GDP (US$ Billion)

16.28 (2018)

World Ranking N/A

GDP Per Capita (US$)

3,562 (2018)

World Ranking N/A

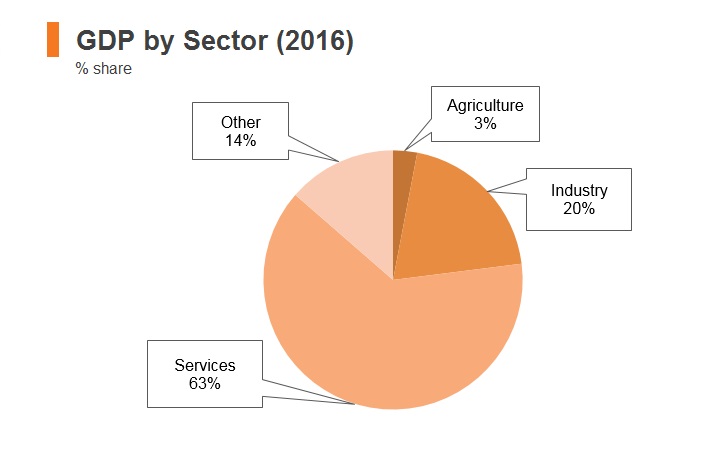

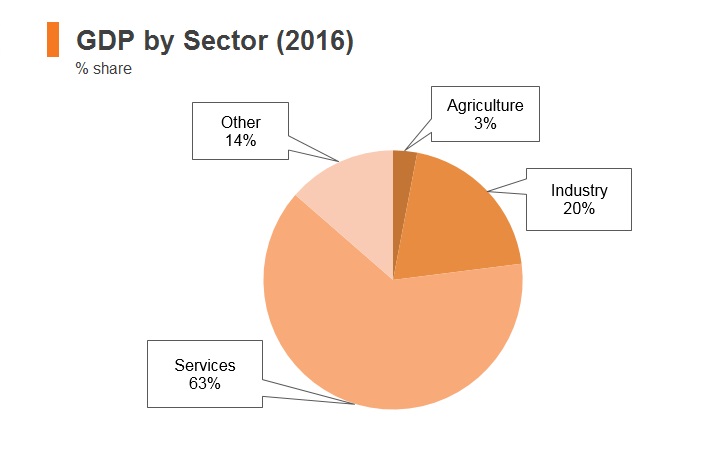

Economic Structure

(in terms of GDP composition, 2016)

External Trade (% of GDP)

79.6 (2018)

Currency (Period Average)

Israeli Shekel

3.56per US$ (2019)

Political System

N/A

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

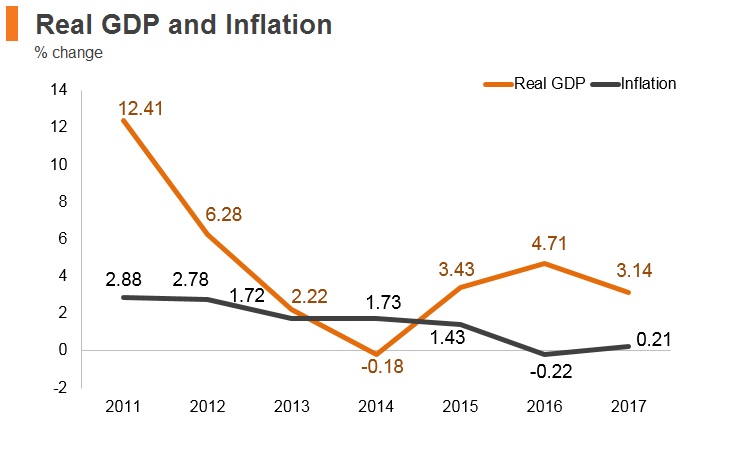

The Palestinian economy is small and relatively open, with several large holding companies dominating certain sectors. Palestinian businesses have a reputation for their professionalism as well as for the quality of their products. Large Palestinian enterprises are internationally connected, with partnerships extending to Asia, Europe, the Gulf and the Americas. Owing to the small size of the local market, access to foreign markets through trade is essential for private sector growth. However, Israeli restrictions on cross-border movements will remain in place, hampering exports and capital goods imports. The lack of progress towards peace has contributed significantly to the economic pressures in the area. The reconciliation process between Hamas and the Palestinian Authority (PA) has stalled and there is little to suggest that further progress will be made in negotiations between the two factions over the quarters ahead. Donor support has significantly declined and a financing gap persists despite a reduction in the deficit during 2018. The division of the internal polity between the West Bank and Gaza means there is uncertainty about the future and the political reconciliation process. Conditions in the West Bank are more favourable than those in Gaza, where declining budget transfers from the PA, dwindling foreign aid inflows and persistent restrictions on the movement of goods, capital and labour all place downward pressure on the economy. In the West Bank, the border restrictions are looser, the funding from the PA greater and private consumption higher, all of which help to support economic growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

October 2017

Hamas let the Ramallah-based unity government took over public institutions in Gaza as part of a reconciliation process between the two rival administrations.

December 2017

President Donald Trump of the United States recognised Jerusalem as the capital of Israel.

March-May 2018

Protests by Palestinian factions in Gaza on the border with Israel led to clashes with Israeli troops.

July-August 2018

The United Nations and Egypt attempted to broker a long-term ceasefire between Israel and Hamas amid an upsurge in violence on the Gaza border from March.

September 2018

The Palestinian mission was ordered to close its operations in the United States.

November 2018

Israel's defence minister resigned after an Egyptian-mediated deal between the government of Israel and Hamas in Gaza, following an intense outbreak of fighting when an Israeli covert mission was compromised. The resignation means elections previously due to be held in November 2019 will now be held in April 2019.

March 2019

The United States closed its consulate in Jerusalem and changed the status of its main diplomatic mission to Palestine by including it in the United States Embassy to Israel. The PA regarded the alteration as confirmation that Israel’s control over east Jerusalem and the west Bank were being officially recognised.

Sources: Fitch Solutions, BBC country profile – Timeline, Haaretz, Al Jazeera

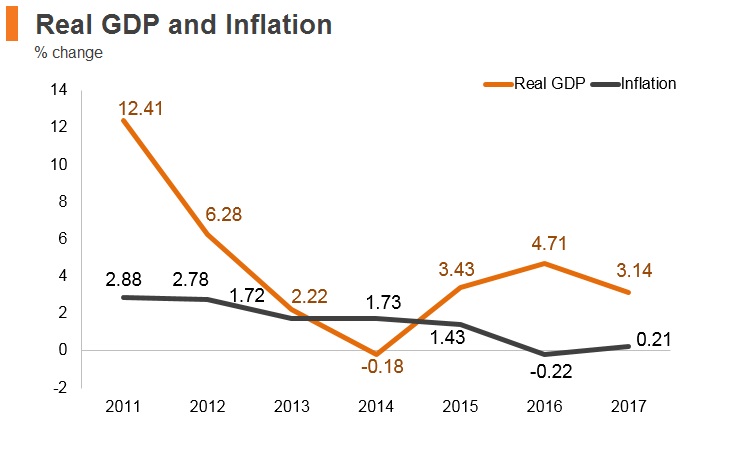

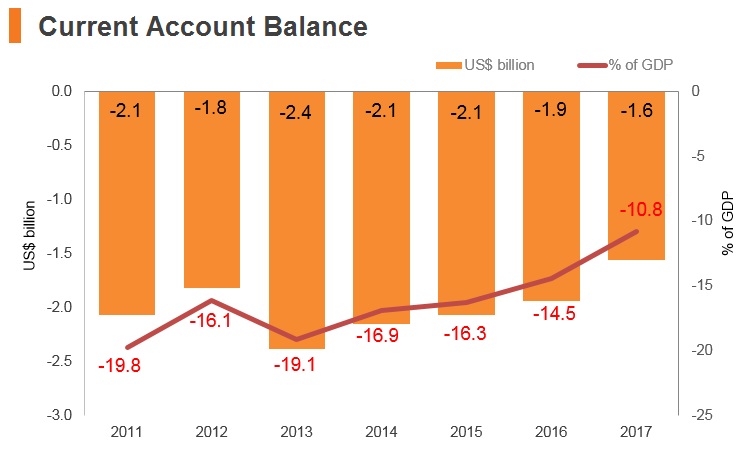

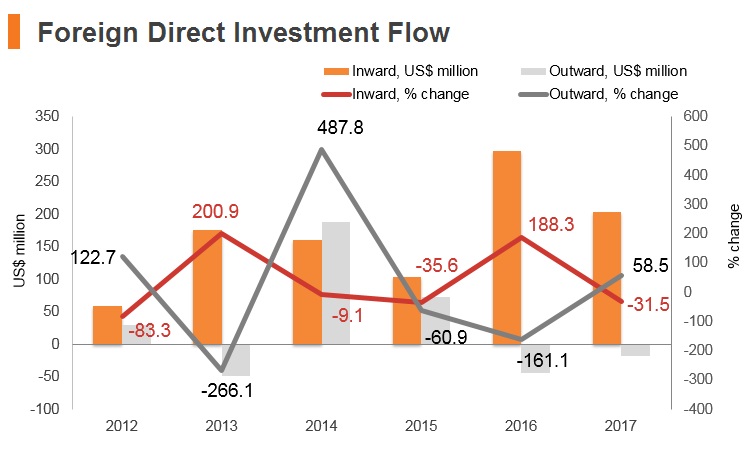

Note: 2017 is the latest available data

Sources: World Bank, Fitch Solutions

Date last reviewed: June 15, 2019

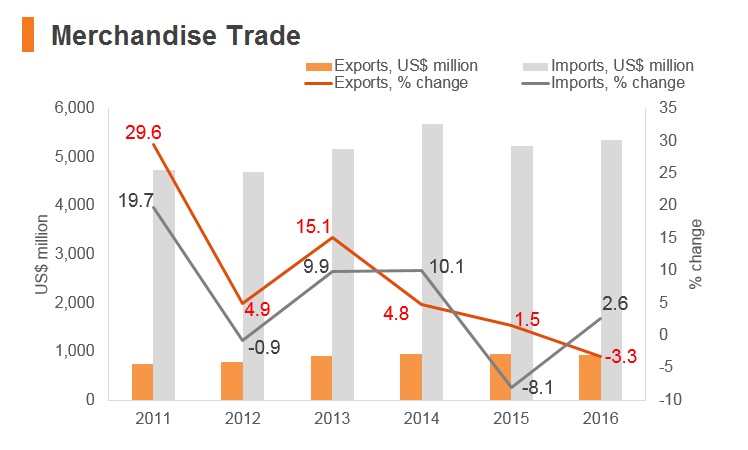

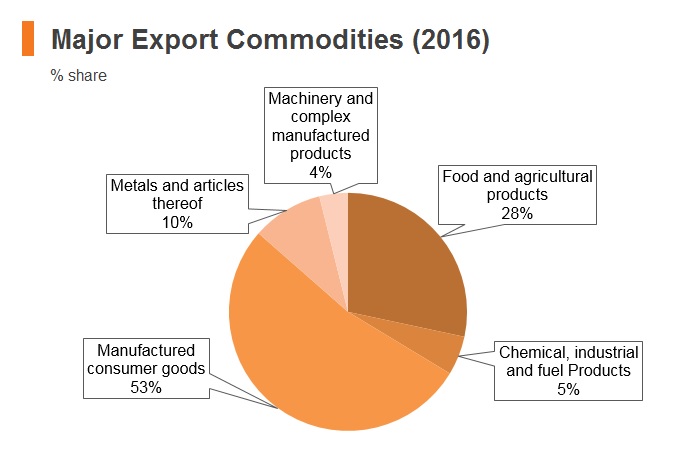

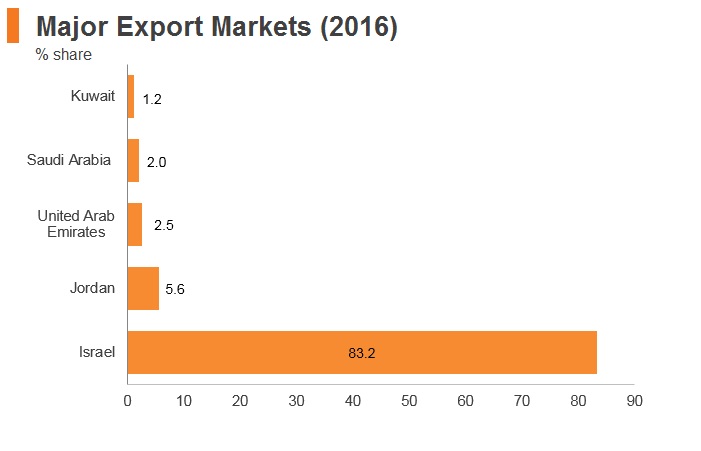

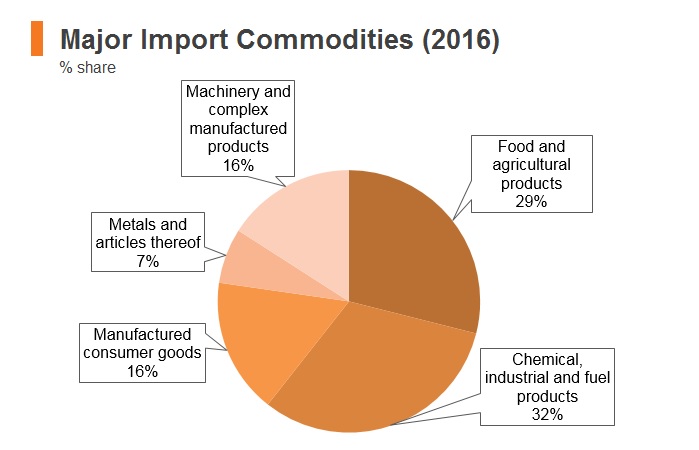

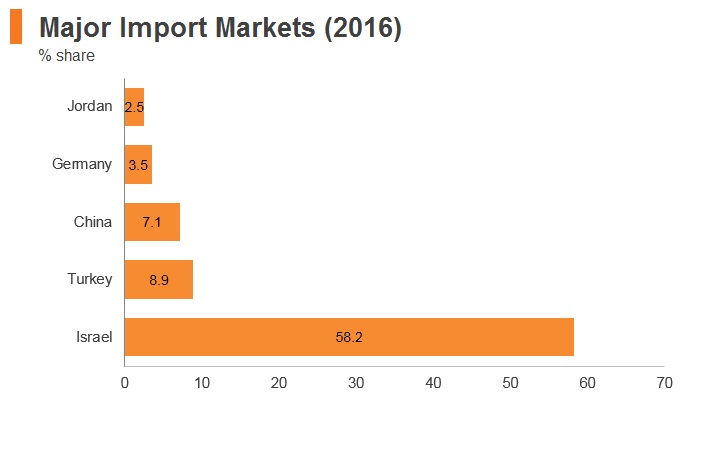

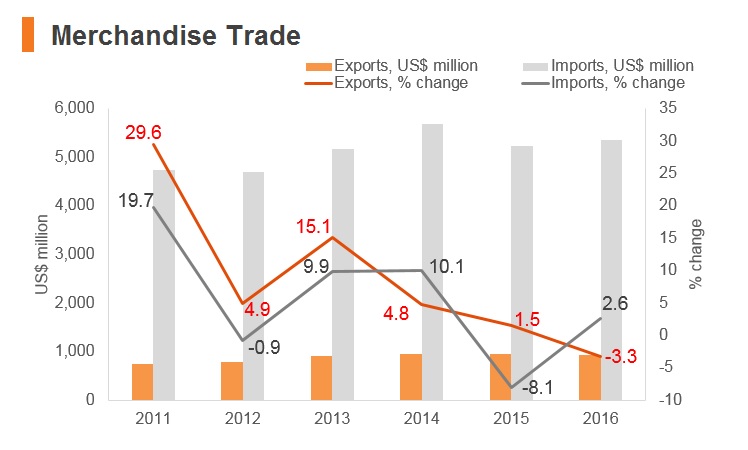

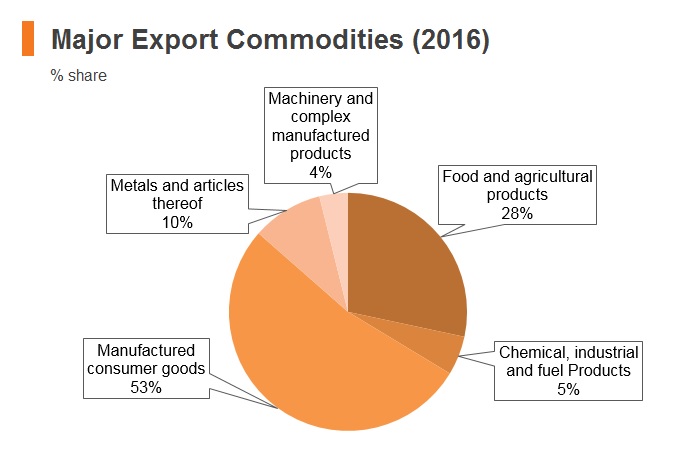

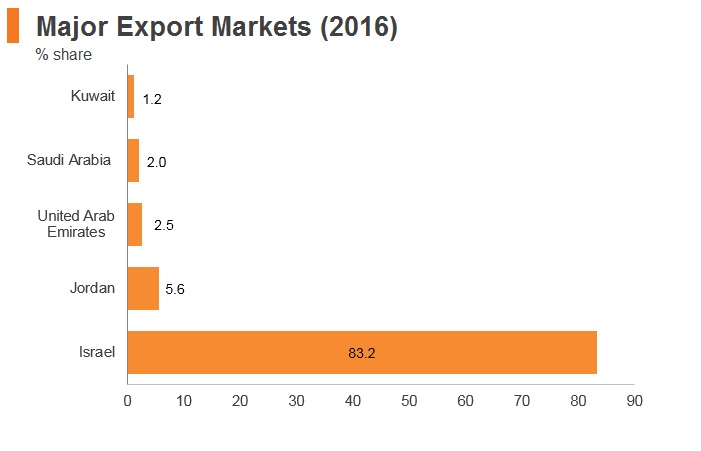

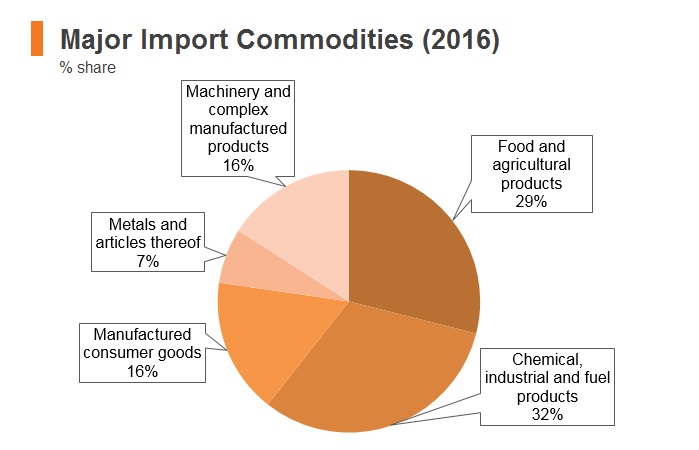

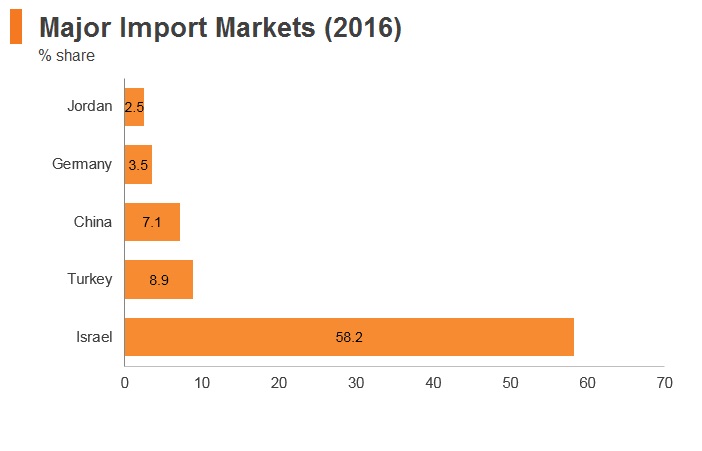

Merchandise Trade

Note: 2016 is the latest data available

Sources: Trade Map, Fitch Solutions

Date last reviewed: June 15, 2019

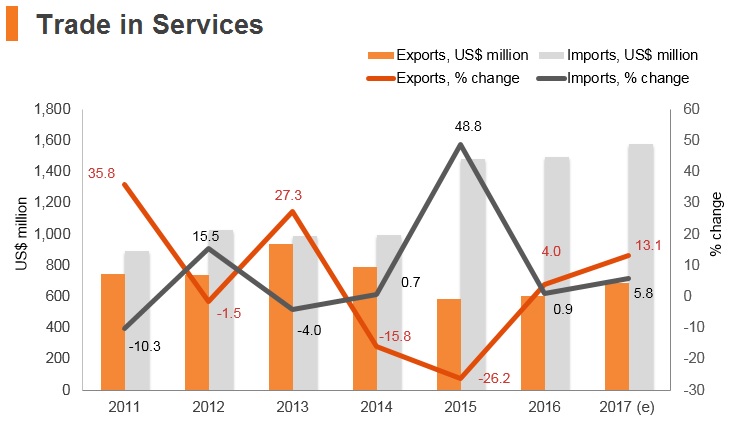

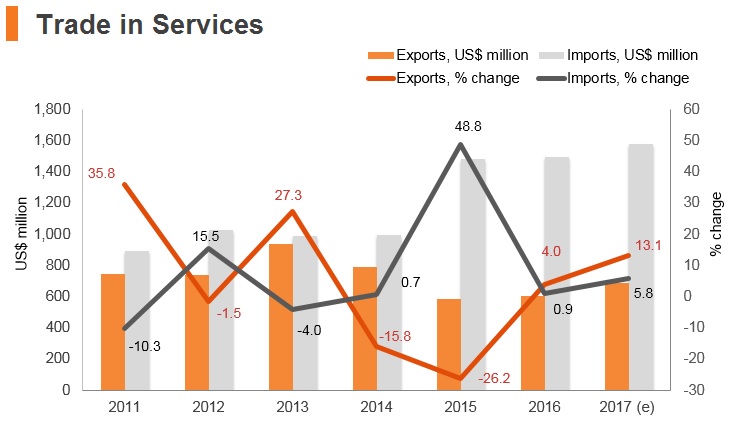

Trade in Services

e = estimate

Note: The values are estimated by UNCTAD, WTO and ITC

Source: Trade Map

Date last reviewed: June 15, 2019

- Palestine is not a member of the World Trade Organization (WTO), but is actively preparing for Permanent Observer status, and participated in the 2005, 2009, 2011, 2013 and 2015 WTO Ministerial meetings as an ad hoc observer.

- Palestine is working on a draft Foreign Trade Law, but it is still in the review process.

- As per the Paris Economic Protocol with Israel, importing and exporting products to and from the Palestinian market and foreign markets is executed through Israeli ports where Israel is in full control of trade movements, in addition to the Israeli control of internal Palestinian trade. It should be noted that when the Paris Protocol was first envisaged, it was built on reciprocity between the Israelis and the Palestinians. It is obvious that this spirit of the Paris Protocol no longer exists, simply because it is not functioning as agreed.

- Because Palestine has limited or no access to regional port facilities in Egypt and Jordan, it is dependent on Israeli ports for its trade. Israel therefore handles a significant amount of Palestinian imports, although Palestinian clearance agents have no access to Israeli port facilities.

- Because the West Bank is landlocked and does not have its own international airport, goods must first pass through Israel and then to other countries. This significantly retards the flow of goods to external markets. The PA petitioned Israel to allow the construction of an international airport within its territory in October 2010, but there has been no major progress reported since.

- Exports from and imports to Palestine are also dependent on Israeli policies. Restrictions imposed by the Israeli government on the movement and access of goods and people between the West Bank, Gaza and external markets continued to have a negative effect on the private sector and limited trade potential and growth in 2017 and 2018.

- Imports will be limited under the current policy of the government of Israel. As stated above, dual-use items are not allowed, which includes many capital goods. Import restrictions are strongly tied to the underperformance in Palestinian export and gross fixed capital formation growth, because they limit the range of goods and services that can contribute to the territories' economic activity.

- Palestine is party to the Pan-Arab Free Trade Area (PAFTA). Within PAFTA, Palestine is treated as a less-developed country and in 2005 began to apply the reductions of tariffs by 16% for a period of five years before reducing by 20% in 2011, the final year. Recently, Palestinian customs started to refund the value of customs duties paid by Palestinian importers for goods subject to customs exemption under this agreement, as an obligation of the membership of Palestine in the PAFTA. Thus, Palestinian traders enjoy duty-free quota-free access for all goods to and from all countries in PAFTA. The agreement has many benefits for the countries involved, including the expansion of their market, increased investment opportunities, the regulation of fair competition and the enhancement of research and development. PAFTA contributes to efforts to establish the Arab Common Market.

- In May 2005, the European Union (EU) and Palestine agreed on a European Neighbourhood Policy (ENP) Action Plan setting out jointly agreed priorities for economic integration and political cooperation. This plan was updated and adopted in March 2013.

- A package of measures to facilitate the trade of Palestinian products with other Euro-Mediterranean partners on a bilateral and regional basis was adopted at the ninth Union for the Mediterranean Trade Ministerial Conference, held in Brussels on November 11, 2010. The conference pledged to facilitate Palestinian trade in the Euro-Mediterranean region in a comprehensive way, through the removal of restrictions on access to markets and enhanced technical support.

- The Agadir Agreement (AA) is open to Arab countries in the Mediterranean that are in an association agreement with the EU and are members of the Arab League. Palestine decided to join the AA in 2009, and eventually the representatives of Palestine announced the PA’s induction to the agreement in 2011 to fulfil the potential of having free trade with the countries associated with the AA.

Sources: WTO – Trade Policy Review, Fitch Solutions, the Palestinian Trade Center

6.1 Multinational Trade Agreements

Active

- Palestine-Israel Paris Economic Protocol: The Paris Protocol is an economic trade agreement concluded on April 9, 1994, between the Palestinian Liberation Organization (PLO) and the government of the state of Israel, stating the basic principles of free trade between the two parties. This agreement resembles a joint customs arrangement built on three basic principles: tariff-free exchange of goods; adoption of a unified tariff by both parties (with the exception that Palestine has the right of customs determination on a limited list of strategic goods); and sharing revenues in customs clearance. The agreement also includes 11 separate articles on trade, including, but not limited to, those on labour, agriculture, tourism, industrial food, insurance and taxes. An additional advantage the Paris Protocol provided is the possibility for the PA to sign free trade agreements (FTAs) and boost diversification of Palestinian trade.

- Palestine and the Pan-Arab Free Trade Area (PAFTA): PAFTA is a multilateral trade agreement between 18 out of the 22 Arab League states that aims to fully liberate the trade of goods between the Arab nations. The agreement was signed in 1997 and brought into force on January 1, 1998. The trade agreement adopts the method of gradual reduction on taxes and customs (10% per annum) eliminating customs and non-tariff barriers on goods traded among the 18 Arab countries, namely: Algeria, Bahrain, Egypt, Iraq, Jordan, Kuwait, the Lebanese Republic, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, the Syrian Arab Republic, Tunisia, the United Arab Emirates and Yemen. As of January 1, 2005, the agreement reached full trade liberalisation of goods through the full exemption of customs duties and charges, having equivalent effect between all Arab countries that are members of PAFTA. Accordingly, since 2005 Palestinian exports enjoy duty-free quota-free treatment in all Arab countries that are members of PAFTA. To further contribute to economic integration among Arab countries through the liberalisation of trade in both goods and services, Arab countries are currently engaged in negotiations to liberalise services and investments among them. This free trade area is only a first step towards achieving a customs union and a common market.

- Palestine-Russia Agreement on Commercial Cooperation: Russia and Palestine extend to each other the status of Most Favoured Nation regarding trade. Imports and exports between the two parties are duty free for the following goods:

- Instruments and items specified for montage and repair;

- Equipment and instruments specified for undertaking experiments and scientific research;

- Articles for demonstration during fairs and exhibitions; and

- Containers and similar packages used in international trade on a return basis.

- Palestine-Jordan FTA: The FTA between Jordan and the PLO was signed in July 1998. It provides preferential tariffs for certain goods traded between Palestine and Jordan; however, for some categories of goods, quotas apply. Products exported to Jordan must meet the Jordanian Rules of Origin – a product should be 'wholly obtained' (grown, produced or manufactured) in either Palestine or Jordan. If not wholly obtained, the product should at least have 35% of the value added produced locally, either in Palestine or Jordan.

- Palestine-EU Interim Association Agreement (IAA): This agreement on Trade and Cooperation with the EU was signed on February 24, 1997, between the PLO and the European Commission, entering into force on July 1, 1997. The agreement was an outcome of the Barcelona Process that was launched by the Euro-Mediterranean Conference of Foreign Ministers in November 1995 to strengthen the relations between Europe and other Mediterranean countries. The IAA started with an immediate duty-free treatment of bilateral industrial trade and a phasing out of tariffs on EU exports to Palestine over five years. In January 2012, the agreement created a duty- and quota-free regime for the import of Palestinian agricultural, processed foods and fish products to EU markets. The agreement is valid for 10 years from its entry into force on January 1, 2012, with the possibility of renewal.

- Palestine-European Free Trade Association (EFTA): An interim FTA was signed between the EFTA states (Iceland, Liechtenstein, Norway and Switzerland) and the PLO for the benefit of Palestine on November 30, 1998, and it came into force on July 1, 1999. It gives duty-free treatment to industrial products, fish and marine products, with reduced tariffs on processed agricultural products. It is worth noting that the EFTA rules of origin are the same as those applied by the EU. Furthermore, the PA has signed separate bilateral agreements on agricultural processed products with EFTA countries because the four EFTA states do not share the same agricultural policy.

Signed

- Palestine-AA: The AA is an FTA signed in 2004 by Egypt, Jordan, Morocco and Tunisia to establish free trade between the countries of the Arab Mediterranean. The agreement aims to develop economic activities and improve living standards within the member countries and to create an opportunities for economic integration between them. Palestine benefits as Agadir is in harmony with PAFTA and the Barcelona Process. The PA was formally admitted into the agreement in 2011 to fulfil the potential of having free trade with the countries associated with the AA.

- Turkey-Palestine FTA: The FTA signed in July 2004 in Istanbul between Turkey and the PLO established a free trading area between the two parties, eliminating tariff and non-tariff barriers in the trade of goods. This agreement regulates numerous subjects, such as sanitary measures, payments and transfers, and safeguard measures. The agreement primarily aims to enhance economic cooperation, gradually eliminate any difficulties and restrictions on the trade in goods (including agricultural products) and contribute to economic growth by removing barriers and creating conditions that will further encourage inward investment.

- The Declaration of Free Trade between the United States and the West Bank and Gaza Strip: This declaration was signed in 1996 to potentially open the door for Palestinian exports into a larger market. It was intended to provide duty-free treatment to all Palestinian products entering the United States and vice versa. However, the Israeli impediments on the movement of goods and discrimination against Palestinian products in the Israeli ports, along with the lack of capacity of local producers, resulted in a minimal utilisation of this important agreement. Traded products must meet the United States' Rules of Origin. In many aspects, this declaration is an extension of the FTA between the United States and Israel (1985), which allows the entrance of goods of both parties to their respective markets, exempt from tariffs.

- The Palestine-Canada Framework on Economic Cooperation and Trade: This framework was signed in 1999 between Canada and the PLO to give Palestinian products the potential to enter a larger market. The arrangement states that Canada will support a programme of economic development in the Palestinian areas, and it focuses on reciprocity in the liberalisation of markets for the products of both sides, taking into consideration that Palestine needs to protect its newly established industries. The framework aims to eliminate and reduce tariffs on industrial products, agricultural products and processed food pursuant to a quota system, as long as the products meet the Canadian Rules of Origin. This arrangement is considered an extension of the Canada-Israel FTA. Therefore, Canadian-applied tariffs on imports from Palestine are the same as those applied for Israel.

- Palestine-Southern Common Market (MERCOSUR) FTA: This FTA was signed in 2011 between Palestine and Mercosur, or Southern Common Market, the regional customs union whose members are Argentina, Brazil, Paraguay, Uruguay and Venezuela (although Venezuela was suspended in 2016). To date, the agreement with Palestine has not entered into force yet. This agreement is consistent with Article XXIV of The General Agreement on Tariffs and Trade (GATT 1994) and the Decision on Differential and More Favourable Treatment, Reciprocity and Fuller Participation of Developing Countries (1979).

Sources: WTO Regional Trade Agreements database, Palestine Trade Center

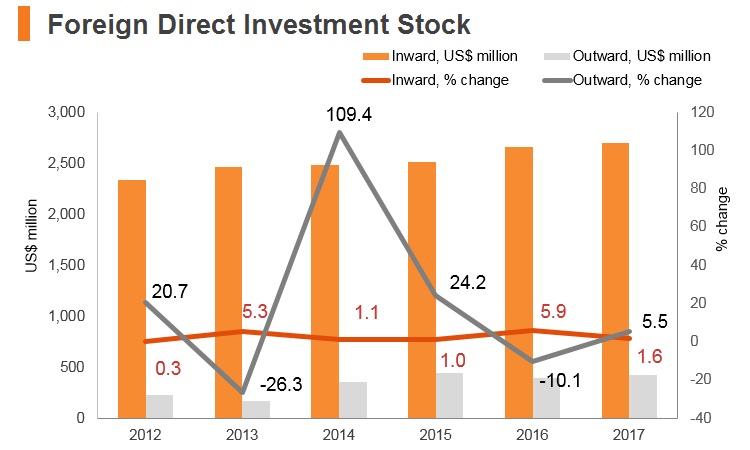

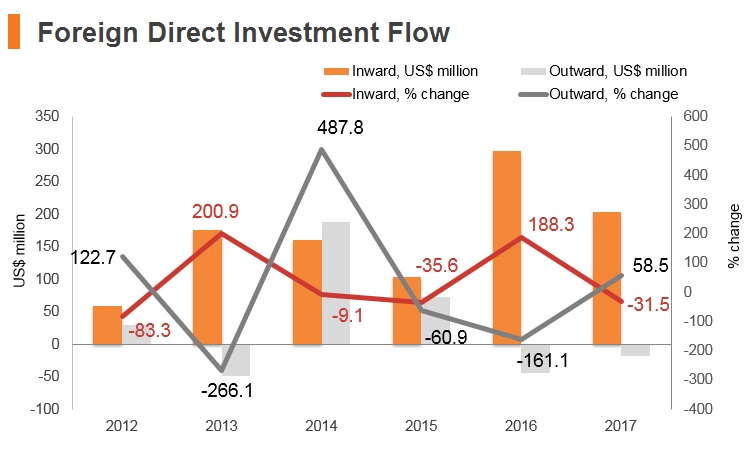

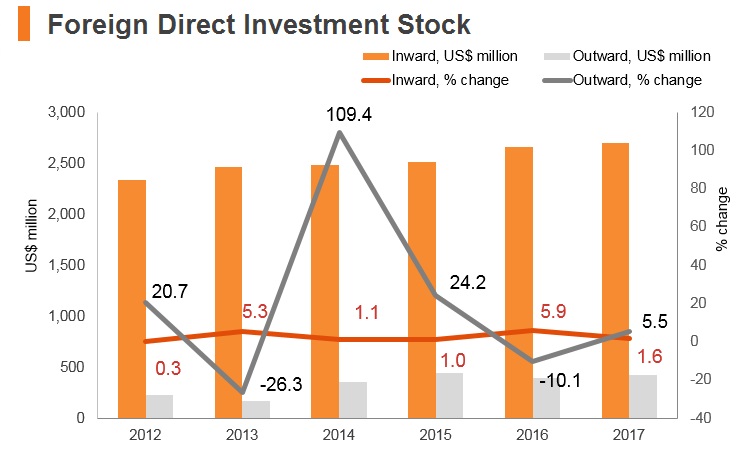

Foreign Direct Investment

Source: UNCTAD

Date last reviewed: June 15, 2019

Foreign Direct Investment Policy

- The PA’s 2014 amendments to Palestine Law on the Promotion of Investment shifted the incentive focus from industrial projects providing large capital investments to employment growth, the development of human capital, increased exports, and the local sourcing of machinery and raw materials. Although the presidential decree enacted the amendments, the specific incentives to be provided are still being determined. The amendments added tourism projects and agricultural projects to the qualifying industries and removing real estate development projects from the industries which are to be promoted through the incentives.

- The amendments also gave additional authority to the Palestinian Investment Promotion Agency (PIPA) to create incentive packages targeted to individual business needs. PIPA expects the changes to create a streamlined investment and incentive process to circumvent some PA bureaucratic red tape to obtain licenses for investment projects. For example, if any step in the business registration process takes longer than 30 days, PIPA can intervene and issue a business license or registration on its own authority.

Significant sectors highlighted by PIPA and in the National Export Strategy for 2014-2018 include the following:

- Stone and marble

- Tourism

- Agriculture, including olive oil, fresh fruits, vegetables and herbs

- Food and beverages, including agro-processed meat

- Textiles and garments

- Manufacturing, including furniture and pharmaceuticals

- Information and communication technology

- Construction and real estate development

- Palestine securities sector

- Renewable energy

- Foreign and domestic private entities may establish and own business enterprises in areas under PA civil control.

- The PA does not have a national currency. Major currencies used in Palestine include the Israeli shekel, Jordanian dinar and the USD.

Sources: WTO – Trade Policy Review, US Department of Commerce, Palestinian Investment Promotion Agency, Fitch Solutions

Free Trade Zones and Investment Incentives

| Free Trade Zone/Incentive Programme | Main Incentives Available | |

| The Palestinian Industrial Estate and Free Zone Authority (PIEFZA) has established industrial estates at Bethlehem and Gaza, an industrial free zone at Jenin, and an agro-industrial park at Jericho. | - The industrial estates at Gaza and Bethlehem were established in 1999 and 2013 respectively. Each offers on-site infrastructure, incentives and one-stop shop business development services. Gaza has target industries of food, wood, plastic and aluminium; Bethlehem favours any small and medium industries. - The Jenin Industrial Free Zone (JIFZ) was established in 2015 when various investment agencies from Turkey took an early interest. JIFZ offers on-site infrastructure, incentives and one-stop shop business development services. JIFZ’s target industries are agro-food companies with high technology and light industry. - Jericho Agro Industrial Park Company was established in 2012 with the help of the Japan International Cooperation Agency. On-site infrastructure is supplied and there are exemptions from company income tax, property and municipal tax, and vehicle tax. |

|

| General Incentives: The 2014 amendment to Article 23 of the Promotion of Investment in Palestine Law granted certain incentives and exemptions for projects approved by PIPA certain criteria are met. | - Income tax of 0% for producers of agricultural products whose income is directly generated from land cultivation or livestock. - Income tax of 5% for a period of up to five years after the date of realising a profit (or for up to four years from commencing operations, whichever is earlier). - Income tax of 10% for a period of up to three years, commencing from the end of the first phase. Thereafter, it will be calculated based on the applicable and in-effect percentages and segments. |

|

Sources: US Department of Commerce, Palestinian Investment Promotion Agency, Jericho Agro Industrial Park, Palestinian Industrial Estate and Free Zone Authority, Fitch Solutions

- Value Added Tax: 16%

- Corporate Income Tax: 15%

Sources: Palestinian Investment Promotion Agency, Fitch Solutions

Business Taxes

| Type of Tax | Tax Rate and Base | |

| Corporate Income Tax |

The standard corporate income tax rate is 15%. A rate of 20% applies to telecommunications companies and companies with specific privileges or monopolies. A rate of 5% applies to life insurance companies' premiums. Agriculture projects are subject to a 0% tax rate. | |

| Capital Gains Tax | Gains from the sale of investments in equity securities are tax exempt. For the remainder of capital gains accrued, the standard corporate income tax rate applies. | |

| Wages and Profits Tax | Imposed at a rate of 16% on financial institutions instead of value-added tax (VAT) and in addition to corporate income tax. | |

| VAT | A consumption-based tax imposed on local godds and services at a rate of 16%. Exemptions from VAT are given to PA-supported investments in financial institutions, pre-school education and projects involved with research and development, transportation, infrastructure, and food processing. VAT is payable by all companies with annual sales in excess of USD12,000. Banks and insurance companies pay VAT on employee salaries each month and on profits generated semi-annually or annually. | |

| Purchase Tax | Imposed at a rate ranging from 5% to 95% depending on the rate set for the type of good. The tax is payable by manufacturers or importers at the port of entry on certain consumer products, as specified by law. | |

| Withholding Taxes | Tax at 15% is withheld at source from dividends distributed in Palestine to shareholders of a foreign company, but there are no taxes due on dividends distributed to shareholders of Palestinian companies regardless of where they live or their nationality. An automatic deduction at source of 25% is withheld from companies unless a Deduction at the Source Certificate is obtained from the district tax office, which will grant a reduced rate ranging from 0% to 5%. | |

Sources: Palestinian Investment Promotion Agency, Fitch Solutions

Date last reviewed: June 15, 2019

Work Permits

While the PA does not require foreign nationals working in the West Bank to seek work permits, the Israeli government requires foreigners to obtain Israeli visas in order to enter the West Bank and Gaza via Israel.

Visa Policy

Israel generally grants foreign passport holders from countries that have diplomatic relations with Israel three-month tourist visas upon arrival, but long-term business visas may only be obtained by businesses or organisations with a presence in Israel.

Sources: Palestinian Authority Ministry of Labour, Israel Ministry of Foreign Affairs, Fitch Solutions

Sovereign Credit Ratings

| Rating (Outlook) | Rating Date | |

| Moody's | Not Rated | N/A |

| Standard & Poor's | Not Rated | N/A |

| Fitch Ratings | Not Rated | N/A |

Competitiveness and Efficiency Indicators

| World Ranking | |||

| 2017 | 2018 | 2019 | |

| Ease of Doing Business Index | 140/190 | 114/190 | 116/190 |

| Ease of Paying Taxes Index | 101/190 | 109/190 | 107/190 |

| Logistics Performance Index | N/A | N/A | N/A |

| Corruption Perception Index | N/A | N/A | N/A |

| IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, IMD, Transparency International

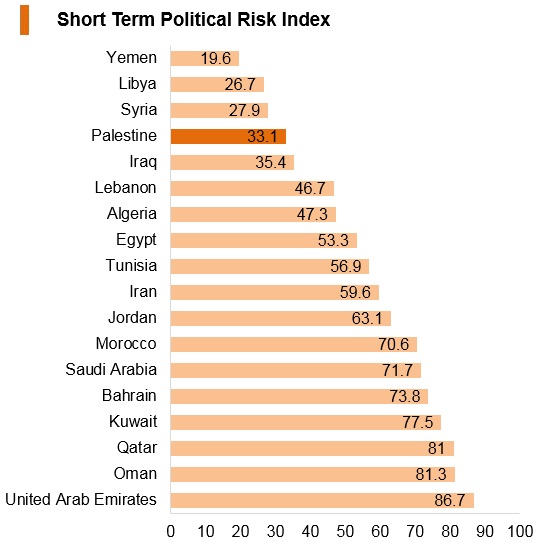

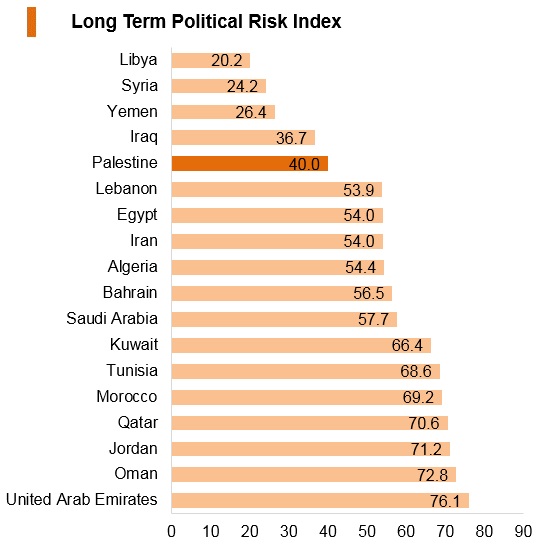

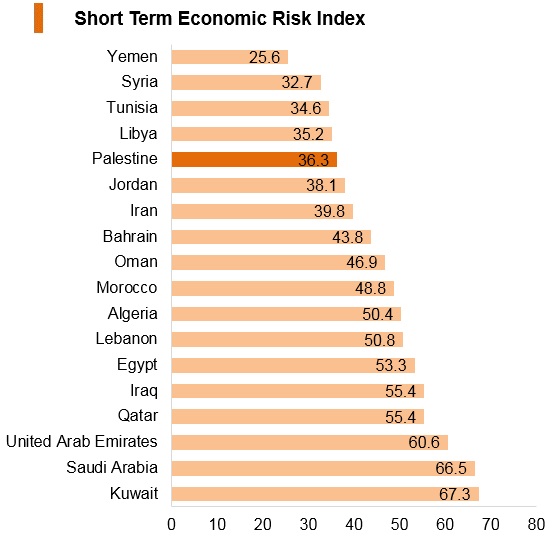

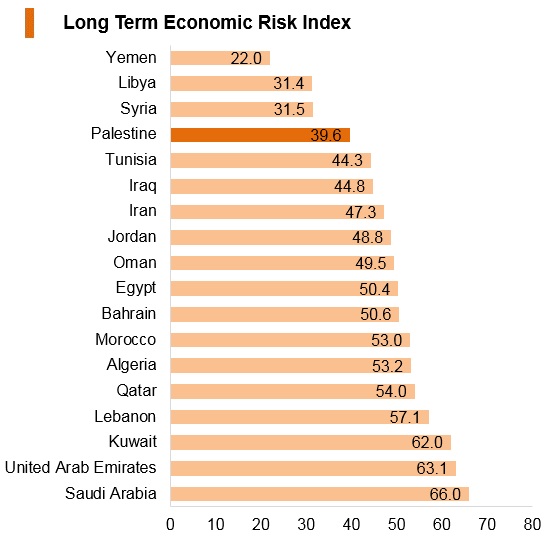

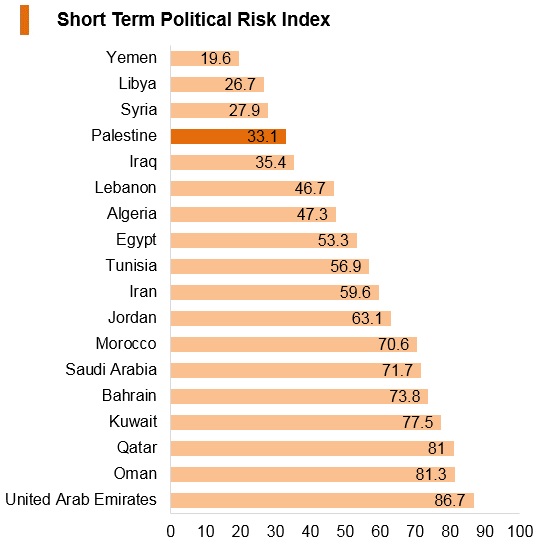

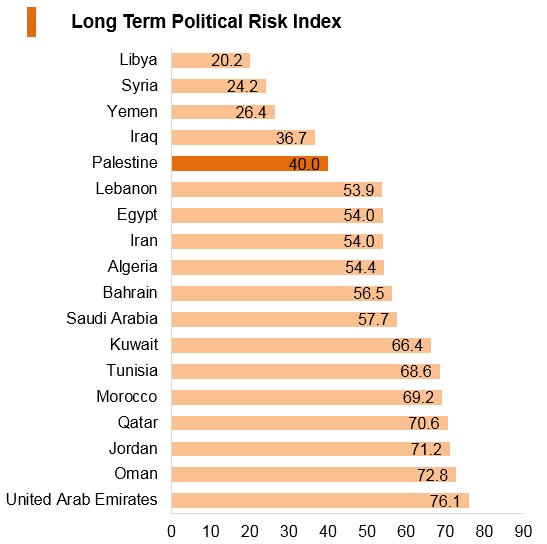

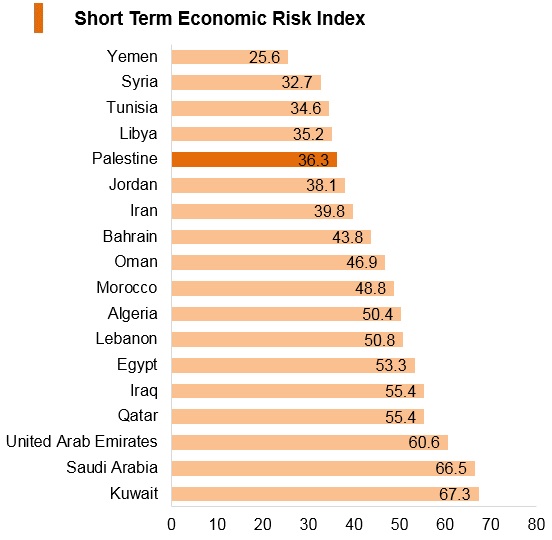

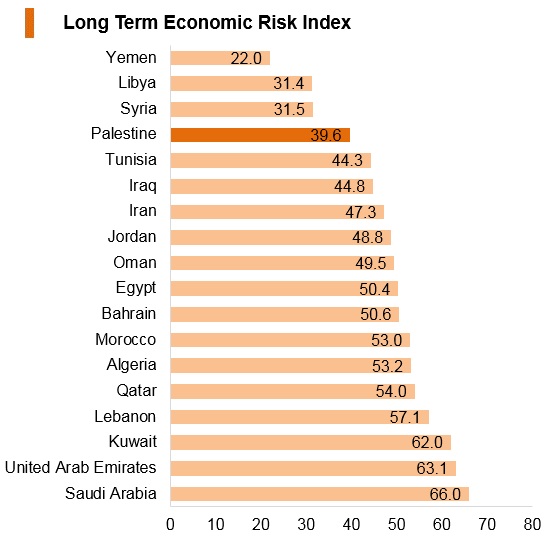

Fitch Solutions Risk Indices

| World Ranking | |||

| 2017 | 2018 | 2019 | |

| Economic Risk Index Rank | N/A | 186/202 | 171/202 |

| Short-Term Economic Risk Score | 36.7 | 35.4 | 36.3 |

| Long-Term Economic Risk Score | 36.0 | 36.6 | 39.6 |

| Political Risk Index Rank | N/A | 185/202 | 184/202 |

| Short-Term Political Risk Score | 33.1 | 33.1 | 33.1 |

| Long-Term Political Risk Score | 40.0 | 40.0 | 40.0 |

| Operational Risk Index Rank | N/A | 168/201 | 162/201 |

| Operational Risk Score | 32.7 | 34.0 | 34.8 |

Source: Fitch Solutions

Date last reviewed: June 15, 2019

Fitch Solutions Risk Summary

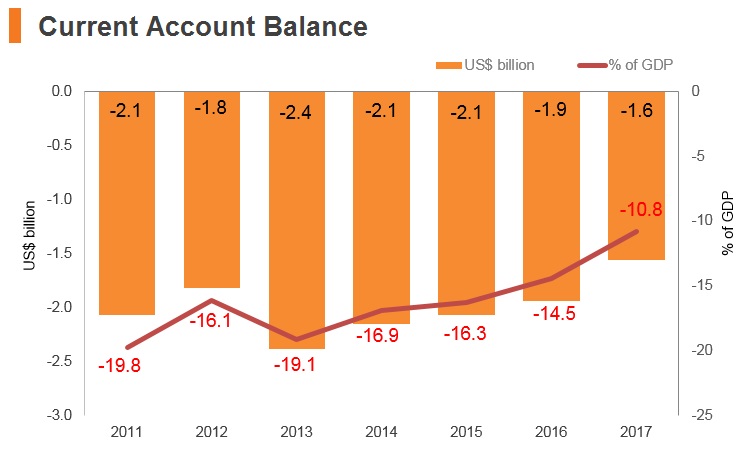

ECONOMIC RISK

External aid inflows look set to decline as the United States ends support for the United Nations Relief and Works Agency for Palestine Refugees in the Near East and as other donors face pressing funding requirements from conflicts elsewhere in the region. The ability of the PA to support economic activity will thus weaken. Both the PA and Hamas are reliant on external aid to support their budgets, while the PA has made efforts to reduce its dependence on donors, this dynamic is not expected to fundamentally shift as long as Israeli restrictions persist. The precarious finances of both factions mean that the reconstruction of the Gaza Strip – which has suffered extensive damage from conflict – will continue to face delays. The International Monetary Fund estimates that, owing to internal restrictions, the share of GDP produced by the tradeable goods, manufacturing, and agriculture sectors has declined to under 20%. Consequently, these constraints have resulted in a disproportionate rise in non-tradeable sectors. The construction and services industries, in particular, have been less hindered by the aforementioned barriers to physical movement and have taken a greater share of GDP.

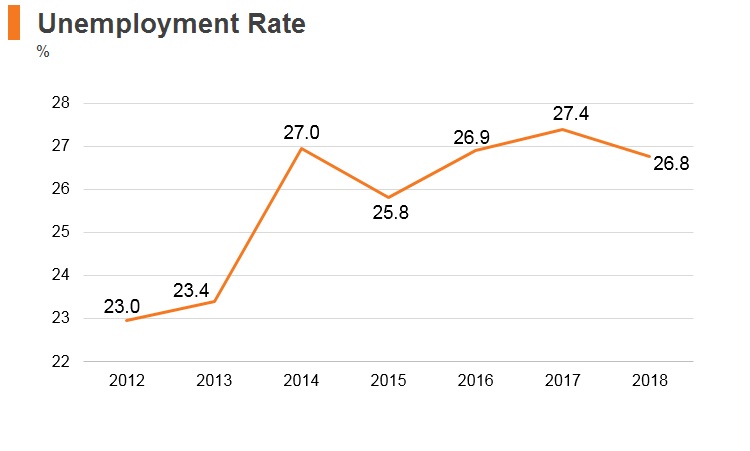

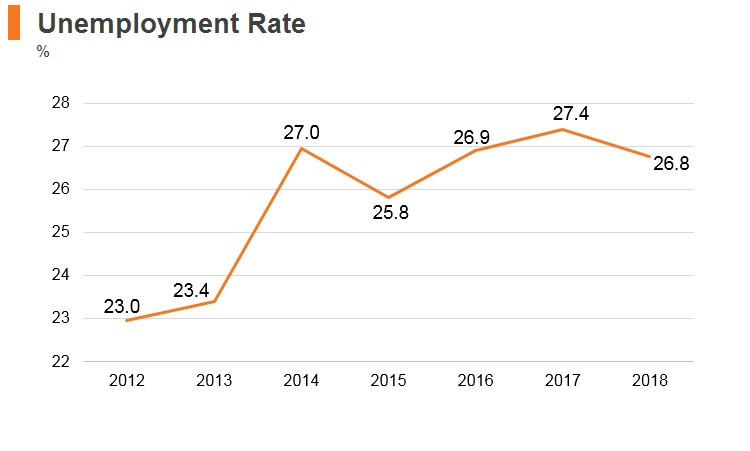

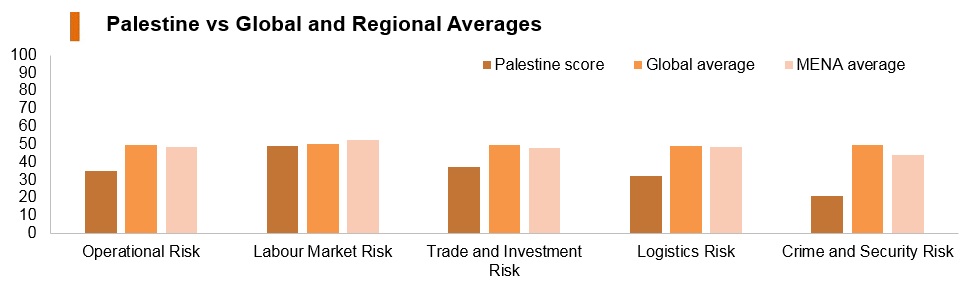

OPERATIONAL RISK

Economic conditions will remain particularly dire in Gaza, where deteriorating living standards and rising unemployment will keep the risks of conflict and unrest elevated. As the peace process continues to stall, Israeli restrictions on cross-border movement will remain in place, hampering exports and capital goods imports. Furthermore, given the obstacles to construction and strict borders controls, there is little scope for foreign direct investment to boost the Palestinian economy unless restrictions are eased. A negotiated settlement to resolve the dispute between Israel and the Palestinians remains highly unlikely.

Sources: Fitch Solutions, IMF

Date last reviewed: June 15, 2019

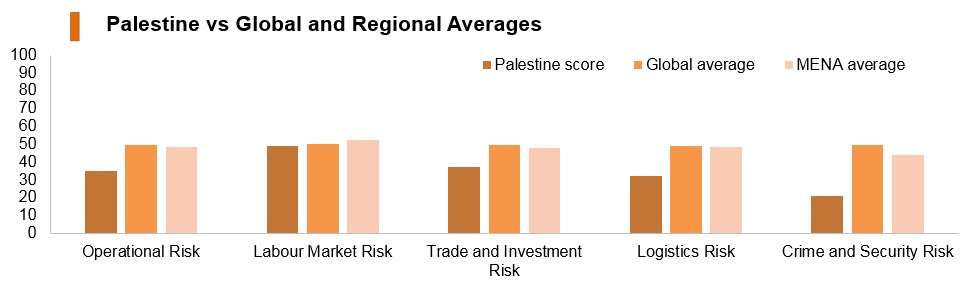

Fitch Solutions Political and Economic Risk Indices

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Political and Economic Risk Indices

Date last reviewed: June 15, 2019

Fitch Solutions Operational Risk Index

| Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Palestine Score | 34.8 |

48.8 |

37.4 | 32.0 | 21.2 |

| MENA Average | 48.3 | 52.3 | 48.0 | 48.7 | 44.1 |

| MENA Position (out of 18) | 14 | 11 | 12 | 14 | 14 |

| Global Average | 49.7 | 50.3 | 49.8 | 49.0 | 49.8 |

| Global Position (out of 201) | 162 | 109 | 145 | 162 | 183 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

| Country | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk | Crime and Security Risk Index |

| UAE | 73.6 | 71.2 | 79.1 | 68.7 | 75.3 |

| Qatar | 66.2 | 65.0 | 61.8 | 71.6 | 66.5 |

| Oman | 66.2 | 62.2 | 61.9 | 64.5 | 76.0 |

| Bahrain | 66.0 | 63.1 | 69.5 | 71.5 | 60.1 |

| Saudi Arabia | 62.6 | 67.2 | 62.1 | 62.7 | 58.6 |

| Jordan | 59.1 | 56.9 | 60.7 | 59.0 | 60.0 |

| Kuwait | 55.5 | 54.2 | 51.2 | 52.5 | 64.1 |

| Morocco | 54.1 | 43.2 | 63.8 | 54.8 | 54.6 |

| Egypt | 49.3 | 49.9 | 45.7 | 56.4 | 45.3 |

| Tunisia | 47.1 | 42.2 | 56.2 | 47.3 | 42.8 |

| Lebanon | 44.7 | 43.0 | 51.9 | 41.4 | 32.4 |

| Iran | 43.0 | 49.5 | 36.7 | 50.8 | 35.1 |

| Algeria | 42.0 | 46.1 | 31.1 | 42.9 | 47.9 |

| Palestine and Gaza | 34.8 | 48.8 | 37.4 | 32.0 | 21.2 |

| Libya | 28.0 | 47.2 | 22.1 | 29.3 | 13.4 |

| Syria | 27.3 | 45.5 | 23.7 | 27.0 | 12.7 |

| Iraq | 27.1 | 43.7 | 24.8 | 28.6 | 11.3 |

| Yemen | 22.4 | 32.7 | 24.9 | 15.8 | 16.1 |

| Regional Averages | 48.3 | 52.3 | 48.0 | 48.7 | 44.1 |

| Emerging Markets Averages | 46.0 | 48.1 | 46.5 | 44.7 | 44.8 |

| Global Markets Averages | 49.7 | 50.3 | 49.8 | 49.0 | 49.8 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: June 15, 2019

Hong Kong’s Trade with Palestine

| 2015 | Growth rate (%) | |

| Number of Palestinian residents visiting Hong Kong | N/A | N/A |

| Number of Palestinians residing in Hong Kong | N/A | N/A |

| 2017 | Growth rate (%) | |

| Number of Middle East residents visiting Hong Kong | 129,816 | -2.5 |

Source: Hong Kong Tourism Board

Date last reviewed: June 15, 2019

Commercial Presence in Hong Kong

| 2016 | Growth rate (%) | |

| Number of Palestinian companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Visa Requirements for Hong Kong Residents

Foreign nationals visiting Palestine need to enter the territory through Israel. There are no visa conditions imposed on foreign nationals other than those imposed by the visa policy of Israel. Israel generally grants foreign passport holders from countries that have diplomatic relations with Israel three-month visas upon arrival, but long-term business visas may only be obtained by businesses or organisations with a presence in Israel. Admission to the West Bank and Gaza Strip is strictly controlled by the Israeli Defense Forces.

Sources: VisaHQ, GOV.UK

Date last reviewed: June 15, 2019

Palestine

Palestine