GDP (US$ Billion)

5.33 (2018)

World Ranking 152/193

GDP Per Capita (US$)

14,571 (2018)

World Ranking 61/192

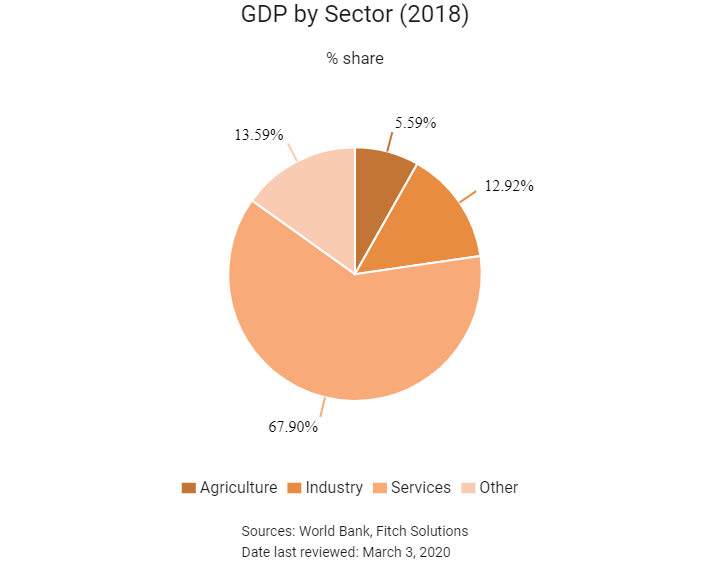

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

135.7 (2019)

Currency (Period Average)

Maldivian Rufiyaa

15.38per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

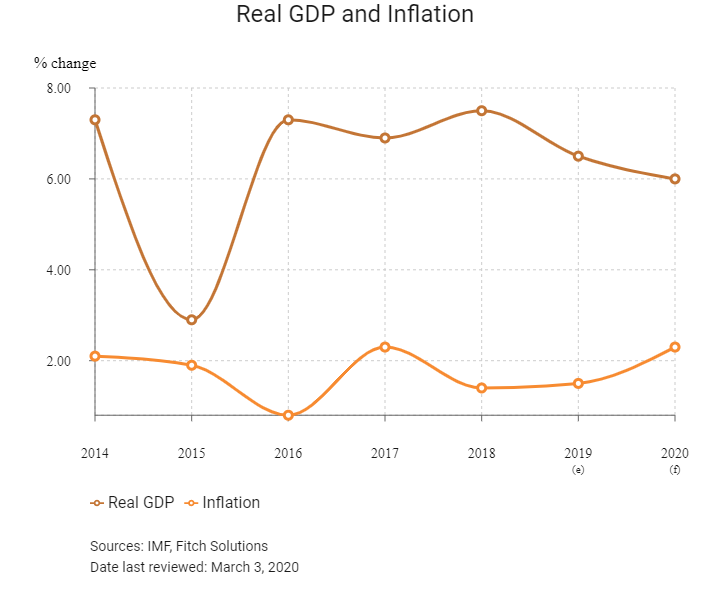

Maldives is an upper-middle-income country with a population of over 400,000 people dispersed across 188 of its 1,190 islands. Maldives' economy is mainly based on tourism, construction and fishing. Construction became the main driver of growth in 2015-2017, partly owing to the government's efforts to encourage people to move from smaller islands to the Greater Malé region to promote more efficient public expenditure. The new government has embarked on an ambitious reform agenda, focusing on macroeconomic stability and sustainable growth.

Sources: World Bank, Asian Development Bank, IMF, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

August 2016

Parliament passed a new defamation bill.

June 2017

The government announced that it had cut diplomatic ties with Qatar; however, its business linked with Qatar remain intact.

February 2018

President Abdulla Yameen declared a state of emergency after the Supreme Court overturned convictions of political opponents.

March 2018

President Abdulla Yameen lifted the 45-day state of emergency.

September 2018

Opposition leader Ibrahim Mohamed Solih won the presidential election, beating the former president, Abdulla Yameen.

April 2019

The Maldivian Democratic Party won the parliamentary election with 65 seats in the 87-seat parliament, solidifying President Solih’s position.

December 2019

The Abu Dhabi Fund for Development (ADFD) provided AED191 million (USD52 million) for Maafaru International Airport in Maldives. The project included the construction of a nearly 2.2km runway, the airport's main building and office buildings, a firefighting station, a control tower, a desalination plant, hangars, and service roads. The airport, which would come up on Noonu Atoll Island, would also have a marina for boats that serve neighbouring islands.

Sources: BBC Country Profile – Timeline, Fitch Solutions

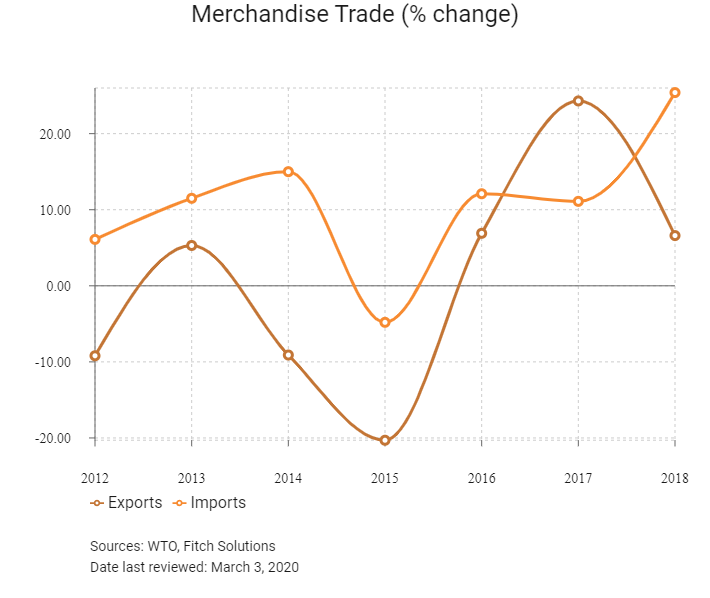

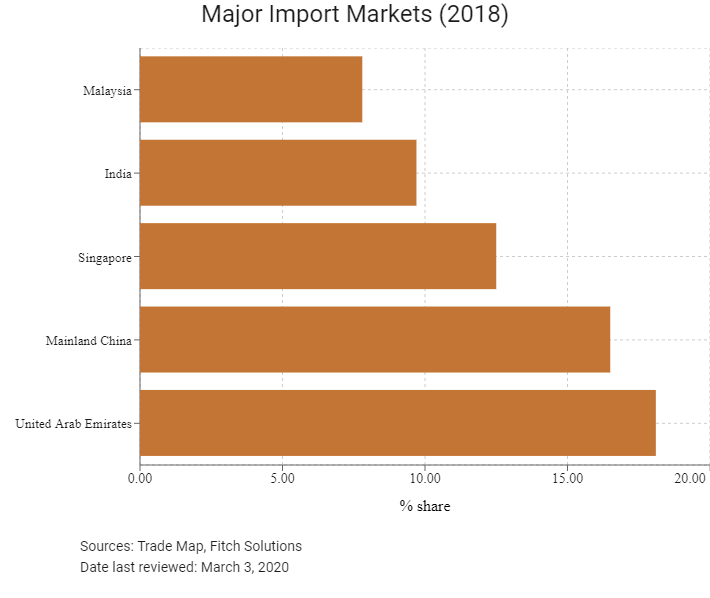

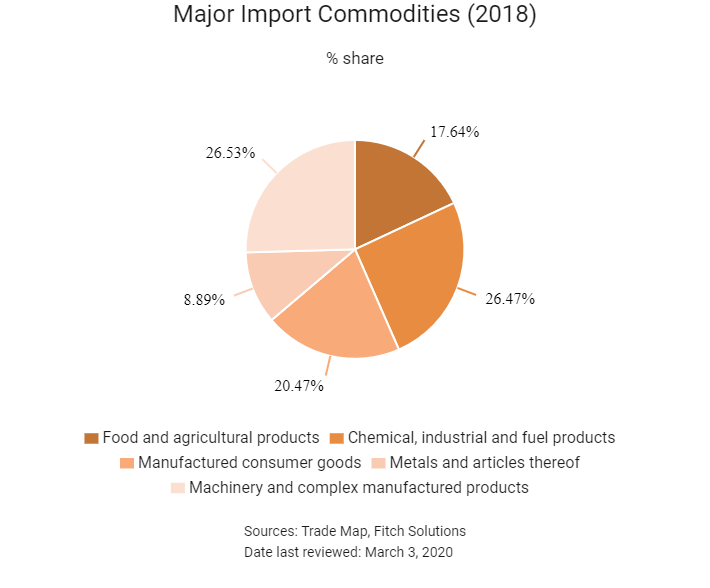

Merchandise Trade

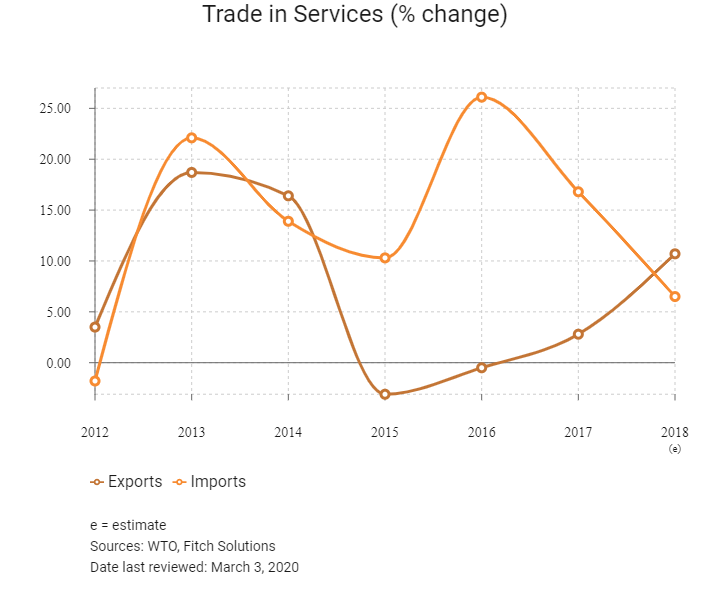

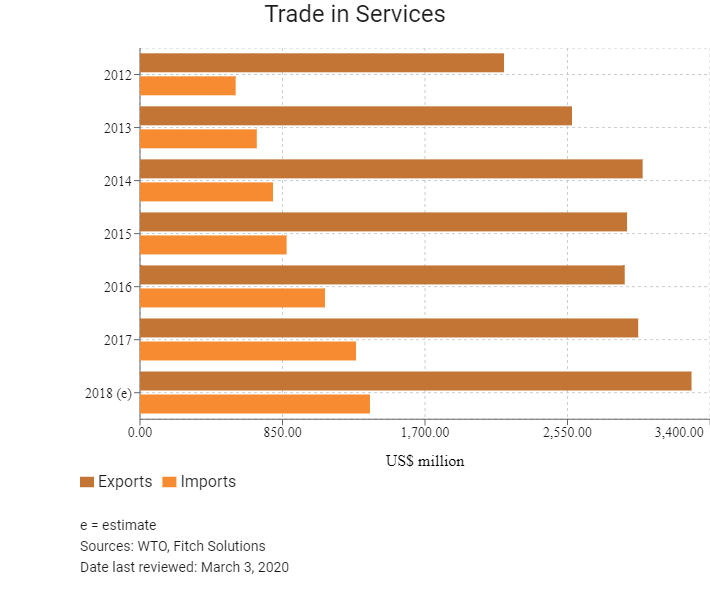

Trade in Services

- Maldives has been a member of the World Trade Organization (WTO) since May 1995 and a member of the General Agreement on Tariffs and Trade since April 1983.

- Maldives is a member of the South Asian Association for Regional Cooperation (SAARC). Other members are Afghanistan, Bangladesh, Bhutan, India, Nepal, Pakistan and Sri Lanka. SAARC was established on December 8, 1985, to accelerate economic growth in South Asia, promote and strengthen collective self-reliance and strengthen cooperation among member states in international forums on matters of common interest.

- In 2012 Maldives embarked on a unilateral most favoured nation (MFN) tariff liberalisation initiative, eliminating tariffs on approximately 31.5% of tariff lines. The average applied MFN tariff rate decreased from 21.4% in 2008 to 13.9% in 2015. Agricultural products face lower tariff rates (averaging 11.3%) than non-agricultural items (14.3%).

- While average tariff protection for agricultural products was reduced, tariffs on tobacco and alcohol products were increased for health, religious and revenue purposes. Staple foods, such as ordinary rice, flour and sugar, continue to be imported mainly through the majority state-owned enterprise State Trading Organisation and are sold at government-controlled prices involving subsidies.

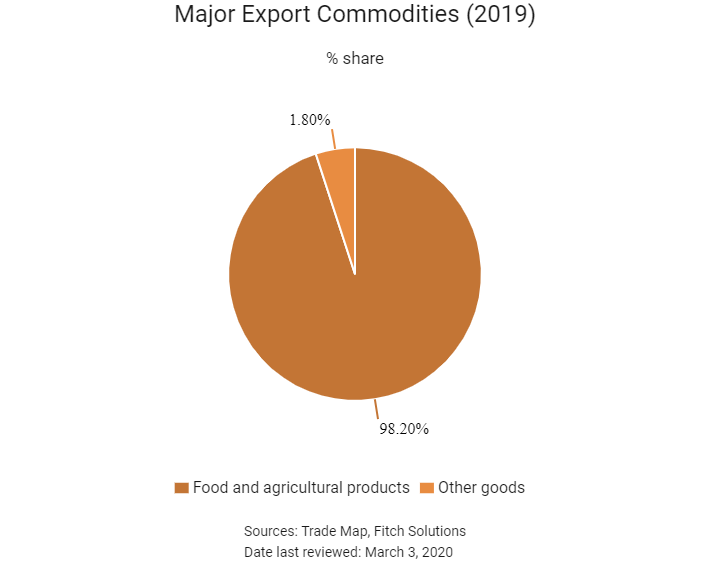

- The Maldivian economy's high degree of openness to international trade and its integration into the world economy continue to be reflected in the high exports of goods and services as a percentage of GDP, which rose to an estimated 125.5% in 2018.

- For religious reasons, the import of alcohol, pork and pork products requires special approval from the Ministry of Economic Development.

- Since April 15, 2019, businesses are no longer required to obtain export, import or re-export licenses from the Ministry of Economic Development. However, all importers, exporters or re-exporters have to register at the Maldives Customs Service.

Sources: WTO – Trade Policy Review, Ministry of Economic Development, Maldives Partnership Forum, Fitch Solutions

Trade Updates

Maldives signed a free trade agreement (FTA) with Mainland China in December 2017. It is Maldives' first FTA with a single country. However, the agreement is not yet in effect, and the new Maldivian administration has threatened to withdraw from the FTA.

Multinational Trade Agreements

Active

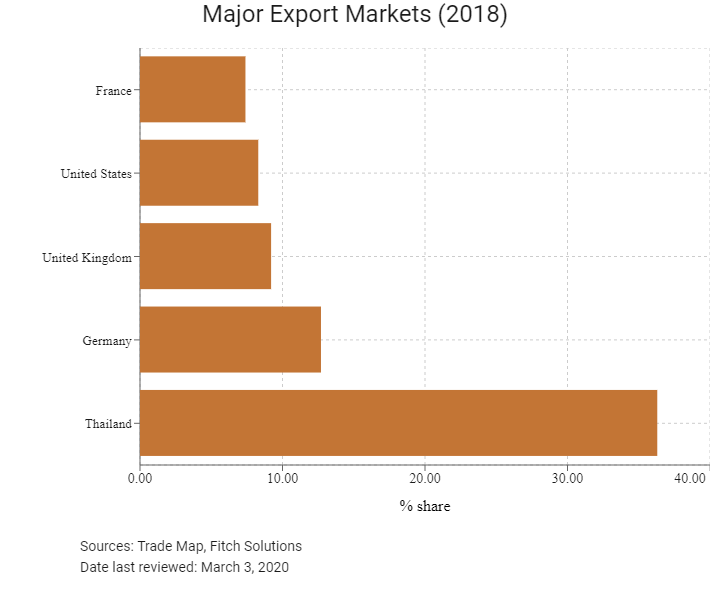

South Asian FTA (SAFTA): SAFTA is a plurilateral FTA between the eight members of the SAARC: Afghanistan, Bhutan, Bangladesh, India, Maldives, Nepal, Pakistan and Sri Lanka. The agreement covers trade in goods and entered into force in January 2006. Afghanistan only joined the FTA in August 2011. SAFTA covers approximately 2 billion people and aims to eliminate customs on all traded goods within the free trade area. SAARC is an important trade partner for Maldives, accounting for 15.6% of Maldives imports and purchasing 6.1% of its exports.

Under Negotiation

Hong Kong-Maldives FTA: The FTA was proposed in May 2016 and has been under negotiation since May 2017. Hong Kong is Maldives' 15th largest import source, accounting for 1.3% of total imports. Hong Kong is also an important export destination for Maldives, with fish and fish products the most valuable export.

Signed But Not in Effect

- Trade Preferential System of the Organisation of the Islamic Conference (TPS-OIC): The agreement between 41 countries was signed in January 2014, but is not yet in effect. The main features of the agreement include the MFN principle, equal treatment of member countries and special treatment for least developed member countries. The preferences include tariff, para-tariff and non-tariff concessions. The TPS-OIC aims to promote trade between OIC members. As a trading bloc, the OIC is an important trading partner for Maldives, accounting for 30.8% of total trade and 32.6% of total imports.

- Mainland China-Maldives FTA: The FTA with Mainland China was signed on December 8, 2017. In addition, a memorandum of understanding was also signed, bringing Maldives into the Maritime Silk Road, a component of the Belt and Road Initiative. Under the FTA, tariffs on over 95% of goods will be reduced to zero. Mainland China is Maldives' second largest source of imports, accounting for 16.5% of all goods imported into Maldives. The new Maldivian administration has threatened to withdraw from the FTA.

Sources: WTO Regional Trade Agreements database, Government websites, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Invest Maldives is the country's investment promotion agency and falls under the Ministry of Economic Development. It is responsible for promoting, regulating and licensing foreign investments in the country. The objective of the agency is to provide a one-stop service for all investors wishing to invest in Maldives. The Ministry of Tourism is tasked with facilitating investments in the tourism sector.

- Foreign investment in Maldives is governed by the Foreign Investment Law, which covers agreements between the government and investors.

- The Special Economic Zones (SEZs) Law covers all investments within Maldives' SEZs. SEZs aim to facilitate strategic development projects. The SEZ board has the powers to freeze potential investors' local assets if the permit is terminated and the investor has any outstanding debt. Investments within SEZs have to align with the strategic priorities of the government. Investors in these zones are granted specific incentives. Investments within SEZs typically have to exceed USD150 million and should match the strategic priorities of the government.

- The Ministry of Economic Development screens and internally reviews all foreign investment proposals. The process includes standard due diligence efforts and a background check, as well as seeking the opinions of other participants in the sector. The Ministry of Economic Development makes the final decision in a fairly transparent process.

- An amendment to the Tourism Act passed in 2010 lends permission to investors to lease an island for 50 years. In April 2014, parliament approved a law to grant the extension of resort leases up to 99 years for a payment of USD5 million. The amendments aim to incentivise investors, make it easier to obtain financing from international institutions and increase revenue for the government. Leases can be renewed at the end of their terms, but a formula for assessing compensation value of a resort at the end of a lease has not yet been developed. All other land may be leased for maximum periods ranging from 10-15 years, depending on the purpose for which the land was initially allocated.

- A prohibition on foreign ownership of any land ended in July 2015 when parliament passed and the president ratified, a constitutional amendment allowing foreigners who invest at least USD1 billion to own land and islands, provided at least 70% of the land is reclaimed.

- There are no country-specific restrictions on foreign investment and Maldives allows foreign investment in all major sectors apart from the following areas, which are restricted to locals only: wholesale of goods; photography and related activities; souvenir trading and related business (wholesale and retail trade); inter-island passenger transfer services by sea (foreign investors can engage in this area with 51% local shareholding); water sports and related activities (foreign investors can engage in this area with 51% local shareholding); operation of bonded warehouses in the customs area; fishing within the Exclusive Economic Zone of the Maldives; and the purchasing, processing and export of skipjack tuna.

- Foreign investment in Maldives has primarily involved resort management, but now also includes sectors such as telecommunications, courier services and manufacturing. In October 2015, the Maldivian government held the second annual investor forum in Beijing, Mainland China and invited foreign investors to invest in the following sectors: banking and financial, renewable energy, real estate, logistics, transport, healthcare, education and construction.

- In January 2019, the government issued the Unsolicited Proposals Policy (USP Policy) to encourage private sector participation in socio-economic development. The USP Policy aims to harness private-sector innovation and capabilities in the delivery of strategic projects.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Invest Maldives, Ministry of Economic Development, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

SEZ Act was passed in 2014. The SEZ Act allows for proposals from the private sector to develop and operate the SEZs. Plans are under way to begin SEZ developments in a number of sectors. Strategic areas considered for SEZ development include: |

- Exemption from business profit tax |

Sources: US Department of Commerce, Ministry of Economic Development, Fitch Solutions

- Value Added Tax: Varies: 6%-12%

- Corporate Income Tax: 0%

Source: Maldives Inland Revenue Authority

Important Updates to Taxation Information

- Income Tax is levied under the Income Tax Act (Law Number 25/2019). The act was published in the Government Gazette on December 17, 2019 and taxation under the act commenced on January 1, 2020. However, remuneration will come within the purview of income effective April 1, 2020. The Business Profit Tax regime imposed under the Business Profit Tax Act will be repealed with the commencement of Income Tax.

- Maldives introduced a broad-based tax system following the establishment of the Maldives Inland Revenue Authority in August 2010. During the past nine years, effective taxation policies have allowed the country to invest in social development.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Business Profit Tax |

Although a tax specifically applicable to corporate profits does not currently apply, a tax of 15% is imposed on the business profits of any person deemed to be carrying on a business. This includes but is not limited to corporations, partnerships and individuals. The taxable profits or losses of a partnership for a year are computed as if it were a body corporate. Resident and non-resident banks are subject to a tax of 25% on taxable profits. |

|

Capital Gains Tax |

15% |

|

Goods and Services Tax |

General goods and services: 6% |

|

Bank Profit Tax |

25% |

|

Green Tax |

Flat rate of USD6 per day of stay - levied on tourists |

|

Withholding Tax |

10% of gross amount of payment made to a non-resident |

|

Remittance Tax |

Banks and money transfer agencies are required to collect a 3% remittance tax on money transferred out of the country by foreigners employed in the Maldives. Employers are required to ensure that their expat employees maintain an account at a local bank. |

Source: Maldives Inland Revenue Authority

Date last reviewed: March 3, 2020

Foreign worker permits

Foreigners intending to work in Maldives are required to obtain a work visa. A work visa grants permission to work only for the employer and work site listed on the visa. Employers need to obtain a foreign worker quota from the Ministry of Economic Development, after which an Employment Approval needs to be obtained for each individual worker. Employers are required to pay a security deposit to immigration to employ each foreign worker. Security deposits are refunded once the foreign worker departs the country. A temporary business visa can be issued to foreign workers for a maximum of 90 days.

Corporate Resident Visa

Significant long-term investors in Maldives are eligible for the Corporate Resident Maldives Visa Scheme and can enter, reside and exit the country without having to undergo frequent visa applications or renewals. Various requirements need to be met, depending on the category of the Corporate Resident Visa.

Visa/Travel Restrictions

Maldives grants visa-free or visa-on-arrival stays to citizens of most countries for up to 30 days.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B2 (Negative) |

19/11/2019 |

|

Standard & Poor's |

Not rated |

N/A |

|

Fitch Ratings |

B+ (Stable) |

09/05/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

136/190 |

139/190 |

147/190 |

|

Ease of Paying Taxes Index |

118/190 |

117/190 |

119/190 |

|

Logistics Performance Index |

86/160 |

N/A |

N/A |

|

Corruption Perception Index |

124/180 |

130/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

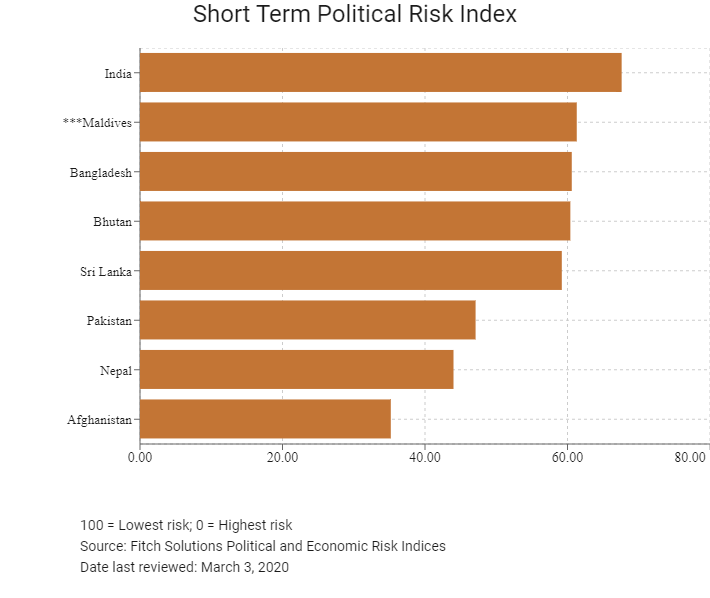

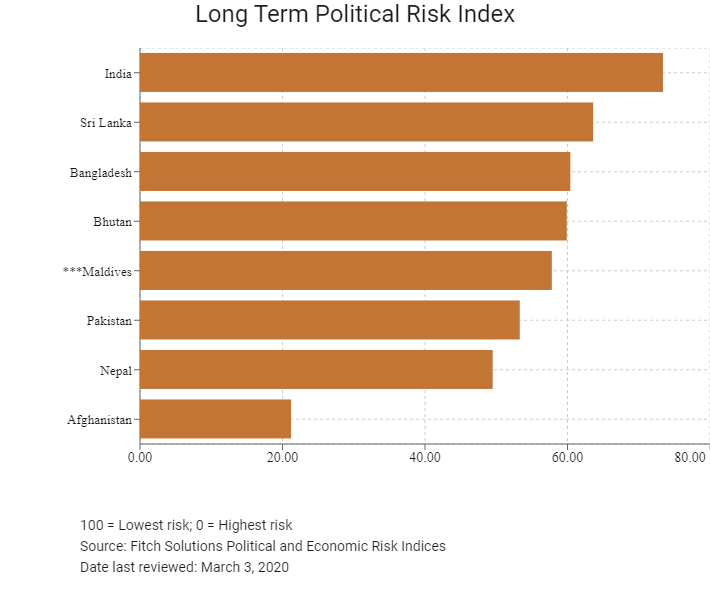

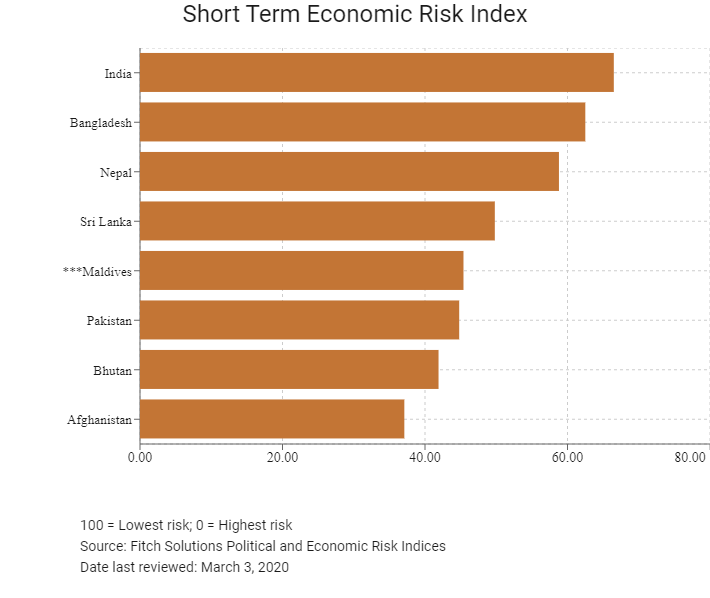

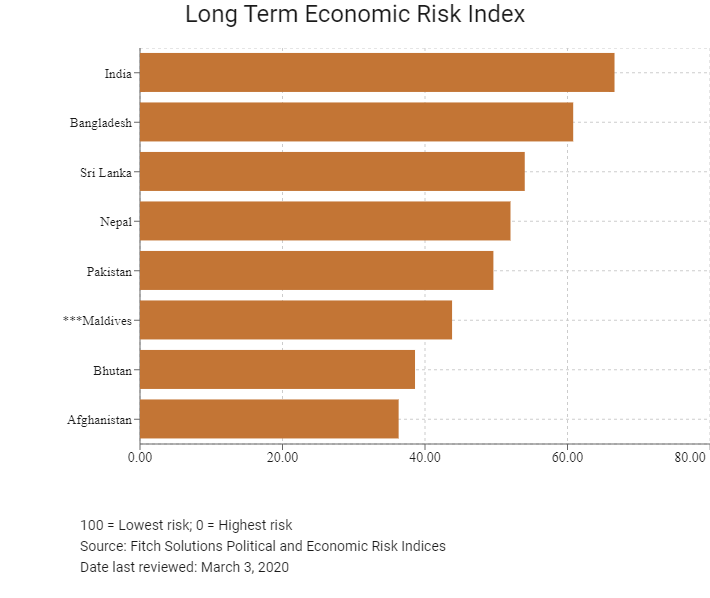

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

167/202 |

154/201 |

151/201 |

|

Short-Term Economic Risk Score |

45 |

42.1 |

45.4 |

|

Long-Term Economic Risk Score |

39.6 |

43.4 |

43.8 |

|

Political Risk Index Rank |

121/202 |

119/201 |

119/201 |

|

Short-Term Political Risk Score |

61.3 |

61.3 |

61.3 |

|

Long-Term Political Risk Score |

57.8 |

57.8 |

57.8 |

|

Operational Risk Index Rank |

104/201 |

122/201 |

122/201 |

|

Operational Risk Score |

48.2 |

44.3 |

44.8 |

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

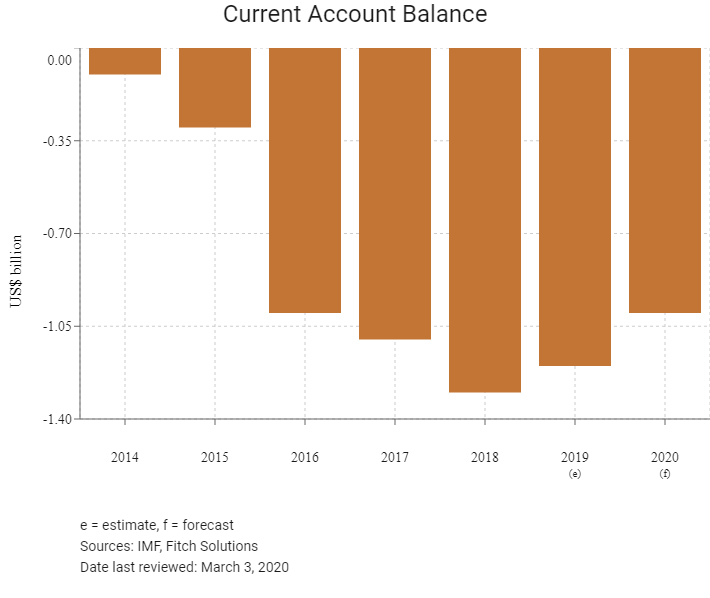

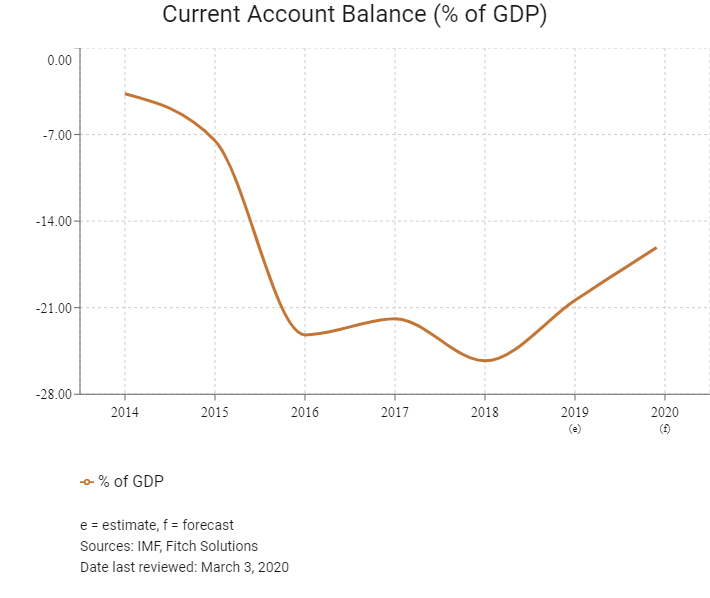

The Maldivian government has initiated a number of infrastructure projects to enable its citizens to move from smaller islands to Greater Malé, and construction has overtaken tourism as the main driver of growth. However, there is increased risk to an economic slowdown with the completion of large infrastructure projects and the slow transition to new ones. In the medium term, with the emphasis on construction, large current account deficits will likely be financed by investment and infrastructure loans. Monetary policy has been accommodative and growth of credit to private sector has improved in the last few years. The large volume of external loans and guarantees on non-concessional terms to finance infrastructure projects represents significant risks.

OPERATIONAL RISK

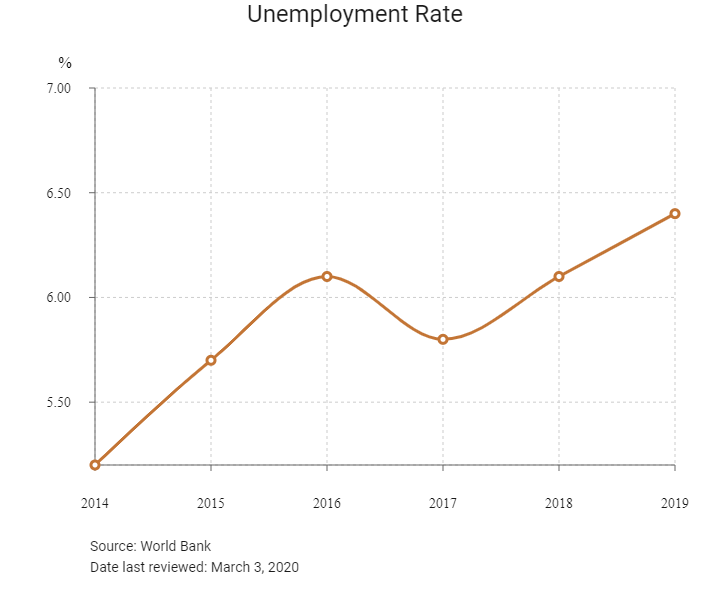

There is a lack of major industries outside the tourism sector, and risks for businesses operating in tourism and key related sectors may rise in the short term owing to political uncertainty and global economic volatility. The labour market also remains small, and options for labour-intensive sectors remain limited. This is as a result of the dispersed population across many small islands which makes service delivery difficult and can limit opportunities for job creation and economic diversification. This has caused relatively elevated levels of youth unemployment, at 15.3%, and low rates of women participating in the workforce.

Source: Fitch Solutions

Date last reviewed: March 4, 2020

Fitch Solutions Political and Economic Risk Indices

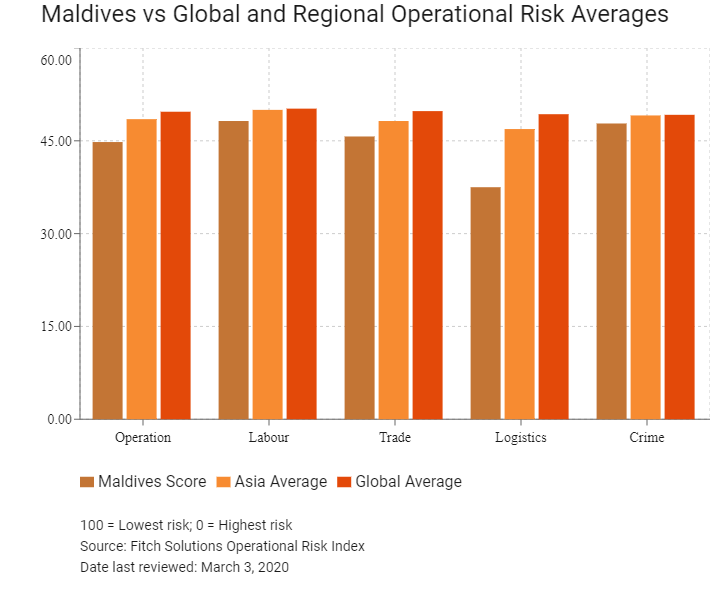

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Maldives Score |

44.8 |

48.2 |

45.7 |

37.5 |

47.8 |

|

South Asia Average |

42.2 |

44.6 |

40.4 |

43.7 |

40.0 |

|

South Asia Position (out of 8) |

4 |

2 |

3 |

6 |

3 |

|

Asia Average |

48.5 |

50.0 |

48.2 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

20 |

18 |

18 |

22 |

19 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

122 |

114 |

119 |

139 |

108 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Secruity Risk Index |

|

India |

53.4 |

46.5 |

53.6 |

66.6 |

47.0 |

|

Sri Lanka |

50.6 |

46.9 |

49.3 |

56.0 |

50.5 |

|

Bhutan |

49.3 |

44.0 |

44.7 |

51.2 |

57.3 |

|

Maldives |

44.8 |

48.2 |

45.7 |

37.5 |

47.8 |

|

Pakistan |

39.4 |

42.6 |

38.3 |

42.4 |

34.4 |

|

Bangladesh |

38.2 |

50.3 |

29.0 |

40.1 |

33.5 |

|

Nepal |

36.8 |

37.7 |

33.3 |

36.6 |

39.7 |

|

Afghanistan |

24.4 |

40.4 |

29.0 |

19.1 |

9.7 |

|

Regional Averages |

42.2 |

44.6 |

40.4 |

43.7 |

40.0 |

|

Emerging Markets Averages |

46.2 |

48.2 |

47.4 |

45.0 |

45.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 3, 2020

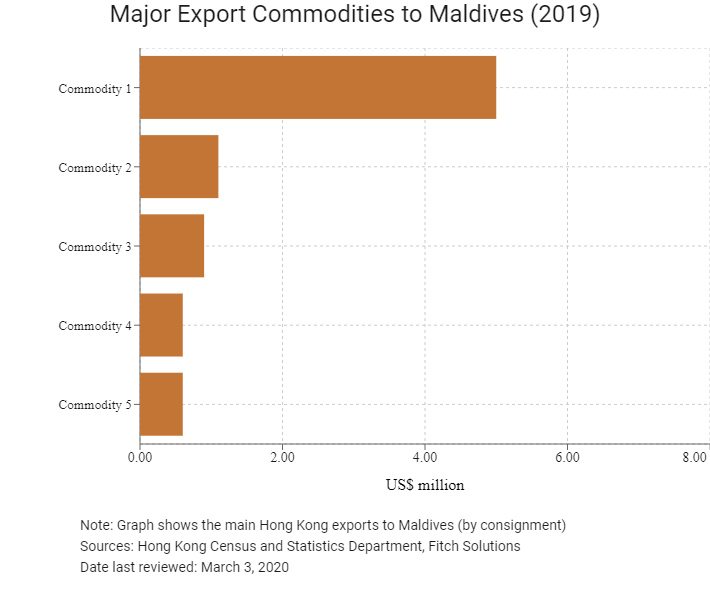

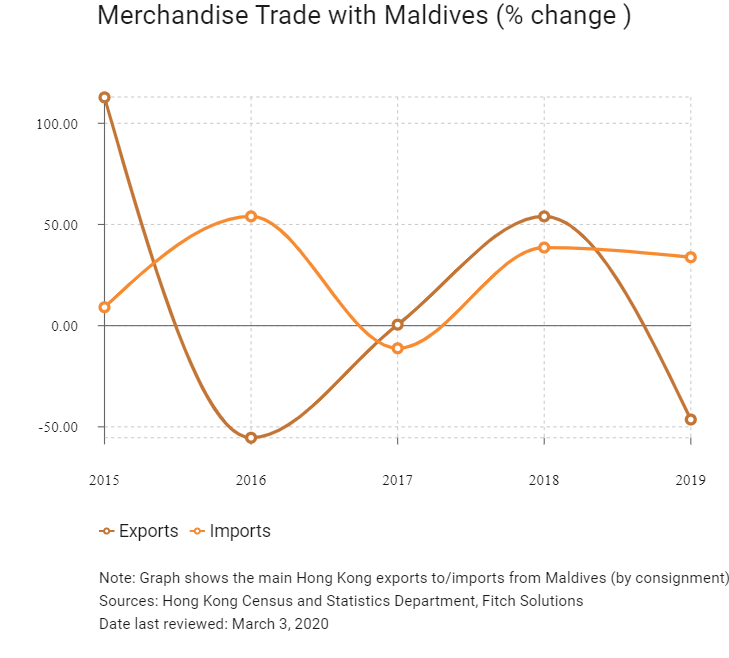

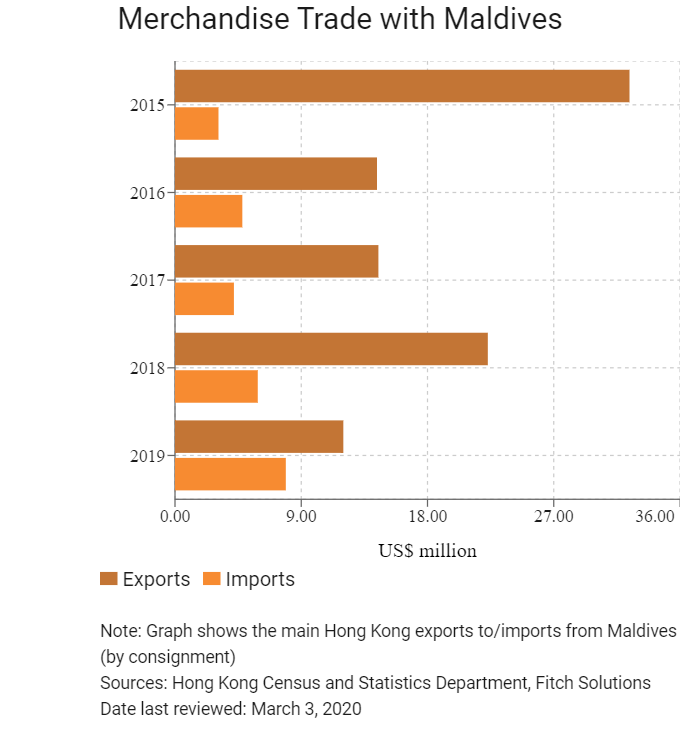

Hong Kong’s Trade with Maldives

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 5.0 |

| Commodity 2 | Miscellaneous manufactured articles | 1.1 |

| Commodity 3 | General industrial machinery and equipment, and machine parts | 0.9 |

| Commodity 4 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 0.6 |

| Commodity 5 | Office machines and automatic data processing machines | 0.6 |

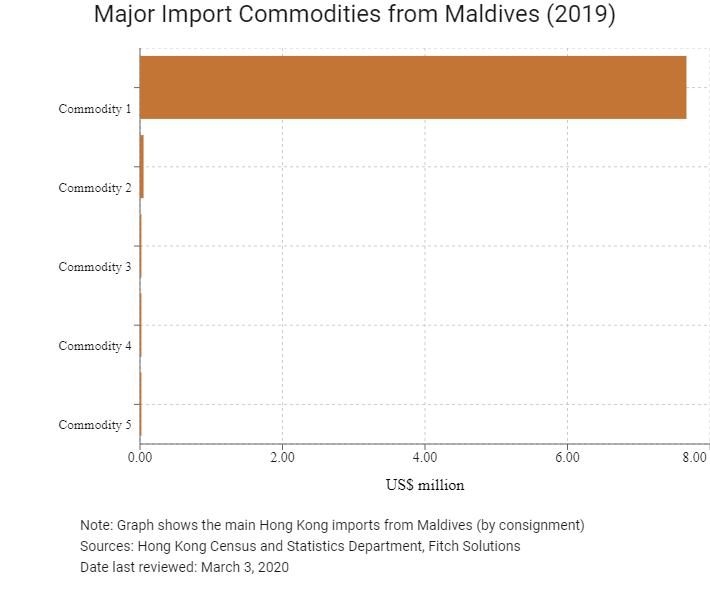

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 7.7 |

| Commodity 2 | Professional, scientific and controlling instruments and apparatus | 0.1 |

| Commodity 3 | Articles of apparel and clothing accessories | 0.0 |

| Commodity 4 | Telecommunications and sound recording and reproducing apparatus and equipment | 0.0 |

| Commodity 5 | Special transactions and commodities not classified according to kind | 0.0 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth Rate (%) |

|

|

Number of Maldivian residents visiting Hong Kong |

778 |

-21.4 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Source: Hong Kong Tourism Board

|

|

2019 |

Growth rate (%) |

|

Number of East Asians and South Asians residing in Hong Kong |

2,834,871 |

3.2 |

Source: United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: March 3, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Maldivian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Chamber of Commerce (or Related Organisations) in Hong Kong

Honorary Consulate-General of the Republic of Maldives in the Hong Kong SAR

Address: Rooms 201-205, Kowloon Centre, 29-39 Ashley Road, Kowloon, Hong Kong

Email: info@maldivesconsulhk.com

Tel: (852) 2376 2114

Fax: (852) 2376 2366

Source: Honorary Consulate-General of the Republic of Maldives in the Hong Kong SAR

Visa Requirements for Hong Kong Residents

HKSAR passport holders receive a free 30-day tourist visa-on-arrival in the Maldives.

Source: Honorary Consulate-General of the Republic of Maldives in the Hong Kong SAR

Date last reviewed: March 3, 2020

Maldives

Maldives