GDP (US$ Billion)

173.76 (2018)

World Ranking 55/193

GDP Per Capita (US$)

4,081 (2018)

World Ranking 116/192

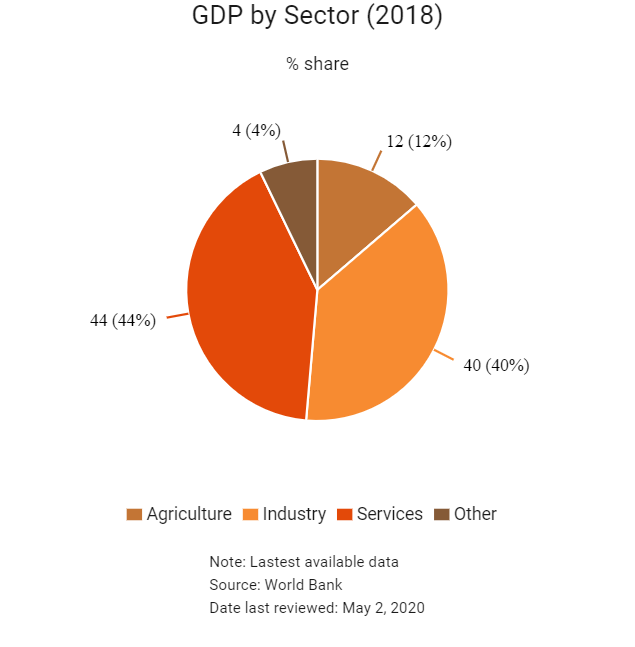

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

58.0 (2018)

Currency (Period Average)

Algerian Dinar

116.59per US$ (2018)

Political System

Presidential republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

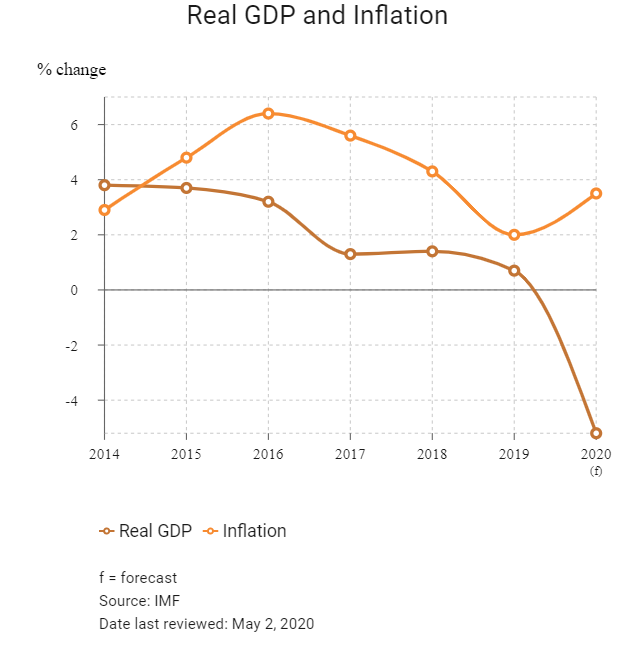

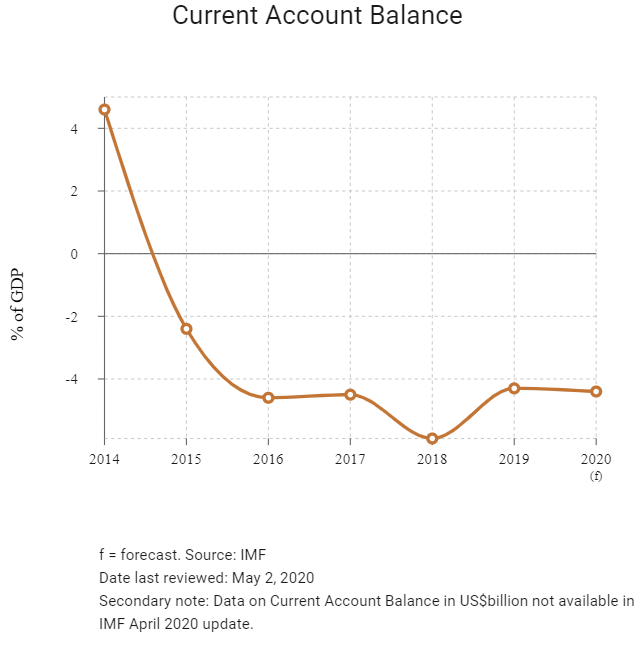

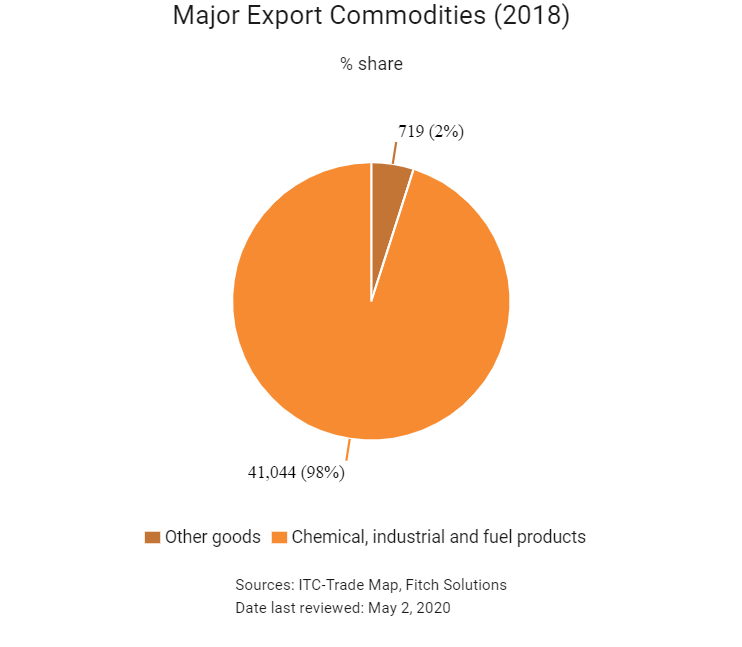

Algeria is ranked as one of the most important economies in the MENA region and within the Maghreb. The country is one of a handful of countries which has achieved 20% poverty reduction in the past two decades. Historic economic growth has been primarily driven by oil and natural gas production, which have traditionally accounted for more than 90% of export revenues, 60% of state budget revenues and 40% of GDP. The Algerian national oil company, Sonatrach, plays a key role in all aspects of the oil and natural gas sectors in Algeria. Looking ahead, the hydrocarbon-reliant Algerian economy will experience a slowdown in growth, as its adjustment to a lower oil price environment continues while reform momentum remains slow.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2016

Parliament passed constitutional reforms limited presidents to two terms, expanded the legislature's power and gave the Berber language official status.

December 2018

Algeria and Mainland China sealed a deal to construct a USD6 billion phosphate project, scheduled to be completed by 2022. The project aimed to exploit huge quantities of high quality phosphate, which would then be used to produce fertilisers, ammonia, silicon and other materials used in economic activities.

February 2019

Nissan Motor unveiled plans to form a joint venture with Groupe Hasnaoui to build a vehicle manufacturing plant in Algeria. The project would entail an investment of USD160 million. The facility, with a capacity to build 63,500 passenger cars and light commercial vehicles annually, would produce several models.

April 2019

President Abdelazziz Bouteflika resigned after postponing presidential elections that were scheduled for April 18.

September 2019

Algeria's interim leader Abdelkader Bensallah announced that elections were rescheduled for December 12, 2019.

September 2019

The General Directorate of Taxes announced the draft budget for 2020, which included measures to implement incentives for high-technology and innovative start-ups, Value Added Tax (VAT) exemptions and methods to prevent VAT fraud.

March 2020

The Bank of Algeria lowered the reserve requirement ratio from 10% to 8%, and its main policy rate to 3.25%.

April 2020

The Bank of Algeria announced that it was easing solvency, liquidity and non-performing loan ratios for banks. Banks were also allowed to extend payments of some loans without a need to provision against them.

The Bank of Algeria also announced that it was cutting its main policy rate to 3%, that it was lowering its reserve requirement ratio to 6%, and that it was lowering haircuts on government securities used in refinancing operations.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

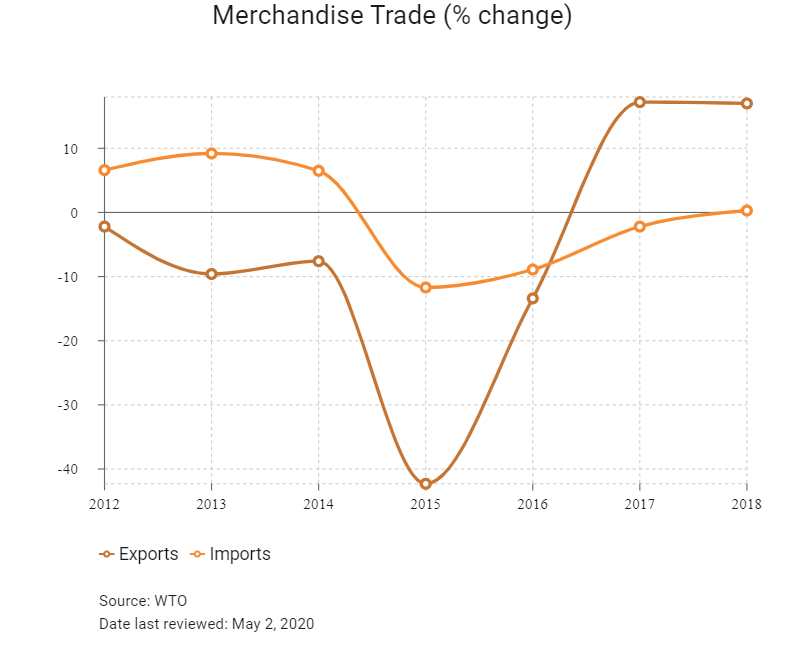

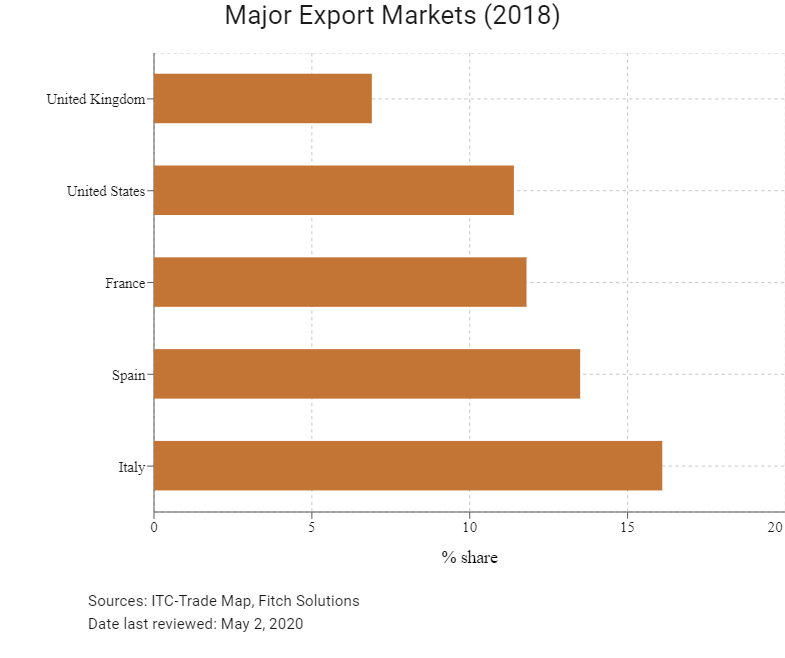

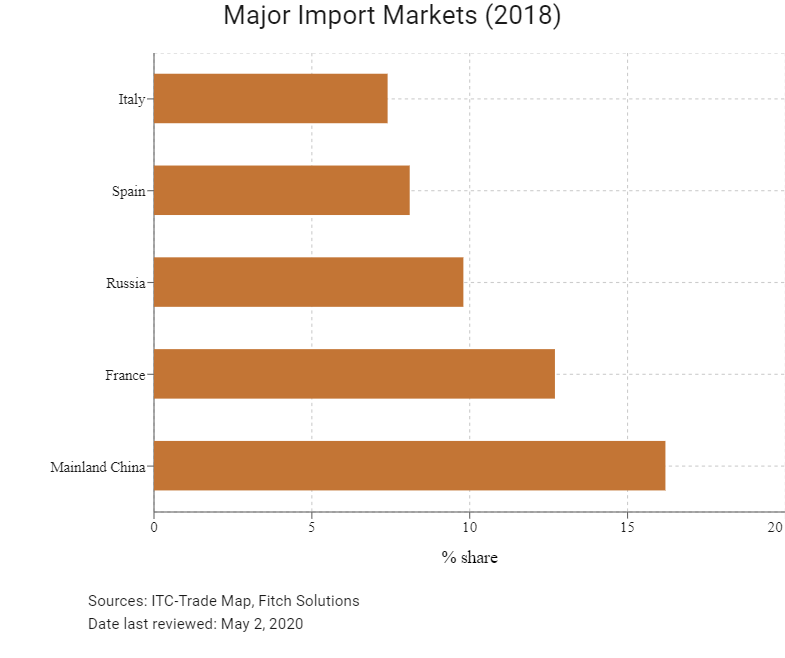

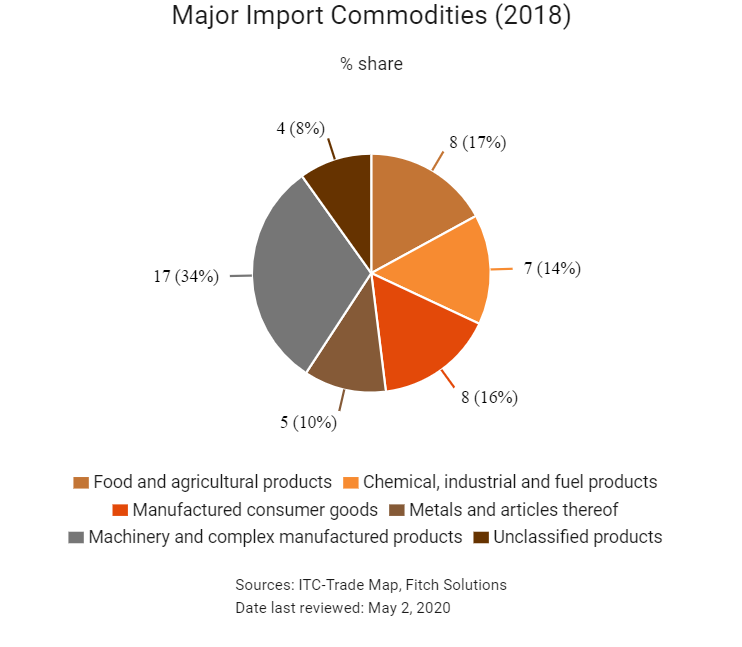

Merchandise Trade

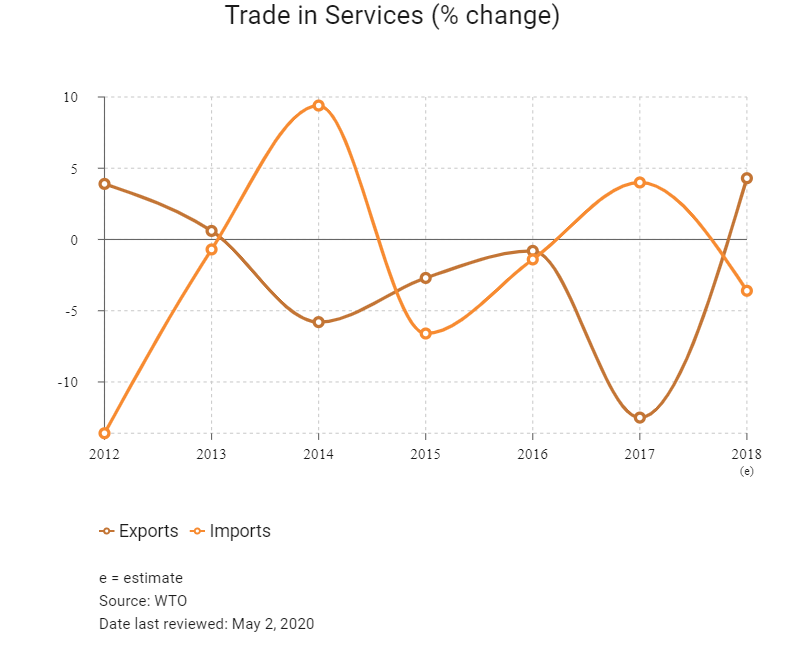

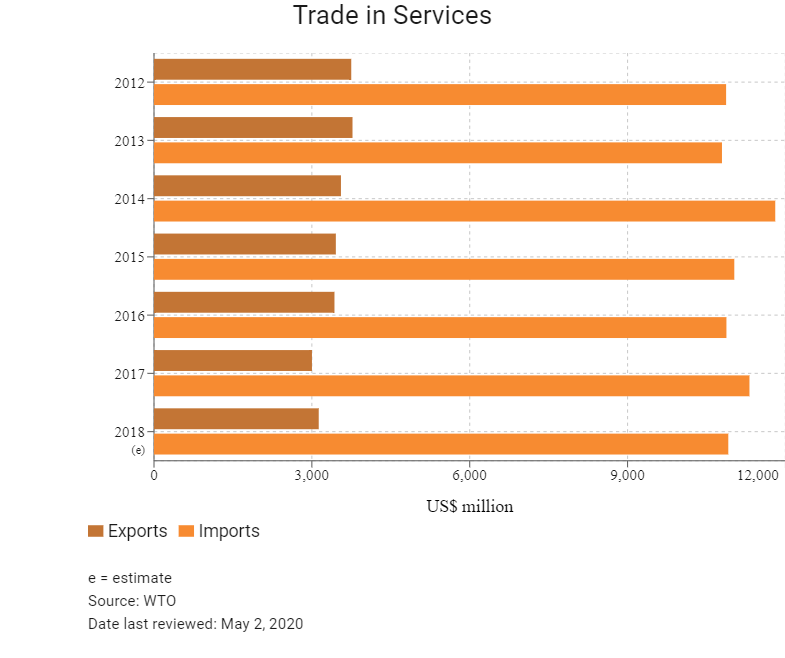

Trade in Services

- Algeria is not a member of any regional economic bloc or of the World Trade Organization (WTO). Algeria is in the process of accession to the WTO, with support from the European Union (EU). Algeria also benefits from being party to the Global System of Trade Preferences among Developing Countries (GSTP) since 1989.

- Generally, Algerian imports are subject to payment of customs duties in the following increments: duty free, 5%, 15%, 30% or 60%.

- The structure of Algerian regulations largely follows European – specifically French – standards.

- Customs clearance remains a challenge facing foreign companies operating in Algeria. In addition to a certificate of origin, the state requires importers to provide certificates of conformity and quality from an independent third party. Starting in mid-2014, the state now requires imported products to have transcripts written in Arabic and to clearly display the origin of the products. The Ministry of Commerce must stamp the shipping documents with a 'Visa Fraud' note indicating that the goods have been successfully subjected to fraud inspection before they can be cleared through customs.

- The government has sought to reduce the country's trade deficit through an openly-espoused policy of import substitution and import bans. A list of banned equipment for importation was published in January 2018. However, companies that set up local manufacturing operations can receive permission to import materials to produce finished products that the government will not approve for import.

- Certain restrictive measures can be imposed on foreign trade with the purpose of conserving limited amounts of natural resources, promoting domestic production and controlling expenditures on foreign products.

- In January 2018, the government of Algeria (via Executive Decree 18-02) suspended the importation of 851 products (defined in the official decree as HS Codes on a 10 digit level). The barred products range from meats, cheeses and certain fruits and vegetables to carpets, cell phones and various home appliances. The import suspension in Executive Decree 18-02 is expected to remain in place until the balance of payments is restored within the Algerian economy (with no further details provided in the Decree itself). In the pharmaceutical sector, an outright import ban remains in place on more than 360 medicines and medical devices.

- Algeria has trade agreements with the EU and the Arab League, although neither has been fully implemented.

Sources: Global Trade Alert, WTO – Trade Policy Review, national sources, Fitch Solutions

Multinational Trade Agreements

Active

- EU-Algeria: The EU-Algeria Association Agreement was signed in April 2002 and entered into force in September 2005. This agreement sets out a framework for the EU-Algeria relationship in all areas, including trade. The EU and Algeria adopted shared partnership priorities in March 2017. Algeria is the EU's 20th largest partner for imports and 24th largest partner for exports. The partnership priorities set up a renewed framework for political engagement and enhanced cooperation. The partnership priorities in the context of EU-Algeria relations up to 2020 focus on a variety of areas, including trade and access to the European single market, energy, the environment and sustainable development. The EU is Algeria's largest trading partner and absorbs the major part of Algerian international trade (accounting for over half of total trade). Total trade between the EU and Algeria amounted to EUR35.2 billion in 2016. Fuel and mining products made up 95.7% of EU imports from Algeria in 2017. Chemicals represented the second most important exported product, worth 2.9% of Algeria's exports to the EU. The EU's main exports to Algeria are machinery (22.2%), transport equipment (13.4%), agricultural products (12.8%), chemicals (12.8%) and iron and steel (10.2%).

- Greater Arab Free Trade Area (GAFTA): GAFTA is a multilateral trade agreement between 18 out of the 22 Arab League states aiming to fully liberalise the trade of goods between Arab nations. GAFTA came into force on January 1, 1998. In March 2001, it was decided to speed up the liberalisation process, and on January 1, 2005, the elimination of most tariffs among GAFTA members was enforced. GAFTA activates the Trade Facilitation and Development Agreement and eliminates most tariffs among GAFTA members. Trade liberalisation has been of great benefit to all member states and has aimed to reduce the cost of imports to Algeria; however, regional instability and domestic security concerns have diminished the effect of this agreement and have created trade barriers. This FTA is only a first step towards achieving a customs union on the way to a common market. The 18 members of GAFTA are Algeria, Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, United Arab Emirates and Yemen.

- African Continental FTA (AfCFTA): The AfCFTA was formally launched on July 7, 2019. This agreement stands out as one of the most ambitious projects of the African Union as it seeks to create the largest single market in the world by country membership. The AfCFTA will cover a market of more than 1.3 billion people with combined nominal GDP of USD2.5 trillion. Out of the continent's 55 states, 54 have signed the agreement, with Eritrea as the only non-signatory. The agreement aims to eliminate tariffs on intra-African trade, reduce unemployment, increase infrastructure development and eventually create a more competitive and sustainable environment for cross-border trade. According to the framework agreement, 90% of trade in goods will be liberalised over the course of five to eight years, 7% of goods will be classed as sensitive and liberalised over 10-13 years and 3% of goods will be exempt from free trade entirely. The allocation of goods to these different categories has yet to be negotiated and regional countries and their respective customs unions are currently preparing offers for their continental counterparts to consider. The 'sensitive items' lists may differ according to each bilateral relationship.

Under Negotiation

US-Middle East: In May 2003, the US-Middle East Free Trade Area (US-MEFTA) initiative was proposed, with the eventual goal of establishing a FTA between the US and a range of countries in the Middle East. The countries targeted to join MEFTA are Algeria, Bahrain, Egypt, Iran, Iraq, Israel (and through Israel, the Palestinian Authority), Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia and Yemen. US-MEFTA includes a wide range of trade and investment issues, such as market access, intellectual property rights and labour and environmental issues. US-MEFTA will help in growing commercial and investment opportunities by identifying and working to remove impediments to trade and investment flows between member states. This expands the scope of markets for businesses in Algeria to export products to and will significantly reduce trade costs.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

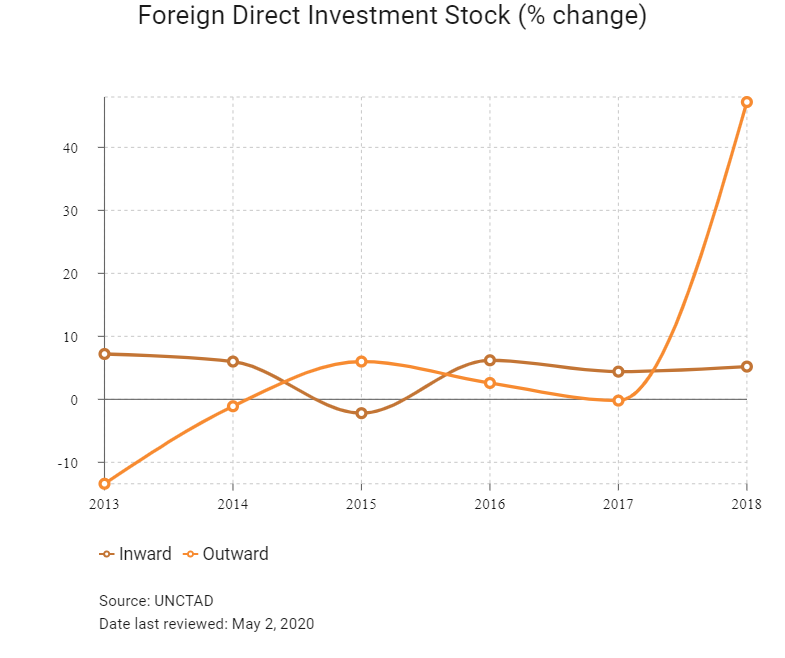

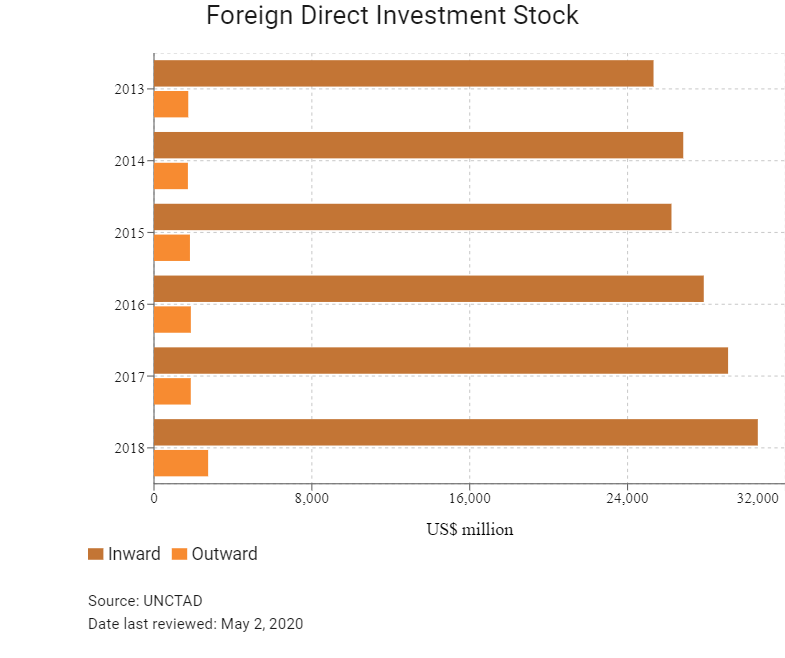

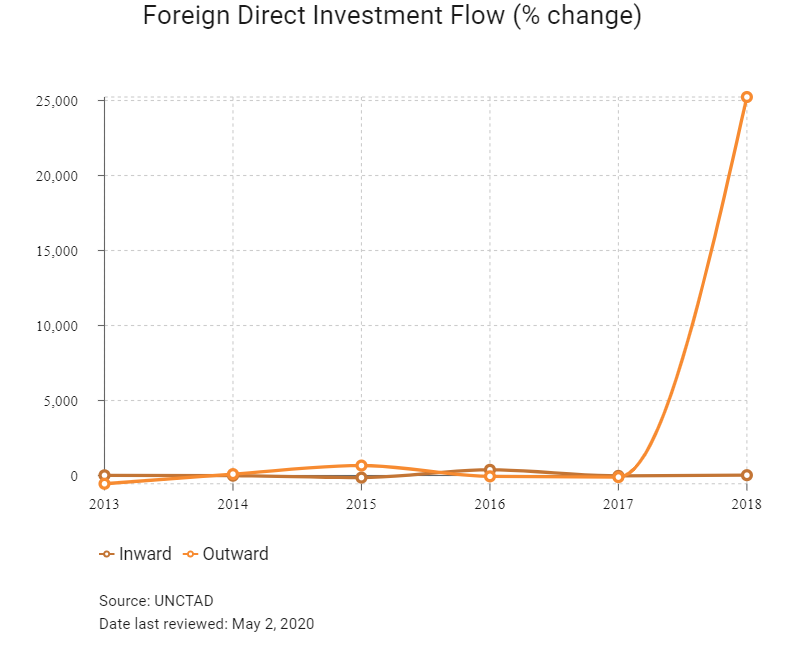

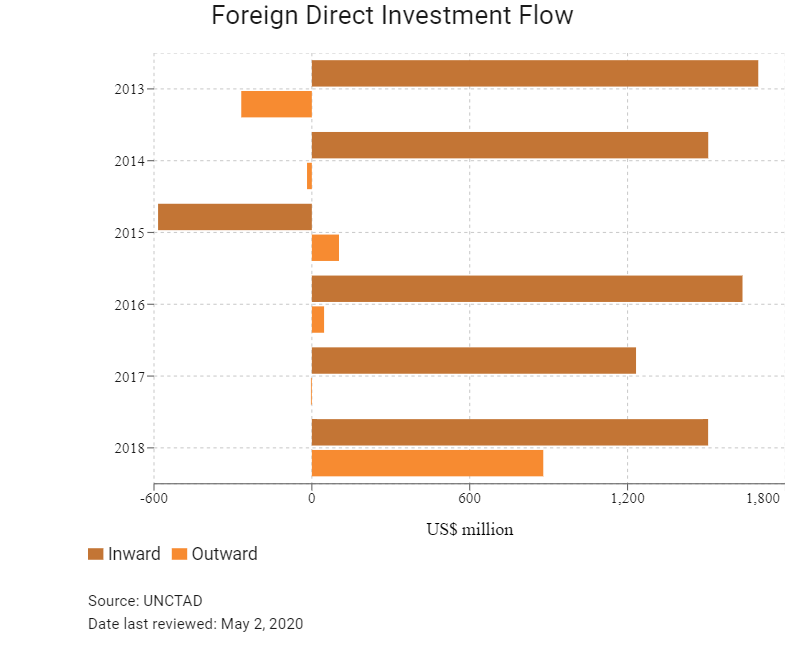

Foreign Direct Investment

Foreign Direct Investment Policy

- There are business opportunities in nearly every sector, including energy, power, water, healthcare, telecommunications, transportation, recycling, agribusiness and consumer goods. Lower oil prices since mid-2014 have spurred the Algerian government to initiate reforms to drive economic diversification, but progress has been slow.

- The National Agency of Investment Development (ANDI) is the primary Algerian government agency tasked with recruiting and retaining foreign investment. ANDI runs branches in each of Algeria's 48 governorates which are tasked with facilitating business registration, tax payments and other administrative procedures for both domestic and foreign investors. In practice, companies from the United States report that the agency is under-staffed and ineffective; its 'one-stop shops' only operate out of physical offices, and there are no efforts to maintain dialogue with investors after they have initiated an investment.

- All regulatory processes are managed by the national government. Accounting, legal and regulatory procedures, as written, are considered consistent with international norms.

- More than half of the formal Algerian economy comprises state-owned enterprises (SOEs), led by the national oil and gas company, Sonatrach, although SOEs are present in all sectors of the economy. Legally, public and private companies compete under the same terms with respect to market share, products and services, and incentives. Private enterprises have the same access to financing as SOEs.

- The economy is reliant on petroleum. Sonatrach plays a key role in all aspects of the oil and natural gas sectors in Algeria. Algeria is a member of the Organization of the Petroleum Exporting Countries, the International Monetary Fund and the World Bank.

- Foreign and domestic private entities have the right to establish and own business enterprises and engage in all forms of remunerative activity. However, the 51/49 rule requires majority Algerian ownership (at least 51%) in all projects involving foreign investment. This requirement was first adopted in 2006 for the hydrocarbons sector and was expanded across all sectors in the 2009 investments law. The rule was removed from the investments law in 2016, but it remains in force by virtue of its inclusion in the 2016 annual finance law.

- A range of tailored measures can mitigate the effect of the 51/49 rule and allows the minority foreign shareholder to exercise other means of control. Some foreign investors use multiple local partners in the same venture, effectively reducing ownership of each individual local partner to enable the foreign partner to own the largest share.

- Since 2013, the Algerian government has not officially screened foreign direct investment. However, foreign investments are still subject to approvals from a host of ministries that cover the proposed project, most often the Ministries of Commerce, Energy, and Industry and Mines. United States companies have reported that certain high-profile industrial proposals, such as for automotive assembly, are subject to informal approval by the Prime Minister. In 2017, the government instituted an Investments Review Council, which the Prime Minister chairs, for the purpose of monitoring investments. Approval by the National Investments Council, also chaired by the Prime Minister, is necessary to obtain benefits and incentives for any project totalling more than DZD5 billion.

- The Algerian Chamber of Commerce and Industry – the nationwide and state-supported chamber of commerce – has the authority to arbitrate investment disputes as an agent of the court.

- The Algerian state can expropriate property under limited circumstances proscribed by law, with the state mandated to pay 'just and equitable' compensation to the defendants. Expropriation of property is extremely rare, with no cases within the last decade.

- The 2016 investments law provides state guarantees for the transfer of incoming investment capital and outgoing profits. Pre-existing incentives established by other laws and regulations also include favourable loan rates well below inflation from public banks for qualified investments.

- In December 2016, it was announced that as of January 1, 2017, the Finance Law 2017 will enter into force within the Algerian jurisdiction. Article 88 of the law introduces new support measures for the assembly industries. Production companies which operate in the assembly field are eligible for a preferential income tax regime. The incentive intends to promote the growth of the local assembly industry. Applicants must document the local value they create in terms of jobs, investment and input sourcing.

- Algeria has signed bilateral investment treaties with Argentina, Austria, Bahrain, BLEU (Belgium-Luxembourg Economic Union), Bulgaria, Mainland China, Cuba, Denmark, Egypt, Ethiopia, Finland, France, Germany, Greece, Indonesia, Iran, Italy, Jordan, Kuwait, Libya, Malaysia, Mali, Mauritania, Mozambique, Netherlands, Niger, Nigeria, Oman, Portugal, Qatar, Romania, Russia, Serbia, South Africa, South Korea, Spain, Sudan, Sweden, Switzerland, Syria, Tajikistan, Tunisia, Turkey, Ukraine, United Arab Emirates, Vietnam and Yemen.

- Any incentive offered by the Algerian government is generally available to any company, although there are multiple tiers of 'common, additional and exceptional' incentives under the 2016 investments law.

- Common incentives available to all investors include exemption from customs duties for all imported production inputs, exemption from value added sales tax (VAT) for all imported goods and services that enter directly into the implementation of the investment project, a 90% reduction on tenancy fees during construction and a 10-year exemption on real estate taxes. Investors also benefit from a three-year exemption on the corporate and professional activity taxes and a 50% reduction for three years on tenancy fees after construction is completed. Additional incentives are available for investments made outside the coastal regions, namely the reduction of tenancy fees to a symbolic dinar per square metre of land for 10 years in the High Plains region and 15 years in the south of Algeria, plus a 50% reduction thereafter. The law also charges the state to cover, in part or in full, the necessary infrastructure works for the realisation of the investment.

- Exceptional incentives apply for investments 'of special interest to the national economy', including the extension of the common tax incentives to 10 years. An investment must receive the approval of the National Investments Council in order to qualify for exceptional incentives; the sectors of special interest have not yet been specified.

- In 2017, the Algerian government began instituting compulsory localisation in the automotive sector. Industry regulations issued in December 2017 require companies producing or assembling cars in the country to achieve a local integration rate of at least 15% within three years of operation. The threshold rises to between 40% and 60% after a company's fifth year of operation. Since 2014, the government has required car dealers to invest in industrial or semi-industrial activities as a condition for doing business in Algeria. Dealers seeking to import new vehicles must obtain an import licence from the Ministry of Commerce. Since January 2017, the ministry has not issued any licences. As the Algerian government further restricts imports, localisation requirements are expected to broaden to other manufacturing industries over the next several years.

- Information technology providers are not required to turn over source codes or encryption keys, but all hardware and software imported to Algeria must be approved by the Agency for Regulation of Post and Telecommunication, under the Ministry of Post, Information Technology and Communication. There are no data sovereignty rules mandating data storage within the country. Due to IT infrastructure issues, most Algerians use email services with foreign domains.

- There are few statutory restrictions on foreign investors converting, transferring or repatriating funds, according to banking executives. Money cannot be expatriated to pay royalties or to pay for services provided by resident foreign companies. The difficultly with conversions and transfers results more from the procedures of the transfers rather than the statutory limitations: the process is heavily bureaucratic and requires almost 30 different steps from start to finish. The slightest misstep at any stage can slow down or completely halt the process.

- Regulations passed in a March 2017 executive decree exclude approximately 150 economic activities from eligibility for the incentives. The list of excluded investments is concentrated on the services sector but also includes manufacturing for some products. All investments in sales, whether retail or wholesale, and the imports business are ineligible.

- In 2001, Algeria and the United States signed a Trade and Investment Framework Agreement, and its council met most recently in Algiers in April 2017.

- Algeria does not have any foreign trade zones or free ports.

- In September 2019, Algeria released its draft budget for 2020, including proposals for a number of tax reliefs. The government has announced that it will offer a profit tax holiday and VAT exemptions for start-up businesses during their initial years, and is looking to roll out four new tax-privileged special economic zones. Furthermore, the government has committed to redouble the enforcement of taxes on wealthy persons and real estate. Finally, the draft budget seeks to relax the '51/49' rules on foreign direct investors that preclude foreign investors from holding a majority shareholding in an Algerian venture.

Sources: WTO – Trade Policy Review, national sources, Global Trade Alert, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

General incentives |

- Tax incentives can be granted to new investors, subject to the application of a specific request with the National Agency of Investment Development. The tax incentives can be granted for the investment phase and for the exploitation phase. They can be granted for a period of three or five years, depending on the type and the size of the business. |

Note: Algeria does not have any foreign trade zones or free ports

Sources: National sources, Fitch Solutions

- Value Added Tax: 19%

- Corporate Income Tax: 19%-26%

Sources: Directorate General of Taxes, Fitch Solutions

Important Updates to Taxation Information

The government’s primary aim in recent years has been balancing the budget by increasing local tax resources and limiting imports. Algeria plans to implement taxes on wealth and property in 2020 for the first time, according to the recently approved draft budget for 2020.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax or IBS |

- 19% for manufacturing activities |

|

Capital Gains Tax |

Same as IBS |

|

Branch Remittance Tax |

15% |

|

Transfer Tax |

5% for registration fees, plus 1% tax applicable for publication formalities of land and building transfer of ownership |

|

Withholding Tax |

Interest: 10% |

|

VAT |

19%, the reduced rate of 9% applies to various basic items where no input tax is recoverable (such as construction, ICT services) |

|

Surtax |

5% for medical importers |

|

Social security contributions |

26% of gross salaries payable by employer; 9% payable by employee |

Sources: Directorate General of Taxes, Fitch Solutions

Date last reviewed: May 2, 2020

Foreign Worker Permits

Foreign nationals who wish to work in Algeria under a contract that has a duration of less than three months must obtain a temporary work authorisation (APT). It can be renewed once in a year. Under Article 9 of Law No. 81-10, a foreigner who is assigned to Algeria for a duration of less than 15 days does not require an APT. However, a temporary work visa is always required. To obtain the visa, a foreign national must justify his or her work in Algeria.

After the granting of an APT and work visa, a work permit is required. A work permit's validity may not exceed two years, but it is renewable. French nationals benefit from a special regime whereby citizens of France need to obtain a foreign worker declaration instead of a work permit.

A foreign worker working as a managing director of an Algerian entity is exempt from the work permit requirement, but needs a business professional card and, in some circumstances, a residence card.

All foreign workers from countries with which Algeria has entered into social security agreements – and who are pursuing an activity in Algeria while maintaining an employment contract with their employers abroad – may elect to be subject to the social security system of their home countries and be exempt from social security contributions in Algeria. To implement this selection, the employer must give a copy of a certificate of coverage (certificat de détachement) to the employee, who then submits it to the national social security fund (Caisse Nationale des Assurances Sociales). Algeria has entered into social security agreements with Belgium, France, Romania and Tunisia.

Visa/Travel Restrictions

Entry visas are required for nationals of the EU, United States and certain Arabic countries, such as Egypt. Algerian embassies or consulates can provide information regarding the documents necessary for obtaining a tourist visa. Moroccan and Tunisian nationals are not required to have entry visas.

Foreign nationals who would like to enter Algeria for a period not exceeding 15 days can enter with a business visa. This visa allows the holding of meetings (internal or with clients) but not the provision of services.

Foreigners who are intending to extend their stay in Algeria beyond the duration specified in the visa must request a residence card 15 days before the expiration of the visa's validity. This card is valid for two years. A residence card with a validity of 10 years can be issued after a regular residency of seven years in Algeria. The application form for the residence card must be sent to the local police office.

Sources: National sources, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Not rated |

N/A |

|

Standard & Poor's |

Not rated |

N/A |

|

Fitch Ratings |

Not rated |

N/A |

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

166/190 |

157/190 |

157/190 |

|

Ease of Paying Taxes Index |

157/190 |

156/190 |

158/190 |

|

Logistics Performance Index |

117/160 |

N/A |

N/A |

|

Corruption Perception Index |

105/180 |

106/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

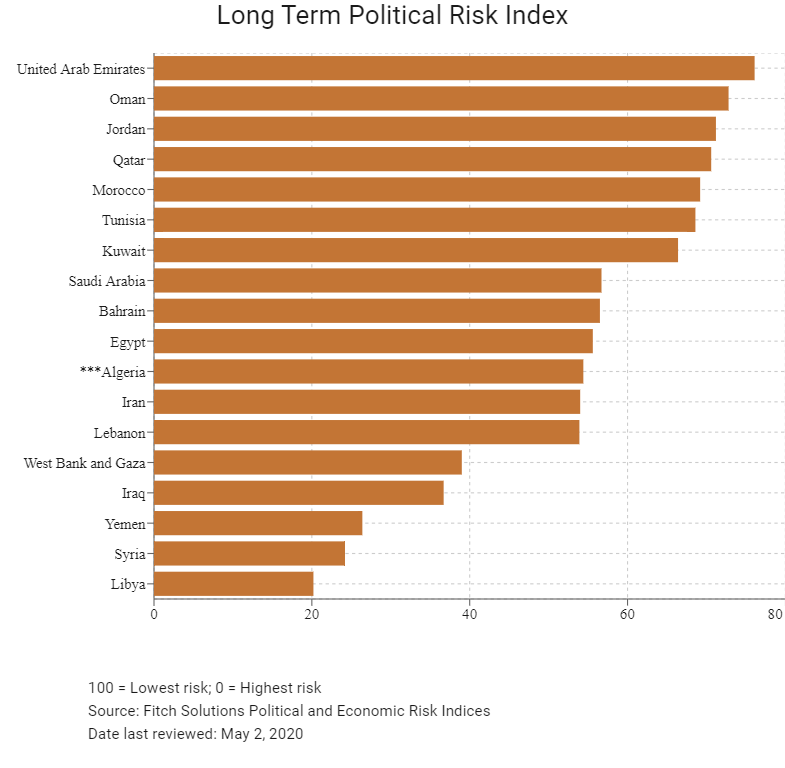

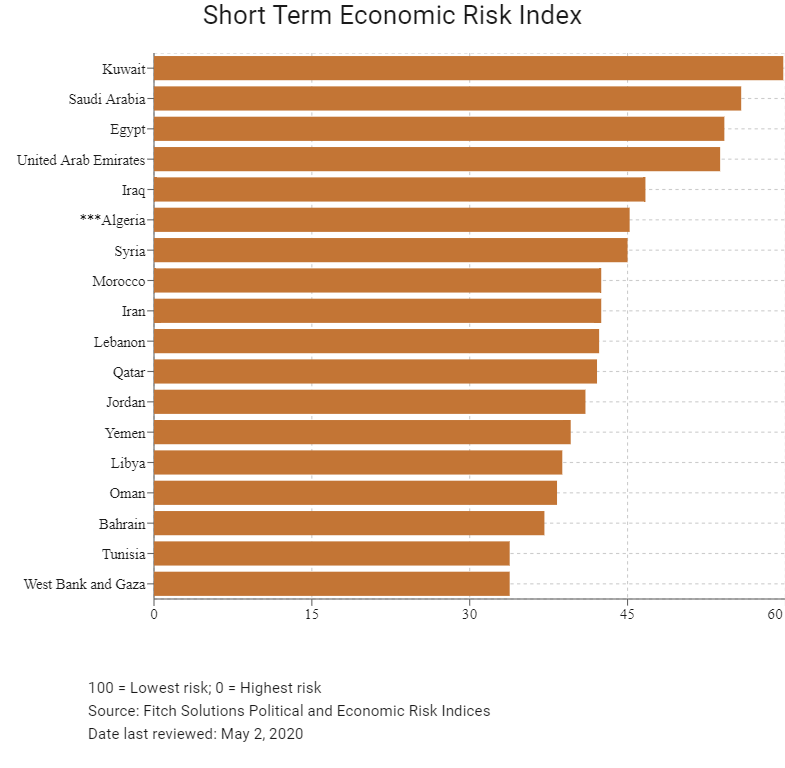

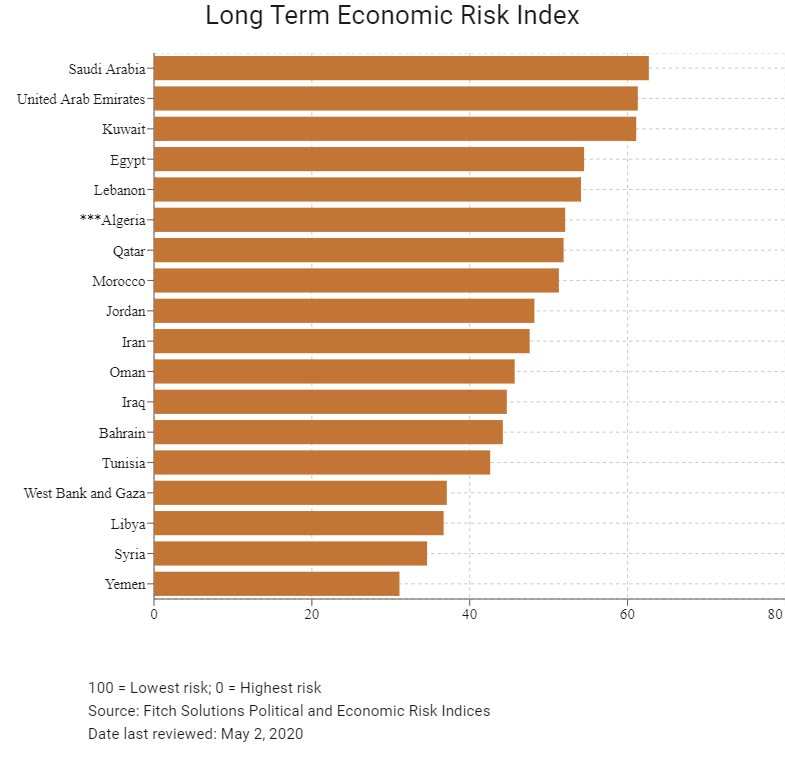

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

83/202 |

84/201 |

99/201 |

|

Short-Term Economic Risk Score |

51.9 |

46.9 |

45.2 |

|

Long-Term Economic Risk Score |

54.1 |

55.0 |

52.1 |

|

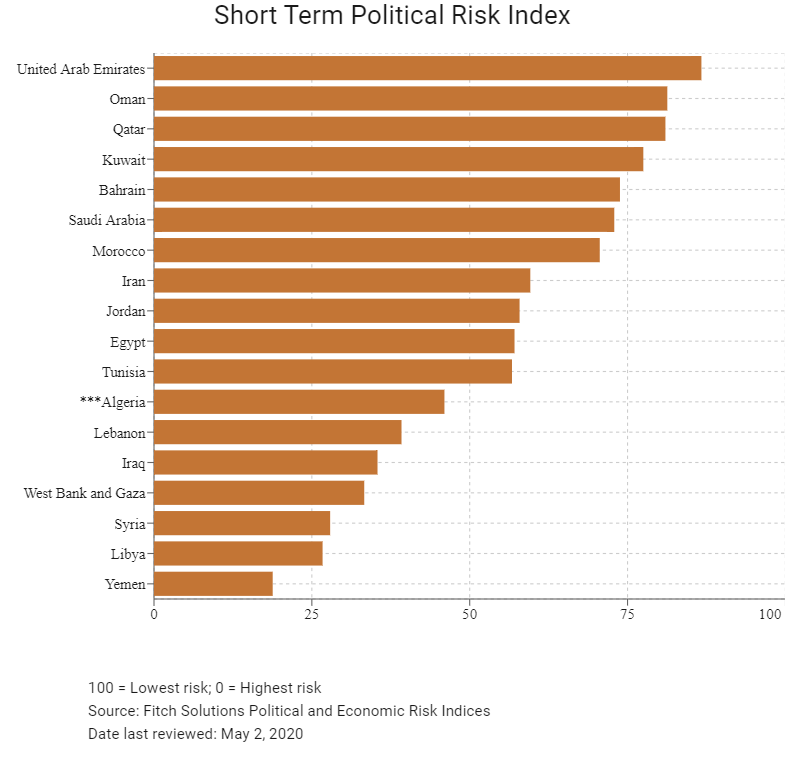

Political Risk Index Rank |

137/202 |

138/201 |

139/201 |

|

Short-Term Political Risk Score |

52.3 |

46.0 |

46.0 |

|

Long-Term Political Risk Score |

54.4 |

54.4 |

54.4 |

|

Operational Risk Index Rank |

134/201 |

144/201 |

139/201 |

|

Operational Risk Score |

41.6 |

38.6 |

39.6 |

Source: Fitch Solutions

Date last reviewed: May 2, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

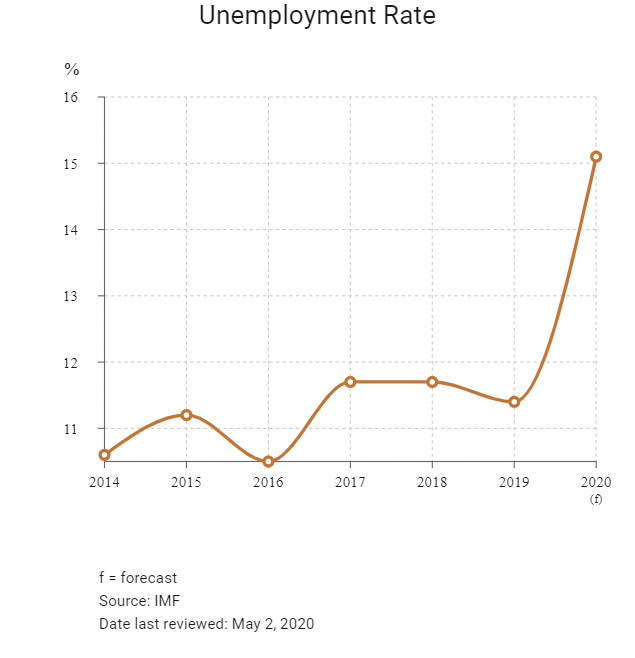

The global coronavirus (Covid-19) outbreak threatens to dent Algeria's fiscal position in 2020 as the country faces two key challenges, the spread of Covid-19 and the sharp decline in oil prices. In the years ahead, despite these risks, the economy will remain highly dependent on the hydrocarbon sector, the main lever behind public spending – which itself is key to fuelling growth in gross fixed capital formation and private consumption. Wider fiscal deficits will be driven by a collapse in revenues from the hydrocarbon sector, as well as lower taxes from income and consumption as Algeria drops into recession in 2020. Government plans to issue foreign debt to reduce its reliance on central bank financing look challenging unattractive operating environment. High levels of youth unemployment and dwindling foreign reserves present significant risks to the long-term outlook.

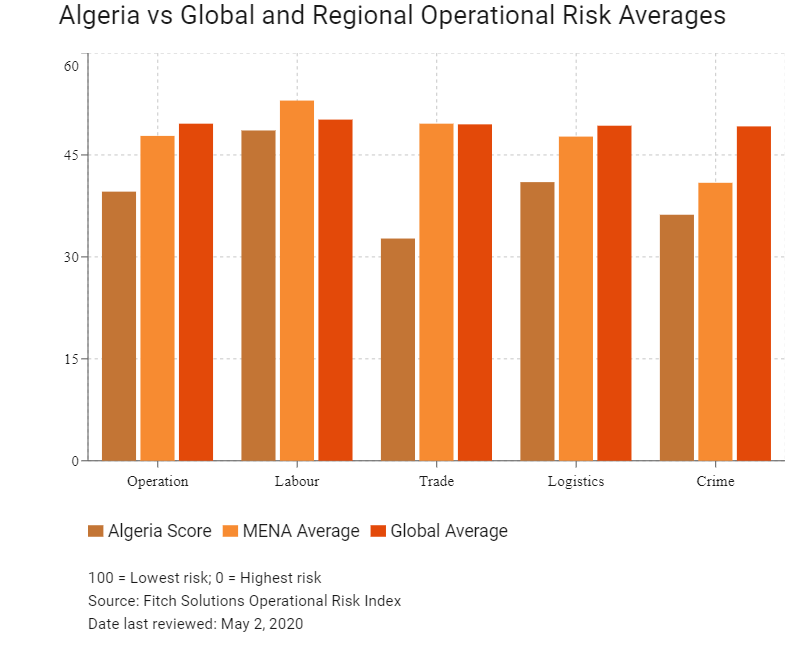

OPERATIONAL RISK

Many sectors – including tourism infrastructure and many transport segments – are yet to be exploited. In addition, Algeria possesses significant potential for renewable energy. The country is positioned in the middle of the Sahara desert and has all the structural pre-conditions for the construction of both solar and wind power plants. With the population projected to grow steadily, the domestic consumer market will remain the second largest in North Africa over the long term (after Egypt). While a growing young population offers a significant potential growth boost, limited employment opportunities amid slow reform implementation pose downside risks to Algeria's long-term outlook. Algeria's adoption of an import substitution policy has sharply restricted foreign trade.

Source: Fitch Solutions

Date last reviewed: May 2, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Algeria Score |

39.6 |

48.6 |

32.7 |

41.0 |

36.2 |

|

MENA Average |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

13 |

11 |

14 |

12 |

11 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

139 |

110 |

162 |

125 |

145 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk |

Crime and Security Risk Index |

|

UAE |

71.6 |

70.6 |

77.5 |

68.0 |

70.5 |

|

Bahrain |

66.5 |

65.5 |

75.4 |

71.6 |

53.6 |

|

Qatar |

66.0 |

66.7 |

62.3 |

73.7 |

61.2 |

|

Oman |

64.9 |

62.7 |

63.4 |

64.2 |

69.2 |

|

Saudi Arabia |

63.6 |

68.3 |

65.8 |

62.5 |

57.7 |

|

Jordan |

57.1 |

58.4 |

62.9 |

54.8 |

52.3 |

|

Kuwait |

55.5 |

58.7 |

56.2 |

50.8 |

56.2 |

|

Morocco |

54.6 |

45.0 |

65.3 |

54.9 |

53.2 |

|

Egypt |

49.4 |

50.7 |

48.8 |

55.2 |

42.9 |

|

Tunisia |

47.1 |

41.0 |

58.5 |

46.7 |

42.3 |

|

Lebanon |

43.6 |

54.0 |

49.8 |

40.9 |

29.7 |

|

Iran |

43.1 |

48.7 |

36.4 |

52.8 |

34.4 |

|

Algeria |

39.6 |

48.6 |

32.7 |

41.0 |

36.2 |

|

West Bank and Gaza |

31.6 |

48.3 |

34.1 |

27.1 |

17.0 |

|

Libya |

29.3 |

43.4 |

29.9 |

26.6 |

17.1 |

|

Syria |

28.6 |

42.6 |

29.2 |

27.6 |

15.0 |

|

Iraq |

26.7 |

43.5 |

24.1 |

26.9 |

12.4 |

|

Yemen |

21.8 |

37.8 |

19.6 |

13.9 |

16.1 |

|

Regional Averages |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 2, 2020

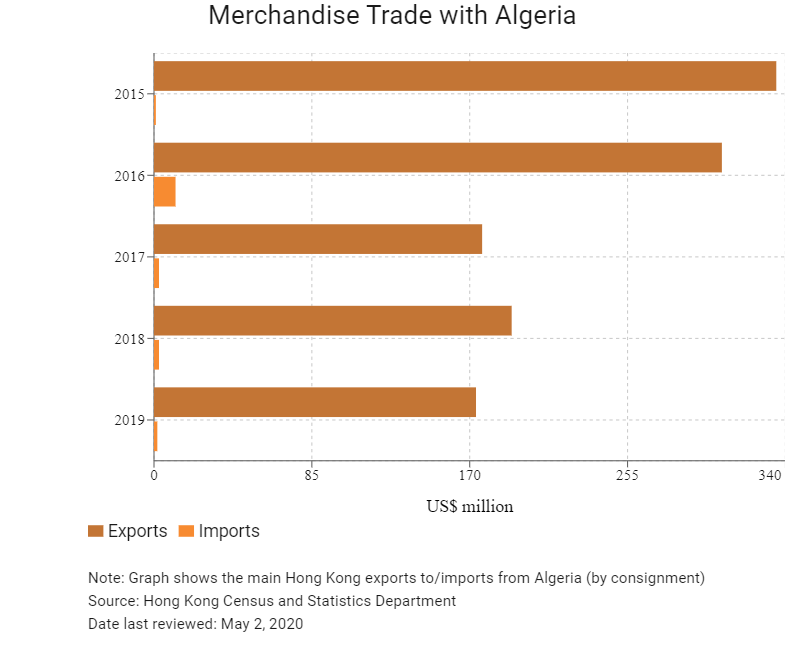

Hong Kong’s Trade with Algeria

|

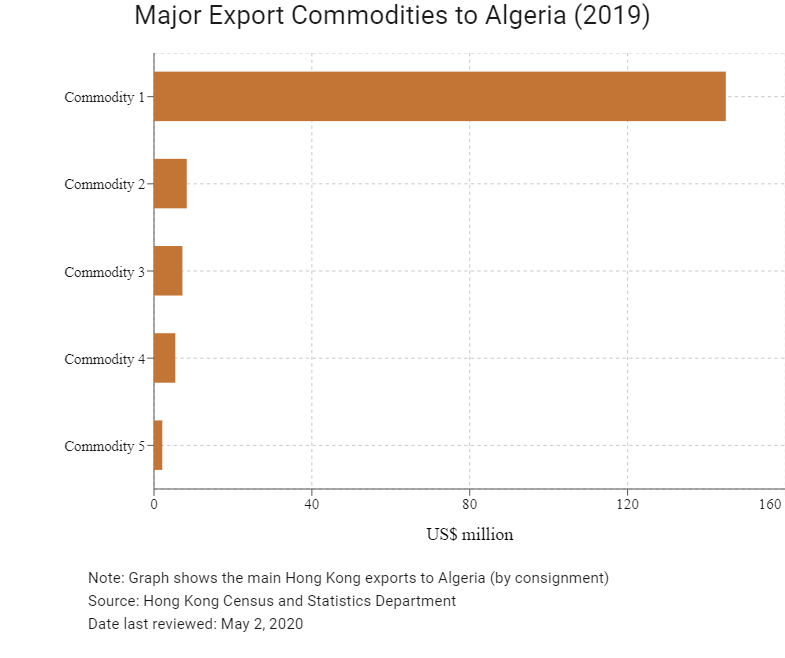

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

144.9 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

8.3 |

|

Commodity 3 |

Professional, scientific and controlling instruments and apparatus |

7.2 |

|

Commodity 4 |

Office machines and automatic data processing machines |

5.4 |

|

Commodity 5 |

Machinery specialised for particular industries |

2.1 |

|

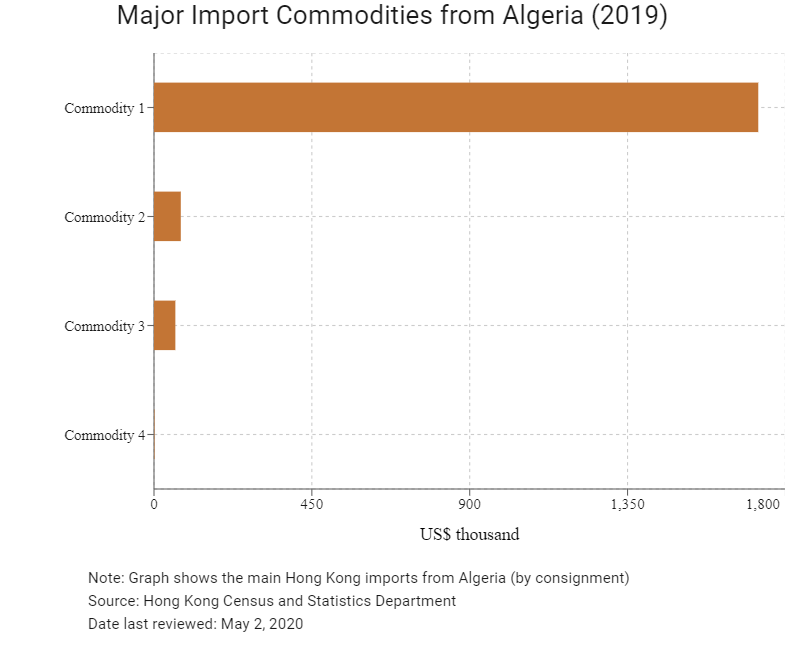

Import Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

1,722.7 |

|

Commodity 2 |

Vegetables and fruit |

76.4 |

|

Commodity 3 |

Telecommunications and sound recording and reproducing apparatus and equipment |

60.9 |

|

Commodity 4 |

Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof |

1.8 |

|

Commodity 5 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

1,722.7 |

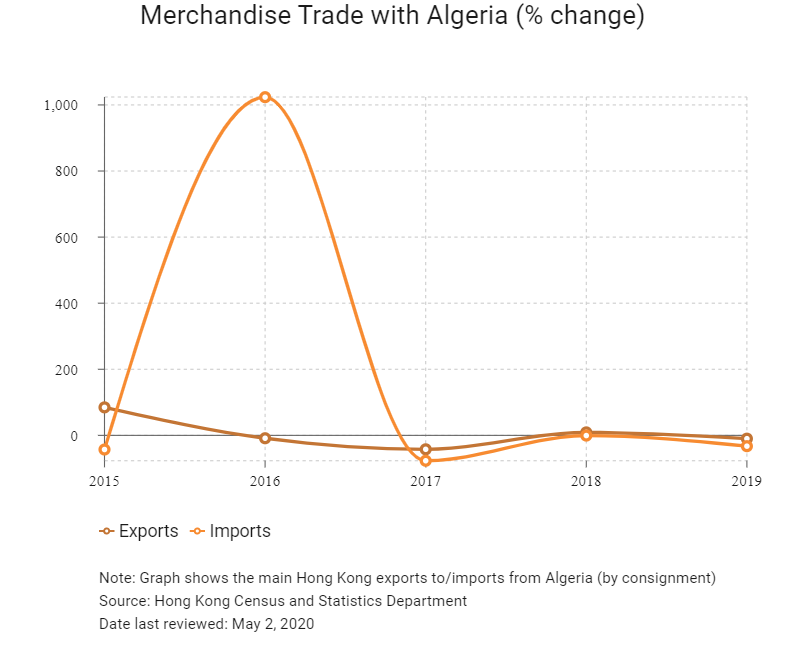

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Algerian residents visiting Hong Kong |

2,615 |

-20.9 |

|

Number of African residents visiting Hong Kong |

123,656 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: May 2, 2020

Commercial Presence in Hong Kong

|

2016 |

Growth rate (%) |

|

|

Number of Algerian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Chamber of Commerce (or Related Organisations) in Hong Kong

The Arab Chamber of Commerce & Industry (ARABCCI) was established in Hong Kong in 2006 as a leading organisation at promoting commercial ties between Hong Kong/Mainland China and the Arab World.

The Arab Chamber of Trade & Industry

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong SAR

Email: info@arabcci.org , secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Visa Requirements for Hong Kong Residents

A visa is required for HKSAR passport holders.

Source: Visa HQ

Date last reviewed: May 2, 2020

Algeria

Algeria