GDP (US$ Billion)

69.55 (2018)

World Ranking 72/193

GDP Per Capita (US$)

115,536 (2018)

World Ranking 1/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

381.5 (2019)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

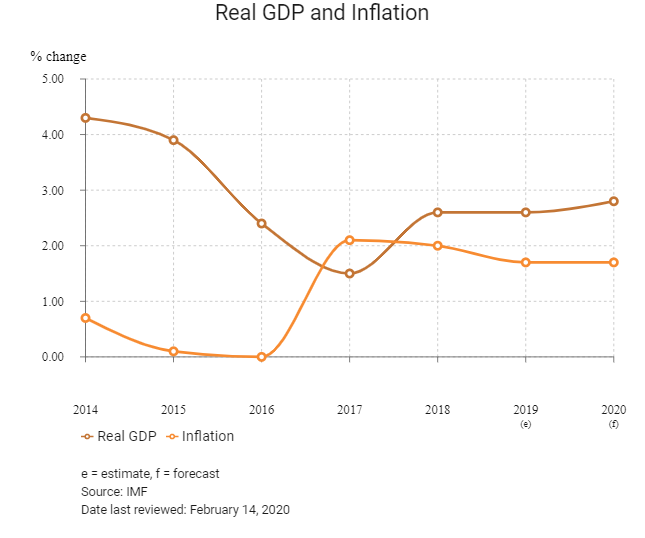

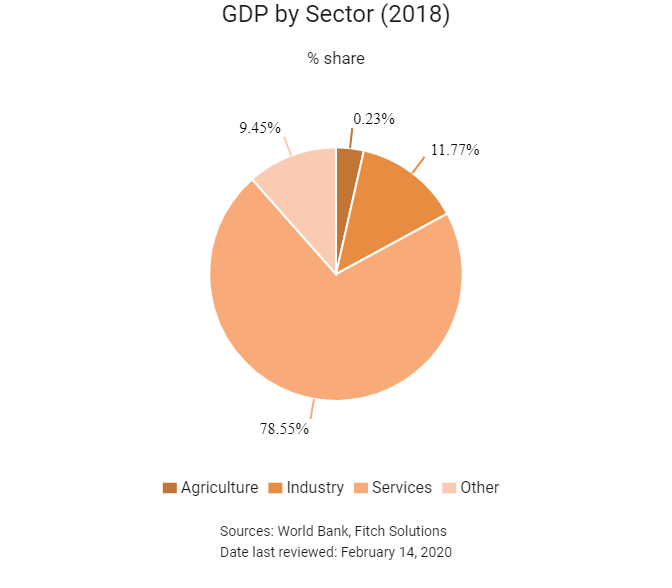

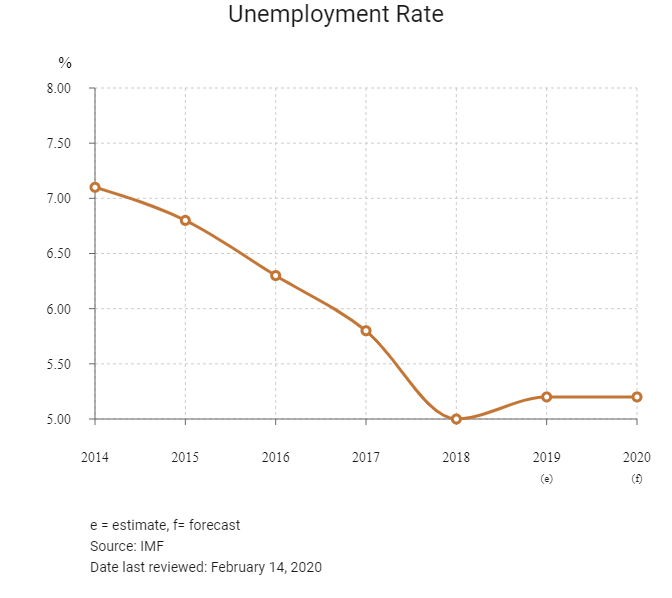

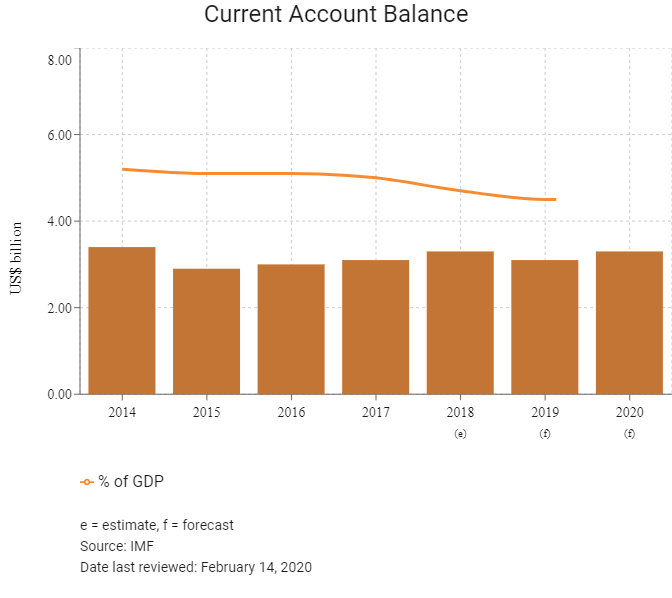

The small, stable, high-income economy, benefiting from its proximity to France, Belgium and Germany, has historically featured solid growth and low unemployment. Luxembourg's success can be attributed to a succession of positive, long-term, focused, and innovative government policies aiming to enhance business and diversity of the country's economy. This approach has allowed Luxembourg to offer companies exceptional opportunities for doing business in Europe. The industrial sector, initially dominated by steel, has become increasingly diversified to include chemicals, rubber, and other products. Even though Luxembourg was impacted by the global economic crisis that began in 2008, the country continues to enjoy an extraordinarily high standard of living. Growth in the financial sector, which now accounts for more than 30% of gross domestic product (GDP), has more than compensated for the decline in steel. Most banks are foreign-owned and have extensive foreign dealings. The economy depends on foreign and cross-border workers for about 70% of its labour force.

Source: Fitch Solutions

Major Economic/Political Events and Upcoming Elections

March 2015

The OECD urged Luxembourg to reduce economic dependence on financial services to multinational businesses to avoid a G20-led crackdown on international tax avoidance.

June 2015

A referendum proposal to allow foreigners to vote in national elections was rejected by a large margin.

October 2017

Luxembourg's Minister for Sustainable Development and Infrastructure, Francois Bausch, unveiled plans to extend the country's first tram line at a cost of EUR214 million. Two extensions have been planned, a seven-stop 4.9km line from Luxemburg central station to Cloche d'Or and a 3.9km line from Luxexpo via Héienhaff to Findel Airport. All the extensions were slated to be completed by 2021.

April 2018

German technology group Voith secured a contract to upgrade a motor-generator at the 1.29GW Vianden pumped storage hydro plant in Luxembourg. This would increase the capacity of the generating set by around 7% to 217MW. The new machine, which would replace the original motor-generator installed in 1976, was expected to be able to respond more quickly to changes in the load requirements from the power grid. Work on the new motor-generator was scheduled to be completed by 2021.

October 2018

Seven parties gained seats in the Luxembourgian Chamber of Deputies following the general elections held in October 2018, with none of these reaching an outright majority. The Christian Social People's Party (CSV), which came first with 21 out of 60 seats, fell short of the 30 seats required to form a government on its own. This paved the way for the renewal of the incumbent coalition led by the Democratic Party (DP), with the support of the Socialist Worker's Party (LSAP) and The Greens.

November 2019

The European Investment Bank (EIB) reached an agreement on its new Energy Lending Policy that paved the way for the ceasing of funding for the vast majority of fossil fuel projects from the end of 2021. Finalising its draft lending policy first published in July, the institution would thereafter require project applications to meet a low emissions performance standard of 250 grams of CO2/kWh. The EIB would now seek to increase the share of its financing for climate change-related projects to reach 50% of its operations from 2025, a move that it claimed would enable EUR1 trillion of climate change-related investment within the 10 years to 2030. Ultimately, these efforts would aim to achieve a renewable energy share of 32% in the EU by 2030.

Sources: BBC Country Profile – Timeline, national sources, Fitch Solutions

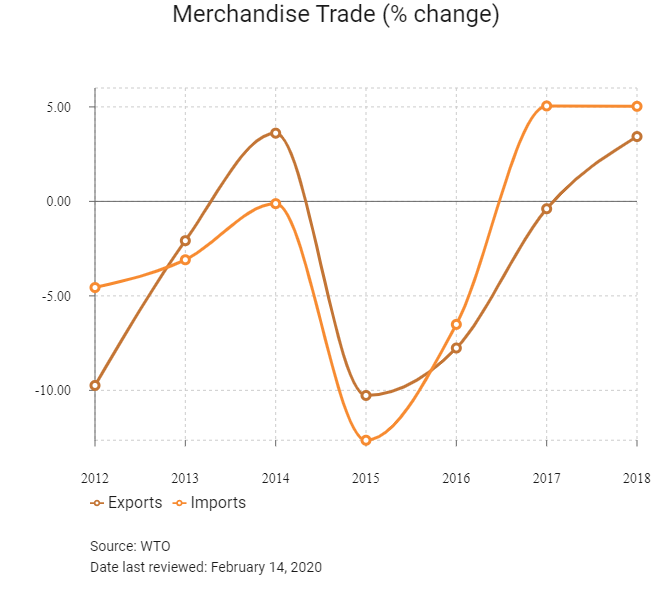

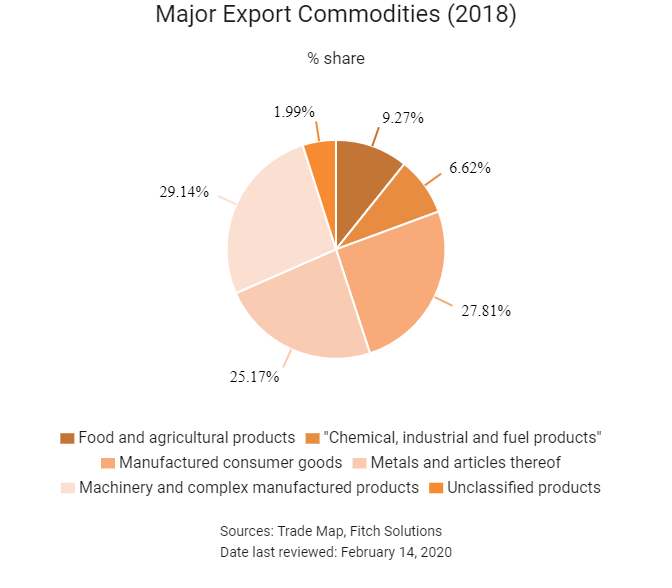

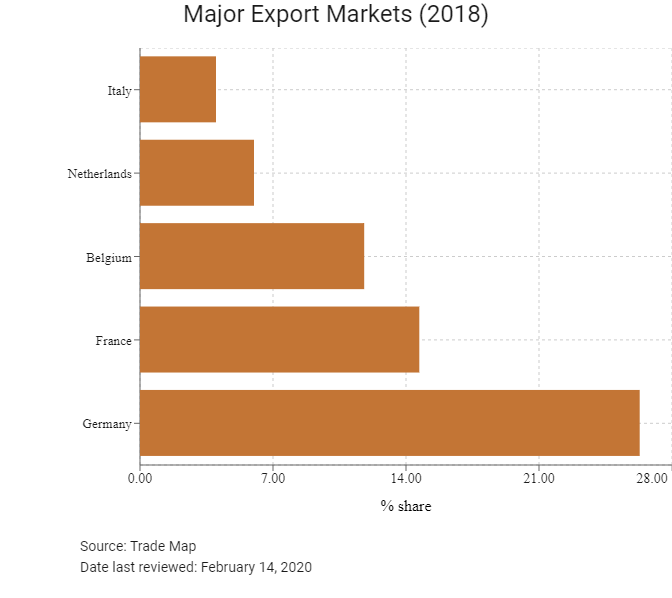

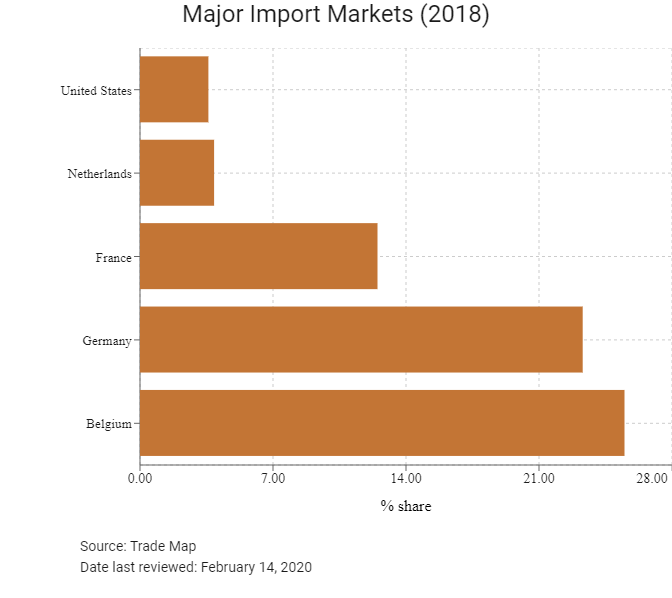

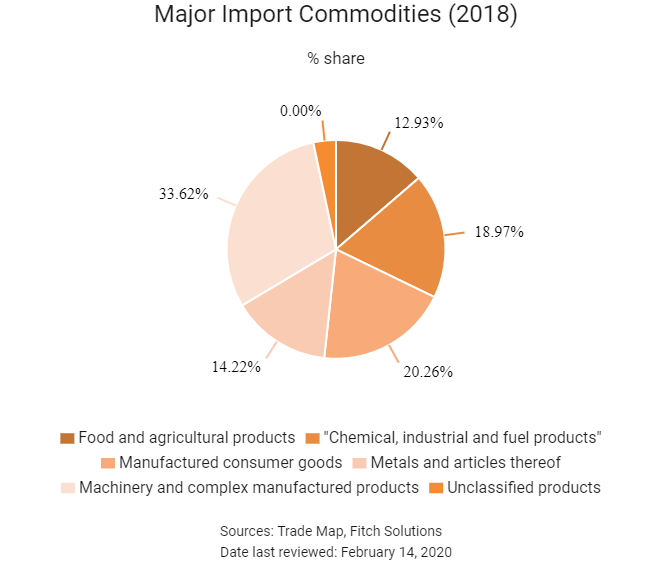

Merchandise Trade

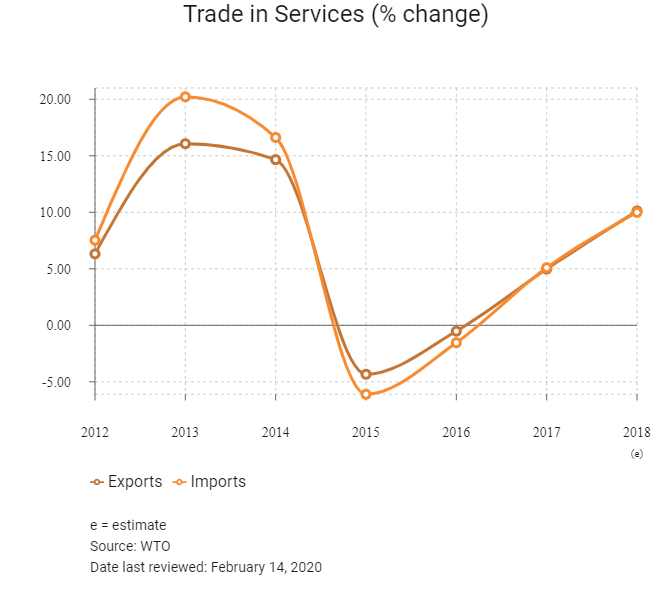

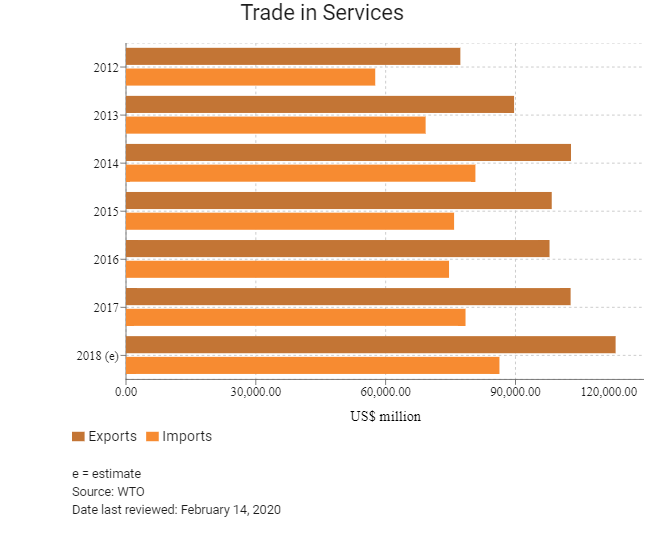

Trade in Services

- Luxembourg has been a World Trade Organization (WTO) member since 1995 and notifies all draft technical regulations to the WTO Committee on Technical Barriers to Trade (TBT). Luxembourg ratified the Trade Facilitation Agreement (TFA) on October 5, 2015 and has an implementation rate of 100%.

- Luxembourg is a member state of the European Union (EU) and transposes EU directives and regulations into domestic law.

- Luxembourg applies the EU's Common External Tariff, which means goods manufactured and imported from within the EU are not subject to customs charges. Most of the country's major trade partners are within the EU, hence tariff burdens for domestic firms are less pronounced.

- Based on a European Regulation, goods entering within the territory of the EU may be subject to customs duties/import tariffs. Applicable rates are based on the nature and on the quantity of the products. There is no stamp duty in Luxembourg.

- The EU has imposed various anti-dumping measures on a wide range of products. As of Q319, the EU and EC apply anti-dumping duties on 52 product categories, affecting 15 states. The EU imposes anti-dumping duties on 30 categories of products from Mainland China and a few other Asian nations, predominantly in the areas of textiles, parts, steel, iron and machinery.

- In 2016, the EC introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

- On January 1, 2017, the EU imposed additional import duties on certain fruit and vegetables if the quantity of the goods exceeds the trigger volume level within the specified application period. As of January 2019, the EC has applied additional import duties on certain fruit and vegetables from Brazil, Israel, South Africa, Peru, Morocco, Egypt, India, Chile and Argentina.

- 73 countries have tariffs products affected by EU and/or EC tariffs; 631 products exported by Mainland China have tariffs placed upon them; 18 products exported by Hong Kong have EU tariffs placed upon them as of Q319.

- The EU imposes import quotas on rice imports from Cambodia, India, United States, Pakistan and Thailand.

- The Luxembourg customs authorities may impose measures, such as seizures or import bans, for a period of six months, which may be renewed at the request of the rights-holder. The customs office tracks the seizures of counterfeit goods, notably at Luxembourg Airport, but this is a small part of customs work. There are no public statistics on such seizures.

- In Luxembourg, the Litigation and Research of the Directorate of Customs and Excise regulates and oversees applications to prohibit the release of counterfeit and pirated goods for free circulation, export, re-export or entry into the country. Customs officers have every right to seize (but not necessarily destroy) goods. Most cases are related to customs declaration abuses by the owner (importing products above the maximum allowable amount for tax-free treatment within the EU) and not to counterfeit goods.

- The merits of a counterfeit goods case are decided by judicial proceedings, thus the ordinary law courts are responsible for deciding whether there are grounds for a case. A number of provisions within the TRIPS Agreement describe different intellectual property rights and allow for the possibility of confiscating, or even destroying, counterfeit goods and the tools or implements used in their production.

- In addition to its open trade with other member states of the EU, and free-trade agreements (FTAs) between the EU and other countries, Luxembourg also signed bilateral agreements with over 90 countries, including Mainland China, South Korea, Hong Kong, Vietnam, India, the United Arab Emirates, Saudi Arabia, Egypt, Brazil, Chile and South Africa.

Sources: WTO, Fitch Solutions, national sources

Multinational Trade Agreements

Active

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 28 member nations of the EU, namely: Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

- European Economic Area-European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the EC, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019 after the EU Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-SADC EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and Swaziland): An agreement between EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of SADC not included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking economic partnership agreements with the EU as part of other trading blocs – such as with East or Central African communities.

Provisionally Active

- The Comprehensive Economic and Trade Agreement (CETA): The CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and EU Parliament in February 2017. However, as of July 2019, the agreement has not been ratified by every European state and has only provisionally entered into force. The following EU countries have ratified CETA, making the agreement provisionally active for these states: Austria, Czech Republic, Denmark, Estonia, Spain, the United Kingdom, Croatia, Lithuania, Latvia, Malta, Portugal, Sweden and Finland. CETA is expected to strengthen trade ties between the two regions, having come into effect in 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (29 of the 34 parties have ratified the agreement as of July 2019). The agreement has been provisionally applied since 2013, with the agreement being provisionally implanted among signatories.

Ratification Pending

- EU-Singapore FTA (EUSFTA): On February 13, 2019, the European Parliament passed the agreement which would see the creation of the EUSFTA. However, before the agreement is implemented, all the states involved will need to ratify the agreement through their individual legislatures; in this case, the FTA may become provisionally active along the lines of states which have already ratified the agreement.

- EU-Vietnam FTA: In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement (IPA). On June 30, 2019, the relevant parties signed the agreement on both the trade agreement and the investment protection agreement. The signed agreements will be presented to both the EU and Vietnamese parliaments, as well as the individual parliaments of EU members, for ratification.

- EU-MERCOSUR FTA: After 19 and a half years, a deal to establish the FTA was agreed upon on June 28, 2019. The signed agreements will be presented to the parliaments of the affected states (EU and MERCOSUR members), as well as to the EU Parliament, for ratification before coming into effect. MERCOSUR consists of Argentina, Brazil, Paraguay and Uruguay (Venezuela's membership has been suspended).

Under Renegotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017, and bilateral trade in services added an additional EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the Trump administration in the United States against the backdrop of rising global trade tensions.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

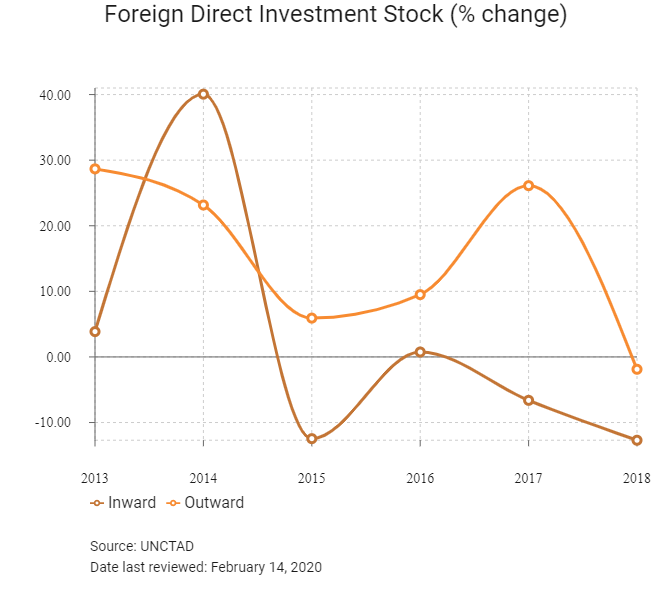

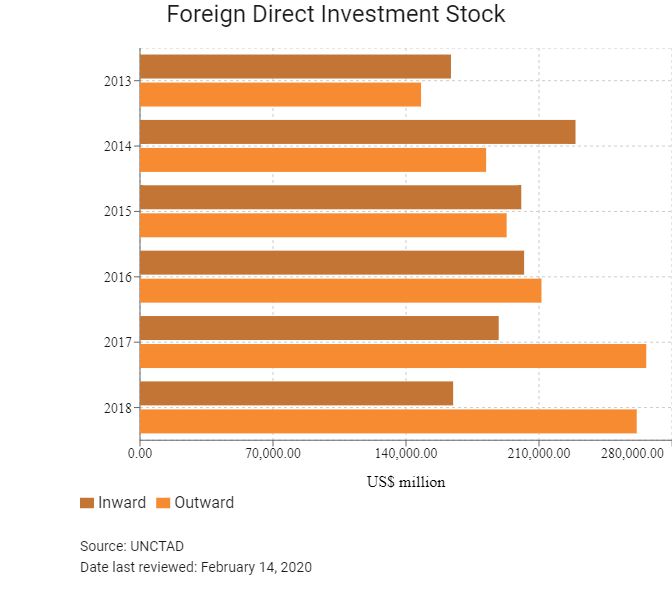

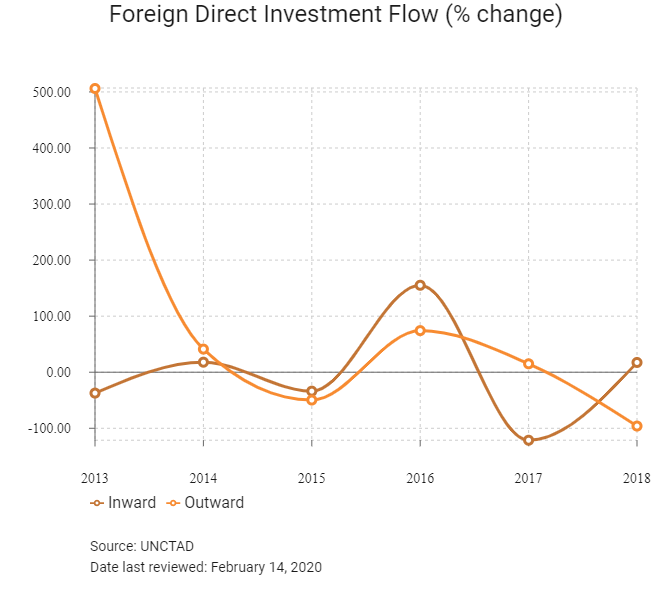

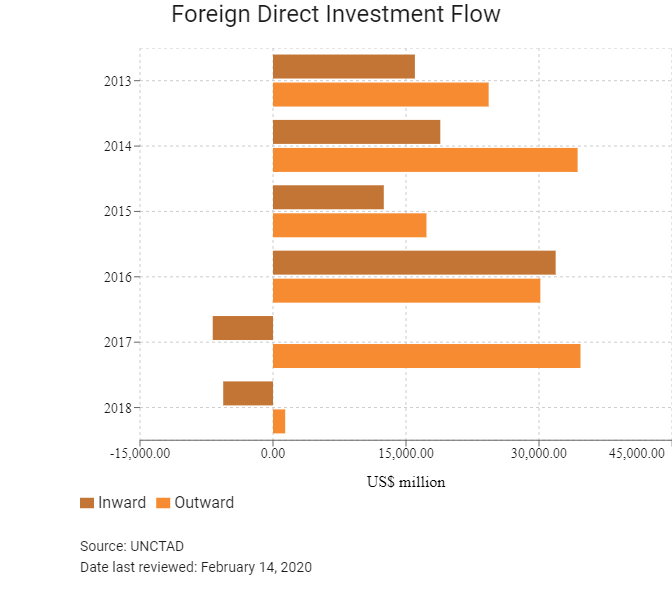

Foreign Direct Investment

Foreign Direct Investment Policy

- Since 2002, the Luxembourg Government has proactively implemented policies and programs to support economic diversification and to attract foreign direct investment (FDI). The government focused on key innovative industries that showed promise for supporting economic growth: logistics, information and communications technology (ICT), health technologies including biotechnology and biomedical research; clean energy technologies, and most recently, space technology and financial services technologies.

- There are no limits on foreign ownership or control, and there are no sector-specific restrictions. The Government has improved the efficiency of investment administrative procedures, notably in the context of the overall "Digitalisation" movement to offer a multitude of government services online or electronically.

- In 2017, the Government reduced the required minimum capitalisation of a new company from EUR12,500 to just EUR1 (a symbolic value), to encourage start-up creation. Between January 2017 and January 2018, over 680 such simplified limited liability companies (SARL-S) have registered. According to the Luxembourgish Chamber of Commerce, one client out of three has requested information on SARL-S. After receiving a certificate from the Registry of Commerce, companies are required by law to register with and pay annual dues to the Luxembourg Chamber of Commerce, as well as the Social Security Administration, the Tax Administration and the Value-Added-Tax (VAT) Authority (TVA). The company will receive an official registration number reflecting the date of inception of the entity, and this number will be used in all business transactions and correspondence with administrative authorities.

- The House of Entrepreneurship, opened in 2016 within the Luxembourg Chamber of Commerce, also provides guidance on the entire registration and creation process of a business. Between 2016 and 2018, the House of Entrepreneurship was contacted 30,000 times.

- Luxembourg has positioned itself as "the gateway to Europe" to establish European company headquarter operations by virtue of its central European location and advanced road, railway, and air connectivity. Due to uncertainties related to Brexit, some 50 insurers, asset managers and banking institutions have decided to re-locate their EU headquarters to Luxembourg or transfer a significant part of their activity to the country.

- In 2017, Luxembourg's Deputy Prime Minister and Minister of the Economy and Foreign Trade, Etienne Schneider, unveiled a strategy to promote economic growth focusing on attracting FDI and supporting companies' moving into other markets. The Luxembourg "Let's Make It Happen" campaign, developed by the state Trade and Investment Board, focuses on five key objectives:

- Improving Luxembourg-based companies' access to international markets

- Attracting FDI in a "targeted, service-oriented" way

- Strengthening the country's international "economic-promotion network"

- Improving Luxembourg's image as a "smart location" for high-performance business and industry

- Ensuring the coherence of economic promotion efforts

- Luxembourg is actively seeking logistics companies to expand the new logistics hub at Luxembourg Airport, home to Cargolux, Europe's largest all cargo airline. Inaugurated in 2017, the Luxembourg Intermodal Terminal (LIT) is ideally positioned as an international hub for the consolidation of multimodal transport flows across Europe and beyond.

- Luxembourg is also seeking ICT companies to use the existing high-security, state-of-the-art datacenters, affording high-speed internet connectivity to major international data hubs. Through various initiatives, Luxembourg seeks to attract financial technology and biomedical start-ups and small companies to make Luxembourg home.

- Luxembourg is a member state to the International Centre for Settlement of Investment Disputes (ICSID Convention). Luxembourg is a signatory of the convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958 New York Convention).

- There is no overall economic or industrial strategy that has discriminatory effects on foreign investors, either at a market-access or post-establishment phase of investment. Luxembourg strives to attract and retain foreign investors with its unique model of "easy-access to decision-makers" and its known ability to "act swiftly."

- Luxembourg has been proactive in developing its IP standards and participates in all the major IP treaties and conventions, including: Bern Convention, Patent Cooperation Treaty (PCT), Paris Convention, Patent Law Treaty (PLT) and Madrid Agreement and Protocol. The country is also a member state of the World Intellectual Property Organization (WIPO) and adequate steps have also been taken to implement and enforce the WTO TRIPS Agreement.

- On March 22, 2018, the Luxembourg Government approved legislative measures to bring Luxembourg's new IP regime into force with effect from January 1, 2018. The new regime is fully consistent with all recommendations made by the Organisation for Economic Cooperation and Development (OECD) Forum on Harmful Tax Practices, including those set out in the OECD/G20 Base Erosion and Profit Shifting (BEPS) Project Action 5 Final Report published in October 2015. Under the new regime, eligible net income from qualifying IP assets will benefit from an 80 percent exemption on income taxes. Consequently, a corporate taxpayer based in Luxembourg City with eligible net income will be taxed on such income at an overall (ie, corporate income taxes plus municipal business tax) effective tax rate of 5.202% in the 2018 tax year. IP assets qualifying for the new regime also benefit from a full exemption from Luxembourg's net wealth tax. Luxembourg is not listed in the United States Trade Representative (USTR) 2019 Special 301 Report, nor is it listed on the Notorious Markets List.

- Luxembourg has assimilated the laws of neighbouring countries according to the nature of the: German tax law, French civil law, and Belgian commercial law. There is no government or authority interference in the court system that could affect foreign investors.

- There are no restrictions on converting or transferring funds associated with an investment (including remittances of investment capital, earnings, loan repayments, lease payments) into a freely usable currency and at a legal market-clearing rate. Luxembourg was a proponent of the euro currency and adopted it immediately at inception in 1999 (as part of the "Eurozone" of EU member states adopting the euro to replace their former domestic currencies.) The European Central Bank is the authority in charge of the euro currency.

- Luxembourg is an OECD member with established practices consistent with OECD guidelines as far as state owned entities (SOEs) are concerned. There is no centralised ownership entity that exercises ownership rights for each of the SOEs.

- In general, if the government has a share in an enterprise, they will receive board of directors' seats on a comparable basis to other shareholders and in proportion to their share, with no formal management reporting directly to a line minister.

- Foreign investors are allowed to participate equally in ongoing privatisation programs, and the bidding process is transparent with no barriers put up against foreign investors at the time of the initial investment or after the investment is made. Moreover, there are no laws or regulations specifically authorising private firms to adopt articles of incorporation or association, which limit or prohibit foreign investment, participation, or control, and there are no other practices by private firms to force local ownership or restrict foreign investment, participation in, or control of domestic enterprises. There has been no evidence to suggest that potential conflicts of interest. Government officials sitting on boards of directors does not appear to have impacted freedom of investment in the private sector.

- Investment funds are subject to subscription tax (at various rates) on their total net assets valued at the last day of each quarter in a given fiscal year. Institutional funds and monetary funds are subject to an annual rate of 0.01% and the other funds to an annual rate of 0.05%. Funds of institutional funds and monetary institutional funds are exempt from subscription tax.

- Exemptions from subscription tax are available for exchange traded funds, and an extension of exemption is available for funds dedicated to multi-employer pension vehicles or to several employers providing pension benefits to their employees.

- Where a foreign Undertakings for Collective Investment (UCI) is managed by a Luxembourg-based management company (or where the foreign UCI's place of effective management is located in Luxembourg), the UCI will not be deemed to be domiciled in Luxembourg and therefore not be subject to subscription tax in Luxembourg.

- Data storage has been greatly enhanced via new state-of-the-art data centres, built by the government as part of the long-term massive ICT infrastructure development plan which includes replacing old transmission lines with fibre-optic cable all across the country. The data centres have served to optimise international connectivity to large hubs, such as Paris, Amsterdam, and Frankfurt, and have attracted major ICT and e-commerce players, such as Amazon and PayPal, which located their EU headquarters in Luxembourg. The centres are rated at the highest security level for data storage.

- A fixed registration duty of EUR75 is levied on certain transactions involving Luxembourg legal entities (ie, incorporation, amendment to the articles of association, and transfer of seat to Luxembourg).

- The sale or transfer of immovable property located in Luxembourg is subject to a proportional registration duty (inclusive of the transcription tax) of 7% (plus a city surtax of 3% if the building is located in Luxembourg City).

- Contributions of immovable property located in Luxembourg in exchange for securities are subject to a proportional registration duty (inclusive of the transcription tax) of 1.1% (plus a city surtax of 0.3% if the building is located in Luxembourg City). Contributions of immovable property located in Luxembourg in exchange for anything other than shares are subject to a proportional registration duty (inclusive of the transcription tax) of 7% (plus a city surtax of 3% if the building is in Luxembourg City). The contribution of immovable property in the context of restructuring transactions are not subject to proportional registration duty if some conditions are met.

- Banking, financial, insurance, and reinsurance transactions are generally exempt activities when it comes to VAT. The VAT paid on costs that have a direct and immediate link with these transactions cannot be recovered except when related to services performed for persons established outside the European Union. Other VAT-exempt transactions, such as exports and related transports, allow the supplier to recover input VAT on related costs.

- Luxembourg resident taxable persons are, in principle, required to be registered for VAT. However, taxable persons carrying on exclusively VAT-exempt activities and who do not have any right to recover input VAT are not required to register for VAT unless they are liable to self-assess VAT on good/services required from abroad. If so, they may be subject to simplified VAT compliance obligations.

- Rental agreements are not subject to any registration obligation, with the exception of long-term leasing agreements. Parties still have the possibility to register lease agreements voluntarily, notably to determine the date of an agreement for civil law purpose, or make them enforceable against third parties. If the rental agreement is voluntarily registered, registration duty at 0.6% would remain due, unless a valid VAT option has been duly approved by the Luxembourg VAT authorities. In that case, only the fixed registration of EUR 75 duty will apply.

- Luxembourg launched its SpaceResources.lu initiative in 2016 and in 2017 announced a fund offering financial support for the space resources industry. More than 50 companies dedicated to space initiatives are now active in Luxembourg.

- Luxembourg tax law also provides for various incentives, with specific requirements, in the areas of risk capital, audio-visual activities, environmental protection, research and development (R&D), professional training, and recruitment of unemployed persons.

Sources: WTO – Trade Policy Review, National sources, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Le Freeport |

- Luxembourg opened this in 2014, which was built and integrated into the cargo logistics centre at Luxembourg Airport. |

|

Inbound and capital investment incentives |

- The most commonly used incentives are the investment tax credits. Luxembourg tax law provides for two types of investment tax credits. |

|

R&D incentives |

- Luxembourg entities involved in innovative and R&D activities can benefit from financial support in addition to the specific IP tax regime and general tax incentives.

- These incentives are available for:

- Innovation in process and organisation and investment in innovation pools can benefit from financial support of between 15% and 35% (50% for public research companies). |

|

Intellectual property (IP) regime |

- Under the new regime, eligible net income from qualifying IP assets benefits from an 80% exemption from income taxes.

- Market-related IP, such as a trademark, is not eligible. |

|

Other incentives by entity |

- Investment funds: Investment funds resident in Luxembourg generally are exempt from corporate income tax, municipal business tax, and withholding tax on dividends. These investment funds are subject to the subscription tax and to the general registration duty regime. |

Sources: Fitch Solutions, national sources

- Value Added Tax: 17%

- Corporate Income Tax: Variable

Source: national sources

Important Updates to Taxation Information

A new Tax Law was voted on December 19, 2018 and is applicable as of January 1, 2019. This new legislation includes the following measures: Interest limitation rules; Controlled foreign company (CFC) rules, Intra-EU anti-hybrid rule and the General anti-abuse rule (GAAR). Additionally, the new Law includes an amendment concerning the domestic definition of permanent establishment (PE). In addition, in April 2019, the Luxembourg Parliament voted to approve the 2019 budget.

The 2019 Budget Law includes two main corporate tax measures:

- A reduction of the corporate income tax (CIT) rate leading to a decrease in the overall corporate tax rate from 26.01% to 24.94% for companies in Luxembourg City.

- It also included a complete rewrite of the legislation governing the Luxembourg tax unity regime, to permit the application of the interest limitation rules at the Luxembourg group level. The changes in the CIT rate are applicable for the 2019 tax year, while changes with regards to the Luxembourg tax unity regime are applicable for accounting years starting on or after January 1, 2019.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

Businesses with taxable income lower than EUR175,000 are subject to CIT at a rate of 15%. Businesses with taxable income between EUR175,000 and EUR200,001 are subject to CIT calculated as follows: EUR 26,250 plus 31% of the tax base above EUR 175,000 (for fiscal year 2019). The CIT rate is 17% for companies with taxable income in excess of EUR200,001 leading to an overall tax rate of 24.94% in Luxembourg City for 2019 (taking into account the solidarity surtax of 7% on the CIT rate, and including the 6.75% municipal business tax rate applicable). |

|

VAT |

The standard rate: 17% or, on certain transactions, at 14% (eg, certain wines, advertising pamphlets, management and safekeeping of securities), 8% (eg, supply of gas or electricity), or 3% (eg, food [except most alcohol beverages]; pharmaceutical products; books [including e-books as of May 17, 2019]; radio and television broadcasting services; shoes, accessories, and clothes designed for children under the age of 14). |

|

Solidarity Surtax |

A 7% solidarity surtax is imposed on the CIT amount. Taking into account the solidarity surtax, the aggregate CIT rate is 19.26% for companies with taxable income in excess of EUR30,000. |

|

Net Wealth Tax (NWT) |

The following scale of rates applies for NWT: |

|

Minimum NWT |

A minimum NWT charge applies for all corporate entities having their statutory seat or central administration in Luxembourg. |

|

Payroll Taxes |

Payroll taxes have to be withheld by the employer. The top payroll tax withholding rate is 42%. A solidarity tax of a maximum of 9% of tax must also be applied. |

|

Municipal Business Tax on income |

Municipal business tax is levied by the communes and varies from municipality to municipality. The municipal business tax for Luxembourg City is 6.75%. |

Sources: National sources, Fitch Solutions

Date last reviewed: February 14, 2020

Work Permit

EU member citizens do not require a work permit, but their employer must inform the job office about their employment. Citizens of the European Economic Area (with EU member states, Iceland, Norway and Lichtenstein) and Switzerland do not require a visa to enter, reside and work in the country.

No work permit is needed by foreigners from outside the EU if they have a permanent residence or family reunion permit, have been granted asylum, study in the country or have blue or green cards.

Obtaining Foreign Worker Permits

Individuals from non-EU countries require residence and work permits. The procedure to be granted a work permit includes a review of the local job market to ensure that there is no Finnish or EU job seekers available to fulfil the position. Employers must first apply for a permit to hire foreign workers. The vacant position must be reported to the local district Labour Office and cannot be changed at a later stage to fit the profile of a potential employee. The candidate must then apply for a work permit. The government issues the permit for a maximum of two years, which can be repeatedly prolonged, but always for a maximum of two years, and may be renewed as many times as needed. The permit process takes an average of one month.

Foreign (non-Luxembourger) workers are treated the same as nationals. Work permit constraints were somewhat relaxed for non-EU applicants, particularly for qualified persons for skilled positions.

The Ministry of Economy continues to support networks and associations acting in favour of female entrepreneurship. The Law of December 15, 2016 incorporated the principle of equal salaries in the Grand Duchy's legislation, which makes any difference in the salaries paid to men and women carrying out the same task or work of equal value, illegal.

Blue Card

Intended for the stay of a highly qualified employee. A foreigner holding a blue card may reside in the country and work in the job for which the blue card was issued, or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education which has lasted for at least three years. The blue card is issued with the term of validity three months longer than the term for which the employment contract has been concluded, but for the maximum period of two years. The blue card can be extended. One of the conditions for issuing the blue card is a wage criterion – the employment contract must contain gross monthly or yearly wage at least at the rate of 1.5 multiple of the gross average annual wage. Generally, the difficulty in obtaining a Residence permit is on par with other western European countries, once the applicant has provided all pertinent information to the authorities and the local district of residence.

Sources: Europa.eu, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Aaa (Stable) |

08/03/2019 |

|

Standard & Poor's |

AAA (Stable) |

14/01/2013 |

|

Fitch Ratings |

AAA (Stable) |

06/09/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

63/190 |

66/190 |

72/190 |

|

Ease of Paying Taxes Index |

21/190 |

22/190 |

23/190 |

|

Logistics Performance Index |

24/160 |

N/A |

N/A |

|

Corruption Perception Index |

9/180 |

9/180 |

N/A |

|

IMD World Competitiveness |

11/63 |

12/63 |

N/A |

Sources: World Bank, IMD, Transparency International

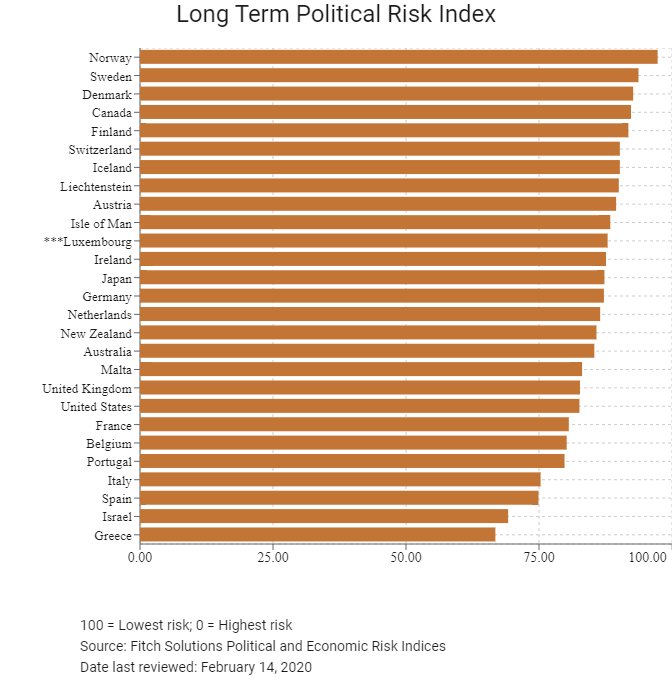

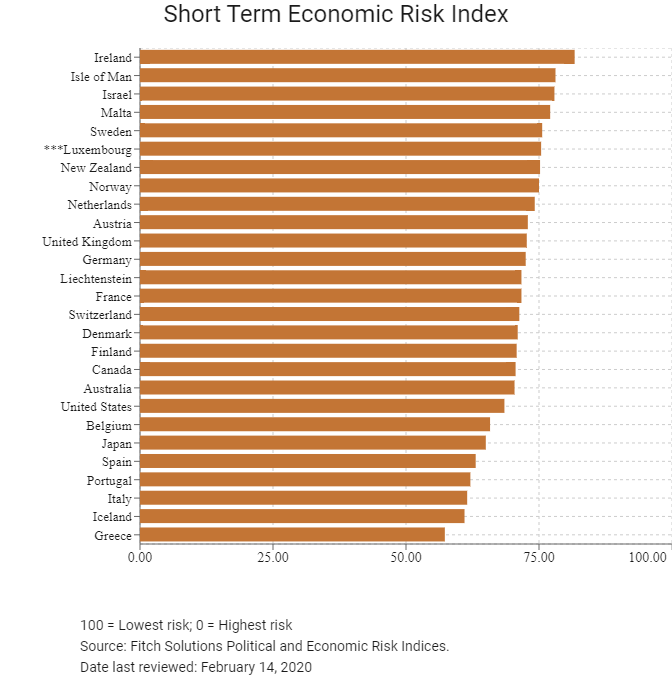

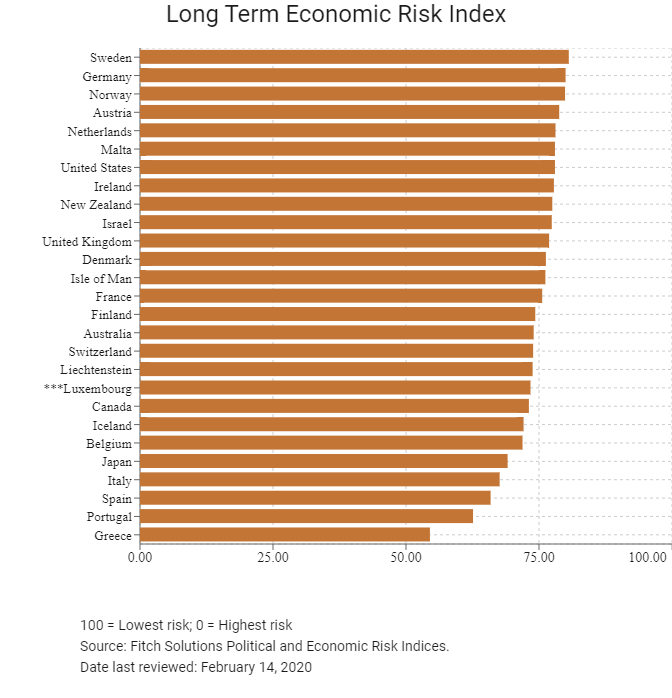

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

20/202 |

23/201 |

27/201 |

|

Short-Term Economic Risk Score |

77.1 |

75.8 |

75.4 |

|

Long-Term Economic Risk Score |

74.3 |

74.3 |

73.4 |

|

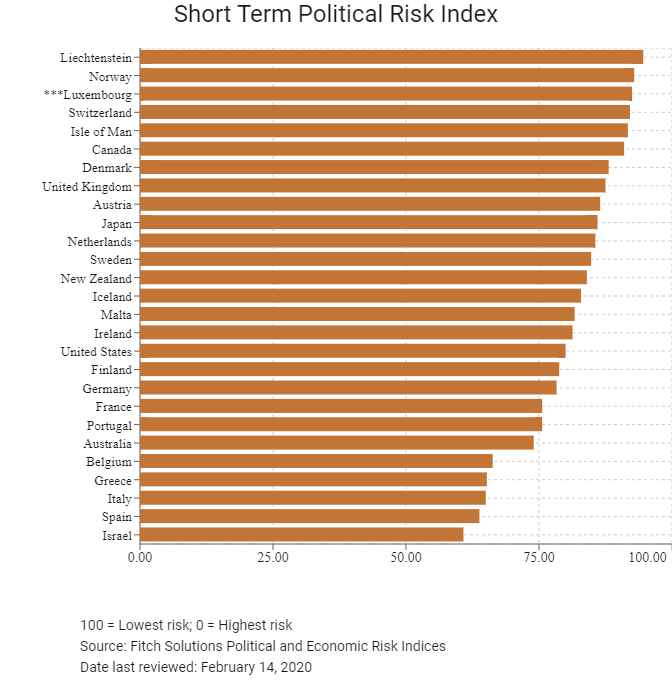

Political Risk Index Rank |

14/202 |

13/201 |

12/201 |

|

Short-Term Political Risk Score |

91.3 |

92.5 |

92.5 |

|

Long-Term Political Risk Score |

87.9 |

87.9 |

87.9 |

|

Operational Risk Index Rank |

14/201 |

15/201 |

15/201 |

|

Operational Risk Score |

74.7 |

73.4 |

73.4 |

Source: Fitch Solutions

Date last reviewed: February 14, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Luxembourg is consistently ranked as one of the world's most open and transparent economies and has no restrictions on foreign-ownership. It is also consistently ranked as one of the world's most competitive and least-corrupt economies. The policy stability of Luxembourg is supported by a political culture of consensus where the parties coexist within the context of a broader agreement on key issues. Such stability is a key component of Luxembourg's development.. In 2020, the economy is expected to remain solid thanks to still-healthy private consumption amid supportive labour market and growth in exports of financial services. However downside risks to near term growth stem from subdued regional and global demand, which could hamper investment and exports.

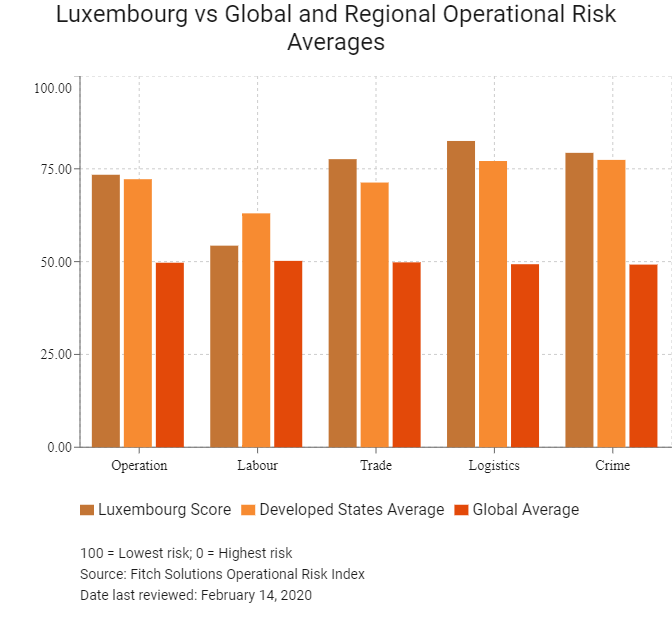

OPERATIONAL RISK

Luxembourg's operating environment is highly competitive. Located at the heart of Europe, Luxembourg has established a reputation as a favoured location for a wide range of international companies from a variety of sectors with diverse business models. Over the past decade, Luxembourg has adopted major fiscal reforms to counter money-laundering, terrorist-financing, and tax evasion. Luxembourg provides companies with the capability to establish and adopt business, regulatory, and tax framework for added-value activities in Europe and beyond. Luxembourg is a unique gateway to the European market, 500 million plus consumers (and around 70% of the EU's wealth) are concentrated in a 700-kilometre area around the Grand Duchy. Luxembourg's banking system is sound and strong, having been shored up following the world financial crisis by emergency investments by the Government of Luxembourg. The Government of Luxembourg actively supports the development of new sectors in an effort to diversify the country's economy, given the dominance of the financial sector. Target sectors include space, logistics, and information technology, including financial technology and biomedicine.

Source: Fitch Solutions

Date last reviewed: February 12, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Luxembourg Score |

73.4 |

54.3 |

77.6 |

82.5 |

79.3 |

|

Developed States Average |

72.2 |

63.0 |

71.3 |

77.1 |

77.4 |

|

Developed States Position (out of 27) |

13 |

22 |

6 |

8 |

13 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

15 |

72 |

9 |

8 |

16 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Denmark |

79.4 |

70.5 |

76.2 |

88.5 |

82.3 |

|

Switzerland |

78.6 |

74.4 |

77.6 |

79.3 |

83.2 |

|

Netherlands |

78.3 |

65.4 |

78.2 |

88.8 |

80.7 |

|

Sweden |

77.6 |

66.8 |

78.1 |

86.7 |

78.6 |

|

United States |

77.6 |

79.7 |

75.3 |

85.9 |

69.3 |

|

New Zealand |

77.2 |

72.0 |

75.7 |

73.0 |

88.3 |

|

Canada |

76.4 |

73.6 |

75.4 |

75.1 |

81.6 |

|

United Kingdom |

76.4 |

70.2 |

79.0 |

78.3 |

78.2 |

|

Norway |

76.3 |

63.8 |

72.2 |

81.2 |

87.9 |

|

Austria |

74.7 |

61.9 |

71.9 |

83.6 |

81.5 |

|

Finland |

74.4 |

54.9 |

74.1 |

84.7 |

83.7 |

|

Ireland |

73.5 |

66.6 |

78.0 |

70.4 |

79.0 |

|

Luxembourg |

73.4 |

54.3 |

77.6 |

82.5 |

79.3 |

|

Germany |

72.4 |

66.1 |

69.0 |

80.8 |

73.6 |

|

Australia |

72.3 |

68.7 |

72.1 |

68.4 |

79.9 |

|

France |

71.8 |

60.7 |

71.1 |

82.6 |

72.8 |

|

Spain |

71.6 |

61.0 |

68.9 |

80.6 |

76.0 |

|

Iceland |

71.3 |

59.8 |

67.2 |

70.0 |

88.1 |

|

Japan |

71.1 |

69.9 |

65.5 |

77.5 |

71.5 |

|

Belgium |

70.8 |

57.1 |

72.8 |

82.3 |

71.1 |

|

Portugal |

69.8 |

52.5 |

66.5 |

81.7 |

78.4 |

|

Liechtenstein |

68.4 |

47.0 |

78.1 |

65.1 |

83.2 |

|

Israel |

67.2 |

71.3 |

64.6 |

70.2 |

62.7 |

|

Malta |

65.0 |

54.3 |

69.0 |

63.0 |

73.7 |

|

Italy |

63.8 |

55.1 |

59.7 |

76.2 |

64.3 |

|

Isle of Man |

62.8 |

49.9 |

62.4 |

56.6 |

82.4 |

|

Greece |

58.0 |

53.2 |

49.2 |

69.9 |

59.6 |

|

Developed Markets Averages |

72.2 |

63.0 |

71.3 |

77.1 |

77.4 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 14, 2020

Hong Kong’s Trade with Luxembourg

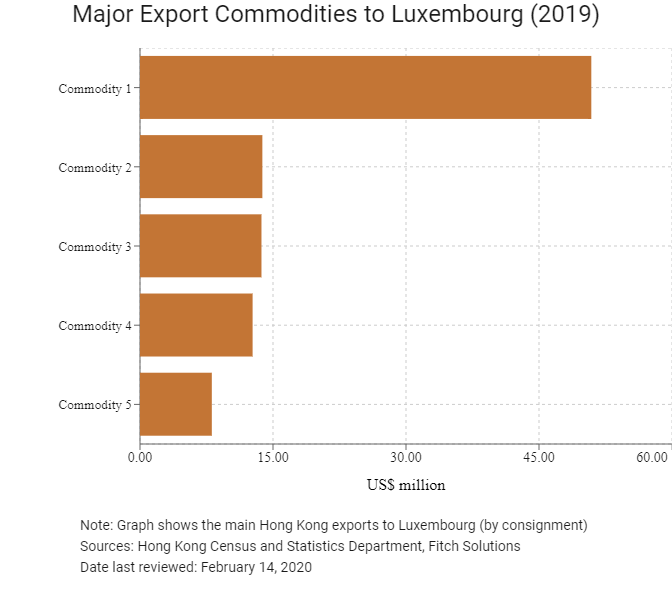

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Miscellaneous manufactured articles | 50.9 |

| Commodity 2 | Power generating machinery and equipment | 13.8 |

| Commodity 3 | Office machines and automatic data processing machines | 13.7 |

| Commodity 4 | Telecommunications and sound recording and reproducing apparatus and equipment | 12.7 |

| Commodity 5 | Other transport equipment | 8.1 |

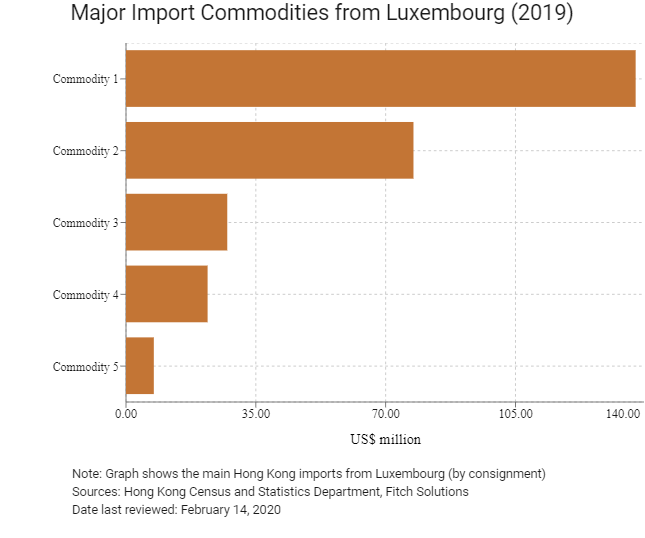

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Power generating machinery and equipment | 137.4 |

| Commodity 2 | Miscellaneous manufactured articles. | 77.5 |

| Commodity 3 | Chemical materials and products. | 27.3 |

| Commodity 4 | Non-ferrous metals | 22.0 |

| Commodity 5 | Essential oils and resinoids and perfume materials; toilet, polishing and cleansing preparations | 7.5 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Luxembourg residents visiting Hong Kong |

2,066 |

-2.7 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of developed States citizens residing in Hong Kong |

83,786 |

29.6 |

Note: Growth rate is from 2015 to 2019. No UN data available for intermediate years.

Source: United Nations Department of Economic and Social Affairs - Population Division

Date last reviewed: February 14, 2020

Commercial Presence in Hong Kong

|

2018 |

Growth rate (%) |

|

|

Number of Luxembourg companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements Between Hong Kong/Mainland China and Luxembourg

Hong Kong and Luxembourg have a double taxation agreement in place. The agreement was signed in November 2007 and came into effect in January 2009.

Source: Inland Revenue Department

Chamber of Commerce or Related Organisations

The Belgium-Luxembourg Chamber of Commerce

Address: Room 1102, Lee Garden One, 33 Hysan Avenue, Causeway Bay, Hong Kong

Email: info@blcchk.org

Source: The Belgium-Luxembourg Chamber of Commerce Hong Kong (BLCCHK)

Honorary Consulate of the Grand Duchy of Luxembourg

Address: Room B, 13/F, Queen's Centre, 58-64 Queen's Road East, Wan Chai, Hong Kong

Email: conluxhk@gmail.com

Tel: (852) 3621 0979

Fax: (852) 3747 4600

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

Hong Kong residents can travel to the Schengen Zone without a visa. They can travel for tourism and business purposes and remain in the region for a period of up to 90 days.

Source: Visa on Demand

Date last reviewed: February 14, 2020

Luxembourg

Luxembourg