Turkiye

Citi, a leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Founded in 1982 as a customs consultancy, Barsan Global Logistics (BGL) had grown to become Turkey’s largest customs company in seven years. Since 1990, the company has been involved in global transportation through land, air, sea, rail and multi-modal freight forwarding, bonded and non-bonded warehousing, and stock management. Hong Kong has played an important role as BGL expanded its global presence, as BGL has today 33 branches in 14 countries and an annual turnover of some 400 million US dollars.

BGL expanded its network in Asia in 2001 when it established “Barsan Global Logistics HK Ltd” in Hong Kong. This Hong Kong branch has been providing research and management advisory services to companies across Asia and Europe, a large part of which is now covered by China’s Belt and Road Initiative. Ebru Busra Tunca, Director of Barsan Global Logistics HK Ltd, said Hong Kong’s Closer Economic Partnership Agreement (CEPA) with the Chinese mainland and its proximity with the dynamic economy of the Pearl River Delta are among the reasons that made Hong Kong one of the strongest logistics bases in Asia. She said Hong Kong’s “East-meets-West” culture has also been an attraction for overseas companies looking to expand their business in the region.

BGL’s Hong Kong branch has proven to be a stepping stone to various emerging markets in Asia, and has remained an important regional office for BGL. BGL subsequently opened its Shanghai branch and became the first Turkish logistics company to establish a presence on the Chinese mainland. This was followed by new branches in Yiwu, Busan, South Korea, as well as Shenzhen and Ningbo. BGL’s steady growth and its worldwide network spanning East Asia, Southeast Asia, Central Asia, Europe and North America have demonstrated the importance of worldwide supply chain management. The company will continue to expand its network, targeting to be among the top ten logistics companies in the world by 2020.

Sitting at the crossroads of Europe, Asia, Middle East and Africa, Turkey has long been regarded as a highly important strategic hub for global trade, logistics and manufacturing. That status has been enhanced by its customs union with the EU and extensive array of free trade agreements (FTAs) with nearly 30 countries, which have given it free or preferential access to a pool of some 900 million consumers.

Coupled with the linking together of the country’s Middle Corridor Initiative (MCI) and China’s Belt and Road Initiative (BRI), and a clutch of generous investment incentives, Turkey has become increasingly attractive to Hong Kong companies eager to trade and invest there. This is particularly true for those which are looking for business and relocation opportunities as a hedge against the problems caused by the lingering Sino-US trade spat.

China’s recent import tariff cuts – part of its shift towards a consumption-driven economy – are also creating Turkish-related opportunities for Hong Kong firms. As Turkish traders look to take advantage of the import control relaxations and enter further into the Chinese mainland market, Hong Kong’s service providers will expect to use their extensive knowledge and experience of the market to play a pivotal role in helping them do so.

Regional Connection

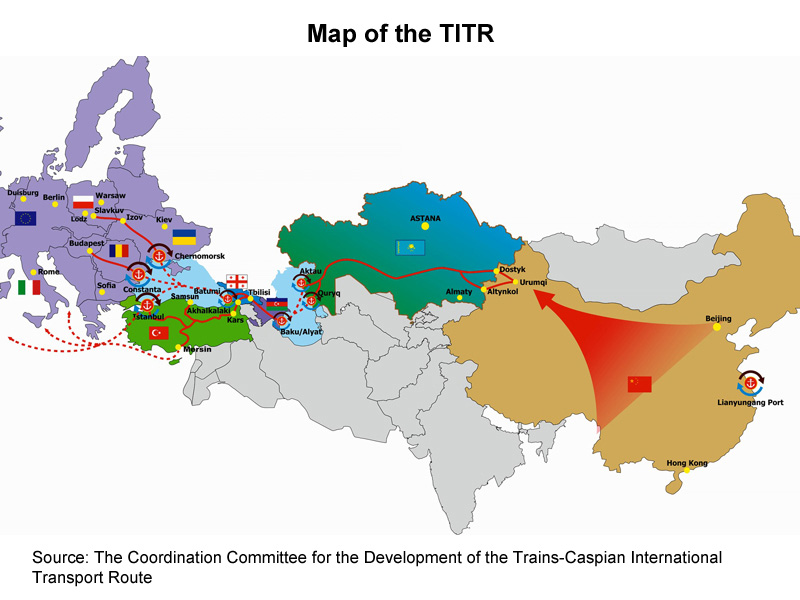

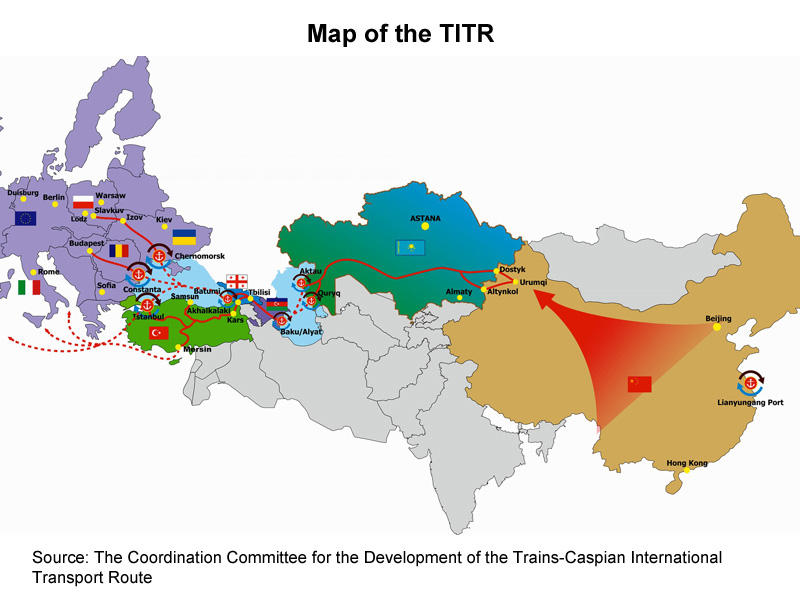

The link-up between Turkey’s MCI and China’s BRI is already bearing fruit. An early example of this is the Trans-Caspian International Transport Route (TITR), which forms the shortest land route between China and Europe, via South-east Asia, Central Asia and the Caspian Sea.

At its heart is the Baku-Tbilisi-Kars (BTK) railway route, which opened in October 2017. It starts at the Caspian Sea in Azerbaijan and runs through Georgia and eastern Turkey before merging with the Turkish and European railway systems.

The TITR is not just a shorter land route for Asian products to reach European, African and Middle Eastern consumers, but also a safer and cheaper one. The corridor is 1,500km shorter than the China-Mongolia-Russia Economic Corridor and is less exposed to extreme winter weather conditions. Cargo trains from North-West China now take as little as 8 to 14 days to reach the Black Sea coast and Turkey, whereas sea voyages between the destinations can take up to 60 days.

Turkey has also been upgrading and developing new maritime logistic infrastructure, most notably in İzmir. Dubbed the Pearl of the Aegean, Izmir is the nation’s third most populated city and home to the North Aegean Çandarlı Port, which when completed will rank as one of the top ten seaports in the world. With an additional annual capacity of up to 12 million 20ft shipping containers or TEUs, the port is expected to increase Turkey’s cargo handling capacity by 70%.

Infrastructure Boom

In line with its ambitious vision to develop Turkey into a US$2 trillion economy by 2023, the Turkish government has been overseeing a spending spree on the country’s infrastructure. The aim is to lay a sound foundation for more dynamic economic development. Among the long list of projects is Istanbul’s new airport, which will replace the 93-year-old Ataturk Airport when it opens on 31 December 2018. It is projected to become the busiest air hub in the world with a planned yearly capacity of 200 million passengers – nearly double that of the current world leader, Hartsfield-Jackson Atlanta International Airport.

The Turkish government also aims to complete 11,700 km of high-speed railway lines linking 41 domestic cities by 2023, which would put Turkey behind only China in terms of the amount of railway construction. Other key projects among the 3,500 reportedly under development or in the planning stage include the Kanal Istanbul (an alternative waterway to the Bosphorus River, linking the Black Sea with the Marmara Sea), the Yavuz Sultan Selim Bridge (the world’s longest, highest and widest suspension bridge with a two-lane railway and eight-lane highway on the same deck), the Eurasia Tunnel, the Istanbul Finance Centre, and the Gebze-Izmir Motorway Project linking Istanbul with Izmir. All this is taking place alongside more than US$200 billion worth of building work and urban renewal across many Turkish cities.

To help finance this, the Turkish government hopes to secure US$350 billion foreign investment on a Public-Private Partnership (PPP) basis. So far, the country has completed a total of 225 PPP projects worth some US$135 billion. These include the İstanbul New Airport, built by the Limak-Kolin-Cengiz-MaPa-Kalyon Consortium, the Yavuz Sultan Selim Bridge and Northern Marmara Highway by the IC İÇTAŞ – Astaldi Consortium ICA and the Eurasia Tunnel by the Turkish-Korean joint venture registered as Eurasian Tunnel Operation Construction and Investment, or ATAŞ.

Manufacturing Powerhouse

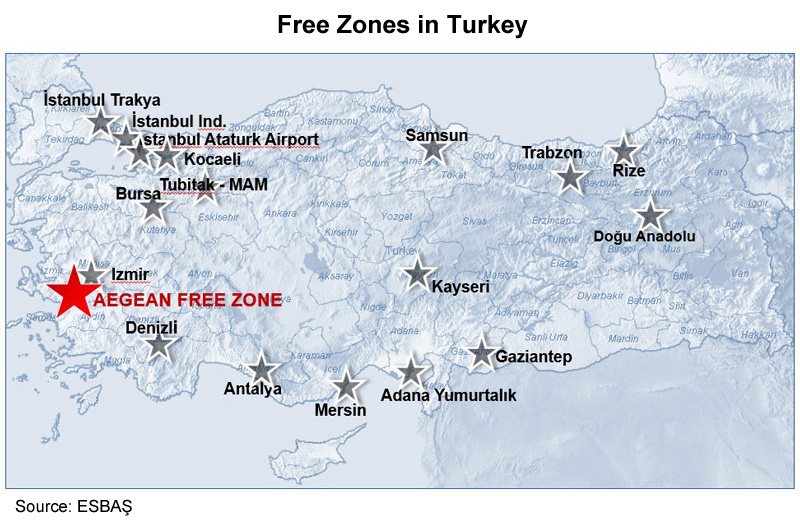

Turkey’s growing economy and its rapidly improving transport connections have made the country attractive to international manufacturers looking to relocate. In order to ride this wave, the Turkish government has been trying to entice foreign export-oriented companies to move their production to the nation’s 19 Free Zones, 322 Organised Industrial Zones and 56 Technology Development Zones (TDZs).

The Aegean Free Zone (ESBAŞ) in İzmir, with its advantageous location and tax, legal and customs incentives, is becoming increasingly popular as a destination for international manufacturers looking to do business in Turkey and the surrounding region. ESBAŞ is home to nearly 180 investors and tenants, mainly in industries such as food processing and packaging, automotive, machinery, IT, medical devices, textiles, electronics and electrical, aviation, avionics and aerospace. These include world-class manufacturers such as US-based Delphi Diesel, which makes injector nozzles, valves and pump parts for diesel motors, France’s FTB Lisi Aerospace, luxury German fashion house Hugo Boss, Eldor Electronics from Italy, Ukrainian manufacturer DEZEGA, which specialises in respiratory protective equipment, and Lasinoch, a subsidiary of Japan’s Pigeon Corporation which produces breast milk feeding pumps, feeding bottles and pacifiers.

Sino-Turkish Co-operation

As a key part of the ancient Silk Road, Turkey is naturally an important partner in today’s Silk Road Economic Belt and Maritime Silk Road, or the BRI. Even before the development of the BRI, there had been a growing collaboration between Turkey and China. In 2010, China was a strategic partner in the financing and construction of Turkey’s national high-speed railway between the cities of Edirne and Kars, providing loans of US$28 billion, while the China Railway Construction Corporation and China National Machinery Import and Export Corporation are members of a Turkish-Chinese consortium (along with Turkey’s Cengiz Construction and Ibrahim Cecen Ictas Construction) which was behind the construction of the İstanbul-Ankara high-speed Railway.

The İstanbul-Ankara High-speed Railway

In 2015, the Chinese joint venture Euro-Asia Oceangate, controlled by Cosco Pacific, China Merchants Holdings (International) (CMHI) and CIC Capital, acquired the majority share of Kumport, the third-largest container terminal in Turkey. The port is close to İstanbul, Turkey’s biggest city and its key trading hub which accounts for over half of the nation’s total trade and serves as a transhipment hub for goods being transported via the Black and Mediterranean Seas. This investment also creates a natural synergy with the Chinese shipper’s investment and expansion plans in Piraeus – Greece's largest port.

This growing Sino-Turkish collaboration should ensure better co-ordination among the connecting nodes of the TITR and the Maritime Silk Road, while further strengthening the position of Turkey and its surrounding region as Asia’s maritime gateway to Central and Eastern Europe (CEE).

Investment Incentives

On the way to the 100th Anniversary of the Republic[1], Turkey is expected to continue its plans to develop and upgrade its infrastructure and – to make good use of the improved logistics and strengthen its role as a regional manufacturing powerhouse – expand its network of industrial parks in an attempt to grow local production capacity alongside rising domestic and external demand. This is good news for Hong Kong manufacturers who are considering relocation amid the fallout from the Sino-US trade dispute.

Turkey’s keenness to attract foreign investment means that it now boasts one of the most competitive investment incentive packages of any emerging economy. This includes a Project-Based Incentive Scheme, under which projects involving at least US$100 million worth of investment that ensure sufficient supply levels of strategic goods and services, and boost technological capacity, research and development (R&D) efforts, competitiveness and added value in production, qualify for a pool of support measures that the investor can use to create whatever incentive package to make the investment most feasible and profitable.

A host of different schemes offering various support measures are available to suit investment size, region, sector and product. Measures include value-added tax (VAT) exemption, customs duty exemption, tax deductions, social security premium support for the employer’s share, interest rate support, land allocation and VAT refunds. For investments in the least developed regions of Turkey, income tax withholding support and social security premium support for the employee’s share are also available.

Hong Kong businesses looking to take advantages of these opportunities should also be helped by the presence in Turkey of major Chinese banks such as Industrial and Commercial Bank of China (ICBC), which has been operating there since May 2015, and Bank of China (BOC), which received its banking licence on 1 December 2017.

Turkey Trade

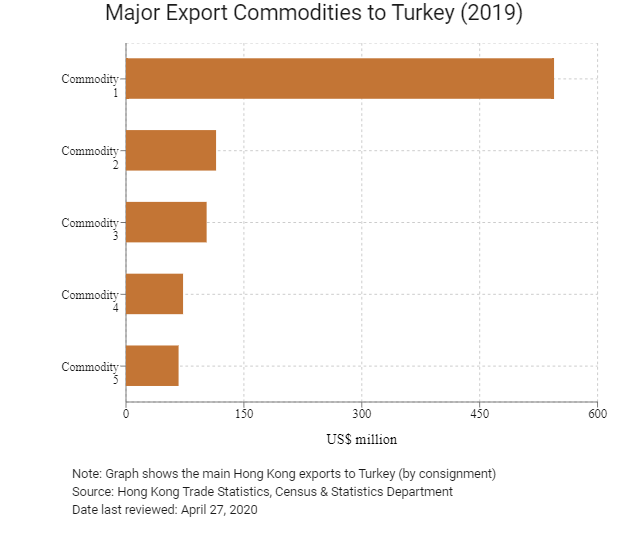

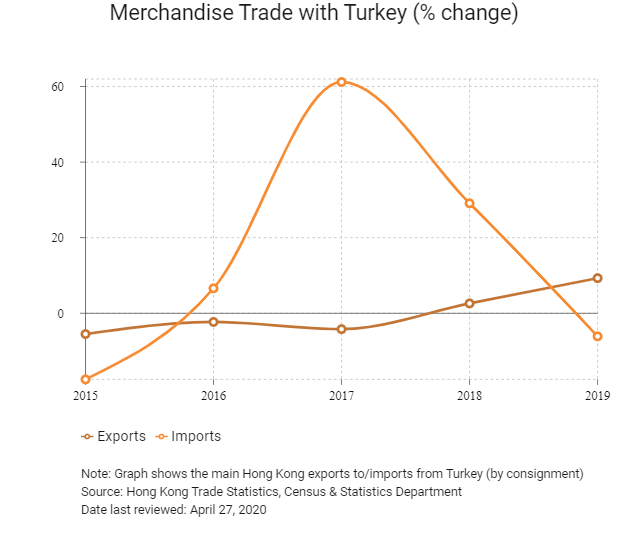

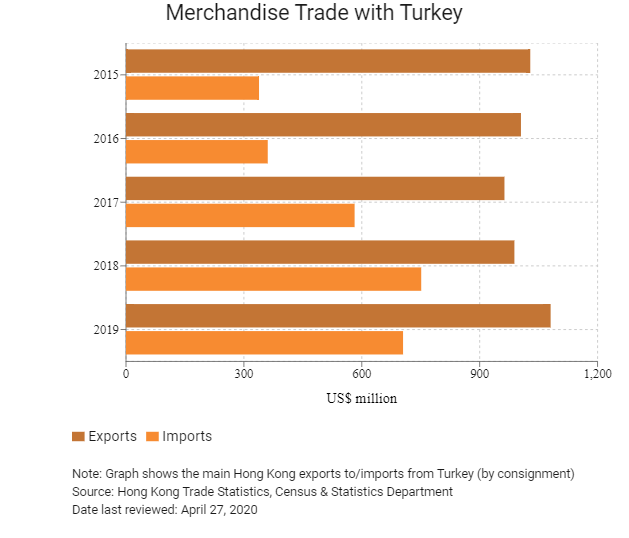

Hong Kong’s trade with Turkey is rising rapidly. In the first nine months of 2018, Hong Kong’s sales to Turkey grew by 15% year-on-year to US$775 million, which compares favourably with the 9% growth in Hong Kong’s total exports over the same period. Electronics and electrical goods such as telecommunication equipment and parts, computers, electrical apparatus for electrical circuits and semi-conductors, electronic valves and tubes, watches and clocks, toys, games and sporting goods, jewellery and pearls, precious and semi-precious stones are selling well in Turkey.

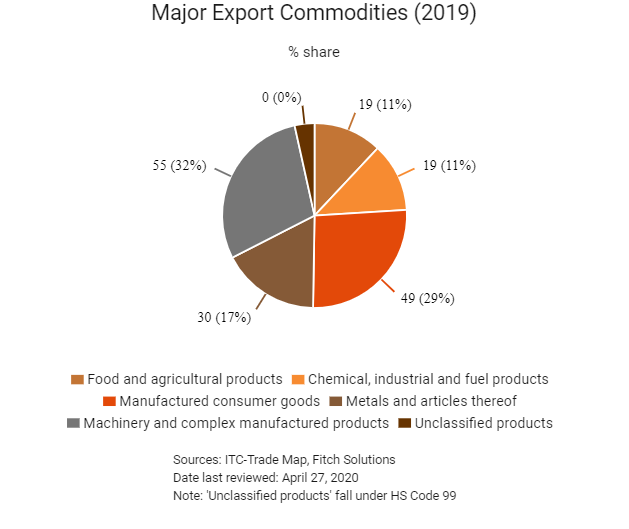

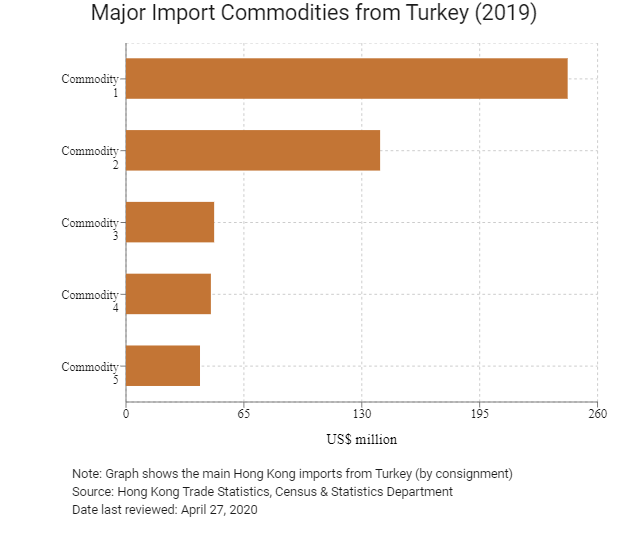

When it comes to Turkey’s exports, the country is becoming a leading global supplier in the field of agribusiness and is now the world’s seventh-largest agricultural producer. In 2017, Turkey sold more than 75% of the world’s total market of hazelnuts and exported nuts, figs and olive oil to as many as 140 countries. Other popular food and beverage products include high-quality tea, wine, honey, dairy products and seafood.

Turkey is also the world’s fourth largest home textile supplier, famous for its towels, furnishing and curtain fabrics bed linens, and Europe’s leading TV and white good producer, selling, for example, refrigerators to some 160 countries.

Online Potential

Online sales in Turkey make up a relatively low share of total retail sales at just 3.5%. This means that the potential in the online market is there to be tapped by global e-commerce players. Alibaba has already made a move, recently announcing its acquisition of Trendyol (Turkey’s largest online fashion retailer, with 90 million monthly visits and 16 million registered users) from the European Bank for Reconstruction and Development (EBRD) and several US investment funds. It hopes to expand and optimise its reach among the country’s growing pool of young, high-income, tech-savvy consumers.

There are also plenty of potential opportunities in Turkey for the provision of the sort of professional services and innovative business models at which Hong Kong excels. Given Turkey’s ambitious list of massive infrastructure projects, high demand is expected not only for project funding and financing, but other professional services such as project evaluation and consultancy, engineering, architecture, logistics, information and communication technology (ICT) and marketing.

However, these opportunities are not limited to those available in Turkey. Turkish businesses are especially keen to make inroads into the Chinese mainland market amid China’s recent import tariff cuts, as evidenced by their presence at the inaugural China International Import Expo (CIIE). This was the world's first import-only-themed national-level expo, which kicked off on 5 November 2018 at the National Exhibition and Convention Centre in Shanghai, bringing together more than 3,600 exhibitors and over 400,000 buyers.

Turkey's Showcases at CIIE

Displays of Turkish exports spanning agricultural and food and beverage products to machinery and services received a very warm welcome from Chinese buyers at the expo. However, while Turkish exporters and service providers seemed convinced that the Chinese market was ready for their products, most admitted that they were unfamiliar with mainland China’s laws and regulations, not to mention the market dynamics in terms of consumer preferences and distribution channels.

Given their language advantages, their extensive knowledge of the Chinese market and regulatory environment and their proximity to the mainland market, Hong Kong companies can play a pivotal role in helping prospective Turkish companies bring their products to the Chinese mainland market.

Hong Kong can also serve as a tailor-made business hub for Turkish enterprises looking to establish headquarters in Asia, offering them an extensive web of the value-added services from finance to branding and research and development (R&D) they will need.

[1] Turkey will celebrate the 100th anniversary of the foundation of the Republic in 2023.

Editor's picks

Trending articles

Five years on from the launch of the Belt and Road Initiative, the second part of a report on the implications for Turkey of China's economic masterplan focuses on the likely long-term geopolitical transformation of the wider Eurasian region.

China's Belt and Road Initiative (BRI) presents a number of opportunities for Turkey, many of which will have wide-ranging implications for the country's economy and geopolitical standing. Naturally enough, many within its business, academic and governmental sectors have strong views as to its possible benefits and likely pitfalls.

With a particular emphasis on the broader geopolitical issues that may influence Turkey's view of China's mega-project, a number of senior Turkish figures were asked to give their assessment of the current state of play. Perhaps unsurprisingly, given the unprecedented scale and nature of the BRI, it was clear, overall, that no real consensus has yet emerged.

Stabilising Influence

While the BRI's primary effect will be economic, the shift in trading routes and patterns it is set to cause will, inevitably, lead to changes in political relationships across Eurasia. While it is a long-held maxim that improved trade and improved stability go hand-in-hand, not everyone in Turkey seems wholly convinced.

There is, however, a widely shared belief that the BRI will transform far more than just trade arrangements. One Turkish businessman who is convinced of that is Şahin Saylik, General Manager of Kırpart, a leading automotive-parts company with operations in China. Seeing its implications as potentially very broad indeed, he said: "The BRI will definitely have a major geopolitical effect in terms of bringing peace to unstable regions, for instance.

"Good trading partnerships will force countries to have more understanding of, and be more sympathetic with, the region's political relationships. Stabilisation and security are must-haves if the project is to succeed.

"It is a gigantic undertaking that involves considerable economic, cultural, social and political development, as well as stabilisation and peace in the region. As a geographically important player, Turkey can only benefit from the positives the project offers."

Turgut Kerem Tuncel, a senior analyst at Ankara's Center for Eurasian Studies, is another who believes the BRI will be a stabilising influence throughout the Eurasian region, saying: "Potentially, the BRI will have a great geopolitical effect on the region. Liberal internationalist experts view the BRI as a driver for peace, arguing that enhanced trade ties among countries will inevitably aid stability. Certainly, there is some truth to that view."

Iran's Importance

One Eurasian nation that could particularly benefit from an increase in regional trade and stability is Iran. It is currently facing a renewal of US sanctions after the Trump administration pulled out of the Joint Comprehensive Plan of Action (JCPOA) nuclear agreement between Tehran and the US, UK, France, Germany, China and Russia. Coupled with the recent anti-Iranian rhetoric from Israel and the US, the move may mean the BRI takes on an even greater significance within its borders.

Highlighting the importance of Iran to Turkey, Salih Işik Bora, an International Trade Analyst at the Center for Eurasian Studies, said: "Turkey has many good reasons to proactively address the geopolitical challenges that could negatively impact on the BRI. Perhaps the most important is the advancement of collaboration with Iran, as the two countries will together form a critical juncture between Central Asia and Europe.

"Tehran is currently moving towards wider integration with the world economy. A major indicator of this trend is Iran's improving ties with Europe, as illustrated by French oil company Total's recent signing of a $4 billion treaty with Tehran. At the same time, Beijing is clearly interested in enrolling Iran in the BRI, as was shown by Xi Jinping's 2016 announcement that China wants to increase its bilateral trade with the country to $600 billon over the next 10 years."

Pointing out that even the end of the JCPOA nuclear agreement and the threat of fresh sanctions may not halt Iran's progress towards greater international economic integration, he added: "Even the American business community seems eager to lift the current sanctions. Boeing, for instance, recently signed a $3 billion deal to supply civilian aircraft to Iran."

Highlighting Afghanistan as another potential beneficiary, Selçuk Çolakoğlu, Professor of International Relations at Ankara's Turkish Center for Asia Pacific Studies, said: "In order to be successful, the BRI is reliant on a wide range of co-operative efforts across a host of different sectors, from infrastructure to developmental aid. This is hugely significant, given that the BRI projects put forward by other countries have largely concentrated just on developing their transportation infrastructure and improving their integration into the world market through trade liberalisation.

"All these efforts aim to build up regional integration through economic and political co-operation. Afghanistan, as one of the heartlands of Asia, could theoretically become a key hub for transit transportation, regional trade and economic and political co-operation with the help of BRI-related initiatives."

Increased Competition

While improved trade may enhance peace and security, a freer flow of goods and services is not without its potential downside. Addressing this particular issue, Tuncel said: "The BRI may well trigger competition among countries. Eurasian nations could compete with one another to try to ensure that various trade routes pass through their own territories as a way of elevating their own geopolitical significance and maximising their own economic benefits. Nevertheless, as long as the competition remains healthy, it may also facilitate the overall modernisation of the region.

"There may also be competition among the major powers. For example, while the EU seems to have a broadly positive view of the BRI, some indicators show the US is somewhat more cynical.

"Russia's view of the BRI is also worth considering. While the Kremlin wants to create a closed regional economic zone, with the Eurasian Economic Union evolving into a political bloc, the success of the BRI depends on openness. As China is likely to become a dominant force in the region, that may cause problems in its future relationship with Russia."

Looking East

As the EU, the world's largest single market, is on its doorstep, Turkey has long been reliant on exporting its goods to Europe. Its attempts to actually join the bloc have been fruitless and, given the current political climate, look set to remain just that.

For some, though, the BRI gives the country an opportunity to turn away from the west and seek new trading relationships in the east. Clearly an advocate of this particular strategy, Nicol Brodie, an analyst with the Australian National University in Canberra, said: "The BRI is an opportunity for Turkey's President Erdoğan and his government to reduce its economic dependence on the European economies and hedge against deteriorating relations with the United States and NATO. It provides Turkey with trade, foreign direct investment and is a vehicle through which it can establish its economic and cultural footprint across central Asia.

"Turkey's relations with the United States, its long-term security partner, and Germany, its major economic partner, have been frosty for some time. The BRI, though, provides Turkey with a way to explore alternatives to these existing economic and strategic partnerships and simultaneously helps China create its own economic architecture.

"Crucially, it allows both nations to strengthen their relationship without entering into direct opposition with the US. It would be difficult, for example, to find specific reasons to support any claim that the Sino-Turkish relationship undermines the latter's NATO membership."

Tuncel also saw distinct benefits in Turkey potentially pivoting from the west to the east, saying: "Obviously, Turkey's deteriorating relations with the US and the EU, which dashed its hopes of accession to the EU, has generated additional interest in the BRI.

"In Turkey, a visible section of the intelligentsia and political class has voiced support for Turkey's looking east at the expense of its historical inclination attachment to the west. For them, deeper relations with China, Iran and Russia are needed to counter the west's perceived hostility.

"The BRI is a potential lever that can allow Ankara to become the ultimate kingmaker in the Eurasian arena, while increasing its economic and political sphere of influence. If Beijing and Ankara can reach a suitable accommodation, Turkey may well become the backbone of the BRI."

Problems for the West

As Turkey increases its focus on its Eurasian connections, the relevance of western institutions is likely to decrease. This may create difficulties for the US and NATO, given Turkey's key position in relation to the Middle East, the Balkans and the Black Sea states.

Focusing on this particular problem for the west, Brodie said: "This will inevitably put the United States and its NATO partners in a difficult position. While they cannot oppose a trade relationship, they will still be worried about Turkey's attempts to slowly decouple itself from the west's economic and strategic embrace.

"Overall, Turkey's engagement with the BRI and its growing relationship with China is likely to become one of the more permanent fixtures of Turkish politics. The BRI, after all, is compatible with Turkey's defence and economic integration with NATO and Europe."

Complacency Concerns

While many in Turkey are optimistic about the opportunities the BRI presents, there is a growing feeling that this very confidence may present risks, with Turks assuming that the country's advantageous geographic position ensures its advantageous participation. Sounding a warning note in this regard, Tuncel said: "Over-confidence among the majority of Turkish experts and policy makers over the country's geostrategic position is a worry. While it is true that Turkey is in a strategically very important location, this only becomes meaningful if the relevant economic and infrastructural projects are actually implemented.

"This requires deeds rather than bombastic rhetoric. In brief, over-confidence, idleness and the possibility of falling behind with infrastructure modernisation seem to be the major obstacles that have to be overcome to ensure that Turkey can both be fully engaged with the BRI and subsequently benefit from its involvement."

George Dearsley, Special Correspondent, Ankara

For further analysis of Turkey's likely role within the BRI, see part one of this report: "While Concerns Linger, Turkey's BRI Commitment Remains Steadfast", 14 May 2018.

Editor's picks

Trending articles

Five years on from the launch of the Belt and Road Initiative, China's economic masterplan, the first of a two-part report considers how Turkey, one of the programme's key partners, is coming to terms with the developmental realities.

For centuries Turkey has been seen as a link between East and West, a vital crossroads for cultural and economic exchange. More recently, it has come to be seen as one of China's key partners as it rolls out the Belt and Road Initiative (BRI), its ambitious international infrastructure development and trade facilitation programme.

Inevitably, given the size and scope of the programme, the BRI has inspired evangelical zeal among some of its proponents across the world, while others have been more reticent and, on occasion, wholly critical. For its part, Turkey has seen both points of view widely aired as business leaders, academics and political figures seek to come to terms with the huge impact the initiative is set to have on this 80-million strong country.

Setting the scene for the debate that has divided many of his countrymen, Salih Işik Bora, an International Trade Analyst with the Ankara-based Center for Eurasian Studies, said: "Today, 16% of the European Union's $1,720 billion imports come from China, making it Europe's largest trading partner. Along this trading route – historically known as the Silk Road – are many of the world's major economies. Unlike the practice of classic times, however, 96% of these products now reach Europe by sea, largely because of the poor land infrastructure found in much of Eurasia.

"As one of its key objectives, the BRI seeks to remedy this and, indeed, has already had some success in doing so. The volume of rail freight between China and Europe, for instance, has increased from 57,000 tonnes in 2013 to 311,000 in 2016.

"At least in this regard, the BRI has been positively received across Eurasia, with many countries along the route having made large contributions to the Asian Infrastructure Investment Bank, the project's key financial conduit. On top of that, a number of European nations, including France, Germany and the United Kingdom, as well as those further afield, such as India, Russia, Iran and Saudi Arabia, have also contributed."

Turkish Support

By and large, the BRI has attracted considerable support in Turkey, with the government embracing it as hugely complementary to its own infrastructure development programme. Acknowledging this close alignment between the political leaders in both countries, Şahin Saylik, the General Manager of Kırpart, an automotive-parts company based in Bursa, one of the largest cities in Northern Turkey, said: "With firm support from both the Chinese and Turkish governments, the success of the BRI is all but assured, especially as Recep Erdoğan, our President, has publicly committed to it.

"For our part, we were previously focused on our own Middle Corridor initiative, a development that was expected to benefit from some US$8 billion of investment. In order to ensure that this can be integrated into the BRI, the Turkish government has already contributed $40 billion in development funding.

"In terms of BRI-related projects already under way, there is the Marmaray Rail Network, the Ormangazi Bridge, a third Istanbul airport and a railway link between Edirne and Baku. More recently, it has also been proposed that a third bridge be built across the Bosporus [a strategic waterway marking the boundary between Europe and Asia] as a way of optimising the trade flow."

Infrastructure Improvements

While the improvements to Turkey's transport infrastructure are clearly apparent and widely welcomed, redeveloping the country's overland transport links is still seen as something of a challenge. The sheer scale of the work that needs to be done, however, has been seen as representing a real opportunity for Turkish businesses.

Emphasising the depths of the country's own redevelopment resources, Turgut Kerem Tuncel, a Senior Analyst with the Center for Eurasian Studies, said: "Turkish companies have long been partners and project leaders within the construction sector, having completed a wide variety of projects in many of the former Soviet countries, the Gulf and North Africa. With their significant experience in large and mid-scale cross-border business projects, many Turkish businesses are keen to participate in the BRI development programme.

"To date, there has already been some co-operation, most notably with regard to the construction of the Baku-Tiflis-Kars Railroad (BTK), which went into operation in October 2017. At the time, it was claimed that it finally provided an overland link between China and London. This, however, was something of an exaggeration.

"If Turkey is ever truly to become a bridge between the Pacific and the Atlantic, its rail network and its supporting infrastructure will need a massive upgrade. At present, there is not even a mainline rail connection between the two sides of the Bosporus."

Maritime Transport

Some, however, remain sceptical that Turkey will ever be able to fully capitalise on the potential of its overland transport routes. Expressing the sentiments of many, Professor Selçuk Çolakoğlu, Director of the Ankara-based Turkish Center for Asia Pacific Studies, said: "A number of China-led initiatives, such as the BRI and the China-Pakistan Economic Corridor (CPEC), have sought to revive the overland routes as an alternative to the maritime corridors.

"At present, it's hard to be sure whether the land routes will ever provide a viable alternative to the maritime routes that already link Europe and Asia. What is clear, though, is that China wants to reduce its current over-dependence on sea freight."

While some question the practicality of rebooting the land transit facilities, some go further still, openly wondering just how closely aligned China and Turkey's long-term objectives really are. Expressing his own scepticism, Çolakoğlu says: "It is still not entirely clear how the Middle Corridor will be integrated into the BRI. Initially, China was proposing to use the Southern (Iranian) Corridor as its primary conduit to Europe, while wholly bypassing the Turkish Middle Corridor. These initial fears were allayed, however, in light of China's commitment to investing in the development of the Edirne-Kars High-speed Railway Link, a key component of the corridor.

"Perhaps more worryingly, at present, Turkey has been excluded from the BRI's proposed maritime routes. As it stands, China sees the northeast Greek port of Piraeus as its preferred hub for accessing Europe.

"Overall then, while there are reasons to be optimistic about Sino-Turkish BRI co-operation, some concrete agreements need to be in place before it can genuinely be considered a success story. Despite that, let's say I remain cautiously optimistic."

Economic Gains

Such concerns aside, many in Turkey are bullish about the economic opportunities likely to emerge from the BRI. Clearly convinced as to the benefits on offer, Bora said: "Given Turkey's central geographical positioning within this proposed trading network, it may well emerge as one of the big winners. Based on current projections, the BRI should account for per annum GDP growth of at least 0.22% in the case of the Turkish economy.

"These gains, however, may not be evenly distributed. While, at present, western Turkey accounts for the largest proportion of the country's international trade, the BRI could act to rejuvenate the currently neglected eastern region. This would see such cities as Sivas and Erzurum once again becoming significant trading hubs, bringing much needed stability and redevelopment to the wider region."

For Çolakoğlu, the benefits are somewhat more prosaic, with the Professor saying: "Fundamentally, Turkey believes that the BRI will foster closer bilateral relations with China, with new railway lines carrying significant quantities of passengers and freight in both directions."

Some, though, remain concerned that, while the BRI will open up international trade, the key beneficiary will be China, with other countries – including Turkey – likely to see their trade deficit with their mighty eastern neighbour only set to widen. Kırpart's Saylik, however, is philosophical about any such eventuality, saying: "As long as Turkey is politically astute, it has no need to worry about the BRI. The trade deficit with China is a separate issue and one that that will need to be addressed regardless of the BRI.

"In general, though, I believe the BRI will have a positive impact on Turkey's bid to close its overall trade deficit, although maybe not so much when it comes to China in particular."

George Dearsley, Special Correspondent, Ankara

For further analysis of Turkey's likely role within the BRI, see part two of this report: "Turkey Set for Eastward Pivot as Potential BRI Benefits Beckons", 4 September 2018.

Editor's picks

Trending articles

Highlights

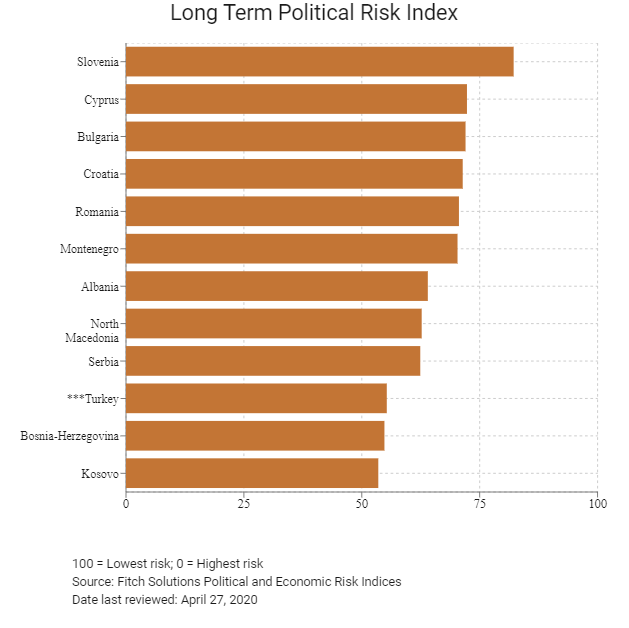

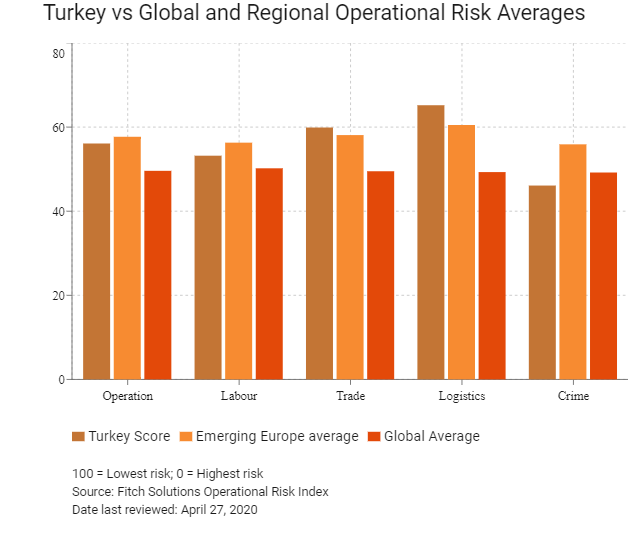

| Political |

|

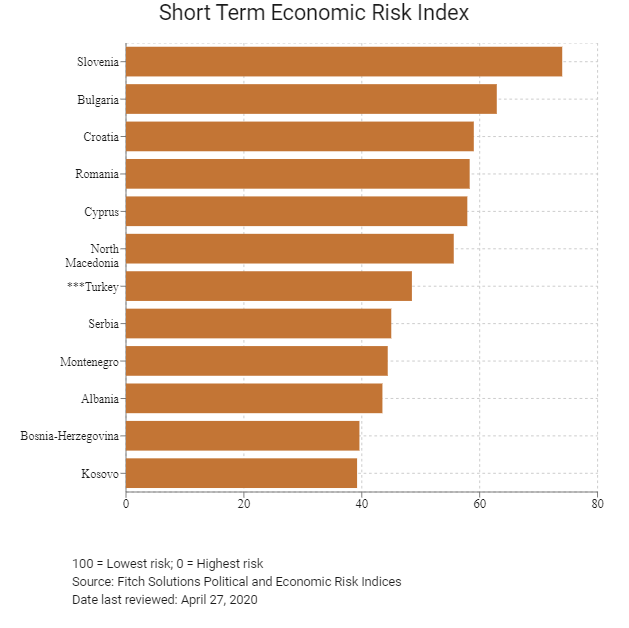

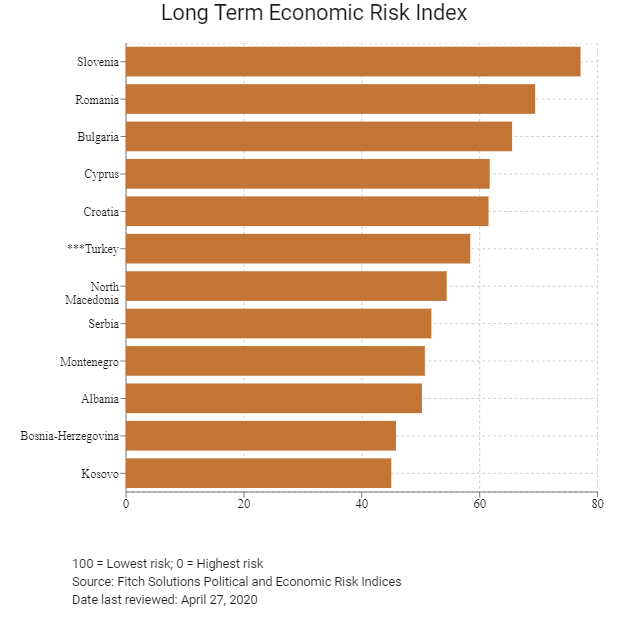

| Economic |

|

Country Overview

Turkey, with a population of around 75 million, is situated at the junction of Asia and Europe. Turkey began to open up the economy in the 1980s, expanding production in the automotive, construction, and electronics industries beyond the traditional textiles and clothing sectors. Over the past decade, GDP per capita has nearly doubled and now exceeds US$ 10,000. Although growth has been promising, Turkey's relatively high current account deficit and its reliance on short-term financing leave the economy vulnerable to capital flows. On-going turmoil in neighboring Syria and Iraq, especially the rapid rise of the extreme jihadi group Islamic State (IS), also represents risk to the country’s stability.

Key Information | |

| Capital | Ankara |

| Population | 75.4 million |

| Area | 783,562 sq km |

| Currency | Turkish lira |

| Official language | Turkish |

| Form of state | Republic |

| Major Merchandise Exports (% of total, 2013) | Major Merchandise Imports (% of total, 2013) |

| Textiles & clothing (18.1%) | Fuel (14.2%) |

| Transport equipment (12.0%) | Chemicals (13.3%) |

| Iron & steel (11.5%) | Machinery (9.3%) |

| Top three export countries (% of total, 2013) | Top three import countries (% of total, 2013) |

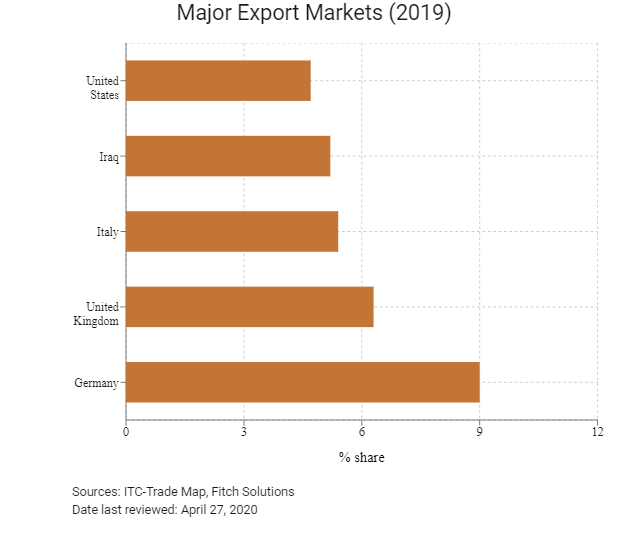

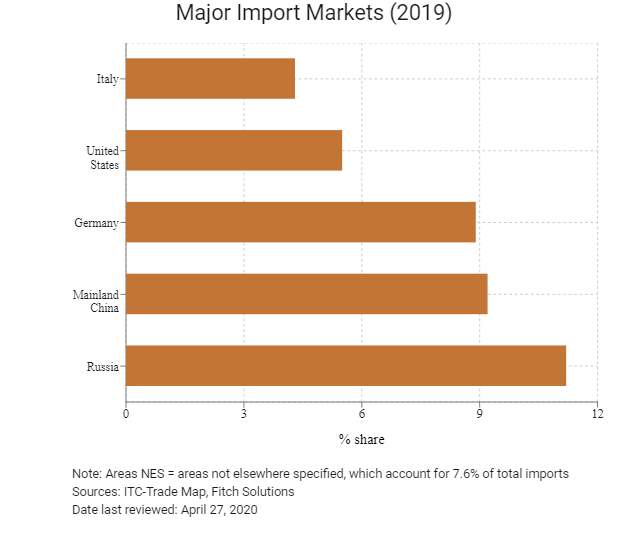

| Germany (8.8%) | Russia (10.0%) |

| Iraq (7.4%) | China (9.8%) |

| UK (5.6%) | Germany (9.6%) |

Source: Economist Intelligence Unit (www.eiu.com)

Political Trend

In August 2014, Erdogan became the country's first directly elected president, by winning about 52% of the votes in the first round.

While his supporters say he has improved Turkey's economy and given a political voice to the country's conservatives, his critics accuse him of having Islamist leanings and an autocratic style. Externally, Turkey began accession membership talks with the European Union in 2005. However, progress has so far been limited amid opposition from countries like Germany, fearing that cultural differences will make it difficult to integrate.

Economic Trend

Economic Indicators | 2011 | 2012 | 2013 | 2014^ | 2015^ |

Nominal GDP (USD bn) | 774.6 | 789.1 | 820.1 | 796.6 | 857.6 |

Real GDP growth (%) | 8.8 | 2.1 | 4.0 | 3.0 | 4.0 |

GDP per capita (USD) | 10,470 | 10,560* | 10,880* | 10,480 | 11,180 |

Inflation (%) | 6.5 | 8.9 | 7.5 | 8.9 | 7.4 |

Budget balance (% of GDP) | -1.4 | -2.1 | -1.2 | -2.6 | -2.7 |

Current account balance (% of GDP) | -9.7 | -6.1 | -7.9 | -5.8 | -6.0 |

External debt/GDP (%) | 39.4 | 42.8 | 47.6 | 48.0 | 44.5 |

* Estimates ^ Forecast

Source: Economist Intelligence Unit (www.eiu.com)

Following a strong rebound in in the aftermath of the global financial crisis, the Turkish economy has been growing at a more moderate pace in recent years. While private consumption remained the major growth engine, high inflation and sluggish wage and employment growth have constrained household spending. In the second quarter of 2014, real GDP growth slowed to 2.1% year-on-year, in the wake of tightening fiscal and monetary conditions. It is expected growth would pick up next year, supported by stronger private consumption and investment.

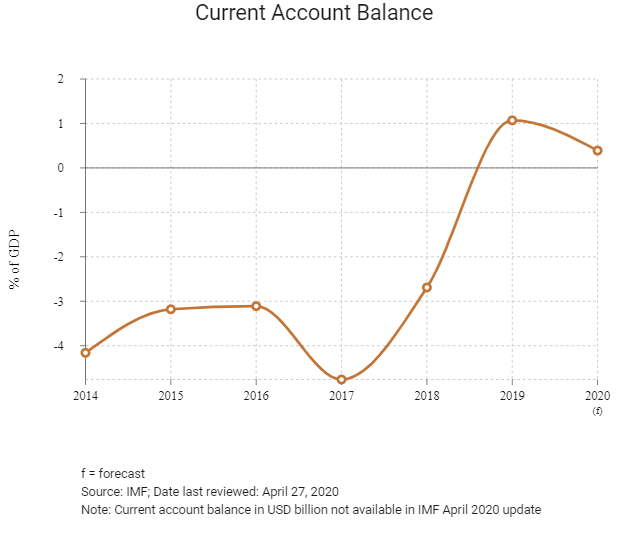

The country’s chronic current account deficit reflects structural issues related to its heavy dependence on imported energy – almost all oil and gas were imported. Meanwhile, Turkey’s industry imports intermediate goods to produce final goods. The country’s current account deficit could only be narrowed at the expense of higher growth, if a significant change in its trade composition is not to happen. The Turkish government has introduced various measures to address the issue. However, the plan will not have an impact on Turkey’s energy dependency in the short term.

Hong Kong - Turkish Trade

Turkey was the 35th largest trading partner of Hong Kong in 2013, the value of Hong Kong exports to Turkey accounted for 0.2% of Hong Kong’s total trading value. Total exports from Hong Kong to Turkey increased by 6.4% from HK$6.3 billion in 2012 to HK$6.7 billion in 2013. The top three export categories to Turkey were: (1) telecommunications, audio & video equipment (-6.6%), (2) electrical machinery, apparatus & appliances & parts (+2.3%), and (3) Photographic apparatus, equipment and supplies and optical goods, watches and clocks (+19.6%), which represented 55.5% of total exports to Turkey.

ECIC Underwriting Experience

The ECIC imposes no restrictions on covering Turkish buyers. Currently, the insured buyers in Turkey range from small and medium-sized companies to large-scale listed companies. For 2013, the number and amount of credit limit applications on Turkey increased by 10.7% and decreased by 9.4% respectively, while insured business rose by 2.1%. Major insured products were chemical products (+89.6%), electronics (+23.9%) and metallic products (+84.3%), which represented 52.0% of ECIC’s insured business in Turkey. The Corporation’s underwriting experience on Turkey has been satisfactory, with three payment difficulty cases of small amounts reported from September 2013 to August 2014, involving electronics goods and jewellery.

Editor's picks

Trending articles

Belt and Road: Turkey’s Logistics Link with Hong Kong

Turkey-based Barsan Global Logistics is using its Belt and Road connections to reduce cargo transit times from Hong Kong to Turkey by more than half, according to Director Ebru Busra Tunca. It’s 35 global branches keep integrated operations running smoothly while Hong Kong acts a super connector for Asia.

Speaker:

Ebru Busra Tunca, Director, Barsan Global Logistics (HK) Ltd

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

GDP (US$ Billion)

771.27 (2018)

World Ranking 19/193

GDP Per Capita (US$)

9,405 (2018)

World Ranking 73/192

Economic Structure

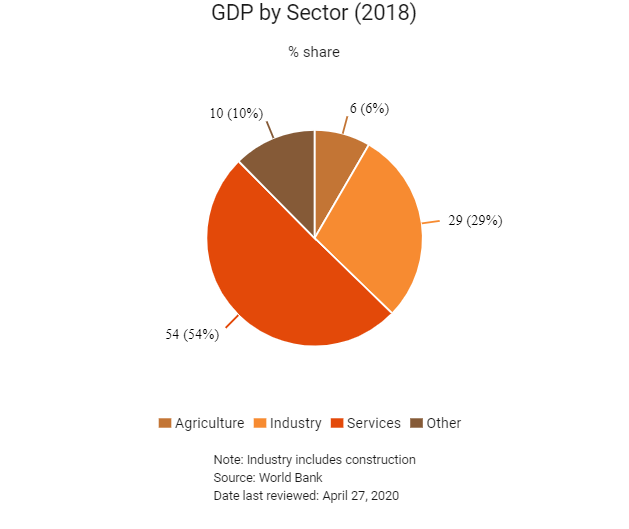

(in terms of GDP composition, 2019)

External Trade (% of GDP)

61.4 (2019)

Currency (Period Average)

Turkish Lira

5.67per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

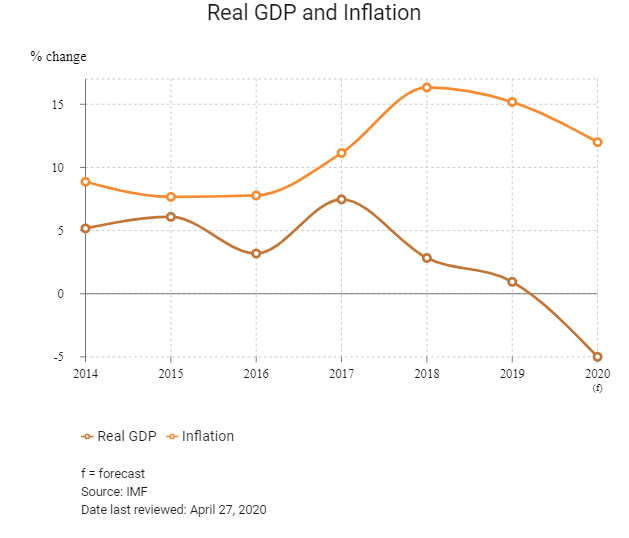

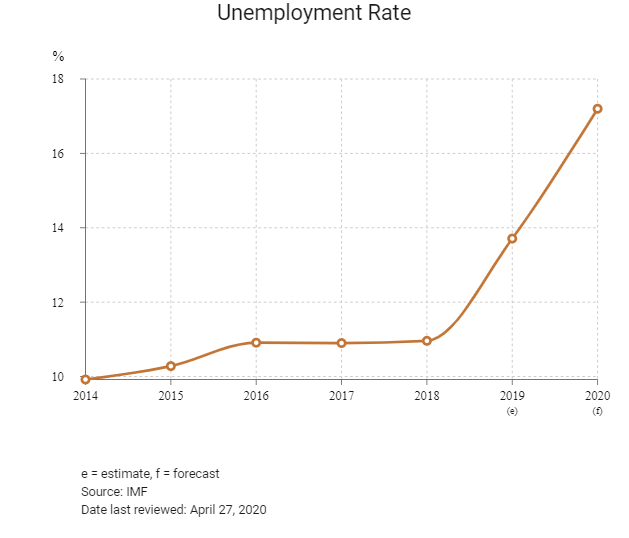

Turkey is a transcontinental Eurasian country located at the crossroads of Europe and Asia, which makes it a country of significant geostrategic importance. Turkey has been an appealing market for investors since the mid-2000s. These factors also mean, given Turkey's own plans for internal transportation connectivity infrastructure, the country could play a pivotal role in Mainland China's Belt and Road Initiative, which has the potential to create an interconnected trading bloc that includes Turkey, Russia, Iran, India and Mainland China. Turkey experienced strong economic growth on the back of the many positive economic and banking reforms it implemented between 2002 and 2007. Turkey's economic performance since 2000 has been robust, and macroeconomic and fiscal stability were at the heart of that, enabling increased employment and making Turkey an upper-middle-income country. Poverty more than halved over 2002–2015, and during this time Turkey urbanised dramatically while simultaneously opening to foreign trade and finance, harmonising many laws and regulations with European Union standards, and greatly expanding access to public services. It also recovered well from the global crisis of 2008–2009. However, some of Turkey's development achievements have been slowing down after the long period of success and risk being undermined, exacerbated internally by the economic turbulence of mid-2018 and challenged externally by the ongoing effects felt worldwide in 2020 from the Covid-19 pandemic. The Turkish economy looks set for a period of slower growth as high inflation, a more restrictive domestic and external financing backdrop, and weakening relationships with some key trading partners prove headwinds to growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2019

It was announced that the EU had signed a EUR275 million grant agreement with Turkey to help finance the construction of the EUR1.2 billion modernisation of the Halkali (Istanbul)-Kapikule (Edrine) line. This represented a significant improvement to a route of strategic importance to the trans-European railway network.

March 2019

Alamos Gold received an operating permit for the USD180 million Kirazli project, which would produce an estimated 104koz of gold per annum. In January 2019, Alacer Gold provided an update on the feasibility study at the USD269 million Gediktepe project, which was set to be completed by the end of the year.

April 2019

The United States decided not to grant any Significant Reduction Exceptions (waivers) to existing importers of Iranian oil.

June 2019

The opposition Republican People's Party won the mayoral election in Istanbul.

October 2029

Turkey's Trade Registry Gazette showed that Volkswagen (VW) had established a subsidiary in the country's western Manisa province. Turkey had first invited VW to invest in 2005 at the Geneva Motor Show. Although VW had identified the location for its plant, expected to result in an investment of around EUR1.3 billion (USD1.4 billion) and with production expected to begin in 2022, a decision to proceed had been postponed.

December 2019

Azerbaijan's President Ilham Aliyev and Turkey's President Erdoğan inaugurated the Trans-Anatolian Pipeline, the longest element of the Southern Gas Corridor which would supply Turkey and Europe with natural gas from Azerbaijan.

January 2020

Morocco’s Minister of Trade Moulay Hafid Elamamy stated that Rabat and Ankara must review their 14-year free trade agreement (FTA). Elalamy also talked about the negative aspects of the FTA, arguing that Morocco loses USD2 billion annually due to its trade deal with Turkey.

February 2020

Zambia announced that it would co-host the inaugural session of the Zambia-Turkey Joint Economic Commission (JEC). According to Zambia’s Foreign Affairs Minister Joseph Malanjihe, the JEC was a designed to promote mutual trade and economic cooperation between the two countries.

In Syria, 33 Turkish soldiers were killed in air strikes by Russia-backed Syrian government forces, increasing tension between Ankara and Moscow.

March 2020

Turkey and Russia carried out their first joint patrol in Syria along a security corridor following a ceasefire agreement between the opposing sides backed by each country.

April 2020

The Treasury and Finance Ministry announced it would repay USD12.6 billion of debt in the May–July period. The previous day it was announced that e-commerce grew by 39% in 2019 to make the market worth USD14.6 billion.

Azerbaijan state oil company SOCAR and BP announced a delay until 2021 to the start of their joint venture construction of a new, USD1.8 billion Turkish petrochemical industrial complex in Izmir originally announced in August 2019.

Scientists tried to contain a stinkbug infestation that threatened to damage Turkey's hazelnut production in the Black Sea region, where two-thirds of the world's hazelnut supply originates.

Turkey's statistical authority announced that tourism income reached USD4.1 bilion in January-March 2020, marking a fall of -11.4% compared to the same period a year earlier.

May 2020

Turkey's largest oil refiner announced the temporary stoppage, until July 1 2020, of production at its Izmir oil refinery due to reduced fuel demand caused by the Covid-19 pandemic.

June 2023

Parliamentary and presidential elections scheduled.

Sources: BBC Country Profile – Timeline, Daily Sabah, Hurriyet Daily News, The Guardian, Reuters, Al Jazeera, Bloomberg, AzerNews, Emerging Europe, Xinhuanet, Eurasianet, Fitch Solutions

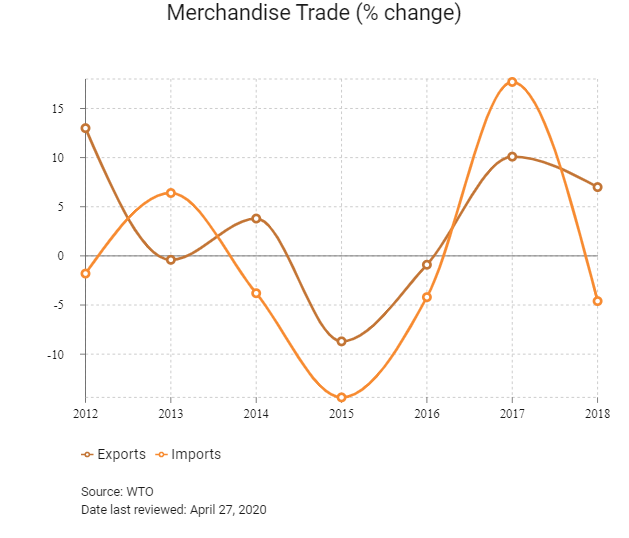

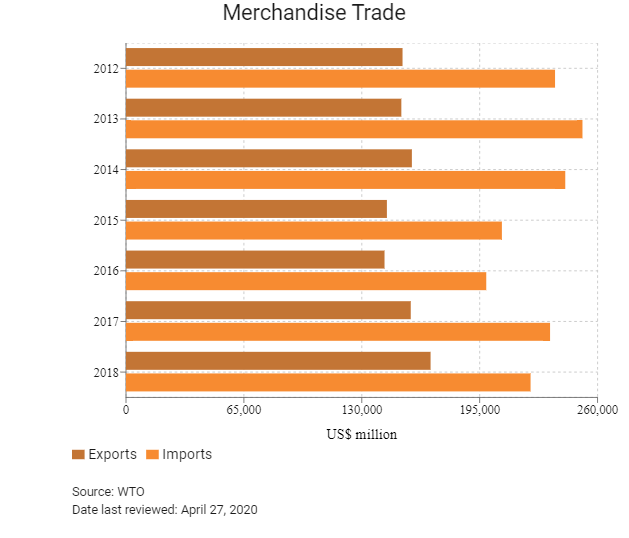

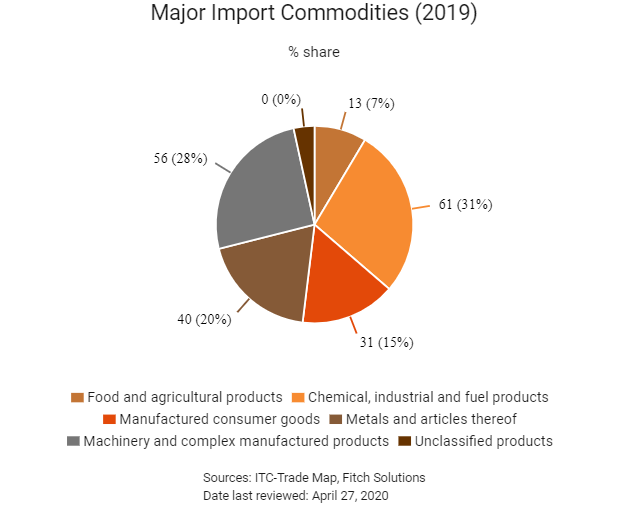

Merchandise Trade

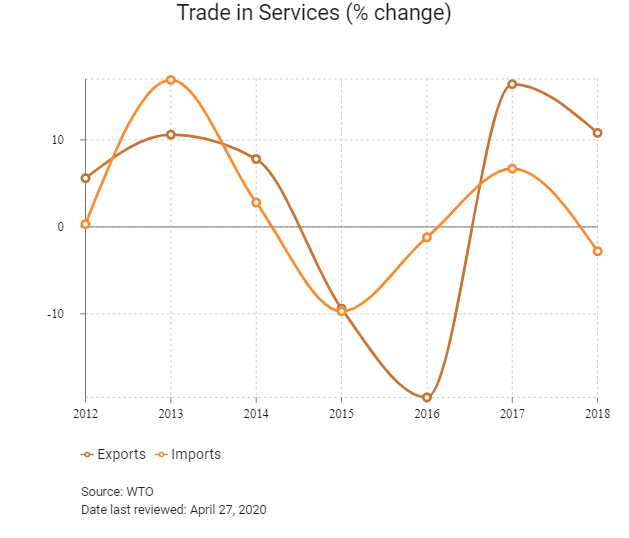

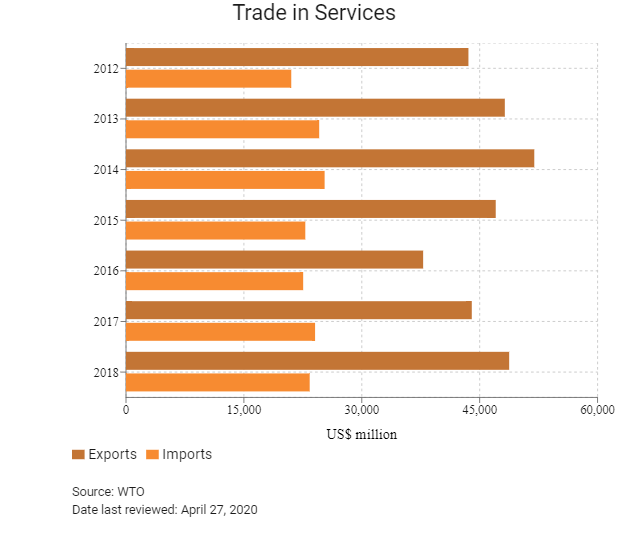

Trade in Services

- Turkey has significantly liberalised its import regime, especially in the last two decades. Any individual or enterprise can freely register to engage in the import business. The country has been a member of the General Agreement on Trade and Tariffs since October 17, 1951, a member of the World Trade Organization (WTO) since March 26, 1995, and its tariff scheme is based on the Harmonised System for commodity coding. The average tariff rate faced by importers stands at 3.2%.

- Trade flows in Turkey have been facilitated by the removal of trade barriers and lowering of tariffs alongside membership of a number of FTAs. In addition to being a member of the WTO, Turkey is also a member of the World Customs Organization. Turkey signed a Customs Union Agreement with the EU on January 1, 1996 and has amended its customs code and legislation in line with those of the EU customs code.

- Turkey has become increasingly integrated with the West by becoming a member of organisations such as the Council of Europe (1950), the North Atlantic Treaty Organization (1952), the Organisation for Economic Co-operation and Development (1960), the Organization for Security and Co-operation in Europe (1973) and the G20 major economies (1999). Turkey began full membership negotiations with the EU in 2005, having been an associate member of the European Economic Community since 1963 and having reached a customs union agreement in 1995.

- Other states that have active FTAs with Turkey include North Macedonia, Bosnia-Herzegovina, Tunisia, Morocco, Albania, Georgia, Montenegro, Serbia, Chile, Jordan and Mauritius. These countries are not major trade partners of Turkey, so these FTAs offer few benefits at present.

- Turkey has also fostered close cultural, political, economic and industrial relations with the East, particularly the Middle East and the Turkic states of Central Asia, through membership in organisations such as the Organization of the Islamic Conference (OIC) and the Economic Cooperation Organization (ECO).

- The lack of clarity surrounding final bound tariff rates means that the government can considerably increase tariffs on imports to protect certain sectors. While this largely affects agricultural imports, higher tariffs may be applied to a wider range of products including finished goods such as furniture and footwear, as well as intermediate inputs and construction materials.

- Import licences are required for some agricultural produce and other goods and documentary compliance can be difficult owing to opaque regulations.

- Following the changes in Turkish economic policy in the 1980s, there has been rapid growth in the foreign trade volume of Turkey. For value added tax (VAT) purposes, any import of goods or services into Turkey is a taxable transaction, regardless of the status of the importer or the nature of the transaction. To equalise the tax burden on import and domestic supply of goods and services, VAT is levied only on the importation of goods and services that are liable for tax within Turkey. Accordingly, any transaction exempt in Turkey may also be exempt on import. The VAT on importation is imposed at the same rates applicable to the domestic supply of goods and services. In the case of importation, the taxable event occurs at the time of actual import. The VAT rates are 1%, 8% and 18%, varying according to the type of goods imported. The import of machinery and equipment under an investment incentive certificate is exempt from VAT.

- If the import transaction is not conducted in cash, there is a special Resource Utilisation Support Fund (RUSF) which should also be paid. The RUSF applied to imports on a credit basis. According to the RUSF's legislation, any importation conducted on credit (if the payment related to the importation is not paid before the actual importation) is subject to a special payment of 6% of the value of the goods to be imported. The important criteria are payment terms and whether it is a cash payment or payment on credit.

- Turkey has also adopted the EU's Common External Tariffs imposed on imports from third countries and economies. Products imported from sources other than the EU and Turkey can thus move freely if all import formalities have been complied with in accordance with customs duties. Generally, the Turkish Customs Code is very similar to that of the EU and aims to harmonise the customs practices of Turkey with those of the EU.

- Some industrial products from less developed and developing countries (in addition to Mainland China) benefit from the EU's Generalised System of Preferences (GSP). With the creation of the customs union between the EU and Turkey, such products are also covered under Turkey's GSP regime.

- Turkey has its own anti-dumping actions which are separate from those of the EU. Dumping and anti-dumping duties are collected at the point of import. To harmonise with the relevant EU directives, the Turkish version of the Restriction of Hazardous Substances Directive entered into force in June 2009, while the Turkish version of the Waste Electrical and Electronic Equipment Directive was published in the Turkish Official Journal on May 22, 2012 and implemented from January 2013 onwards.

- The Turkish Standards Institution (TSE) is the product standardisation body of Turkey and is responsible for setting product standards and ensuring compliance; for example, while there is a minimum two-year warranty requirement for electrical and electronic products, before products can be imported and placed on the Turkish market it is also necessary to obtain technical approval by the TSE and European CE standard certification under the requirements set out by the TSE. As for toys, the TSE also imposes a number of safety standards which, in large part, follow those required by the EU. Therefore, the attainment of CE standard certification can serve as a good reference for fulfilling the TSE requirements.

- In certain cases, such as temporary importation or inward processing, the customs administration will require a guarantee letter to secure the taxes. The amount of this guarantee shall cover all the taxes payable in the case of an importation.

- In 2011 the then Prime Minister Erdoğan outlined a 12-year plan called '2023 Vision', which set out a number of targets to grow Turkeys GDP and improve living standards by the 100th anniversary of the country in 2023. The targets included a number of major infrastructure projects and incentives to attract more inward private investment.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

Thailand and Turkey signed a declaration in Ankara in July 2018 to start negotiations for an FTA, setting a goal to increase bilateral trade between the two countries by 40%. The first phase of agreement negotiations would only cover merchandise trade, while investments and services and e-commerce will be incorporated into the FTA at a later stage.There are expectations the FTA coud be concluded in 2020.

Multinational Trade Agreements

Active

- Turkey-EU Customs Union: Turkey and the EU are linked by a customs union agreement which came into force on December 31, 1995. Turkey has been a candidate country to join the EU since 1999 and is a member of the Euro-Mediterranean partnership. The customs union with the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. The EU is Turkey's number one import and export partner. Turkey is the EU's fourth-largest export market and fifth-largest provider of imports. Turkey also enjoys tariff-free access to the states with which the EU has concluded FTAs, including Mexico, South Africa, Ukraine and Morocco. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the customs union agreement covers all industrial goods, but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural as well as coal and steel products. In December 2016, the European Commission (EC) proposed the modernisation of the customs union and to further extend the bilateral trade relations to areas such as services, public procurement and sustainable development, but that mandate has not yet been adopted.

- Turkey-European Free Trade Association (EFTA – Iceland, Liechtenstein, Norway and Switzerland): Turkey and the EFTA states signed a FTA on December 10, 1991, which came into force on on April 1, 1992, and covers trade in goods. Switzerland is a large source of imports and assists with regional trade flows to Europe.

- Turkey-Israel FTA: Israel is an important trade partner in the Middle East and there is potential for expansion of trade flows. Under the current FTA, which was signed with Israel on March 14, 1996 and went into force on May 1, 1997, numerous trade-related areas including sanitary and phytosanitary measures, internal taxation, balance of payments, public procurement, state aid, intellectual property rights, anti-dumping, rules of origin and various safeguard measures are addressed. The stipulations of the agreement on industrial products, all the customs taxes and charges that have an equivalent effect were abolished on January 1, 2000. Regarding agricultural products, Turkey and Israel granted each other unlimited tariff elimination or reduction and/or tariff reduction or elimination in the form of tariff quotas for some agricultural products originating in the other party. Furthermore, in 2006 and 2007, both parties revised the list of agricultural products that are granted preferential treatment under the original agreement.

- Turkey-Egypt FTA: The FTA between Egypt and Turkey was signed on December 27, 2005 in Cairo and entered into force on March 1, 2007. Egypt is a relatively large export market, particularly for refined fuel.

- Turkey-South Korea FTA: The expanded FTA will allow each of the two countries to secure government policy authority (South Korea in the agriculture, energy and real estate sectors, and Turkey in the agriculture and fisheries, mining and real estate sectors) while modernising investor state dispute settlement to protect South Korean companies with a stake in Turkey. South Korea is a key source of complex manufactured goods. The Agreement on Trade in Services and The Agreement on Investment were negotiated and signed on February 26, 2015 and entered into force on August 1, 2018.

- Turkey–Republic of Singapore FTA (TRSFTA): The FTA between Turkey and the Republic of Singapore was signed on November 14, 2015, and entered into force on October 1, 2017. The agreement covers market access for goods, trade remedies, sanitary and phytosanitary measures, technical barriers to trade, customs and trade facilitation, trade in services, investment, government procurement, competition policy, intellectual property rights, transparency and dispute settlement mechanisms. The TRSFTA also addresses non-tariff barriers to trade in three major sectors: telecommunications, electronic commerce and financial services

- Turkey-Morocco FTA: Morocco and Turkey signed the FTA deal in 2004, and the agreement took effect in 2006. With this FTA, tariffs and non-tariff barriers were eliminated in trade between the parties. The agreement regulates numerous areas, such as sanitary and phytosanitary measures, state monopolies, intellectual property rights, internal taxation, public procurement, balance of payments, anti-damping, safeguard measures, and rules of origin. This FTA will be reviewed over 2020.

Under Negotiation

- Turkey-Mercosur FTA: Trade with Mercosur (comprised of Argentina, Brazil, Paraguay, Uruguay and Venezuela) is limited and may expand significantly under FTAs.

- Turkey is currently discussing a potential bilateral FTA with Ukraine.

Signed But Not Ratified

Turkey-Lebanon, Kosovo, Moldova, Malaysia and the Faroe Islands: Trade flows with these countries are not substantial and they offer relatively limited markets – though Malaysia offers an alternative source of energy.

Negotiation Suspended

Turkey-Gulf Cooperation Council (GCC): Although negotiations have been suspended, tariff-free access to the GCC would reduce costs on energy imports.

Sources: WTO Regional Trade Agreements database, European Commission, Ministry of Foreign Affairs, Ministry of Trade and Industry Singapore, Fitch Solutions

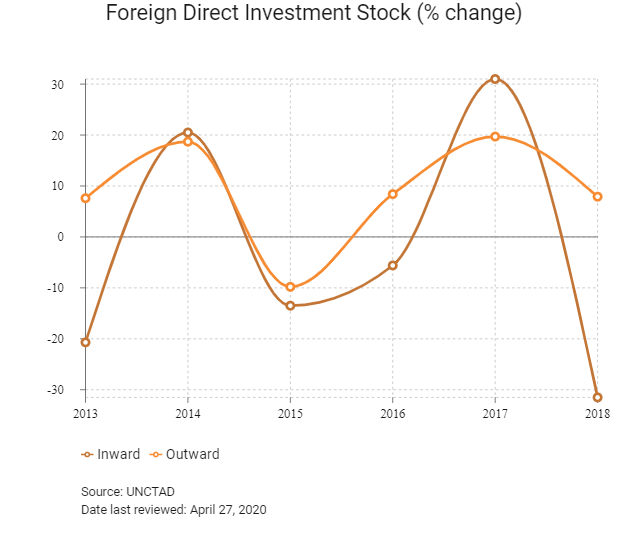

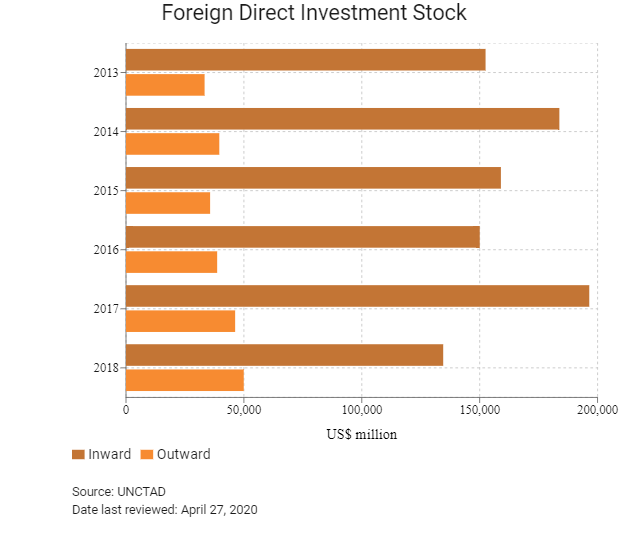

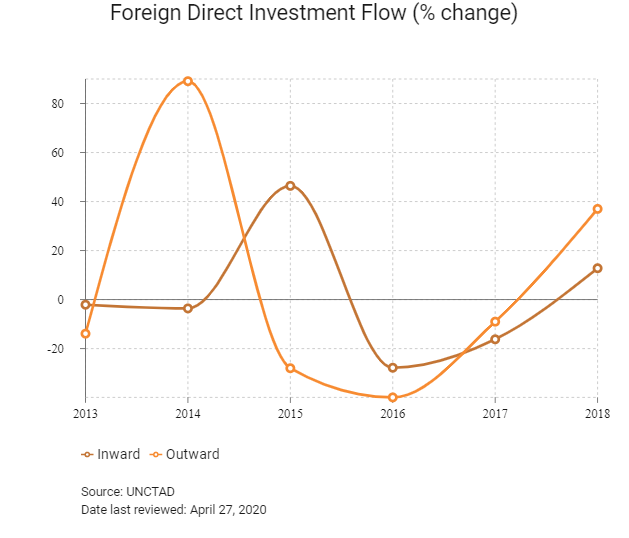

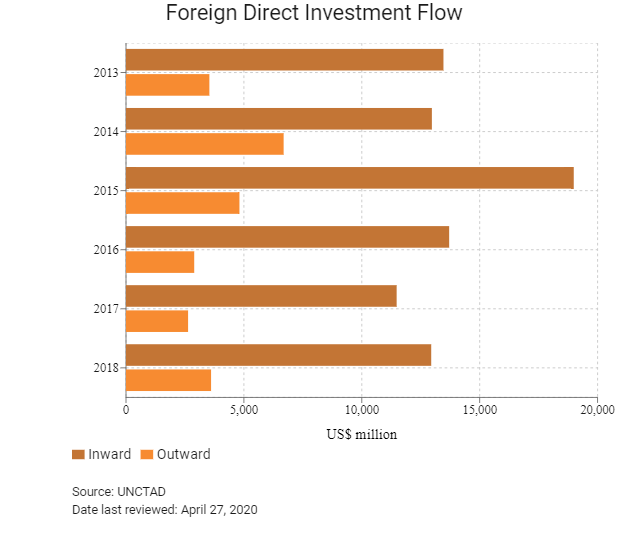

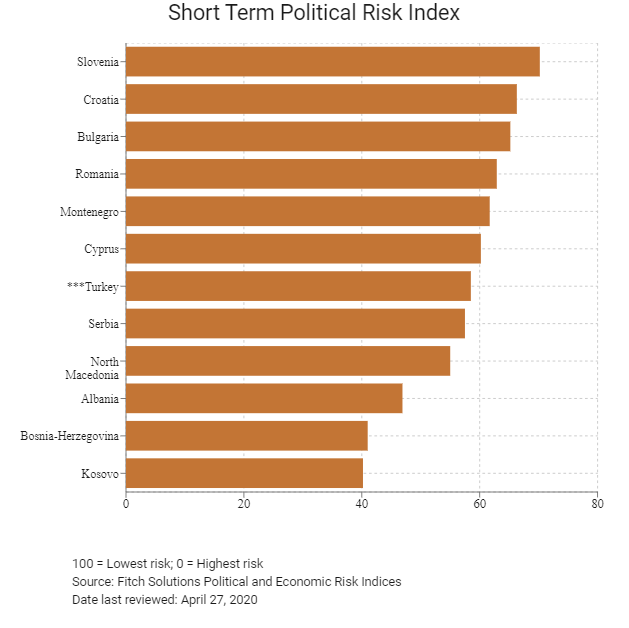

Foreign Direct Investment

Foreign Direct Investment Policy

- The Turkish government has pursued wide-ranging reforms since 2001, aimed at opening up the economy to greater foreign involvement in order to enhance industrial capacity and boost growth. There are consequently few regulatory restrictions on foreign direct investment (FDI), while an ongoing privatisation process is reducing the state's role in the economy and further widening access for foreign investors to strategic industries. Turkey's government acknowledges that it needs to attract significant new FDI to meet its ambitious development goals, as well as finance its current account deficit. As a result, Turkey has one of the most liberal legal regimes for FDI in the Organisation for Economic Cooperation and Development (OECD).

- Turkey does not screen, review or approve FDI specifically. However, the government established regulatory and supervisory authorities to regulate different types of markets. Important regulators in Turkey include the Competition Authority; the Energy Market Regulation Authority; the Banking Regulation and Supervision Authority; the Information and Communication Technologies Authority; the Tobacco, Tobacco Products and Alcoholic Beverages Market Regulation Board; the Privatisation Administration; the Public Procurement Authority; the Radio and Television Supreme Council; and the Public Oversight, Accounting and Auditing Standards Authority. Some of the aforementioned authorities screen as needed without discrimination, primarily for tax audits. Screening mechanisms are executed to maintain fair competition and for other economic benefits. If an investment fails a review, possible outcomes vary from a notice to remedy, which allows for a specific period of time to correct the problem, to penalty fees. The Turkish judicial system allows for appeals of any administrative decision, including tax courts that deal with tax disputes.

- Most sectors open to the Turkish private sector are also open to foreign participation and investment, 100% foreign ownership is permitted in most industries. Both domestic and foreign investors enjoy equal rights and protections under law and both are eligible for the incentives provided to investment in new projects. There are no capital controls imposed and investors are free to transfer earnings into foreign currency and remit profits abroad.

- The Turkish government has several investment incentives meant to encourage investments with the potential to reduce dependency on the importation of intermediate goods vital to the country's strategic sectors, identified as agriculture and food, automotive, business services, chemicals, electronics, energy and renewables, financial services, healthcare and pharmaceuticals, information communication technology, infrastructure, machinery, manufacturing, mining, real estate, tourism and transportation and logistics. The incentives include VAT or customs duty exemption and social security contributions support.

- Since 2001, Turkey has pursued a comprehensive investment climate reform programme aimed at streamlining investment-related procedures and attracting more FDI. The government has launched the Coordination Council for the Improvement of the Investment Environment (YOIKK), which involves stakeholders from the public and private sectors, to advise on current investment policies. A supplementary role is played by the Investment Advisory Council of Turkey, which convenes yearly under the chairmanship of the prime minister and involves representatives from multinational companies, international institutions and non-governmental organisations. The recommendations supplied by this council are applied as guidelines for the YOIKK agenda.

- The Privatisation Administration has been used to divest state assets in a wide range of industries, with nearly all 188 former state-owned entities now boasting some level of private sector participation. Another government programme of more direct relevance is the Investment Support and Promotion Agency, which offers information and advice to foreign investors as well as support in setting up operations. All of these initiatives have been successful in improving the investment environment and increasing foreign participation in Turkey's economy.

- Turkey's generous and wide-ranging incentive programme and suite of free zones offers numerous fiscal benefits, funding support and logistical advantages to new projects. The current incentive system was established in 2012 and updated in 2015 and aims to encourage investment in strategic sectors, high value-added industries and underdeveloped regions. The programme is divided into five different schemes which offer a varying range of benefits depending on the sector, location and amount of investment, namely the General, Regional, Priority, Large-Scale and Strategic Investment Incentive Schemes. More information on the investment environment and regulations can be found at the Investment Support and Promotion Agency of Turkey. In August 2019 the programme was amended (Presidential Decrees No. 1402 and No. 1403): the Large-Scale scheme was abolished and a 'Technology Focused Industry Move Program' was introduced to encourage investment in products from the Priority Products List determined by the Ministry of Industry and Technology. The minimum investment requirement was set at TRY50 million for the new programme but increased to TRY500 million for the other schemes.

- Turkey has 18 operational free zones, plus another being established, located close to the European Union and Middle Eastern markets, with access to international trade routes via ports on the Medierranean Sea, Agean Sea and Black Sea. The advantages offered have resulted in the accumulation of sophisticated industrial clusters which offer immediate access to quality local suppliers and international trade routes, significantly reducing supply chain risks and logistics costs.

- A number of provisions may be applied to government tenders which are detrimental to foreign investors, including restrictions on bids by foreign companies, the potential to offer price advantages of up to 15% for domestic bidders, a requirement to accept only the lowest bids and the use of model contracts all of which leave little room for flexibility and specialisation.

- The government mandates a local employment ratio of 10 Turkish citizens per foreign worker. These schemes do not apply equally to senior management and boards of directors, but their numbers are included in the overall local employment calculations. Foreign legal firms are forbidden from working in Turkey except as consultants; they cannot directly represent clients and must partner with a local law firm. There are no onerous visa, residence, work permits or similar requirements inhibiting mobility of foreign investors and their employees. There are no known government-imposed conditions on permissions to invest, including tariff and non-tariff barriers.

- The Council of Ministers published a amending the Decree No. 32 on the Protection of the Value of the Turkish Currency (Decree No. 32) in the Official Gazette No. 30312 on January 25, 2018. The amendments providing restrictions on foreign exchange loans entered into force on May 2, 2018. Prior to the amendments, Turkish residents were not entitled to use foreign currency denominated loans from abroad. With the amendments, Turkish residents that do not have foreign exchange income will no longer be able to use foreign currency denominated loans from abroad, with certain exceptions.

- Corporations are liable for income tax at a rate of 22% for the years 2018, 2019 and 2020 on net profits generated, as adjusted for exemptions and deductions and including prior year losses carried forward, to a limited extent. Deliveries of goods and services are subject to VAT at rates varying from 1% to 18%. The general rate is 18%.

- Turkey is party to 76 bilateral investment treaties (BIT) with countries or economic unions, including one with Mainland China. An additional 44 treaties have been signed but are not yet in force (including an updated BIT with Mainland China).

- Turkey is party to 16 treaties with investment provisions and is currently in negotiation with Hong Kong over an investment promotion and protection agreement.

Sources: WTO – Trade Policy Review, the International Trade Administration, Investment Support and Promotion Agency of Turkey, Trade Ministry, Ministry of Treasury and Finance, UNCTAD, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

General Investment Incentive Scheme: available regardless of location and investment amount and applied to all other investment incentive programmes. |

Exemption from VAT and customs duty |

|

Regional Investment Incentive Scheme: offers a range of benefits depending on the development level of the region in which the project is located. All regions of Turkey are allocated a number from one to six, whereby one represents the most developed and offers the fewest incentives. The minimum investment amount is TRY1 million for zones one and two and TRY500,000 for the remaining four zones. |

- Automatic government land allocation |

|

Priority Investment Incentive Scheme: focused on specific sectors, including high-tech manufacturing, pharmaceutical, defence industry, automotive, mining, education, LNG, power generation, rail and maritime transport. |

- All incentives allocated to firms located in zone five regions are available to these industries regardless of location. |

|

Strategic Investment Incentive Scheme on a projects basis to be decided by the presidency (minimum investment TRY500.million) |

- Investment contribution of up to 200% |

|

Free zones: 19 (18 operational and one being established) located throughout the country, mostly along the coastline and close to strategic ports such as Istanbul, Izmir and Mersin |

- Exemption from VAT, customs duty, stamp duty and real estate tax |

|

Technology development zones: 84 (63 operational and 21 approved and under construction) located throughout the country and designed to support R&D activities and attract investment in high-technology fields |

- Sales of application software are exempt from VAT until December 31, 2023 |

|

Organised industrial zones: 331 (234 operational and 97 under construction) located in 80 provinces, designed to allow companies to operate within an investor-friendly environment with ready-to-use infrastructure (including roads, water, natural gas, electricity, communications, waste treatment and other services) and social facilities |

- Exemption from VAT for land acquisition |

Sources: US Department of Commerce, national sources, Investment Support and Promotion Agency of Turkey, UNCTAD, Ministry of Treasury and Finance, Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 22%

Sources: Turkey Ministry of Finance

Important Updates to Taxation Information

- In Turkey the corporate income tax rate levied on business profits is 20%. The rate for corporate income tax has been increased to 22% for the tax periods 2018, 2019 and 2020, but the Council of Ministers has the authority to reduce the 22% rate back to 20% and that will be the rate from 2021.

- On December 7, 2019, Law No. 7194 (the Law) was published in Turkey’s Official Gazette; the Law entered into force on the same date. The Law introduces new taxes, namely the digital services tax, the luxury housing tax and the hospitality tax. It also covers changes in income tax rates for individuals.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

22% |

|

Local income tax |

Corporate income is not subject to additional provincial or municipal forms of taxation. |

|

Capital gains tax |

Treated as part of ordinary corporate income |

|

VAT |

18% is the standard rate applicable to the supply of goods or services, unless those are specific goods or services deemed to be lower rated (for example, a rate of 1% applies to certain agricultural products, including raw cotton and dried hazelnuts, and a rate of 8% applies to basic foodstuffs and pharmaceutical products) or exempt, such as healthcare and education, or water, gas electricity and renewable energy, or licensed bank and insurance company transactions. |

|

Banking and Insurance transactions tax |

5% is the general rate applicable to the transactions of licensed bank and insurance company |

|

Digital services tax |

7.5% is the rate applicable to revenue derived from the provision of digital services. The president has the authority to reduce this to 1% or double it to 15%. A provider with revenue of less than TRY20 million in Turkey or EUR750 million worldwide is exempt for the first year of the DST. The president has the authority to triple the exemption threshold or alter it to zero. |

|

Social security contributions |

A social security contribution is payable of 34.5% of gross remuneration, with 20.5% paid by the employer and 14% by the employee, and an unemployment contribution of 3% of gross remuneration, with 2% paid by the employer and 1% by the employee. |

|

Accommodation tax |

1% until December 31, 2020, and 2% from January 1, 2021, is the rate applicable to the service amount charged, net of VAT, by hotels, motels, guest houses and other providers of accommodation to holidaymakers. The president has the authority to double or halve the rate. |

|

Property taxes |

Buildings, apartments and land owned are subject to real estate tax at a rate of 0.1% - 0.6%, while a Contribution to the Conservation of Immovable Cultural Property is levied at a rate of 10% of the real estate tax. In December 2019 a regulation was passed that from January 2020 levies a 0.3% tax on properties valued at TRY5 - 7.5 million, 0.6% on those valued at TRY7.5 -10 million and 1% on those valued at over TRY10 million. |

|

Withholding taxes |

15% on dividend income paid to non-residents, 20% on royalties and 10% on interest. These are reduced to 10% for non-residents from Mainland China. A withholding tax rate of 5% is payable on professional fees from petroleum activities and 20% on professional fees from non-petroleum activities. |

Source: Ministry of Treasury and Finance

Date last reviewed: April 27, 2020

Localisation Requirements

Since January 2015, employers seeking to recruit foreign nationals must meet a number of stipulations which have increased the obstacles to importing foreign workers.

Businesses must meet the following criteria in order to be eligible to employ foreign workers: a local employment quota of five local employees per foreign national; one of either a minimum amount of paid-in capital of TRY100,000, gross sales of TRY800,000 or exports to the value of USD250,000; and minimum monthly salary levels ranging between 1.5 and 6.5 times the minimum wage for the foreign worker, depending on their position.

Obtaining Foreign Worker Permits for Skilled Workers

For a foreign national to work in Turkey, an employment visa and a work permit (which also serves as a residency permit) must be acquired. This entails an application for a work permit to the Turkish Embassy in the home country of the expatriate, an application to the Ministry of Labour and Social Security in Ankara within 10 days of the date of filing the application with the Turkish Embassy and an application for an employment visa within 90 days after obtaining the work permit from the ministry.

Work permits are granted for an initial period of one year and are renewable first for up to three years and following this for up to six years. However, the employee must stay with the designated employer during this period, meaning that long-term expatriate workers, who will be in high demand for their skills and experience of working in Turkey, will not be available for recruitment by other businesses, restricting recruitment options for businesses.

Owing to the fact that professional services such as engineering, city planning and architecture are carefully regulated in Turkey, work permit applications for foreign nationals holding one of these degrees differ from the regular work permit applications and can take up to a year.

Visa/Travel Restrictions

Visitors from many European, Middle Eastern and South American countries may visit Turkey visa free for up to 90 days. Visitors from other countries (including the United States, Mainland China and the United Kingdom) may obtain visas for tourism or business purposes via the electronic visa application system. This system, which was launched in 2013, allows visitors from some countries to obtain an e-visa online, which streamlines the process for foreign business travellers needing to visit Turkey. E-visas are generally cheaper than visas obtained on arrival.

Refugee Employment Restrictions

Although Syrian refugees are permitted to apply for work permits to join the formal labour market, this scheme is not well publicised and has seen limited success. Businesses that want to formally employ Syrian refugees are expected to provide sponsorship and other payments. Compliance and supply chain issues for businesses employing refugees will therefore remain pertinent in the medium term.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (Negative) |

14/06/2019 |

|

Standard & Poor's |

B+ (Stable) |

17/08/2018 |

|

Fitch Ratings |

BB- (Stable) |