GDP (US$ Billion)

240.90 (2018)

World Ranking 48/193

GDP Per Capita (US$)

23,437 (2018)

World Ranking 41/192

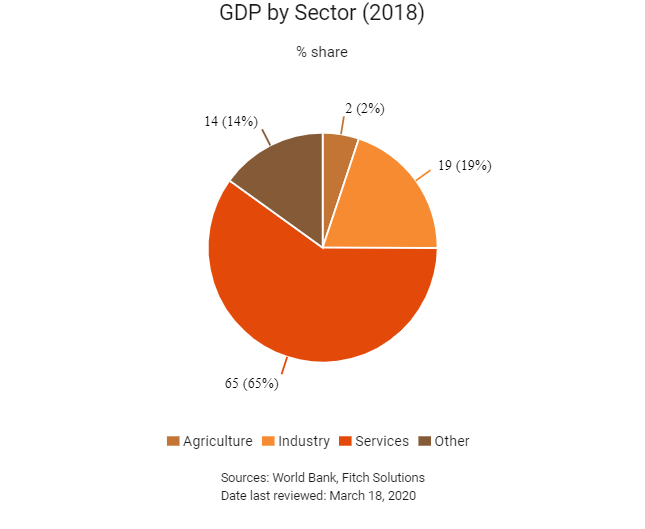

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

87.6 (2019)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Portugal is a founding member of the North Atlantic Treaty Organization (NATO) and entered the European Community (now the European Union, or EU) in 1986. Since entering the union, Portugal has become a diversified and increasingly service-based economy. Portugal supports international efforts to promote human and economic development, reduce poverty and boost shared prosperity around the world. Portugal has recovered from its post-financial crisis turbulence, allowing it to exit the EU's excessive deficit procedure in mid-2017. The incumbent centre-left minority Socialist government has unwound some unpopular austerity measures while managing to remain within most EU fiscal targets. Ongoing structural reform of the public sector will continue to provide positive dividends going forward.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

November 2015

Following inconclusive parliamentary elections, Socialist leader Antonio Costa forms centre-left government.

October 2016

Former prime minister Antonio Guterres was appointed UN Secretary General.

October 2018

Construction on the Tamega Hydroelectric Complex began. The hydropower plant was expected to contribute 2,320MW of electricity to the national grid and regional power pool. Construction was estimated to be completed in 2023.

October 2019

Incumbent Prime Minister António Costa of the Socialist Party (PS) won the October 6 parliamentary elections in Portugal with more than 36% of the vote (106 seats), gaining 20 additional seats in parliament compared with the last election in 2015.

February 2020

The 2020 State Budget was passed in parliament. The budget included a decrease in value-added tax (VAT) paid on electricity and an increase in public investment spending.

March 2020

The government announced a EUR9.2 billion stimulus package to support the economy amid the Covid-19 pandemic.

Sources: BBC Country Profile – Timeline, Reuters, Fitch Solutions

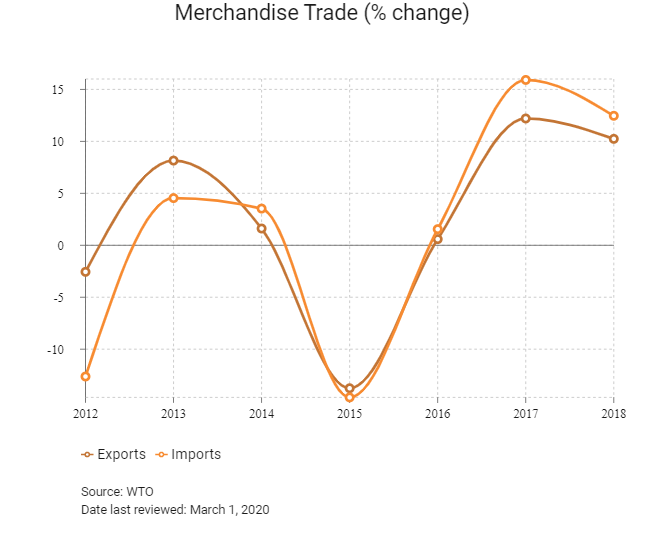

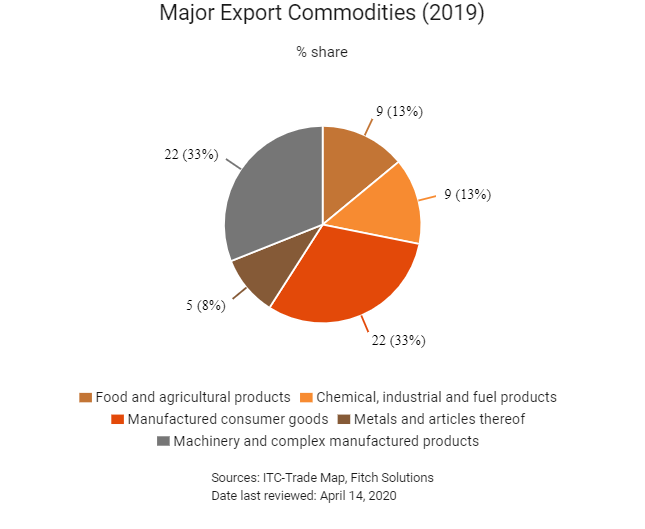

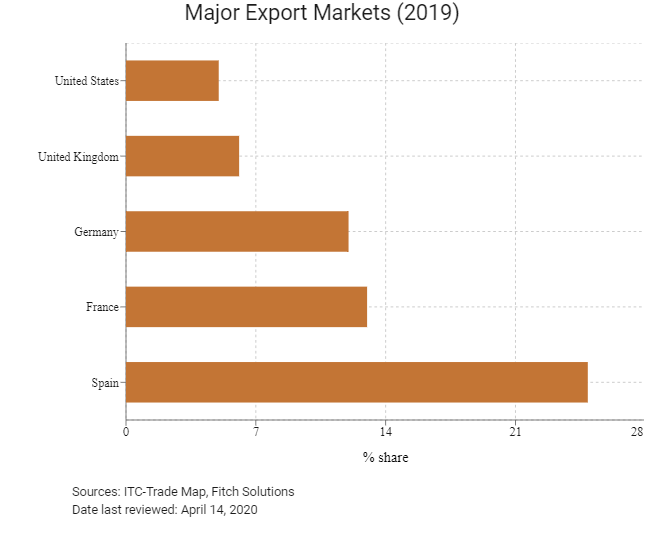

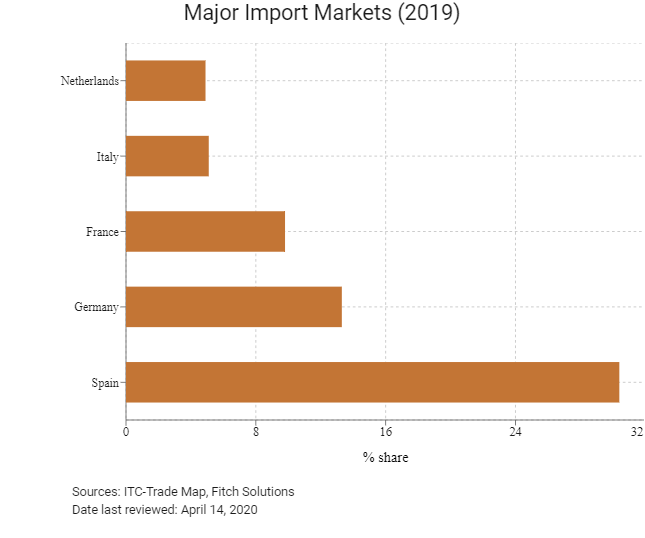

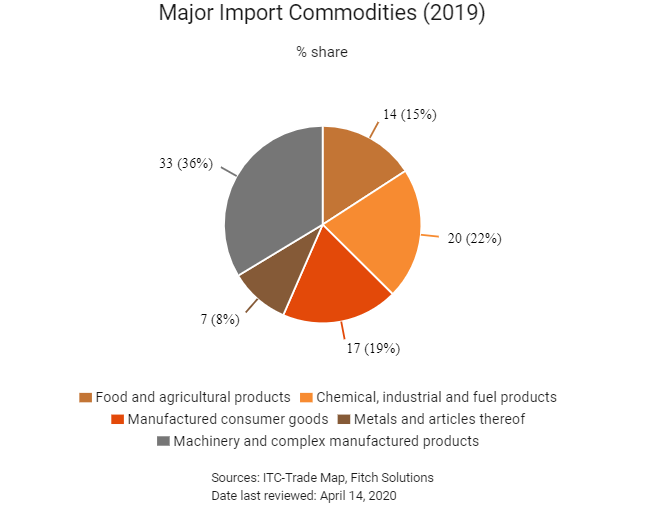

Merchandise Trade

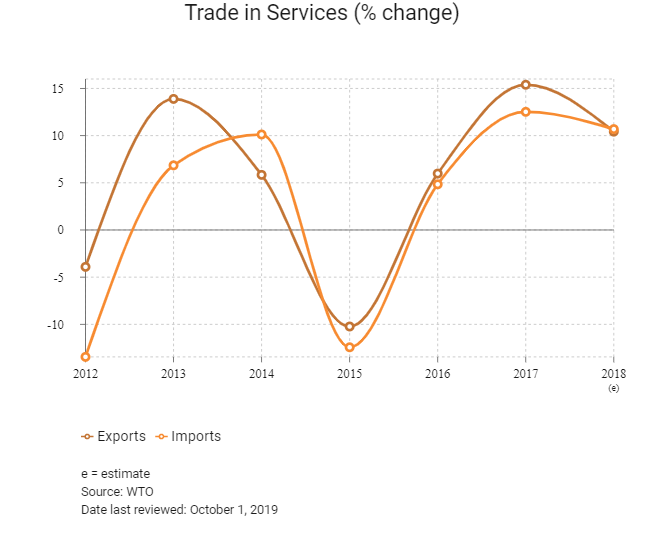

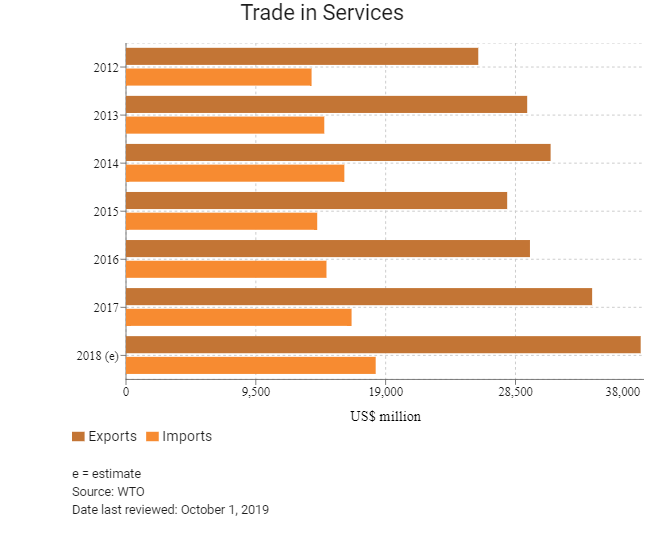

Trade in Services

- Portugal joined the World Trade Organization in January 1995, having been a member of the General Agreement on Tariffs and Trade since 1962. Portugal is also a member state of the European Union (EU) and incorporates EU regulatory norms. As a eurozone member, it has adopted the euro as its legal tender.

- As Portugal is an EU member, a common tariff applies to the import of goods across the external borders of the EU. The EU has an overall simple tariff of 5.1%. Once goods are cleared by customs authorities upon entry into any EU member state, these imported goods can move freely among member states without any additional customs procedures. The EU updated its trade policy (and, by extension, its import tariffs, customs, duties and procedures) in 2017 and 2018. The customs duties' rates applied in Portugal vary according to the origin of the goods. There are several origin agreements where the importation of goods from certain countries are exempt from customs duties or are subject to reduced rates.

- The EU is party to some 50 free trade agreements and access to other markets is mediated through those agreements. The EU's scheme on a generalised system of preferences entered into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded US$4,000 for four years in a row. As a result, the number of countries that enjoy preferential access to EU markets was reduced from 176 to less than 80. While Mainland China remains a beneficiary, many of its exports – such as toys, electrical equipment, footwear, textiles, wooden articles, watches and clocks – have already been graduated from preferential treatment. Hong Kong has been fully excluded from the EU's generalised scheme of preferences since May 1, 1998.

- In 2018 the EU modernised its trade defence instruments in response to EU states wanting to shield EU producers from damage caused by unfair competition and to ensure a level playing field for businesses. Anti-dumping and anti-subsidy regulations have been amended to better respond to unfair trade practices and to furnish Europe's trade defence instruments with more transparency, quicker procedures and more effective enforcement. In exceptional cases, such as in the presence of distortions in the cost of raw materials, the EU will be able to impose higher duties through the limited suspension of the lesser duty rule.

- The EU has imposed various anti-dumping measures on a wide range of products, predominantly in the areas of textiles, machine parts, steel, iron and machinery, and certain goods coming from Mainland China and a few other Asian nations in order to protect domestic industries. Currently, a number of products originating from Mainland China are subject to the EU's anti-dumping duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards and solar glass, which are of interest to Hong Kong and regional exporters. In November 2016, the European Commission (EC) imposed a provisional anti-dumping duty on imports of some primary and semi-processed metals from Mainland China. The rate of duty is between 43.5% and 81.1% of the net free-at-union-frontier price before duty, depending on the company. As of April 2020, the EU is not applying any anti-dumping measures on imports from Hong Kong.

- In 2016, the EC introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

Sources: WTO – Trade Policy Review, European Commission, Fitch Solutions

Major Multinational Trade Agreements

Active

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 27 member nations of the EU, namely: Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden. As Portugal's main trade partners are in the EU, the absence of customs charges with member countries greatly enhances its trade volumes.

- European Economic Area (EEA)-European Free Trade Association: This economic integration agreement entered into force on January 1, 1994. The EEA unites EU member states and European Free Trade Association states (Iceland, Liechtenstein, Norway and Switzerland) to form an internal market governed by the same basic rules. These rules aim to enable goods, services, capital and persons to move freely in the EEA in an open and competitive environment, a concept referred to as the four freedoms. While it enhances trade flows between these countries and Portugal, only Switzerland is a fairly major trading partner.

- EU-Turkey Customs Union: The EU and Turkey are linked by a customs union agreement that entered into force on January 1, 1996. Turkey has been a candidate country to join the EU since 1999 and is a member of the Euro-Mediterranean Partnership. The customs union with the EU provides Turkey with tariff-free access to the European market, benefitting both exporters and importers. Turkey is the EU's fourth largest export market and its fifth largest provider of imports. The EU is by far Turkey's number one import and export partner. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the customs union agreement covers all industrial goods but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural, coal and steel products. In December 2016, the European Commission (EC) proposed the modernisation of the customs union and to further extend bilateral trade relations to areas such as services, public procurement and sustainable development.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1.0 billion annually. According to the EC, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019, after the EU Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86.0 billion. The key parts of the agreement will cut duties on a wide range of agricultural products while seeking to open up services markets – particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-Southern African Development Community (SADC) EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and eSwatini): An agreement between EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of SADC included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking economic partnership agreements with the EU as part of other trading blocs – such as with East or Central African communities.

Provisionally Active

The Comprehensive Economic and Trade Agreement (CETA): The CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and EU Parliament in February 2017. However, the agreement has not been ratified by every European state and has only provisionally entered into force. CETA is expected to strengthen trade ties between the two regions, having come into effect in 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

Ratification Pending

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (30 of the 34 parties have ratified the agreement as of April 2020). The agreement has been provisionally applied since 2013.

- EU-Mercosur: The EU and Mercosur (Argentina, Brazil, Paraguay and Uruguay) signed a trade deal on June 28, 2019, after 20 years of negotiations. The trade agreement for goods and services will cover nearly 25% of global GDP and almost 800 million people. The deal is expected to cut duties on EU exports to Mercosur by EUR4.0 billion annually and eliminate tariffs on 93% of Mercosur's exports to the EU and 91% of EU exports to Mercosur states. The deal will also include access to public procurement contracts. Mercosur states will greatly benefit from increased access to the EU for agricultural goods, which has resulted in opposition to the deal by European farmers. European firms, especially those in the manufacturing and industrial sector, will have an advantage over other competitors after the removal of high tariffs.

- EU-Singapore FTA (EUSFTA): On February 13, 2019, the European Parliament passed the agreement, which would see the creation of the EUSFTA. However, before the agreement is implemented, all the states involved will need to ratify the agreement through their individual legislatures; in this case, the FTA may become provisionally active along the lines of states that have already ratified the agreement.

- EU-Vietnam Free Trade Agreement (FTA): In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement. The EU describes the agreement as the most ambitious it has ever concluded with a developing country, expecting it to increase EU exports to Vietnam by around 29% and Vietnam's exports to the EU by around 18%. In February 2020, members of the European Parliament approved the FTA, but the Investment Promotion Agreement is still awaiting approval. The agreement still needs to be formally concluded.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48.0 billion in 2017, and bilateral trade in services added another EUR27.0 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to, or doing business in, Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States Transatlantic Trade and Investment Partnership (TTIP): This agreement was expected to increase trade in goods and services, but talks were suspended at the end of 2016. In January 2019, the EC published its draft negotiating directives, which include a trade agreement focused on the removal of tariffs on industrial goods, excluding agriculture. On April 15, 2019, EU member states gave the EC their approval to start formal negotiations. The negotiating directives for the TTIP are no longer relevant.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

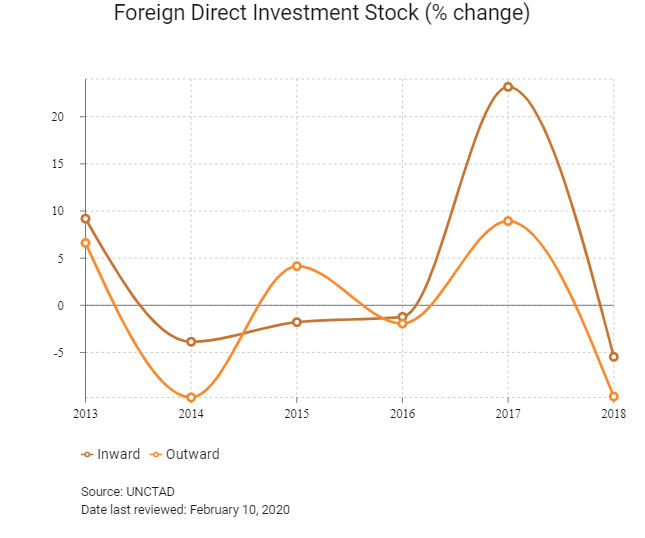

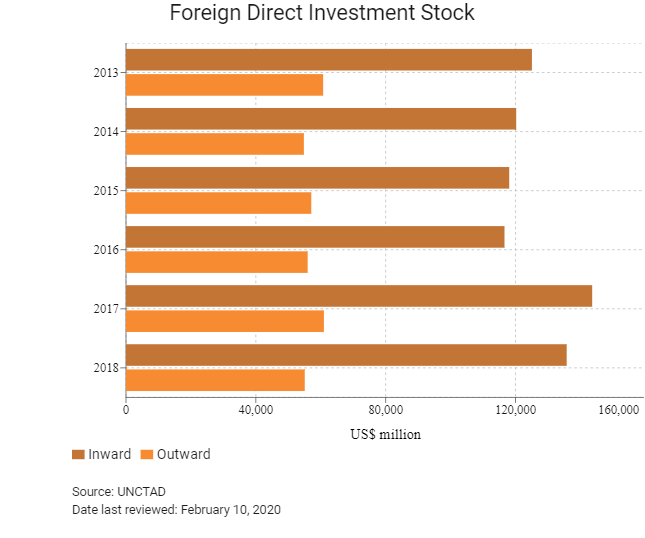

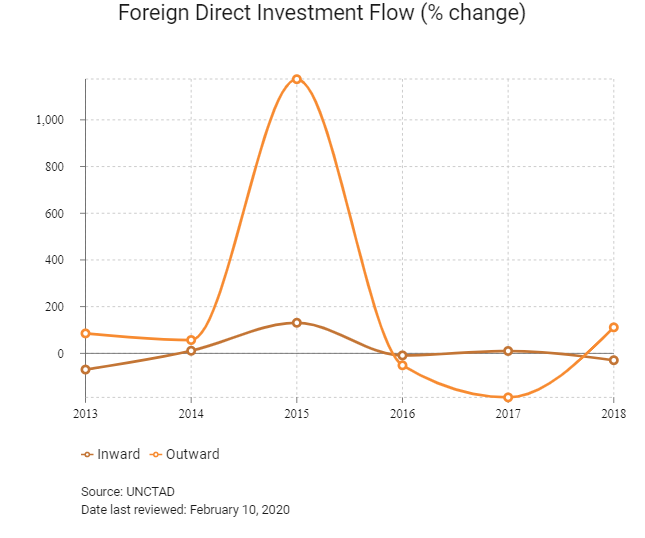

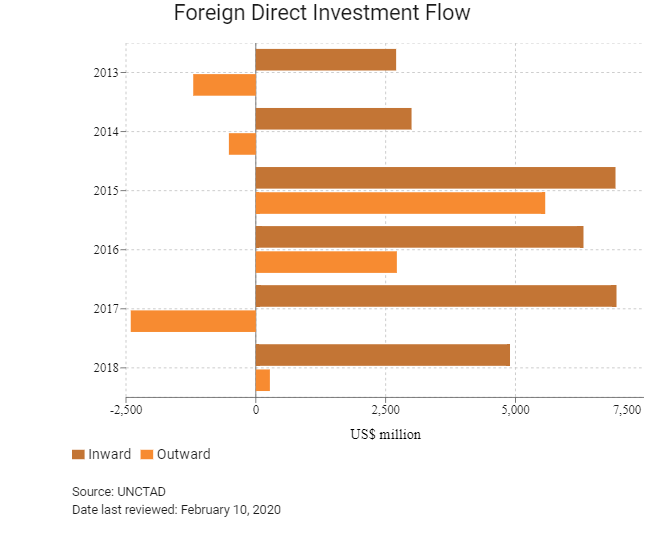

Foreign Direct Investment

Foreign Direct Investment Policy

- AICEP Portugal Global, Portugal's investment agency, is a government agency promoting investment inflows and assisting international companies in finding business opportunities in Portugal. It also aims to contribute to the success of Portuguese companies abroad in their internationalisation processes or export activities. AICEP offers comprehensive, one-stop investment consultancy services while providing a single point of contact in all phases: pre-investment, incentives negotiation, settling in and after care.

- There is no discrimination between domestic and foreign investors with respect to establishing business in almost all the economic sectors that are open to private investment. Foreign investors must register within 30 days of the investment.

- Authorisation is required for investments in sensitive areas, including defence and water management.

- Investors wishing to set up a new credit agency, or who wish to acquire the controlling stake of a Portuguese bank or financial institute require approval from the Bank of Portugal and/or the Ministry of Finance.

- Portugal ensures landowners’ compensation in the case of expropriation; however, such cases have little-to-no precedent in Portugal's recent history.

- Portugal has signed more than 50 bilateral investment treaties with countries not in the European Union.

- The government has implemented various policies to encourage investment in a number of priority sectors, including biotechnology and high-end tourism.

Sources: WTO – Trade Policy Review, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Madeira Free Trade Zone (FTZ), which is also known as the International Business Centre, and the Santa Maria Island FTZ |

- Offers a lowered Corporate Income Tax (CIT) rate of 5% (in comparison with the standard CIT rate in the rest of Portugal, which stands at 21%) if business is conducted with an entity not situated in Portugal. - Reduced CIT rates have a ceiling applied to them, with the limit determined by the number of jobs created by the entity in question. - To qualify for tax reductions, companies must meet one of the following criteria:

- No property transfer tax. - No withholding tax on dividends paid to members of EU states or with states that have a double tax agreement with Portugal. - 80% exemption on stamp duty. - 80% exemption on municipal property tax. - A 50% reduction in taxable income if the entity fulfils two of the following criteria:

Creation of 15 jobs for a period of 5 years. |

Sources: US Department of Commerce, International Business Centre of Madeira, Fitch Solutions

- Value Added Tax: 6-23%

- Corporate Income Tax: 21%

Source: Tax and Customs Authority

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate income tax (CIT) |

Standard rate: 21% |

|

Capital gains tax |

• Taxed as CIT |

|

Surtaxes |

The following surtaxes can also apply: |

|

VAT |

Mainland Portugal |

|

Withholding tax: dividends, interest and royalties |

25% to non-residents (35% if recipient is located in a tax haven) |

|

Transfer tax |

6% on residential property |

|

Payroll tax: Social security |

23.75% of an employee's salary (as paid for by the employer) and the contributions by an employer are tax deductible |

Source: Tax and Customs Authority

Date last reviewed: April 16, 2020

Work Permit

EU member citizens do not require a work permit, but their employer must inform the job office about their employment. Citizens of the European Economic Area (with EU member states, Iceland, Norway and Lichtenstein) and Switzerland do not require a visa to enter, reside and work in the country.

No work permit is needed by foreigners from outside the EU if they have a permanent residence or family reunion permit, have been granted asylum, study in the country or have blue or green cards.

Obtaining Foreign Worker Permits

Individuals from non-EU countries require residence and work permits. The procedure to be granted a work permit includes a review of the local job market to ensure that there is no Portuguese or EU job seeker available to fulfil the position. Employers must first apply for a permit to hire foreign workers. The vacant position must be reported to the local district Labour Office and cannot be changed at a later stage to fit the profile of a potential employee. The candidate must then apply for a work permit. The government issues the permit for a maximum of two years, which can be repeatedly prolonged, but always for a maximum of two years, and may be renewed as many times as needed. The permit process takes an average of one month.

Blue Card

Intended for the stay of a highly qualified employee. A foreigner holding a blue card may reside in the country and work in the job for which the blue card was issued, or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education that has lasted for at least three years. The blue card is issued with the term of validity three months longer than the term for which the employment contract has been concluded, but for the maximum period of two years. The blue card can be extended. One of the conditions for issuing the blue card is a wage criterion – the employment contract must contain gross monthly or yearly wage at least at the rate of 1.5 multiple of the gross average annual wage.

Sources: Government websites, European Commission, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Baa3 (Positive) |

09/08/2019 |

|

Standard & Poor's |

BBB (Stable) |

24/04/2020 |

|

Fitch Ratings |

BBB (Stable) |

17/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

29/190 |

34/190 |

39/190 |

|

Ease of Paying Taxes Index |

38/190 |

39/190 |

43/190 |

|

Logistics Performance Index |

23/160 |

N/A |

N/A |

|

Corruption Perception Index |

30/180 |

30/180 |

N/A |

|

IMD World Competitiveness |

33/63 |

39/63 |

N/A |

Sources: World Bank, IMD, Transparency International

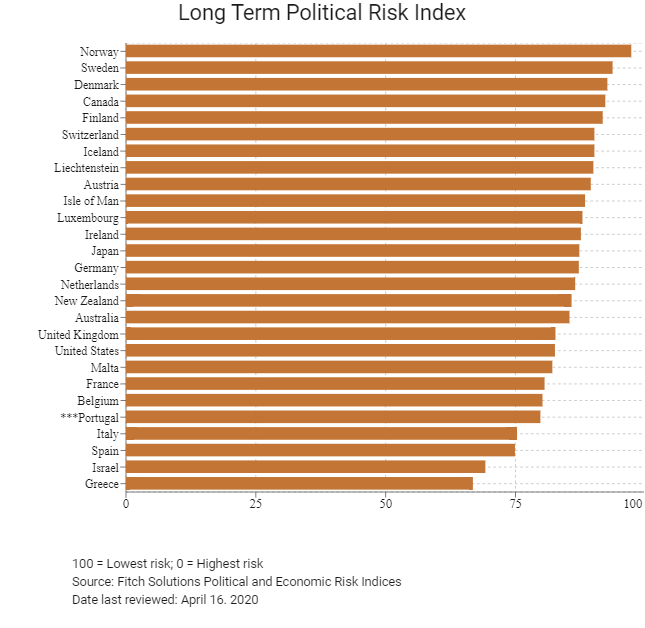

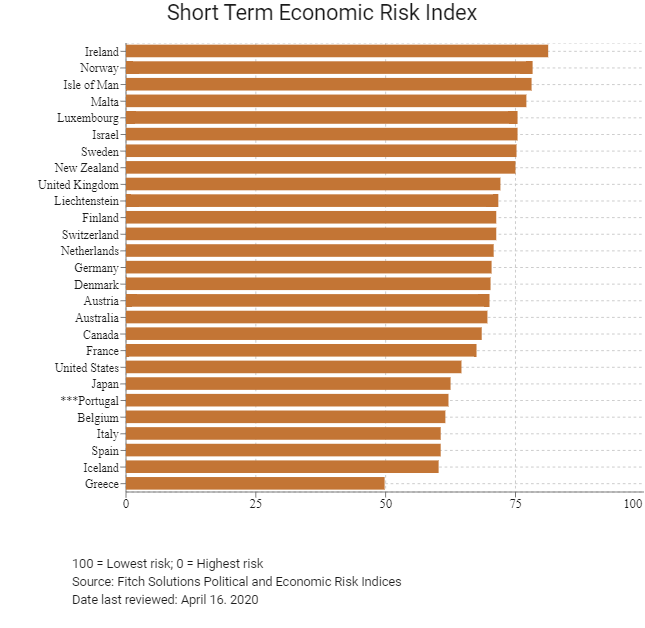

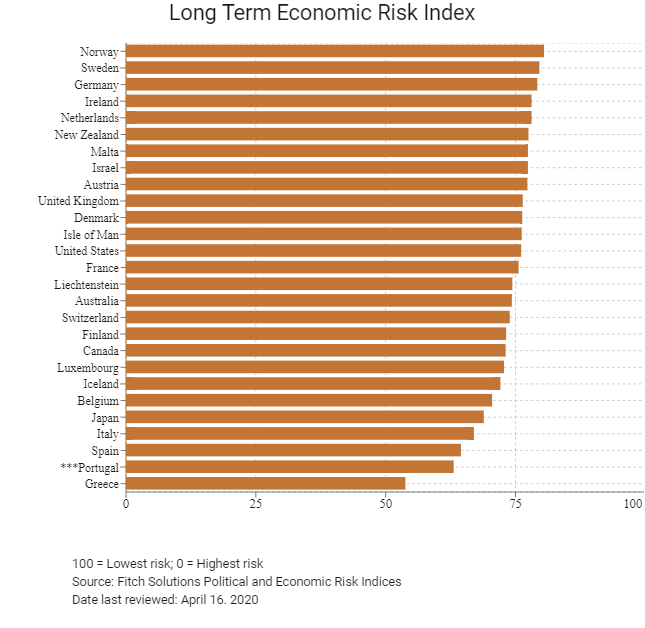

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

62/202 |

61/201 |

54/201 |

|

Short-Term Economic Risk Score |

65.8 |

64.6 |

62.1 |

|

Long-Term Economic Risk Score |

62.5 |

61.9 |

63.1 |

|

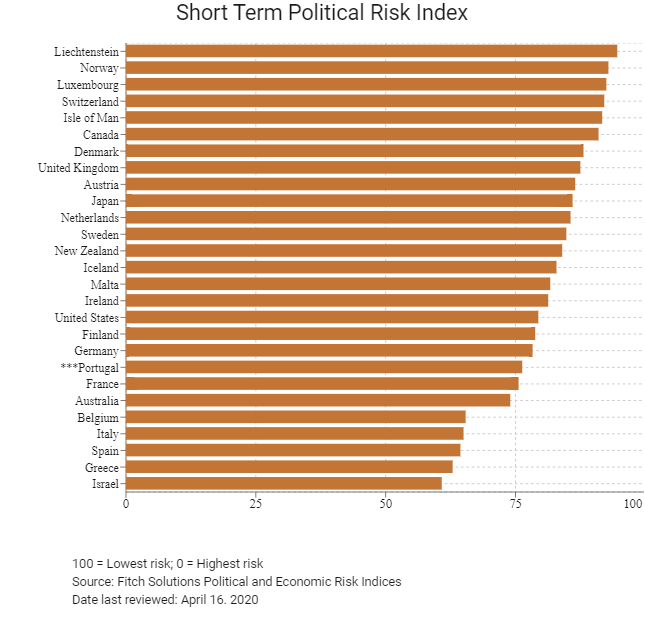

Political Risk Index Rank |

33/202 |

33/201 |

32/201 |

|

Short-Term Political Risk Score |

75.6 |

75.6 |

76.3 |

|

Long-Term Political Risk Score |

79.8 |

79.8 |

79.8 |

|

Operational Risk Index Rank |

27/201 |

28/201 |

27/201 |

|

Operational Risk Score |

70.8 |

69.6 |

70.0 |

Source: Fitch Solutions

Date last reviewed: April 16, 2020

Fitch Solutions Risk Summary

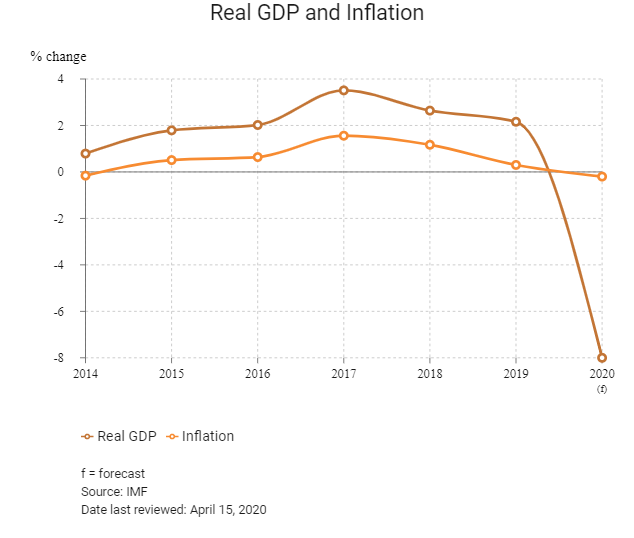

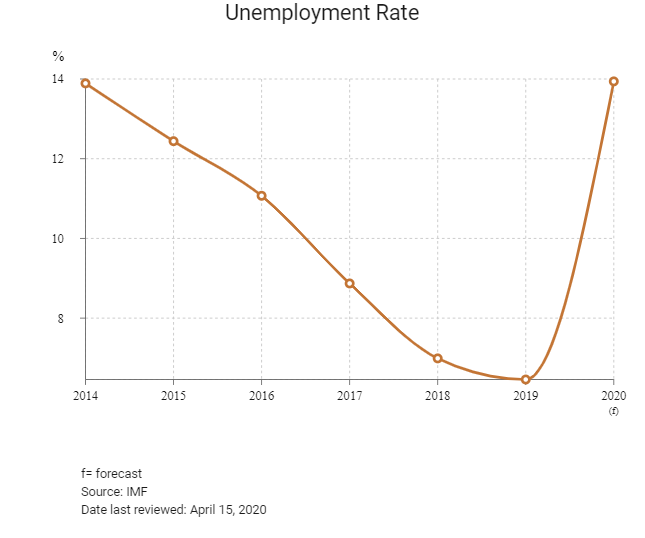

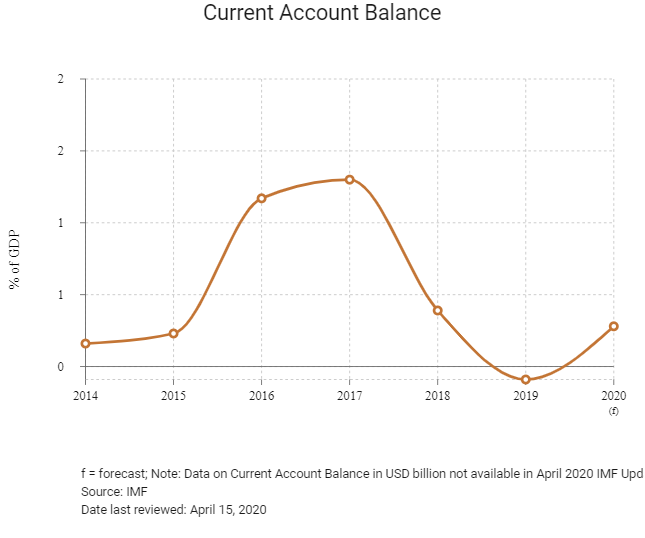

ECONOMIC RISK

Portugal's shift towards an investment and export-oriented growth model will depend crucially on its ability to keep the reform momentum going. The minority government led by Socialist Party leader Prime Minister Antonio Costa has proven to be a sound fiscal steward, bringing the budget deficit to within European Union limits quicker than expected. Growth headwinds in 2020 stem from a slowdown in global growth amid the coronavirus pandemic. In addition, there remains a risk of a cliff edge Brexit when the UK's European Union (EU) transition period expires in December 2020. Furthermore, some austerity measures are being reversed, and progress on privatisation has slowed, with the government remaining averse to sell state-owned enterprises. This will limit the prospects of more fiscal flexibility and would miss an opportunity to boost competitiveness of key industries.

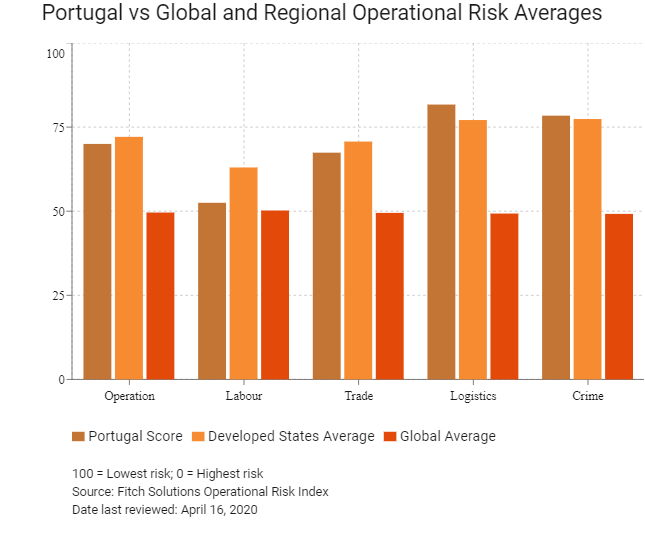

OPERATIONAL RISK

Portugal's long-term demographic dynamics suggest that the country will see a decline in both the working-age and total population in the years ahead, as migration outflows, ageing local populations and declining fertility rates take their toll. As the population ages, health and pension spending is set to rise to 25-30% of GDP by 2027, compared with half that in 2000. The shift in demographic structure will also put increasing pressure on the working-age population to underwrite the country's large welfare state, potentially complicating fiscal consolidation efforts and austerity measures. Portugal has lost – not gained – ground on core European states in terms of productivity since joining the euro. While the last few years have seen a reversal due to structural reforms, it could take several more before Portugal becomes competitive. However, the country's historic trade and investment linkages with Angola and Brazil, among others, present an opportunity for Portugal to shift away from its trade interdependence on the eurozone, which is poised for sluggish growth in the coming years.

Source: Fitch Solutions

Date last reviewed: April 16, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Portugal Score |

70.0 |

52.5 |

67.4 |

81.7 |

78.4 |

|

Developed States Average |

72.1 |

63.0 |

70.7 |

77.1 |

77.4 |

|

Developed States Position (out of 27) |

21 |

25 |

22 |

10 |

16 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

27 |

83 |

38 |

10 |

19 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Denmark |

79.5 |

70.5 |

76.6 |

88.5 |

82.3 |

|

Switzerland |

78.4 |

74.4 |

76.9 |

79.3 |

83.2 |

|

Netherlands |

78.3 |

65.4 |

78.2 |

88.8 |

80.7 |

|

United States |

77.7 |

79.7 |

75.8 |

85.9 |

69.3 |

|

Sweden |

77.3 |

66.8 |

76.9 |

86.7 |

78.6 |

|

New Zealand |

76.9 |

72.0 |

74.5 |

73.0 |

88.3 |

|

Canada |

76.2 |

73.6 |

74.4 |

75.1 |

81.6 |

|

United Kingdom |

76.1 |

70.2 |

77.9 |

78.3 |

78.2 |

|

Norway |

76.0 |

63.8 |

71.1 |

81.2 |

87.9 |

|

Austria |

74.8 |

61.9 |

72.1 |

83.6 |

81.5 |

|

Finland |

73.9 |

54.9 |

72.2 |

84.7 |

83.7 |

|

Ireland |

73.5 |

66.6 |

78.1 |

70.4 |

79.0 |

|

Luxembourg |

73.4 |

54.3 |

77.6 |

82.5 |

79.3 |

|

Australia |

72.4 |

68.7 |

72.5 |

68.4 |

79.9 |

|

Germany |

72.1 |

66.2 |

67.9 |

80.8 |

73.6 |

|

Spain |

71.9 |

61.0 |

70.0 |

80.6 |

76.0 |

|

France |

71.5 |

60.7 |

70.1 |

82.6 |

72.8 |

|

Belgium |

71.4 |

57.0 |

75.1 |

82.3 |

71.1 |

|

Iceland |

71.4 |

59.8 |

67.6 |

70.0 |

88.1 |

|

Japan |

71.2 |

69.9 |

65.9 |

77.5 |

71.5 |

|

Portugal |

70.0 |

52.5 |

67.4 |

81.7 |

78.4 |

|

Israel |

67.9 |

71.3 |

67.3 |

70.2 |

62.7 |

|

Malta |

64.9 |

54.3 |

68.6 |

63.0 |

73.7 |

|

Isle of Man |

64.4 |

49.9 |

68.6 |

56.6 |

82.4 |

|

Italy |

63.8 |

55.1 |

59.8 |

76.2 |

64.3 |

|

Liechtenstein |

63.1 |

47.0 |

57.1 |

65.1 |

83.2 |

|

Greece |

57.9 |

53.2 |

48.9 |

69.9 |

59.6 |

|

Regional Averages |

72.1 |

63.0 |

70.7 |

77.1 |

77.4 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 16, 2020

Hong Kong’s Trade with Portugal

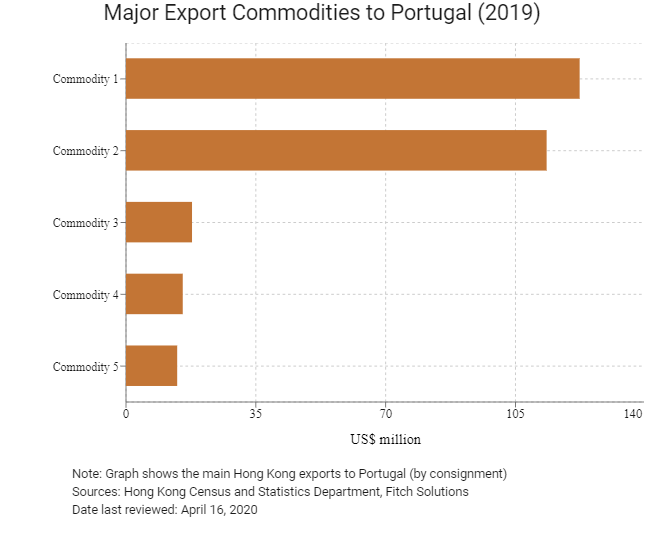

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

122.3 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

113.4 |

|

Commodity 3 |

Miscellaneous manufactured articles |

17.8 |

|

Commodity 4 |

Office machines and automatic data processing machines |

15.3 |

|

Commodity 5 |

Professional, scientific and controlling instruments and apparatus |

13.8 |

|

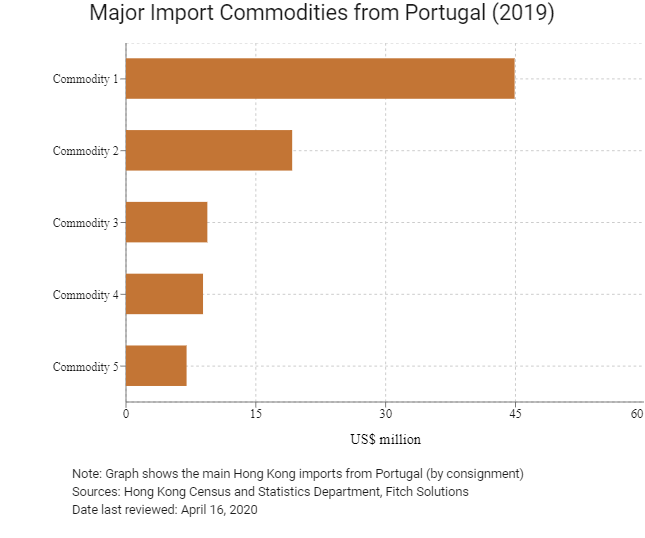

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Photographic apparatus, equipment and supplies, and optical goods; watches and clocks |

44.9 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

19.2 |

|

Commodity 3 |

Articles of apparel and clothing accessories |

9.4 |

|

Commodity 4 |

Miscellaneous manufactured articles |

8.9 |

|

Commodity 5 |

Textile yarn, fabrics, made-up articles and related products |

7.0 |

Exchange rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Portuguese residents visiting Hong Kong |

27,510 |

5.2 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

|

2019 |

Growth rate (%) |

|

Number of Portuguese residing in Hong Kong |

141 |

29.4 |

|

Number of Developed State citizens residing in Hong Kong |

83,786 |

29.6 |

Note: Growth rates for resident data are from 2015 to 2019. No UN data available for intermediate years.

Sources: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: February 12, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

2334 |

22.5 |

|

- Regional headquarters |

507 |

14.2 |

|

- Regional offices |

764 |

23.0 |

|

- Local offices |

1063 |

26.5 |

Treaties and Agreements between Hong Kong and Portugal

- Portugal and Hong Kong signed a comprehensive double tax avoidance agreement in March 2011, with the agreement coming into effect in June 2012.

- Mainland China and Portugal signed a double tax avoidance agreement in April 1998. The agreement entered into force in June 2000.

- A bilateral investment treaty between Mainland China and Portugal entered into force in July 2008.

Sources: Hong Kong – Inland Revenue Department, UNCTAD

Chamber of Commerce or Related Organisations

Hong Kong-European Chamber of Commerce

Address: Room 1302, 13/F, 168 Queen’s Road, Central, Hong Kong

Email: info@eurocham.com.hk

Tel: (852) 2511 5133

Fax: (852) 2511 6833

Source: Hong Kong – European Chamber of Commerce

Portugal-Hong Kong Chamber of Commerce

Address: 18/F, Tin On Sing Commercial Building, 41-43 Graham Street, Central, Hong Kong

Email: info@phkcci.com

Tel: (852) 2801 4868

Source: Portugal-Hong Kong Chamber of Commerce

Honorary Portuguese Consulate in Hong Kong

Address: Room B, 25/F, Yardley Commercial Building 3, Connaught Road West, Sheung Wan, Hong Kong

Email: info@hkportugalcon.org

Tel: (852) 2587 7182

Fax: (852) 2587 7331

Visa Requirements for Hong Kong Residents

Hong Kong Residents can travel to the Schengen Zone without a visa. They can travel for tourism and business purposes, and remain in the region for a period of up to 90 days.

Source: Hong Kong Immigration Department

Date last reviewed: April 16, 2020

Portugal

Portugal