GDP (US$ Billion)

59.64 (2018)

World Ranking 80/193

GDP Per Capita (US$)

6,283 (2018)

World Ranking 93/192

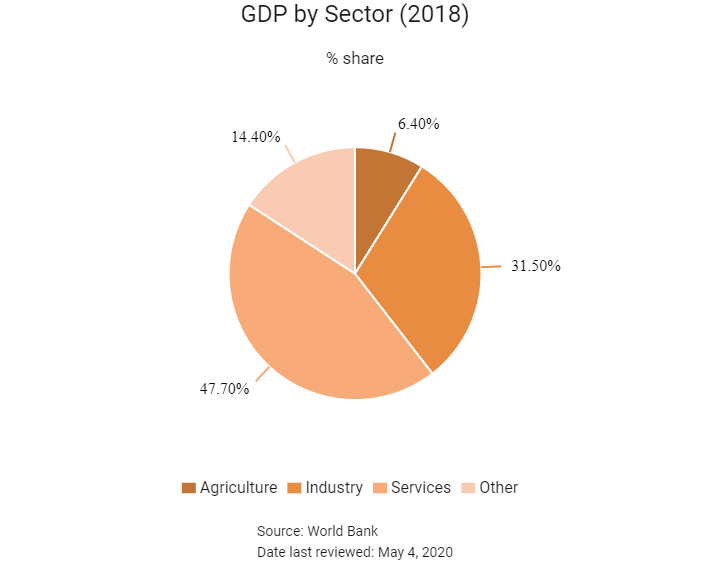

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

139.4 (2018)

Currency (Period Average)

Belarusian Rubles

2.09per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Economic growth in Belarus has been accompanied by a substantial decrease in the number of households below the poverty line and an increase in household income among the bottom 40% over the past few decades. However, the factors that enabled Belarus' past achievements are no longer in play. Limited structural reforms and a modest expansion of the private sector have weighed on Belarus' economic transition. The capacity of capital accumulation to drive economic growth is waning, energy subsidies stemming from bilateral agreements with Russia are smaller and public debt ratios to gross domestic product are rising, all against a backdrop of weakened foreign exchange reserves. A sustainable improvement in living standards will, therefore, require economic, social and institutional transformation, with an enhanced role for private enterprise – among others. While closer relations with the European Union (EU) will bode well for much-needed political reforms and greater transparency at state level, this is unlikely to significantly reduce the country's economic reliance on Russia.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2018

Lukashenko voiced concerns over Russia's planned introduction in 2019 of a new tax regime for oil that would potentially cost Belarus billions of dollars because of its re-exports of refined oil to the EU and the Commonwealth of Independent States.

April 2019

The Export-Import Bank of China and Belarusian Railway entered into a USD65.7 million loan agreement for the electrification of two sections of the country's rail system. The project was scheduled to be completed in 2020.

June 2019

Following protests by residents, the city of Brest's regional executive committee suspended the opening of a recently built lead-acid battery plant recently. The IPower project, a joint venture between investors from Mainland China and the United States, still needed the necessary permissions to begin operating.

July 2019

Renewable energy company RECOM Solar announced that it would build a photovoltaic (PV) module factory in the country. The factory would be based near Minsk international airport and is expected to be commissioned in late 2019.

September 2019

The newspaper Kommersant published details of a Russia-Belarus economic integration agreement said to have been signed on September 6 by the two countries' prime ministers. According to the report, there would be a partial unification of the two economies after 2021, including a single tax code.

October 2019

Serbia signed a free trade agreement (FTA) with the Eurasian Economic Union (EAEU), replacing Serbia's current trade arrangements with Belarus dating from 2008, albeit not yet confirmed at the World Trade Organization (WTO).

It was reported in Moscow that an agreement on trade and economic cooperation had come into force between the EAEU and Mainland China, all parties having ratified the document signed in May 2018. The agreement did not lower duties and was instead designed to increase the transparency of regulatory systems, simplify trade procedures and bolster economic links.

May 2020

Belarus has implemented a number of measures to curb the spread of Covid-19, such as travel restrictions and social distancing. The government has also announced a package of fiscal measures, which include additional resources for the healthcare sector and tax relief and tax deferral measures to support businesses.

August 2020

The presidential election will be held no later than the end of August 2020, with parliamentary elections due on September 10, 2020.

Sources: BBC Country Profile – Timeline, World Bank, Balkan Insight, Belarus News, Fitch Solutions

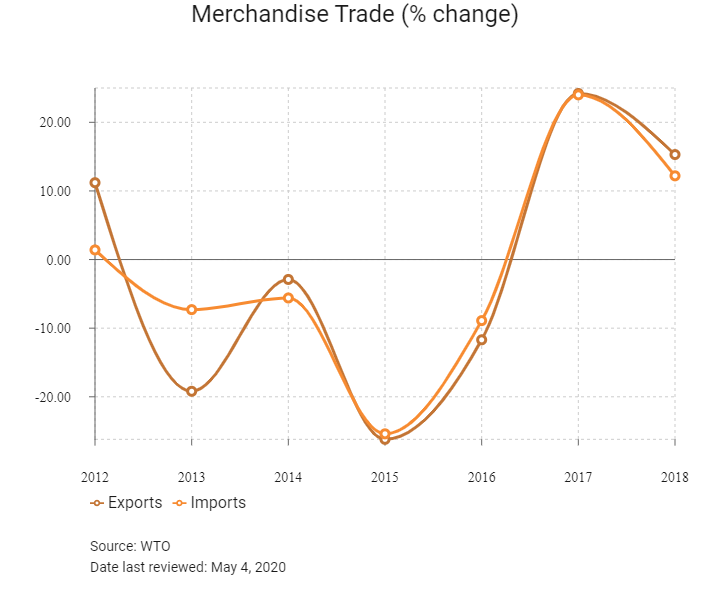

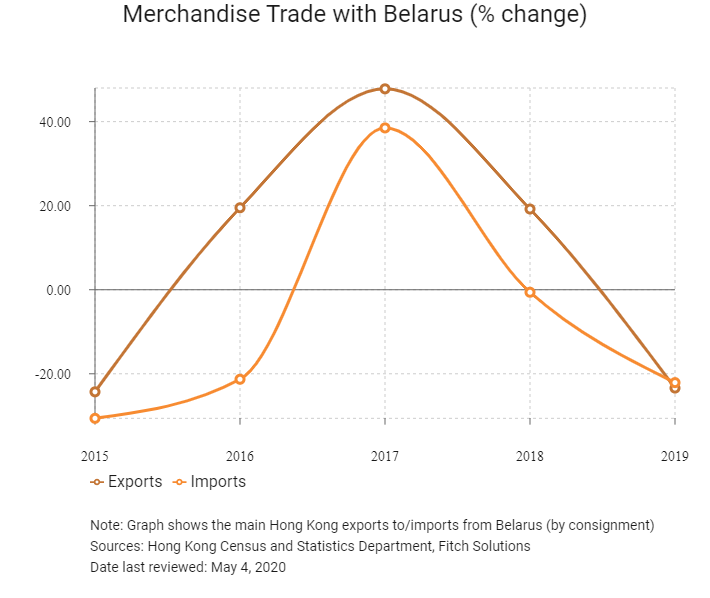

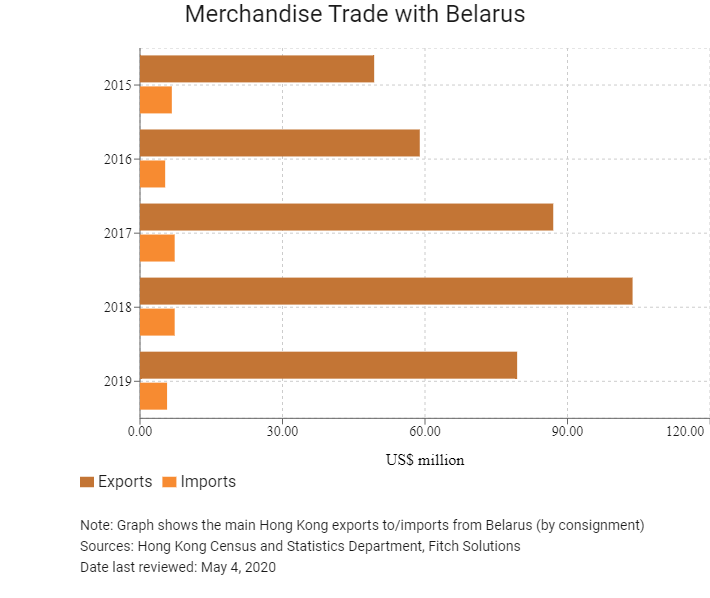

Merchandise Trade

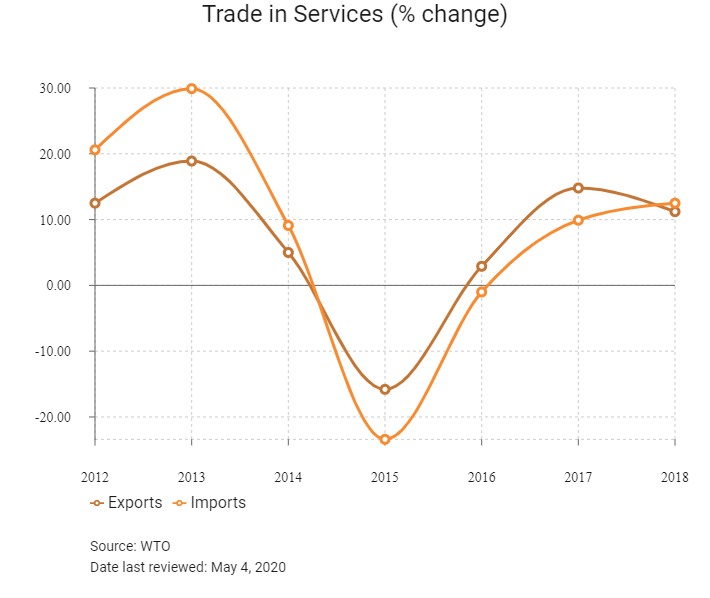

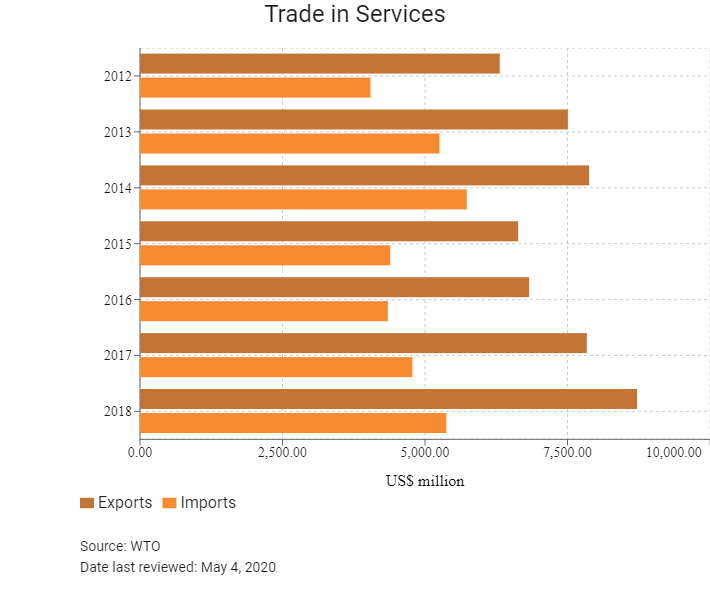

Trade in Services

- Belarus, a founding member of the EAEU, serves not only as a gateway to the EAEU's other signatories – namely Russia, Kazakhstan, Armenia and Kyrgyzstan – but also to the whole regional market. Every year more than 100 million tonnes of European cargo crosses Belarus, of which 90% is bound for either Russia or the EU. Belarus' strategic location and role as a transport gateway at the crossroads of east-west and north-south trade routes make the country of current and future interest to those wanting to develop transport initiatives to connect Asia with markets in Central and Western Europe.

- Under Belarus' membership of the EAEU, products made in Belarus can be treated, subject to the country of origin rules, as Belarusian-made and are, therefore, exportable tariff-free to other EAEU markets. This, coupled with the country's geographical proximity to most of the markets in Europe and well-connected road and rail transportation networks, helps to make Belarus an attractive destination for foreign manufacturing companies.

- Belarus has been fulfilling all of the WTO's obligations since 2012 as these obligations, as well as Russia's obligations in the WTO, are the basis of the EAEU legislation.

- In 2016, a new composition of the Interministerial Commission on Belarus' accession to the WTO was set up. It is headed by the first deputy prime minister of Belarus. Apart from the government authorities, the commission includes representatives of business associations and non-governmental organisations.

- The ambassador-at-large of the Ministry of Foreign Affairs was appointed as a chief negotiator for Belarus' accession to the WTO. 'As of 2017, there have been clear signals that Belarus sees WTO accession as one of the priorities for the government. This renewed high-level political engagement from Minsk has injected new impetus into the process and is very much supported by the WTO members,' said Ambassador Kemal Madenoğlu (Turkey), chairperson of the Working Party. At the 12th meeting of the Working Party on the Accession of Belarus, held on July 11, 2019, a high-level delegation reaffirmed Minsk's intention to complete WTO accession negotiations by the next Ministerial Conference to be held in June 2020 in Kazakhstan. Belarus was urged to make an extra effort to update its trade regime in conformity with WTO norms if the target date was to be met.

- Belarus has few mineral resources of its own and is therefore striving to stimulate foreign investment to promote privatisation, economic restructuring and innovative development. Priority areas include pharmaceuticals, food, transport and logistics, chemistry and petro-chemistry, mechanical engineering, renewable energy and information technology.

Sources: WTO Trade Policy Review, WTO, Fitch Solutions

Trade Updates

- In May 2019, the European Commissioner for European Neighbourhood Policy and Enlargement Negotiations announced that Belarus had been participating actively in the multilateral formats of the Eastern Partnership and that the bilateral relationship will be strengthened through the EU-Belarus Partnership Priorities being negotiated. Negotiations on a Visa Facilitation and Readmission Agreement with Belarus were also finalised. From 2014 to 2018, the EU's assistance to Belarus in the European Neighbourhood Instrument amounted to EUR110 million. The EU has a share of almost one-third of the country's overall trade.

- In June 2019, the Minister of State for Trade Policy at the Department for International Trade of the United Kingdom said that Belarus is one of the countries that the UK is in discussions with regarding the possibility of entering into a FTA. The minister identified the IT sector and the country's High-Tech Park (HTP) as an area for possible collaboration between the two countries.

- In July 2019, Russia and Belarus agreed to begin preparing legislation to establish common industry markets by 2021.

- In July 2019, Belarus entered into cooperation agreements with the regional governments of the Russian regions of Ingushetia and Saratov Oblast, and the administration of the Smolensk Oblast region. The agreements cover trade, the economy, science and technology.

- In February 2020, Belarus and Egypt signed 12 agreements and memorandum of understanding to promote trade and industrial cooperation.

Multinational Trade Agreements

Active

- EAEU: The EAEU allows for the free movement of goods, services, capital and labour, and pursues a coordinated and harmonised single policy in the sectors determined by the treaty and international agreements within the union. The member states of the EAEU are Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. The launch of the EAEU in January 2015 marked a step forward in the formation of a common market based on the norms and principles of the WTO. Firms benefit from a large population and high industrial, scientific and technological potential. Firms within member states already trade extensively with each other and this will boost mutual growth in the medium term. However, they remain removed from the EU and other major trade blocs.

- The Commonwealth of Independent States Free Trade Area (CISFTA): This agreement is in force between Russia, Ukraine, Belarus, Uzbekistan, Moldova, Armenia, Kyrgyzstan and Kazakhstan. It was designed to reduce all trade fees on a number of goods between participating countries. Overall, the move will bring about investment in Belarus' economy, ease trade and stimulate employment. In 2014, the turnover with CIS countries (excluding Russia) was USD8.2 billion. Ukraine, Kazakhstan, Azerbaijan, Turkmenistan and Moldova are Belarus' major trade partners, accounting for more than 95% of the country's exports to the CIS region (excluding Russia). Member states are thus aiming for more intense scientific and technical cooperation, and further development in agriculture, transport, science, culture, education, sport and tourism.

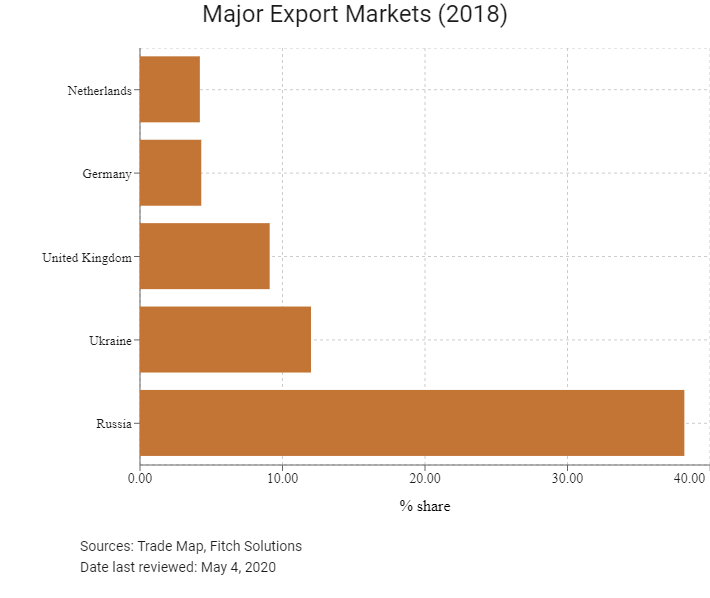

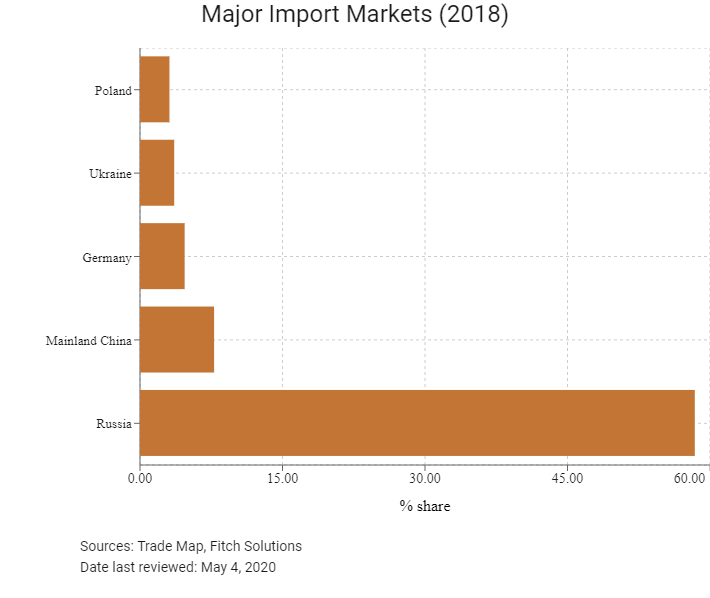

- The Agreement on the Establishment of the Union State of Belarus and Russia: The strategic partnership with Russia is a result of geographical proximity, close historic and cultural links, and long-standing economic ties and cooperation between Belarusian and Russian businesses. The agreement (signed in 1999) sets up a legal basis for integration between the two countries. Russia is both a key trade partner and major export market for Belarusian manufacturers. In 2017, the mutual trade amounted to USD31 billion, with exports to Russia reaching USD12.5 billion and imports from Russia reaching USD18.5 billion. Russia accounts for 50.7% of Belarusian foreign trade. In 2017, Belarus was Russia's fourth major trading partner, behind Mainland China, the Netherlands and Germany. Belarus and Russia cooperate in the area of energy resources. Belarus contributes significantly to regional energy security by fulfilling its obligations in terms of the transit of Russian energy resources to other European countries. Along with cooperation in the framework of the union state, the two countries support the strengthening of multilateral cooperation and participate actively in other integration projects in the post-Soviet era. Businesses in Belarus benefit from subsidised raw materials from Russia, and economic integration with a considerably larger nation provides some financial support in times of crisis.

- EAEU-Vietnam: On May 29, 2015, after three years of negotiations, a free trade and economic integration agreement between the EAEU and Vietnam was signed. The agreement provides for significant tariff reduction for Belarusian exports to Vietnam (potash fertilisers, meat and dairy products, tractors, combines, trucks, refrigerators, medicines and food products). The agreement also provides for an efficient level of market protection for Belarusian producers and came into effect in October 2016.

Under Negotiation

The Association of Southeast Asian Nations (ASEAN)-EAEU: ASEAN and the EAEU are negotiating to strengthen trade ties. As the ASEAN Economic Community moves closer to completion, it is likely that the EAEU's efforts to liberalise trade with ASEAN will intensify. Firms in the EAEU can take advantage of the opportunities that this presents to boost trade with the more-advanced economies in ASEAN. Companies will have the opportunity to expand into these markets and service a large consumer base. Asian fuel demand remains high and this will be of great benefit to Belarus. The two parties signed a memorandum of understanding in September 2018 on the framework for talks over the coming years.

Sources: WTO Regional Trade Agreements database, European Commission, Fitch Solutions

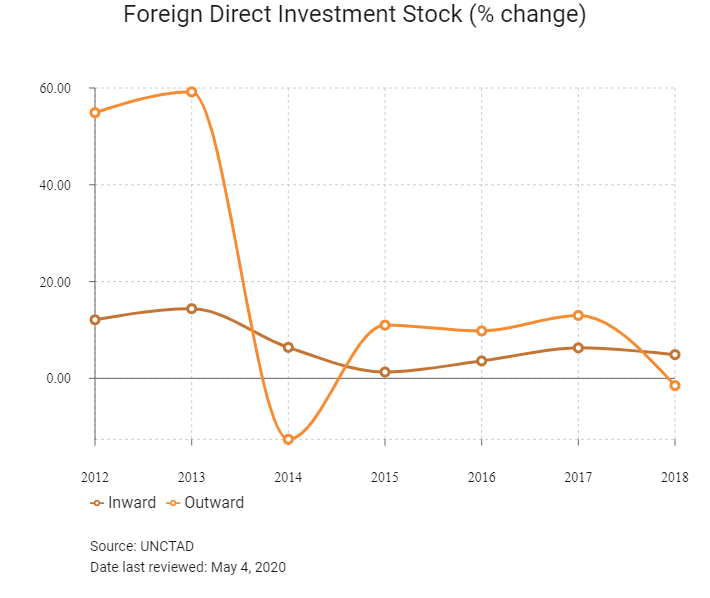

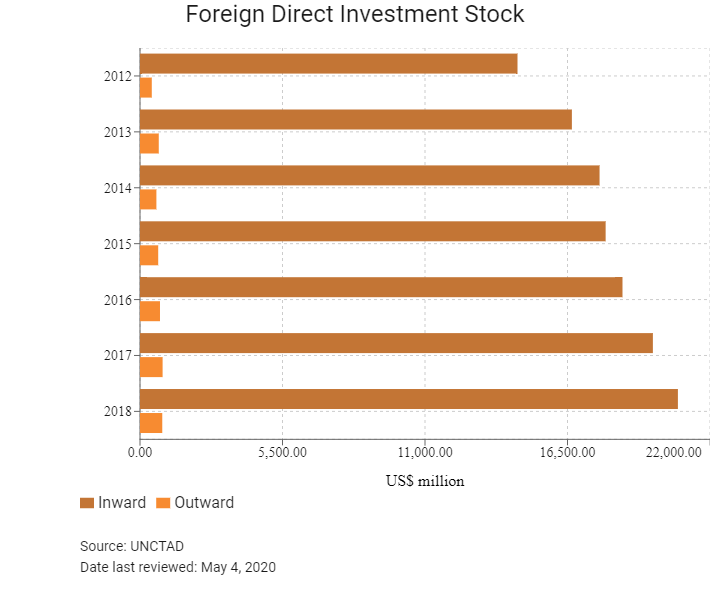

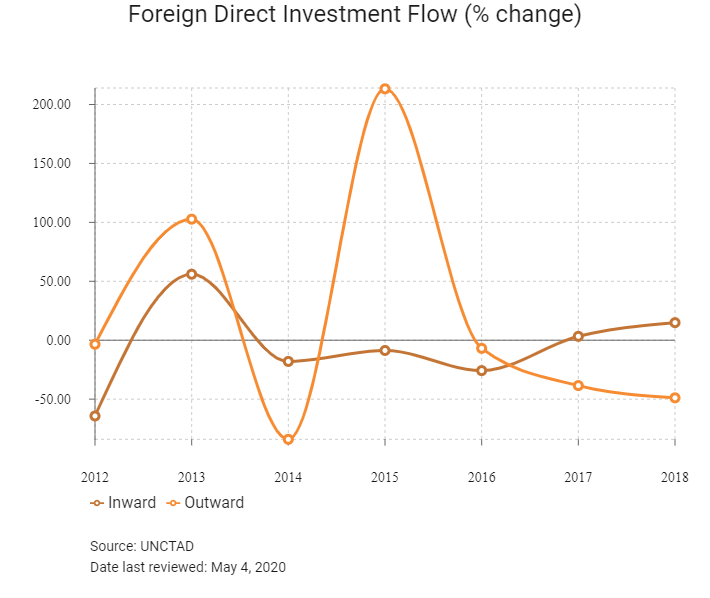

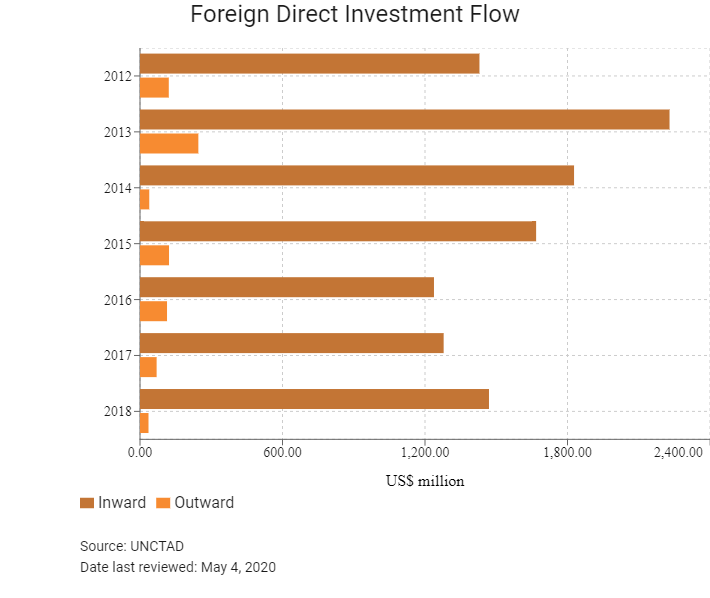

Foreign Direct Investment

Foreign Direct Investment Policy

- In policy, the Belarusian government maintains that it is highly welcoming of foreign direct investment (FDI). Incentives include the country's favourable geographical location, qualified workforce and various infrastructure. To date, FDI has predominantly focused on the transport, construction and industrial sectors, as well as the banking sector, mobile communications, commercial real estate development, food and beverage, and retail.

- According to a draft version of the country's 2035 strategy for FDI (released in March 2019), Belarus is aiming for between USD1.5 million and USD1.6 million in FDI inflows by 2020, with the figure expected to rise to around USD3 billion by 2025.

- The National Agency of Investment and Privatization exists to assist foreign investors to find a niche for doing business in Belarus and acts as a free 'one-stop shop' for foreign direct investors.

- Belarus has bilateral investment treaties (BITs) in force with more than 50 countries and has signed additional BITs that are not yet in force, including one with the United States and a dozen others. Belarus has concluded double taxation agreements with 70 states, including one with Hong Kong that came into force on November 30, 2017.

- The HTP was established in Minsk in 2005 to promote information technology (IT) in Belarus by offering IT firms a special regime. The regime has been extended until 2049, effective from March 2018, and the list of activities in which HTP residents can engage has been expanded.

- Belarus has six free economic zones (FEZs) established until December 31, 2049. The first FEZ was set up in 1996 in Brest, in the south west of Belarus near the Polish border, and the six in existence are strategically located around the country – in Minsk, Gomel, Vitebsk, Grodno, Brest and Mogilev. These zones were set up to create strong private-sector enterprise and investment in Belarus and offer an array of incentives to both foreign and domestic investors. Each is a customs-free zone and has its own administrative officers to help members. Joining an FEZ confers a 40% reduction in the tax burden compared with non-membership. Businesses wanting to register within an FEZ must make a minimum investment of EUR1.0 million and will receive tax incentives and streamlined bureaucratic procedures. So far, almost 270 foreign businesses have taken advantage of the opportunity. The Great Stone Mainland China-Belarus Industrial Park (CBIP) was created in 2012 with support from Mainland China as a hub for firms at the cutting edge of innovation and technology. The CBIP is located in Smolevichi near Minsk and any company wanting resident status there must be involved in an industry such as telecommunications, pharmaceuticals, biotechnology or big-data storage and processing, and must make a minimum investment of USD5 million, or USD500,000 if pursuing a research project. As of August 2019, the CBIP has 56 resident companies.

- On January 9, 2019, the CBIP was granted the status of a territorial special economic zone (SEZ), giving companies located there the maximum customs advantages in the area of logistics and manufacturing provided for in the Eurasian Economic Union Customs Code. The code permits territorial SEZs to be set up: one each in Armenia, Kazakhstan and Kyrgyzstan; two in Belarus and three in Russia. As a result, the CBIP is Belarus' first territorial SEZ.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of Commerce, FDI Intelligence, National Agency of Investment and Privatization, UNCTAD

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

|

|

FEZs: Brest, Gomel, Grodno, Minsk, Mogilev and Vitebsk |

- The FEZ resident is exempt from profits tax for five years beginning on the date in which profits are declared for the first time. After the end of the five-year period, the FEZ resident pays corporate profits tax at 50% of the standard rate, but the tax rate may not exceed 12%.

- 50% discount on VAT on import substitution goods manufactured within an FEZ; |

|

HTP |

- Resident companies are exempt from income tax, property tax, VAT on goods produced in Belarus, customs duties and land tax for the construction period. |

|

Great Stone CBIP |

- Resident companies benefit from a variety of incentives, including being exempted from income tax for 10 years and a reduced rate of 50% until 2062, no land or immovable property tax until 2062, no income tax on dividends for five years after the income is declared and payments to the Social Security Fund that are 35% of the national average. |

Sources: US Department of Commerce, National Agency of Investment and Privatization, Great Stone Industrial Park, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 18%

Sources: Tax and Duties Ministry of the Republic of Belarus, National Agency of Investment and Privatization, Fitch Solutions

Important Updates to Taxation Information

On January 1, 2019, Belarus introduced its new Tax Code aimed at upholding state budget revenue while simplifying taxation and tax reporting in order to have a beneficial effect on business activity. Various simplification measures were introduced, including an increase in the revenue tax period from one month to one quarter for foreign companies.

Sources: Tax and Duties Ministry of the Republic of Belarus, National Agency of Investment and Privatization, Fitch Solutions

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax (CIT) |

- 18% on operating profits |

|

VAT |

- Standard rate of 20% |

|

Land Tax |

Ranges from 0.025% to 3% depending on value determined by survey means (cadastral services) |

|

Real Estate Taxes |

- Immovable property is taxed at an annual rate of 1% on the residual value of the property. |

|

Social security contributions (health insurance, pension) |

- Belarus applies a social insurance contribution tax of 35%-34% of which is paid by employers. Out of the 34% paid out by employers, 28% contribute to pension funds, whereas the remaining 6% goes towards general social insurance. 1% of the overall 35% rate of contributions is withheld from employees' salaries for the purpose of payment to the social insurance contribution. |

|

Withholding Taxes (applicable only to non-residents) |

- Dividends: 12% on net earnings |

Sources: Tax and Duties Ministry of the Republic of Belarus, National Agency of Investment and Privatization, Fitch Solutions

Date last reviewed: May 4, 2020

Foreign Worker Permits

If an employer wants to hire 10 foreign workers or more (excluding, for example, the CEO of a foreign company or highly skilled workers), they must apply for a special type of work permit from the Belarusian Ministry of Labour. The permit is valid for one year and such permits may be granted for two years for highly skilled workers. The Belarusian government does not apply any strict caps on the number of foreign workers that can be hired and does not impose any strict hiring quotas (in terms of employing Belarusian citizens) that must be met. Only Eurasian Economic Union citizens and citizens of certain members in the Commonwealth of Independent States may work in Belarus without having to obtain a work permit. Citizens of all other states require an offer of employment beforehand and there are various processes that must be completed before the work permit can be granted, which can be time consuming. The employer must first apply for a permit to be able to engage in hiring foreign workers from the Belarusian Ministry of Labour. Once this is obtained, various documents must be submitted to the Ministry of Labour for approval for the work permit to be granted.

Localisation Requirements

Foreigners temporarily staying in Belarus must register with the local unit of the Ministry of Internal Affairs within five days from the date of arrival.

Visa/Travel Restrictions

A presidential decree effective from July 27, 2018, introduced visa-free travel to Belarus for citizens of 74 countries for stays of up to 30 days when entering and exiting through Minsk National Airport. Key markets include all EU member states, Australia, Brazil, Indonesia, the United States and Japan. As an important step in encouraging greater synergy between Hong Kong and Belarus, Hong Kong citizens have been allowed to visit Belarus visa-free for 14 days from February 13, 2018, onwards, after the Comprehensive Agreement for the Avoidance of Double Taxation between Hong Kong and Belarus came into force on November 30, 2017.

Sources: Ministry of Foreign Affairs of the Republic of Belarus, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B3 (Stable) |

28/02/2020 |

|

Standard & Poor's |

B (Stable) |

06/10/2017 |

|

Fitch Ratings |

B (Stable) |

15/05/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

38/190 |

37/190 |

49/190 |

|

Ease of Paying Taxes Index |

96/190 |

99/190 |

99/190 |

|

Logistics Performance Index |

103/160 |

N/A |

N/A |

|

Corruption Perception Index |

70/180 |

66/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International, national sources

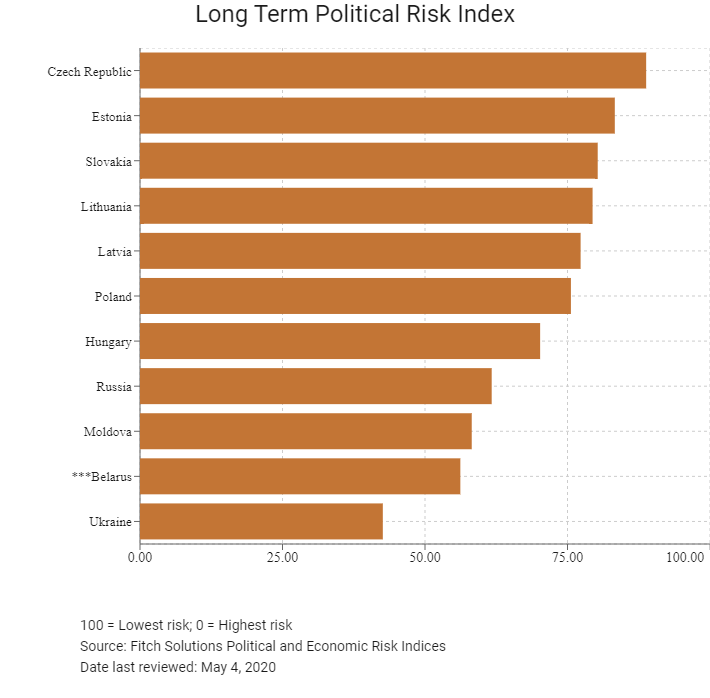

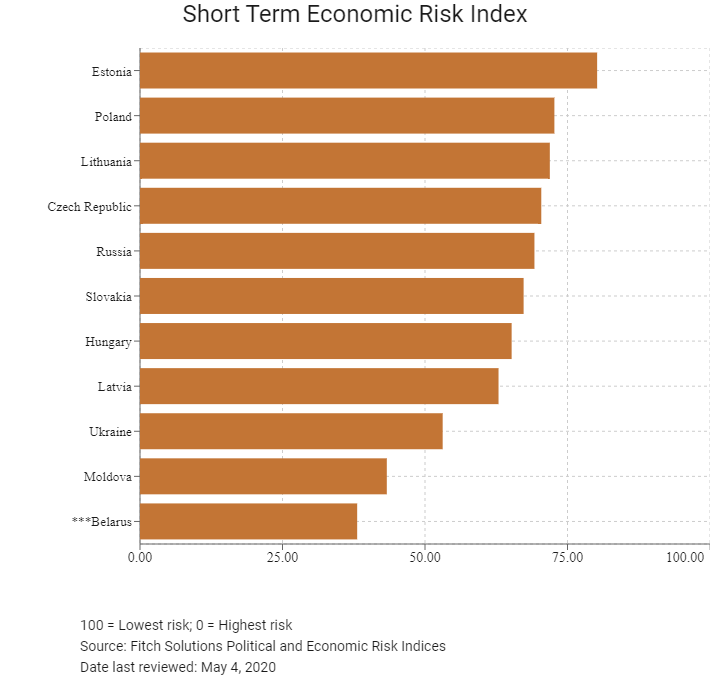

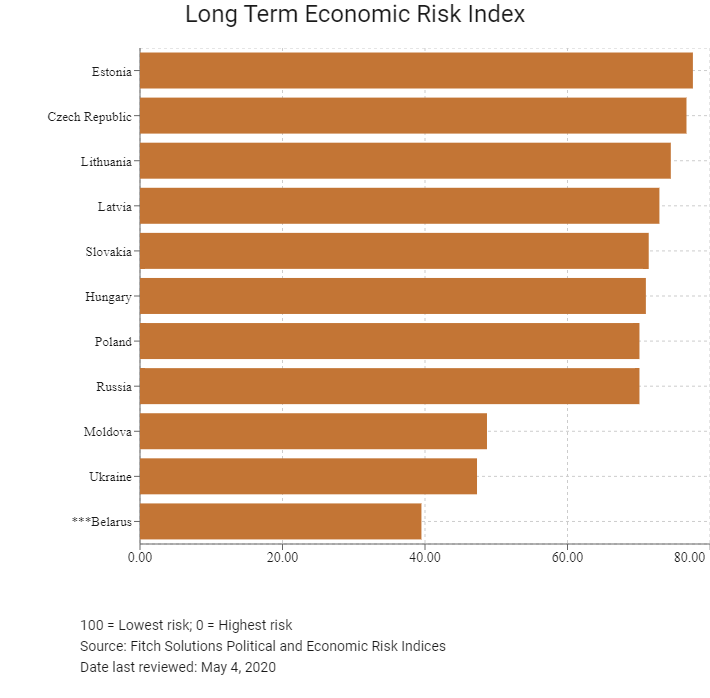

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

169/202 |

171/201 |

170/201 |

|

Short-Term Economic Risk Score |

46.0 |

41.7 |

38.1 |

|

Long-Term Economic Risk Score |

39.4 |

40.0 |

39.5 |

|

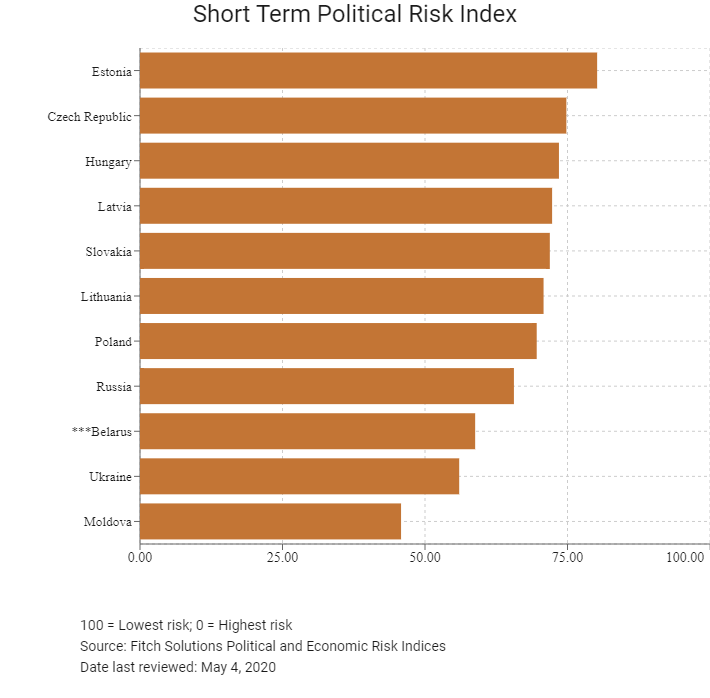

Political Risk Index Rank |

130/202 |

130/201 |

129/201 |

|

Short-Term Political Risk Score |

62.5 |

61.7 |

58.8 |

|

Long-Term Political Risk Score |

56.2 |

56.2 |

56.2 |

|

Operational Risk Index Rank |

63/201 |

59/201 |

59/201 |

|

Operational Risk Score |

57.2 |

58.7 |

59.2 |

Source: Fitch Solutions

Date last reviewed: May 4, 2020

Fitch Solutions Risk Summary

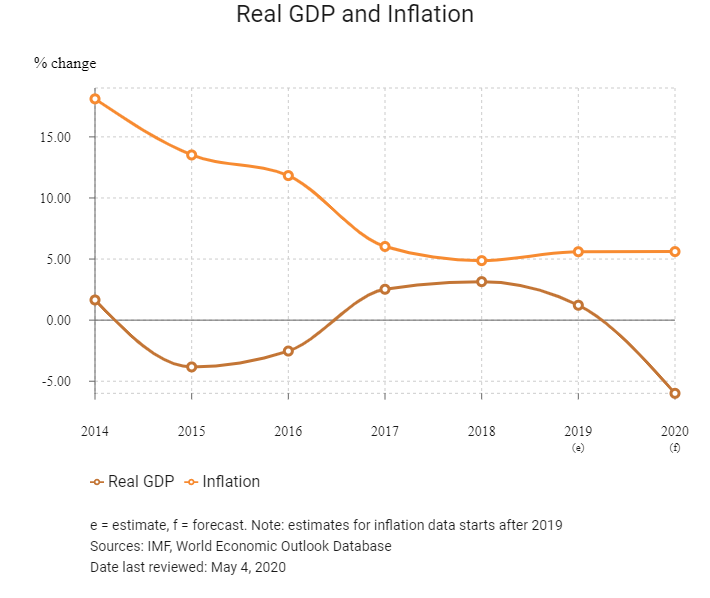

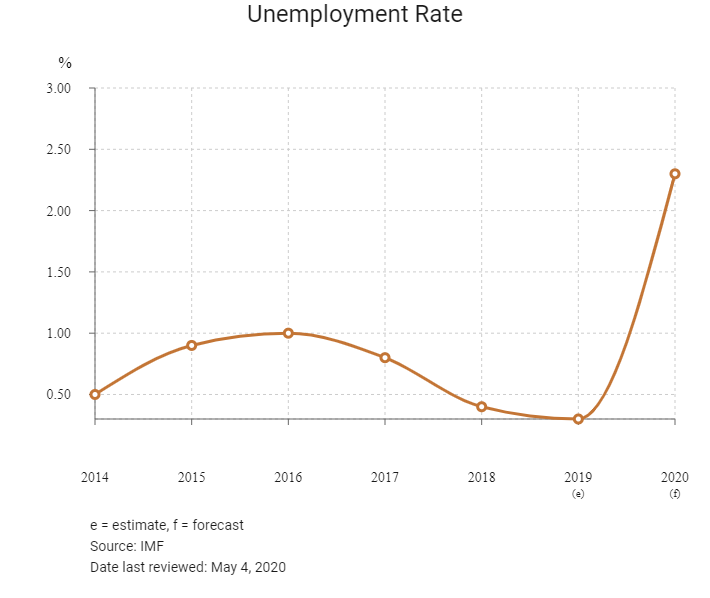

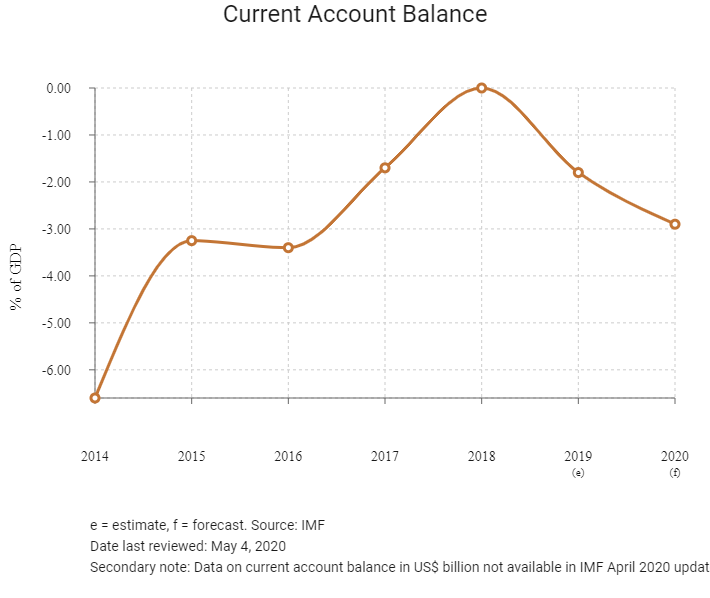

ECONOMIC RISK

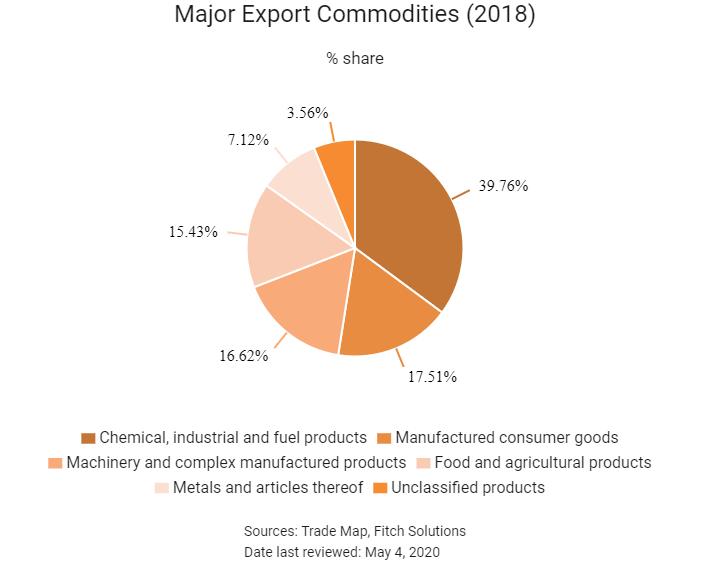

Belarus is heavily reliant on Russia for concessional loans and hydrocarbon exports. The state-dominated economy is the primary driver of employment and economic output, making Belarus dependent on external support in order to provide it with much-needed foreign exchange reserves. The build-up of debt at the country's state-owned enterprises and the continued misallocation of resources as a result of policy-driven lending practices will ensure that growth remains weak over the coming years. We believe that Belarusian real GDP growth will fall into negative territory in 2020 owing to an ongoing dispute with Russia over the supply of crude oil to Belarusian refineries and an uncertain global outlook due to Covid-19. The lack of meaningful structural reform, essential for long-term growth, also poses a near-term risk to economic stability. On the upside, the country benefits from a comparative advantage in relatively high-skilled areas, including heavy manufacturing, chemicals and refined fuel products, which could help to boost export growth.

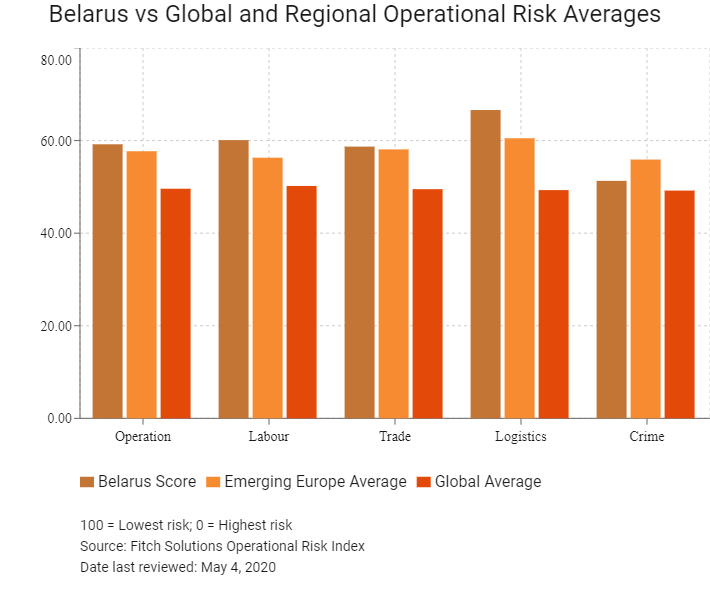

OPERATIONAL RISK

Belarus’ highly educated and urbanised labour force partly improve the country’s operating environment. Businesses that operate in the city will not have difficulty in acquiring technically skilled labour. The logistics sector in Belarus will be attractive to investors as the country boasts inexpensive utilities particularly fuel and electricity. A downside to the labour market in Belarus is that, labour laws afford more protection to workers than employers, which stems from the Soviet Union era labour market system and has resulted in businesses being exposed to rigid labour regulations in Belarus. In the medium-to-long term the judicial system will remain under the influence of the president. Belarus’ continued reliance on Russia for trade and economic assistance as well as the significant role of state-owned enterprises across multiple sectors in the economy will continue to negatively weigh down on Belarus as an attractive investment destination.

Source: Fitch Solutions

Date last reviewed: May 4, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Belarus Score |

59.2 |

60.1 |

58.7 |

66.6 |

51.3 |

|

Central and Eastern Europe Average |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Central and Eastern Europe Position (out of 11) |

8 |

6 |

8 |

9 |

8 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

16 |

10 |

19 |

11 |

21 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

59 |

41 |

65 |

47 |

94 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

70.9 |

63.1 |

75.0 |

71.0 |

74.3 |

|

Czech Republic |

69.4 |

60.6 |

67.0 |

73.6 |

76.5 |

|

Lithuania |

69.4 |

61.3 |

71.1 |

74.3 |

71.0 |

|

Poland |

68.1 |

59.2 |

64.9 |

75.5 |

72.8 |

|

Latvia |

67.1 |

63.5 |

68.2 |

69.4 |

67.4 |

|

Slovakia |

63.7 |

52.1 |

66.2 |

66.8 |

69.6 |

|

Hungary |

63.6 |

55.7 |

62.5 |

70.1 |

66.3 |

|

Belarus |

59.2 |

60.1 |

58.7 |

66.6 |

51.3 |

|

Russia |

58.0 |

65.9 |

57.4 |

67.9 |

40.6 |

|

Moldova |

49.7 |

44.8 |

51.4 |

53.4 |

49.3 |

|

Ukraine |

48.6 |

57.9 |

48.4 |

54.4 |

33.6 |

|

Regional Averages |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 4, 2020

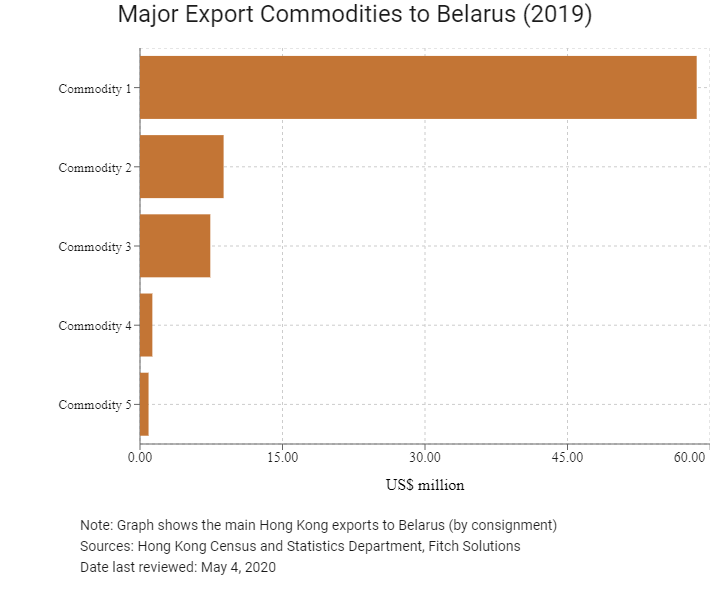

Hong Kong’s Trade with Belarus

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

58.6 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

8.8 |

|

Commodity 3 |

Office machines and automatic data processing machines |

7.4 |

|

Commodity 4 |

Professional, scientific and controlling instruments and apparatus |

1.3 |

|

Commodity 5 |

Miscellaneous manufactured articles |

0.9 |

|

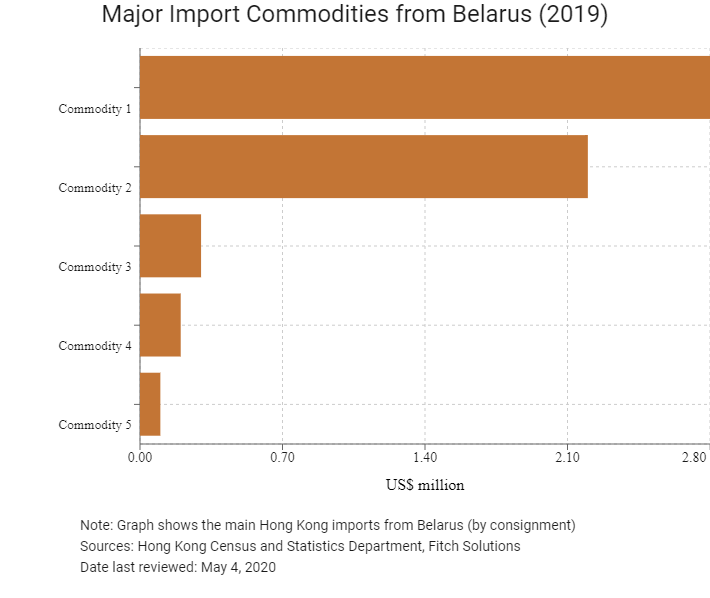

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

2.8 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

2.2 |

|

Commodity 3 |

Professional, scientific and controlling instruments and apparatus |

0.3 |

|

Commodity 4 |

Miscellaneous manufactured articles |

0.2 |

|

Commodity 5 |

Non-metallic mineral manufactures |

0.1 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Belarusian residents visiting Hong Kong |

5,863 |

16.6 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board

Date last reviewed: May 4, 2020

Commercial Presence in Hong Kong

|

2018 |

Growth rate (%) |

|

|

Number of Belarus companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong, Mainland China and Belarus

- As an important step in encouraging greater synergy between Hong Kong and Belarus, as of February 13, 2018, Hong Kong citizens have been allowed to visit Belarus visa free for 14 days, after the Comprehensive Double Taxation Agreement between Hong Kong and Belarus came into force on November 30, 2017.

- Belarus has a BIT with Mainland China that entered into force on January 14, 1995.

- Belarus has had a tax treaty with Mainland China that has been applicable since October 3, 1996.

Sources: Hong Kong Inland Revenue Department, UNCTAD, State Administration of Taxation of The People's Republic of China

The Belarusian Chamber of Commerce and Industry

The Belarusian Chamber of Commerce and Industry has been a member of the Silk Road Chamber of International Commerce since September 2016.

Address: Room 811-817, 26/F, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong

Email: info@srcic.com

Tel: (852) 2852 9522

Fax: (852) 2852 8521

Visa Requirements for Hong Kong Residents

No visa is required for HKSAR passport holders for short stays (up to 14 days as per the January 2018 mutual agreement). However the Immigration Department of Hong Kong announced a mutual extension of visa-free period with Belarus in April 2019.

The period of mutual visa-free entry will be extended from up to 14 days to 30 days with effect from April 10, 2019. This is aimed to foster cooperation and exchanges between Hong Kong and the Belt and Road countries.

Source: Hong Kong Immigration Department

Date last reviewed: February 15, 2020

Belarus

Belarus