GDP (US$ Billion)

330.91 (2018)

World Ranking 40/193

GDP Per Capita (US$)

3,104 (2018)

World Ranking 133/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

68.6 (2019)

Currency (Period Average)

Philippine Peso

51.8per US$ (2019)

Political System

Unitary republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

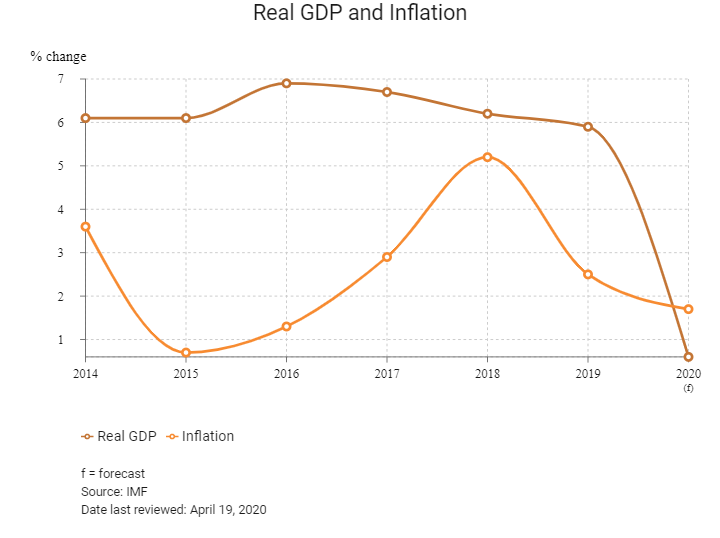

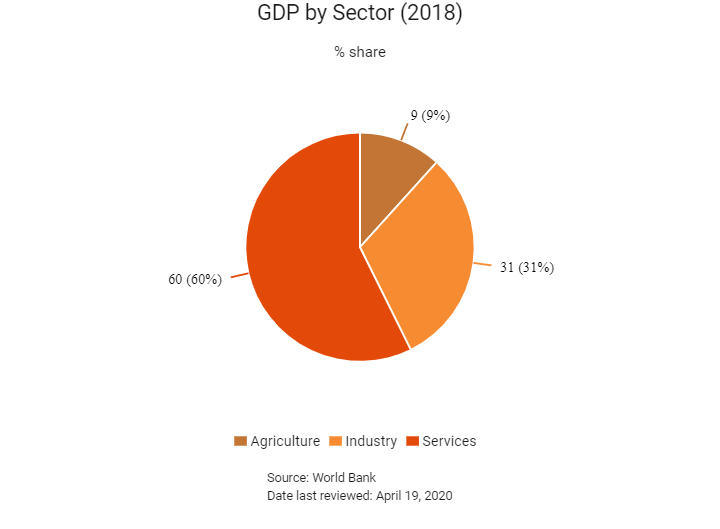

The Philippines has one of the most dynamic economies in the East Asia and the Pacific region. With increasing urbanisation, a growing middle income class, and a large and young population, the Philippines' economic dynamism is rooted in strong consumer demand supported by improving real incomes and robust remittances. Business activities are buoyant with notable performance in the services sector (including business process outsourcing), real estate, and finance and insurance industries.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

June 2016

Rodrigo Duterte was elected president and announced a hard-line crackdown on drugs. He also suggested that he might pivot from the United States to Mainland China.

May 2017

Martial law was imposed on the island of Mindanao after fighting erupts between security forces and Islamic State-linked militants.

May 2018

Barangay elections were held on May 14, 2018.

May 2019

The 2019 Philippine general election was held on May 13, 2019. The winners took office on June 30, 2019, midway through President Rodrigo Duterte's six-year term. The election saw 12 seats in the House of Representatives, as well as all seats at the senate, provincial, city and municipality level contested.

September 2019

In September 2019, Philippines reformed the corporate tax system through the Corporate Income Tax (CIT) and Incentives Rationalization Act (CITIRA), which would reduce CIT from 30% to 20% over a 10 year period as well as introduce specific tax incentives for capital expenditure and labour up-skilling.

December 2019

The Asian Development Bank (ADB) approved a USD200 million loan for the preparation and execution of various development projects in the Philippines. The loan would support detailed engineering design of the Bataan-Cavite Interlink Bridge Project and the Metro Rail Transit Line 4 linking Ortigas in Metro Manila to Taytay in the province of Rizal, among other works.

February 2020

On February 11, the Philippines notified the United States Embassy in Manila on their decision to terminate the Visiting Forces Agreement (VFA) and that the agreement would end in 180 days, provided the decision was not reversed following bilateral negotiations that were scheduled for March 2020. The termination does not spell the end of military relations between the long-term allies, with the long-standing (August 1951) Mutual Defense Treaty (MDT) and more recent (April 2014) Enhanced Defense Cooperation Agreement (EDCA) both still in place. The VFA, which came into effect May 1999, allowed military personnel from either country visa or judicial privileges, amongst other benefits, as well the United States the right to operate vessels and aircraft in the Philippines freely.

February 2020

Angat Hydropower Corporation awarded GE Renewable Energy a contract for the rehabilitation of 218MW Angat hydropower plant in the Philippines. The facility, located on Angat River, was commissioned in 1967. Under the deal, GE Renewable Energy would supply two new 50MW Francis turbines, four new 50MW generators as well as three new upgraded auxiliary turbines and generators. The firm would also be responsible for assessing the penstock, the powerhouse and providing a new control system. GE Renewable Energy would collaborate with local partner DESCO, which would install and commission the plant. The upgraded plant was due to start operations in 2023 with an increased output of 226.6MW.

April 2020

Work on the new passenger terminal building of Clark International Airport was progressing as scheduled despite the enhanced community quarantine in Luzon, Philippines. Contractor Megawide GMR Construction Joint Venture (MGCJV) stated that work was now 96% complete with only minor works remaining. The new terminal was expected to increase airport's annual passenger handling capacity from 4.2 million to 12.2 million. MGCJV won the construction package in December 2017 by submitting a bid of PHP9.36 billion (USD185.37 million) under a hybrid public-private partnership scheme. The new terminal was expected to be delivered before July 31 2020.

April 2020

The government announced a PHP27.1 billion fiscal package (about 0.15% of 2019 GDP) in response to the Covid-19 pandemic, which comprised, among other areas, support to the tourism and agriculture sectors. Financial assistance would also be provided to affected SMEs and vulnerable households through specialised microfinancing loans and loan restructuring.

Sources: BBC Country Profile – Timeline, Fitch Solutions

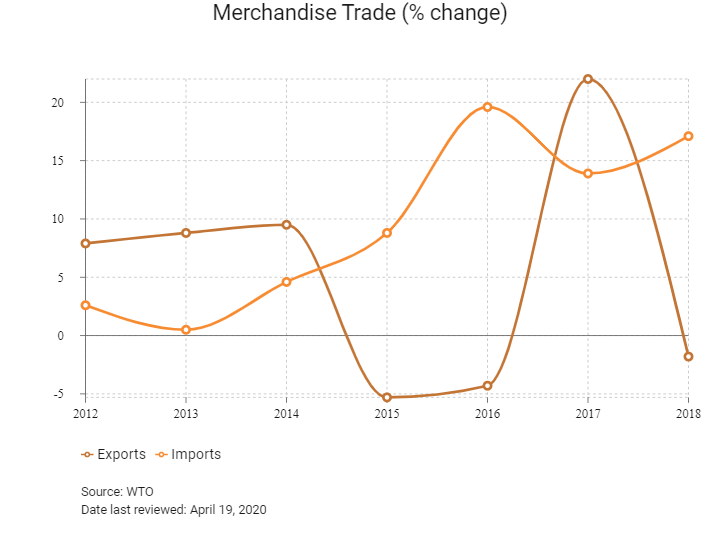

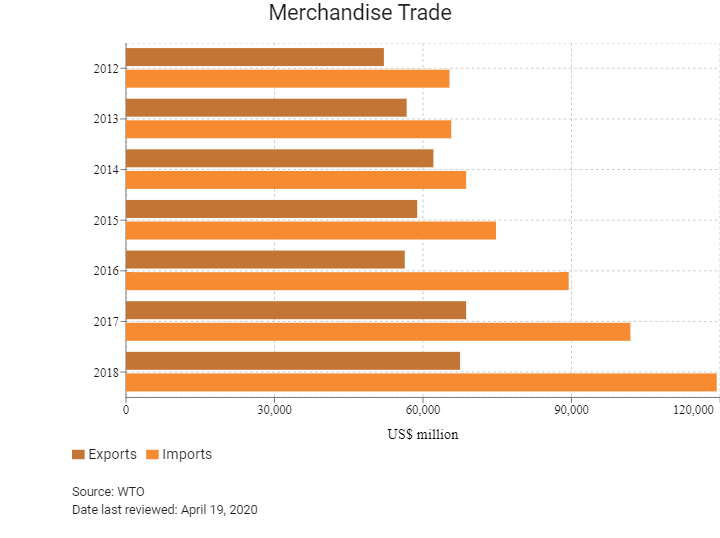

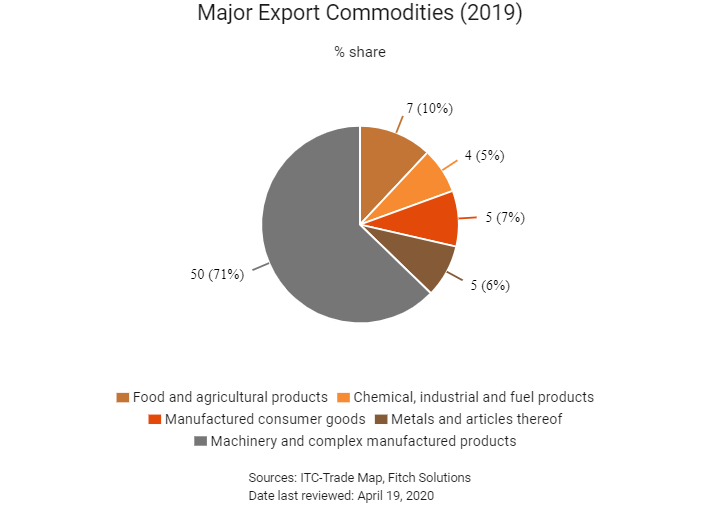

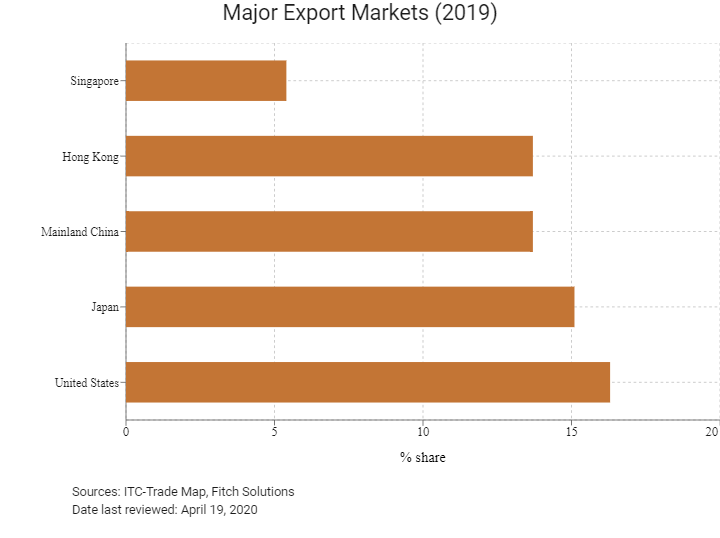

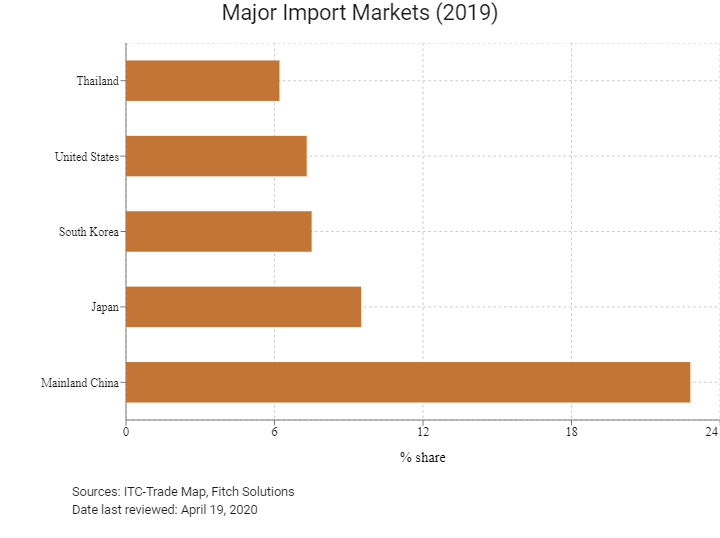

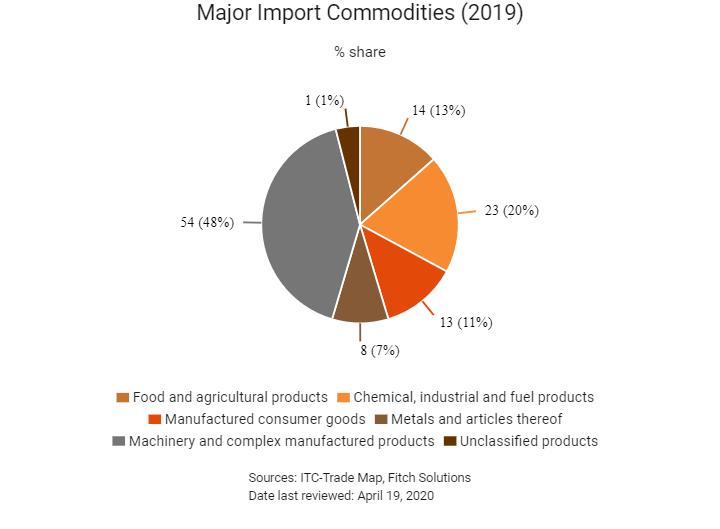

Merchandise Trade

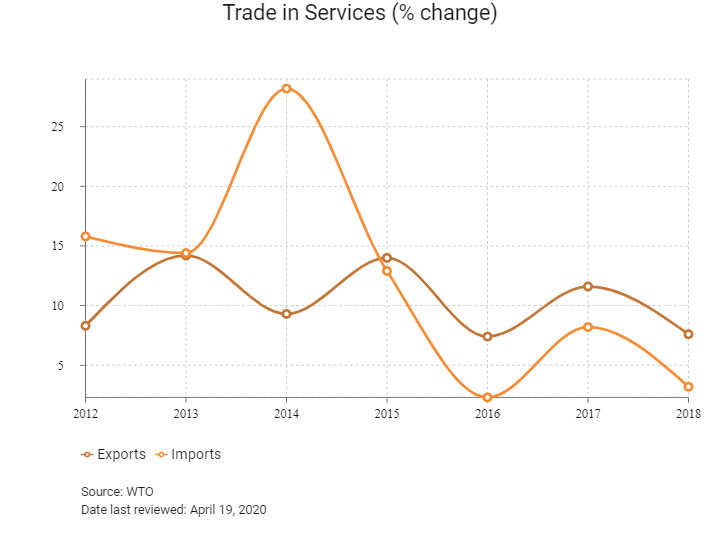

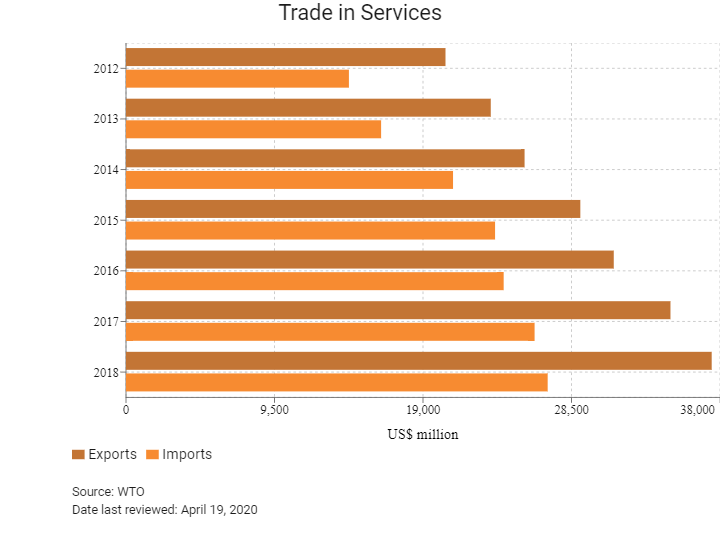

Trade in Services

- The Philippines has been a member of World Trade Organization (WTO) since January 1, 1995.

- The Department of Trade and Industry remains responsible for the implementation and coordination of trade and investment policies as well as for promoting and facilitating trade and investment.

- The Philippines grants most favoured nation (MFN) treatment to all WTO members. The Philippines' simple average MFN tariff was 7.1% in 2016 and 6% of its applied tariffs is 20% or higher. All agricultural tariffs and about 60% of non-agricultural tariff lines are bound under the Philippines' WTO commitments. The simple average bound tariff in the Philippines is 23.5%.

- Imported manufactured goods competing with locally produced goods face higher tariffs than those without local competition. The Philippine government cites domestic and global economic developments to justify the modification of applied rates of duty for certain products to protect local producers in the agriculture and manufacturing sectors.

- The Philippines eliminated tariffs on approximately 99% of all goods from the Association of South East Asian Nations (ASEAN) trading partners as a commitment under the ASEAN Free Trade Area (AFTA) agreement. The Philippines has been a member of ASEAN since 1967.

- Food products and agricultural inputs are exempt from value-added tax (VAT) which is typically 12%. Excise taxes are levied on alcoholic beverages, tobacco products, automobiles, petroleum products, minerals, perfumes and jewellery.

- A vast range of goods are subject to licences or permits when imported. For certain products, multiple permits or licences are required and informal payments have been reported by the business community.

- About 80% of standards are aligned to international norms. There are 72 mandatory technical regulations covering a wide range of goods. The Philippines Accreditation Bureau has accredited 243 conformity assessment bodies. The Philippines has reformed its food safety regime based on a 'farm-to-fork' approach to enhance food safety. A new Food Safety Act was promulgated in 2013 and its implementing legislation entered into force in 2015. However, the Philippines' sanitary and phytosanitary measure (SPS)-related import requirements for food, which appear to be complex, remain largely unchanged. During the period of 2013 to 2015, the Philippines submitted 46 technical barriers to trade (TBT) notifications and over 200 SPS notifications. Members have not raised any specific trade concerns regarding its SPS and TBT measures.

- Philippine marking and labelling requirements are specified in the Consumer Act of the Philippines (Republic Act No. 7394) and Philippine National Standards (PNS). The Department of Trade and Industry's Bureau of Philippine Standards (BPS) is the national standards body that develops and implements the PNS. All consumer products sold domestically, whether manufactured locally or imported, must contain the following information on their labels:

- Correct and registered trade name or brand name

- Registered trademark

- Registered business name and address of the manufacturer

- Importer or re-packer of the consumer product in the Philippines

- General make or active ingredients

- Net quality of contents, in terms of weight and country of manufacture (if imported)

- The BPS implements a product certification mark scheme to verify conformity of products to PNS and other international standards. This includes critical products such as electrical equipment and electronics, as well as consumer, chemical and construction and building materials. Products manufactured locally must bear a Philippine Standard mark, while imported products must bear Import Commodity Clearance certification marks duly issued by the BPS.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

The government is actively seeking new free trade agreements (FTAs) with key trade partners, such as the European Union (EU), and remains committed to reducing current tariff lines for certain products in order to boost competitiveness and ease the trading process for businesses.

Multinational Trade Agreements

Active

- The Philippines is a member of WTO (effective date: 1995).

- AFTA: Came into effect in January 1993. AFTA reduces tariff and non-tariff barriers between 10 member states – Brunei, Indonesia, Malaysia, Philippines, Singapore, Vietnam, Laos, Myanmar, Indonesia and Cambodia.

- ASEAN-Australia-New Zealand FTA (AANZFTA): Signed on February 27, 2009, AANZFTA is ASEAN's first FTA with two developed countries simultaneously and the first ASEAN FTA done in a single undertaking. AANZFTA represents ASEAN's most ambitious FTA to date, covering 18 chapters, including new areas that ASEAN had previously never negotiated on, such as competition policy and intellectual property. The AANZFTA also includes an AANZFTA Economic Cooperation Support Programme, which will provide technical assistance and capacity building to the parties of the agreement with the aim of supporting the implementation of it, as well as to support the overall regional economic integration process. The agreement entered into force for all parties in 2012 and work is currently underway to resolve and implement the built-in agenda as stipulated under the agreement. The agreement aims to eliminate tariffs on 99% of exports to key ASEAN markets by 2020.

- ASEAN-Mainland China: The ASEAN-Mainland China FTA covers goods and services. The FTA for goods came into force on January 1, 2005, and the FTA for services came into force on July 1, 2007. The agreement aims to eliminate tariffs, encourage investment and address the barriers that impede the flow of goods and services. The ASEAN-Mainland China Free Trade Area came into force on January 1, 2010 and was upgraded in 2014. In 2019, the ASEAN was the recipient of 14.4% of Mainland China's exports and the source of 13.6% of imports. Total merchandise trade between the ASEAN and Mainland China hit a record high of USD642 billion in 2019.

- ASEAN-South Korea: The ASEAN-South Korea FTA (AKFTA) came into force in June 2007 and May 2009 for goods and services, respectively. The investment agreement entered into force in June 2009. AKFTA aims to create more liberal, facilitative market access and investment regimes between South Korea and ASEAN. A business council was set up in December 2014 to enhance economic cooperation between parties and boost total trade to USD200 billion by 2020. ASEAN was the recipient of 17.5% of South Korea's exports in 2019 and the source for 11.2% of imports. Total trade between the ASEAN and South Korea has more than doubled between 2007 and 2019.

- ASEAN-Japan FTA: Japan provides a huge market for a wide range of goods, with tariff-free trade. This benefits a number of important sectors, including manufacturing, agriculture, mining and chemicals production. Philippines only bilateral free trade agreement is also with Japan, called the Philippines – Japan Economic Partnership Agreement (PJEPA), which covers trade in goods and services, investments, movement of natural persons, intellectual property, custom procedures, improvement of the business environment and government procurement. PJEPA was implemented in December 2008 and provides duty free access to 80% of Philippine exports to Japan, consisting of 7,476 products such as food products, garments and textiles, furniture, metal manufactures, minerals, machinery and equipment parts, electronics, motor vehicle parts and chemicals.

- ASEAN-India FTA: The ASEAN-India Trade in Goods Agreement was signed at the seventh ASEAN Economic Ministers-India Consultations on August 13, 2009. The Agreement entered into force on January 1, 2010 for India and some ASEAN member states. The ASEAN-India Trade in Services and Investment Agreements were signed in November 2014. The Philippines benefits from trade preference in terms of tariff exemption or reduction under the AIFTA, which is a trade bloc agreement between India and ASEAN. This will help member states in terms of trade growth and diversification given the size and performance of the Indian economy and other ASEAN member states.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and ASEAN commenced negotiations of an FTA and an Investment Agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and forged the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, trade in services, investment, economic and technical co-operation, dispute settlement mechanism and other related areas. The agreements will bring legal certainty, better market access and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and Investment Agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019, but will take time for all members of ASEAN to comply as implementation is subject to completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process. Hong Kong's potential as a key export market increases the importance of AHKFTA.

- Philippines-European Free Trade Association (EFTA) FTA: The FTA covers trade in goods, services, investment, competition, the protection of intellectual property rights, government procurement and trade and sustainable development with EFTA states (Iceland, Liechtenstein, Norway and Switzerland). All customs duties on industrial products are abolished and the Philippines will gradually lower or abolish duties on the vast majority of such products.

Under Negotiation

- Regional Comprehensive Economic Partnership (RCEP): A regional economic agreement that involves the 10-member ASEAN bloc and their FTA partners: Australia, Mainland China, Japan, New Zealand and South Korea. Negotiations on a framework agreement for the RCEP have stalled after India announced its withdrawal from the trade pact at a RCEP summit held in Bangkok in November 2019. Expectations had been for negotiations to conclude in 2019, paving the way for the agreement to enter force by late 2020. RCEP negotiations without India may now be concluded in 2020, but the withdrawal of India represents a setback to attempts to counter the growing wave of protectionism in the US and other parts of the world. The RCEP is envisioned to be a modern, comprehensive, high-quality and mutually beneficial economic partnership agreement that aims to advance economic cooperation, and broaden and deepen integration in the region. The RCEP will lower tariffs and other barriers to the trade of goods among the 15 countries that are in the agreement, or have existing trade deals with ASEAN.

- Philippines-EU FTA: Negotiations are underway to further increase trade flows between the EU and the Philippines under an FTA. The issues of high tariffs for EU automotive exports remain high on the agenda.

- Philippines-South Korea FTA: Negotiations are underway to strengthen bilateral trade between the two states under an FTA. Semiconductors are the most traded product between the two countries, with South Korea also shipping auto parts, pharmaceutical goods and petrochemical products to the Philippines. The Philippines exports agricultural products and garments to South Korea. Negotiations which commenced in June 2019 are anticipated to be concluded in H120.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The Philippines Board of Investment (BOI) remains responsible for implementation and coordination of investment policies.

- Foreign enterprises are treated equally under law with their domestic counterparts.

- The Philippines is fast becoming a fintech, blockchain and cryptocurrency hub. This is largely due to the relatively accommodating stance which Philippine financial authorities have taken toward cryptocurrency and blockchain adoption.

- Corporations wishing to invest in the Philippines must register with the Securities and Exchange Commission, while individually-owned enterprises must register with the Bureau of Trade Regulation and Consumer Protection in the Department of Trade and Industry. Investors must also register with the relevant agency in order to qualify for incentives.

- An enterprise registered with the BOI – pursuant to the 1987 Omnibus Investments Code – is entitled to a range of incentives, provided they meet the requirements listed. Projects that may be eligible for incentives under the BOI include investments in manufacturing of goods not yet produced in the Philippines, manufacturing that uses new methods or designs, agriculture, forestry, mining, services, nonconventional fuels, enterprises exporting at least 70% of output and projects in less developed areas. The same incentives are also available to businesses that set up operations in one of the numerous special economic zones which operate outside of the Philippines customs area and offer substantial fiscal and non-fiscal advantages to businesses.

- The government has a mandated 'negative list' of sectors (the Foreign Investment Negative List) in which foreign participation is capped at a certain level. The list consists of two parts. Part A lists sectors in which foreign ownership is restricted (such as mass media and private security) and Part B lists sectors in which foreign ownership is limited (such as educational institutions and advertising) for reasons such as national security and public health. The government publishes regular updates to the negative list where restrictions have gradually been reduced on a number of sectors. For example, as of 2014, the government has allowed 100% foreign equity in local subsidiaries of banks. Furthermore, a law signed in 2014 allows foreign banks to enter the Philippine market, where they can establish branches, but cannot open more than six branch offices each.

- Foreigners are banned from fully owning land, although foreign investors can lease a contiguous parcel of up to 1,000 hectares for 50 years, renewable one time for an additional 25 years.

- Philippine law allows expropriation of private property for public use or in the interest of national welfare or defence and offers fair market value compensation. In the case of expropriation, foreign investors have the right to receive compensation in the currency in which the investment was originally made and to remit it at the equivalent exchange rate.

- According to the World Bank Doing Business 2020, the Philippines strengthened minority investor protections by requiring greater disclosure of transactions with interested parties and enhancing director liability for transactions with interested parties.

Sources: WTO – Trade Policy Review, National Sources, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Philippines Economic Zones Authority (PEZA) – 300 zones managed privately and by the government, mainly in the manufacturing, IT, tourism, medical tourism, logistics/warehousing and agro-industrial sectors. |

- Companies established under PEZA receive the same incentives as listed below as well as a 5% tax rate on gross income following the expiration of the income tax holiday. |

|

Philippines BOI Incentives |

- Income tax holidays of four-to-six years. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 12%

- Corporate Income Tax: 30%

Sources: Philippines Bureau of Internal Revenue, Fitch Solutions

Important Updates to Taxation Information

In September 2019, Philippines reformed the corporate tax system through the CIT and Incentives Rationalization Act, which will reduce CIT from 30% to 20% over a 10-year period as well as introduce specific tax incentives for capital expenditure and labour up-skilling.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

30% |

|

Capital Gains Tax |

- 6% on disposal of real property |

|

VAT |

12% on sale of goods and services |

|

Social security contributions |

Maximum contribution of PHP1,178.7 per month per employee |

|

Local Government Taxes |

Up to 3% depending on location |

|

Real Property Tax |

1% in a province or 2% if located in a city |

|

Branch Remittance Tax |

15% on after tax profits |

|

Withholding Tax |

- 15% or 30% on dividends paid to foreign non-resident corporations |

Sources: National Sources, Philippines Bureau of Internal Revenue, Fitch Solutions

Date last reviewed: April 19, 2020

Alien Employment Permit (AEP)

The AEP authorises an individual to work in the country and is valid for either one year or for the length of time stipulated in the employee's contract (but no longer than three years). The AEP is only valid for the respective position and applicable company and a new AEP is required when an employee takes on a new position or joins a different company. Intra-corporate transfers do not require a new AEP. The application for an AEP may be made by either the employee or the employer. The AEP is issued by the Department of Labour and Employment.

9(G) Visa

The AEP is required before obtaining the 9(G) Visa. The 9(G) Visa, or the pre-arranged employment visa, allows for the employment of individuals with skills or qualifications which are not available within the Philippines. The Bureau of Immigration issues this visa and candidates must have secured a job with a company based in the country. A holder of a 9(G) Visa may only work for the employer specified by the visa. If the individual changes employers, the 9(G) Visa automatically downgrades to a tourist visa, requiring the individual to reapply for the 9(G) Visa. The visa is valid for an initial period of one, two, or three years, and can be extended up to three years at a time (depending on the duration of the employment contract) and may be renewed multiple times.

9(D) Visa

The 9(D) Visa (also known as the Treaty Trader Visa) only applies to nationals from Japan, Germany and the United States. To qualify, foreign nationals must prove that they or their employers are engaged in substantial trade, involving investment of at least USD120,000 between the Philippines and their country of origin, they intend to leave the Philippines upon the completion or termination of their work contract, they hold the same nationality as their employer or company's major shareholder and they hold a position of a supervisor or executive in the company. The visa is valid for up to two years.

Provisionary Work Permit

The Provisional Work Permit (PWP) may be obtained while the 9(G) or 9(D) visas is being issued. The AEP is needed for a PWP. The permit is valid for six months.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Baa2 (Stable) |

20/07/2018 |

|

Standard & Poor's |

BBB+ (Stable) |

30/04/2019 |

|

Fitch Ratings |

BBB (Stable) |

07/05/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

113/190 |

124/190 |

95/190 |

|

Ease of Paying Taxes Index |

105/190 |

94/190 |

95/190 |

|

Logistics Performance Index |

60/160 |

N/A |

N/A |

|

Corruption Perception Index |

99/180 |

113/180 |

N/A |

|

IMD World Competitiveness |

50/63 |

46/63 |

N/A |

Sources: World Bank, IMD, Transparency International

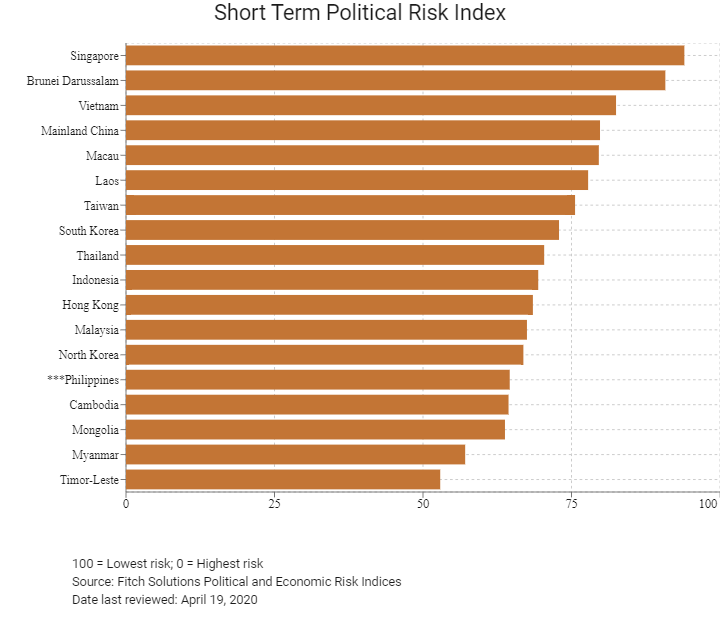

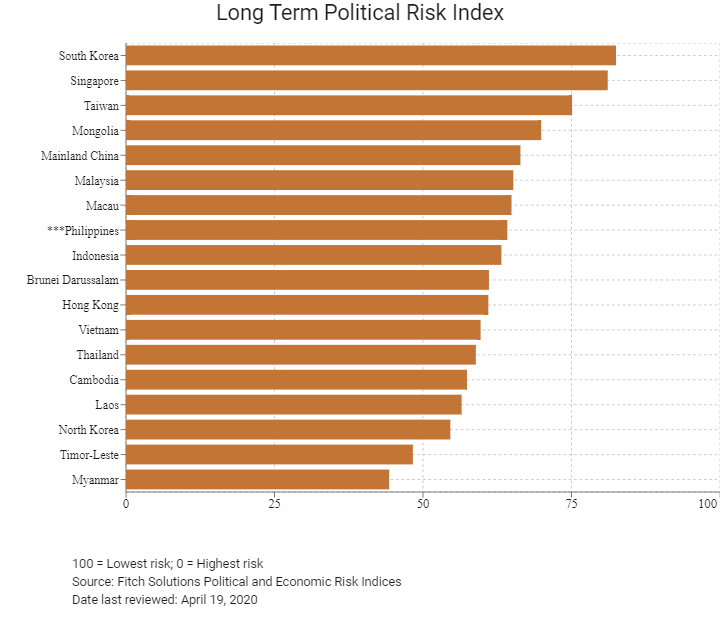

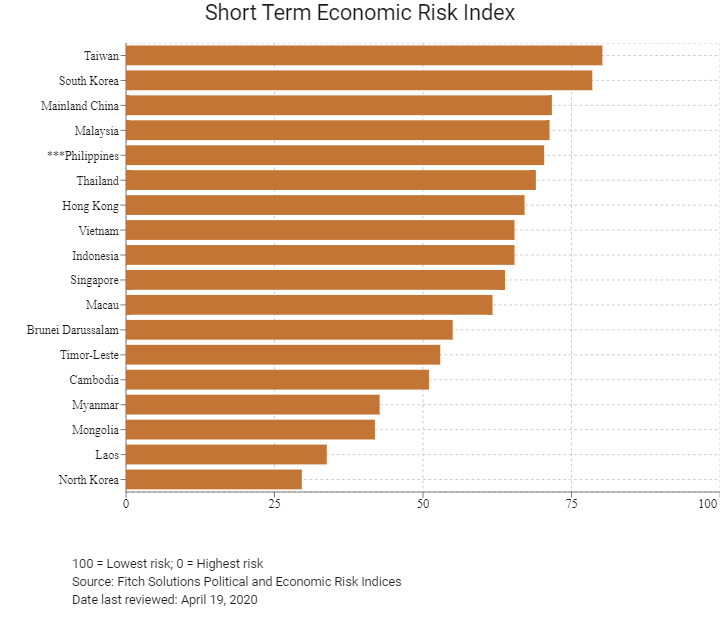

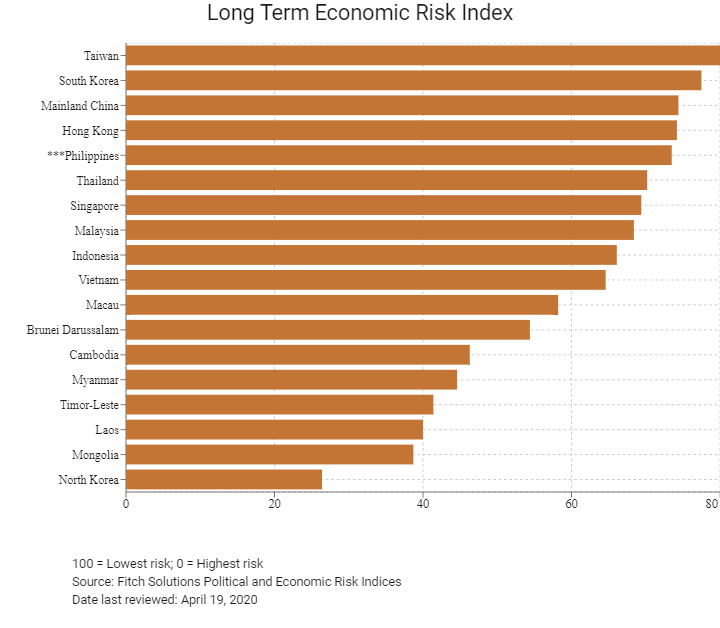

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

31/202 |

29/201 |

26/201 |

|

Short-Term Economic Risk Score |

69.6 |

67.7 |

70.4 |

|

Long-Term Economic Risk Score |

72.1 |

72.9 |

73.5 |

|

Political Risk Index Rank |

92/202 |

88/201 |

87/201 |

|

Short-Term Political Risk Score |

63.1 |

62.7 |

64.6 |

|

Long-Term Political Risk Score |

64.2 |

64.2 |

64.2 |

|

Operational Risk Index Rank |

124/201 |

112/201 |

110/201 |

|

Operational Risk Score |

43.1 |

47.3 |

47.3 |

Source: Fitch Solutions

Date last reviewed: April 19, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

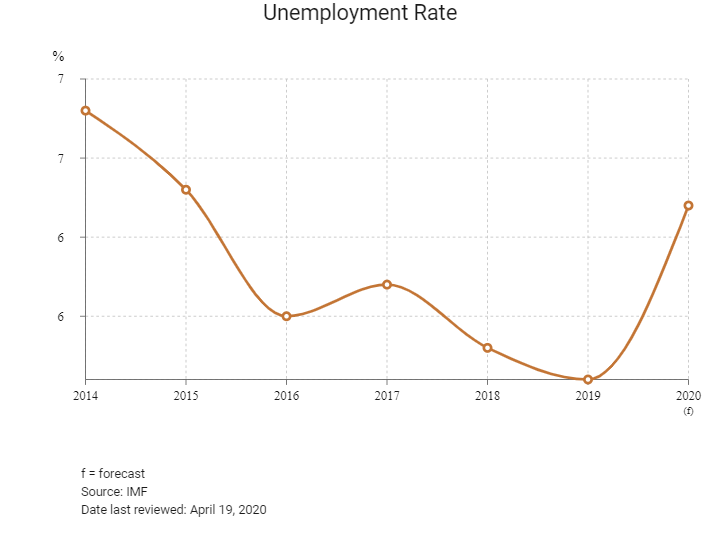

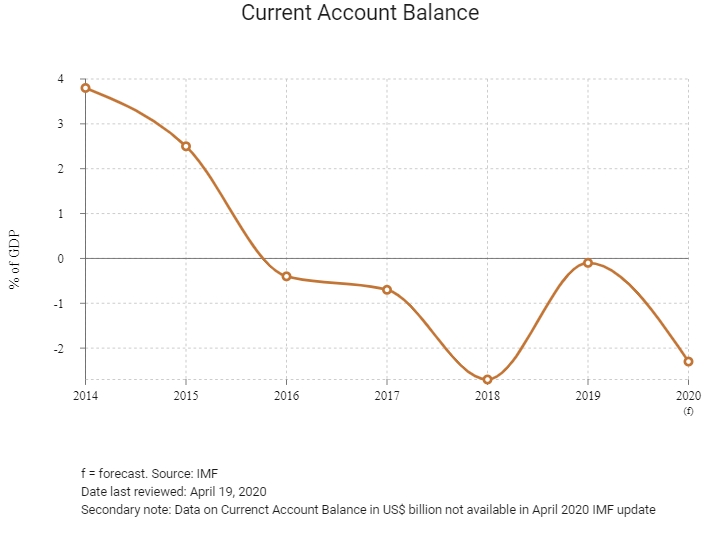

The Philippines’ benefits from continued strong remittances as well as receipts from the business process outsourcing sector, which offset the country’s substantial trade deficit. The country's long-term economic growth prospects have also improved markedly, as the former Aquino administration had sought to address key structural issues and improve the business environment. However, the Covid-19 outbreak poses significant risks to the Philippine economy, particularly if lockdowns are prolonged and extended countrywide.

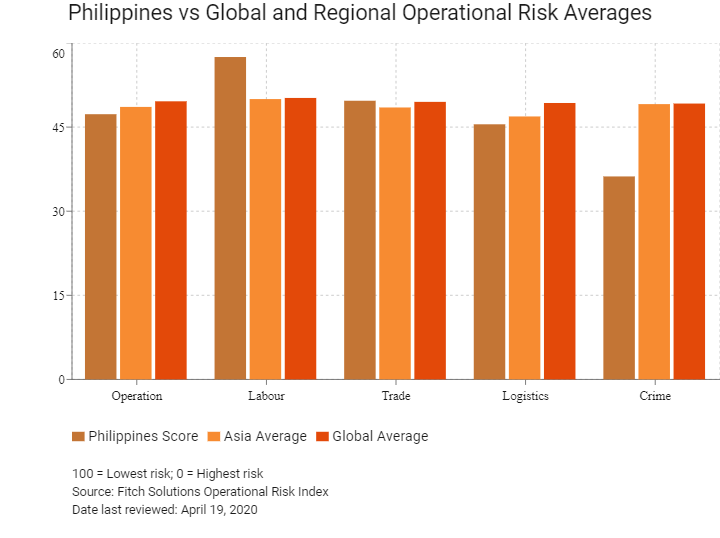

OPERATIONAL RISK

The Philippines has a large labour market and strong external trade connectivity. However, there are a number of key risks in certain areas, such as internal transport networks and labour costs, which may pose a challenging environment. Philippines' twin deficits leave it somewhat exposed to a sudden bout of risk-off sentiment, with inflation a risk if the peso were to weaken significantly, which in turn could put upwards pressure on import costs for businesses. On a longer term, growing investor sentiment, coupled with an improving business environment on the back of strong reforms, will help propel investment growth in the Philippines.

Source: Fitch Solutions

Date last reviewed: April 20, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Philippines Score |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

East and Southeast Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia Position (out of 18) |

13 |

8 |

13 |

12 |

15 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

17 |

8 |

15 |

15 |

28 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

110 |

53 |

100 |

106 |

144 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 19, 2020

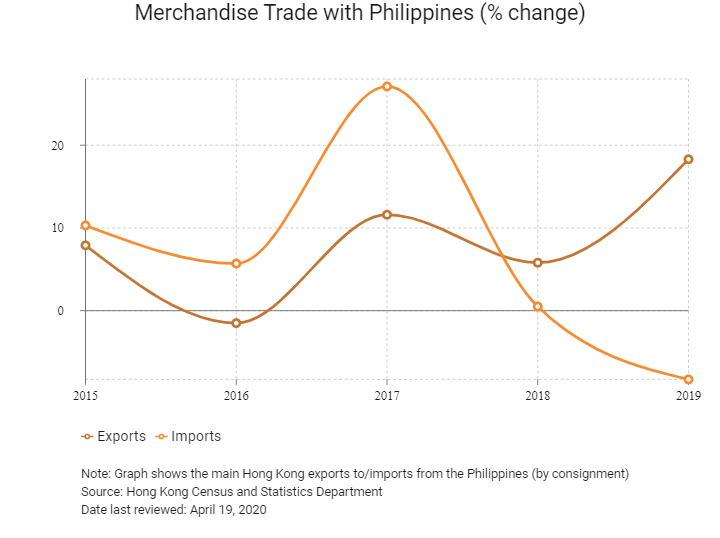

Hong Kong’s Trade with Philippines

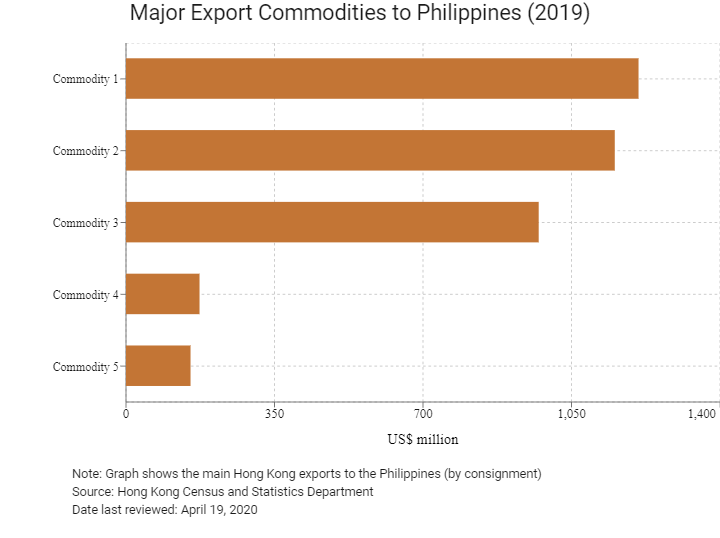

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Office machines and automatic data processing machines | 1,208.0 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 1,152.0 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 972.7 |

| Commodity 4 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 173.3 |

| Commodity 5 | Miscellaneous manufactured articles | 152.1 |

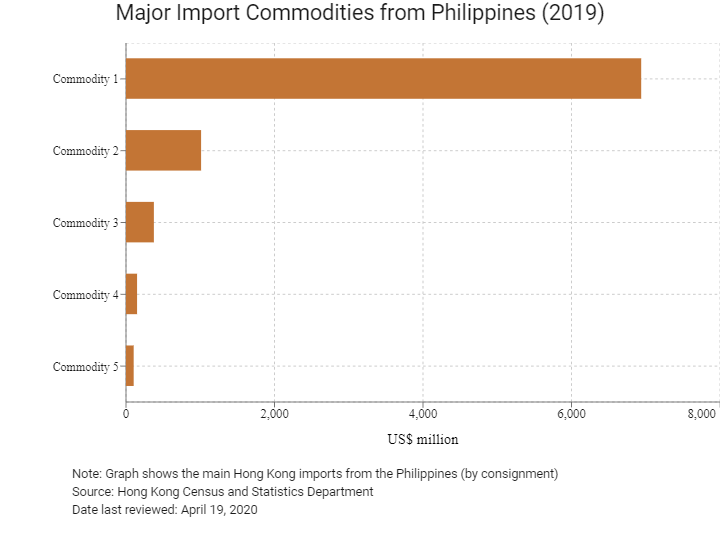

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 6938.7 |

| Commodity 2 | Office machines and automatic data processing machines | 1011.4 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 375.4 |

| Commodity 4 | Power generating machinery and equipment | 149.1 |

| Commodity 5 | Vegetables and fruit | 103.4 |

Exchange rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Philippine residents visiting Hong Kong |

875,897 |

-2.11 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of Filipinos residing in Hong Kong |

152,771 |

-29.6 |

|

Number of East Asians and South Asians residing in Hong Kong |

2,834,871 |

3.4 |

Note: Growth rate is from 2015 to 2019, no UN data available for intermediate years.

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: April 19, 2020

Commercial Presence in Hong Kong

|

2017 |

Growth rate (%) |

|

|

Number of Philippine companies in Hong Kong |

39 |

N/A |

|

- Regional headquarters |

N/A |

|

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Treaties and Agreements between Hong Kong and Philippines

- The Philippines has a Bilateral Investment Treaty with Mainland China that entered into force on September 8, 1995.

- The Philippines has a Double Taxation Agreement with Mainland China that has been applicable since January 1, 2002.

Sources: Fitch Solutions, UNCTAD

Chamber of Commerce or Related Organisations

Philippine Consulate General Hong Kong, China

Address: 14/F, United Centre Building, 95 Queensway, Admiralty, Hong Kong

Email: hongkong.pcg@dfa.gov.ph

Tel: (852) 2823 8501 / 9155 4023

Fax: (852) 2866 9885 / 2866 8559

Source: Hong Kong Protocol Division of Government Secretariat

Visa Requirements for Hong Kong Residents

HKSAR passport holders have been granted visa-free or visa-on-arrival for the Philippines. This visa-free arrangement is valid for 14 days from entering into the country.

Source: Philippine Consulate General Hong Kong, China

Date last reviewed: April 19, 2020

Philippines

Philippines