GDP (US$ Billion)

30.76 (2018)

World Ranking 101/193

GDP Per Capita (US$)

23,330 (2018)

World Ranking 42/192

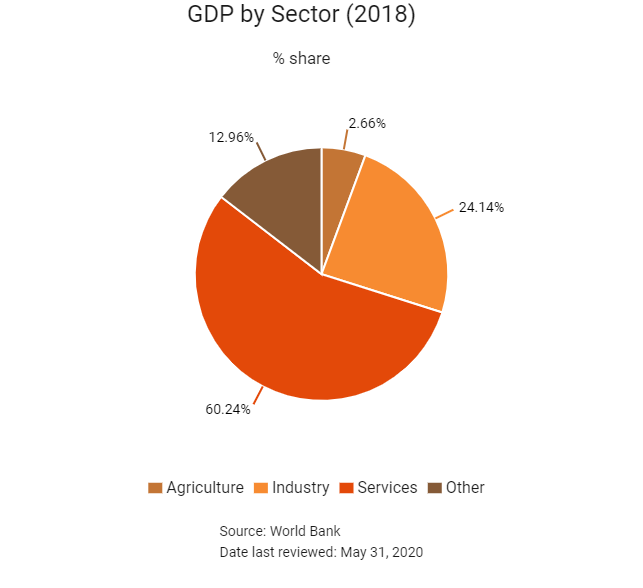

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

141.2 (2019)

Currency (Period Average)

Euro

0.89per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Estonia's political environment is characterised by consensus among major political parties towards liberal economic policy, conservative fiscal management and European Union (EU) convergence. This has helped to substantially mitigate policy risks through recession, preventing any major breakdown in leadership. In 2020, slower economic growth will be the result of an increasingly challenging external backdrop, amid the Covid-19 outbreak and sluggish eurozone demand. That said, Estonia looks well positioned to cope with a potential slowdown in eurozone growth caused by the pandemic in 2020, as Estonia will continue operating with one of the most solid fiscal profiles of any eurozone country, implying the country has ample firepower to offset the negative effects of the virus on economic activity.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2019

The government of Estonia cleared the Rail Infrastructure Fund Action Plan for 2019-2024, which calls for investments worth EUR431 million (USD490.3 million).

March 2019

The opposition Reform Party won the parliamentary election but fell short of a majority and was unable to put together a government.

The proposed high-speed rail-link tunnel between Finland and Estonia received EUR15 billion in funding. The 100km-long tunnel is to run between Helsinki (Finland) and Tallinn (Estonia) under the Gulf of Finland.

Hamburg-based port logistics provider HHLA acquired Estonia's biggest terminal operator Transiidikeskuse.

April 2019

A coalition between the Centre Party, Pro Patria and the Conservative People's Party was sworn into government on April 29, 2019. Jüri Ratas of the Centre Party remained as prime minister.

The European Investment Bank announced a EUR20 million framework loan to the municipality of Tartu to support its educational development plan for 2018-2025.

May 2019

According to the Digital Life Abroad Report from the online expatriate network InterNations, Estonia was ranked first out of 68 countries in which to live a connected life abroad.

Switzerland-based Larkwater Group announced plans to build Europe's largest methanol plant in Paldiski, which at EUR1 billion will be the biggest-ever industrial investment in Estonia.

September 2019

The government launched a thorough review of the state budget in order to assess whether the current expenditure was justified and taxpayer money is being used as efficiently as possible.

October 2019

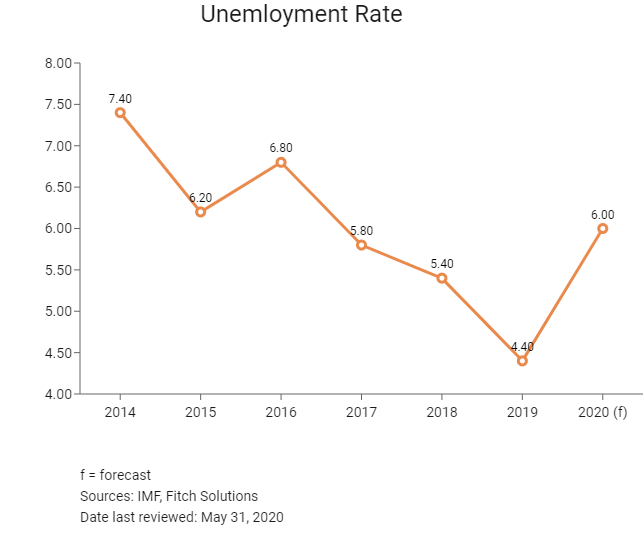

The Bank of Estonia issued a press release identifying three factors as having impacted the labour market in 2019: loss of momentum in growth in the economy, loss of competitiveness in the oil shale sector and a large number of foreign workers coming to Estonia for the short term.

Swedbank replaced the top management of its Estonian business following a money laundering incident. In June, the state regulator pledged to tighten controls after a scandal in 2018 involving USD228 billion of suspicious transactions at the Estonian branch of Denmark's largest bank, Danske Bank.

March 2020

The European Commission amended the temporary export licensing requirement imposed on certain personal protective equipment, allowing exports to member countries of the European Free Trade Association and other territories without a licence. On the other hand, an export ban on certain pharmaceutical drugs following the Covid-19 outbreak was imposed.

April 2020

In addressing the socio-economic impact of the Covid-19 health crisis, the parliament approved a supplementary budget, where the government is considering a support package of about EUR2 billion (7% of GDP). The package included support to the Unemployment Insurance Fund to cover for wage reduction (EUR250 million); health insurance fund (EUR213 million); business loans to rural companies through the rural development fund (EUR200 million); guarantees/collateral for bank loans to allow for the rescheduling of payments (EUR1 billion); business loans earmarked for liquidity support to companies (EUR500 million); support to local authorities (EUR130 million); investment loans to companies (EUR50 million); and compensation for the direct costs of cancelled cultural and sporting events (EUR3 million). The government had also suspended payments to the Pillar II pension fund. The government signed an order raising the maximum volume of short-term notes that Estonia can issue by EUR600 million, from EUR400 million previously, bringing the total to EUR1 billion. The government signed a 15-year loan of EUR750 million with the Nordic Investment Bank, and further plans to issue EUR1 billion Eurobonds to finance the increased spending needs due to the Covid-19 pandemic.

April 2020

The European Commission temporary eliminated the value-added tax on imports and import duty on goods needed during the Covid-19 outbreak.

May 2020

Rail Baltic Estonia launched a tender for the design of the Muuga multimodal freight terminal in Estonia. The winning bidder will be responsible for the freight station's design, the terminal connections and the infrastructure directly related, such as a railway tunnel, catenary, traffic control systems, control centre and maintenance depot. The last date for the submission of bids is June 19. Once the Rail Baltica starts operations, the terminal will handle 4-5 million tonnes of goods.

Sources: BBC Country Profile – Timeline, Life in Estonia, Work in Estonia, Bank of Estonia, European Investment Bank, Reuters, IMF, Fitch Solutions

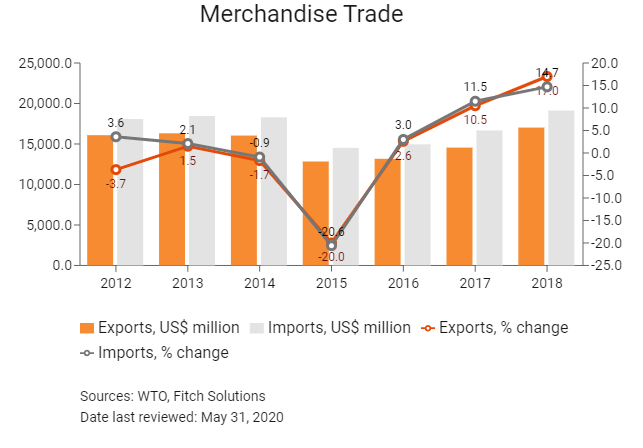

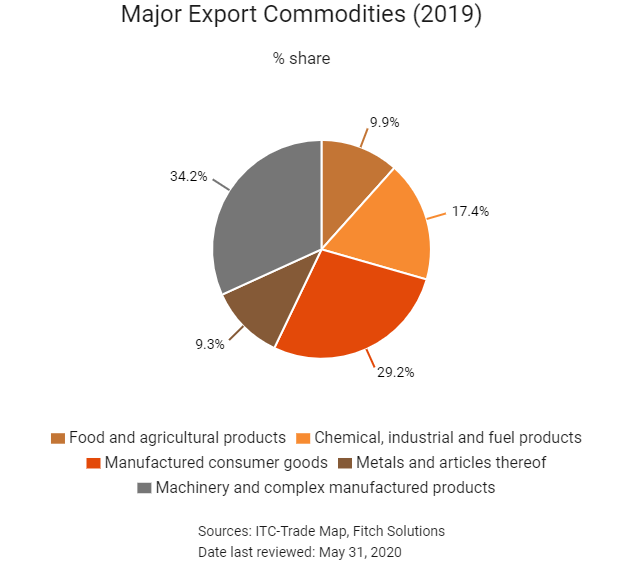

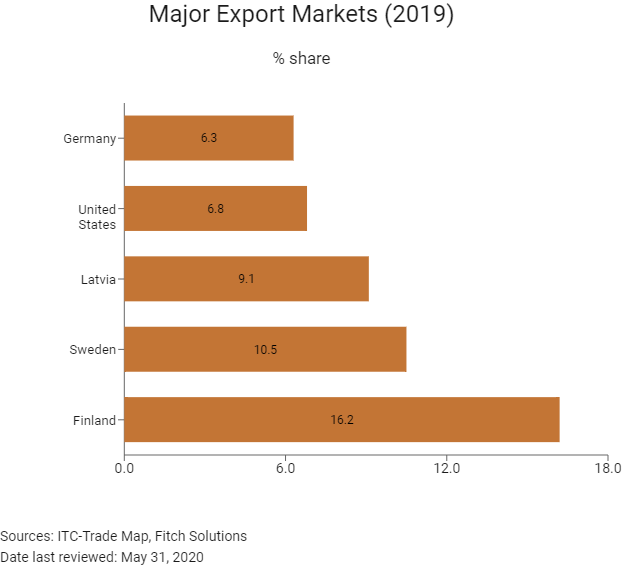

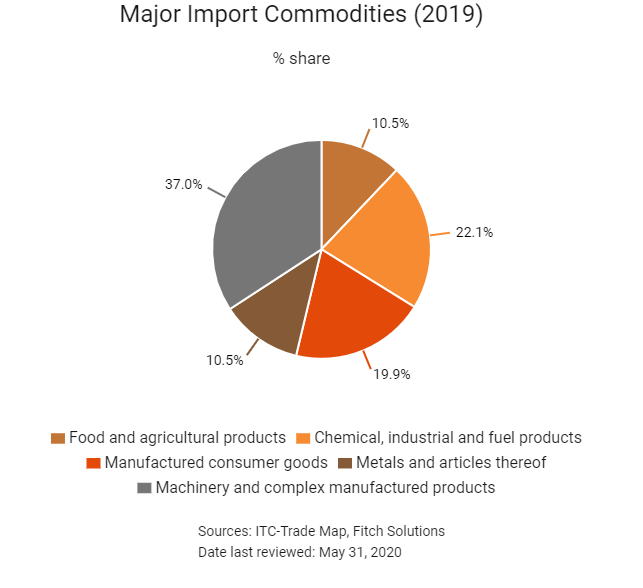

Merchandise Trade

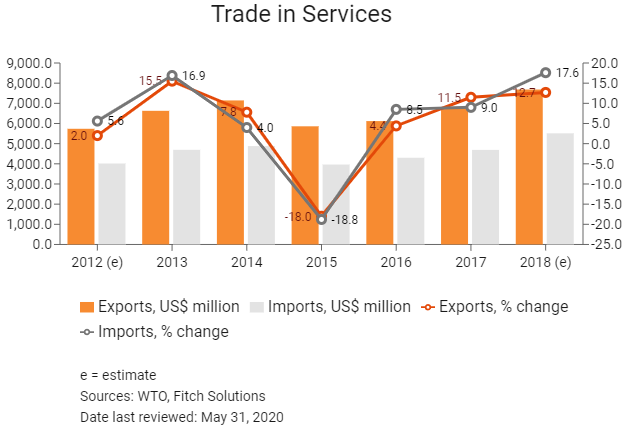

Trade in Services

- Estonia has been a World Trade Organization (WTO) member since November 13, 1999, and joined the EU on May 1, 2004.

- As a member state of the EU, Estonia incorporates EU regulatory norms. As a eurozone member, Estonia adopted the euro as its legal tender from January 1, 2011.

- As a member of the EU, Estonia applies the EU's Common External Tariff, which means goods manufactured and imported from within the EU are not subject to customs charges. Once goods are cleared by customs authorities upon entry into any EU member state, these imported goods can move freely among EU member states without any additional customs procedures. The trade policy is largely identical to that of the wider regional bloc. The EU updated its trade policy (and by extension its import tariffs, customs, duties and procedures) in 2017 and 2018.

- In February 2020, the Council of the EU amended the 2019-2020 import tariff quota list as so far as it relates to certain hard fish roes.

- The EU has an overall simple tariff of 5.1%. The duties for non-European countries are also relatively low, especially for manufactured goods (4.2% on average). However, textiles, clothing items (high duties and quota system) and food-processing industry sectors (average duties of 17.3% and numerous tariff quotas) still see protective measures. Most of Estonia's major trade partners are within the EU, and risks are thus less pronounced.

- In 2018, the EU modernised its trade defence instruments with a view to shielding EU producers from damage caused by unfair competition. Anti-dumping and anti-subsidy regulations have been amended to better respond to unfair trade practices and to furnish Europe's trade defence instruments with more transparency, quicker procedures and more effective enforcement. In exceptional cases, such as in the presence of distortions in the cost of raw materials, the EU will be able to impose higher duties through the limited suspension of the lesser-duty rule.

- The EU has the largest web of preferential trade agreements in the world, being party to some 70 free trade agreements (FTAs) spanning five continents, and access to other markets of the countries concerned is currently mediated through those agreements. The EU's Generalised System of Preferences (GSP) came into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded US$4,000 for four years in a row. As a result, the number of countries that enjoy preferential access to EU markets was reduced from 176 to less than 80. While Mainland China remains a beneficiary, many of its exports – such as toys, electrical equipment, footwear, textiles, wooden articles, and watches and clocks – have already been graduated from the preferential treatment. Hong Kong has been fully excluded from the EU's GSP scheme since May 1, 1998.

- Nine types of goods imported into the EU are subject to licensing. These goods are broadly textiles, various agricultural products, iron and steel products, ozone-depleting substances, rough diamonds, waste shipment, harvested timber, endangered species and drug precursors. No quotas are currently imposed on textiles and clothing exports or non-textile product exports from Hong Kong and Mainland China.

- In order to protect domestic industries, a number of products from Mainland China are subject to the EU's anti-dumping duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards, and solar glass, which are of interest to Hong Kong exporters. For example, in November 2016, the European Commission (EC) imposed a provisional anti-dumping duty on imports of some primary and semi-processed metals from Mainland China. The rate of duty is between 43.5% and 81.1% of the net free-at-union-frontier price before duty, depending on the company. By way of comparison, the rate of duty for similar goods from Belarus is 12.5% of the net, free-at-union-frontier price before duty. As of November 2019, the EU did not apply any anti-dumping measures on imports originating from Hong Kong. In October 2019, following an appeal heard by the General Court of the EU, a judgment was issued that annuls the anti-dumping duties imposed on imports of solar glass from Mainland China.

- In August 2019, the EC initiated an anti-dumping investigation on imports of certain hot-rolled stainless steel sheets and coils from Mainland China, Taiwan and Indonesia. In April 2020, a provisional duty was imposed. The investigation is in progress.

- The EC has introduced an import licensing regime for certain iron, steel and aluminium products exceeding 2.5 tonnes. The regulation was active until May 15, 2020.

- To combat the spread of the Asian long-horned beetle, in July 1999 the EU introduced emergency controls on wooden packaging material originating in Mainland China. Wood covered by the measures must be stripped of its bark and free of insect bore holes greater than 3mm across, or have been kiln-dried to below 20% moisture content.

- For health reasons, the EU has adopted a directive on the control of the use of nickel in objects intended to be in contact with the skin, such as watches and jewellery. The EU has also adopted a directive to permanently ban the use of some phthalates in certain PVC toys and childcare articles, which came into effect from January 16, 2007. In addition, the EU has adopted a directive to prohibit the trading of clothing, footwear, and other textile and leather articles that contain azo-dyes, from which aromatic amines may be derived.

- In March 2016, the EC imposed a definitive countervailing duty (8.7% or 9%) on imports consisting largely of textile products originating in India.

- In the second quarter of 2015, the EC issued regulations on trade restrictions with Turkey regarding cattle, beef, watermelons and prepared tomatoes to protect domestic agriculture and regional farming businesses.

- In December 2019, the EU issued a regulation imposing an additional import duty on a number of fruit and vegetables for the period 2020-2021.

- On January 1, 2017, the EU imposed additional import duties on certain fruit and vegetables if the quantity of the goods exceeded the trigger volume level within the specified application period. On November 15, 2017, the EC allocated a total value of EUR62 million (USD74.4 million) for funding promotional campaigns of EU agricultural products implemented in the internal market for 2018. The budget consists of various promotional topics of EU goods in the internal market, with an additional focus on the promotion of fruit, vegetables and sheep or goat meat.

- The EU has adopted a number of directives for environmental protection, which may have an impact on the sale of a wide range of consumer goods and consumer electronics. Notable examples include the directive on Waste Electrical and Electronic Equipment (WEEE) implemented in August 2005 and the directive on the Restriction of Hazardous Substances (RoHS) implemented in July 2006. A recast WEEE directive entered into force in August 2012, as a result member states must adhere to higher collection and recycling targets (a 45% collection rate as of 2016 and 65% from 2019). The directive is also wider in scope, covering all electric and electronic equipment, while establishing producer responsibility as a means of encouraging greener product designs. The recast RoHS directive was published on July 1, 2011, and entered into force on January 2, 2013. The new directive continues to prohibit electrical and electronic equipment that contains the same six dangerous substances as listed in the original RoHS directive. Since July 22, 2019, the new directive has widened the scope of the previous directive by including any electrical and electronic equipment that will have fallen out of the old RoHS directive's scope, with only limited exceptions. Following those recast directives, the EU's new framework directive for setting eco-design requirements for energy-related products (ErP) is now in place. The ErP Directive is no longer limited to electrical and electronic equipment (as it was under its predecessor, the energy-using product or EuP Directive), but potentially covers any product that is related to the use of energy, including shower heads and other bathroom fittings, as well as insulation and construction materials.

- The Registration, Evaluation, Authorisation and Restriction of Chemicals regulation entered into force in June 2007. It requires EU manufacturers and importers of chemical substances to gather comprehensive information on the properties of these substances produced or imported in volumes of one tonne or more per year and to register such substances prior to manufacturing in or importing into the EU.

- With talks between the EU and the United States on a Transatlantic Trade and Investment Partnership having been suspended at the end of 2016, in April 2019 the EU and United States chemical industries proposed an enhanced aligned approach that could serve as a global blueprint for regulatory cooperation to reduce barriers and increase trade in the chemicals sector.

- Estonia's position slipped several places in the 2019 IMD World Competitiveness Rankings, which rated the country highly for its business-friendly environment and dynamism but regarded it as unattractive for reliable infrastructure and government competency.

Sources: WTO – Trade Policy Review, European Commission, IMD World Competitiveness, Fitch Solutions

Multinational Trade Agreements

Active

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 27 member nations of the EU, namely: Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden. As Estonia’s main trade partners are in the EU, the absence of customs charges with member countries greatly enhances its trade volumes.

- European Economic Area (EEA) European Free Trade Association (EFIA): The EEA unites the EU Member States and the EFTA States (Iceland, Liechtenstein, Norway and Switzerland) into an Internal Market governed by the same basic rules. These rules aim to enable goods, services, capital, and persons to move freely about the EEA in an open and competitive environment, a concept referred to as the four freedoms. While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Japan Economic Partnership Agreement (EPA): The agreement entered into force on February 1, 2019, creating the largest open trade zone in the world. The EU and Japan trade deal promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the European Commission, the EU-Japan EPA creates a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017. The total trade volume of goods and services between the EU and Japan is EUR86 billion. The key parts of the agreement cut duties on a wide range of agricultural products and it seeks to open up services markets, in particular financial services, e-commerce, telecommunications and transport. Japan is the EU's second largest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments and electrical machinery.

- EU-Turkey Customs Union: the EU and Turkey are linked by a Customs Union agreement, which came into force on December 31, 1995. Turkey has been a candidate country to join the EU since 1999, and is a member of the Euro-Mediterranean partnership. The customs union with the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. Turkey is the EU's fourth largest export market and fifth largest provider of imports. The EU is Turkey's largest import and export partner. Turkey's exports to the EU are mostly machinery and transport equipment, followed by manufactured goods. At present, the Customs Union agreement covers all industrial goods, but does not address agriculture (except processed agricultural products), services or public procurement. Bilateral trade concessions apply to agricultural as well as coal and steel products. In December 2016, the EC proposed the modernisation of the Customs Union and to further extend the bilateral trade relations to areas, such as services, public procurement and sustainable development.

- EU-Canada Comprehensive Economic and Trade Agreement (CETA): CETA is expected to strengthen trade ties between the two regions, having provisionally entered into force on September 21, 2017. Some 98% of trade between Canada and the EU is duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- EU-Southern African Development Community (SADC) EPA: An agreement between the EU and a group of SADC countries (Botswana, Eswatini, Lesotho, Mozambique, Namibia and South Africa) was signed on June 10, 2016, with Angola having an option to join the agreement in the future. The agreement provisionally entered into force for most countries on October 10, 2016, but only became fully operational after Mozambique began applying the EPA in February 2018. Nine of the remaining members of SADC not included in the deal (Comoros, the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Seychelles, Tanzania, Zambia and Zimbabwe) have, or are seeking, EPAs with the EU as part of other regional trading blocs, such as with the East African Community and the or the Economic Community of Central African States.

- EU-Singapore Free Trade Agreement (EUSFTA): On February 13, 2019, the European Parliament passed the agreement which would see the creation of the EUSFTA. The main aims of the agreement are to eliminate almost all customs duties; enhance the trade of electronic goods, food products and pharmaceuticals and stimulate green growth, remove trade obstacles for green technology and create opportunities for environmental services. All the states involved were required to ratify the agreement through their individual legislatures for it to be implemented. The agreement entered into force on November 21, 2019.

Ratification Pending

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica and Panama): An agreement between the parties was reached in 2012 and is awaiting ratification (29 of the 34 parties have ratified the agreement as of April 2019). The agreement has been provisionally applied since 2013.

- EU-Mercosur Trade Agreement: An agreement between the parties was reached on June 28, 2019. The agreement means the EU is the first major partner to make a trade pact with the Mercosur bloc, which comprises Argentina, Brazil, Paraguay and Uruguay. The agreement will cover a population of 780 million and gives EU-based companies easier entry into a market with an enormous economic potential, saving them EUR4.0 billion in duties annually. Currently, EU exports in goods and services are worth approximately EUR68 billion. The EU is the biggest foreign investor in Mercosur, with stock of EUR381 billion, while Mercosur's investment stock in the EU is worth EUR52 billion. The agreement contains specific commitments on labour rights and environmental protection, including the implementation of the Paris Agreement and related enforcement rules. The EU will not fully open its market for imports of agri-food products, although beef, poultry and honey imports from the Mercosur countries will be permitted to increase over a five-year phasing- in period.

- EU-Vietnam Free Trade Agreement (FTA) and Investment Protection Agreement (IPA): On June 30, 2019, the EU and Vietnam signed the final texts for the EU-Vietnam FTA and the EU-Vietnam IPA. As of May 2020, the FTA and IPA are only waiting for the Vietnamese National Assembly for ratification. Once in force, the agreements will provide opportunities to increase trade and support jobs and growth on both sides by eliminating 99% of all tariffs, reducing regulatory barriers and overlapping 'red tape', ensuring protection of geographical indications, opening up services and public procurement markets, and establishing the means to ensure the agreed rules are enforceable.

- EU-Singapore FTA (EUSFTA): On February 13, 2019, the European Parliament passed the agreement, signed earlier on October 19, 2018, which would see the creation of the EUSFTA. However, before the agreement is implemented, all the states involved need to ratify the agreement through their individual legislatures; in this case, the FTA may become provisionally active along the lines of states which have already ratified the agreement.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017, and bilateral trade in services added an additional EUR27.0 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the Trump administration in the United States against the backdrop of rising global trade tensions.

Source: WTO Regional Trade Agreements Database, Australia Department of Foreign Affairs and Trade, Fitch Solutions

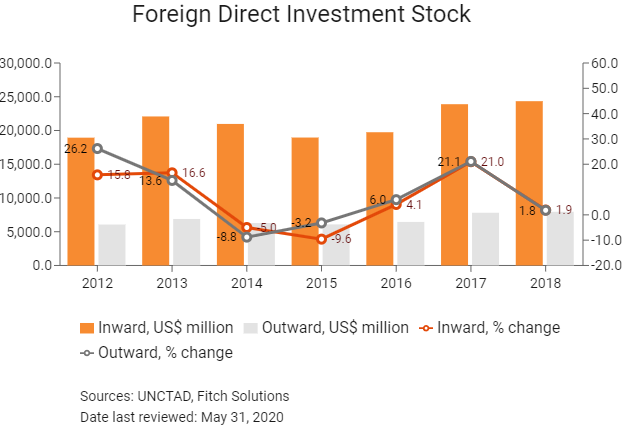

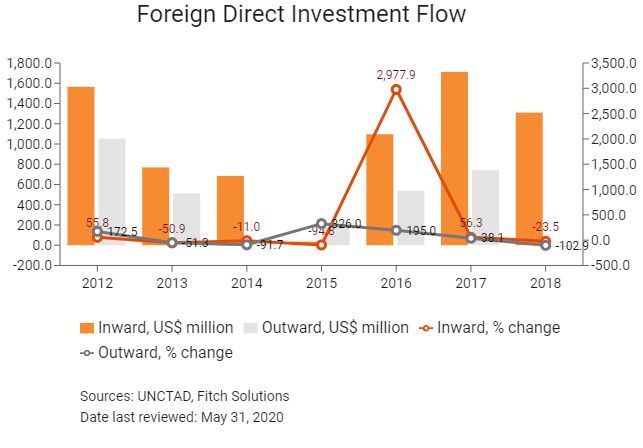

Foreign Direct Investment

Foreign Direct Investment Policy

- The Estonian Investment Agency (EIA), a part of Enterprise Estonia, is a government agency promoting foreign investments in Estonia and assisting international companies in finding business opportunities in Estonia. EIA offers comprehensive, one-stop investment consultancy services free of charge. The agency's goal is to increase awareness of business opportunities in Estonia and promote the image of Estonia as an attractive country for investments.

- Estonia has developed three trade zones which are open to foreign direct investment (FDI). A range of incentives are applicable to the free trade zones, which are monitored by the Estonian Tax and Customs Board. Estonia has also set up a number of industrial parks with pre-developed infrastructure for manufacturing and logistics companies.

- Licences are required if foreign investors want to enter the following sectors: mining, energy, gas and water supply, railroad and transport, waterways, ports, dams and other water-related structures, and telecommunications and communication networks.

- Estonia's government has not set limitations on foreign ownership and it does not screen foreign investment.

- As an EU member, Estonia maintains liberal policies in order to attract investment and export-oriented companies. Creating favourable conditions for FDI and openness to foreign trade has been the foundation of Estonia's economic strategy. Existing requirements are not intended to restrict foreign ownership but rather to regulate it and establish clear ownership responsibilities.

- Investments in Estonia by other EU member states are governed by the provisions of the Treaty of Rome and by EU law. Estonia has bilateral investment treaties (BITs) with 27 countries or economic blocs around the world: Austria, Azerbaijan, BLEU (Belgium-Luxembourg Economic Union), Finland, France, Georgia, Germany, Greece, Israel, Jordan, Kazakhstan, Latvia, Lithuania, Mainland China, Moldova, Morocco, the Netherlands, Norway, Spain, Sweden, Switzerland, Turkey, Ukraine, the United Arab Emirates, the United Kingdom, the United States and Vietnam. A BIT between Estonia and Belarus has been signed but is not yet in force.

- Estonia has treaties with investment provisions in force with 57 individual countries and economic blocs worldwide. A further 17 have been signed but are not yet in force.

- Estonia has concluded double taxation agreements with 60 states, including one with Mainland China that came into force on January 8, 1999. A double taxation agreement with Hong Kong has been signed but not yet entered into force.

- Estonia is a member of the Organisation for Economic Co-operation and Development, the World Trade Organization and the United Nations Conference on Trade and Development.

Sources: WTO – Trade Policy Review, Invest in Estonia, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Three free trade zones: Muuga Free Zone (near Tallinn), Sillamäe Free Zone (north-east Estonia), Paldiski Free Zone (north-west Estonia) |

- All free trade zones are open for foreign direct investment on the same terms as Estonian investments |

Sources: US Department of Commerce, Invest in Estonia, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 20%

Source: Ministry of Finance, Estonia

Important Updates to Taxation Information

- The stated goal of the government of Estonia is to shift the tax burden from taxation of income to taxation of consumption. According to the budget forecast for 2018-2021, the annual growth of tax receipts will average 6.5% and tax changes will make the system more growth friendly, with a tax burden that will remain below 36.0% of GDP. There is no separate capital gains tax. Gains derived by resident companies, or branches of foreign companies, are exempt until a distribution is made.

- Estonia is regarded as offering a relatively favourable income tax regime because all undistributed corporate profits are tax exempt. Estonia levies a corporate income tax only on profits that are distributed as dividends, share buybacks, capital reductions, liquidation proceeds or deemed profit distributions. Distributed profits are generally subject to 20% corporate tax (20/80 on the net amount of the profit distributed).

- Since January 1, 2019, regularly payable dividends have been taxed at a reduced corporate icome tax (CIT) rate of 14%. If the taxable amount is less than or equal to dividends paid throughout the preceding three years (set at the higher CIT rate of 20%), the taxable rate will be set at 14% (or 14/86 of the net amount instead of the standard 20/80).

- Effective from January 1, 2019, amendments based on the anti-tax avoidance rules from the European Union 2016/1164 Anti-Tax Avoidance Directive are disposed into Estonian legislation. These amendments have introduced controlled foreign company rules, a new general anti-abuse rule,and thin capitalisation rules in the form of taxation of 'exceeding borrowing costs'.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate icome tax (CIT) |

The standard rate is 20% but can be reduced to 14% for companies making regular dividend distributions equivalent to one-third of the profit |

|

Capital gains tax |

Treated as ordinary income and only taxed when there is a distribution of profit |

|

Withholding tax (WHT) |

No WHT is applied to dividends or interest, with a few exceptions. As an exception, 7% WHT applies to dividends paid to resident and non-resident individuals if the distribution has been subject to the reduced CIT rate at the hands of the paying company. WHT on royalties (and on technical services) is levied at a rate of 10% |

|

Branch remittance tax |

None |

|

VAT/GST |

The standard rate is 20%, but a lower rate of 9% applies to certain items such as books, newspapers, hotel accommodation and medicinal products |

|

Social security contributions |

All employers pay a total social tax of 33% (consisting of two deductions of 20% to fund state pensions and 13% to fund public health insurance). |

|

Transfer tax |

None |

|

Real estate tax |

An annual tax rate ranging from 0.1 to 2.5%, depending on the municipality, is levied based on the assessed value of the land and payable in two instalments each year |

Source: Ministry of Finance, Estonia, Tax and Customs Board

Date last reviewed: May 31, 2020

Foreign Worker Permits

EU nationals, citizens of the member states of the EEA and citizens of Switzerland do not require a visa to enter, reside and work in the country. EU citizens can stay in Estonia for up to three months, after which they are required to register their place of residence.

Employers are required to apply for permission from the Estonian Unemployment Insurance Fund to hire foreign workers.

Blue Card

Intended for the stay of a highly qualified employee. A foreigner holding a blue card may reside in the country and work in the job for which the blue card was issued, or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education which has lasted for at least three years. The blue card is issued with the term of validity three months longer than the term for which the employment contract has been concluded, however, for the maximum period of two years. The blue card can be extended. One of the conditions for issuing the blue card is a wage criterion - the employment contract must contain gross monthly or yearly wage at least at the rate of 1.5 multiple of the gross average annual wage.

Localisation Policies

Permission to hire a foreigner will only be granted by the Unemployment Insurance Fund on the condition that the position cannot be filled by an Estonian citizen, EU citizen or foreign national already living in Estonia.

Visa Requirements

Estonia is one of 26 countries in the Schengen Area, which means that there is one common visa and no border controls for all nationals of the EU, the EEA or a third country national holding a residence permit of a Schengen state. Other than EU passport holders, Estonia waives visas for 62 other countries globally, including Hong Kong and Macau, but all non-EU/EEA/Swiss nationals who wish to stay for longer than 90 days need to apply for a long-term visa.

Sources: Work in Estonia, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A1 (Stable) |

10/05/2019 |

|

Standard & Poor's |

AA- (Positive) |

28/02/2020 |

|

Fitch Ratings |

AA- (Stable) |

27/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

12/190 |

16/190 |

18/190 |

|

Ease of Paying Taxes Index |

14/190 |

14/190 |

12/190 |

|

Logistics Performance Index |

N/A |

N/A |

N/A |

|

Corruption Perception Index |

18/180 |

18/180 |

N/A |

|

IMD World Competitiveness |

31/63 |

35/63 |

N/A |

Sources: World Bank, IMD, Transparency International

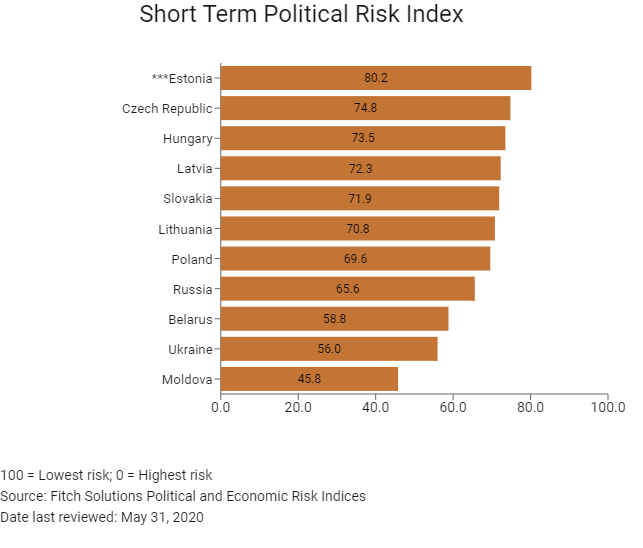

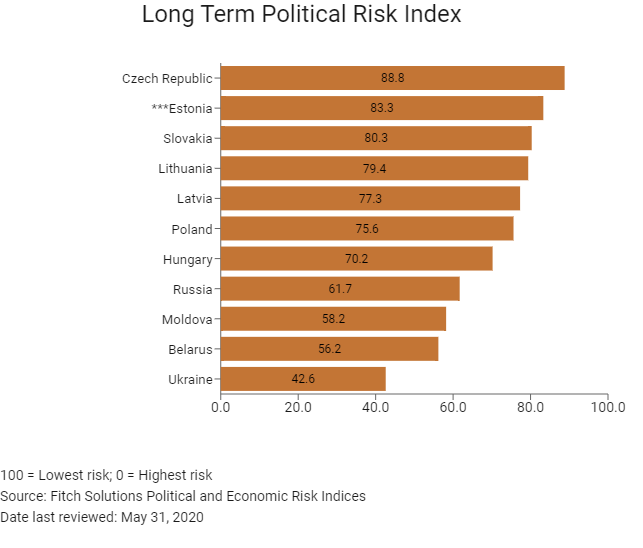

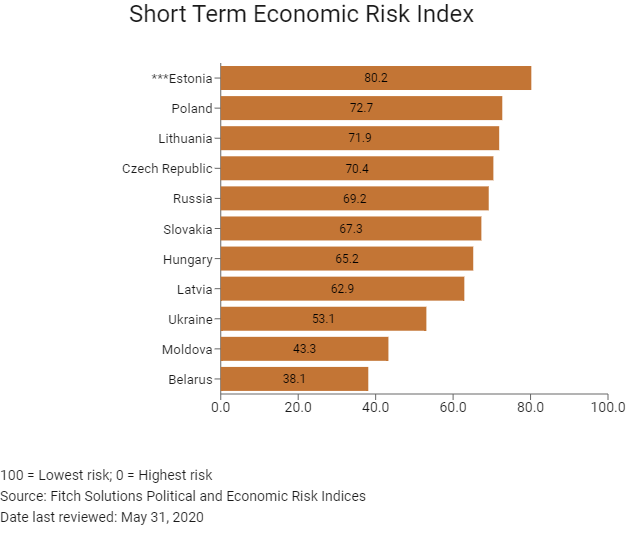

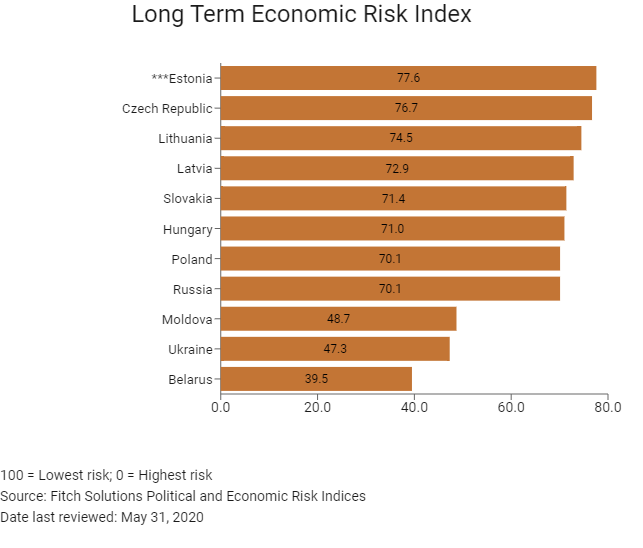

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

23/202 |

10/201 |

7/202 |

|

Short-Term Economic Risk Score |

81.3 |

81.3 |

80.2 |

|

Long-Term Economic Risk Score |

73.7 |

77.7 |

77.6 |

|

Political Risk Index Rank |

21/202 |

20/201 |

19/201 |

|

Short-Term Political Risk Score |

84.4 |

80.2 |

80.2 |

|

Long-Term Political Risk Score |

83.3 |

83.3 |

83.3 |

|

Operational Risk Index Rank |

25/201 |

27/201 |

25/201 |

|

Operational Risk Score |

71.3 |

71.1 |

70.9 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

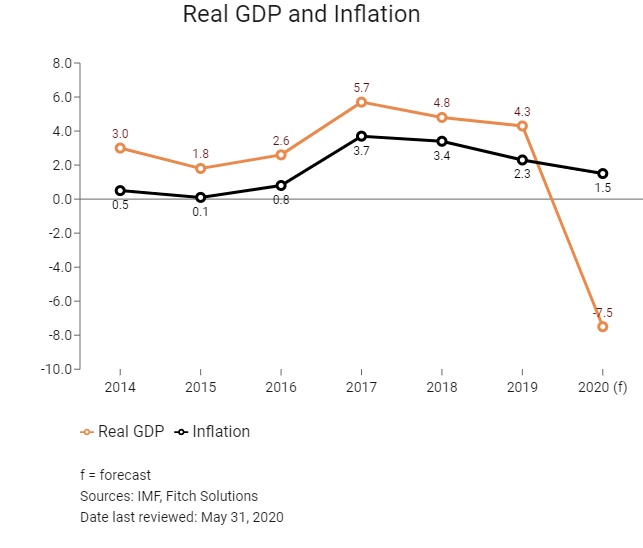

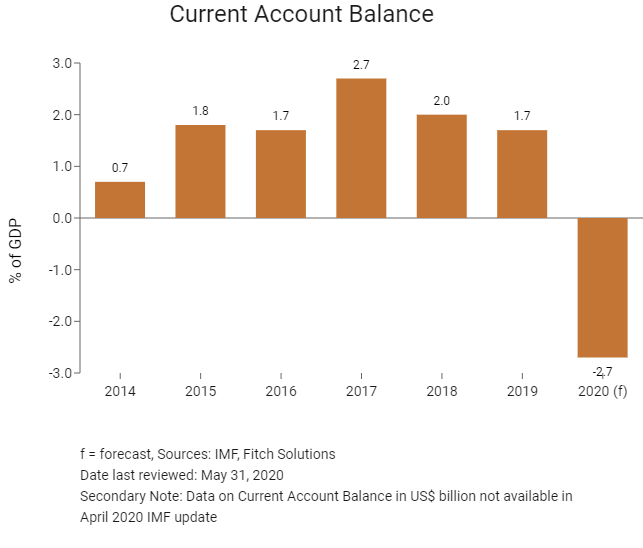

ECONOMIC RISK

The economy is expected to shrink significantly in 2020, due to the impact of the Covid-19 pandemic. Contracting investment activity and sliding private consumption are set to erode domestic demand, while a collapse in foreign demand and nosediving tourist arrivals will likely hamper the external sector. A jump in public spending should cushion the overall downturn somewhat, however. . Furthermore, in the medium term, the Estonian economy remains on a path of sustainable growth, although competition in the labour market became tighter during 2019. Although Estonia's rapid recovery from severe recession following the global economic downturn in 2008 was characterised by export-led growth, economic activity will be increasingly driven by domestic demand in the coming years. Estonia will aim to increase its share of global trade on the back of strong competitiveness gains since 2010. In addition to a diversified manufacturing sector, the high value-added services sector will increase its presence in the economy.

OPERATIONAL RISK

While the broad consensus among political parties for responsible economic management and market liberalism is likely to remain in play, the potential for change in policies exists given the new coalition government.

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Estonia Score |

70.9 |

63.1 |

75.0 |

71.0 |

74.3 |

|

Central and Eastern Europe Average |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Central and Eastern Europe Position (out of 11) |

1 |

3 |

1 |

4 |

2 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

1 |

5 |

1 |

5 |

3 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

25 |

27 |

15 |

32 |

23 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

70.9 |

63.1 |

75.0 |

71.0 |

74.3 |

|

Czech Republic |

69.4 |

60.6 |

67.0 |

73.6 |

76.5 |

|

Lithuania |

69.4 |

61.3 |

71.1 |

74.3 |

71.0 |

|

Poland |

68.1 |

59.2 |

64.9 |

75.5 |

72.8 |

|

Latvia |

67.1 |

63.5 |

68.2 |

69.4 |

67.4 |

|

Slovakia |

63.7 |

52.1 |

66.2 |

66.8 |

69.6 |

|

Hungary |

63.6 |

55.7 |

62.5 |

70.1 |

66.3 |

|

Belarus |

59.2 |

60.1 |

58.7 |

66.6 |

51.3 |

|

Russia |

58.0 |

65.9 |

57.4 |

67.9 |

40.6 |

|

Moldova |

49.7 |

44.8 |

51.4 |

53.4 |

49.3 |

|

Ukraine |

48.6 |

57.9 |

48.4 |

54.4 |

33.6 |

|

Regional Averages |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

Hong Kong’s Trade with Estonia

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Estonian residents visiting Hong Kong |

2,756 |

-21.6 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

1,948 |

2.3 |

|

- Regional headquarters |

449 |

1.1 |

|

- Regional offices |

625 |

0.6 |

|

- Local offices |

874 |

4.0 |

Note: The EU-located companies are from Belgium, France, Germany, Italy, the Netherlands, Sweden and the United Kingdom.

Source: Business Expectation Statistics Section of the Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Estonia

- The Double Taxation Agreement (DTA) between China and Estonia was signed on May 12, 1998 and entered into force in both countries on January 8, 1999.

- Estonia and China have a Bilateral Investment Treaty that entered into force in June 1994.

Sources: UNCTAD, Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

Estonian Honorary Consulate in Hong Kong

Address: Suite 3101, 31/F, 9 Queen's Road Central, Central, Hong Kong

Email: info@estoniaconsulate.com.hk

Tel: (852) 2868 3110

Fax: (852) 2868 5006

Source: Protocol Division Governmnet Secretariat

Visa Requirements for Hong Kong Residents

Hong Kong residents do not need a visa for Estonia for a period of up to 90 days.

Source: Hong Kong Immigration Department

Date last reviewed: May 31, 2020

Estonia

Estonia