Indonesia

Despite the two-year delay occasioned by land-acquisition issues, services on the China-funded Jakarta-Bandung High-Speed Rail Line are set to begin within three years, representing a new high-water mark for Beijing-Jakarta relations.

The BRI-backed Jakarta-Bandung high-speed rail line is said to be back on track, with its contractors confident it will now enter operation in 2021. Although this is a full two years behind the completion date envisaged when the project was first given the go-ahead in 2015, it does mean that progress – long-stalled over land-ownership issues – is finally being made.

Once completed, the line will be 150km long and have the capacity to handle trains travelling at up to 250km/h. Initially, it is expected to have an average daily passenger flow of some 44,000, a figure expected to climb dramatically. Its most significant benefit, though, is the cut in transit time it offers for journeys between two of the country's primary hubs, with the present five-hour duration falling to just 36 minutes.

Summing up the current state-of-play on the project, Tumiyana Tumiyana, the President Director of Wijaya Karya (Wika) – the state-owned Indonesian construction company that is the local partner on the project – said: "If work on a 150km high-speed rail project occasionally experiences a few problems, that's only to be expected. Today, the level of physical construction stands at 65.1%, with 81.7% of the overall land clearance also completed.

"In fact, it's all starting to come together rather quickly now, with significant progress having been made at 22 key construction sites along the route. We are now confident that work on the line will finish by early 2021, with the service then starting to run once three months of trials have been completed."

Wika, the company Tumiyana represents, is part of Kereta Cepat Indonesia China (KCIC), the Chinese-Indonesian consortium responsible for developing the project, the country's first high-speed rail line, in association with the China Railway International Corporation (CRIC). The optimism shown by such a senior figure within the cross-country partnership will, no doubt, come as some reassurance to many of the project's stakeholders, with several of them having become notably jittery over the delays and uncertainty that has dogged the development of the line.

Given the scale of the project, it is somewhat unusual that its two-year overrun is more down to land-acquisition issues than the somewhat more common problem of nailing down the finance. The funding for the project, indeed, has been in place almost since the outset.

In line with this, earlier this year, Wika received US$770 million (Rp 11.1 trillion) from the China Development Bank, the latest tranche of the $5.5 billion China has allocated to the project. The funding comes within the remit of the BRI – the Belt and Road Initiative, China's ambitious international infrastructure development and trade facilitation programme.

Despite some concern on the part of local opposition groups that Indonesia will be permanently in hock to China and unable to meet its repayment obligations, Tumiyana is confident the financial targets are realistic. Assessing the profit potential of the line and the agreed repayment terms, he said: "Firstly, you have to remember that we have been given a 40-year soft loan at a very cheap rate. Secondly, as part of the overall plan, the consortium will develop the property in the immediate vicinity of the railway stations, a strategy that, we believe, will generate up to Rp362 trillion in revenue over the next 40 years."

Despite Tumiyana's optimism, the project's progress may yet be far from smooth, with a number of land-acquisition issues remaining unresolved. As of May this year, only 73% of the designated land had been successfully acquired, with just 60% of that officially allocated to the developer.

Murkier still, five companies whose premises need to be acquired and demolished to make the proposed route viable, have initiated legal action against the consortium, demanding total compensation of $141 million. Of these actions, three have already been granted leave to proceed to court by state legislators.

In light of these actions, it is believed that that consortium is considering a number of changes, which would see the proposed rail line diverted away from the contested properties. Despite this apparent late-in-the day rethink, the consortium has officially stated that this will not push completion beyond the proposed 2021 deadline.

Despite these local difficulties, it is believed that both China and Indonesia remain firmly committed to making the completion of the line a reality. A similar optimism also characterises many of the other BRI-related infrastructure projects under way in Indonesia.

Since 2015, when China first committed to developing the Jakarta-Bandung line, mainland investment in Indonesia has more than doubled and seems set to continue to grow. As recently as April this year, China agreed an additional $23.3 billion in funding for five further Indonesian infrastructure projects.

Indonesia, however, is keen not to appear wholly dependent on China for its programme of economic renewal. This has seen it partner with Japan on the 730km long Jakarta-Surabaya High-Speed Rail Link, a route five times the length of the China-backed Jakarta-Bandung line.

Overall, though, the closer links wrought between China and Indonesia by the scale and scope of the BRI have clearly benefitted both countries. For Indonesia, the advantages are obvious – in order to continue to develop economically it has no choice but to improve connectivity both within the country and with its neighbours and the high-value importers in the more developed economies. China picking up the tab for such an undertaking was clearly an opportunity the country could not turn down.

For China, the benefits of its BRI partnership with Indonesia are both multifold and slightly more nebulous. Most obviously, this closer collaboration gives China easier access to Indonesia's strategically significant ports and marine facilities. At the same time, it also gives China a direct route into Indonesia's relatively-young, newly-affluent consumer base. With a population in excess of 261 million, Indonesia has more than twice as many consumers as any other country in the ASEAN bloc, making it a priority target for China's export-oriented business sector.

Less obviously, the improved working relationship allows China to develop an affinity with one of the world's leading Muslim nations, a major bridge-building exercise for a country that is often seen as at odds with its own domestic Muslim population. It also sees China establish a distinct alliance with a country that is fast emerging as a force in its own right within the region. With its focus on soft-power, China is understandably keen to nurture as many influential friends within the wider Asia-Pacific region as it possibly can.

Marilyn Balcita, Special Correspondent, Jakarta

Editor's picks

Trending articles

One of the incidental benefits of the far-reaching Belt and Road Initiative is the opportunities it has opened up for mainland businesses throughout Southeast Asia, with Indonesia emerging as one of the most lucrative markets on offer.

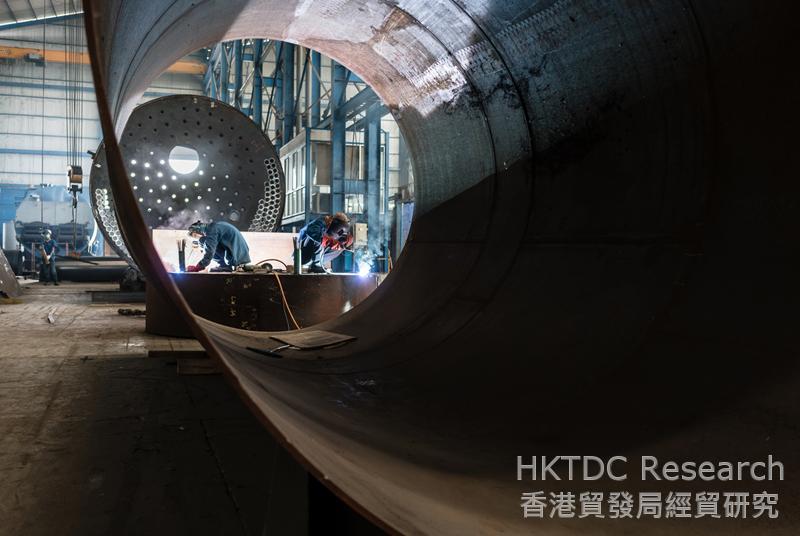

As well as promoting international infrastructure development, China's Belt and Road Initiative (BRI) has also proved an effective means for mainland manufacturers to access new overseas markets, at least according to exhibitors at the recent China Machinery & Electronic Brand Show (Indonesia). Of these markets, Indonesia – a country with a population of more than 200 million and a rapidly growing manufacturing sector – has emerged, unsurprisingly, as one of the primary targets for any Chinese manufacturer looking to expand into Southeast Asia.

Acknowledging the spur provided by his home country's policy-makers, Martin Lin, Investment Management Head at Fujian-based Keneng Electrical Equipment, said: "Our government has done much to encourage private enterprises to expand beyond China and that played a huge part in bringing us to Jakarta for this event."

Making its first appearance at the show, the company was keen to promote its range of meters, gearboxes, engines and generator sets. It also produces diesel engines in partnership with Lijia Co, another Fujian-based business.

Another Jakarta debutante was Friend Control Systems, a Shandong-based high-tech manufacturing enterprise that produces a proprietary range of pressure-measurement instruments, temperature instruments and flow-measurement systems. Again acknowledging the prompt provided by the BRI, Li Ming, the company's General Manager, said: "This policy has definitely encouraged Chinese companies to look to new markets, particularly those within Southeast Asia.

"There is a huge market for us here Indonesia, largely because of the country's rapidly growing manufacturing sector. I have every hope that our products will be successful here."

In the case of the Beijing-based Valve General Factory, it seemed as though government intervention was even more direct, with Overseas Sales Manager Caroline Ling saying: "We were officially advised to come here to test the Indonesian market and to look for distributors and trading partners."

The company has a 63-year history of producing high, middle pressure and steam-trap valves. To date, it has supplied mainly domestic clients and has had only limited exposure to the key export markets. It currently operates from a 60,000-square-metre plant in the Panggezhuang Industrial Development Park in the Daxing District of southern Beijing and has more than 1,100 employees.

For Shandong-based TigerTec, it was trusting in state-sponsored overseas promotion to help drive sales of its computer numeric control (CNC) machines. Outlining the company's expectations, Sales Manager Tina Li said: "While we already have a partner in Indonesia, we have very few customers here. We hope this new government initiative will help promote our products in Indonesia and in a number of other countries.

"In the case of Indonesia, we are well aware of how competitive a market it is. Despite this, though, we have attracted a lot of interest throughout the course of this expo."

The company's CNC machines primarily have applications within the wood-working, sign-making, model-making, mould-making and stone-engraving sectors. It also manufactures plasma-cutting and rotary-engraving machines.

Another Shandong-based CNC machine manufacturer hoping to capitalise on the expanding Indonesian market was Sinmic Machinery. Maintaining her company had quite a different proposition to other CNC suppliers, Sales Manager Jessica Shu said: "We pride ourselves that we offer configurations suitable to every customers' needs, while also having a number of budgetary options on offer."

Currently on the look-out for Indonesian partners, the company specialises in the provision of woodworking and plastic CNC routers, woodworking machining centres, CNC engravers, sign-making CNC routers, 3D laser scanners, mould-making CNC machines, five-axis machining centres and high-power laser metal-cutting machines.

Concerns that the notoriously price-sensitive Indonesian market might not be willing to invest in higher-quality equipment were widespread at the event. Outlining his own company's solution to this particular problem, Dante Lin, Marketing Director of Superwatt Power Equipment, said: "We are planning to introduce different, more economical products to our standard range in order to meet the price requirements of Indonesian customers."

Shandong-based Superwatt manufactures diesel generator sets, mobile lighting towers, vehicle power stations, and gas generator sets.

Still finding its feet in the Indonesian market was Acepow, a Fujian-based generator manufacturer. Explaining the reasons behind its presence at the event, Sales Manager Clark Zheng said: "This is our way of taking a closer look at the opportunities the country offers. Hopefully, we can find a local partner that will help us grow here as we continue to expand into Southeast Asia.

"For our part, we believe that businesses need generators to ensure a continuous power supply. When you buy from us, what you're really signing up for is power reliability."

Another first-timer at the Jakarta show was the Shanghai Valve Factory. The publicly traded company manufactures valves for use in power plants, petrochemical plants, long-distance pipelines, ships, the metallurgy industry, paper production, the pharmaceutical industry, environmental protection and a number of defence-related sectors.

Seeing a clear synergy with the needs of the Indonesian industrial sector, Overseas Sales Manager Wang Jianwei said: "This could be a huge market for us as the majority of the country's manufacturers are already using similar valves to the ones we produce. Now it's just down to us to give them a good price."

With direct trade between China and Indonesia still something of a logistically and legally thorny issue, one business that was hoping to bridge the gap was Indotrading.com, a Jakarta-based e-commerce platform established to help SMEs promote their products and services online.

Explaining the problem, Rahman Anzi, one of the site's Business Consultants, said: "Indonesia is a huge market and, despite the large number of businesses and manufacturers already active here, there is room for expansion.

"Foreign companies, though, cannot sell directly to customers in Indonesia. In line with government regulations, foreign businesses need to have a local partner in order to trade here. As a result, Chinese companies are not allowed to list their products on our portal unless they have a link to a domestic business, meaning they are missing out on our 4.5 million monthly visitors."

The 2017 China Machinery & Electronic Brand Show (Indonesia) took place at the Jakarta International Expo.

Marilyn Balcita, Special Correspondent, Jakarta