law is the first law to govern China’s charity sector and is extremely important to its mechanism and system. Last but not least, the Law also provides reliable legal protection to the development of China’s charitable industry.

Chang Rongjun: CPPCC must actively offer strategic advice and participate in policy discussion

Deputy Secretary-General of CPPCC Chang Rongjun stressed that since the government has been valuing highly of CPPCC members’ opinions, and committee members have confidence on the government’s work, all members have shown much enthusiasm in policy discussion during the sessions.

Quality, constructive proposals

Chang thought that China’s confidence in economic development has come from a comprehensive reform and efforts from every direction have to be converged. He praised the rather high quality of proposals put forward during the current “Two Sessions”.

Resolving responsibility issues from their roots

Regarding how CPPCC should play its role in putting strategic advices forward and in policy discussion, as well as how members perform their duties actively, Chang reckoned that relevant issues must be resolved from their roots, which is why he suggested the tactic called “1420”.

Hong Kong and Macau must grasp the opportunities

Chang quoted the comments of some Hong Kong and Macau committee members, who said the “13th Five-year” Plan has offered invaluable opportunities for the future development of the two locations. Hong Kong and Macau must put their own competitive edges to full play and actively take part in the “13th Five-year” Plan and the implementation of “One Belt and One Road” initiative, playing the role of “super connector” between the Mainland and the international markets.

Lastly, he commented the sessions must act as a bridge and help achieve consensus among divergences. He also quoted Yu Zhengsheng, Chairman of CPPCC, pointing out that the community of CPPCC members should actively participate in the realization of a moderately prosperous society, doing its best to demonstrate to the public that members always put the public first and are right next to them.

Liu Shijin: reforming supply side; focusing on reducing production capacity

Many people are keen to know which direction the future of the Chinese economy would go under the “13th Five-year” Plan. Former Deputy Director of State Council Development Research Center Liu Shijin believed that China’s economy is still facing rather strong downward pressure at the moment.

The research of Liu shows that, after a long period of economic growth, when the per capita GDP reaches 11,000 international dollars, slowdown in economic growth happens without exception. As such, he deduced that China would also follow the trend and turned from high-speed growth to medium-speed growth around 2013. The deduction has now become the “new constant”.

Unsynchronized supply and demand resulted in over-capacity

So when will the pace of economic growth hit its rock bottom? Liu thought that from the demand side, the Chinese economy is basically stable, and a more accurate estimation is the second half of this year till the first half of the next. On the supply side, export and real estate are both recording negative growth, but industries such as construction materials, steel and petrochemicals are not slowing down as quickly, resulting in serious over-capacity.

Liu commented that the solution is to eliminate over-capacity, so that both the PPI and the corresponding profit can bounce back. China will only be able to align its supply and demand, allowing both to reach their lowest point, by achieving so.

Efficiency enhancement most critical

The core to the reform on the supply side is to increase efficiency. Liu pointed out that there is a lack of market-oriented adjustment mechanism in the Mainland. As such, an environment favorable for competition should be created for the market to regulate and to lower prices on its own.

He also suggested that the Mainland should speed up industrial transformation and upgrading; it should also reduce and eliminate different kinds of economic bubbles. He thought that an innovative environment should be nurtured based on a respect on the laws of innovation. The government should not interfere too much, but it must work hard to protect property rights, in particular intellectual property rights.

Growth trend to appear as “big L and small W” after all time low

Liu believed that it would be more likely for the growth trend to take the shape of an “L” after hitting the rock bottom. In other words, the pace of growth will stop going down. However, some smaller fluctuations will take place during this time, which will form a new growth platform in the shape of a big L with small Ws. He estimated that the situation would last for 10 years or longer. Liu stressed that “the reform on the supply side would be a long-term battle. Changes must be made in state-owned businesses, land, tax, finance, social security and government functions in order to obtain actual progress and to lay a strong foundation for quality, effective, undiluted and sustainable growth.”

Wang Tongsan: distinguished progress with emerging conflicts

Academician of Chinese Academy of Social Sciences Wang Tongsan analyzed this year’s Government Work Report and said that the Mainland had achieved the goals set out in the “12th Five-year” Plan in multiple aspects. Yet, there are a number of threats as the country made progress.

Development milestones of the “12th Five-year” Plan

According to Wang, China’s GDP is now twice as much as that of Japan’s and standing strong as the world’s second largest economy. He estimated that China will surpass the US and becomes the world’s number one within 10 years’ time.

Wang pointed out that the “12th Five-year” Plan made significant progress in structural adjustment. The service industry is now the biggest sector in China, while consumer spending is a major drive to support economic growth. The urbanization rate in China is now over 50%, with evident improvement in people’s standard of living.

Decelerating growth

But he pointed out directly that a number of domestic and external issues are gradually surfacing. At present, the global economy is recovering weakly. Wang estimated that the global economic growth of 2015 would not exceed 3%. Growth in international trade is just as lackluster, which poses a great impact to China. Diverging monetary policies among advanced economies have also added many external uncertainties for the country.

At home, Wang saw downward pressure for the economy. The quarter-on-quarter growth for GDP over the past four quarters has been continuously slowing down. Growth in investment was also weak during the past year. Wang was also concerned about the drop in import and export trade volume saying that “Whether it was calculated in RMB or USD, the total volume in both import and export in the Mainland dropped last year.”

Certain companies facing difficulties

Another domestic issue is the diverging trends in the regions and sectors. Wang said that there are obvious differences in the growth of regional GDP. Growth in fixed asset investment in different areas also saw evident variances. New and high-technology industries are growing stronger in the Mainland and they also yield higher profit. Resource industries such as coals and steel, etc. have shown clear profit decline.

The operational difficulties of companies are also reflected on the total profit of state-owned businesses, which fell 6.7% year-on-year in 2015. Compared to the 5.6% decline among central state-owned enterprises, regional ones recorded bigger drops. Wang explained that, economic slowdown led to decelerated growth in the salary guidelines of various locations.

Conflict in fiscal balance

He also pointed out that the National General Public Budget income of last year was 15.2217 trillion dollars, while the expenditure was 17.5768 trillion; the lever effect resulted in a contradicting fiscal balance.

Wang saw risks and threats in the Mainland’s financial industry. He said, “Fluctuations in the stock and foreign exchange market are quite obvious. Property prices are also polarized between first-tier cities and other cities, in particular, third and fourth-tier cities. Property prices of first-tier cities are increasing quickly, but third and fourth-tier ones find it rather difficult to destock.” Last year, foreign reserves dropped 13%, that is a few hundreds of billions of US dollars less. The amount shrank more than US$ 100 billion within one month in February alone and that reflects instability.

Lau Siu-kai: Hong Kong’s participation in “One Belt and One Road” an irresistible trend

Vice-President of the Chinese Association of Hong Kong & Macao Studies Lau Siu-kai analyzed the importance of “One Belt and One Road” for Hong Kong. He reckoned that “in the long run, it will be related to the pace, method and direction of Hong Kong’s development in the future; it also connects to Hong Kong’s position, role and function at the national and the international levels.”

Lau pointed out that “One Belt and One Road” is on one hand an active and positive response made by the country to address the changes in the international setting and its own development needs; and on the other, a move to change the prevalent international setting. If it turns out to be successful, significant changes will happen in the international setting and global relations. Under such circumstances, the global importance of Asia will be lifted, and China will become Asia’s most influential country. He also described “One Belt and One Road” as a “westward strategy” that China puts forward in response to the “Rebalancing toward Asia’’ strategy of the US, aiming to further expand and widen strategic space for China.

Hong Kong will rely less on Western economies

Lau analyzed that, if “One Belt and One Road” is successful, Asia will become the center of gravity of the global economy and the locomotive for economic growth. Much of Hong Kong’s progress will come from Asia, in particular, eastern Asia and Southeast Asia. As a result, Hong Kong’s reliance on Western economies will constantly reduce.

Lau added that, with the European-Asian- African free trade zone made possible by “One Belt and One Road”, Hong Kong will gain more new development opportunities, service targets, job opportunities, and more importantly, international position or role. These will help strengthen and develop “one country, two systems”, and will be favorable to tighten the relationship between Hong Kong people and Mainland Chinese.

Hong Kong people should adjust their mindsets according to changes

According to Lau, “Hong Kong people must understand that big changes are taking place in the mainland environment and international setting, and that keeping the existing status is impossible. The past attitude that put little emphasis on Asia and the tendency to over-rely on the West have to be appropriately adjusted and balanced.” He stressed that while “One Belt and One Road” would have limited influence and impact on Hong Kong in the short run, it has long-term connection to whether Hong Kong can continue to develop prosperously, its value to the country, as well as its international standing.

As for the challenges faced by Hong Kong in taking part in the “One Belt and One Road” initiative, Lau reckoned that while “opposing powers’’ and “nativists” have raised their doubts and are setting up hurdles, we must understand that shutting our doors and exclusivism do no good to Hong Kong; they also go against the greater global trend. He suggested that the SAR government and all sectors of the society should work on explaining to the people of Hong Kong about the significance of “one country, two systems” for our territory, as well as to overcome the hindrance created by opponents.

This article was firstly published in the magazine CGCC Vision 2016 May issue. Please click here to view the full article.

(Remark: This is a free translation. For the exact meaning of the article, please refer to the Chinese version.)

Editor's picks

Trending articles

10 Jun 2016

Back to the Future: China’s ‘One Belt, One Road’ Initiative

By Vassilis Ntousas, International Relations Policy Advisor at the Foundation for European Progressive Studies

Since its introduction in the fall of 2013, China’s ‘One Belt, One Road’ initiative has been the centre of a plethora of in-depth analyses and policy announcements. Heralded by many as a centrepiece of President Xi Jinping’s foreign policy and domestic economic strategy, this grandiose initiative has certainly captured the attention of many policy-makers, analysts and commentators, marking a significant milestone in the country’s trajectory of engagement in the international milieu. Whether China’s grand design for its new trade routes will ultimately become a game-changer remains to be seen, yet its ‘back-to-the-future’ approach contained in its OBOR policy presents many potential benefits for Beijing, despite the evident risks. …

China’s (potential for a) game changer

Highly ambitious in its goals and Herculean in its proportions, the OBOR initiative has been characterised as the ‘most significant and far-reaching initiative that China has ever put forward’. If played correctly by China, the initiative has the potential of being much more than its individual parts, elevating China both economically but also politically. For Beijing, OBOR’s added value could be multi-faceted, ranging from creating new markets through economic penetration, widening the trading and commercial horizons to export Chinese surpluses, improving the innovation and competitiveness of Chinese industries, whilst providing the necessary impetus, vision, and know-how for a more coherent regional policy aimed at alleviating internal inequalities amongst provinces and for a more active and better-founded foreign policy that will promote the Chinese interests in a more reliable and efficient manner.

Inherent in the project’s vision and scope, both in its continental and its maritime component, one can also trace the many obstacles that exist and that will largely decide the project’s future success. Although the initiative is still in its early stages, critics point to the its sheer size and ambition as the source of many vexing challenges: from the incredibly varied political, economic, legal and regulatory framework within which OBOR will have to function, to the political uneasiness, if not antipathy, it could create in many areas along its routes. Regardless of the levels of financial firepower that will be employed, building a network of Sino-centric trading routes along a milieu of great diversity and even greater risks will lead China to engage more actively with regional affairs. If the initiative succeeds, whether it is the intention of Beijing or not, this will create both an opening and an additional layer of risk: China’s rise, not least in the economic sphere, will embolden the country’s position internationally, yet, as the eyes of the world focus more on China, there will be a greater degree of scrutiny regarding its praxis in the region. Whether China’s Grand Design for its new trade routes will ultimately become a game-changer remains an open question, yet its ‘back-to-the-future’ approach contained in its OBOR policy presents many potential benefits for Beijing, despite the evident risks.

Please click here for the full article.

Editor's picks

Trending articles

14 Jun 2016

“One Belt, One Road”: An Economic Roadmap

By The Economist Corporate Network

The Silk Road Economic Belt and 21st Century Maritime Silk Road - better known by its popular shorthand terms of One Belt, One Road (OBOR) and the Belt-Road initiative - has become one of the most discussed topics about China’s evolving role in the global economy today. The Economist Corporate Network has produced "One Belt, One Road": an economic roadmap to add clarity to the discussion and stimulate more informed consideration about the implications of OBOR. To that end, this report explores seven key regional spheres covered by the Belt-Road initiative: Africa, Central Asia, Eastern Europe, the Middle East, Russia, South Asia and South-east Asia.

As Belt-Road projects heavily emphasise infrastructure development, the regional mapping lists out infrastructure project pipelines. These lists do not aim to provide a complete accounting of projects but rather a varied sampling to show the types of development activities that characterise a region. For the sake of transparent, readily verifiable data, the lists draw from publicly accessible sources such as the World Bank, InfraPPP and CG/LA Infrastructure’s Strategic 100: 2016 Global Infrastructure Report. The information is current as of February-March 2016. The regional analysis sections also give overviews of the infrastructure needs of a region’s constituent countries. The analysis further delves into examining the progress, results and the wider ramifications of prominent OBOR projects.

Please click here to view the full report.

Editor's picks

Trending articles

17 Jun 2016

Belt and Road Initiative Infrastructure Projects: Implementation Principles and Practices

By Joseph W. Ferrigno III, Managing Partner, AMCG Partners

Summary

A. The Belt and Road Initiative (“BnR”) is a comprehensive vision for the development of China and other countries during the 21st Century initiated by China in 2013. The Asian Development Bank has estimated that Asia needs an average US$730 billion a year in infrastructure investment until 2020, including only some of the identified BnR related projects. According to the Peterson Institute for International Economics, “…investment in the Belt and Road is expected to reach $4 trillion”.

B. Asia’s overall national infrastructure investment need is estimated to be US$8 trillion over 2010-20. BnR is attractive to governments and the private sector because of the significant potential economic and political benefits if BnR projects are successfully implemented.

C. Requirements for capital, risk absorption and management capabilities necessary to successfully implement BnR-inspired projects far exceed what governments can provide. Public/private partnerships ("PPP"), via various models, are essential to contribute ideas, capital, risk absorption and project management capabilities. The private sector, working closely with the public sector helps plan and control BnR projects resulting in projects which have the most appropriate designs, the most cost-efficient construction and the most efficient operation.

D. The implementation of PPP projects, which typically involve multiple parties of different nationalities, is highly complex and requires special expertise and experience and is more of an art than a science. The “packaging” for such projects, getting them ready for construction start, is quite difficult and requires dealing with many challenges and problems which must be solved during long project development periods.

E. In my experience with the packaging of PPP projects, in both developed and developing economies, there are effective solutions which require the relentless application of sound project implementation general principles and specific practices. Although each project is unique, and correct timing is a critical factor, such principles and practices can be applied to result in the successful implementation of PPP infrastructure projects.

F. Hong Kong is functioning effectively as a kind of “Super-connector” putting together various parties which are interested participating in BnR-inspired projects so that they have opportunities to meet and consider collaborating. In addition, Hong Kong’s well-developed project services sectors - including its expertise in infrastructure development sectors - are unique in Asia in terms of their international business orientation, depth of service, expertise and professionalism. Moreover, an essential characteristic of Hong Kong is the reliability of the enforcement of contracts. The independence of the Hong Kong Judiciary and the adherence to the Rule of Law are of high importance for international businesses, investors and creditors involved with infrastructure projects.

Please click here to view the full report.