GDP (US$ Billion)

19.63 (2018)

World Ranking 116/193

GDP Per Capita (US$)

545 (2018)

World Ranking 182/192

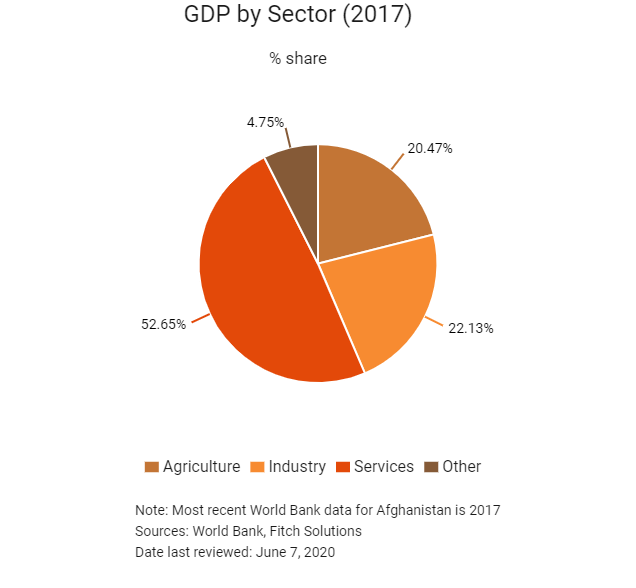

Economic Structure

(in terms of GDP composition, 2017)

External Trade (% of GDP)

51.2 (2017)

Currency (Period Average)

Afghan Afghani

77.74per US$ (2019)

Political System

Islamic republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Afghanistan's economic recovery remains weighed down by a range of structural factors, including continued insecurity and political instability as well as stalling improvements in private investment and consumer demand. The agricultural sector has recorded strong production of fruit and vegetables in recent quarters, but unfavourable weather conditions have negatively affected wheat production; the service and industry sectors have also seen tepid growth in recent years. In the near term, progress with a negotiated peace settlement with the Taliban could have a significant positive impact on investment confidence, providing some upside for a political transition. In the long term sustained economic growth requires structural economic transformation and improved governance. Afghanistan holds significant deposits of minerals and hydrocarbons, and extractive industries are thus a major area of potential growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

October 2018

United States diplomat Zalmay Khalilzad held talks with the Taliban in Doha, Qatar. The round concluded in January 2019.

October 2018

Parliamentary elections were held successfully, despite the ongoing campaign of violence by the Taliban. Presidential elections were scheduled for April 2019.

November 2018

Talks, aimed at national reconciliation and ending the war in Afghanistan, began in Moscow between delegates from the Kabul government and a group representing the Taliban. Officials from a dozen other nations, including the United States also attended.

December 2018

Afghan officials informed the UN Assistance Mission in Afghanistan that the elections due in April 2019 would have to be delayed by three months until July.

February 2019

At the World Economic Forum in Davos, Afghanistan's Acting Minister of Finance and Chief Advisor on Infrastructure signed a memorandum of understanding with Germany's Siemens that declared that both sides would cooperate to develop and strengthen Afghanistan's energy infrastructure.

February 2019

In his State of the Union address United States President Donald Trump stated that progress in negotiations with the Taliban would enable a reduction in United States troops and a renewed focus on counter-terrorism.

March 2019

The Independent Election Commission (IEC) of Afghanistan announced a further delay in elections. The presidential elections were announced to take place on September 28, 2019.

February 2020

The Untied States and the Taliban signed an agreement aimed at ending the war fought in Afghanistan.

May 2020

On May 28 the government began a partial easing of the lockdown in Kabul and other major cities for workers but retained restrictions on movement and mass gatherings. To avoid further outbreak of coronavirus, the government announced new working hours for government and non-government organizations: two shifts following even and odd days of the week from 7am to 1 pm. Workers in the financial sector are exempt from the guideline. On May 17 Pakistan re-opened its Torkham and Chaman borders points with Afghanistan.

Sources: BBC Country Profile – Timeline, United Nations News, Afghan Ministry of Finance, Outlook Afghanistan, Aljazeera, The Economic Times, IMF, Fitch Solutions

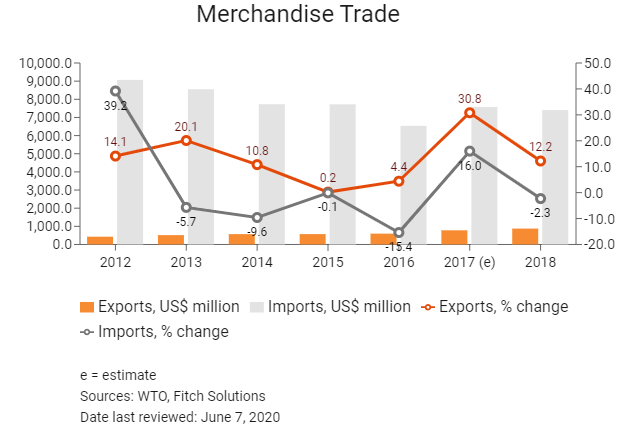

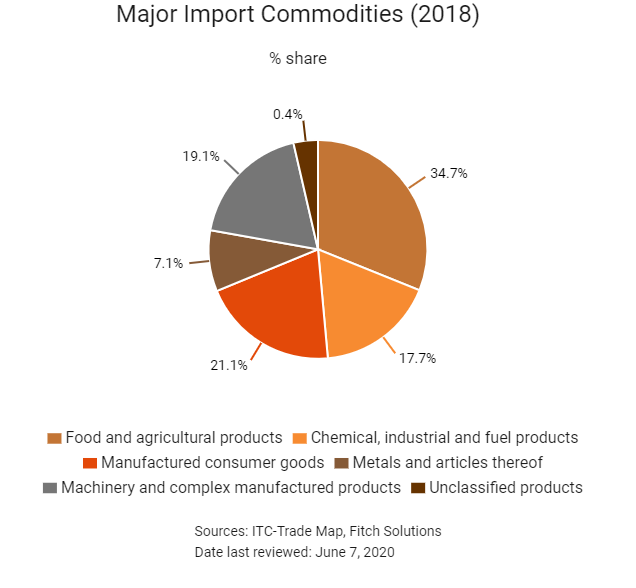

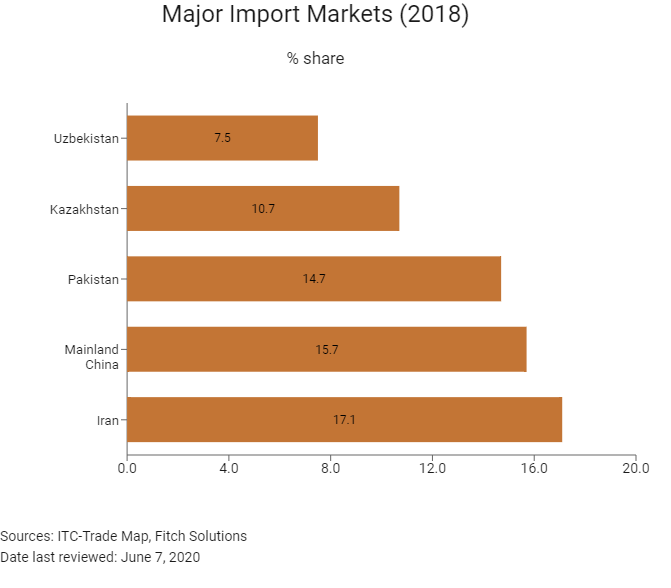

Merchandise Trade

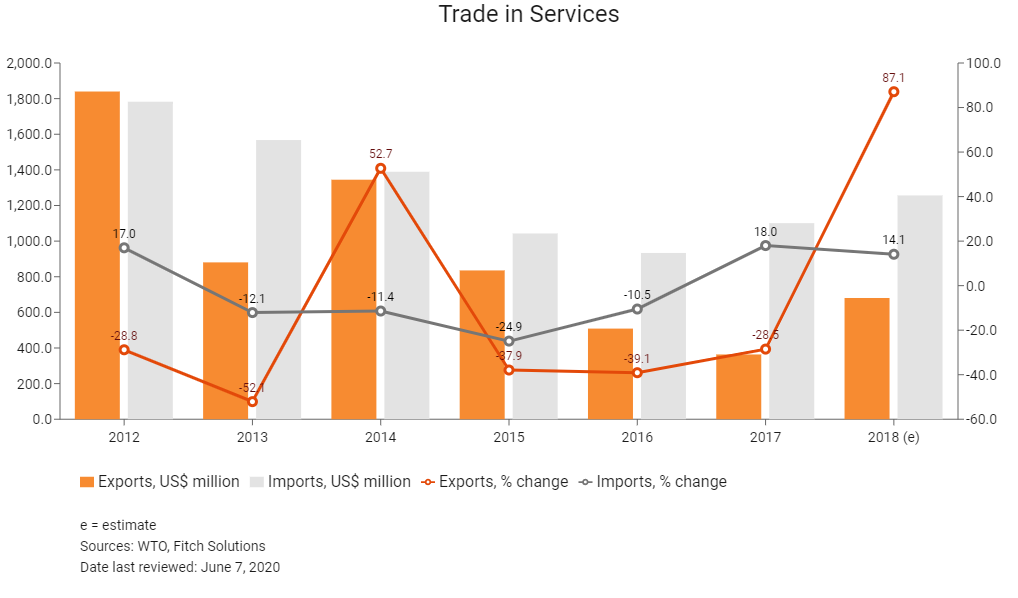

Trade in Services

- Afghanistan joined the World Trade Organization (WTO) in July 2016 as its 164th member, after nearly 12 years of negotiating its accession terms. It has also formally accepted the WTO's new Trade Facilitation Agreement. Afghanistan was the ninth least-developed country to accede to the WTO since the organisation was established in 1995.

- The Customs Law of 2005 authorises the government to prohibit or restrict the imports of certain goods. Under this law, Afghanistan currently prohibits the importation of alcoholic drinks, live pork and pork products, cotton seeds and narcotics.

- In July 2010, Afghanistan introduced export duties on scrap metal and waste, with applied rates varying between 5% and 40%.

- In February 2010, Afghanistan introduced a royalty tax on the exports of minerals (the Minerals Law), which regulates the extraction of minerals in the country for exportation. It sets a royalty tax of 15% on the commercial invoice value of all minerals, except for lapis lazuli. With respect to lapis, it sets a royalty tax of 15%, depending on the grade of the estimated stone value.

- In February 2010, the government of Afghanistan introduced export duties on certain natural resources. The duties vary from 2.5% to 40%, depending on the product.

- Afghanistan has an average tariff rate of 7%, the third-lowest (out of eight countries) in the South Asia region, which reflects, according to officials, the government's intention to establish an open, market-based economy.

- Trade with Afganistan is complicated and cumbersome. The World Bank's Ease of Doing Business 2018 report ranks Afghanistan 175th out of 190 countries in the Trading Across Borders Index. Basic communications and support for automated processes are held back by unreliable electricity supplies at major crossing points and the long and porous border. Traders face unclear procedures at the borders and extra-legal duties and bureaucratic hurdles. Coordination is very low between customs and other government authorities. Customs reform efforts are underway to establish standardised fees and procedures for imported goods, as well as streamlined procedures for exports, along with a trained cadre of professional staff.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

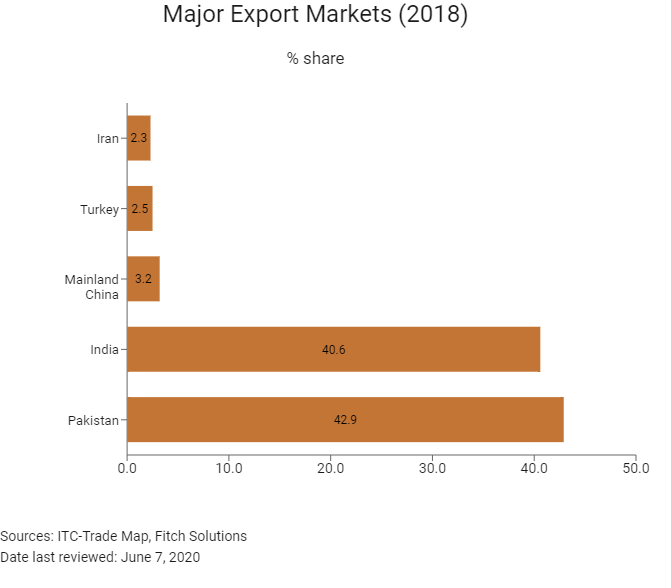

After the first air corridor between Afghanistan and Turkey was launched in May 2018, officials from the two states spoke about Afghanistan-Turkey trade ties and the importance of the new air corridor for mutual trade. Afghanistan's Minister of Commerce and Industries, Humayun Rasa stated that a new trade agreement will be signed between the two countries in the near future, which would increase Afghanistan's exports to Turkey.

Multinational Trade Agreements

Active

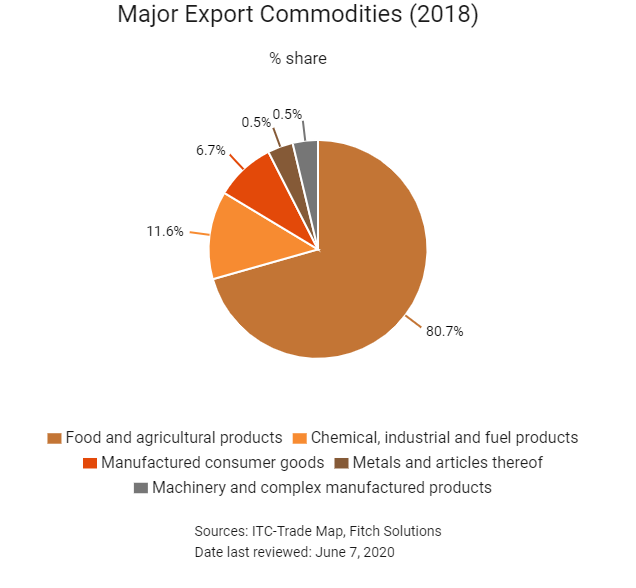

- Afghanistan-India Bilateral Partial Scope Agreement: This agreement covers trade in goods and entered into force in May 2003. India is Afghanistan's second-largest export market; as of 2016 (latest direct data available), India received 38.6% of Afghanistan's total exports, of which edible fruit and nuts, peel of citrus fruit and melons made up the highest percentage.

- South Asian Free Trade Agreement (SAFTA): SAFTA's signatories are Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka. The agreement covers trade in goods and originally entered into force on January 1, 2006; Afghanistan joined later on August 7, 2011. Under SAFTA, Afghanistan currently has duty-free access to India for all traded goods, except cigarettes and alcohol, and pays duties of 5% to Pakistan on non-sensitive goods.

- Afghanistan-Pakistan Transit Trade Agreement (APTTA): APTTA came into force on June 12, 2011, with the purpose of facilitating the movement of goods between the two countries, as well as to India and mainland China and the rest of the world through the ports at Karachi, Port Qasim and Gwadar. The main provisions of the agreement include freedom of transit through each state's territory via pre-defined routes, facilitation of clearance procedures, the establishment of technical requirements for the admittance of road vehicles and drivers, and the elimination of customs duties and taxes on all goods in transit, and means of transit and transport, regardless of destination or purpose.

- Afghanistan-United States Trade and Investment Framework Agreement (TIFA): TIFA was signed and came into effect on June 26, 2004. It has aimed to establish a framework for the discussion of economic relations between Afghanistan and the United States. Since then, there have been annual meetings of the United States-Afghanistan Council on Trade and Investment, established under the auspices of the TIFA, to further the bilateral cooperation needed to achieve Afghanistan's goals of creating an environment conducive to economic reform, private sector development and trade expansion.

Signed But Not Active

Economic Cooperation Organisation Trade Agreement (ECOTA): ECOTA is a trade agreement between Afghanistan, Azerbaijan, Iran, Kazakhstan, Kyrgyzstan, Pakistan, Tajikistan, Turkey, Turkmenistan and Uzbekistan that was signed on July 17, 2003. The agreement is not yet in force.

Sources: WTO Regional Trade Agreements database, Afghanistan Customs Department

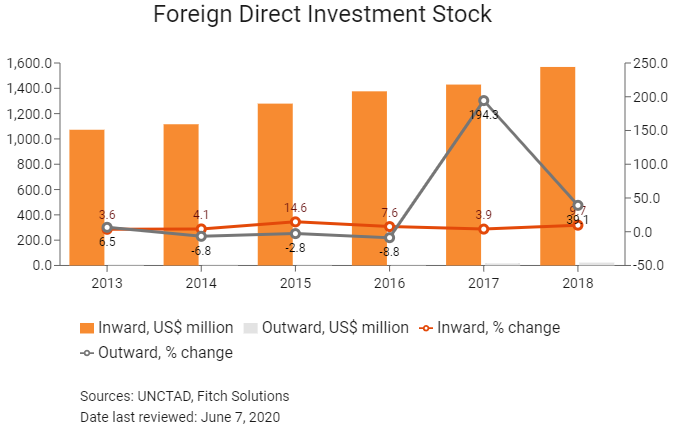

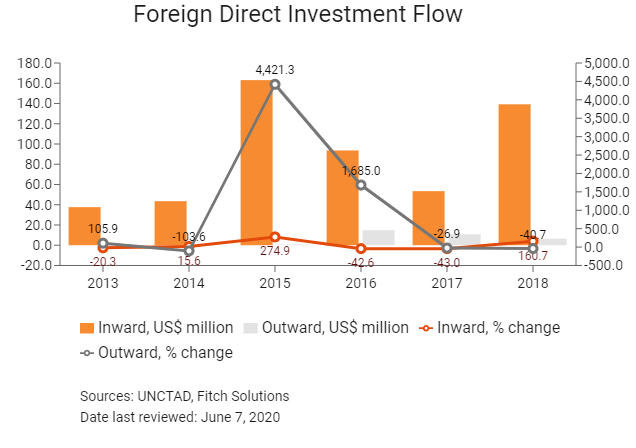

Foreign Direct Investment

Foreign Direct Investment Policy

- The Afghanistan Investment Support Agency (AISA) is the country's investment promotion body that was merged into the Ministry of Commerce and Industries (MoCI) in October 2016. The transition period is ongoing, which means that AISA continues to play a semi-independent role, while MoCI has taken on the role of promoting business growth, investment and trade.

- Under Afghanistan's Private Investment Law (PIL), passed in 2003 and amended in 2006, qualified domestic or foreign entities may invest in all sectors of the economy except in nuclear energy and gambling establishments. The Afghan government, at all levels, has stressed its commitment to bolstering private sector-led development, and increasing domestic and foreign investment. Foreign and domestic private entities have equal standing and may establish and own business enterprises, engage in all forms of remunerative activity, and freely acquire and dispose of interests in business enterprises. Although the High Commission on Investment (HCI) has authority to limit the share of foreign investment in industries – such as production and sales of weapons and explosives, non-banking financial activities, insurance, natural resources and infrastructure (power, water, sewage, waste treatment, airports, telecommunications, and health and education facilities) – that authority has never been exercised. In practice, investments may be 100% foreign owned. Direct investment exceeding USD3.0 million, however, requires HCI approval.

- The Afghan Constitution and the PIL do not allow foreign ownership of land; however, foreigners may lease land for up to 50 years.

- There is no requirement for foreigners to secure Afghan partners; in practice, however, most foreign firms find it necessary to collaborate with an Afghan partner. so as to navigate the business and bureaucratic world.

- The authorities increased the frequency of Financial Stability Committee meetings, enhanced the monitoring of early signs of liquidity stress and reviewed banks’ business continuity plans. In 2020 Da Afghanistan Bank (DAB) suspended administrative penalties and fees, postponed the International Financial Reporting Standard 9 implementation to June 2021 and froze loan classifications at the pre-pandemic cut-off at the end of February.

- DAB remains focused on price stability and is committed to exchange rate flexibility, limiting its foreign interventions to preventing excessive volatility. DAB has engaged money-service providers, who play a systemic role in financial intermediation, including in foreign currency, to ensure uninterrupted services.

- It is estimated that there are more than 80 million barrels of oil in the Amu Darya Basin and two billion tonnes of high-quality iron ore at Hajigak. In an attempt to realise the economic potential of these natural resources, the Ministry of Mines and Petroleum is trying to change from an owner-operator to become a policymaker and regulator, increasing and managing inward investment in the country's extractives industry in order to better harness the potential wealth for the economic and social benefit of Afghanistan's government and local communities.

- In March 2011, Afghanistan's Ministry of Mines and Petroleum initiated the liberalisation of the country's hydrocarbons sector by issuing a tender offer for oil exploration and production in the Amu Darya Basin in the northern part of the country. This first public tender was based on the country's new hydrocarbon law which states that 'all hydrocarbon operation contracts shall be awarded through public tenders'.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Afghanistan Investment Support Agency

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

There are currently no free trade zones in Afghanistan |

The withdrawal of United States and NATO forces in 2014 left USD2 billion worth of well-developed infrastructure and sophisticated machinery at eight strategic airfields in Afghanistan, with Bastion-Helmand and Bagram-Kabul two of the most important. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 10% (by 2021)

- Corporate Income Tax: 20%

Source: Ministry of Finance 1398 National Budget

Important Updates to Taxation Information

Afghanistan is committed to introducing policies and making administrative improvements that will increase domestic revenue. The WTO Agreement requires the government to eliminate fixed taxes on imports and implement value added tax (VAT) before January 1, 2021. A VAT rate of 10% is expected to yield an additional 1.9% of GDP.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

20% Corporate Income Tax under Article 4 of the income tax law in Afghanistan |

|

Capital Gains Tax |

- Capital gains are treated as, and included in, taxable income at a rate of 20% |

|

Business Receipt Tax |

VAT will replace the business receipt tax levied on some items and services (such as hotel and restaurant services). Currently, there is no separate comprehensive regulation for VAT. The government plans to levy VAT on various services and goods by January 2021. |

|

Branch Income/Profits Tax |

20% of income after allowing certain deductible expenses |

|

Withholding Tax |

20% on dividend income/ royalties/ interest |

Sources: Ministry of Finance, Islamic Republic of Afghanistan, Afghanistan Revenue Department

Date last reviewed: June 7, 2020

Foreign Worker Permits

The Foreigners Employment law in Afghanistan stipulates that foreigners can be employed on the basis of a work permit issued by the Ministry of Labour and Social Affairs. Work permits are issued for one year and are renewable. Foreign citizens travelling to Afghanistan for employment need to obtain business visas and work permits.

Localisation Requirements

The employment of foreign workers is allowed, but a 2005 labour regulation requires that priority be given to equally qualified Afghan workers.

Visa/Travel Restrictions

Citizens of all countries require a visa to visit Afghanistan. Exemptions apply to visitors born in Afghanistan or born to Afghan parents, as well as for holders of diplomatic or service passports of mainland China, India (diplomatic only), Indonesia, Iran, Tajikistan and Turkey for visits of up to 30 days.

Security is a concern for foreigners travelling to Afghanistan due to the threat from terrorism, armed conflict and kidnapping. It is advised that no foreigners travel to Afghanistan unless travel is essential (although essential travel is restricted to only a few areas, including Kabul). Owing to the ongoing conflict in Afghanistan, any foreign workers sent to the country will need high levels of security or protection as well as additional compensation. Foreign workers would need to be paid a danger pay of approximately 35% of their basic compensation as well as a hardship pay of 35% of their basic compensation on top of their normal wages or salaries.

Sources: Government websites, US Department of Commerce, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

N/A |

N/A |

|

Standard & Poor's |

N/A |

N/A |

|

Fitch Ratings |

N/A |

N/A |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

183/190 |

167/190 |

173/190 |

|

Ease of Paying Taxes Index |

176/190 |

177/190 |

178/190 |

|

Logistics Performance Index |

160/160 |

N/A |

N/A |

|

Corruption Perception Index |

172/180 |

173/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International, Fitch Solutions

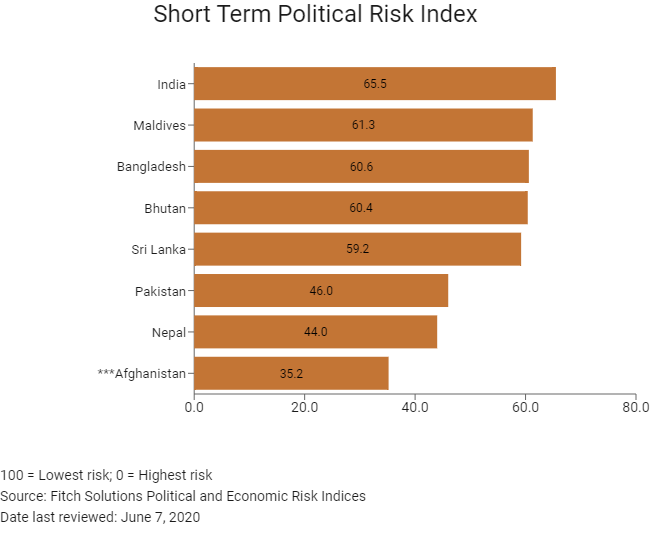

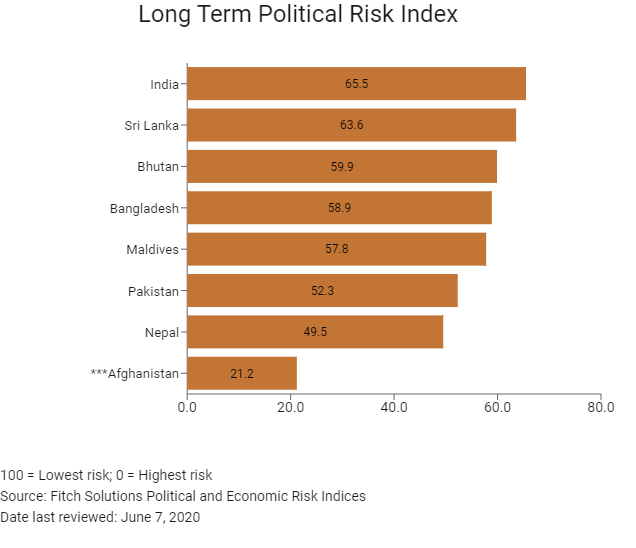

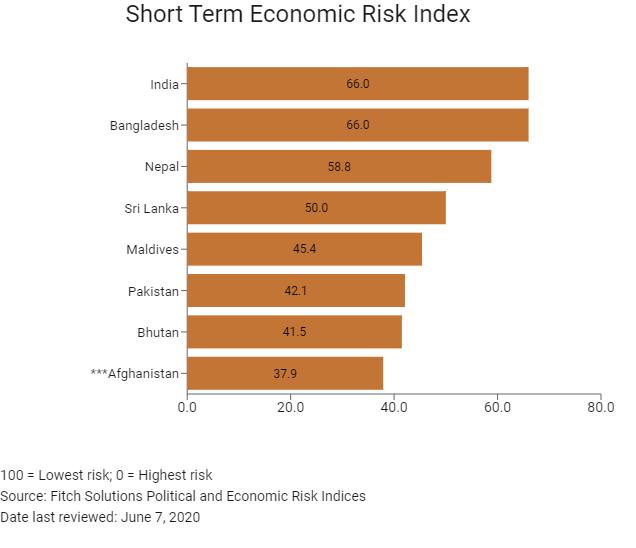

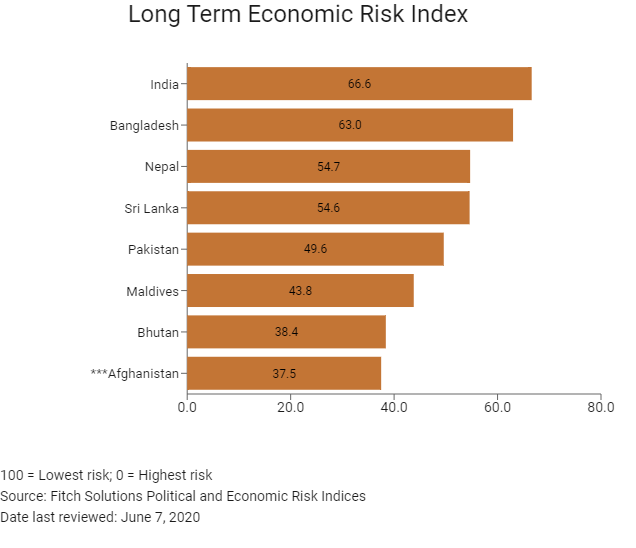

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

187/202 |

172/201 |

178/201 |

|

Short-Term Economic Risk Score |

36.0 |

37.7 |

37.9 |

|

Long-Term Economic Risk Score |

36.5 |

39.5 |

37.5 |

|

Political Risk Index Rank |

199/202 |

198/201 |

198/201 |

|

Short-Term Political Risk Score |

35.8 |

35.8 |

35.2 |

|

Long-Term Political Risk Score |

21.2 |

21.2 |

21.2 |

|

Operational Risk Index Rank |

197/201 |

193/201 |

196/201 |

|

Operational Risk Score |

22.3 |

25.1 |

23.1 |

Source: Fitch Solutions

Date last reviewed: June 7, 2020

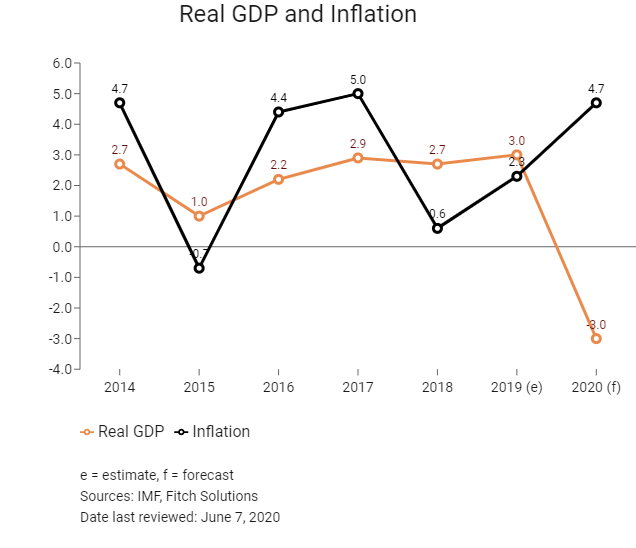

Fitch Solutions Risk Summary

ECONOMIC RISK

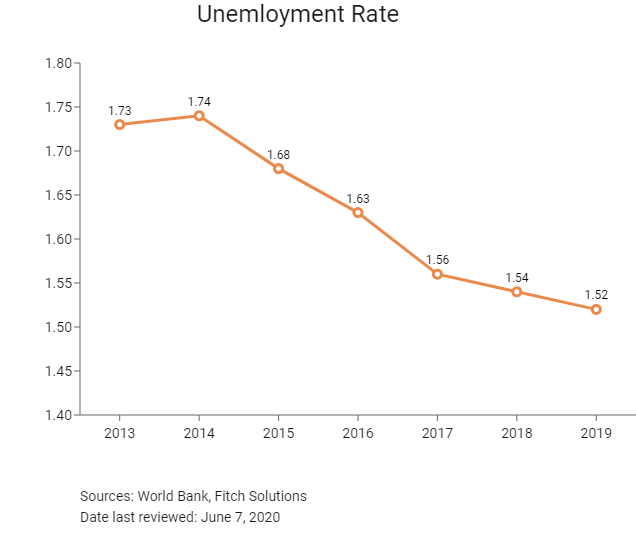

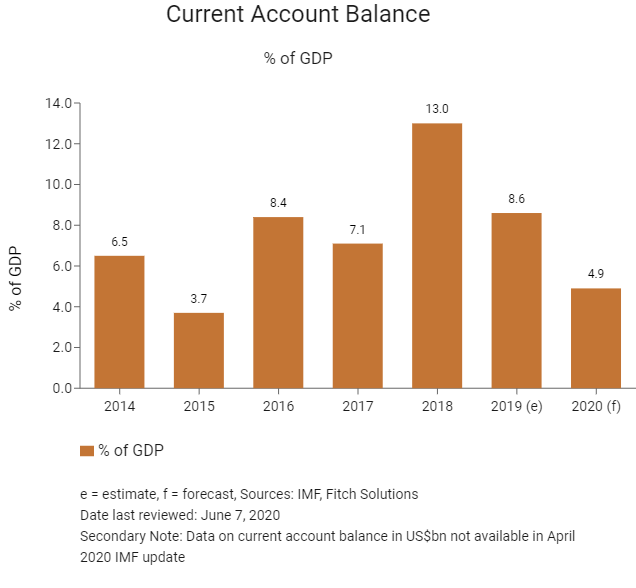

The Covid-19 pandemic has hit the economy significantly in 2020 as trade and transportation have been disrupted and domestic activity has slowed sharply, upending the livelihood of thousands of Afghan families. Border closures and panic buying in Q220 led to a temporary spike in prices of some foodstuffs, which abated after private wholesalers boosted supply at the government’s request. Afghanistan's long-term economic risk is among the highest in the world, but slightly lower than other extremely troubled states, such as South Sudan, Yemen and Syria. The high risk reflects a high degree of volatility in economic growth and other key economic indicators, high inflation and unemployment, very wide fiscal and current account deficits (when foreign assistance is stripped out), and weak financial systems.

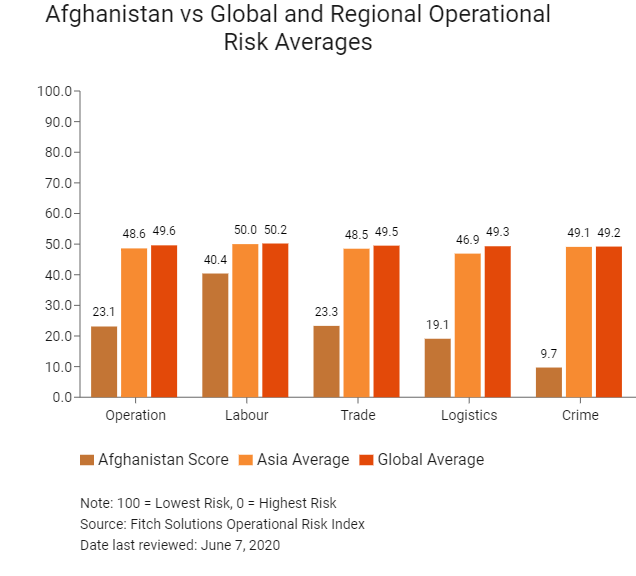

OPERATIONAL RISK

Afghanistan continues to face considerable challenges in rebuilding its economy following long periods of conflict, and the contracts it has signed with mainland China will go some way in providing support for the development of the country's infrastructure. However, the weak security outlook poses risks to foreign involvement in the country.

Source: Fitch Solutions

Date last reviewed: June 6, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Afghanistan Score |

23.1 |

40.4 |

23.3 |

19.1 |

9.7 |

|

South Asia average |

42.2 |

44.5 |

40.6 |

43.7 |

40.0 |

|

South Asia position (out of 8) |

8 |

7 |

8 |

8 |

8 |

|

Asia average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia position (out of 35) |

35 |

28 |

34 |

35 |

35 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

196 |

159 |

190 |

197 |

198 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Secruity Risk Index |

|

India |

53.8 |

46.4 |

55.0 |

66.6 |

47.0 |

|

Bhutan |

50.7 |

44.0 |

50.5 |

51.2 |

57.3 |

|

Sri Lanka |

50.4 |

46.8 |

48.3 |

56.0 |

50.5 |

|

Maldives |

44.0 |

48.0 |

42.9 |

37.5 |

47.8 |

|

Pakistan |

40.5 |

42.6 |

42.6 |

42.4 |

34.4 |

|

Bangladesh |

38.1 |

50.3 |

28.5 |

40.1 |

33.5 |

|

Nepal |

37.0 |

37.7 |

34.1 |

36.6 |

39.7 |

|

Afghanistan |

23.1 |

40.4 |

23.3 |

19.1 |

9.7 |

|

Regional Averages |

42.2 |

44.5 |

40.6 |

43.7 |

40.0 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: June 7, 2020

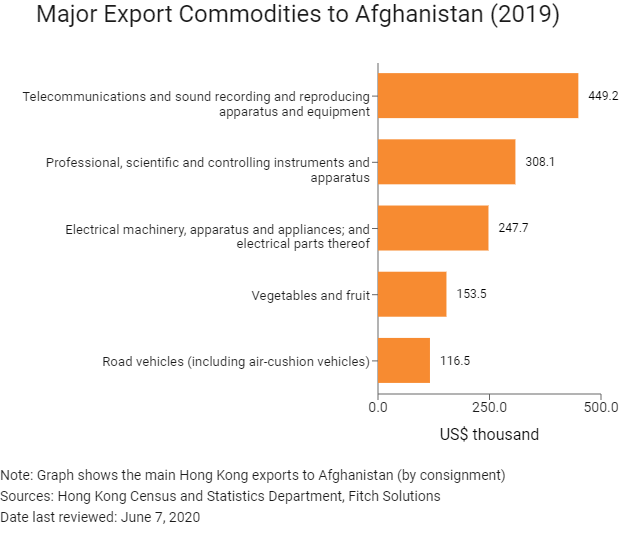

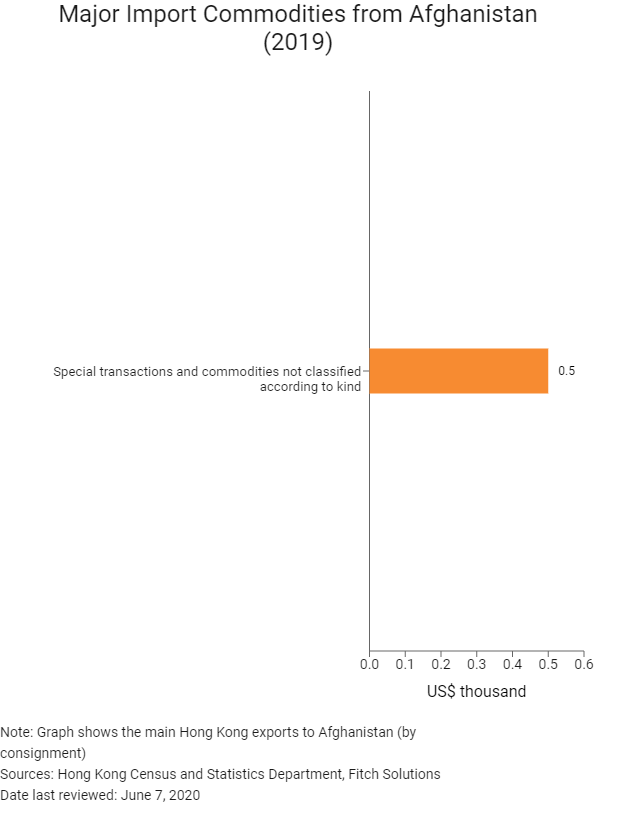

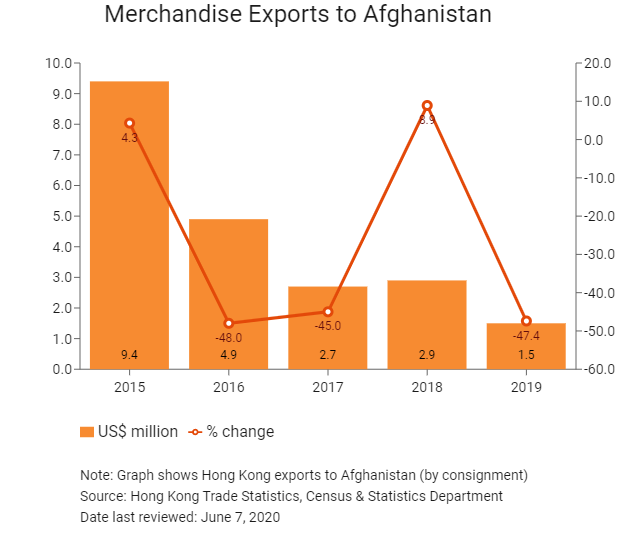

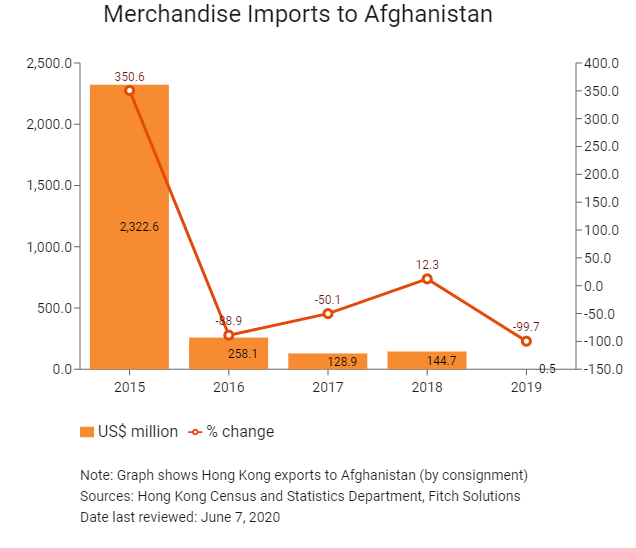

Hong Kong’s Trade with Afghanistan

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Afghan residents visiting Hong Kong |

165 |

-2.4 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: June 7, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Afghan companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Visa Requirements for Hong Kong Residents

A visa is required for travel to Afghanistan for HKSAR passport holders. Application must be completed prior to travel.

Sources: Ministry of Foreign Affairs, Embassy of Afghanistan, London, Embassy of Afghanistan, Washington

Date last reviewed: June 7, 2020

Afghanistan

Afghanistan