GDP (US$ Billion)

141.65 (2018)

World Ranking 58/193

GDP Per Capita (US$)

30,969 (2018)

World Ranking 31/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

100.5 (2018)

Currency (Period Average)

Kuwaiti Dinar

0.3per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

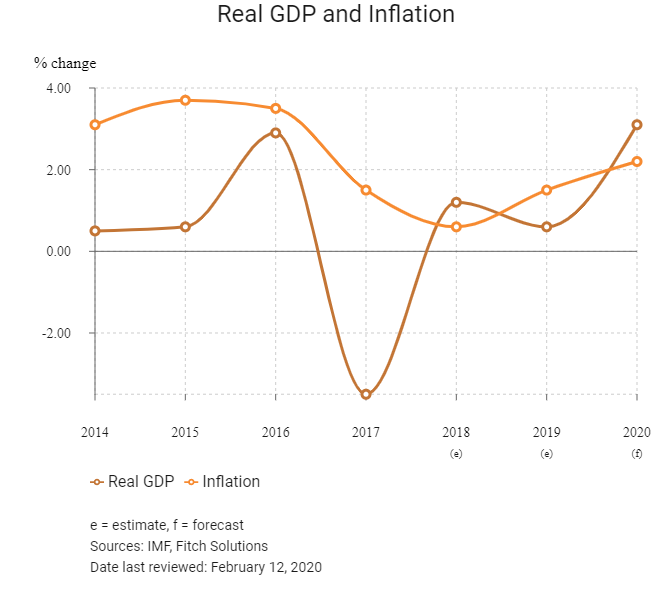

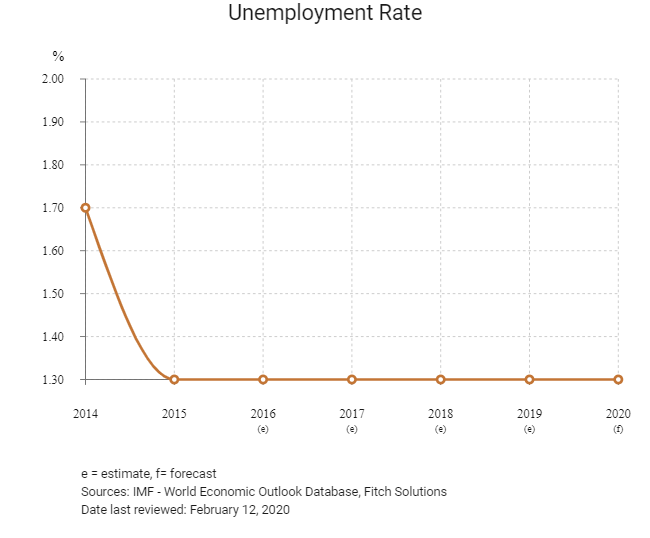

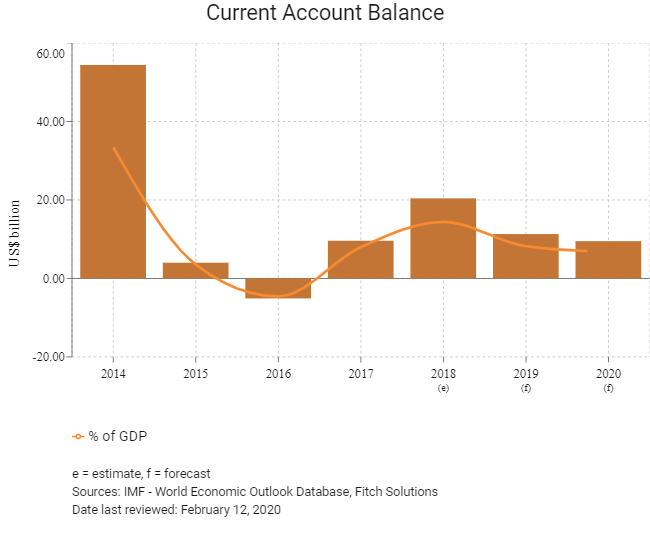

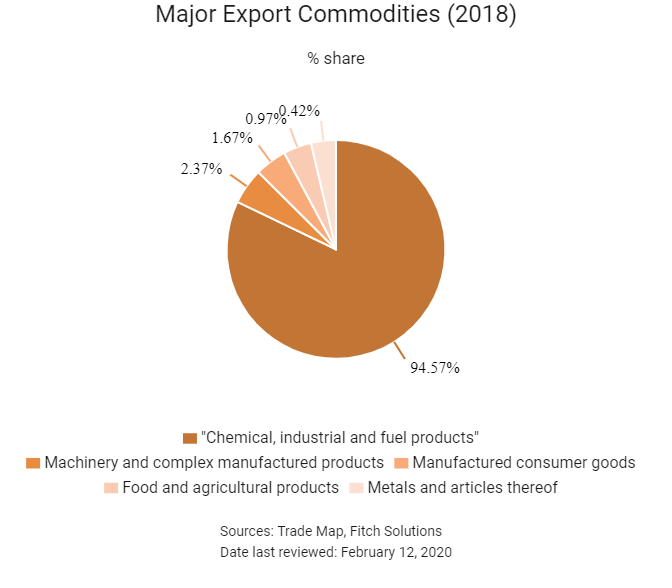

Kuwait has a geographically small, but wealthy, and relatively open economy with significantly high crude oil reserves. An extension of OPEC+ production cuts will weigh on Kuwait's growth rate over the coming quarters. Against this backdrop, fiscal revenues from the oil and gas sector, which typically make up 90% of total revenues, will lead to a decline in total revenues. At the same time, there is little likelihood that spending will be meaningfully reined in, in light of lower revenues. Public finances should also be supported by the gradual implementation of spending and revenue reforms, including the implementation of a value-added tax (VAT) in the near future. Absolute poverty and involuntary unemployment are virtually non-existent. In addition, 80% of employed Kuwaiti nationals work in the public sector. In contrast, expatriates, who make up two-thirds of the population, constitute the bulk of lower-income residents.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

June 2013

The Constitutional Court ordered dissolution of parliament, effectively dismissed results of parliamentary polls.

November 2015

Opposition groups and their allies in Kuwait won nearly half the 50 seats in parliament.

October 2018

The Public Authority for Roads and Transportation in Kuwait was set to award up to 13 deals pertaining to road projects across the country. The schemes to be contracted include an extension of the Seventh Ring Road Project, which involved building 93km of highways; an extension of the Salmi highway; and the construction of a northern regional road from Al Mutla'a. It would also cover work for phases two and three of the South Surra Road modernisation package, which included the construction of roads, bridges and sewerage systems.

March 2019

Kuwait's Ministry of Public Works launched tenders for around 125 development projects across the country, as part of its plan for the FY2019/2020 ending March 31, 2020 (Arab Times). Of the total, 23 belong to the healthcare engineering sector, while 51 were classified as maintenance engineering projects. Some were renovation projects including road repair and refurbishment of government buildings. The schemes would include construction of aircraft parking stands and transport corridors for Kuwait International Airport's new Terminal 2, a new private school in the southern commercial hub of Egaila, a volunteer centre and a children's hospital.

April 2019

Korea Land and Housing Corporation (LH), as part of a consortium, was preparing the master plan for South Saad Al-Abdullah New City in Kuwait. South Saad Al-Abdullah New City would come up on 64.4sq km site and would be one of the nine new cities that Kuwait plans to build. The city would feature minimum 25,000 houses. LH had commissioned specialists to examine the project site and start design work, drawing up a master plan to construct a futuristic city connected with smart devices.

July 2019

Planning was under way to build an industrial techno-complex in Kuwait. The facility, covering an area of 200,000 square meters, would contribute to industrial and technical research and innovation, especially in the petrochemical, renewable energy and water resources sectors. It would also include training and rehabilitation centres for the industrial sector.

November 2019

SSH was appointed as design consultant for the Hessah Al Mubarak mixed-use district project, which had a total leasable built-up area of 381,000sq m, in Kuwait. The project would consist of 82 plots for residential buildings, serviced apartments, offices, clinics, health clubs and retail spaces, among others. SSH would provide design consultancy services, which included architectural, interior design, landscape, structural, civil and mechanical, electrical and plumbing engineering design for various plots located in different segments within the master plan. It would also undertake quantity surveying, preparation of tender documentation, and delivering permitting and tendering services for the scheme, according to a press release from SSH.

2020

Kuwait was expecting the Clean Fuels Project and the Al-Zour refineries to come online in 2020. This would increase Kuwait’s refined products production by almost 30% in 2020, which in turn would offer a substantial boost in goods exports.

Sources: BBC country profile – Timeline, Fitch Solutions

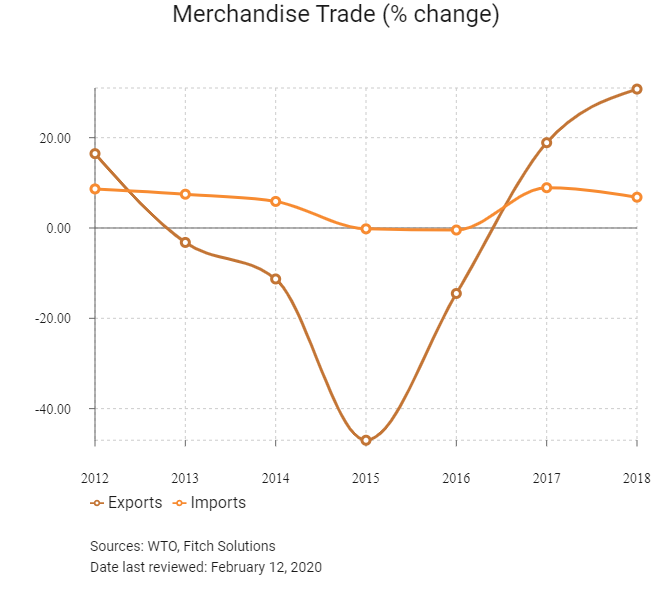

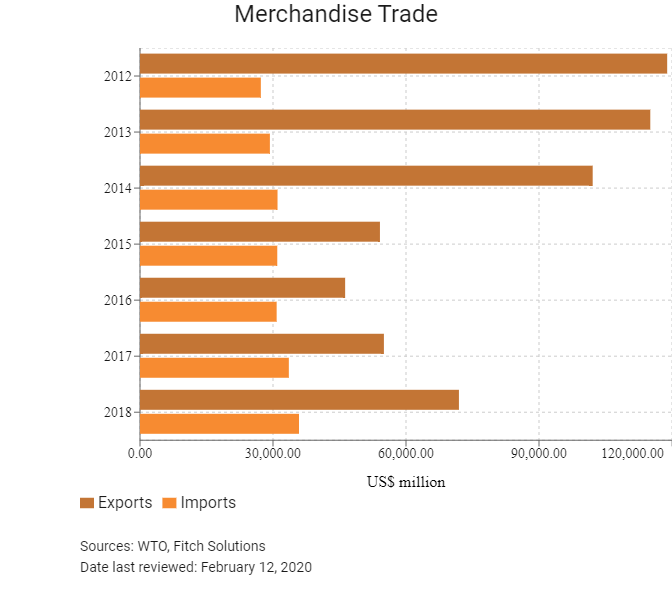

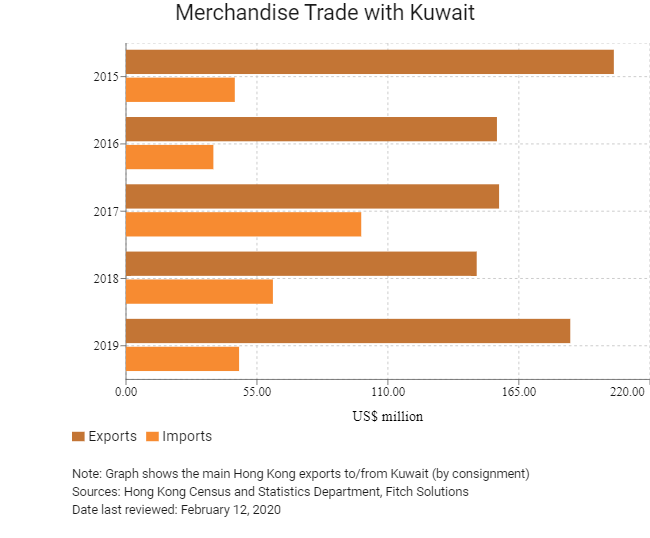

Merchandise Trade

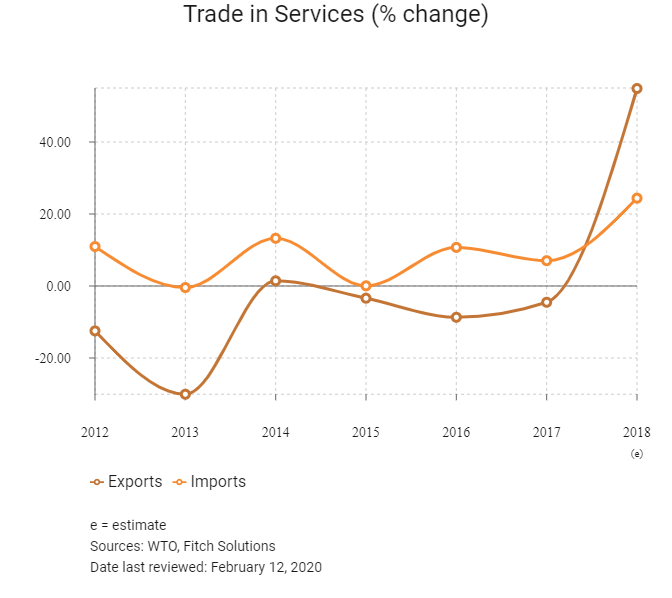

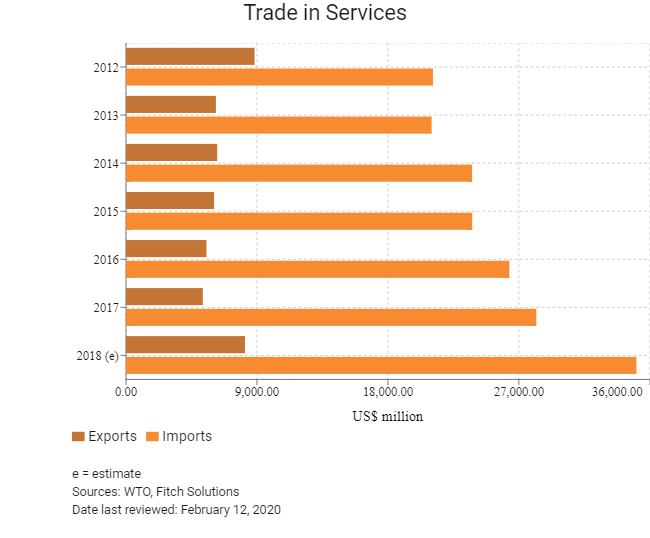

Trade in Services

- Kuwait has been a World Trade Organization (WTO) member since January 1, 1995 and a member of GATT since May 3, 1963.

- The country's Gulf Cooperation Council (GCC) membership means that it is part of a single market and customs union with a common external tariff. A tariff of only 5% is imposed on the majority of items imported from non-GCC countries, and there is a single point of entry where tariffs are collected once imports enter the GCC. Only imports on certain sensitive goods from GCC countries will face tariffs and there is freedom of movement between GCC countries without customs or non-customs restrictions.

- The average applied import tariff for goods entering Kuwait is 3.9%. This is the fifth highest out of six GCC states. Bahrain does not levy customs duties on any exports. Some further import trade barriers exist for sensitive goods and prominent domestic industries, although the overall impact on these is fairly minimal.

- The most extensive non-tariff barrier for trade that mostly applies for non-GCC states is the extensive trade bureaucracy and associated costs that come with exporting and importing from and to Kuwait. On average, the times and associated costs for border and documentary procedures (both for exports and imports) are some of the longest and highest in the GCC, which reduces the country's competitiveness as a trading destination when compared to its regional peers.

- For cultural and religious reasons an import ban is applicable for alcoholic drinks imports.

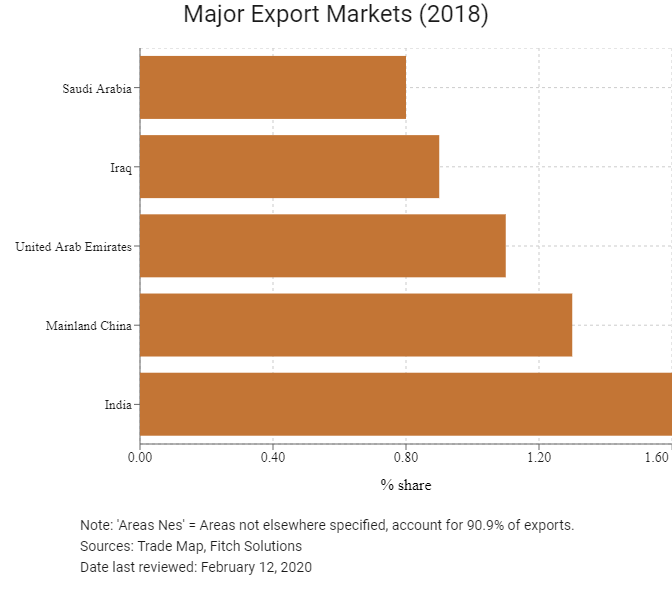

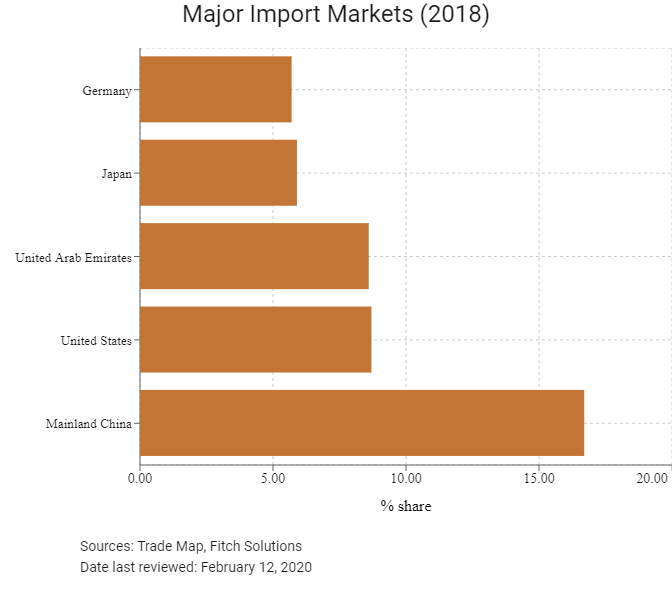

- Kuwait's main exporting partners are largely reflective of the economic bloc and free trade agreements that the country is party to.

Sources: WTO - Trade Policy Review, Fitch Solutions

Trade Updates

The gradual implementation of spending and revenue forms part of efforts to diversify revenues among GCC members.

Multinational Trade Agreements

Active

- Greater Arab Free Trade Area (GAFTA): GAFTA came into force on January 1, 1998. In March 2001, it was decided to speed up the liberalisation process, and on January 1, 2005 the elimination of most tariffs among GAFTA members was enforced. The 17 members of GAFTA are Algeria, Bahrain, Egypt, Iraq, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, UAE and Yemen. GAFTA was declared within the Social and Economic Council of the Arab League as an executive programme to activate the Trade Facilitation and Development Agreement and the elimination of most tariffs among GAFTA members. GAFTA saw tariffs between 17 Arab states rapidly decline from an average of 15% in 2002 to 6% in 2009. Trade liberalisation has been of great benefit to all member states and has aimed to reduce the cost of imports to Saudi Arabia; however, regional instability and domestic security concerns have diminished the effect of this agreement and have created trade barriers.

- The GCC: Kuwait's trade with GCC countries is tariff free. The geographic proximity of these countries and their general adoption of free trade economic policies are factors that foster a competitive business environment. Trade between Kuwait and the GCC amounted to more than US$8.2 billion in 2018, with the bulk consisting of imports (USD6.2 billion).

- GCC-European Free Trade Association (EFTA - Iceland, Liechtenstein, Norway and Switzerland): The EFTA is one of Kuwait's largest trade partners. The EFTA States signed a Free Trade Agreement with the GCC in Hamar, Norway, on 22 June 2009. The Agreement entered into force on 1 July 2014. The agreement covers the progressive elimination of tariffs in trade in services and manufactured goods, as well as investment and other trade-related issues such as the protection of intellectual property, and is fully consistent with provisions of the World Trade Organization. In addition, bilateral arrangements on agricultural products between three individual EFTA states and the GCC form part of the instruments establishing the free trade area between both sides.

- GCC-Singapore FTA: The GCC-Singapore FTA (GSFTA) took effective on September 1, 2013. The GSFTA eliminates most tariffs (99%) of Singapore's exports to the GCC. This is a comprehensive agreement covering trade in goods, rules of origin, customs procedures, trade in services and government procurement among others. Key sectors benefitting include telecommunication, electrical and electronic equipment, petrochemicals, jewellery, machinery and iron and steel-related industry. The recognition of the halal certification of Singapore's Majlis Ugama Islam Singapura will also pave the way for trade in halal-certified products to gain faster access to the GCC countries.

Under Negotiation

- The United States-Middle East Free Trade Area Initiative (MEFTA): In 2004, the United States and Kuwait signed into force the Trade and Investment Framework Agreement, with the aim of regulating all commercial matters between Kuwait and the United States. The countries targeted to join MEFTA are Algeria, Bahrain, Egypt, Iran, Iraq and Israel (and through Israel, the Palestinian Authority), Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia and Yemen. This includes a wide range of trade and investment issues such as market access, intellectual property rights, and labour and environmental issues. MEFTA will help in growing commercial and investment opportunities by identifying and working to remove impediments to trade and investment flows between member states. This expands the scope of markets for businesses in Kuwait to export products to, and will significantly reduce trade costs.

- Australia-GCC: Australia and the GCC share a significant economic relationship, encompassing trade and investment across a broad range of goods and services. The GCC is a key market for agricultural exports such as livestock, meat, dairy products, vegetables, sugar, wheat and other grains. The agreement provides an opportunity to address a range of tariff and non-tariff barriers related to food exports that will benefit the GCC.

- GCC-Mainland China: The first-round of negotiations of the GCC-Mainland China FTA commenced on April 27, 2005. Greater trade liberalisation will help develop the industrial and service sectors. Trade liberalisation with the GCC will help the group integrate and grow with mutual cooperation and comprehensive tariff reduction. In 2018, Mainland China accounted for around 10% of the GCC's total global trade.

- India-GCC: The GCC and India are negotiating an FTA. The agreement is expected to remove restrictive duties, push down tariffs on goods and pave the way for more intensive economic engagement between the nations. More than 50% of India's oil and gas comes from GCC countries.

- Japan-GCC: Japan and the GCC are negotiating an FTA. This agreement will seek to reduce tariffs and liberalise services trade and investment. Japan mainly imports aluminium, natural gas, liquid natural gas and petroleum products from the GCC, while Japan mainly exports electronics, vehicles, machinery and other industrial products to the GCC.

- Other: A number of other GCC FTAs are currently under negotiation. The countries engaged in negotiations include Pakistan, New Zealand, South Korea, the Mercosur bloc and Turkey.

Signed But Not Yet In Effect

The Trade Preferential System of the Organization of the Islamic Conference (TPS-OIC): The agreement would see to the promotion of trade between member states by including most-favoured nation principles, harmonising policy on rules of origin, exchanging trade preferences among member states, promoting equal treatment of member states and special treatment for least developed member states and providing for regional economic bodies made up of OIC nations to participate as a block. The agreement will cover all commodity groups. The OIC is made up of 57 members, making a full realisation of such an agreement highly impactful, encompassing approximately 1.8 billion people. Although the Framework Agreement, the Protocol on Preferential Tariff Scheme and the Rules of Origin have all been agreed on, a minimum of 10 members are required to update and submit their concessions list for the agreements to come into effect. As of January 2019, only seven nations have done so.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Kuwait continued to encourage foreign direct investment (FDI) with the implementation of Law No.116 of 2013 Regarding the Promotion of Direct Investment in the State of Kuwait (hereafter referred to as the FDI law). With the decline in oil revenue and the need to diversify its economy, the government seeks more foreign investments. The FDI law established the Kuwait Direct Investment Promotion Authority (KDIPA) to solicit investment proposals, evaluate their potential and assist in the licensing processes. In reviewing licensing requests, the KDIPA places emphasis on creating jobs and training/education opportunities for Kuwaitis, technology transfer, diversification of national income sources, increasing exports, support for local SMEs, and the use of Kuwaiti products and services.

- The KDIPA is a specialised public authority that is responsible for promoting direct investment in Kuwait through developing, promoting, advocating and regulating the environment. The Kuwait Investment Authority (KIA) is the oldest sovereign wealth fund in the world. KIA traces its roots to the Kuwait Investment Board, which was established in 1953, eight years before Kuwait's independence in 1961. In 1982, KIA was created by Law No. 47 as an autonomous governmental body responsible for the management of the assets of the country.

- While FDI law allows 100% foreign ownership in several industries, the KDIPA excludes foreign firms from investment in national security and state-owned sectors. Opportunities may increase as the KDIPA takes over the existing free trade zone at Shuwaikh and creates two new zones at Al-Abdali and Al-Nuwaiseeb.

- Move towards privatisation have continued in the stock exchange, as well as in the aviation, telecommunications and postal services sectors, potentially bringing increased opportunities for more competition in the coming years. In 2014, the Central Bank of Kuwait announced that foreign banks could open multiple branches in Kuwait and this presents opportunities in the financial sector. The National Assembly established the cornerstones of the current Kuwait Development Plan (KDP), with the intent to create a 'one-stop shop' designed to streamline and simplify investment procedures and thus attract greater levels of FDI. Since 2015, the KDP has issued foreign ownership business licences to companies such as IBM, Huawei, General Electric and the Berkeley Research Group.

- In 2014, the country passed new public private partnership (PPP) legislation, which is leading the way for significantly increased private participation in Kuwait's construction sector. Kuwait's Law No. 116 streamlines existing laws and introduces new regulations that improve transparency and investor safeguards. This has been the catalyst for the rapid development of the country's PPP market, with it going from a single PPP project in 2013 to 17 in 2016 (the second most in the MENA region). Therefore, Kuwait's economy is slowly emerging as being more open to foreign and private investment. Meanwhile, Kuwait has limited FTAs or special economic and industrial zones.

- Non-GCC nationals are not allowed to own land in Kuwait. Foreign investment in the extractive and real estate sectors is not permitted. Prior to the coming into force of the FDI law, foreign businesses were highly restricted in how they conducted business in Kuwait. Foreign businesses were not allowed to open independently or even establish a branch office, without the appointment of a Kuwaiti partner or agent. This Kuwait partner or agent had to own at least 51% of the business. Now under the new FDI law, 100% business ownership is permitted in a variety of sectors. However, businesses must apply through the KDP for a foreign ownership licence in order for this 100% ownership rule to apply.

- Given growing unemployment levels in the public and extractive sectors, the Kuwaiti government has started to impose stricter rules for the hiring of foreign workers since 2014.

Sources: WTO – Trade Policy Review, Government websites, Fitch Solutions

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| Kuwait Free Trade Zone (KFTZ) at Shuwaikh port | - 100% foreign ownership is permitted - Improved access to work permits for expatriate staff - Indefinite exemption from all income taxes - Moderate utility rates - Low land rental and utility rates - Exemption from taxation on all imports and exports from the zone - Modern infrastructure including IT and multimedia facilities - Capital and profits are freely transferable outside the KFTZ and are not subject to any foreign exchange controls |

Source: Fitch Solutions

- Value Added Tax: 0%

- Corporate Income Tax: 15%

Sources: Ministry of Finance Kuwait, Fitch Solutions

Important Updates to Taxation Information

- Kuwait is cooperating with the IMF to discuss the introduction of a corporate tax for locally based ventures, while the GCC has announced the introduction of a value-added tax of 5% in the GCC region (originally scheduled for implementation in Kuwait in 2018, but now postponed to 2021).

- Kuwaiti Members of Parliament advocated further restrictions on the employment of foreign workers, thus making Kuwait a more expensive relocation destination. In January 2018, the Kuwait Public Authority for Manpower reported that the ban should be implemented by July 2018. This will have a negative impact on the availability of skilled foreign labour and creates uncertainty for businesses operating in the country. While the government rejected a proposal to introduce a tax on expatriates' remittances, providing some relief to the availability of crucial foreign labour, such measures remain a key risk for businesses.

Business Taxes

Type of Tax | Tax Rate and Base |

| Corporate Income Tax (CIT) | 15% |

| Withholding Tax | - Dividends: generally not taxed; 15% if paid by investment funds, investment companies and bank - Interest: 0% - Royalties: 0% |

| Capital Gains Tax | 15% (treated as CIT) |

| VAT | 0% (5% likely to be implemented from 2021) |

| Zakat | 1% on operating profits (imposed on annual net profits of public and closed Kuwaiti shareholding companies) |

| Social security contributions | Employer contribution of 11.5% and employee contribution of 8% on gross salaries. Social security contributions are levied only with respect to Kuwaiti employees and employees who are citizens of other member states in the Gulf Cooperation Council. Payable monthly by up to KWD2,750 |

| National Labour Support Tax | 2.5% on operating profits (for listed companies) |

| Contribution to the Kuwait Foundation for the Advancement of Sciences (KFAS) | 1% on operating profits |

Sources: Ministry of Finance Kuwait, Fitch Solutions

Date last reviewed: February 12, 2020

Localisation Requirements

The Kuwaiti government is attempting to increase the employment of its citizens in the private sector. The government has applied more stringent requirements for the employment of foreign workers since 2014 as part of its 'Kuwaitisation' policy. A recent development was in April 2019, when Kuwait hiked its medical fees for expatriates in the country. They will now have to pay a USD33 (KWD10) fee to access medical treatment at polyclinics. The move comes after the country increased healthcare fees for foreigners for the first time in more than two decades in 2017. Kuwait made significant efforts to reduce the number of foreign workers in the domestic labour force over the course of 2016. In January 2017, it was reported that the Kuwaiti authorities deported more than 29,000 foreign workers throughout 2016 (an average of 80 per day) for reasons such as work permit violations, criminal activity and labour law violations. Kuwaiti Members of Parliament (MPs) are continuing their clampdown on foreign workers in Kuwait by advocating for further restrictions on their employment and making Kuwait a more expensive relocation destination. The authorities announced that all non-Kuwaitis working for the government will be replaced by locals over the next five years. This follows a range of proposals since a November 2016 election that led to a large increase in the number of seats held by the opposition in parliament. The majority of these opposition MPs are anti-austerity populists who have made a range of proposals targeting foreigners in the country, including the imposition of a 5% tax on all remittances being sent home by foreign workers and the removal of subsidised healthcare for non-Kuwaitis. Other proposals have included the introduction of nationality quotas and increasing charges for residency permits and visas for visiting family members.

Obtaining Foreign Worker Permits

To live and work in Kuwait, expatriates from outside the GCC must have iqama (a residence permit) which requires a Kuwaiti sponsor to obtain. The sponsoring employer must apply for a work permit from the Ministry of Social Affairs and Labour and acquire a no-objection certificate from the General Administration of Criminal Investigation at the Ministry of Interior. From January 1, 2018, the immigration and labour authorities no longer issue new work permits to professional foreign nationals under the age of 30.

Visa/Travel Restrictions

Visitors from non-GCC states require a visa for business or tourism purposes. British citizens can obtain a visa on arrival. It is noted that Israeli passport holders or those with an Israeli stamp in their passport may be denied entry to Kuwait on arrival. From January 2018, expatriate employees have to provide evidence of their educational qualifications in order to renew their visas.

The 'Kafala' Sponsorship System

While the 'Kafala' system has provided ease of access to inexpensive foreign labour imports for many businesses in Kuwait for years, this has also limited Kuwaiti employers from employing foreign labourers who are already in the country. This is because foreign workers currently employed under the 'Kafala system' in Kuwait require the permission of their current employer (the 'sponsor' of their work permit) if they want to change employers. After receiving significant criticism from international human rights groups over the fact that the country has not made significant reforms to its 'Kafala system' as many other GCC states have done, the Kuwaiti government announced in February 2017 that it was considering the cancellation of this system. The government is currently considering a system where it would effectively be the sponsor of all foreign private sector employees and where foreign workers (especially in low-skilled positions) would be accorded more rights.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | Aa2 (Stable) | 02/05/2019 |

| Standard & Poor's | AA (Stable) | 20/07/2011 |

| Fitch Ratings | AA (Stable) | 11/04/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 96/190 | 97/190 | 83/190 |

| Ease of Paying Taxes Index | 6/190 | 7/190 | 6/190 |

| Logistics Performance Index | 63/160 | N/A | N/A |

| Corruption Perception Index | 78/180 | 85/180 | N/A |

| IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

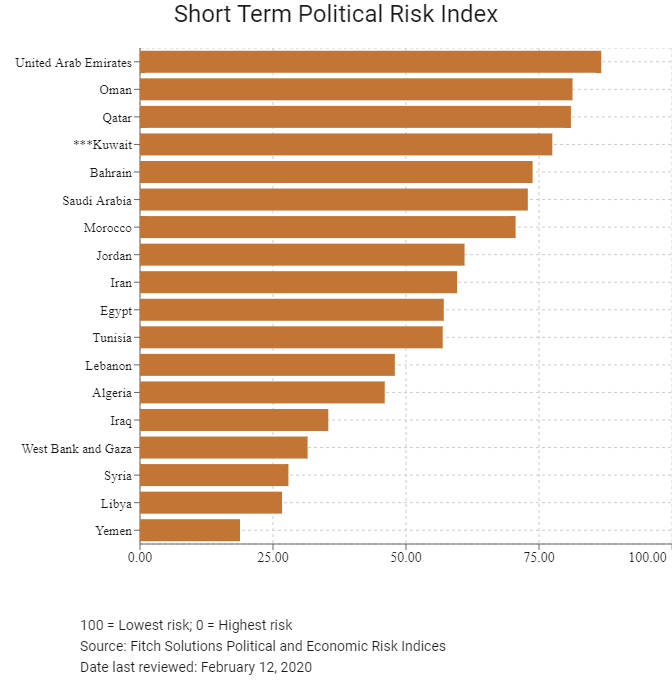

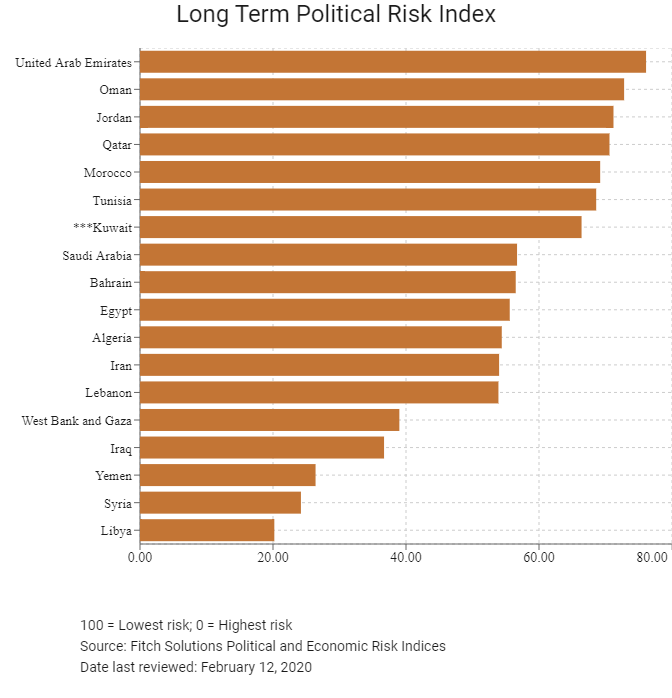

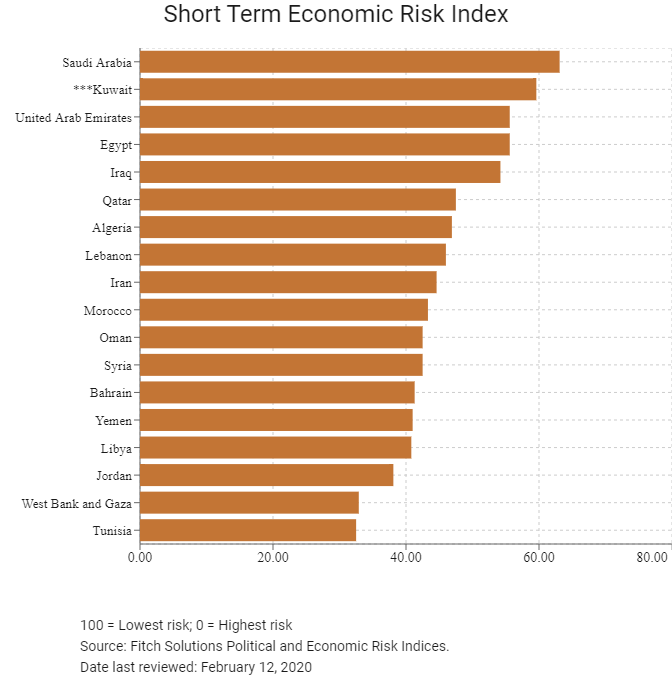

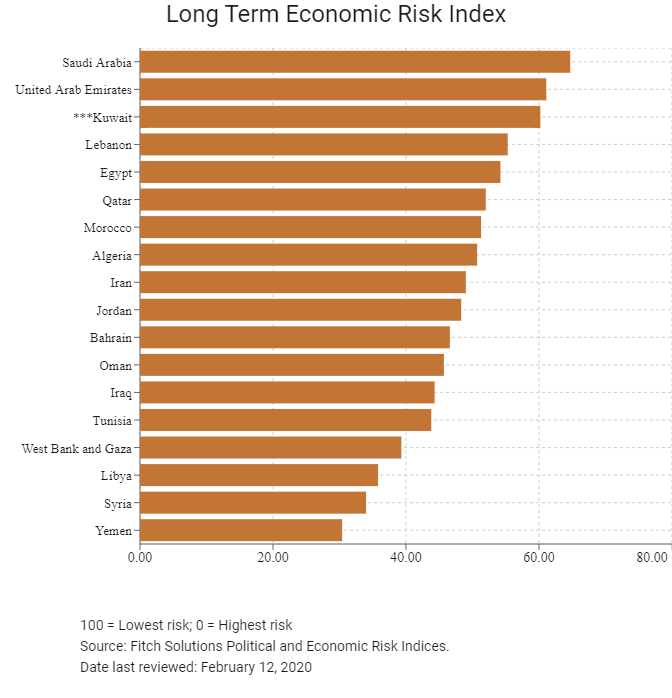

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index | 52/202 | 69/201 | 66/201 |

| Short-Term Economic Risk Score | 66 | 61.5 | 59.6 |

| Long-Term Economic Risk Score | 64.6 | 59.6 | 60.2 |

| Political Risk Index | 83/202 | 82/201 | 81/201 |

| Short-Term Political Risk Score | 73.8 | 77.5 | 77.5 |

| Long-Term Political Risk Score | 66.4 | 66.4 | 66.4 |

| Operational Risk Index | 70/201 | 83/201 | 75/201 |

| Operational Risk Score | 55.1 | 53.1 | 54.3 |

Source: Fitch Solutions

Date last reviewed: February 12, 2020

Fitch Solutions Risk Summary

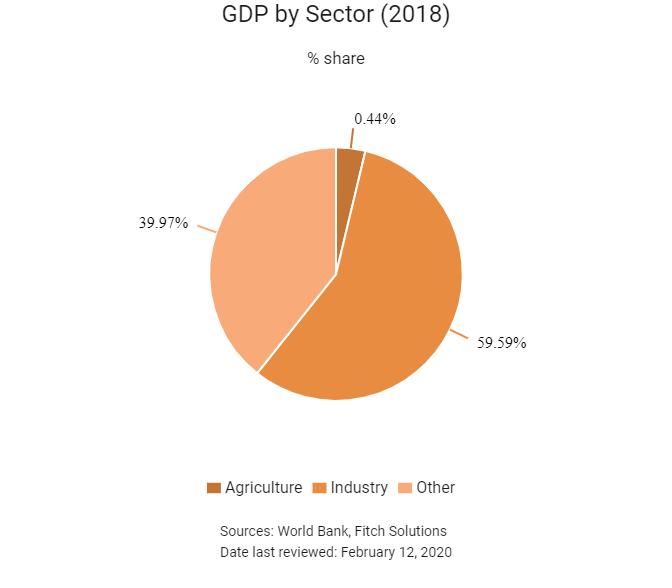

ECONOMIC RISK

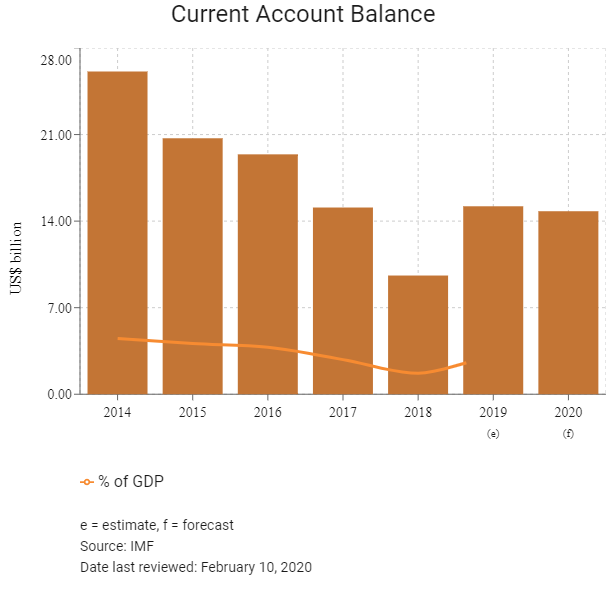

Kuwait has made substantial fiscal and structural progress; however, with oil revenues accounting for almost two thirds of the economy and 90% of the government's revenues, the economy remains vulnerable to fluctuations in global energy markets. Meanwhile, the process of diversifying the economy away from oil has been pedantic.

OPERATIONAL RISK

Kuwait is attractive for commercial businesses as it offers one of the more secure operating environments in the region, along with its excellent availability of low-cost fuel and basic utilities. However, stringent foreign investment policies, limited economic diversity and an over-reliance on the hydrocarbon sector inhibit opportunities for investors, while extensive and time-consuming bureaucracy hinders many business operations.The absence of a rail network also exerts high pressure and severe congestion on the road network.

Source: Fitch Solutions

Date last reviewed: February 21, 2020

Fitch Solutions Political and Economic Risk Indices

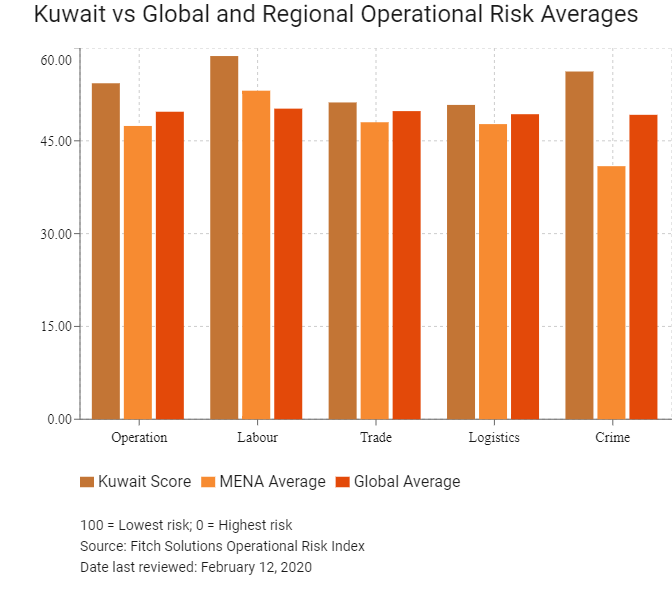

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Kuwait Score | 54.3 | 58.7 | 51.2 | 50.8 | 56.2 |

| MENA Average | 47.4 | 53.1 | 48.0 | 47.7 | 40.9 |

| MENA Position (out of 18) | 7 | 6 | 10 | 10 | 5 |

| Global Average | 49.7 | 50.2 | 49.8 | 49.3 | 49.2 |

| Global Position (out of 201) | 75 | 48 | 98 | 89 | 75 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

| UAE | 72.0 | 70.6 | 79.1 | 68.0 | 70.5 |

| Qatar | 65.9 | 66.8 | 61.8 | 73.7 | 61.2 |

| Bahrain | 65.0 | 65.5 | 69.5 | 71.6 | 53.6 |

| Oman | 64.5 | 62.7 | 61.9 | 64.2 | 69.2 |

| Saudi Arabia | 62.6 | 68.3 | 62.1 | 62.5 | 57.7 |

| Jordan | 56.5 | 58.4 | 60.7 | 54.8 | 52.3 |

| Kuwait | 54.3 | 58.7 | 51.2 | 50.8 | 56.2 |

| Morocco | 54.2 | 45.0 | 63.8 | 54.9 | 53.2 |

| Egypt | 48.7 | 50.7 | 45.7 | 55.2 | 42.9 |

| Tunisia | 46.5 | 41.0 | 56.2 | 46.7 | 42.3 |

| Lebanon | 44.1 | 54.0 | 51.9 | 40.9 | 29.7 |

| Iran | 43.2 | 48.9 | 36.7 | 52.8 | 34.4 |

| Algeria | 39.2 | 48.7 | 31.1 | 41.0 | 36.2 |

| West Bank and Gaza | 32.5 | 48.3 | 37.4 | 27.1 | 17.0 |

| Syria | 27.3 | 42.8 | 23.7 | 27.6 | 15.0 |

| Libya | 27.3 | 43.3 | 22.1 | 26.6 | 17.1 |

| Iraq | 26.9 | 43.5 | 24.8 | 26.9 | 12.4 |

| Yemen | 23.2 | 37.8 | 24.9 | 13.9 | 16.1 |

| Regional Averages | 47.4 | 53.1 | 48.0 | 47.7 | 40.9 |

| Emerging Markets Averages | 46.2 | 48.2 | 46.5 | 45.0 | 44.9 |

| Global Markets Averages | 49.7 | 50.2 | 49.8 | 49.3 | 49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 12, 2020

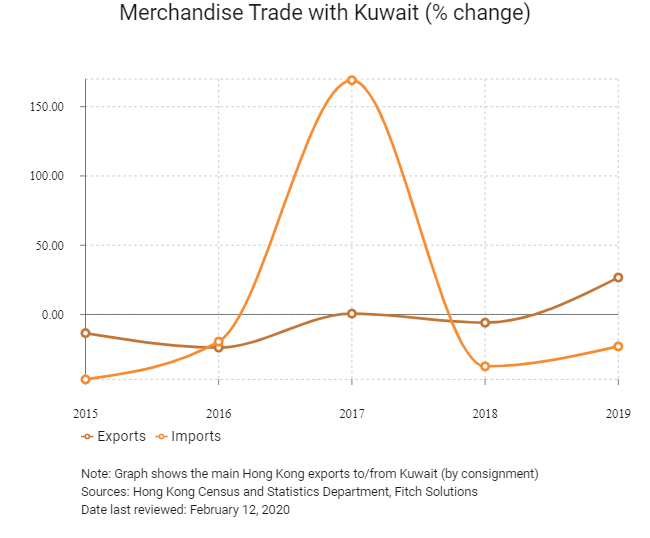

Hong Kong’s Trade with Kuwait

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 116.0 |

| Commodity 2 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 14.2 |

| Commodity 3 | Miscellaneous manufactured articles | 12.3 |

| Commodity 4 | Office machines and automatic data processing machines | 12.3 |

| Commodity 5 | Articles of apparel and clothing accessories | 9.6 |

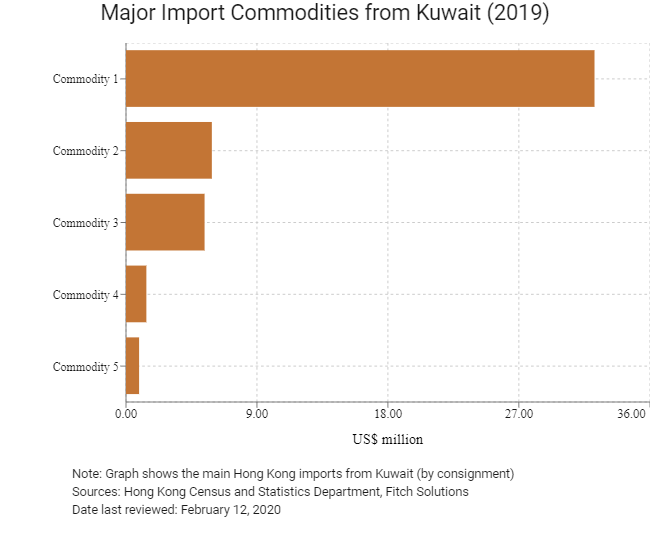

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Plastics in primary forms | 32.2 |

| Commodity 2 | Metalliferous ores and metal scrap | 5.9 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 5.4 |

| Commodity 4 | Road vehicles (including air-cushion vehicles) | 1.4 |

| Commodity 5 | Miscellaneous manufactured articles | 0.9 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Kuwaiti residents visiting Hong Kong | 2,860 | -19.42 |

| Number of Middle Eastern residents visiting Hong Kong | 113,850 | -12.77 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: February 12, 2020

Commercial Presence in Hong Kong

2020 | Growth rate (%) | |

| Number of Kuwait companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Sources: Hong Kong Census And Statistics Department, Fitch Solutions

Treaties and agreements between Hong Kong and Kuwait

The Double Taxation Agreement (DTA) between Hong Kong and Kuwait was signed by the two nations on May 13, 2010 and entered into force on July 24, 2013.

Source: Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

The Arab Chamber of Commerce & Industry

The Arab Chamber of Commerce & Industry (ARABCCI) was established in Hong Kong 2006 as a leading organisation at promoting commercial ties between Hong Kong/Mainland China and the Arab World.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Source: The Arab Chamber of Commerce and Industry

Consulate General of the State of Kuwait Hong Kong

Address: Unit 4502, Office Tower, Convention Plaza, 1 Harbour Road, Wanchai, Hong Kong

Email: kuconshk@netvigator.com

Tel: (852) 2832 7866

Fax: (852) 2832 7028

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

A Kuwait tourist visa for Hong Kong residents can be issued on arrival for stay up to 30 days. The Ministry of the Interior of the State of Kuwait has launched an online eVisa system through which nationals from 52 countries, including Hong Kong residents, can obtain a tourist visa to the State of Kuwait online. A tourist visa allows its holder a temporary stay for a maximum of 3 months starting from the entry date.

Source: Visa on Demand

Date last reviewed: February 12, 2020

Listing of Government and Related Organisations in Kuwait

- General Secretariat of the Supreme Council for Planning and Development

- Kuwait Authority For Partnership Projects

- Kuwait Investment Authority

- Kuwait Direct Investment Promotion Authority

- Kuwait Chamber of Commerce & Industry

- Kuwait Fund for Arab Economic Development

- Capital Markets Authority

- Ministry of Commerce and Industry

Kuwait

Kuwait