GDP (US$ Billion)

112.23 (2018)

World Ranking 75/193

GDP Per Capita (US$)

17,588 (2018)

World Ranking 75/192

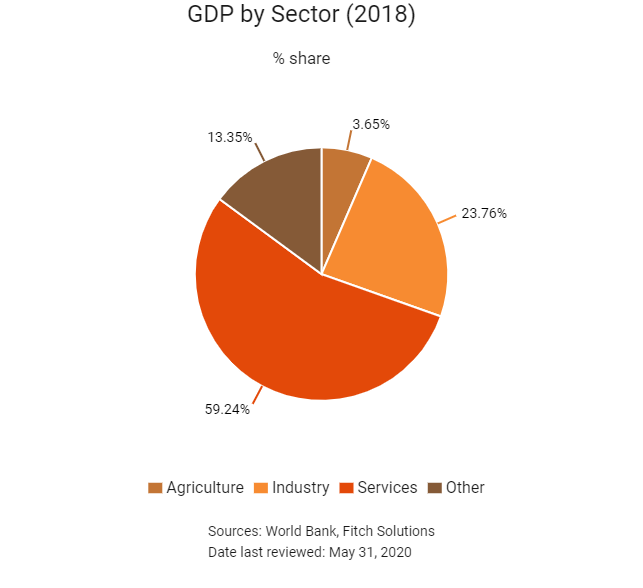

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

131.3 (2018)

Currency (Period Average)

Bulgarian Lev

1.75per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

The World Bank classifies Bulgaria's economy as an upper middle-income economy. As a member of the European Union (EU), Bulgaria has well-developed macroeconomic policies and is one of the most financially stable economies in Central and Eastern Europe. Thanks to the Bulgarian lev's peg to the euro, the country's monetary policy will continue to mirror that of the European Central Bank. Bulgarian households will remain the driving force of the economy, accounting for around 60% of GDP over the next five years. Private consumption growth will be supported by rising employment and relatively strong real wage growth. In recent years Bulgaria has been an increasingly attractive destination for outsourcing of businesses in a number of sectors, such as the pharmaceutical industry and the communications sector. However, over the long-term greater structural reform will be needed in order to arrest stagnating productivity growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

March 2019

Bulgaria opened the process of inviting investors for its stalled nuclear power plant in the town of Belene on the Danube River border with Romania.

October 2019

After 12 years of monitoring under the European Commission’s (EC) Cooperation and Verification Mechanism (CVM), which assesses a country’s efforts to reform its judiciary, fight against corruption and organised crime, the EC’s CVM report, issued on October 22, concluded that Bulgaria has made sufficient progress in meeting its commitments regarding the mechanism. That said, monitoring of the CVM will only formally cease after the European Parliament and the Council have given the EC their consent to end the mechanism, likely by the end of 2019.

November 2019

State-owned National Railway Infrastructure Company (NRIC) signed a BGN498.8 million (USD280.6 million) contract with a consortium for the modernisation of the Elin Pelin-Vakarel railway section in Bulgaria. The 20km section will have a 6.8km long tunnel, and a new railway station will be built at Elin Pelin and Pobit Kamuk. The scope of the work includes a new contact network and new systems and facilities for external power supply and the lighting of station areas. It will also include road overpasses and underpasses, eight bridges, drainage facilities, new signalling and telecommunication systems, and the construction of new surveillance systems. Dzhen-Duy Railway Elin Pelin consortium, comprising Turkey-based companies Duygu Muhendislik Insaat and Cengiz Holdings, will be undertaking the works. The section is part of the Modernisation of the Sofia-Plovdiv Railway Line Project and is being co-financed by the Cohesion Fund under the Transport and Transport Infrastructure 2014-2020 Programme. Works at the Elin Pelin-Vakarel section are expected to be completed in 72 months.

December 2019

The Government of Bulgaria approved BGN483 million (USD275.7 million) for the Ministry of Regional Development and Public Works' 2019 budget to support the design and construction of the last section of the Hemus motorway. The motorway links Sofia with the Black Sea port of Varna. To be built by Avtomagistrali, the 88.9 km last section starts near the Hemus motorway junction with road I-5 near Veliko Tarnovo in north-central Bulgaria and runs east to the Buhovtsi-Belokopitovo section, which wass under construction. The funding is part of the total BGN1.4billion (USD787.7 million) earmarked for the section, which is expected to be executed in three sections by 2022.

March 2020

A memorandum of understanding was signed between the governments of Bulgaria and Greece to expedite construction of a EUR3.7 billion (USD4.1 billion) railway project connecting the two European countries. The two countries proposed setting up a joint committee, which together with EU authorities would be responsible for the feasibility study, financing and execution of the project. The double-track electrified line will start from Thessaloniki in Greece and pass through Kavala, Alexandroupolis, Burgas and Varna to reach the Bulgarian city of Ruse.

March 2020

The Bulgarian authorities amended Council Decision 159/2020 introducing an export licensing requirement on certain disinfectants in response to the Covid-19 pandemic. The Bulgarian authorities also introduced an export ban on quinine-based drugs and certain medical equipment. The EC amended the temporary export licensing requirement imposed on certain personal protective equipment allowing exports to EFTA countries and other territories without a license.

April 2020

The EC temporary eliminated the VAT on imports and import duty on goods in response to the Covid-19 outbreak.

April 2020

In response to the Covid-19 pandemic, key tax and spending measures were implemented under the revised 2020 budget. These include coverage of 60% of the wages of the employees in affected sectors that would have been otherwise laid off, including the social security contributions due by the employers (over 1.2% of 2019 GDP); deferment of the payment of corporate taxes until June 30 (about 0.5% of 2019 GDP); additional remunerations in the ministries of health, interior and defence (0.4% of 2019 GDP); possibility for registered unemployed to sign labour contracts with agriculture producers without losing their unemployment benefits; bonus payments to medical and social services staff and expansion of social patronage services; support for various vulnerable groups, such as freelancers in the area of culture, one-off transfers to parents forced to be on unpaid leave during the state of emergency; and VAT reduction for restaurant services (until the end of 2021) and books (permanently) to 9% (from 20%).

April 2020

The Bulgarian National Bank implemented some measures in response to the Covid-19 pandemic. These included, among others, an increase in liquidity of the banking system by BGN7 billion (6% of 2019 GDP) by reducing foreign exposures of commercial banks; an agreement on a moratorium on bank loan payments for up to six months (but not later than the end of 2020); a capital increase of state-owned Bulgarian Development Bank by BGN700 million (0.6% of 2019 GDP), of which BGN500 million is to be used for the issuance of portfolio guarantees to commercial banks for the extension of corporate loans with the remaining BGN200 million to provide interest-free loans to employees on unpaid leave (up to BGN4,500); the allocation of BGN1 billion to state-owned company The Fund of Funds to provide subsidies to micro enterprises, the self-employed, entrepreneurs from vulnerable groups, and eligible small- and medium-sized enterprises (SMEs) and companies; the allocation of BGN800 million to a joint initiative organisation between the European Investment Fund and the EC to provide guarantee/credit to SMEs; and the allocation of BGN418 million to Urban Development Funds, managed by Fund of Funds, for long-term investment and working capital targeting municipalities, public-private partnerships and businesses hit by the crisis, including tourism and transport.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

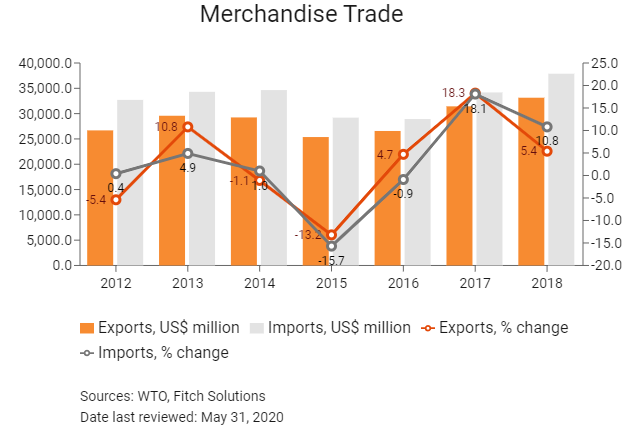

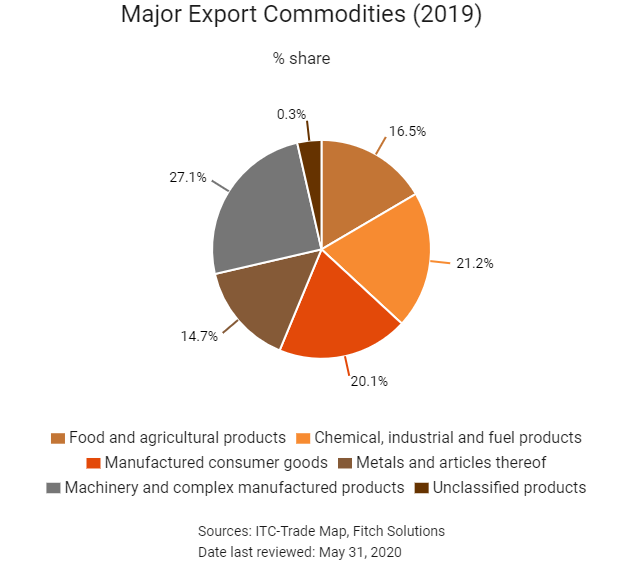

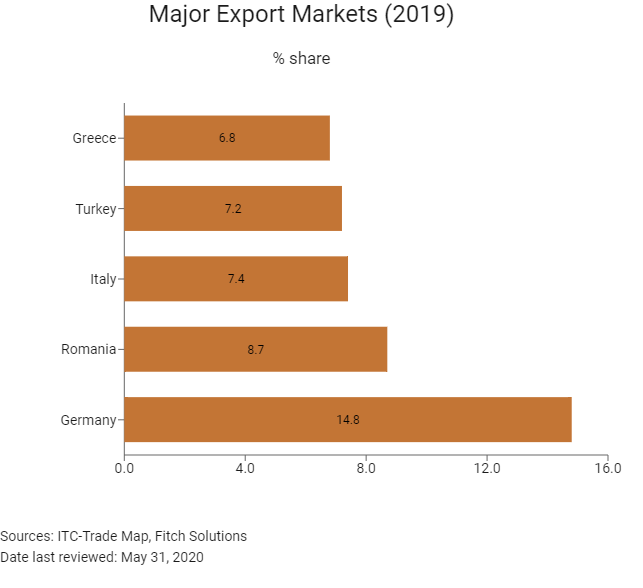

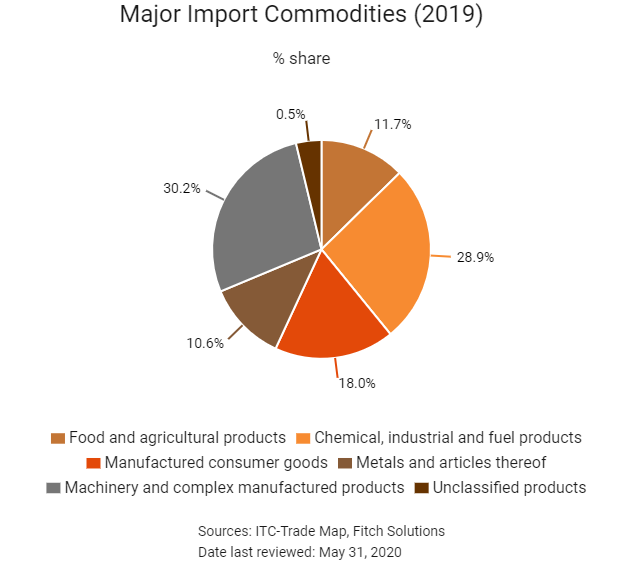

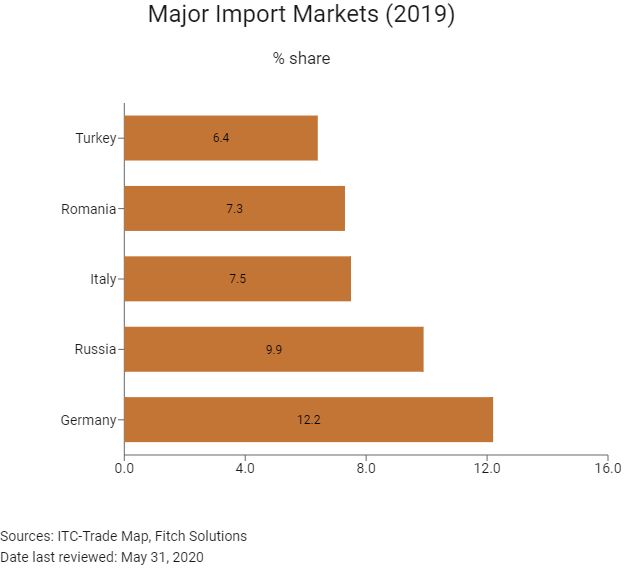

Merchandise Trade

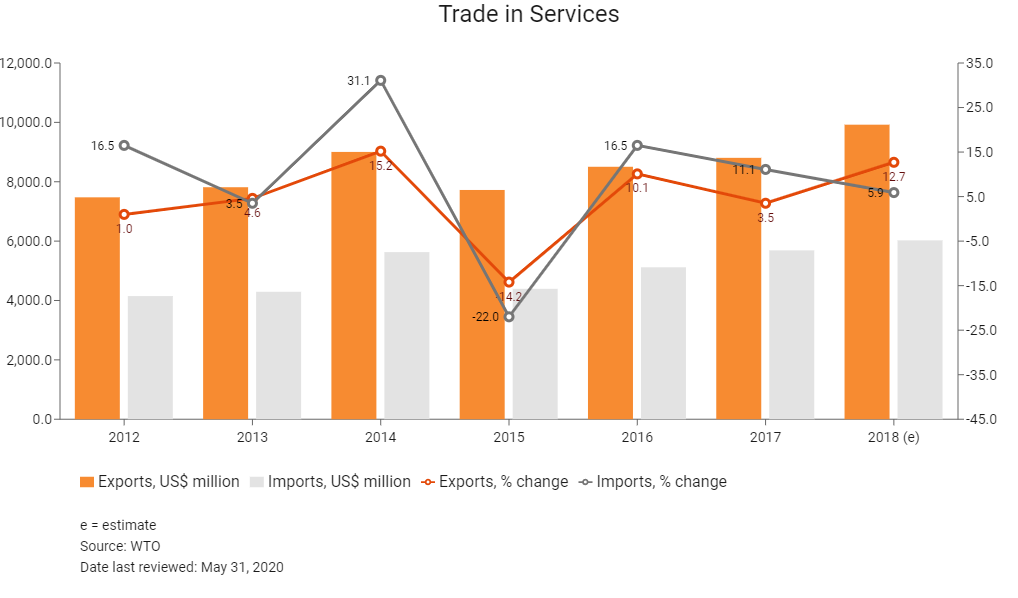

Trade in Services

- Bulgaria has been a member of the World Trade Organization (WTO) since December 1, 1996. Bulgaria bound all of its tariffs under the General Agreement on Tariffs and Trade on accession to the WTO, including zero rates for products falling under the Plurilateral Agreement on Civil Aviation and the Agreement on Information Technology.

- Bulgaria has been a member of the EU since January 2007. This means that a common tariff applies to the import of goods across the external borders of the EU. Once goods are cleared by customs authorities upon entry into any EU member state, these imported goods can move freely among EU member states without any additional customs procedures. At an average of 1.6%, tariff rates in Bulgaria are particularly low.

- Bulgaria applies the EU's Common External Tariff, which means that goods manufactured and imported from within the EU are not subject to customs charges. The trade policy is, thus, largely the same as that of the wider regional bloc. The EU updated its trade policy (and by extension its import tariffs, customs, duties and procedures) in 2017.

- In February 2020, the Council of the EU amended the 2019-2020 import tariff quota list as so far as it relates to certain hard fish roes.

- Goods from outside of the EU will attract import tariffs which can range from 0% (for books) to 48.5% (for bicycles imported from China). Additional taxes may be payable on alcohol and tobacco products.

- In December 2019, the EU issued a regulation imposing an additional import duty on a number of fruit and vegetables for the period 2020-2021.

- The EU is party to some 50 free trade agreements (FTAs), and access to other markets of the countries concerned is currently mediated through those agreements. The EU's Generalised System of Preferences came into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded USD4,000 for four years in a row. Bulgaria is a relatively open market, but certain administrative and procedural requirements can become non-tariff trade barriers. Poor intellectual property rights protection and the need for greater transparency and predictability in the regulatory environment are common market access issues for investors.

- The EU has imposed various anti-dumping measures on a wide range of products – predominantly textiles, parts, steel, iron and machinery – on goods coming from Mainland China and a few other Asian nations in order to protect domestic industries. A number of Mainland China-origin products are subject to the EU's anti-dumping duties, including bicycles, bicycle parts, ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards, and solar glass. On November 13, 2016, the EC imposed a provisional anti-dumping duty on imports of some of the primary and semi-processed metals from Mainland China. As of the end of December 2017 the EU did not apply any anti-dumping measures to imports originating from Hong Kong.

- In August 2019, the EC initiated an anti-dumping investigation on imports of certain hot-rolled stainless steel sheets and coils from Mainland China, Taiwan and Indonesia. In April 2020, a provisional duty was imposed. The investigation is still in progress. In March 2016, the EC imposed a definitive countervailing duty (8.7% or 9.0%) on imports, consisting largely of textile products, originating from India.

- In 2016 the EC introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation was active until May 15, 2020.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

In September 2019, Bulgaria temporarily backed off from its bid to join the EU's Schengen Agreement.

Multinational Trade Agreements

Active

- EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 27 member nations of the EU, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

- European Economic Area (EEA)-European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers.

- EU-Canada Comprehensive Economic and Trade Agreement (CETA): CETA is expected to strengthen trade ties between the two regions, having come into effect in October 2016. Some 98% of trade between Canada and the EU is duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the European Commission, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019, after the European Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products, and it seeks to open up service markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments and electrical machinery.

- EU-Southern African Development Community (SADC) EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and Swaziland): An agreement between EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six members of the SADC not included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking EPAs with the EU as part of other trading blocs, such as the East African Community and the Economic Community of Central African States.

Provisionally Active

CETA: CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and the EU Parliament in February 2017. However, the agreement has not been ratified by every European state and has only provisionally entered into force. CETA is expected to strengthen trade ties between the two regions, having come into effect in October 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport. The EU is Canada's second biggest trading partner after the United States, accounting for around10 % of its trade in goods with the world.

Ratification Pending

- EU-Vietnam Free Trade Agreement: The EU and Vietnam signed a trade agreement and investment protection agreement on June 30, 2019. The agreements are now waiting on the Vietnamese National Assembly for ratification.

- EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification. The agreement has been provisionally applied since 2013.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2018 with bilateral trade in services adding an additional EUR33 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Transatlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the administration led by Untied States President Donald Trump against a backdrop of rising global trade tensions.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

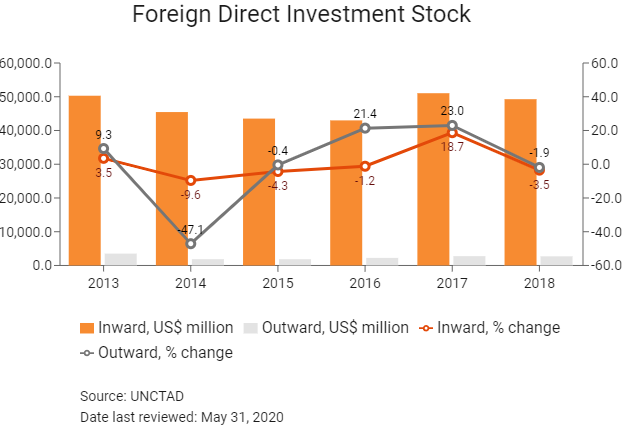

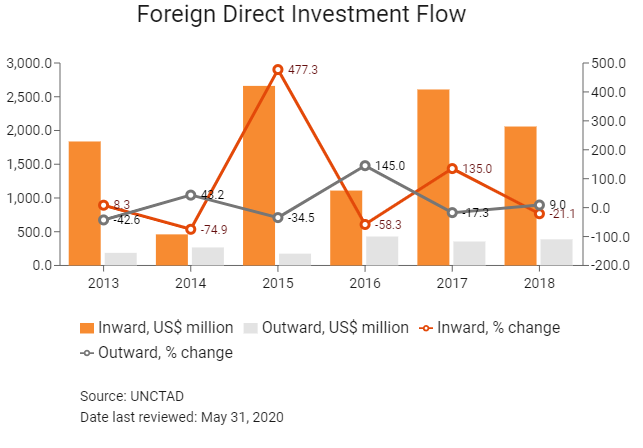

Foreign Direct Investment

Foreign Direct Investment Policy

- InvestBulgaria, the government's investment coordinating body, provides information, administrative services and incentive assessments to prospective foreign investors.

- There are no sectors that are off limits to investors nor are there any restrictions on the number of foreign-owned enterprises. In the majority of cases foreign entities are given the same treatment as national firms and their investments are not screened or otherwise restricted.

- The Investment Promotion Act (2004) stipulates equal treatment of foreign and domestic investors. The law encourages investment in the high-tech manufacturing industries as well as in education and human resource development. It creates investment incentives by helping investors purchase land, providing state financing for basic infrastructure and training new staff, and facilitating tax incentives and opportunities for public-private partnerships with the central and local government.

- Tax incentives may apply in certain circumstances, such as partial granting of the corporate income tax due for performance of agricultural activities; additional tax deductions for hiring individuals who are long-term unemployed, handicapped, or elderly; and granting back of up to 100% of the corporate income tax due for investment in regions with high unemployment.

- Bulgaria offers one of the most attractive tax environments for business in Europe, with benefits such as a corporate income tax rate of 10%, a flat personal income tax of 10%, tax exemption for industries in high-unemployment areas and a two-year VAT exemption for the import of equipment for investment projects of more than EUR5 million that create at least 50 jobs.

- The Offshore Companies Act was amended on June 15, 2016. The amended act lists 28 activities banned for business by companies registered in offshore jurisdictions with more than 10% offshore participation. However, the law allows those companies to do business if the physical owners of the parent company are Bulgarian citizens and known to the public, if the parent company's stock is publicly traded or if the parent company is registered in a jurisdiction with which Bulgaria enjoys a treaty for the avoidance of double taxation.

- The most common type of organisation for foreign investors is a limited liability company. The required minimum for registering a limited liability company is one euro. Other typical corporate entities include joint stock companies, joint ventures, business associations, general and limited partnerships, and sole proprietorships.

- Foreign investment in the production and manufacturing industries also benefit from 30% off the price of heavy machinery, 50% off the price of computer hardware and software, and five years of corporate tax exemption for investment in areas of high unemployment.

- Bulgaria is becoming a popular tourist destination, with arrivals increasing by more than 3% annually over the past decade, and investment in tourism infrastructure may potentially require outside expertise.

Sources: WTO – Trade Policy Review, Fitch Solutions, InvestBulgaria Agency

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| Industrial zones located at Rakovski, Kuklen, Maritsa, Parvomai and Letnitsa | - 100% foreign ownership permitted - 100% exemption of corporate income tax for all businesses involved in manufacturing in regions with high unemployment - Fewer bureaucratic procedures - All necessary skilled labour and administrative resources provided |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 10%

Source: National Revenue Agency, Bulgaria

Important Updates to Taxation Information

- As of January 1, 2020, VAT registration is mandatory for foreign companies performing taxable supplies in Bulgaria for which VAT is due by the supplier, irrespective of their taxable turnover.

- Taxation in Bulgaria is generally reasonable, with personal income and corporate tax rates generally set at 10%. However, high VAT and social security contributions create a heavy tax burden for Bulgarian employers and businesses, and a stagnant and inefficient bureaucracy increases delays excessively. These create an unattractive taxation environment for investors.

- The taxability of subsidiaries or branches of foreign commercial operations active in the country would depend on the existence of a bilateral treaty for the avoidance of double taxation between Bulgaria and the entity's host nation. To this end Bulgaria has concluded 68 agreements on the avoidance of double taxation, including the United Kingdom, the United States, Russia, Germany and Japan. This is a sizeable number and greatly reduces risks to investors and businesses seeking to operate in Bulgaria.

Business Taxes

Type of Tax | Tax Rate and Base |

| Resident company: Corporate Tax | Corporate income is subject to corporate income tax at a flat rate of 10%. |

| Dividends | Foreign entities are taxed for the profits earned through a permanent establishment in Bulgaria or for the sale or transfer of property as well as for the income from a source in Bulgaria. |

| VAT | - The standard tax rate of 20% is applied to: taxable deliveries (except those that are expressly specified as zero-rated); import of goods within the country; taxable intra-community acquisitions. - The decreased tax rate of 9% is applicable in the cases of accommodation provided at hotels and similar establishments, including the provision of holiday accommodation and letting of places for campsites or trailers. - Some supplies explicitly specified in the law are zero-rated (such as supply of goods sent or transported outside the EU); international transport of passengers and goods; intra-community supply of goods, among others. |

| Witholding Tax | -The Withholding Tax in Bulgaria is 10%. It should be withheld by the entity paying the income and should be transferred to the state budget.The withholding tax is final, i.e. the income is taxed only at the recipient level. - The withholding tax is 5% on dividends and liquidation quotas distributed by local entities for the benefit of foreign entities |

Source: National Revenue Agency, BulgariaDate last reviewed: May 31, 2020

Foreign Workers

Foreigners may reside in Bulgaria for short-term periods (90 days from the date of entry), continuous stay (one year), long-term periods (with an initial authorised period of five years renewable) and permanently (for an indefinite period).

Foreigners can obtain continuous residence permits in the following circumstances:

- The foreigner is engaged in commercial activity in Bulgaria and has at least 10 Bulgarian citizens employed.

- The foreigner is a specialist staying in Bulgaria under international treaties.

- The foreigner is a representative of foreign companies.

Localisation Requirements

Foreigners can obtain a work permit under the following conditions:

- No Bulgarian citizenship is required for the position under the law.

- Account is taken of the development and public interest of the national labour market.

- The total number of foreign employees of the local employer does not exceed 10% of the average number of staff on the payroll for the preceding 12 months.

- The conditions of labour and remuneration of foreigners are not less favourable than those for the comparable Bulgarian worker.

Foreign Worker Permits

EU nationals, citizens of European Economic Area member states and citizens of Switzerland enjoy the right of free movement within the EU. They do not need to obtain a work permit or register with the National Employment Agency to work or engage in self-employment activities in Bulgaria. Individuals who do not enjoy preferential treatment who intend to work in the country under a local employment contract or under the terms of a secondment or intercorporate transfer must obtain a work permit from the National Employment Agency. The term of validity of the standard work permit is up to one year and should be renewed each year. In general, non-EU nationals may not reside in Bulgaria while their work permit application is being processed. Work permits are inexpensive, averaging around BGN600 and residence permits are around BGN500.

Sources: Government websites, InvestBulgaria Agency, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | Baa2 (Positive) | 30/08/2019 |

| Standard & Poor's | BBB (Stable) | 29/05/2020 |

| Fitch Ratings | BBB (Stable) | 24/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 50/190 | 59/190 | 61/190 |

| Ease of Paying Taxes Index | 90/190 | 92/190 | 97/190 |

| Logistics Performance Index | 52/160 | N/A | N/A |

| Corruption Perception Index | 77/180 | 74/180 | N/A |

| IMD World Competitiveness | 48/63 | 48/63 | N/A |

Sources: World Bank, IMD, Transparency International

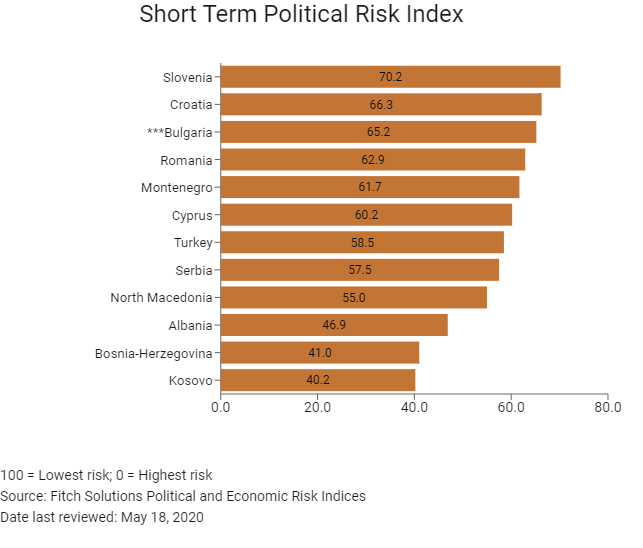

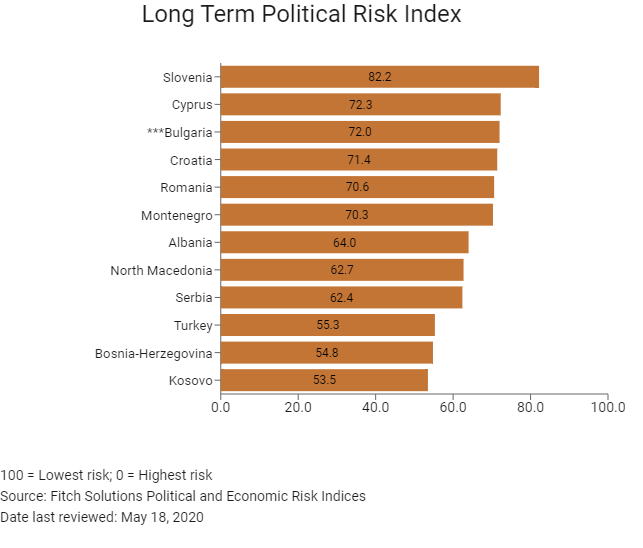

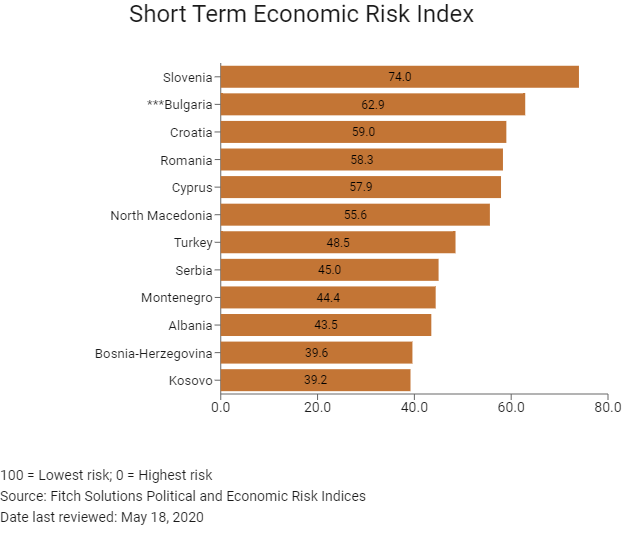

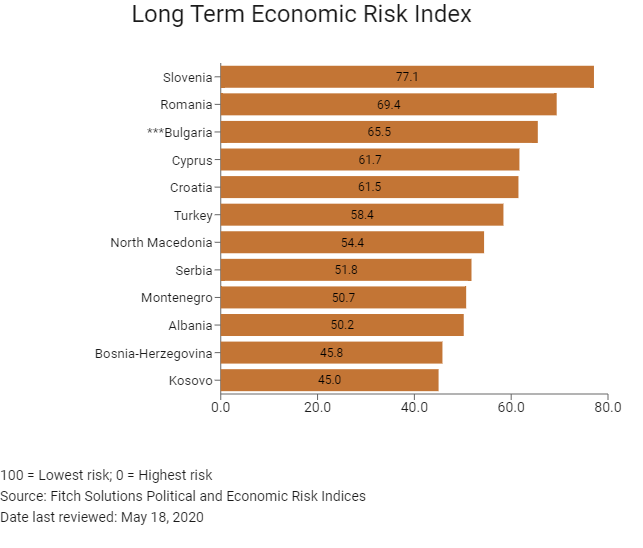

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index Rank | 64/202 | 55/201 | 49/201 |

| Short-Term Economic Risk Score | 63.5 | 61.5 | 62.9 |

| Long-Term Economic Risk Score | 62.0 | 64.1 | 65.5 |

| Political Risk Index Rank | 57/202 | 57/202 | 57/201 |

| Short-Term Political Risk Score | 65.2 | 65.2 | 65.2 |

| Long-Term Political Risk Score | 72.0 | 72.0 | 72.0 |

| Operational Risk Index Rank | 55/201 | 54/201 | 52/201 |

| Operational Risk Score | 60.1 | 61.8 | 61.7 |

Source: Fitch Solutions

Date last reviewed: November 11, 2019

Fitch Solutions Risk Summary

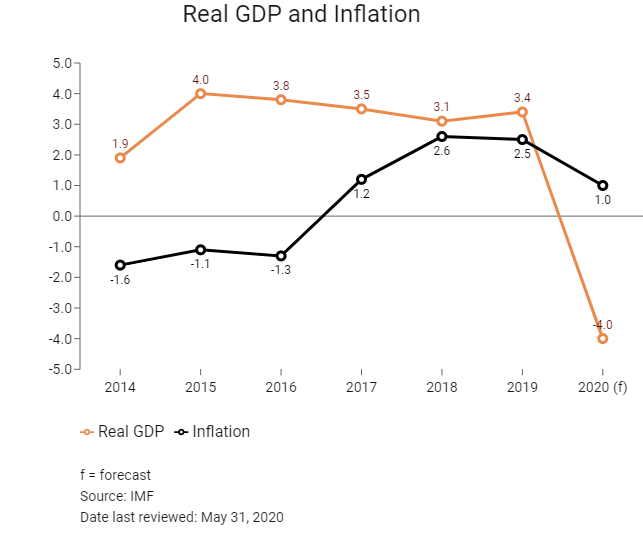

ECONOMIC RISK

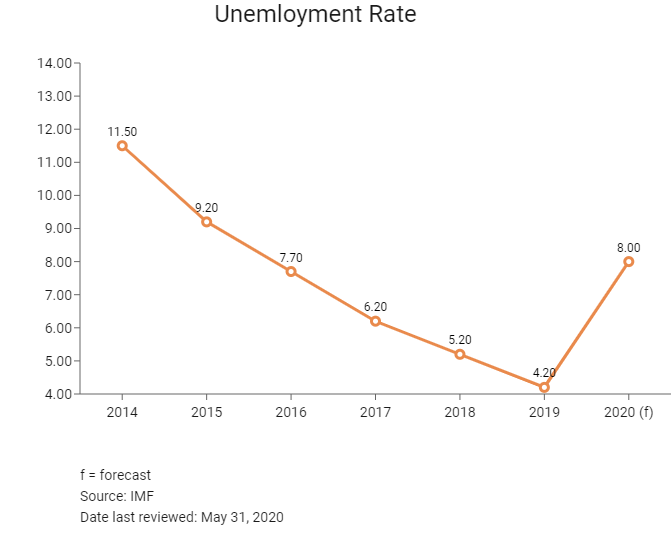

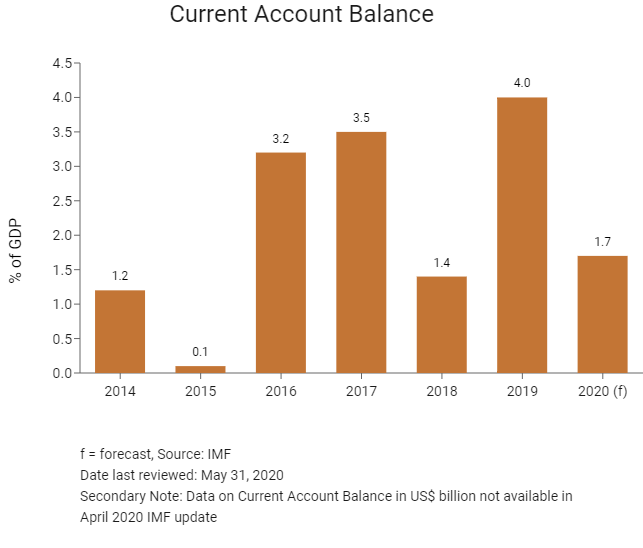

As a member of the EU, Bulgaria has well-developed macroeconomic policies and is one of the most financially stable economies in the Central and Eastern region of Europe. Following a sustained period of deflation from 2013 to 2016, inflation returned to positive territory in 2017 but will remain relatively subdued in the coming years. With Bulgaria aiming to apply for membership with the European Exchange Rate Mechanism (ERM II), the adoption of the euro seems feasible after the obligatory two-year stay in the ERM. Apart from the necessary legal convergence, Bulgaria already fulfils all of the remaining eurozone convergence criteria. Bulgaria's current account surplus will continue to narrow over 2020 thanks to a strong outlook for the services account, driven by the sustained boom of the Bulgarian tourism industry. That said, economic growth could slow in 2020 as softer labour market dynamics will drag on consumer spending growth and also due to a less expansionary fiscal stance. That said, the economy should sustain a healthy pace of expansion in the years ahead, underpinned by robust investment activity.

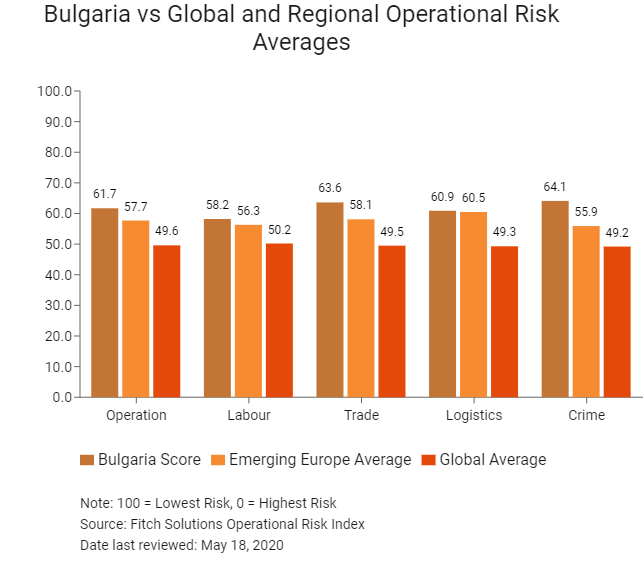

OPERATIONAL RISK

Bulgaria remains a sound destination for investment in the South East Europe region owing to its foreign direct investment-oriented policies, access to EU trade and financial markets, streamlined and low cost trade procedures, and labour costs relative to other EU members. In addition, the country offers businesses access to an extensive road network, stable electricity supply, low cost fuel and high levels of internet penetration. That said, the quality of road and rail infrastructure lags behind its regional peers and the presence of organised criminal gangs and cybersecurity threats in the form of ATM skimming and hacking present pertinent risks to investors.

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Bulgaria Score | 61.7 | 58.2 | 63.6 | 60.+ | 64.1 |

| Southeast Europe Average | 57.5 | 52.9 | 57.9 | 60.7 | 58.5 |

| Southeast Europe Position (out of 12) | 5 | 3 | 2 | 6 | 5 |

| Emerging Europe Average | 57.7 | 56.3 | 58.1 | 60.5 | 55.9 |

| Emerging Europe Position (out of 31) | 13 | 14 | 9 | 16 | 12 |

| Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

| Global Position (out of 201) | 52 | 50 | 48 | 58 | 50 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk Index | Crime and Security Risk Index |

| Slovenia | 69.2 | 57.7 | 63.5 | 74.1 | 81.4 |

| Romania | 63.7 | 60.0 | 60.8 | 66.1 | 67.8 |

| Cyprus | 62.7 | 56.0 | 66.0 | 63.0 | 65.8 |

| Croatia | 62.5 | 53.2 | 56.9 | 70.3 | 69.5 |

| Bulgaria | 61.7 | 58.2 | 63.6 | 60.9 | 64.1 |

| Serbia | 58.2 | 59.6 | 60.1 | 60.7 | 52.4 |

| Montenegro | 58.1 | 56.7 | 59.8 | 57.7 | 58.0 |

| North Macedonia | 56.3 | 44.9 | 62.7 | 59.8 | 57.8 |

| Turkey | 56.1 | 53.2 | 59.9 | 65.2 | 46.1 |

| Albania | 48.3 | 44.2 | 43.3 | 48.3 | 57.4 |

| Bosnia-Herzegovina | 47.5 | 46.0 | 44.3 | 50.7 | 49.0 |

| Kosovo | 46.0 | 45.1 | 54.0 | 51.6 | 33.2 |

| Regional Averages | 57.5 | 52.9 | 57.9 | 60.7 | 58.5 |

| Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

| Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

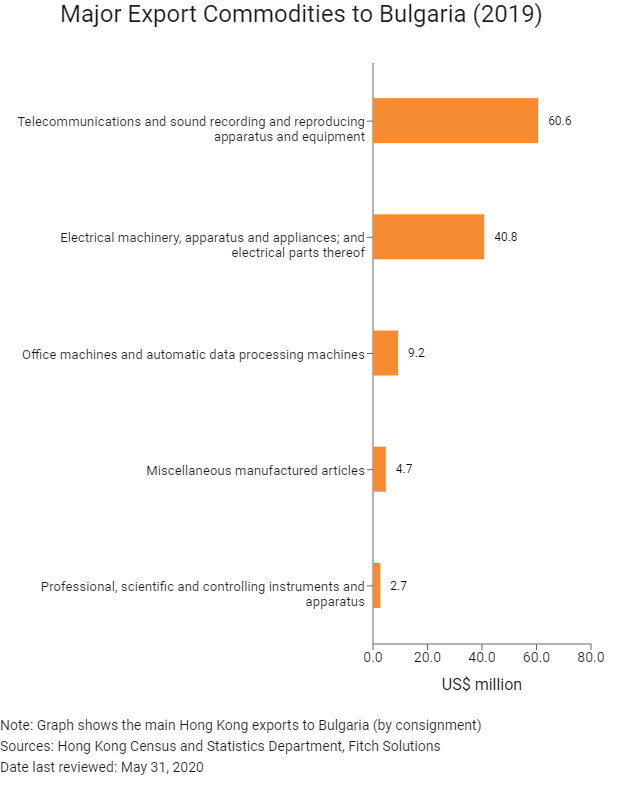

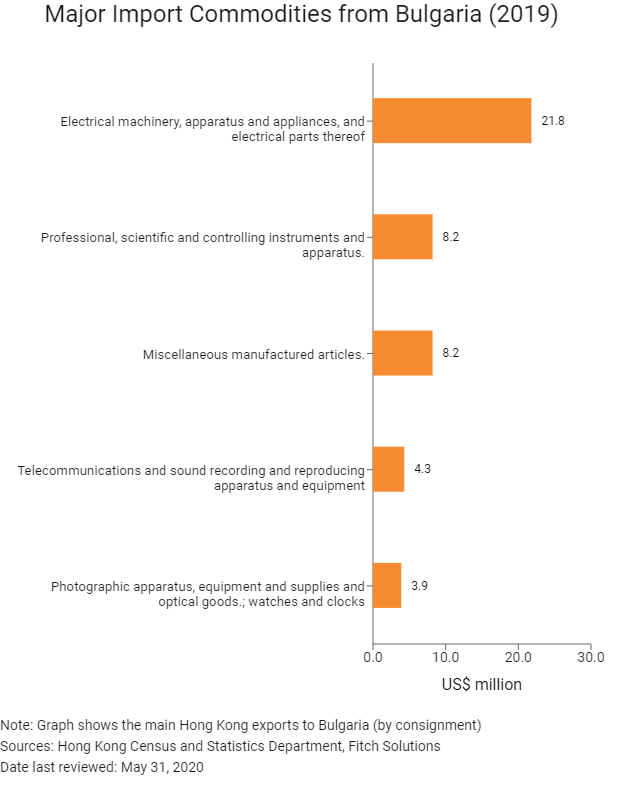

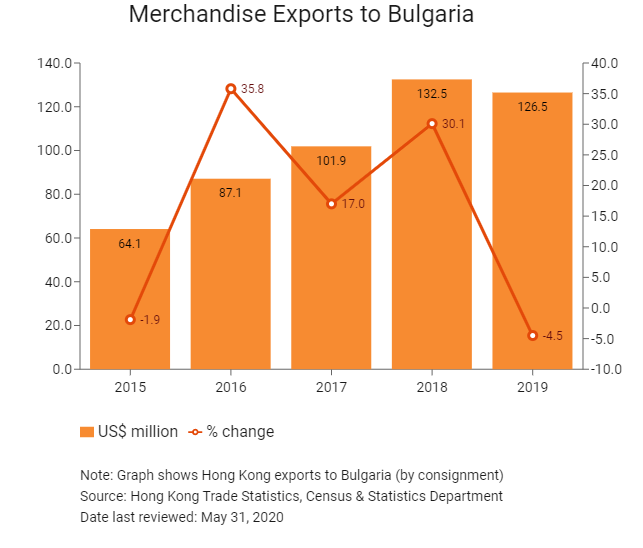

Hong Kong’s Trade with Bulgaria

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Bulgarian residents visiting Hong Kong | 5,224 | -5.8 |

| Number of European residents visiting Hong Kong | 1,747,763 | -10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

2019 | Growth rate (%) | |

| Number of Bulgarian companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and Agreements between Hong Kong and Bulgaria

There is an existing agreement between Mainland China and Bulgaria for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to taxes on income and capital. The original agreement entered into force in May 1990. The ammended agreement entered into force in January 2003.

Source: State Administration of Taxation

Chamber of Commerce (or Related Organisations) in Hong Kong

Hong Kong Bulgarian Association of Commerce

Address: 25/F, Singga Commercial Building, 148 Connaught Road West, Sheung Wan, Hong Kong

Tel: (852) 5178 8834

Source: Hong Kong Bulgarian Association of Commerce

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not need a visa to visit Bulgaria for a period of up to 90 days.

Source: Hong Kong Immigration Department

Date last reviewed: May 31, 2020

Bulgaria

Bulgaria