GDP (US$ Billion)

56.69 (2019)

World Ranking 83/194

GDP Per Capita (US$)

16,111 (2019)

World Ranking 55/193

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

41 (2019)

Currency (Period Average)

Uruguayan Peso

35.26per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

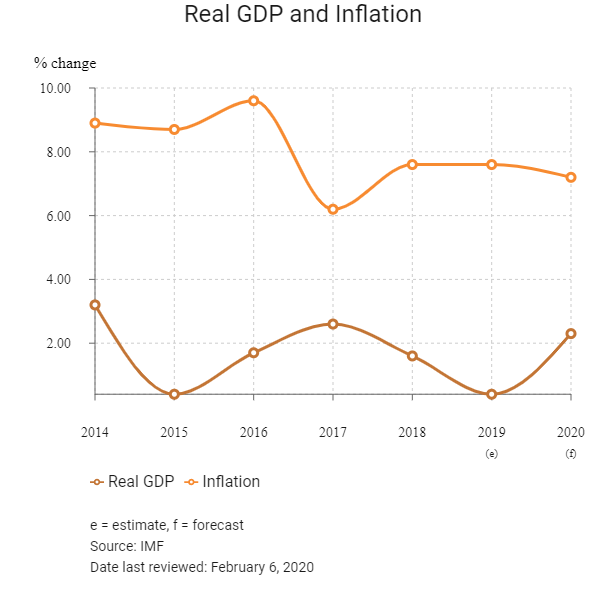

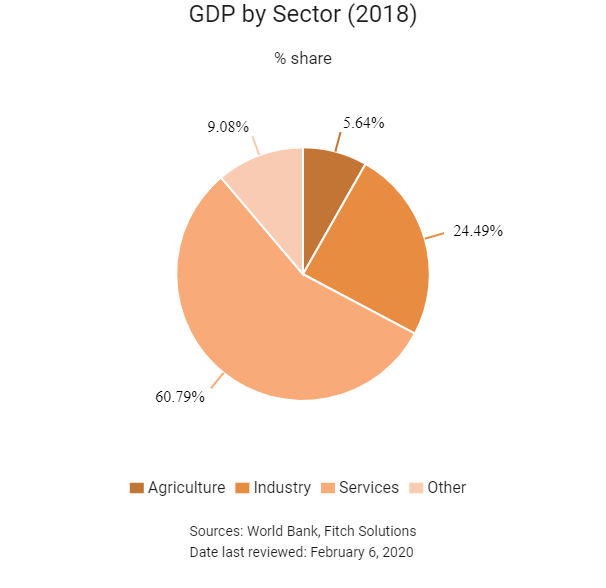

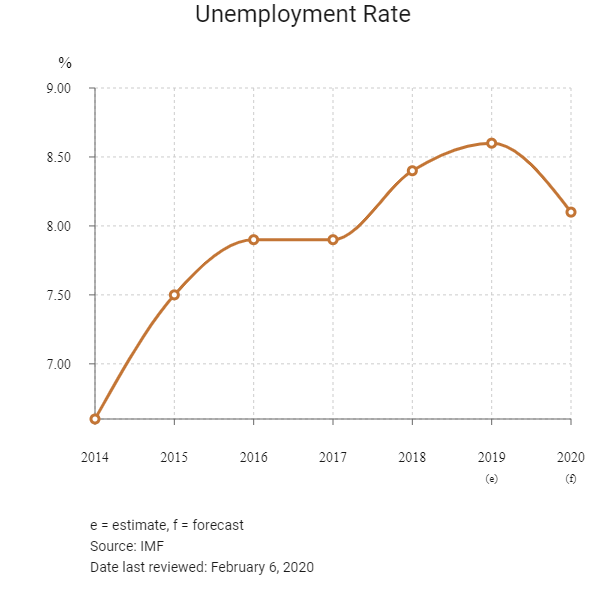

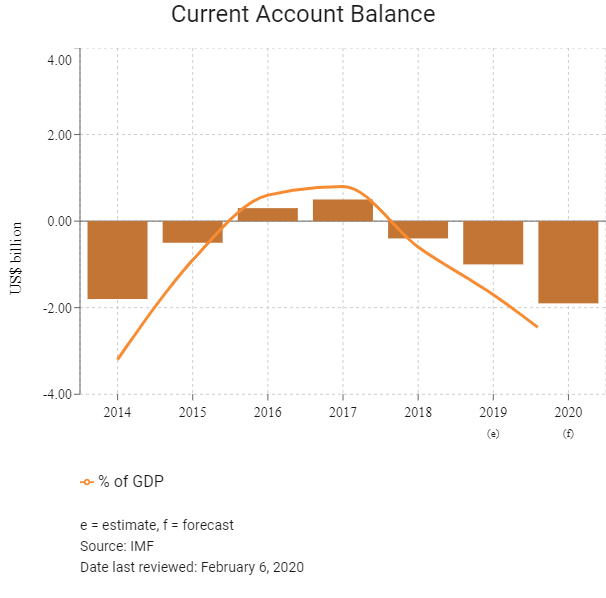

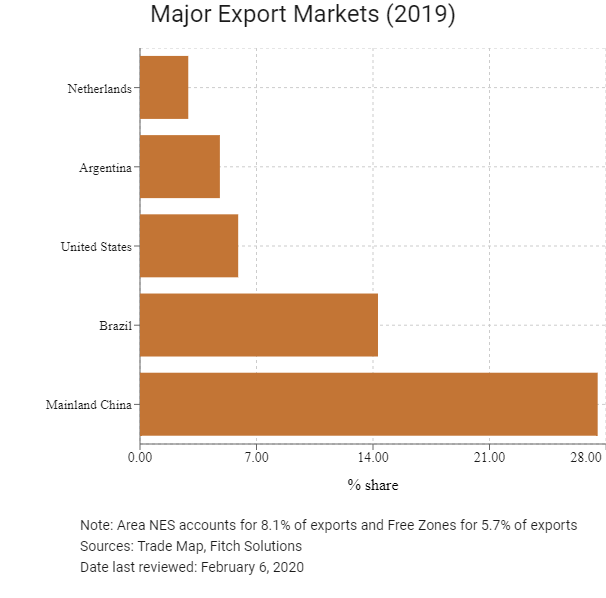

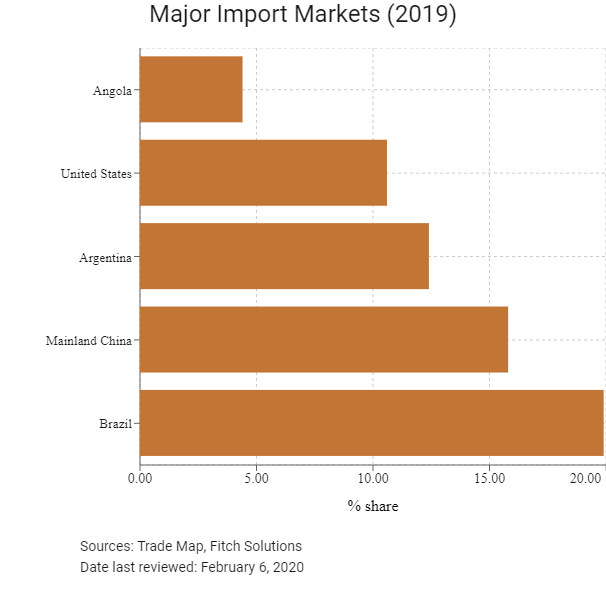

Uruguay is a high-income economy characterised by a large volume of agricultural exports and free-market policies, accompanied by high levels of social spending by the government. Downturns in Brazil and Argentina, the country’s key trading partners, will likely limit growth in the external sector, while stagnant wages, high unemployment and currency depreciation will drag on domestic demand. On the other hand, the European Union (EU)-MERCOSUR trade deal, if ratified, will boost medium-term prospects, as should UPM’s paper mill project. Since the commodity price shock of 2014-2016, Uruguay's policymakers have seen the need for greater economic diversification to ensure sustainable growth. As the country's economy becomes more integrated with the rest of the world, it will be able to hedge against downturns in regional demand.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

November 2014

A general election run-off between the Broad Front and the National Party resulted in the former receiving 56.6% of the vote, enabling the formation of a government. Tabaré Vázqued was sworn in as president, taking over from former Broad Front leader, José Mujica. The Broad Front also retained its majority in the Chamber of Deputies (the lower house of the Uruguayan General Assembly), but lost its majority in the 30-seat upper house, the Senate.

July 2018

Uruguay became the first country to legally produce and sell marijuana for recreational use. The cultivation of the plant was first legalised in 2013 in efforts to counter the funding of drug cartels operating in the region.

July 2019

On 23 July, Finnish papermaking firm UPM announced a USD3 billion investment to build a pulp plant in Uruguay by 2022, which would generate an estimated 4,000 jobs.

October 2019

Uruguay was set to hold general elections. Incumbent President Tabaré Vázquez was ineligible to run as he has reached his limit of terms served.

September 2019

Austrian MPs delayed ratification of the EU–Mercosur trade deal, cited concerns about Brazil's environmental policies.

October 2019

Fotmer Life Sciences made the first commercial shipment of medical cannabis from Latin America, destined for patients in Australia. The company believed a billion-dollar industry could be established in Uruguay to supply a booming global market in medical marijuana. Some analysts forecast the United States' market alone would be worth USD80 billion by 2030.

November 2019

In the general election Luis Lacalle Pou became the newly elected president and would formally replace incumbent President Tabaré Vázquez in March 2020 for a five-year term.

December 2019

Uruguay undertook an official mission to Mainland China to market the country as a regional hub and gateway into Latin America. A memorandum of understanding was signed between Uruguay and Guangzhou to promote and deepen cooperation.

January 2020

Protests were held in France, Germany and Spain in opposition to the EU-Mercosur deal, which unions complained would expose Europe's farmers to unfair competition.

The coronavirus outbreak in Mainland China was likely to have an impact on the leading economies of Latin America, including Uruguay.

Austria's new government under Chancellor Kurz said it would reject the Mercosur deal in its current form.

Sources: BBC Country Profile – Timeline, Reuters, Invest in Uruguay, Fitch Solutions

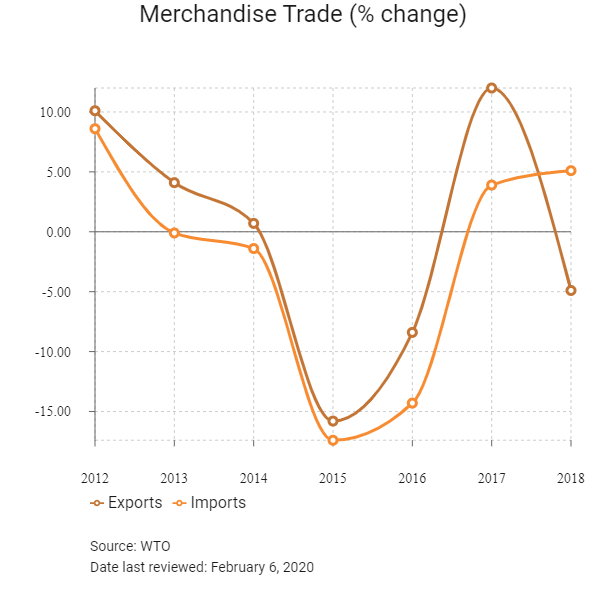

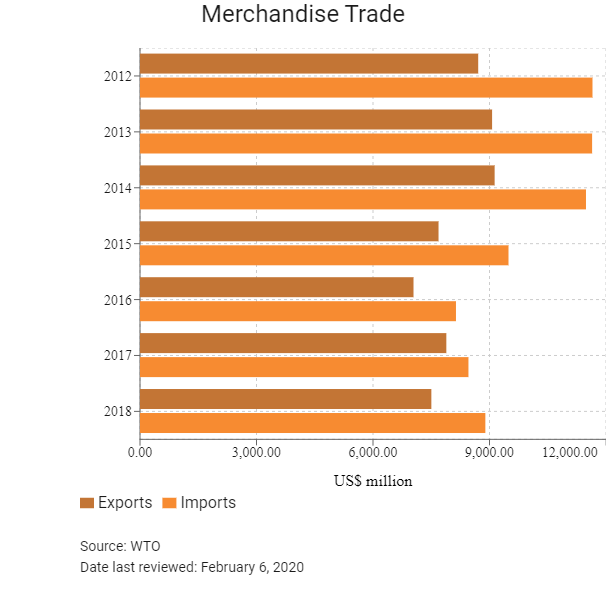

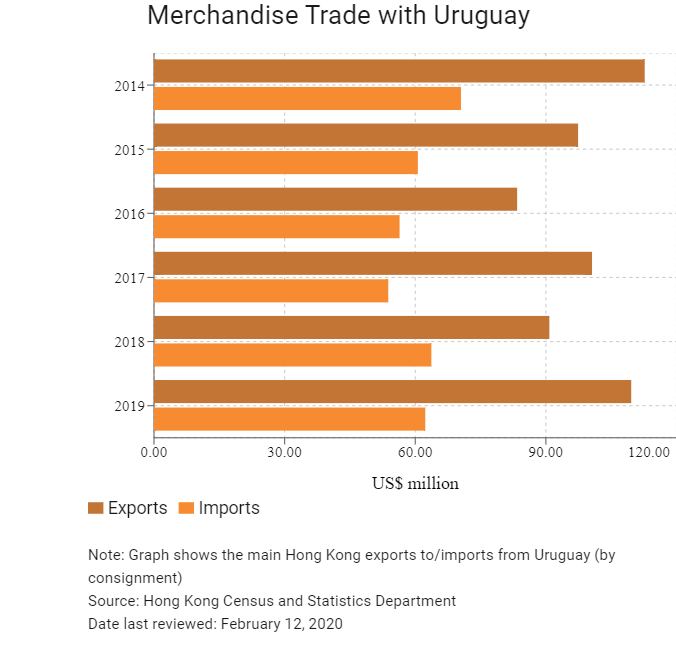

Merchandise Trade

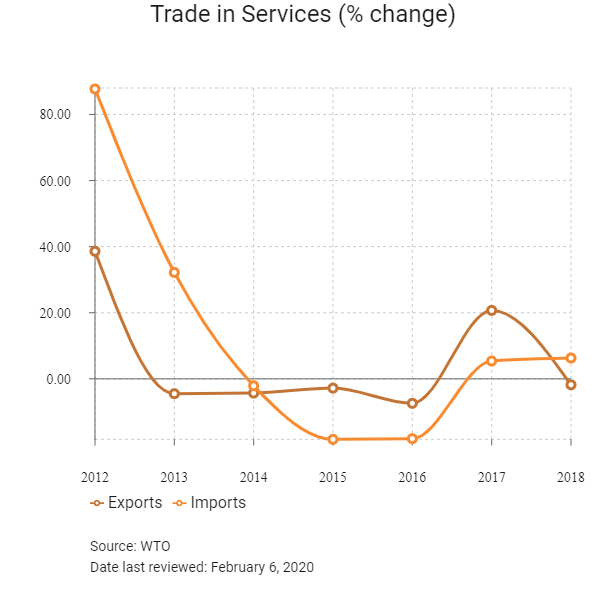

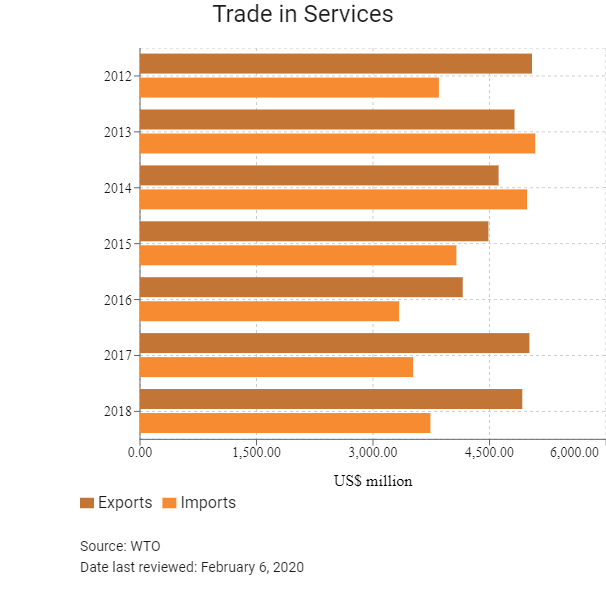

Trade in Services

- Uruguay has been a World Trade Organization (WTO) member since January 1, 1995 and a member of the General Agreement on Tariffs and Trade since December 6, 1953. The country is also a member of MERCOSUR (since 1991).

- Uruguay imposes a regionally competitive average weighted tariff rate on imports of 4.8%. This is the 12th lowest out of 30 Caribbean and Central and South American states with data readily available.

- The country currently has only one anti-dumping measure in place, affecting certain types of electric water heaters from Mainland China.

- Uruguay currently imposes tariffs on 105 products originating from 32 countries, including Mainland China.

- In addition to tariffs put in place by Uruguay, MERCOSUR members also impose tariffs on 10 products originating from 16 countries – including from Mainland China.

- Import tariffs are highest on finished goods and many capital goods and intermediate inputs face lower or eliminated rates.

- Generally, no tariffs are charged on goods traded between MERCOSUR countries. Uruguay has championed the free trade of goods throughout the trade bloc.

- Inefficient trade bureaucracy remains an issue, but procedures are generally more efficient than in neighbouring Argentina and Brazil, increasing Uruguay's appeal as an entry point to the MERCOSR trade bloc.

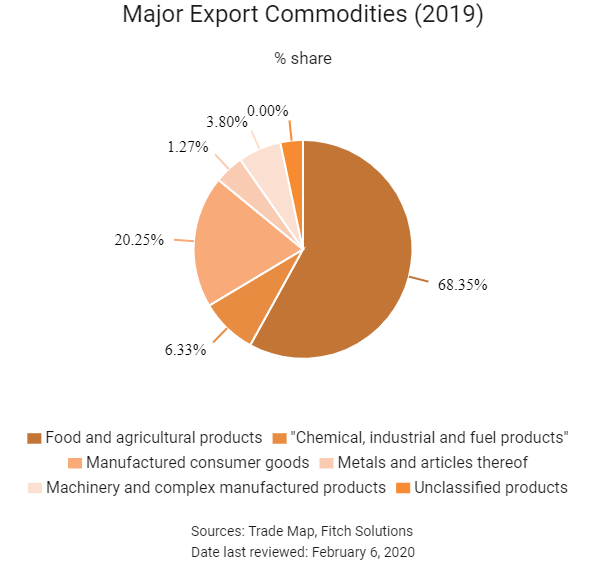

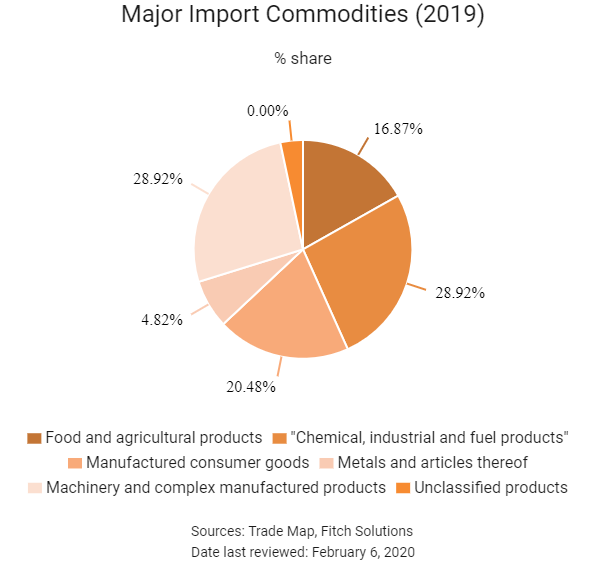

- Although food and agricultural products remain Uruguay's main source of export revenue, chemical, industrial and fuel products comprise an important export sector, with pulp and paper production an important national industry.

- Uruguay has a few non-tariff barriers but these are mainly used to protect public health, national security, the environment, phytosanitary conditions and consumers.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- MERCOSUR: A regional customs union with Brazil, Argentina, Paraguay, Uruguay and Venezuela (the latter was incorporated as a member in 2012 but is currently suspended). The Mercosur (which stands for Southern Common Market) agreement covers goods and services; the agreement on goods was signed on March 26, 1991, and entered into force on November 29, 1991, while the agreement on services was signed on December 15, 1997, and entered into force on December 7, 2005. The agreement facilitates trade with these neighbouring countries through the removal of tariff and non-tariff barriers. In particular, Argentina and Uruguay are key trade partners of Brazil. The customs union is still in the process of being fully implemented with some significant exceptions to the common external tariff in individual countries and double-application of import tariffs on goods imported to one member and subsequently moved into another. Bolivia is in the process of becoming a full member. Mercosur encompasses approximately 75% of South America's GDP and is one of the world's largest economic blocs.

- MERCOSUR associate members: The free trade agreement (FTA) between MERCOSUR and associate members. However, MERCOSUR's associate members – Chile, Colombia, Ecuador, Guyana, Peru and Suriname – do not enjoy full voting rights or complete access to markets.

- MERCOSUR-India Preferential Trade Agreement (PTA): The PTA between MERCOSUR and India was signed on January 25, 2004, and came into force on June 1, 2009.

- MERCOSUR-Israel FTA: The agreement, agreed on Montevideo in 2007, was signed on December 18, 2007, and came into effect on December 23, 2009. The FTA provides concessions on tariff preferences for approximately 8,000 products (mainly manufactured goods).

- Uruguay-Mexico FTA and Economic Integration Agreement: The agreement, which covers goods and services, was signed on November 5, 2003, and entered into force on July 15, 2004.

- MERCOSUR-Mexico Partial Scope Agreement: The agreement covers goods, was signed on July 7, 2016, and entered into force on December 28, 2016.

- MERCOSUR-Egypt FTA: The agreement, signed in August 2010, became operational in 2017 and exempts products from import taxes (with 65% of all traded goods between the two regions becoming exempt in 2017, with the remainder gradually lowering after).

- MERCOSUR-SACU PTA: The PTA between MERCOSUR and the Southern African Customs Union (SACU) countries (Botswana, Eswatini, Lesotho, Namibia and South Africa) which covers goods, was signed on December 15, 2008, and came into effect in April of 2016. The agreement offers concessions on 1,062 tariff lines for MERCOSUR traders doing business with SACU (and concessions on 1,052 tariff lines for SACU countries doing business with MERCOSUR).

Ratification Pending

EU-MERCOSUR Trade Agreement: After 19 and a half years, an agreement between the parties was reached on June 28, 2019. The signed agreements will be presented to the parliaments of the EU and Mercosur bloc members, as well as to the EU Parliament, for ratification before coming into effect. The agreement will cover a total population of 780 million and, currently, Mercosur countries import goods and services from the EU worth approximately EUR68.0 billion. Mercosur's investment stock in the EU is worth EUR52.0 billion while the EU is the biggest foreign investor in Mercosur, with stock of EUR381.0 billion. The agreement contains specific commitments on labour rights and environmental protection, including the implementation of the Paris climate agreement and related enforcement rules. The EU will not fully open its market for imports of agri-food products, although beef, poultry and honey imports from the Mercosur countries will be permitted to increase over a five-year phasing in period. Several EU countries are obstructing ratification of the deal in its current form.

Sources: WTO Regional Trade Agreements database, Fitch Solutions, European Commission

Foreign Direct Investment

Foreign Direct Investment Policy

- 'Uruguay XXI' is the state's investment and business facilitating agency, making up part of the National System of Productive Transformation and Competitiveness (Transforma Uruguay) that works to promote the productive and innovative economic development of the country, with sustainability, social equity and environmental and territorial balance. This body has a centralising role for all administrations and ministries to facilitate all procedures.

- The repatriation of funds from Uruguay is not restricted. In order to repatriate funds, however, entities must fulfil the requirements of the Uruguayan Companies Act.

- Foreign investors are not required to partner with a local company or resident in order to invest, but because Uruguay lacks a developed capital market foreign direct investments are made primarily through acquisitions of property, infrastructure or domestic companies.

- Foreign investors are not required to meet any specific standard before being allowed to invest in the country. However, industry regulations concerning mining, telecommunications, banking, insurance and pension fund administration may require capital outlay prior to investment.

- Investors are largely treated the same as local investors (except for some restrictions, as mentioned below).

- Only Uruguayans are allowed to own companies involved in radio or television broadcasts within the country.

- Sectors that carry national security concerns are generally off limits to foreign investors.

- The presence of some legal monopolies present significant hurdles to entering the market in competition to these state-run companies.

- There has been no expropriations of land or property in Uruguay over the country's recent history. Although this does not exclude the possibility, it would make any such actions highly irregular.

- The government offers tax incentives to promote investment in specific sectors, including tourism, the creative industries (journalism, theatre and broadcasting), call centres, the electronic industry, forestry and timber, information technology, vehicle manufacturing, pharma and life sciences, biofuels and energy-generation including renewables.

- Uruguay is party to 30 active bilateral investment treaties, including one with Mainland China. An additional two treaties have been signed, but are not in force (with Australia and the United Arab Emirates).

- Uruguay is party to 14 treaties with investment provisions.

Sources: WTO – Trade Policy Review, Uruguay XXI, Uruguay XXI Investment Promotional Schemes, Fitch Solutions

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

There are 12 free trade zones (FTZs) strategically located nationwide, consisting of four types: industrial (Rivera, Colonia, UPM Fray Bentos and Punta Pereira); trade and logistics (Floridasur, Libertad and Nueva Palmira); services (Aguada Park and WTC Free Zone); and mixed (Zonamérica, Parque de las Ciencias and Colonia Suiza) |

The main incentives include: |

|

Research and development (R&D) incentives |

Corporate income tax (CIT) exemption for R&D in biotechnology and bioinformatics and software production. |

|

Industrial park incentives |

Companies or entities which either establish an industrial park or operate within one are eligible to benefit from: |

Sources: Ministerio de Economía y Finanzas, Invest in Uruguay, Fitch Solutions

- Value Added Tax: 22%

- Corporate Income Tax: 25%

Source: DGI

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

25% |

|

Capital Gains Tax |

Subject to the same fiscal treatment as IRAE and taxed at 25% |

|

Net Wealth Tax |

A corporation paying IRAE is subject to this tax at a standard rate of 1.5% of its net worth, calculated as the difference between taxable assets and deductible liabilities. |

|

VAT |

The standard rate is 22% but a lower rate of 10% applies to basic foodstuffs, medicines, hotel services, new buildings and the first sale of immovable assets; and some things are zero-rated, including milk, books, magazines, cattle, real estate leases, agricultural machinery and certain bank services. |

|

Withholding Tax |

Dividends: 7% for non-residents Interest: 7% or 12%, depending on the duration of the loan and the currency used; 25% if paid to an entity located in a low-tax jurisdiction Royalties: 12% for non-residents and 25% if paid to an entity located in a low-tax jurisdiction |

|

Real Estate Tax |

An annual tax rate ranging from 0.25 to 1%, depending on the municipality, is levied based on the assessed value of the land/buildings and payable in several instalments each year. |

|

Transfer Tax |

2% on the sale of real estate, to be paid by both buyer and seller |

|

Payroll Tax: social security |

All employers pay a total social tax of 12.6% (consisting of deductions of 7.5% to fund retirement contributions, 5% to fund medical/public health insurance, 0.1% for the labour restructuring fund and 0.025% for the labour credit guarantee fund) All employees pay a total social tax of 18.1–23.1% (consisting of deductions of 15% to fund retirement contributions, 3–8% to fund medical/public health insurance depending on marital and parental status and 0.1% for the labour retraining fund) |

Source: DGI

Date last reviewed: February 6, 2020

Foreign Worker Permits

Foreign workers must obtain work permits and a Uruguayan identity card and may reside in Uruguay under either a temporary or permanent residency visa. It can take up to two years to obtain permanent residency, but this should not pose additional risks to investors looking to bring in foreign workers, as residency permits are very likely to be issued eventually. Workers may reside in the country under a temporary visa until the permanent visa is issued.

Local and Foreign Worker Quotas

There are no quotas for employment in Uruguay, except for businesses based in free trade zones, which must employ a workforce which is at least 75% Uruguayan, although this is negotiable.

Sources: Europa.eu, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Baa2 (Stable) |

06/08/2019 |

|

Standard & Poor's |

BBB (Stable) |

30/05/2017 |

|

Fitch Ratings |

BBB- (Negative) |

20/02/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

94/190 |

95/190 |

101/190 |

|

Ease of Paying Taxes Index |

106/190 |

101/190 |

103/190 |

|

Logistics Performance Index |

85/160 |

85/160 |

N/A |

|

Corruption Perception Index |

23/10 |

21/10 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

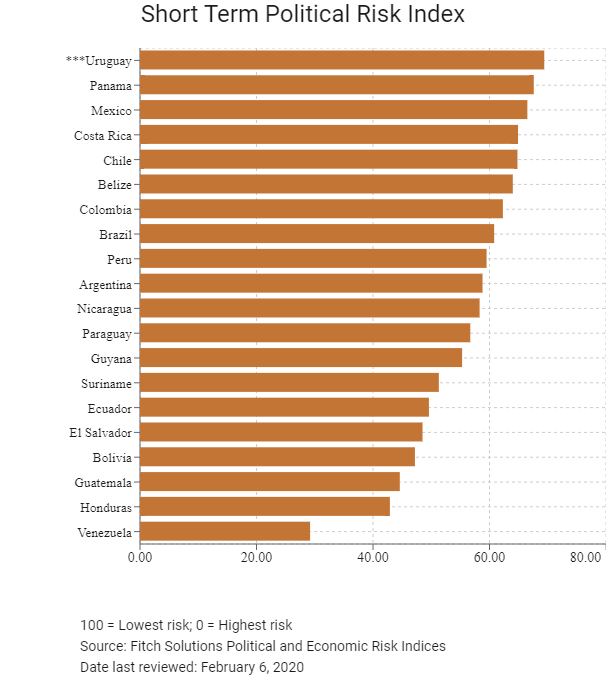

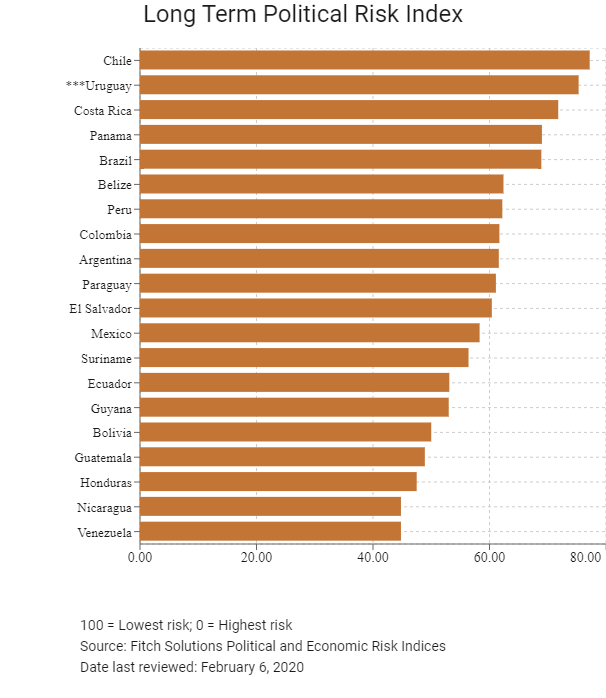

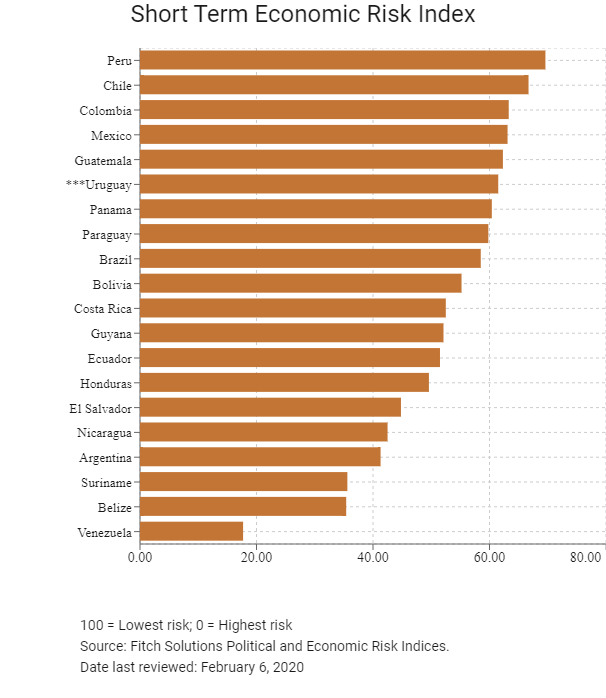

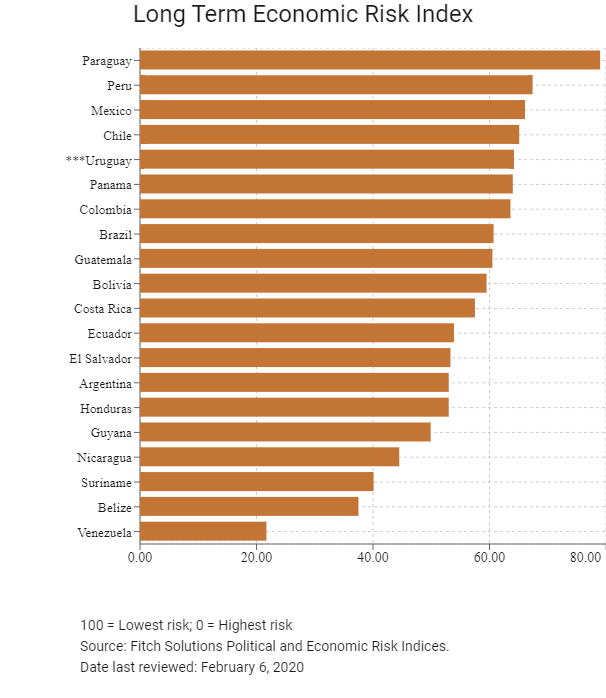

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

60/202 |

57/202 |

54/202 |

|

Short-Term Economic Risk Score |

60.4 |

58.1 |

61.5 |

|

Long-Term Economic Risk Score |

62.6 |

63.5 |

64.2 |

|

Political Risk Index Rank |

42/202 |

42/202 |

43/202 |

|

Short-Term Political Risk Score |

71.5 |

66.9 |

69.4 |

|

Long-Term Political Risk Score |

75.3 |

75.3 |

75.3 |

|

Operational Risk Index Rank |

75/201 |

75/201 |

74/201 |

|

Operational Risk Score |

54.0 |

54.4 |

54.6 |

Source: Fitch Solutions

Date last reviewed: February 6, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The importance of exports to the Uruguayan economy, coupled with the country's reliance on Argentina's demand for Uruguayan goods, will lead to slower growth over the short term as Argentina's recession continues. This will be compounded by weakness across the manufacturing and construction sectors, constraining the outlook for exports. Over the long term, consumption is likely to play a greater role in driving growth, as policymakers act on the need to diversify away from an agricultural exports-driven model of growth.

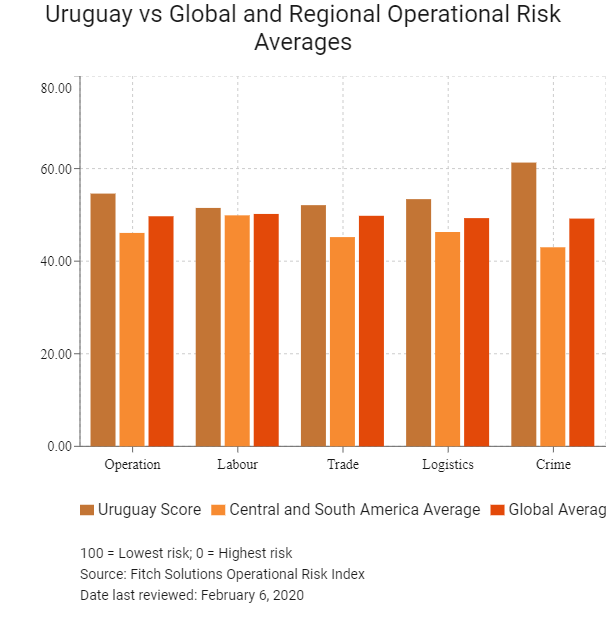

OPERATIONAL RISK

Uruguay benefits from limited risks to businesses. Uruguay offers a better educated and more flexible labour market, a higher quality and less congested transport network, a more open foreign direct investment policy, and a safer environment for foreign workers and businesses than several leading Latin American countries – including neighbouring Argentina and Brazil. Politically, the government of Uruguay is among the most stable in Latin America and well above the emerging market average. Businesses will face some risks in terms of high labour costs and corporate tax burden, but this does not undermine the country's overall regional competitiveness.

Source: Fitch Solutions

Date last reviewed: February 10, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Uruguay Score |

54.6 |

51.5 |

52.1 |

53.4 |

61.3 |

|

Central and South America Average |

46.1 |

49.9 |

45.2 |

46.3 |

43.0 |

|

Central and South America Position (out of 20) |

4 |

9 |

6 |

5 |

2 |

|

Latin America Average |

48.2 |

49.7 |

48.9 |

44.8 |

49.3 |

|

Latin America Position (out of 42) |

9 |

16 |

17 |

6 |

6 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

74 |

89 |

92 |

79 |

54.0 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Chile |

64.9 |

64.2 |

68.6 |

63.0 |

63.8 |

|

Costa Rica |

56.3 |

53.6 |

60.3 |

52.2 |

59.3 |

|

Panama |

56.2 |

50.7 |

56.4 |

67.1 |

50.6 |

|

Uruguay |

54.6 |

51.5 |

52.1 |

53.4 |

61.3 |

|

Mexico |

52.3 |

57.5 |

58.2 |

57.4 |

35.9 |

|

Colombia |

51.8 |

57.5 |

54.7 |

51.8 |

43.1 |

|

Brazil |

50.3 |

47.4 |

48.4 |

53.9 |

51.5 |

|

Peru |

49.1 |

61.4 |

51.5 |

42.8 |

40.5 |

|

Argentina |

49.0 |

52.8 |

42.4 |

50.5 |

50.4 |

|

Ecuador |

45.8 |

52.4 |

37.6 |

50.9 |

42.4 |

|

El Salvador |

42.9 |

46.0 |

44.5 |

48.0 |

33.0 |

|

Suriname |

42.8 |

52.0 |

35.6 |

41.2 |

42.5 |

|

Belize |

41.9 |

51.0 |

38.1 |

40.9 |

37.8 |

|

Paraguay |

41.2 |

43.9 |

44.0 |

39.2 |

37.6 |

|

Guatemala |

40.8 |

43.8 |

44.7 |

41.0 |

33.5 |

|

Honduras |

40.0 |

40.2 |

46.9 |

40.1 |

32.7 |

|

Nicaragua |

39.4 |

40.4 |

39.1 |

37.0 |

41.1 |

|

Guyana |

36.8 |

44.5 |

38.3 |

29.6 |

34.6 |

|

Bolivia |

36.6 |

38.9 |

28.7 |

38.2 |

40.6 |

|

Venezuela |

29.2 |

48.5 |

13.1 |

28.4 |

26.8 |

|

Regional Averages |

46.1 |

49.5 |

45.2 |

46.3 |

43.0 |

|

Emerging Markets Averages |

46.2 |

48.6 |

45.4 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.3 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 6, 2020

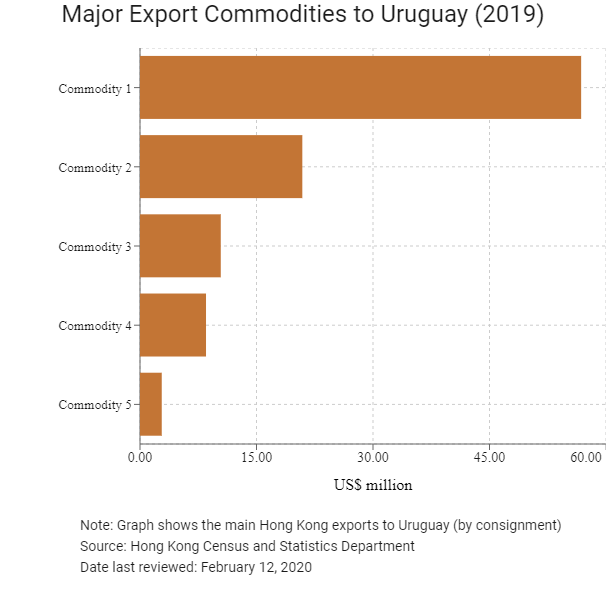

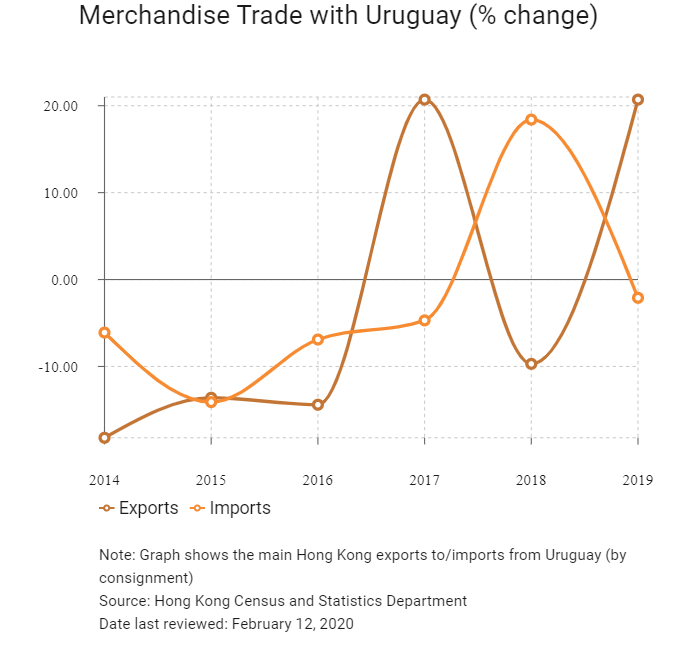

Hong Kong’s Trade with Uruguay

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

56.8 |

|

Commodity 2 |

Office machines and automatic data processing machines |

20.9 |

|

Commodity 3 |

Tobacco and tobacco manufactures |

10.4 |

|

Commodity 4 |

Articles of apparel and clothing accessories |

8.5 |

|

Commodity 5 |

Electrical machinery, apparatus and apppliances, and electrical parts thereof |

2.8 |

|

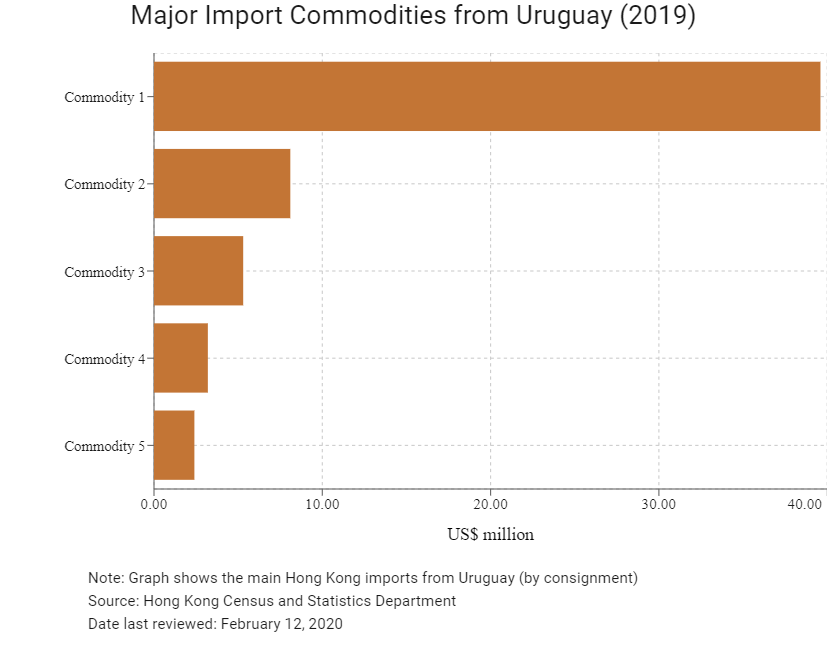

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Meat and meat preparations |

39.6 |

|

Commodity 2 |

Essential oils and resinoids and perfume materials; toilet, polishing and cleansing preparations |

8.1 |

|

Commodity 3 |

Metalliferous ores and metal scrap |

5.3 |

|

Commodity 4 |

Leather, leather manufactures, and dressed furskins |

3.2 |

|

Commodity 5 |

Photographic apparatus, equipment and supplies and optical goods; watches and clocks |

2.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Latin American residents visiting Hong Kong |

175,111 |

-8.0 |

|

Number of Uruguay residents visiting Hong Kong |

2,043 |

-9.4 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Date last reviewed: February 6, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Uruguayan companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong and Uruguay

Uruguay has a bilateral investment treaty with Mainland China that entered into force on December 1, 1997.

Chamber of Commerce (or Related Organisations) in Hong Kong

Honorary Consulate of Uruguay

Address: 16/F, Hong Kong Club Building, 3A Chater Road, Central, Hong Kong

Email: cdhongkong@mrree.gub.uy / afreris@netvigator.com / urulinks@hotmail.com

Tel: (852) 2168 0832

Fax: (852) 8108 0097

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

Hong Kong residents can travel to Uruguay without a visa for tourism and business purposes and remain in the region for a period of up to 90 days.

Source: Visa on Demand

Date last reviewed: February 6, 2020

Uruguay

Uruguay