Nordic Opportunities: FinTech Developments

Nordic Opportunities: FinTech Developments

With deep roots in information and communications technology (ICT) innovation and application, Nordic countries lead in many financial innovations, such as e-banking, e-invoicing, digital wallets, mobile money and ‘cryptocurrencies’. Attracting a total investment of US$390 million in the 15 months ending March 2016, the Nordic financial technology, or ‘FinTech’, industry has been fast developing into the region’s most popular investment.

Accounting for a lion’s share of FinTech start-up investments in the Nordics, Sweden is the third largest FinTech hub in Europe, trailing only the UK and Germany, while Finland is a global leader in electronic invoicing and Denmark is on track to become the world’s first cashless nation.

Fundamentals for FinTech success

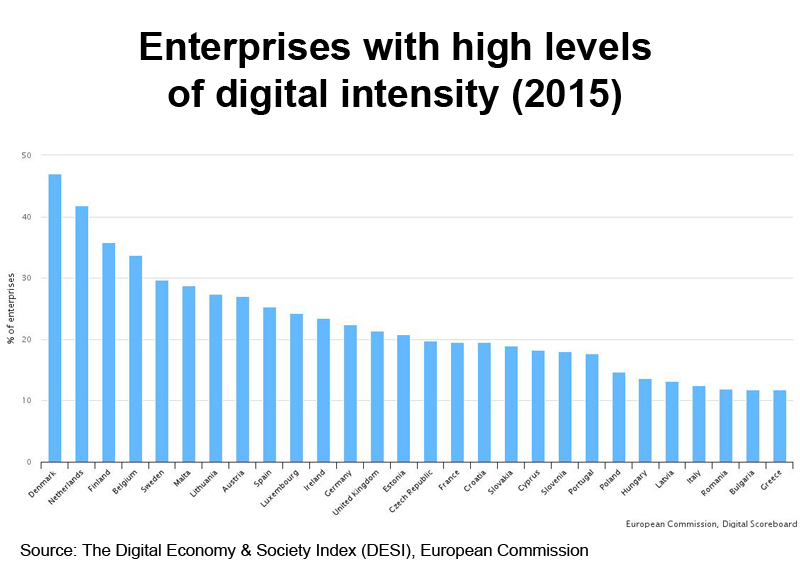

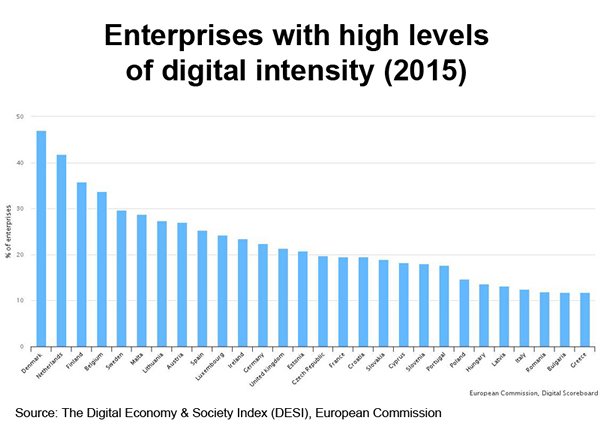

From the first 3rd Generation (3G) mobile phone licences (March 1999, Finland) to the success of mobile phone giants such as Nokia (Finland) and Ericsson (Sweden) and the EU’s highest corporate digital intensity (Denmark), Nordic countries are often described as perennial e-readiness leaders, jockeying for position and carrying out cutting-edge research and development in next-generation mobile telecommunications standards, such as 5G.

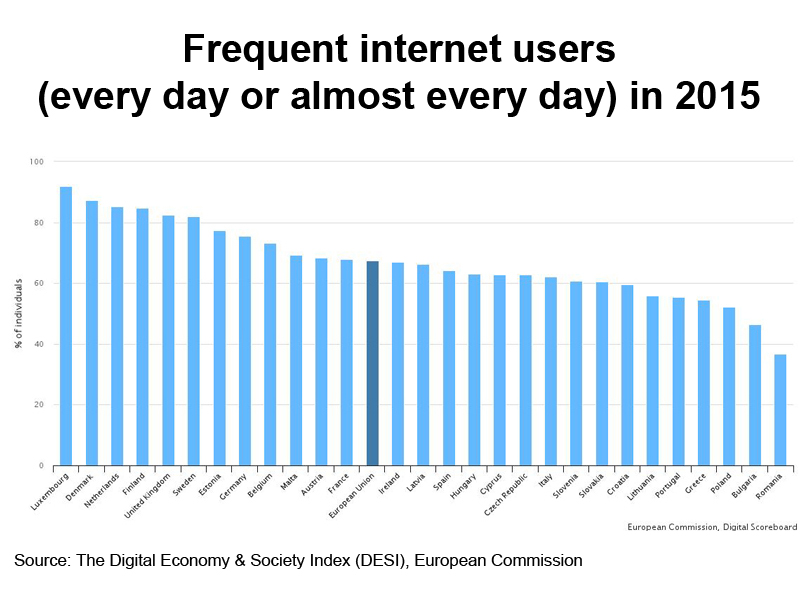

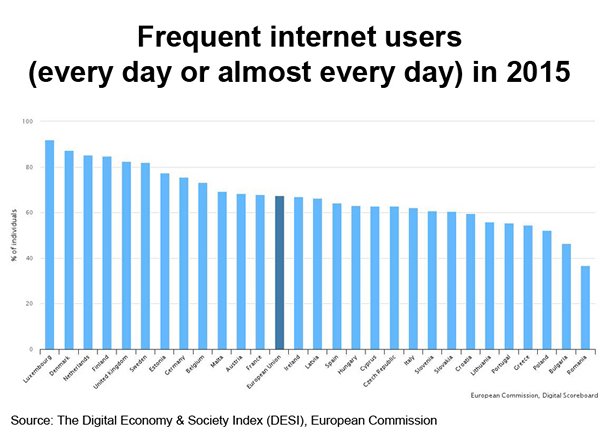

Boasting such advanced digital economies, Nordic countries like Denmark, Finland and Sweden have all the fundamentals to fast-track FinTech development. Riding on the solid ICT infrastructure, Nordic people have become adept, frequent internet users and early adopters of e-services, making them ready targets for FinTech developers.

Close to becoming a cash-free economy (e.g. bills and coins represent only 2% of Sweden’s economy, compared with 8% in the US and 10% in the Eurozone, while Denmark has a stated goal of “eradicating cash” by 2030), most Nordic countries see remarkable acceptance of not only online service orders and electronic payments, but cryptocurrencies (digital money or e-money) such as Bitcoin.

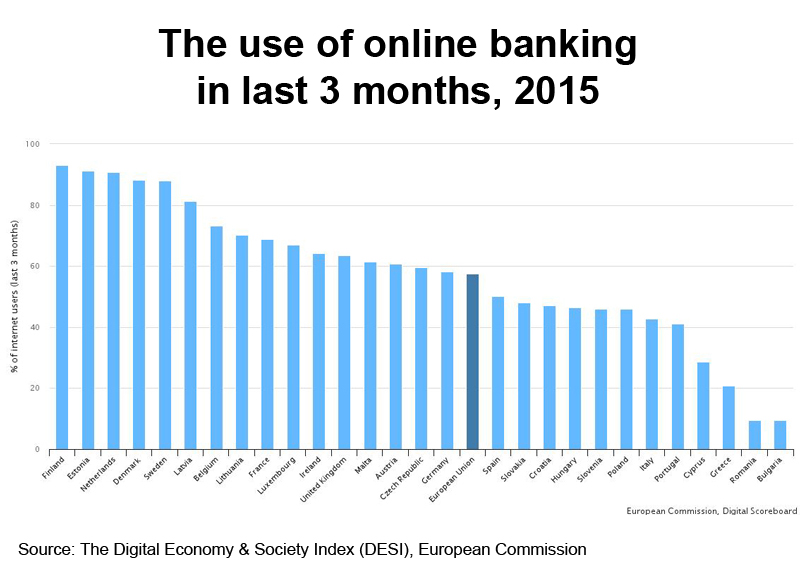

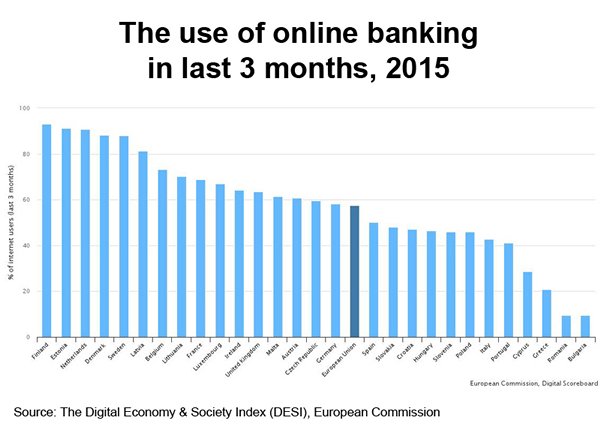

Thanks to promotion of electronic public services by Nordic governments and sound regulatory frameworks in the region’s banking and finance sector, most Nordic consumers are not only highly receptive in making online purchases such as holiday accommodation, travel plans and event tickets, but also readily use banking and managing savings, insurance and other financial plans such as crowd-funding over the Internet.

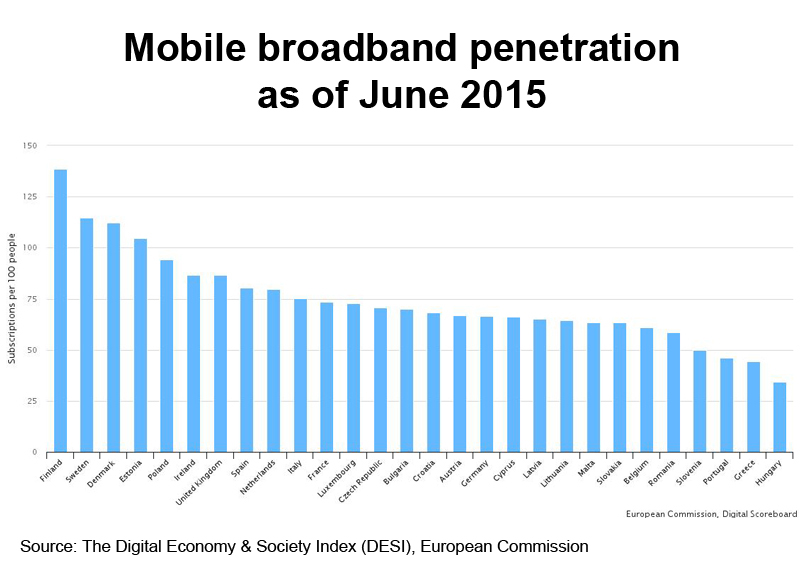

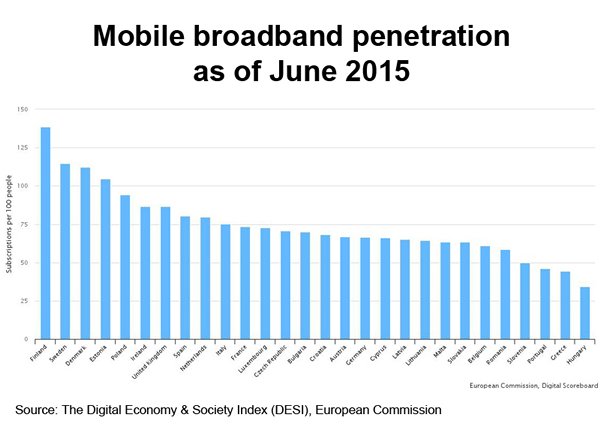

Complementing the trend is the region’s high mobile broadband penetration. Having the highest number of active mobile broadband SIM cards per 100 people in the EU, Nordic countries are fast following the trend of accessing the internet via smartphones. This, in turn, makes e-banking, e-insurance, e-securities and other FinTech applications more commonplace and readily accessible to their target audience.

Aside from the individual level, Nordic enterprises are also frontrunners in driving the digital revolution by unlocking the power of new, visionary concepts such as the Internet of Things (IoT) and Big Data. Electronic supply chain management, e-invoicing, enterprise resource planning (ERP) or customer relationship management (CRM) software, social media and web sales are commonplace among Nordic companies, providing FinTech developers a ready clientele to promote their innovative offers and a steady stream of fund for both start-ups and scale-ups.

A vibrant FinTech scene

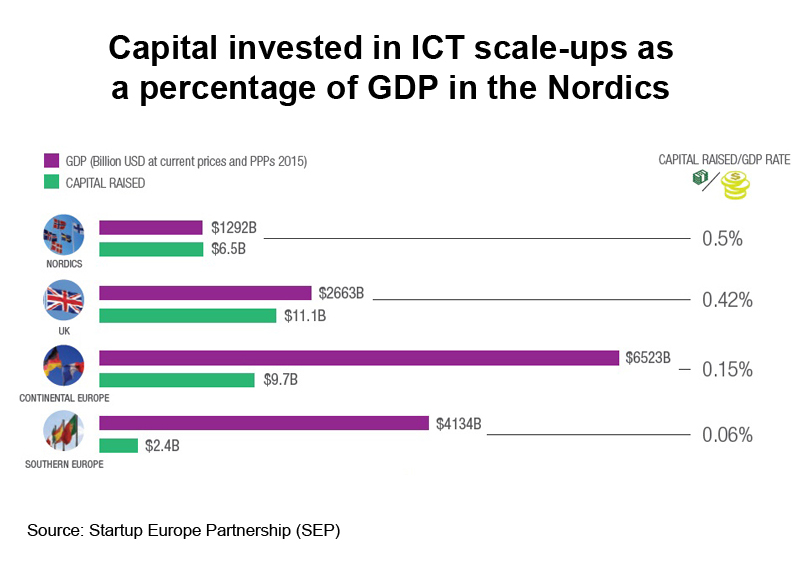

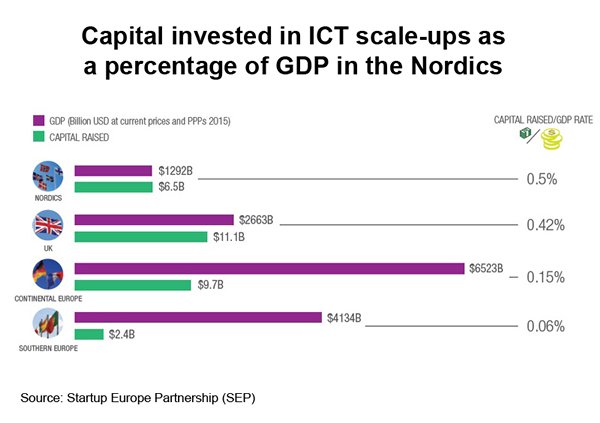

Established by the European Commission in January 2014, Startup Europe Partnership (SEP), a pan-European platform dedicated to transforming start-ups into scale-ups, describes the Nordics as a vital and productive start-up ecosystem for ICT players. Apparently, that the Nordics have injected more of their GDP into ICT scale-ups than other parts of Europe, creating a favourable scene for FinTech development.

According to data from The Nordic Web, a resource on venture capital for the Nordic start-up scene, 51 FinTech investments of US$390 million were tracked in the Nordics in the 15 months ending March 2016, making the emerging financial service sector the most attractive investment segment in the region for the first time.

Out of those 51 investments, 32 were made in Sweden, eight in Finland, five in Denmark and four in Norway, while nearly one in 10 investments in the Nordics is currently made in the field of FinTech. Such an encouraging investment landscape has not only made Sweden the third-largest FinTech hub in Europe, after UK and Germany, but highly conducive to FinTech research and development in the Nordic region as a whole. This, coupled with the strongly export-oriented Nordic economies, makes Nordic countries an unequalled partner for both greenfield and brownfield FinTech projects.

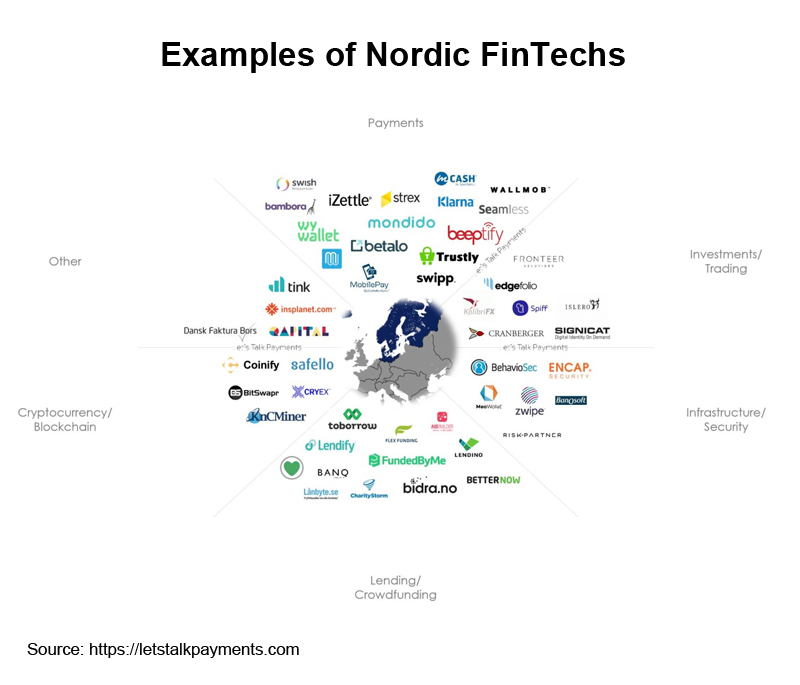

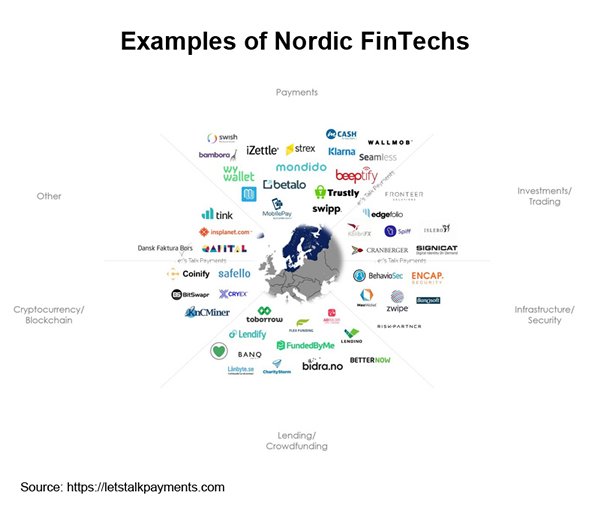

While the majority of Nordic FinTech investments are still in their infancy with investment mostly in the US$1-3 million range, first fruits of Nordic’s FinTech success include Sweden’s iZettle (mobile payment solutions), Klarna (payment solutions to e-stores) and FundedByMe (crowd-funding), Denmark’s Coinify (Bitcoin services) and Holvi (company banking solutions) and Finland’s Zervant (e-invoicing solutions). Given their small home market, most of these fast-growing Nordic FinTech companies have expanded overseas to find markets as well as in search of investment to further scaling up, creating a good environment for Hong Kong-Nordic collaboration.

A way forward for Hong Kong-Nordic FinTech collaboration

With respect to the Nordic’s vibrant FinTech scene, although Hong Kong is yet to evolve into the most attractive destination for greenfield FinTech projects, it can serve as a risk manager, assisting Nordic FinTech companies in screening prospective investors from the Chinese mainland and other parts of Asia. This is particularly useful when Nordic companies encounter problems with potential Chinese mainland investors, and when it comes to advising on such highly sought-after resources as government incentives and incubation schemes, accelerators, angels and venture capitalists, which are commonplace in Hong Kong but less so in Europe.

Sharing many similarities with the Nordics with respect to ICT, Hong Kong, as a free, well-connected and competitive economy with robust ICT infrastructure, is a leading digital economy, consistently achieving top rankings in e-readiness and internet access capabilities. The city’s broadband networks cover nearly all commercial and residential buildings in the territory, with household (84.0% as of Feb 2016) and mobile penetration rates (229% as of Feb 2016) ranking among the highest in the world.

The success of the FinTech industry in London over Silicon Valley and New York highlights the importance of proximity to a healthy financial centre, alongside a rich pool of talent and strong government/regulatory support. Similar patterns have also been observed in the Nordic FinTech field, with Sweden dominating the scene. Hong Kong, positioned as a major international financial centre and the premier capital formation centre for the Chinese mainland, therefore possesses all the ingredients for a FinTech hub.

As a long-time enabler for overseas services providers to develop products that are not just made for domestic market demand, but potentially transferable between geographies in Asia, the local knowledge of Hong Kong financial companies is a valuable resource for Nordic FinTech companies in the process of localising their technology to cater to the peculiar needs of the burgeoning Asian market as well as other Belt and Road economies which are striving for better physical as well as virtual connectivity.

The growing middle class in the Chinese mainland plus the Chinese government’s drive, under the 13th Five-Year Plan, towards the development of high-speed and safe next-generation ICT infrastructure, as well as quickening the pace of implementing the “Internet +” action plans and developing IoT and big data technology and applications, is set to create a wealth of opportunities for FinTech companies.

Given also the unprecedented pace of e-commerce adoption and the dire need for lucrative investment opportunities and diversified financial products among cash-rich Chinese enterprises and individuals, the demand for convenient, reliable FinTech solutions, such as crowd-funding or alternative banking platforms will see a hefty increase as people’s receptiveness to financial innovation grows and mobile broadband penetration is expected to reach 85% by 2020 from 57% in 2015.

By representing Nordic FinTech start-ups and helping them find partners in Hong Kong and the Chinese mainland, connecting them with relevant financial sector regulators and guiding them through setting up procedures such as business registration, incentive application and contract signing (e.g., the inclusion of the arbitration clauses stipulated by the home-grown Hong Kong International Arbitration Centre), Hong Kong’s financial services companies can be ideal facilitators of Sino-Nordic FinTech projects.

| Content provided by |

|