Tajikistan

Kerry Logistics is an Asia-based, global 3PL with the strongest network in Asia. Its core businesses encompass integrated logistics, international freight forwarding, express and supply chain solutions. With its head office in Hong Kong, Kerry Logistics has a global footprint in 53 countries and territories, supported by an agency network across six continents.

Currently, Kerry Logistics is serving more than 40 of the world’s Top 100 Brands ranked by Interbrand across a spectrum of industries. Its core competence is to provide highly customised solutions to multinational corporations and international brands, meeting their needs from sourcing, manufacturing to selling in Asia and across the globe. The benefits to customers include enhanced supply chain efficiency, reduced overall costs and improved response time to market.

By managing 60 million sq ft of land and logistics facilities, Kerry Logistics provides customers with high reliability and flexibility to support their expansion and long-term growth. With the most extensive rail and road freight network across Eurasia, it provides customers with flexible and cost-efficient multimodal solutions.

In 2018 and 2019, Kerry Logistics received several international recognitions: Best 3PL and Best Logistics Service Provider - Air Freight at the Asian Freight, Logistics and Supply Chain Awards 2019, and Logistics Award at the Lloyd’s List Asia Pacific Awards 2018.

Kerry Logistics Network Limited is listed on the main board of The Stock Exchange of Hong Kong Limited (Stock Code 0636.HK) and is a selected Member of the Hang Seng Corporate Sustainability Index Series 2017-2018.

Geodis is a global logistics company wholly owned by SNCF Group in France. Geodis has presence in more than 60+ countries and employed more than 41,000 employees worldwide. Geodis focuses in 5 activities serving the needs of the entire supply chain namely Road Transport, Freight Forwarding, Supply Chain Optimization, Contract Logistics and Distribution & Express. Geodis presence in Greater China is particularly strong. Greater China is one of the major growth engines of Geodis with key freight forwarding activities in Air Freight, Ocean Freight and Rail Freight Services. Geodis is ranked number 6 as the global freight forwarder and top 5 Rail Freight Service provider to Europe in China. Both our Intercontinental Rail Freight services from China to Europe and Road Transportation services across Singapore, Malaysia, Thailand and China could well support the One Belt, One Road – the global development strategy adopted by the Chinese government. For Rail Freight Service, Geodis has already established 61 lanes between Europe and China. For Road Transportation, Geodis has the Cross-border Trucking well covering major cities in Singapore, Malaysia, Thailand and China. Geodis will endeavor to make continuous efforts and provide best-in-class comprehensive services to fit in the One Belt, One Road initiatives in the years to come.

Lockton is a global professional services firm with 6,500 Associates who advise clients on protecting their people, property and reputations. Lockton has grown to become the world’s largest privately held, independent insurance broker by helping clients achieve their business objectives.

Lockton Companies (Hong Kong) Limited, established in 1983 and controlling office of the Greater China’s operation of Lockton Companies LLC, is a leading provider of risk consulting, insurance broking services and employee benefits solutions to a wide range of businesses. Our operation today comprises of 140 experienced professionals and our operating divisions cater to our clients’ needs and offer them access to experts throughout Asia and around the globe.

Our Services: risk management, insurance & reinsurance solutions to: construction and property development, catering and restaurants, financial services, hotel and hospitality, innovation and technology, manufacturing, power and energy, professional Services, retail and trading, marine hull & P&I.

Deloitte is one of the region's leading professional services networks with more than 16,000 specialists in 22 offices across the Mainland China, Hong Kong, Macau and Mongolia. Since establishing a presence in Hong Kong more than four decades ago, we have grown to more than 2,600 staff including 191 partners and gained extensive market recognition:

· named to top tier in CICPA’s Comprehensive Assessment of the Top 100 Accounting Firms for 14 consecutive years

· Central Banking Publications’ Advisory Services Provider of the Year 2019

· Recognized as a leader in Information Security Consulting by Forrester

· Awarded 5A Designation, the highest honor in China’s tax profession

· China TOP5 Most Influential M&A Service Provider to Listed Companies

Deloitte serves more than 80% of Chinese companies in the Fortune Global 500 and ranks No.1 in HK IPO and HKEX-listed company services.

Deloitte offers innovative, one-stop BRI solutions across Audit & Assurance, Risk Management, M&A consulting and Human Capital advisory, helping Chinese and international businesses expand their global footprints. Bringing the full extent of our regional and global resources to bear, we provide deep insights into BRI markets and policies through research reports, participation in events including the Belt and Road Forum for International Cooperation, as well as internal initiatives like our Belt and Road Roundtable and Deloitte with B&R WeChat campaign. Our insights and expertise in BRI projects has supported the expansion journeys of dozens of large SOEs including the Silk Road Fund, China Railway Group and State Power Investment Corporation.

Grant Thornton is one of the leading business advisers of independent assurance, tax and advisory services that helps dynamic organisations unlock their potential for growth. Our brand is respected globally, as one of the major global accounting organisations recognised by capital markets, regulators and international standards setting bodies. As a US$4.7bn global organisation of member firms with 40,000 people in over 130 countries, we have the scale to meet your changing needs, as well as the insight and agility that helps you to stay one step ahead. Privately owned, publicly listed and public sector clients come to us for our technical skills and industry capabilities but also for our different way of working. Our partners and teams invest the time to truly understand your business, giving real insight and a fresh perspective to keep you moving. Together with our International Business Centres (IBCs), we can draw on the resources and supports from Grant Thornton’s global network, deep knowledge of the latest regulations, techniques and business practices in major jurisdictions worldwide. Whether a business has domestic or international aspirations, Grant Thornton can help you unlock your potential for growth.

GDP (US$ Billion)

7.52 (2018)

World Ranking 147/193

GDP Per Capita (US$)

826 (2018)

World Ranking 173/192

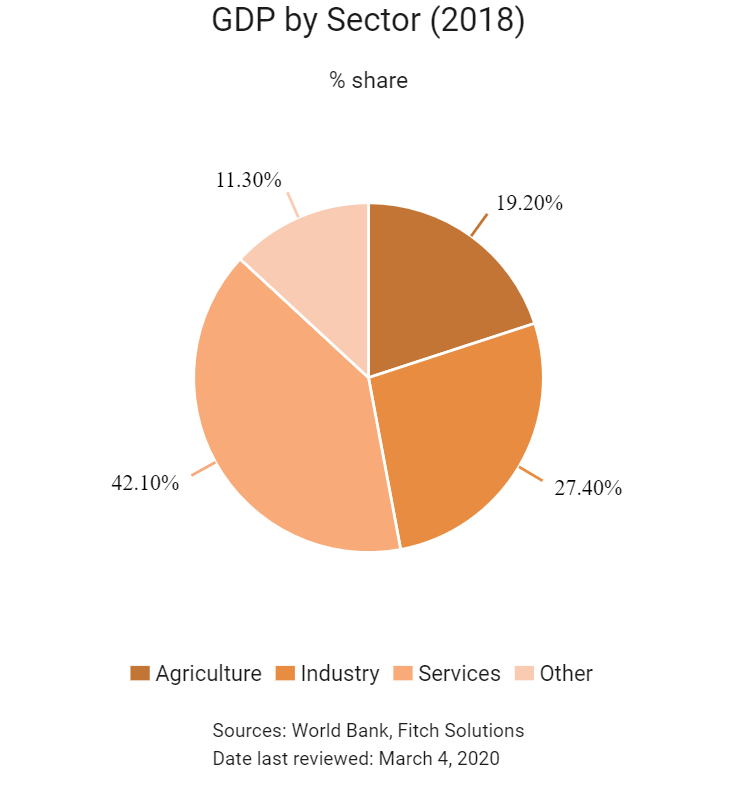

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

56.6 (2017)

Currency (Period Average)

Tajikistani Somoni

9.53per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

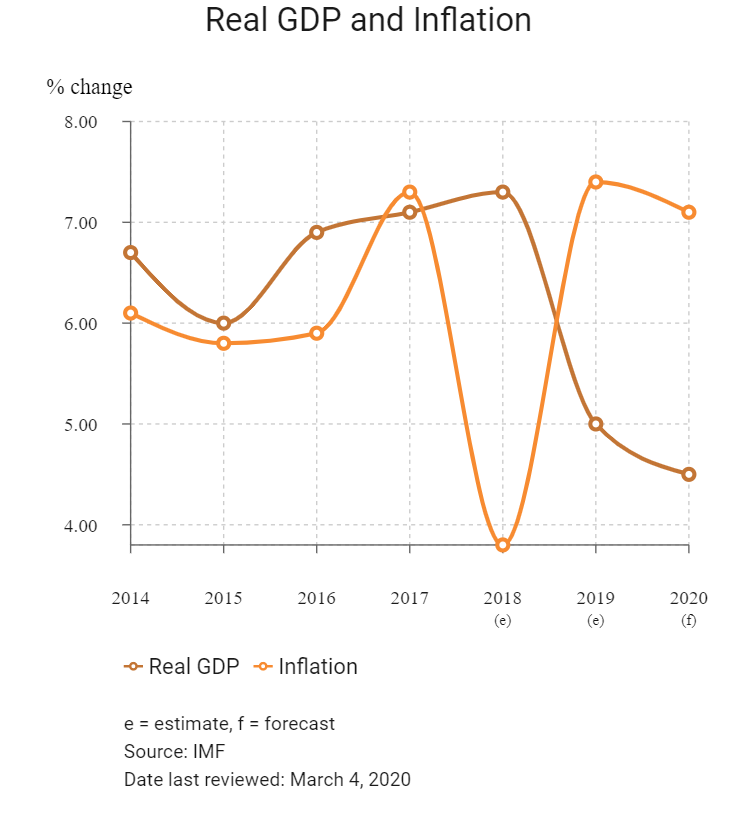

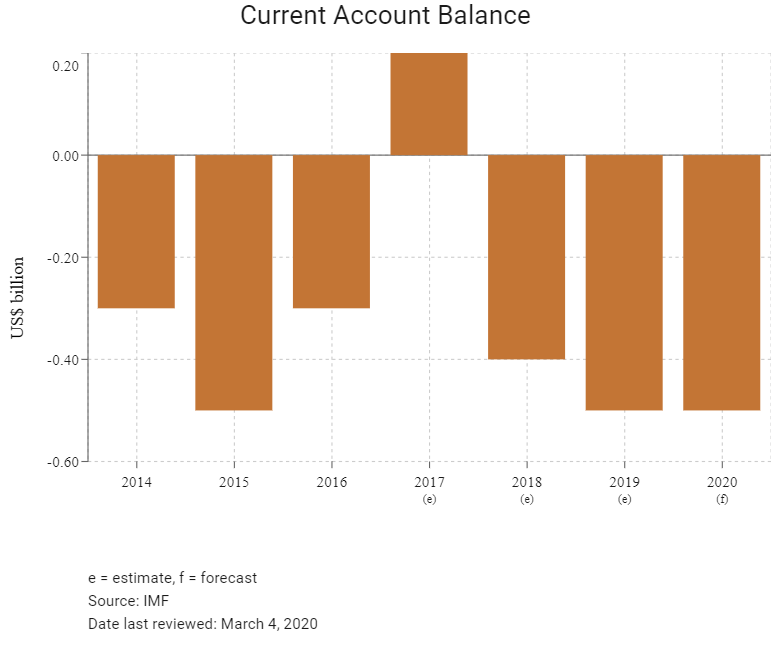

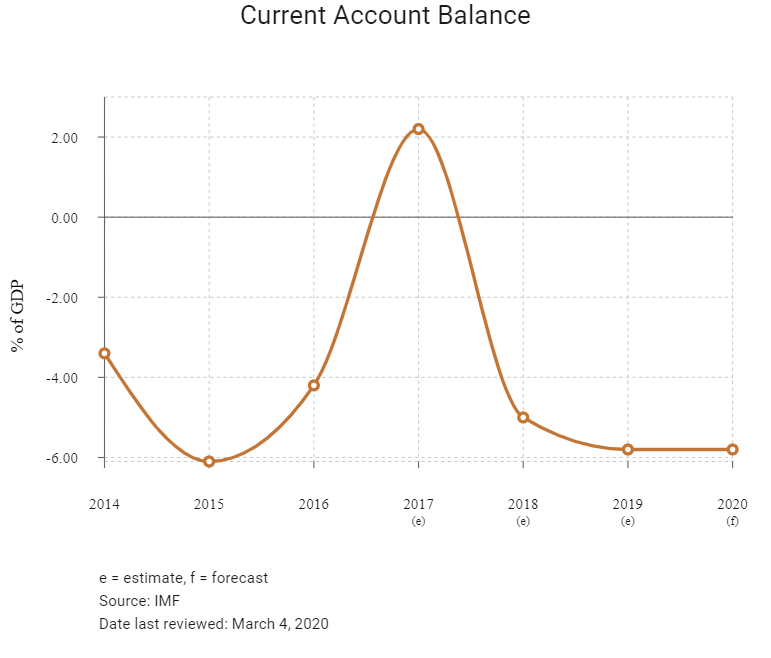

Remittances from Russia account for half of Tajikistan's economic output, with the economy under pressure from its gross external debt. The country's debt levels are expected to rise further as it ramps up construction of the Rogun dam. Adding to the state's fiscal woes is the banking sector's struggles with a high number of non-performing loans. In the medium term, Tajikistan's economic stability will be increasingly tied to the timely construction of the Rogun dam. The dam will make Tajikistan an electricity surplus country, while a failure to complete the project risks complicating the debt situation further.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2016

A referendum supported constitutional changes which removed presidential term limits.

October 2016

Work began on the Rogun hydroelectric dam on the Vakhsh River. Downstream neighbour Uzbekistan had strongly opposed the dam, fearing the impact on its agriculture.

September 2018

Representatives from the International Monetary Fund visited Tajikistan in September 2018 raising the prospects of reaching an agreement with the government. The deal would focus on fiscal consolidation, reducing the economy's external vulnerabilities and securing a sustainable growth path.

February 2019

The CASA-1000 project was launched, which was an interregional electricity transmission project in Central and South Asia to connect four countries: Kyrgyzstan, Tajikistan, Pakistan and Afghanistan. The project was expected to be completed by 2021 and to generate an annual income of more than USD150 million.

March 2020

Parliamentary elections took place, with the ruling People's Democratic Party of Tajikistan securing a majority win.

Sources: BBC Country Profile – Timeline, Fitch Solutions

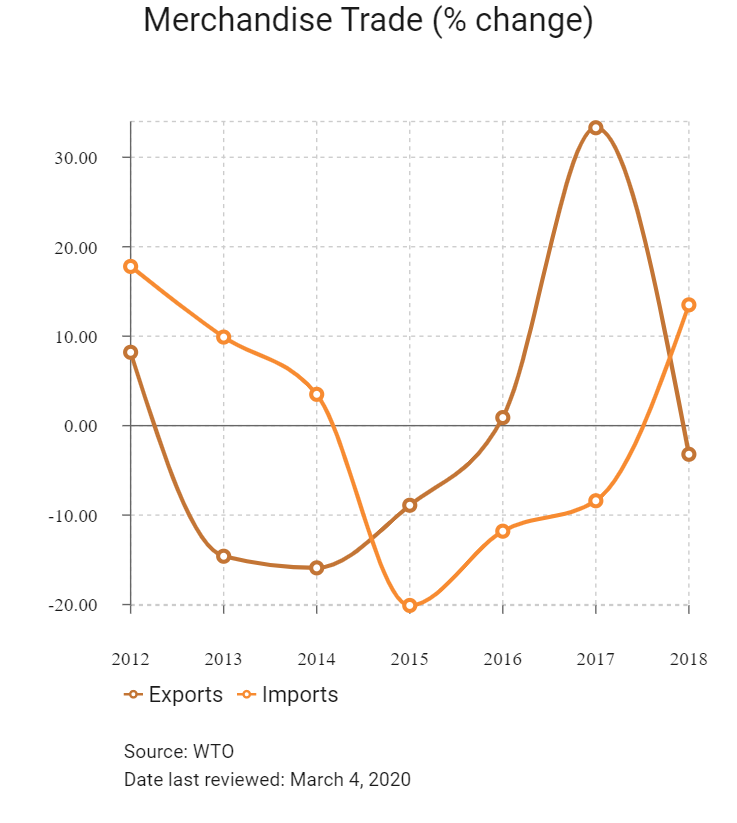

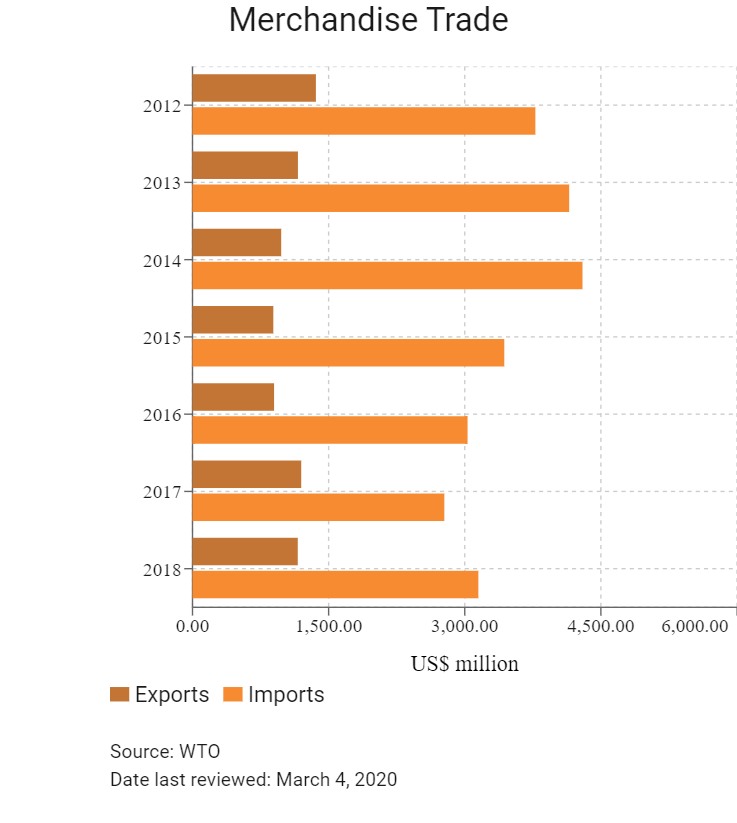

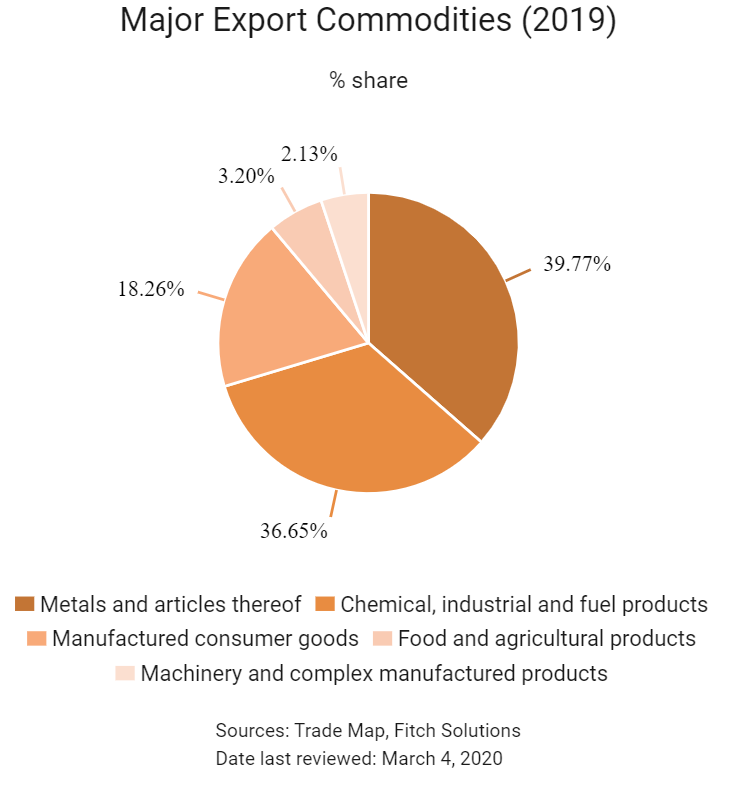

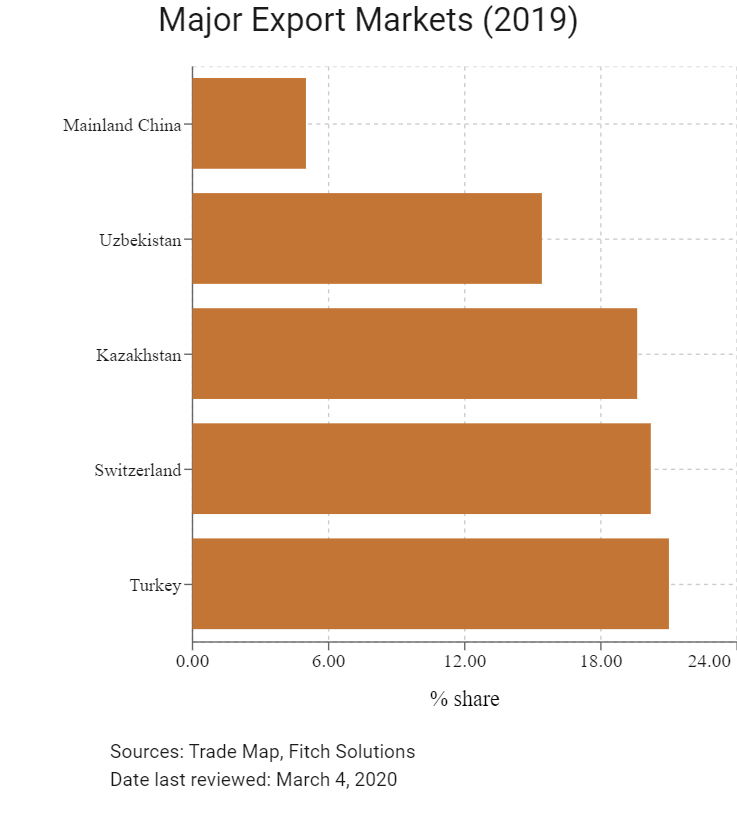

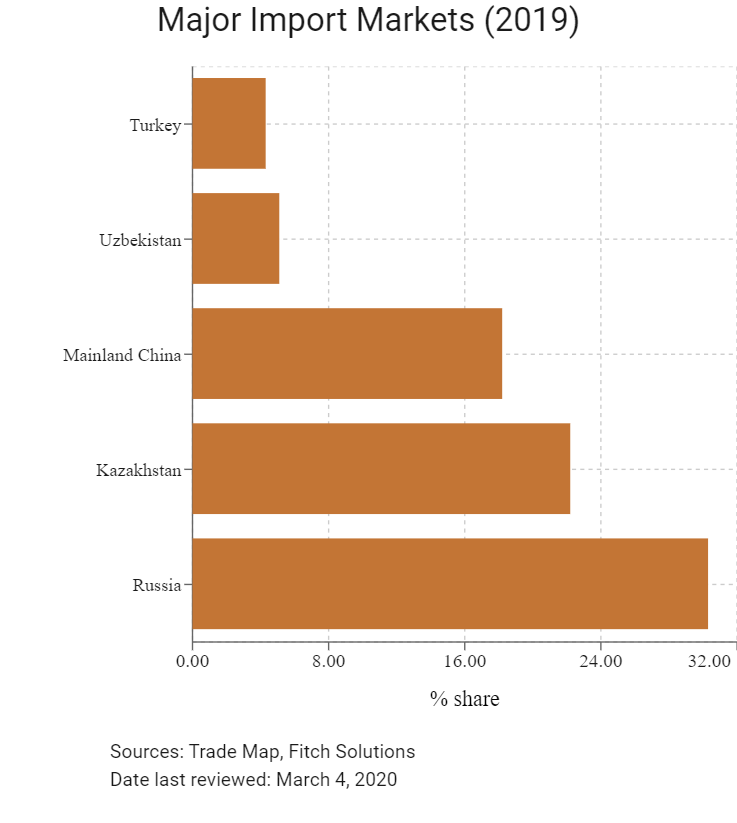

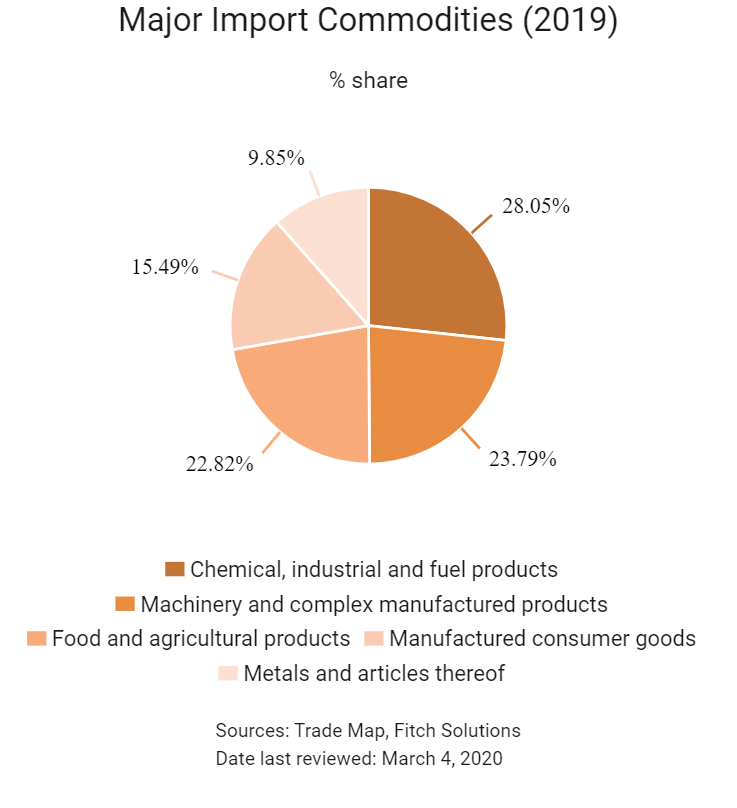

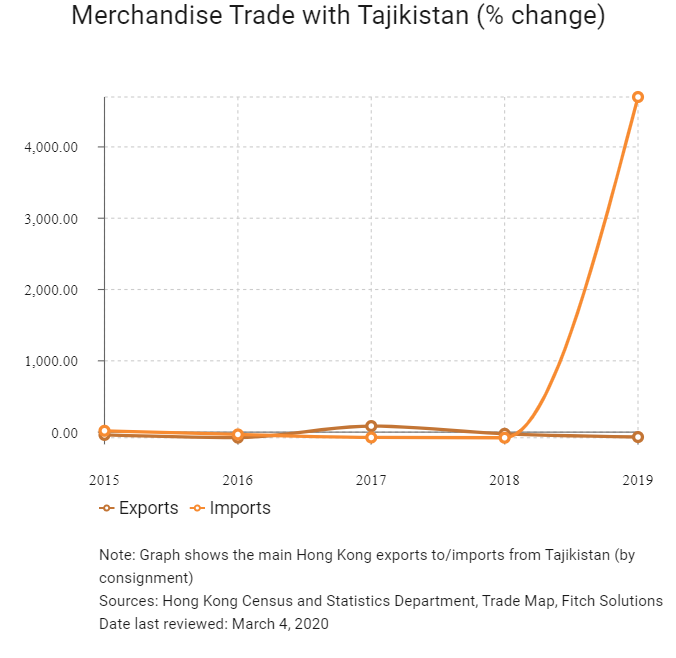

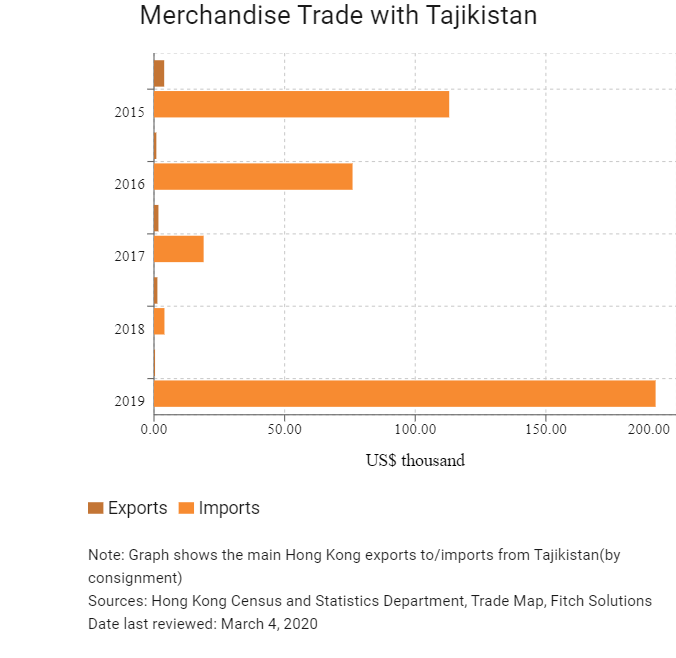

Merchandise Trade

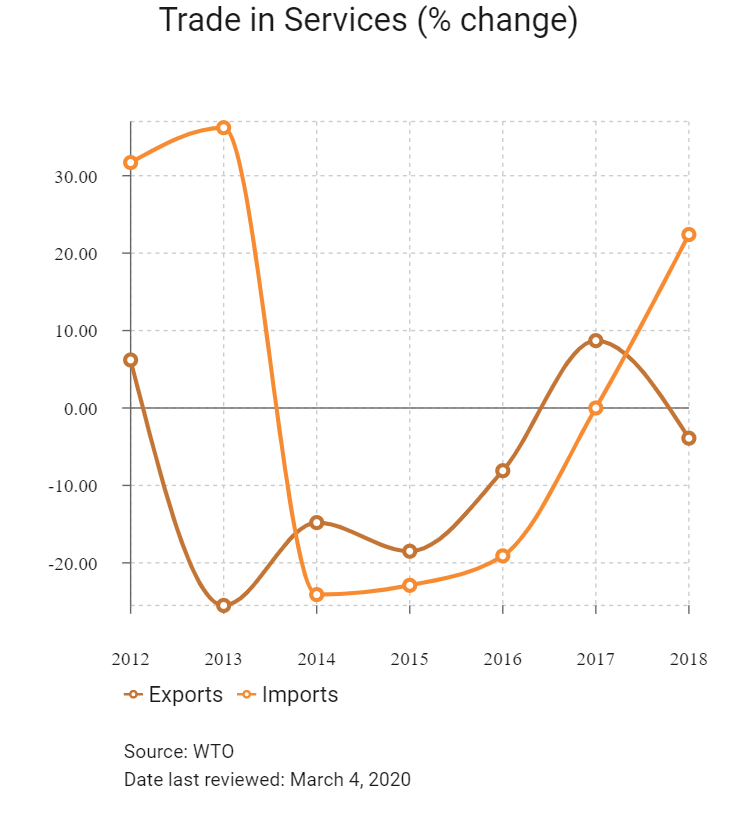

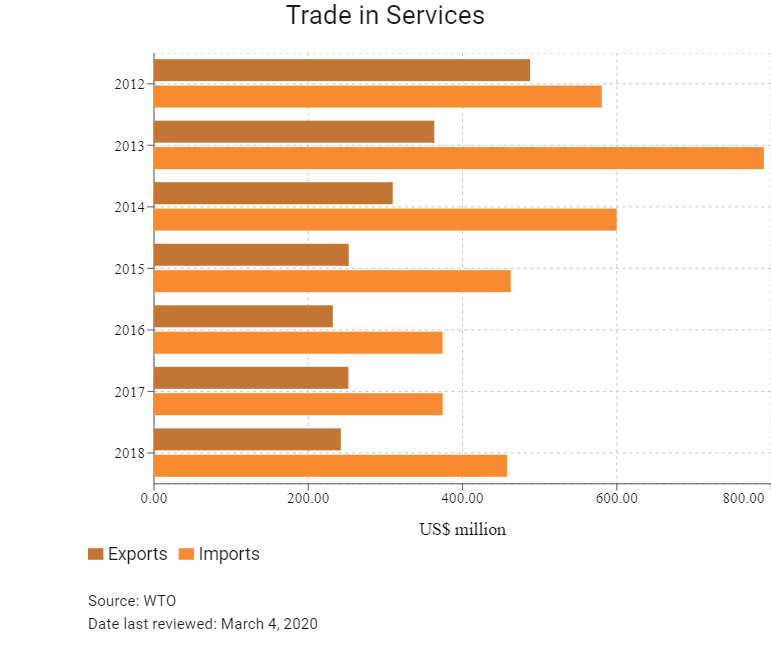

Trade in Services

- Tajikistan has been a member of the World Trade Organization (WTO) since March 2, 2013.

- Tariff rates range between 0 and 15%, with the overall trade-weighted import tariff averaging out to around 7.18%. The tax rate of 0% is granted to certain types of goods (such as for some types of printed publication, unwrought wool, gaseous hydrocarbons, and electricity). The country has kept an export promotion trade policy with little to no export duties.

- Tajikistan is signatory to several free trade agreements (FTAs), primarily among the following Commonwealth of Independent States (CIS) countries: Russia, Belarus, Kazakhstan, and Kyrgyzstan.

- The importation of alcohol and tobacco products in Tajikistan may be subject to quantitative restrictions and excessive requirements for health, safety and security.

Sources: WTO - Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- Armenia (effective March 1994): Tajikistan's main exports to Armenia in 2016 were other made-up textile articles, sets, worn clothing and worn textile articles and rags. Tajikistan's main imports from Armenia in 2016 were pharmaceutical products.

- Belarus (effective 1998): Belarus exports to Tajikistan include sugar, tractors, carpets and flooring, construction materials, medications, malt, refrigerators and freezers. Tajikistan exports to Belarus include cotton yarn, untreated cotton fibre, dried fruits and nuts.

- Kyrgyzstan (effective January 2006): Tajikistan mainly exports fruits, nuts and tobacco to Kyrgyzstan. Tajikistan's imports from Kyrgyzstan include coffee, tea, milk, preparations of cereals, spirts and vinegar.

- Russia (effective April 1993): In 2017, Russia's trade with Tajikistan totalled USD717.6 million, up 4.31% compared to 2016.

- Ukraine (effective July 2002): The main imported goods from Ukraine to Tajikistan are foodstuff, canned goods, sugar, confectionery, pharmaceuticals, cement, bauxite, coal, coke, pitch, oil, synthetic corundum, aluminium oxide, aluminium hydroxide, motors and generators, turbines, paper, building materials, metal products, home appliances, agricultural equipment, tractors, machinery, products used in the electrical, railway cars, furniture and accessories. The main exported goods from Tajikistan to Ukraine are raw cotton and food products, including fruit and vegetables, and dried fruit.

- Uzbekistan (effective January 1996): Uzbekistan's exports to Tajikistan are mainly transportation services, mineral fertilisers and food products. The list of exported Tajikistani goods includes cables, carpet products, building materials and coal. With a growing range of products traded, it is hoped that bilateral trade will reach USD500 million by 2020.

- Commonwealth of Independent States Free Trade Area (FTA; effective September 2012): This is an FTA between Russia, Ukraine, Belarus, Uzbekistan, Moldova, Armenia, Kyrgyzstan and Kazakhstan. The agreement was designed to reduce all trade fees on a number of goods between participating countries.

- Economic Cooperation Organization Trade Agreement (effective 2008): This trade agreement consists of a free trade region formed between Afghanistan, Azerbaijan, Iran, Kazakhstan, Kyrgyzstan, Pakistan, Tajikistan, Turkey, Turkmenistan and Uzbekistan. Intra-regional trade accounts for around 7.64% of the total trade among member states.

Under Negotiation

- Pakistan-Tajikistan Preferential Trade Agreement: Pakistan's major exports to Tajikistan include sugar, dairy products, medical and pharmaceutical products, and construction material including cement. Raw cotton, chemical materials and products, and glass and glassware are imported from Tajikistan.

- Eurasian Economic Union: Consists of Russia, Kazakhstan, Belarus, Krygyzstan and Armenia. No customs are levied on goods travelling within the customs union and members of the customs union impose a common external tariff on all goods entering the union. In a step towards joining this union, Tajikistan has applied a zero rate in import duty for goods originating from member states.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

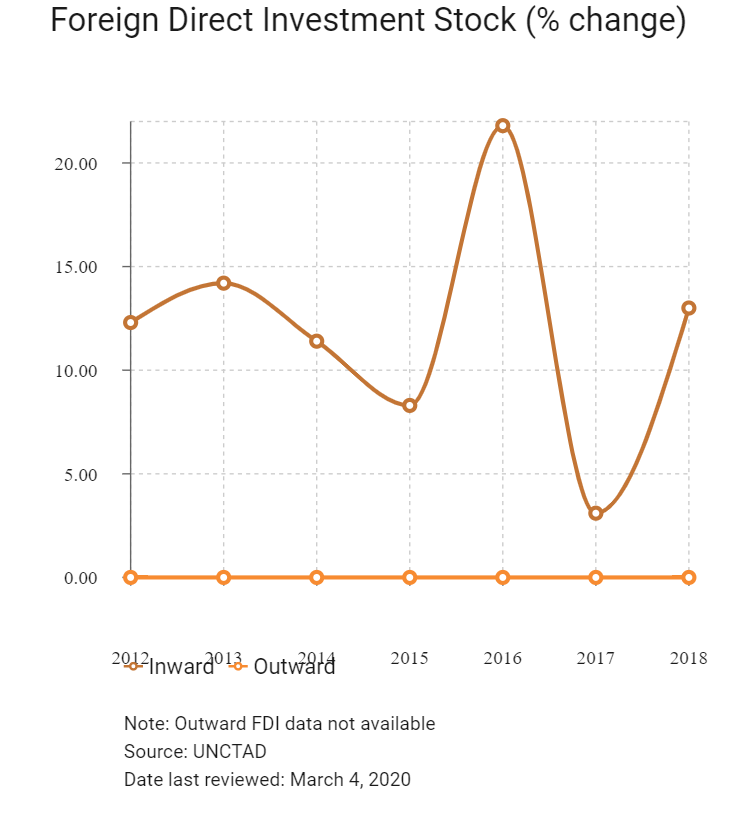

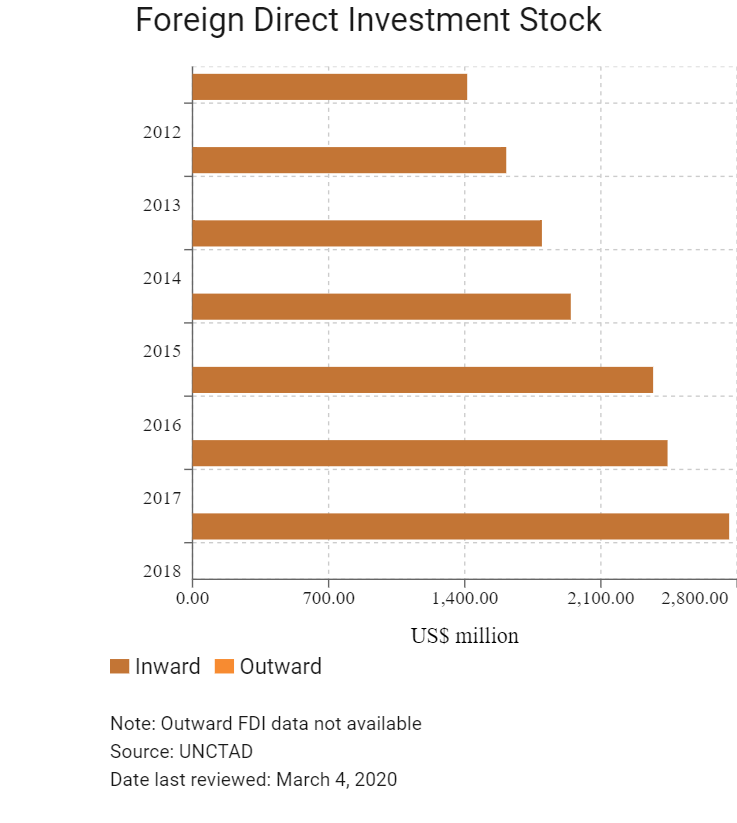

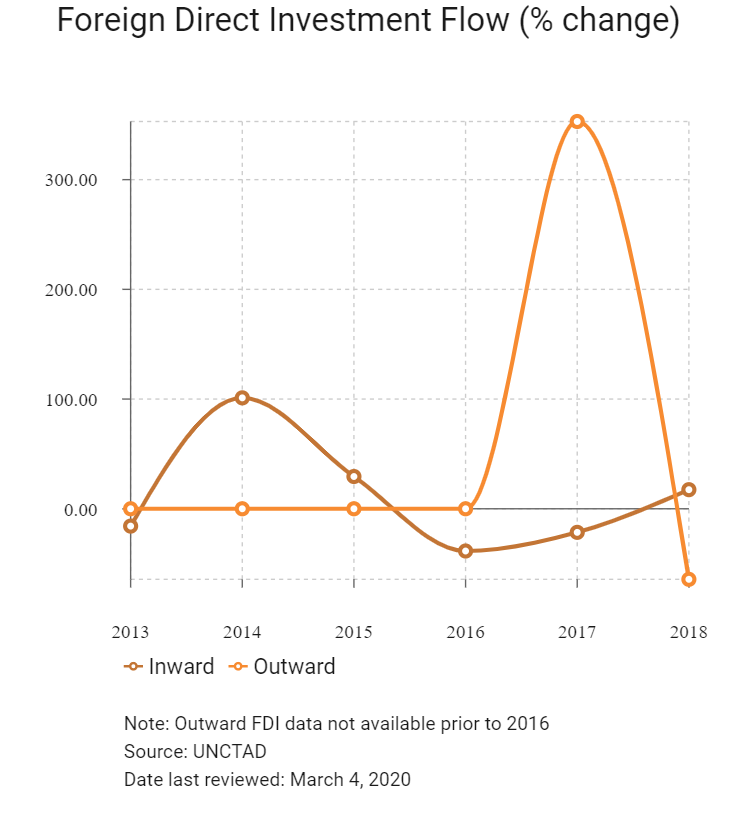

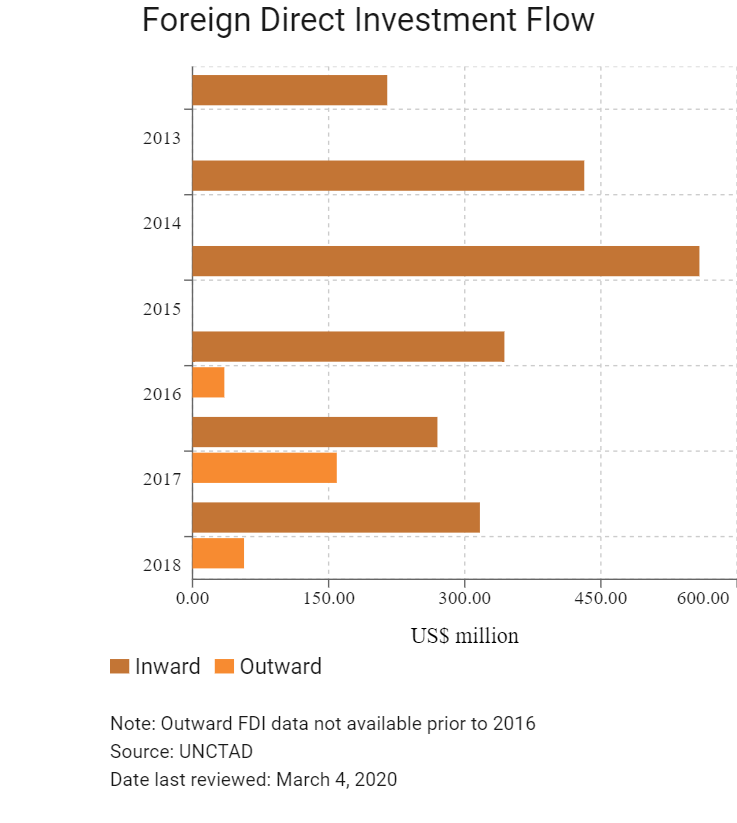

Foreign Direct Investment

Foreign Direct Investment Policy

- The Tajikistani government continues to publicly advocate for increased foreign investment, particularly in energy and transport infrastructure. All sectors of Tajikistan’s economy are open to foreign participation with the exception of aviation, defence, security, and law enforcement, which require special government permission for the operation of such types of businesses or services.

- Among the key foreign investors are Nelson Gold Corporation (mining of gold and silver), Gulf International Minerals (mining of gold fields), Kabool Textiles and Adjind International (textile industry).

- Tajikistan’s legislation allows for 100% foreign ownership of local companies, but the government can legally expropriate property under the terms of Tajikistan's Law on Investments, Law on Privatisation, Law on Joint Stock Companies and Criminal Code.

- The State Committee on Investments and State Property Management of the Republic of Tajikistan chiefly facilitates FDI in the country.

- Tajikistan’s Investment Law (Article 4) guarantees equal rights for both local and foreign investors. According to this law, foreigners can invest by jointly owning shares in existing companies with other Tajikistani companies or Tajikistani citizens, by creating fully foreign-owned companies, or by concluding agreements with legal entities or citizens of Tajikistan that provide for other forms of foreign investment activity.

- Tajikistani law allows foreign firms to acquire assets, including shares and other securities, as well as land and mineral usage rights. Foreign firms may also exercise all property rights to which they are entitled, either independently or shared with other Tajikistani companies and citizens of Tajikistan.

- The State Investments and Property Management Committee is responsible for filing and coordinating foreign investment project proposals as they pass through the review pipeline.

- Tajikistan has a history of expropriating land based on the grounds that the properties involved were illegally privatised following Tajikistan's independence.

Sources: WTO - Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free Economic Zones (FEZs): Sughd, Pyanj, Ishkoshim and Dangara |

In these zones, investors benefit from: |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 13-23%

Source: Tax Committee under the Government of the Republic of Tajikistan

Important Updates to Taxation Information

- The Tajik tax system is still relatively new and many tax concepts and issues that are standard in most market economies are just emerging. The process of paying taxes is complex, resulting in high administrative costs for businesses, except for goods producing industries such as manufacturing as they benefit from low corporate income tax (CIT).

- The import of technology, equipment and materials to meet the needs of the fish farming sector and (or) the import of goods by the companies operating in the field of fish farming directly for its own needs is exempt from value added tax (VAT).

- Companies operating in the field of fish farming are exempt from CIT; VAT, except for VAT on goods imported for further domestic sale; and road and property tax for a period of six years.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

- 23% on operating profits |

|

Capital Gain Tax |

Part of business income (gains derived by investors and issuers from trade at a stock exchange are exempted for five years from the beginning of participating on the stock market) |

|

Withholding Tax |

-Royalties: 15% |

|

Branch Remittance Tax |

15% on net earnings |

|

VAT (standard) |

18% on the value of the products |

|

Social Tax |

Social tax is withheld by the employer at the rate of 1% of the employment income, 25% contribution on gross salaries by employer. |

Source: Tax Committee under the Government of the Republic of Tajikistan

Date last reviewed: March 4, 2020

Localisation Requirements

The employment of foreign nationals is not discouraged, but there are few jobs available. According to the Tajikistani Law on Audits, local companies require at least 70% of all employees to be Tajikistani. If the CEO of the company is foreign, then the percentage of staff who should be Tajikistani is raised to at least 75%.

Foreign Worker Permits

Work visas for foreigners are issued in Tajikistan for a duration of no more than three months. Work visas can be extended on the basis of a work permit, provided by the Migratory Service of the Ministry of Internal Affairs of the Republic of Tajikistan. Companies attempting to employ foreign citizens must apply for a corporate work licence in order to receive permission to hire foreign employees. A letter must be submitted to the immigration authority outlining the staff list of the company. A corporate work licence is issued, subject to application and the demands of the local labour market. A corporate work licence is usually issued for up to one year, but can be extended on an annual basis. Work permits for foreign nationals must be obtained by a company on the individual's behalf and last for up to one year, with the possibility of an extension. Dependents may accompany a main traveller by obtaining a visa on the basis of the main applicant's application.

Visa/Travel Restrictions

For most foreign nationals, visas must be obtained in their respective home country, prior to entering the Republic of Tajikistan. To receive a visa upon arrival, a registered letter from the Tajik Ministry of Foreign Affairs confirming the applicant's request for a visa is required. A visa upon arrival will be issued for 45 days only at the Immigration Office at the International Airport in Dushanbe. Tajikistan has a visa-free regime with 19 countries, including several of its neighbours and Russia, Mainland China, India, Iran and North Korea.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B3 (Negative) |

10/12/2018 |

|

Standard & Poor's |

B- (Stable) |

28/08/2017 |

|

Fitch Ratings |

Not Rated |

Not Rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

123/190 |

126/190 |

106/190 |

|

Ease of Paying Taxes Index |

132/190 |

136/190 |

139/190 |

|

Logistics Performance Index |

134/160 |

N/A |

N/A |

|

Corruption Perception Index |

152/180 |

153/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

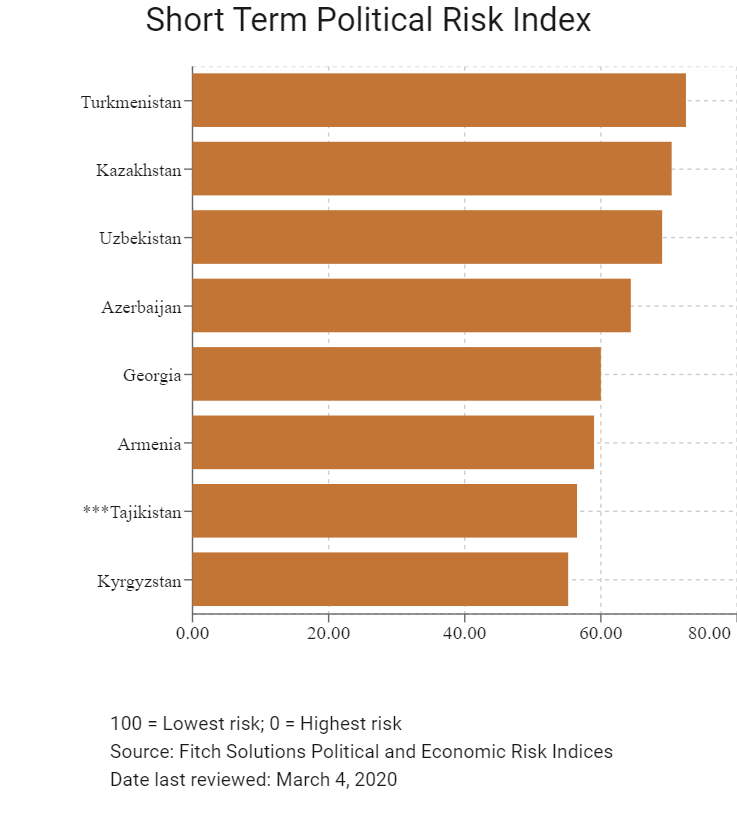

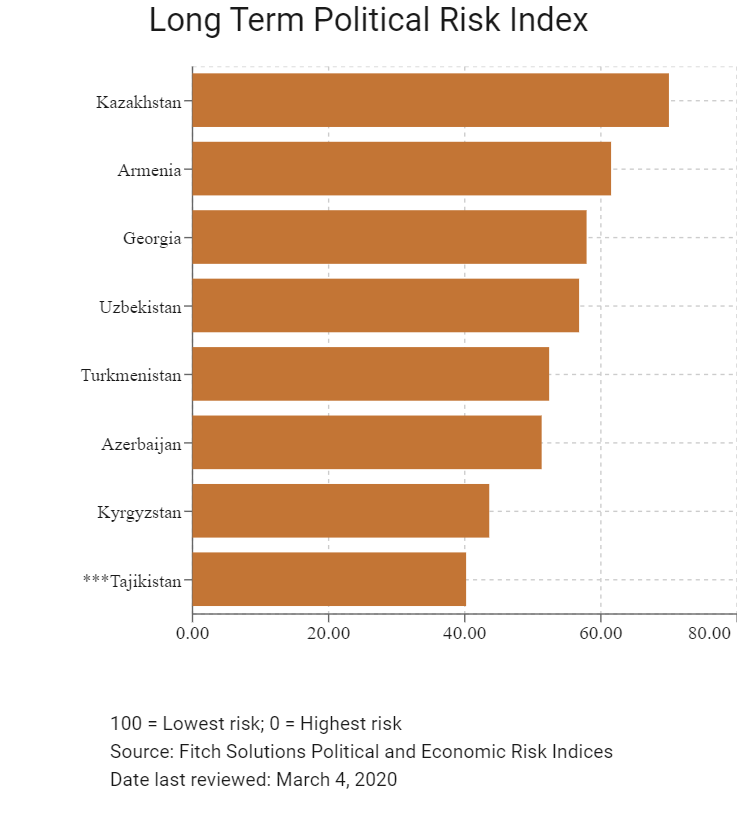

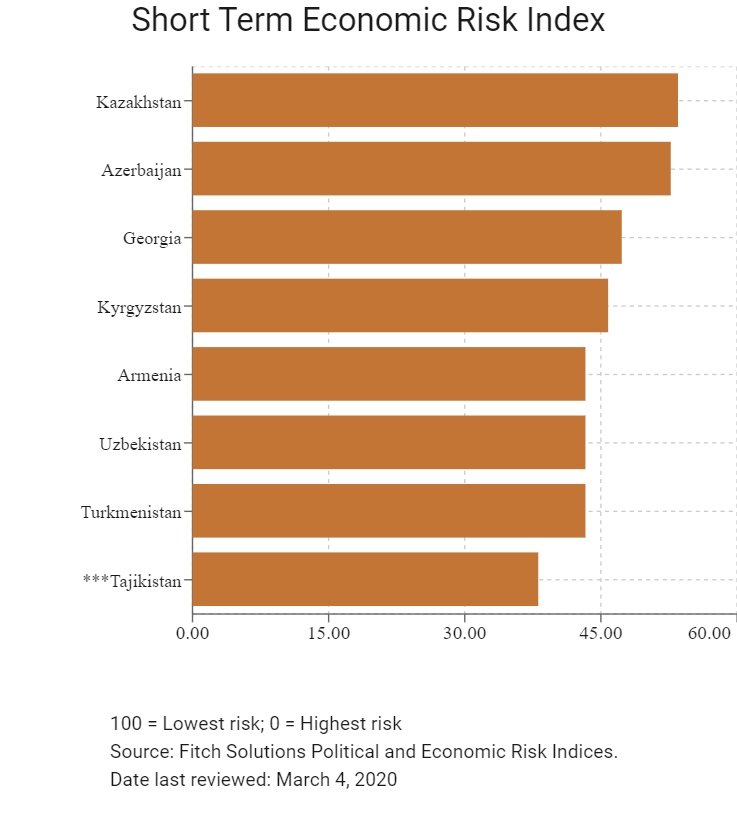

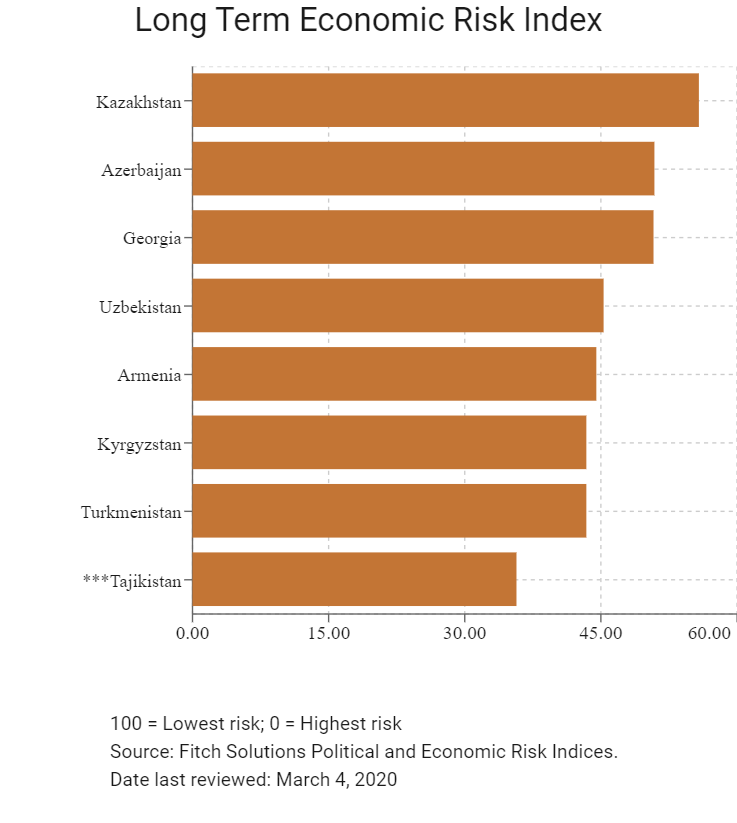

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

188/202 |

184/201 |

188/201 |

|

Short-Term Economic Risk Score |

40.2 |

42.3 |

38.1 |

|

Long-Term Economic Risk Score |

36.3 |

36.0 |

35.7 |

|

Political Risk Index Rank |

189/202 |

184/201 |

183/201 |

|

Short-Term Political Risk Score |

49 |

49.0 |

56.5 |

|

Long-Term Political Risk Score |

36.2 |

40.2 |

40.2 |

|

Operational Risk Index Rank |

126/201 |

124/201 |

124/201 |

|

Operational Risk Score |

43 |

43.7 |

44.6 |

Source: Fitch Solutions

Date last reviewed: March 4, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Tajikistan is one of the risk-exposed countries in the Central Asian region, as it remains excessively dependent on remittances from Russia. Tajikistan's economic success hinges on an agreement with the International Monetary Fund and the construction of the Rogun dam, which is projected to be completed in 2032. The government issued USD500 million of 10-year Eurobonds to finance the construction. If completed in time, the dam will produce enough electricity to meet Tajikistan's needs and to be sold to neighbouring countries. This would be a boost to the economy, which suffers from recurrent power outages. However, failure to complete the project risks complicating the process of restructuring its debt.

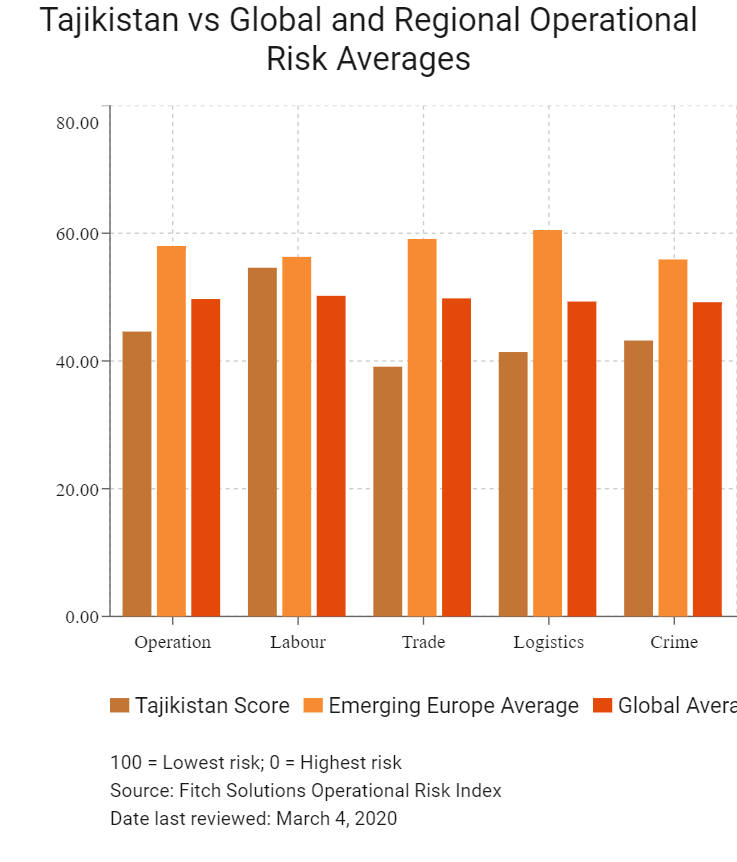

OPERATIONAL RISK

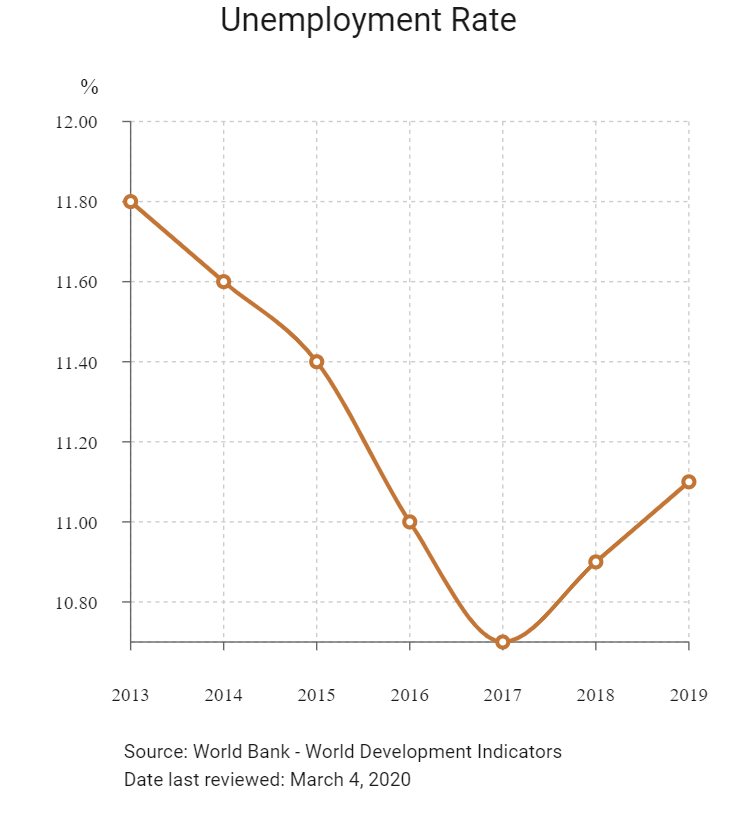

Businesses evaluating opportunities in Tajikistan will face a poor operating environment. The country's weakest points are its logistical profile and security environment, as ageing utilities and transport infrastructure mean power outages and road accidents are commonplace. The country's trade and investment, and labour environments do not perform much better, with factors such as a heavy economic reliance on remittances from Russia, high public debt and significant levels of bureaucratic red tape making it difficult to do business. Education levels are also poor in Tajikistan, with most workers in the formal economy being employed within the agricultural sector.

Date last reviewed: March 4, 2020

Fitch Solutions Political and Economic Risk Indicies

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Tajikistan Score |

44.6 |

54.6 |

39.1 |

41.4 |

43.2 |

|

Caucasus and Central Asia Average |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Caucasus and Central Asia Position (out of 8) |

7 |

6 |

8 |

7 |

5 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

30 |

21 |

31 |

30 |

25 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

124 |

71 |

139 |

120 |

120 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Georgia |

62.3 |

63.5 |

71.4 |

56.1 |

58.3 |

|

Azerbaijan |

61.2 |

62.5 |

62.5 |

66.4 |

53.2 |

|

Kazakhstan |

60.2 |

73.5 |

58.9 |

57.0 |

51.5 |

|

Armenia |

56.8 |

60.5 |

58.6 |

53.9 |

54.2 |

|

Kyrgyzstan |

44.9 |

54.1 |

44.6 |

43.1 |

37.7 |

|

Uzbekistan |

44.7 |

54.8 |

53.1 |

39.2 |

31.7 |

|

Tajikistan |

44.6 |

54.6 |

39.1 |

41.4 |

43.2 |

|

Turkmenistan |

39.6 |

42.4 |

39.3 |

47.3 |

29.4 |

|

Regional Averages |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 4, 2020

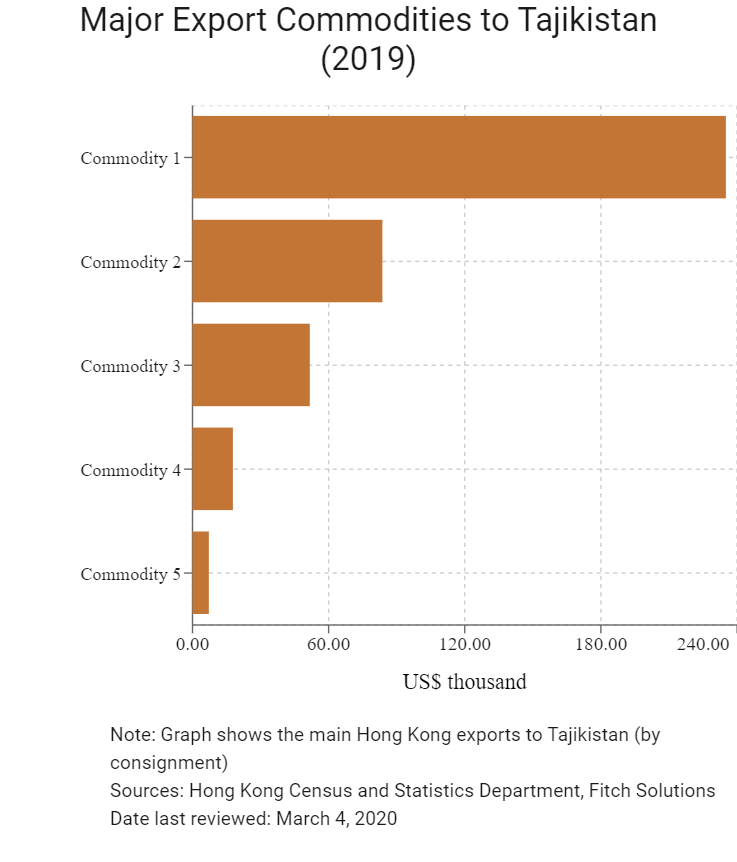

Hong Kong’s Trade with Tajikistan

|

Export Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Professional, scientific and controlling instruments and apparatus |

235.1 |

|

Commodity 2 |

Telecommunications and sound recording and reproducing apparatus and equipment |

83.7 |

|

Commodity 3 |

Office machines and automatic data processing machines |

51.7 |

|

Commodity 4 |

Electrical machinery, apparatus and appliances and electrical parts thereof |

17.8 |

|

Commodity 5 |

Chemical material and products, N.E.S. |

7.2 |

|

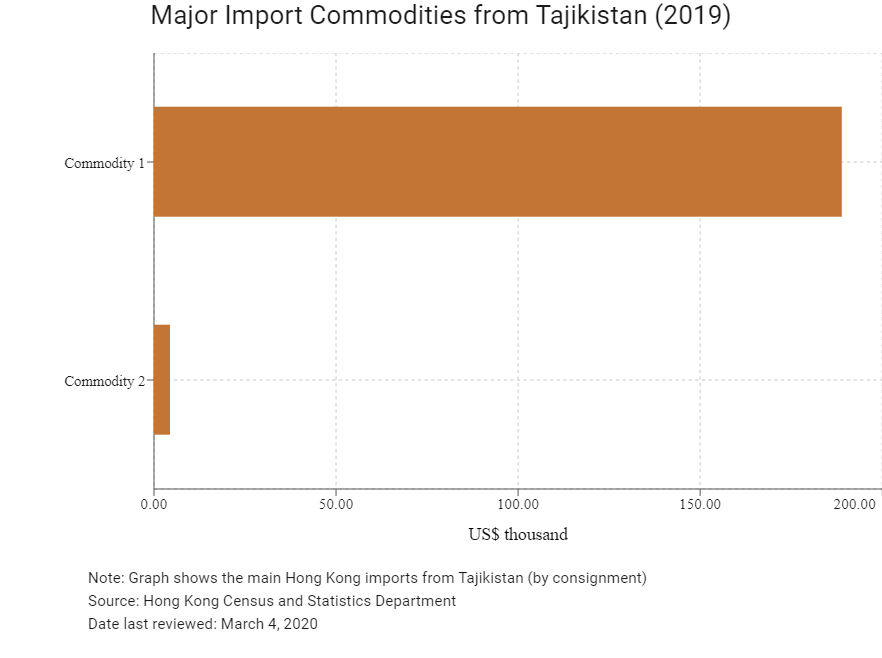

Import Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

188.9 |

|

Commodity 2 |

Crude animal and vegatable materials |

4.4 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

| 2019 | Growth rate (%) | |

| Number of Tajik residents visiting Hong Kong | 47 | -21.7 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of emerging Europe citizens residing in Hong Kong |

114 |

29.5 |

Sources: United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years

Date last reviewed: March 4, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Tajik companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Treaties and Agreements between Hong Kong/PRC and Tajikistan

A bilateral investment treaty with Mainland China entered into force in January 1994.

Visa Requirements for Hong Kong Residents

HKSAR passport holders need to apply online for an electronic visa for stays with a duration of up to 45 days. Applicants need to fill in their personal information, upload a copy of their passport and pay a fee of USD50 by credit card via the website. Once this is done, applicants receive an electronic visa by email within two days.

Source: e-Visa Tajikistan

Date last reviewed: March 4, 2020

7291 Views

7291 Views

Tajikistan

Tajikistan