GDP (US$ Billion)

368.14 (2018)

World Ranking 34/193

GDP Per Capita (US$)

6,354 (2018)

World Ranking 91/192

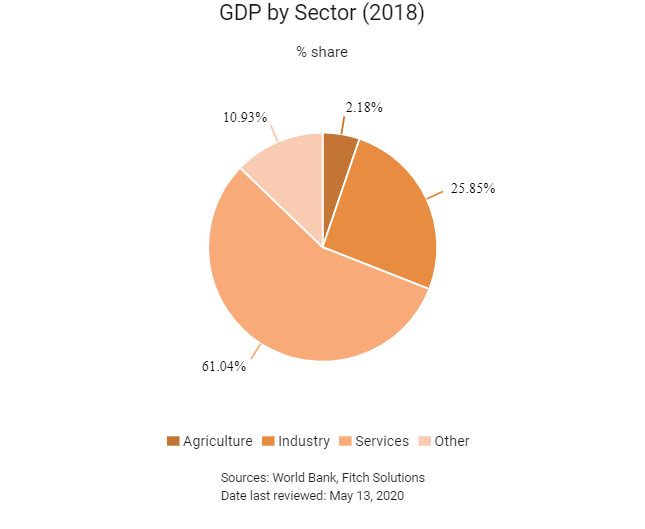

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

59.2 (2019)

Currency (Period Average)

South African Rand

14.45per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

South Africa has made considerable strides towards improving the well-being of its citizens since its transition to democracy in the early 1990s, but the slow pace of transformation in recent years has meant that income inequality remains structurally high, and economic growth has remained sluggish over the past decade. The current administration is aware of the immense challenges it needs to overcome in order to accelerate progress and build a more inclusive society. Its vision and recent efforts to address priority areas are outlined in the 2030 National Development Plan, which comprises the two main strategic goals of eliminating poverty and significantly reducing inequality by 2030. Owing to consistent and sound budgetary policies since 1994, South Africa has been able to tap into international bond markets with reasonable sovereign risk spreads compared with its African peers. Finally, the country is pursuing a broad reform agenda that seeks to liberalise the investment environment in the years ahead.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2018

President Jacob Zuma resigned under pressure from the governing African National Congress (ANC). Veteran trade unionist and businessman Cyril Ramaphosa succeeded him.

September 2018

President Cyril Ramaphosa announced a package of economic reforms and spending plans in an effort to boost South Africa's sluggish economy.

February 2019

In February 2019, South African President Cyril Ramaphosa handed over South Africa’s deposit of instruments on the ratification of the African Free Continental Trade Area (AfCFTA) to the African Union. The AfCFTA was formally launched on July 7, 2019.

May 2019

Elections in South Africa were held for the National Assembly, provincial legislatures and municipal councils. The ruling ANC won re-election with 57.5% of the national vote.

June 2019

As of June 1, South Africa’s government introduced Carbon Tax, in an effort to reduce carbon dioxide emissions.

June 2019

The Trans-Caledon Tunnel Authority in South Africa started implementing of the ZAR12.3 billion (USD853 million) Mokolo Crocodile Water Augmentation Project Phase 2A. The scheme would boost water supplies to the Lephalale municipality, Eskom's Matimba and Medupi power stations and Exxaro's Grootegeluk coalmine. It would also enable the further development of the mineral and energy prospects in the larger Waterberg region, and was also essential for the integration of flue gas desulphurisation air-pollution management systems at Eskom's Medupi power station. The scheme was scheduled for completion in May 2026. The overall Mokolo Crocodile Water Augmentation Project entailed construction of two main bulk raw water transfer systems to meet the growing demand for power generation, mining activities and domestic use.

July 2019

The South African government announced that it would spend around ZAR38 billion (USD2.6 billion) over the next 36 months on upgrading signalling systems, depots, perway and stations, as well as buying 600 new trains for the Metrorail service.

November 2019

South Africa's Central Energy Fund reportedly began working with Saudi Arabian Oil Co to build a new refinery along the east coast of the African country. The refinery, which would have a capacity of 300,000 barrels per day, was likely to become operational by 2028. The project, which was at an early stage, was expected to cost around USD10 billion. The scheme would be funded through debt as well as equity.

February 2020

South Africa unveiled plans to launch a sovereign wealth fund and a state bank.

March 2020

The central bank (SARB) reduced the policy rate to 5.25% from 6.25% on March 19 and then again to 4.25% on April 14. On March 20 it announced other measures to ease liquidity conditions. Part of the programme aimed to purchase government securities in the secondary market across the entire yield curve and extend the main refinancing instrument maturities from three months to 12 months. The SARB also announced that it would continue its long-standing practice of not intervening in the foreign exchange market.

April 2020

Net capital outflew (bonds and equities) since the beginning of the Covid-19 pandemic had amounted to USD6.6 billion (2.3% of GDP), and the local currency had depreciated by 25% against the US dollar.

May 2020

On May 1 2020, a phased lifting of the lockdown began, allowing a few sectors to resume operation and others only partially. Remote work was still encouraged where possible.

2021

The Waterberg Project, which seeks to unlock the unexploited coal reserves in South Africa's Limpopo province and connect to neighbouring Botswana's coalfields will boost logistical capacity in the mining sector. Work is now expected to begin in the second half of 2021. The first phase of the Waterberg project involves unlocking the unexploited coal reserves in the town of Lephalale and delivering these to the Richards Bay Coal Terminal (RBCT) in KwaZulu-Natal Province. This entails upgrading the existing 560km heavy-haul line stretching from Lephalale in Waterberg to the key logistics junction in the mining town of Ermelo in Mpumalanga, increasing coal capacity on the line from 4mn tonnes to 23mn. Ermelo is already linked to the RBCT via a 588km rail line. The project seeks to tap into Botswana's massive coalfields, which would involve the construction of a 4km bridge connecting Botswana to the existing Waterberg-Ermelo line. Following this, the aim is to eliminate non-coal traffic from the export channel between Ermelo and the RBCT to ease congestion on the line, thereby allowing for the efficient delivery of the commodity to domestic and international markets. To achieve this, the line from Waterberg to Ermelo is intended to link with the planned 146km Swazilink line – a new route reaching the Sidvokodvo Junction in Swaziland – for the movement of general freight to the RBCT, and from Maputo to Mozambique.

Sources: BBC country profile – Timeline, Engineering News, IMF, South African government, Fitch Solutions

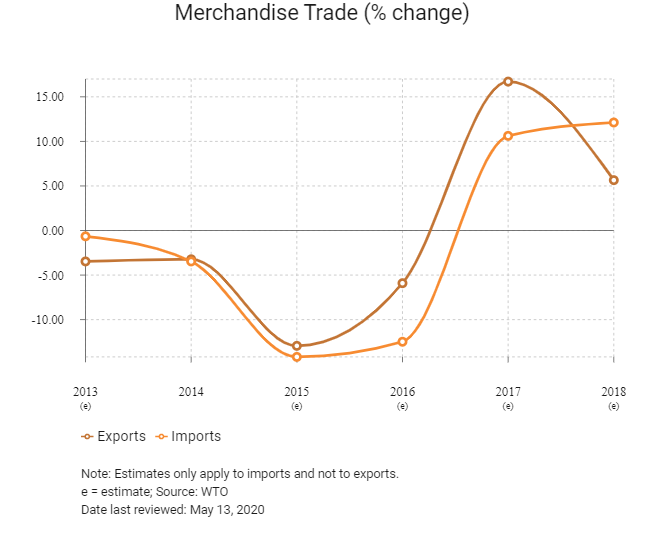

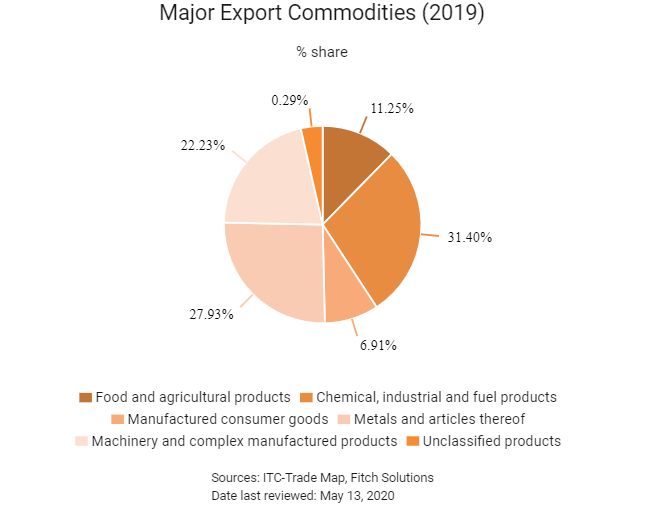

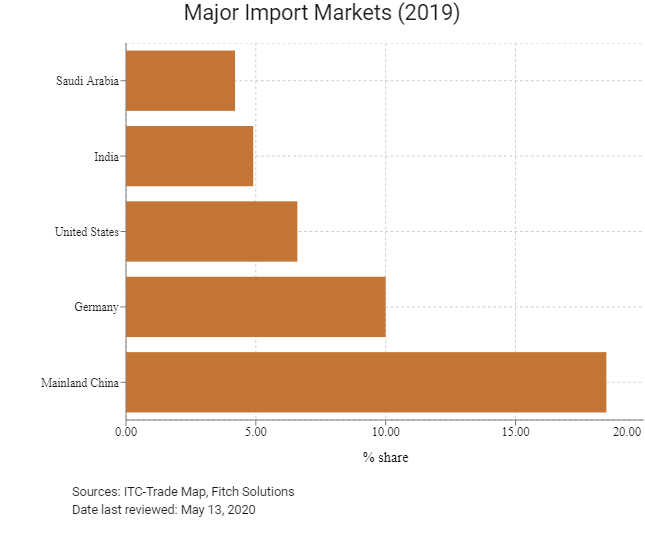

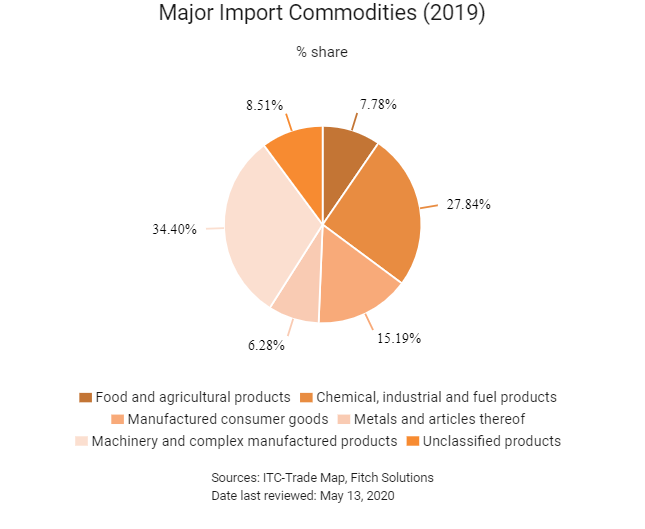

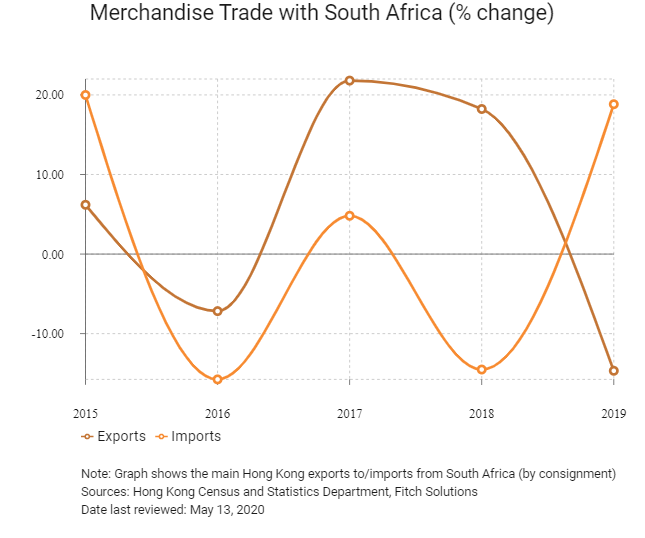

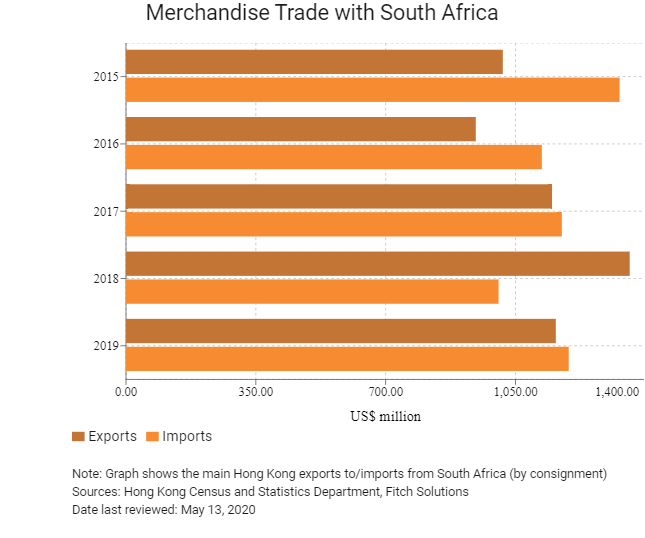

Merchandise Trade

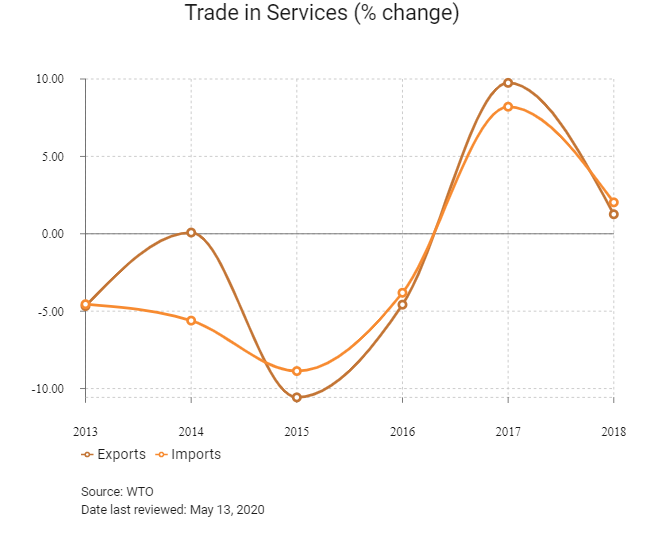

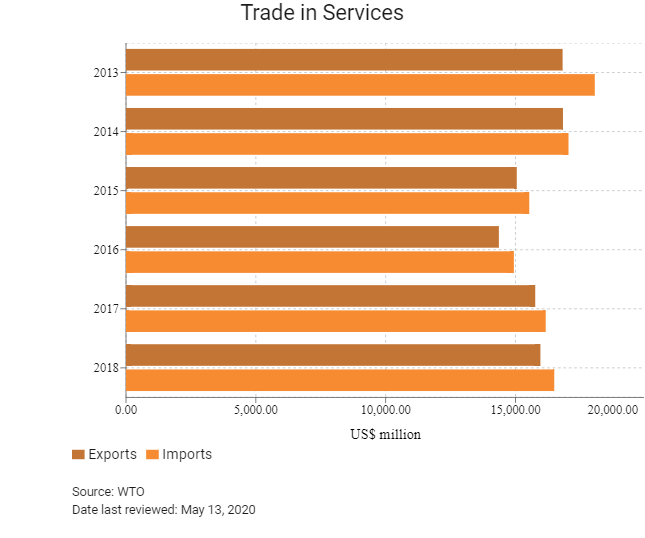

Trade in Services

- South Africa is a member of the World Trade Organization (WTO). Imports originated from other WTO members, including Hong Kong and the Mainland China, are subject to the country's most-favoured-nation (MFN) tariff rates. In addition to import tariffs, most goods are subject to a VAT, the standard rate of which is currently set at 15%. However, VAT on goods imported for use in manufacturing or resale by registered traders can be claimed as an input tax reduction.

- South Africa may initiate anti-dumping or countervailing investigation and impose duties when unfair trade allegations are substantiated. However, there are no anti-dumping measures against Hong Kong products at present.

- Customs duties are generally charged on the import of goods into South Africa at rates ranging between 3% and 45%. In addition, import duties may also include anti-dumping and countervailing duties of up to 150%. No customs duties are charged on trade between South Africa and Botswana, Lesotho, Namibia, and Eswatini as these five countries constitute the Southern African Customs Union (SACU).

- In trying to protect the local poultry industry from low-cost United States and European Union (EU) chicken product exports, South African has imposed additional duties and quotas on both the United States and the EU chicken imports into the country.

- Excise duty is levied on certain locally manufactured goods as well as their imported equivalents. A specific duty at a pre-determined amount is levied on tobacco and liquor, and an ad valorem duty (calculated as a percentage of price) on certain luxury goods and automobiles. Relief from excise duty is available for exported products and for certain products produced in the course of specified farming, forestry, and (limited) manufacturing activities.

- VAT is an indirect tax that is largely directed at the domestic consumption of goods and services and at goods imported into South Africa. The tax is designed to be paid mainly by the ultimate consumer or purchaser in South Africa. It is levied at two rates, namely a standard rate and a zero rate. With effect from April 1, 2018, the standard rate of VAT is 15% (prior to that date, the standard rate was 14%).

- Payments of import duties and VAT can be deferred if the goods are put in bonded warehouses. The South African government has also relaxed some of the country's import taxation rules, such as removing the requirement for a taxpayer to have a tax invoice prior to claiming an input tax credit.

- Most goods can be imported into South Africa without a permit, except for certain goods such as foodstuffs, petroleum products, chemicals, second-hand goods, finished machinery and gold. Import permits are usually issued by the Department of Trade and Industry, and are used mainly to collect information rather than to limit trade.

Sources: WTO – Trade Policy Review, Fitch Solutions, South African Revenue Service

Trade Updates

The AfCFTA was formally launched on July 7, 2019. This agreement stands out as one of the most ambitious projects of the African Union (AU) as it seeks to create the largest single market in the world, by country membership. The AfCFTA will cover a market of more than 1.3 billion people with combined nominal GDP of USD2.5 trillion. Out of the continent’s 55 states, 54 have signed the agreement, with Eritrea as the only non-signatory. Countries with diversified trade baskets, extensive transport links, strong industrial and services sectors and competitive operational risk profiles, such as South Africa, are likely to benefit the most from tariff reductions and the harmonisation of trade rules.

Multinational Trade Agreements

Active

- EU-Southern African Development Community (SADC) Economic Partnership Agreement (EPA) and the EU-South Africa Trade, Development and Co-operational Agreement: On June 10, 2016, the EU-SADC EPA was signed, with SADC members Botswana, Lesotho, Mozambique, Namibia, South Africa and Eswatini all party to the agreement. This grants improved market access to EU markets for South Africa (in addition to the benefits granted under the EU-South Africa Trade, Development and Cooperation Agreement).

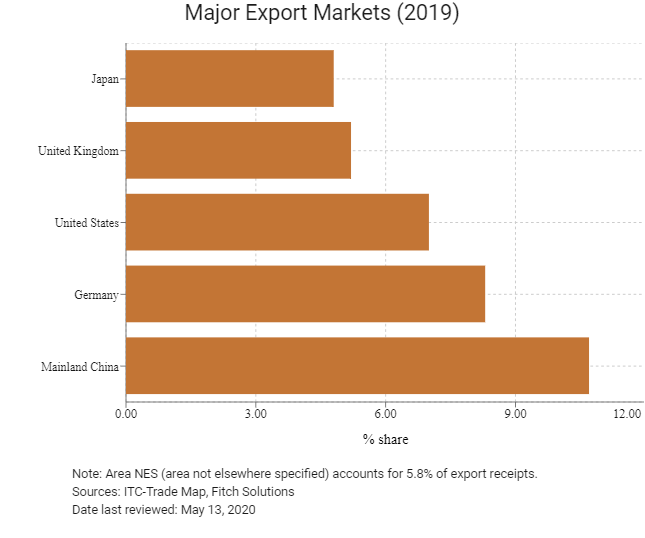

- SACU: The union consists of South Africa, Botswana, Lesotho, Namibia and Eswatini. Duty-free movement of goods with a common external tariff on goods entering any of the countries from outside the SACU is a key benefit. This has greatly enhanced trade flows between these countries. Namibia and Botswana are two of South Africa's largest regional exporting partners.

- SADC Free Trade Area (12 member states): The SADC free trade area was achieved in August 2008, when a phased programme of tariff reductions that had commenced in 2001 resulted in the attainment of minimum conditions for the free trade area – 85% of intra-regional trade among the partner states attained zero duty. While the minimum conditions were met, maximum tariff liberalisation was only attained by January 2012, when the tariff phase down process for sensitive products was completed. For countries falling under the SACU, this process was completed in January 2007.

- Africa Growth and Opportunity Act (AGOA): This was granted by the United States to 39 Sub-Saharan Africa countries (South Africa included). The United States is South Africa's second largest export partner. Preferential access to the United States market for many South African exports is granted through lower tariffs or no tariffs on some products. Duty-free access to the United States market under the combined AGOA/generalised system of preferences programme stands at approximately 7,000 product tariff lines.

- SACU-Common Market of the South (Mercosur) Preferential Trade Agreement (PTA): In October 2016 the PTA between the SACU and Mercosur entered into force. Mercosuris a full customs union and trading bloc consisting of Argentina, Brazil, Paraguay and Uruguay. This PTA offers reciprocal preferential tariff rates on around 1,000 product lines ranging from 10-100%. This agreement is new; and Latin America currently only accounts for around 1% of South Africa's export revenues and South Africa only imports around 4% of total import products from Latin America as a region.

- AfCFTA: The AfCFTA was formally launched on July 7, 2019. This agreement stands out as one of the most ambitious projects of the AU as it seeks to create the largest single market in the world, by country membership. The AfCFTA will cover a market of more than 1.3 billion people with combined nominal GDP of USD2.5 trillion. Out of the continent’s 55 states, 54 have signed the agreement, with Eritrea as the only non-signatory. The agreement aims to eliminate tariffs on intra-African trade, reduce unemployment, increase infrastructure development and eventually create a more competitive and sustainable environment for cross-border trade. According to the framework agreement, 90% of trade in goods will be liberalised over the course of five to eight years, 7% of goods will be classed as sensitive and liberalised over 10-13 years, and 3% of goods will be exempt from free trade entirely. The allocation of goods to these different categories has yet to be negotiated and regional countries and their respective customs unions are currently preparing offers for their continental counterparts to consider. The 'sensitive items' lists may differ according to each bilateral relationship.

Under Negotiation

Tripartite Free Trade Agreement (FTA): This agreement links the Common Market for Eastern and Southern Africa, the SADC and the East African Community. While most of South Africa's main African trading partners are already within the SADC area, reducing tariffs between South Africa and other African countries will undoubtedly increase trade flows between South Africa and the rest of the continent. South Africa needs to diversify its main export base in order to reduce its exposure to shifts in external demand from its core export base, which mostly consists of Mainland China and other SACU member states.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

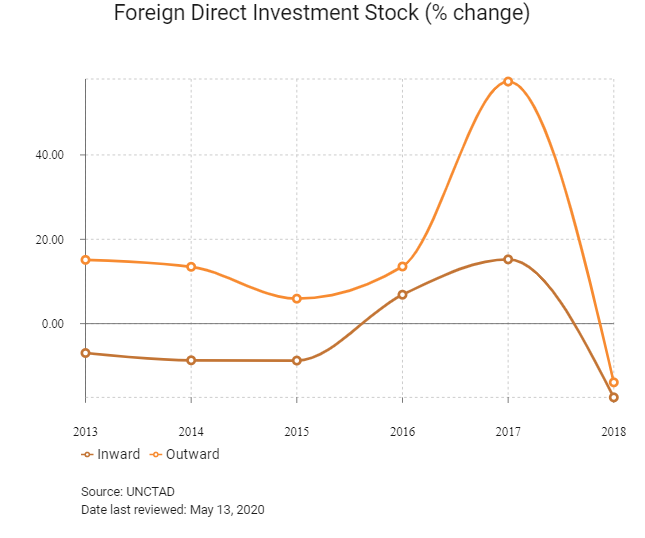

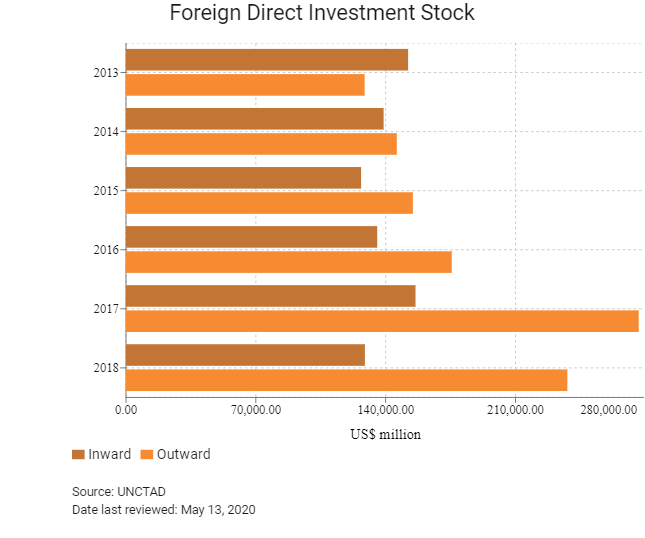

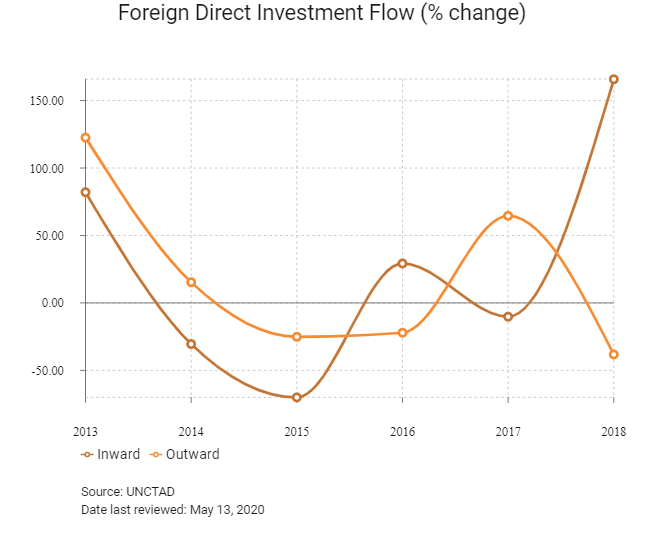

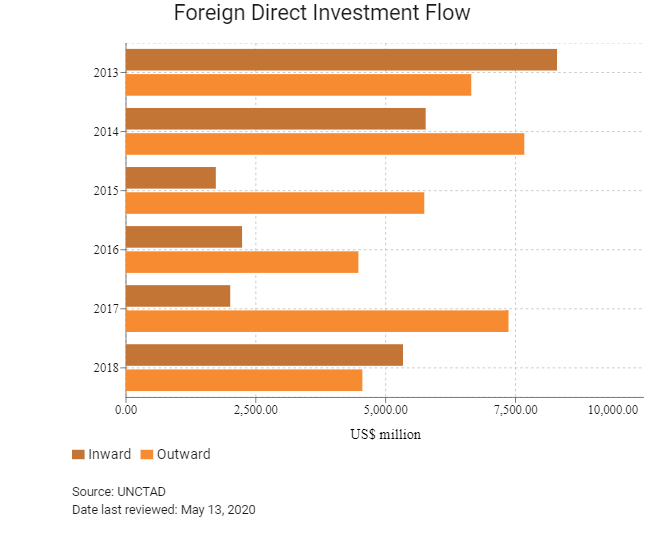

Foreign Direct Investment

Foreign Direct Investment Policy

- The Government of South Africa is generally open to foreign investment as a means to drive economic growth, to improve international competitiveness, and to access foreign markets. Merger and acquisition activity is more sensitive and requires advanced work to answer potential stakeholder concerns.

- In 2008, a ZAR20 billion incentive package for investors in energy efficient projects was announced. The incentive is available for industrial projects participating in the manufacturing sector (other than alcohol or alcohol-related products, tobacco or tobacco-related products, arms and ammunition, and biofuels). Companies are divided into those with a qualifying status and those with a preferred status. The status is determined in terms of a point system. In addition to the above a company may also claim a deduction known as an additional training allowance.

- The proposed project must either be a 'brownfield project' (expansion or upgrade of an existing industrial project) or a 'greenfield project' (a wholly new industrial project, which uses new and unused manufacturing assets). Approved projects may be granted a tax allowance known as an additional investment allowance equal to 55% (100% if located in an industrial development zone) of the cost of any manufacturing asset used in an industrial policy project with preferred status or 35% (75% if located in an industrial development zone) of the cost of any manufacturing asset used in any other approved industrial policy project.

- Since assuming office in February 2018, President Cyril Ramaphosa has committed to improving the investment climate. The early steps he has taken are encouraging, but the challenges are enormous.

- Virtually all business sectors are open to foreign investment. Certain sectors require government approval for foreign participation, including energy, mining, banking, insurance, and defence. Except for those sectors, no government approval is required to invest, and there are few restrictions on the form or extent of foreign investment.

- The development of port and rail infrastructure will dominate transport investment focus over the next decade, given the need to upgrade freight logistics to export key commodities such as coal more efficiently. Some focus is also being placed on roads in the South African province of KwaZulu-Natal, which is an important area considering the role the port of Durban plays as a maritime gateway for international trade coming to and from the wider Sub-Saharan Africa region.

- The Department of Trade and Industry (DTI)'s Trade and Investment South Africa division provides assistance to foreign investors. They recently announced a one-stop shop for investment support, with offices in Pretoria, Cape Town and Durban and an online presence on the South African government website. The DTI most actively courts manufacturing industries in which research indicates that the foreign country has a comparative advantage. It also favours manufacturing owing to the belief that it can be labour intensive and because suppliers can be developed from local industry. In 2017, the DTI launched a national InvestSA One Stop Shop (OSS) to simplify administrative procedures and guidelines for foreign companies wishing to invest in South Africa. The DTI, in conjunction with provincial governments, opened physical OSS locations in Cape Town, Durban and Johannesburg. These physical locations bring together key government entities dealing with issues including policy and regulation, permits and licensing, infrastructure and finance and incentives, with a view to reducing lengthy bureaucratic procedures, reducing bottlenecks and providing post-investment services.

- In February 2014, the DTI introduced a new special economic zones (SEZs) bill focused on industrial development. The bill was subsequently passed, and the SEZs are in the process of being created. The SEZs are intended to encompass the industrial development zones and also provide scope for economic activity beyond export-driven industry to include innovation centres and regional development.

- An SEZ incentive has been introduced for companies operating a business in an SEZ comprising of a reduced corporate tax rate of 15% as well as a 10% allowance in respect of the cost of new and unused buildings owned by a qualifying company or any new or unused improvements to any building owned by a qualifying company. In addition, employment incentives have also been introduced for employers operating in an SEZ that will allow for an employees' tax reduction for the employer in respect of qualifying employees, up to a prescribed monthly amount.

- TISA offers information on sectors and industries, consultation on the regulatory environment, facilitation for investment missions, links to joint venture partners, information on incentive packages, assistance with work permits, and logistical support for relocation.

- There are currently no limitations on foreign ownership although the Private Security Industry (General) Regulation Act (PSIRA) which has passed parliament and is awaiting presidential signature to become law, has a clause requiring 51% South African ownership and control of companies in the security industry.

- Income from international shipping of a resident company which holds a share in a South African flagged ship is exempt from income tax. Qualifying shipping companies can also use a currency other than the rand as their functional currency.

- In the early 1990s, South Africa entered into Bilateral Investment Treaties (BITs) with many foreign countries; these governed the foreign investment regime for investors from those countries in South Africa (in terms of offering guarantees in the event of expropriation and recourse to certain dispute resolution mechanisms). However, in 2013 South Africa unilaterally cancelled many of its BITs or expressed that the BITs would not be renewed (mainly with EU members) in order to make changes to the way in which those protections are ensured, while maintaining its right to implement policies to address the country's social and economic requirements and to redress the injustices of the past through its affirmative action policies.

- In order to assist small and medium-sized businesses to raise capital to finance businesses, a tax incentive for investors in small and medium-sized enterprises through venture capital companies was introduced. A deduction is allowed from the income of a taxpayer in respect of expenditures actually incurred by that person in respect of shares issued to that person by a venture capital company.

- South African laws, policies, and reforms seek to produce economic transformation to increase the economic participation of, and opportunities for, historically disadvantaged South Africans. The government views its role as the primary driver of development and aims to promote greater industrialisation. Government initiatives to accelerate transformation have included tightening labour laws to achieve proportional racial, gender, and disability representation in workplaces and including performance requirements for government procurement such as equity stakes and localisation.

- Following the adoption of a resolution at the December 2017 conference of the African National Congress, investors are closely watching how the government will implement land reform initiatives and what parliament will decide as a result of its review of the constitution and the issue of expropriation of land without compensation.

- The government has changed the process of settling of legal disputes between foreign investors and the South African government. In terms of dispute settlement, the foreign investor must exhaust all domestic remedies before they are entitled to take the matter to an international tribunal. Protection under this legislation for foreign direct investment (FDI) is, therefore, considerably less than under the old BITs (which remain in force until this legislation is given a promulgation date).

- The current costs related to certain R&D activities carried on in South Africa are 150% deductible, subject to pre-approval by a government-appointed approval committee. The cost of machinery and other capital assets acquired for the purposes of R&D may be depreciated 40% in the first year of use, 20% in the second, 20% in the third year, and 20% in the fourth. Buildings used in the process of R&D may be written-off over a 20-year period.

- The carbon tax bill came into effect in June 2019. The bill will be aligned with the proposed carbon budget system and this is likely to affect the mining, power, transport and energy-intensive industrial sectors. It has also been proposed that regulations prescribing foreign electronic services subject to VAT be broadened to include cloud computing and other online services, which could also affect the services sector.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Industrial development zones (IDZs) include Dube Trade Port IDZ in Durban, Coega IDZ in Port Elizabeth, East London IDZ, Richard's Bay IDZ and Saldanha Bay IDZ |

In 2000 the South African government initiated the IDZ programme as part of a broader national effort to promote special economic zones, including free ports, free trade zones, IDZs and sector development zones. Various tax incentives are on offer which differ between the various zones and sectors. Building Allowance: Businesses and operators operating within a SEZ may be eligible for tax relief, including the building allowance, subject to requirements contained in the Income Tax Act. Employment Incentive: Businesses and Operators operating within an SEZ may be eligible for tax relief, including the employment tax incentive subject to requirements contained in the Employment Tax Incentive Act, 2013 (Act No. 26 of 2013). |

|

SEZs |

Main incentives include a preferential 15% corporate tax: Businesses (prescribed in the SEZ Act) that are located in an SEZ may be eligible for tax relief, including the reduced rate of corporate income taxation. In addition to satisfying the requirements of the SEZ Act, further criteria for some of the available tax incentives are stipulated in the Income Tax Act, 1962 (Act No. 58 of 1962). |

|

Existing SEZs: Maluti - A- Phofung SEZ, OR Tambo SEZ, Musina/Makhado SEZ |

Customs Controlled Area: Businesses and operators located within a customs controlled area of an SEZ will be eligible for tax relief. 12I Tax Allowance: The 12I Tax Incentive is designed to support greenfield investments (i.e., new industrial projects that utilise only new and unused manufacturing assets), as well as brownfield investments (i.e., expansions or upgrades of existing industrial projects). The new incentive offers support for both capital investment and training. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 15%

- Corporate Income Tax: 28%

Source: South African Revenue Service

Important Updates to Taxation Information

- South Africa’s carbon tax came into effect on June 1, 2019 and will be implemented in phases. The first phase of the tax is from June 1,2019 to December 2022 with a tax rate of ZAR120.0 per tonne of carbon dioxide (CO2) equivalent. Allowable tax breaks will reduce the effective rate to between ZAR6 and ZAR48 per tonne of CO2. The second phase will run from 2023 to 2030. This tax will affect several heavy industries that are significant emitters of CO2 including manufacturing and mining.

- The corporate income tax rate applicable for corporate income of both resident and non-resident companies for tax years ending between April 1, 2018 and March 31, 2019 is a flat 28%. Small business corporations (ie, companies with gross income of not more than ZAR20 million) are taxed at the following rates:

- 0% on the first ZAR78,150 of taxable income

- 7% on taxable income above ZAR78,150 but not exceeding ZAR365,000

- 21% on taxable income above ZAR365,000 but not exceeding ZAR550,000

- 28% on taxable income exceeding ZAR550,000

Special tax rates apply in certain industries, such as mining and long-term insurance. Those companies classified as residents are then taxed on their global incomes. However, non-resident companies are not taxed on their non-South African incomes.

- From April 1, 2018, the VAT rate increased from 14% to 15% (the VAT rate was last increased in the early 1990s). It has been proposed that regulations prescribing foreign electronic services subject to VAT be broadened to include cloud computing and other online services.

- A tax on sugar-sweetened beverages, in the form of the Health Promotion Levy on Sugary Beverages, was introduced on April 1, 2018. The base on which the levy is applied is the sugar content of the beverage. The rate of the levy is 2.1 cents per gram for sugar content in excess of 4g/100ml. For powder and liquid concentrates, sugar content is calculated on the total volume of the prepared beverage.

- There are targeted tax breaks available under a scheme overseen by the DTI. Seeking to promote new business and encourage trade, the tax breaks of 50% or 100% are available for certain approved investments if they are managed through the Strategic Industrial Project programme of the DTI.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Tax Rates |

Resident companies: |

|

Dividends Tax |

A dividends tax of 20% is payable on all dividends declared and paid by resident companies and non-resident companies in relation to shares listed on the Johannesburg Stock Exchange and paid to South Africa residents. This tax is not payable if the beneficial owner of the dividend is an South Africa resident company, an South Africa retirement fund, or other prescribed exempt person. |

|

Securities Transfer Tax |

0.25% of the taxable amount in respect of the transfer of a security |

|

Skills Development Levy |

1% of payroll |

|

Unemployment insurance fund contributions |

1% of gross remuneration payable to an employee, with a monthly cap of ZAR148.72 per employee. Another 1%, subject to the same cap, is payable by the employee and withheld by the employer. |

|

Donations Tax |

- 20% of the value of property donated, provided this value does not exceed ZAR30 million |

|

VAT (standard) |

15% |

Sources: South Africa Ministry of Finance, South African Revenue Service

Date last reviewed: May 13, 2020

Localisation Requirements

Hiring procedures in South Africa are strictly regulated. Various affirmative action policies have been implemented since 1994 to promote the employment of South Africa's black population.

These resulted in the passing of the Broad-Based Black Economic Empowerment (BBBEE) Act of 2003, for which new codes were introduced in 2015. BBBEE policies are aimed at increasing the participation of previously disadvantaged people in the formal economy in relation to ownership and employee hiring. Companies may undergo a BBBEE audit and obtain a BBBEE score in terms of these codes.

While BBBEE code compliance is voluntary for private companies, these codes are legally binding on state institutions and state-owned enterprises, which are also obliged to use the codes to measure BBBEE compliance when choosing suppliers, granting licences or making concessions.

When companies are participating in a public procurement process, the higher their BBBEE rating, the higher their competitive edge will be in the tendering process.

Obtaining Foreign Worker Permits for Skilled Workers

In 2015, South Africa enacted new immigration laws. There are two types of visas that apply: the critical skills work visa and the general work permit. The South African government has acknowledged that in order to advance national interest, it needs to be easier for foreign workers with critical skills required for South Africa's economy to be granted permits to work in the country. Critical skills visas apply to a wide range of professionals in fields such as engineering, construction, agriculture and financial services.

The critical skills visa can be applied for without a formal job offer and takes three months with minimal paper work. However, for companies wanting to employ foreign workers who do not fall within a critical skill set, the application procedure is particularly onerous. Prior to submitting an application for a general work visa (which can only be applied for from the applicant's country of origin), the prospective employer is required to apply to South Africa's Department of Labour for a certificate which confirms, among many things, that despite having conducted a diligent search, the prospective employer has been unable to find a suitable candidate with qualifications or skills and experience equivalent to those of the applicant.

Once this has been granted the visa is supposed takes two to three months to issue, but delays are regular. It is therefore a highly extensive and costly process required for employers and potential foreign employees to obtain this type of visa.

Visa/Travel Restrictions

Citizens of most North and South American states, European states and African states are not required to obtain a visa for a visit lasting up to 90 days to South Africa. Citizens of most Asian countries are not required to obtain a visa for a visit lasting up to 30 days. Citizens of Mainland China and Russia require visas.

Changes to South Africa's visa regime, which came into force in 2014, included requirements that persons applying for a South African tourism visa must submit biometric data to the South African embassy they applied at, which means that all applications have to be made in person. Any adults travelling with minors needed an unabridged birth certificate for the child in question and proof of consent from both of the child's parents for that child to travel.

These changes have since been amended, so that foreigners who have applied for a South African visa can now do so via postal application or have a travel agency do it for them, and they are no longer required to carry an unabridged birth certificate for minors.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ba1 (Negative) |

27/03/2020 |

|

Standard & Poor's |

BB- (Stable) |

29/04/2020 |

|

Fitch Ratings |

BB (Negative) |

03/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

82/190 |

82/190 |

84/190 |

|

Ease of Paying Taxes Index |

46/190 |

46/190 |

54/190 |

|

Logistics Performance Index |

33/160 |

N/A |

N/A |

|

Corruption Perception Index |

73/180 |

70/180 |

N/A |

|

IMD World Competitiveness |

53/63 |

56/63 |

N/A |

Sources: World Bank, IMD, Transparency International

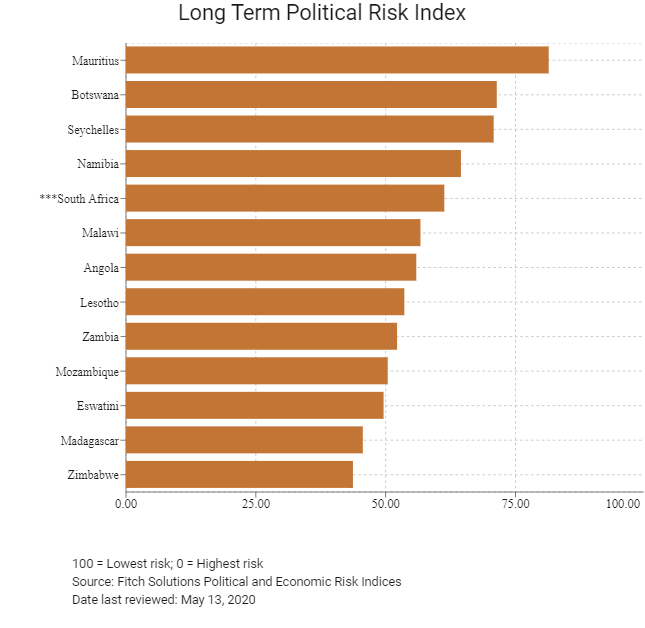

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

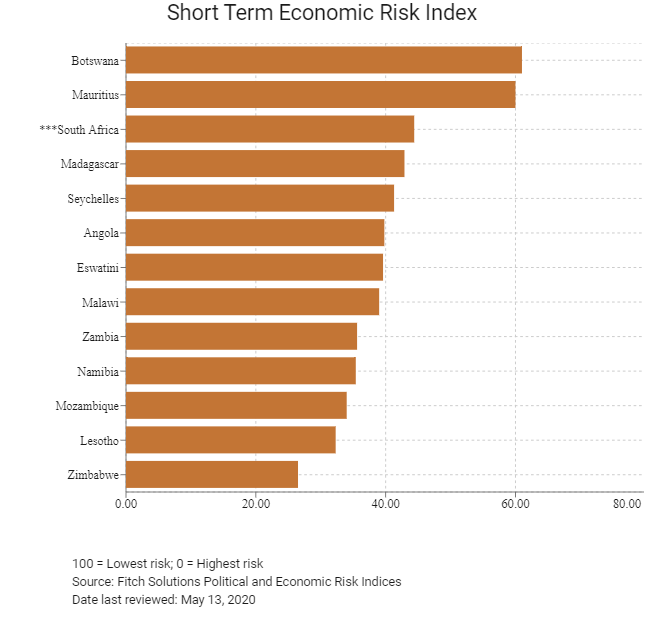

Economic Risk Index Rank |

70/202 |

76/201 |

73/201 |

|

Short-Term Economic Risk Score |

48.3 |

49.0 |

44.4 |

|

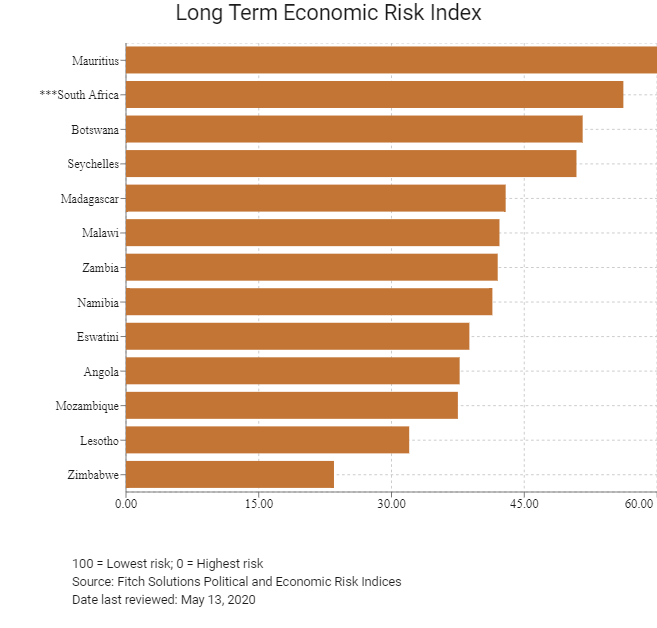

Long-Term Economic Risk Score |

58.3 |

57.4 |

56.2 |

|

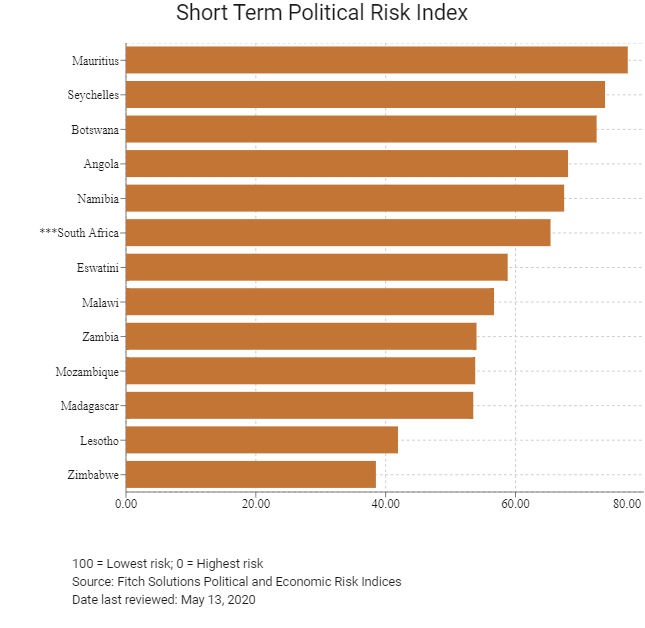

Political Risk Index Rank |

106/202 |

103/201 |

103/201 |

|

Short-Term Political Risk Score |

65.4 |

65.4 |

65.4 |

|

Long-Term Political Risk Score |

61.3 |

61.3 |

61.3 |

|

Operational Risk Index Rank |

88/201 |

85/201 |

84/201 |

|

Operational Risk Score |

51.3 |

52.8 |

52.1 |

Source: Fitch Solutions

Date last reviewed: May 13, 2020

Fitch Solutions Risk Summary

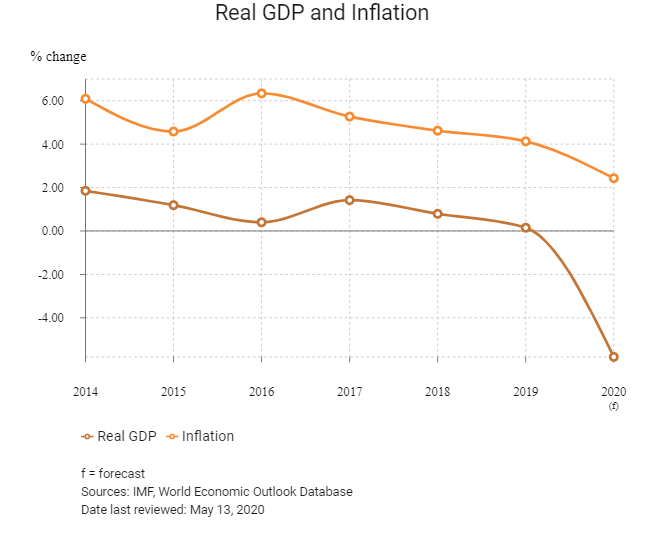

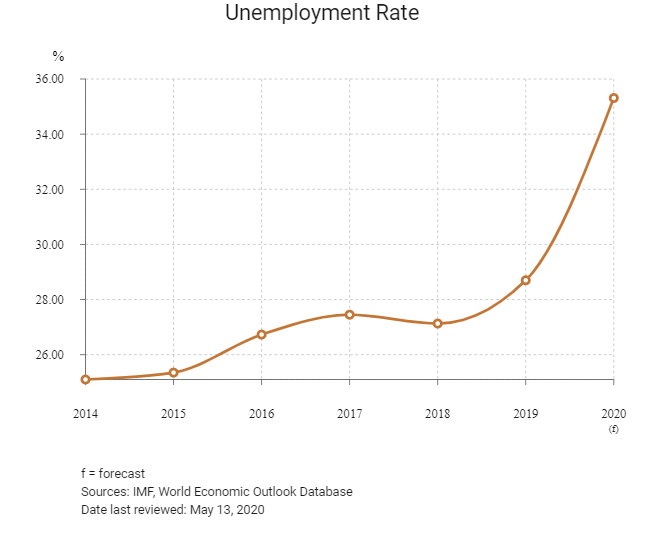

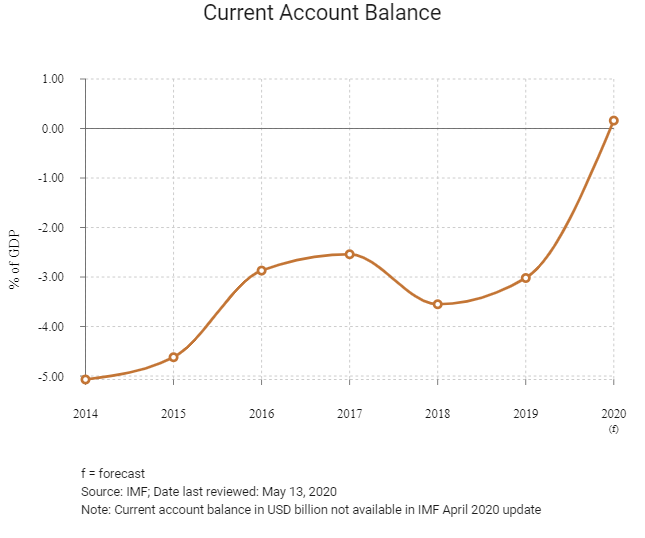

ECONOMIC RISK

Given South Africa's close links with the global economy, the country remains heavily exposed to the external environment. The economy is set to contract sharply in 2020 following near-stagnant growth levels in 2019. Capital flight prompted by the health crisis and by Moody’s downgrading the country’s last investment-level credit rating will hurt fixed investment, and rising unemployment is weighing on consumption. A dire fiscal outlook and struggling state-owned enterprises may lead the government to seek additional support from multilateral lenders. Over the long term, elevated unemployment and sluggish credit growth will continue to weigh on private consumption, and continued uncertainty over some elements of policy and the challenging operating environment will act as a headwind to investment. South Africa's current account deficit remains under pressure, and controlling the country's rising debt burden will remain a challenge over the medium term.

OPERATIONAL RISK

South Africa boasts the most advanced and broad-based economy in Sub-Saharan Africa. The investment climate is fortified by stable institutions, a vibrant legal sector committed to upholding the rule of law, mature telecommunications, banking and financial services sectors, good transport infrastructure, and a broad selection of experienced local partners. South Africa encourages investments that develop ICT and the manufacturing of goods for export. However, the country's performance is less competitive on the labour and crime and security fronts. This is largely due to high labour costs, the frequency of widespread perennial strikes, high crime levels and policy uncertainty, which are considered major drawbacks for investors. South Africa's economic outlook and trade and investment profile have come under significant threat from fiscal slippages, commodity prices weakness and significant policy shifts over the past five years. The impact of the Covid-19 pandemic raises notable risks to the business environment in the near term, and the country will see investment and trade fall in 2020. Structural reform momentum will remain limited.

Source: Fitch Solutions

Date last reviewed: May 11, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

South Africa Score |

52.1 |

50.9 |

56.1 |

53.4 |

48.2 |

|

Southern Africa Average |

42.6 |

42.0 |

41.2 |

42.0 |

45.4 |

|

Southern Africa Position (out of 13) |

3 |

3 |

2 |

3 |

5 |

|

SSA Average |

34.6 |

38.8 |

34.6 |

32.7 |

32.3 |

|

SSA Position (out of 48) |

3 |

4 |

2 |

3 |

7 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

84 |

94 |

78 |

81 |

107 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk |

Crime and Security Risk Index |

|

Mauritius |

63.8 |

51.3 |

72.0 |

63.5 |

68.5 |

|

Seychelles |

54.0 |

48.9 |

54.5 |

57.2 |

55.4 |

|

South Africa |

52.1 |

50.9 |

56.1 |

53.4 |

48.2 |

|

Botswana |

50.9 |

52.2 |

47.5 |

48.3 |

55.9 |

|

Namibia |

50.2 |

50.4 |

47.1 |

49.5 |

53.6 |

|

Eswatini |

42.1 |

36.9 |

34.5 |

53.0 |

44.0 |

|

Zambia |

39.8 |

39.9 |

43.8 |

33.0 |

42.4 |

|

Lesotho |

37.6 |

36.2 |

30.8 |

36.1 |

47.4 |

|

Malawi |

35.8 |

34.9 |

31.7 |

32.3 |

44.3 |

|

Zimbabwe |

32.5 |

35.3 |

22.1 |

28.9 |

43.8 |

|

Mozambique |

32.5 |

34.0 |

35.8 |

34.8 |

25.3 |

|

Angola |

31.9 |

41.8 |

24.6 |

27.8 |

33.3 |

|

Madagascar |

31.2 |

34.1 |

35.2 |

27.7 |

27.9 |

|

Regional Averages |

42.6 |

42.0 |

41.2 |

42.0 |

45.4 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 13, 2020

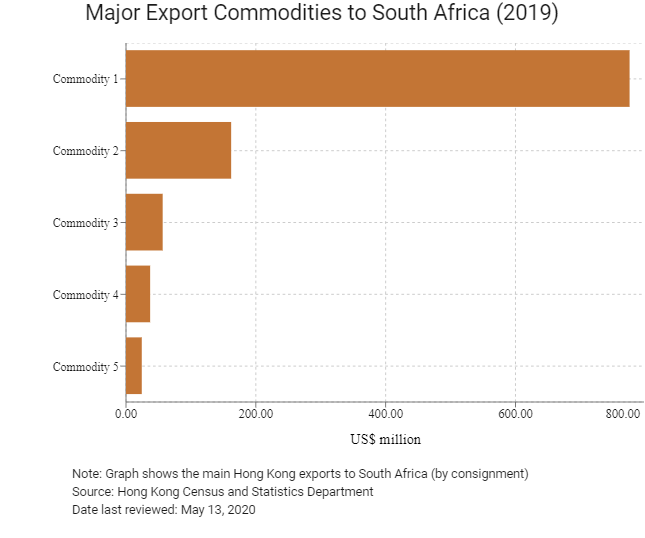

Hong Kong’s Trade with South Africa

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 775.8 |

| Commodity 2 | Office machines and automatic data processing machines | 162.0 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 56.5 |

| Commodity 4 | Miscellaneous manufactured articles | 37.2 |

| Commodity 5 | Articles of apparel and clothing accessories | 24.3 |

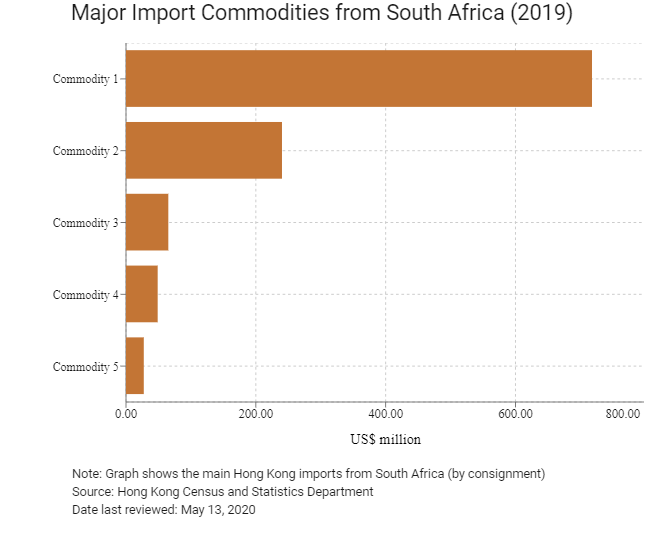

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Non-ferrous metals | 717.9 |

| Commodity 2 | Vegetables and fruit | 240.3 |

| Commodity 3 | Non-metallic mineral manufactures. | 65.2 |

| Commodity 4 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 48.8 |

| Commodity 5 | Telecommunications and sound recording and reproducing apparatus and equipment | 27.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of South African residents visiting Hong Kong |

59,865 |

-12.9 |

|

Number of African residents visiting Hong Kong |

123,656 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: May 13, 2020

Commercial Presence in Hong Kong

|

2016 |

Growth rate (%) |

|

|

Number of South African companies in Hong Kong |

15 |

N/A |

|

- Regional headquarters |

0 |

|

|

- Regional offices |

5 |

|

|

- Local offices |

10 |

Treaties and agreements between Hong Kong and South Africia

Hong Kong and South Africa concluded comprehensive Double Taxation Agreements on October 20, 2015. This is the first income tax treaty Hong Kong has with a jurisdiction in Africa.

Source: South African Revenue Service

Chamber of Commerce (or Related Organisations) in Hong Kong

South African Business Forum Hong Kong

Address: Transact24 Limited, Unit 2801, 28/F, Wu Chung House, 213 Queen's Road East, Wanchai, Hong Kong

Email: info@sacg.hk

Tel: (852) 2851 0145

Fax: (852) 2851 0143

Source: South African Business Forum Hong Kong

South Africa Consulate General in Hong Kong SAR

Address: Room 1906-08, 19/F, Central Plaza, 18 Harbour Road, Wanchai, Hong Kong

General Enquiries: info@sacg.hk

Consular Section: consular@sacg.hk

Trade and Economics: satrade@dtihk.org.hk

Tel: (852) 3926 4300

Fax: (852) 2890 1975

Source: Consulate General of South Africa in Hong Kong

Visa Requirements for Hong Kong Residents

- HKSAR passport holders do not require a visa for stays of up to 30 days. Stays longer than 30 days would require a visa.

- In terms of Immigration Regulation 9(2) of 2014 any applicant applying for any visa (permit) must submit his or her application in person at any foreign mission of the Republic where the applicant is ordinarily resident or holds citizenship or to the Mission to which the country is accredited.

Source: Visa on Demand

Date last reviewed: May 13, 2020

South Africa

South Africa