Georgia: A Free Trade Partner

Georgia has huge potential as a new trading partner for Hong Kong, with a substantial number of business opportunities arising from its combination of firm support for the Belt and Road Initiative (BRI), its open and business-friendly economy and its strategic location in the central Caucasian region of Eurasia. A country of 3.7 million people, its prime setting at the very crossroads of China and Europe, as well as its extensive array of Free Trade Agreements (FTAs) – including treaties with the Chinese mainland and Hong Kong – sees it offering a host of new trade and investment possibilities.

Its appeal has been boosted by a number of ongoing reforms, including a greater emphasis on open governance, improvements to the local business environment and an ambitious infrastructure development programme. In the case of the latter, this has seen a number of landmark investment projects being given the greenlight, including the US$2.5bn Anaklia Deep Sea Port and Special Economic Zone, the Baku-Tbilisi-Kars Railway and ongoing railway track modernisation work. Taken together, these projects are not only seen as representing major steps forward for Georgia’s international connectivity, but also as playing a key role in the country’s evolution from being a simple transit hub to becoming a true regional logistics and industrial centre. Hong Kong investors and professional service providers, of course, could clearly play a huge role in facilitating this ambitious and capital-intensive reinvention process.

A Leading Reformer in Europe and Central Asia

Georgia, which borders Russia to the north, the Black Sea to the west and Turkey, Armenia and Azerbaijan to the South, is a leading reformer and significant emerging Caucasian market. According to the World Bank, it has implemented 47 business-friendly reforms in the past 15 years, topping the ranking of European and Central Asian countries.

Owing to these reforms, all tax procedures and customs clearances in the country are now web-based and unified under one tax code. This has reduced the average number of days and procedures to register a new business greatly, from 25 days and nine procedures in 2003 to just two days and two procedures now.

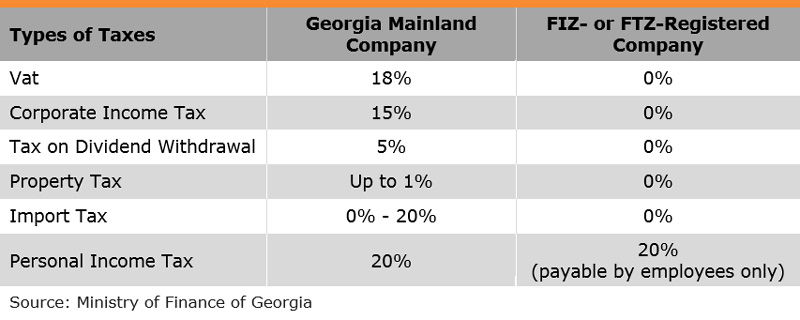

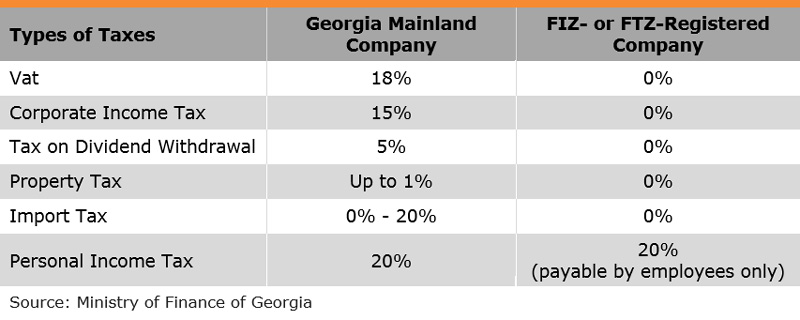

The 2005 tax code changes were especially significant, transforming the country’s fiscal landscape. The types of taxes applicable in Georgia were slashed from 21 in 2004 to six simple, flat taxes with rates so low that the country has once been ranked fourth in the world (after Qatar, the UAE and Hong Kong) in terms of how much it taxes its citizens. Today, to introduce new taxes or increase existing rates, the Georgian government would have to call a national referendum as required by its constitution.

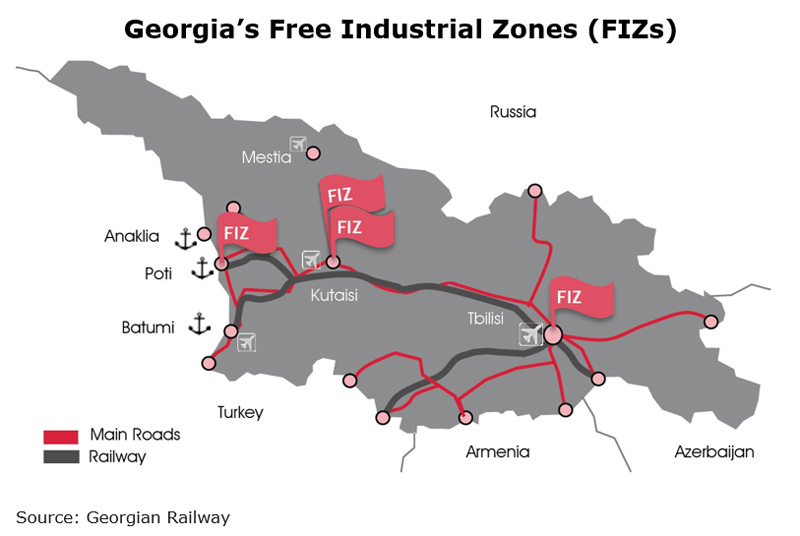

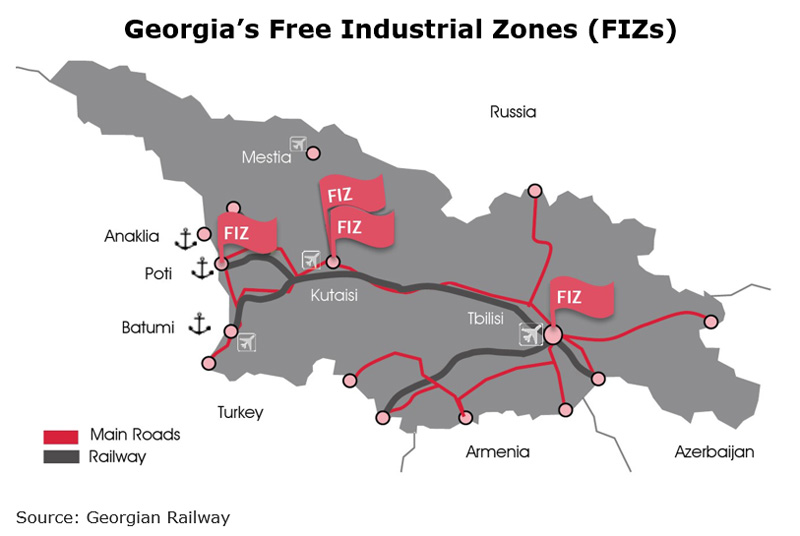

While most of the taxes are already exempted in the country’s four free industrial zones (FIZs) and two free tourism zones (FTZs), the Georgian government also introduced a new growth-oriented model of corporate income tax in 2017. The relevant tax payment is postponed or deferred until actual profit distribution in a bid to promote re-investment of earned profits into existing and/or new business endeavours.

The reform-driven economic success has helped Georgia lay a solid foundation for continued economic progress. In the two decades ending 2017, the country registered an average economic growth of more than 5%, a pace far higher than many of its Commonwealth of Independent States (CIS) peers, such as Russia, Ukraine, Belarus and Kyrgyzstan.

A Staunch Supporter of Free Trade

Georgia, given its strategic geographical location and dearth of natural resources beyond agribusiness, has developed a transit-oriented economy, where up to 60% of the cargo flows the country handles are actually in transit. This is in stark contrast to its Caucasian neighbours, such as Russia and Armenia, which are rich in mineral resources such as oil and gas, iron, copper, molybdenum, lead, zinc, gold, silver, antimony, aluminium, as well as other rare metals.

To facilitate trade and strengthen its role as a transit hub, Georgia supports free trade and has entered into an extensive network of FTAs. Agreements are in place with most, if not all, of its key trading partners, including European Union (EU) and CIS countries, European Free Trade Association (EFTA) members, Turkey, Mainland China and Hong Kong. Apart from the unfettered market access to a 2.3 billion-strong market under this web of FTAs, Georgia also enjoys preferential Generalised System of Preferences (GSP) treatments on some 3,400 products from Canada, Japan and the US.

As a historic step in the continued effort to support the BRI, Georgia signed the FTA with Mainland China in May 2017, coming into force on 1 January 2018. The Sino-Georgia FTA is not only the first FTA China has signed with a Eurasian country, but also the first Chinese-initiated FTA since the BRI was put forward in 2013.

Under the Sino-Georgia FTA since 1 January 2018 Georgia imposes zero tariffs on 96.5% of mainland products, covering 99.6% of the total imports from Mainland China. The mainland imposes zero tariffs on 93.9% of Georgia’s products, covering 93.8% of China's total imports from Georgia, of which 90.9% of product types (taking up 42.7% of imports) will have zero tariffs immediately and the remaining 3% of product types (51.1% of imports) will be phased out within five years.

In a similar vein, Hong Kong and Georgia signed an FTA on 28 June 2018, scheduled to come into effect by the end of the year, after completion of the necessary procedures. The Hong Kong-Georgia FTA is comprehensive in scope; encompassing trade in goods, trade in services, investment, dispute settlement mechanisms and other related areas in 18 chapters. On coming into effect, Georgia will eliminate all import tariffs for products of Hong Kong origin, with the exception of 3.4% of tariffs lines, comprising mainly agricultural products, such as a fruits and nuts and their preparations, as well as beverages and spirits, due to domestic sensitivity.

In addition to merchandise trade, both Sino-Georgia and Hong Kong-Georgia FTAs have chapters for trade in services, under which both sides will further open their markets to each other on the basis of their WTO commitments. Broad consensus has been reached in many fields, such as environment and trade, competition, intellectual property, investment and e-commerce.

These FTAs will bring legal certainty and better access to the Georgian market for Hong Kong and mainland businesses, while offering potential opportunities as a gateway to the Caucasian region of Eurasia covered under the BRI. They will also enhance trade and investment flows between Hong Kong, the Chinese mainland, Georgia and the greater Eurasian region.

Unique Taste and Fashion Ready for Export

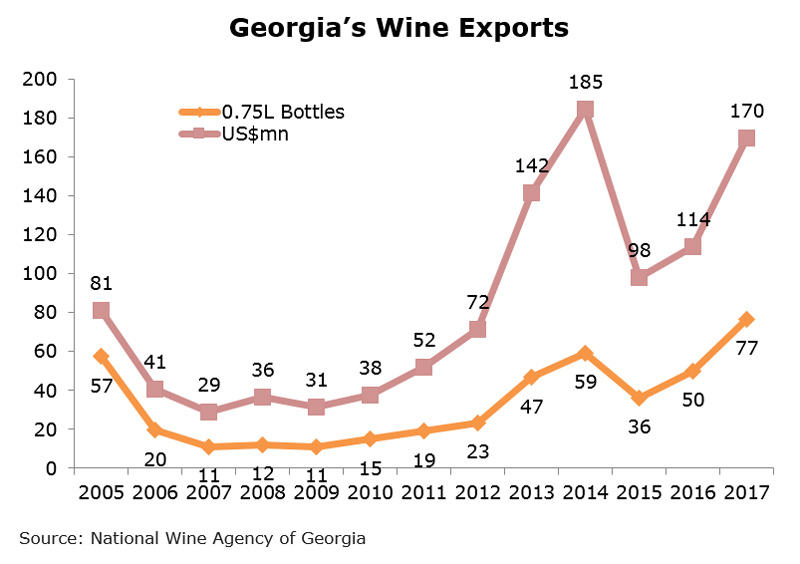

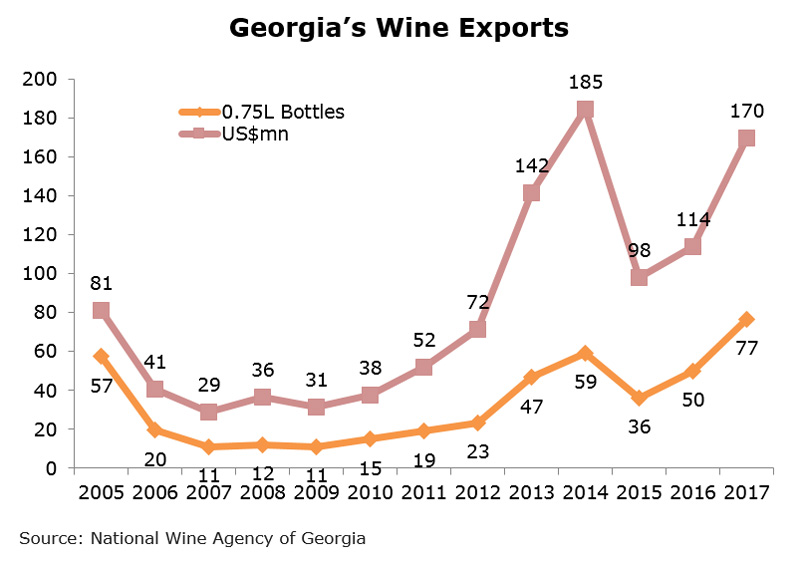

Among the many export sectors likely to benefit from the new FTAs are Georgia’s wine, food and fashion industries. Georgia has an 8,000-year wine-making history and 525 indigenous grape varieties, such as Kristel, Mtsvane and Saperavi highly popular in former soviet republics, but novel to many Asian drinkers. Georgian wine has already become a rising star in the Chinese wine market, with exports increasing exponentially since 2008[1]. Last year, the mainland, buying 7.6 million bottles of Georgian wine, became its third largest wine export market after Russia and Ukraine.

Riding on the success in the mainland, Georgian winemakers are looking for new growth opportunities in the burgeoning Asian market. Some of them, with the state support from the National Wine Agency of Georgia, have been actively exhibiting in wine fairs, organising wine-tasting activities and appointing agents/distributors in the region. Exports aside, the National Wine Agency of Georgia is also keen on promoting wine-related investment opportunities in Georgia to Asian investors.

Irakli Cholobargia, Head of the Marketing and Public Relations Department of the National Wine Agency of Georgia, said: “Although there are more than 500 companies producing wine in Georgia, only about 25 out of the country’s 525 indigenous grape varieties have been widely used in the industry. There is plenty room for growth and foreign investment.”

Hong Kong, with zero duty and duty-related customs/administrative controls for wine as well as widely-recognised neutrality in trading and promoting wine is a ready trading and distribution hub for Georgia wine in Asia. Hong Kong can also offer a good platform for Georgia winemakers to meet prospective Asian investors who are now the prime movers in global wine investment, with a growing appetite not just for fine wines, but vineyards and wineries.

Wine aside, Georgia, with 22 micro-climates varying from cool and dry to warm and humid, was also seen as a quality food supplier during soviet era. Nowadays, Georgian fresh fruits and vegetables are still well-regarded as healthy and of good quality in the CIS region. Also, the country’s traditional delights, such as the sausage-shaped churchkhela[2] confectionary and Borjomi fizzy mineral water, are reportedly gaining more attention from the increasingly health-conscious consumers worldwide.

Long dubbed the culinary capital of Asia, with some 14,000 restaurants serving an array of cuisines from all over China, the rest of Asia and the world, Hong Kong can be a good showroom for Georgian food companies to launch into Asia. In particular, Hong Kong businessmen, who have a good understanding of mainland consumer tastes, can help Georgian food exporters show how their produce can be used with Asian ingredients and culinary skills to complement favours found in Asian cuisines.

In addition to agribusiness, design – including fashion – is booming in Georgia, as the government promotes the use of modern design to convey core values, such as administrative transparency. This goes hand in hand with Georgian consumers, especially the younger generation, becoming more fashion savvy. This demand is driven by increases in income as well as a reaction to the soviet era when outfits tended to be more standardised.

The greater willingness and ability to spend on fashion has also led to the emergence of a number of designer brands such as Avtandil and Rosebud that have built a following in both the domestic and international markets. Given their relatively small production volume, they usually either only sell online or rely on fashion houses and showrooms in West Europe (including Milan and Paris) to reach out to Asian fashion lovers. These budding fashion brands are therefore ready clients for Hong Kong fashion traders able to offer extensive industry knowledge and distribution networks in the Asian region.

Growing Chinese Foothold in Georgian Trade and Investment

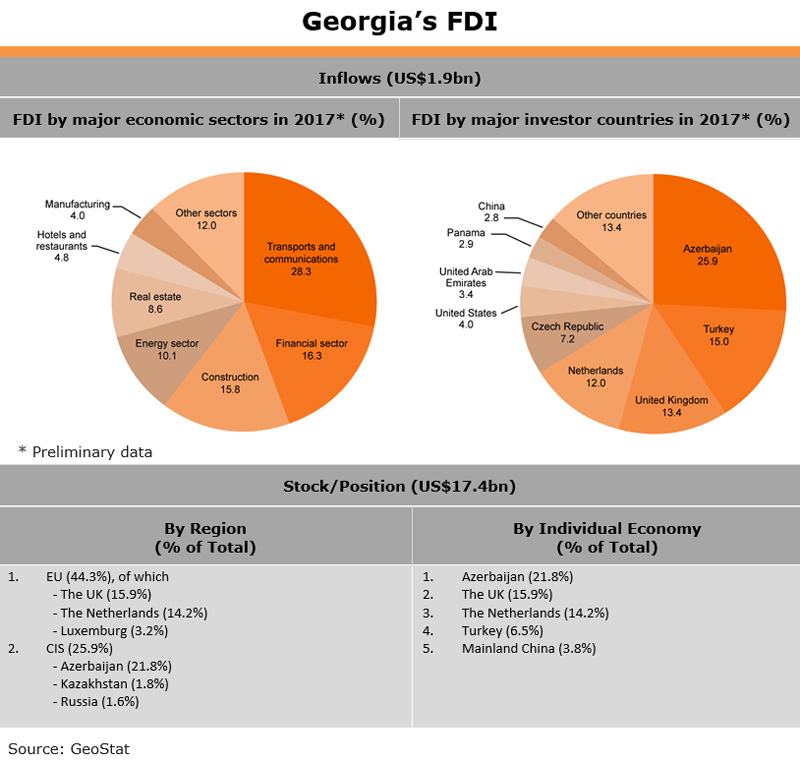

Given the geographical proximity and historic ties, CIS members, EU countries and Turkey are Georgia’s principal trading partners. In 2017, these key partners accounted for 75% of Georgia’s total trade. Thanks to the BRI and wider presence of Chinese enterprises in Georgia, the mainland has fast gained a foothold in Georgia and has become the country’s biggest Asian trading partner.

Last year, Mainland China was Georgia’s fifth-largest export market and third-largest import source, accounting for 7.6% of the country’s total exports and 9.2% of its total imports. Hong Kong sold US$103 million worth of goods to Georgia and bought US$6.3 million in 2017, accounting respectively for 0.2% and 1.3% of Georgia’s total imports and exports.

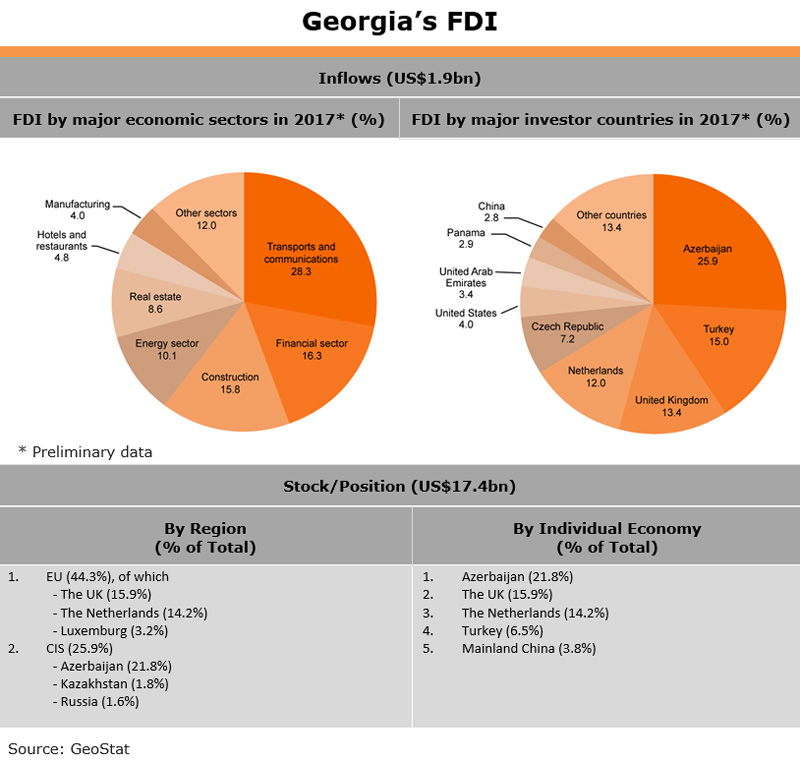

The growing Chinese presence permeates not only in trade, but also investment in Georgia. In spite of a similar EU and CIS dominance, the mainland is estimated to have grown to be the country’s fifth-largest foreign investor, growing from a US$590 million position in 2015 to US$656 million in 2017. An estimated US$51.9 million of the US$1.9 billion annual FDI inflow to Georgia last year came from China, accounting for some 2.8% of the total.

Falling largely in line with Georgia’s economic strengths, Chinese investors have a diversified investment portfolio in the country. Investment span many different sectors such as infrastructure development, engineering contracting, project contracting, trading, banking and finance, hospitality and real estate, telecommunication, forest resources development, building materials processing, manufacturing, renewable energy and mineral exploitation.

Examples of leading Chinese investors in Georgia include Xinjiang Hualing Group Corporation, CEFC China Energy, Sichuan Electric Power Import and Export Company, China State Grid International Development Corporation, Georgia Sinohydro, China 20th Metallurgical Construction Co., Ltd., Huawei Technologies, ZTE Corporation and Manzhouli Heyuan Economic and Trade Co., Ltd.

As the largest Chinese investor in Georgia, Xinjiang Hualing Group Corporation, for example, has already realised eight projects, including a landmark real estate development in Tbilisi, the capital. The Youth Olympic Village was converted into a residential and commercial complex, comprising Hualing Tbilisi Sea New City, Hualing Tbilisi Sea Plaza and Hualing Hotels & Preference Tbilisi, with abundant warehousing, retailing, wholesaling and meetings, incentives, conferences and exhibitions (MICE) capacity.

Source: Hualing Group

In consonance with Georgia’s vision to transform itself from a logistic junction into an industrial hub, Hualing has also strengthened its investment in the country’s manufacturing sector by taking a stake in the Kutaisi Free Industrial Zone (FIZ). This, together with CEFC China Energy’s recent investment in Poti FIZ on the eastern Black Sea coast to build an export hub for Chinese goods and services to Europe and Central Asia, has made Chinese investors vital for the future of two of the country’s four FIZs, and important partners in realising Georgia’s industrial potential.

Also worth noting is the growing visibility of Chinese investors in Georgia’s banking and finance sector. A good example is Hualing’s purchase of the Basis Bank in 2012, with an aim to grow RMB cross-border settlement businesses between China and Georgia. This was to facilitate bilateral trade and investment, and became one of the leading cases of Chinese private enterprises purchasing commercial banks abroad.

On a similar note, CEFC China Energy is reportedly planning to work with the Georgian government to set up a Georgian Development Bank. This will bolster RMB-denominated financial services and cross-border RMB settlement, while co-operating with the Georgian National Sovereign Fund to establish a Georgian Construction Fund to invest in financial services for projects such as roads, electric power, telecommunications and other infrastructure.

Also of interest to Chinese investors are the country’s strategic infrastructure projects, including hydropower plants and the ongoing railway modernisation. The recognition gained by a handful of Chinese investors and builders, such as China Railway 23rd Bureau Group, taking part in various signature projects in Georgia, will give Chinese investors a better position in the country’s future infrastructure development.

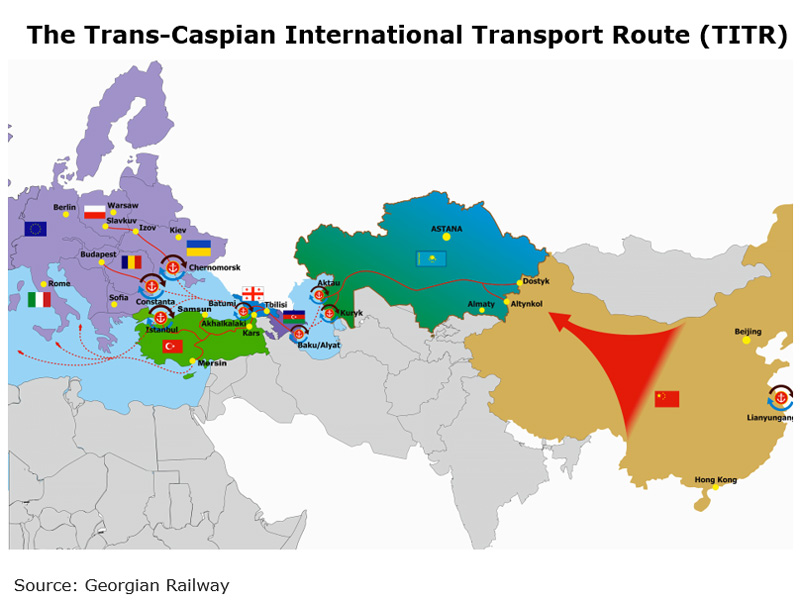

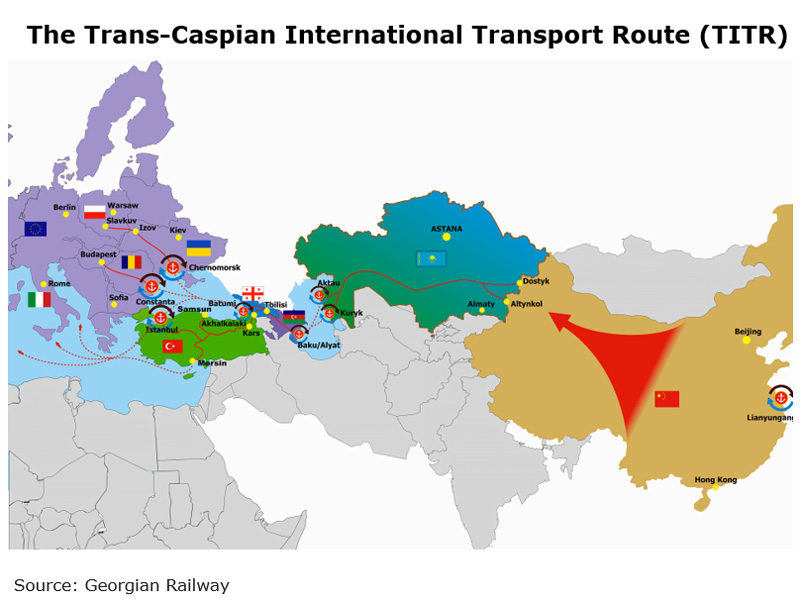

Situated on the shortest land route between China and Europe and being a key component of the Trans-Caspian International Transport Route (TITR) or the Middle Corridor, which stretches from Southeast Asia and China to Europe via Central Asia and the Caspian Sea, Georgia is an important BRI partner. Its strategic role as a logistic hub has been further strengthened with the October 2017 opening of the Baku-Tbilisi-Kars (BTK) railway route, which starts on the Caspian Sea in Azerbaijan and runs through Tbilisi and the eastern part of Turkey before merging with the Turkish and European railway systems.

Cargo trains from North-West China can now take as little as eight days to reach Georgia’s Black Sea coast, compared to sea voyages which can take up to 45 days. But to realise the target of receiving more than 250 cargo trains in 2018 and fully exploit the BTK, further local road and rail infrastructure enhancement work would have to be carried out in order to better connect the domestic rail networks and industrial facilities with the BTK. The route has a current annual capacity of 1 million passengers and 5 million tonnes of freight and the potential to expand to 3 million passengers and 17 million tonnes of freight.

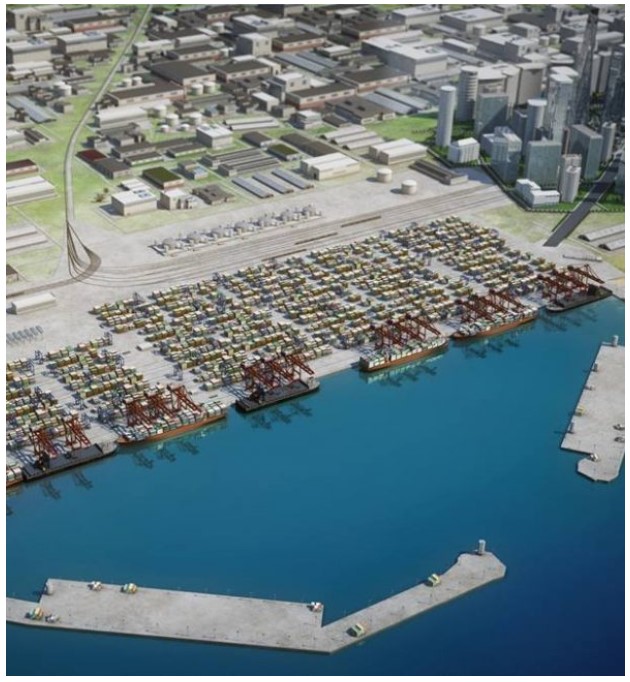

Source: Anaklia Development Consortium

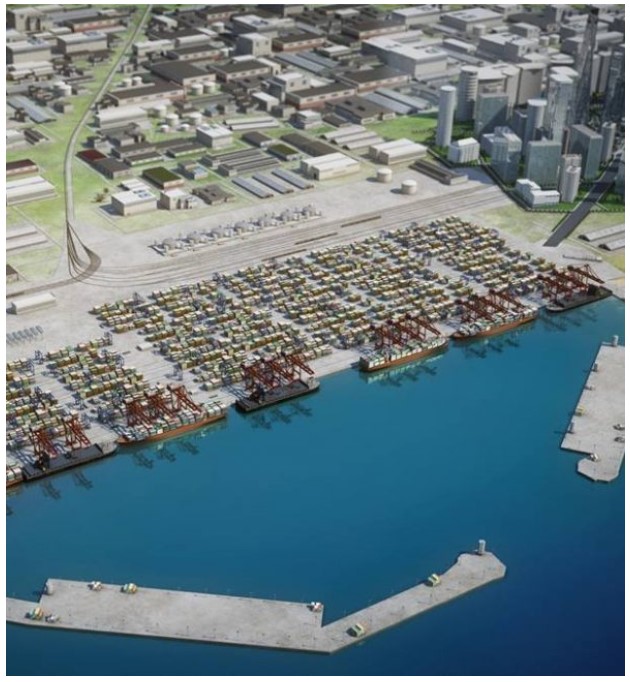

High on the country’s keynote project list is the US$2.5 billion Anaklia Deep Sea Port and Special Economic Zone (SEZ) project. This is the first deep sea port and the largest greenfield maritime infrastructure development in Georgia’s history, marking the beginning of the country’s transformation from a transit economy into a regional logistics and industrial hub capable of attracting Panamax and Post-Panamax vessels from Asia and Europe.

Under the 52-year build-own-transfer (BOT) concession agreement, the Georgian government has committed US$120 million for the construction and development of railway and road transportation links connecting the port to the region to help establish a new maritime trade corridor from Asia to Europe. Expected to receive the first vessels by 2020, the port will open new trade routes to the landlocked Caucasus, Caspian and Central Asian regions and provide badly-needed[3] infrastructure to support regional economic and trade development there.

Anaklia SEZ is close to the port and boasts an initial land plot up to 400ha, with the possibility of expanding to a city-scale project of up to 2,000ha. As a pioneering step to promote the development of light manufacturing and assembly, logistics, warehousing, distribution centres, retail and other service businesses, the SEZ will not only feature a green and smart city concept, but also enjoy a special status to provide a more favourable regulatory environment and tax system (e.g. British Common Law, international arbitration, IP laws, etc.).

Highlights of the Anaklia Deep Sea Port and SEZ Project

| Anaklia Deep Sea Port | Anaklia City and Special Economic Zone |

| Build-own-transfer (BOT) with a 52-year concession | Special Economic Zone (SEZ) adjacent to the deep-sea port site |

| 340ha port development area | Initial project land plot up to 400ha, with expansion to a city-scale project up to 2,000ha |

| Port depth of 16m CD | Focus on light manufacturing, logistics, warehousing, manufacturing and assembly, distribution centres, retail and other essential businesses |

| 14mn tonne capacity by 2030 (Phases 1 & 2) | New legislation to provide regulatory grounds for Anaklia City and Special Economic Zone development |

| Able to accommodate vessels up to 10,000 TEU | Green and Smart City concept with full pledge on urban and spatial planning from the outset |

| Up to 100mn tonne annual capacity following completion of all development phases | |

| Total cost estimated at US$2.5bn in nine development phases |

Source: Anaklia Development Consortium

As a long-term project with nine development phases spanning over more than 50 years, the Anaklia Deep Sea Port and SEZ is set to become a focal point for not only international businesses exploring new manufacturing relocation and regional distribution possibilities, but also investors looking for lucrative investment opportunities and partnerships in Georgia for many years to come.

In order to reach out to prospective investors across Asia and in other Belt and Road- connected regions, the Anaklia Development Consortium participated in the 2018 Belt and Road Summit in Hong Kong. The same event saw the signing of the Hong Kong-Georgia FTA and the promotion of the Anaklia Deep Sea Port and SEZ project to a 5,000-strong audience of investors, project operators and service providers from 55 countries and regions.

[1] According to Meiburg Wine Media, Georgia’s wine exports to China have been growing at an annual rate of more than 100% since 2008.

[2] Churchkhela is made from natural grape juice and different kinds of nuts.

[3] Existing Georgian ports are expected to reach full capacity limit with five years.