GDP (US$ Billion)

191.36 (2018)

World Ranking 54/193

GDP Per Capita (US$)

70,379 (2018)

World Ranking 7/192

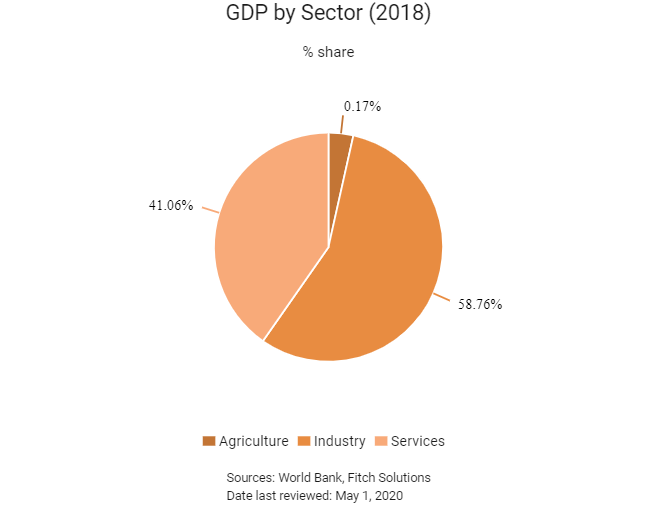

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

86.5 (2019)

Currency (Period Average)

Qatari Riyal

3.64per US$ (2019)

Political System

Constitutional emirate

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

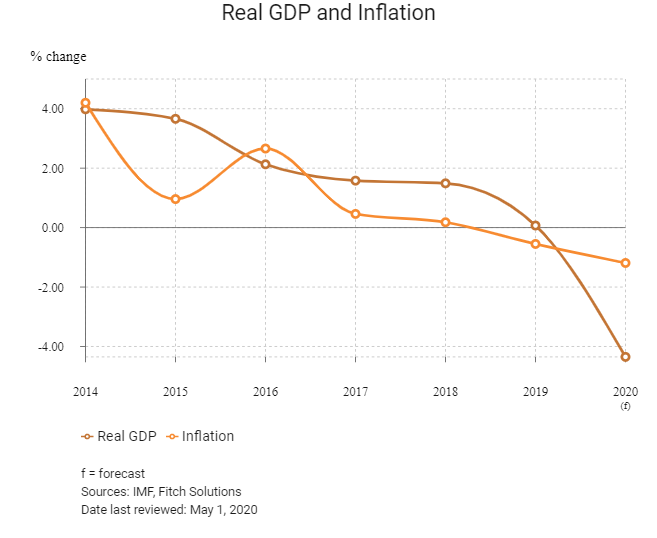

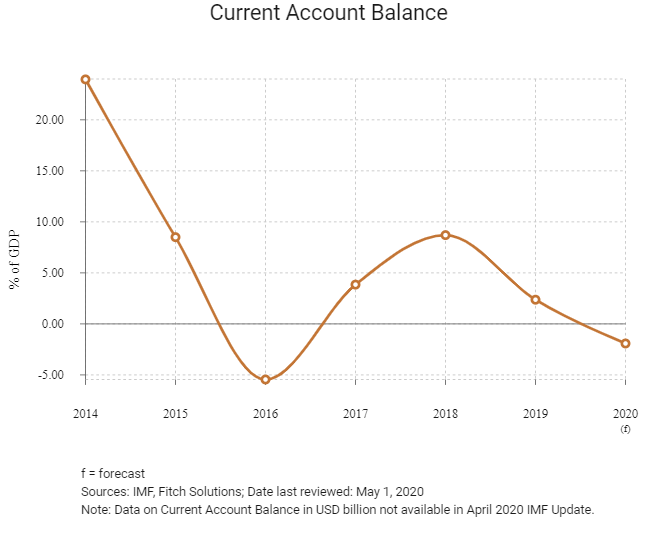

Economic growth in Qatar will be supported by spending on the multi-year infrastructure upgrades ahead of the FIFA World Cup and the USD10 billion Barzan natural gas facility which comes online in 2020. Government investment in economic diversification initiatives will continue apace even as hydrocarbon output is set for moderate expansion. Under the Qatar National Vision 2030 some USD16.4 billion in infrastructure and real estate investment is planned over the next four years to help offset falling FIFA-investment spending. Qatar will also increase liquefied natural gas (LNG) capacity by more than a third. Qatar's peg to the US dollar means that monetary policy will continue to track the United States Federal Reserve's tightening cycle. Government efforts to ease the costs and lighten the effects of the blockade on the population will likely limit the scope for cutting spending.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

January 2018

In a bid to boost non-Gulf Cooperation Council (GCC) foreign investment (especially in the wake of the GCC crisis), Qatar passed a new foreign investment law in January 2018 (which came into effect from March 2018). This law removed the 49% cap on foreign ownership of businesses in Qatar in a wide variety of sectors.

March 2018

The CEO of the Qatar Financial Centre announced that Qatar was looking to attract investment from Asia. Qatar announced plans to make it easier for foreigners to obtain work visas and purchase real estate within its borders.

January 2019

Qatar withdrew from the Organization of the Petroleum Exporting Countries, following an earlier announcement in December 2018 citing a move towards a greater reliance on gas exports rather than petroleum.

September 2019

The IAAF World Athletics Championships were hosted successfully in Doha.

September 2019

A survey by Qatar's Ministry of Planning and Qatar Bank revealed that foreign investment in Qatar rose 11.3% at the end of the three months to June compared with the same period in 2018.

October 2019

The International Labour Organisation (ILO) stated that by January 2020 Qatar would have legislated against the 'kafala' system and would introduce the region's first 'non-discriminatory minimum wage'. The news came in the wake of reports of unsafe working conditions on several World Cup stadium construction sites.

October 2019

Doha commissioned a carbon capture-and-storage plant that aimed to sequester five million tonnes of carbon dioxide from LNG facilities by 2025. The energy minister also invited foreign energy companies to submit bids to help to expand the world's largest natural gas field.

January 2020

Qetaifan Projects signed a memorandum of understanding with ADMARES Construction and Trading for the construction of 16 floating hotels in Qatar. ADMARES would build and operate the hotels on the shores of Qetaifan Island North, which would accommodate fans during the FIFA World Cup 2022. The Sigge Architects-designed hotels would be identical, with each having a length of 72m and width of 16m. Each four-storey hotel would have 101 guest rooms, a restaurant and a lounge bar.

January 2020

Hyundai Engineering and Construction Co secured a construction contract worth KRW613 billion (USD527 million) from Lusail Real Estate Development Company for an office tower project in Qatar. To be located in Lusail City Financial District, the development comprised a 70-storey office building with five underground floors. Construction was scheduled to be completed by the end of October 2022.

February 2020

Qatar Company for Airports Operation and Management (Matar) unveiled plans for the ongoing two-phase expansion works at the Hamad International Airport. A joint venture (JV) between Midmac Contracting, TAV Tepe Akfen Investment Construction and Taisei Corporation was working on the construction of a 140,000sq m passenger terminal building and a central concourse building, among others. The expanded terminal would have a total area of 240,000sq m. The first phase of airport expansion project would enable the airport to handle more than 53 million passengers each year by 2022. The second phase would increase to capacity to more than 60 million passengers.

March 2020

Qatar’s QAR75 billion (USD20.6 billion or about 13% of GDP) package to reduce the effects of Covid-19 was announced on March 16. The programme aimed at shoring up small businesses and hard-hit sectors (hospitality, tourism, retail, commercial complexes and logistics), including through six-month exemptions on utilities payments (water, electricity). Logistics areas and small and medium industries were exempt from rent payments for six months. Food and medical goods were exempt from customs duties for six months (provided that this was reflected in the selling price), and the price and profits for sanitizers and antiseptics had been set. Migrant workers who were in quarantine or undergoing treatment would receive full salaries.

March 2020

The Qatar Central Bank (QCB) lowered its policy rates twice in March in line with the US Federal Reserve (to maintain the currency peg). The deposit rate had been reduced by 100bps to 1%; the lending rate had been reduced by 175 bps to 2.5%; and repo rate had been reduced by 100 bps to 1.5%. The QCB would also provide additional liquidity to banks operating in the country through a special repo window at zero interest rate for postponing loan instalments or granting new loans. QCB put in place mechanisms to encourage banks to postpone loan instalments and obligations of the private sector with a grace period of six months. The Qatar Development Bank would postpone instalments of all borrowers for six months. Qatar Islamic Bank was providing interest free loans to private companies under the National Guarantee Program funds of QAR3 billion (USD815,000). The Qatar Financial Centre cut the rate on late tax payments to zero from 5% until September 1, 2020. In addition, the deadlines for filing taxes and audited financial statements had been extended. Government funds had been directed to increase investments in the stock market by QAR10 billion (USD2.75 billion).

Sources: BBC Country Profile – Timeline, The Guardian, Al Jazeera, IMF, Fitch Solutions

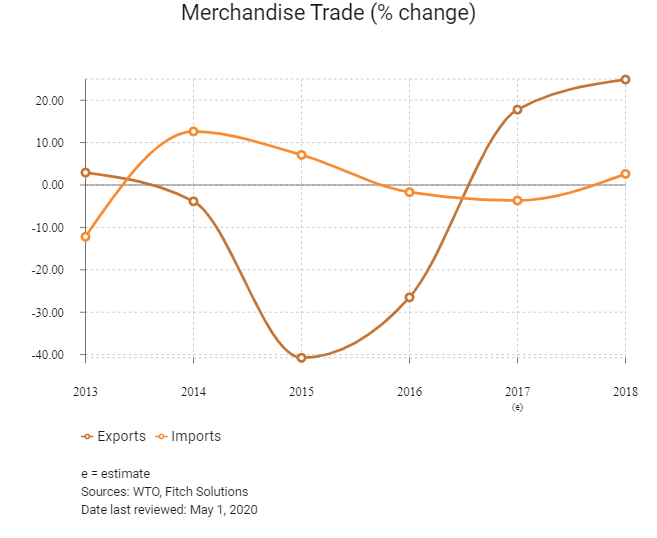

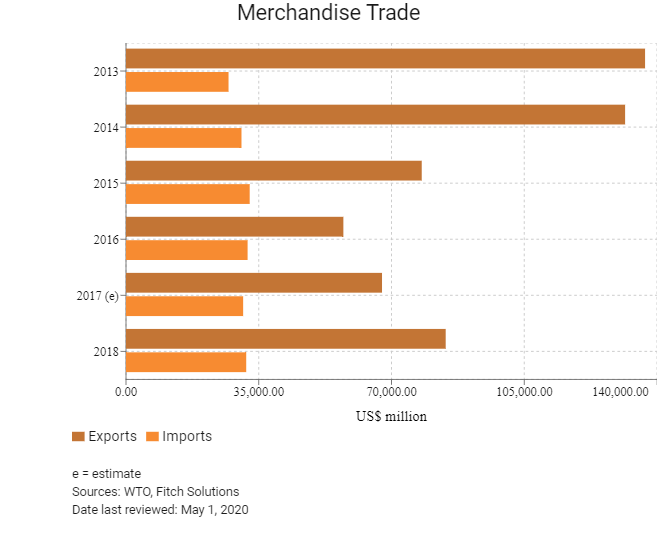

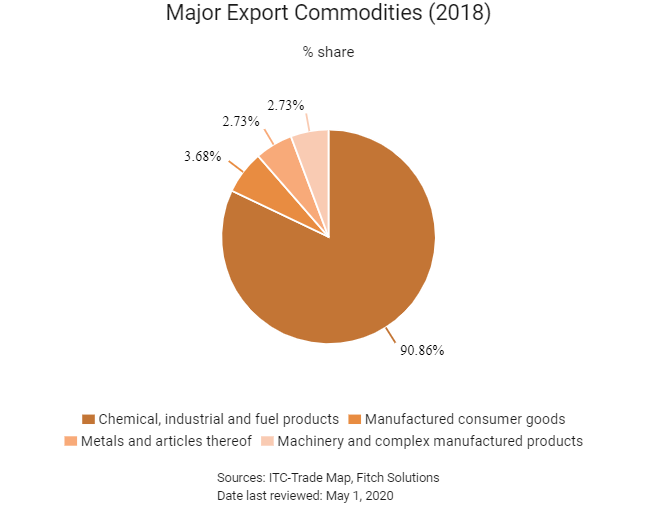

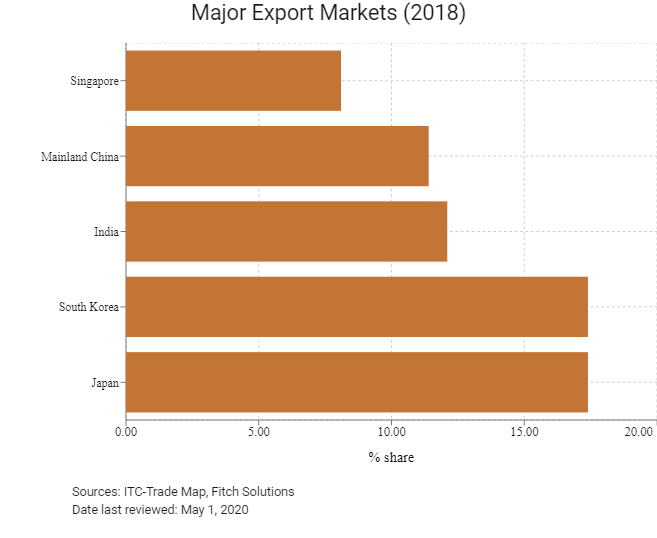

Merchandise Trade

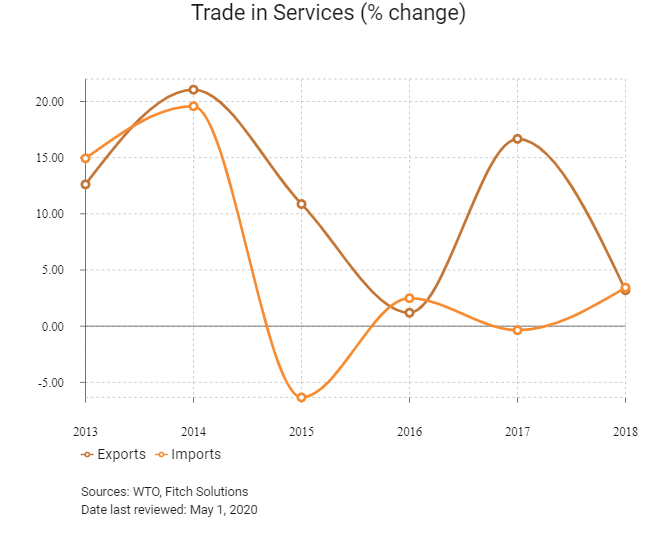

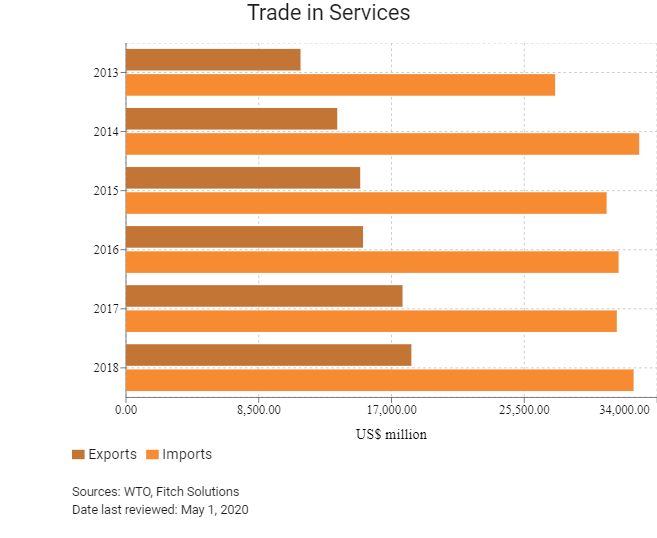

Trade in Services

- Qatar has been a member of the World Trade Organization (WTO) since January 13, 1996, and a member of the General Agreement on Tariffs and Trade since April 7, 1994.

- Qatar is a member of the GCC, which consists of Saudi Arabia, Kuwait, Oman, the United Arab Emirates (UAE), Bahrain and Qatar. GCC membership means that Qatar is part of a single market and customs union with a common external tariff. Under the accord, goods imported into the GCC area can be freely transported throughout the region without paying additional tariffs.

- The standard rate of external tariff is 5% (ad valorem) in accordance with the GCC customs union. According to the WTO, Qatar's simple average most favoured nation applied tariff was set at 5.7% for agricultural goods and 4.6% for non-agricultural goods in 2016.

- VAT of 5% will likely be introduced in 2020 in accordance with the GCC's harmonisation policies.

- The average applied import tariff for goods entering Qatar is 3.36%.

- For cultural and religious reasons, import tariffs of 100% are levied on alcoholic drinks, and import tariffs of 200% are levied on tobacco products (GCC tariff). The Qatar Distribution Company, a subsidiary of the national air carrier Qatar Airways, has the sole authority to import alcoholic products.

- Even before the blockade, importers to Qatar have faced, on average, the highest tariff rates out of all six GCC member states. The country imposes additional tariffs beyond the common external tariff on a wide range of products and has a stringent import-licensing regime.

- Non-Qataris are barred from engaging in distribution activities in Qatar. Importers, who must be Qatari nationals, have to register in the Importers Register and be approved by the Qatar Chamber of Commerce and Industry.

- Certain local manufacturers are protected by a higher customs duty. For example, Qatar has a 15% tariff on records and musical instruments, 20% on steel and cement and 30% on urea. Imports of pork and pork products are prohibited. With the approval of the Director General of Customs, some categories of goods may be allowed to be imported temporarily without collection of customs duties. These include heavy machinery and equipment for project execution, semi-finished products, use in exhibitions and temporary events, machinery and commercial samples. This approval is normally valid for a period of six months but may be extended by another six months.

- Sanctions were imposed on June 5, 2017, by Saudi Arabia, the UAE, Bahrain, Egypt, Yemen and the Maldives, among others, which cut diplomatic and transport ties with Qatar, accusing it of supporting terrorism. Modest price pressures associated with higher import costs from the ongoing diplomatic crisis in the Gulf – and resultant restrictions on intra-regional cross-border movements – appear mostly transitory, and are fading with the government-led (and partly government-funded) development of new supply chains.

- There are additional import requirements for meat and meat products to ensure that they are halal-compliant.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

- The Saudi-led land, air and sea blockade has made exporting and importing products to and from Qatar far costlier and more difficult. Because the only land border with Saudi Arabia has been closed, ships destined for Qatar cannot dock at certain ports and its aircraft are not allowed to use certain airspace. However, Qatar has mostly proved resilient and has found ways to work around the barriers imposed by its neighbours.

- Negotiations for a free trade agreement between the European Union (EU) and the Gulf Cooperation Council started in 1990 but were suspended in 2008. The region represents an important export market for the EU and ongoing co-operation between the two led to a more structured informal dialogue on trade and investment being launched in May 2017.

Multinational Trade Agreements

Active

- GCC Customs Union: This customs union, which entered into force on January 1, 2003, seeks to enhance ties between member countries and allows the free movement of local goods among member states. Members of the GCC are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE. This agreement helps member states to leverage one another's industrial capacity and logistics networks. The geographic proximity of these countries and their general adoption of free trade economic policies are factors that foster a competitive business environment. Only imports on certain sensitive goods from GCC countries face tariffs, and there is freedom of movement between GCC countries without customs or non-customs restrictions. All members benefit from having common regulations and procedures and unified standards and specifications for all products. There is freedom of movement between GCC countries for the vast majority of goods without restrictions, reducing the overall time and cost burdens for supply chains.

- GCC-Singapore Free Trade Agreement (FTA): The GCC-Singapore FTA (GSFTA) applies to the trade in goods and services and became effective on September 1, 2013. The GSFTA eliminates most tariffs (99%) on Singapore's exports to the GCC. This is a comprehensive agreement covering trade in goods, rules of origin, customs procedures, trade in services and government procurement, among others. Key sectors benefitting include telecommunications, electrical and electronic equipment, petrochemicals, jewellery, machinery, and iron and steel-related industry. The recognition of the halal certification of Singapore's Majlis Ugama Islam Singapura will also pave the way for trade in halal-certified products to gain faster access to the GCC countries.

- The Pan-Arab Free Trade Area (PAFTA): PAFTA was established in order to create an Arab economic bloc that could effectively compete with other countries while ensuring that member countries increased trade with each other. PAFTA entered into force on January 1, 1998. The most important aspect of the agreement was that over the next decade (to 2008), each member country would seek to reduce customs fees by 10% per annum as well as gradually eliminate trade barriers. In March 2001, the member countries decided to reduce the period over which the reductions in tariffs could be made so as to speed up the process and in January 2005 the elimination of most tariffs among PAFTA members was enforced. Parties to PAFTA include Algeria and the Palestinian Authority as well as the original signatories: Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, the UAE and Yemen.

Signed But Not Yet In Effect

The Trade Preferential System of the Organization of the Islamic Conference (OIC): The agreement would see the promotion of trade between member states by including most-favoured-nation principles, harmonising policy on rules of origin, exchanging trade preferences among member states, promoting equal treatment of member states and special treatment for the least developed member states, and providing for regional economic bodies made up of OIC nations to participate as a block. The agreement will cover all commodities groups. The OIC comprises 57 members, which means fully realising such an agreement would be highly impactful, encompassing approximately 1.8 billion people. Although the framework agreement, the protocol on preferential tariff scheme and the rules of origin have all been agreed on, a minimum of 10 members are required to update and submit their concessions list for the agreements to come into effect.

Under Negotiation

- Australia-GCC: Australia and the GCC share a significant economic relationship, encompassing trade and investment across a broad range of goods and services. The GCC is a key market for agricultural exports such as livestock, meat, dairy products, vegetables, sugar, wheat and other grains. The agreement provides an opportunity to address a range of tariff and non-tariff barriers related to food exports that will benefit the GCC. To date, there have been four rounds of Australia-GCC FTA negotiations, with the last one held in June 2009. An Australia-GCC FTA would provide an opportunity to reduce barriers to trade in mineral commodities and automotive parts. Provisions on investment would both encourage inward investment from the GCC as well as enhance security for Australian investments in GCC countries themselves, including in such areas as mining or the development of educational campuses. No progress is expected on an FTA with the GCC while the intra-Gulf tensions, which commenced in June 2017, remain unresolved.

- GCC-Mainland China: The first-round negotiations of the GCC-Mainland China FTA commenced on April 27, 2005. Greater trade liberalisation will help develop the industrial and service sectors. Trade liberalisation with the GCC will help the group integrate and grow with mutual co-operation and comprehensive tariff reduction. In 2018 Mainland China accounted for around 14% of the GCC's total imports. Thus far, the two parties have held nine rounds of negotiations and have reached an agreement on the majority of issues concerning trade in goods.

- India-GCC: India and the GCC are negotiating an FTA. The agreement is expected to remove restrictive duties, push down tariffs on goods and pave the way for more intensive economic engagement between the nations. More than 50% of India's oil and gas comes from the GCC countries.

- Japan-GCC: Japan and the GCC are negotiating an FTA. This agreement will seek to reduce tariffs and liberalise services, trade and investment. Japan mainly imports aluminium, natural gas, liquid natural gas and petroleum products from the GCC, while Japan mainly exports electronics, vehicles, machinery and other industrial products to the GCC.

- GCC-Pakistan FTA: Negotiations are currently ongoing between the GCC and Pakistan for the conclusion of an FTA between them (the third round of negotiations was held in August 2017). While in 2016 Pakistan accounted only for an estimated 1.2% of Qatari exports (mostly liquefied natural gas and a small amount of crude) and around only 0.3% of Qatari imports, there has been a recent shift in these dynamics brought on by the GCC diplomatic crisis. Since June 2017, when the Saudi-led bloc severed all diplomatic and transport ties with Qatar, Qatar has been required to diversify its import partner portfolio (especially for foodstuffs). Therefore, in August 2017, a new direct shipping route was launched between Qatar's Port of Hamad and Pakistan's Port of Karachi (with shipping times estimated at taking around four days). Qatar Airways has also reportedly strengthened its air operations to Pakistan, and it is now much easier for Pakistani citizens to obtain visas to work in Qatar. Since the blockade was imposed in 2017, trade flows between Qatar and Pakistan have received a significant boost.

- Other: A number of other GCC FTAs are currently under negotiation. The countries engaged in negotiations include New Zealand, South Korea, the Mercosur bloc and Turkey.

Sources: WTO Regional Trade Agreements database, European Commission, Australian Government Department of Foreign Affairs and Trade, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The Qatar Business Development and Investment Promotion Department under the Ministry of Economy and Commerce (MEC) is responsible for promoting business development and attracting foreign direct investment. Information related to Qatar's investment climate and incentive schemes are provided on the MEC website.

- Qatar launched its economic diversification plan Vision 2030 in October 2008, which aims to transform the country's state-owned and petroleum-dominated economy into a model more characterised by increased diversification and private sector involvement.

- Two free zones, namely the Qatar Financial Centre and the Qatar Science & Technology Park, have been established, with tax and duty incentives provided. Currently, Qatar's government is encouraging foreign investment by streamlining licensing and financial sector regulations, with the corporate tax rate set at 10%. More recently, following the establishment in 2011 of the company Manateq, Qatar has started work on industrial zones, logistics and warehousing parks and the country's new special economic zones, which will be divided into three projects (Ras Bufontas, Umm Alhoul and Al Karaana) to focus on different sectors. By 2022 all three zones are expected to be completed and offer favourable tax and duty incentives as part of a Qatar Free Zones Authority.

- Qatar used its trade surplus accumulated from oil and gas wealth to establish the Qatar Investment Authority (QIA) in 2006. QIA and its subsidiaries invest in leading companies in non-oil sectors, such as hotels, retail, real estate and manufacturing, in the hope of lifting Qatari standards and diversifying the economy. Most investments are outside Qatar, with assets including Volkswagen, Canary Wharf and Credit Suisse. The establishment of sizeable financial endowments helps Qatar provide continuity and predictability of funding for essential services, such as health and education, despite the fluctuation of hydrocarbon receipts.

- Massive infrastructure projects are underway, including the construction of stadiums, rail connections and highways. In an effort to increase the transparency of available investment projects, in June 2016 the Qatari government launched a new online procurement portal to consolidate information on all government tenders.

- In a bid to boost non-Gulf Cooperation Council (GCC) foreign investment (especially in the wake of the GCC crisis), Qatar passed a new foreign investment law in January 2018 (which came into effect from March 2018). This law removed the 49% cap on foreign ownership of businesses in Qatar in a wide variety of sectors. Since January 2019, 100% foreign ownership has been permitted in many economic sectors, with no Qatari equity partner required. Restrictions on the purchasing of real estate and franchises still apply, and government approval for banking and insurance licences is still required.

- Qatar has some restrictions on the foreign ownership of property. Although GCC nationals are allowed to own up to three properties in Qatar, other foreigners are limited in terms of the areas in which they can purchase freehold real estate. Non-GCC foreigners can own property in 10 specific areas, land or residential (Pearl-Qatar, West Bay, Al Khor, Rawdat Al Jahaniyah, Al Qassar, Al Dafna, Onaiza, Al Wasail, Al Khraij and Jabal Theyleeb), or they can enjoy rights to property for a period of 99 years (which is renewable) in almost twice as many investment areas. This right has to be registered in order to be legally recognised.

- Foreign participation is not allowed at all in the public transport, electricity and water, steel, cement, and the fuel distribution and marketing sectors.

- Quotas exist for the mandatory employment of Qatari nationals in certain sectors, such as banking and insurance.

- The telecoms sector was opened to private competition from 2007, and there are some international players operating in Qatar in the critical oil and gas sector.

- Foreign players hold interests in the upstream oil sector. However, the downstream sector is completely dominated by state-owned Qatar Petroleum. Qatar's large and lucrative hydrocarbons industry has historically offered the main attractions for foreign investment, with exploration and production by foreign companies permitted through production sharing contracts with Qatar Petroleum, which controls all hydrocarbons activities in the country. Foreign investment is nevertheless warmly received owing to the technology and expertise that can be provided by foreign businesses.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of Commerce, Ministry of Commerce and Industry, Qatar National Vision 2030, UNCTAD, Qatar Investment Authority, Manateq, Qatar Free Zones Authority

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| Qatar Science & Technology Park in Doha aims to be an international hub for scientific and technology innovation, tech-based entrepreneurship and high-tech businesses | This park is intended to attract companies with a science and research focus. Applicants who receive a licence to operate within this free trade zone receive the following benefits: - Operate as a local company or operate as a branch of a foreign company - 100% foreign ownership - Hire expatriate employees - No taxes - Duty-free import of goods, services, equipment and tools into the free zone Unrestricted repatriation of capital and profits |

| Three further free trade zones are under development in Doha, with two currently operational: Ras Bufontas near the Hamad International Airport (with a focus on light manufacturing, pharmaceuticals and financial services) and Umm Alhoul near Hamad Port (for advanced manufacturing, polymers and plastics, and maritime industries), adjacent to Mesaieed industrial zone, with its emphasis on the energy sector | These zones allow businesses to import goods and services customs free and offer a range of other incentives. |

| Qatar Financial Centre (QFC) | The QFC was set up in 2005 in order to help turn Qatar into a global financial hub and encourage investment from foreign banks and financial services providers in Qatar. Incentives include: - 100% foreign ownership - 100% profit repatriation - A flat 10% corporate tax on locally sourced profits only A legal environment based on English common law |

Sources: Qatar Science & Technology Park , Qatar Financial Centre , Fitch Solutions

- Value Added Tax: 0%

- Corporate Income Tax: 10%

Source: Qatar General Tax Authority

Important Updates To Taxation Information

- January 2019 saw Qatar establish the General Tax Authority (GTA). The GTA will be tasked with the implementation of tax laws, as well as improving the country's level of tax compliance. These duties and responsiblities previously fell under the Qatari Ministry of Finance.

- Qatar has entered into double tax agreements with more than 40 countries, including Mainland China and a comprehensive double taxation agreement with Hong Kong, which was concluded in 2013.

- The GCC countries have signed a VAT common framework. The Cabinet of Qatar has approved a draft law on VAT and its executive regulations as put forth by the Qatar Ministry of Finance. In December 2018 the Excise Tax Law was signed and has been in effect in Qatar since January 1, 2019.

Business Taxes

Type of Tax | Tax Rate and Base |

| Corporate income tax (CIT) | Resident companies wholly owned by Qatari citizens or GCC nationals are exempt from corporate income tax. Resident companies not wholly owned by Qatari citizens/GCC nationals are taxable up to the levels of profits ultimately attributable to non-GCC national shareholders and GCC shareholders who are not tax residents in Qatar, at a flat rate of 10% (but only on profits of Qatari-sourced income) unless the companies are involved in the petrochemical industry or petroleum operations where a minimum rate of 35% is applicable |

| Capital gains tax | The same as the corporate income tax rate |

| Excise tax | Excise tax is a consumption tax applied to specific harmful goods with the aim of encouraging a healthier lifestyle. A rate of 100% is levied on tobacco and tobacco products, energy drinks and special purpose goods, which include alcohol and pork products; and a rate of 50% on carbonated drinks |

| Withholding tax | Dividends: 0% Interest: 5% (with certain exceptions when 7% may apply) Royalties: 5% |

| Stamp duty | None |

| Property transfer tax | None |

Source: Qatar General Tax Authority

Date last reviewed: May 1, 2020

Localisation Requirements

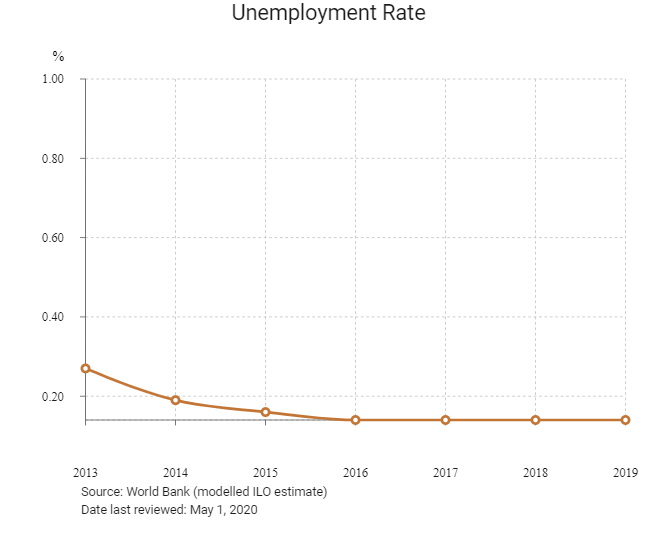

Developing human capital and increasing nationals' workforce participation constitute key elements of the GCC member states' economic diversification plans and will continue to drive labour market policies across the region over the coming decade. Localisation policies have been devised to promote the employment of Qatari nationals in the private and public sectors. Therefore, quotas for the mandatory employment of Qatari nationals exist in certain sectors, such as banking and insurance.

'Kafala' System and New Immigration Law

Typically, as a result of relatively small domestic populations and the fact that a large portion of the domestic working-age population is employed by the public sector in all six of the GCC states, employing foreign workers to fill low-skilled and high-skilled positions for the private sector has been relatively easy. The large presence of migrant workers in Qatar is attributed to the 'kafala' (sponsorship) system, which emerged in many GCC states in order to regulate the relationship between employers and migrant workers in these countries. The employer is seen as the foreign worker's sponsor and is entirely responsible for their visa and legal status. A downside risk is that some foreign workers have had their passports and wages illegally withheld by GCC employers, and some risk not being allowed to leave the country or change employers without their current employer's permission.

The main commercial objective of the 'kafala' system is to facilitate the steady supply of temporary and rotating labour rapidly to such countries during times of economic boom – a labour force that could then be expelled fairly easily in less prosperous periods. However, owing to increasing pressure on GCC states from human rights groups about the exploitation of foreign workers under this system (specifically in relation to the treatment of foreign workers on various construction projects for FIFA 2022 projects), paired with rising economic pressures in GCC states owing to the 2015/2016 global slump in oil prices, the ease and costs of hiring foreign workers in Qatar is expected to become more difficult over the medium term. From December 2016, the Qatari government announced the coming into force of its New Immigration Law. Under this law, the Qatari government plans to change the sponsorship relationship, which forms the basis of the 'kafala' system, to one of an employment contract.

Furthermore, migrant workers employed under the 'kafala' system will no longer require their employer's permission to leave the country, but are instead required to apply to the Ministry of Interior which will in turn inform the employer. Migrant workers who have completed their fixed-term contracts will no longer need their employer's permission to take another job. In April 2019 the Qatari authorities announced that by the end of 2019 exit visas for all foreign workers, irrespective of the work sector, would be abolished. The death knell for the entire system may well have been sounded with the announcement in October 2019 that Qatar will reform and dismantle the 'kafala' scheme from 2020.

Obtaining Foreign Worker Permits for Skilled Workers

Under Qatar's New Immigration Law (which came into force in late 2016), a foreign worker may only apply for a work permit if they have an offer of employment from a Qatari national, a business registered as a legal entity or a resident family member on whom the individual is dependent.

Once the employer has made the application to the relevant Qatari labour authority, the expatriate employee will be issued their residence permit (if granted) within 30 days.

Visa/Travel Restrictions

In a bid to make Qatar a more attractive international tourist and business destination for countries outside the Gulf region, in early August 2017 the Qatari government announced the launch of its new visa-free programme for more than 80 countries worldwide. Nationals from more than 33 countries will be allowed to enter and stay in Qatar for up to 180 days without a visa (only a valid passport is required), and citizens of another 47 countries will be permitted to stay in Qatar for up to 30 days without a visa. This will make business travel to the country far easier for a wide range of international companies. Citizens of GCC states and Turkey do not require a visa. Citizens from a wide array of countries (the main eurozone states, the United States, various Central Asian states, Japan and Malaysia) may apply for a 30-day visa on arrival.

Sources: Visit Qatar, State of Qatar Ministry of Interior, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | Aa3 (stable) | 13/07/2018 |

| Standard & Poor's | AA- (stable) | 7/12/2018 |

| Fitch Ratings | AA- (stable) | 13/02/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 83/190 | 83/190 | 77/190 |

| Ease of Paying Taxes Index | 1/190 | 2/190 | 3/190 |

| Logistics Performance Index | 30/160 | N/A | N/A |

| Corruption Perception Index | 33/180 | 30/180 | N/A |

| IMD World Competitiveness | 14/63 | 10/63 | N/A |

Sources: World Bank, IMD, Transparency International

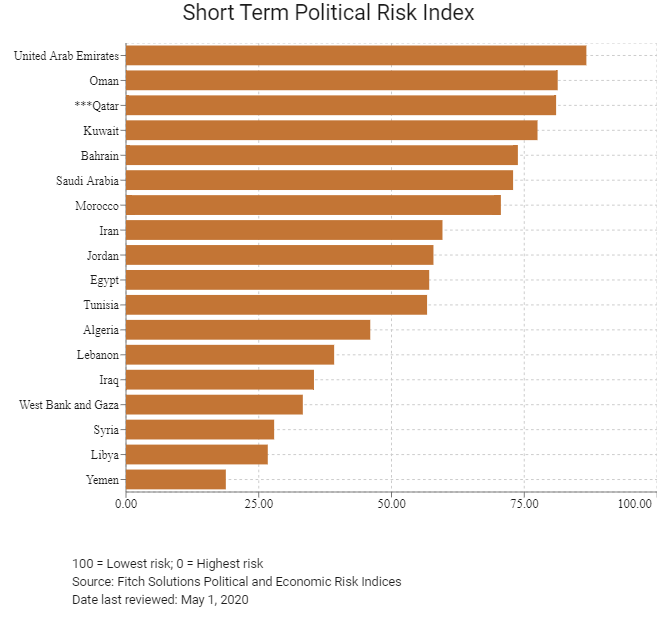

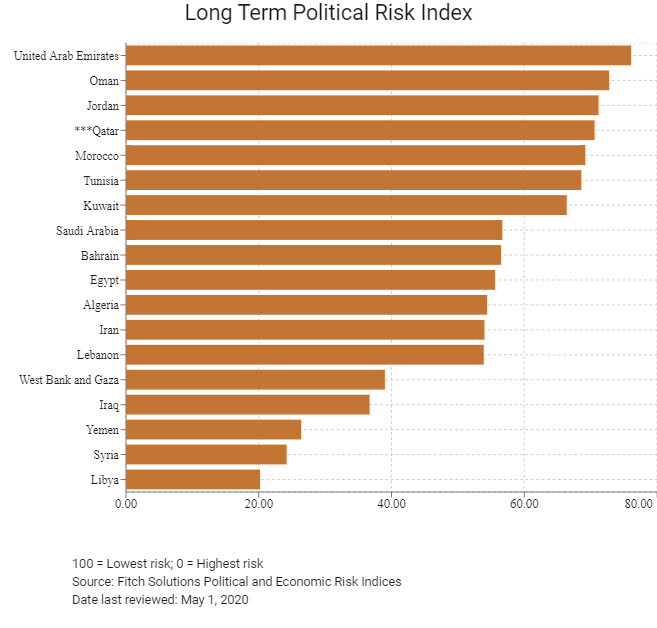

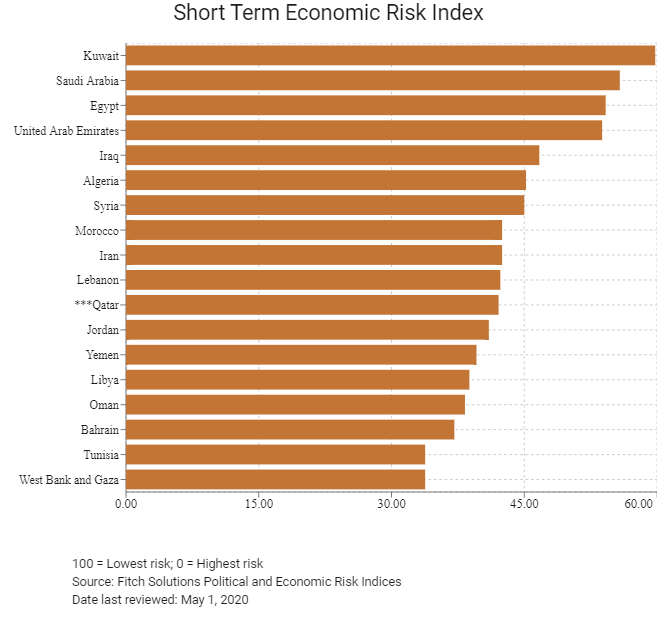

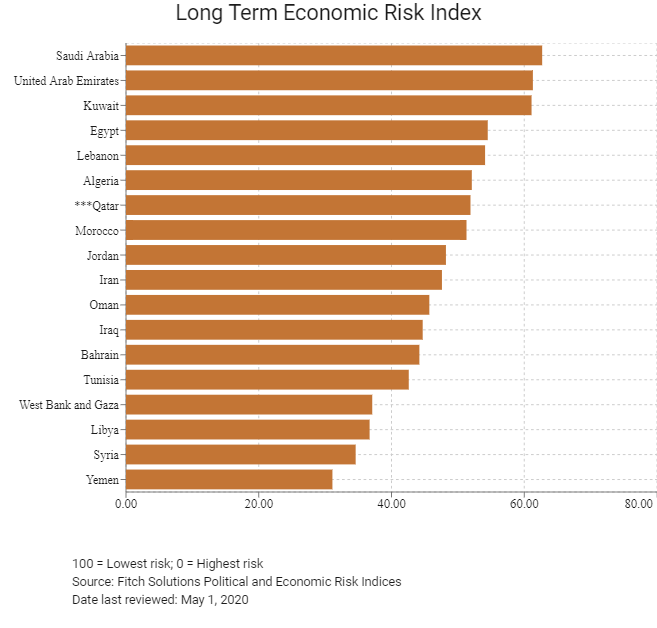

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index Rank | 77/202 | 102/201 | 100/201 |

| Short-Term Economic Risk Score | 55.6 | 46.5 | 42.1 |

| Long-Term Economic Risk Score | 56.1 | 51.9 | 51.9 |

| Political Risk Index Rank | 76/202 | 67/201 | 64/201 |

| Short-Term Political Risk Score | 84.4 | 81.0 | 81.0 |

| Long-Term Political Risk Score | 69.0 | 70.6 | 70.6 |

| Operational Risk Index Rank | 35/201 | 37/201 | 36/201 |

| Operational Risk Score | 66.2 | 65.4 | 66.0 |

Source: Fitch Solutions

Date last reviewed: May 1, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The primary economic threat for Qatar is lower energy prices, given its over-reliance on hydrocarbon exports. Nevertheless, the sheer size of the country's exports of LNG - Qatar accounts for one-third of global LNG trade - means that the fiscal account will remain roughly balanced even in a structurally lower energy price environment. In addition, Qatar has a vast sovereign wealth fund, estimated to hold assets equivalent to over 197% of GDP, which insulates it against external shocks.

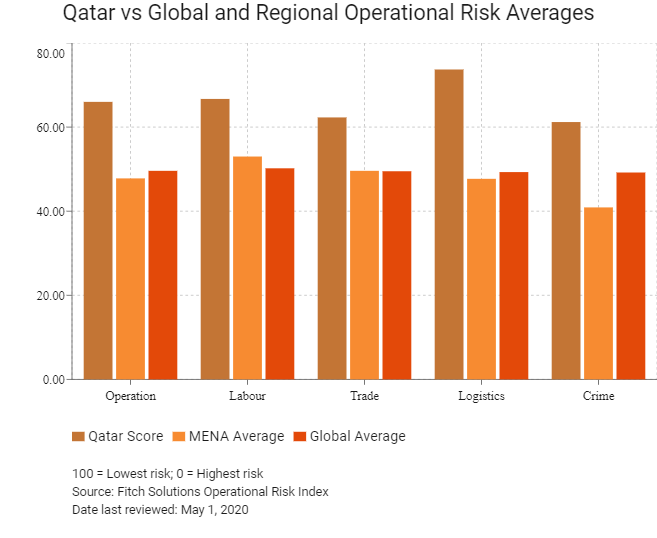

OPERATIONAL RISK

Qatar is one of the GCC and regional outperformers in terms of the relatively sound operating environment that this market provides for businesses. Qatar is a regional outperformer for its logistics network, and the country provides a safer operating environment than many of its regional peers. Qatar has efficient tax, bureaucratic and legal systems; a low tax burden relative to its regional peers. Interstate tensions between Qatar and the Saudi-led bloc have become more thawed in recent months, and we do not expect tensions to escalate further. However, regarding trade, Qatar is perceived as less economically open than some of its Middle East and North Africa peers owing to its reliance on liquefied natural gas exports and various restrictions on foreign direct investment. Investors should also be aware of the considerable obstacles to investment, which include stringent laws governing the employment of expatriates and restrictions on foreign ownership in many sectors.

Source: Fitch Solutions

Date last reviewed: May 3, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Qatar Score | 66.0 | 66.7 | 62.3 | 73.7 | 61.2 |

| MENA Average | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

| MENA Position (out of 18) | 3 | 3 | 7 | 1 | 3 |

| Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

| Global Position (out of 201) | 36 | 17 | 54 | 27 | 55 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

UAE | 71.6 | 70.6 | 77.5 | 68.0 | 70.5 |

Bahrain | 66.5 | 65.5 | 75.4 | 71.6 | 53.6 |

Qatar | 66.0 | 66.7 | 62.3 | 73.7 | 61.2 |

Oman | 64.9 | 62.7 | 63.4 | 64.2 | 69.2 |

Saudi Arabia | 63.6 | 68.3 | 65.8 | 62.5 | 57.7 |

Jordan | 57.1 | 58.4 | 62.9 | 54.8 | 52.3 |

Kuwait | 55.5 | 58.7 | 56.2 | 50.8 | 56.2 |

Morocco | 54.6 | 45.0 | 65.3 | 54.9 | 53.2 |

Egypt | 49.4 | 50.7 | 48.8 | 55.2 | 42.9 |

Tunisia | 47.1 | 41.0 | 58.5 | 46.7 | 42.3 |

Lebanon | 43.6 | 54.0 | 49.8 | 40.9 | 29.7 |

Iran | 43.1 | 48.7 | 36.4 | 52.8 | 34.4 |

Algeria | 39.6 | 48.6 | 32.7 | 41.0 | 36.2 |

West Bank and Gaza | 31.6 | 48.3 | 34.1 | 27.1 | 17.0 |

Libya | 29.3 | 43.4 | 29.9 | 26.6 | 17.1 |

Syria | 28.6 | 42.6 | 29.2 | 27.6 | 15.0 |

Iraq | 26.7 | 43.5 | 24.1 | 26.9 | 12.4 |

Yemen | 21.8 | 37.8 | 19.6 | 13.9 | 16.1 |

Regional Averages | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 1, 2020

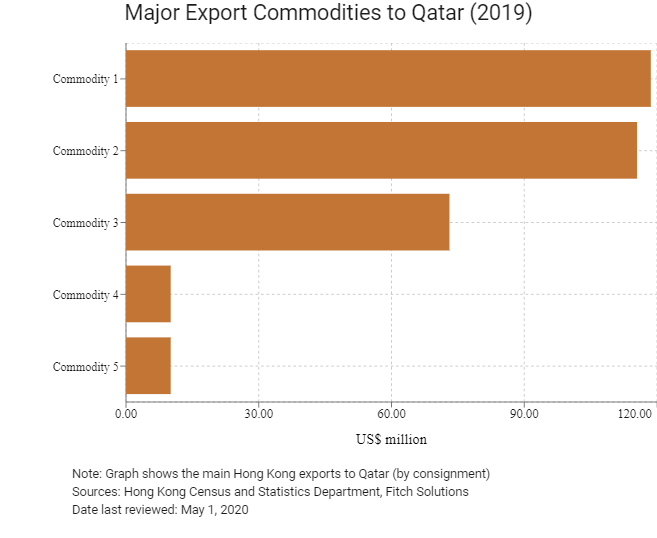

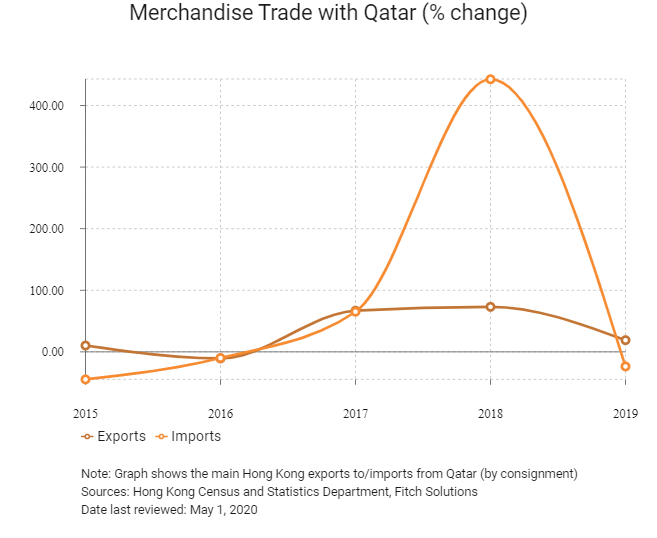

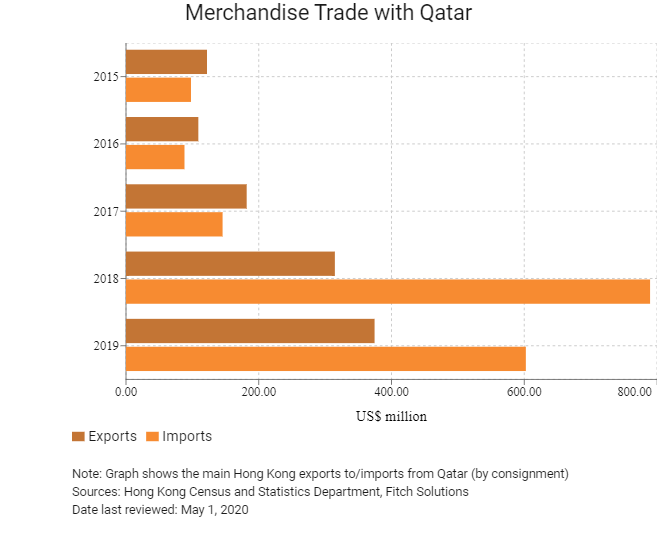

Hong Kong’s Trade with Qatar

Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Miscellaneous manufactured articles | 118.6 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 115.5 |

| Commodity 3 | Power generating machinery and equipment | 73.1 |

| Commodity 4 | Articles of apparel and clothing accessories | 10.1 |

| Commodity 5 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 10.1 |

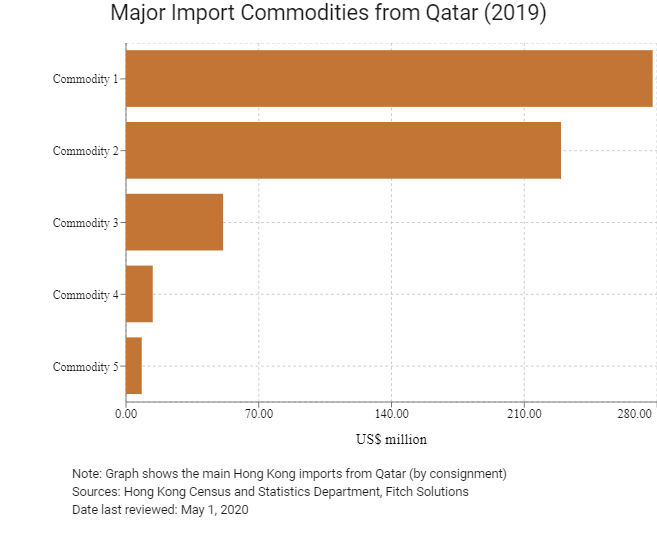

Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Iron and steel | 277.7 |

| Commodity 2 | Petroleum, petroleum products and related materials | 229.4 |

| Commodity 3 | Miscellaneous manufactured articles. | 51.2 |

| Commodity 4 | Plastics in primary forms | 14.1 |

| Commodity 5 | Power generating machinery and equipment | 8.3 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Qatari residents visiting Hong Kong | 3,259 | -1.7 |

| Number of Middle Eastern residents visiting Hong Kong | 113,849 | -12.8 |

Source: Hong Kong Tourism Board

Date last reviewed: May 1, 2020

Commercial Presence in Hong Kong

2020 | Growth rate (%) | |

| Number of Qatari companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and agreements between Hong Kong and Qatar

- There is a bilateral investment treaty between Qatar and Mainland China that entered into force on April 1, 2000.

- Qatar has a comprehensive double taxation agreement with Hong Kong that entered into force on December 5, 2013.

- Qatar has a double taxation agreement with Mainland China that entered into force on October 21, 2008.

Sources: UNCTAD, Hong Kong Inland Revenue Department, State Administration of Taxation of The People's Republic of China

Chamber of Commerce or Related Organisations

The Arab Chamber of Commerce & Industry (ARABCCI)

The ARABCCI was established in Hong Kong in 2006 to promote commercial ties between Hong Kong, Mainland China and the Arab World.

Address: 20/F, Central Tower,28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Source: The Arab Chamber of Commerce and Industry, Hong Kong

The Consulate General of The State of Qatar in Hong Kong

Address: Suites 5501-5502, 55 Floor, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong

Email: hongkong@mofa.gov.qa

Tel: (852) 3769 8383/(852) 3769 8384

Fax: (852) 2517 8300

Visa Requirements for Hong Kong Residents

HKSAR passport holders enjoy 30‑day visa‑free access to Qatar.

Source: Visa on Demand

Date last reviewed: May 1, 2020

Qatar

Qatar