GDP (US$ Billion)

249.56 (2018)

World Ranking 45/193

GDP Per Capita (US$)

2,573 (2018)

World Ranking 137/192

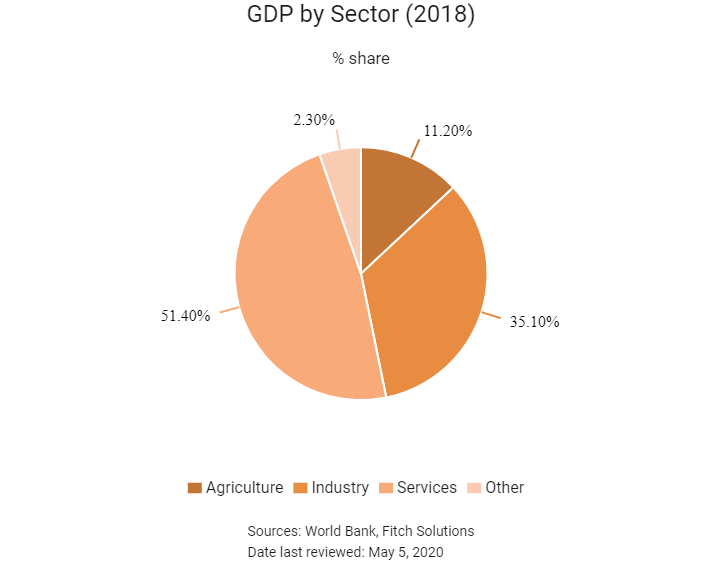

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

48.3 (2018)

Currency (Period Average)

Egyptian Pound

16.77per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

The successful implementation of macro-economic and structural reforms by the Egyptian government have helped to stabilise the economy, sustain growth and lay the groundwork for more dynamic private sector participation in the economy. Egypt also benefits from relatively good relationships with neighbouring states, with the exception of Iran. The progress of key structural economic reforms provides greater room for market entry for foreign investors and the expansion of existing entities through value addition. The sectors that have been the main drivers of growth are construction, the extractive sector, real estate, tourism and wholesale and retail trade.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

January 2019

Egypt took up chairmanship of the African Union.

April 2019

A constitutional referendum was held in Egypt from April 20 to 22, 2019, which proposed changes to extend the presidential term from four years to six and allows President Abdel Fattah el-Sisi to run for re-election in 2024.

June 2019

Former president Mohamed Morsi died in Cairo.

July 2019

Egypt and the United States signed a memorandum of understanding for the judicial cooperation between the two countries.

July 2019

The upper house of Russian Parliament, the Russian Federation Council, approved a law ratifying a treaty between Russia and Egypt for partnership and strategic cooperation between the two countries.

October 2019

Smart Engineering Solutions, in partnership with Egyptian Ministry of Defence and Military Production, unveiled plans to invest USD1.2 billion in a project that involved the construction of five concentrated solar thermal power plants with a combined capacity of 250MW in Egypt. The investment would also be directed towards establishing a facility that would produce components for the construction of the power plants. About 70% of the project's cost would be financed from international institutions, while 10-15% would be provided by local banks. Final bidders for the development of schemes were due to be appointed by the end of 2019.

November 2019

Israel would start exporting natural gas to Egypt as part of a USD15 billion agreement between Israel-based firm Delek Drilling, US-based Noble Energy and an Egyptian partner. The natural gas would be provided to the Egyptian national grid from Israel's offshore fields.

2020

Construction of EGP17 billion Alexandria Metro underground system in Egypt would start in the first quarter of 2020, according to the Governor of Alexandria Abdul Aziz Qansua. The metro project would be implemented in three phases, with phase one extending from the Abu Qir railway station to the Ramses (Misr) station in Cairo. The second phase would have the line running from the Ramses (Misr) station to the El Max station, and the final phase to stretch from the El Max station to Alkyl and further 21km to Alexandria-Matrouh road. Technical and financial studies of the project had been completed. The government of Alexandria and the Ministry of Transport had partnered to implement the project and were in the final review phase to launch an international tender in the beginning of 2020. The first phase of the project was expected to be completed in two years.

February 2020

During Egypt’s three-day Petroleum Show (EGYPS 2020), over 24 agreements with international companies and institutions were signed. One of the key agreements signed was the Egyptian Petrochemicals Holding Company’s deal with the Uniited States Bechtel Corporation to implement a refining and petrochemical complex in the Suez Canal Economic Zone, an investment worth USD6.7 billion.

March 2020

The government announced a stimulus package amounting to USD6.1 billion (EGP100 billion, 1.8% of GDP) to mitigate the economic impact of COVID-19. As part of the EGP100 billion stimulus, EGP50 billion was announced for the tourism sector, which contributes close to 12% of Egypt’s GDP, 10% of employment, and almost 4% of GDP in terms of receipts, as of 2019.

The moratorium on the tax law on agricultural land had been extended for 2 years. The stamp duty on transactions and tax on dividends had been reduced. Capital gains tax had been postponed until further notice.

Energy costs had been lowered for the entire industrial sector; real estate tax relief had been provided for industrial and tourism sectors; subsidy pay-out for exporters had been stepped up, and discount on fuel price had been announced for the aviation sector.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

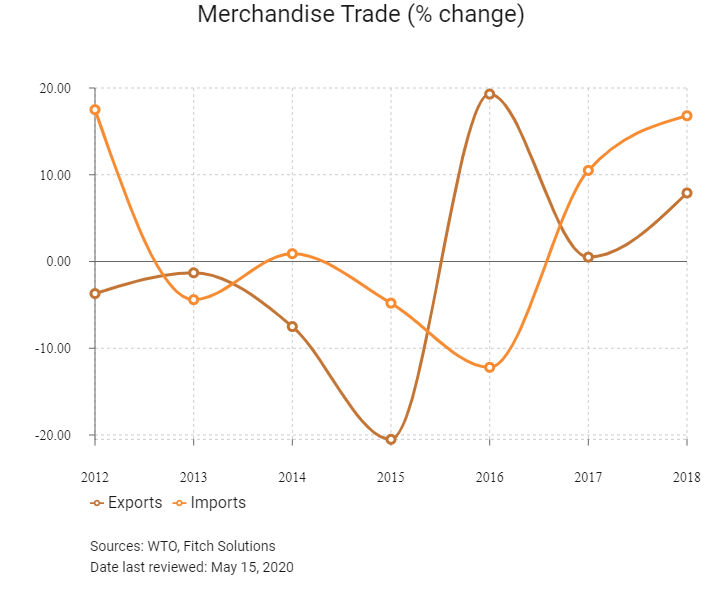

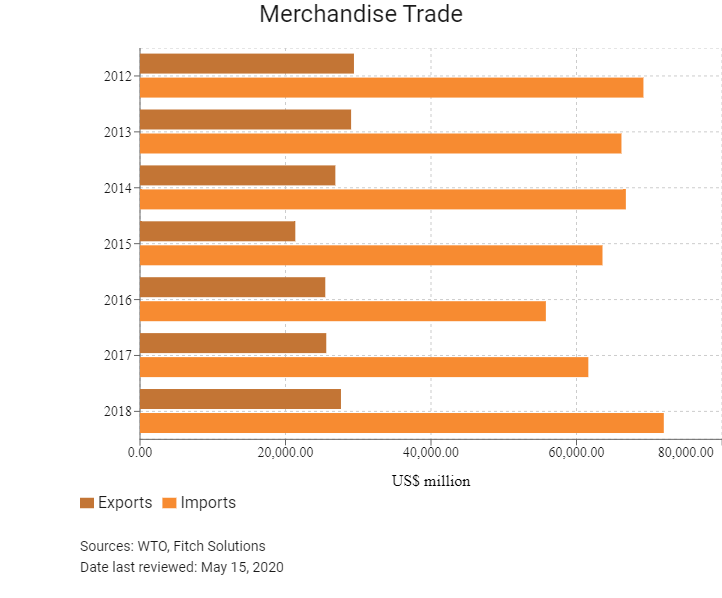

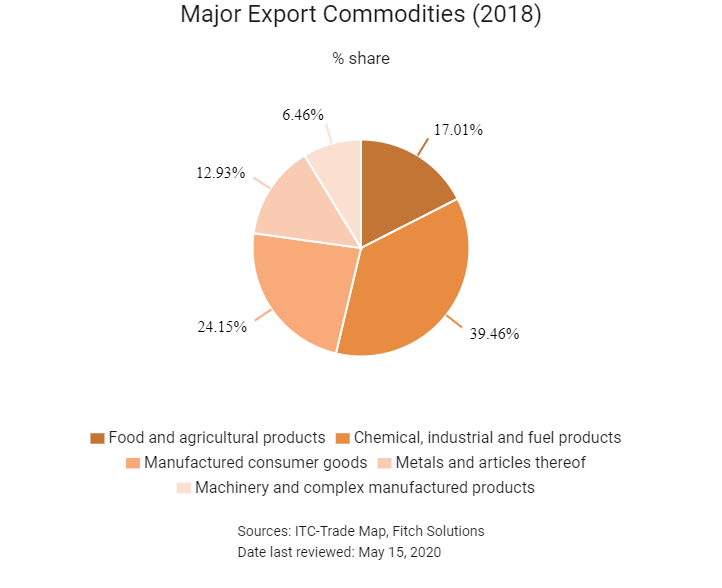

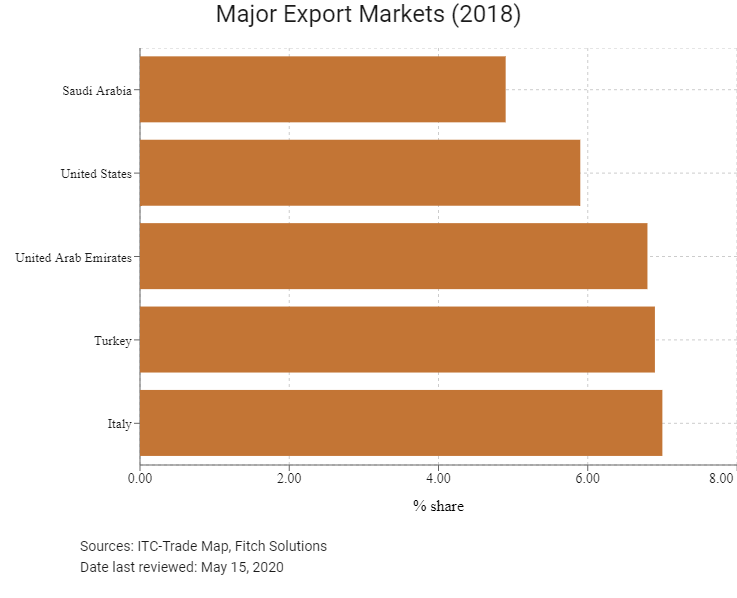

Merchandise Trade

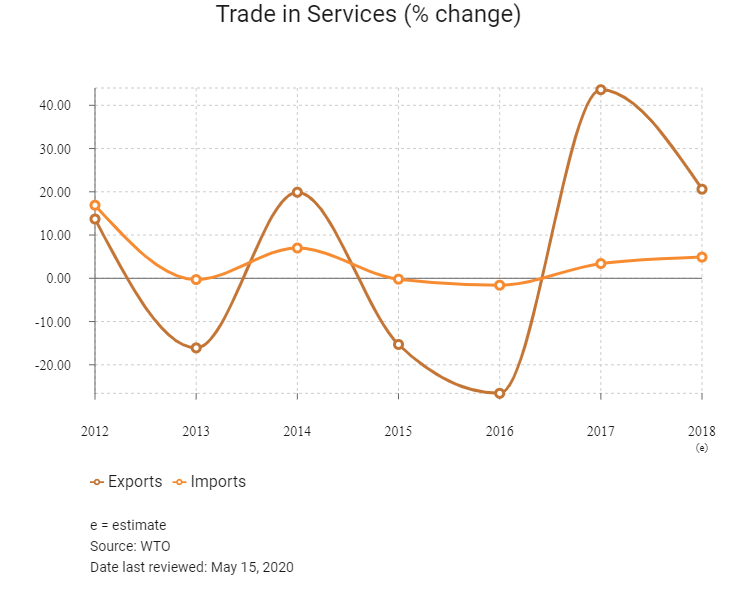

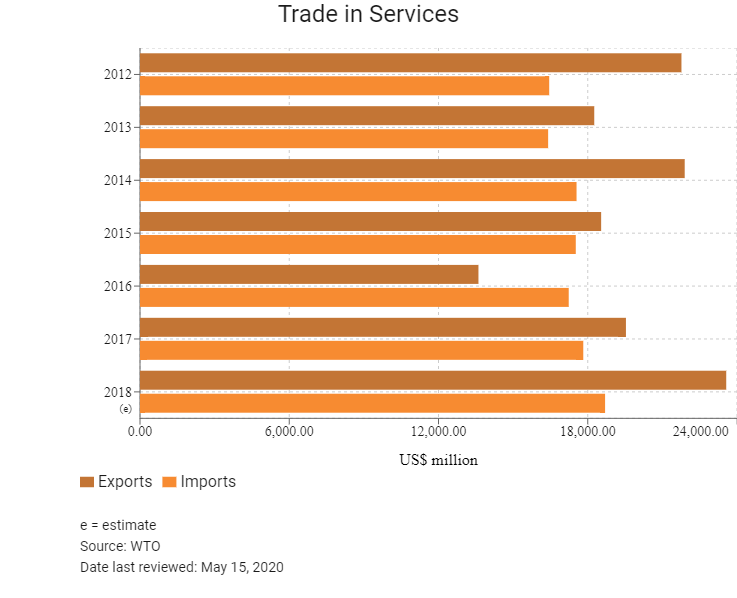

Trade in Services

- Egypt has gradually moved towards a more liberal trade regime. It became a member of the World Trade Organization (WTO) in 1995 and revamped its tariff regime in 2004 as agreed in its accession agreement.

- Egypt participates actively in the multilateral trading system, both in the regular work of the WTO and in the Doha Development Agenda negotiations. It grants most favoured nation (MFN) status to all WTO members. Egypt is a party to the Agreement on Trade in Civil Aircraft and to the Information Technology Agreement, but not to the Agreement on Government Procurement. In June 2017, Egypt domestically ratified the Trade Facilitation Agreement, but it must still submit its instrument of acceptance of the agreement to the WTO.

- Egypt's simple average applied MFN tariff rate was 19.1% in 2017, slightly down from 20.0% in 2005, but higher than 16.5% in 2012. Some two-thirds of all tariff lines are subject to rates of 10.0% or lower. The 51.6% average tariff in agriculture reflects tariff peaks for alcohol and tobacco, which can be as high as 3,000%. Egypt has bound 99.3% of its tariff lines; the general simple average bound tariff is 37.2%. In 2017 some 46 lines exceeded their bindings. All tariff rates are ad valorem, with the exception of 21 lines. In addition to tariffs, imports are now subject to a value-added tax (VAT) of 14.0%, which also applies to domestically produced goods; exported goods are exempt and services are zero rated. Egypt also applies excise taxes on some products in addition to the general VAT rate.

- Egypt's trade policy objectives are set out in the Industrial Development Strategy (IDS) for 2016-2020, in accordance with its Sustainable Development Strategy: Egypt Vision 2030. The aim is to help Egypt become a leading industrial economy in the Middle East and North Africa region, and a main export hub for medium-technology manufactured products by 2025. The IDS covers the following areas: industrial development for micro-, small- and medium-sized enterprises (MSMEs); export promotion and import rationalisation; innovation promotion; energy conservation; the development of technical and vocational education, and improvement of the business climate. The main goals are to accelerate industrial growth, increase the contribution of MSMEs to GDP, spur export growth and create productive jobs.

- As a measure designed to protect the local automotive industry, imported vehicles are subject to a tariff ranging from 40-135%, depending on the engine size. Vehicles with engines over 2,000cc are subject to an additional sales tax of up to 45%. However, tariffs on European Union (EU) vehicles are planned to be abolished in 2019 (although will still be eligible for VAT).

- The Presidential Decree 25 of 2016 also significantly increased import tariffs on a wide range of products such as household appliances, electronic devices, clothing, shoes, watches and some agricultural produce. In September 2018, Egypt implemented additional tariffs on a list of more than 5,791 items - with approximately one-quarter of these products relating to machinery. A number of tariffs have also been raised from 5% to 40%. Further changes include a 40% tariff on imported food commodities, electrical appliances and clothing, 20% on all tourism industry imports, and another 2% on imported materials used in the manufacturing of baby formula.

- Egypt requires proper labelling for the import of food products. All food products should be packed in appropriate packages, which should be clean, intact and odourless so as to preserve the product and not affect its characteristics.

- Imported products must be marked and labelled in Arabic. The language requirement is mandatory for all information, including the brand and type of products, country of origin, date of production, expiry date and instructions on handling products. For imported tools, machines and equipment, a user manual in Arabic has to be attached.

- Egypt has continued its reform process, with a view to making its customs administration more efficient and transparent, by reducing the number of documents required for import and export processes, and allowing their presentation electronically. Some changes have already been introduced to facilitate trade. These changes include activating the Authorised Economic Operator system, introducing x-ray devices in most customs posts to facilitate customs control and reduce release times, and implementing an e-freight import and export system for air freight. The Ministerial Steering Council for Egyptian Trade Facilitation has been established, aimed at the creation of an Egyptian National Single Window system.

- Import prohibitions and restrictions are maintained for economic, environmental, health, religious, safety, sanitary and phytosanitary reasons. They are applied equally to all trading partners. Import prohibitions apply to chicken offal and limbs, fowl livers, goods bearing marks considered sensitive to religious beliefs, and various hazardous chemicals and pesticides, among others. There are also restrictions on the import of used products, which must meet certain conditions.

- A number of products are subject to quality control inspections when imported. Additionally, the import of a relatively large number of items is subject to special conditions and requires a licence, including cars, shoes, textiles, car parts, certain food products (such as milk) and other consumer goods.

- The import of certain products is subject to specific administrative formalities and requires government approval. This is the case for wheat grains, corn used for the feed industry and soybean seeds for oil extraction.

- Egypt has accepted the WTO Code of Good Practice for the Preparation, Adoption and Application of Standards. Technical regulations are issued by the different ministries. As of November 2017 (most current data available), Egypt had in place some 8,500 standards covering six sectors, with the largest number pertaining to engineering and chemical products, food, textiles and measurement products. In addition, according to the authorities, more than 7,000 national standards had been aligned with international standards in several sectors. All imported goods subject to technical regulations are inspected to verify conformity with each regulation. The Egyptian Accreditation Council is the sole national body for the assessment and accreditation of conformity assessment bodies and laboratories in Egypt performing testing and calibration, inspection and certification activities for products, systems and personnel.

- Egypt is a relatively active user of trade remedy measures: between January 2005 and June 30, 2017, it initiated 31 anti-dumping investigations, 16 of which resulted in the imposition of definitive anti-dumping duties. Three anti-dumping measures were extended. During the same period, Egypt initiated 14 safeguard investigations and imposed provisional measures in all products and final safeguard measures on three products: blankets, steel rebar, and cotton and mixed yarns. There are currently no countervailing measures in place.

- Egypt imposes export taxes on a number of products, including sugar, waste plastic, some fertilisers, fish, sand, some skins, marble and raw granite, among others. Egypt introduced an export tax on sugar for an unlimited duration, effective March 2017.

- Exports can be prohibited or restricted in order to meet local demand or for environmental purposes. Exports of rice of any kind have been banned since August 2016; this measure has unlimited validity and was imposed owing to the lack of water resources. In addition, Egypt bans the export of raw or tanned hides, skins or leather in its wet state.

- There are various controls and inspection procedures for food products, live animals, and animal and plant products that have been implemented by the corresponding responsible agency. Importers of plants must obtain an import permit prior to importation and are required to notify the exporting trading partner of the corresponding import regulatory requirements, which are set according to the potential risk associated with pests. Imports of live animals require an import permit from the Central Administration of Veterinary Quarantine. Importers of meat products and chicken must provide a number of certificates before the product is accepted, including a slaughter certificate proving that the animal was slaughtered in accordance with the Islamic ritual (halal), a veterinary certificate and a certificate of origin.

- Egypt is a member of most of the main international treaties on intellectual property rights (IPRs). Intellectual Property Law No. 82/2002 is a unified law that covers the major areas referred to in the Agreement on Trade-Related Aspects of IPRs. There are no provisions in Egypt's IPR legislation that expressly allow or prohibit parallel imports. According to the authorities, Egypt's IPR policy recognises the importance of IPR protection as a key factor in economic growth and development. The enforcement of IPR legislation is handled by various specialised authorities, some of which are entitled to act ex officio regarding IPR crimes. Border measures may be applied on all forms of intellectual property.

- Besides the association agreement with the EU, Egypt has signed a number of free trade agreements (FTAs) to help Egyptian exports gain preferential access to markets of the signatories. Such FTAs include the Greater Arab FTA (17 members including Egypt), the Common Market for Eastern and Southern Africa (19 members including Egypt), the Agadir Agreement (Egypt, Morocco, Tunisia and Jordan) and the Mercosur-Egypt FTA (Argentina, Brazil, Paraguay and Uruguay). A number of additional agreements are also being negotiated, such as the African Continental FTA and the Eurasian Economic Union-Egypt FTA.

- Egypt has also signed bilateral trade agreements with Lebanon, Syria, Morocco, Tunisia, Libya, Jordan and Iraq. Egypt also offers improved market access to least-developed countries and participates in the Framework Agreement on the Trade Preferences System of the Organization of Islamic Cooperation, which is still to enter into force.

- Egypt is negotiating trade agreements with various countries and regions, including Nigeria, Tanzania, India, Sri Lanka, Russia, the West African Economic and Monetary Union, and the CEMAC Group (including Cameroon, Central African Republic, Chad, Congo, Gabon and Equatorial Guinea).

- Egypt enjoys Generalised System of Preferences status provided by Australia, Canada, Japan, Kazakhstan, New Zealand, Russia, Turkey and the United States. Preferential tariff and duty-free treatment on certain items are granted to Egypt by these countries.

Sources: WTO – Trade Policy Review, Global Trade Alert, Fitch Solutions

Trade Updates

The Tripartite Free Trade Area (FTA) was officially launched in Egypt in June 2015, with an estimated finalisation date of 2025. This agreement is aimed at bringing together three of Africa's major regional economic communities: the Southern African Development Community, the East African Community, and the Common Market for Eastern and Southern Africa (COMESA). In July 2019, Rwanda became the fifth country to ratify the agreement. It will enter into force once it has been ratified by at least 14 member states. At the time of writing, Egypt, Uganda, South Africa, Kenya and Rwanda had ratified the agreement.

Multinational Trade Agreements

Active

- Greater Arab FTA (GAFTA): This FTA comprises Algeria, Bahrain, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, the United Arab Emirates and Yemen. Egypt is party to this bloc and the other member states are important trade partners. The reduction or elimination of tariffs has eased trade flows.

- EU-Egypt Association Agreement: This agreement has been in force since 2004. This creates a FTA between the EU and Egypt by removing tariffs on industrial products and making agricultural products easier to trade. EU-Egypt trade has more than doubled from EUR11.8 billion in 2004 to EUR27.9 billion in 2017. The EU is both Egypt's biggest import and export partner, covering 29.7% of Egypt's trade volume in 2017. In June 2013, the EU and Egypt began discussing how to deepen their trade and investment relations through a Deep and Comprehensive FTA (DCFTA). A future DCFTA would aim to improve market access and the investment climate. It would also support Egyptian economic reforms and extend beyond the association agreement to include trade in services, government procurement, competition, intellectual property rights and investment protection.

- Egypt-European FTA (EFTA): EFTA comprises Norway, Iceland, Switzerland and Liechtenstein. No states are key trade partners, but this facilitates trade with other parts of Europe.

- COMESA: This agreement comprises Burundi, Comoros Islands, the Democratic Republic of the Congo, Djibouti, Eritrea, Ethiopia, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia and Zimbabwe. Not all members subscribe to the FTA, and trade flows with other African states remain lower than with Europe, the Middle East and Asia. There is upside potential for intra-African trade with the prospects of a regional trade agreement brightening.

- Egypt-Turkey FTA: Turkey is an important trade partner, providing a key source of refined fuel and a market for textiles. This FTA was signed on December 27, 2005, in Cairo and entered into force on March 1, 2007. With the Turkey-Egypt FTA, tariffs and non-tariff barriers were eliminated in trade between the states. The agreement also covers numerous trade-related areas, such as sanitary and phytosanitary measures, trade in services, foreign direct investment, internal taxation, balance of payments, public procurement, state aid, intellectual property rights, anti-dumping and safeguard measures, and rules of origin. Customs duties applied by Turkey on industrial goods originating from Egypt have been abolished by the agreement. Customs duties applied by Egypt on industrial goods originating from Turkey will be abolished gradually until January 1, 2020, according to the lists provided in the first protocol of the agreement. Regarding agricultural products, Turkey and Egypt granted each other unlimited tariff elimination and/or tariff reduction, or the elimination of tariff quotas for some agricultural products originating from the other party. The agricultural products that are subject to tariff reduction or elimination are listed in the second protocol of the agreement.

- Mercosur-Egypt FTA: In 2010, Mercosur (Southern Common Market) signed an FTA with Egypt, which has seen gradual implementation since 2017. Trade with Latin America is relatively low, and despite the potential for expansion, closer markets in Europe and Asia will remain the major trade partners. Mercosur is an economic and political bloc comprising Argentina, Brazil, Paraguay, Uruguay and Venezuela. Products exported from Brazil to Egypt that will reap the immediate benefits of this agreement include beef products, cereal, ore and inorganic chemical products, while Egyptian exports covered by the agreement will include both organic and inorganic fertilisers, vegetables, cotton and textiles.

- African Continental FTA (AfCFTA): In April 2019, Egypt became the 18th member state to deposit instruments to ratify the agreement. The AfCFTA encompasses all African states and is set to come into force on July 1, 2020. The FTA has been proposed to potentially boost intra-Africa trade by 52.3% if trade barriers are eliminated and a further 50.0% if non-trade barriers are removed. The FTA is envisioned as a potential precursor to a continent-wide customs union.

Under Negotiation

- Egypt-United States: The United States and Egypt cooperate on trade under the bilateral Trade and Investment Council. The council, established under the July 1999 Trade and Investment Framework Agreement, discusses ways to further expand fair and reciprocal trade and investment between the two countries. The United States is a top trade partner, and tariff-free access will boost Egyptian exporters. Working groups have been established on customs administration and reform, government procurement, sanitary and phytosanitary issues, and agricultural tariff issues. On January 28, 2020, the United States Ambassador to Egypt stated that official negotiations regarding a bilateral free trade agreement between the two states are scheduled to begin in 2021.

- Egypt-Israel: Under the United States umbrella, Egypt signed a trade protocol with Israel on December 14, 2004. The protocol establishes what are called qualified industrial zones in Egypt. Products from these zones will enjoy duty-free access to the United States, provided that 35% of their components are the product of Israeli-Egyptian cooperation.

- Eurasian Economic Union (EAEU)-Egypt: The first round of talks between Egypt and the EAEU was completed in January 2019. Talks centred on ensuring the predictability of trade terms and transparency of trade regulation. Trade in commodities between Egypt and the EAEU grew approximately 21.0% over 2017-2018, signalling the benefit of the agreement for future trade. The third round of talks took place in October 2019 with a final agreement anticipated for mid-2020, according to Egypt’s Minister of Trade and Industry.

Sources: WTO Regional Trade Agreements database, the Government of Egypt, Fitch Solutions

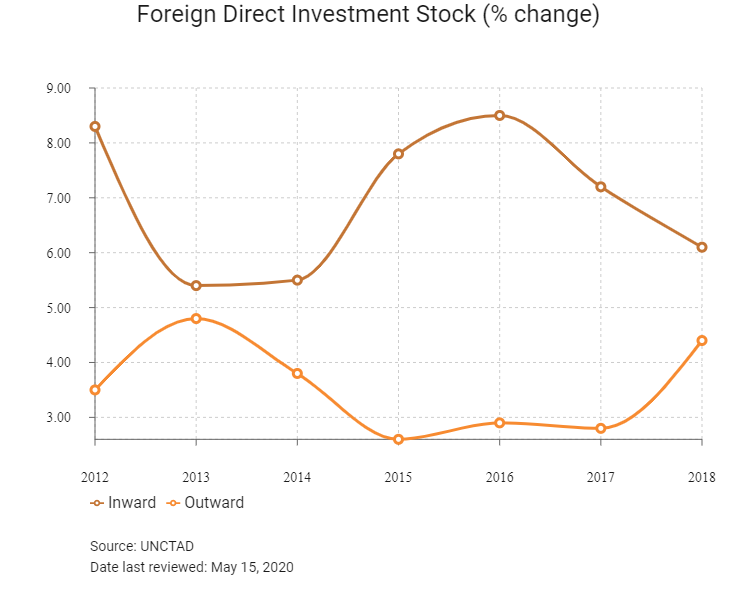

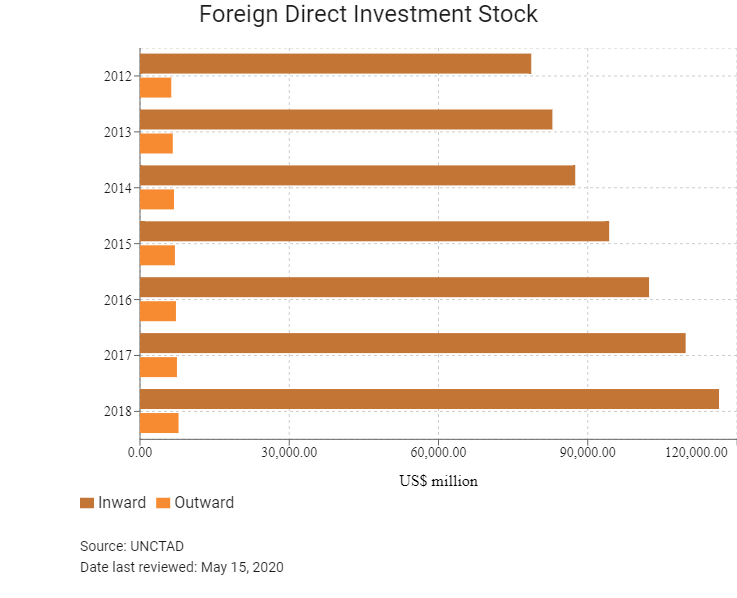

Foreign Direct Investment

- Egypt is reliant on external financing and foreign aid to drive its economic development. In April 2015, France signed contracts worth USD1.5 billion with Egypt for various transport and electricity projects. President Abdel Fattah el-Sisi is actively courting aid and investment from Asia, including Mainland China, Japan and South Korea. In January 2016, Mainland China announced loans of USD1.7 billion to Egypt, alongside USD15 billion worth of energy, infrastructure and construction projects in Egypt awarded to Chinese companies. In addition to seeking an IMF loan of USD12 billion, Egypt signed a currency swap deal with Mainland China for about USD2.6 billion in December 2016 in order for Cairo to prop up its official reserves. The EU is the main foreign investor in Egypt, followed by the United States and a number of Arab countries.

- A new investment law passed in June 2017 offers an upside regarding Egypt's regulatory environment. The law aims to cut red tape and simplify procedures for businesses through the creation of a new investor service centre tasked with issuing licences. The law also introduces various tax incentives, including the restoration of a number of free zones and substantial tax breaks, especially for investment in the country's less developed areas. The implementation of Egypt's new investment law will further boost investor confidence and drive fixed capital formation in the country.

- There are provisions that allow a residence permit to foreign investors throughout the term of their investment projects in Egypt, as well as fair treatment of both foreign and Egyptian investors. Investors maintain the right to repatriate profits and receive international finance without any restrictions. From Q418, residence permits can also be granted for foreigners who buy property in the country. The residence permits are aimed to incentivise foreign direct investment (FDI) in Egypt's real estate sector. A one-year residence permit will be granted to foreigners who buy a property for as little as USD100,000, and a three- and five-year residence permit will be granted for property purchases worth USD200,000 and USD400,000, respectively.

- The new investment law includes a chapter on investment in technological zones, which will provide dedicated support to businesses working on the design and development of electronics, data centres, outsourcing activities, software development and technological education. Businesses located in the hubs are eligible for tax and customs duty exemptions on the tools, supplies and machinery that they require for their operations. Technology investors will also be covered by other guarantees and incentives featured in the legislation – which is aimed at bringing about a more robust legal environment for foreign businesses – including guaranteeing the equitable treatment of foreign and local investors, and the right to export the investment project's products without needing to sign up with the Exporters Registry. In July 2019, Egypt’s House of Representatives preliminarily approved a bill to make amendments to the law, including the establishment of new product lines and the imposition of fees for the ratification of contract signatures for companies.

- Under the new investment law, investors have the right to directly import raw materials, equipment, spare parts and transport means as necessary for investment projects without registering with the Importers Registry, which can help to lower start-up costs. Once operational, investors also have the right to export the investment projects' products, whether directly or indirectly, without registering with the Exporters Registry. The application of a unified custom duty at a flat rate of only 2% of the value of any equipment, machinery and devices that are necessary for the establishment of infrastructure and investment projects is a positive boost to foreign investors. Furthermore, the law provides exemption from the customs duty that is imposed on the import of some tools for temporary use on industrial projects and to be re-exported afterwards.

- Technological zones can also be established by decree as long as they cover information and communications technology (ICT) projects, such as designing and developing electronics, ICT education programmes, technological development, establishing data centres and other related activities. Furthermore, the tools and equipment that are necessary for the investment projects that are established in the technological zones will not be subject to any taxes and customs duties, according to specific requirements and procedures to be stated in the Executive Regulation of the New Investment Law.

- There are a total of 10 free trade zones (FTZs) in Egypt: Cairo (Nasr City), Alexandria, Port Said, Suez, Ismailia, Damietta, Media, Shebin El-Kom, Qeft and Port Said East Port. Goods exported from or imported into the FTZs are not subject to normal import or export customs procedures, duties or other taxes and fees. Likewise, all instruments, machinery, equipment and transport means necessary for establishments authorised within the FTZs are exempt from customs and duties.

- New regulations for the establishment of FTZs are contained in the new investment law, Law No. 72/2017. The incentives offered in these zones are meant primarily to attract investment, to provide employment for Egyptians and to encourage exports. There are two types of FTZs: public and private. Public FTZs are established for several projects, whereas private FTZs are confined to one specific project or company and must meet certain conditions, inter alia with respect to minimum capital (USD10 million) and exports (they must amount to no less than 80% of the production value). Enterprises in these zones benefit from complete exemption from import tariffs, income taxes and value-added tax. However, they are charged a fee of 1% or 2% in lieu of taxes. FTZ investors may sell all or part of their products on the Egyptian market after payment of the relevant customs duties. There are currently nine public FTZs in operation. Egypt also has one special economic zone (SEZ), which benefits from special and simplified customs procedures, tariff-free imports of inputs and equipment, and lower taxes.

- FTZs can be established in the form of public or private free zones by virtue of a decree mainly for export purposes. FTZs can be established in all investment sectors, except for oil, the liquidation or production of natural gas; fertilisers; steel production; transport; alcohol production; heavy energy-use industries as specified by the Supreme Energy Council; weapons and explosives production, as well as any other products related to national security. All products imported or exported by the investment projects inside any of the FTZs, with few exceptions, will not be subject to the import and export regulations applied outside them or customs duties or any other tax. Nevertheless, these investment projects are required to pay 2% of the aggregate value of the imported products for storage projects (with the exception of transit goods), as well as 1% of the aggregate value of the exported products (free on board) for production projects and 1% of the aggregate income for any investment project that is not involved in importation or exportation.

- The Suez Canal continues to spur investment growth in Egypt, particularly in the infrastructure space, as investors gravitate towards strategically located projects supported by the requisite logistics and export capabilities. The Egyptian Ministry of Petroleum plans to invest USD6.8 billion for the construction of a petrochemical complex near Ain Sokhna Port in Suez Governorate. UAE-owned DP World has agreed to partner with the Suez Canal Economic Authority to develop an industrial and residential zone along the trade route. The zone will host light and medium industries ranging from medical devices to food processing. Russian-Egyptian trade was reported to have risen to USD2.5 billion across the first seven months of 2017 (up from USD2.2 billion). Egypt aims to finalise its agreement with Russia over the creation of an industrial zone in the Suez Canal Economic Zone in the near term. The zone will aim to provide an international hub for manufacturers, providing access to both European and African markets.

- The allocation of plots of land free of charge for strategic business activities is also available. The prime minister can also grant a refund of 50% of the value of any plot of land that is allocated to industrial projects, as long as the operation thereof takes place within two years from when the land is allocated.

- Egypt implements a number of incentive programmes that can be general or sector specific. There are also regional support programmes and programmes for micro-, small- and medium-sized enterprises (MSMEs), which include facilitating access to credit at preferential conditions. There are currently 12 investment zones specialised in various fields. They enjoy the same benefits as free zones in terms of the facilitation of licence issuance, but they are not granted tax exemptions. A new governmental agency was created in 2017 to provide support to MSMEs.

- Under the new investment law, Egypt also provides regional incentives in the form of a discount on taxable net profits, depending on the region.

- Competition policy is mainly regulated by the new Constitution of 2014 and the Egyptian Competition Law of 2005, its executive regulations and their amendments. The Competition Law sets out prohibitions regarding the abuse of a dominant position and provides a list stating nine prohibited acts. It also prohibits vertical agreements or contracts between a person and their supplier or clients if they are intended to restrict competition. Recent amendments to the Competition Law gave the Egyptian Competition Authority (ECA) the power to initiate criminal lawsuits and to settle with violators, and generally strengthened its enforcement faculties. Between its inception in 2006 and April 2017, the ECA completed 109 investigations, 37 studies and 13 advisory opinions. During this period, the ECA proved 36 violations of the law, 28 of which were during the 2012-2016 period.

- A 15% price preference is given to Egyptian products in all government procurement. Egyptian subsidiaries of foreign companies can benefit from the preference. Additionally, MSMEs must be given an extra 10% preference in any tender.

- The presence of the state in the economy is important in Egypt, which has about 150 state-owned enterprises engaged in activities in a number of sectors, including petroleum, transport, telecommunications, post and industrial activities. Three state-owned banks own some 40% of the banking sector's assets.

- Egypt is pursuing its efforts to solve the electricity supply crisis by raising electrical generation and distribution capacity through a combination of new investments and regulatory reforms, thereby hoping to open and partially unbundle the sector. Egypt has adopted a number of measures to promote renewable energies and to facilitate public-private partnerships in them.

- The financial services sector is well supervised and open. Egypt has a large banking sector – although during the period under review, the number of banks declined somewhat as Egypt has not delivered any new banking licences since 2009. Banks, both domestic and foreign, must register with and obtain a licence from the Central Bank of Egypt. A number of conditions must be met prior to registration, including a minimum capital requirement of USD50 million for a foreign bank branch. There are no legal limitations to the number of licences that can be granted, but there is a policy of consolidation of existing banks. Licences are open-ended.

- Insurance companies must take the form of joint stock companies and meet the relevant minimum capital requirements. Foreign companies applying for a licence in Egypt must have been granted a licence in their home country. Branches of foreign insurance companies are not allowed.

- Mobile telecommunications services are open to foreign investment, although state ownership remains present in two of the four licence holders. Fixed-line services have been gradually liberalised since 2009.

- Egypt has a liberal aviation policy with few restrictions. All domestic airlines are privately-owned, and foreign investment plays a large role in some of them. Except for two management contracts, airports remain publicly-owned and managed, and third-party handling is not allowed.

- Maritime transport is the main means of transportation used for Egypt's international trade. Cabotage in maritime transport is reserved for national flag carriers. However, waivers can be granted to foreign vessels to practise cabotage in case of the breakdown of an Egyptian vessel and when a supplier terminates its service. The bilateral and plurilateral agreements signed by Egypt do not grant any reciprocal preferential treatment to partner states for cargo sharing. There are no restrictions on the exercise of onshore maritime transport activities and auxiliary services (except for maritime agency services). There are no foreign ownership restrictions for cargo handling or maritime terminal activities, or for specialised ports. Egypt does not grant preferential treatment for national flag vessels' access to ports and port services.

- The tourism sector is largely open to foreign investment, and the authorities are trying to promote it through the incentives provided in the new Investment Law.

- Egypt is set to complete 13 industrial complexes later in 2019, according to Minister of Trade and Industry Amr Nassar. The government aims to build a total of 22 complexes by 2020 as per a strategy set by the ministry. The complexes will be completed in 12 governorates and will have 4,300 industrial units. Of the 13 complexes, nine will be allocated to Upper Egypt. The Industrial Development Authority will develop industrial land across the region. The ministry is to begin work on the first phase of a textile industry zone in Sadat City and an industrial zone in Abu Zenaima in the South Sinai governorate in 2019.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of Commerce, Government of Egyptian

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

Public Free Zones - Alexandria, Nasr City, Port Said, Suez, Ismailia, Damietta, Media, Shebin, Qeft, East Port Said, Ain Sokhna | - Exemption from customs duties and sales tax on the imports of capital goods, raw materials and intermediate inputs |

The Suez Canal Economic Zone (SCZone) has four unique zones and six strategically located ports inside. The four zones are: | - Reduced income tax rates for businesses and individuals |

The Golden Triangle Special Economic Zone (GTZone) | - Reduced income tax rates for businesses and individuals |

Sources: US Department of Commerce, Fitch Solutions

Localisation Requirements

The Egyptian government encourages investment in sectors that create employment, generate foreign exchange, and create forward and backward links with rural areas. Labour regulations continue to restrict the employment of foreign nationals, particularly in low-skilled sectors. Labour rules prevent companies from hiring more than 10% non-Egyptians (25% in free zones), and foreigners are not allowed to operate sole proprietorships or simple partnerships. Work permits are required for all foreign nationals intending to work in Egypt.

Visa/Travel Restrictions

A foreign national must obtain a work permit to be able to stay and work in Egypt. In 2011, Egyptian authorities enacted regulations designed to restrict access for foreigners to Egyptian worker visas, particularly for low-skilled labour. Visas for unskilled workers will be phased out. For most other jobs, employers may hire foreign workers on a temporary six-month basis, but they must also hire two Egyptians to be trained to do the job during that period. Only jobs where it is not possible for Egyptians to acquire the requisite skills may remain open to foreign workers. The procedures are easier for managers than for employees. A joint stock company or a limited liability company operating under the umbrella of the Investment Law can appoint a number of managers commensurate to the value of its capital. It usually takes around two months from application to obtain a residency visa, and it costs around EGP3,000.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

Moody's | B2 (Stable) | 11/05/2020 |

Standard & Poor's | B (Stable) | 11/05/2018 |

Fitch Ratings | B+ (Stable) | 25/11/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

Ease of Doing Business Index | 128/190 | 120/190 | 114/190 |

Ease of Paying Taxes Index | 167/190 | 159/190 | 156/190 |

Logistics Performance Index | 67/160 | N/A | N/A |

Corruption Perception Index | 105/180 | 106/180 | N/A |

IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, IMD, Transparency International

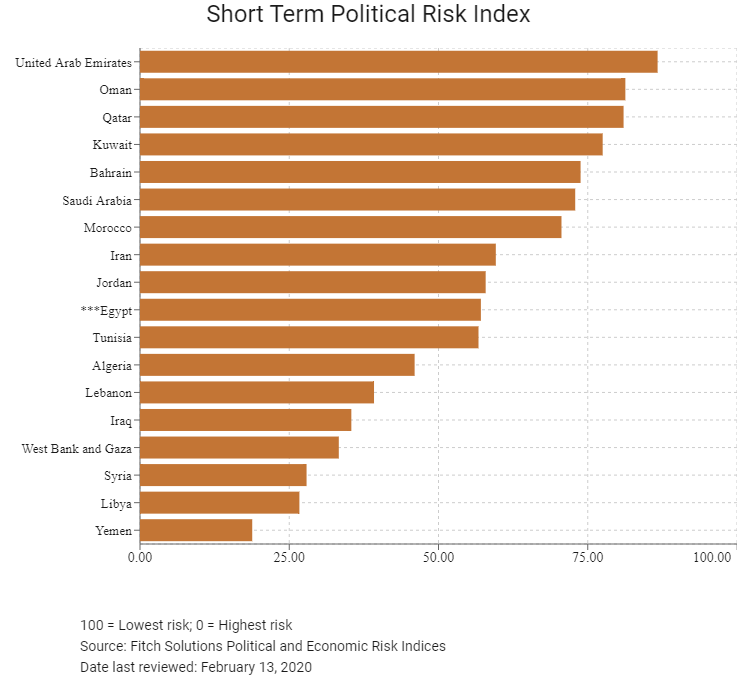

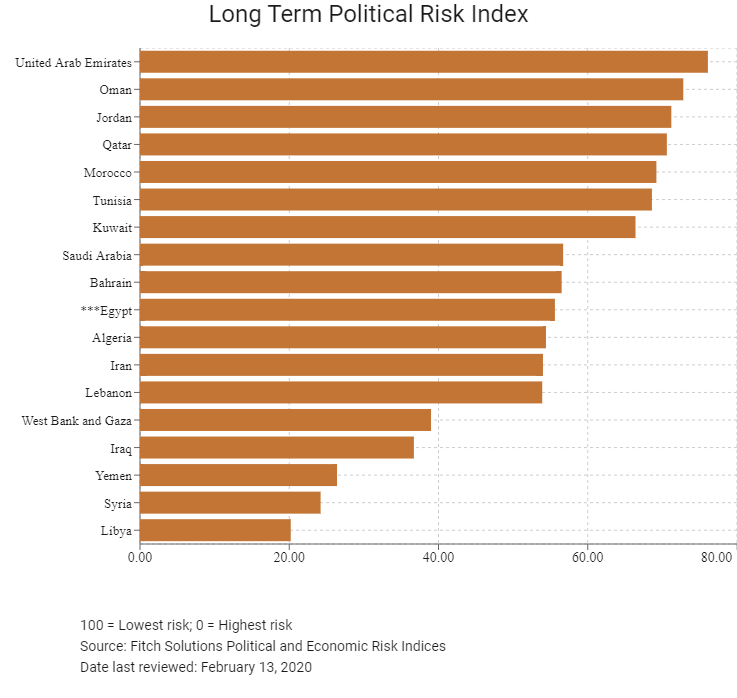

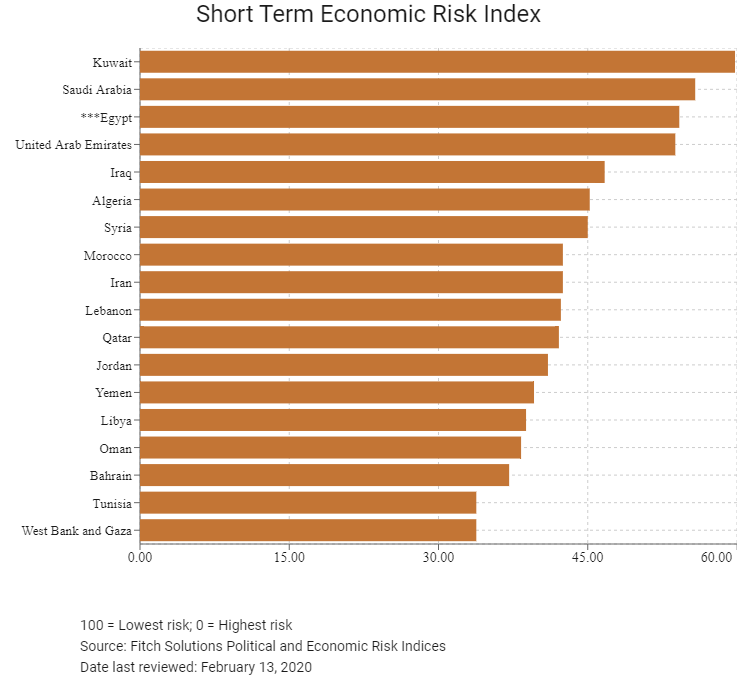

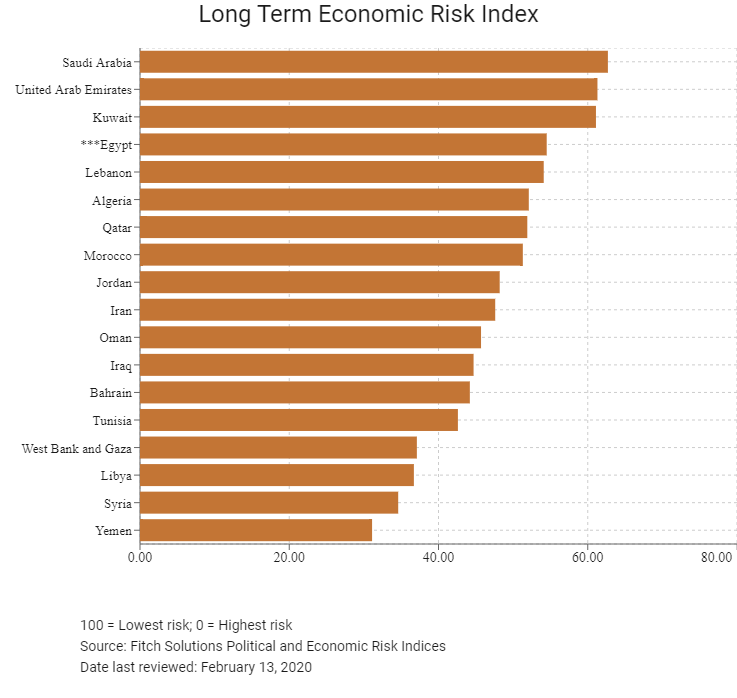

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

Economic Risk Index | 101/202 | 80/201 | 82/201 |

Short-Term Economic Risk Score | 55.8 | 51.9 | 54.2 |

Long-Term Economic Risk Score | 51.8 | 55.8 | 54.5 |

Political Risk Index | 138/202 | 134/201 | 133/201 |

Short-Term Political Risk Score | 53.3 | 56.5 | 57.1 |

Long-Term Political Risk Score | 54.0 | 55.6 | 55.6 |

Operational Risk Index | 103/201 | 107/201 | 97/201 |

Operational Risk Score | 48.5 | 48.4 | 49.4 |

Source: Fitch Solutions

Date last reviewed: May 15, 2020

Fitch Solutions Risk Summary

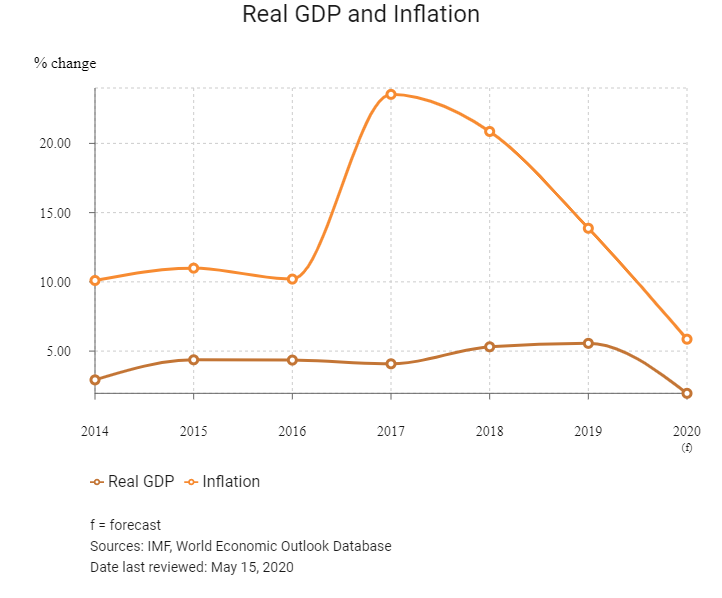

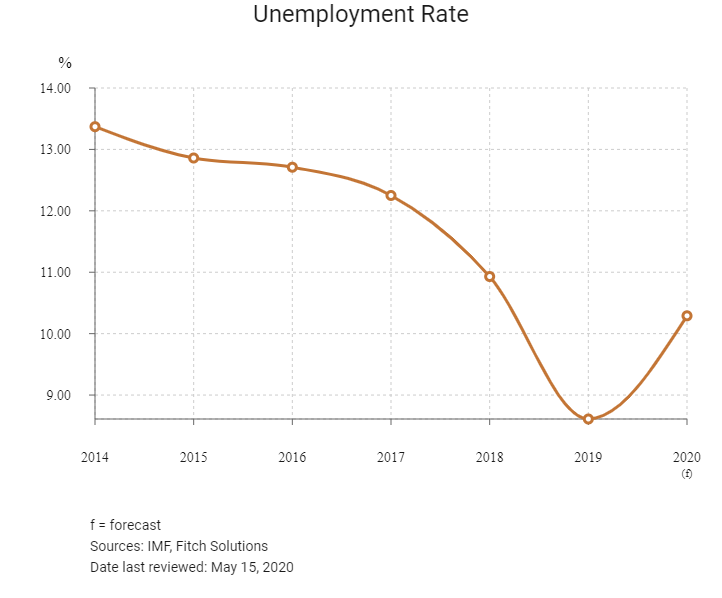

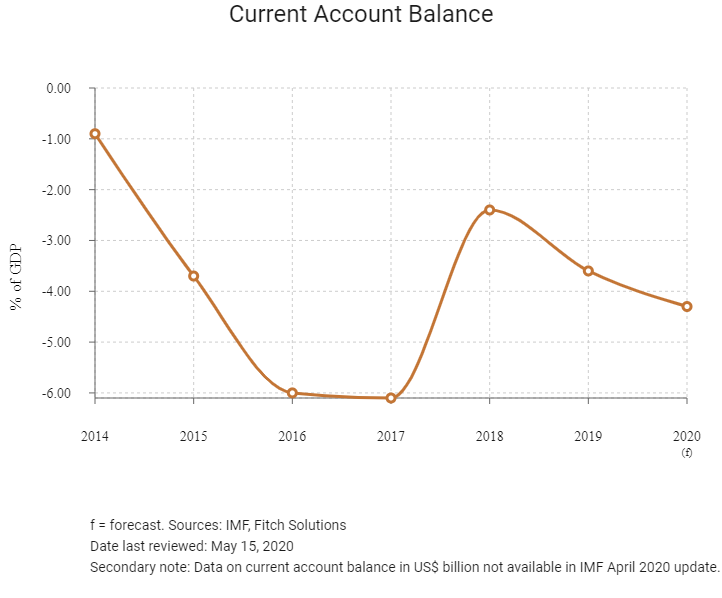

ECONOMIC RISK

Growth will slow substantially in Egypt in FY2019/20 (ending June 30) and the next fiscal year, highlighting the severity of the ongoing Covid-19 crisis. Expected medium-term real GDP growth will drive Egyptian exports and investments, supported by the country's fast-expanding gas sector. Investment will increasingly drive growth on the back of low base effects and pent-up demand, while government and household spending growth will remain tepid. The natural gas sector will continue to attract FDI and be a key driver of growth, boosting both exports and investment. Non-hydrocarbon investment and consumption will recover more gradually, on the back of continued easing of monetary policy as inflation slows; however, Egyptian households and businesses will remain under pressure in the near term. The long-term outlook is more positive given the significant growth opportunities in banking, housing and infrastructure.

OPERATIONAL RISK

A number of inherent features augment the Egyptian market's long-term growth potential. These include a strategic geographical, political and cultural position in the region, a large and growing working-age and consumer population, a strong infrastructure project pipeline and a well-developed financial sector. Furthermore, the underdeveloped private sector, combined with the progress of structural economic reforms, offers potential for expansion through value addition. However, Egypt's operating environment holds myriad risks that weigh on the market's potential, including onerous customs procedures and non-tariff trade barriers, a rigid labour market structure, and elevated security risks. Moreover, the country's utility networks are prone to periodic service disruptions and capacity limitations, which can be disruptive for business activity.

Source: Fitch Solutions

Date last reviewed: May 4, 2020

Fitch Solutions Political and Economic Risk Indices

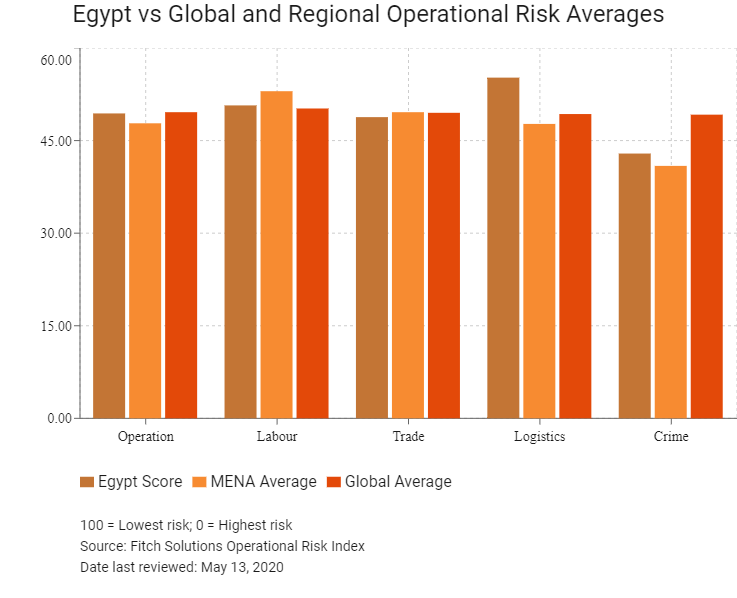

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

Egypt Score | 49.4 | 50.7 | 48.8 | 55.2 | 42.9 |

MENA Average | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

MENA Position (out of 18) | 9 | 9 | 11 | 6 | 9 |

Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

Global Position (out of 201) | 97 | 95 | 102 | 73 | 124 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk | Crime and Security Risk Index |

United Arab Emirates | 71.6 | 70.6 | 77.5 | 68.0 | 70.5 |

Bahrain | 66.5 | 65.5 | 75.4 | 71.6 | 53.6 |

Qatar | 66.0 | 66.7 | 62.3 | 73.7 | 61.2 |

Oman | 64.9 | 62.7 | 63.4 | 64.2 | 69.2 |

Saudi Arabia | 63.6 | 68.3 | 65.8 | 62.5 | 57.7 |

Jordan | 57.1 | 58.4 | 62.9 | 54.8 | 52.3 |

Kuwait | 55.5 | 58.7 | 56.2 | 50.8 | 56.2 |

Morocco | 54.6 | 45.0 | 65.3 | 54.9 | 53.2 |

Egypt | 49.4 | 50.7 | 48.8 | 55.2 | 42.9 |

Tunisia | 47.1 | 41.0 | 58.5 | 46.7 | 42.3 |

Lebanon | 43.6 | 54.0 | 49.8 | 40.9 | 29.7 |

Iran | 43.1 | 48.7 | 36.4 | 52.8 | 34.4 |

Algeria | 39.6 | 48.6 | 32.7 | 41.0 | 36.2 |

West Bank and Gaza | 31.6 | 48.3 | 34.1 | 27.1 | 17.0 |

Libya | 29.3 | 43.4 | 29.9 | 26.6 | 17.1 |

Syria | 28.6 | 42.6 | 29.2 | 27.6 | 15.0 |

Iraq | 26.7 | 43.5 | 24.1 | 26.9 | 12.4 |

Yemen | 21.8 | 37.8 | 19.6 | 13.9 | 16.1 |

Regional Averages | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 13, 2020

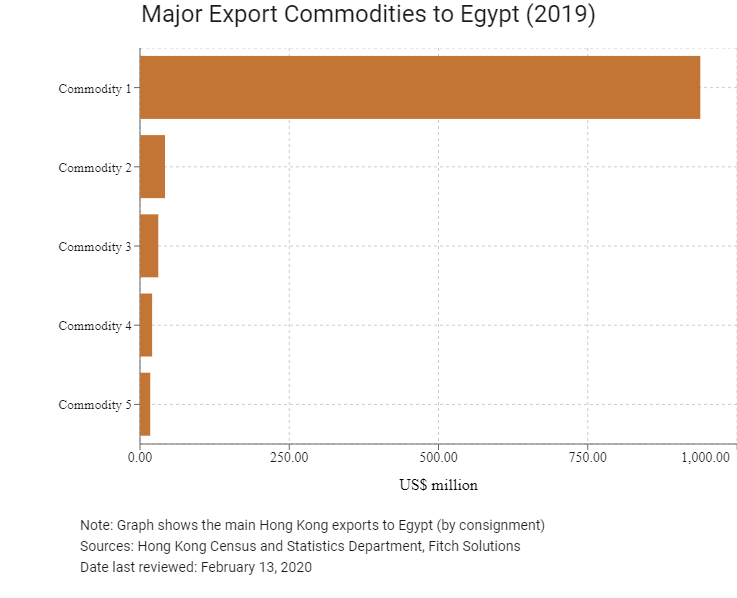

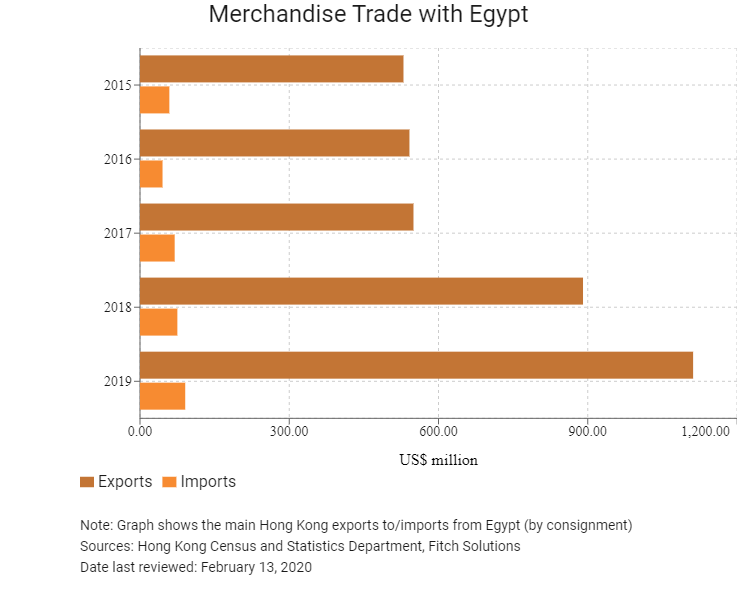

Hong Kong’s Trade with Egypt

Export Commodity | Commodity Detail | Value (US$ million) |

Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 938.5 |

Commodity 2 | Office machines and automatic data processing machines | 41.9 |

Commodity 3 | Power generating machinery and equipment | 30.6 |

Commodity 4 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 20.3 |

Commodity 5 | Textile yarn, fabrics, made-up articles, and related products | 17.1 |

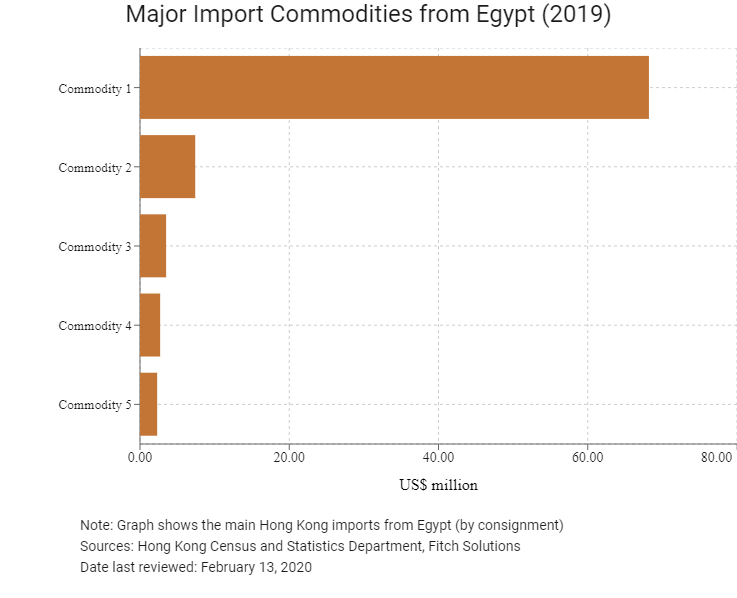

Import Commodity | Commodity Detail | Value (US$ million) |

Commodity 1 | Vegetables and fruit | 68.2 |

Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 7.4 |

Commodity 3 | Articles of apparel and clothing accessories | 3.5 |

Commodity 4 | Leather, leather manufactures, and dressed furskins | 2.7 |

Commodity 5 | Non-metallic mineral manufactures | 2.3 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

Number of Egyptian residents visiting Hong Kong | 8,580 | -21.6 |

Number of African residents visiting Hong Kong | 123,656 | -10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: May 15, 2020

Commercial Presence in Hong Kong

2018 | Growth rate (%) | |

Number of Egyptian companies in Hong Kong | N/A | N/A |

- Regional headquarters | ||

- Regional offices | ||

- Local offices |

Chamber of Commerce (or Related Organisations) in Hong Kong

The Arab Chamber of Commerce & Industry (ARABCCI)

ARABCCI was established in Hong Kong 2006 as a leading organisation at promoting commercial ties between Hong Kong/Mainland China and the Arab World.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Source: ARABCCI

The Arab Republic of Egypt Consulate General in Hong Kong

Address: Suite No. 1, 22/F, Sino Plaza, 255-257 Gloucester Road, Causeway Bay, Hong Kong

Email: consulate.hongkong@mfa.gov.eg

Tel: (852) 2827 0668

Fax: (852) 2827 2100

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

Bahrain, Hong Kong, Kuwait, Macao, Oman, Saudi Arabia and the United Arab Emirates residents can enter without a visa (for periods of up to three months). For other visitors, the necessary Egypt travel documents are a passport and a visa.

Source: Visa on Demand

Date last reviewed: February 13, 2020

Egypt

Egypt