GDP (US$ Billion)

446.11 (2018)

World Ranking 28/193

GDP Per Capita (US$)

5,417 (2018)

World Ranking 101/192

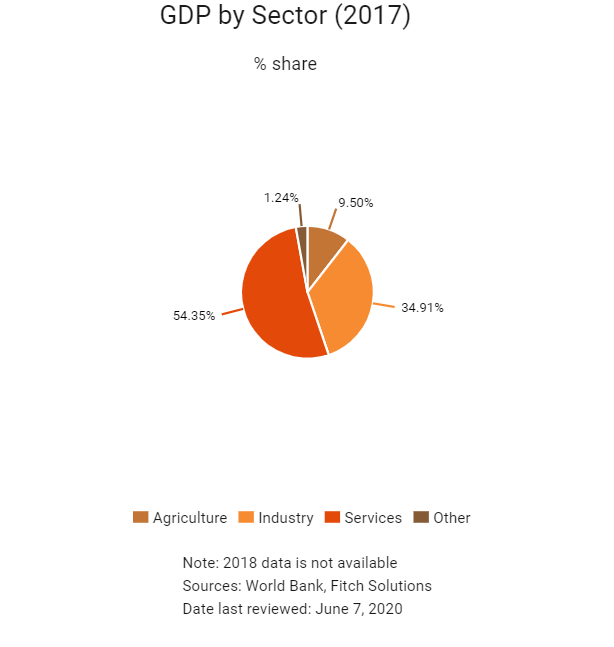

Economic Structure

(in terms of GDP composition, 2017)

External Trade (% of GDP)

48.8 (2017)

Currency (Period Average)

Iranian Rial

42000.00per US$ (2019)

Political System

Unitary Islamic republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

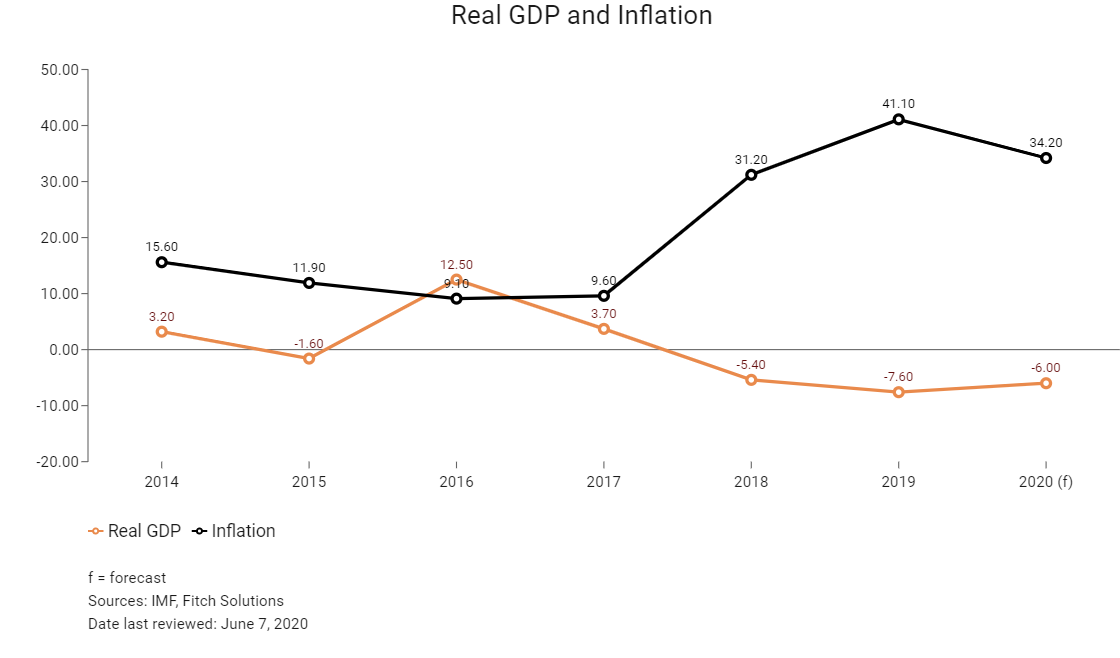

With a population of nearly 81 million people, Iran's economy is dominated by the hydrocarbon, agriculture and services sectors. Iran ranks second in the world in natural gas reserves and fourth in proven crude oil reserves. Economic activity and government revenues still depend, to a large extent, on oil revenues and, therefore, remain volatile. While hydrocarbons are the dominant sector in Iran and account for the majority of exports, growth in recent years has increasingly been based on non-oil sectors, as well as a short-lived recovery in consumption and investment demand. In the medium term, the economy is set to experience a downward trajectory as oil exports and non-oil sector activity will fall considerably following the phased reintroduction of United States sanctions culminating in November 2018 and the impact of the Covid-19 pandemic.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2018

United States President Donald Trump announced the United States' withdrawal from the 2015 international deal on Iran's nuclear programme and the re-imposition of United States sanctions on Iran. The Iranian currency fell to record lows over the summer after the United States pulled out of the nuclear deal.

November 2018

The United States re-imposed sanctions on Iran. The United States also granted relevant waivers to eight countries, including Mainland China, allowing them to continue to import oil from Iran for a six-month period after November 2018.

May 2019

The waivers on Iranian oil exports (previously granted to eight countries) expired on May 1, 2019.

July 2019

On July 1, Iran announced that its enriched uranium stockpile has exceeded 300kg, thereby breaching one of its commitments under the 2015 Joint Comprehensive Plan of Action (JCPOA, 'Iran nuclear deal').

September 2019

The Russian government stated they would allocate a EUR1.2 billion (USD1.32 billion) loan for construction of the 1.4GW Sirik thermal power plant in the Iranian province of Hormozgan, according to Iran's Minister of Energy Reza Ardakanian. The project comprised four units of 350MW capacity each. The plant was expected to become operational in five years.

October 2019

A free trade agreement (FTA) between Iran and the EAEU entered into force on October 27, creating conditions for preferential trade between Iran and the current EEAU members: Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. The FTA would give Iran access to a single market comprised of 183 million people and with an aggregate GDP of USD4 trillion.

November 2019

The United States imposed additional sanctions on Iran that target several transportation firms. The moves would subject foreign firms and governments that do business with the targeted entities to sanctions themselves, including a freeze on any assets they might have in United States jurisdictions.

February 2020

Conservatives won the parliamentary elections that took place on February 21, 2020.

April 2020

In response to the Covid-19 crisis, Iran’s National Development Fund was instructed by the Supreme Leader to transfer USD1.1 billion in budget deficit financing as of April 6.

On April 15, the government embarked on its biggest-ever initial public offering, selling its residual shares in 18 companies (including 12 percent share of Social Welfare Fund (SHASTA), the largest public company) to generate income as it grapples with the economic consequences of Covid-19 and US sanctions. The estimated privatization proceeds are at around IRR165 trillion (0.6% of GDP) from banks and insurance companies and IRR70 trillion (0.2% of GDP) from SHASTA.

Sources: BBC Country Profile – Timeline, Fitch Solutions

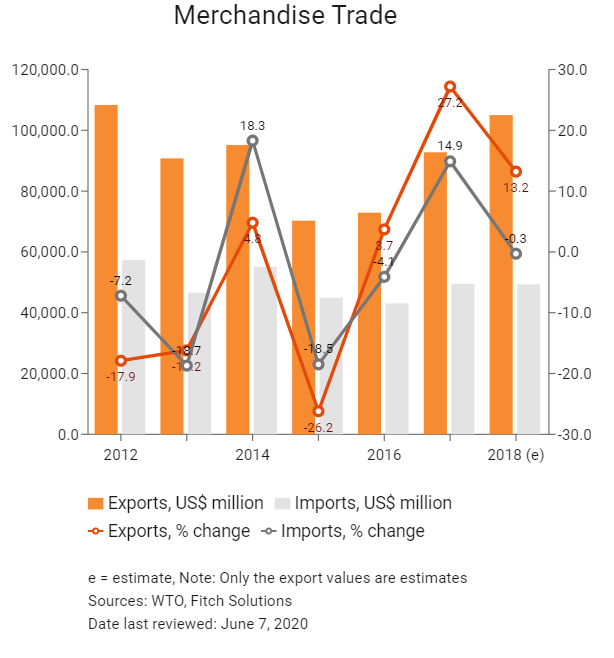

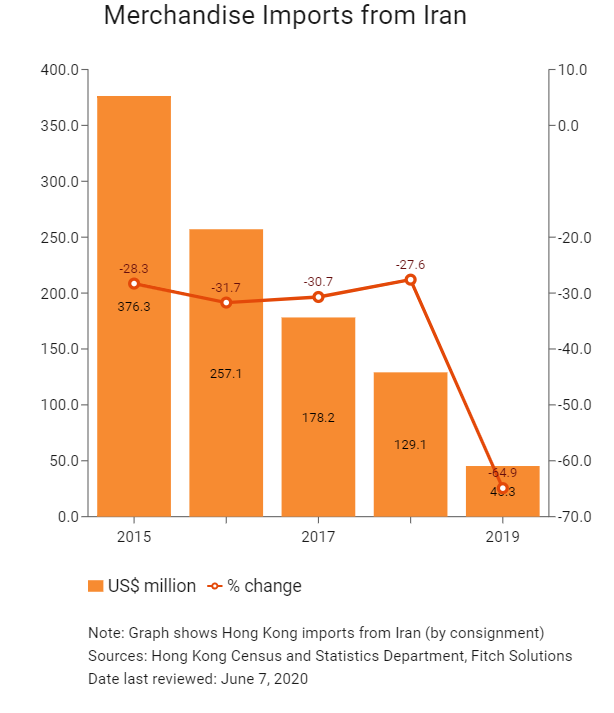

Merchandise Trade

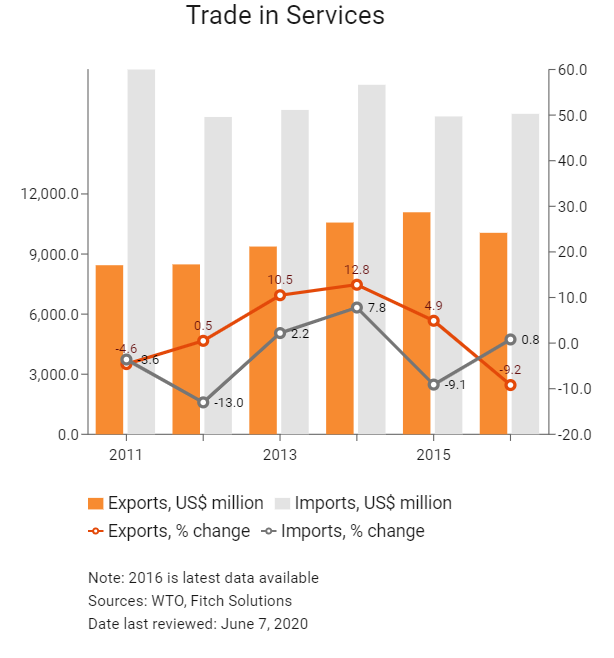

Trade in Services

- United States sanctions have presented major barriers to trade growth in Iran. Although Iran has been under sanctions of varying severity imposed by the United States since the Islamic Revolution in 1979, these were significantly widened and further taken up by the European Union (EU) and the United Nations in 2011 as a response to the country's continuing nuclear programme. Sanctions in Iran have specifically targeted the development of nuclear facilities and the procurement of arms. Sanctions also include a ban on the involvement of Western companies in the oil and gas industry, the prohibition of oil exports to key developed markets, such as the United States and the EU, and the exclusion of the banking sector from the international finance industry. Even though most sanctions were lifted in 2016, United States primary sanctions continued to obstruct international trade by preventing the use of USD for transactions with Iran.

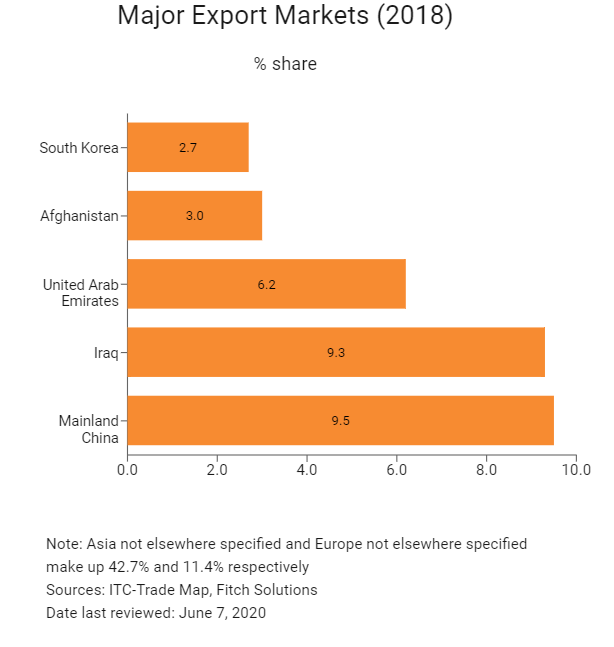

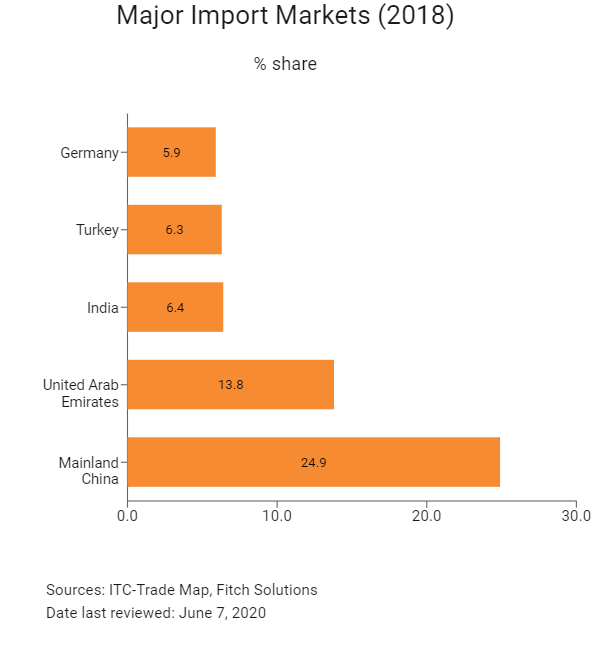

- International trade in Iran has been shaped by the sanction regime from which the country began to emerge in 2016. The imposition of sanctions, led by the EU and the Untied States, affected trade volumes for Iran's key commodity export (oil) and investment in the hydrocarbons industry. Sanctions have also halted the use of USD for international trade and have driven the focus of trade flows towards Asian countries.

- United States President Donald Trump's decision in May 2018 to withdraw from the 2015 nuclear deal has paved the way for the re-imposition of United States sanctions against Iran. The first phase began on August 7, 2018. The first round targeted Iranian purchases of USD, metal trading, coal, industrial software and the Iranian autos sector. The second batch targeted its banking system and oil exports. These sanctions were implemented on November 5, 2018.

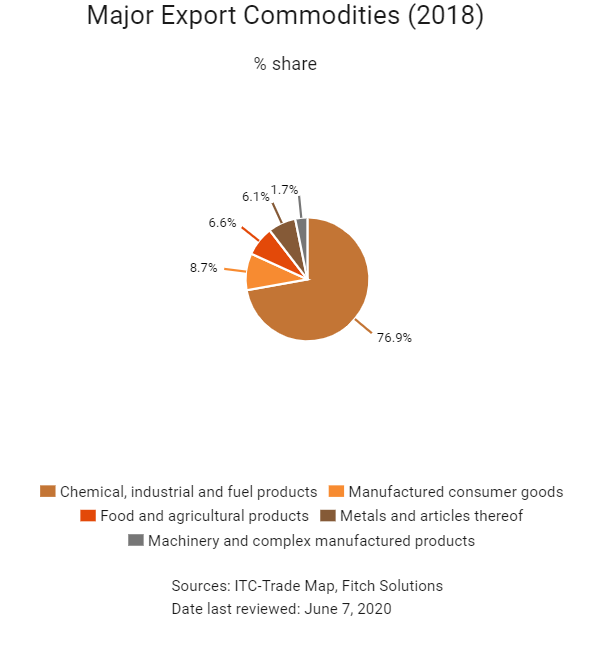

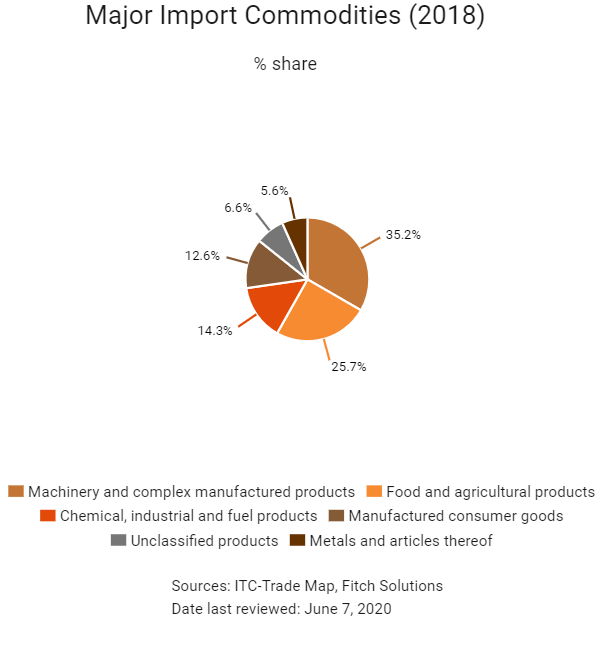

- Trade volumes in Iran are dominated by high-value hydrocarbons exports, which are the main drivers of economic growth and the major sources of government income. Import demand in Iran is also largely driven by the oil and gas sector. Nonetheless, Iran's vast natural resource wealth suggests that potential trade volumes could be far higher than the current level.

- Trade flows are hindered by considerable average import tariff rates, standing at an estimated 15.2% (in 2016), which is the eighth highest globally. This is partly due to the fact that Iran has yet to become a full member of the World Trade Organization (WTO) as its membership has been held up by United States vetoes and slow progress on accession since its application was accepted in 2005. The Iranian government has traditionally applied high tariffs on imports to protect and encourage growth in domestic industries, but this significantly increases the costs of imported inputs for businesses and reduces Iran's competitiveness.

- Trade bureaucracy and customs delays are a major hindrance to business activity in Iran. Convoluted procedures significantly increase the time and cost required for international trade, and particularly complicate the import process.

- The inability to use USD for trade transactions significantly increases the difficulty of selling into and operating in the Iranian market, as payments have to be made in alternative currencies, such as euro or yuan, instead.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

Firms doing business in Iran face risks after President Donald Trump of the United States imposed the first batch of secondary sanctions against the Middle Eastern nation in Q318. August 6, 2018, marked the first of two deadlines that the United States president gave companies to wind down activities in Iran. In May 2018, he announced that he was pulling the United States out of the Iranian nuclear deal – officially known as the Joint Comprehensive Plan of Action (JCPOA).

The JCPOA was agreed on between Iran and Mainland China, France, Russia, the United Kingdom, the United States and the EU in 2015. While the United States has long maintained its tough stance on United States persons dealing with Iran, the JCPOA meant that it agreed to lift its secondary sanctions – those that apply to non-United States persons and entities engaged in Iranian transactions. These sanctions, however, have now been re-imposed.

With the EU expected to enforce a blocking regulation – a statute that makes it illegal for any EU company or person to comply with those United States sanctions – EU firms will face significant challenges when it comes to doing business in Iran and complying with United States requirements. A number of states within the EU have committed to implementing the blocking regulation as of Q219.

Multinational Trade Agreements

Active

- Syria-Iran Preferential Trade Agreement: Syria is not a viable trade partner while its civil conflict continues and, therefore, the FTA is unlikely to offer attractive trading opportunities for many years, even if the war ends.

- Economic Cooperation Organization (ECO): The partial scope agreement came into force in February 1992. The list of signatories includes Iran, Pakistan and Turkey.

- Global System of Trade Preferences Among Developing Countries (GSTP): The partial scope agreement came into force in April 1989.

- Iran- Eurasian Economic Union (EAEU) FTA: The EAEU is an economic union of states located in central and northern Asia and Eastern Europe. The Treaty on the Eurasian Economic Union was signed on 29 May 2014 by the leaders of Belarus, Kazakhstan and Russia, and came into force on 1 January 2015. An FTA between Iran and the EAEU entered into force on October 27, 2019, creating conditions for preferential trade between Iran and the current EEAU members: Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. The FTA will give Iran access to a single market comprised of 183 million people and with an aggregate GDP of USD4 trillion.

Under Negotiation

- Gulf Cooperation Council (GCC): Iran is reliant on GCC states for imports, which flow through the better connected ports of the United Arab Emirates. Iran is currently negotiating an FTA with the GCC.

- Pakistan-Iran FTA: In December 2016, Pakistan and Iran started negotiating an FTA with the resolve to complete the negotiation process and achieve the objective of enhancing bilateral trade for the betterment of people of both countries. As of June 2019, negotiations are ongoing although the negotiations are reportedly entering its final phase, with the Pakistan Ministry of Commerce seeking comprehensive analysis of Iran-Pakistan trade relations prior to approving the agreement.

- Indonesia-Iran FTA: Indonesia is a large economy that could provide a significant market for Iranian oil exports. As of June 2019, plans have not passed the discussion phase.

- Turkey-Iran: Turkey is conveniently located next to Iran and is among the top five trade partners for Iran in terms of both exports and imports, which offers a huge market for Iranian hydrocarbons. A successful trade agreement between the two countries would open up considerable opportunities for businesses to take advantage of.

Sources: Preferential Trade Agreement between the Syrian Arab Republic and the Islamic Republic of Iran, Fitch Solutions

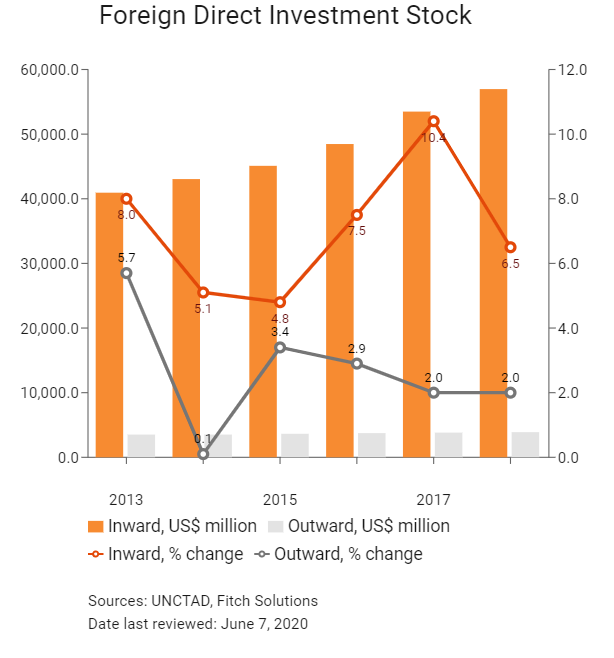

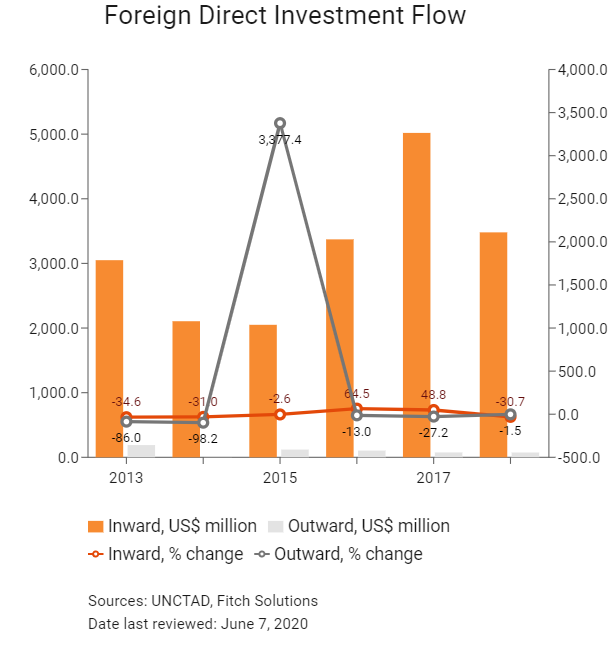

Foreign Direct Investment

Foreign Direct Investment Policy

- Iran offers one of the most difficult markets in the world for foreign investors to navigate. This is largely owing to the international sanctions placed on the country by the United States, which precluded investment by Western businesses in many sectors, including the valuable oil and gas industry, and continue to severely limit access to financing for firms based in Iran.

- Foreign direct investment (FDI) inflows continued during the sanctions regime, particularly from Mainland China, while South Korean and Indian firms have also been among the first to secure investment in infrastructure development following the lifting of sanctions.

- Sanctions imposed by the United States primarily focused on Iran's economically vital oil and gas industry and its financial sector, specifically preventing Western companies from involvement in the financing of oil exploration, production and refining. Iran's banking industry was excluded from global financial markets through the banning of trade in precious metals from Europe and expelling Iranian banks from SWIFT. By targeting these sectors in particular, the sanctions imposed a blanket ban on investment in Iran by Western firms. United States primary sanctions remain in place, causing difficulties for businesses with United States interests and preventing the use of United States dollars for transactions.

- Despite ongoing talks between Europe and Iran aimed at salvaging the nuclear deal and keeping European businesses in Iran, major European companies are already leaving the Iranian market in order to avoid United States sanctions.

- Ownership of natural resources is confined to the Iranian state. In the oil industry, private investment is restricted to buyback contracts (which allow private firms to provide the capital and expertise required for extraction) and require production sites to be returned to the ownership of the National Iranian Oil Company after the initial set-up.

- Foreign companies are required to strike joint venture agreements with state-owned enterprises in order to invest in some industries.

- Foreign investment is currently coordinated under the Foreign Investment Promotion and Protection Act, which was introduced in 2002.

- Iran has revealed several measures designed to encourage investment. These include abolishing restrictions on the percentages of foreign shareholding within a company, a three-year residence licence for foreign investors, directors and experts, as well as tax incentives and reduced administrative obligations for foreign investors.

Sources: US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free Trade Zones (FTZs) located at Kish, Qeshm, Chabahar, Aras, Anzali, Maku, Abadan |

- Visa-free entry for foreign nationals |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 9%

- Corporate Income Tax: 25%

Source: Iran National Tax Administration

Important Updates to Taxation Information

The government has introduced a simplified flat corporate income tax rate that is applicable to both resident and non-resident entities.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 25% on profits |

|

Social security contributions |

23% on gross salaries (all employers) |

|

VAT/GST |

9% on sale of goods and services (standard) |

|

Withholding Tax |

Dividends: 0% |

|

Property Transfer Tax |

5% on land value (levied on the acquisition of real estate) and the transfer of goodwill is taxed at 2% on the transferred goodwill’s value. |

Source: Iran National Tax Administration

Date last reviewed: June 7, 2020

Localisation Requirements

The saturation of the Iranian labour market means that the employment of foreign nationals is not encouraged, and the percentage of foreign workers employed in a company may be capped at 20%. The process of employing expatriate staff is made slightly easier if investment is through the 2002 Foreign Investment Promotion and Protection Act, which allows work and residence permits to be granted for foreign investors, directors, experts and their immediate family members.

Foreign Worker Permits

Companies wishing to employ foreign workers in Iran for more skilled positions must apply for work permits and seek permission from the Department General for the Employment of Foreign Nationals. Employment permits will only be granted if certain stipulations are met, namely that there is a lack of expertise for the position among Iranian nationals, the foreign national is qualified for the position and the expertise of the foreign national will be used to train Iranian workers who will subsequently replace the expatriate. Work permits are issued for a period of one year and cost USD130 to be issued or renewed (a renewal also lasts for one year).

Visa/Travel Restrictions

Citizens of the United States, the United Kingdom, Canada and some South Asian and Middle Eastern countries must obtain visas in advance, and independent travel may be limited. Israeli citizens cannot travel to Iran and citizens of developing countries who have visited Israel may be refused entry to Iran.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Withdrawn |

Withdrawn |

|

Standard & Poor's |

Not rated |

Not rated |

|

Fitch Ratings |

Not rated |

Not rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

124/190 |

128/190 |

127/190 |

|

Ease of Paying Taxes Index |

150/190 |

149/190 |

144/190 |

|

Logistics Performance Index |

64/160 |

N/A |

N/A |

|

Corruption Perception Index |

138/180 |

146/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International, Fitch Solutions

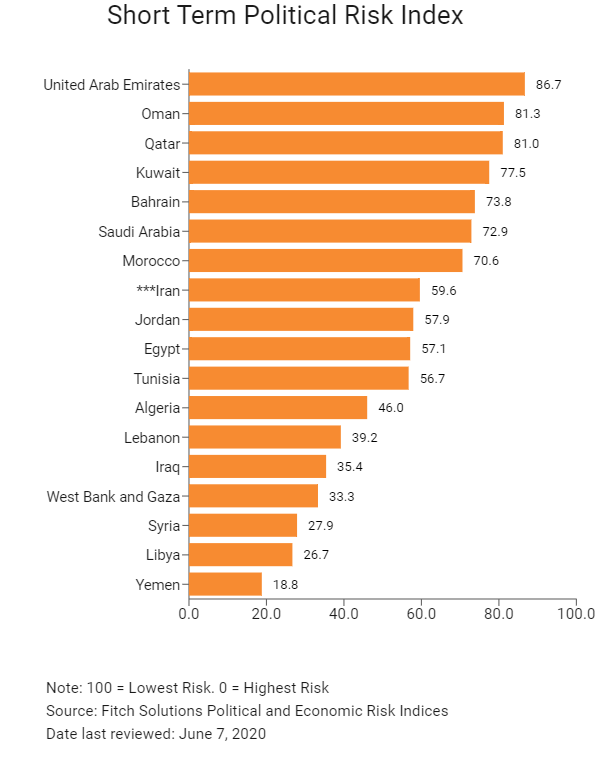

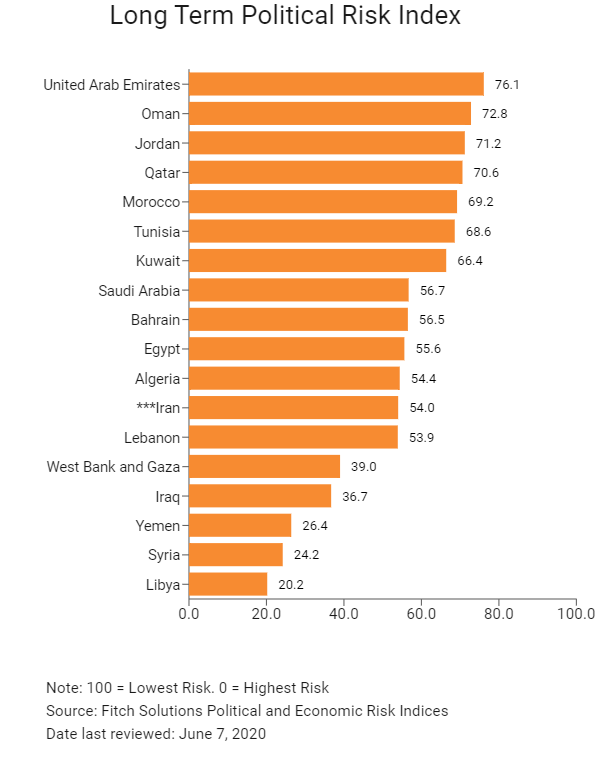

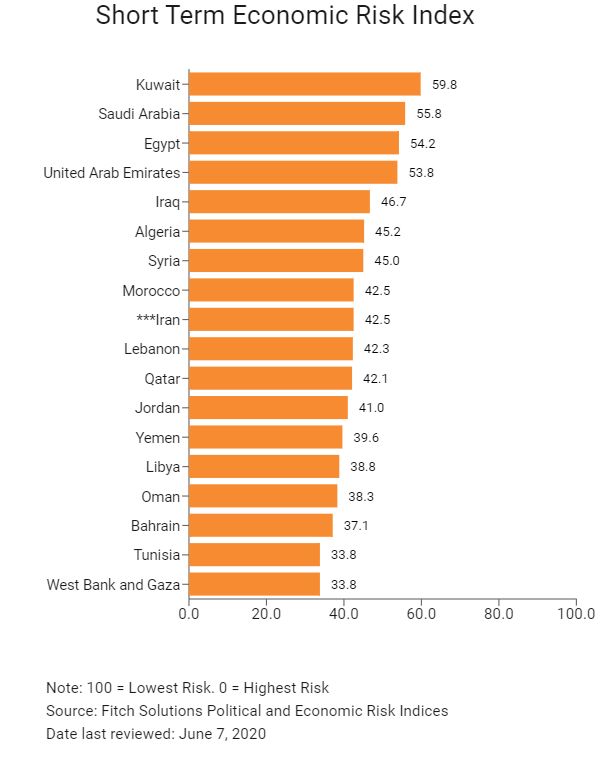

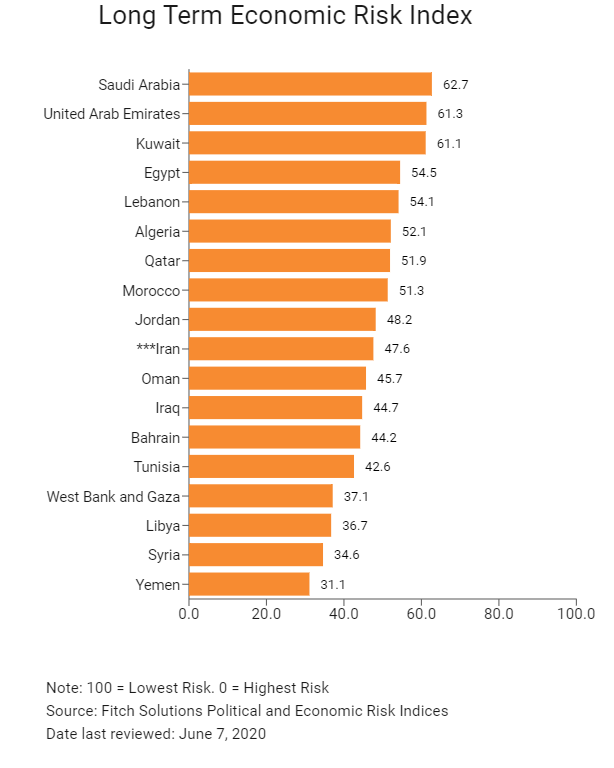

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

127/202 |

137/201 |

130/201 |

|

Short-Term Economic Risk Score |

46 |

39.4 |

42.5 |

|

Long-Term Economic Risk Score |

47.2 |

46.3 |

47.6 |

|

Political Risk Index Rank |

138/202 |

139/201 |

140/201 |

|

Short-Term Political Risk Score |

62.1 |

59.6 |

59.6 |

|

Long-Term Political Risk Score |

54.0 |

54.0 |

54.0 |

|

Operational Risk Index Rank |

122/201 |

126/201 |

127/201 |

|

Operational Risk Score |

43.2 |

43.3 |

43.2 |

Source: Fitch Solutions

Date last reviewed: June 7, 2020

Fitch Solutions Risk Summary

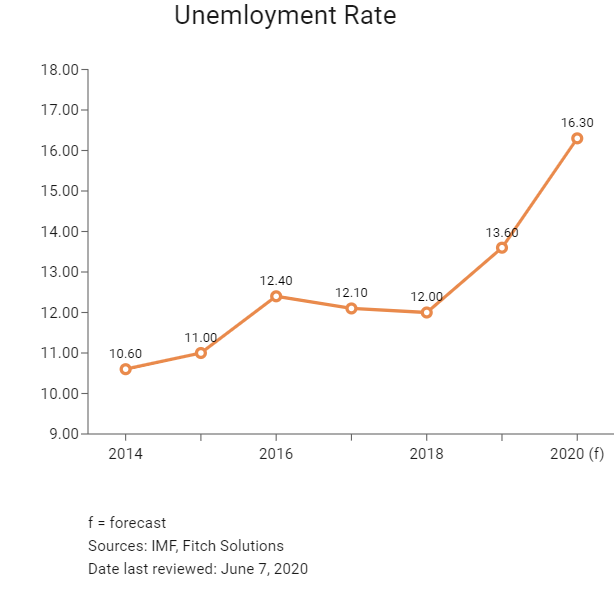

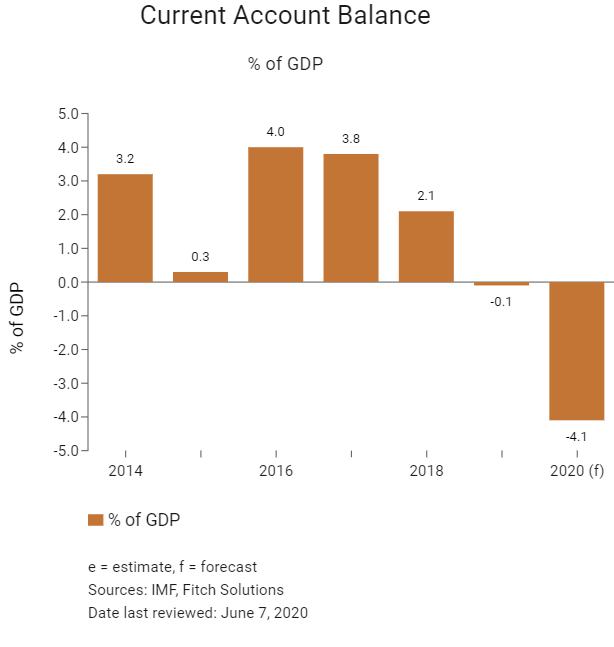

ECONOMIC RISK

In 2020 the economy will contract for the third consecutive year. United States sanctions on the manufacturing sector will weigh on the non-oil private sector, while the oil economy remains crippled by prior sanctions and depressed energy prices. Moreover, the Covid-19 outbreak will further constrict activity. The risk of escalation of United States sanctions will impact the country's oil exports and investment inflows in the quarters ahead. Local currency depreciation and rising inflation are weighing on investment and consumption in real terms. Nevertheless, with some trade with Asia and Russia still likely to be maintained. In addition, Iran's long-term economic outlook could be one of the most promising in the Middle East and North Africa region, particularly in the event that the country can secure sanction relief, against the backdrop of a positive consumer story and efforts to comply with structural reforms to the economy and security sector. In the interim domestic political risk, elevated inflation and geopolitical tensions pose downside risks to the country’s near term outlook.

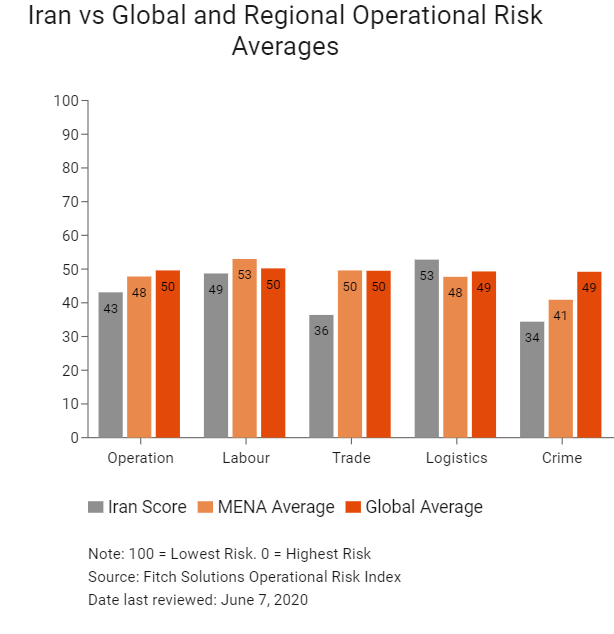

OPERATIONAL RISK

Iran's operating environment is facing considerable setbacks resulting from the decision of United States President Donald Trump to reintroduce broad sanctions and withdraw from the nuclear agreement reached in July 2015. While the other signatories to the agreement (the EU, Russia and Mainland China) have tentatively agreed to continue upholding it, most improvements to Iran's economy and business environment over the last three years are likely to be negatively affected by these recent developments. Doing business in the country will become more difficult once again, particularly for Western firms, while structural risks – including obstacles to trade, regulatory restrictions, onerous taxes and stringent labour laws – are likely to remain in place amid slow reform momentum.

Source: Fitch Solutions

Date last reviewed: June 9, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Iran Score |

43.1 |

48.7 |

36.4 |

52.8 |

34.4 |

|

MENA Average |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

12 |

10 |

12 |

9 |

12 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

127 |

109 |

147 |

83 |

150 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

UAE |

71.6 |

70.6 |

77.5 |

68.0 |

70.5 |

|

Bahrain |

66.5 |

65.5 |

75.4 |

71.6 |

53.6 |

|

Qatar |

66.0 |

66.7 |

62.3 |

73.7 |

61.2 |

|

Oman |

64.9 |

62.7 |

63.4 |

64.2 |

69.2 |

|

Saudi Arabia |

63.6 |

68.3 |

65.8 |

62.5 |

57.7 |

|

Jordan |

57.1 |

58.4 |

62.9 |

54.8 |

52.3 |

|

Kuwait |

55.5 |

58.7 |

56.2 |

50.8 |

56.2 |

|

Morocco |

54.6 |

45.0 |

65.3 |

54.9 |

53.2 |

|

Egypt |

49.4 |

50.7 |

48.8 |

55.2 |

42.9 |

|

Tunisia |

47.1 |

41.0 |

58.5 |

46.7 |

42.3 |

|

Lebanon |

43.6 |

54.0 |

49.8 |

40.9 |

29.7 |

|

Iran |

43.1 |

48.7 |

36.4 |

52.8 |

34.4 |

|

Algeria |

39.6 |

48.6 |

32.7 |

41.0 |

36.2 |

|

West Bank and Gaza |

31.6 |

48.3 |

34.1 |

27.1 |

17.0 |

|

Libya |

29.3 |

43.4 |

29.9 |

26.6 |

17.1 |

|

Syria |

28.6 |

42.6 |

29.2 |

27.6 |

15.0 |

|

Iraq |

26.7 |

43.5 |

24.1 |

26.9 |

12.4 |

|

Yemen |

21.8 |

37.8 |

19.6 |

13.9 |

16.1 |

|

Regional Averages |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: June 7, 2020

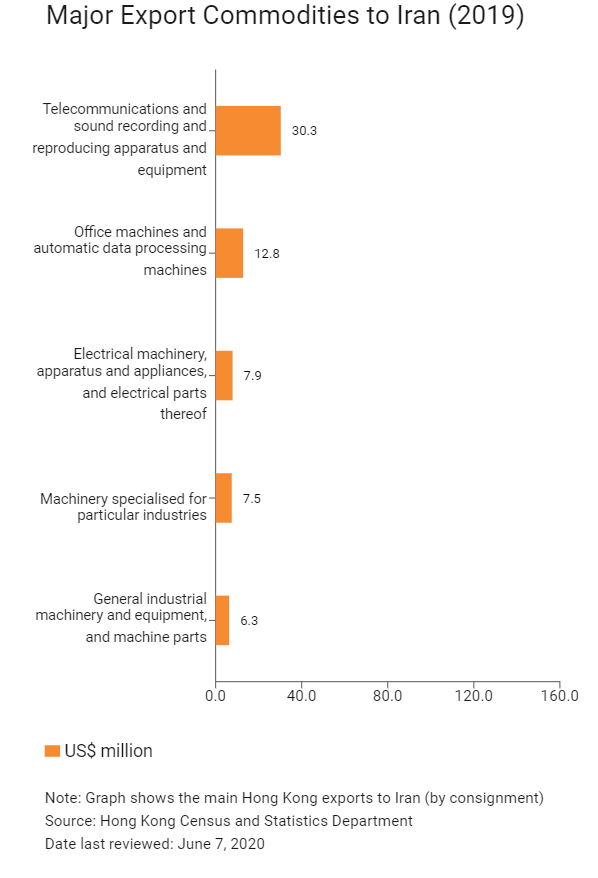

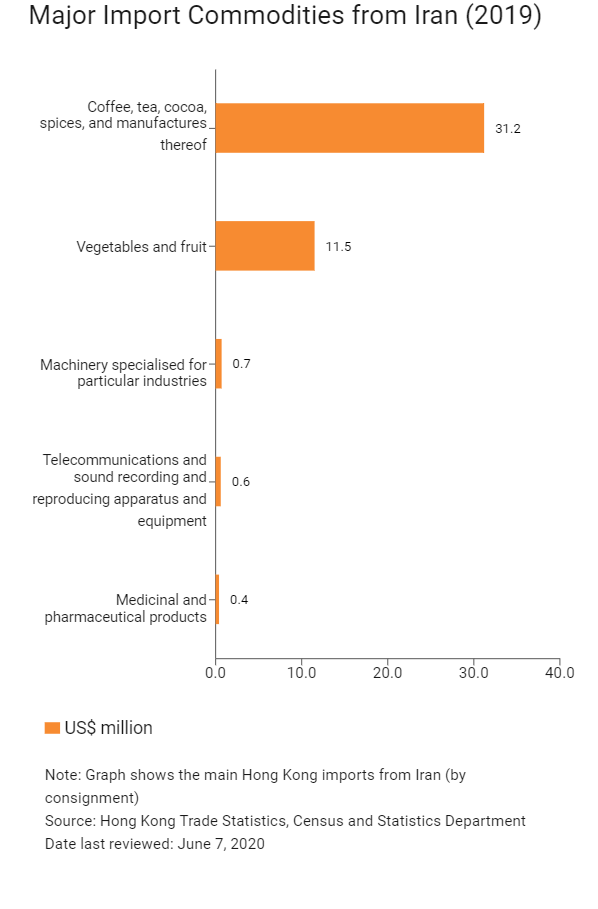

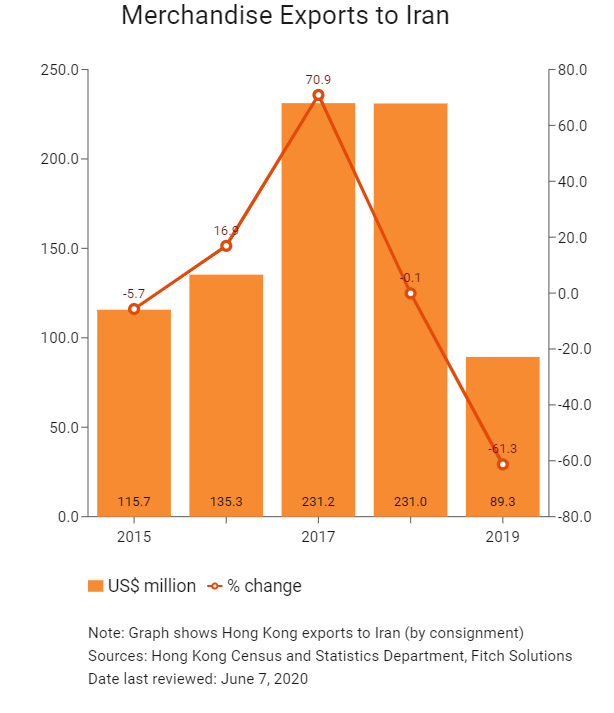

Hong Kong’s Trade with Iran

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Iranian residents visiting Hong Kong |

1,644 |

-34.2 |

|

Number of MENA residents visiting Hong Kong |

113,849 |

-12.8 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: June 7, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Iranian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Iran

- An investment Promotion and Protection Agreement is under negotiation between Iran and Hong Kong.

- Agreement on Reciprocal Promotion and Protection of Investment between Mainland China and Iran entered into force in July 2005.

Sources: National sources, Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

The Iranian Chamber of Commerce and Investment in Hong Kong and Macau

Address: Unit 1101, 11/F, Asia Trade Centre, 79 Lei Muk Rd, Kwai Chung, New Territory, Hong Kong

Email: chamber@irancham.org.hk

Tel: (852) 2151 8681

Fax: (852) 2151 8682

Source: The Iranian Chamber of Commerce and Investment in Hong Kong and Macau

Consulate General of the Islamic Republic of Iran in Hong Kong

Address: Unit 701, 7/F, The Sun's Group Centre, 200 Gloucester Road, Causeway Bay, Hong Kong

Email: iranconsulate.hkg@mfa.gov.ir / info@iranconsulate.org.hk

Tel: (852) 2845 8002 / 2845 8003 / 2845 8005

Fax: (852) 2845 8007

Visa Requirements for Hong Kong Residents

Iran has waived visa for Hong Kong, Macau and Chinese citizens since 22 July 2019. They can enjoy a 21-day stay upon each entry for business or sightseeing. No prior application is needed and the passports will be no longer stamped at the borders.

Source: Visa on Demand

Date last reviewed: June 7, 2020

Iran

Iran