GDP (US$ Billion)

771.27 (2018)

World Ranking 19/193

GDP Per Capita (US$)

9,405 (2018)

World Ranking 73/192

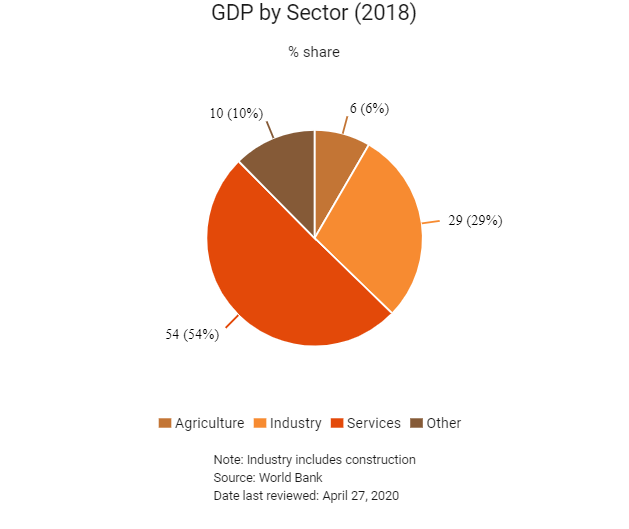

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

61.4 (2019)

Currency (Period Average)

Turkish Lira

5.67per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

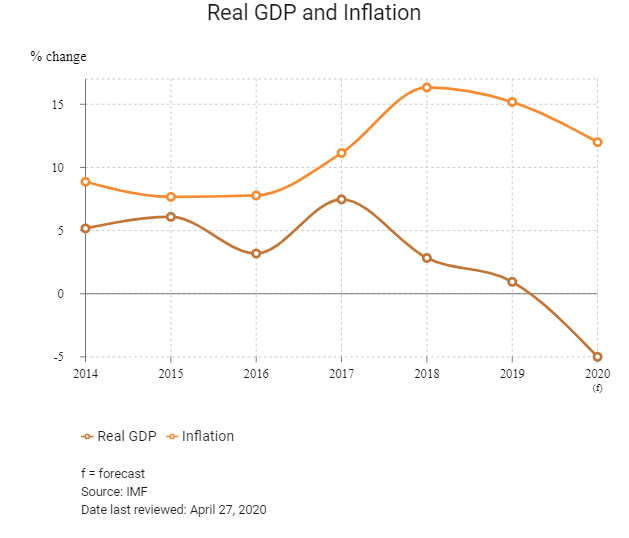

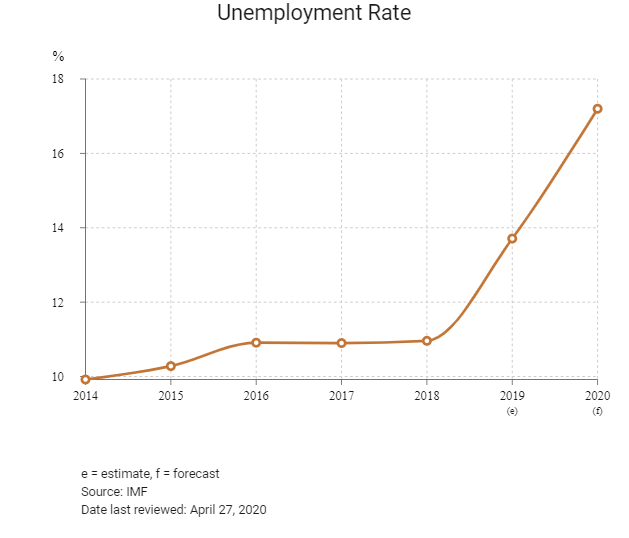

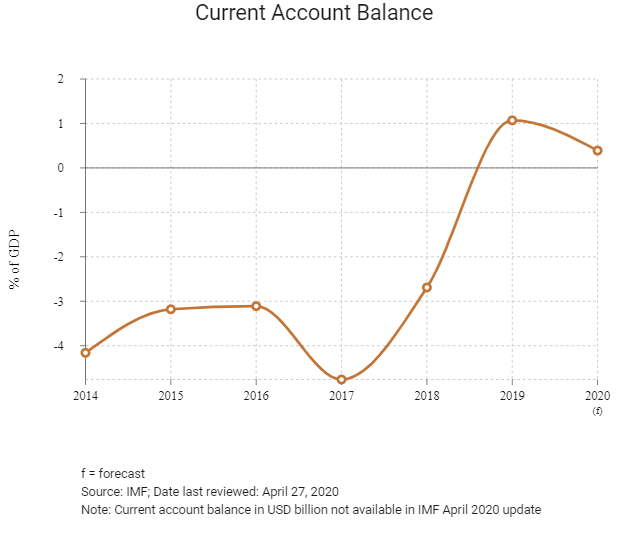

Turkey is a transcontinental Eurasian country located at the crossroads of Europe and Asia, which makes it a country of significant geostrategic importance. Turkey has been an appealing market for investors since the mid-2000s. These factors also mean, given Turkey's own plans for internal transportation connectivity infrastructure, the country could play a pivotal role in Mainland China's Belt and Road Initiative, which has the potential to create an interconnected trading bloc that includes Turkey, Russia, Iran, India and Mainland China. Turkey experienced strong economic growth on the back of the many positive economic and banking reforms it implemented between 2002 and 2007. Turkey's economic performance since 2000 has been robust, and macroeconomic and fiscal stability were at the heart of that, enabling increased employment and making Turkey an upper-middle-income country. Poverty more than halved over 2002–2015, and during this time Turkey urbanised dramatically while simultaneously opening to foreign trade and finance, harmonising many laws and regulations with European Union standards, and greatly expanding access to public services. It also recovered well from the global crisis of 2008–2009. However, some of Turkey's development achievements have been slowing down after the long period of success and risk being undermined, exacerbated internally by the economic turbulence of mid-2018 and challenged externally by the ongoing effects felt worldwide in 2020 from the Covid-19 pandemic. The Turkish economy looks set for a period of slower growth as high inflation, a more restrictive domestic and external financing backdrop, and weakening relationships with some key trading partners prove headwinds to growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2019

It was announced that the EU had signed a EUR275 million grant agreement with Turkey to help finance the construction of the EUR1.2 billion modernisation of the Halkali (Istanbul)-Kapikule (Edrine) line. This represented a significant improvement to a route of strategic importance to the trans-European railway network.

March 2019

Alamos Gold received an operating permit for the USD180 million Kirazli project, which would produce an estimated 104koz of gold per annum. In January 2019, Alacer Gold provided an update on the feasibility study at the USD269 million Gediktepe project, which was set to be completed by the end of the year.

April 2019

The United States decided not to grant any Significant Reduction Exceptions (waivers) to existing importers of Iranian oil.

June 2019

The opposition Republican People's Party won the mayoral election in Istanbul.

October 2029

Turkey's Trade Registry Gazette showed that Volkswagen (VW) had established a subsidiary in the country's western Manisa province. Turkey had first invited VW to invest in 2005 at the Geneva Motor Show. Although VW had identified the location for its plant, expected to result in an investment of around EUR1.3 billion (USD1.4 billion) and with production expected to begin in 2022, a decision to proceed had been postponed.

December 2019

Azerbaijan's President Ilham Aliyev and Turkey's President Erdoğan inaugurated the Trans-Anatolian Pipeline, the longest element of the Southern Gas Corridor which would supply Turkey and Europe with natural gas from Azerbaijan.

January 2020

Morocco’s Minister of Trade Moulay Hafid Elamamy stated that Rabat and Ankara must review their 14-year free trade agreement (FTA). Elalamy also talked about the negative aspects of the FTA, arguing that Morocco loses USD2 billion annually due to its trade deal with Turkey.

February 2020

Zambia announced that it would co-host the inaugural session of the Zambia-Turkey Joint Economic Commission (JEC). According to Zambia’s Foreign Affairs Minister Joseph Malanjihe, the JEC was a designed to promote mutual trade and economic cooperation between the two countries.

In Syria, 33 Turkish soldiers were killed in air strikes by Russia-backed Syrian government forces, increasing tension between Ankara and Moscow.

March 2020

Turkey and Russia carried out their first joint patrol in Syria along a security corridor following a ceasefire agreement between the opposing sides backed by each country.

April 2020

The Treasury and Finance Ministry announced it would repay USD12.6 billion of debt in the May–July period. The previous day it was announced that e-commerce grew by 39% in 2019 to make the market worth USD14.6 billion.

Azerbaijan state oil company SOCAR and BP announced a delay until 2021 to the start of their joint venture construction of a new, USD1.8 billion Turkish petrochemical industrial complex in Izmir originally announced in August 2019.

Scientists tried to contain a stinkbug infestation that threatened to damage Turkey's hazelnut production in the Black Sea region, where two-thirds of the world's hazelnut supply originates.

Turkey's statistical authority announced that tourism income reached USD4.1 bilion in January-March 2020, marking a fall of -11.4% compared to the same period a year earlier.

May 2020

Turkey's largest oil refiner announced the temporary stoppage, until July 1 2020, of production at its Izmir oil refinery due to reduced fuel demand caused by the Covid-19 pandemic.

June 2023

Parliamentary and presidential elections scheduled.

Sources: BBC Country Profile – Timeline, Daily Sabah, Hurriyet Daily News, The Guardian, Reuters, Al Jazeera, Bloomberg, AzerNews, Emerging Europe, Xinhuanet, Eurasianet, Fitch Solutions

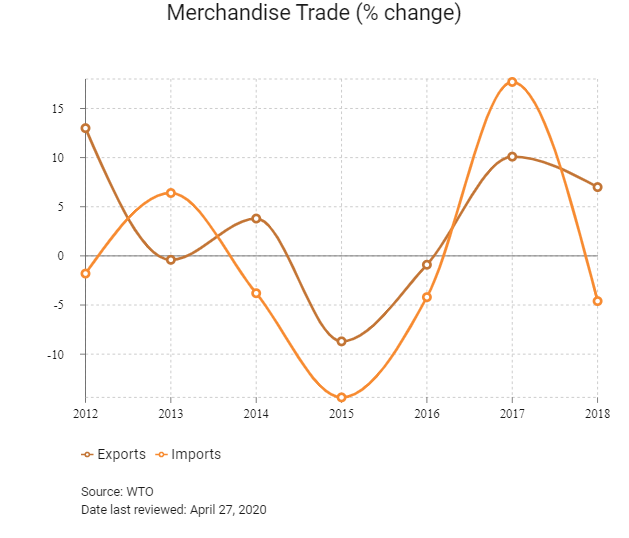

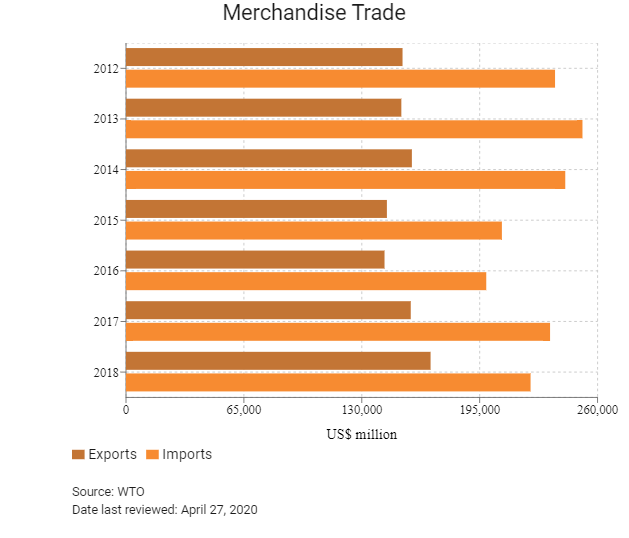

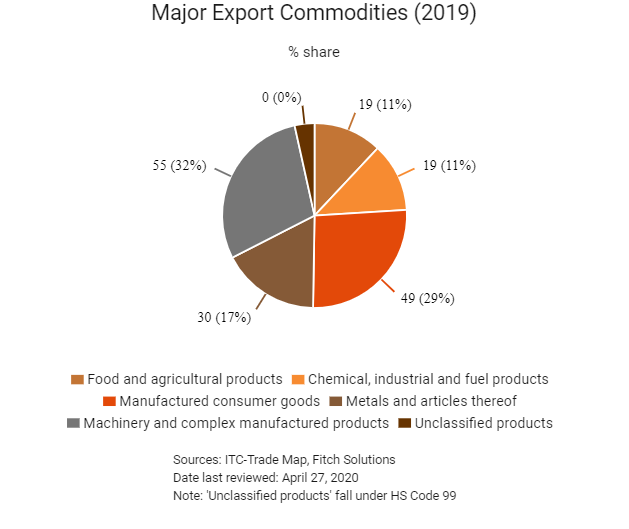

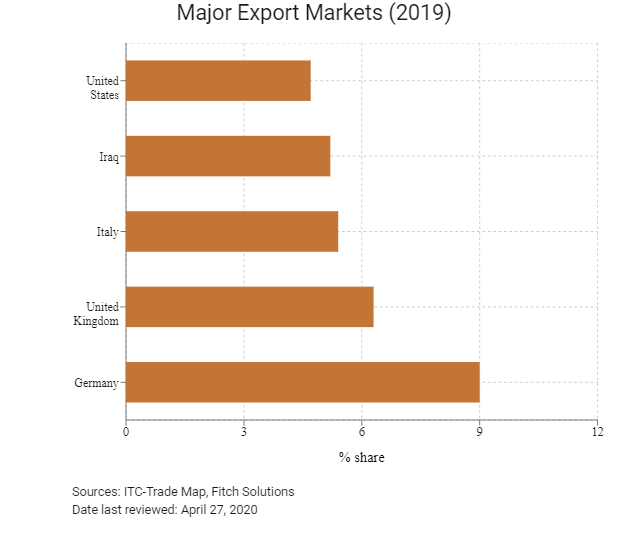

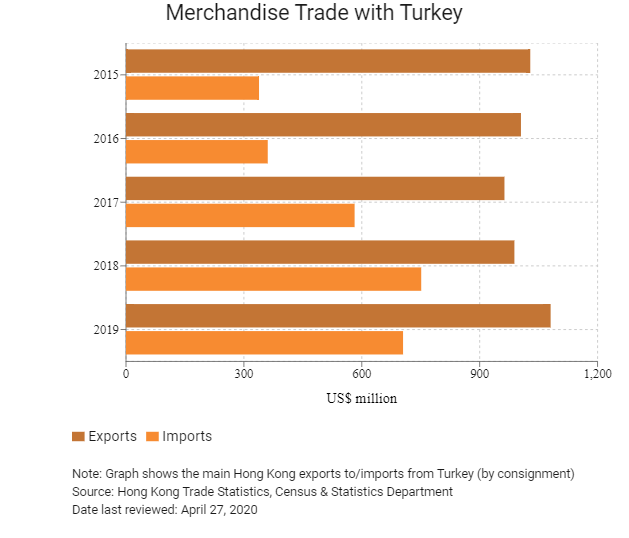

Merchandise Trade

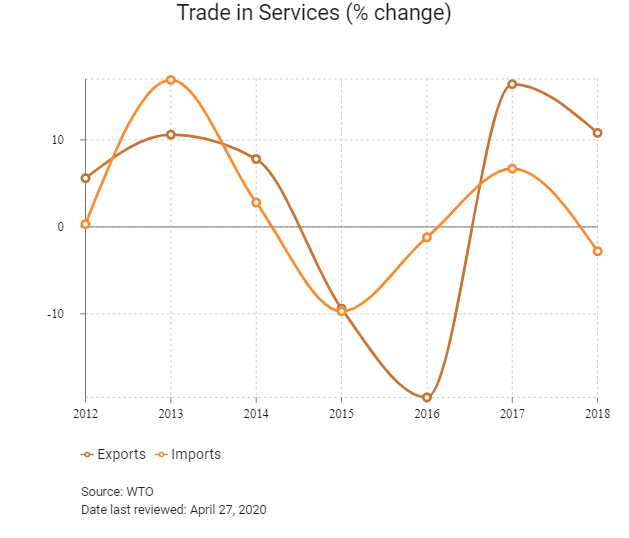

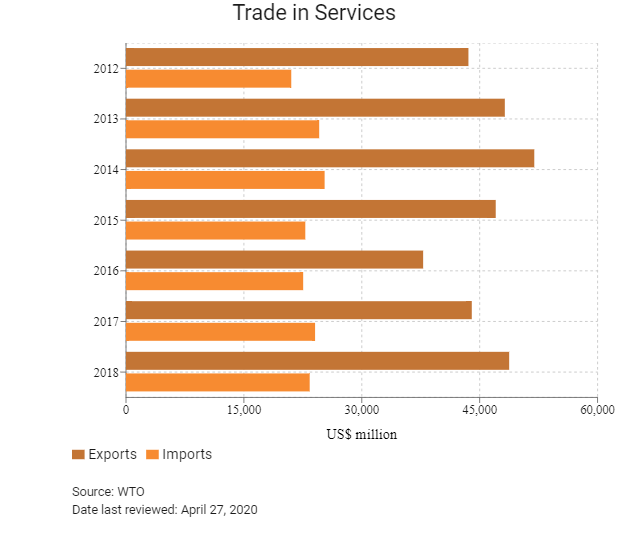

Trade in Services

- Turkey has significantly liberalised its import regime, especially in the last two decades. Any individual or enterprise can freely register to engage in the import business. The country has been a member of the General Agreement on Trade and Tariffs since October 17, 1951, a member of the World Trade Organization (WTO) since March 26, 1995, and its tariff scheme is based on the Harmonised System for commodity coding. The average tariff rate faced by importers stands at 3.2%.

- Trade flows in Turkey have been facilitated by the removal of trade barriers and lowering of tariffs alongside membership of a number of FTAs. In addition to being a member of the WTO, Turkey is also a member of the World Customs Organization. Turkey signed a Customs Union Agreement with the EU on January 1, 1996 and has amended its customs code and legislation in line with those of the EU customs code.

- Turkey has become increasingly integrated with the West by becoming a member of organisations such as the Council of Europe (1950), the North Atlantic Treaty Organization (1952), the Organisation for Economic Co-operation and Development (1960), the Organization for Security and Co-operation in Europe (1973) and the G20 major economies (1999). Turkey began full membership negotiations with the EU in 2005, having been an associate member of the European Economic Community since 1963 and having reached a customs union agreement in 1995.

- Other states that have active FTAs with Turkey include North Macedonia, Bosnia-Herzegovina, Tunisia, Morocco, Albania, Georgia, Montenegro, Serbia, Chile, Jordan and Mauritius. These countries are not major trade partners of Turkey, so these FTAs offer few benefits at present.

- Turkey has also fostered close cultural, political, economic and industrial relations with the East, particularly the Middle East and the Turkic states of Central Asia, through membership in organisations such as the Organization of the Islamic Conference (OIC) and the Economic Cooperation Organization (ECO).

- The lack of clarity surrounding final bound tariff rates means that the government can considerably increase tariffs on imports to protect certain sectors. While this largely affects agricultural imports, higher tariffs may be applied to a wider range of products including finished goods such as furniture and footwear, as well as intermediate inputs and construction materials.

- Import licences are required for some agricultural produce and other goods and documentary compliance can be difficult owing to opaque regulations.

- Following the changes in Turkish economic policy in the 1980s, there has been rapid growth in the foreign trade volume of Turkey. For value added tax (VAT) purposes, any import of goods or services into Turkey is a taxable transaction, regardless of the status of the importer or the nature of the transaction. To equalise the tax burden on import and domestic supply of goods and services, VAT is levied only on the importation of goods and services that are liable for tax within Turkey. Accordingly, any transaction exempt in Turkey may also be exempt on import. The VAT on importation is imposed at the same rates applicable to the domestic supply of goods and services. In the case of importation, the taxable event occurs at the time of actual import. The VAT rates are 1%, 8% and 18%, varying according to the type of goods imported. The import of machinery and equipment under an investment incentive certificate is exempt from VAT.

- If the import transaction is not conducted in cash, there is a special Resource Utilisation Support Fund (RUSF) which should also be paid. The RUSF applied to imports on a credit basis. According to the RUSF's legislation, any importation conducted on credit (if the payment related to the importation is not paid before the actual importation) is subject to a special payment of 6% of the value of the goods to be imported. The important criteria are payment terms and whether it is a cash payment or payment on credit.

- Turkey has also adopted the EU's Common External Tariffs imposed on imports from third countries and economies. Products imported from sources other than the EU and Turkey can thus move freely if all import formalities have been complied with in accordance with customs duties. Generally, the Turkish Customs Code is very similar to that of the EU and aims to harmonise the customs practices of Turkey with those of the EU.

- Some industrial products from less developed and developing countries (in addition to Mainland China) benefit from the EU's Generalised System of Preferences (GSP). With the creation of the customs union between the EU and Turkey, such products are also covered under Turkey's GSP regime.

- Turkey has its own anti-dumping actions which are separate from those of the EU. Dumping and anti-dumping duties are collected at the point of import. To harmonise with the relevant EU directives, the Turkish version of the Restriction of Hazardous Substances Directive entered into force in June 2009, while the Turkish version of the Waste Electrical and Electronic Equipment Directive was published in the Turkish Official Journal on May 22, 2012 and implemented from January 2013 onwards.

- The Turkish Standards Institution (TSE) is the product standardisation body of Turkey and is responsible for setting product standards and ensuring compliance; for example, while there is a minimum two-year warranty requirement for electrical and electronic products, before products can be imported and placed on the Turkish market it is also necessary to obtain technical approval by the TSE and European CE standard certification under the requirements set out by the TSE. As for toys, the TSE also imposes a number of safety standards which, in large part, follow those required by the EU. Therefore, the attainment of CE standard certification can serve as a good reference for fulfilling the TSE requirements.

- In certain cases, such as temporary importation or inward processing, the customs administration will require a guarantee letter to secure the taxes. The amount of this guarantee shall cover all the taxes payable in the case of an importation.

- In 2011 the then Prime Minister Erdoğan outlined a 12-year plan called '2023 Vision', which set out a number of targets to grow Turkeys GDP and improve living standards by the 100th anniversary of the country in 2023. The targets included a number of major infrastructure projects and incentives to attract more inward private investment.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

Thailand and Turkey signed a declaration in Ankara in July 2018 to start negotiations for an FTA, setting a goal to increase bilateral trade between the two countries by 40%. The first phase of agreement negotiations would only cover merchandise trade, while investments and services and e-commerce will be incorporated into the FTA at a later stage.There are expectations the FTA coud be concluded in 2020.

Multinational Trade Agreements

Active

- Turkey-EU Customs Union: Turkey and the EU are linked by a customs union agreement which came into force on December 31, 1995. Turkey has been a candidate country to join the EU since 1999 and is a member of the Euro-Mediterranean partnership. The customs union with the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. The EU is Turkey's number one import and export partner. Turkey is the EU's fourth-largest export market and fifth-largest provider of imports. Turkey also enjoys tariff-free access to the states with which the EU has concluded FTAs, including Mexico, South Africa, Ukraine and Morocco. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the customs union agreement covers all industrial goods, but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural as well as coal and steel products. In December 2016, the European Commission (EC) proposed the modernisation of the customs union and to further extend the bilateral trade relations to areas such as services, public procurement and sustainable development, but that mandate has not yet been adopted.

- Turkey-European Free Trade Association (EFTA – Iceland, Liechtenstein, Norway and Switzerland): Turkey and the EFTA states signed a FTA on December 10, 1991, which came into force on on April 1, 1992, and covers trade in goods. Switzerland is a large source of imports and assists with regional trade flows to Europe.

- Turkey-Israel FTA: Israel is an important trade partner in the Middle East and there is potential for expansion of trade flows. Under the current FTA, which was signed with Israel on March 14, 1996 and went into force on May 1, 1997, numerous trade-related areas including sanitary and phytosanitary measures, internal taxation, balance of payments, public procurement, state aid, intellectual property rights, anti-dumping, rules of origin and various safeguard measures are addressed. The stipulations of the agreement on industrial products, all the customs taxes and charges that have an equivalent effect were abolished on January 1, 2000. Regarding agricultural products, Turkey and Israel granted each other unlimited tariff elimination or reduction and/or tariff reduction or elimination in the form of tariff quotas for some agricultural products originating in the other party. Furthermore, in 2006 and 2007, both parties revised the list of agricultural products that are granted preferential treatment under the original agreement.

- Turkey-Egypt FTA: The FTA between Egypt and Turkey was signed on December 27, 2005 in Cairo and entered into force on March 1, 2007. Egypt is a relatively large export market, particularly for refined fuel.

- Turkey-South Korea FTA: The expanded FTA will allow each of the two countries to secure government policy authority (South Korea in the agriculture, energy and real estate sectors, and Turkey in the agriculture and fisheries, mining and real estate sectors) while modernising investor state dispute settlement to protect South Korean companies with a stake in Turkey. South Korea is a key source of complex manufactured goods. The Agreement on Trade in Services and The Agreement on Investment were negotiated and signed on February 26, 2015 and entered into force on August 1, 2018.

- Turkey–Republic of Singapore FTA (TRSFTA): The FTA between Turkey and the Republic of Singapore was signed on November 14, 2015, and entered into force on October 1, 2017. The agreement covers market access for goods, trade remedies, sanitary and phytosanitary measures, technical barriers to trade, customs and trade facilitation, trade in services, investment, government procurement, competition policy, intellectual property rights, transparency and dispute settlement mechanisms. The TRSFTA also addresses non-tariff barriers to trade in three major sectors: telecommunications, electronic commerce and financial services

- Turkey-Morocco FTA: Morocco and Turkey signed the FTA deal in 2004, and the agreement took effect in 2006. With this FTA, tariffs and non-tariff barriers were eliminated in trade between the parties. The agreement regulates numerous areas, such as sanitary and phytosanitary measures, state monopolies, intellectual property rights, internal taxation, public procurement, balance of payments, anti-damping, safeguard measures, and rules of origin. This FTA will be reviewed over 2020.

Under Negotiation

- Turkey-Mercosur FTA: Trade with Mercosur (comprised of Argentina, Brazil, Paraguay, Uruguay and Venezuela) is limited and may expand significantly under FTAs.

- Turkey is currently discussing a potential bilateral FTA with Ukraine.

Signed But Not Ratified

Turkey-Lebanon, Kosovo, Moldova, Malaysia and the Faroe Islands: Trade flows with these countries are not substantial and they offer relatively limited markets – though Malaysia offers an alternative source of energy.

Negotiation Suspended

Turkey-Gulf Cooperation Council (GCC): Although negotiations have been suspended, tariff-free access to the GCC would reduce costs on energy imports.

Sources: WTO Regional Trade Agreements database, European Commission, Ministry of Foreign Affairs, Ministry of Trade and Industry Singapore, Fitch Solutions

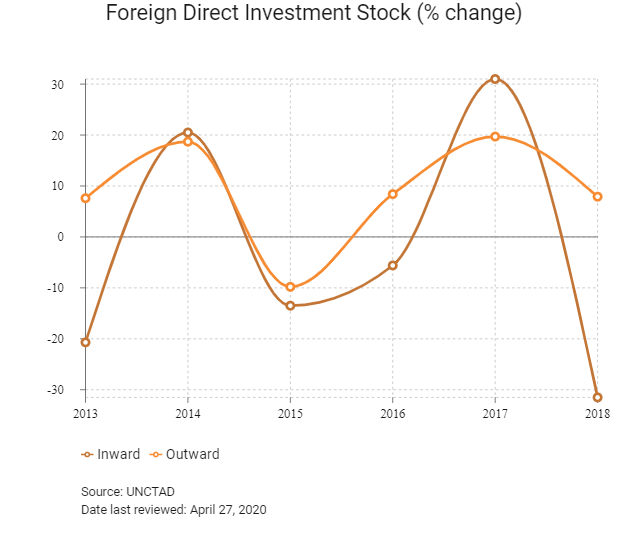

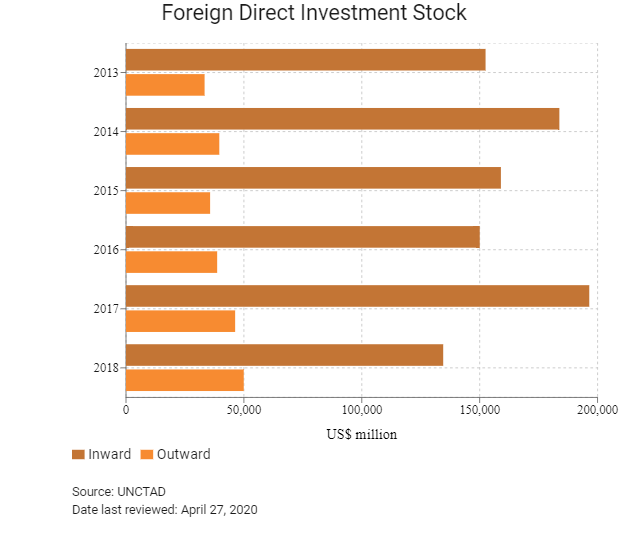

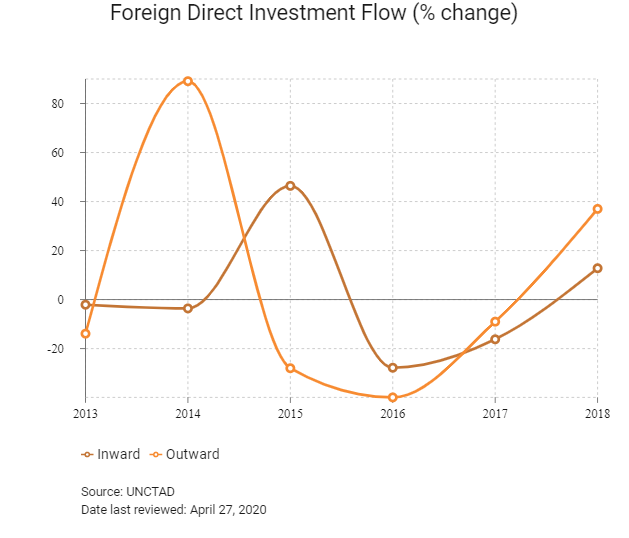

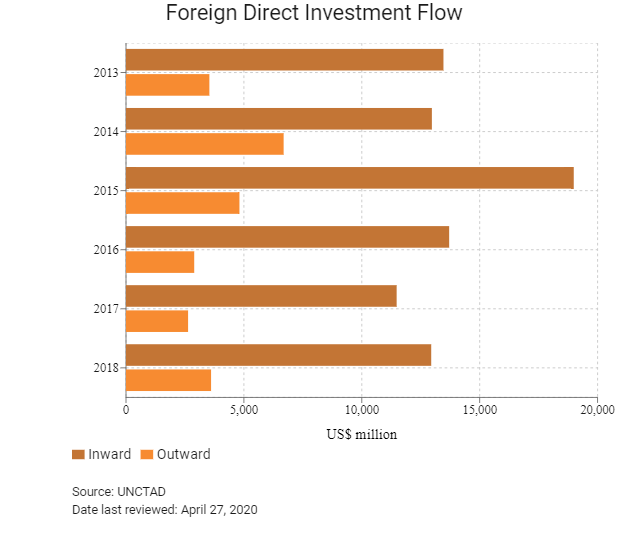

Foreign Direct Investment

Foreign Direct Investment Policy

- The Turkish government has pursued wide-ranging reforms since 2001, aimed at opening up the economy to greater foreign involvement in order to enhance industrial capacity and boost growth. There are consequently few regulatory restrictions on foreign direct investment (FDI), while an ongoing privatisation process is reducing the state's role in the economy and further widening access for foreign investors to strategic industries. Turkey's government acknowledges that it needs to attract significant new FDI to meet its ambitious development goals, as well as finance its current account deficit. As a result, Turkey has one of the most liberal legal regimes for FDI in the Organisation for Economic Cooperation and Development (OECD).

- Turkey does not screen, review or approve FDI specifically. However, the government established regulatory and supervisory authorities to regulate different types of markets. Important regulators in Turkey include the Competition Authority; the Energy Market Regulation Authority; the Banking Regulation and Supervision Authority; the Information and Communication Technologies Authority; the Tobacco, Tobacco Products and Alcoholic Beverages Market Regulation Board; the Privatisation Administration; the Public Procurement Authority; the Radio and Television Supreme Council; and the Public Oversight, Accounting and Auditing Standards Authority. Some of the aforementioned authorities screen as needed without discrimination, primarily for tax audits. Screening mechanisms are executed to maintain fair competition and for other economic benefits. If an investment fails a review, possible outcomes vary from a notice to remedy, which allows for a specific period of time to correct the problem, to penalty fees. The Turkish judicial system allows for appeals of any administrative decision, including tax courts that deal with tax disputes.

- Most sectors open to the Turkish private sector are also open to foreign participation and investment, 100% foreign ownership is permitted in most industries. Both domestic and foreign investors enjoy equal rights and protections under law and both are eligible for the incentives provided to investment in new projects. There are no capital controls imposed and investors are free to transfer earnings into foreign currency and remit profits abroad.

- The Turkish government has several investment incentives meant to encourage investments with the potential to reduce dependency on the importation of intermediate goods vital to the country's strategic sectors, identified as agriculture and food, automotive, business services, chemicals, electronics, energy and renewables, financial services, healthcare and pharmaceuticals, information communication technology, infrastructure, machinery, manufacturing, mining, real estate, tourism and transportation and logistics. The incentives include VAT or customs duty exemption and social security contributions support.

- Since 2001, Turkey has pursued a comprehensive investment climate reform programme aimed at streamlining investment-related procedures and attracting more FDI. The government has launched the Coordination Council for the Improvement of the Investment Environment (YOIKK), which involves stakeholders from the public and private sectors, to advise on current investment policies. A supplementary role is played by the Investment Advisory Council of Turkey, which convenes yearly under the chairmanship of the prime minister and involves representatives from multinational companies, international institutions and non-governmental organisations. The recommendations supplied by this council are applied as guidelines for the YOIKK agenda.

- The Privatisation Administration has been used to divest state assets in a wide range of industries, with nearly all 188 former state-owned entities now boasting some level of private sector participation. Another government programme of more direct relevance is the Investment Support and Promotion Agency, which offers information and advice to foreign investors as well as support in setting up operations. All of these initiatives have been successful in improving the investment environment and increasing foreign participation in Turkey's economy.

- Turkey's generous and wide-ranging incentive programme and suite of free zones offers numerous fiscal benefits, funding support and logistical advantages to new projects. The current incentive system was established in 2012 and updated in 2015 and aims to encourage investment in strategic sectors, high value-added industries and underdeveloped regions. The programme is divided into five different schemes which offer a varying range of benefits depending on the sector, location and amount of investment, namely the General, Regional, Priority, Large-Scale and Strategic Investment Incentive Schemes. More information on the investment environment and regulations can be found at the Investment Support and Promotion Agency of Turkey. In August 2019 the programme was amended (Presidential Decrees No. 1402 and No. 1403): the Large-Scale scheme was abolished and a 'Technology Focused Industry Move Program' was introduced to encourage investment in products from the Priority Products List determined by the Ministry of Industry and Technology. The minimum investment requirement was set at TRY50 million for the new programme but increased to TRY500 million for the other schemes.

- Turkey has 18 operational free zones, plus another being established, located close to the European Union and Middle Eastern markets, with access to international trade routes via ports on the Medierranean Sea, Agean Sea and Black Sea. The advantages offered have resulted in the accumulation of sophisticated industrial clusters which offer immediate access to quality local suppliers and international trade routes, significantly reducing supply chain risks and logistics costs.

- A number of provisions may be applied to government tenders which are detrimental to foreign investors, including restrictions on bids by foreign companies, the potential to offer price advantages of up to 15% for domestic bidders, a requirement to accept only the lowest bids and the use of model contracts all of which leave little room for flexibility and specialisation.

- The government mandates a local employment ratio of 10 Turkish citizens per foreign worker. These schemes do not apply equally to senior management and boards of directors, but their numbers are included in the overall local employment calculations. Foreign legal firms are forbidden from working in Turkey except as consultants; they cannot directly represent clients and must partner with a local law firm. There are no onerous visa, residence, work permits or similar requirements inhibiting mobility of foreign investors and their employees. There are no known government-imposed conditions on permissions to invest, including tariff and non-tariff barriers.

- The Council of Ministers published a amending the Decree No. 32 on the Protection of the Value of the Turkish Currency (Decree No. 32) in the Official Gazette No. 30312 on January 25, 2018. The amendments providing restrictions on foreign exchange loans entered into force on May 2, 2018. Prior to the amendments, Turkish residents were not entitled to use foreign currency denominated loans from abroad. With the amendments, Turkish residents that do not have foreign exchange income will no longer be able to use foreign currency denominated loans from abroad, with certain exceptions.

- Corporations are liable for income tax at a rate of 22% for the years 2018, 2019 and 2020 on net profits generated, as adjusted for exemptions and deductions and including prior year losses carried forward, to a limited extent. Deliveries of goods and services are subject to VAT at rates varying from 1% to 18%. The general rate is 18%.

- Turkey is party to 76 bilateral investment treaties (BIT) with countries or economic unions, including one with Mainland China. An additional 44 treaties have been signed but are not yet in force (including an updated BIT with Mainland China).

- Turkey is party to 16 treaties with investment provisions and is currently in negotiation with Hong Kong over an investment promotion and protection agreement.

Sources: WTO – Trade Policy Review, the International Trade Administration, Investment Support and Promotion Agency of Turkey, Trade Ministry, Ministry of Treasury and Finance, UNCTAD, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

General Investment Incentive Scheme: available regardless of location and investment amount and applied to all other investment incentive programmes. |

Exemption from VAT and customs duty |

|

Regional Investment Incentive Scheme: offers a range of benefits depending on the development level of the region in which the project is located. All regions of Turkey are allocated a number from one to six, whereby one represents the most developed and offers the fewest incentives. The minimum investment amount is TRY1 million for zones one and two and TRY500,000 for the remaining four zones. |

- Automatic government land allocation |

|

Priority Investment Incentive Scheme: focused on specific sectors, including high-tech manufacturing, pharmaceutical, defence industry, automotive, mining, education, LNG, power generation, rail and maritime transport. |

- All incentives allocated to firms located in zone five regions are available to these industries regardless of location. |

|

Strategic Investment Incentive Scheme on a projects basis to be decided by the presidency (minimum investment TRY500.million) |

- Investment contribution of up to 200% |

|

Free zones: 19 (18 operational and one being established) located throughout the country, mostly along the coastline and close to strategic ports such as Istanbul, Izmir and Mersin |

- Exemption from VAT, customs duty, stamp duty and real estate tax |

|

Technology development zones: 84 (63 operational and 21 approved and under construction) located throughout the country and designed to support R&D activities and attract investment in high-technology fields |

- Sales of application software are exempt from VAT until December 31, 2023 |

|

Organised industrial zones: 331 (234 operational and 97 under construction) located in 80 provinces, designed to allow companies to operate within an investor-friendly environment with ready-to-use infrastructure (including roads, water, natural gas, electricity, communications, waste treatment and other services) and social facilities |

- Exemption from VAT for land acquisition |

Sources: US Department of Commerce, national sources, Investment Support and Promotion Agency of Turkey, UNCTAD, Ministry of Treasury and Finance, Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 22%

Sources: Turkey Ministry of Finance

Important Updates to Taxation Information

- In Turkey the corporate income tax rate levied on business profits is 20%. The rate for corporate income tax has been increased to 22% for the tax periods 2018, 2019 and 2020, but the Council of Ministers has the authority to reduce the 22% rate back to 20% and that will be the rate from 2021.

- On December 7, 2019, Law No. 7194 (the Law) was published in Turkey’s Official Gazette; the Law entered into force on the same date. The Law introduces new taxes, namely the digital services tax, the luxury housing tax and the hospitality tax. It also covers changes in income tax rates for individuals.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

22% |

|

Local income tax |

Corporate income is not subject to additional provincial or municipal forms of taxation. |

|

Capital gains tax |

Treated as part of ordinary corporate income |

|

VAT |

18% is the standard rate applicable to the supply of goods or services, unless those are specific goods or services deemed to be lower rated (for example, a rate of 1% applies to certain agricultural products, including raw cotton and dried hazelnuts, and a rate of 8% applies to basic foodstuffs and pharmaceutical products) or exempt, such as healthcare and education, or water, gas electricity and renewable energy, or licensed bank and insurance company transactions. |

|

Banking and Insurance transactions tax |

5% is the general rate applicable to the transactions of licensed bank and insurance company |

|

Digital services tax |

7.5% is the rate applicable to revenue derived from the provision of digital services. The president has the authority to reduce this to 1% or double it to 15%. A provider with revenue of less than TRY20 million in Turkey or EUR750 million worldwide is exempt for the first year of the DST. The president has the authority to triple the exemption threshold or alter it to zero. |

|

Social security contributions |

A social security contribution is payable of 34.5% of gross remuneration, with 20.5% paid by the employer and 14% by the employee, and an unemployment contribution of 3% of gross remuneration, with 2% paid by the employer and 1% by the employee. |

|

Accommodation tax |

1% until December 31, 2020, and 2% from January 1, 2021, is the rate applicable to the service amount charged, net of VAT, by hotels, motels, guest houses and other providers of accommodation to holidaymakers. The president has the authority to double or halve the rate. |

|

Property taxes |

Buildings, apartments and land owned are subject to real estate tax at a rate of 0.1% - 0.6%, while a Contribution to the Conservation of Immovable Cultural Property is levied at a rate of 10% of the real estate tax. In December 2019 a regulation was passed that from January 2020 levies a 0.3% tax on properties valued at TRY5 - 7.5 million, 0.6% on those valued at TRY7.5 -10 million and 1% on those valued at over TRY10 million. |

|

Withholding taxes |

15% on dividend income paid to non-residents, 20% on royalties and 10% on interest. These are reduced to 10% for non-residents from Mainland China. A withholding tax rate of 5% is payable on professional fees from petroleum activities and 20% on professional fees from non-petroleum activities. |

Source: Ministry of Treasury and Finance

Date last reviewed: April 27, 2020

Localisation Requirements

Since January 2015, employers seeking to recruit foreign nationals must meet a number of stipulations which have increased the obstacles to importing foreign workers.

Businesses must meet the following criteria in order to be eligible to employ foreign workers: a local employment quota of five local employees per foreign national; one of either a minimum amount of paid-in capital of TRY100,000, gross sales of TRY800,000 or exports to the value of USD250,000; and minimum monthly salary levels ranging between 1.5 and 6.5 times the minimum wage for the foreign worker, depending on their position.

Obtaining Foreign Worker Permits for Skilled Workers

For a foreign national to work in Turkey, an employment visa and a work permit (which also serves as a residency permit) must be acquired. This entails an application for a work permit to the Turkish Embassy in the home country of the expatriate, an application to the Ministry of Labour and Social Security in Ankara within 10 days of the date of filing the application with the Turkish Embassy and an application for an employment visa within 90 days after obtaining the work permit from the ministry.

Work permits are granted for an initial period of one year and are renewable first for up to three years and following this for up to six years. However, the employee must stay with the designated employer during this period, meaning that long-term expatriate workers, who will be in high demand for their skills and experience of working in Turkey, will not be available for recruitment by other businesses, restricting recruitment options for businesses.

Owing to the fact that professional services such as engineering, city planning and architecture are carefully regulated in Turkey, work permit applications for foreign nationals holding one of these degrees differ from the regular work permit applications and can take up to a year.

Visa/Travel Restrictions

Visitors from many European, Middle Eastern and South American countries may visit Turkey visa free for up to 90 days. Visitors from other countries (including the United States, Mainland China and the United Kingdom) may obtain visas for tourism or business purposes via the electronic visa application system. This system, which was launched in 2013, allows visitors from some countries to obtain an e-visa online, which streamlines the process for foreign business travellers needing to visit Turkey. E-visas are generally cheaper than visas obtained on arrival.

Refugee Employment Restrictions

Although Syrian refugees are permitted to apply for work permits to join the formal labour market, this scheme is not well publicised and has seen limited success. Businesses that want to formally employ Syrian refugees are expected to provide sponsorship and other payments. Compliance and supply chain issues for businesses employing refugees will therefore remain pertinent in the medium term.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (Negative) |

14/06/2019 |

|

Standard & Poor's |

B+ (Stable) |

17/08/2018 |

|

Fitch Ratings |

BB- (Stable) |

21/02/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

60/190 |

43/190 |

33/190 |

|

Ease of Paying Taxes Index |

88/190 |

80/190 |

26/190 |

|

Logistics Performance Index |

47/160 |

N/A |

N/A |

|

Corruption Perception Index |

78/180 |

91/180 |

N/A |

|

IMD World Competitiveness |

46/63 |

51/63 |

N/A |

Sources: World Bank, IMD, Transparency International

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

63/202 |

71/201 |

69/201 |

|

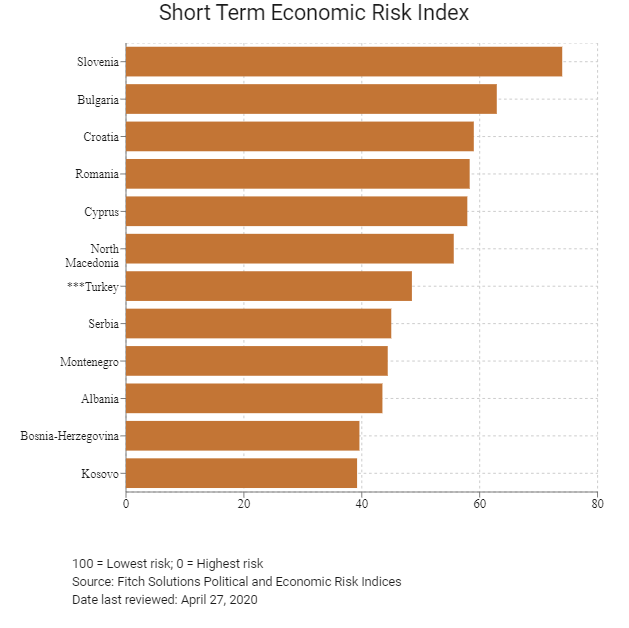

Short-Term Economic Risk Score |

54.0 |

46.5 |

48.5 |

|

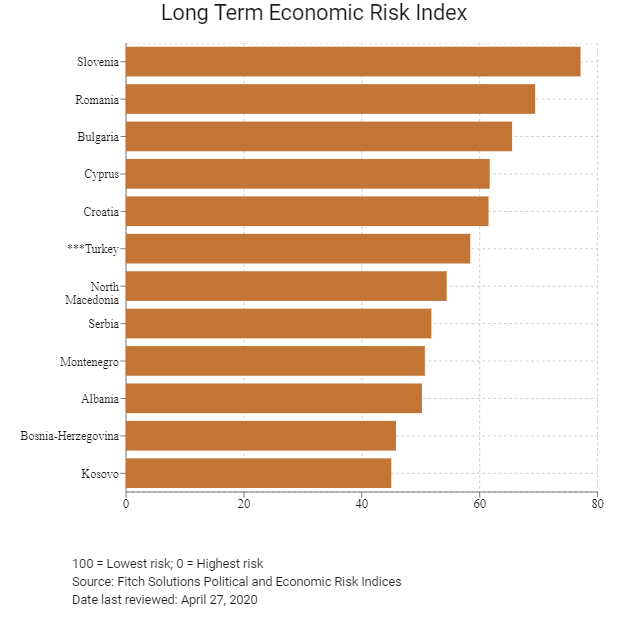

Long-Term Economic Risk Score |

62.3 |

58.2 |

58.4 |

|

Political Risk Index Rank |

133/202 |

135/201 |

135/201 |

|

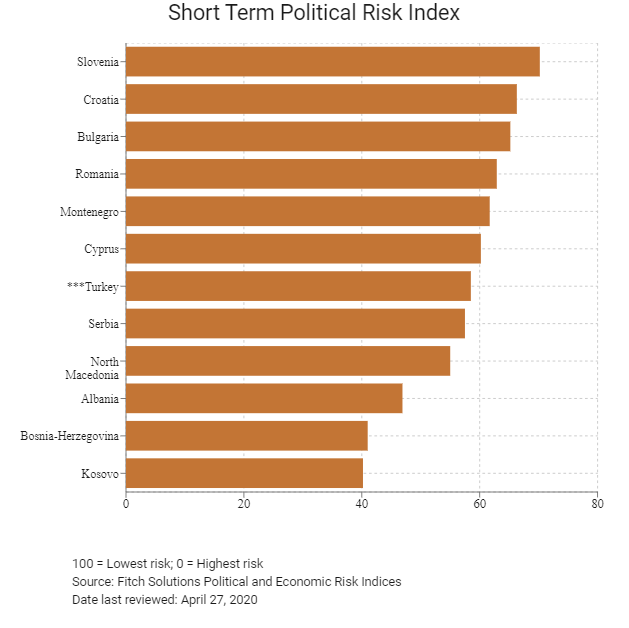

Short-Term Political Risk Score |

56.5 |

58.5 |

58.5 |

|

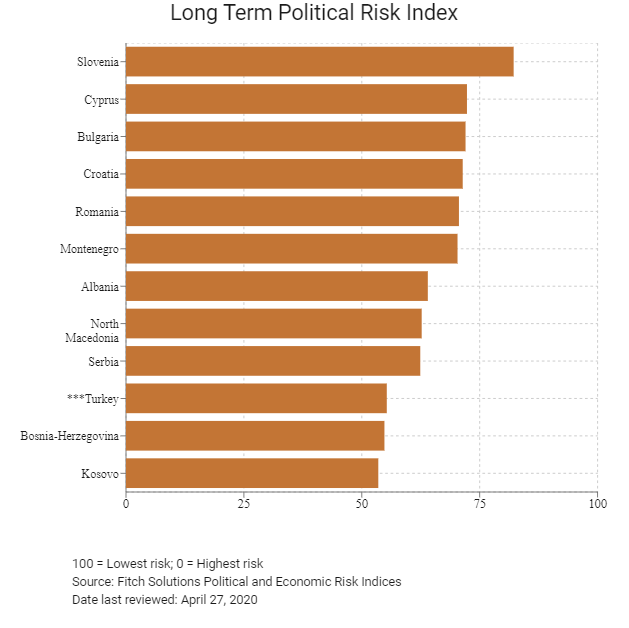

Long-Term Political Risk Score |

55.3 |

55.3 |

55.3 |

|

Operational Risk Index Rank |

78/201 |

71/201 |

69/201 |

|

Operational Risk Score |

52.9 |

55.8 |

56.1 |

Source: Fitch Solutions

Date last reviewed: April 27, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The Turkish economy, ranked among the top 20 globally (in purchasing power parity terms), has significant long-term growth potential. The country enjoys a strategic geographic location and an open, liberal trade and investment climate. However, the economy faces risks of falling domestic demand amid high inflation, rising unemployment and a weak currency. The Turkish economy looks set for a period of slower growth due to structurally high inflation and a more restrictive domestic and external financing backdrop. Additionally, near term headwinds are the risk of an economic and external financing crisis due to Covid-19. Public debt could rise over the coming years as the government is forced to take on private sector and state-owned enterprise debt. Turkey's need to reduce its reliance on foreign capital, narrow external deficits, improve geopolitical relations and rebalance away from private consumption towards more domestic saving and investment will bring about a period of slower trend growth in the medium term.

OPERATIONAL RISK

Turkey continues to offer considerable investment potential, particularly due to its large labour force, strong fundamentals, demographic structure and open trade policies. Its location at the crossroads of Europe and Asia makes Turkey a country of significant geostrategic importance. Due to this powerful suit of factors, foreign direct investment inflows to Turkey have been continuing. Including real estate investments, Turkey attracted over USD10 billion annually on average over the last 10 years. However, in the near term, the external environment remains uncertain. Persistently above target inflation, currency volatility, elevated unemployment and high debt servicing burdens will also weigh on investor confidence in the short term.

Source: Fitch Solutions

Date last reviewed: May 1, 2020

Fitch Solutions Political and Economic Risk Indices

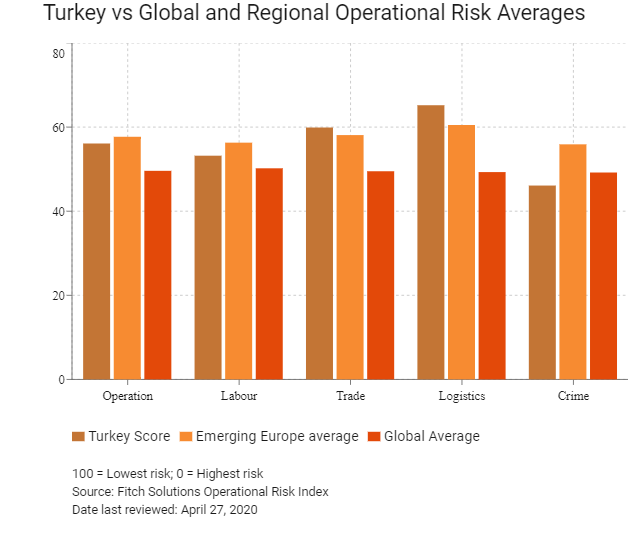

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Turkey Score |

56.1 |

53.2 |

59.9 |

65.2 |

46.1 |

|

Southeast Europe Average |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Southeast Europe Position (out of 12) |

9 |

8 |

7 |

4 |

11 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

22 |

24 |

16 |

14 |

24 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

69 |

80 |

59 |

50 |

112 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Slovenia |

69.2 |

57.7 |

63.5 |

74.1 |

81.4 |

|

Romania |

63.7 |

60.0 |

60.8 |

66.1 |

67.8 |

|

Cyprus |

62.7 |

56.0 |

66.0 |

63.0 |

65.8 |

|

Croatia |

62.5 |

53.2 |

56.9 |

70.3 |

69.5 |

|

Bulgaria |

61.7 |

58.2 |

63.6 |

60.9 |

64.1 |

|

Serbia |

58.2 |

59.6 |

60.1 |

60.7 |

52.4 |

|

Montenegro |

58.1 |

56.7 |

59.8 |

57.7 |

58.0 |

|

North Macedonia |

56.3 |

44.9 |

62.7 |

59.8 |

57.8 |

|

Turkey |

56.1 |

53.2 |

59.9 |

65.2 |

46.1 |

|

Albania |

48.3 |

44.2 |

43.3 |

48.3 |

57.4 |

|

Bosnia-Herzegovina |

47.5 |

46.0 |

44.3 |

50.7 |

49.0 |

|

Kosovo |

46.0 |

45.1 |

54.0 |

51.6 |

33.2 |

|

Regional Averages |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 27, 2020

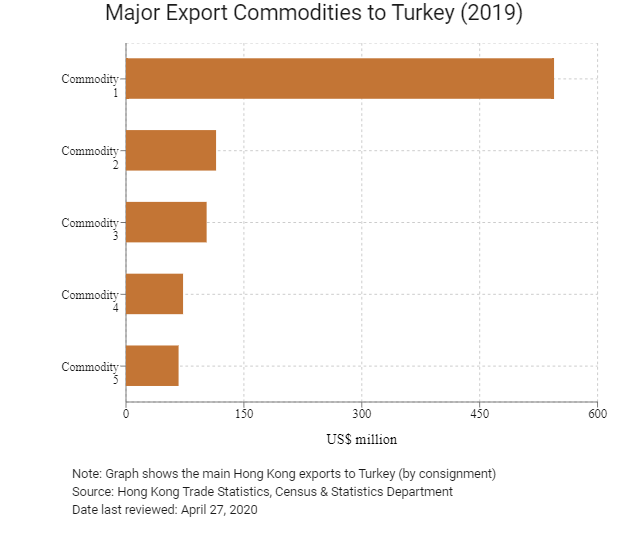

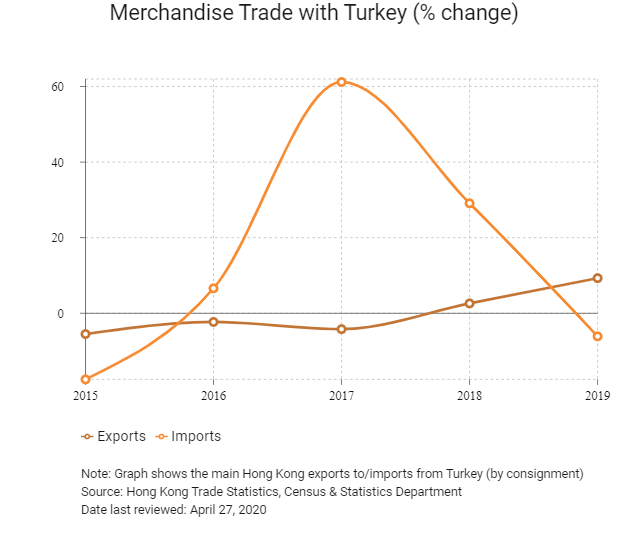

Hong Kong’s Trade with Turkey

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

544.6 |

|

Commodity 2 |

Power generating machinery and equipment |

114.6 |

|

Commodity 3 |

Electrical machinery, apparatus, and appliances, and electrical parts thereof |

102.6 |

|

Commodity 4 |

Office machines and automatic data processing machines |

72.6 |

|

Commodity 5 |

Miscellaneous manufactured articles |

66.9 |

|

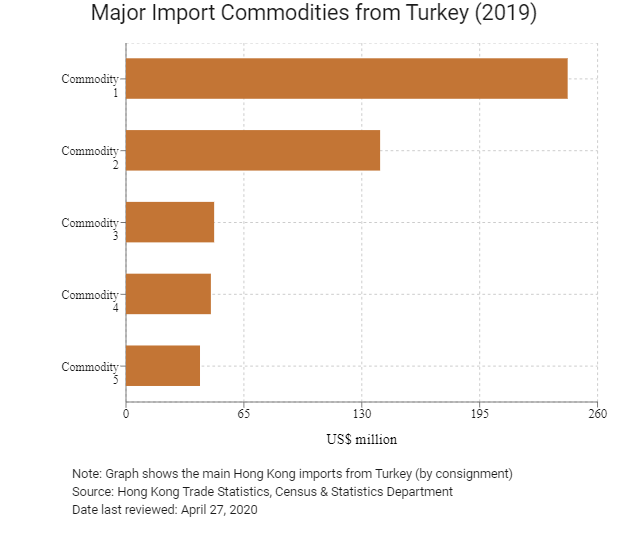

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Miscellaneous manufactured articles |

243.5 |

|

Commodity 2 |

Iron and steel |

140.1 |

|

Commodity 3 |

Power generating machinery and equipment |

48.6 |

|

Commodity 4 |

Textile yarn, fabric, made-up articles, and related products |

46.8 |

|

Commodity 5 |

Articles of apparel and clothing accessories |

40.8 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Turkish residents visiting Hong Kong |

19,386 |

-18.7 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of Emerging Europe citizens residing in Hong Kong |

114 |

29.5 |

Source: United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: April 29, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Turkish companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Sources: Hong Kong Census and Statistics Department, Fitch Solutions

Treaties and Agreements between Hong Kong and Turkey and Mainland China and Turkey

- There are no formal treaties and agreements between Hong Kong and Turkey.

- Turkey and Mainland China signed a Double Taxation Avoidance (DTA) Agreement in May 1995. This entered into force on January 20, 1997.

- Turkey signed a bilateral investment treaty with Mainland China in November 1990 and it has been in force since August 1994. A new bilateral investment treaty with Mainland China was signed in July 2015 but it is not yet in force.

Chamber of Commerce (or Related Organisations) in Hong Kong

Turkish Consulate General in Hong Kong

Address: Room 301, 3/F, Sino Plaza, 255-257 Gloucester Road, Causeway Bay, Hong Kong

Email: consulate.hongkong@mfa.gov.tr

Tel: (852) 2572 1331 / 2572 0275

Fax: (852) 2893 1771

Source: Republic of Turkey, Turkish Consulate General in Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not need a visa to visit Turkey for a stay of up to 90 days. HKSAR passport holders who have a British National Overseas passport and were born in Hong Kong are required to acquire a visa: they can obtain a three-month multiple entry e-visa via the website. Those who hold a Hong Kong Document of Identity for Visa Purposes must get their visas from the Turkish diplomatic or consular missions abroad.

Source: Visa on Demand

Date last reviewed: April 27, 2020

Turkey

Turkey