GDP (US$ Billion)

225.37 (2018)

World Ranking 50/193

GDP Per Capita (US$)

7,007 (2018)

World Ranking 88/192

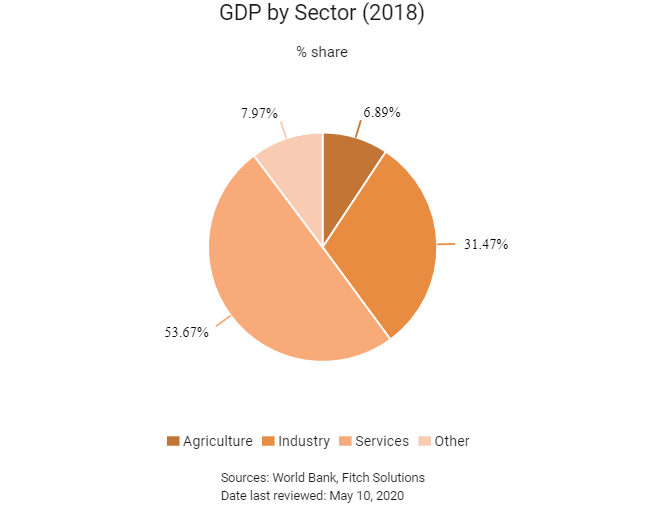

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

47.1 (2019)

Currency (Period Average)

Peruvian Sol

3.34per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

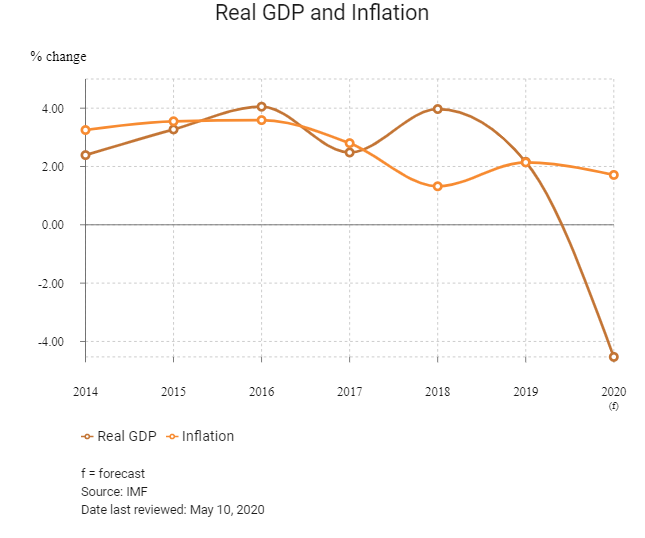

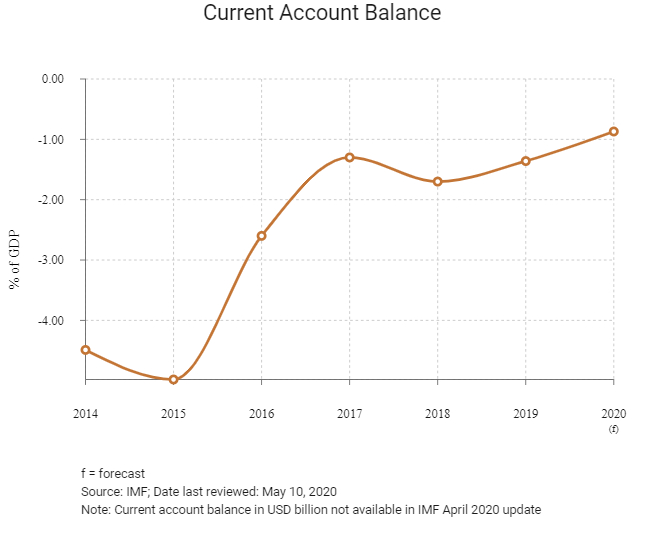

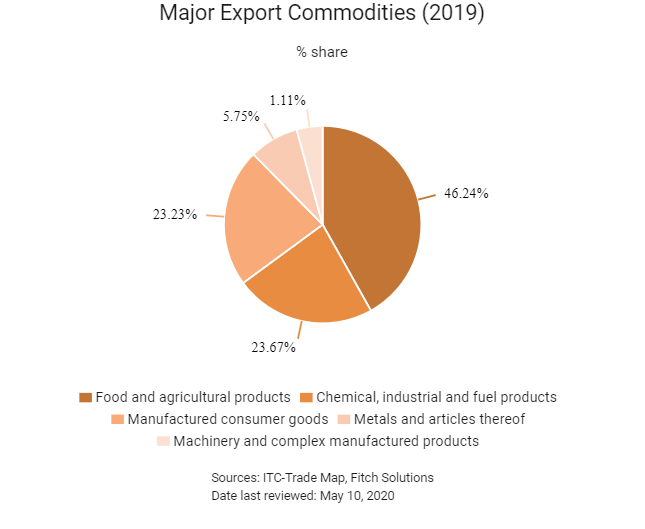

Between 2002 and 2013, Peru was one of the fastest-growing countries in Latin America, with an average GDP growth rate of 6.1% annually. A favourable external environment, prudent macroeconomic policies and structural reforms in different areas created a scenario of high growth and low inflation. Between 2014 and 2018, however, GDP growth slowed to an average rate of 3.2%, mainly owing to the decline in international commodity prices, including copper, the leading Peruvian export commodity (with mineral products representing an estimated 46% of all Peruvian exports). In the medium term, economic growth will be sustained by strong domestic demand and a gradual increase in exports. That said, the country is vulnerable to external shocks such as a decline in commodity prices, global trade tensions, or changes in international financial conditions. Peru’s economy is also exposed to natural risks, including recurrent weather phenomena such as El Niño. To address these risks, the Peruvian economy has established monetary, exchange-rate and fiscal cushions to mitigate their impact.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

March 2018

President Pablo Kuczynski resigned from office. Martín Vizcarra, the acting vice president, succeeded Kuczynski as president of Peru.

October 2019

Peruvian president Martín Vizcarra dissolved Congress.

October 2019

Peru approved a USD300 million boost to economic spending in housing, agriculture and education sectors.

November 2019

A study carried out by the consultant AF-Mercados EMI, on behalf of Chilean and Peruvian governments, has demonstrated the technical and economic feasibility of a 220kV, 53km power interconnection between the two countries. The line would allow Chile to export electricity to Peru during hours of high renewable generation, while Peru would export electricity to Chile in peak demand hours.

November 2019

Construction works on Line 3 of the Lima Metro in Peru are expected to start at the end of 2021 or at the beginning of 2022 according to the Peruvian Minister of Transportation and Communications Edmer Trujillo Mori. The pre-investment/feasibility study for the project was likely to be completed at the end of 2019. The project would be either concessioned in work and operation via private investment promotion agency ProInversión or would be executed via a government-government agreement.

January 2020

Parliamentary elections were held.

March 2020

Amid the outbreak of Covid-19, the government declared a state of national emergency and implemented a number of measures to limit the spread of the virus, including closing of national borders, restrictions to interprovincial movement, national isolation and curfews.

Finance Minister María Antonieta Alva announced a package that could reach PEN90 billion, or 12% of GDP, that would provide cash transfers to many low-income Peruvian households and other citizens affected by the Covid-19 quarantine. Since announcing the scheme, the Vizcarra administration also enacted plans to partially subsidise the wages and public health care contributions of non-essential workers.

April-June 2021

Presidential, congressional and gubernatorial elections to take place.

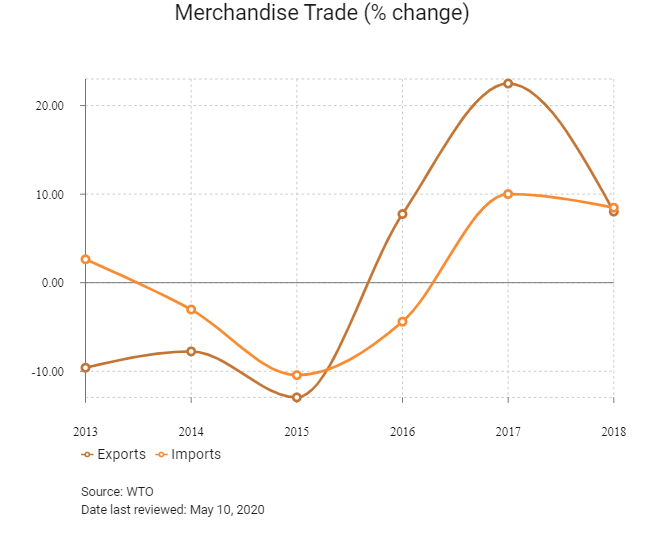

Merchandise Trade

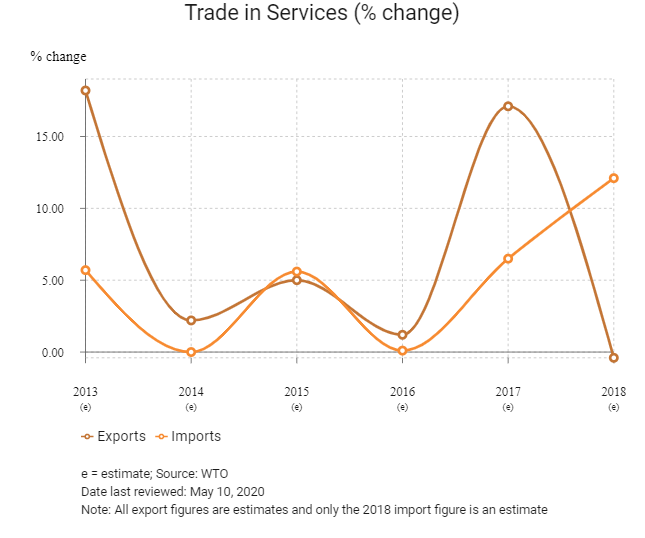

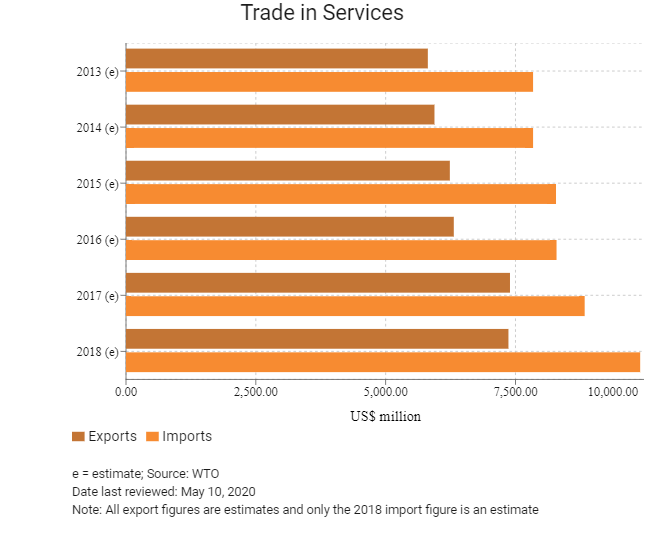

Trade in Services

- Peru has been a World Trade Organization (WTO) member since January 1, 1995. Prior to its membership to the WTO, Peru has been a member of the General Agreement on Tariffs and Trade since October 7, 1951.

- Peru has adopted an export-oriented trade policy. Peru is highly reliant on the export of mineral products, with an estimated 49% of all exports falling into the category of chemical, industrial and fuel products. Metals and articles thereof account for the second-most exported goods (in terms of value); within this category, copper ore comprises the largest share and represents the biggest export commodity in Peru. This exposes Peru to volatility in the demand of copper and any resulting price fluctuations.

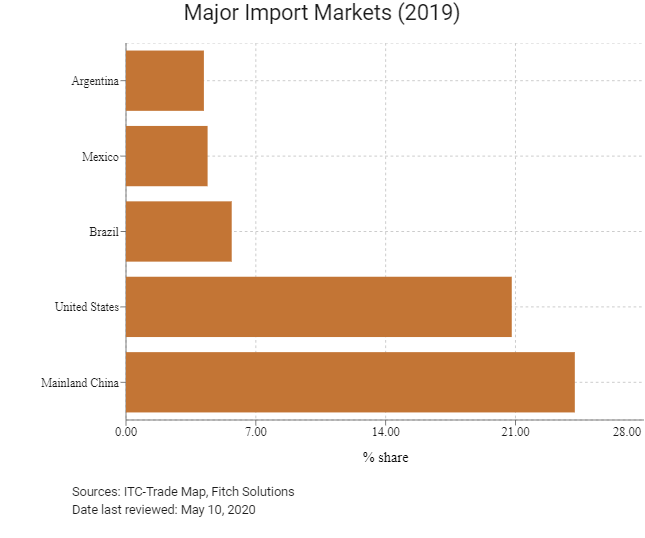

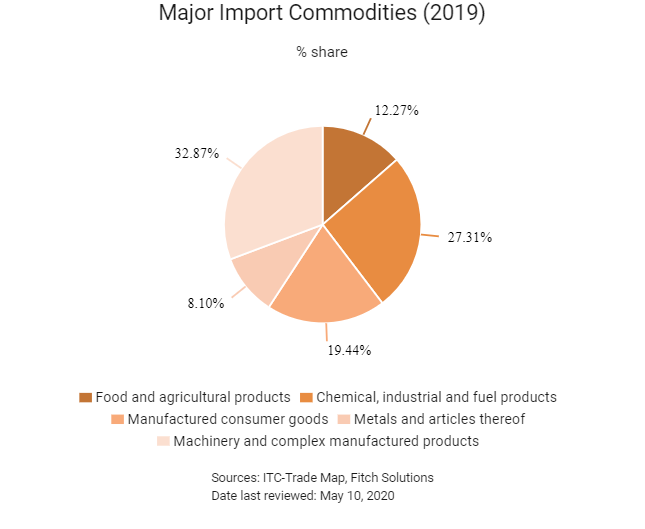

- Despite the country’s status as an oil-producing state, it still lacks the refining capacity to meet domestic demand. Its biggest import category is refined oil products which comprises 7.4% of all imports entering Peru. Machinery and complex manufactured goods is the largest import category in Peru, representing 33% of all imports.

- The Peruvian currency, the sol, is one of the least volatile in the region and supports the economy's trade ambitions by incentivising exports. Monetary policy is partially aligned to promoting Peru's competitiveness in terms of international trade.

- Peru is a member of the Andean Community (CAN) and the Latin American Integration Association.

- Peru has implemented anti-dumping measures on the following products:

- Biodiesel from the United States

- Biodiesel B100 from Argentina

- Certain types of poplin fabrics of polyester-cotton blend from Pakistan and India

- Stainless steel cutlery from Mainland China

- Certain footwear from Mainland China

- Zip fasteners and parts thereof from Mainland China

- Fundamental to Peru's international trade success are its strategic free trade agreements (FTA) with several key Latin America economies including Mexico and Chile.

- Imports are subject to the general sales tax of 16%, the municipal promotion tax of 2% and a tariff of either 0%, 6% or 11% (according to the tariff subheading of the merchandise imported). Traders are advised to seek additional information from the Superintendencia Nacional de Aduanas y de Administración Tributaria (SUNAT), the Peruvian tax authority, for specifics concerning the exact nature of tariffs on products. That said, import tariffs are the lowest in the region, at 1.4% on average, largely due to the wide range of FTAs in force which cover the vast majority of international trade. Consequently, most imported goods are subject to 0% tariffs rather than most favoured nation (MFN) bound tariffs.

- The average MFN applied rate is low, at 2.4%, indicating that even goods not covered by FTAs are not generally subject to significant tariffs. The highest duties are imposed on clothing and textiles.

- Peru will impose surcharges on certain agricultural products from time to time in order to protect local Peruvian farmers. These surcharges do not apply in most cases where a country has an FTA with Peru.

- Most exporting companies in Peru are small- or medium-sized entities, accounting for around 82% of all exporting companies.

Sources: WTO – Trade Policy Review, Fitch Solutions

Major Multinational Trade Agreements

Active

- CAN Customs Union and Free Trade Area (Bolivia, Ecuador, Peru and Colombia): Trade between the Andean nations is substantial and has been increasing under the customs union, which allows businesses access to a larger market in the region and lowers tariff and non-tariff barriers to trade.

- Pacific Alliance (PA) (FTA and economic integration agreement): The PA trade bloc, consisting of Chile, Colombia, Mexico and Peru, further assists with promoting regional growth. The PA focuses on boosting external trade with strategic partners, including those in Asia as well as adopting a business-friendly agenda aimed at incentivising investment into the region to enable companies to better access Latin American markets and create intra-regional supply chains. PA members represent nearly 36% of Latin American GDP and exported approximately USD1 trillion in 2015.

- Peru-United States: The US is an important trade partner for Peru. This agreement lowers costs for importers sourcing goods from the US and opens up a large market for Peruvian exporters. This agreement is particularly important since the US pulled out of the Trans-Pacific Partnership (TPP), giving Peru an advantage over other Pacific Rim countries which do not have a prior agreement with the US.

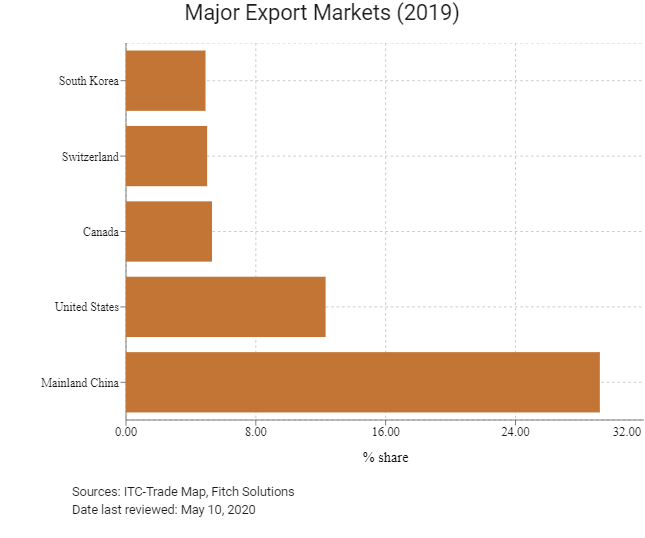

- Peru-Mainland China: Mainland China is Peru's largest trade partner, making this agreement extremely important for Peru. The agreement allows access for Peruvian goods, primarily metals such as copper, to the largest market in the world. This considerably boosts the country's appeal to mining and metalworking companies, while also reducing the costs of imported machinery, textiles, and consumer goods for Peruvian companies and consumers.

- European Union-Andean Community (EU-CAN): In January 2017, the Andean Community ratified a FTA and economic integration agreement with the EU. The agreement eliminates tariffs for all industrial and fisheries products, increases market access for agricultural products, improves access to public procurement and services, and further reduces technical barriers to trade. The FTA also includes commitments to effectively implement international conventions on labour rights and environmental protection, which are monitored with the systematic involvement of civil society.

- Southern Common Market-Andean Community (Mercosur-CAN): As a member of the Andean Community, Peru is party to commercial agreements with Mercosur (Brazil, Argentina, Paraguay and Uruguay). Mercosur member states present greater economic opportunities for firms in Peru, and the agreement brings about greater economic integration. This supports the Free Trade Area of the Americas – an agreement that reduces the trade barriers among all countries in Latin America.

- Peru-South Korea: South Korea is a key trade partner and is not yet included in the TPP, meaning Peru will stand to benefit from this bilateral FTA.

- The Comprehensive and Progressive Agreement for TPP (CPTPP): The agreement – comprising Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam – is in effect. The agreement was ratified in Q418, with the deal representing 13.4% of global GDP, making it the third-largest trade agreement after the United States-Mexico-Canada Agreement and the EU. The agreement aims to cut tariffs, improve access to markets and set common ground on labour and environmental standards and intellectual property protections.

- Peru also has active FTAs with Honduras, Japan, Costa Rica, Panama, Mexico, Canada, Singapore, Chile and Thailand.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

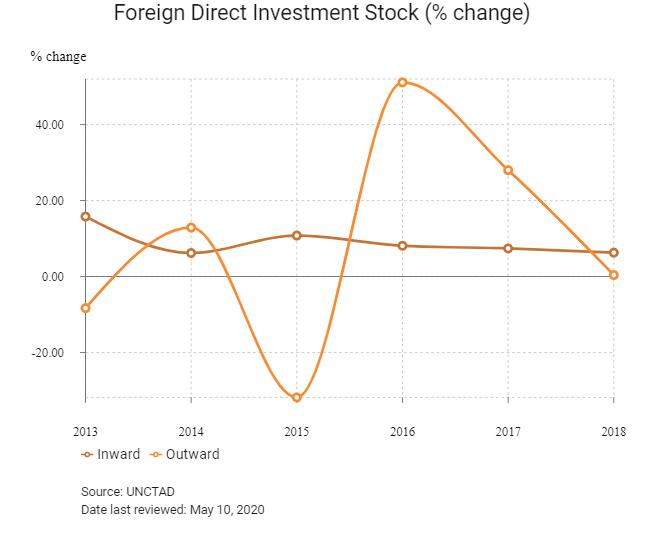

Foreign Direct Investment Policy

- ProInversión is a public entity attached to the Ministry of Economy and Finances and is responsible for the execution of the national private investment promotion polices. ProInversión aims to promote investment in public services and infrastructure through the use of public-private partnerships. Additionally, ProInversión offers assistance and information to investors.

- ProInversión also participates in the privatisation of public sector companies and industries based on natural resources.

- Peru's investment policies and profile are based on legal frameworks set out under the Foreign Investment Promotion Law, the Private Investment Growth Framework Law and the Legal Stability Scheme for Foreign Investments, and are protected by the Peruvian Constitution (1993).

- Foreign investment in Peru does not require prior authorisation and is allowed without restriction in the large majority of economic activities. A number of industries, however, are restricted from foreign investment, including:

- Air transport

- Sea transport

- Private security and surveillance

- Investments in protected natural areas

- The manufacture of weapons of war

- Basic rights for foreign investors include:

- Non-discriminatory treatment in comparison to local investors

- Freedom of trade and industry

- Export and import freedom

- The ability to send remittances abroad for profit or gains, after having paid any applicable taxes

- A guarantee to freely possess and use foreign currency

- The ability to use the most favourable exchange rate in the market

- The ability to freely re-export any capital investments

- Unlimited access to domestic credit

- Free hiring of technology and remittance of royalties

- The ability to purchase shares owned by national investors

- The ability to take investment insurances abroad

- The ability to enter into legal stability agreements with the Peruvian government, for their investments in Peru

- Foreign investors cannot purchase or own mines, land, forests, water, fuel or energy sources within 50 kilometres from international borders. Exceptions to these restrictions may be allowed in cases of public necessity as approved by the government (via the Council of Ministers).

- Property, if expropriated by the government, is only allowed after payment of a fair sum which includes compensation for eventual damages.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, ProInversión

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

There are a number of free trade zones (FTZs), named CETICOS, which are based at Matarani and Ilo in the south, and Paita and Tumbes in the north |

These zones allow various activities including manufacturing, packaging, storage and repair of vehicles and machinery to take place, with exemption from income tax, sales tax and import duties until 2022. |

|

FTZs located at Tacna and Puno |

- These offer similar tax exemptions as the FTZs based at Matarani and Ilo in the south, and Paita and Tumbes in the north |

|

Deductions for technological and scientific endeavours |

Projects related to scientific research, technological development and technological innovation have provisions for special tax deductions. |

|

Stability agreement |

Investors may enter into a stability agreement with the government, allowing for the guarantee of the following for 10 years: |

|

Investment promotion – the Amazon |

VAT and income tax benefits are available to investments benefitting the Amazon region. The industries affected are: |

Source: Fitch Solutions

- Value Added Tax: 18%

- Corporate Income Tax: 29.5%

Source: SUNAT

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

29.5% |

|

Withholding Tax |

- 5% on dividends |

|

Sales Tax |

18% on the sale of goods, services and most product imports |

|

Net Assets Tax |

0.4% |

|

Social Security Contributions |

9% on employee's salaries, as paid by employers |

Source: SUNAT

Date last reviewed: May 10, 2020

Localisation Requirements

The employment of foreign workers in Peru is regulated under the aegis of the Ministry of Labour. The 'Foreigners Contract Law' allows businesses to hire foreign workers, with certified work visas, up to a maximum of 20% of the company's total workforce, provided that the salaries of the foreigners do not exceed 30% of the entity's total payroll. Moreover, contracts must be completed (in writing) for a maximum three-year period. These can be extended for similar periods if approved by the Ministry of Labour.

Visa/Travel Restrictions

A working visa is normally very easy to obtain, but only allows the individual to stay in the country for the duration of his/her employment contract and only after it has been approved by the Peruvian General Directorate of Immigration and Naturalisation. The ability of companies operating in Peru to import foreign labour has also become easier as of November 2016. The process has been simplified and businesses are no longer required to submit educational diplomas and certificates when applying for work permits for foreign workers. All that is required for the visa application is that employers submit a sworn affidavit which states that all Peruvian labour laws have been complied with in the hiring process as well as a copy of the prospective foreign worker's employment contract.

For citizens of North and South America, Western Europe, Australia, New Zealand and South Africa, only a passport is required to stay for a period of up to three months, but the individual is not permitted to work during this period. Business visas allow individuals to stay for up to 90 days, which can be extended by another 30 days if required, to discuss contracts and investment opportunities, but they cannot receive any income from a Peruvian source. Foreign nationals can apply for citizenship after two consecutive years of legal residency in Peru, be it by marriage or work.

Sources: Peru Ministry of Labour, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A3 (Stable) |

25/06/2019 |

|

Standard & Poor's |

BBB+ (Stable) |

19/08/2013 |

|

Fitch Ratings |

BBB+ (Stable) |

12/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

58/190 |

68/190 |

76/190 |

|

Ease of Paying Taxes Index |

121/190 |

120/190 |

121/190 |

|

Logistics Performance Index |

83/160 |

N/A |

N/A |

|

Corruption Perception Index |

105/180 |

101/180 |

N/A |

|

IMD World Competitiveness |

54/63 |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

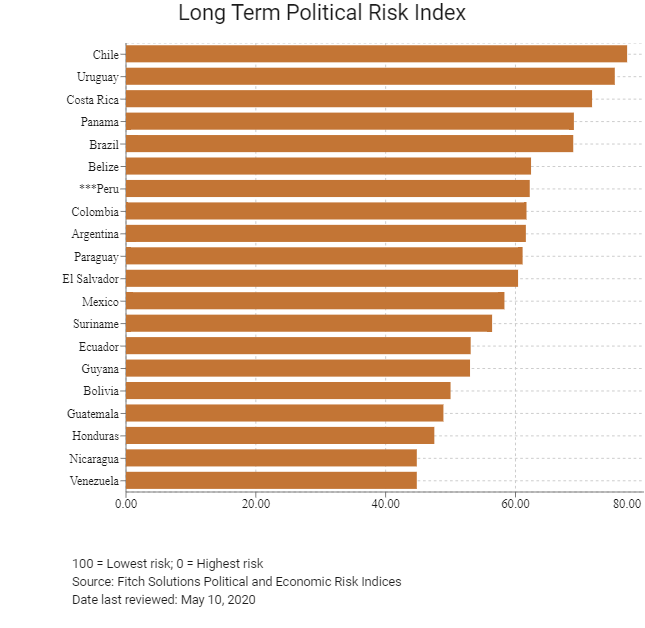

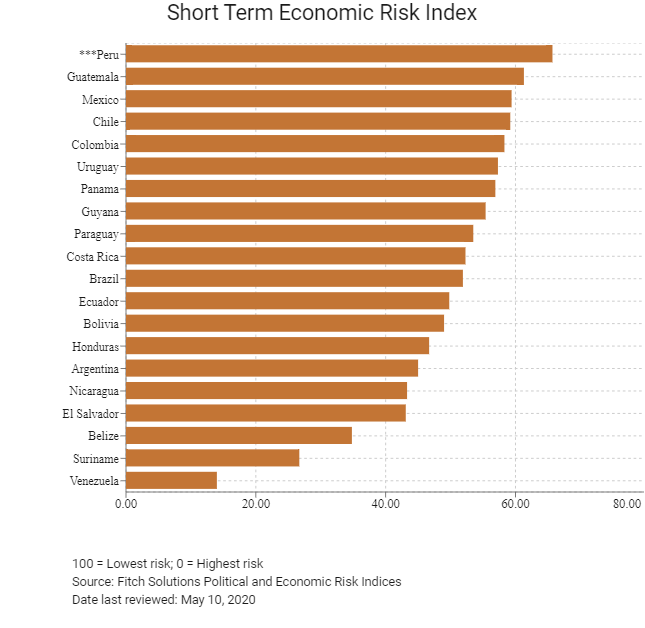

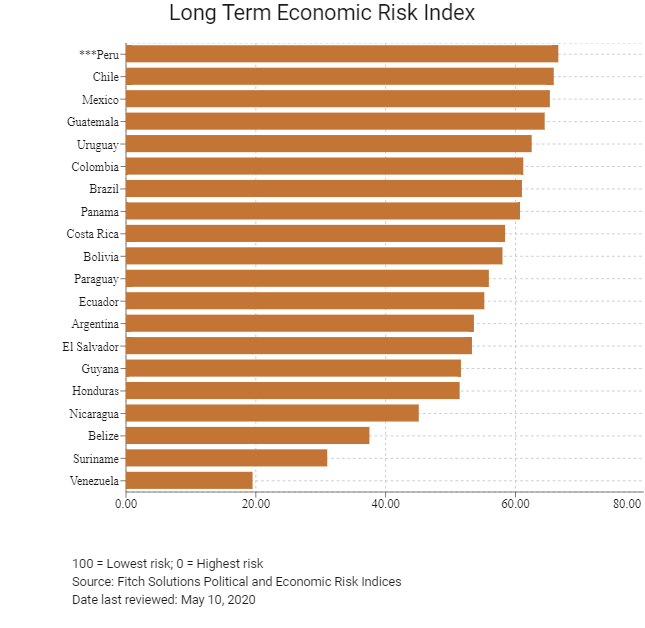

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

43/202 |

48/201 |

45/202 |

|

Short-Term Economic Risk Score |

70.6 |

69.2 |

66.6 |

|

Long-Term Economic Risk Score |

66.7 |

65.7 |

65.7 |

|

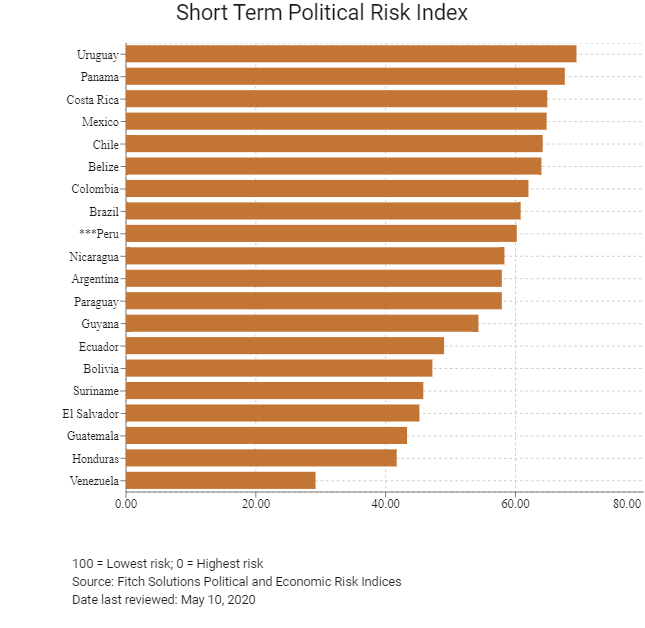

Political Risk Index rank |

98/202 |

93/201 |

98/202 |

|

Short-Term Political Risk score |

58.8 |

59.5 |

60.2 |

|

Long-Term Political Risk Score |

62.5 |

62.9 |

62.2 |

|

Operational Risk Index Rank |

99/201 |

108/201 |

104/202 |

|

Operational Risk Score |

49.1 |

48.1 |

48.7 |

Source: Fitch Solutions

Date last reviewed: May 10, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

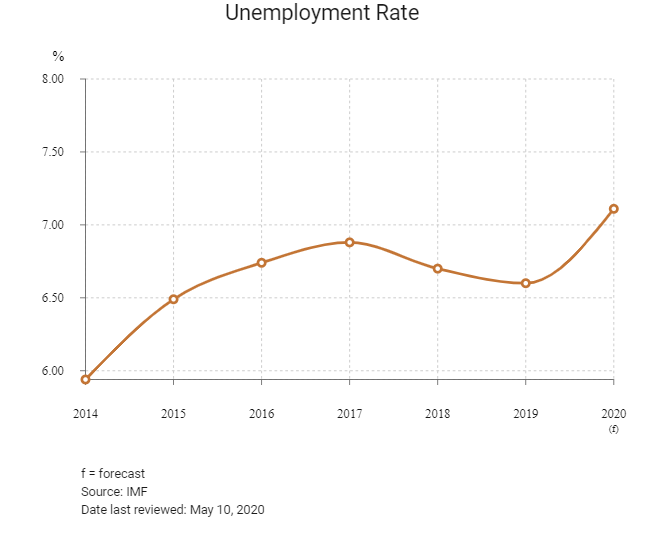

The Covid-19 pandemic will push the Peruvian economy into its deepest recession in over 25 years in 2020. Many of the downside risks to real GDP in Peru that we previously highlighted have begun to play out as Covid-19 will cause a global recession in the coming months. We are increasingly downbeat on the short-term economic outlooks for China and the US, Peru's two largest export markets, which will cause a significant contraction in goods exports and weaken Peru's investment appeal in the coming months. In the coming years, the Peruvian economy is expected to expand at lower average rates than in the past decade, as weaker metals prices weigh on export growth. Nonetheless, an expected surge in infrastructure investment will support region-leading growth and aid the development of its manufacturing and agricultural sectors. While the mining sector will remain a key economic driver, the rise of non-traditional exports will offer additional opportunities for growth.

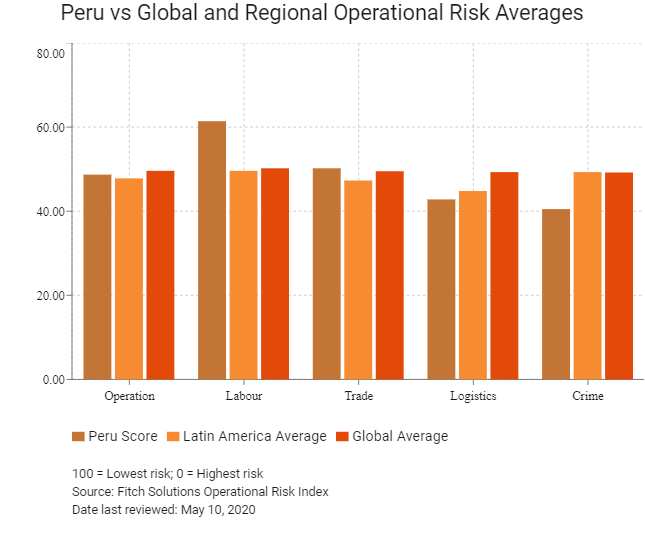

OPERATIONAL RISK

Peru offers a wide range of opportunities and advantages to investors seeking to enter the Latin American market. An open economy, substantial natural resources and a welcoming climate for foreign direct investment serve to pique investor interest, while a large, urbanised and low-cost labour market, as well as efficient trade procedures supported by strong international connections further boost Peru's appeal relative to regional peers. These considerations are somewhat offset by the risks posed by the inherent weaknesses in the country's poor internal logistics network, the limited pool of skilled workers and the prevalence of organised crime, compounded by an erratically-enforced rule of law.

Source: Fitch Solutions

Data last reviewed: May 10, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operation Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Peru Score |

48.7 |

61.4 |

50.2 |

42.8 |

40.5 |

|

Central and South America average |

46.0 |

49.9 |

44.7 |

46.3 |

43.0 |

|

Gentral and South America position (out of 20) |

9 |

2 |

7 |

11 |

12 |

|

Latin America position |

47.8 |

49.6 |

47.3 |

44.8 |

49.3 |

|

Latin America position (out of 42) |

23 |

3 |

18 |

24 |

33 |

|

Global average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global average (out of 201) |

104 |

34 |

96 |

115 |

135 |

100= Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operations Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Chile |

64.9 |

64.2 |

68.6 |

63.0 |

63.8 |

|

Costa Rica |

56.1 |

50.6 |

55.9 |

67.1 |

50.6 |

|

Panama |

55.9 |

53.6 |

58.7 |

52.2 |

59.3 |

|

Uruguay |

54.6 |

51.5 |

52.0 |

53.4 |

61.3 |

|

Mexico |

52.2 |

57.5 |

57.9 |

57.4 |

35.9 |

|

Colombia |

51.3 |

57.5 |

52.8 |

51.8 |

43.1 |

|

Brazil |

50.0 |

47.3 |

47.4 |

53.9 |

51.5 |

|

Argentina |

49.3 |

52.8 |

43.6 |

50.5 |

50.4 |

|

Peru |

48.7 |

61.4 |

50.2 |

42.8 |

40.5 |

|

Ecuador |

45.6 |

52.3 |

36.8 |

50.9 |

42.4 |

|

El Salvador |

42.9 |

51.1 |

41.8 |

40.9 |

37.8 |

|

Suriname |

42.9 |

45.9 |

44.5 |

48.0 |

33.0 |

|

Belize |

42.7 |

52.0 |

35.1 |

41.2 |

42.5 |

|

Paraguay |

41.2 |

43.9 |

44.1 |

39.2 |

37.6 |

|

Guatemala |

40.5 |

43.8 |

43.5 |

41.0 |

33.5 |

|

Honduras |

39.4 |

40.1 |

44.5 |

40.1 |

32.7 |

|

Nicaragua |

38.4 |

40.4 |

35.3 |

37.0 |

41.1 |

|

Bolivia |

37.3 |

44.4 |

40.7 |

29.6 |

34.6 |

|

Guyana |

37.0 |

38.9 |

30.2 |

38.2 |

40.6 |

|

Venezuela |

28.4 |

48.5 |

10.1 |

28.4 |

26.8 |

|

Regional Averages |

46.0 |

49.9 |

44.7 |

46.3 |

43.0 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest Risk; 0 = Highest Risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 10, 2020

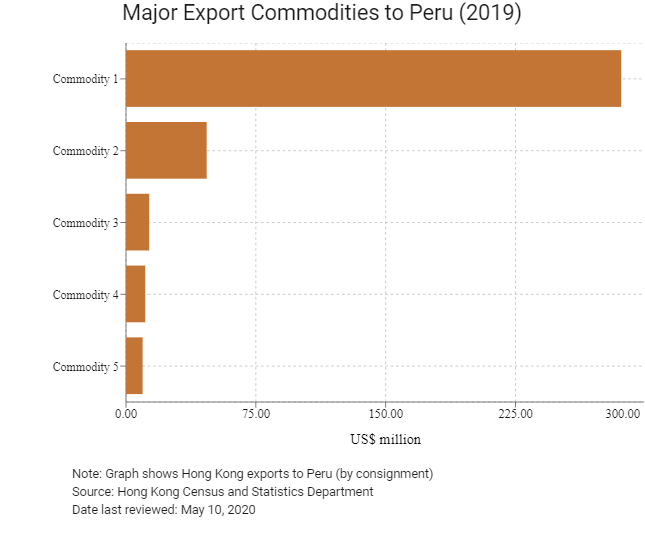

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

286.1 |

|

Commodity 2 |

Office machines and automatic data processing machines |

46.6 |

|

Commodity 3 |

Electrical machinery, apparatus and appliances and electrical parts thereof |

13.4 |

|

Commodity 4 |

Miscellaneous manufactured articles |

11.1 |

|

Commodity 5 |

Photographic apparatus, equipment and supplies and optical goods, and watches and clocks |

9.6 |

|

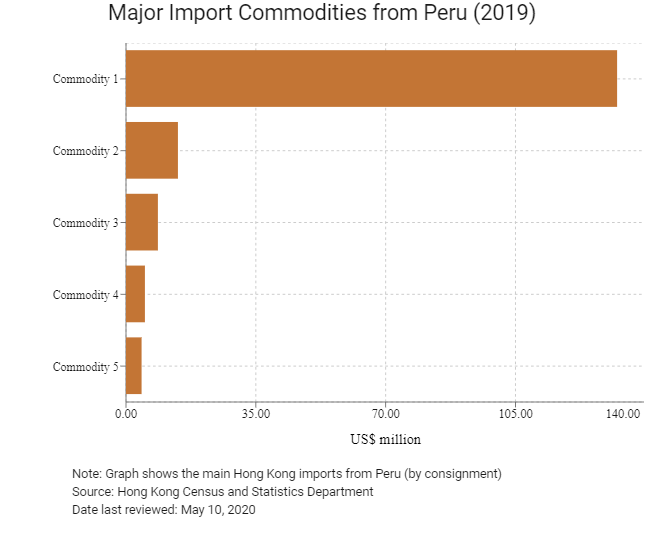

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Vegetables and fruit |

132.4 |

|

Commodity 2 |

Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof |

14.0 |

|

Commodity 3 |

Articles of apparel and clothing accessories |

8.6 |

|

Commodity 4 |

Telecommunications and sound recording and reproducing apparatus and equipment |

5.1 |

|

Commodity 5 |

Metalliferous ores and metal scrap |

4.2 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth Rate (%) |

|

|

Number of Peruvian residents visiting Hong Kong |

7,638 |

5.0 |

|

Number of Latin American residents visiting Hong Kong |

175,111 |

-8.0 |

Source: Hong Kong Tourism Board

Date last reviewed: May 10, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth Rate (%) |

|

|

Number of Peruvian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- local offices |

Treaties and Agreements between Hong Kong and Peru

Peru and Mainland China signed a bilateral investment treaty (BIT) in 1994. The BIT came into effect in 1995.

Source: Fitch Solutions

Chamber of Commerce or related Organisations

Trade Commission of Peru in Hong Kong

Address: Suite 3706, 37/F, Hopewell Centre, 183 Queens Road East, Wan Chai, Hong Kong

Tel: (852) 3705 5656

Consulate General of Peru in Hong Kong and Macau

Address: Unit 1401, 14/F, China Merchants Tower, 168-200 Connaught Road Central, Hong Kong

Email: secretary@peruconsulate.org.hk

Tel: (852) 2868 2622

Fax: (852) 2840 0733

Source: Visa on Demand

Visa Requirments for Hong Kong Residents

HKSAR and BNO passport holders do not require a visa for sightseeing travel, provided that the passport is valid for at least 6 months from the day of arrival in Peru. Visa is required for business trip.

Source: Visa on Demand

Date last reviewed: May 12, 2020

Peru

Peru