GDP (US$ Billion)

56.85 (2018)

World Ranking 81/193

GDP Per Capita (US$)

1,040 (2018)

World Ranking 165/192

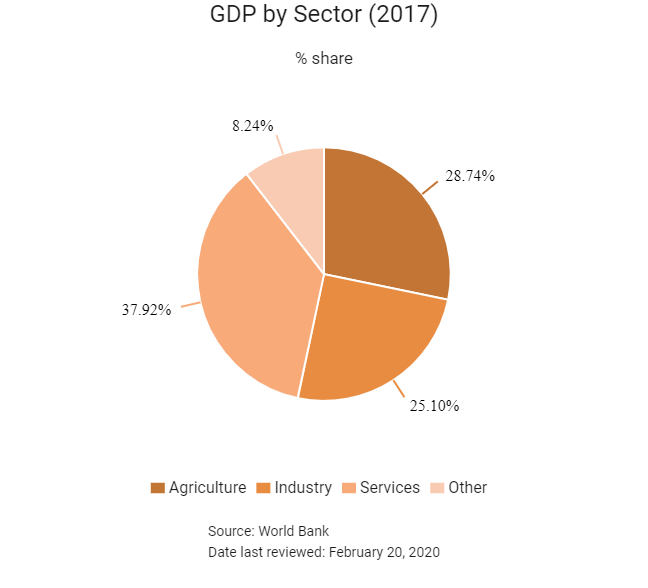

Economic Structure

(in terms of GDP composition, 2017)

External Trade (% of GDP)

32.2 (2017)

Currency (Period Average)

Tanzanian Shilling

2288.21per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

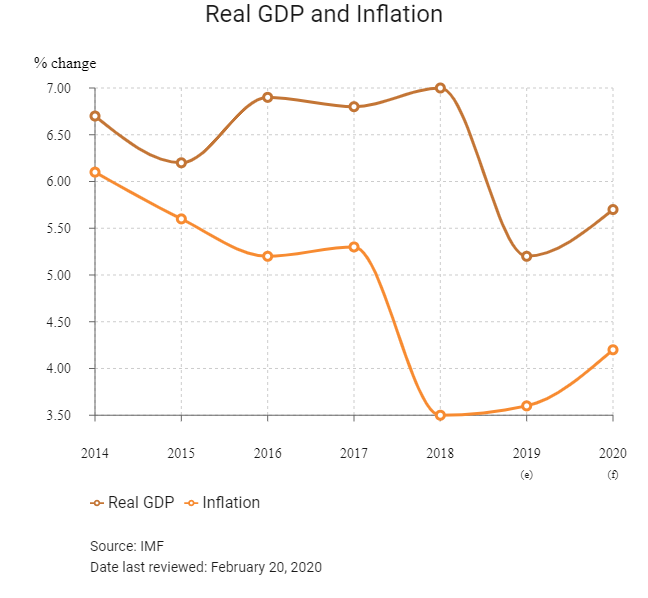

Tanzania has sustained relatively high economic growth over the last decade, averaging 6-7% annually and the country benefits from its strategic geographic position – lying on Africa's eastern coast (with access to maritime trade via Dar es Salaam), while also being situated between Southern, Central, and East African states. The Magufuli administration has prioritised efforts to, improve public administration and manage public resources for improved social outcomes. Financial inclusion among Tanzanians continues to improve, as does the country's growing transport infrastructure profile. With a large and growing population (approximately 55 million), as well as rising per capita incomes particularly in urban areas, the country presents significant opportunities for consumer-facing sectors and labour-intensive industries.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2016

Tanzania and Uganda agreed to build East Africa's first major oil pipeline.

January 2019

The Tanzania Investment Centre (TIC) provided required incentives to Mainland China-based Sinoma International Engineering and Hengya Cement to begin construction of a USD1 billion Greenfield cement plant in the African country's Tanga region. The facility will have an annual production capacity of 7 million tonnes. The project will have a 1.2GW captive power plant. At least 70% of the cement produced would be exported and the remainder would be sold domestically.

March 2019

Tanzania ordered all mineral-producing regions in the country to set up government-controlled trading centres by the end of June 2019, accelerating efforts to curb illegal exports of gold and other precious minerals. The trading centres would give small-scale miners direct access to a formal, regulated market where they could go and directly trade their gold.

March 2019

The governments of Tanzania and Malawi launched a joint commission of the Songwe River Basin to run irrigation and power generation projects on Songwe River Basin. The aim was to supervise the management of resources in the basin for the advantage of people residing around the development area in the two countries. The commission was expected to accelerate construction of the lower Songwe dam and hydro project, several village-based schemes, two irrigation schemes and Songwe and Kasumulu town's water supply schemes. Construction of dams, costing USD829 million, were planned under the Songwe River Basin Project.

March 2019

The African Development Bank (AfDB) had signed a USD256.2 million concessional loan deal to support completion of Kasulu-Manyovu road project in the western region of Kigoma, Tanzania. The project involved upgrading the 260.6 km Kabingo-Kasulu-Manyovu road section to bitumen standard. The route would link the port of Dar es Salaam with the country's western regions and open up regional markets in Burundi, Rwanda, Uganda and the Democratic Republic of Congo.

May 2019

The governments of Tanzania and Zambia unveiled plans to build an oil pipeline connecting Tanzanian capital Dar Es Salaam with the Ndola in Zambia. The 1,349 km pipeline would require an investment of USD1.5 billion and would transport refined products between the two countries. Details for the construction timeline or project financing had not been disclosed. A feasibility study for the project would be carried out in FY2019-2020, ending June 30, 2020.

October 2019

Tanzania lifted its export ban on mineral concentrates.

February 2020

Tanzania received a USD1.2 billion loan from Standard Chartered Bank for its standard gauge railway (SGR) project. The loan from the bank would finance the first and second phases of the project which would cover a distance of 550 km from Dar es Salaam to Makutupora. Tanzania aimed to have a 2,190 km SGR network, which would connect the port of Dar es Salaam with Mwanza on Lake Victoria, Kigali in Rwanda and Musongati in Burundi.

October 2020

General elections to be held.

Sources: BBC Country Profile – Timeline, Fitch Solutions

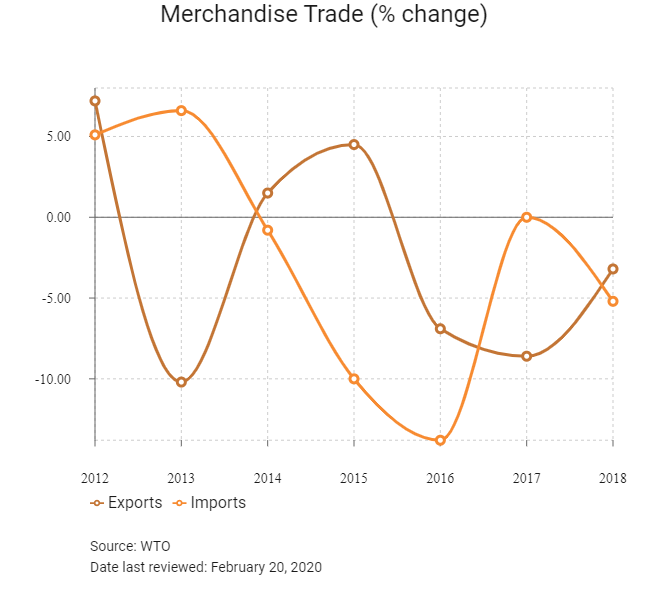

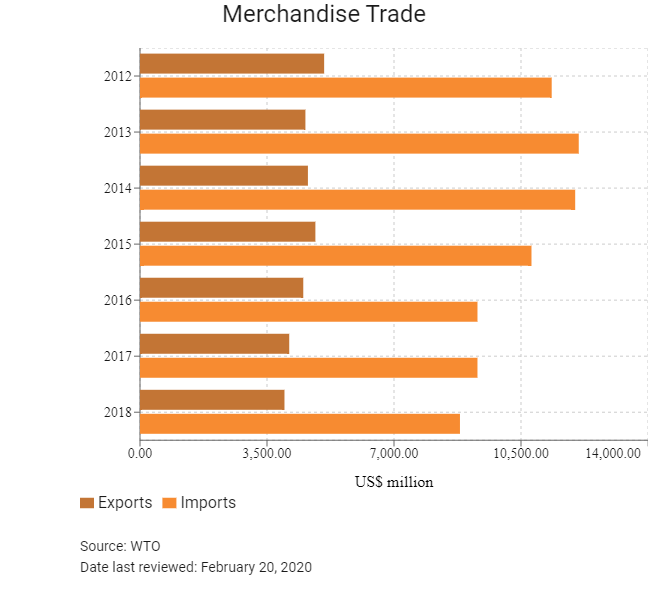

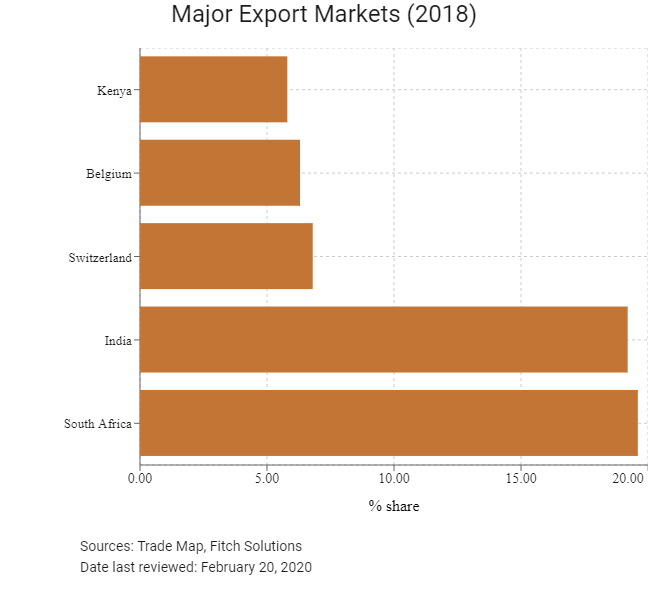

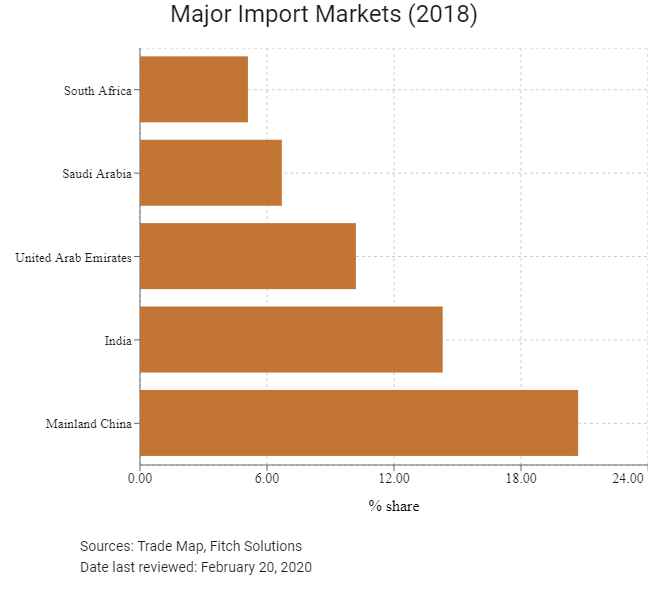

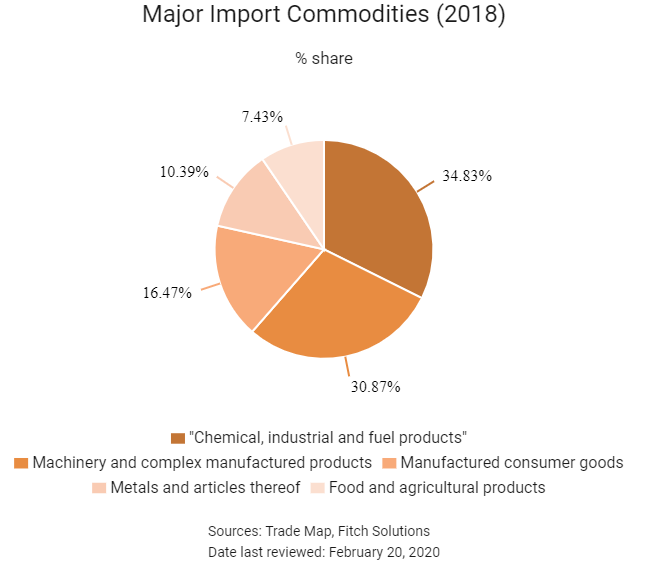

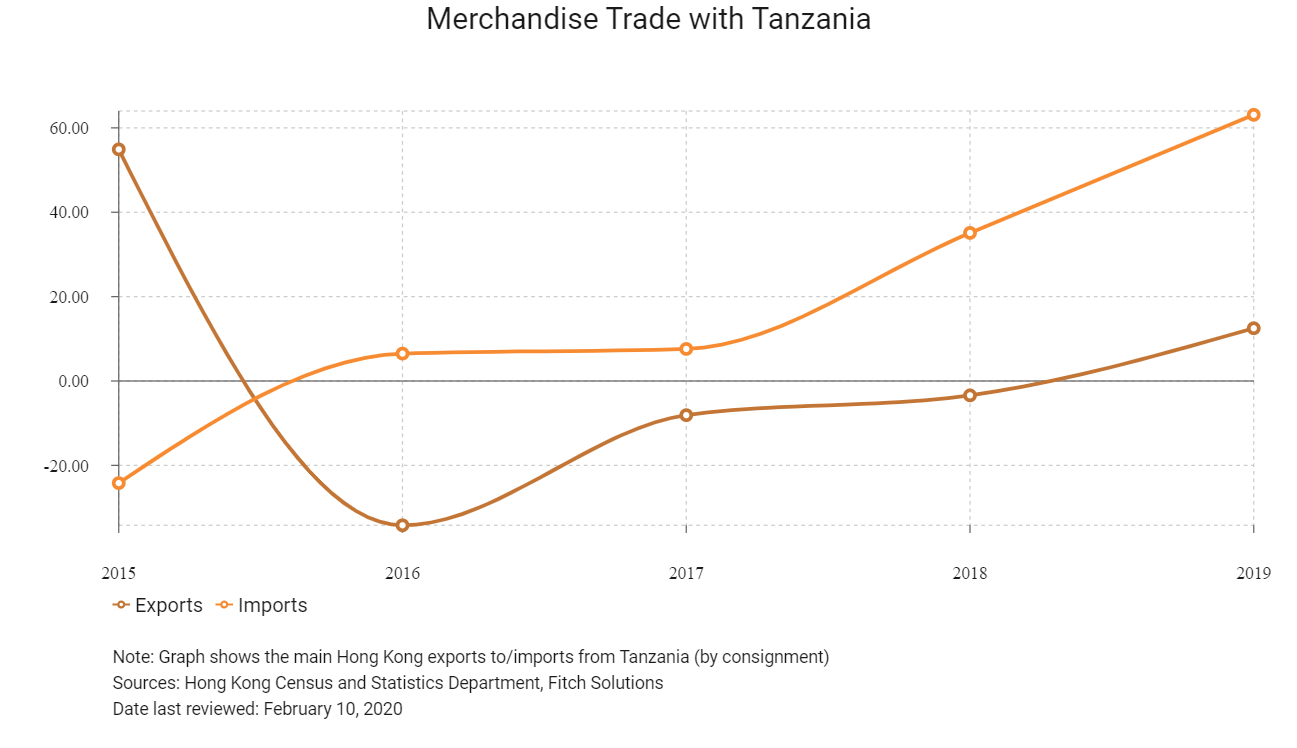

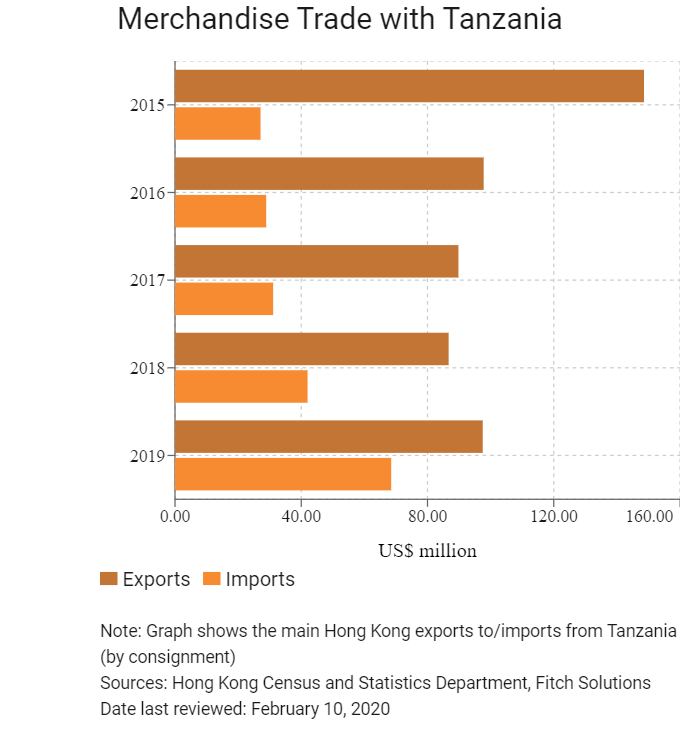

Merchandise Trade

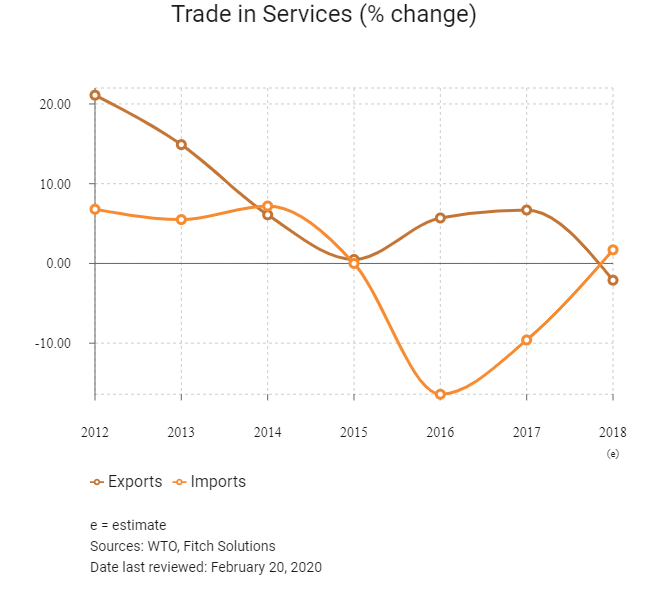

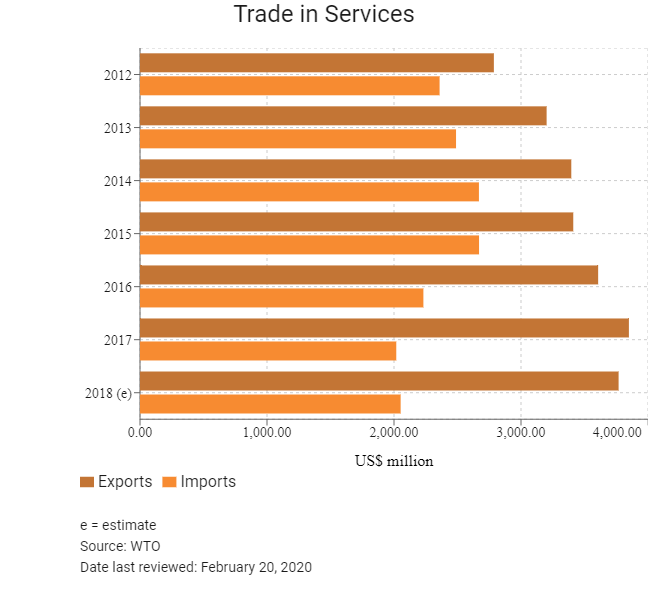

Trade in Services

- Tanzania has been a member of the World Trade Organization (WTO) since 1995, as well as the WTO's precursor – the General Agreement on Trade and Tariffs – since 1961.

- The government has introduced a directive banning coal imports. Coal consumers are required to enter into supply contracts with local producers to protect growth of local industry.

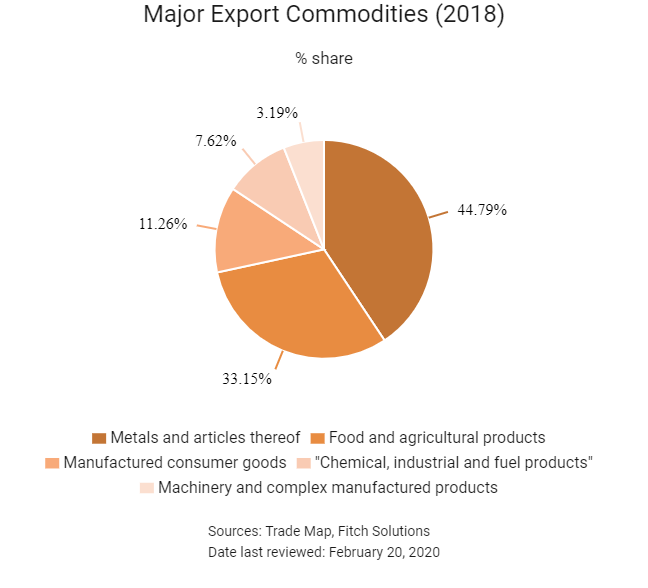

- A ban on unprocessed mineral exports is in place as the government aims to develop mineral processing industries within the country.

- Tanzania is a member of the East African Community (EAC), which became a Customs Union on January 1, 2005 on the implementation of the East African Customs Union Protocol. This protocol provides for a common external tariff (CET), elimination of internal tariffs, rules of origin, anti-dumping measures, a common customs law, and common export promotion schemes. Import duty rates under the CET range from 0% for raw materials, capital goods, agricultural inputs, pure-bred animals, medicines; to 10% for semi-finished goods and 25% for finished final goods.

- Under the EAC CET, machinery and spare parts imported by licensed mining companies and used in mining activities as well as machinery, spares, and inputs imported by licensed company for direct use in oil, gas, and geothermal exploration are exempt from customs duties.

- Tanzania is a member of the Southern African Development Community (SADC), an organisation that helps to reduce trade barriers among the Southern African member states.

- Tanzania's trade policies are undergoing harmonisation with other EAC countries, and SADC members receive tariff preferences from Tanzania, greatly facilitating regional trade.

- Tanzania bans the export of raw tanzanite gemstones, affecting trade with France, Hong Kong, India, South Africa, Thailand, the United States, Belgium, and Germany. Export restrictions on scrap metal are also in place.

- The export of hides and skins to India has additional taxes imposed upon it.

Sources: WTO - Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- The EAC Common Market: In addition to Tanzania, the community comprises Burundi, Rwanda, Kenya, Uganda and South Sudan was formalised in 2000, with Dodoma signing on to the agreement a year later in 2001. The customs union aids regional trade flows and allows businesses to use Tanzania as a gateway to the African market. The EAC Common Market is becoming increasingly important to foreign investors, offering access to a large consumer market with free movement of factors of production. Tanzania's trade with neighbouring states is substantial.

- The EAC-United States Trade and Investment Framework Agreement (TIFA): The TIFA, in connection with the United States' Africa Growth and Development Act, removes tariffs for some product exports to the United States (such as textiles), reducing trade barriers for exporters and easy access to the large United States market.

- EBA: All EU countries, as well as all countries designated as 'less-developed' (LDCs) are eligible to be party to the EBA. The EBA agreement allows businesses in Tanzania full access to the EU market for all products (excluding arms and armaments). The agreement also provides Tanzanian businesses duty-free and quota-free access to EU markets with no expiry date. EBA status can be withdrawn under exceptional circumstances.

- The SADC: In addition to Tanzania, SADC comprises Angola, Botswana, the DRC, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Swaziland, Zambia and Zimbabwe. Tanzania joined SADC in 1992, the same year as the community's creation. SADC measures help to reduce trade barriers among member states, while greater market access across SADC and improved regional logistical developments lower trade costs and increases the potential consumer market.

Ratified, But Not Yet In Effect

The African Continental FTA (AfCFTA): AfCFTA is a trade agreement between African Union member states with the goal of creating a single market followed by free movement and a single currency union. The AfCFTA encompasses all African states and is set to come into force on July 1 2020. The free trade agreement (FTA) has been proposed to potentially boost intra-Africa trade by 52.3% if trade barriers are eliminated and a further 50.0% if non-trade barriers are removed. The FTA is envisioned as a potential precursor to a continent-wide customs union.

Under Negotiation

EAC-EU EPA: The EAC finalised the negotiations for an EPA with the EU on October 16, 2014. Kenya and Rwanda signed the EPA in September 2016 and Kenya has ratified it. For the EPA to enter into force, the four remaining EAC members need to sign and ratify the agreement. EU states are key trade partners and the EPA facilitates access to this large market. Trade preferences include duty-free entry of all industrial products, as well as a wide range of agricultural products, including beef, fish, dairy products, cereals, fresh and processed fruits, and vegetables. Tanzania has indicated the desire to resume negotiations surrounding the agreement following a prolonged suspension in talks. The implementation of the EPA will supersede the EBA agreement. As of February 2020, the agreement is still under negotiation.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

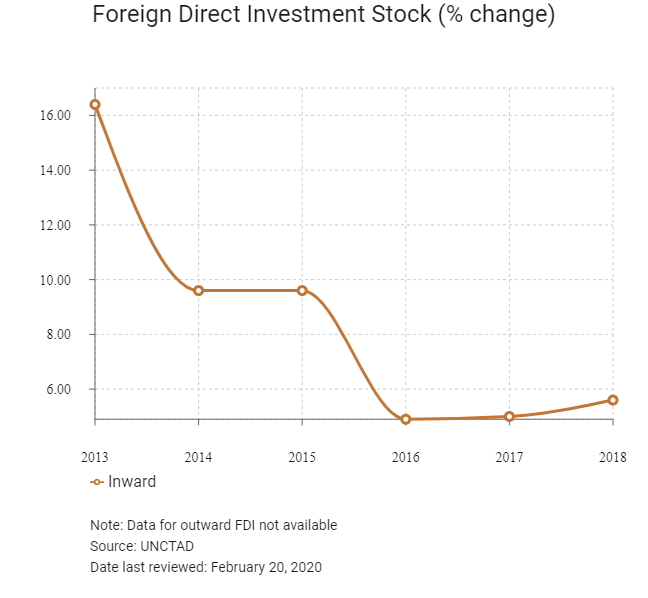

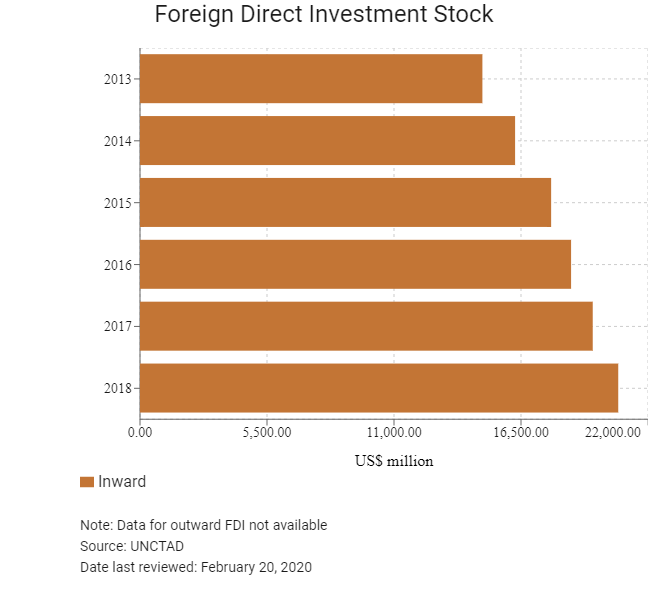

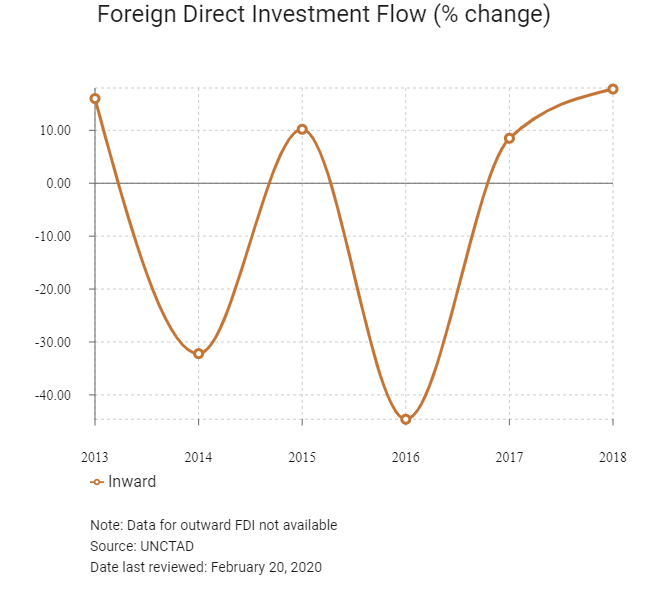

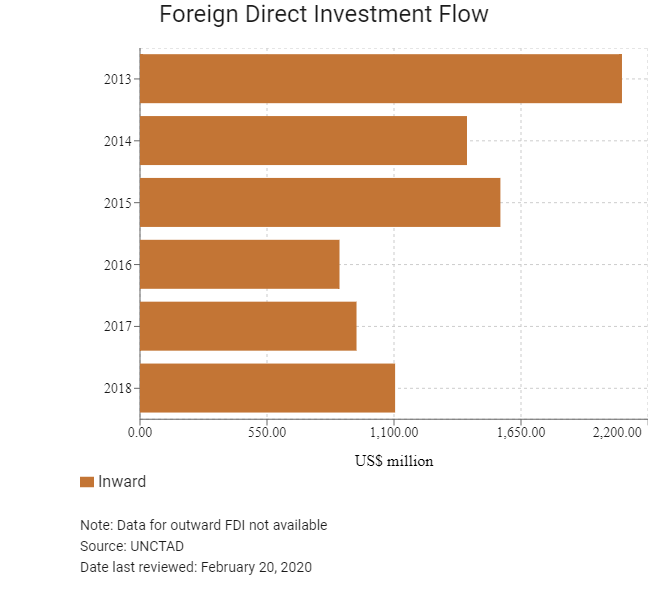

Foreign Direct Investment

Foreign Direct Investment Policy

- In practice, the investment climate in Tanzania is relatively open, with no overriding rules that prohibit foreigners from investing across a wide range of sectors, however, some restrictions are in place.

- The Tanzanian government has taken steps towards setting up policies and incentives to attract more foreign investment. The TIC is the country’s primary investment promotion agency offering investment services, assistance with work permits, licences and certificates, online registration with multiple entities and administration. Both the Mainland and Zanzibar have their respective investment promotion bodies, the TIC and the Zanzibar Investment Promotion Authority (ZIPA). As a result, foreign enterprises will encounter a lighter burden of red tape and simplified business procedures.

- Tanzania restricts the purchase of land by foreigners; land ownership among foreigners is restricted to land designated for investment purposes. Land may be leased for up to 99 years.

- In the fisheries and tourism sectors, certain operations are restricted to locals. Investment in the extractive sectors is increasingly subject to local content requirements and the mandatory listing of shares on local capital markets.

- The fisheries sector has discriminatory treatment on fishing vessels and licensing practices that make foreign involvement in the sector difficult or prohibitive.

- Investment in the Tanzania is mainly a non-Union matter, thus there are different laws, policies, and practices for the Mainland and Zanzibar. However, international agreements on investment are covered as Union matters and therefore apply to both regions.

- Investment benefits are available to investors who satisfy the following capital requirements:

- Locally owned firms need to invest a minimum of USD100,000.

- Foreign owned or joint venture firms need to invest a minimum of USD500,000.

- In addition to the above-mentioned criteria, a business or investor can also qualify as a strategic investment partner. Strategic investment status provides further benefits to businesses on a case-by-case basis.

- Under the EAC Model Investment Code, a strategic investor in Tanzania (excluding Zanzibar) require:

- A minimum of USD20 million investment if the business is local.

- A minimum of USD50 million investment if the business is foreign.

- In order to benefit from strategic investor status in Zanzibar, a business must invest a minimum of USD100 million. The required rate is reduced to USD50 million for disadvantaged areas.

- In March 2015, the TIC and the Investment Climate Facility for Africa (ICF) signed an agreement worth USD950,000 aimed at promoting investments in the country by expanding, consolidating and promoting the TIC. Tanzania had received the most FDI over 2017 and 2018 out of all East African states.

- A number of tax incentives in the form of reduced corporate tax (standard corporate income tax is 30%) are in place to encourage investment.

- New manufacturers of pharmaceutical products and leather products face a 10% reduction in the first five years of operation.

- Newly listed companies have a three year grace period of paying lower taxes amounting to 25% provided at least 30% of their shares are issued to the public.

- The largest tax deduction will be experienced by new assemblers of vehicles, tractors and fishing boats. In their first five years of operation, tax is reduced to 10%. With these tax breaks, new passenger-transport equipment firms, in particular, will enjoy lower operating costs, allowing them to divert funds for production expansion.

- Foreign investors are given a guarantee that the repatriation of funds is not restricted, promoting returns on foreign investors' investments.

- The government applies discounts on customs duties for import firms and value added tax (VAT) reductions on all capital goods for investments in the following industries:

- Mining

- Power

- Telecommunications

- Infrastructure

- Agribusiness

- Utilities

- Tanzania is focusing its promotional efforts on 21 specific sectors, namely:

- Agriculture and livestock development

- Natural resources

- Tourism

- Manufacturing

- Oil and gas exploration and production

- Mining

- Transportation

- Real estate

- Services

- Information and communication technologies

- Financial institutions

- Telecommunication

- Energy

- Broadcasting

- Education sector

- Health sector

- Insurance services

- Security services

- Construction industry

- Water and sanitation

- Integrated waste management

- Tanzania has 11 bilateral investment treaties in effect. The countries covered by these treaties are: Canada, Mainland China, Denmark, Finland, Germany, Italy, Mauritius, Netherlands, Sweden, Switzerland and the United Kingdom. Agreements with Oman, Singapore, Thailand, Kuwait, Iran, and Zimbabwe have all been entered into, but have not come into effect as of yet.

- Tanzania is looking to conclude bilateral investment treaties with Algeria, Bangladesh, Belgium, Luxembourg, France, India, Japan, Libya, Malawi, Malaysia, Qatar, Slovakia, the United Arab Emirates, and Vietnam.

- In August 2016, the government identified six new areas slated for Special Economic Zone (SEZ) development – including the Coast, Morogoro, Iringa, Njombe, Mbeya and Songwe Regions – while the country’s Five-Year Development Plan prioritises SEZ development in Bagamoyo, Mtwara, Kigoma, Tanga, Ruvuma, Dodoma and Manyoni, and the Kurasini Logistic Centre.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Benjamin William Mkapa SEZ in Dar Es Salaam |

- Exemption from payment of taxes and duties on capital goods and raw materials to be used for purposes of development of SEZ infrastructure. |

|

Export Processing Zones (EPZ): Hifadhi and Kisongo |

- Offers similar incentives as SEZs, including a 10 year exemption from corporate taxes. |

|

Manufacturers of leather or pharmaceutical goods |

- Foreign and local investors entering the leather or pharmaceutical production industry stand eligible to benefit from a reduced corporate income tax rate ranging between 20% and 30% for the initial five years of operations. |

|

Listing incentives |

- Companies listing on the Dar Es Salaam Stock Exchange, and which have at least 30% of its stock publicly traded, are eligible for a reduced corporate income tax rate for the three year period following the listing. |

Sources: US Department of Commerce, Fitch Solutions, national sources

- Value Added Tax: 18%

- Corporate Income Tax: 30%

Source: Tanzania Revenue Authority

Important Updates to Taxation Information

- According to the Financial Act 2019, new investors in manufacturing of sanitary pads who have a performance agreement with the Tanzanian government face reduced corporate income tax (CIT) from 30% to 25% for the first two years, from 2019/20 to 2020/21, to encourage local manufacturing.

- A draft of new legislation (commencing in 2018) targeting the mining sector has been introduced. These measures include the government's ban on unprocessed mineral exports and regulations stipulating that the government will have a right to renegotiate or dissolve existing mining contracts at any time.

- Other key changes brought in by the Finance Act 2018 are the reduction in corporate income tax rate for new manufacturers of pharmaceutical or leather products who have a performance agreement with the government from 30% to 20% for the first five years from commencement of operations to encourage manufacturers in these two sectors.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 30% on operating profits |

|

Alternative Minimum Tax |

0.5% payable by organisations with perpetual unrelieved losses for three consecutive years. Exemptions apply to companies in agriculture and firms involved in provision of health and education. |

|

Capital Gains Tax |

30% on operating profits (taxable as business income) |

|

Skills and development levy |

4.5% on of payroll cash costs (paid by employer) |

|

VAT |

18% on value of the products |

|

Workers compensation fund |

1% or 0.5% of cash sums paid to employees, payable on a monthly basis (1% for private sector and 0.5% for public sector) |

|

Social security contributions |

20% on gross salaries (10% paid by employer, 10% by the employee) |

Source: Tanzania Revenue Authority

Date last reviewed: February 20, 2020

Localisation Requirements

According to the Non-Citizens Employment Act (2015), the hiring of non-citizens is restricted to jobs for which local talent is unavailable. Legislation also requires the employers to have succession plans in place, with the non-citizen employee eventually being replaced by a local worker. Employers are, therefore, required to implement training during the non-citizen employee's employment tenure in order to upskill a Tanzanian citizen capable of replacing the non-citizen employee.

Foreign Worker Permits

Work permits must be secured for employees, and sponsored by a locally licensed and incorporated entity. There are three categories of work permits:

- Class A: for foreign directors of companies operating or wishing to invest in Tanzania. The process is estimated to take one day to complete. The permit is issued free of charge.

- Class B: issued to non-citizen employees who possess prescribed professional skills, including medical and health care professionals, experts in the oil and gas industry, teachers and university lecturers in science and mathematics. The process is estimated to take between 16 and 17 days to complete. The permit is issued at a cost of USD500.

- Class C: issued to non-citizen employees who do not qualify for Class A or Class B work permits. The process is estimated to take between 16 and 17 days to complete. The permit is issued at a cost of USD1,000.

Visa/Travel Restrictions

A number of visa types exist for visitors to the country, including:

- Transit visas – valid for seven days from entry. Required for those traveling to a third location via Tanzania.

- Business visas – applicable to stays not exceeding 90 days (continuous). Issued to those individuals who:

- are conducting special assignments, such as repairing machines or to run short term training (among others)

- are conducting professional roles such as auditing accounts (among others)

- are conducting lawful business according to the laws of the country

- Single entry visas

- Multiple entry visas – for official visits, government missions, family re-unions or any other circumstances as may be determined by the Office of the Commissioner General of Immigration which call for frequent visits to Tanzania.

All non-citizens require a visa to enter the country unless they are from Botswana, Hong Kong, Malawi, Namibia, Zambia, Gambia, Kenya, Malaysia, eSwatini, Zimbabwe, Ghana, Lesotho, Mozambique or Uganda. Visas can be obtained at any Diplomatic or Consulate Mission of the United Republic of Tanzania abroad, normally within one business day. It is possible, however, to obtain a tourist's visa for a single entry at any one of the following four main entry points to Tanzania, subject to the fulfilment of all immigration and health requirements:

- Dar es Salaam International Airport

- Zanzibar International Airport

- Kilimanjaro International Airport (KIA)

- Namanga Entry Point (Tanzania-Kenya boarder point)

Sources: Government websites, Fitch Solutions, Tanzania Investment Centre

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (Negative) |

23/08/2019 |

|

Standard & Poor's |

Not Rated |

N/A |

|

Fitch Ratings |

Not Rated |

N/A |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

137/190 |

144/190 |

141/190 |

|

Ease of Paying Taxes Index |

154/190 |

167/190 |

165/190 |

|

Logistics Performance Index |

N/A |

N/A |

N/A |

|

Corruption Perception Index |

99/180 |

96/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

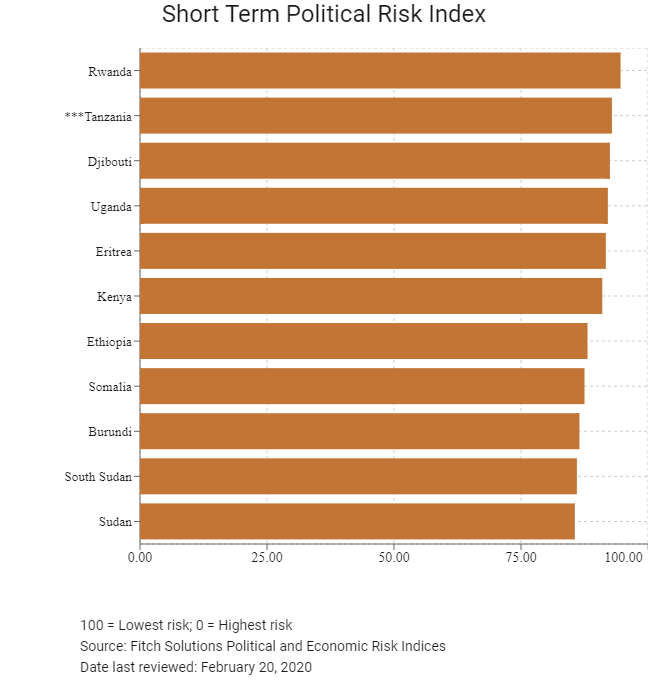

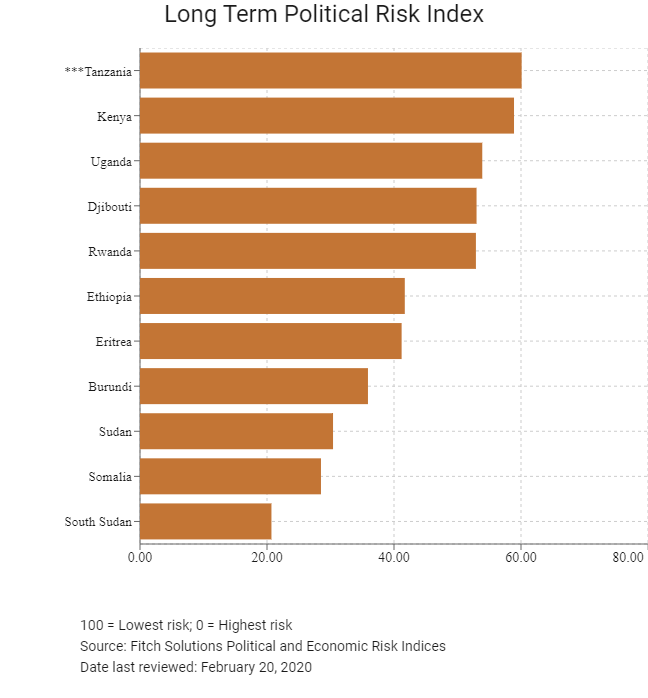

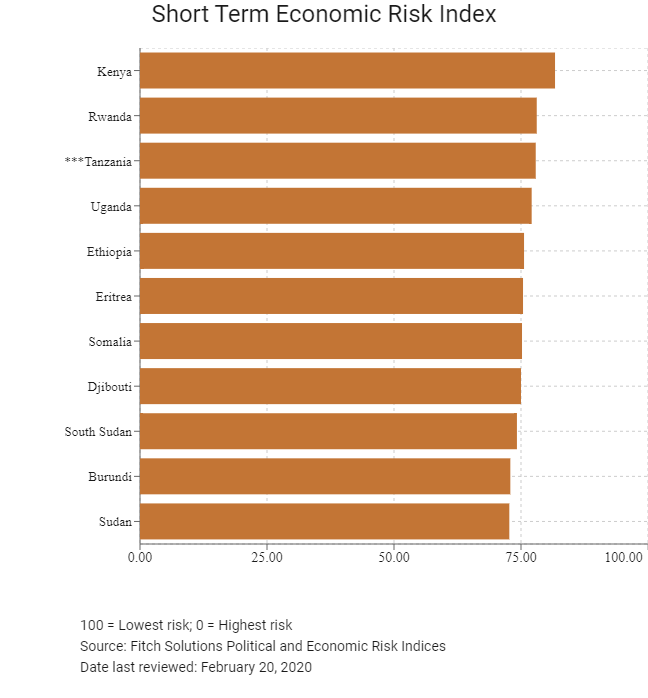

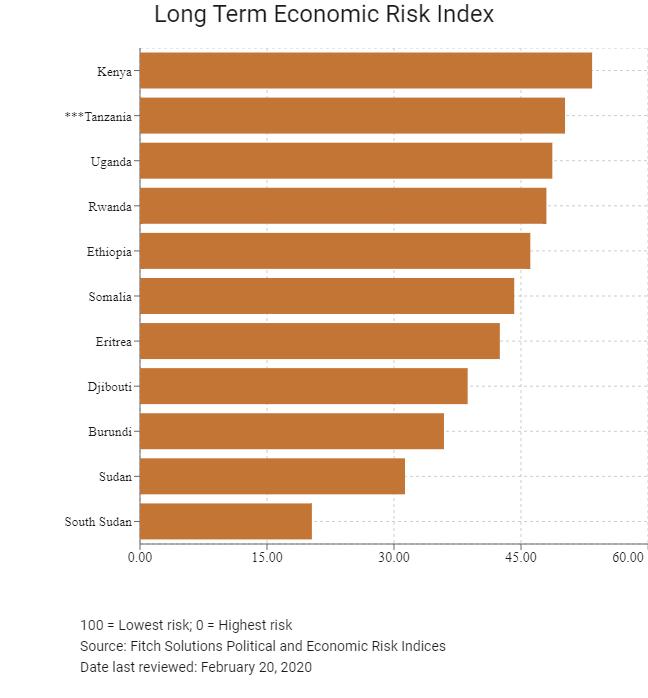

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

114/202 |

96/201 |

110/201 |

|

Short-Term Economic Risk Score |

47.1 |

45.6 |

44.8 |

|

Long-Term Economic Risk Score |

49.5 |

52.5 |

50.2 |

|

Political Risk Index Rank |

91/202 |

109/201 |

108/201 |

|

Short-Term Political Risk Score |

63.8 |

62.9 |

62.9 |

|

Long-Term Political Risk Score |

64.4 |

60.1 |

60.1 |

|

Operational Risk Index Rank |

161/201 |

161/201 |

162/201 |

|

Operational Risk Score |

35.4 |

35.4 |

35.5 |

Source: Fitch Solutions

Date last reviewed: February 20, 2020

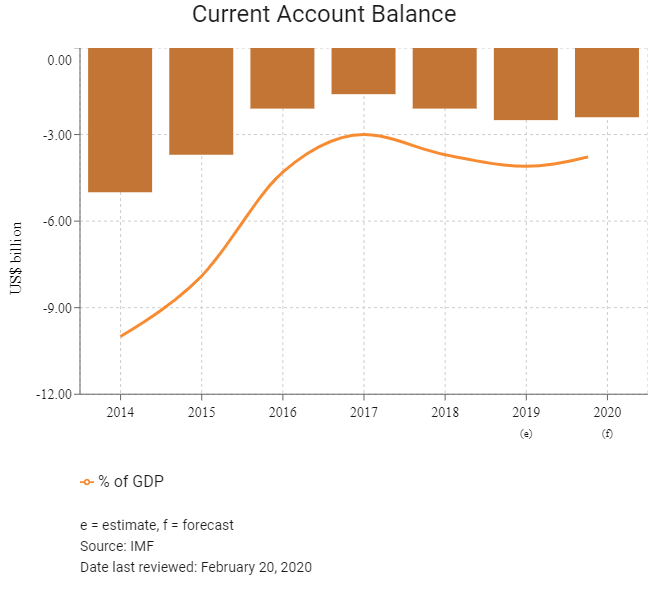

Fitch Solutions Risk Summary

ECONOMIC RISK

The country's appeal to investors is buoyed by its wealth of natural resources, consistent robust growth and relative political stability. The country further benefits from its membership to the EAC and SADC, while direct port access boosts its profile as a growing regional trade hub. Infrastructure investment and rising consumer demand will spur growth in the construction and consumer retail sectors, boosting economic activity in Tanzania over the medium term, while narrowing fiscal and current account deficits have improved the country's overall economic environment. Nonetheless, a less hospitable investment environment for foreign capital, the weaker outlook for the agricultural sector and a challenging global macroeconomic backdrop will be the main headwinds to growth in the medium term.

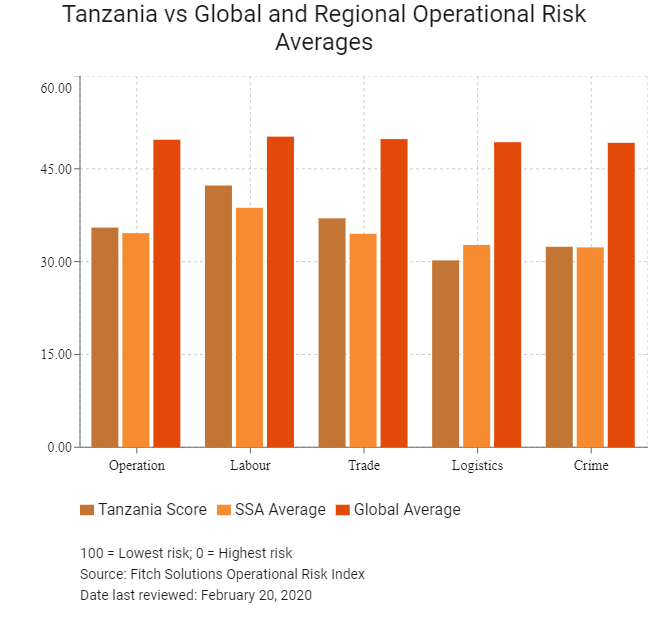

OPERATIONAL RISK

Tanzania offers a large labour pool with a low level of labour risk to investors. Benefits include flexibility in hiring and firing workers, a high percentage of women employed in the workforce, and increasing educational attainment levels in the workforce. Further advantages include membership of the East African Community (EAC) and Southern African Development Community (SADC) bloc, and direct port access. Due to its strategic location, Tanzania's transport system serves as an important link in regional trade, enabling landlocked neighbours to access maritime trade routes through Tanzania. Over the medium- to long term, risks presented by the country's transport and utilities logistics will be gradually mitigated by robust investment in infrastructure – particularly in road rail and port developments, as well as new power plants within Tanzania and the wider East Africa region. Nonetheless, in the near term businesses will continue to face onerous barriers, such as a dearth of adequate transport and utilities infrastructure hindering efficient supply chain flows, an underdeveloped financial sector, low levels of urbanisation and a predominantly unskilled workforce. In addition, numerous regulatory changes and increased regulation in sectors such as energy, the extractive sector and telecommunications elevate risks for foreign investors and will inhibit economic diversification in the medium term.

Source: Fitch Solutions

Date last reviewed: February 20, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Tanzania Score |

35.5 |

42.3 |

37.0 |

30.2 |

32.4 |

|

East Africa average |

32.0 |

40.4 |

33.0 |

31.1 |

23.5 |

|

East Africa position (out of 11) |

4 |

5 |

5 |

6 |

3 |

|

SSA average |

34.6 |

38.7 |

34.5 |

32.7 |

32.3 |

|

SSA position (out of 48) |

21 |

12 |

16 |

25 |

24 |

|

Global average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global position (out of 201) |

162 |

149 |

146 |

162 |

162 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Rwanda |

49.1 |

49.5 |

52.7 |

44.3 |

50.1 |

|

Kenya |

43.4 |

45.5 |

45.1 |

49.5 |

33.8 |

|

Uganda |

36.7 |

46.9 |

39.2 |

31.1 |

29.7 |

|

Tanzania |

35.5 |

42.3 |

37.0 |

30.2 |

32.4 |

|

Ethiopia |

33.9 |

41.5 |

30.5 |

39.1 |

24.7 |

|

Djibouti |

33.6 |

32.1 |

42.8 |

32.1 |

27.4 |

|

Sudan |

28.1 |

44.3 |

26.7 |

28.7 |

12.8 |

|

Burundi |

26.8 |

39.3 |

25.6 |

24.1 |

18.0 |

|

Eritrea |

23.7 |

36.5 |

15.5 |

24.0 |

18.9 |

|

Somalia |

22.9 |

33.8 |

28.7 |

22.6 |

6.4 |

|

South Sudan |

18.5 |

33.0 |

19.3 |

16.9 |

4.8 |

|

Regional Averages |

32.0 |

40.4 |

33.0 |

31.1 |

23.5 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 12, 2020

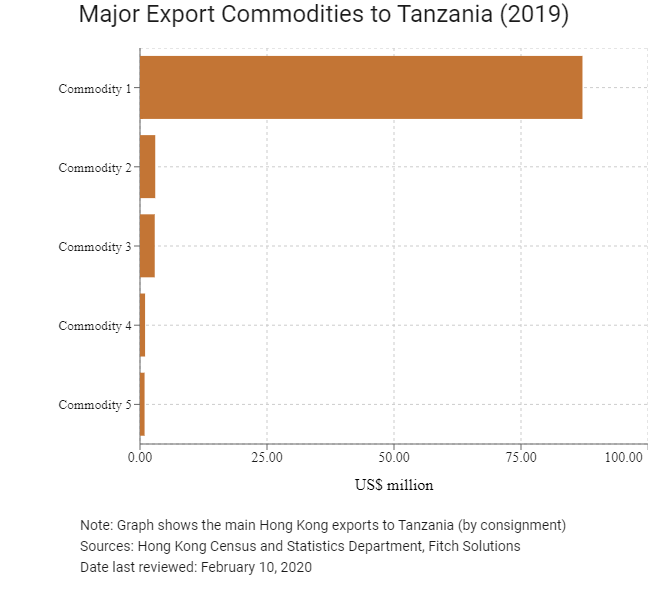

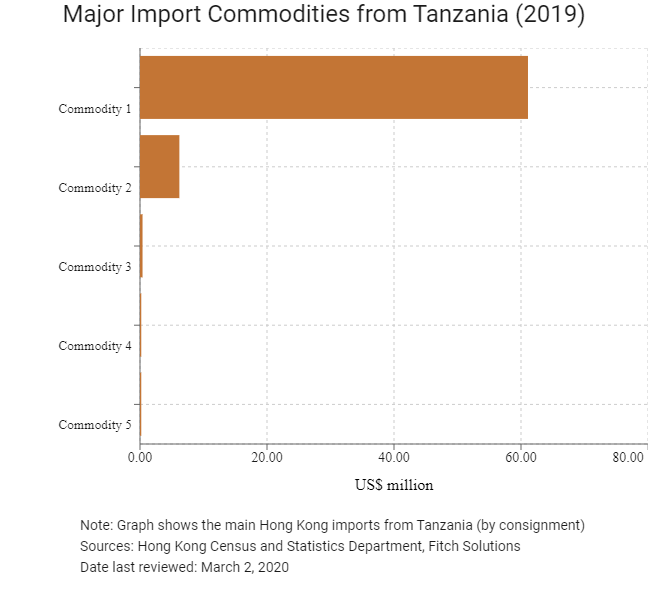

Hong Kong’s Trade with Tanzania

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 87.1 |

| Commodity 2 | Office machines and automatic data processing machines | 3.0 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 2.9 |

| Commodity 4 | Prefabricated buildings; sanitary, plumbing, heating and lighting fixtures and fittings | 1.0 |

| Commodity 5 | Professional, scientific and controlling instruments and apparatus | 0.9 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 61.1 |

| Commodity 2 | Non-metallic mineral manufactures, nes | 6.2 |

| Commodity 3 | Vegetables and fruit | 0.4 |

| Commodity 4 | Metalliferous ores and metal scrap | 0.2 |

| Commodity 5 | Road vehicles (including air-cushion vehicles) | 0.2 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Tanzanian residents visiting Hong Kong |

1,924 |

-17.0 |

|

Number of African residents visiting Hong Kong |

123,656 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: February 10, 2020

Commercial Presence in Hong Kong

|

2016 |

Growth rate (%) |

|

|

Number of Tanzanian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong/Mainland China and Tanzania

Mainland China and Tanzania have a bilateral investment treaty (BIT) that entered into force on April 17, 2014.

Source: UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate of the Republic of Tanzania in Hong Kong

Address: Room 15, 5/F, Wah Shing Centre, 11 Shing Yip Street, Kwun Tong, Kowloon, Hong Kong

Email: info@tzhonconsulhk.com

Tel: (852) 2763 9020

Fax: (852) 2341 0379

Source: Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

A visa is not required for HKSAR passport holders for a stay up to 90 days.

Source: Tanzanian Immigration Authority

Date last reviewed: February 20, 2020

459 Views

459 Views

Tanzania

Tanzania