GDP (US$ Billion)

105.90 (2018)

World Ranking 63/193

GDP Per Capita (US$)

3,621 (2018)

World Ranking 123/192

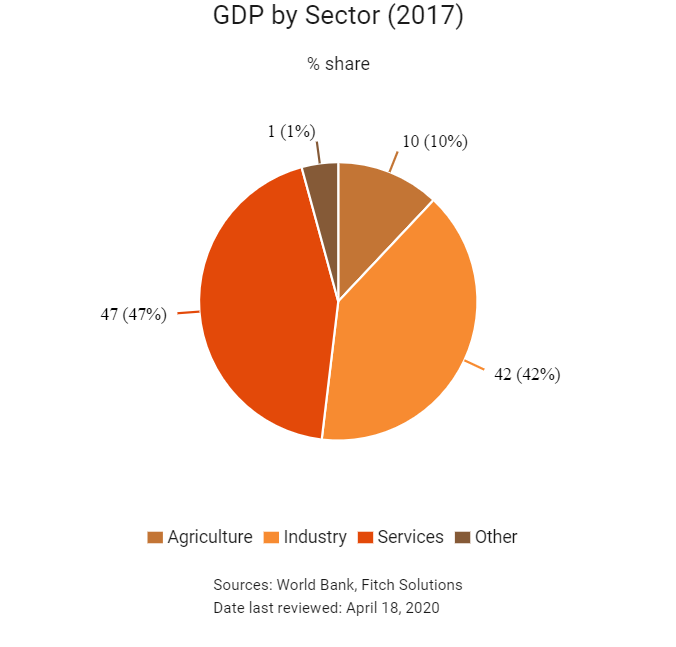

Economic Structure

(in terms of GDP composition, 2017)

External Trade (% of GDP)

52.3 (2017)

Currency (Period Average)

Angolan Kwanza

364.83per US$ (2019)

Political System

Presidential republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

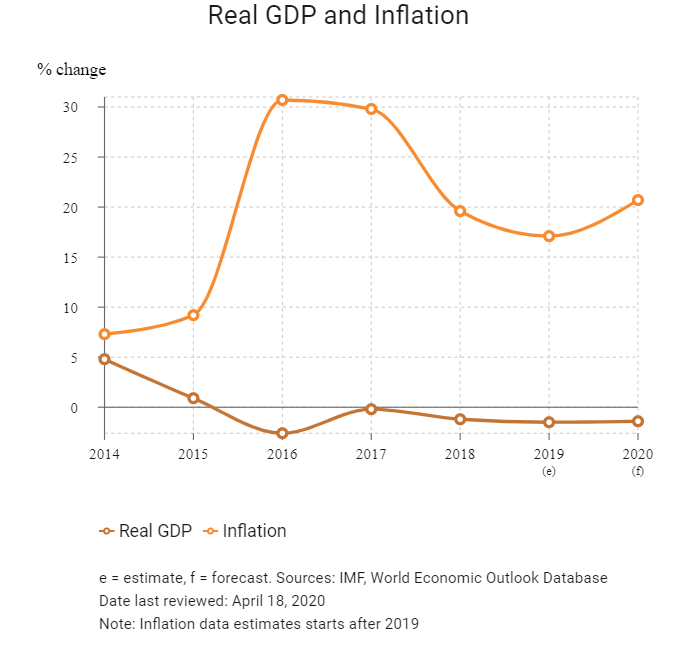

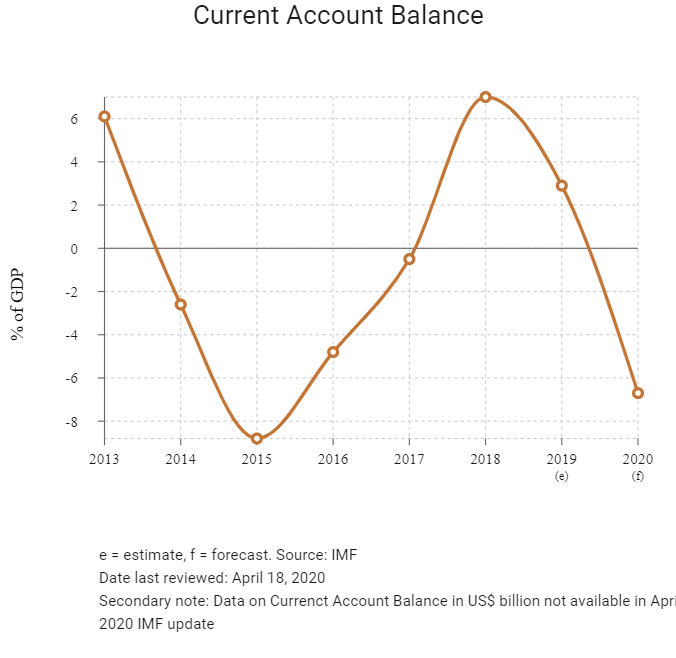

Angola is run by a multiparty regime, with its president as the chief of state. Its legal system is based on Portuguese civil law and customary law which has been modified to accommodate political pluralism and increased use of free markets. The administration of President João Lourenço has embraced reforms on several fronts to achieve macroeconomic stability and create a favourable environment for economic growth. After devaluing the currency, the government took further steps towards a more transparent and market-based foreign exchange market. Monetary policy remained tight and a substantial budget surplus was achieved in 2018. The new macroeconomic framework is being supported by a three-year International Monetary Fund Extended Financial Facility in the amount of USD3.7 billion. Internationally, Angola is becoming more assertive and demonstrating a more steadfast commitment to peace and stability in Africa, particularly in the Great Lakes region. However, the country continues to face internal development challenges, which include reducing its dependency on oil and diversifying the economy, rebuilding its infrastructure, and improving institutional capacity, public financial management systems and human development indicators.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

August 2017

The ruling MPLA was confirmed as election winners. João Lourenço became president and began to implement reforms and ramped up anti-corruption efforts.

August 2017

Construction on the Caculo Cabaca Hydropower Project began in August 2017 and was slated for completion in 2024. The facility would produce an additional 2,170MW to add to Angola's electricity generation capacity.

March 2018

As of the end of March 2018, citizens from 61 countries could apply for a tourist visa valid for up to 30 days with a pre-visa system. Applicants applied for the pre-visa online and then would be granted the visa at Luanda Airport. These countries included the European Union (EU), Mainland China, Brazil, Canada, India, Indonesia, Israel, Japan, Russia, the United Arab Emirates and the United States.

May 2018

The Angolan government announced that it intended to, at least partially, privatise around 74 state-owned enterprises by 2021. These include Angola's ports, its national air carrier, Ensa (the state-owned insurance company), BCI Bank and Angola Telecom.

September 2018

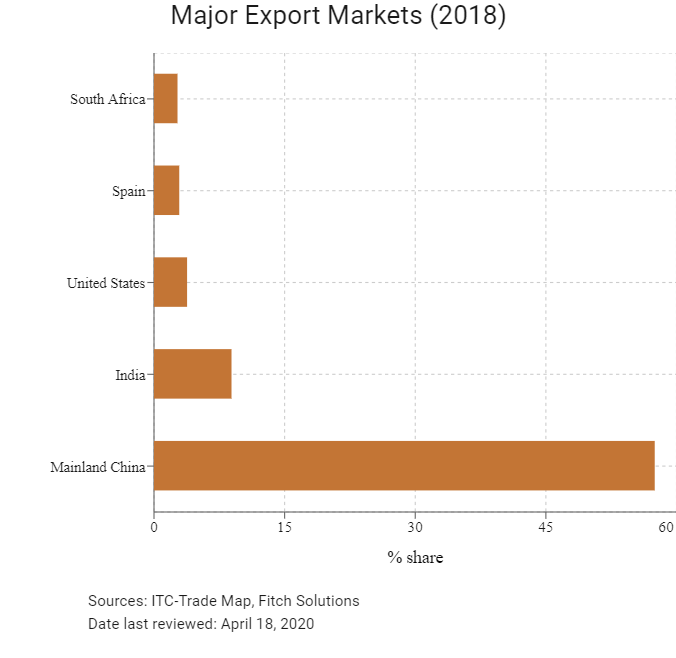

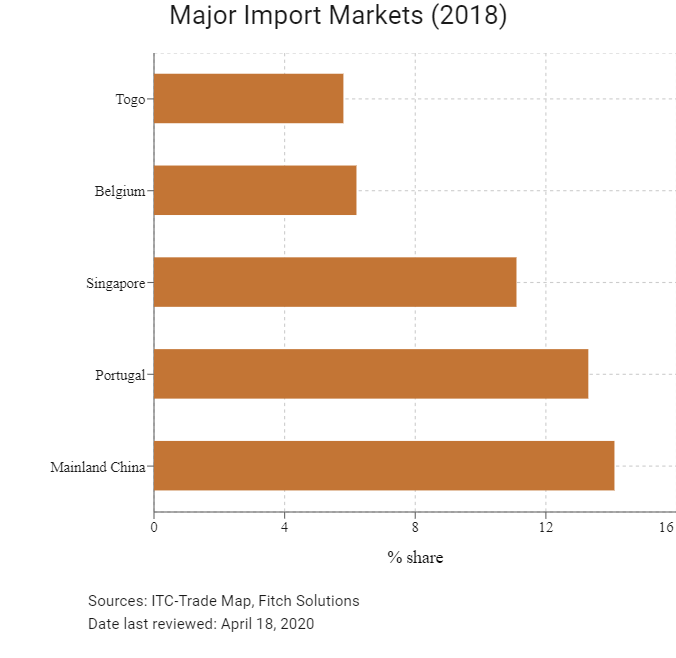

Angola reached an agreement with Mainland China for a USD11 billion credit facility in September 2018 following the Forum on China-Africa Cooperation. The credit obtained from Mainland China has reportedly been earmarked for investment in infrastructure. Assistance from Mainland China to Angola over the last decade and a half had been prolific, with Angola receiving more financial assistance from Beijing than any African state.

December 2018

The International Monetary Fund approved a USD3.7 billion loan programme for Angola.

October 2019

The introduction of value added tax (VAT), which was initially scheduled for January 2019, had been postponed to October 2019. The introduction of VAT would replace Consumer Tax. The rate of VAT introduced was 14%, with exceptions for certain basic products.

October 2019

The Government of Angola decided to retain Caioporto as concessionaire of the USD831.9 million Novo Porto do Caio project in the Cabinda province. In a decree on October 2, 2019, President João Lourenço decided to annul the commission created to negotiate the termination of the current concession contract, which was currently with Caioporto. The Angolan government would provide 85% of the project cost, with the remainder to be provided by the concession holder. The port project would be carried out in three phases by the China Road and Bridge Corporation. Phase one work included the construction of port infrastructure and a 1square kilometre cargo service area as well as a 775m long quay. The port would have a 1.13km berth, customs facilities, workshop warehouses and commercial establishments.

October 2019

In early October 2019, Angola's Ministry of Mineral Resources and Petroleum opened an international tender for the acquisition of rights to prospect and exploit diamond, iron and phosphate in five regions of the country. The diamond concessions are located in eastern Lunda Norte and Lunda Sul, while the iron is in northern Cuanza-Norte and phosphate in northern Cabinda and Zaire provinces. This opened up new business opportunities for investors in the extractive sector, which aided the country in its diversification efforts, making it more attractive to foreign investment.

March 2020

The central bank announced a cash injection of AOA100 billion (approximately USD186 million) for the purchase of government securities from non-financial corporations. In addition to this, the central bank extended liquidity support to banks, amounting to 0.5% of GDP. Further to this, the BNA expanded its credit-stimulus programme that allows banks to deduct from their reserve requirement obligations the amount of credit extended to selected sectors targeted by an ongoing import substitution or export promotion programme.

April 2020

The National Assembly approved a package of revenue and expenditure measures to fight the Covid-19 outbreak in the country and to minimise its negative economic impact. Additional healthcare spending to respond to the virus, estimated at USD40 million, was announced. Tax exemptions on humanitarian aid and donations and some delays on filing taxes for selected imports were granted.

Sources: BBC Country Profile – Timeline, national sources, Fitch Solutions

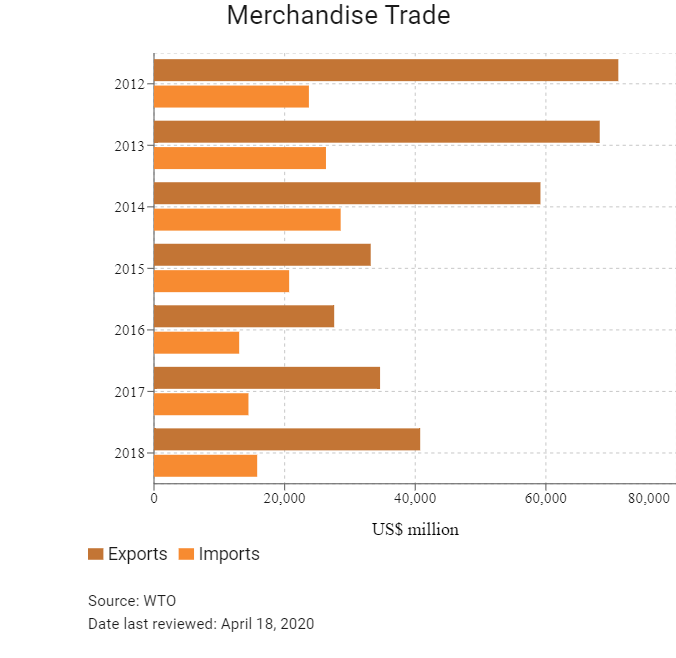

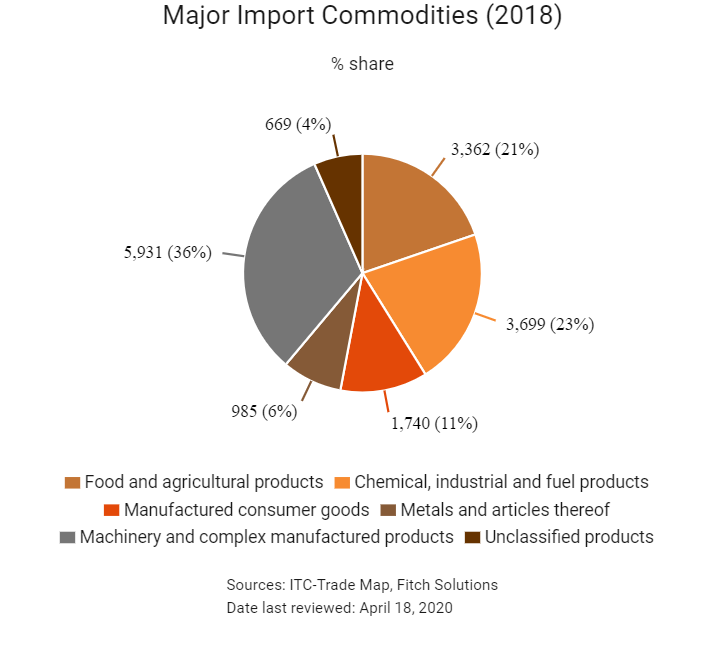

Merchandise Trade

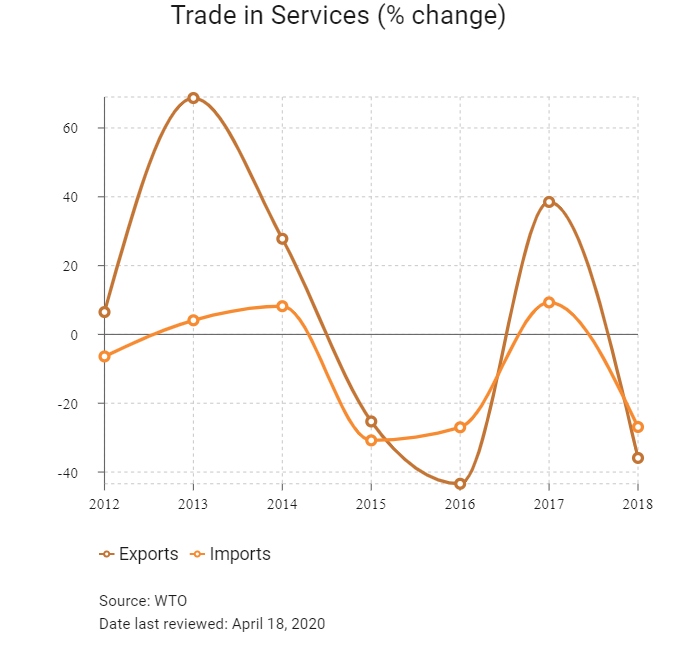

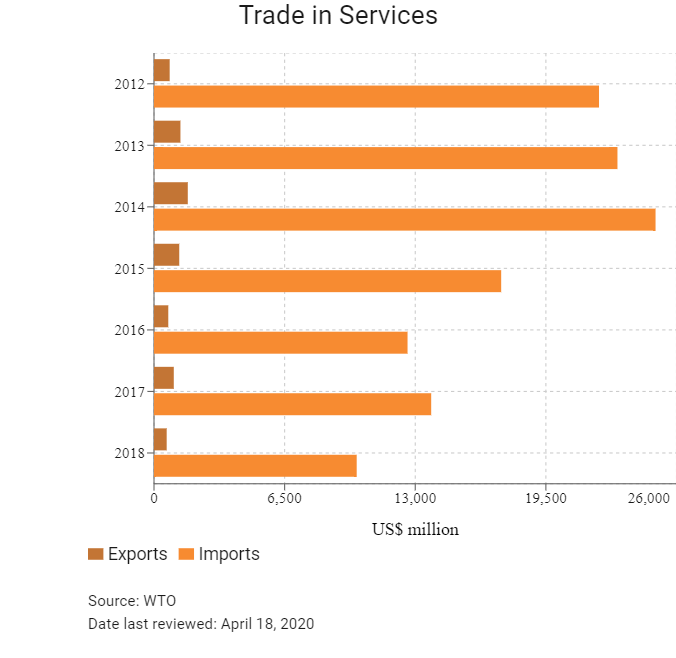

Trade in Services

- Angola has been a member of the World Trade Organization (WTO) since 1996.

- While Angola is a member of the Southern African Development Community (SADC), it is not a member of the SADC free trade agreement (FTA). However, at the time of writing Angola is yet to join SADC's FTA. South Africa is already a significant trade partner with Angola, with the latter opting to maintain a blanket tariff rate on all goods and services from South Africa so as to protect local industry.

- A number of categories of goods require authorisation from the relevant government agency for their importation. The following categories of goods all require authorisation prior to import:

- Pharmaceutical substances, saccharine and products derived thereof (Ministry of Health).

- Fiscal or postal stamps, radios, transmitters, receivers, and other devices (Ministry of Post and Telecommunications).

- Weapons, ammunition, fireworks, and explosives (Ministry of Interior).

- Plants, roots, bulbs, microbial cultures, buds, fruits, seeds, and crates and other packages containing these products (Ministry of Agriculture).

- Poisonous and toxic substances and drugs (Ministries of Agriculture, Industry, and Health).

- Goods imported to be given away as samples (Ministry of Customs).

- Customs duties are levied on imports at ad valorem rates ranging from 2% to 70% and consumption tax at ad valorem rates varying from 2% to 30%.

- Listed equipment may be imported temporarily if a guarantee is provided in favour to the Angola tax authorities.

- A 1% stamp tax is also due on the importation and customs fees (from 2%).

- The exportation of goods that are not produced in Angola is subject to customs duties at the rate of 20% plus customs fees (at rate of 0.5%) computed on the customs value, with the exception of goods covered by the Customs Regime Applicable to the Petroleum and Mining Sectors.

- A special exemption regime applies for the oil industry for some listed equipment.

- From October 1, 2019, excise duty entered into force in Angola. All production, imports and sales by public auction are subject to excise duty, with different rates of 2%, 5%, 19% and 25% depending on the product. The rates applicable to the oil derivatives remain, generally, at 2%.

- The excise duty code covers operations with sugar and alcoholic beverages, tobacco and its derivatives, fireworks and firearms, jewellery and goldsmith articles, aircraft, art objects, petroleum products, vehicles, plastic bags and straws and tyres. Producers are required to assess the excise duties when goods are made available to purchasers or clients and should be submitted in duplicate and electronically, until the last day of each month.

- The excise duty code also provides for some exemptions, including exports by the producer, goods imported by international organisations, raw materials for domestic industry, goods intended for laboratory and scientific research purposes, personal goods defined by customs legislation, consumer goods as shipboard supplies, products sold on board, products benefiting from the suspension of customs duties and products sold in duty-free stores.

- With the implementation of the VAT and excise duties codes, financing operations, leasing, report, insurance and reinsurance transactions that are subject to and not exempted from VAT are exempt from stamp tax. In addition, the VAT code revoked stamp tax on customs. Additionally, with the entrance into force of the VAT, the taxable persons covered by the general regime of the VAT as well as those covered by the transitional regime are exempt from 1% stamp tax on the receipts (in cash or in kind). Stamp tax is payable on a wide variety of transactions and documents at specific amounts or at a percentage based on value.

Sources: Global Trade Alert, WTO – Trade Policy Review, national sources, Fitch Solutions

Trade Updates

In September 2019, Angola and South Africa agreed to strengthen trade relations. In particular, the agreement looks to ensure the relationship with their business partners translates into a productive partnership that will enable the participation of small-, micro- and medium-sized enterprises and the transfer of specialised skills and technology. This strategy will help Angola diversify its economy and open up business opportunities for firms that operate in other non-oil sectors.

Multinational Trade Agreements

Active

- Angola-United States: Angola benefits from the Africa Growth Opportunity Act (AGOA), the United States preferential trade agreement which provides duty-free status for qualifying goods exported from Angola to the United States. The Angolan government is working to diversify its economy and recently established an export promotion agency to encourage exports, including those to the United States that could take advantage of AGOA.

- The African Continental FTA (AfCFTA): The AfCFTA was formally launched on July 7, 2019. This agreement stood out as one of the most ambitious projects of the African Union (AU) as it seeked to create the largest single market in the world by country membership. The AfCFTA would cover a market of more than 1.3 billion people with combined nominal GDP of USD2.5 trillion. Out of the continent's 55 states, 54 have signed the agreement, with Eritrea as the only non-signatory. The AfCFTA was signed in Kigali, Rwanda on March 21, 2018, and was ratified by the necessary 22 states in April 2019. According to the framework agreement, 90% of trade in goods will be liberalised over the course of five to eight years, 7% of goods will be classed as sensitive and liberalized over 10-13 years, and 3% of goods will be exempt from free trade entirely. The allocation of goods to these different categories has yet to be negotiated and regional countries and their respective customs unions are currently preparing offers for their continental counterparts to consider. The 'sensitive items' lists may differ according to each bilateral relationship.

Under Negotiation

The SADC: At a regional level, Angola is a member of the SADC, but is not party to the SADC FTA which involves 12 out of the 15 member countries with the objective of reducing trade barriers among countries in the region. The country has been unwilling to join the SADC FTA due to the government's concern that such a union would limit the competitiveness of local industries by lowering trade tariffs.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

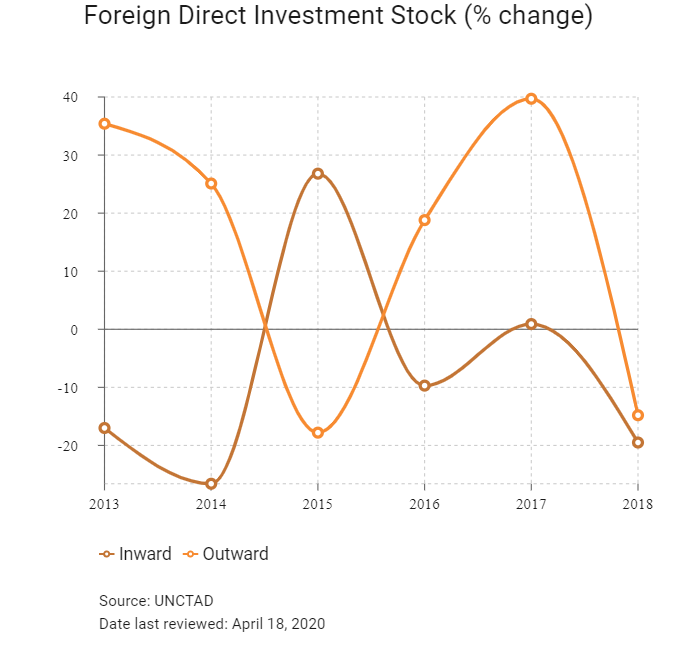

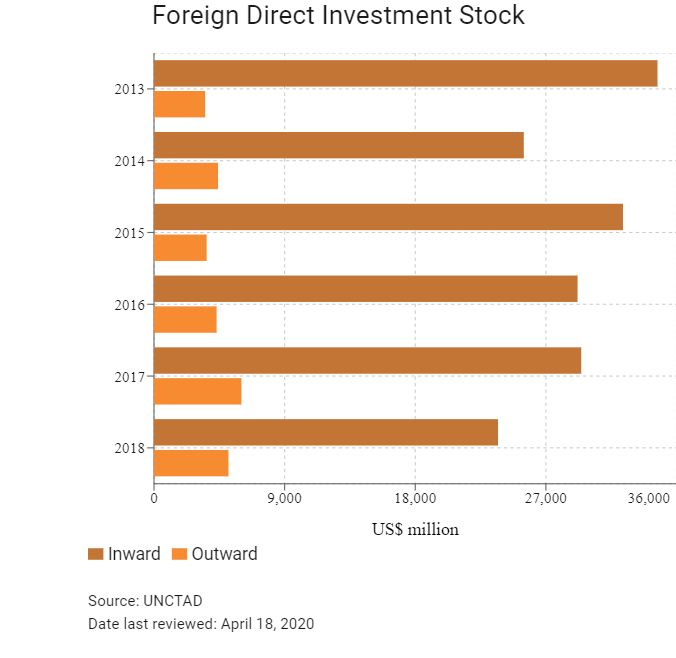

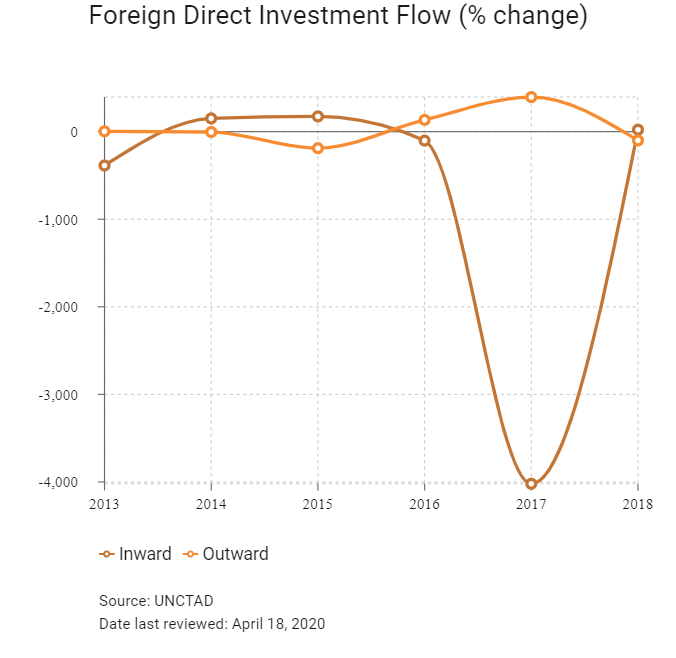

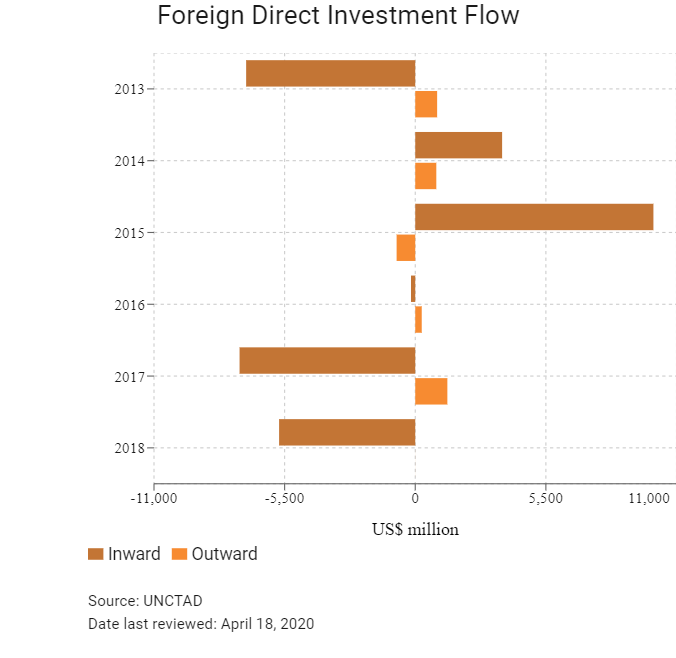

Foreign Direct Investment

Foreign Direct Investment Policy

- The new administration of President João Lourenço – which took office after the 2017 general elections – has embraced reforms on several fronts to achieve macroeconomic stability and create a favourable environment for economic growth. After devaluing the currency, the government took further steps towards a more transparent and market-based foreign exchange market. Exchange rate misalignments were reduced in 2018 with greater exchange rate flexibility.

- On April 1 2020, Angola's central bank introduced an electronic platform for foreign exchange transactions, which will be progressively extended for all such transactions as part of the government's response to mitigate the impact of Covid-19 on the economy. This will ease currency conversion for businesses reliant on foreign exchange amid foreign currency shortages facing the state.

- In May 2018, with input from the private sector, the government approved a new private investment law. The new law eliminates the local partnership requirement for foreign investors, and offers greater business facilitation and tax incentives for investors. Under the new regime, local content restrictions were eliminated (except for those originating from industry specific legal statutes, such as on oil and gas, mining, banking and financial services, aviation, and shipping).

- The government has also created the Agency for Investment and Promotion of Exports of Angola (Agencia de Investimento e Promocao de Exportacoes de Angola-AIPEX). It is a single body that aims to promote investments and exports and the international competitiveness of Angolan companies.

- With the new 2018 investment law, Angola's limits on foreign equity participation will substantially reduce, bringing it more in line with those of its Sub-Saharan African neighbours. Foreign ownership will remain limited to 49% in the oil and gas sectors, 50% in insurance and 10% in the banking sectors. The Angolan government eliminated the 35% local content requirement in foreign investments, and it offers incentives to companies investing in the domestic economy, while maintaining minimal FDI screening processes. There are several objectives that the government seeks to accomplish through its FDI screening process: first, to create jobs for Angolans or transfer expertise to Angolan companies as part of the 'Angolanisation' plan; second, to protect sensitive industries such as defence and finance; third, to prevent capital flight or any other behaviour that could threaten the stability of the Angolan economy; and finally, to diversify the economy.

- Further reform momentum will stem from the three-year International Monetary Fund programme as well as the planned privatisation of 195 state-owned enterprises and stakes from 2019 to 2022 – with assistance of the World Bank – in pursuit of improving competition and efficiency in the business environment. The privatisation programme is set to include the full or partial divestment of several firms including national airline TAAG, diamond company Endiama, and 50 subsidiary companies and other assets of state-owned oil company Sonangol. While the timeline for the process may be ambitious – aiming to sell 20 companies and assets by the end of 2019 and 26 over 2020 – we believe the government's reformist agenda will be regarded positively by investors.

- According to Decree 151/17 effective from July 4, 2017, the three-year maximum duration of work permits granted to foreigners has ceased to be applicable within the Angolan jurisdiction. Instead, these work permits will from now on be granted for as long as the contracts of foreign employees are valid.

- All companies must prepare their financial statements in accordance with the Angolan Accounting Law and the Angolan General Accounting Plan.

- The government has made progress in the establishment of the antitrust law, followed by the creation of a competition authority.

- Under the Land Tenure Act of 2004, all land belongs to the state and the state reserves the right to expropriate land from any settlers. The state may also allow for land usage through a 60-year lease, after which it reserves the legal right to take over ownership.

- Angola is not a member state to the International Centre for Settlement of Investment Disputes (ICSID Convention), but has ratified the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards. Its ratification was endorsed domestically via resolution No. 38/2016, published in the Official Gazette of Angola on August 12, 2016.

- Angola plans to auction nine oil blocks in 2019 and is seeking to build new refineries as Africa’s second-biggest oil producer looks to benefit from the rise in crude prices that could boost companies’ appetite for investments. The tenders for the offshore areas are part of efforts to lure back global explorers. The nine blocks are located in the Namibe basin, and are part of 55 blocks which are expected to be auctioned through to 2025.

- The government is offering tax concessions for companies developing smaller fields, is cutting bureaucracy and selling parts of state-owned oil company Sonangol to attract foreign companies. Some of the efforts are bearing fruit as French major Total SA and Italy’s Eni began pumping from new areas in the past year, and other blocks are set to start or resume in 2019, according to the government.

- President João Lourenço announced in 2018 that the government aims to reform Angola's state-owned Sonangol. Several state-owned enterprises are being lined up to be privatised in the near term, in line with the government's announcement in April 2019 that it would start the privatisation programme with the sale of seven industrial units. Among the key deals include the proposed sale of a minority stake (estimated at around 45%) in Angola Telecom, currently scheduled for 2021, a holding in state-owned oil giant Sonangol in 2022 and in national air carrier TAAG. Foreign investors in the energy, telecoms, aviation and construction sectors stand to benefit the most given a relaxation of stringent local content requirements that previously were significant barriers of entry in these sectors.

- Angola is party to several investment related treaties and conventions. In May 2009, Angola signed a Trade and Investment Framework Agreement (TIFA) with the United States, intended to provide a forum to address trade issues and to help enhance trade and investment relations between the two countries. The first meeting of the TIFA Council under this agreement took place in June 2010 with the recent meetings in 2015 and 2016 at the working level focused on a plan development, AGOA market access, and strategies to improve the business climate, but with limited engagement by the Angolan government under the then Minister of Commerce.

- In July 2010, the United States and Angola signed a Memorandum of Understanding establishing a bilateral Strategic Partnership Dialogue, which commits the two parties to increased bilateral relations. Angola has bilateral investment agreements in force with Cabo Verde, Germany, Italy, and Russia. Angola has also signed agreements with Portugal, South Africa, Spain, Brazil, France, and the United Kingdom, but these agreements have not yet entered into force.

- Angola is a member of the World Bank, African Development Bank, the Organisation of Petroleum Exporting Countries (January 2007), the United Nations and most of its specialised agencies - International Conference on Reconstruction and Development.

- Angola conducts several bilateral negotiations with Portuguese Speaking countries, Cuba and Russia and extends trade preferences to Mainland China due to credit facilitation terms, while attempting to encourage and protect local content.

- In 2009, Angola established the Luanda-Bengo Special Economic Zone. Under the new investment law, Angola is divided into four economic zones, Zone A to D, offering different incentives. Porto Caio is under construction in the province of Cabinda. The port is designated as a free trade zone and is slated to provide numerous opportunities for warehousing, distribution, storage, lay down area and development of oil, and gas related activity. The port will also serve as a new major gateway to international markets from the west coast of Angola, and the development will facilitate exports and render them more cost-effective for companies.

Sources: WTO – Trade Policy Review, World Bank, national sources

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Micro enterprises |

- Exemption on stamp duties |

|

Small- to medium-sized enterprises |

- Tax reduction ranging between 10% and 50% for the first two- to five years (depending on location or zone) |

|

Special zones |

- Zone A (which covers the province of Luanda, Benguela and Huíla headquarters and Lobito municipality) offers a three-year tax exemption for capital tax and a reduction in the tax burden by 25-50%. Regarding private investment in Zone A, the provisional industrial tax was reduced by 20% for a period of two years. Capital application stipulations require that private investors pay 11.25% of tax, in two years, against the previous 15%. |

Sources: National sources, Fitch Solutions

- Value Added Tax: 14%

- Corporate Income Tax: 30%

Sources: The Angolan Ministry of Finance, The Angolan General Tax Administration

Important Updates to Taxation Information

- The introduction of VAT, which was initially scheduled for January 2019, has been postponed to October 2019. The introduction of VAT will replace consumption tax. The introduction of VAT aims to increase neutrality in the taxation of consumption, while also promoting the collection of revenue owed to the state. The rate of VAT to be introduced will be 14%, with exceptions for certain products included in the basic basket of goods. VAT will initially be charged to 1,600 companies registered with the Tax Office of Large Taxpayers and others that have voluntarily joined the general scheme. Companies that have opted for the general VAT regime will now submit a periodic statement that will be checked by the General Tax Administration, and from January 2020 onwards they will start submitting their invoices electronically, which will be checked in more detail.

- From 2021 onwards all taxpayers with turnover or equivalent annual revenue in kwanzas of USD250,000 will be covered by VAT.

- The country categorises businesses and corporate entities into two groups: A and B. Group A encompasses companies with a share capital exceeding AOA2 million and with an annual turnover exceeding AOA500 million, as well as permanent establishments of non-resident companies, public companies, associations and foundations. Group B contains all other groups. In addition, special tax regimes apply to the oil and gas industry and to the mining industry.

- Exemptions from corporate income tax (CIT) are provided for non-resident shipping and airline operators (as long as reciprocity exists in the foreign jurisdiction). Each of these categories applies a different CIT rate, as demonstrated below. These groupings (Group A, Group B, Mining and Oil and Gas) also have their tax schedules influenced by their location, as the four different zones in use in Angola present different incentive rates and deductions.

Corportate Income Tax Rates by Group

|

Group A |

Group B |

Mining |

|

|

CIT |

30% |

15% |

40% |

Taxes and Special Provisions Relating to the Oil and Gas Sector

|

Type of Tax |

Tax Rate and Base |

|

CIT |

- 50% – production-sharing agreements |

|

Oil Production Tax |

20% |

|

Oil Transaction Tax and a surface surcharge |

70%, plus USD300 million per square kilometre, not applicable to production-sharing agreements |

|

Training Levy on production and refining companies |

USD0.15 per barrel |

|

Training Levy on companies in possession of a prospecting license |

USD100,000 per year |

|

Training Levy on exploration companies |

USD300,000 per year |

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Withholding Tax |

- Payments received for services rendered: 6.5% |

|

Investment Income Tax |

- The rate is generally 15%, with the exception for certain income, where the rate is 10% or 5%. |

|

VAT |

14% |

|

Special contribution |

- This is levied on payments due to non-residents under Foreign Technical Assistance and Management Contracts. |

|

Real Estate Transfer Tax |

2% for all acts that involve the transfer for consideration of property |

|

Social security contributions on salaries |

8% by employer; 3% by employee |

Sources: The Angolan Ministry of Finance, The Angolan General Tax Administration, MacauHub

Date last reviewed: April 18, 2020

Localisation Requirements

Under the law, private investors should hire Angolan staff and provide professional training and ensure social and payment conditions, accordingly with their professional skill, without discrimination.

Under the 'Angolanisation' principle, at least 70% of the workforce at a company that employs more than five workers must be Angolan nationals and only 30% may be foreign non-residents (ie, expatriate) individuals.

Obtaining Foreign Worker Permits for Skilled Workers

The appropriate visa allowing a foreign national to undertake remunerated activities in Angola is the Work Visa. The Work Visa is granted for the duration of the employment contract and must be applied for at the Angolan Consulate or Embassy in the applicant's country of origin or residence.

In order to employ any non-resident foreign worker, the employee must meet the following main requirements: be of age, have a technical or scientific qualification, have physical and mental ability and not have any criminal record.

In the oil sector, the employment of foreign personnel is subject to previous authorisation from the Ministry of Petroleum, and the grounds for the employment of foreign workers instead of national workers must be justified.

As of April 2017, some of these stringent visa requirements have been eased. Employers are now not limited in the time duration of the contracts that they negotiate with foreign employees, and can agree to pay employees in the foreign currency of their choice and provide incentives and allowances higher than 50% of the employee's base salary.

Temporary Visas

Various types of temporary visas may be granted to foreign nationals who intend to come to Angola. The type of visa depends on the reason and period of stay.

- Ordinary visas are granted to foreign nationals for business or family reasons. They are granted for 30 days, extendable twice, up to a maximum of 90 days. Ordinary visas do not allow its holders to perform remunerated activities in the country, for which a work visa is required, or apply for residence.

- Privileged visas may be granted to foreign investors, representatives or proxies of investing companies in order for them to implement and execute investment projects in Angola.

Resident Permits

Residence permits are granted to foreign nationals that intend to establish residence in Angola, provided that they meet the requirements imposed by the Angolan law. The application for a residence permit may include spouses, underage children and any dependents of the applicant.

The following residence permits may be granted:

- A Temporary Residence Card Type A is granted to foreign nationals with authorisation to establish residence in Angola. It allows the holder to establish residence for one year and is extendable for equal time periods.

- A Temporary Residence Card Type B is granted to foreign nationals living in the country for more than five consecutive years. It is valid for three years and is extendable for equal time periods.

- A Permanent Residence Card is granted to foreign nationals resident in the country for more than 10 consecutive years. It is valid for five years and is extendable for equal time periods.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B3 (Under review) |

31/03/2020 |

|

Standard & Poor's |

CCC+ (Stable) |

26/03/2020 |

|

Fitch Ratings |

B- (Stable) |

06/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Rating

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

175/190 |

173/190 |

177/190 |

|

Ease of Paying Taxes Index |

103/190 |

104/190 |

106/190 |

|

Logistics Performance Index |

159/160 |

N/A |

N/A |

|

Corruption Perception Index |

165/180 |

146/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

163/202 |

166/201 |

177/201 |

|

Short-Term Economic Risk Score |

41.3 |

40.0 |

39.8 |

|

Long-Term Economic Risk Score |

40.8 |

41.3 |

37.7 |

|

Political Risk Index Rank |

131/202 |

131/201 |

130/201 |

|

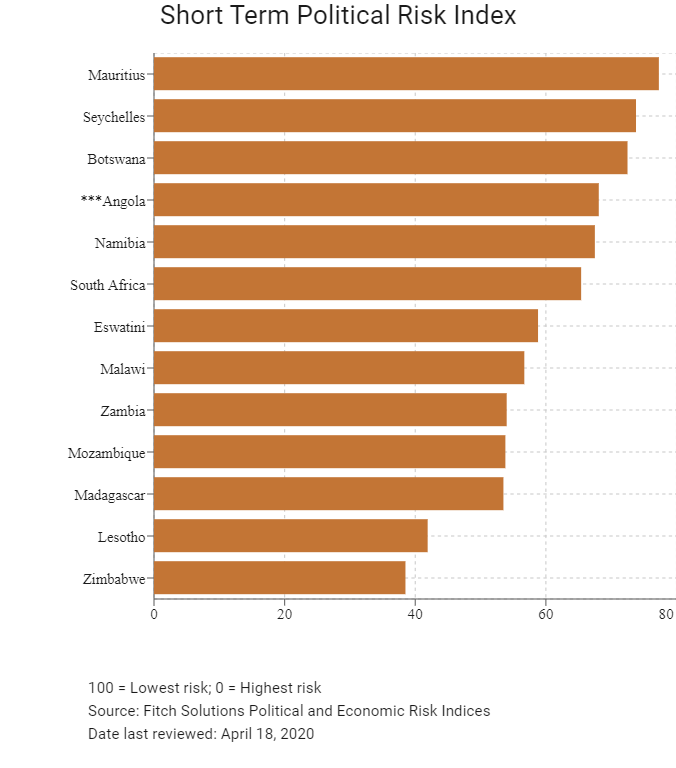

Short-Term Political Risk Score |

67.5 |

66.9 |

68.1 |

|

Long-Term Political Risk Score |

55.9 |

55.9 |

55.9 |

|

Operational Risk Index Rank |

177/201 |

169/201 |

171/201 |

|

Operational Risk Score |

31.4 |

32.4 |

31.9 |

Source: Fitch Solutions

Date last reviewed: April 18, 2020

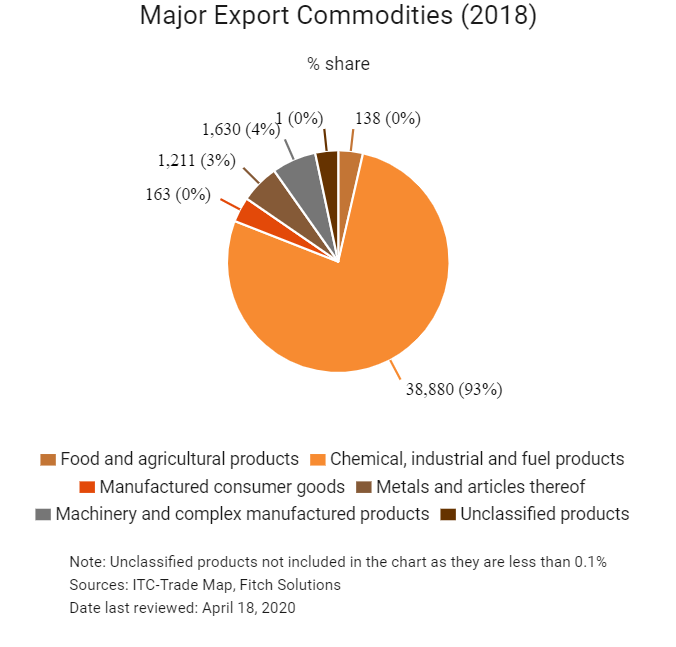

Fitch Solutions Risk Summary

ECONOMIC RISK

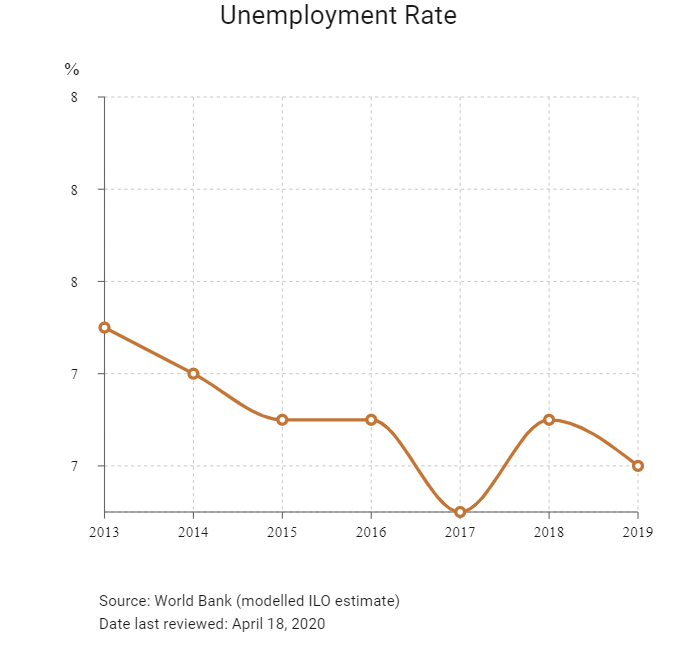

The 2020 outlook for the economy is negative as both domestic activity and the external sector are likely to contract due to the impact of the Covid-19 pandemic. Exports should be particularly hard hit as plummeting global demand hampers oil prices. The oil sector still accounts for one-third of GDP and more than 90% of exports. Meanwhile, rising external and fiscal deficits, and mounting funding pressures threaten Angola's macroeconomic stability. While business-friendly reforms and external financing provide upside potential for investment inflows and economic growth in the long term, Angola remains highly vulnerable to external shocks that can weigh on growth prospects in the short-to-medium term.

OPERATIONAL RISK

Angola's economy is heavily dependent on hydrocarbons, with oil traditionally comprising over 40% of GDP, more than 70% of fiscal revenues and over 90% of merchandise export earnings. This has served the nation well during periods of rising commodity prices, but keeps Angola highly vulnerable to external price shocks. Businesses in Angola face a challenging operating environment over the short-to-medium term. Angola's recent economic challenges have been exacerbated by a decline in production in the economically important oil sector, foreign currency risks, structurally weaker global oil prices in 2020, the Covid-19 crisis and the impact of climate change on food security. Business operations face structural deficiencies in the country's logistics environment that will keep investment in non-oil sector activity significantly stymied by electricity, water and fuel shortages as reform and diversification efforts remain slow. Angola does, however, benefit from having a large and young pool of potential labour.

Source: Fitch Solutions

Date last reviewed: May 3, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Angola Score |

31.9 |

41.8 |

24.6 |

27.8 |

33.3 |

|

Southern Africa average |

42.6 |

42.0 |

41.2 |

42.0 |

45.4 |

|

Southern Africa position (out of 13) |

12 |

6 |

12 |

12 |

11 |

|

SSA average |

34.6 |

38.8 |

34.6 |

32.7 |

32.3 |

|

SSA position (out of 48) |

28 |

13 |

40 |

33 |

22 |

|

Global average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global position (out of 201) |

171 |

150 |

186 |

173 |

157 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk |

Crime and Security Risk Index |

|

Mauritius |

63.8 |

51.3 |

72.0 |

63.5 |

68.5 |

|

Seychelles |

54.0 |

48.9 |

54.5 |

57.2 |

55.4 |

|

South Africa |

52.1 |

50.9 |

56.1 |

53.4 |

48.2 |

|

Botswana |

50.9 |

52.2 |

47.5 |

48.3 |

55.9 |

|

Namibia |

50.2 |

50.4 |

47.1 |

49.5 |

53.6 |

|

Eswatini |

42.1 |

36.9 |

34.5 |

53.0 |

44.0 |

|

Zambia |

39.8 |

39.9 |

43.8 |

33.0 |

42.4 |

|

Lesotho |

37.6 |

36.2 |

30.8 |

36.1 |

47.4 |

|

Malawi |

35.8 |

34.9 |

31.7 |

32.3 |

44.3 |

|

Zimbabwe |

32.5 |

35.3 |

22.1 |

28.9 |

43.8 |

|

Mozambique |

32.5 |

34.0 |

35.8 |

34.8 |

25.3 |

|

Angola |

31.9 |

41.8 |

24.6 |

27.8 |

33.3 |

|

Madagascar |

31.2 |

34.1 |

35.2 |

27.7 |

27.9 |

|

Regional Averages |

42.6 |

42.0 |

41.2 |

42.0 |

45.4 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 18, 2020

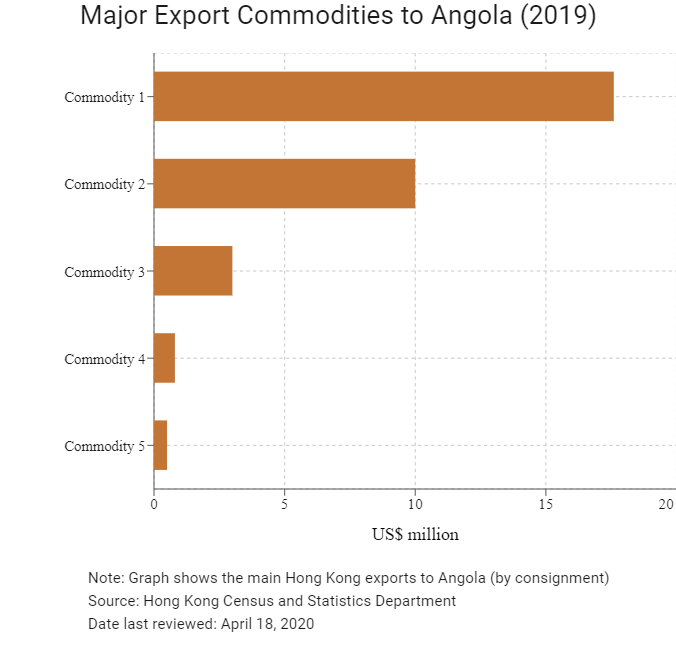

Hong Kong’s Trade with Angola

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

17.6 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

10.0 |

|

Commodity 3 |

Office machines and automatic data processing machines |

3.0 |

|

Commodity 4 |

Articles of apparel and clothing accessories |

0.8 |

|

Commodity 5 |

Miscellaneous manufactured articles |

0.5 |

|

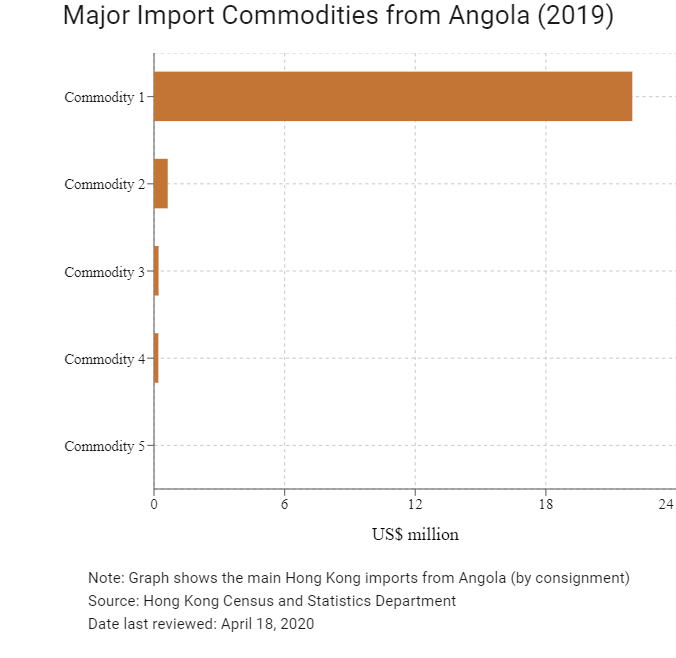

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Non-metallic mineral manufactures |

21.97 |

|

Commodity 2 |

Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof |

0.63 |

|

Commodity 3 |

Telecommunications and sound recording and reproducing apparatus and equipment |

0.21 |

|

Commodity 4 |

Metalliferous ores and metal scrap |

0.20 |

|

Commodity 5 |

Crude animal and vegetable materials |

0.01 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

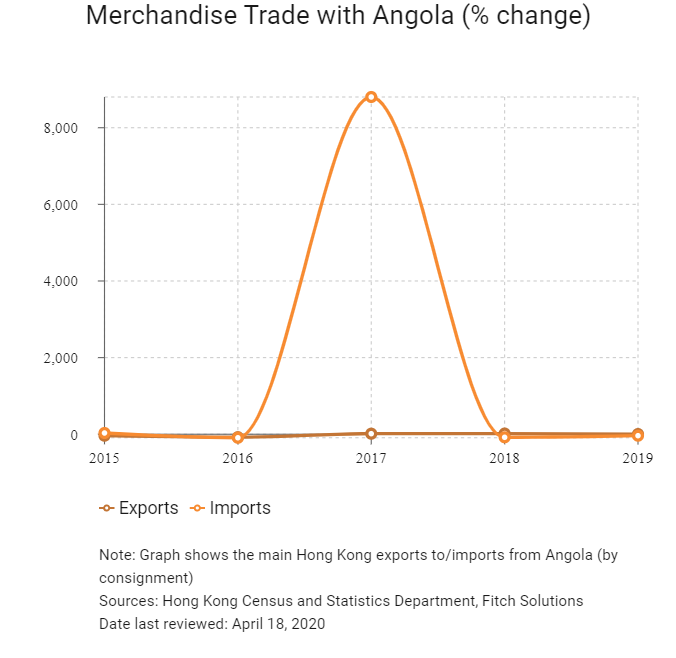

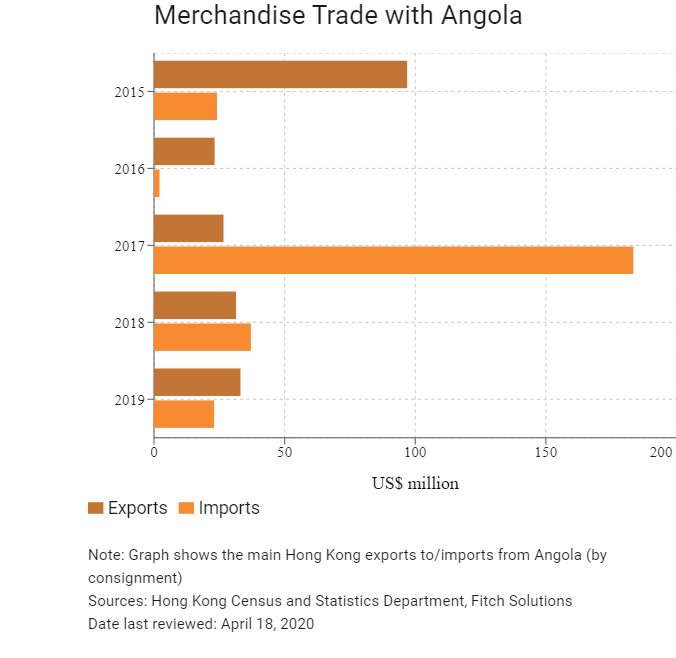

Sources: Hong Kong Census and Statistics Department, Fitch Solutions

|

|

2019 |

Growth rate (%) |

|

Number of Angolan residents visiting Hong Kong |

209 |

-31.9 |

|

Number of African residents visiting Hong Kong |

123,656 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: April 18, 2020

Commercial Presence in Hong Kong

|

2016 |

Growth rate (%) |

|

|

Number of Angolan companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Treaties and Agreements between Hong Kong/China and Angola

In October 2018, under the witness of Mainland China's president, Xi Jinping, and Angolan president, João Lourenço, the administrator of State Administration of Taxation, Wang Jun, and the minister of Angola's Ministry of Finance, Archer Mangueira, signed a bilateral Agreement for the Elimination of Double Taxation with Respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance and Protocol.

The agreement will provide tax certainty for cross-border taxpayers between two countries in avoiding double taxation and play a positive role in further pushing forward the bilateral economic cooperation and exchanges of capital, technology and personnel.

Source: State Administration of Taxation of The People's Republic of China

Chamber of Commerce (or Related Organisations) in Hong Kong

Angolan Consulate General in Hong Kong

Address: Units 2302-4, 23/F, Office Tower, Convention Plaza, 1 Harbour Road, Wan Chai, Hong Kong

Email: reception@consuladogeral-angola.hk

Tel: (852) 3798 3888

Fax: (852) 3101 0873/3101 0682

Source: VisaHQ

Visa Requirements for Hong Kong Residents

An Angola tourist visa is required for HKSAR passport holders. All applicants must apply in person at the nearest Embassy of Angola. It is important to note that the Angolan embassy only accepts lodgings on a Monday and Tuesday and only allows collections on a Wednesday and Thursday.

Source: VisaHQ

Date last reviewed: April 18, 2020

Angola

Angola