GDP (US$ Billion)

57.92 (2019)

World Ranking 82/194

GDP Per Capita (US$)

1,742 (2019)

World Ranking 152/193

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

73 (2019)

Currency (Period Average)

Uzbekistani Som

8836.79per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

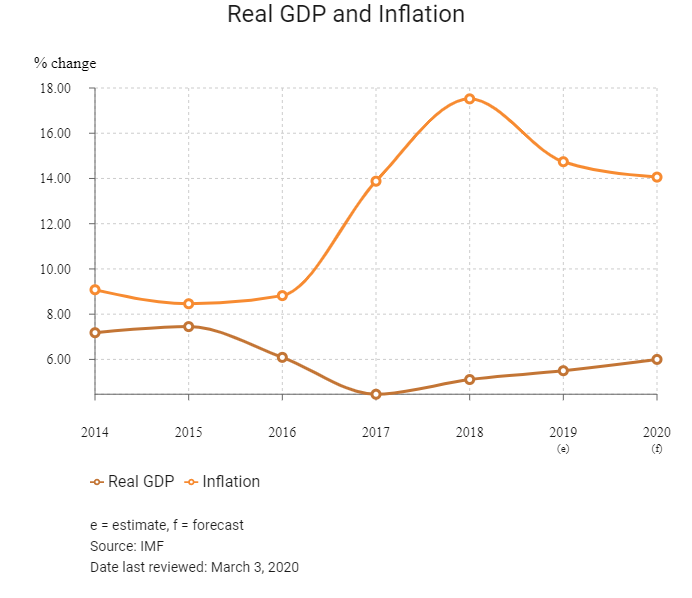

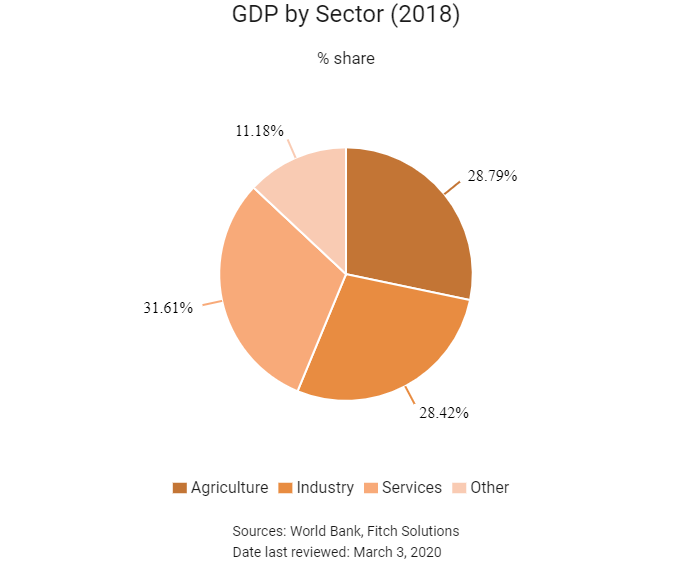

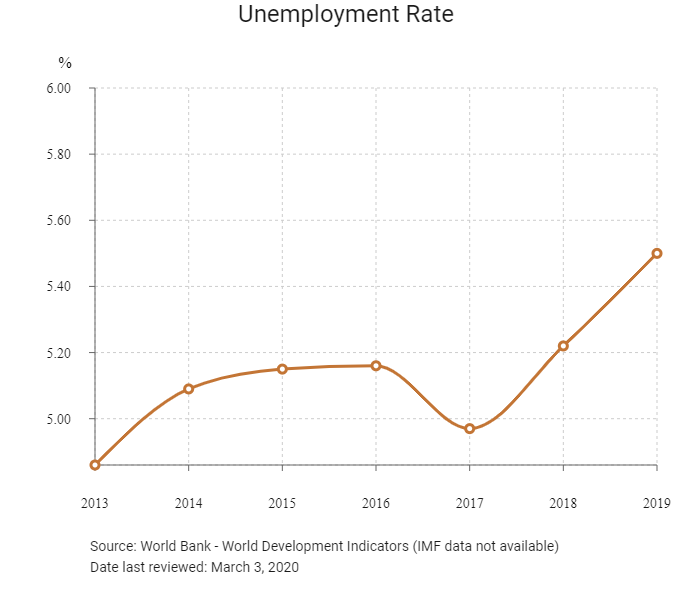

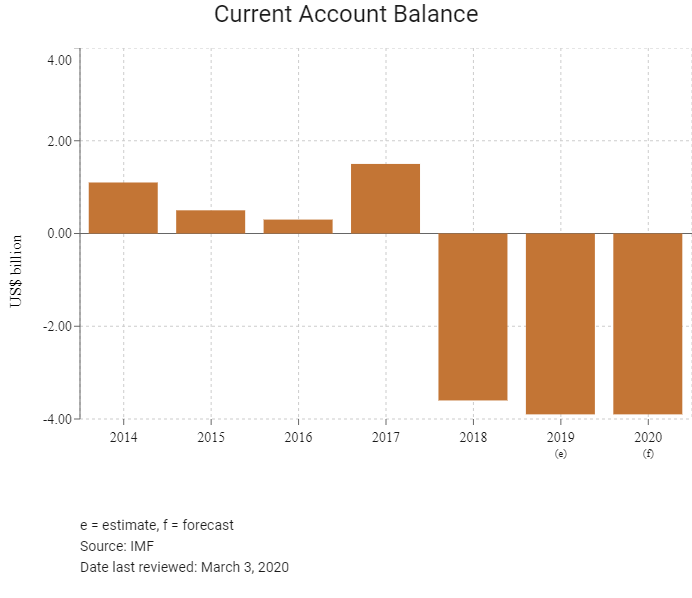

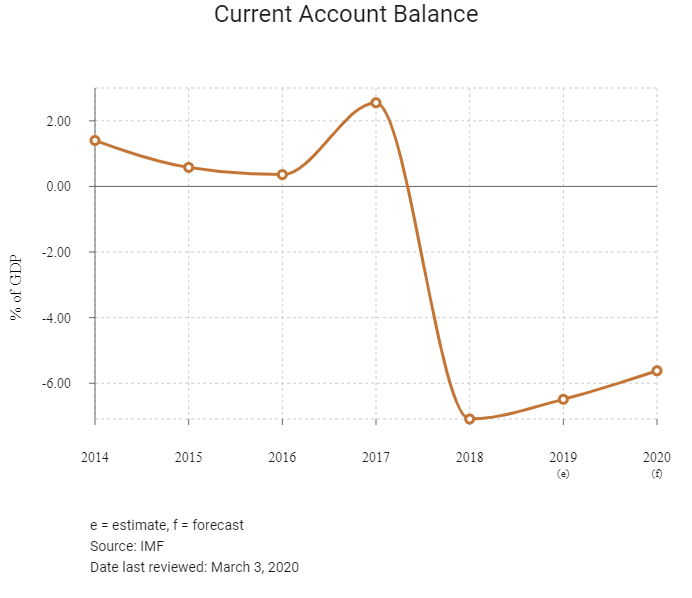

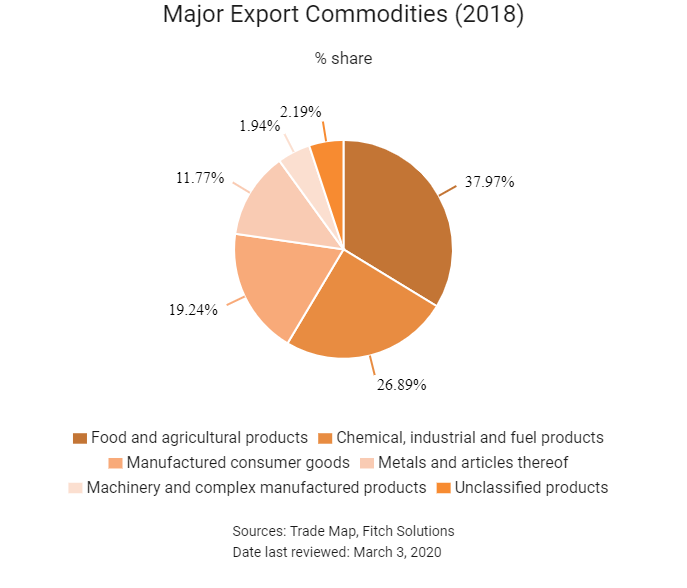

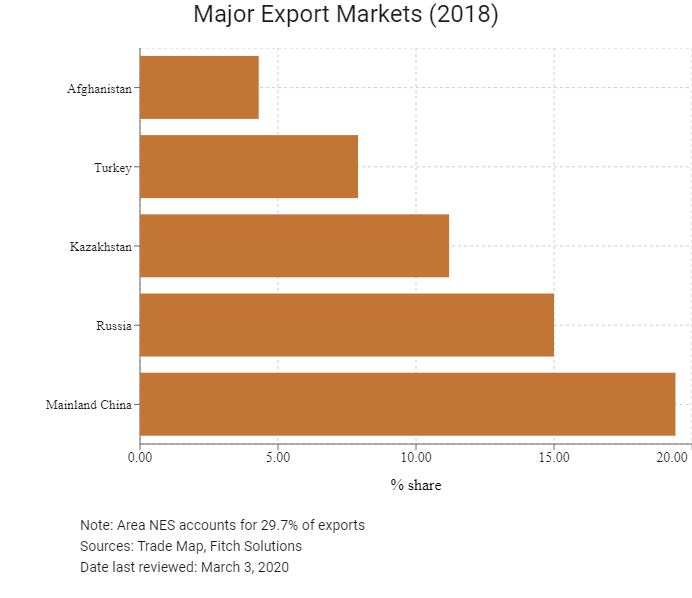

Independent since 1991, Uzbekistan seeks to gradually lessen its dependence on agriculture while developing its gold, uranium and petroleum reserves. Total investment growth moderated from 9.5% in 2016 to 7.1% in 2017, but remained the main growth engine for the economy. Energy supplies and hydrocarbons, including natural gas and petroleum, provide a significant share of exports. Other major export earners include cotton, food, services and metals. Since President Shavkat Mirziyoyev came to power, Uzbekistan has seen improved relations with its neighbours and the country has begun to take steps towards boosting economic and political reforms. The authorities are working on improving the tax system and tax administration procedures, as well as on creating greater economic data transparency, which includes joining the General Data Dissemination Standard of the International Monetary Fund. In the near term, monetary policy is forecast to tighten, with the priorities being to contain inflation and balance the current account surplus. In January 2019, the Government adopted a “Reform Roadmap”, with the support of the World Bank, which outlines how the country will achieve economic, social and political openness over the 2019-2021 period. There were 23 projects in the World Bank portfolio in Uzbekistan at the end of 2019, with commitments totalling slightly more than USD4 billion, ranking the country as the World Bank's second-largest programme in Europe and Central Asia.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2016

Prime Minister Shavkat Mirziyoyev won the presidential election and set out to repair relations with Russia, China and the United States, opened up the economy, and relaxed the investment policy environment.

February 2017

Mirziyoyev allowed commercial flights to Tajikistan for first time in more than 20 years.

October 2018

Russian President Vladimir Putin's state visit to Uzbekistan included business deals totalling USD27 billion, including a contract worth USD11 billion for a nuclear power plant.

February 2019

Uzbekistan's Eurobond issuance outperformed expectations, with an oversubscription rate of 8.2 times its original estimated demand. This indicated that investor sentiments towards the country had turned upwards, following a charm offensive by Mirziyoyev and his government. The President paid a state visit to a number of countries ahead of the Eurobond issuance, assuring investors, including India, France, Germany, Russia and Belgium.

The president paid a state visit to a number of countries ahead of the Eurobond issuance, assuring investors such as India, France, Germany, Russia and Belgium.

July 2019

On July 24, the Foreign Ministry of Uzbekistan announced that Uzbekistan had begun official negotiations with the WTO over membership.

November 2019

The construction of an Uzbek-Chinese pharmaceutical plant began in the Navoi Free Economic Zone (FEZ), specialising in the synthesis of medicinal substances.

December 2019

Elections strengthened the position of Mirziyoyev, who is backed by a coalition of parties in the legislature.

January 2020

In a state of the union address to parliament, Mirziyoyev outlined his intentions to modernise the national economy, reform the banking sector and ensure that trade ties aligned with the country's development plans. The president mentioned particular focuses on developing the agricultural sector, the tourism industry and housebuilding for increased urbanisation. In addition, he acknowledged the need to reform the country's Soviet-era system of citizen registration, which limits internal migration and therefore hampers the economy.

The government also announced its intention to end the state monopoly in cotton and wheat trading.

February 2020

A global survey of the fastest-growing tourist destinations placed Uzbekistan fourth in 2019, with a 27.3% increase in visitors compared with 2018.

Turkish company Rönesans Holding announced it would be investing more than USD8 billion in Uzbekistan, including USD4.1 billion to modernise and develop the Olmaliq Mining and Metallurgy Plant.

Sources: BBC Country Profile – Timeline, Fitch Solutions

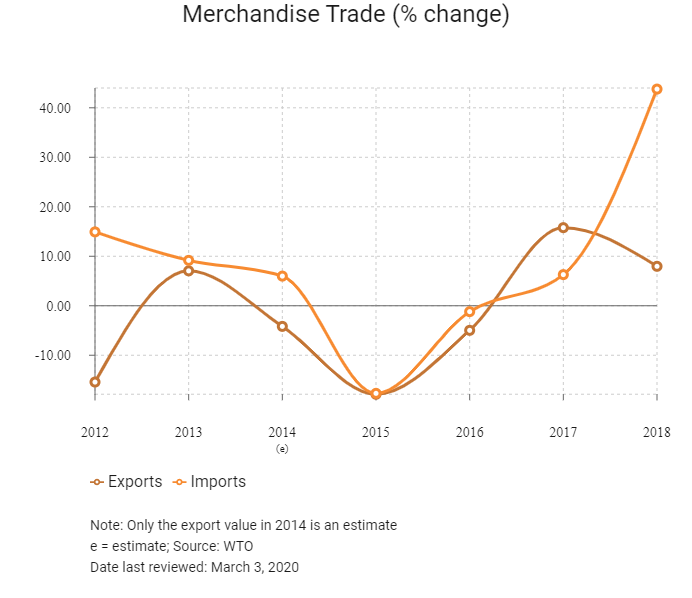

Merchandise Trade

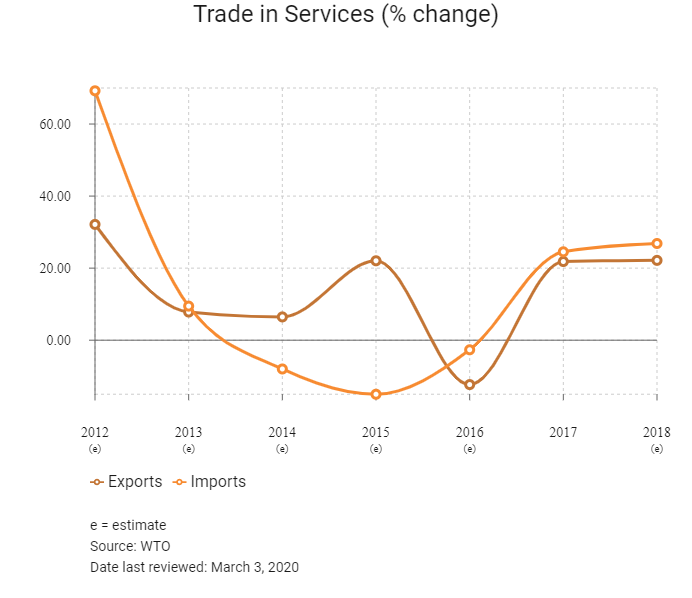

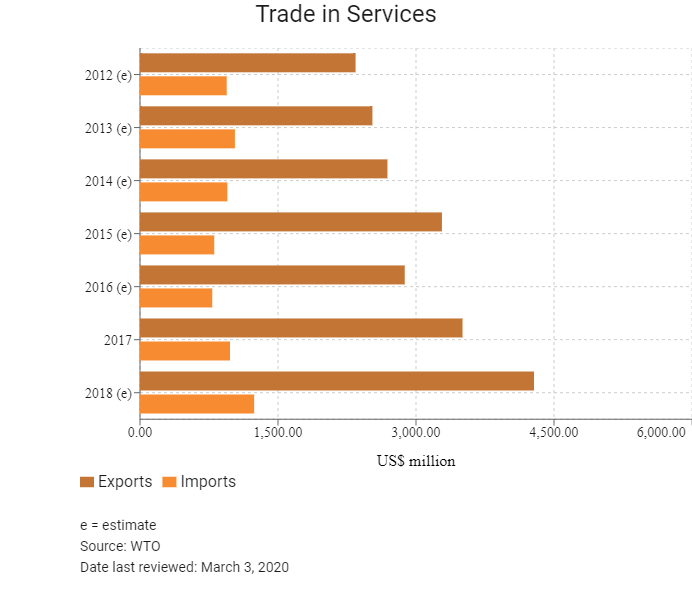

Trade in Services

- Uzbekistan is still negotiating the terms of accession to the WTO and has approached Russia for assistance in the matter, a positive sign for Tashkent given Moscow's membership and status on the international front, as well as signalling a continued détente between the two countries on grounds of economic and diplomatic cooperation.

- Uzbekistan is a founding member of the Commonwealth of Independent States (CIS) and has joined the CIS Free Trade Area (CISFTA).

- Although no formal application to join the Eurasian Economic Union (EAEU) has been made, President Shavkat Mirziyoyev has indicated that he intends to coooperate more with the EAEU. In April 2018, Uzbekistan's customs regime reforms signalled a shift to harmonising trade policies with the EAEU.

- The import of certain goods to Uzbekistan is subject to customs duties. The taxable base is determined as the customs value of imported goods. Rates of customs duties vary from 5% to 70%, depending on the type of imported goods. There is also a customs clearance fee of 0.2% of the customs value of imported goods, but not less than USD25 and not exceeding USD3,000.

- Uzbekistan has the highest average import tariff rate out of eight Caucasus and Central Asian countries. The tariff rate on imported live animals, milk and cream, wheat and computer hardware is 5%; 10-30% on clothing, furniture, metals and foodstuffs; and 50% and above on luxury goods, vehicles and cigarettes.

- All imports must pass stringent labelling requirements which must be in the Uzbek language.

- The Uzbekistani government allows duty-free import of machinery and equipment for certain sectors to develop local industries. For example, there are no import duties for textile equipment and machinery, and for spare parts.

- Excise tax, charged as a percentage of the declared customs value, must be paid on certain products, such as cigarettes, vodka, ice-cream, oil and gas condensate, fuels, cars and carpets.

Sources: WTO - Trade Policy Review, Fitch Solutions

Trade Updates

Uzbekistan began official negotiations on accession to the WTO with assistance from Russia. Uzbekistan's Working Party was established on December 21, 1994, and met for the third time in October 2005. A WTO Accessions conference was held in Moscow in December 2019 and a fourth Working Party meeting is planned for spring 2020.

Multinational Trade Agreements

Active

Tajikistan-Uzbekistan: This bilateral free trade agreement (FTA) on goods has been in effect since January 1996. Uzbekistan trades extensively with Tajikistan, and this trade is set to grow with greater industrial development in both countries.

Azerbaijan-Uzbekistan: This bilateral FTA on goods has been in effect since 1996. Uzbekistan supplies vehicles, non-ferrous metals, pharmaceutical products, fertilisers, electrical and mechanical appliances, and agricultural products to Azerbaijan, and renders services in the transport, tourism and other spheres. Azerbaijan's export to Uzbekistan mainly consists of mechanical appliances, confectionery products, various organic and chemical compounds, tanning and dyeing extracts.

Ukraine-Uzbekistan: This bilateral agreement on goods was signed in December 1994 and became effective in January 1996. Uzbekistan's imports from Ukraine mainly consist of iron and steel, the products of the light and chemical industries, and agricultural products. Uzbekistan supplies various types of engineering products, chemical products, pharmaceuticals and agricultural products to Ukraine. Both countries have stressed the importance of expanding bilateral relations between their respective business communities and the implementation of joint projects to enhance economic cooperation.

Russia-Uzbekistan: This bilateral agreement on goods was signed in November 1992 and became effective in March 1993. The trade turnover between Russia and Uzbekistan for 2017 increased by 34% to USD3.65 billion compared to 2016 (latest data available).

Kazakhstan-Uzbekistan: This bilateral FTA on goods has been in effect since January 1997. Trade turnover between Kazakhstan and Uzbekistan amounted to USD2 billion in 2017 (latest data available), 31.2% higher than in 2016. Exports from Kazakhstan grew by 35% in 2017 to USD1.3 billion, while imports increased by 25.1% to USD735.2 billion.

Kyrgyzstan-Uzbekistan: This bilateral agreement on goods was signed in December 1996 and became effective in March 1998. In 2017 (latest data available), the trade turnover between Uzbekistan and Kyrgyzstan increased by almost 60%.

Georgia-Uzbekistan: This bilateral agreement on goods became effective in January 1995. The trade turnover between the two countries amounted to USD105 million in 2015 (latest data available), up 54% from 2014.

CISFTA: After it came into effect in September 2012, this agreement created a FTA between eight of the 11 CIS states – Russia, Ukraine, Belarus, Moldova, Armenia, Kyrgyzstan, Tajikistan and Kazakhstan. Uzbekistan became the ninth member when it joined in April 2014. It provides for the free movement of goods within the territory of the CIS, non-application of import customs duties, non-discrimination, gradual decrease of export customs duties and abolishment of quantitative restrictions in mutual trade between the CISFTA member states.

EU-Uzbekistan: Bilateral trade relations between the EU and Uzbekistan are governed by a Partnership and Cooperation Agreement (PCA) that has been effective since July 1999. In terms of trade, the PCA is a non-preferential agreement ensuring most-favoured nation (MFN) treatment and prohibiting quantitative restrictions in bilateral trade. MFN treatment is granted with respect to: custom duties and charges applied to imports and exports; direct and indirect taxes applied to imported goods; and rules relating to the sale, purchase, transport, distribution and use of goods on the domestic market. The EU and Uzbekistan have held three rounds of negotiations on an Enhanced PCA.

Sources: WTO Regional Trade Agreements database, European Commission, Asia Regional Integration Center, United Nations ESCAP

Foreign Direct Investment

Foreign Direct Investment Policy

Foreign investors can get consultations, business registration and other legal assistance from the Investment Promotion Agency, which operates as a branch of the Ministry of Investments and Foreign Trade, or from the Chamber of Commerce and Industry of Uzbekistan. These agencies provide investors with consulting services, as well as information and analysis support.

Foreign ownership and control are prohibited for airlines, railways, power generation, long-distance telecommunication networks, and other sectors deemed to be related to national security.

The Law on Denationalisation and Privatisation (adopted in 1991, last amended in 2018) lists state assets that cannot be privatised, including land with mineral and water resources, the air basin, flora and fauna, cultural heritage sites and assets, foreign and gold reserves, state trust funds, the central bank, enterprises that facilitate monetary circulation, military and security-related assets and enterprises, firearms and ammunition producers, nuclear research and development enterprises, some specialised producers of drugs and toxic chemicals, emergency response entities, civil protection and mobilisation facilities, public roads and cemeteries.

In August 2019, the president signed a law (ZRU-522) that allows for the privatisation of specified non-agricultural land plots and it will come into force on March 1, 2020. Foreign citizens and non-resident legal entities may not acquire privatised plots unless otherwise provided by the Land Code.

In December 2019, the president signed a new law (ZRU-598) on investments and investment activities, and it entered into force on January 27, 2020. The law recognises three categories of investment: capital, financial and social. The law introduces new investor-support mechanisms, such as an investment tax credit that allows an investor to deduct a certain percentage of specific investment-related taxes from their tax liability; and an investment subsidy that enables the government to finance the construction of an external infrastructure element that might be required for an investment project. The law makes the Ministry of Investment and Foreign Trade a one-stop shop for investors.

The government of Uzbekistan is trying to attract direct, private foreign investment into the following economic sectors by offering tax benefits to particular industries, including: electronics, tourism, ICT, textiles, food, building materials, chemicals and pharmaceuticals.

Foreign investment in media enterprises is limited to 30%. In finance, foreign investors may operate only as joint venture partners with Uzbek firms, and banks with foreign participation face minimum fixed charter funding requirements (EUR10 million for commercial banks, EUR5.0 million for private banks and EUR1.5-6 million for insurance companies – equivalent to USD10.7 million, USD5.3 million and USD1.6-6.4 million, respectively), while the required size of charter funds for Uzbek firms is set on a case-by-case basis.

As of October 2019, the World Bank's International Finance Corporation's (IFC) investment portfolio in Uzbekistan amounted to USD58 million in the financial and textile sectors. In addition, the IFC's advisory services are assisting the country in its plans to privatise state-owned enterprises (SOEs), improve the cotton sector (including fewer exports of raw cotton and more domestic textile production), develop and diversify the financial market, pilot public-private partnerships in the renewables and health sectors, and promote energy efficiency in the chemical sector. In July 2019 a credit line of USD35 million was approved by the IFC to support the transformation of state-owned Ipoteka Bank.

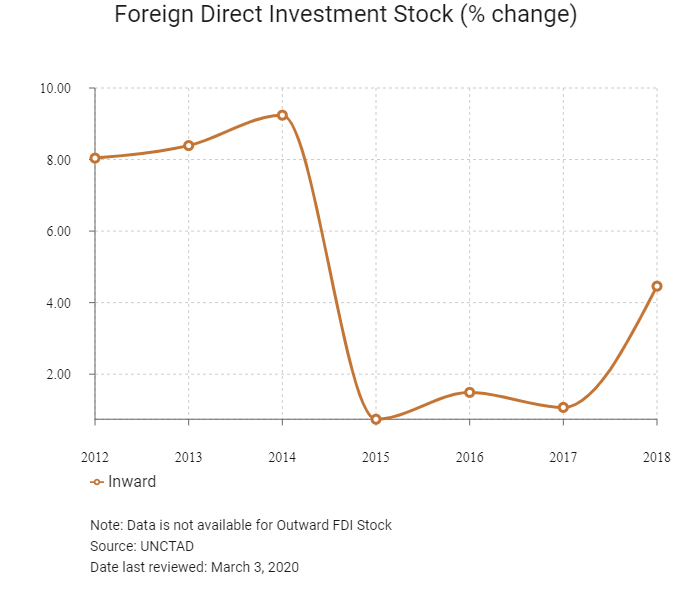

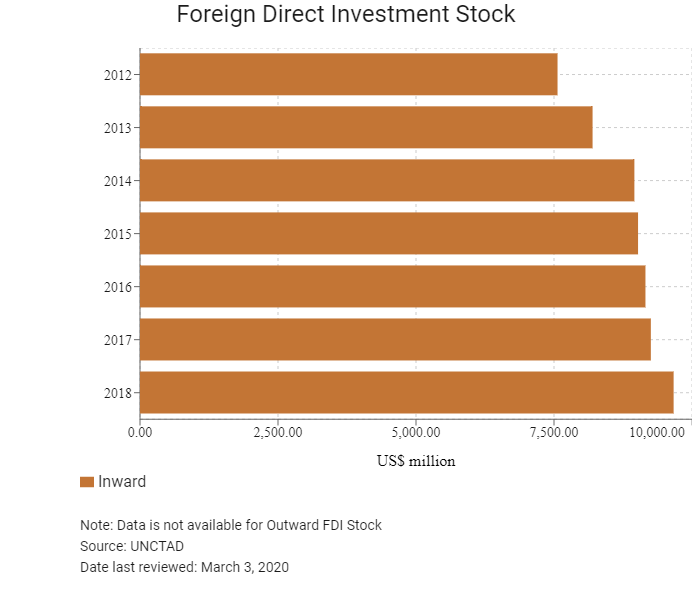

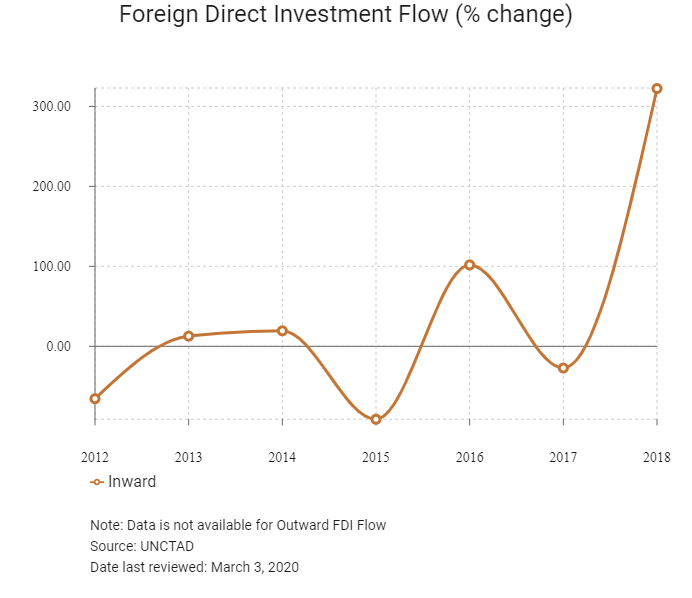

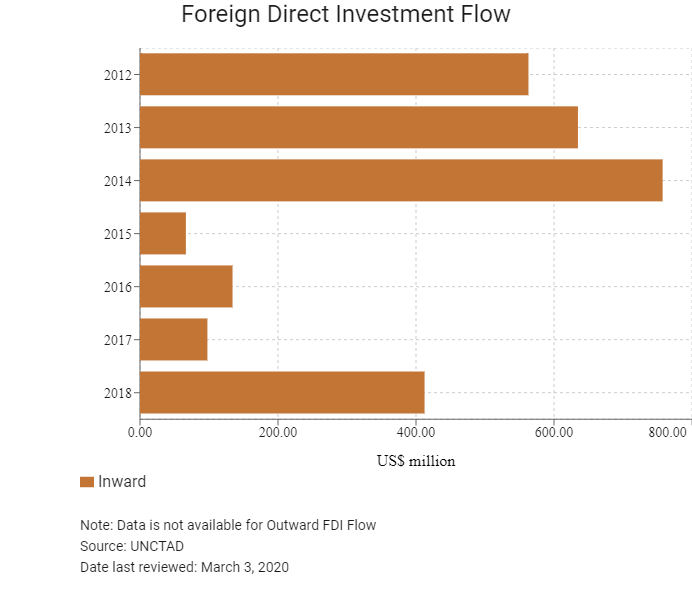

Although official figures are not yet available, Mirziyoyev claimed in his January 2020 address to parliament that FDI in 2019 had reached USD4.2 billion, almost four times the total in 2018, and that the investment rate had risen to 37%. The figures suggest that Uzbekistan is opening up to international finance and trade.

Uzbekistan has bilateral investment treaties in force with 46 countries or economic unions, such as the Belgium-Luxembourg Economic Union. It has signed a further five BITs that have not yet come into force.

Uzbekistan is a signatory to the United States-Central Asia Trade and Investment Framework Agreement (TIFA), a treaty with investment provisions, which has been in force since 2004 with the United States, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan.

Source: WTO – Trade Policy Review, The International Trade Administration, US Department of Commerce, Investment Promotion Agency, Ministry of Investments and Foreign Trade of the Republic of Uzbekistan, Chamber of Commerce and Industry of Uzbekistan, World Bank, UNCTAD

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

There are 22 Free Economic Zones (FEZs): Navoi, Angren, Jizzakh, Urgut, Gijduvan, Kokand, Namangan, Hazarasp, Termez, Nukus-pharm, Zomin-pharm, Kosonsoy-pharm, Sirdaryo-pharm, Boysun-pharm, Bustonlik-pharm, Parkent-pharm, Andijan-pharm, Charvak, Balik, Sirdaryo, Bukhoro-agro and Chirokchi |

- Businesses in FEZs are exempt from a number of payments, including: land tax; income tax; tax on the property of legal entities; tax on improvement to and development of social infrastructure; mandatory contributions to the Republican Road Fund and extra-budgetary fund for the reconstruction, overhaul and equipment of secondary schools, professional colleges, academic lyceums and medical institutions; customs payments (except for clearance fees) for equipment, raw materials and components imported for production needs; customs payments (except for clearance fees) for construction materials not produced in the republic, imported within the framework of approved projects.

- For those investing USD10 million-plus, a reduced rate of tax on profits (50% lower than the prevailing rate) will apply during the next five years following the exemption period. |

|

Extraction and exploration incentives for oil companies |

- Tax exemptions during the operating period |

|

Incentives for exporters |

Companies involved in exporting its own goods can defer payment of VAT on imported materials to make the goods being exported. The deferment lasts for 90 days and does not accrue interest due. |

|

Customs exemptions |

- Vehicles used for the international transportation of goods, luggage, and passengers |

Source: US Department of Commerce, Fitch Solutions, Ministry of Investments and Foreign Trade of the Republic of Uzbekistan, World Bank

- Value Added Tax: 15%

- Corporate Income Tax: 12%

Source: Ministry of Finance of the Republic of Uzbekistan

Important Updates to Taxation Information

As of January 1, 2018, corporate income tax (CIT) was unified with the infrastructure development tax (IDT). Mandatory contributions to designated funds (the pension fund, road fund and educational/medical institutions fund) have been collated into a single contribution known as unified social payment (USP). On September 26, 2019, Presidential Decree 5837 stipulated that from October 1, 2019, VAT would be reduced and excise rates for most excisable goods would increase. The Cabinet of Ministers was also instructed to take into account the following changes when preparing the budget in 2020: setting the CIT base rate at 15% and reducing the USP applicable to state entities, or where the state holds a majority share, from 25% to the rate of 12% currently applicable to other entities.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT (standard) |

12% |

|

CIT for commercial banks |

20% on operating profits |

|

CIT for providers of mobile telecommunications services |

20% irrespective of profits |

|

Capital Gains |

Subject to the normal CIT rate |

|

Dividends |

Dividends paid to residents or nonresidents are subject to a 10% withholding tax. |

|

Withholding Tax |

Interest: 10% |

|

VAT |

The standard rate is 15%, but most financial services are exempt from VAT and lower rates apply to certain entities: catering and hotel services is 10%, construction businesses 8%, retailers and wholesalers 6%, and entities selling agricultural products (other than their own produce) 4%. |

|

Property and Land Tax |

- Property tax is charged at an annual rate of 2% of the net book value of the immovable property, adjusted for the effect of revaluation, and it can be doubled if there is overdue construction. - Businesses are exempt from paying property tax for the first two years after their initial registration. - All enterprises in Uzbekistan (including foreign ones) that own land or rights to the use of land (such as through a lease agreement) are liable to pay land tax and it is usually a fixed fee depending of the location, quality and area of the relevant plot of land. |

|

Payroll Tax: Social security |

All employers pay a USP of 12%, but for state organisations, or a legal entity in which the state holds a 50% or greater interest, the USP payable is currently 25%. |

Source: Ministry of Finance of the Republic of Uzbekistan

Date last reviewed: March 3, 2020

Localisation Requirements

The Uzbekistan government's agency on Foreign Labour Migration sets quantitative restrictions for the hiring of foreign workers in certain sectors. For example, all head accountants in banks and auditing firms operating in the country must be Uzbek nationals. Furthermore, for projects conducted under production sharing agreements, only 20% of the workforce employed is permitted to be foreign.

Foreign Worker Permits

In order to be allowed to hire foreign personnel, companies must demonstrate that an Uzbek national does not have the requisite skills for the relevant position. Any company wanting to employ foreign labour also needs to obtain a foreign labour licence from the Uzbekistan government. Foreign worker permits generally take one month to be issued and are subject to a state duty of around USD480. Foreign workers must register with Uzbekistan's Ministry of Labour and Social Protection. It is therefore a fairly lengthy process.

By virtue of the country's CIS membership and Soviet heritage, it is easy for workers from Russia and other CIS member states to work in Uzbekistan.

Exemptions for Business Travel

A bilateral visa-free regime has been established with Kyrgyzstan (up to 60 days), Tajikistan (up to 30 days), Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Moldova, Russia and Ukraine. From February 10, 2018, a visa-free regime is introduced for a 30-day period for citizens of seven new countries, including Japan, Indonesia, Israel, Republic of Korea, Malaysia, Singapore and Turkey. Citizens from Mainland China and Hong Kong can use a simplified procedure for the issuing of tourist visas since February 10, 2018. Previously, the simplified procedure for issuing visas was available for citizens of Austria, Belgium, the UK, Germany, Spain, Italy, Latvia, France, Switzerland, Thailand, the Czech Republic and Poland. The citizens of 53 countries (including Mainland China and Hong Kong) can now enjoy a visa-free transit entry stay for up to five days, provided certain arrival criteria are met.

The visa-free regime applies to citizens of select countries, and holders of all categories of passports (diplomatic, service and civil) planning to visit the Republic of Uzbekistan for up to 30 days, regardless of the purpose of their trip.

Sources: Investment Promotion Agency, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (Stable) |

12/02/2019 |

|

Standard & Poor's |

BB- (Stable) |

21/12/2018 |

|

Fitch Ratings |

BB- (Stable) |

11/10/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

74/190 |

76/190 |

69/190 |

|

Ease of Paying Taxes Index |

78/190 |

64/190 |

69/190 |

|

Logistics Performance Index |

99/160 |

N/A |

N/A |

|

Corruption Perception Index |

158/180 |

153/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

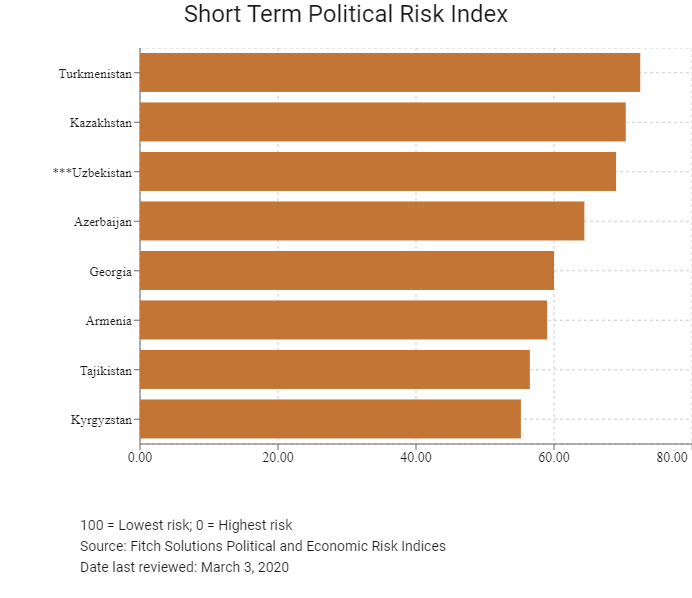

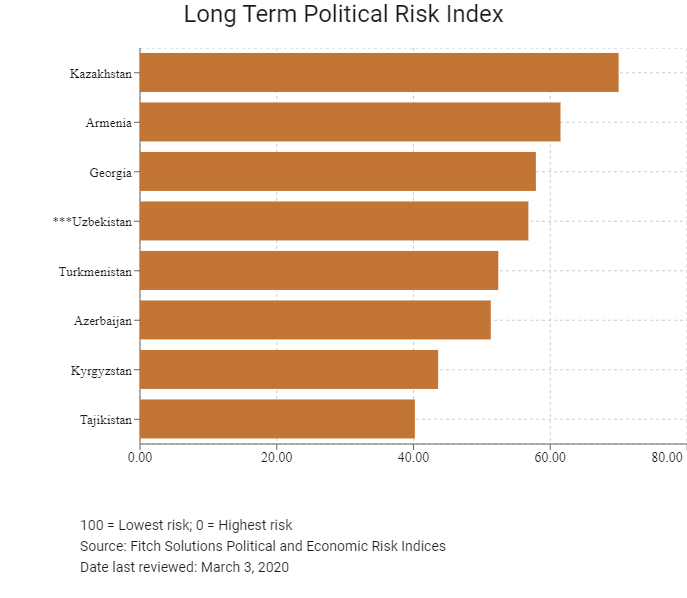

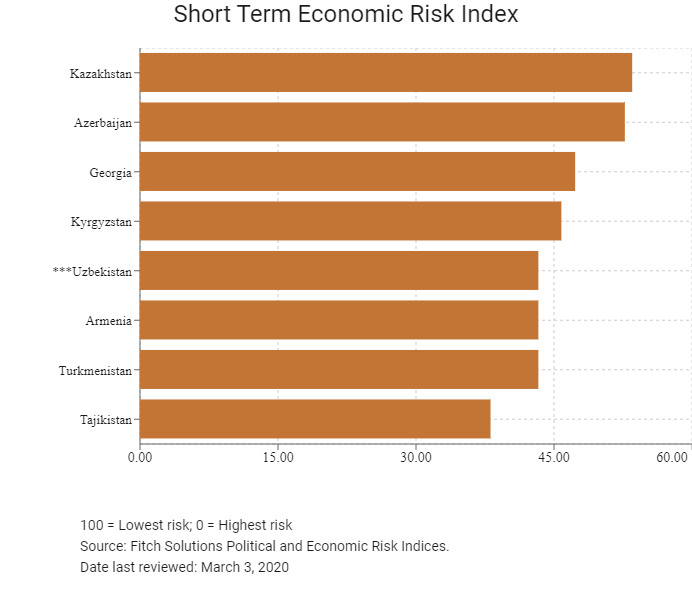

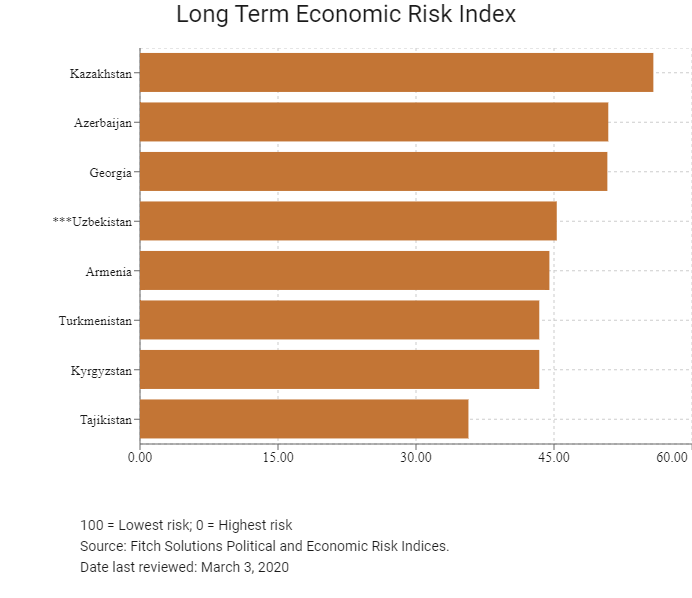

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

92/202 |

126/202 |

142/201 |

|

Short-Term Economic Risk Score |

47.7 |

41.5 |

43.3 |

|

Long-Term Economic Risk Score |

52.8 |

48.6 |

45.3 |

|

Political Risk Index Rank |

127/202 |

124/202 |

123/202 |

|

Short-Term Political Risk Score |

66.3 |

69 |

69 |

|

Long-Term Political Risk Score |

56.8 |

56.8 |

56.8 |

|

Operational Risk Index Rank |

135/201 |

124/201 |

123/201 |

|

Operational Risk Score |

41.3 |

44.3 |

44.7 |

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The devaluation of the soum on September 5, 2017, and the removal of currency controls were major steps in opening up Uzbekistan's economy to foreign direct investment and international trade. Moreover, President Shavkat Mirziyoyev has sought to build international trade links, modernise key industries and reduce tensions with neighbours. Ties with Uzbekistan's neighbours have been improving under Mirziyoyev's leadership, and disputes around water supplies and borders are being resolved. Improving relations with Russia are a positive and further cooperation in relation to a potential threat from instability in Afghanistan seems likely. The prospect of Uzbekistan joining the Eurasian Economic Union has also risen. Nevertheless, the economy remains largely dependent on commodity exports and the country is developing only slowly after years of isolation. Uzbekistan's economic growth prospects face headwinds in the near term, but are bright for the future. Inflationary pressures and a need to tighten fast credit growth will weigh in the short term, but reform momentum is expected to drive longer-term growth.

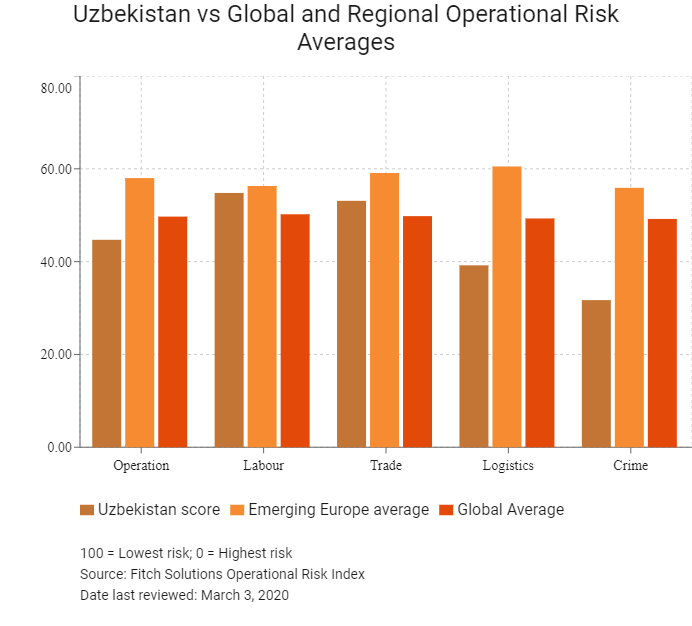

OPERATIONAL RISK

Companies seeking to capitalise on Uzbekistan's strong growth trajectory, natural resources and strategic position on Mainland China's new Silk Road route, the Belt and Road Initiative, have had their confidence renewed since Mirziyoyev's election on the back of increased prospects for the implementation of business-friendly structural reforms aimed at opening up the economy. The presence of oil, gold and agricultural land, and the biggest population in the region also point to promises of growth over the medium to long term.

Source: Fitch Solutions

Date last reviewed: February 26, 2020

Fitch Solutions Political and Economic Risk Indicies

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Uzbekistan score |

44.7 |

54.8 |

53.1 |

39.2 |

31.7 |

|

Caucasus and Central Asia Average |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Caucasus and Central Asia Position (out of 8) |

6 |

5 |

5 |

8 |

7 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

29 |

20 |

24 |

31 |

30 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

123 |

70 |

90 |

133 |

166 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Georgia |

62.3 |

63.5 |

71.4 |

56.1 |

58.3 |

|

Azerbaijan |

61.2 |

62.5 |

62.5 |

66.4 |

53.2 |

|

Kazakhstan |

60.2 |

73.5 |

58.9 |

57.0 |

51.5 |

|

Armenia |

56.8 |

60.5 |

58.6 |

53.9 |

54.2 |

|

Kyrgyzstan |

44.9 |

54.1 |

44.6 |

43.1 |

37.7 |

|

Uzbekistan |

44.7 |

54.8 |

53.1 |

39.2 |

31.7 |

|

Tajikistan |

44.6 |

54.6 |

39.1 |

41.4 |

43.2 |

|

Turkmenistan |

39.6 |

42.4 |

39.3 |

47.3 |

29.4 |

|

Regional Averages |

51.8 |

58.2 |

53.4 |

50.5 |

44.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 3, 2020

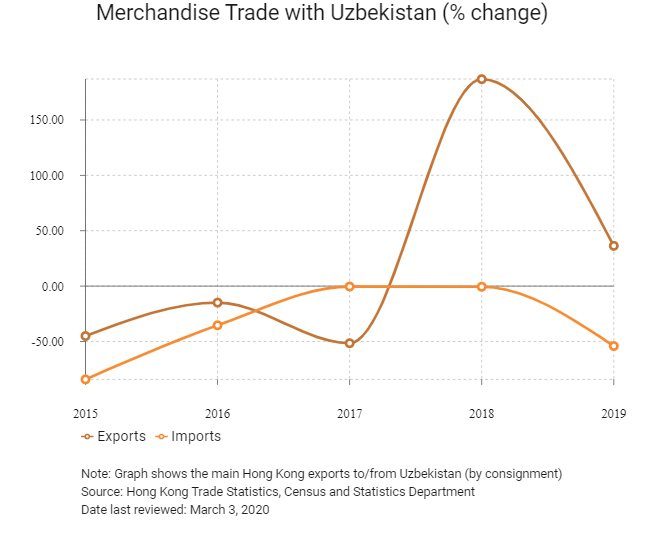

Hong Kong’s Trade with Uzbekistan

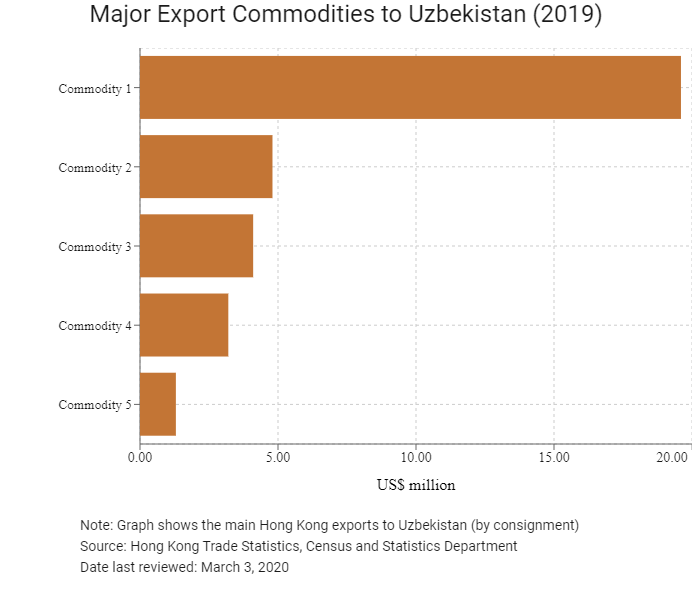

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 19.6 |

| Commodity 2 | Office machines and automatic data processing machines | 4.8 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 4.1 |

| Commodity 4 | General industrial machinery and equipment, and machine parts | 3.2 |

| Commodity 5 | Miscellaneous manufactured articles | 1.3 |

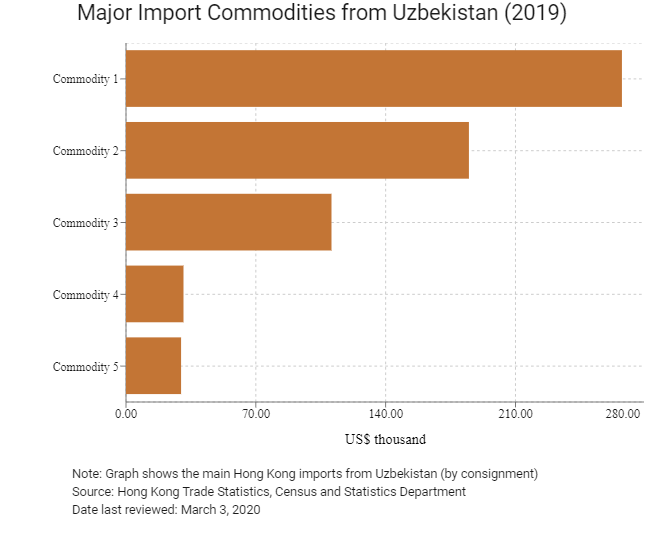

| Import Commodity | Commodity Detail | Value (US$ thousand) |

| Commodity 1 | Textile yarn, fabrics, made-up articles, and related products | 267.4 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 184.9 |

| Commodity 3 | Miscellaneous manufactured articles | 110.8 |

| Commodity 4 | Live animals other than animals of division 03 | 31.0 |

| Commodity 5 | Vegetables and fruit | 29.7 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Uzbek residents visiting Hong Kong |

331 |

-4.9 |

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

|

Number of emerging Europe citizens residing in Hong Kong |

114 |

29.6 |

Note: Growth rate for resident data is from 2015 to 2019, no UN data available for intermediate years

Sources: Hong Kong Tourism Board, United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Date last reviewed: March 3, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Uzbek companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Uzbekistan

Uzbekistan has a bilateral investment treaty with Mainland China that entered into force on September 1, 2011.

Visa Requirements for Hong Kong Residents

From February 10, 2018, a simplified procedure for issuing Uzbekistani tourist visas was introduced for Hong Kong residents that implies getting a visa within two working days, not counting the day of receiving documents. Tourists will be given multiple-entry visas for up to one month, and representatives of the business community for up to one year, without requiring a tour voucher or an invitation from an inviting legal or physical person in Uzbekistan.

Since January 1, 2020, Hong Kong citizens can visit Uzbekistan for a visa-free stay of up to five days when arriving through Uzbekistan's international airports, provided the visitor has a return air ticket.

Sources: Ministry of Foreign Affairs of the Republic of Uzbekistan

Date last reviewed: February 21, 2020

Uzbekistan

Uzbekistan