Hong Kong

China, the world’s second largest economy, enjoys vibrant trade and economic ties with international communities. Although the world economy is affected by uncertainty due to the recent trade conflict between China and the US, many mainland Chinese enterprises are still pursuing their “going out” and “bringing in” strategies with the aim of opening new markets and diversifying their market risks. They are also looking to improve their sustainable development capability by bringing in outside partners and optimising their business portfolios.

Against this backdrop, mainland enterprises increasingly need professional services that are in line with international practices to support their growing international business, while helping them adapt to the increasingly complicated investment environment. Shanghai and the coastal provinces in the Yangtze River Delta (YRD) are among the centres for economic cooperation with foreign countries, as well as major sources of outflows of foreign direct investment (FDI) in China. Enterprises in these areas are actively seeking professional services to help them improve their “going out” strategies.

To assess the latest developments, HKTDC Research conducted a new round of questionnaire survey with mainland enterprises in the YRD in the first quarter of 2019, with the support of the Shanghai Municipal Commission of Commerce. Despite the on-going China-US trade dispute, 72% of the mainland enterprises surveyed said they would consider exploring business opportunities in overseas countries in the next one to three years, including the advanced economies as well as those along the Belt and Road Initiative (BRI) routes. Of these, 45% indicated that Hong Kong was their preferred choice when seeking professional services outside the mainland. Among those mainland enterprises with clear overseas destinations in mind, more than half said Hong Kong was their preferred service platform for “going out”.

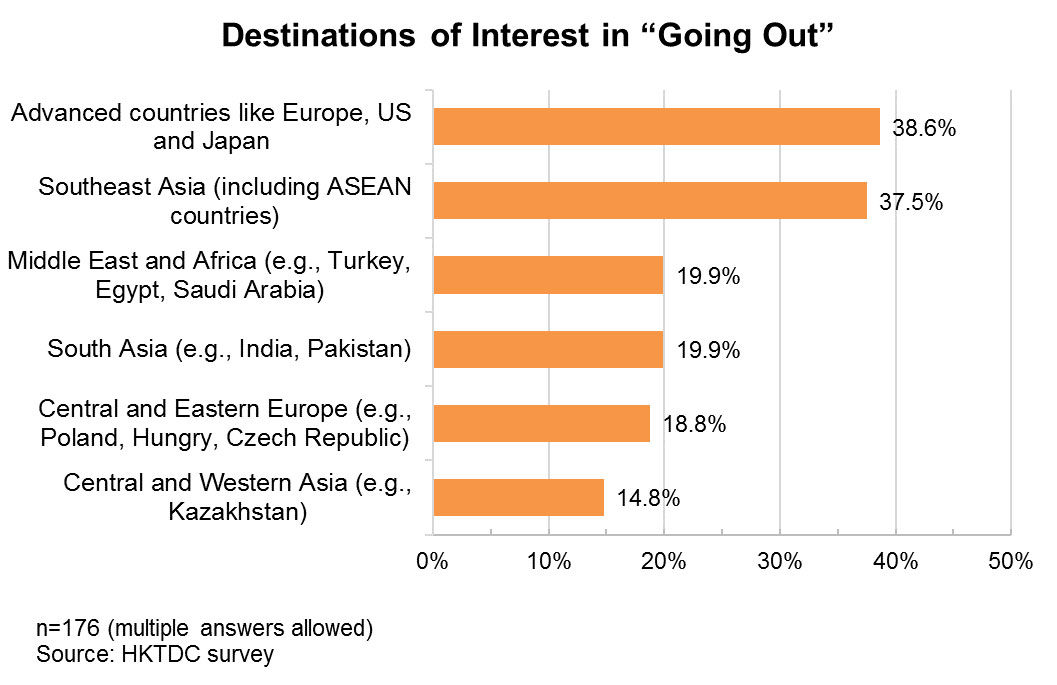

Overseas destinations that respondents showed the greatest interest in exploring included advanced economies such as Europe, the US and Japan (39%) and BRI regions like Southeast Asia (38%). 71% said they were interested in selling more products to overseas markets, 38% were looking to source goods abroad, while 26% were looking to invest in and set up factories.

Hong Kong service suppliers have been providing a wide range of professional services to mainland enterprises and helping them conduct trade and investment activities in Hong Kong and overseas markets for many years. Their services make Hong Kong the preferred platform for mainland enterprises to manage their “going out” businesses. Further efforts by mainland/YRD enterprises to capture overseas business opportunities are therefore bound to generate more business for Hong Kong.

“Going Out” to Expand Business Overseas

Mainland enterprises are increasingly involved in economic activities overseas. China’s foreign trade volume stood at US$4.6 trillion in 2018, higher than any other country [1]. Total trade with BRI countries amounted to US$1.3 trillion, up 16.3% from the year before, and accounted for 27.4% of China’s total foreign trade last year. On the other hand, China was ranked as the second-largest source of FDI outflows only after Japan last year [2]. Chinese figures showed that outflows of FDI in non-financial sectors by mainland investors totalled US$120.5 billion in 2018 (up 0.3% year-on-year), and encompassed 5,735 companies in 161 different countries and regions [3]. FDI outflows to BRI countries in particular saw sustained growth. Direct investments in non-financial sectors by Chinese enterprises in 56 BRI countries reached US$15.64 billion, up 8.9% year-on-year and comprised 13% of China’s total non-financial FDI outflows last year. Most of this was in countries like Singapore, Laos, Vietnam, Indonesia, Pakistan, Malaysia, Russia, Cambodia, Thailand and the United Arab Emirates. [4]

Despite the uncertain world economic outlook, China is still promoting its “going out” and BRI development strategies and encouraging enterprises to go overseas to capture business opportunities. “Going out” has become an important driving force for the development of mainland enterprises. As Hong Kong has always been the preferred service platform for these enterprises, further “going out” and the development of BRI is expected to spur demand for various types of professional services from mainland enterprises.

HKTDC Research conducted a questionnaire survey with mainland enterprises in Shanghai and Jiangsu, visiting some of these enterprises and holding business forums with the support of the Shanghai Municipal Commission of Commerce in the first quarter of 2019 to find out more about the challenges facing businesses in the region. The survey also considered how these enterprises were adjusting their business strategies, their intention of “going out” to mature markets in advanced countries or BRI countries, and their demand for relevant professional services.

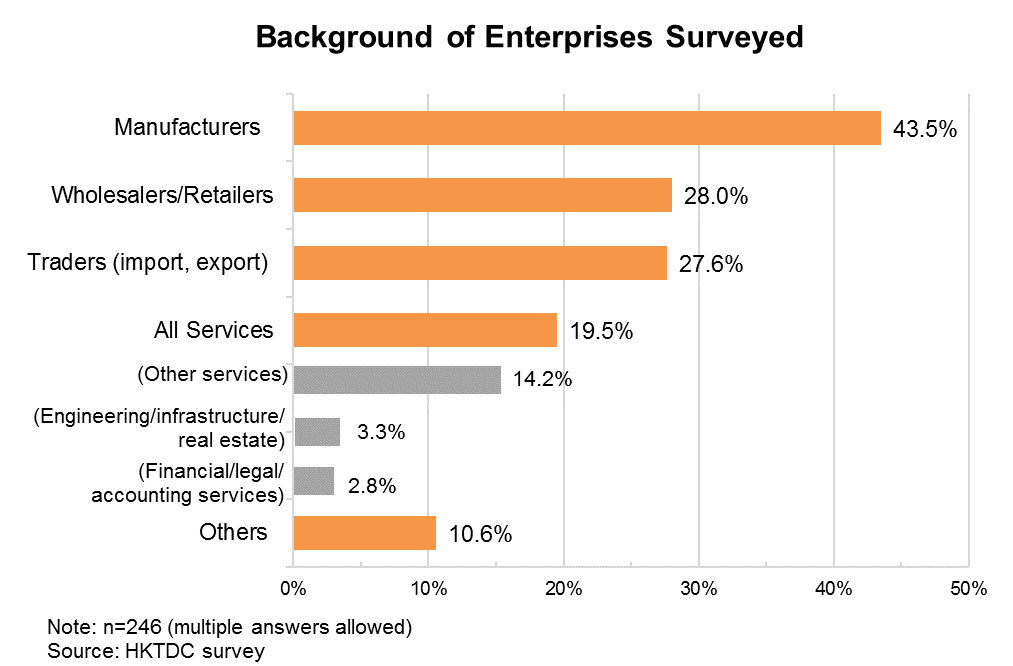

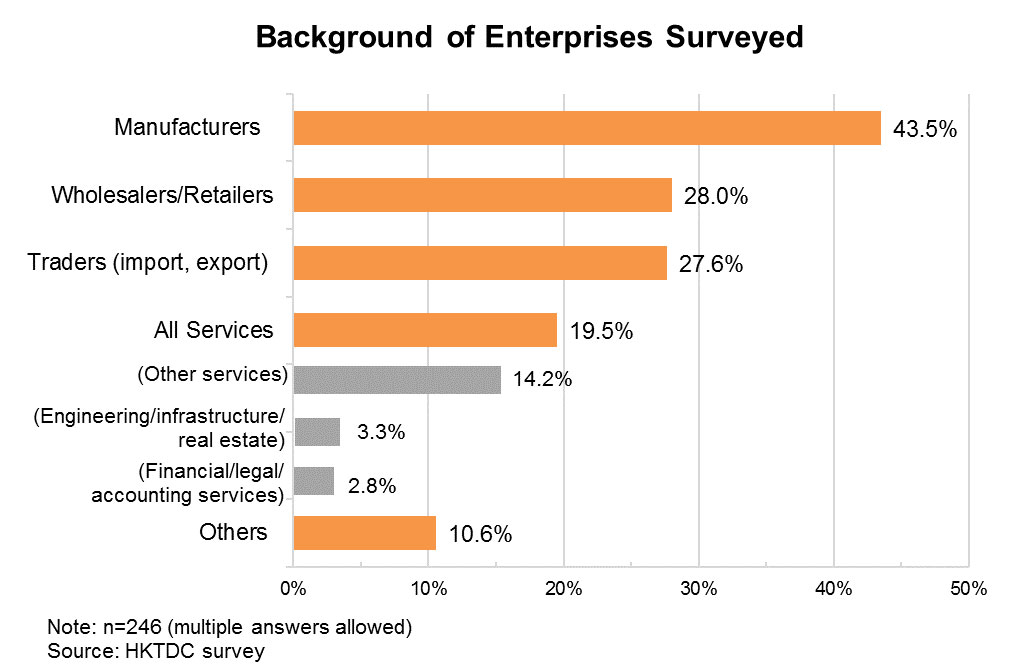

This survey was similar to the one conducted by HKTDC Research in 2016-2017. This time a total of 310 questionnaires were collected. Of these, 246 valid questionnaires were completed by mainland enterprises, including manufacturers, traders and service suppliers. What follows is a summary of the views expressed by these 246 mainland enterprises on “going out” to develop business overseas.

Major Challenges: Inadequate Orders and Rising Costs

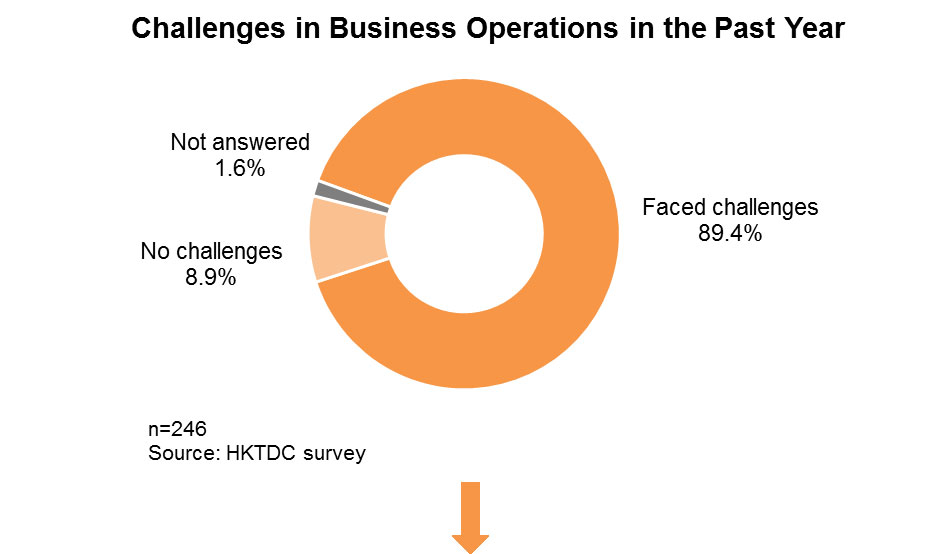

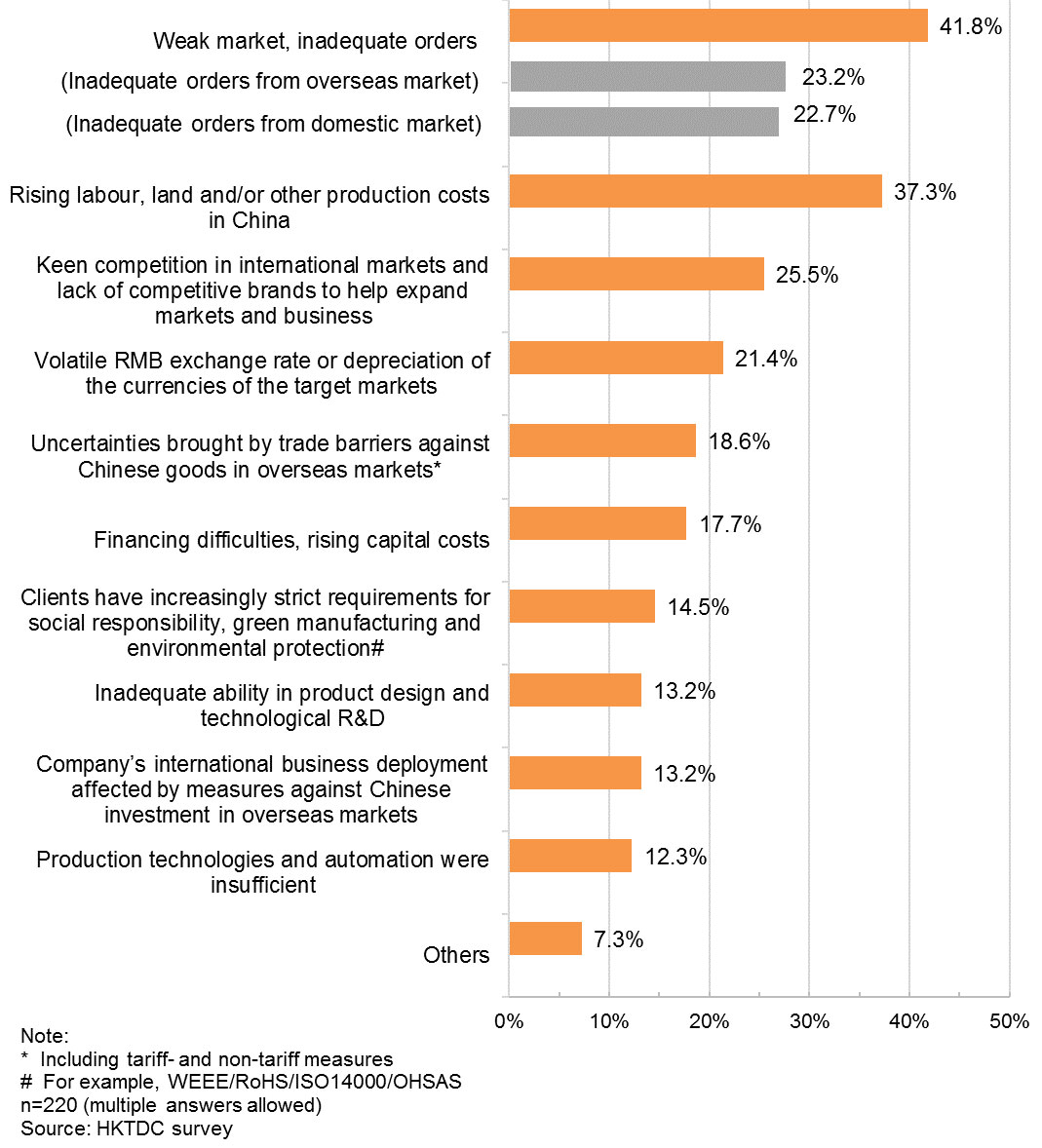

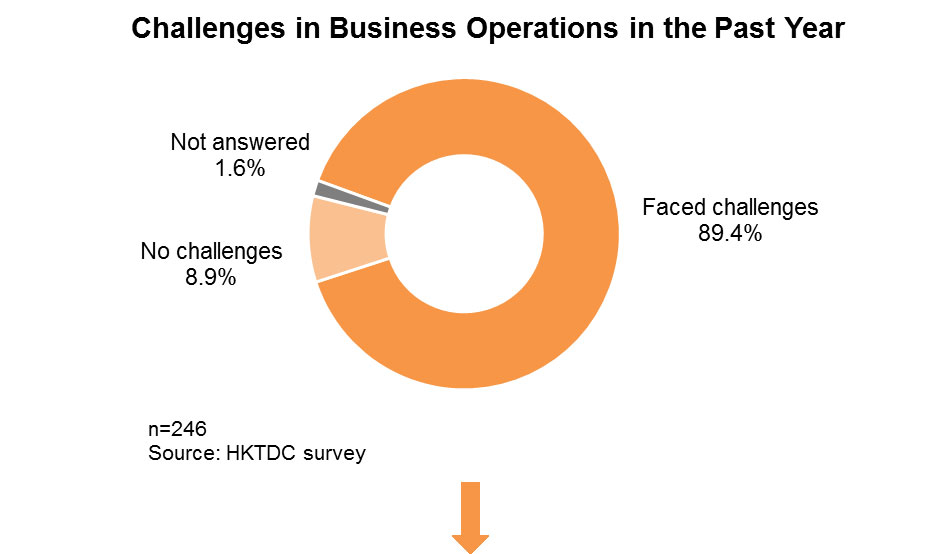

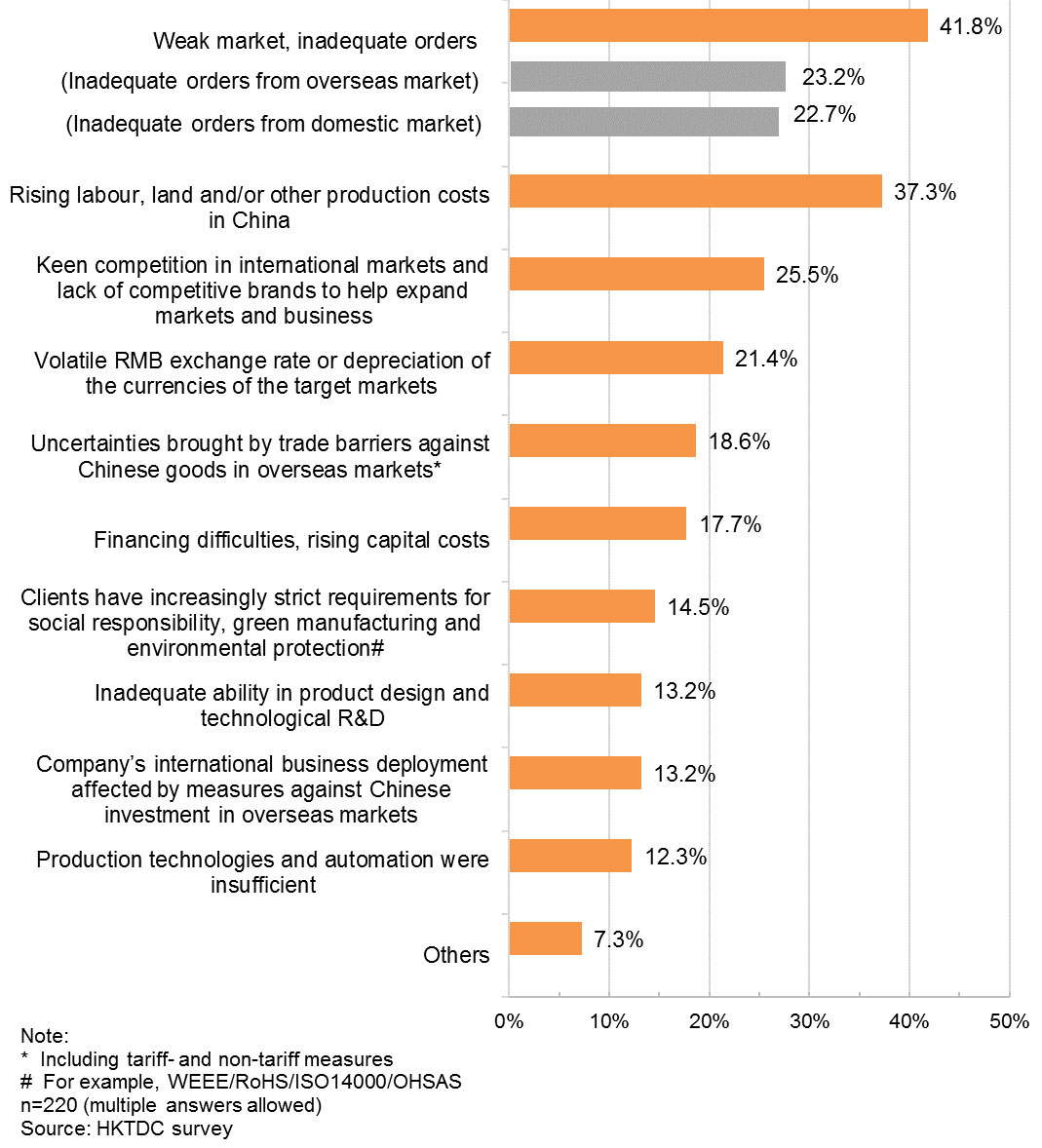

89% of the respondents said their business operations faced a variety of challenges over the past year. 42% said their foremost concerns were weak overseas and local markets and inadequate orders, while 37% said they were affected by rising labour, land and/or other production costs on the mainland. Other challenges included keen competition in international markets/lack of competitive brands (25%), a volatile RMB exchange rate (21%) and uncertainties caused by trade barriers against Chinese goods in overseas markets (19%).

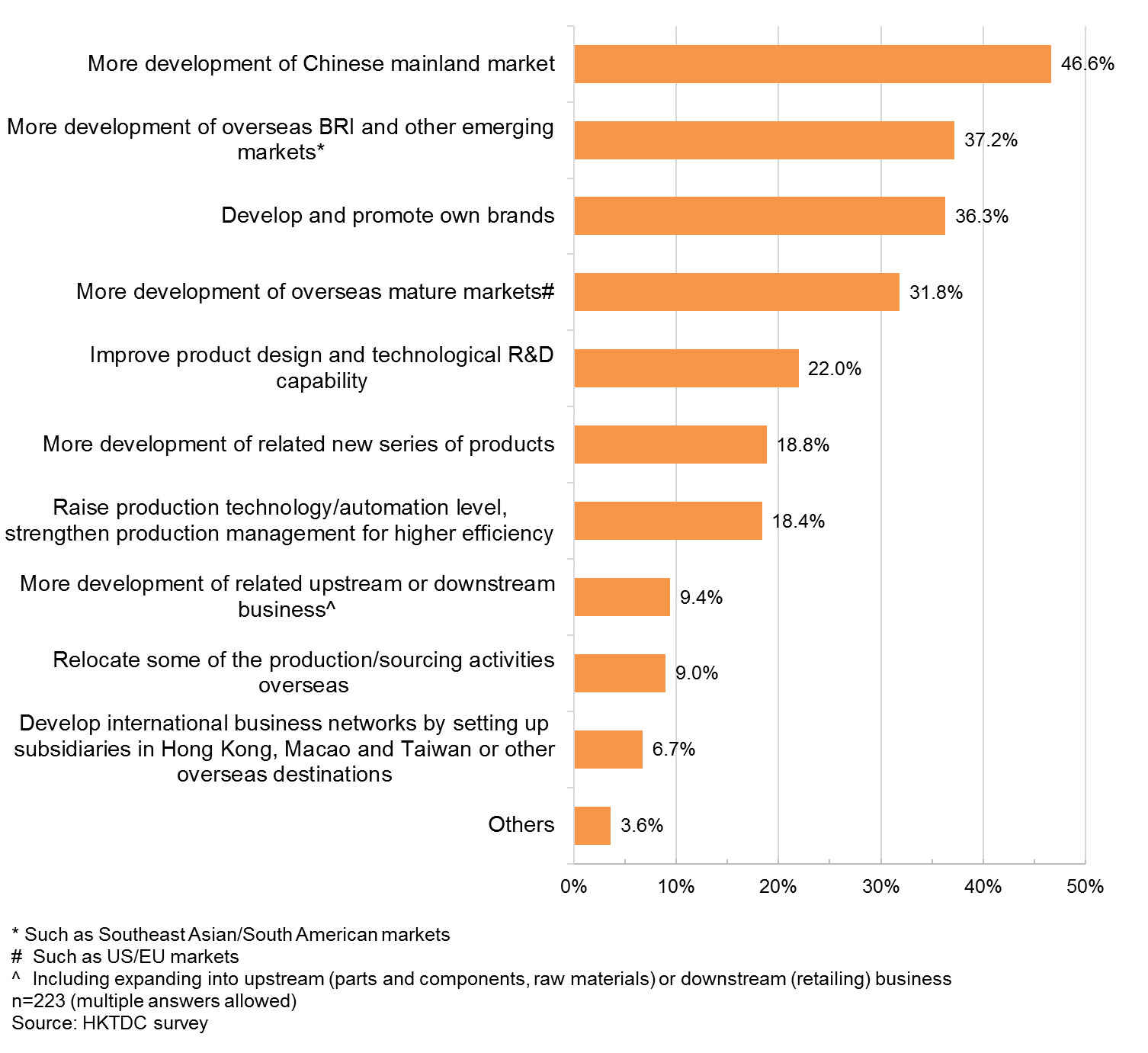

Stepping up Business Development in mainland China and BRI Markets

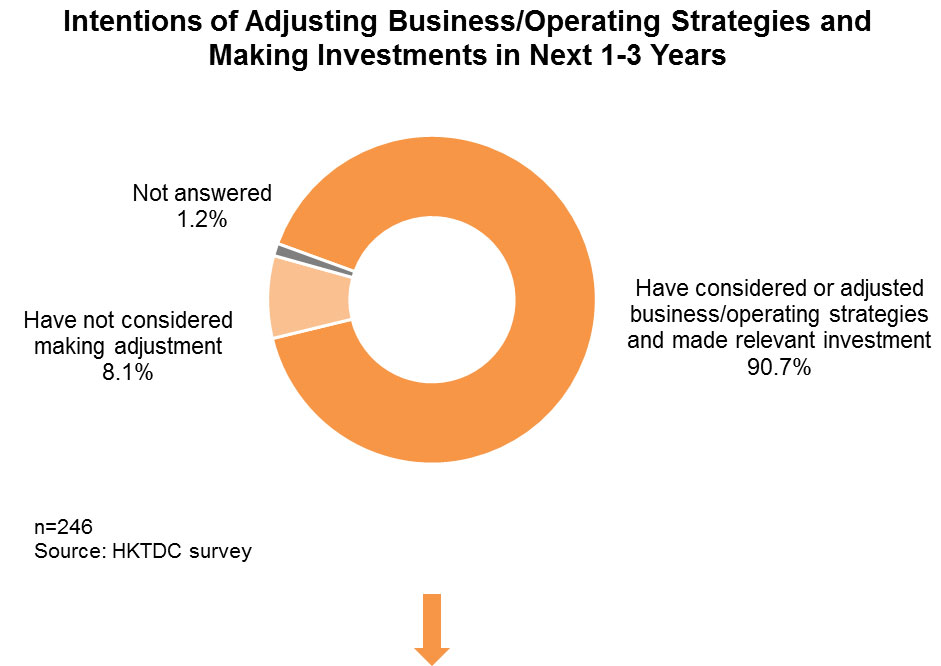

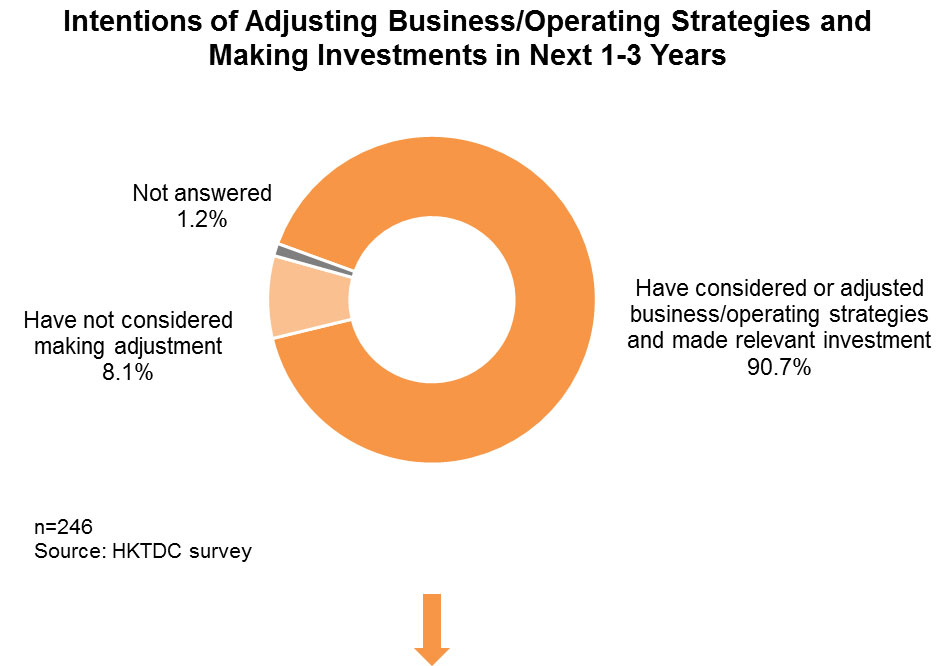

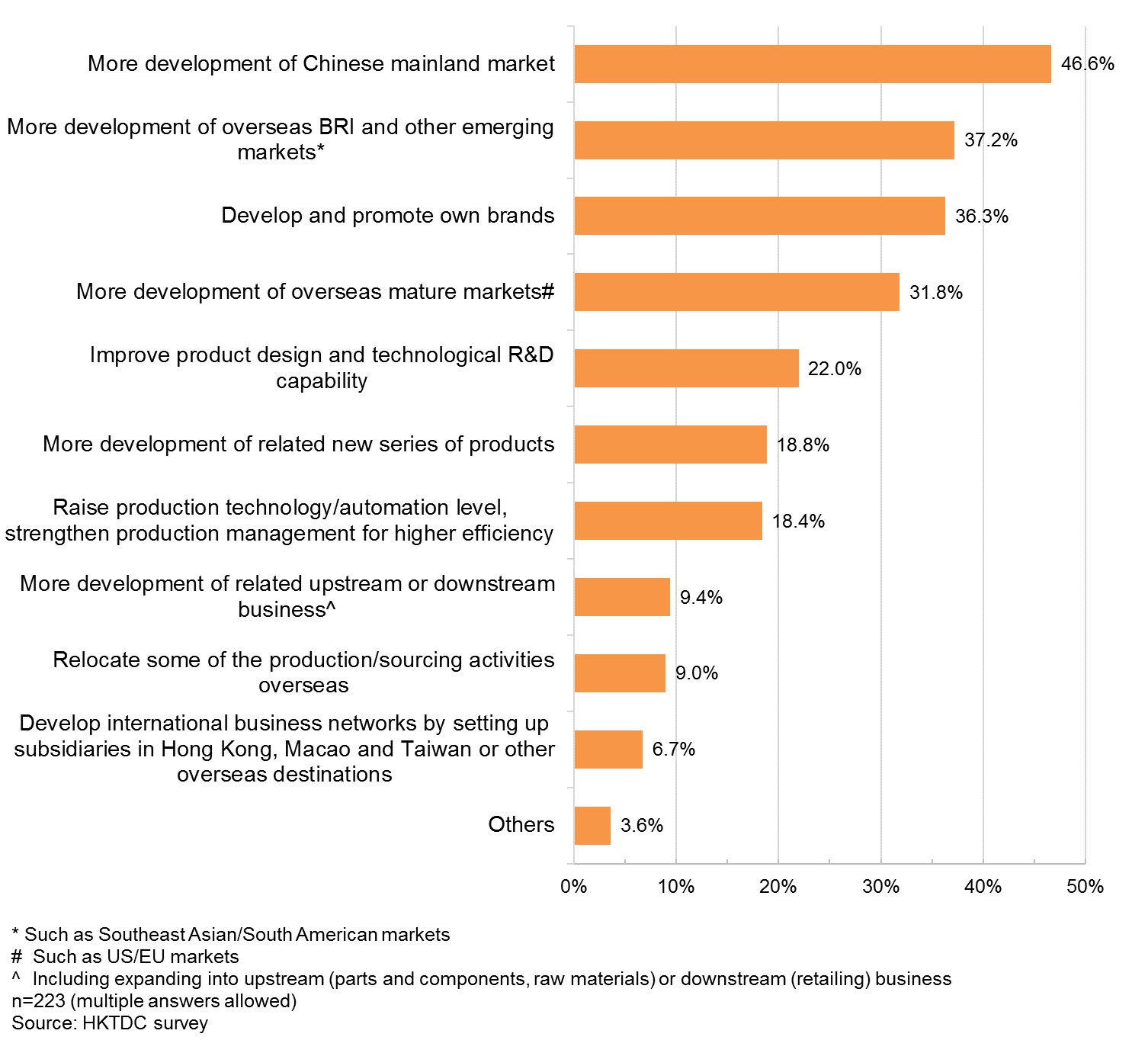

To tackle these challenges, 91% of the enterprises polled indicated they would consider adjusting their business/operating strategies and making relevant investments in the next one to three years, or had already done so. Among these, 47% indicated that their preferred option was to develop the mainland market, 37% said they would like to develop more BRI and other emerging markets (such as Southeast Asian and South American markets), and 36% said they would develop/promote their own brands. Meanwhile, 32% said they would focus on overseas mature markets, such as the US and the EU.

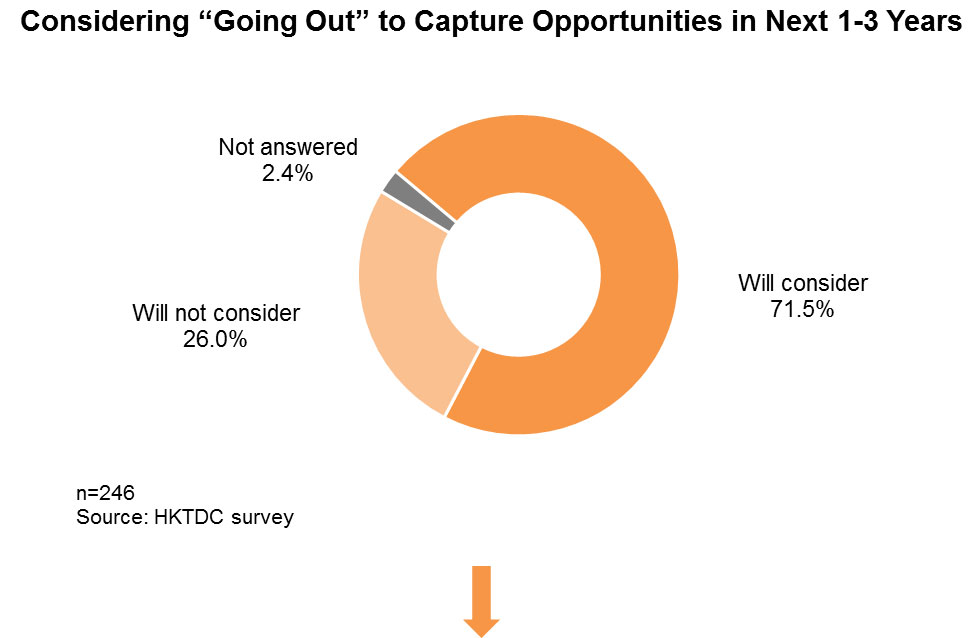

Continue “Going Out” to Develop International Business

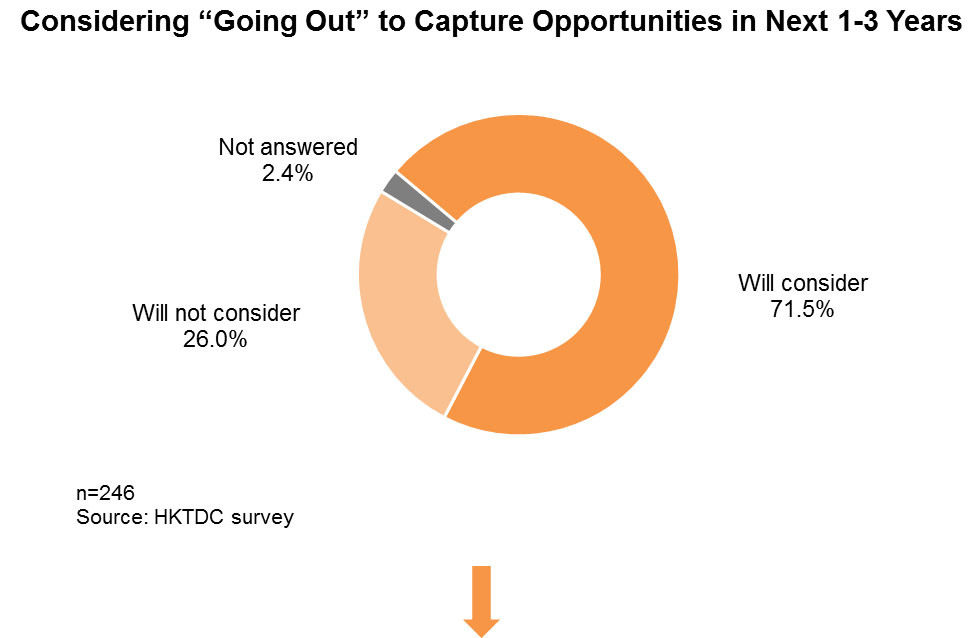

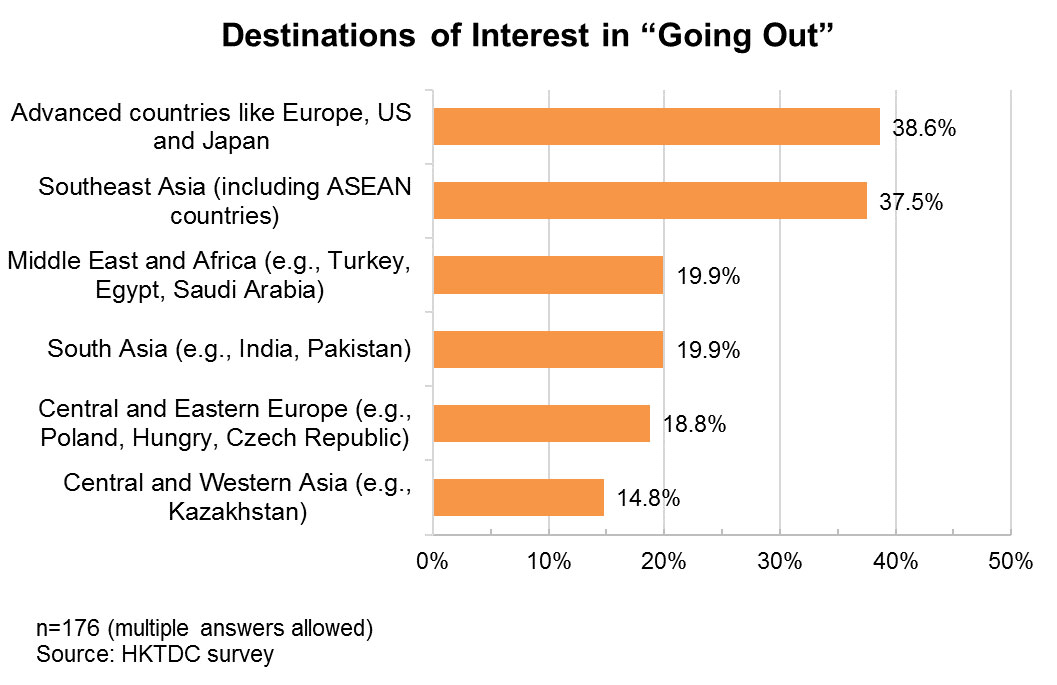

Although the external investment environment is becoming increasingly complicated and the international market has been affected by the China-US trade dispute, 72% of the respondents still said they would consider “going out” to capture opportunities abroad in the next one to three years. Among these, 39% said they were interested in Europe, the US, Japan and other mature markets, while 38% said they would look to Southeast Asia, including the 10 ASEAN countries / other BRI countries. Only 20% said they would choose the Middle East and Africa, South Asia was also favoured by 20%, while 19% picked Central and Eastern Europe and 15% opted for Central and Western Asia.

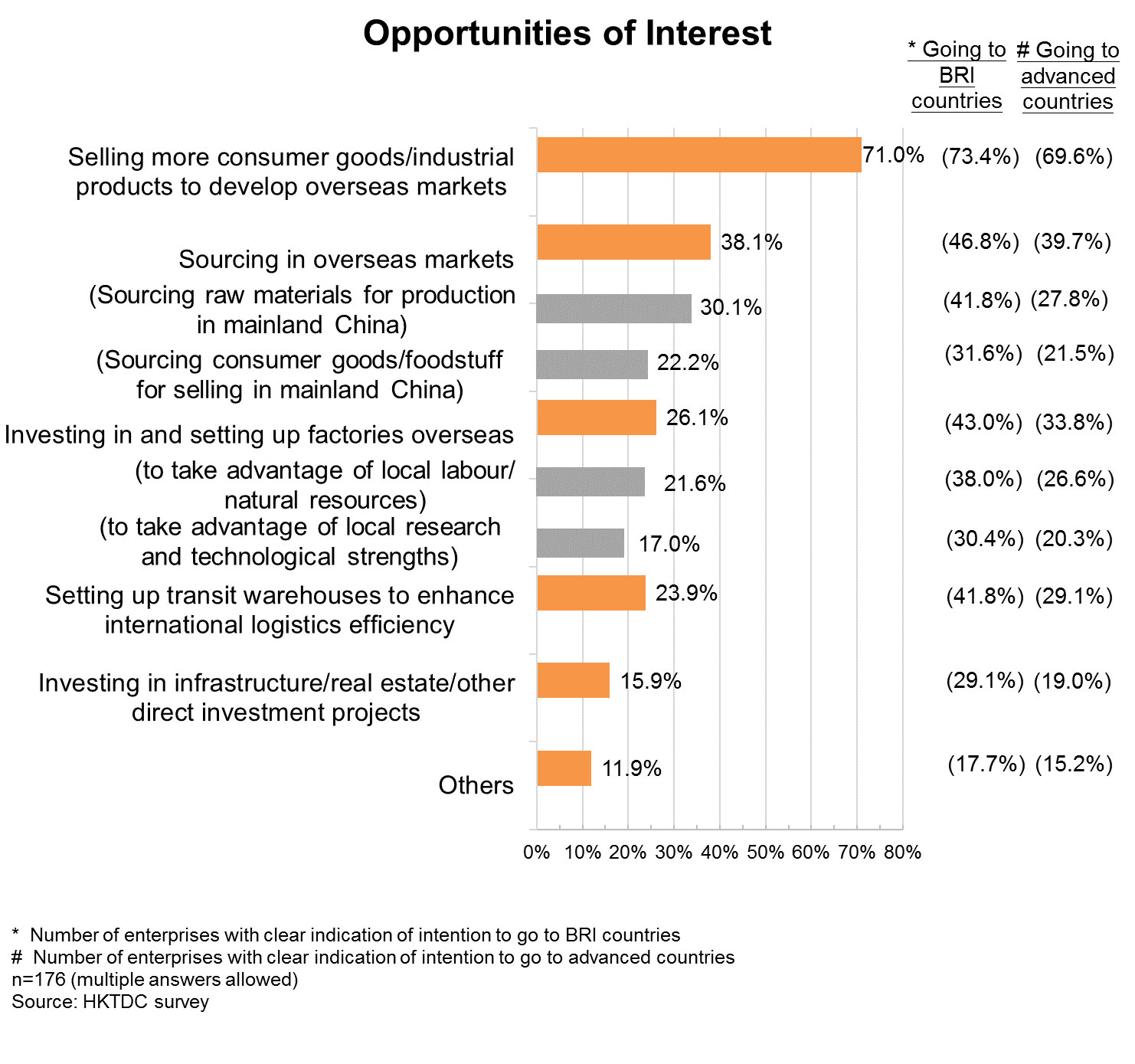

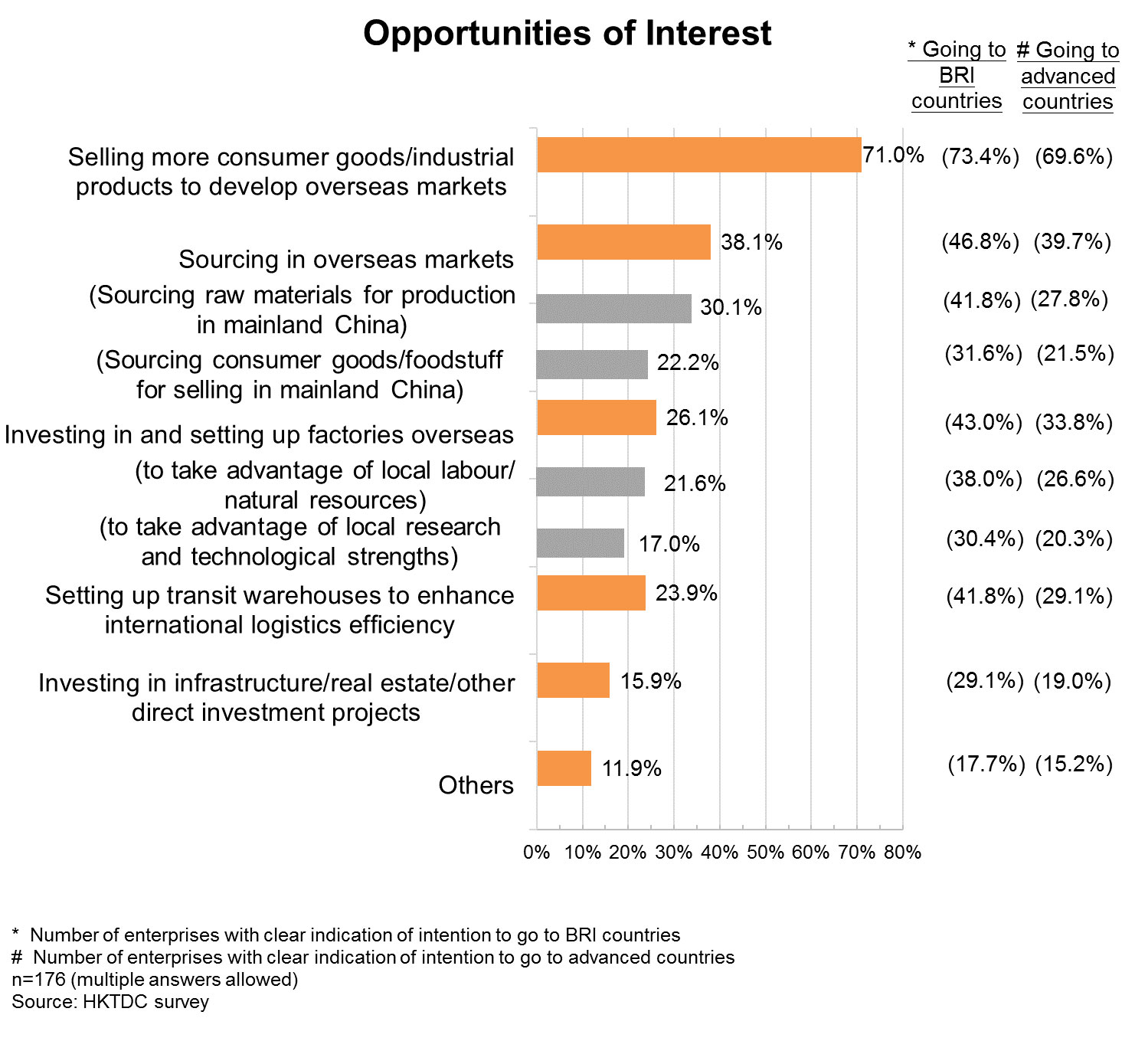

Among those enterprises interested in “going out”, 71% said they hoped to sell more consumer goods/industrial products in overseas markets. 38% were interested in “going out” for sourcing activities, including 30% looking to source raw materials for production in mainland China and 22% wanting to source consumer goods/foodstuff to sell in the mainland. 26% said they hoped to invest in and set up factories for production overseas and 24% were looking to set up transit warehouses to enhance international logistics efficiency. 16% said they hoped to go overseas to invest in infrastructure/real estate and other direct investment projects.

It is worth noting that, whether enterprises were looking towards advanced economies or BRI and other emerging markets, there was little difference in their business interests. Their main objective was to sell more products to overseas markets and conduct sourcing from abroad, which suggests that most companies interested in “going out” are looking to develop in a similar direction.

HKTDC Research conducted workshops and visited some enterprises in the YRD with the help of the Shanghai Municipal Commission of Commerce to discover more about the wants and needs of mainland enterprises considering “going out”.

Remark: For further details, please see: Mainland Firm Uses Hong Kong Professional Services to Overcome Offshore Investment Challenges |

Keen Demand for Professional Services

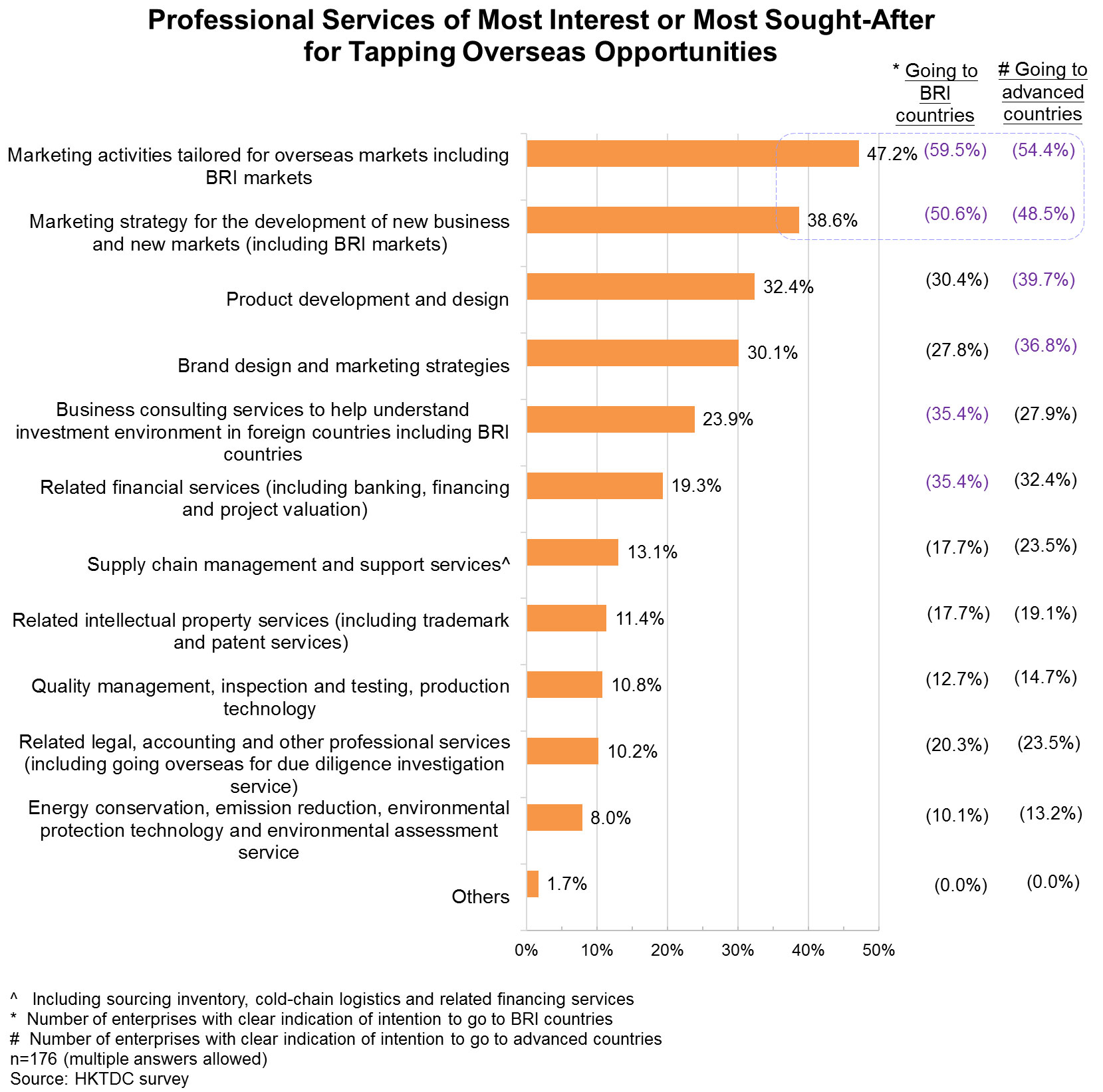

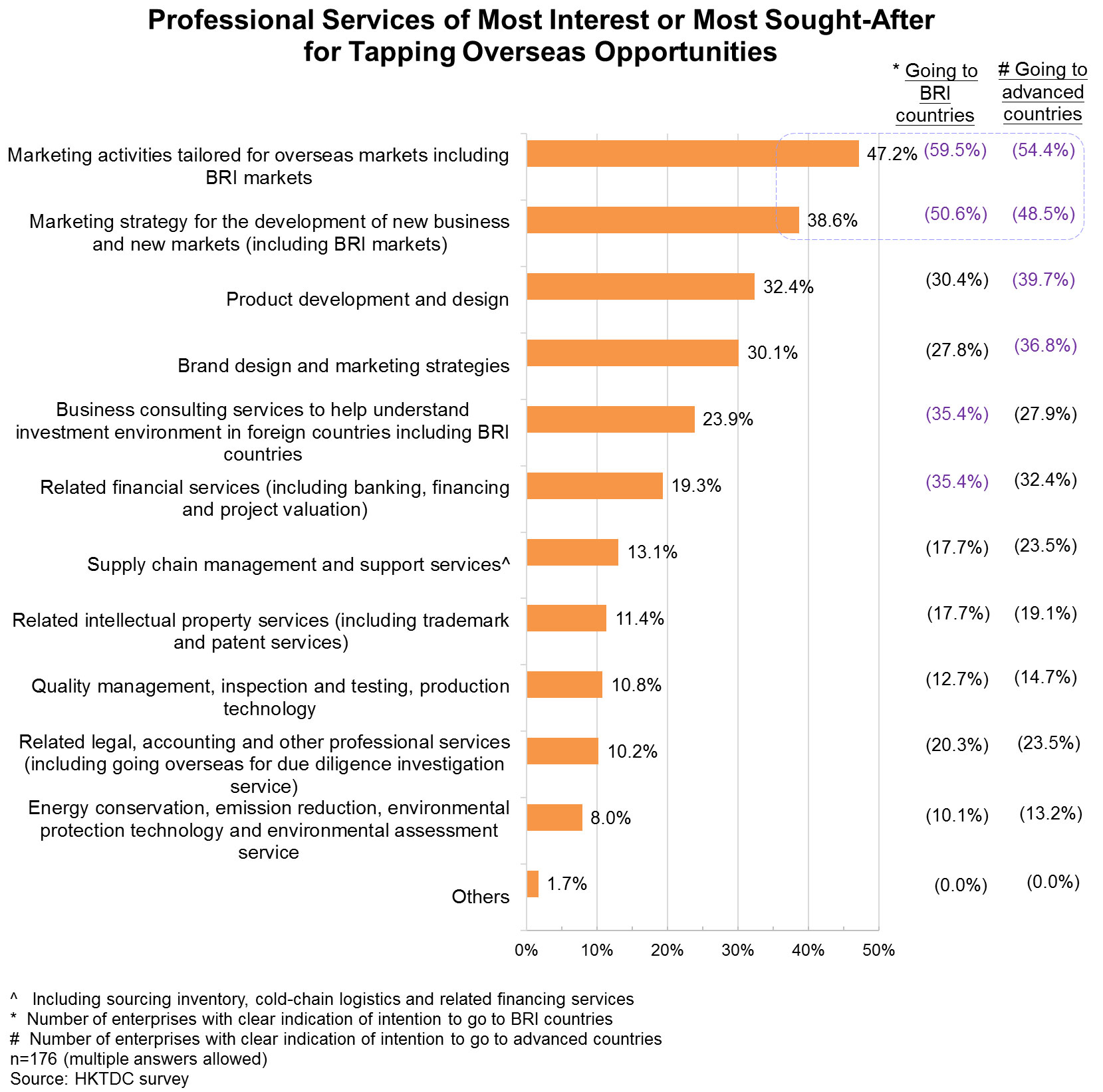

Most enterprises interested in developing their overseas business said they needed professional services support. Among those respondents considering “going out”, 47% said they were interested in marketing activities tailored for overseas markets, while 39% were looking for marketing strategies for the development of new business and new markets. Enterprises intending to develop BRI and advanced markets [5] all said they needed support in these two areas the most.

Many enterprises looking to tap into BRI opportunities also said they would require business consulting services to help understand the investment environment and related financial services (35%) in BRI countries. 40% of enterprises targeting advanced markets said they needed professional services’ support in the field of product development and design, while 37% cited a desire for help with brand design and marketing strategies.

Hong Kong As Preferred Service Platform for “Going Out”

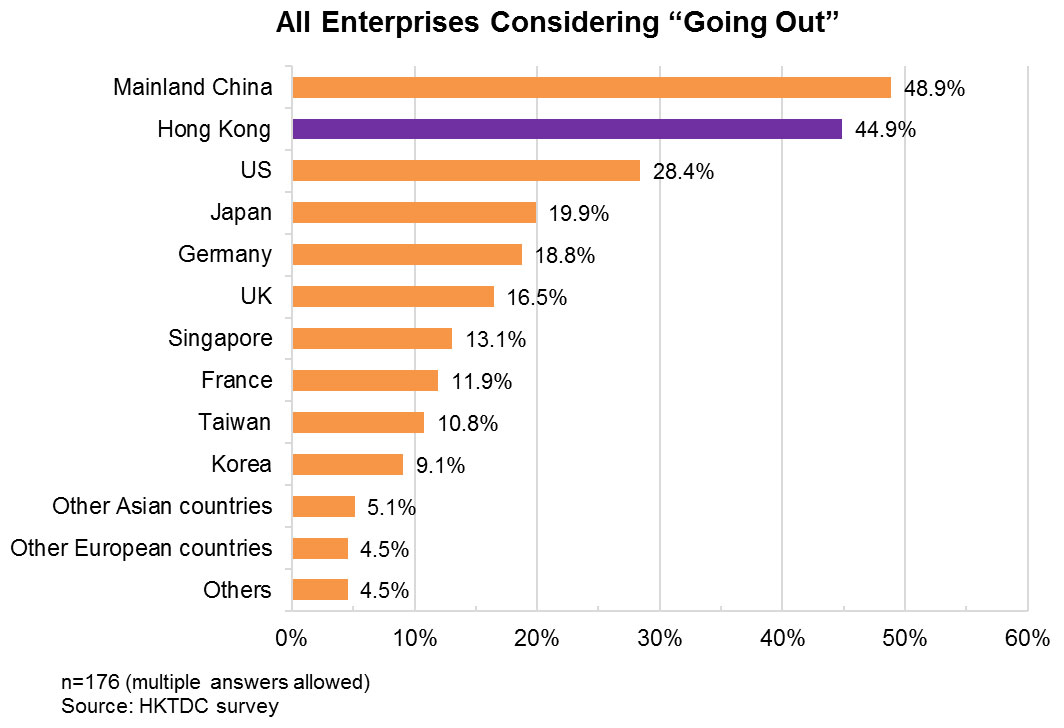

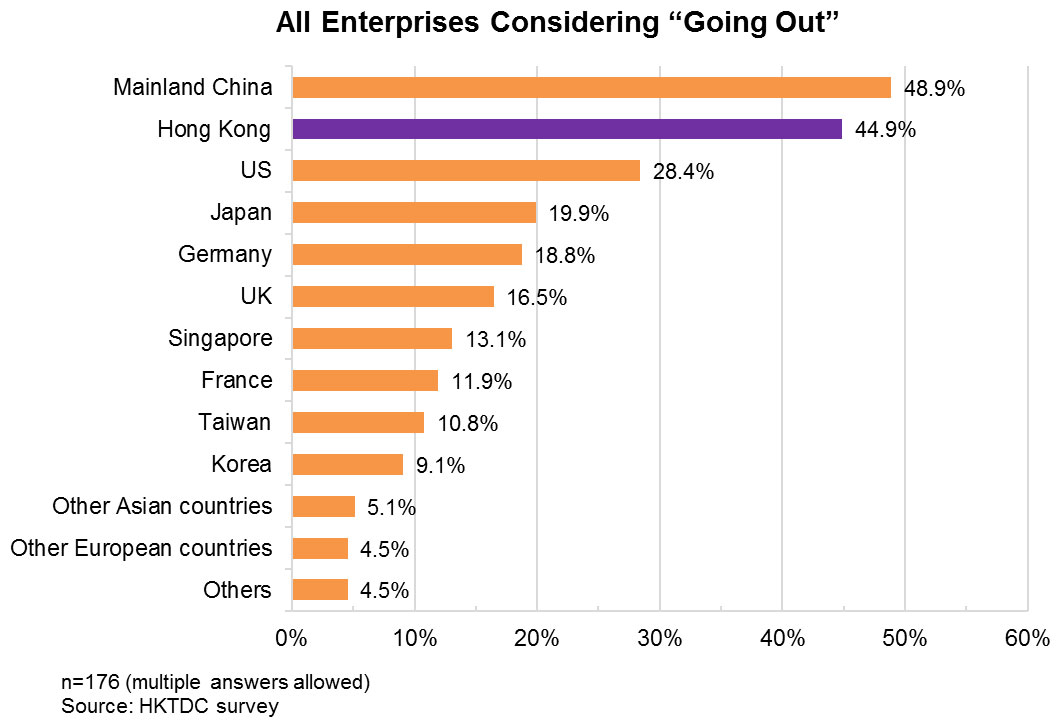

When looking for professional services support, nearly half (49%) of all enterprises considering “going out” said they would first try to source it locally. However, a significant number said they would also seek various professional services outside the mainland. Hong Kong was the preferred destination for 45% of enterprises considering “going out”. 28% said they also would look to the US, 20% to Japan and 19% to Germany.

Hong Kong was the top choice for professional services among those enterprises clearly indicating their intention to explore BRI opportunities, with 53% picking Hong Kong as their preferred location. Hong Kong was also the most preferred location among enterprises with a clear intention of “going out” to advanced countries (52%). However, among those enterprises without a clear “going out” destination in mind, most would first look for services support locally (58%) and only 30% would look to Hong Kong. Overall, though, the survey findings show Hong Kong is regarded as an important services platform for mainland enterprises considering “going out”.

Preferred Destinations for Seeking Professional Services

| Mainland China | Hong Kong | US | Japan | Germany | |

| All enterprises with “going out” intention, of which: | 48.9% | 44.9% | 28.4% | 19.9% | 18.8% |

| Enterprises with clear indication of intention to go to BRI countries | 50.6% | 53.2% | 34.2% | 25.3% | 22.8% |

| Enterprises with clear indication of intention to go to advanced countries | 41.2% | 51.5% | 41.2% | 32.4% | 27.9% |

| Enterprises without clear indication of destination | 58.0% | 30.1% | 17.5% | 13.3% | 9.8% |

n=176 (multiple answers allowed)

Source: HKTDC survey

HKTDC Research would like to acknowledge the help extended by the Shanghai Municipal Commission of Commerce in conducting the survey.

[1] Source: China Customs, World Trade Organisation

[2] Source: “World Investment Report 2019”, UNCTAD

[3] Source: Ministry of Commerce of China

[4] Source: Ministry of Commerce of China

[5] Do not include the number of enterprises that only indicated they would consider “going out” but did not have a clear destination.

Editor's picks

Trending articles

Growing numbers of mainland companies have gained considerable experience in construction and engineering in recent years through their involvement in massive infrastructure projects across China. Their achievements are remarkable by any standards. Logistics service providers supporting these projects have also benefitted, continuously innovating and offering total logistics solutions to construction projects with advanced technologies and specialised equipment.

However, the standards that Chinese companies in the construction and engineering project logistics fields currently work to are not the same as those used in overseas markets. Even companies with many projects under their belt have difficulty winning overseas business opportunities solely on the strength of their track record. In order to overcome this hurdle, some are hoping to gain international recognition by servicing construction projects in Hong Kong, in the expectation that this will help them explore overseas and Belt and Road markets. A Shanghai-based engineering project logistics firm told HKTDC Research that mainland enterprises may also use their overseas experience to gain access to the Hong Kong market.

(Photo courtesy of China Shipping Vastwin)

Daisy Liu, Deputy Director of the Engineering Design Centre of China Shipping Vastwin Project Logistics Co (China Shipping Vastwin) [1], explained how working in Hong Kong can help mainland businesses win contracts overseas, saying: “Construction projects in Hong Kong are up to international standards in their design, quality and safety requirements. They are also in line with international industry standards and certification systems. Leading Hong Kong and international construction firms and related service providers have won international recognition for their track record, and also know very well how to meet the requirements of their overseas peers. Mainland companies can gain valuable experience and become proficient in international industry standards, technological requirements and certification systems by participating in construction projects in Hong Kong. This way they can effectively bridge the gap between Chinese and overseas standards.”

A joint venture between COSCO Shipping Logistics Co - a subsidiary of the China COSCO Shipping Group - and the Jiangsu Vastwin Logistics Holding Co, China Shipping-Vastwin specialises in project logistics. Capitalising on its core engineering design capabilities, China Shipping-Vastwin focuses on ocean engineering, oil and gas refining, municipal infrastructure, new energy and special engineering projects. It offers on-time, safe and cost-effective total logistics solutions to clients in the electricity/new energy, petroleum/coal chemical industry and specialised logistics subcontracting fields, using advanced transportation equipment.

China Shipping-Vastwin runs an office in Hong Kong. As well as using the territory’s financial services platform to handle funds for projects in the Middle East, the US and other overseas markets, it also makes use of its innovative engineering technologies and specialised transportation equipment to provide logistics services for Hong Kong’s infrastructure projects. An example of this would be the delivery of various types of modular structures and complete units of oversize or overweight load. Liu hopes to provide more logistics services to large-scale construction projects in Hong Kong, such as the airport extension project and the construction of roads and bridges, and team up with Hong Kong companies looking to take advantage of Belt and Road opportunities.

[Remark: For more information, please refer to HKTDC research article: Hong Kong as the Major Service Platform for “Going-out” Enterprises: 2019 YRD Survey Results]

Editor's picks

Trending articles

Ramboll Hong Kong Limited is a wholly owned subsidiary of Ramboll – an international technical and scientific consultancy providing state-of-the-art scientific, engineering, and strategic risk management assistance to clients worldwide including national and international industrial and commercial concerns, law firms, developers and property managers, trade associations, lending institutions, insurance professionals, and public sector agencies.

Ramboll Hong Kong limited provides comprehensive environmental management consultancy services ranging from air quality, noise, water quality, waste management, hazard, land contamination, ecological impact, drainage and sewerage impact assessment`s to BEAM Plus/ LEED certification and green building design.

Ramboll Hong Kong Limited is ISO9001 and ISO14001 certified and we have over 10 BEAM Professionals registered with the Hong Kong Green Building Council, a LEED Accredited Professional registered with the US Green Building Council and a WELL Accredited Professional. Staffs of Ramboll are also familiar with the requirement of Air Ventilation Assessment in Hong Kong. Staff of Ramboll has undertaken over 1,000 individual environmental assessment studies locally in Hong Kong on a variety of projects for public utilities companies, Government departments, and the private sectors in the past decade. Ramboll has proven track record of 100% success rate in all Environmental Impact Assessment (EIA) undertaken under the EIA Ordinance since its enactment in 1998.

Apart from EIAs, Ramboll also acts as the environmental consultant for hundreds of town planning applications. Ramboll is familiar with statutory and non-statutory requirement for town planning applications and has also participated in consultation process with District Council and other stakeholders.

Zurich Insurance (Hong Kong) is the Hong Kong branch of the global multi-line insurer, Zurich International Life (“Zurich”). Headquartered in Zurich, Switzerland, Zurich serves in more than 210 countries and territories with a wide range of property and casualty, and life insurance products and services. With the development of the Guangdong-Hong Kong-Macao Bay Area, Zurich Insurance (Hong Kong) firmly believes that Hong Kong’s insurance industry will gain unprecedented cross-border cooperation opportunities, and support Hong Kong as a regional project and personal risk management center.

Bowtie is a licensed life insurance company and Hong Kong’s very first virtual insurer. Built with modern technology and medical expertise, Bowtie’s powerful platform offers medical insurance plans under the Voluntary Health Insurance Scheme (VHIS) and other real insurance products to customers instantly and directly. By eliminating paper, commissions and intermediaries, Bowtie’s mission is to enable a new generation of consumers to access real insurance protection and take control of life protection decisions for themselves. Bowtie is backed with HKD 234 million from Sun Life Financial and supported by leading international reinsurers. Stay up to date at www.bowtie.com.hk

10 DESIGN is an international award-winning practice of architects and creative talents with studios in Hong Kong, Shanghai, Edinburgh, Dubai, Miami, and London.

We aspire to create innovative design solutions for multicultural projects, with economic and social integrity.

The practice works at diverse scales, from the design of individual buildings to the planning of cities. We have expertise in the planning and design of projects in hospitality, residential, cultural, retail, commercial, education, aviation, and railway sectors.

Our work focuses on context, both physical and social and the connections between new and existing urban fabric. We strive to provide opportunities to create living environments with positive impact far beyond site boundaries.

Since its inception in 2010, 10 DESIGN has won over 70 international awards and major design competitions and has been ranked in the World Architecture Top 100 Architects since 2012.

Embracing talent is part of 10 DESIGN’s ethos. We employ over 200 creatives from more than 30 nationalities, speaking over 30 languages and dialects. This important cultural advantage brings diversity and creativity to 10 DESIGN’s work in around 60 cities across Europe, Asia, North America and the MENA.

AIM Group, headquartered in Hong Kong since 1998, provides valuable input at all stages of a major project, from design development, tender construction phases to successful project completion. In 2019 AIM is celebrating 21 years of successful service to the engineering and infrastructure industry in the ASEAN region. We are strategically positioned, in Hong Kong and our regional Singapore office, to play a key role in the Belt and Road Initiative (BRI). We are particularly looking for partnerships with Chinese and other international infrastructure investors to participate in opportunities along the BRI route, especially in the ASEAN, Middle East and MENA countries.

We aim to work closely with our potential BRI partners to provide informed investment management services utilizing our extensive knowledge of the engineering infrastructure and construction industry. AIM has unique expertise as well as a network of associates in the fields of programme management, risk analysis, risk management, infrastructure masterplanning, dispute avoidance and alternative dispute resolution. We encourage the use of modern technology in infrastructure management along the BRI route, where appropriate, through the use of Building Information Modelling (BIM) and we are set up to provide BIM management consulting services.

1897 Views

1897 Views