GDP (US$ Billion)

585.82 (2018)

World Ranking 22/193

GDP Per Capita (US$)

15,426 (2018)

World Ranking 59/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

106.2 (2019)

Currency (Period Average)

Polish Zloty

3.84per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

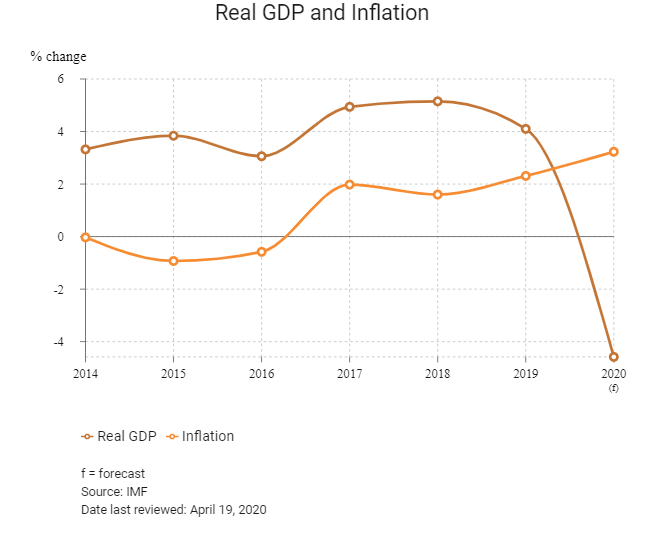

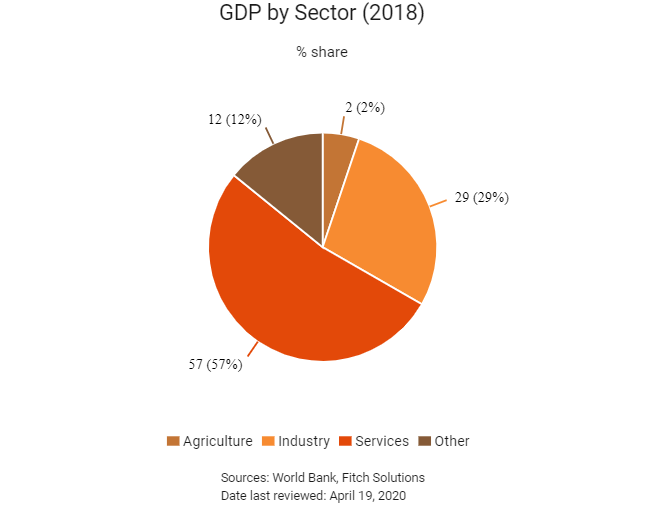

Poland has reached high-income status over a relatively short period of time, and this has translated into remarkable progress in poverty reduction and shared prosperity. Few middle-income countries have experienced such consistent broad-based growth at both a fast and stable rate. Owing to a very well developed financial sector, services contribute maximum share to the country’s GDP. The Polish economy continues to perform strongly, with real GDP growth reaching 5.1% in 2018. The three main challenges ahead for Poland are a shortage of labour in the economy, pro-cyclical government policies encouraged by the political calendar and adverse global factors.

Sources: World Bank, Fitch Solutions

Economic/Political Events and Upcoming Elections

December 2017

The resignation of Prime Minister Beata Szydło and subsequent promotion of Mateusz Morawiecki, the former deputy prime minister and minister of economic development and finance, marked significant changes within the governing Law and Justice party (PiS) leadership. Morawiecki took over as prime minister of the PiS government.

July 2018

General Electric (GE) signed a contract with Elektrownia Ostrołęka to build a 1GW ultra-supercritical coal power plant in north east Poland. Under the contract, GE would design and construct the power plant and manufacture and deliver boiler and steam turbine generators. GE would also supply air quality control systems in accordance with the latest European Union (EU) standards in terms of local emissions. The power plant, called Ostrołęka C, was likely to generate sufficient power for 300,000 Polish homes. The plant was expected to start operating in 2023, according to a GE press release.

October 2018

Poland's ruling PiS party increased its hold on regional parliaments following local elections.

May 2019

The European Investment Bank had signed a financing agreement with Bank Gospodarstwa Krajowego (BGK), provided a EUR300 million (USD335.5 million) loan for a highway upgrade project in Poland.

August 2019

Telecom gear-maker Ericsson would increase production and invest further in its Tczew plant in Poland in preparation for the ramp up of a next-generation 5G mobile network across Europe.

October 2019

The ruling PiS secured victory in the country’s parliamentary election, won nearly 44% of votes and increased its share of seats in the lower house. The biggest opposition bloc, Civic Coalition (KO), secured 27.2% of votes and the Left Alliance secured 12.5%.

January 2020

Poland’s new Finance Minister Tadeusz Koscinski announced that he wanted to tax United States tech company AirBnB on the revenues it earns in Poland.

February 2020

BGK signed an agreement with the European Investment Fund (EIF) for additional resources to support Polish small- and medium-sized enterprises (SMEs). Thanks to this agreement under the EU's SME programme COSME, the supported SME loan volume was expected to reach a total of PLN10.5 billion (EUR2.5 billion).

March 2020

Poland’s parliament on March 31 approved a coronavirus rescue package to support the economy but rejected many changes proposed by the opposition such as mandatory weekly coronavirus tests for medical workers. The lower house of parliament, the Sejm, controlled by the ruling nationalist Law and Justice (PiS) party, first approved a package offering up to PLN75 billion (USD18.07 billion) of additional budget spending on jobs and infrastructure.

March 2020

Poland’s ruling party also fast-tracked changes to the electoral code as part of the rescue package which was approved by the Czech parliament on March 31 2020 to allow seniors and those under quarantine to vote by post in a bid to press ahead with presidential elections in May 2020.

April 2020

The Polish government had decided to proceed with the presidential election scheduled for May 10 2020, sparking a new debate between the governing PiS party and the opposition on how to properly hold the vote amid the Covid-19 pandemic.

May 2020

Presidential elections did not take place due to the coronavirus. The head of Poland's electoral commission told parliament that it had 14 days to declare the new date of the presidential election.

Sources: BBC country profile – Timeline, Fitch Solutions

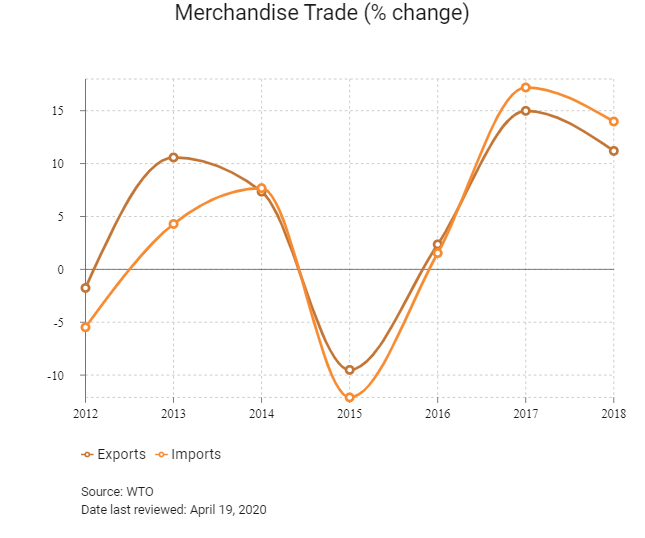

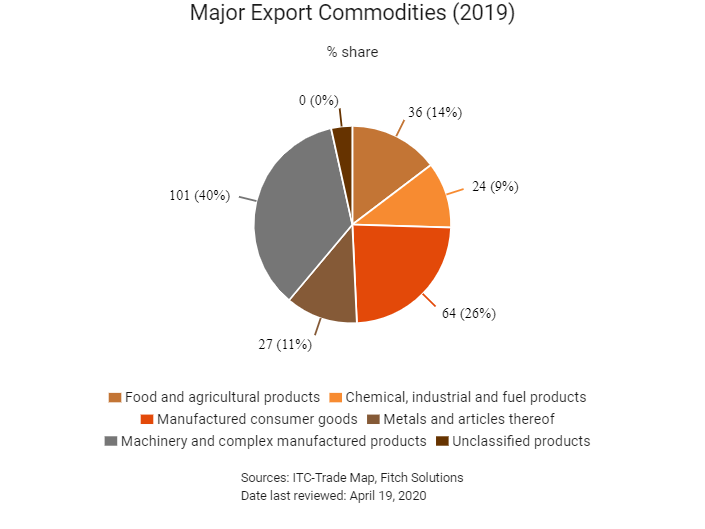

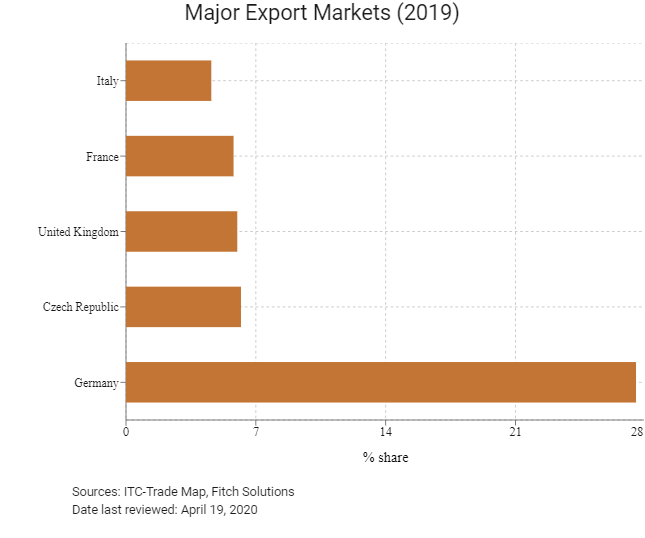

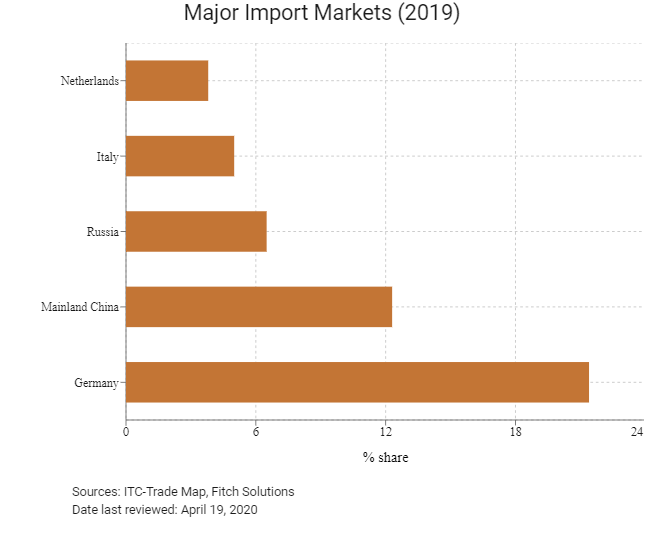

Merchandise Trade

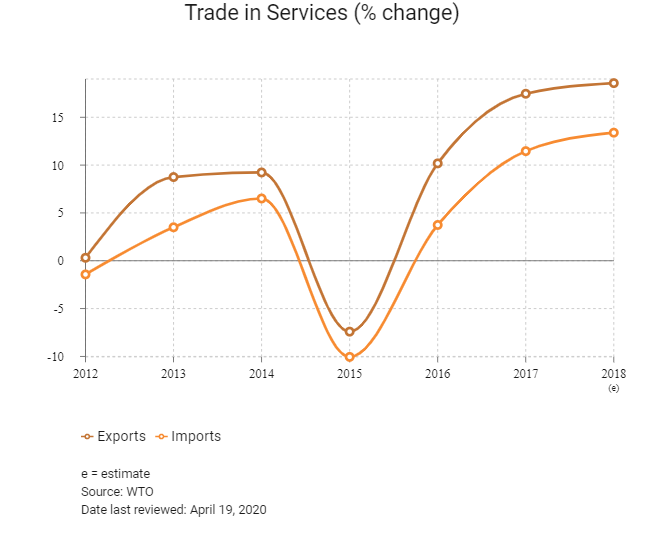

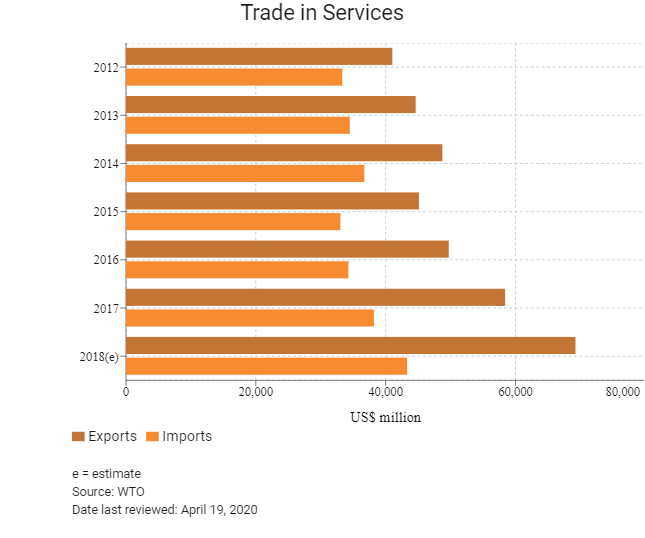

Trade in Services

- Poland has been a member of World Trade Organization (WTO) since July 1, 1995 and a member of General Agreement on Tariffs and Trade (GATT) since October 18, 1967.

- Poland has been a member of the EU since 2004. All EU member states are WTO members.

- Trade flows are largely unhindered by import tariffs, which at 1.5% on average, are among the lowest in the world, and non-tariff barriers to trade are minimal. There are no currency controls or import substitution policies that would burden importers, and trade standards and policies adhere to EU rules.

- Poland applies the EU's Common Customs Tariff, which means that goods manufactured and imported from within the EU are not subject to customs charges. The average tariff rate for EU states is just 1%, which is among the lowest globally, although goods imported from outside the EU will incur duties of 0-17%.

- The EU has imposed various anti-dumping measures on a wide range of products, predominantly in the areas of textiles, machine parts, steel, iron and machinery on goods coming from Mainland China and a few other Asian nations to protect domestic industries. Currently, a number of products originating from Mainland China are subject to duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards and solar glass. These products are of interest to Hong Kong and regional exporters. In November 2016, the European Commission (EC) imposed a provisional anti-dumping duty on imports of some primary and semi-processed metals from Mainland China. The rate of duty is between 43.5% and 81.1% of the net free-at-Union-frontier price before duty depending on the company. In the same vein, the rate of duty for similar goods from Belarus is 12.5% of the net free-at-Union-frontier price before duty. As of end December 2018 (latest data available), the EU did not apply any anti-dumping measures on imports from Hong Kong.

- In 2016, the EC introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

- In February 2018, the Polish government officially enacted its Act on Electromobility and Alternative Fuels. The Act will introduce excise duty exemptions for electric vehicles (EVs), tax exemptions for companies using EVs, a new government procurement plan based on electrifying its government fleet as well as support for charging infrastructure development. This reform will position Poland well in terms of attracting investors that are higher up on the automotive and technology value chains.

- Value-added tax (VAT) is charged at a rate of 23% on the sale of goods, services and imports; 0% applies to exports and supplies of goods within the EU. Reduced rates are applicable to specified goods and services indicated in the VAT Act, such as food, agricultural products and medical equipment.

- In April 2015, the Polish parliament amended the pharmaceutical law, restricting exports of medicinal products from the country. The amendment also introduced strict reporting obligations for marketing authorisation holders and warehouses.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- Poland has been a member of the WTO since July 1, 1995 and the EU since 2004.

- The EU: The EU is a political and economic union of 28 member states that are located primarily in Europe. As an EU member, Poland applies the EU Common Customs Tariff and enjoys tariff-free trade within the EU. Within the Schengen Area, passport controls have been abolished. A monetary union was established in 1999 and came into force in 2002. It consists of 19 EU member states that use the euro; however, Poland still maintains its own currency.

- EU-Canada Comprehensive Economic and Trade Agreement (CETA): This agreement was provisionally applied as of September 21, 2017. The agreement is expected to boost trade between partners as CETA removes all tariffs on industrial products traded between the EU and Canada. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa, though some sectors are restricted. The agreement will only enter into force fully and definitively when all EU member states have ratified the agreement.

- EU-Europe Free Trade Association (EFTA): This agreement includes Switzerland, Norway, Liechtenstein and Iceland. The European Economic Area (EEA) unites the EU member states and the four EEA EFTA states (Iceland, Liechtenstein, Norway and Switzerland) into an internal market governed by the same basic rules. The agreement on the EEA, which entered into force on January 1, 1994, aims to enable goods, services, capital and persons to move about freely in the EEA in an open and competitive environment. This concept is referred to as the four freedoms.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers.

- EU-Japan Economic Partnership Agreement (EPA) : In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the European Commission, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The EPA was finalised in late 2017 after four years of negotiation and came into force on February 1, 2019 after the EU Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is estimated at EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments and electrical machinery.

- EU-South African Development Community (SADC) EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and eSwatini): An agreement between EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of the SADC now included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking economic partnership agreements with the EU as part of other trading blocs – such as with East or Central African communities.

Ratification Pending

EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (29 of the 34 parties have ratified the agreement as of October 2018). The agreement has been provisionally applied since 2013.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, launched negotiations for a comprehensive trade agreement between the two parties. Bilateral trade in goods between the two has risen steadily in recent years, reaching almost EUR48 billion in 2017, while bilateral trade in services added an additional EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the current administration in the United States against the backdrop of rising global trade tensions.

- EU-West Africa EPA: West Africa is the EU's largest trading partner in sub-Saharan Africa. EU’s main imports from West Africa consist mainly of fuels and food products while its exports to West Africa consist of processed foods, machinery and chemicals and pharmaceutical products. The EU has initialed an EPA with 16 West African states. Until the adoption of the full regional EPA with West Africa, EPAs with Côte d'Ivoire and Ghana have been entered into provisional application on 3 September 2016 and 15 December 2016 respectively.

- EU-Vietnam Free Trade Agreement (FTA): In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement. In Q219 the conclusion of the agreement in the European Parliament was delayed until 2020 as a result of Brexit proceedings and EU parliamentary elections.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

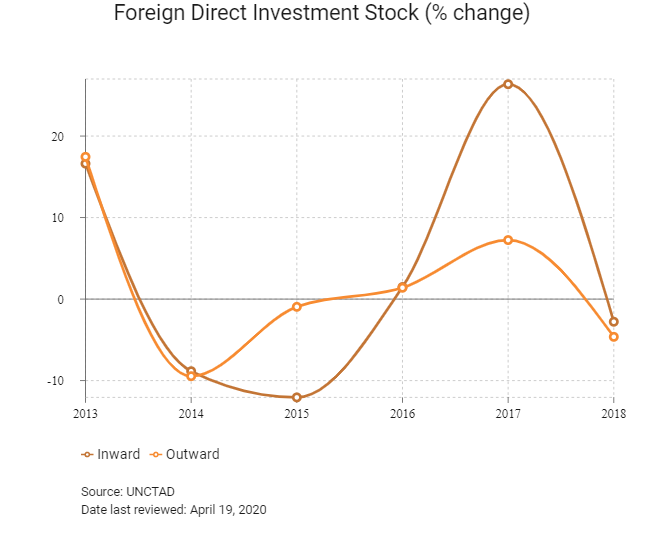

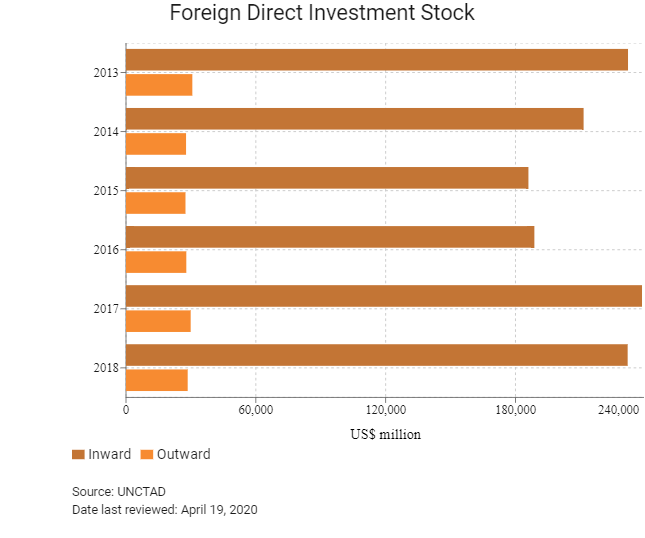

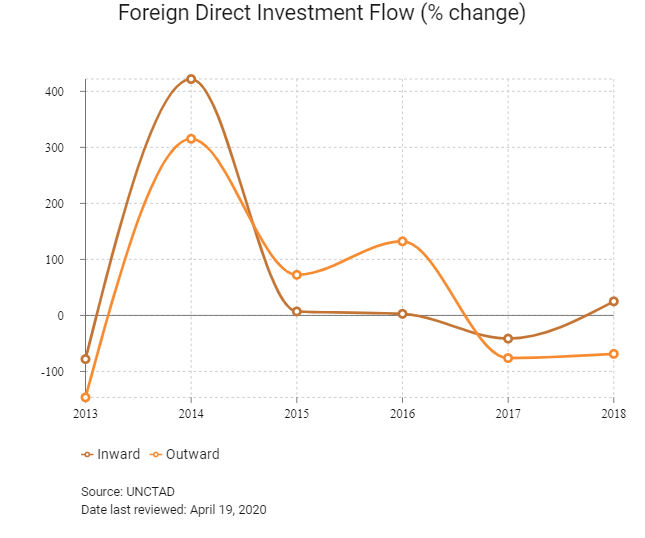

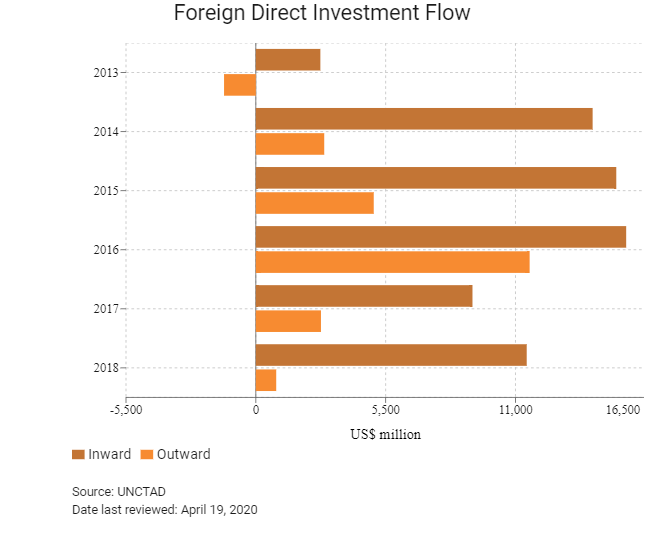

Foreign Direct Investment

Foreign Direct Investment Policy

- There are a variety of Polish agencies involved in investment promotion. The Economic Development Ministry has two departments involved in investment promotion and facilitation: the Large Investment Support Department and the International Relations Department. The Foreign Affairs Ministry promotes Poland's foreign relations, including economic relations, and along with the Polish Chamber of Commerce organises missions of Polish firms abroad and hosts foreign trade missions to Poland. Starting February 2017, the Polish Investment and Trade Agency (PAIH) replaced the Polish Information and Foreign Investment Agency as the main institution responsible for the promotion and facilitation of foreign investment. The rebranding is connected with the expansion of the scope of the agency's activities. Apart from providing services to investors in the country, PAIH will support Polish investors abroad. The agency will operate as part of the Polish Development Fund, which integrates government development agencies. PAIH will coordinate all operational instruments, such as diplomatic missions, commercial fairs and programmes dedicated to specific markets and sectors, as well as promote the Polish economy and attract foreign investors to the country. These services are available to all investors.

- Related laws and regulations on foreign investment are well established; however, some restrictions still remain on foreign direct investment (FDI), such as limits on foreign ownership and business activity in core sectors. The Act on the Control of Certain Investments entered into force in 2015 and provides for the screening of acquisitions in energy generation and distribution; petroleum production, processing and distribution; telecommunications and the manufacturing and trade of explosives, weapons and ammunition.

- Poland's support for foreign investors is generally sectoral in focus; regional support is provided in the context of sectoral investments. Any company investing in Poland, either foreign or domestic, may apply for assistance from the Polish government. Foreign investors have the potential to access grants and certain incentives. There are 14 special economic zones (SEZs) located throughout Poland on major supply chain routes. The benefits available for locating in these zones include income tax exemption, real estate tax exemption, competitive land prices and close access to high-quality local suppliers.

- Foreign ownership is permitted, with the exception of some sectors that are designated as strategic sectors. Polish law restricts foreign investment in land and real estate. Polish law limits non-EU citizens to 49% ownership of a company's capital shares in the air transport, energy, radio and television broadcasting and airport and seaport operations sectors.

- Licences and concessions for defence production and management of seaports are granted on the basis of national treatment for investors from the Organisation for Economic Co-operation and Development countries.

- Polish law restricts foreign investment in land and real estate. Since Poland's EU accession, foreign citizens from EU member states and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland) do not need permission to purchase non-agricultural real estate or to acquire or receive shares in a company owning non-agricultural real estate in Poland. Land usage types, such as technology and industrial parks, business and logistic centres, transport, housing plots, farmland in SEZs, household gardens and plots up to two hectares are exempt from agricultural land purchase restrictions. Citizens from countries other than the EU and EFTA are allowed to purchase an apartment, 0.4 hectares of urban land, or up to half a hectare of agricultural land with building restrictions and restrictions on eligibility for government support programmes. In order to make large commercial real estate purchases, foreign citizens must obtain a permit from the Ministry of Interior (with the consent of the Defence and Agriculture Ministries), pursuant to the Act on Acquisition of Real Estate by Foreigners. Laws to restrict farm land and forest purchases came into force on April 30, 2016.

Sources: WTO – Trade Policy Review, government websites, Fitch Solutions

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| There are 14 SEZs located throughout Poland on major supply chain routes | - Exemption from custom duties and VAT - Competitive land prices - Real estate tax and Income tax exemption - Good access to high quality local suppliers - The amount of government aid available to investors is subject to the EU's aid intensity programme, whereby projects in less developed regions benefit from incentives of up to 50% of the costs of new investment, with this percentage falling to 10% in the most developed region, Warsaw. - Investment grants of up to 50% of investment costs (or 70% for small or medium-sized enterprises) are available. Grants for research and development and other activities, such as environmental protection, training, logistics or use of renewable energy sources, are also available. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 23%

- Corporate Income Tax: 19%

Sources: Poland National Revenue Administration, Fitch Solutions

Important Updates to Taxation Information

- Poland's tax regime is applied evenly to both resident and non-resident businesses. In June 2018 new regulations concerning SEZs entered into force. The new rules significantly change the situation for investors planning to get income tax incentives in relation to new investment projects. Zonal permits are no longer issued by the authorities, but entities may apply for decisions based on the new regulations. The biggest change in the SEZs system is its availability, as obtaining a tax incentive does not depend on the location of the new investment.

- With effect from January 1, 2019, a lower corporate income tax rate is in force for companies whose revenues in a given fiscal year are lower than EUR1.2 million. Under certain conditions, companies that start operations from 2019 will be eligible to apply a lower corporate tax rate of 9%, compared to the standard corporate income tax rate of 19%.

- As of January 2019, an exit tax was introduced, which refers to taxation of unrealised profits related to moving one's assets to another country. The exit tax may be applicable to foreigners working in Poland and emplyees leaving Poland to work abroad.

- Effective from January 2019, an Innovation Box Regime (IBR) has been introduced. The IBR is aimed at incentivising innovative research and development activities by taxing profits from qualifying intellectual property rights at a preferential 5% tax rate.

Business Taxes

Type of Tax | Tax Rate and Base |

| Corporate Income Tax (CIT) | 19%; 9% corporate tax rate applies to revenue not exceeding EUR1.2 million. |

| 19% on profits (same as CIT rate) | |

| Capital Gains Tax | Treated as taxable income; 19% |

| Withholding Tax (interest, royalties, services) | 20% on net earnings |

| Withholding Tax (dividends) | 19% on net earnings |

| VAT | 23% on sale of goods, services and imports; 0% applies to exports and supplies of goods within the EU. Reduced rates are applicable to specified goods and services indicated in the VAT act, such as food, agricultural products and medical equipment. |

| Social security contributrions | An employeer is obligated to pay: - between 19.48% and 22.14% of an employee's gross salary if below the cap of PLN142,950 in 2019 - between 3.22% and 6.14% of an employee's gross salary if equal or above the cap of PLN142,950 in 2019 |

| Real Estate Tax | 5% |

Sources: National sources, Poland National Revenue Administration, Fitch Solutions

Date last reviewed: April 19, 2020

Localisation Requirements

Foreigners can only be employed in positions for which no suitable candidate could be found within Poland or in other EU member states. After a five-year period, EU citizens acquire the status of permanent resident if they continue to fulfil the respective conditions.

Obtaining Foreign Worker Permits for Skilled Workers

In order to employ foreign workers from outside the EU, businesses must apply for work permits according to the type of activity the worker will undertake and the length of their stay in Poland. The rules and regulations regarding labour mobility are broadly in line with EU directives, allowing for the free movement of labour within the EU. People from the EU do not need a work permit, but their employer must inform the job office about their position. Most non-EU citizens require a work visa and permit in order to work in the country, which generally takes about a month to obtain.

Blue Card

The Blue Card is intended for the stay of a highly qualified employee. A foreigner holding a Blue Card may reside in Poland and work in the job for which the Blue Card was issued or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education which lasted for at least three years. The Blue Card is issued with a term of validity that is three months longer than the term for which the employment contract has been concluded; however, this is for a maximum period of two years. The Blue Card can be extended. One of the conditions for issuing the Blue Card is a wage criterion: the employment contract must contain gross monthly or yearly wage at least 1.5 times the gross average annual wage.

Visa/Travel Restrictions

The work permit holder must have worked and resided in Poland lawfully for at least two continuous years before becoming eligible to sponsor accompanying family members for residence in Poland. Dependants and family members that are non-EU or non-EEA citizens must enter Poland as tourists and obtain visas according to their nationality. Businesses that bring workers with family members that are EU/EEA/Swiss nationals can enter Poland with a valid identification document confirming their citizenship. Family members of EU/EEA/Swiss nationals who are not citizens of these countries can enter Poland with a valid travel document and a visa, if required. After a continuous period of residence of five years on Polish territory, an EU/EEA/Swiss national obtains permanent resident status. The European Parliament and the Council of the EU tightened the Schengen Borders Code regulations on external border crossings in November 2017 by making it mandatory for all non-EU persons crossing an external border to undergo thorough checks and make an entry in the computerised entry-exit system, which will be operational by 2020.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | A2 (Stable) | 19/04/2019 |

| Standard & Poor's | A- (Stable) | 12/10/2018 |

| Fitch Ratings | A- (Stable) | 27/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 27/190 | 33/190 | 40/190 |

| Ease of Paying Taxes Index | 51/190 | 69/190 | 77/190 |

| Logistics Performance Index | 28/160 | N/A | N/A |

| Corruption Perception Index | 36/180 | 41/180 | N/A |

| IMD World Competitiveness | 34/63 | 38/63 | N/A |

Sources: World Bank, IMD, Transparency International

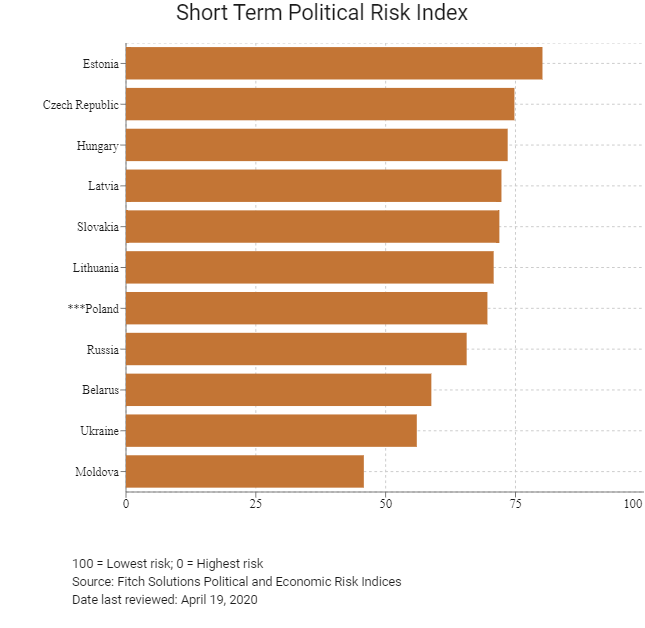

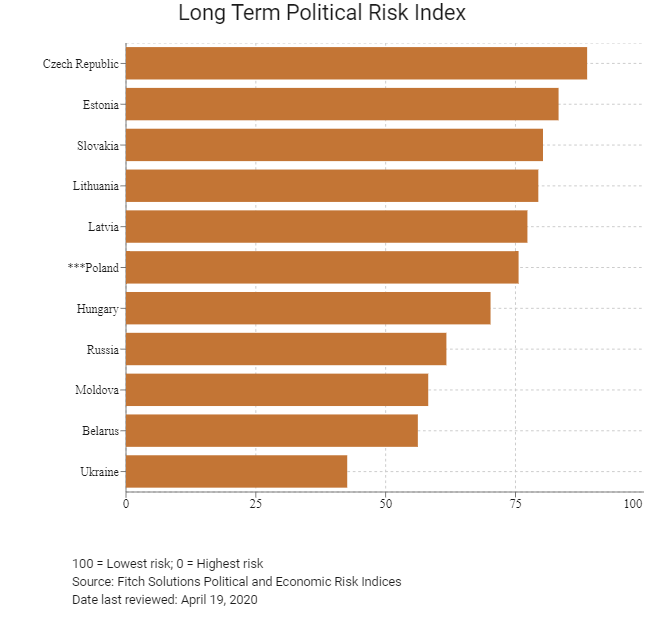

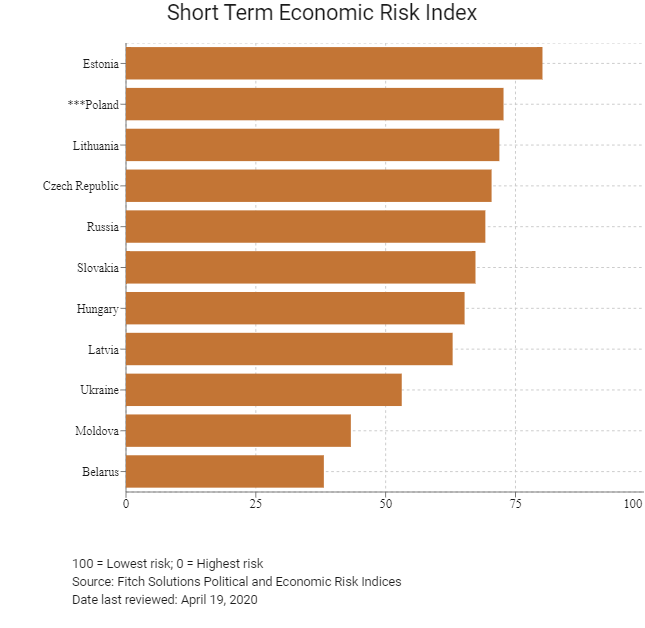

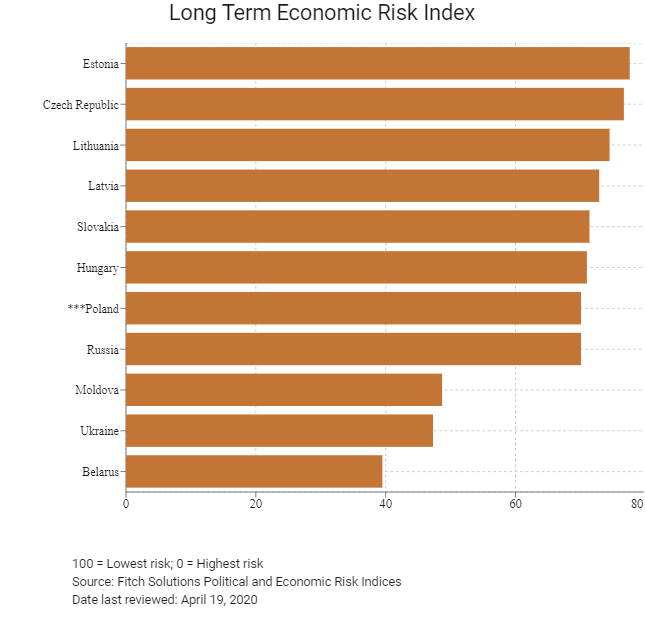

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2019 | |

| Economic Risk Index Rank | 33/202 | 39/201 | 36/201 |

| Short-Term Economic Risk Score | 72.5 | 71.7 | 72.7 |

| Long-Term Economic Risk Score | 70.1 | 68.1 | 70.1 |

| Political Risk Index Rank | 40/202 | 41/201 | 41/201 |

| Short-Term Political Risk Score | 69.6 | 69.6 | 69.6 |

| Long-Term Politica Risk Score | 75.6 | 75.6 | 75.6 |

| Operational Risk Index Rank | 30/201 | 32/201 | 32/201 |

| Operational Risk Score | 69.5 | 69.0 | 68.1 |

Source: Fitch Solutions

Date last reviewed: April 19, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

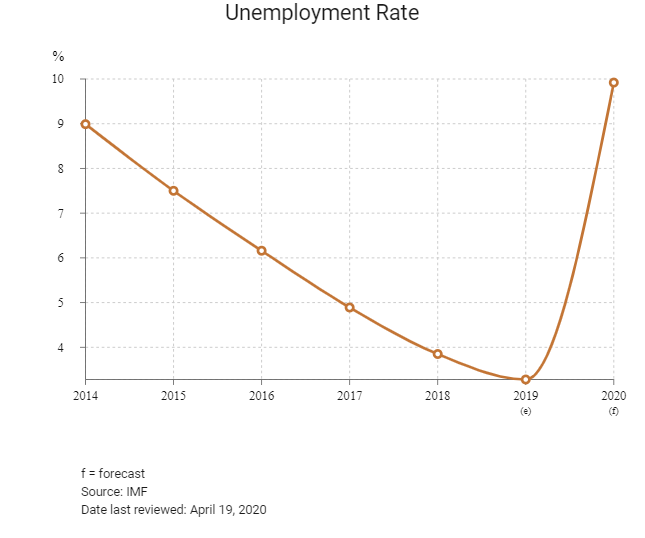

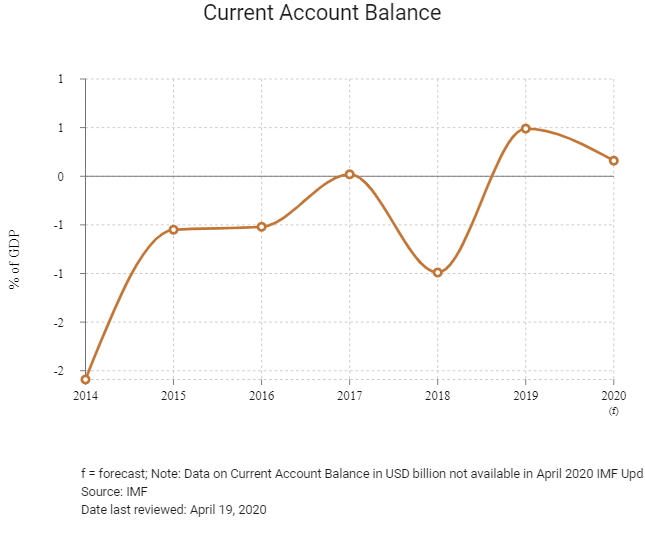

Poland's long-term economic outlook reflects the country's solid growth trajectory and steady convergence with Western EU member states. In the short term, economic growth is set to contract in 2020 due to the economic fallout from the Covid-19 pandemic, which will likely translate into the first yearly contraction of the Polish economy on record. That said, the economy should continue to expand solidly once regional and global demand recover, further supported by resilient household spending amid the tight labour market, tax cuts, higher pensions and wage hikes.

OPERATIONAL RISK

Poland remains an attractive investment destination, owing to factors such as a relatively safe operating environment, a well-developed domestic financial market and broad investment incentives, access to a large domestic and regional consumer market, EU membership and a diversified domestic manufacturing base - all of which are key elements that support healthy growth in trade and investment. The country also boasts a well-developed domestic financial market and broad investment incentives. Cross-border trade is facilitated by strong road and rail connections to neighbouring states, and international maritime connections. There are some key risks to consider, however, including the government's increasingly populist leanings, its interference in the independence of key institutions such as the judiciary and the resultant tensions with the EU, rising risks of cybercrime, a shrinking labour pool and uncompetitive utility costs.

Source: Fitch Solutions

Date last reviewed: April 19, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Poland Score | 68.1 | 59.2 | 64.9 | 75.5 | 72.8 |

| Central and Eastern Europe Average | 62.5 | 58.6 | 62.8 | 67.5 | 61.2 |

| Central and Eastern Europe Position (out of 11) | 4 | 7 | 6 | 1 | 3 |

| Emerging Europe Average | 57.7 | 56.3 | 58.1 | 60.5 | 55.9 |

| Emerging Europe Position (out of 31) | 5 | 13 | 8 | 1 | 4 |

| Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

| Global Position (out of 201) | 32 | 46 | 46 | 22 | 26 |

100 = Lowest risk; 0 = highest risk

Source: Fitch Solutions Operational Risk Index

Country | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

Estonia | 70.9 | 63.1 | 75.0 | 71.0 | 74.3 |

Czech Republic | 69.4 | 60.6 | 67.0 | 73.6 | 76.5 |

Lithuania | 69.4 | 61.3 | 71.1 | 74.3 | 71.0 |

Poland | 68.1 | 59.2 | 64.9 | 75.5 | 72.8 |

Latvia | 67.1 | 63.5 | 68.2 | 69.4 | 67.4 |

Slovakia | 63.7 | 52.1 | 66.2 | 66.8 | 69.6 |

Hungary | 63.6 | 55.7 | 62.5 | 70.1 | 66.3 |

Belarus | 59.2 | 60.1 | 58.7 | 66.6 | 51.3 |

Russia | 58.0 | 65.9 | 57.4 | 67.9 | 40.6 |

Moldova | 49.7 | 44.8 | 51.4 | 53.4 | 49.3 |

Ukraine | 48.6 | 57.9 | 48.4 | 54.4 | 33.6 |

Regional Averages | 62.5 | 58.6 | 62.8 | 67.5 | 61.2 |

Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 19, 2020

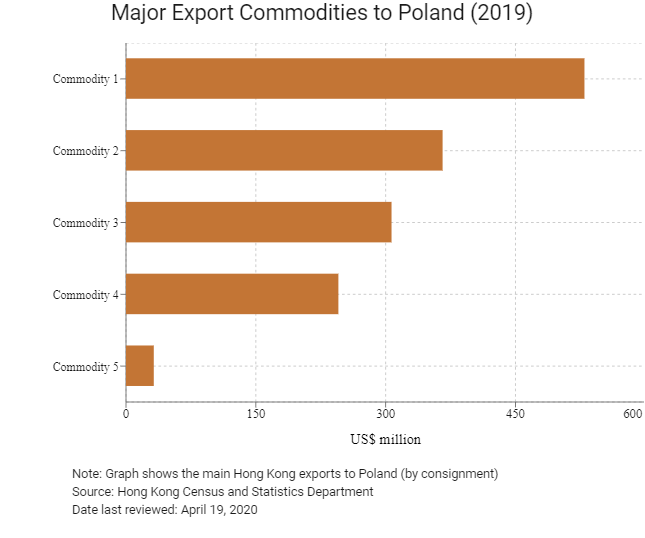

Hong Kong’s Trade with Poland

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 529.7 |

| Commodity 2 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 365.8 |

| Commodity 3 | Office machines and automatic data processing machines | 306.8 |

| Commodity 4 | Miscellaneous manufactured articles | 245.4 |

| Commodity 5 | Professional, scientific and controlling instruments and apparatus | 32.1 |

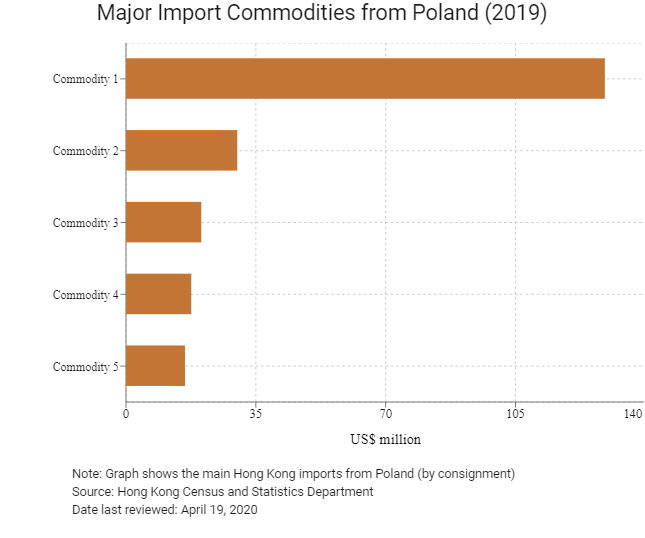

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Meat and meat preparations | 129.1 |

| Commodity 2 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 30.0 |

| Commodity 3 | Essential oils and resinoids and perfume materials; toilet, polishing and cleansing preparations | 20.3 |

| Commodity 4 | Office machines and automatic data processing machines | 17.6 |

| Commodity 5 | Telecommunications and sound recording and reproducing apparatus and equipment | 15.9 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Poland residents visiting Hong Kong | 28,228 | -4.9 |

| Number of European residents visiting Hong Kong | 1,747,763 | -10.9 |

Sources: Hong Kong Tourism Board, United Nations Department Of Economic And Social Affairs – Population Division

Date last reviewed: April 19, 2020

Commercial Presence in Hong Kong

2019 | Growth rate (%) | |

Number of EU companies in Hong Kong | 2,334 | 22.5 |

- Regional headquarters | 507 | 14.2 |

- Regional offices | 764 | 23.0 |

- Local offices | 1,063 | 26.5 |

Source: Hong Kong Census and Statistics Department

Treaties and Agreements between Hong Kong and Poland

Poland has double taxation agreements (DTAs) with Mainland China, but there are no separate agreements in place with Hong Kong. Mainland China has a DTA with Poland covering dividends (10% in both), royalties (0% in Mainland China and 10% in Poland) and interest (7% in Mainland China and 10% in Poland).

Source: Hong Kong Department of Justice

Chamber of Commerce or Related Organisations

The Poland Hong Kong Chamber of Commerce

The Poland Hong Kong Chamber of Commerce was establised in 2009 with the aim of supporting individuals and businesses based locally and also promoting trade, networking and investment in Hong Kong.

Address: Level 3A, Causeway Corner, 18 Percival Street, Causeway Bay, Hong Kong

Email: info@polcham.hk

Source: The Poland Hong Kong Chamber of Commerce

Poland Hong Kong Business Association

Email: PLHK@PLHK.pl

Tel: (48) 22 623 8508

Fax: (48) 22 623 8314

Website: www.PLHK.pl

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Consulate General of the Republic of Poland in Hong Kong

Address: Room 2506, Hopewell Centre, 183 Queens Road East, Wan Chai, Hong Kong

Tel: (852) 2840 0779

Fax: (852) 2596 0062

Source: Consulate General of the Republic of Poland in Hong Kong

Visa Requirements for Hong Kong Residents

Generally, HKSAR passport holders do not need a visa to visit the Schengen area for a stay of up to 90 days in any 180-day period. If a visa is required, a visa application must be completed prior to travel. It is obligatory to register the visa application online prior to visiting the consulate. The visa process takes 15 calendar days from the date of submitting the application. However, the time may vary according to the nature of the case and the number of applications submitted at the same time. The visa fee is EUR60.

Source: Ministry of Foreign Affairs, Republic of Poland

Date last reviewed: April 19, 2020

Poland

Poland