Central Asia

Thursday 25 April 2019 (Beijing) – It was announced today that 27 global institutions have signed up to a set of voluntary principles – the Green Investment Principles (GIP) for the Belt and Road -- to promote green investment in the Belt &Road region.

The announcement was made at the GIP signing ceremony as part of the Financial Connectivity Forum organized by the People’s Bank of China (the Central Bank) and the Ministry of Finance in Beijing during the second Belt and Road High-level Forum. Deputy Governor Chen Yulu from the People’s Bank of China attended the GIP signing ceremony.

Chen Yulu, Deputy Governor of the People’s Bank of China

As a mandate from the China-UK Economic and Financial Dialogue in 2017, the Green Finance Committee of China Society for Finance and Banking and the City of London Corporation’s Green Finance Initiative led the initiative to develop the GIP, which was first published in London in November 2018. The World Economic Forum, UNPRI, Belt & Road Bankers Roundtable, the Green Belt and Road Investor Alliance and the Paulson Institute are also part of the drafting group. A full list of the principles is provided at the bottom of this release.

Building on existing responsible and ESG investment initiatives, the GIP aims to incorporate low-carbon and sustainable development practices into investment projects in Belt and Road countries, which will host the majority of the world’s infrastructure investments in coming decades.

Since its launch five months ago, the GIP has received strong backing from the global financial industry, including commercial banks, development banks, institutional investors, stock exchanges and other stakeholders that invest or help mobilize investment in the Belt and Road. As of April 25, 2019, twenty-seven institutions have signed up to the GIP. These institutions include (in alphabetical order):

Agricultural Bank of China, Agricultural Development Bank of China, Al Hilal Bank, Astana International Exchange, Bank of China, Bank of East Asia, China Construction Bank, China Development Bank, China International Contractors Association, China International Capital Corporation, Crédit Agricole-CIB, DBS Bank, Deutsche Bank, Export-Import Bank of China, First Abu Dhabi Bank, Habib Bank of Pakistan, Hong Kong Exchanges and Clearing, Industrial and Commercial Bank of China, Industrial Bank, Khan Bank, Luxembourg Stock Exchange, Mizuho Bank, Natixis Bank, Silk Road Fund, Standard Chartered Bank, Trade and Development Bank of Mongolia and UBS Group.

These signatories include all major banks from China that invest in the Belt & Road region and some of the largest financial institutions from (in alphabetical order) France, Germany, Hong Kong, Japan, Kazakhstan, Luxembourg, Mongolia, Pakistan, Singapore, Switzerland, United Arab Emirates and the United Kingdom. Several service providers, including Deloitte, Ernst & Young, KPMG and PWC, have also expressed their support for the GIP.

Ma Jun, Chairman of China’s Green Finance Committee, announced at the GIP signing ceremony that a Secretariat would be established to support future work of the GIP. The GIP Secretariat will work on expanding the membership, the development of implementation tools and case studies, a green project database for the Belt & Road, as well as compiling the progress report.

Chen Yulu, Deputy Governor of the People’s Bank of China, said at the signing ceremony: “The financial institutions represented here today are the leading institutions of green investment for the Belt and Road. I hope that all signatories can seize the great opportunity of the BRI, and actively promote the GIP and enhance their capacity for green investment.”

Dr. Ma Jun said: “The majority of global infrastructure investment in the coming decades will be in the Belt and Road region and they will have a significant impact on the implementation of the Paris Agreement and UN Sustainable Development Goals. The aim of the GIP is to ensure that environmental friendliness, climate resilience, and social inclusiveness are built into new investment projects in the Belt and Road.”

Ma Jun, Chairman of China Green Finance Committee

Catherine McGuinness, Chair of Policy at City of London Corporation commented: “While there is some way to go to ensuring the Belt and Road is truly green, today’s announcement is another step in the right direction, and a powerful statement of intent from financial firms in China, the UK and across the world.”

Catherine McGuinness, Chair of Policy at City of London Corporation

Family photo of major GIP Signatories

David Aikman, Chief Representative Officer of China and Member of the Executive Committee, World Economic Forum, addressed the importance of making GIP an opportunity for green transformation in the region and said: “It will be a shared opportunity for inter-connectivity, environmental friendliness and economic development through green investment in many countries around the world.”

Signatories also expressed their commitment to greening their investment practices with the implementation of GIP. “Business and economic ties between China, Europe, and BRI countries continue to strengthen”, said Werner Steinmueller, Deutsche Bank Management Board Member and Chief Executive Officer for Asia Pacific. “We are one of the most active foreign banks participating in BRI with full corporate and investment banking offerings along the route. By committing to the GIP, we are pledging that we will not only help steer BRI’s open collaboration across countries from China to Europe, but also strive to ensure these projects are as sustainable as possible.”

Gu Shu, President of Industrial and Commercial Bank of China, commented: “Green investments play a critical role in addressing environmental and climate challenges along the Belt and Road. ICBC has participated actively in the drafting of the GIP. We have also invited BRBR members to sign up to the GIP and integrate environmental factors into the BRI-related financing decisions, operations, product development and risk management.”

Gu Shu, President of Industrial and Commercial Bank of China

Bill Winters, Group Chief Executive of Standard Chartered PLC, stated: “We have been supporting our clients in managing their environmental and social risks for decades and are committed to working with all parties to implement the Green Investment Principles and contribute to commerce and prosperity across the Belt and Road markets.”

Benjamin Hung Pi Cheng, Regional CEO of Greater China & North Asia, Standard Chartered

Philippe Brassac, CEO of Crédit Agricole S.A and the Chairman of Crédit Agricole CIB, said: “Today, we reaffirm our ambition to be your long-term banking partner for your energy transition projects. A partner that is both realistic and demanding concerning the climate.”

“As China’s development finance institution and its major bank for the Belt and Road, the China Development Bank will stay committed to green finance, implement green investment principles, increase the provision of green finance, and grow the capacity for green development, to contribute to sustainable economic and social development along the Belt and Road”, said Hu Zhirong, Director of International Finance Bureau of China Development Bank.

Huang Liangbo, Vice President of Export-Import Bank of China, said: “To cater to the needs of the BRI participating parties to conserve resources, protect the environment and cope with climate change, the Export-Import Bank of China has been diversifying its financial products and services related to green projects, and played a major role in investing and financing green infrastructures.”

Lin Jingzhen, Vice President of Bank of China, said: “By signing up to the GIPs, it marks a milestone for Bank of China to integrate green development strategy into our efforts of supporting the construction of the Belt and Road ‘financial artery’. We look forward to working with international counterparts to foster the green and sustainable development along the Belt and Road.”

Qian Wenhui, President of Agricultural Development Bank of China, said: “Agricultural Development Bank of China will gather forces from all sides and assist domestic agriculture-related enterprise and projects to participate in the Belt and Road green investments.”

Tao Yiping, President of Industrial Bank, commented: “By proactively supporting the low-carbon, green and sustainable development of countries along the Belt and Road, GIP will support global financial institutions to establish more extensive and intensive corporations within multilateral frameworks and to increase environmental and social risk management ability.”

Xie Duo, Chairman of the Silk Road Fund, commented: “The Silk Road Fund, being a medium to long-term development and investment fund to support the BRI, is committed to implementing and promoting green investment philosophy, and dedicated to building a green Silk Road.”

Muhammad Aurangzeb, President and CEO of Habib Bank of Pakistan, said: “It is a great initiative taken by China Green Finance Committee and City of London for this GIP signing. As Pakistan’s largest Bank, and the largest executor of CPEC related financing in Pakistan, HBL is positioned to play an integral role towards a greener CPEC, with the ultimate goal of a greener BRI.”

Tim Bennett, CEO of Astana International Exchange, said: “The sign up to the GIP emphasizes the regional perspective of AIX to support infrastructure and economic development in Kazakhstan and in the region in accordance with environmentally and socially friendly international practices.”

Abdulhamid Saeed, Group Chief Executive Officer of First Abu Dhabi Bank, stated: “By becoming one of the first signatories to the GIP, we intend to take a more active role in the Belt and Road Initiative and in supporting global efforts to promote green investments within the UAE and beyond.”

For more information, please contact:

CHENG Lin

China Coordinator of the GIP, China Green Finance Committee

Tel: +86 (10) 8302 1702

Email: lin.cheng@greenfinance.org.cn

Simon Horner

Head of Policy and Innovation, City of London

Tel: +44 (0) 7721 977119

Email: simon.horner@cityoflondon.gov.uk

ANNEX: GREEN INVESTMENT PRINCIPLES FOR THE BELT AND ROAD

Principle 1: Embedding sustainability into corporate governance

We will embed sustainability into our corporate strategy and organisational culture. Our boards and senior management will exercise oversight of sustainability-related risks and opportunities, set up robust systems, designate competent personnel, and maintain acute awareness of potential impacts of our investments and operations on climate, environment and society in the B&R region.

Principle 2: Understanding Environmental, Social and Governance Risks

We will strive to better understand the environmental laws, regulations, and standards of the business sectors in which we operate as well as the cultural and social norms of our host countries. We will incorporate environmental, social and governance (ESG) risk factors into our decision-making processes, conduct in-depth environmental and social due diligence, and develop risk mitigation and management plans, with the help of independent third-party service providers, when appropriate.

Principle 3: Disclosing environmental information

We will conduct analysis of the environmental impact of our investments and operations, which should cover energy consumption, greenhouse gas (GHG) emissions, pollutants discharge, water use and deforestation, and explore ways to conduct environmental stress test of investment decisions. We will continually improve our environmental/ climate information disclosure and do our best to practice the recommendations of the Task Force on climate-related Financial Disclosure.

Principle 4: Enhancing communication with stakeholders

We will institute stakeholder information sharing mechanism to improve communication with stakeholders, such as government departments, environmental protection organizations, the media, affected communities and civil society organizations, and set up conflict resolution mechanism to resolve disputes with communities, suppliers and clients in a timely and appropriate manner.

Principle 5: Utilizing green financial instruments

We will more actively utilize green financial instruments, such as green bonds, green asset backed securities (ABS), Yield Co, emission rights based financing, and green investment funds, in financing green projects. We will also actively explore the utilisation of green insurance, such as environmental liability insurance and catastrophe insurance, to mitigate environmental risks in our operations.

Principle 6: Adopting green supply chain management

We will integrate ESG factors into supply chain management and utilize international best practices such as life cycle accounting on GHG emissions and water use, supplier whitelists, performance indices, information disclosure and data sharing, in our investment, procurement and operations.

Principle 7: Building capacity through collective action

We will allocate funds and designate personnel to proactively work with multilateral organizations, research institutions, and think tanks to develop our organizational capacity in policy implementation, system design, instruments development and other areas covered in these principles.

Editor's picks

Trending articles

China Aircraft Leasing Group Holdings Ltd (CALC), an aircraft operating lessor founded in Hong Kong, specialises in providing aircraft full-life solutions, such as aircraft leasing, purchase and leaseback, structured financing to airlines around the world. It also provides value-added services including fleet planning, fleet upgrade and aircraft recycling. In a dynamic market that has been gaining traction year after year, CALC is one of the market players that stand to benefit from the boom. Today, the company has grown to become China’s largest independent aircraft operating lessor, Asia’s first large-scale aircraft recycling facility operator, and one of the top 10 global aircraft lessors in terms of the combined asset value of its fleet and orders placed. Its global presence is continuing to expand.

CALC’s business is mainly divided into two areas: CALC itself is responsible for the leasing of new aircraft; its member company, Aircraft Recycling International (ARI), focuses on the disassembling and recycling of used aircraft and spare parts supply. This unique business model means the company’s services cover an aircraft’s full life cycle – from its days as a new plane to the time it comes to the end of its lifespan. As the first full value-chain aircraft solutions provider in Asia, CALC currently owns and manages 130 aircraft in its fleet and is on track to expand its fleet to more than 300 by year 2023.

Over the past three decades, the aviation leasing industry has been growing at a remarkable speed as more and more airlines prefer to lease, rather than own, their aircraft for operation flexibility and efficiency. The outlook for the industry has become even more positive in recent years, with low interest rates and surging demand for air travel providing strong tailwinds. Amid the boom, CALC launched in 2014 a “globalisation strategy” aimed to carve out a global presence for the company. In less than two years, CALC’s clientele expanded to include airlines in Asia Pacific, Southeast Asia, Europe, Middle East and the United States, many of which are flag carriers or top-tier airlines in their markets.

The aircraft lessor first set its sights on Harbin, the pivot hub of the Longjiang Silk Road Economic Belt under the Belt and Road framework, which connects Eurasia with the Pacific and Baltic countries through a comprehensive land and sea transportation network. In 2014, CALC signed an agreement with the Harbin Municipal Government on the establishment of China’s first and largest aircraft disassembly project, the China Aircraft Disassembly Centre. The centre features an ageing aircraft material recycling system, which provides services to countries including those along the Belt and Road routes.

Also in 2014, CALC entered into leasing agreements with Air India – its first non-Chinese customer – for five new Airbus A320 aircraft. The first of the five planes was delivered during Indian Foreign Minister Sushma Swaraj's trip to China in February 2015.

As the “Aviation Silk Road” continued to gather momentum, CALC expanded its reach into more and more Belt and Road countries. In 2016, it delivered two new Airbus A320 aircraft to Pegasus Airlines, Turkey’s leading low-cost carrier, and four Airbus A320 aircraft to Jetstar Pacific, Vietnam’s first low-cost carrier. In 2017, CALC continued to deliver aircraft to airlines in various parts of the world, including in Russia, one of the largest markets on the Belt and Road.

Currently, aviation is one of the key areas of focus of the Belt and Road Initiative. As of the end of December 2016, China had signed bilateral air transportation agreements with 120 countries and regions. Mike Poon, Chief Executive Officer of CALC, said CALC sees great growth opportunities arising from the Belt and Road Initiative.

“In China, demand for domestic and international air transport services, including different aviation financial services, is growing rapidly. Meanwhile, many Belt and Road countries are emerging economies with an underdeveloped aviation sector. We believe our growth potential is high since we are the first-mover in the industry and one of the few operators that provide full value-chain aircraft solutions and value-added services to our clients around the world,” Poon said.

That is not to say there is no challenge. As with many other cross-border industries, the aircraft lessor sector is exposed to different operational risks, including political instability, credit risk and interconnectivity risk. To counter the risks, which are not unusual in Belt and Road countries, CALC relies on its own professional team with substantial experience in global financing and a comprehensive risk management system. This enables the company, which is listed on the Hong Kong Stock Exchange, to keep risks under control when expanding internationally.

According to Poon, in its continued effort to expand its international presence, CALC, being a Hong Kong company, also enjoys a diversity of advantages that the city offers. They include an open economy, the city’s sophisticated banking and financial sector, the common law system, and Hong Kong’s role as a facilitator of Belt and Road opportunities. In addition, the Hong Kong government’s move last year to grant aircraft leasing tax concessions to qualifying lessors has taken the city a step towards establishing itself as an international aircraft leasing hub. All these local advantages stand CALC in good stead, enabling it to grow fast and in the right direction while playing an effective role in building the “Aviation Silk Road”.

When Anthony Espina visited Kazakhstan for the first time in 2007, he felt right at home. “I was struck by how similar Kazakhstan was to Australia, from the open fields to the friendly people and multicultural society,” said Espina, a Filipino-Indonesian born in Hong Kong and educated in Australia.

Espina was attracted by the growth potential of Kazakhstan. On his first trip to the country in 2007, Espina, then owner of a Hong Kong-based securities dealer of the Hong Kong stock market and Chairman of the Hong Kong Securities Association, was part of a government delegation to promote Hong Kong Stock Exchange as a destination for listing Kazakh companies. Meeting the locals allowed him to glean a better understanding of Kazakhstan, which, as he learned, has an abundance of natural resources and is one of the best economic performers among all former republics of the Soviet Union in Central Asia. Espina immediately saw business opportunities.

His instinct proved right. A few months later, a Kazakh business contact approached him and sought his help to import TV set-top boxes from China.

“They had sourced set-top boxes from Ukraine and other former Soviet republics. The cost was US$40 to $50 per unit, compared with only $30 from Shenzhen manufacturers. So they wanted to source directly from China. But in those days, trade between China and Kazakhstan was rare and language was a barrier. Chinese companies required Kazakh buyers to settle all payments before goods were shipped out of China,” Espina said.

“For me, the deal was very simple. I only had to cross the border to liaise with mainland manufacturers and help with the shipping, making sure everything was right before and after payment was made,” he said. “Hong Kong is a long-established trading port and we have the experience to handle such deals.”

The collaboration was soon followed by more business opportunities. For instance, another Kazakh company enlisted Espina’s help to import agricultural chemicals. Espina also started to dabble in Kazakhstan’s financial sector, facilitating companies to complete merger and acquisition transactions. In 2012, a turning point came. The Italian bank UniCredit wanted to sell its stake in ATF Bank, one of Kazakhstan’s five largest banks by assets. At the time, Espina had been with a Kazakh company handling a merger and acquisition transaction. He then helped that company take over ATF from UniCredit. The deal was closed in early 2013 upon getting approval from the National Bank of Kazakhstan, and Espina has been ATF’s CEO since then.

For Hong Kong businesses interested in investing in Kazakhstan, Espina said patience and finding a reliable local partner are key. “There are many business opportunities in Kazakhstan, but it takes time to capture them.”

In September 2013, Chinese President Xi visited Kazakhstan and outlined for the first time the plan to build a Silk Road Economic Belt when he delivered a speech at Nazarbayev University in Astana. The Silk Road Economic Belt is a land-based component that, together with the oceanic Maritime Silk Road, forms the Belt and Road Initiative.

It is a development that has excited Espina till this day. “Central Asia occupies the biggest share of the Belt and Road. Kazakhstan, the biggest country in the region, has many advantages as far as the Belt and Road Initiative is concerned,” he said.

According to the Kazakh government, Kazakhstan and China have drafted more than 50 projects totalling US$27 billion and involving various fields, including the chemical, mining, infrastructure, energy and agricultural sectors.

Hong Kong, being a financial hub that has long been playing the role of financial intermediary to China, also stands to gain, Espina said. “Under the Belt and Road Initiative, Hong Kong is the ideal place for fundraising for Kazakh companies and foreign companies doing projects in Kazakhstan. Given Hong Kong’s financial knowledge, we can help Kazakh companies carry out feasibility studies and raise funds at lower financial costs.” he said. “Hong Kong is more than a ‘connector’. It is an international financial centre that Kazakhstan can use to build its own capital and debt markets.”

According to Espina, the Kazakh government has set a strategic goal to reduce its role in the economy through privatisation. In February 2018, he was appointed as advisor to the CEO and Chairman of the management board of Samruk Kazyna, the sovereign wealth fund of Kazakhstan. The fund is the holding company of all the major state-owned enterprises of Kazakhstan. Espina is currently advising on the privatisation of four companies of the fund. The state-owned companies to be privatised will be listed on the Astana International Exchange (AIX), which is part of the Astana International Financial Centre (AIFC).

Officially opened in July 2018, the AIFC is a planned financial free zone in Astana designed to open up the country for international business. Positioned as a financial hub in Central Asia, it has a special legal framework based on the principles of English law and the preferential tax regime, which will make it easier for foreigners to invest in Kazakhstan. Espina said the AIFC encourages Kazakh companies to list debt and equity securities there, and in the long run other Central Asian companies will also be attracted to list their shares on the AIFC. In the process of privatisation, Hong Kong can also play a part, he said.

“Hong Kong has played an important role in the privatisation of mainland state-owned enterprises. We have the knowledge, expertise and experience in facilitating the privatisation of mainland companies. We can do the same for Kazakhstan,” Espina explained.

“If Kazakh companies decide to dual-list their shares on the Hong Kong Stock Exchange (SEHK) and the Astana International Exchange (AIX), then Hong Kong-based financial services providers will definitely have to set up operations in the AIFC to advise on SEHK listing rules. Also, if Kazakh companies were to raise funds through Hong Kong from the Chinese mainland, for example, the financial services providers can also advise on taxation and other issues.

Espina called for the Hong Kong government, the Financial Services Development Council and the SEHK to take the initiative to promote Hong Kong’s advantages and bring Hong Kong-based financial services companies to Kazakhstan.

Georgia has huge potential as a new trading partner for Hong Kong, with a substantial number of business opportunities arising from its combination of firm support for the Belt and Road Initiative (BRI), its open and business-friendly economy and its strategic location in the central Caucasian region of Eurasia. A country of 3.7 million people, its prime setting at the very crossroads of China and Europe, as well as its extensive array of Free Trade Agreements (FTAs) – including treaties with the Chinese mainland and Hong Kong – sees it offering a host of new trade and investment possibilities.

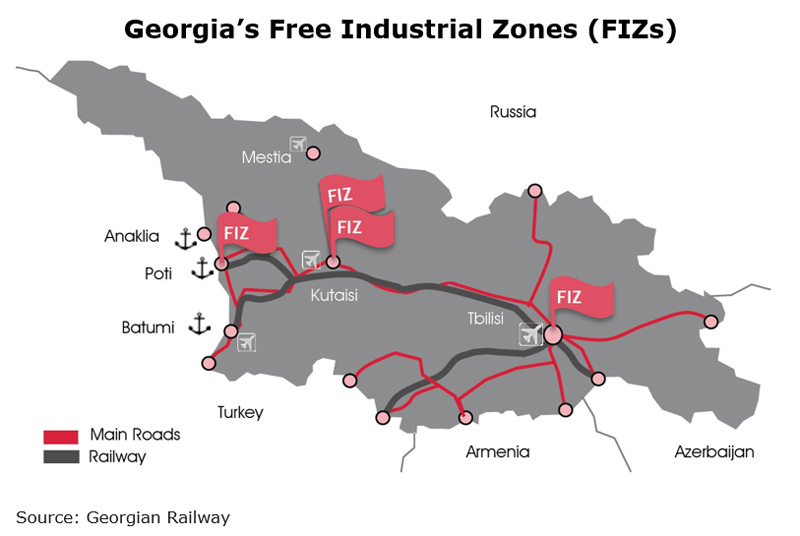

Its appeal has been boosted by a number of ongoing reforms, including a greater emphasis on open governance, improvements to the local business environment and an ambitious infrastructure development programme. In the case of the latter, this has seen a number of landmark investment projects being given the greenlight, including the US$2.5bn Anaklia Deep Sea Port and Special Economic Zone, the Baku-Tbilisi-Kars Railway and ongoing railway track modernisation work. Taken together, these projects are not only seen as representing major steps forward for Georgia’s international connectivity, but also as playing a key role in the country’s evolution from being a simple transit hub to becoming a true regional logistics and industrial centre. Hong Kong investors and professional service providers, of course, could clearly play a huge role in facilitating this ambitious and capital-intensive reinvention process.

A Leading Reformer in Europe and Central Asia

Georgia, which borders Russia to the north, the Black Sea to the west and Turkey, Armenia and Azerbaijan to the South, is a leading reformer and significant emerging Caucasian market. According to the World Bank, it has implemented 47 business-friendly reforms in the past 15 years, topping the ranking of European and Central Asian countries.

Owing to these reforms, all tax procedures and customs clearances in the country are now web-based and unified under one tax code. This has reduced the average number of days and procedures to register a new business greatly, from 25 days and nine procedures in 2003 to just two days and two procedures now.

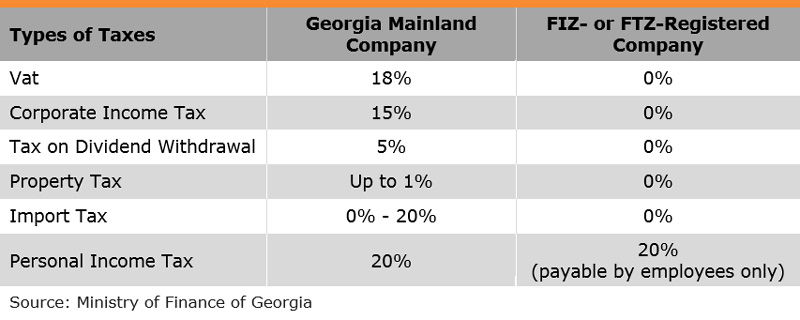

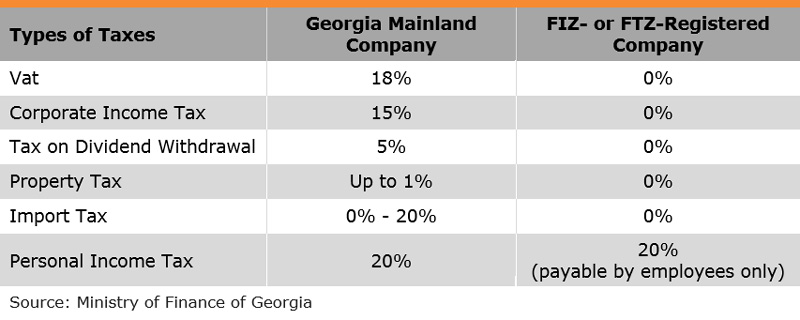

The 2005 tax code changes were especially significant, transforming the country’s fiscal landscape. The types of taxes applicable in Georgia were slashed from 21 in 2004 to six simple, flat taxes with rates so low that the country has once been ranked fourth in the world (after Qatar, the UAE and Hong Kong) in terms of how much it taxes its citizens. Today, to introduce new taxes or increase existing rates, the Georgian government would have to call a national referendum as required by its constitution.

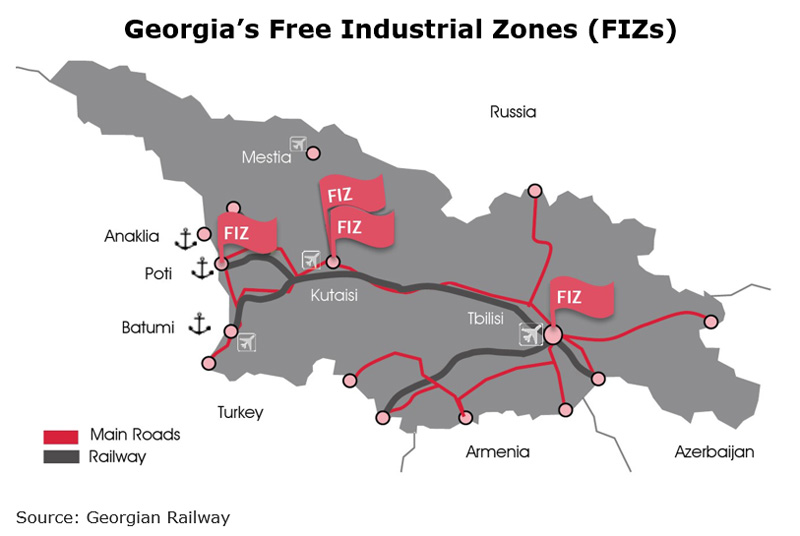

While most of the taxes are already exempted in the country’s four free industrial zones (FIZs) and two free tourism zones (FTZs), the Georgian government also introduced a new growth-oriented model of corporate income tax in 2017. The relevant tax payment is postponed or deferred until actual profit distribution in a bid to promote re-investment of earned profits into existing and/or new business endeavours.

The reform-driven economic success has helped Georgia lay a solid foundation for continued economic progress. In the two decades ending 2017, the country registered an average economic growth of more than 5%, a pace far higher than many of its Commonwealth of Independent States (CIS) peers, such as Russia, Ukraine, Belarus and Kyrgyzstan.

A Staunch Supporter of Free Trade

Georgia, given its strategic geographical location and dearth of natural resources beyond agribusiness, has developed a transit-oriented economy, where up to 60% of the cargo flows the country handles are actually in transit. This is in stark contrast to its Caucasian neighbours, such as Russia and Armenia, which are rich in mineral resources such as oil and gas, iron, copper, molybdenum, lead, zinc, gold, silver, antimony, aluminium, as well as other rare metals.

To facilitate trade and strengthen its role as a transit hub, Georgia supports free trade and has entered into an extensive network of FTAs. Agreements are in place with most, if not all, of its key trading partners, including European Union (EU) and CIS countries, European Free Trade Association (EFTA) members, Turkey, Mainland China and Hong Kong. Apart from the unfettered market access to a 2.3 billion-strong market under this web of FTAs, Georgia also enjoys preferential Generalised System of Preferences (GSP) treatments on some 3,400 products from Canada, Japan and the US.

As a historic step in the continued effort to support the BRI, Georgia signed the FTA with Mainland China in May 2017, coming into force on 1 January 2018. The Sino-Georgia FTA is not only the first FTA China has signed with a Eurasian country, but also the first Chinese-initiated FTA since the BRI was put forward in 2013.

Under the Sino-Georgia FTA since 1 January 2018 Georgia imposes zero tariffs on 96.5% of mainland products, covering 99.6% of the total imports from Mainland China. The mainland imposes zero tariffs on 93.9% of Georgia’s products, covering 93.8% of China's total imports from Georgia, of which 90.9% of product types (taking up 42.7% of imports) will have zero tariffs immediately and the remaining 3% of product types (51.1% of imports) will be phased out within five years.

In a similar vein, Hong Kong and Georgia signed an FTA on 28 June 2018, scheduled to come into effect by the end of the year, after completion of the necessary procedures. The Hong Kong-Georgia FTA is comprehensive in scope; encompassing trade in goods, trade in services, investment, dispute settlement mechanisms and other related areas in 18 chapters. On coming into effect, Georgia will eliminate all import tariffs for products of Hong Kong origin, with the exception of 3.4% of tariffs lines, comprising mainly agricultural products, such as a fruits and nuts and their preparations, as well as beverages and spirits, due to domestic sensitivity.

In addition to merchandise trade, both Sino-Georgia and Hong Kong-Georgia FTAs have chapters for trade in services, under which both sides will further open their markets to each other on the basis of their WTO commitments. Broad consensus has been reached in many fields, such as environment and trade, competition, intellectual property, investment and e-commerce.

These FTAs will bring legal certainty and better access to the Georgian market for Hong Kong and mainland businesses, while offering potential opportunities as a gateway to the Caucasian region of Eurasia covered under the BRI. They will also enhance trade and investment flows between Hong Kong, the Chinese mainland, Georgia and the greater Eurasian region.

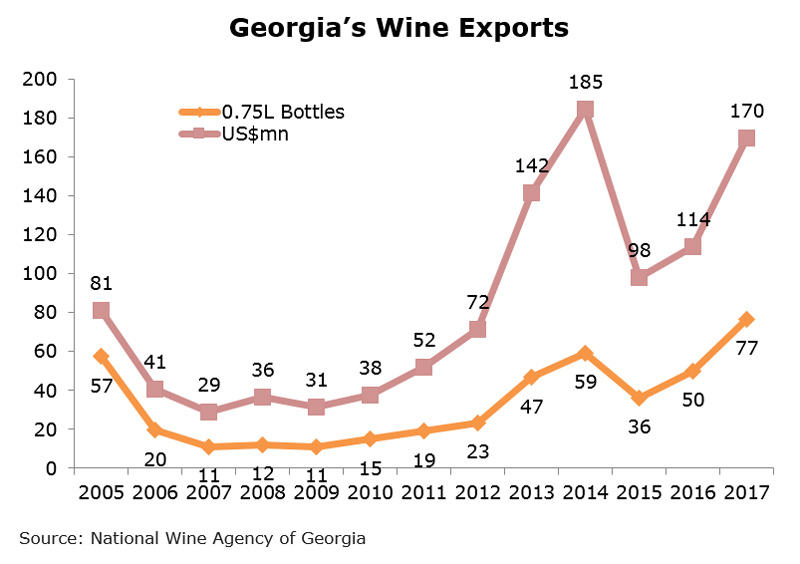

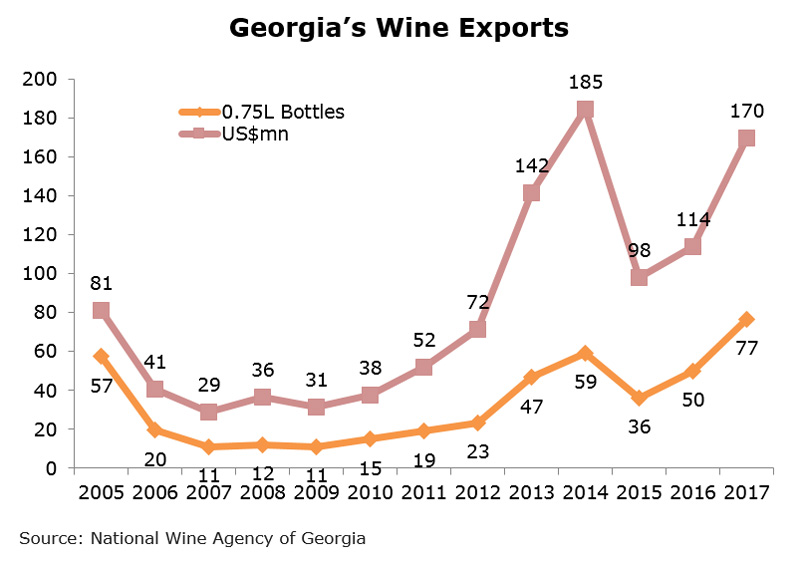

Unique Taste and Fashion Ready for Export

Among the many export sectors likely to benefit from the new FTAs are Georgia’s wine, food and fashion industries. Georgia has an 8,000-year wine-making history and 525 indigenous grape varieties, such as Kristel, Mtsvane and Saperavi highly popular in former soviet republics, but novel to many Asian drinkers. Georgian wine has already become a rising star in the Chinese wine market, with exports increasing exponentially since 2008[1]. Last year, the mainland, buying 7.6 million bottles of Georgian wine, became its third largest wine export market after Russia and Ukraine.

Riding on the success in the mainland, Georgian winemakers are looking for new growth opportunities in the burgeoning Asian market. Some of them, with the state support from the National Wine Agency of Georgia, have been actively exhibiting in wine fairs, organising wine-tasting activities and appointing agents/distributors in the region. Exports aside, the National Wine Agency of Georgia is also keen on promoting wine-related investment opportunities in Georgia to Asian investors.

Irakli Cholobargia, Head of the Marketing and Public Relations Department of the National Wine Agency of Georgia, said: “Although there are more than 500 companies producing wine in Georgia, only about 25 out of the country’s 525 indigenous grape varieties have been widely used in the industry. There is plenty room for growth and foreign investment.”

Hong Kong, with zero duty and duty-related customs/administrative controls for wine as well as widely-recognised neutrality in trading and promoting wine is a ready trading and distribution hub for Georgia wine in Asia. Hong Kong can also offer a good platform for Georgia winemakers to meet prospective Asian investors who are now the prime movers in global wine investment, with a growing appetite not just for fine wines, but vineyards and wineries.

Wine aside, Georgia, with 22 micro-climates varying from cool and dry to warm and humid, was also seen as a quality food supplier during soviet era. Nowadays, Georgian fresh fruits and vegetables are still well-regarded as healthy and of good quality in the CIS region. Also, the country’s traditional delights, such as the sausage-shaped churchkhela[2] confectionary and Borjomi fizzy mineral water, are reportedly gaining more attention from the increasingly health-conscious consumers worldwide.

Long dubbed the culinary capital of Asia, with some 14,000 restaurants serving an array of cuisines from all over China, the rest of Asia and the world, Hong Kong can be a good showroom for Georgian food companies to launch into Asia. In particular, Hong Kong businessmen, who have a good understanding of mainland consumer tastes, can help Georgian food exporters show how their produce can be used with Asian ingredients and culinary skills to complement favours found in Asian cuisines.

In addition to agribusiness, design – including fashion – is booming in Georgia, as the government promotes the use of modern design to convey core values, such as administrative transparency. This goes hand in hand with Georgian consumers, especially the younger generation, becoming more fashion savvy. This demand is driven by increases in income as well as a reaction to the soviet era when outfits tended to be more standardised.

The greater willingness and ability to spend on fashion has also led to the emergence of a number of designer brands such as Avtandil and Rosebud that have built a following in both the domestic and international markets. Given their relatively small production volume, they usually either only sell online or rely on fashion houses and showrooms in West Europe (including Milan and Paris) to reach out to Asian fashion lovers. These budding fashion brands are therefore ready clients for Hong Kong fashion traders able to offer extensive industry knowledge and distribution networks in the Asian region.

Growing Chinese Foothold in Georgian Trade and Investment

Given the geographical proximity and historic ties, CIS members, EU countries and Turkey are Georgia’s principal trading partners. In 2017, these key partners accounted for 75% of Georgia’s total trade. Thanks to the BRI and wider presence of Chinese enterprises in Georgia, the mainland has fast gained a foothold in Georgia and has become the country’s biggest Asian trading partner.

Last year, Mainland China was Georgia’s fifth-largest export market and third-largest import source, accounting for 7.6% of the country’s total exports and 9.2% of its total imports. Hong Kong sold US$103 million worth of goods to Georgia and bought US$6.3 million in 2017, accounting respectively for 0.2% and 1.3% of Georgia’s total imports and exports.

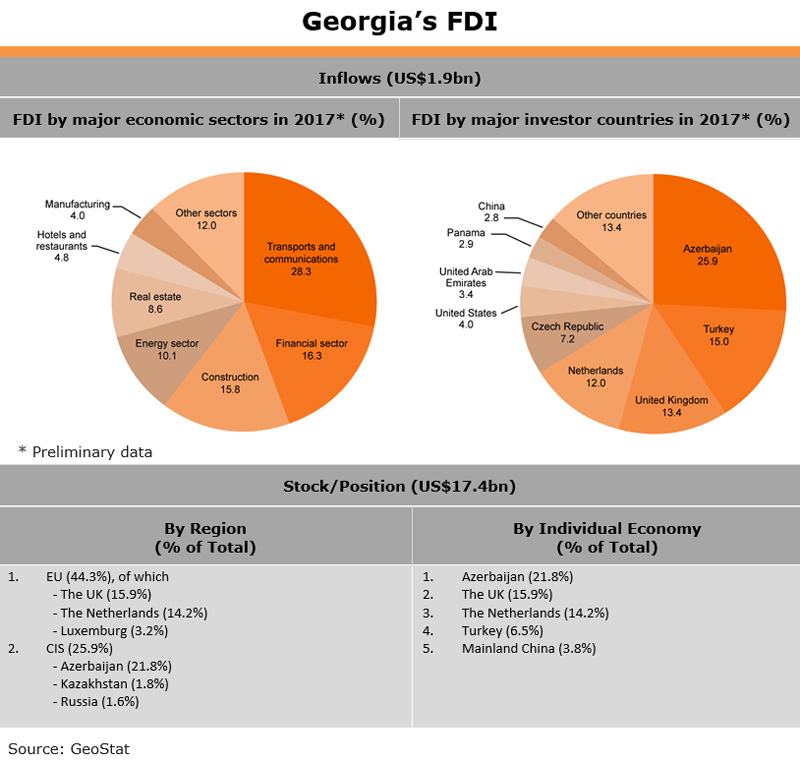

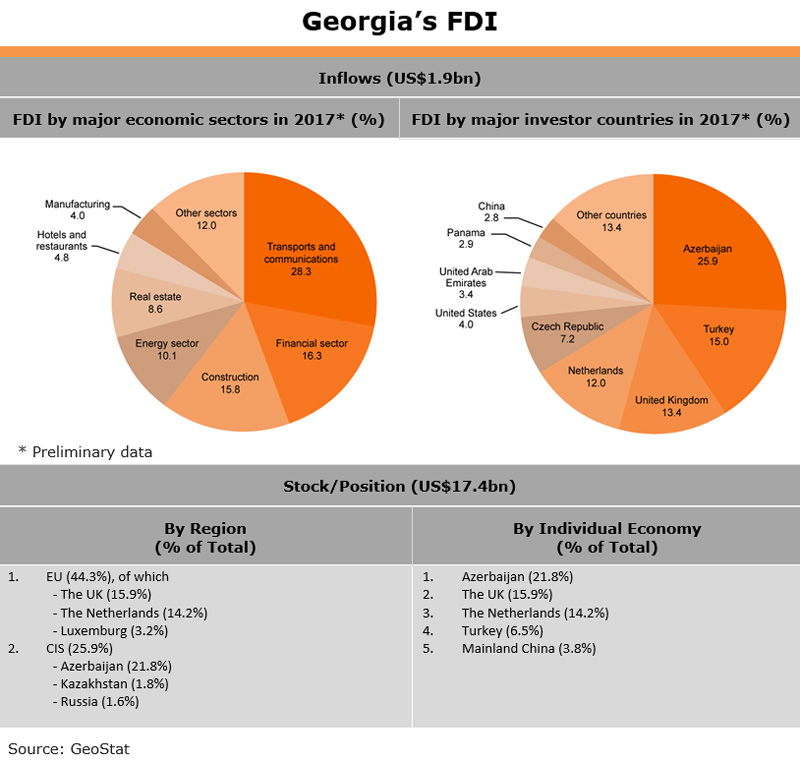

The growing Chinese presence permeates not only in trade, but also investment in Georgia. In spite of a similar EU and CIS dominance, the mainland is estimated to have grown to be the country’s fifth-largest foreign investor, growing from a US$590 million position in 2015 to US$656 million in 2017. An estimated US$51.9 million of the US$1.9 billion annual FDI inflow to Georgia last year came from China, accounting for some 2.8% of the total.

Falling largely in line with Georgia’s economic strengths, Chinese investors have a diversified investment portfolio in the country. Investment span many different sectors such as infrastructure development, engineering contracting, project contracting, trading, banking and finance, hospitality and real estate, telecommunication, forest resources development, building materials processing, manufacturing, renewable energy and mineral exploitation.

Examples of leading Chinese investors in Georgia include Xinjiang Hualing Group Corporation, CEFC China Energy, Sichuan Electric Power Import and Export Company, China State Grid International Development Corporation, Georgia Sinohydro, China 20th Metallurgical Construction Co., Ltd., Huawei Technologies, ZTE Corporation and Manzhouli Heyuan Economic and Trade Co., Ltd.

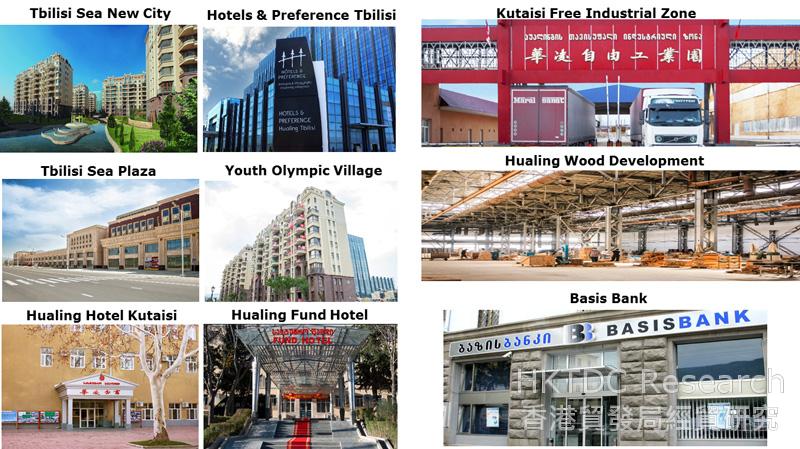

As the largest Chinese investor in Georgia, Xinjiang Hualing Group Corporation, for example, has already realised eight projects, including a landmark real estate development in Tbilisi, the capital. The Youth Olympic Village was converted into a residential and commercial complex, comprising Hualing Tbilisi Sea New City, Hualing Tbilisi Sea Plaza and Hualing Hotels & Preference Tbilisi, with abundant warehousing, retailing, wholesaling and meetings, incentives, conferences and exhibitions (MICE) capacity.

Source: Hualing Group

In consonance with Georgia’s vision to transform itself from a logistic junction into an industrial hub, Hualing has also strengthened its investment in the country’s manufacturing sector by taking a stake in the Kutaisi Free Industrial Zone (FIZ). This, together with CEFC China Energy’s recent investment in Poti FIZ on the eastern Black Sea coast to build an export hub for Chinese goods and services to Europe and Central Asia, has made Chinese investors vital for the future of two of the country’s four FIZs, and important partners in realising Georgia’s industrial potential.

Also worth noting is the growing visibility of Chinese investors in Georgia’s banking and finance sector. A good example is Hualing’s purchase of the Basis Bank in 2012, with an aim to grow RMB cross-border settlement businesses between China and Georgia. This was to facilitate bilateral trade and investment, and became one of the leading cases of Chinese private enterprises purchasing commercial banks abroad.

On a similar note, CEFC China Energy is reportedly planning to work with the Georgian government to set up a Georgian Development Bank. This will bolster RMB-denominated financial services and cross-border RMB settlement, while co-operating with the Georgian National Sovereign Fund to establish a Georgian Construction Fund to invest in financial services for projects such as roads, electric power, telecommunications and other infrastructure.

Also of interest to Chinese investors are the country’s strategic infrastructure projects, including hydropower plants and the ongoing railway modernisation. The recognition gained by a handful of Chinese investors and builders, such as China Railway 23rd Bureau Group, taking part in various signature projects in Georgia, will give Chinese investors a better position in the country’s future infrastructure development.

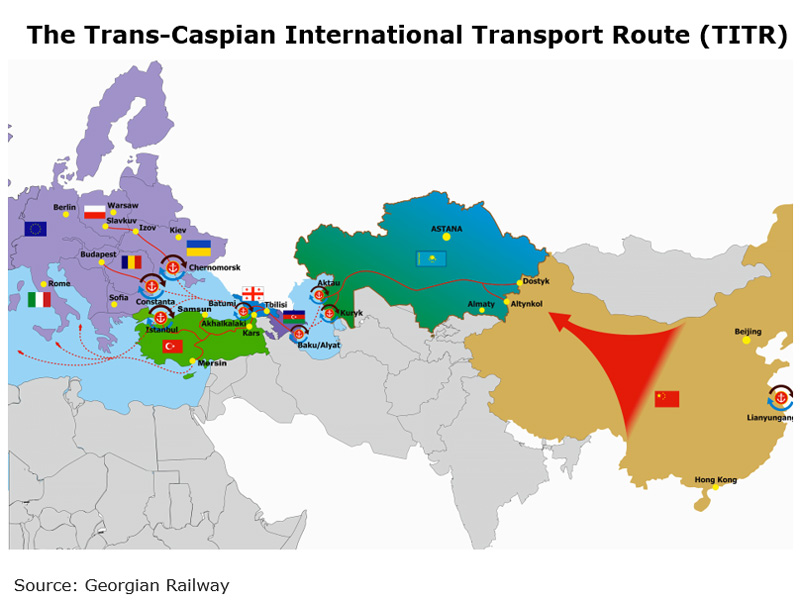

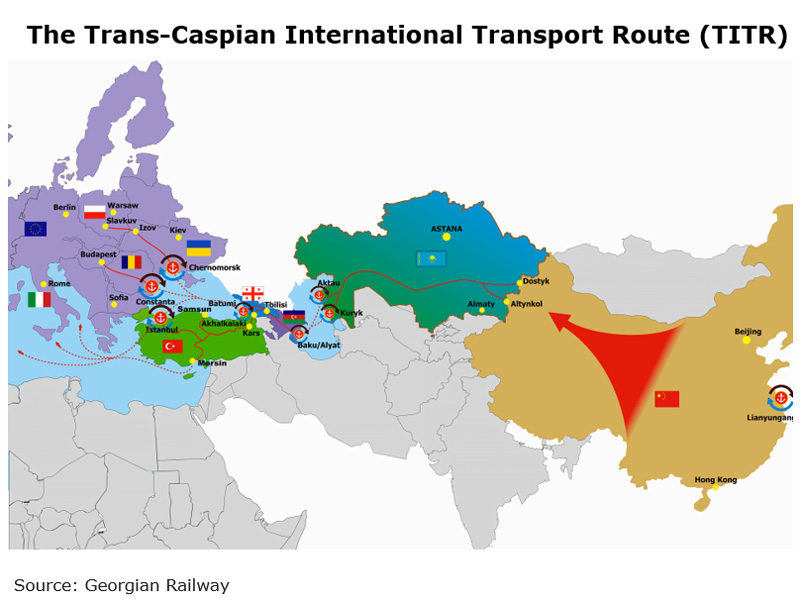

Situated on the shortest land route between China and Europe and being a key component of the Trans-Caspian International Transport Route (TITR) or the Middle Corridor, which stretches from Southeast Asia and China to Europe via Central Asia and the Caspian Sea, Georgia is an important BRI partner. Its strategic role as a logistic hub has been further strengthened with the October 2017 opening of the Baku-Tbilisi-Kars (BTK) railway route, which starts on the Caspian Sea in Azerbaijan and runs through Tbilisi and the eastern part of Turkey before merging with the Turkish and European railway systems.

Cargo trains from North-West China can now take as little as eight days to reach Georgia’s Black Sea coast, compared to sea voyages which can take up to 45 days. But to realise the target of receiving more than 250 cargo trains in 2018 and fully exploit the BTK, further local road and rail infrastructure enhancement work would have to be carried out in order to better connect the domestic rail networks and industrial facilities with the BTK. The route has a current annual capacity of 1 million passengers and 5 million tonnes of freight and the potential to expand to 3 million passengers and 17 million tonnes of freight.

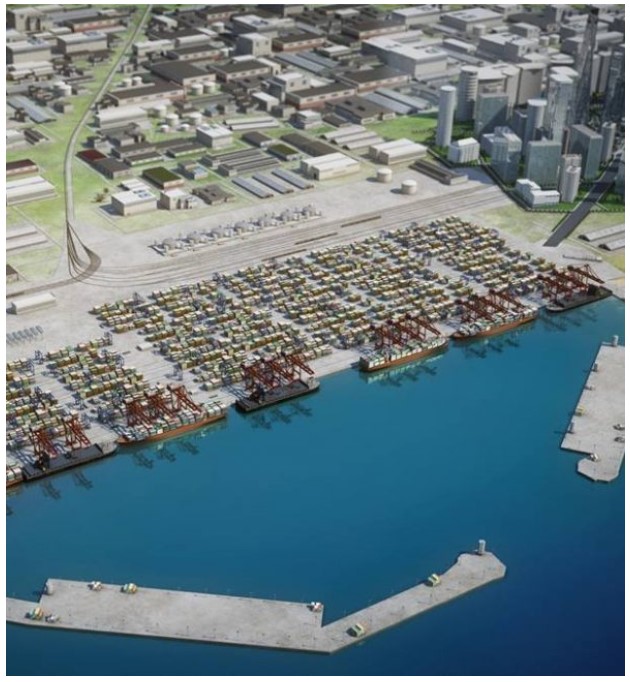

Source: Anaklia Development Consortium

High on the country’s keynote project list is the US$2.5 billion Anaklia Deep Sea Port and Special Economic Zone (SEZ) project. This is the first deep sea port and the largest greenfield maritime infrastructure development in Georgia’s history, marking the beginning of the country’s transformation from a transit economy into a regional logistics and industrial hub capable of attracting Panamax and Post-Panamax vessels from Asia and Europe.

Under the 52-year build-own-transfer (BOT) concession agreement, the Georgian government has committed US$120 million for the construction and development of railway and road transportation links connecting the port to the region to help establish a new maritime trade corridor from Asia to Europe. Expected to receive the first vessels by 2020, the port will open new trade routes to the landlocked Caucasus, Caspian and Central Asian regions and provide badly-needed[3] infrastructure to support regional economic and trade development there.

Anaklia SEZ is close to the port and boasts an initial land plot up to 400ha, with the possibility of expanding to a city-scale project of up to 2,000ha. As a pioneering step to promote the development of light manufacturing and assembly, logistics, warehousing, distribution centres, retail and other service businesses, the SEZ will not only feature a green and smart city concept, but also enjoy a special status to provide a more favourable regulatory environment and tax system (e.g. British Common Law, international arbitration, IP laws, etc.).

Highlights of the Anaklia Deep Sea Port and SEZ Project

| Anaklia Deep Sea Port | Anaklia City and Special Economic Zone |

| Build-own-transfer (BOT) with a 52-year concession | Special Economic Zone (SEZ) adjacent to the deep-sea port site |

| 340ha port development area | Initial project land plot up to 400ha, with expansion to a city-scale project up to 2,000ha |

| Port depth of 16m CD | Focus on light manufacturing, logistics, warehousing, manufacturing and assembly, distribution centres, retail and other essential businesses |

| 14mn tonne capacity by 2030 (Phases 1 & 2) | New legislation to provide regulatory grounds for Anaklia City and Special Economic Zone development |

| Able to accommodate vessels up to 10,000 TEU | Green and Smart City concept with full pledge on urban and spatial planning from the outset |

| Up to 100mn tonne annual capacity following completion of all development phases | |

| Total cost estimated at US$2.5bn in nine development phases |

Source: Anaklia Development Consortium

As a long-term project with nine development phases spanning over more than 50 years, the Anaklia Deep Sea Port and SEZ is set to become a focal point for not only international businesses exploring new manufacturing relocation and regional distribution possibilities, but also investors looking for lucrative investment opportunities and partnerships in Georgia for many years to come.

In order to reach out to prospective investors across Asia and in other Belt and Road- connected regions, the Anaklia Development Consortium participated in the 2018 Belt and Road Summit in Hong Kong. The same event saw the signing of the Hong Kong-Georgia FTA and the promotion of the Anaklia Deep Sea Port and SEZ project to a 5,000-strong audience of investors, project operators and service providers from 55 countries and regions.

[1] According to Meiburg Wine Media, Georgia’s wine exports to China have been growing at an annual rate of more than 100% since 2008.

[2] Churchkhela is made from natural grape juice and different kinds of nuts.

[3] Existing Georgian ports are expected to reach full capacity limit with five years.

Editor's picks

Trending articles

By Asian Development Bank

Highlights

- Developing Asia will need to invest $26 trillion from 2016 to 2030, or $1.7 trillion per year, if the region is to maintain its growth momentum, eradicate poverty, and respond to climate change (climate-adjusted estimate). Without climate change mitigation and adaptation costs, $22.6 trillion will be needed, or $1.5 trillion per year (baseline estimate).

- Of the total climate-adjusted investment needs over 2016–2030, $14.7 trillion will be for power and $8.4 trillion for transport. Investments in telecommunications will reach $2.3 trillion, with water and sanitation costs at $800 billion over the period.

- East Asia will account for 61% of climate-adjusted investment needs through 2030. As a percentage of gross domestic product (GDP), however, the Pacific leads all other subregions, requiring investments valued at 9.1% of GDP. This is followed by South Asia at 8.8%, Central Asia at 7.8%, Southeast Asia at 5.7%, and East Asia at 5.2% of GDP.

- The $1.7 trillion annual estimate is more than double the $750 billion Asian Development Bank (ADB) estimated in 2009. The inclusion of climate-related investments is a major contributing factor. A more important factor is the continued rapid growth forecasted for the region, which generates new infrastructure demand. The inclusion of all 45 ADB member countries in developing Asia, compared to 32 in the 2009 report, and the use of 2015 prices versus 2008 prices also explain the increase.

- Currently, the region annually invests an estimated $881 billion in infrastructure (for 25 economies with adequate data, comprising 96% of the region’s population). The infrastructure investment gap—the difference between investment needs and current investment levels—equals 2.4% of projected GDP for the 5-year period from 2016 to 2020 when incorporating climate mitigation and adaptation costs.

- Without the People’s Republic of China (PRC), the gap for the remaining economies rises to a much higher 5% of their projected GDP. Fiscal reforms could generate additional revenues equivalent to 2% of GDP to bridge around 40% of the gap for these economies. For the private sector to fill the remaining 60% of the gap, or 3% of GDP, it would have to increase investments from about $63 billion today to as high as $250 billion a year over 2016–2020.

- Regulatory and institutional reforms are needed to make infrastructure more attractive to private investors and generate a pipeline of bankable projects for public–private partnerships (PPPs). Countries should implement PPP-related reforms such as enacting PPP laws, streamlining PPP procurement and bidding processes, introducing dispute resolution mechanisms, and establishing independent PPP government units. Deepening of capital markets is also needed to help channel the region’s substantial savings into productive infrastructure investment.

- Multilateral development banks (MDB) have financed an estimated 2.5% of infrastructure investments in developing Asia. Excluding the PRC and India, MDB contributions rise above 10%. A growing proportion of ADB finance is now going to private sector infrastructure projects. Beyond finance, ADB is playing an important role in Asia by sharing expertise and knowledge to identify, design, and implement good projects. ADB is scaling up operations, integrating more advanced and cleaner technology into projects, and streamlining procedures. ADB will also promote investment friendly policies and regulatory and institutional reforms.

This article was first published by the Asian Development Bank. Please click to read the full report.

Editor's picks

Trending articles

Domestic structural and legislative changes within the region's most populous nation could have far wider implications.

Traditional Uzbakistani jewellery: A treasure lost to the wider world for more than 20 years.

The Uzbekistan jewellery sector is the latest to benefit from the largesse of Shavkat Mirziyoyev, the 60-year-old career politician who became the country's President in November last year. His most recent legislative initiative has seen import tariffs scrapped for jewellery equipment, raw materials, parts/components, and finished items. To crown it all, he has also abolished VAT on the sale of imported and domestically-produced jewellery until at least January 2020.

The move, however, didn't come about without one or two stipulations. Primarily, the government has specified that all of the additional revenue accruing to the industry on the back of these duty cuts must be re-invested in updating the sector's technological resources, with any remaining funds used as working capital, allowing manufacturers and exporters to up their output.

Assuming jewellery businesses adhere to their side of the deal, any such upgrade, coupled with the enhanced cash flow, could prove most timely. As well as boosting the domestic industry, Mirziyoyev's initiative has also opened up the market, with the end of its prohibitive import tariff regime suddenly making Uzbekistan's jewellery sector a tempting prospect for both overseas purchasers and investors, with Russia, Ukraine, China and Turkey seen as the most likely beneficiaries.

While the end of its offputtingly excessive levies may mark something of a new dawn for the country's jewellery trade, another earlier initiative is also set to make a substantial impact. Back in September, the country's 20-year-old policy of pegging the som – the local currency – to the US dollar at an artificially low rate was abandoned, while restrictions on the amount of foreign currency that businesses and ordinary Uzbekistanis could purchase were also removed.

This change was designed to end the country's two decades of virtual economic isolation, with would-be investors long-deterred by the unjustifiable exchange rate and the currency restrictions. It is now anticipated that Uzbekistan – the most populous country in formerly Soviet Central Asia – could see overseas investment levels return to the highs enjoyed prior to 1994, the year that Mirziyoyev's predecessor, Islam Karimov, introduced the fixed-rate currency exchange system.

As a sign of the importance of the jewellery industry within the country's newly liberalized economic regime, the Uzbekistan Jewellery Industry Association (Uzbekzargarsanoati) was launched by presidential decree late last month in Tashkent, the national capital. As well as taking on responsibility for preserving and enhancing the country's centuries-old traditional jewellery styles and craftsmanship, the body will also have a more contemporary mandate, which will see it charged with driving exports, overseeing overall quality standards and ensuring the industry's major players follow through on the government's call for a widespread technological upgrade.

The legislative, structural and technological changes set to reinvent the country's jewellery industry, however, are expected to have repercussions well beyond its borders. In fact, many within the business anticipate that Uzbekistan's re-emergence onto the wider economic scene could transform Central Asia's jewellery sector.

At present, the jewellery scene in the region is dominated by two particular players – Kazakhstan and Kyrgyzstan – both of which bring something entirely different to the market. Kazakhstan has a high proportion of affluent consumers, many of whom are keen jewellery purchasers, attributes that have seen the country develop an admirable distribution network, while also seeing it as home to the Esentai Mall, the region's only truly premium shopping destination.

By contrast, Kyrgyzstan has made itself equally important to the Central Asian jewellery trade by clearly establishing itself as the region's key re-export hub. Overall, the country has its extremely liberal business regime and its accompanying low import tariffs to thank for its strategic – and lucrative – re-exporting role.

Ironically, all of this jostling for position within the region may see many of the countries re-adopt the supplier/distributor roles they held some 2,000 years ago at the time of the classic Silk Road. With the Belt and Road Initiative – China's ambitious infrastructure development and trade facilitation programme, widely seen as the successor to this ancient trade route – set to snake its way through Central Asia and Eastern Europe, it could be most timely that such a venerable hierarchy is about to be restored.

Leonid Orlov, Moscow Consultant

Editor's picks

Trending articles

Tax incentives and financing expertise for Belt and Road Initiative projects offer huge opportunities for Hong Kong as a treasury centre, says Paul She of global accounting and consultancy firm, Mazars. The firm is focusing on technology clients related to the Belt and Road – some for IPO launch on the Hong Kong Stock Exchange – companies “often missed by the market”.

Speaker:

Paul She, Practising Director, Mazars CPA Limited

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

Hong Kong’s success as an art hub for the Belt and Road includes “perfect” logistics, a proliferation of arts venues and international trade connections, says Kevin Ching of top auction house, Sotheby’s. With Hong Kong being Sotheby’s headquarters for Asia, he says the emergence of Chinese and Southeast Asian art in global markets are joined by work by other talented artists from Belt and Road areas that include the Caucuses and Central Asia.

Speaker:

Kevin Ching, CEO Asia, Sotheby’s

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

“Distributed power” is a flexible and cost-effective means of energising both developing and developed markets within the Belt and Road Initiative, says Rorce Au Yeung of Hong Kong’s VPower Group. Using toy Lego building blocks as a metaphor, VPower stations can be extended or re-deployed according to a market’s requirements. Mr Au Yeung says Hong Kong is pivotal for finance, investment and project control.

Speaker:

Rorce Au Yeung, Co-Chief Executive, VPower Group

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

Based in Hong Kong with a history spanning more than a century, China Construction Bank (Asia) Corporation Ltd (“China Construction Bank (Asia)” or “CCB (Asia)”) is the flagship subsidiary of China Construction Bank Corporation (“CCB”) with the largest and most comprehensive operation, the most diverse range of products, and a pool of exceptional talents for CCB’s overseas business. With the establishment of its Credit Approval Centre Asia-Pacific in Hong Kong, CCB (Asia) will continue to play a pivotal role working in partnership with other CCB affiliates in Hong Kong in supporting Chinese mainland enterprises’ “going global” as well as participation in the Belt and Road Initiative.

As an international financial hub, Hong Kong is a key strategic link within the Belt and Road Initiative. As most mainland enterprises have chosen to set up their offshore headquarters or fund management platforms in Hong Kong, the Special Administrative Region has become the “going global” bridgehead for mainland enterprises, presenting CCB (Asia) with tremendous opportunities. Hong Kong is one of Asia’s most dynamic markets in syndicated loans, bonds, IPOs, asset management and corporate treasury management. It is also the world’s leading offshore renminbi market with a high degree of connectivity to global markets. To mainland enterprises, Hong Kong possesses a distinctive talent edge by virtue of its biliterate and trilingual financial talent pool armed with global insight and vision, its wealth of professionals in accounting, law and tax, as well as its high level of marketisation in human resources and flexible employment mechanism.

CCB (Asia) has in recent years assembled and cultivated a pool of specialists who, by playing key roles in major overseas financing projects in the past, have been instrumental in driving the development of CCB’s overseas financing business. As CCB’s largest comprehensive banking platform outside of the mainland, CCB (Asia) is a key financing centre for major overseas projects involving mainland enterprises. Its independent Structured Finance Team and Syndication Team are in a position to offer companies a suite of financial services products ranging from international syndication and M&A loans to project financing and asset financing. Its services include deal structuring, project evaluation and advisory services, financial modelling, syndicated loan distribution, loan documentation negotiation, arrangement for signing of legal documents and loan drawdown.

The establishment of the Credit Approval Centre Asia-Pacific in Hong Kong signifies an important milestone in CCB’s internationalisation and will help to elevate the quality and efficiency of the loan approval process. It also underscores Hong Kong’s status as a “super-connector” between the mainland and international practices and standards. With the accumulation of valuable experience through execution of live deals, CCB's Hong Kong Training Centre leverages Hong Kong’s advantage in having a concentration of resources, information and talents to provide CCB staff with the mentorship of experienced professionals and the kind of international exposure vital to understanding offshore business. Furthermore, they will benefit from the synergies between enterprises and the financial services community. These advantages make Hong Kong the ideal location for CCB to provide superior support for Chinese enterprises’ “going global”.

1091 Views

1091 Views