GDP (US$ Billion)

288.42 (2018)

World Ranking 43/193

GDP Per Capita (US$)

1,749 (2018)

World Ranking 149/192

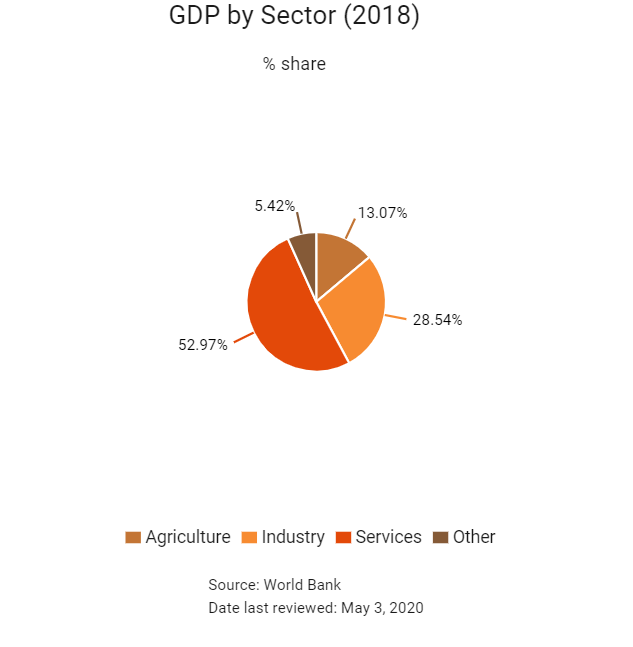

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

38.2 (2018)

Currency (Period Average)

Bangladeshi Taka

84.45per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

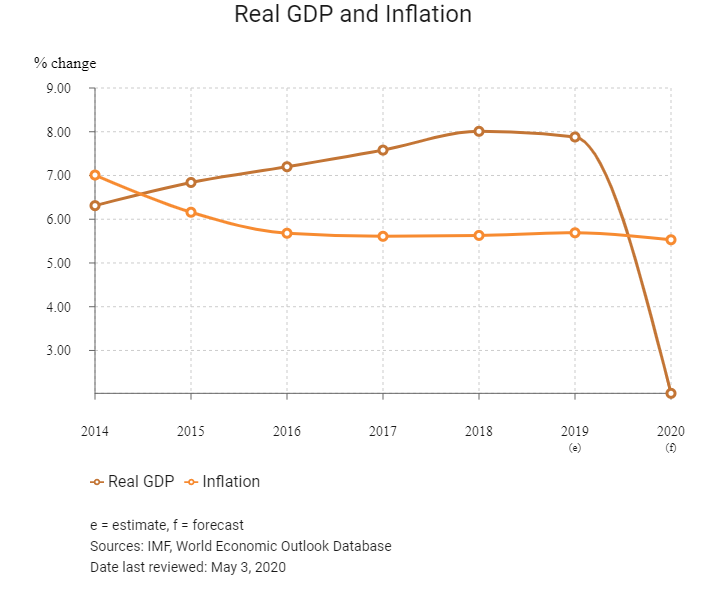

Bangladesh has a strong track record for growth and development. It has made great progress in reducing poverty and has grown steadily over the past decade. Sustained economic growth has rapidly increased urbanisation as well as the demand for energy and transport infrastructure. To achieve its aspiration of becoming an upper-middle income country by 2031, the country urgently needs to implement structural reforms, expand investment in human capital, improve domestic revenue mobilisation, increase female labour force participation and raise productivity through increased global value chain integration. Improving infrastructure, such as transport and access to reliable and affordable power, as well as the business climate would allow new productive sectors to develop and generate jobs. However, we hold a less-than-sanguine outlook on Bangladesh’s economic and political reform momentum despite minor improvements in its Ease of Doing Business ranking. This is despite the Awami League’s supermajority in parliament, an advantage that, if utilised properly, would facilitate the policymaking process and reform. Weak reform momentum is unlikely to impact short-term growth given that growth is still driven by low value-added industries such as construction and garment manufacturing. Lastly, a lack of reforms would weigh on the country’s long-term growth potential and hinder the social mobility of the majority of the population.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2018

Prime Minister Sheikh Hasina and the ruling Awami League secured a third consecutive term in the general election.

January 2019

The United Nations strongly recommended that Bangladesh sign free trade agreements (FTAs) with major trading partners such as Mainland China to counter a regime without a duty-free and quota-free facility after Bangladesh graduated from being a least developed country to a developing nation after 2027.

June 2019

A Joint Steering Committee of Nepal and Bangladesh agreed to jointly invest in feasible hydropower projects and collaborate on alternative energy in Nepal. Joint investments would cover the 1.1GW Sunkoshi II and 536MW Sunkoshi III reservoir hydropower projects, among others. The two nations had also agreed to build a new high-voltage transmission line to Bangladesh through India. The committee also decided to hold talks with India for exporting power from Nepal to Bangladesh by utilising Indian electricity transmission lines. Bangladesh had already formulated a policy to buy 9GW of electricity from Nepal by 2040 and to achieve this construction of transmission line, selection of projects and co-operation on alternative energy are in the pipeline.

July 2019

The Japan International Cooperation Agency signed an agreement with the Government of Bangladesh to provide an official development assistance loan of around USD1.3 billion to construct a coal-fired power plant with a rated output of 1.2GW in the Matarbari area of Cox's Bazar District. The project was expected to stabilise the country's power supply and promote energy efficiency. The loan had a repayment term of 30 years along with a 10-year grace period. The project was expected to be completed in July 2024.

During a visit to Mainland China Prime Minister Hasina signed agreements and memoranda of understanding covering the power, investment, culture, tourism and technology sectors, including loans worth USD1.7 billion for Bangladesh's power sector. Beijing also assured Dhaka that it would align its projects under the Belt and Road Initiative with Bangladesh's development priorities.

August 2019

Bangladesh ended a self-imposed export ban of fresh produce to Europe, introduced two years earlier in response to European Union (EU) regulators detecting pests in consignments of exports to Europe. Bangladesh had since improved the quality of its packing standards.

October 2019

Officials from Bangladesh and the EU met in Dhaka to discuss the key priorities for the post-2020 co-operation agenda and to look into the Bangladesh government's five-year plan from 2021.

The Oxford Internet Institute reported that Bangladesh was the second largest supplier of online labour in the world, and because two-thirds of its population was under 25 years of age, it could potentially add many new workers to the digital pool in the years ahead.

January 2020

Bangladesh's Prime Minister announced that the country would set up an economic zone for the United Arab Emirates by 2023. Formalities regarding the economic zone were ongoing and once complete, more details on the zone would be released. Bangladesh would provide the land for the development of the zone that would be used for the manufacturing of export-oriented halaal products, the prime objective of the economic zone.

March 2020

Bangladesh Bank announced a move to set up a special fund to support the stock markets – as reported by the Dhaka Tribune. The fund saw a mixture of seven state-owned and private banks borrowing (at a low interest rate) and then invested BDT200 crore each in the stock market, taking the combined size of the special fund to BDT1,400 crore.

May 2020

Officials from the Asian Development Bank board said that it was likely to approve USD500 million worth of credit support for to help it meet its budget deficit during the current financial year. Following the approval, the government was expected to sign a loan agreement within 7-10 days to get the fiscal support.

May 2020

Bangladesh Bank aimed to release new currency notes of BDT250 billion (USD2.9 billion) in the market before May 24 2020. Some officials at the central bank said the decision to release new cash in the market is part of its move to withdraw old notes and replace them with new ones to prevent the spread of Covid-19.

May 2020

Trade between neighbours India and Bangladesh had been completely cut off from May 4, 2020, through the Benapole port due to the movement of the Trinamool Congress, the ruling party in West Bengal state, in Bangaon of India.

Sources: BBC Country Profile – Timeline, The Guardian, The Diplomat, BDNews24.com, Dhaka Tribune, Al Jazeera, Fitch Solutions

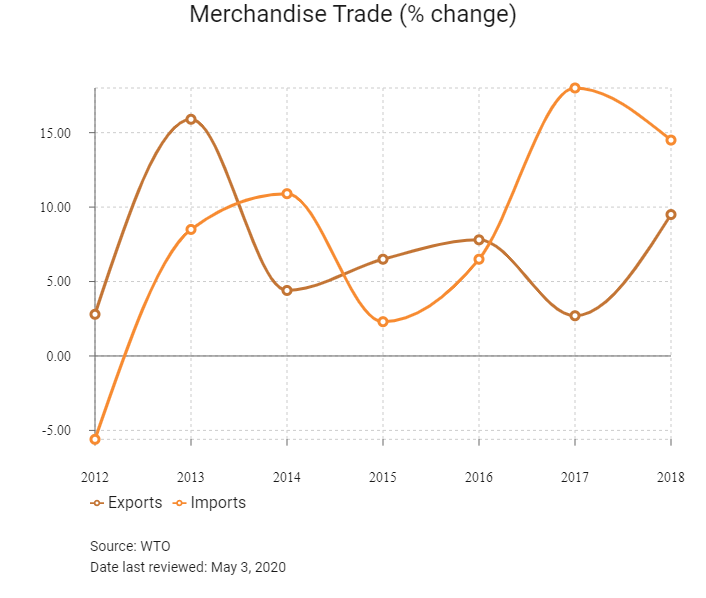

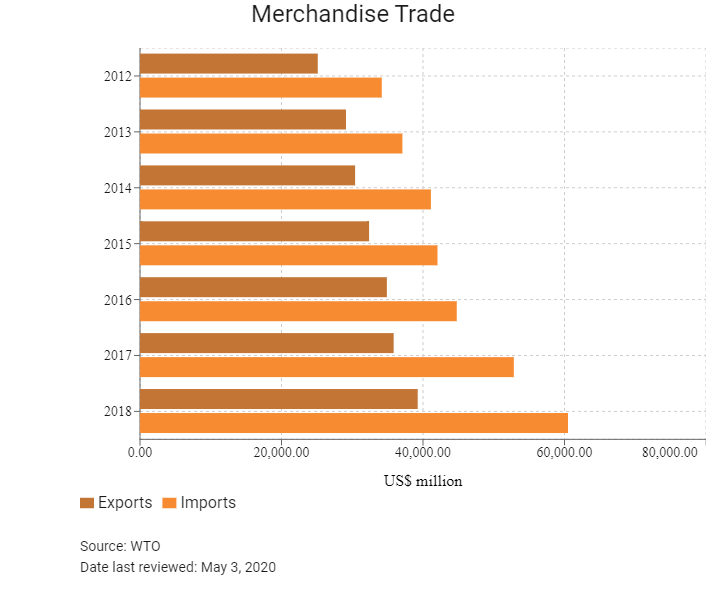

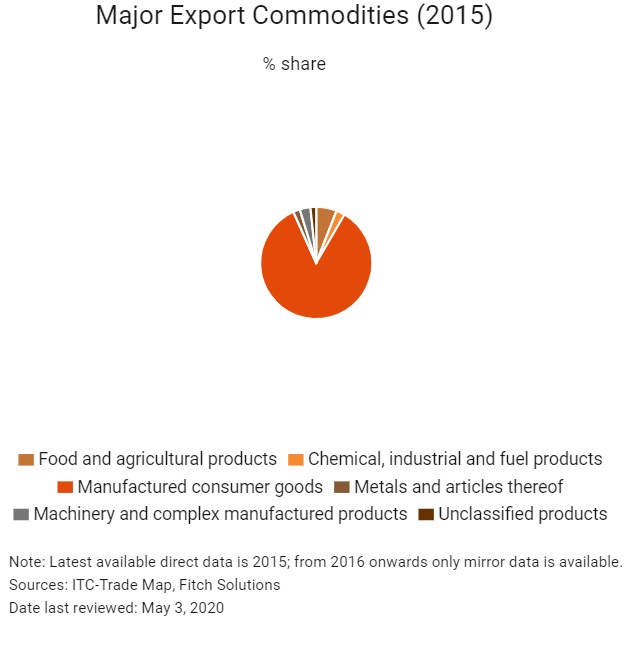

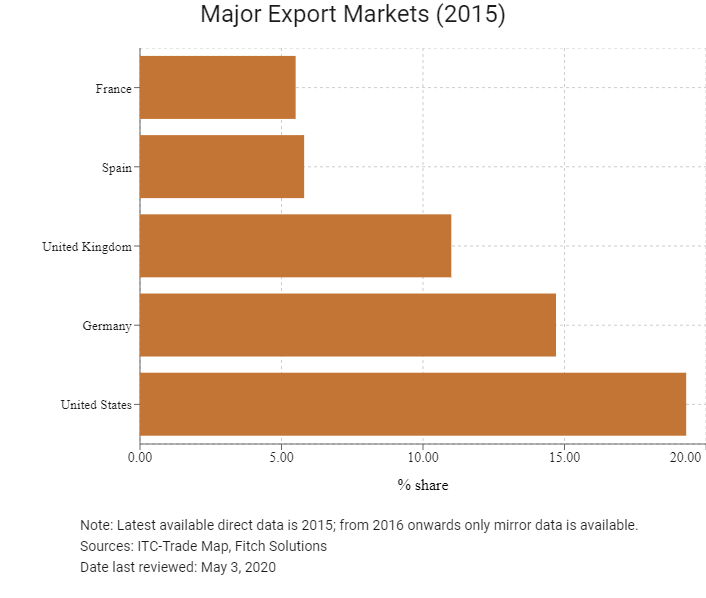

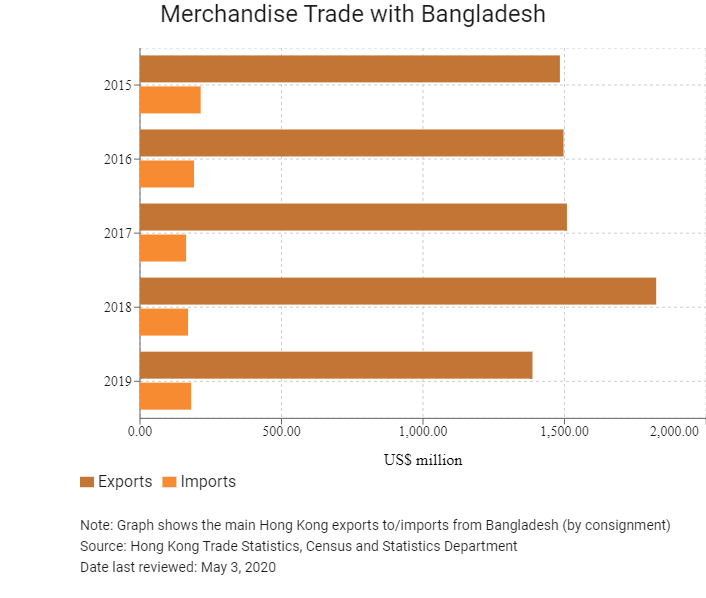

Merchandise Trade

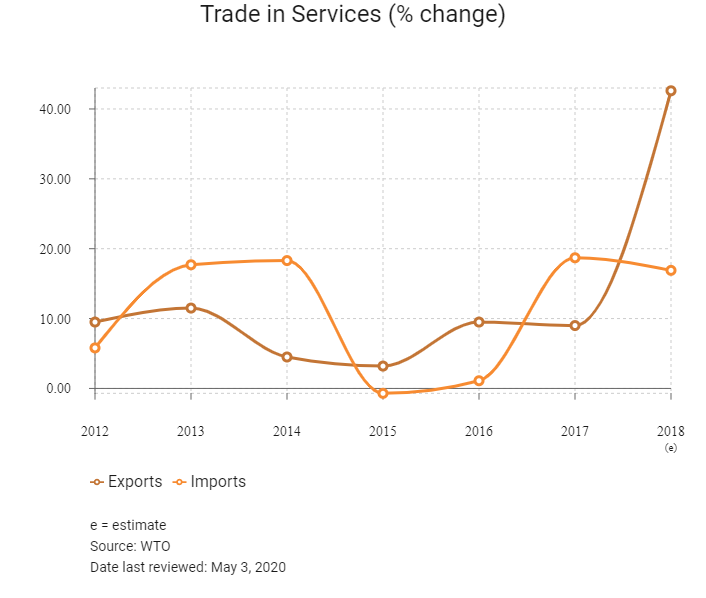

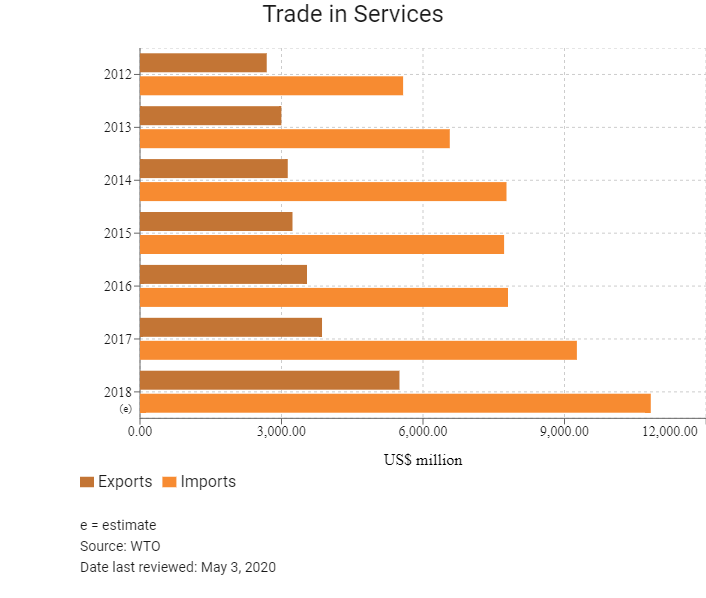

Trade in Services

- In July 1978, Bangladesh joined the World Customs Organization and in January 1995 Bangladesh became a member of the World Trade Organization (WTO).

- Bangladesh used to benefit from preferential access to the United States market through the Generalized System of Preferences (GSP) programme, but in June 2013 President Barack Obama suspended Bangladesh's membership in light of the government's insufficient progress in securing the rights of Bangladeshi workers. The Untied States government has provided Bangladesh with a 16-point action plan that, if implemented, will provide a basis for the reinstating of GSP trade benefits. The Untied States is the single largest export destination for Bangladesh. As a least developed country, 97% of goods originating from Bangladesh enjoy duty-free benefits on export to the United States. However, the country's main export item – garments – has not been included in this package despite comprising 95% of Bangladeshi exports to the United States per year. As a result, Bangladeshi exporters face a 15.6% tariff on export of apparel items to the Untied States, although some competing countries, such as Mainland China, Vietnam, Pakistan and India, face far lower tariffs.

- Bangladesh continues to impose high tariffs on imports, which increases costs for businesses, with an average tariff rate of 10.7%, rising to 25% for some finished products. In addition, a 4% infrastructure development surcharge is levied on almost all imports, as well as VAT of 15%. Although some raw materials and capital goods imports are exempt from customs duties, these charges increase the difficulty of operating in Bangladesh.

- Bangladesh and India's joint membership of regional free trade areas eases the flow of goods between the two countries, with India providing an important source of imports for Bangladesh. Dhaka has attempted to improve its economic relationship with India in recent years by reducing trade barriers and improving connectivity.

- Bangladesh has imposed an export ban on raw hides and wet blue leather. Only exports of finished leather and leather goods are allowed.

- In August 2015, Bangladesh imposed a regulatory import duty of 20% on raw and refined sugar. The measure was initiated to protect local suppliers in times of falling global prices of sugar. The budget for the upcoming 2019-2020 fiscal year proposes to raise it to 30% and to impose VAT on soybean oil, which was previously exempt.

- Vehicles imported into Bangladesh are subject to a 165% import duty and domestically assembled vehicles are subject to a 60% tax. Domestically assembled vehicles are, therefore, more affordable.

Sources: WTO – Trade Policy Review, Dhaka Tribune, Fitch Solutions

Trade Updates

- Bangladesh and Sri Lanka expressed interest in signing a FTA in March 2017 in an attempt to boost bilateral trade ties. The two countries are set to benefit significantly from the FTA as Bangladesh produces textiles, pharmaceuticals, cement, paper, electrical items and jute products, which are in high demand in Sri Lanka. Sri Lanka is also an important transhipment hub for the region. It was hoped that the FTA will be signed in 2019. As at April 2020, the deal is yet to be signed.

- In October 2018, Brazil and Bangladesh agreed to sign an FTA to boost bilateral trade. Brazil also seeks to form a chamber of commerce and industry with Bangladesh to encourage private sector investors from both countries to enhance business communication. Exports from Bangladesh to Brazil are currently subject to duties of 35%. It is not yet certain when negotiations will begin, but in August 2019 the four countries of the Mercosur bloc indicated to a Bangladeshi delegation that they were interested in an FTA.

Multinational Trade Agreements

Active

- South Asian FTA (SAFTA): SAFTA consists of Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka. SAFTA entered into force on January 1, 2006, and covers trade in goods. In 2008 Afghanistan joined the original signatories. The agreement is an attempt to increase intra-regional trade through the gradual dismantling of some tariff barriers; however, the agreement leaves out a large number of products denoted as sensitive and does not address non-tariff trade barriers. Intra-regional trade has the potential to increase existing trade by over 300%. Growing demand in the region for agricultural products creates an opportunity for exploring new avenues of intra-regional trade and investment in this sector.

- EU-Bangladesh Co-operation Agreement: EU countries are major export markets and businesses enjoy duty- and quota-free access for most goods exports to the bloc under the Everything But Arms agreement. The agreement entered into force on March 1, 2001. The EU is Bangladesh's main trading partner, accounting for around 24% of Bangladesh's total trade in 2015. EU imports from Bangladesh are dominated by clothing, accounting for over 90% of the EU's total imports from Bangladesh. EU exports to Bangladesh are dominated by machinery and transport equipment (49%). From 2008 to 2015 EU imports from Bangladesh almost trebled, from EUR5.5 billion to EUR15.2 billion, which is nearly half of Bangladesh's total exports. There will be increasing pressure on the government to improve working conditions in the garment industry as the EU will be closely observing Bangladesh. Several European importers have already come forward to help the country in improving safety features of ready-made garment factories, which is a good sign for the country.

- Asia-Pacific Trade Agreement (APTA): APTA consists of Bangladesh, Mainland China, India, Laos, South Korea and Sri Lanka. Some 4,721 Bangladeshi products enjoy duty-free access to Mainland China under APTA (in effect since September 1, 2006). In 2013 Bangladesh sought duty-free access for 17 more items. The country will have to grant duty-free access to products from Mainland China in its market if an FTA is signed between Bangladesh and Mainland China.

Under Negotiation

- BIMSTEC: BIMSTEC is a regional organisation comprising Bangladesh, India, Myanmar, Sri Lanka, Thailand, Bhutan and Nepal. Apart from India, developing Asian states are not key trade partners for Bangladesh, although this agreement creates opportunities to increase regional trade flows. The organisation has been active since 2006. Negotiations for a tariff-free zone began between various actors at multiple points in 2014. Once in place, the agreement is expected to further integrate the seven-nation area and aid regional development. Only India and Bhutan are not currently participating in Mainland China's Belt and Road Initiative, which may explain why the government led by Narendra Modi in India appears to be according a new priority to BIMSTEC in its foreign policy.

Sources: WTO Regional Trade Agreements database, Asia Regional Integration Centre, The Diplomat, European Commission, Dhaka Tribune, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The Bangladesh Investment Development Authority (BIDA) is the principal authority tasked with supervising and promoting private investment. The Bangladesh Export Processing Zones Authority (BEPZA) acts as the investment supervisory authority in export processing zones (EPZs). BEPZA is the one-stop service provider and regulatory authority for companies operating inside EPZs. Investments that are wholly foreign owned, joint ventures and wholly Bangladeshi-owned companies are all permitted to operate and enjoy equal treatment in the EPZs.

- Bangladesh’s World Bank Ease of Doing Business ranking improved by eight places to 168th out of 190 in 2020, supported by reforms that reduced the cost of starting a business, improved the process of obtaining electricity and credit access. However, at 168th position, Bangladesh still places near the bottom of the list, scoring poorly in areas such as property registration (184), contract enforcement (189), cross-border trade (176), insolvency resolution (151) and, despite the aforementioned reform, the obtaining of electricity (176).

- Some key sectors are reserved for government investment, such as defence equipment and machinery, forest plantation and mechanised extraction within the bounds of reserved forests, production of nuclear energy, and certain media and security services. In addition, there are 17 controlled sectors that require clearance from the respective line authorities. These sectors include fisheries; banking, insurance and other financial institutions; power generation; supply and distribution of power in the private sector; mineral extraction; large-scale infrastructure projects; crude oil refineries; energy-intensive operations; transport services; telecommunications; and media. BIDA lists more than a dozen potential sectors where investment is being encouraged through fiscal incentives: agribusiness, garments and textiles, ICT, leather and leather goods, electrical and electronic products, plastics, light engineering, shipbuilding, tourism, frozen food, renewable energy, ceramics, medical equipment, and healthcare.

- The government's industrial policy favours manufacturing and labour-intensive industries using local inputs. Various subsidies and other incentives are available to different industrial ventures, primarily in export sectors and, to some degree, import substitution sectors. The government also provides loans at concessionary rates through state banks and government-owned development banks for exports, cottage industries and agriculture.

- The Bangladeshi government is keen to attract more foreign direct investment and has set out an ambitious plan to build 100 special economic zones (SEZs) by 2030. The Bangladesh Zones Act was passed in 2010 and to date the Bangladesh Economic Zones Authority has obtained approval to establish 88 SEZs, comprising 59 government-owned zones and 29 private zones. In addition, there are other economic zones being established: public-private partnership (PPP) EZs, of which two have opened, and government-to-government (G2G) EZs. There are also plans to set up three special tourism parks in Cox's Bazar district, which have attracted investment interest from Thailand and Singapore, as well as an environmentally friendly ecotourism park at Sonadia Island. The G2G EZs reflect requests from several Asian countries to have specialised economic zones in Bangladesh: India has signed a memorandum of understanding to create two, in Kustia and Mongla; a Chinese economic and industrial zone is being developed at Anwara in Chittagong; and a Japanese economic zone is expected near Dhaka, to be developed by Sumitomo Corporation.

- Under the Belt and Road Initiative, Mainland China intends to set up economic corridors in alliance with other countries – for example, the Bangladesh, Mainland China, India and Myanmar Economic Corridor. The corridor will link Kolkata in India, Kunming in Mainland China, Mandalay in Myanmar and Dhaka in Bangladesh (among the key points). The Government of Mainland China has pledged to finance multi-billion dollar infrastructure projects in Bangladesh, including the construction of a 220km-long oil pipeline in Bangladesh, which will reduce the time and costs of transferring and unloading imported crude oil to onshore facilities in the country.

- Plans to improve on the country’s transportation infrastructure are outlined in the latest development plan (Seventh Five-Year Plan, FY2016-2020), which places a priority on all aspects of transportation infrastructure, and the promotion of the usage of public-private partnership (PPP) models.

Sourcea: WTO – Trade Policy Review, the International Trade Administration (ITA), US Department of Commerce, Bangladesh Investment Development Authority, Bangladesh Economic Zones Authority, Bangladesh Export Processing Zones Authority

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

EPZs: general incentives |

|

|

EPZs: Mongla, Ishwardi and Uttara: specific tax holiday incentives |

|

|

EPZs: Chittagong, Dhaka, Comilla, Adamjee, Karnaphuli: specific tax holiday incentives |

|

|

General incentives |

|

Sources: Bangladesh Economic Zones Authority, Fitch Solutions

This document has been composed with the online instant web content converter which can be found at htmleditor.tools

- Value Added Tax: 15%

- Corporate Income Tax: 25%

Source: Bangladesh National Board of Revenue

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 25% on profits for listed companies |

|

Branch Remittance Tax |

20% |

|

VAT |

15% on the sale of most goods and services, but a reduced rate of 5% applies to electricity supply, information technology services, online business services, 4.5% on photography and garages, 2% on goldsmiths, and 1.5% on construction. Bangladesh introduced a new VAT regime on July 1, 2019, which made available reduced VAT rates of 7.5%, 5% and 10%. Certain products and services are exempt from VAT (foodstuffs, agricultural supply, public transport, pharmaceutical products and educational services). |

|

Capital Gains Tax |

15% net earnings |

|

Withholding Taxes (paid to non-residents) |

- 20% on dividend income |

|

Stamp Duty |

Stamp duty dating from the 1899 Stamp Act is levied on a variety of things, including financial instruments, property and specified transactions – for example, mobile phone operators are subject to rates of 0.07 to 4% depending on the dutiable transaction. |

Source: Bangladesh National Board of Revenue

Date last reviewed: May 3, 2020

Localisation Requirements

The BIDA stipulates that private sector industrial enterprises wanting to employ foreign nationals are required to apply in advance. Foreign nationals can normally be employed for jobs for which local personnel are not available, and the number of foreign employees should not exceed 5% of total employees (including management staff) in the industrial sector and 20% in the commercial sector. In addition, foreign nationals are initially considered for a term of only two years, after which employment may be extended dependent on BIDA approval.

Visa/Travel Restrictions

All foreign nationals seeking paid employment in Bangladesh must be in possession of a valid work permit. The tenure of a work permit for a foreign worker is generally two years. Foreign citizens or nationals of India, Pakistan and South Korea travelling by air to Bangladesh with a valid visa for 90 days or longer are required to register at the airport.

Sources: Bangladesh Investment Development Authority, Bangladesh Consulate General, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ba3 (Stable) |

19/03/2020 |

|

Standard & Poor's |

BB- (Stable) |

06/04/2010 |

|

Fitch Ratings |

BB- (Stable) |

25/11/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

177/190 |

176/190 |

168/190 |

|

Ease of Paying Taxes Index |

152/190 |

151/190 |

151/190 |

|

Logistics Performance Index |

100/160 |

N/A |

N/A |

|

Corruption Perception Index |

149/180 |

146/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

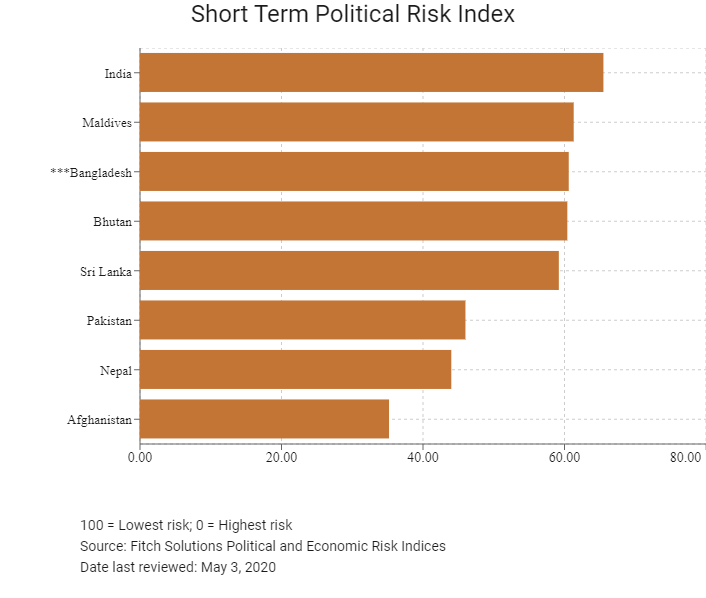

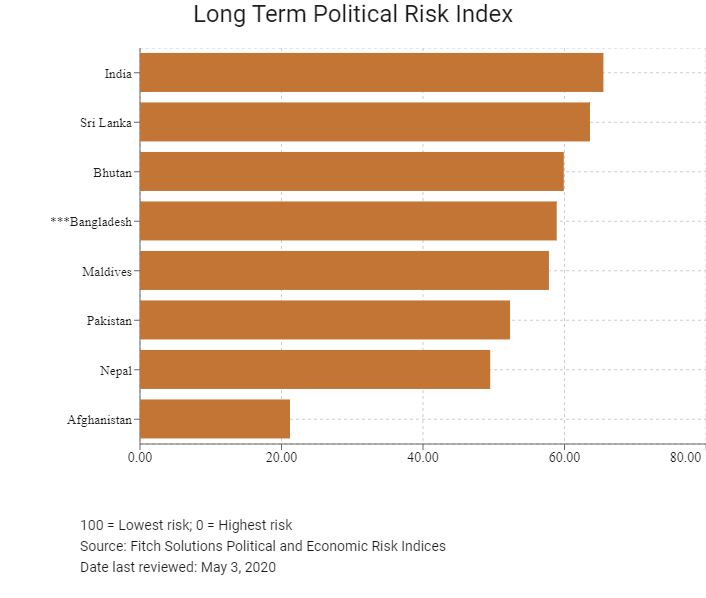

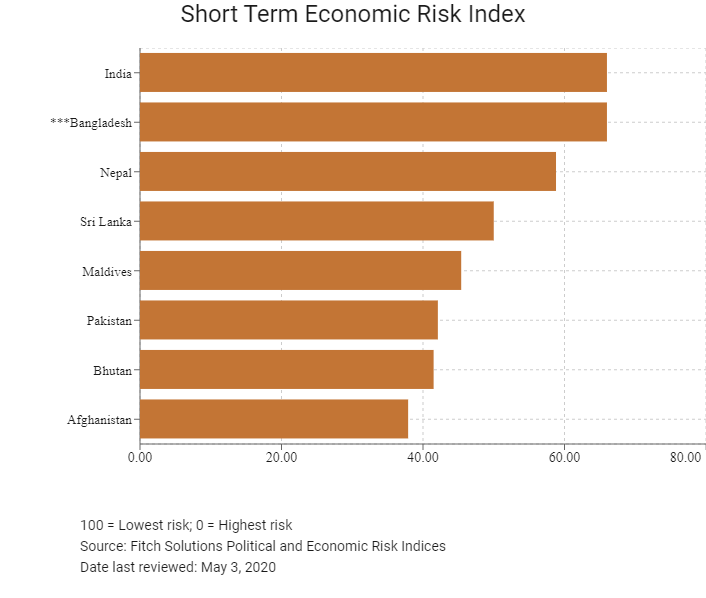

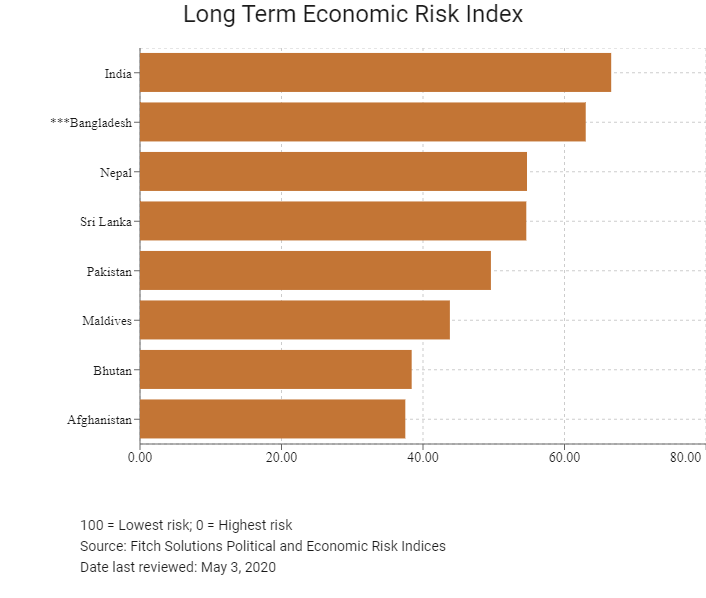

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

57/202 |

64/201 |

55/201 |

|

Short-Term Economic Risk Score |

70.0 |

63.3 |

66.0 |

|

Long-Term Economic Risk Score |

63.4 |

61.4 |

63.0 |

|

Political Risk Index |

109/202 |

106/201 |

112/201 |

|

Short-Term Political Risk Score |

58.1 |

60.6 |

60.6 |

|

Long-Term Political Risk Score |

60.4 |

60.4 |

58.9 |

|

Operational Risk Index |

142/201 |

145/201 |

148/201 |

|

Operational Risk Score |

38.6 |

38.5 |

38.1 |

Source: Fitch Solutions

Date last reviewed: May 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

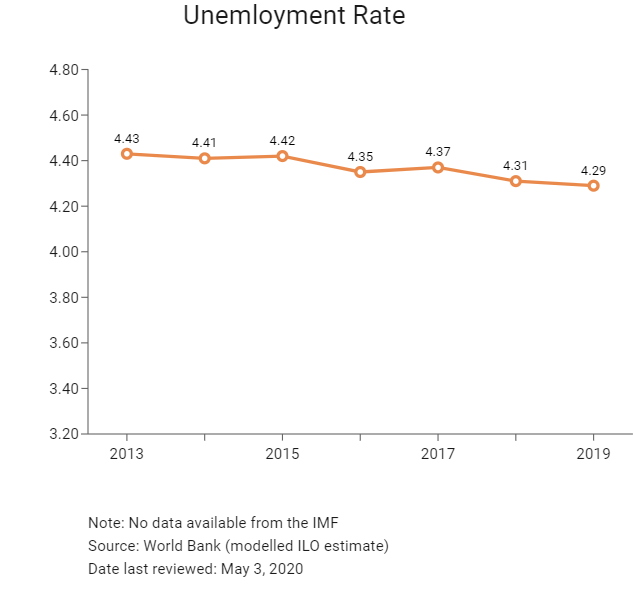

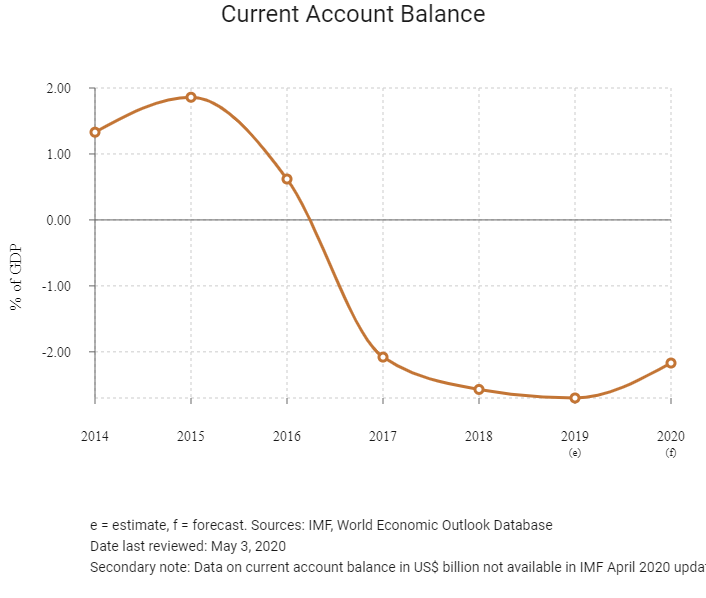

Bangladesh has relatively low economic risk by regional comparison, which is a reflection of the country's high economic growth rate amid still elevated inflation and long-running fiscal deficit. Remittances from overseas workers help to cover the substantial goods and services trade deficit. However, the trade gap remains a risk to economic growth in the near term amid rising global headwinds. That said, in 2020 economic growth will slow, due to Covid-19. In addition, downside risks include threats from a banking system under strain from non-performing loans and vulnerability to natural disasters such as flooding and cyclones.

OPERATIONAL RISK

Bangladesh's overall investment attractiveness is weighed down by structural weaknesses in the country. Underdeveloped transport and utilities infrastructure and significant legal and security risks will preclude rapid foreign direct investment growth in the medium term. In addition, firms experience significant barriers to entry in some sectors, emanating from onerous taxes, sector-specific foreign participation restrictions as well as legal and reputational concerns, particularly regarding factory safety and domestic working conditions. These factors, combined with burdensome bureaucracy, will lead to supply chain disruptions, elevated business costs and further deteriorate risk sentiment. Upside risks stem from the country's large population, competitive labour costs and proximity to key source markets, which are significant pull factors for businesses looking to set up labour-intensive operations, particularly in industries such as ready-made garments, footwear and other forms of light manufacturing.

Source: Fitch Solutions

Date last reviewed: May 4, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

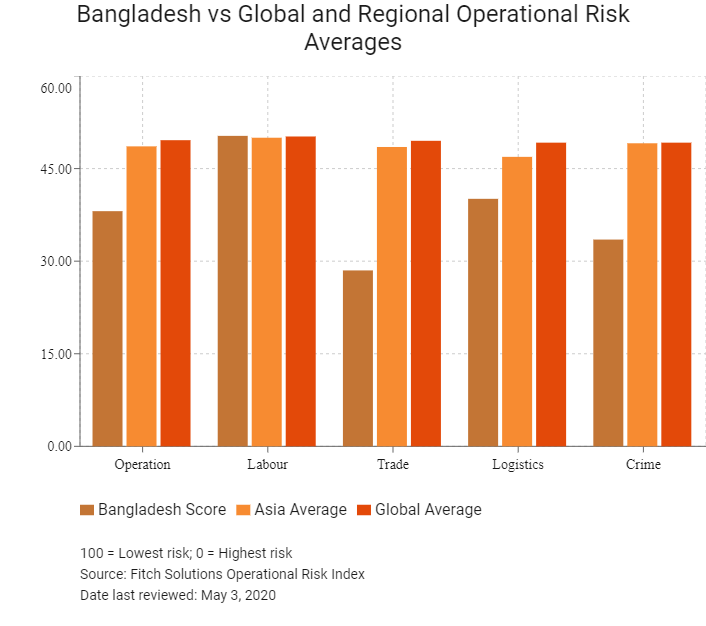

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Bangladesh Score |

38.1 |

50.3 |

28.5 |

40.1 |

33.5 |

|

South Asia Average |

42.2 |

44.5 |

40.6 |

43.7 |

40.0 |

|

South Asia Position (out of 8) |

6 |

1 |

7 |

5 |

7 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

27 |

16 |

32 |

21 |

30 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

148 |

101 |

179 |

130 |

156 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Secruity Risk Index |

|

India |

53.8 |

46.4 |

55.0 |

66.6 |

47.0 |

|

Bhutan |

50.7 |

44.0 |

50.5 |

51.2 |

57.3 |

|

Sri Lanka |

50.4 |

46.8 |

48.3 |

56.0 |

50.5 |

|

Maldives |

44.0 |

48.0 |

42.9 |

37.5 |

47.8 |

|

Pakistan |

40.5 |

42.6 |

42.6 |

42.4 |

34.4 |

|

Bangladesh |

38.1 |

50.3 |

28.5 |

40.1 |

33.5 |

|

Nepal |

37.0 |

37.7 |

34.1 |

36.6 |

39.7 |

|

Afghanistan |

23.1 |

40.4 |

23.3 |

19.1 |

9.7 |

|

Regional Averages |

42.2 |

44.5 |

40.6 |

43.7 |

40.0 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 3, 2020

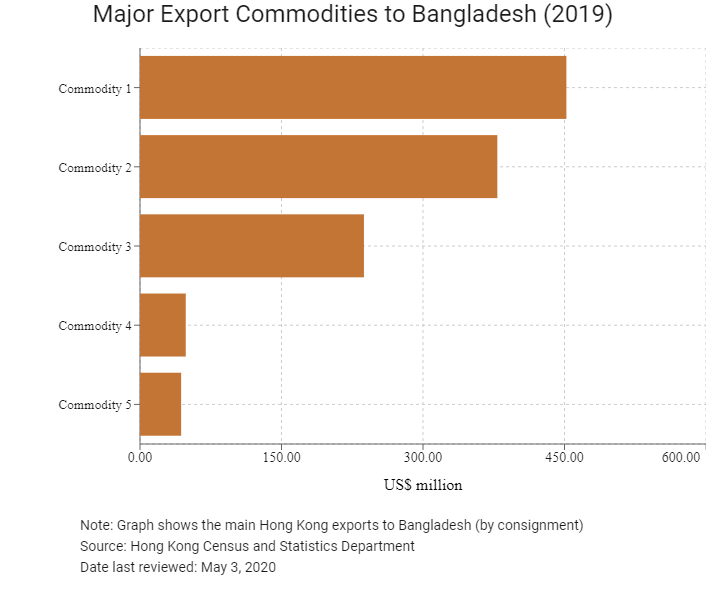

Hong Kong’s Trade with Bangladesh

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Textile yarn, fabrics, made-up articles, and related products

|

452.0

|

|

Commodity 2 |

Telecommunications and sound recording and reproducing apparatus and equipment |

378.8 |

|

Commodity 3 |

Miscellaneous manufactured articles |

237.4 |

|

Commodity 4 |

Articles of apparel and clothing accessories |

48.5 |

|

Commodity 5 |

Manufactures of metals |

43.6 |

|

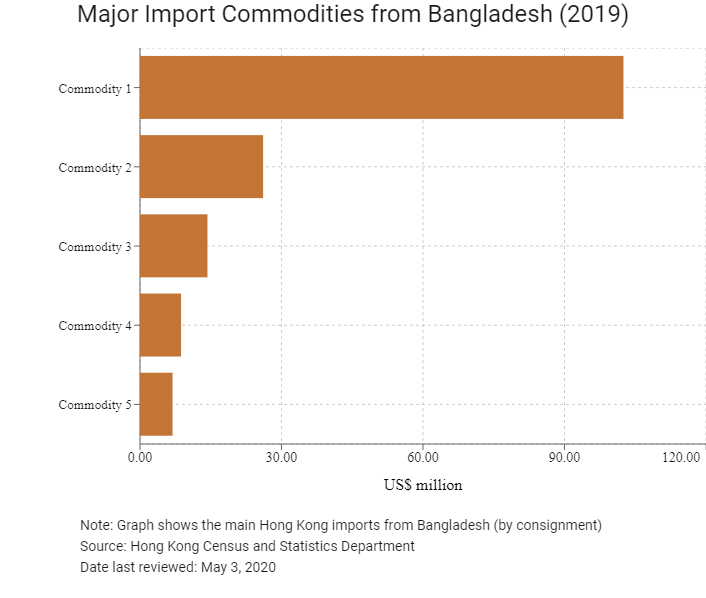

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Articles of apparel and clothing accessories |

102.5 |

|

Commodity 2 |

Leather, leather manufactures, and dressed furskins |

26.1 |

|

Commodity 3 |

Footwear |

14.3 |

|

Commodity 4 |

Photographic apparatus, equipment and supplies and optical goods; watches and clocks |

8.7 |

|

Commodity 5 |

Travel goods, handbags and similar containers |

6.9 |

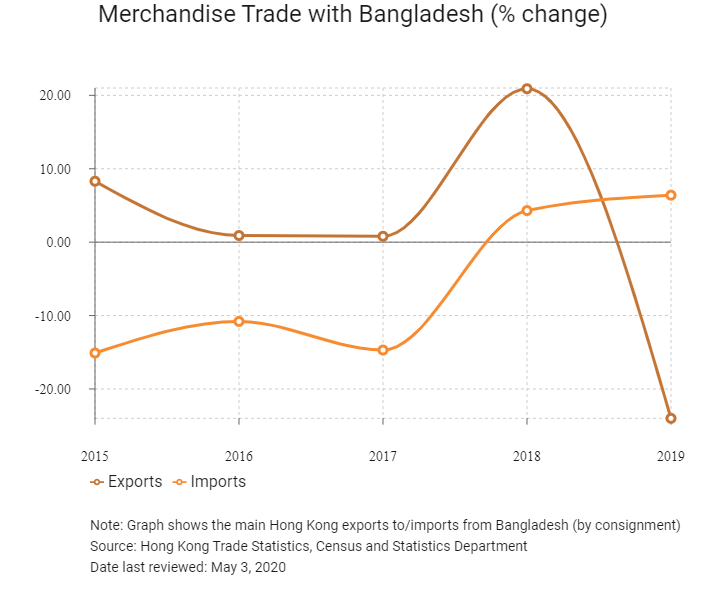

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Bangladeshis visiting Hong Kong |

4,434 |

-16.1 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of Bangladeshis residing in Hong Kong |

575 |

29.5 |

|

Number of South Asia residents residing in Hong Kong |

46,794 |

29.6 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years

Date last reviewed: May 3, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Bangladeshi companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong, Mainland China and Bangladesh

- Hong Kong has an air services agreement with Bangladesh which entered into force December 9, 2005.

- Bangladesh has a double taxation agreement with Mainland China, which entered into force on April 10, 1997.

- Bangladesh has a bilateral investment treaty with Mainland China, which entered into force on March 25, 1997.

Sources: Inland Revenue Department, Government of Hong Kong, State Administration of Taxation of The People's Republic of China, UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Bangladesh Chamber of Commerce and Industry Hong Kong

Address: Room 1913-1916, China Merchants Tower, Shun Tak Centre, 200 Connaught Road, Central, Hong Kong

Email: info@bccihk.org

Tel: (852) 2812 1528 / 2834 1991

Fax: (852) 2575 2907

Source: Bangladesh Chamber of Commerce and Industry Hong Kong (BCCIHK)

Consulate General of the People's Republic of Bangladesh in Hong Kong

Address: 24 floor, SUP Tower, 75-83 King's Road, North Point, Hong Kong

Email: mission.hongkong@mofa.gov.bd

Tel: (852) 2827 4278 / 2827 4279

Fax: (852) 2827 1916

Source: Consulate General of The People's Republic of Bangladesh in Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders need one of several types of visa issued before arrival when visiting Bangladesh.

Source: Consulate General of The People's Republic of Bangladesh in Hong Kong

Date last reviewed: May 3, 2020

Bangladesh

Bangladesh