GDP (US$ Billion)

56.37 (2018)

World Ranking 82/193

GDP Per Capita (US$)

9,251 (2018)

World Ranking 76/192

Economic Structure

(in terms of GDP composition, 2019)

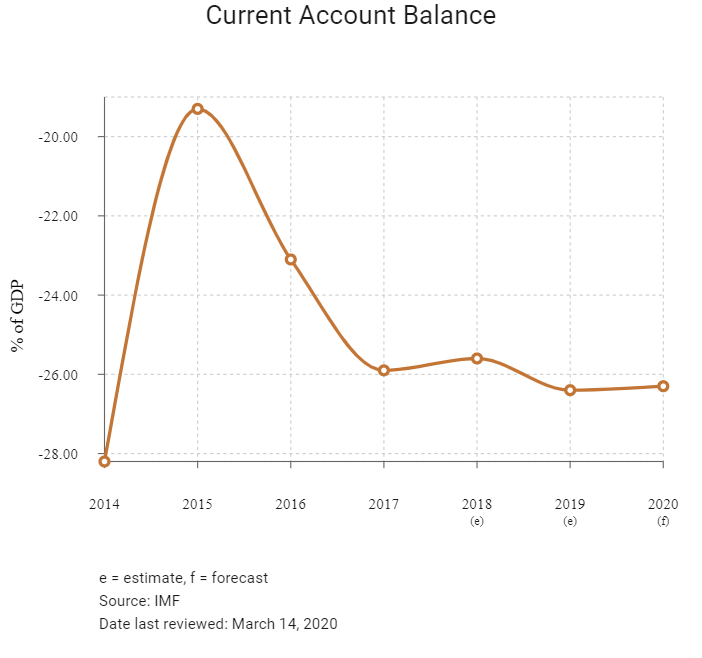

External Trade (% of GDP)

63.6 (2019)

Currency (Period Average)

Lebanese Pound

1507.50per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

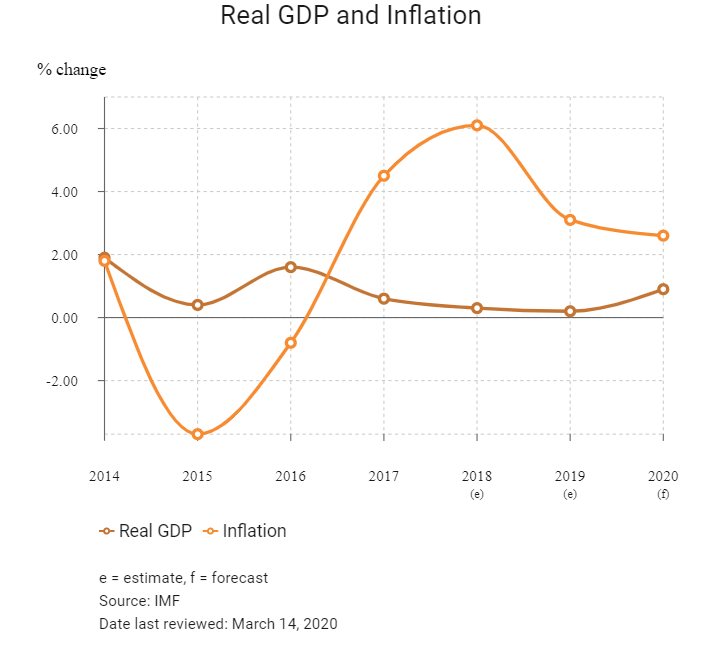

A small and open economy, Lebanon has been strongly affected by the spillover from the civil war in neighbouring Syria. Between 2011 and 2016, annual economic growth has averaged just 1.7% in real terms, and IMF studies suggest that income inequality and poverty in the country have increased significantly as a result of the influx of more than 1.4 million Syrian refugees. Lebanon’s government continues to favour a strong role for the private sector in a liberal policy environment. That said, the impact of the Syrian crisis, domestic security challenges, high levels of public debt, service delivery constraints and the challenging operating environment present significant risks to investors in the near term. In the absence of a credible reform plan, despite the formation of a new government, mounting pressure on Lebanon's financing model could eventually result in a sharp external or fiscal adjustment. It is likely that growth in the Lebanese economy will be slow over the coming decade, as a result of regional security risks, political instability, the government's inability to undertake structural reform to the economy, and slowing population growth.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

June 2017

A new electoral law was approved by parliament.

July 2017

Hizbullah and the Syrian army launched a military operation to dislodge jihadist groups from the Arsal area, near the border with Syria.

November 2017

Prime Minister Hariri announced his resignation in a televised address from Saudi Arabia. He then withdrew his resignation a month later.

May 2018

General elections held in Lebanon on May 6, 2018 triggered the start of cabinet negotiations.

August 2018

Construction started on a nearly 1,802.32 square metre medical facility in Choukine, Lebanon. The Medrar Foundation was developing the project in partnership with the American University of Beirut's Medical Centre. The centre was expected to be ready by the end of 2020.

September 2018

Germany and Saudi Arabia agreed the return of their ambassadors to Lebanon.

September 2018

Lebanon's parliament ratified the international Arms Trade Treaty. The 2014 treaty sought to regulate international trade in conventional arms and prevent illicit trade.

December 2018

The Lebanese army strengthened its military presence in the country's southern border town of Meiss Ej Jabal in order to bolster national security.

March 2019

The Investment Policy Review (IPR) of Lebanon was discussed at the United Nations in Geneva in December 2018 and officially presented at an in-country launch of the IPR in Beirut on March 6, 2019. Lebanon's Minister of Information stated that the country would implement reforms for economic growth and job creation in close alignment with the IPR recommendations. Key priorities included a focus on capacities, awareness and institutional cooperation, the preparation of the investment promotion strategy, and the expansion of knowledge and networks for targeted activities.

February 2020

On February 11, Prime Minister Hassan Diab’s proposed cabinet was approved by parliament. This followed the resignation of former Prime Minister Saad Hariri, paving the way for the nomination of Diab, the former education minister, to lead the next cabinet.

March 2020

Beirut failed to make a USD1.2 billion Eurobond payment due in March.

Sources: BBC Country Profile – Timeline, Fitch Solutions

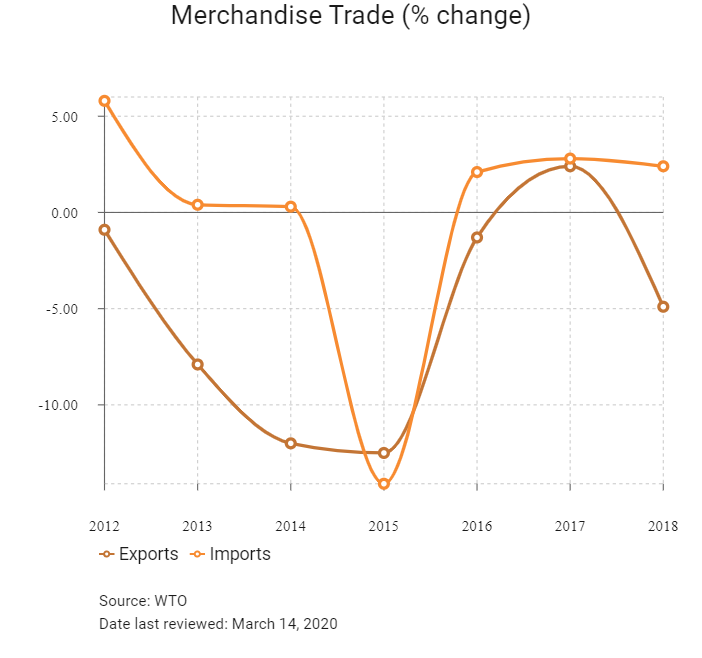

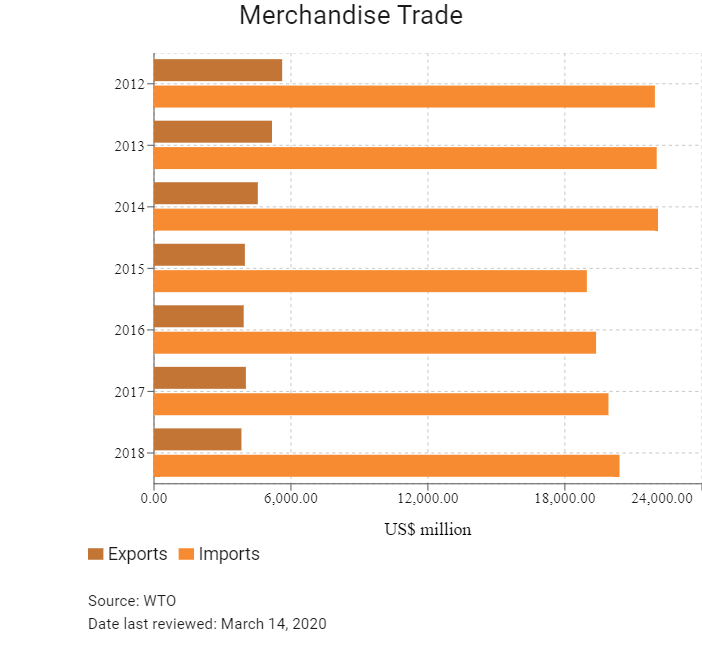

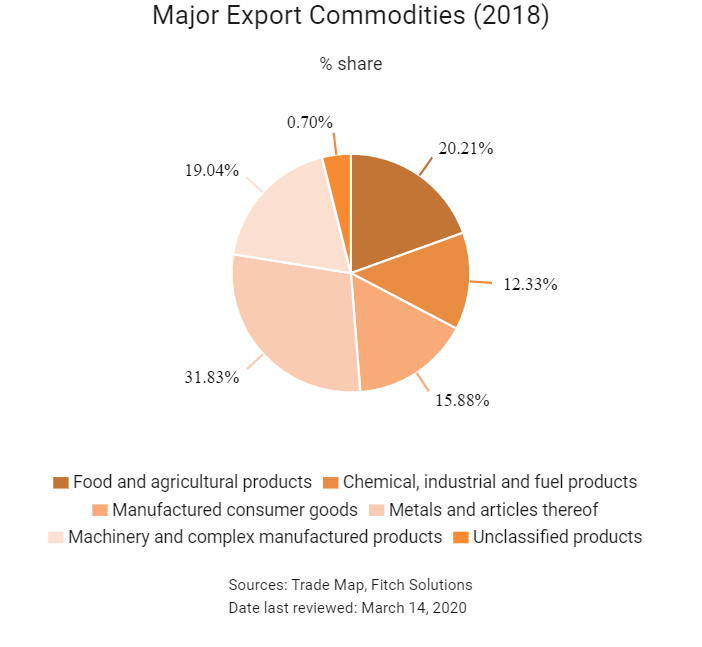

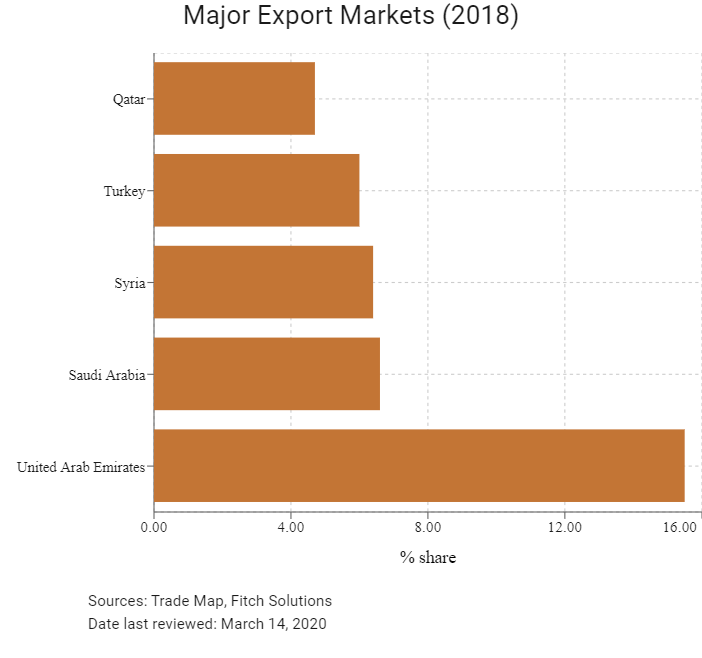

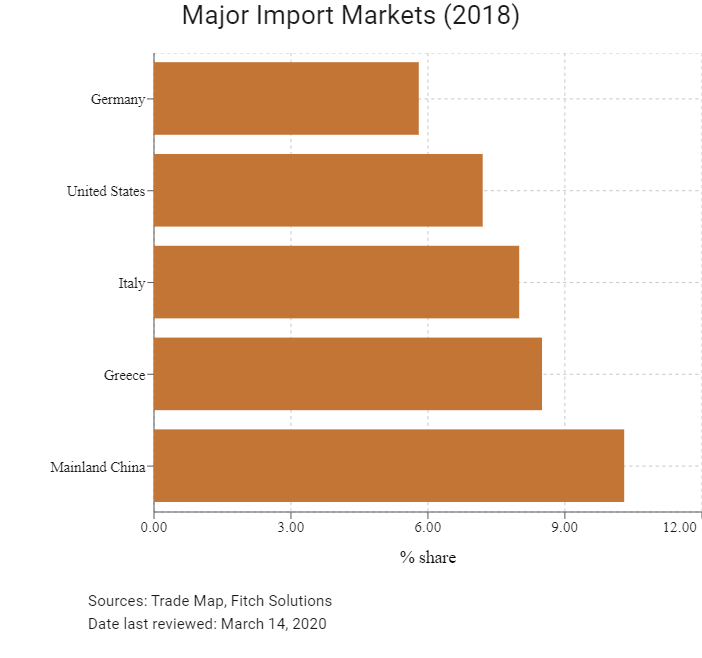

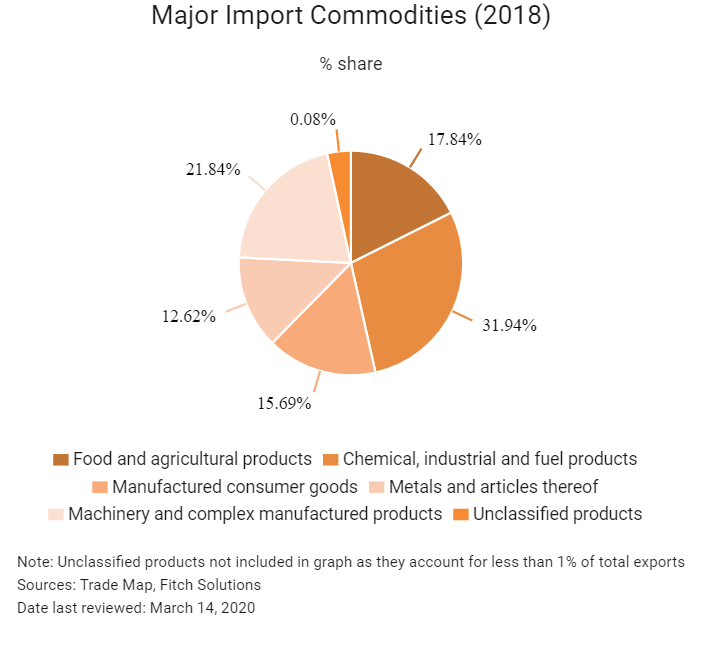

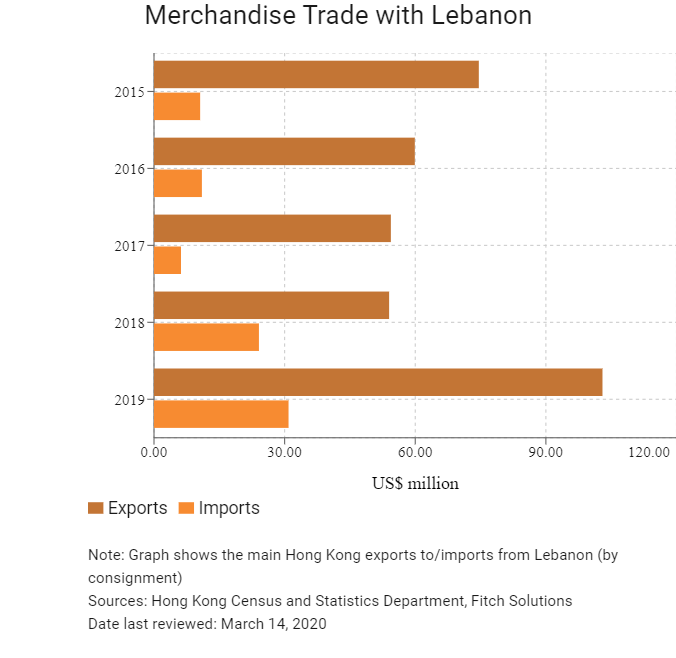

Merchandise Trade

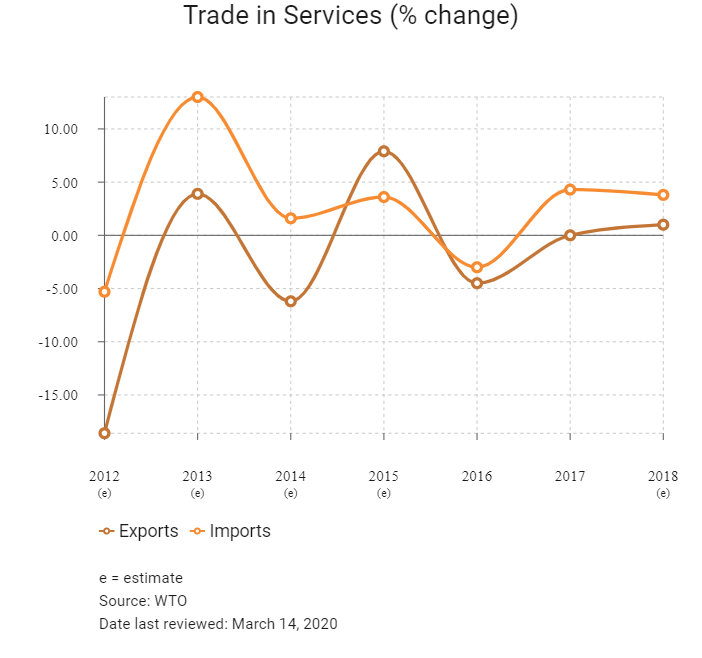

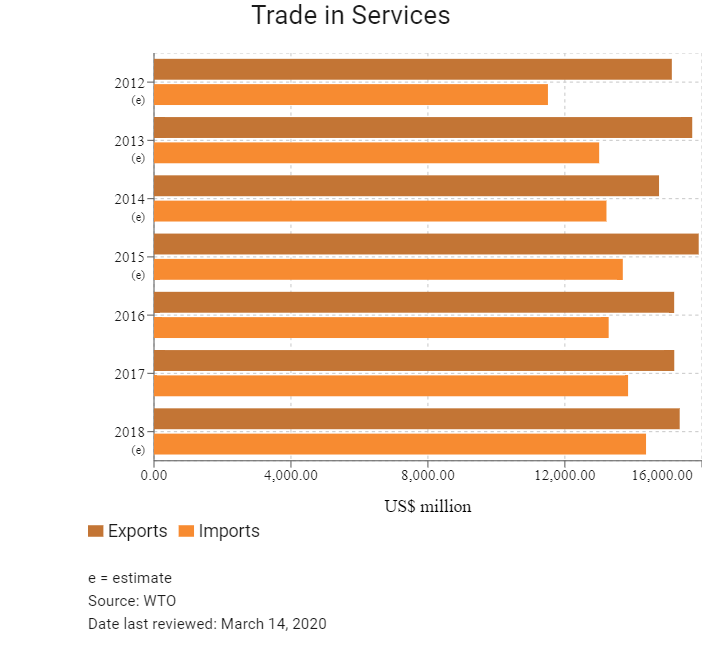

Trade in Services

- Businesses face supply chain disruption due to the ongoing conflict in Syria, which has closed off overland trade routes, while additional concerns emanate from Lebanon's current exclusion from the World Trade Organization (WTO). Lebanon is in negotiations in order to accede to the WTO.

- Additional concerns emanate from Lebanon's current exclusion from the WTO. Lebanon is in negotiations in order to accede to the WTO.

- Lebanon's import-reliant economy generally offers an open environment for international trade, with few major regulatory, tariff or customs barriers impeding trade flows. The Lebanese economy is highly reliant on international trade, with most growth in trade value driven by imports, due to the strength of private consumption and the relative lack of domestic manufacturing industries. The government operates an open policy with regard to trade; furthermore, both tariff and non-tariff barriers are low, encouraging greater trade flows.

- Modern, simple and efficient assessment means are adopted by the customs authorities in order to smooth trade through the use of electronic declarations, declaration in advance, applying international procedures in clearing the goods, selective inspection, auditing the goods after their release, and adopting the unique declaration. Customs rates are imposed and modified according to decisions from the Lebanese customs authorities. These decisions are adopted based on the need of the Lebanese markets of some goods and the need to protect key domestic sectors.

- Safeguard measures are provided for in relation to imported goods particularly when an increase of imports (of goods that can be produced domestically) is witnessed compared to the same period during the previous year. The rates are determined based on a specific schedule created in conformity with the Harmonised System of Nomenclature. This conformity with the unified system makes Lebanon an importer-friendly environment for traders. The normal rates are applied where there is no preferential agreement. When the origin of the good or part of the good is a country with which Lebanon has a preferential customs treatment, preferential rates apply.

- Customs rates in Lebanon are either determined in percentage or paid as a lump sum per unit of imported product. Based on Article 59 of Budget Law 2019, 3% in additional custom fees is enforced for three years on imported goods that are subject to value added tax (VAT), except for fuel, industrial equipment, and raw materials used in manufacturing and agriculture.

- Import tariffs are highest on fruit and vegetable products and beverages and tobacco, but most intermediate inputs and many finished goods face competitive tariff rates. The fact that Lebanon is not a member of the WTO poses risks that tariffs could be hiked unilaterally with no recourse for the country's trade partners, but Lebanon's reliance on imports and commitment to free trade make such actions unlikely.

- Lebanon signed an Association Agreement with the European Union (EU) in June 2002, which entered into force in April 2006. As a result, Lebanese industrial as well as most agricultural products benefit from free access to the EU market. Bilateral trade between the EU and Lebanon has been increasing steadily over the past years, with average annual growth of 7.5% since 2006.

- There are few non-tariff barriers to trade with Lebanon, with less than 1% of exports and imports subject to additional requirements such as phyto-sanitary certificates, import licencing or technical standards certificates. The customs process has been largely digitised and updated to remain in line with international standards, easing the trade process.

Sources: WTO – Trade Policy Review, Fitch Solutions, national sources

Multinational Trade Agreements

Active

- Greater Arab Free Trade Area (GAFTA): GAFTA was declared within the Social and Economic Council of the Arab League as an executive programme to activate the Trade Facilitation and Development Agreement that has been in force since January 1, 1998. On January 1, 2005 the elimination of most tariffs among the GAFTA members was enforced.

- European Free Trade Association (EFTA)-Lebanon Free Trade Agreement (FTA): Of the EFTA states (Switzerland, Norway, Iceland and Lichtenstein), Switzerland is a key trade partner of Lebanon, although trade with the other member states is much more limited. The EFTA-Lebanon FTA covers trade in industrial and agricultural goods, the latter covered by agreements concluded bilaterally between each EFTA state and Lebanon, forming part of the instruments creating the free trade area. The agreement also contains substantive provisions on intellectual property, competition and dispute settlement and covers certain aspects of services, investment and government procurement.

- EU-Lebanon Association Agreement: The EU-Lebanon Association Agreement progressively liberalised trade in goods between the EU and Lebanon. Its gradual implementation was overseen between 2008 and 2014 and Lebanese industrial as well as most agricultural products benefit from free access to the EU market, with a view to creating a bilateral free trade area. The association agreement is part of the Euro-Mediterranean Partnership which aims to foster trade and investment links between the EU and the southern Mediterranean. In November 2010, the EU and Lebanon signed a protocol establishing a dispute settlement mechanism applicable to disputes under the trade provisions of the association agreement. Due to its FTA with the EU, Lebanon ceased to benefit from preferential access to the EU market under the Generalised System of Preferences scheme from January 2014.

- United States-Lebanon Trade and Investment Framework Agreement (TIFA): The United States and Lebanon signed the TIFA with the aim of regulating all commercial matters between the two countries and strengthening bilateral trade. This includes a wide range of trade and investment issues such as market access, intellectual property rights, and labour and environmental issues. The TIFA will also help in growing commercial and investment opportunities by identifying and working to remove impediments to trade and investment flows between the two countries. This will create more opportunities in a key market for businesses in Lebanon.

Sources: ITA, US Department of Commerce, Fitch Solutions

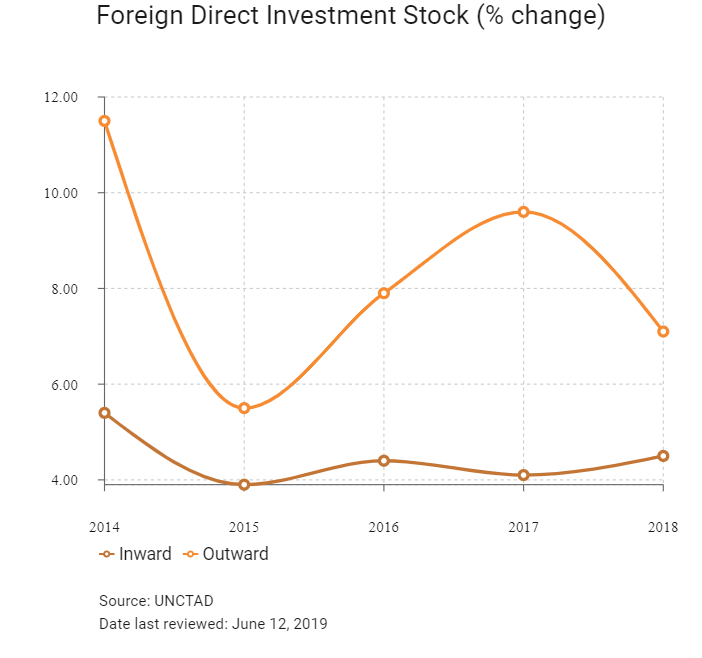

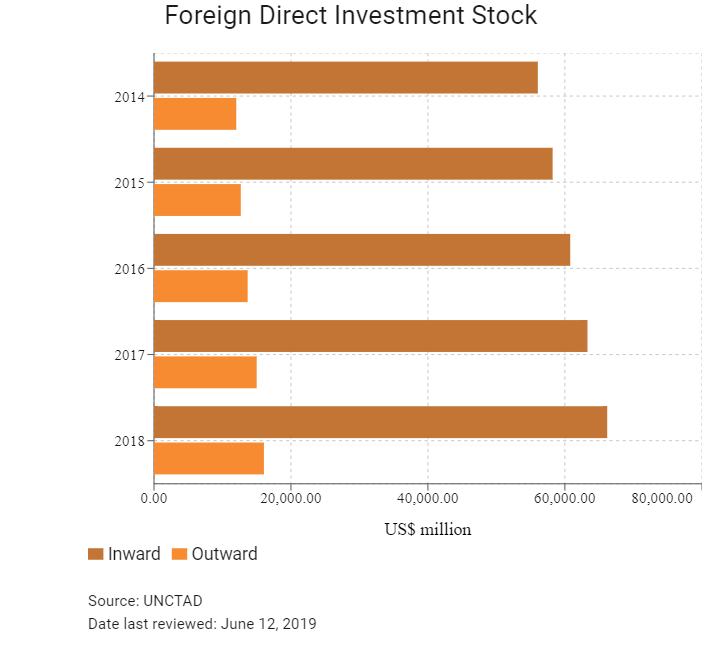

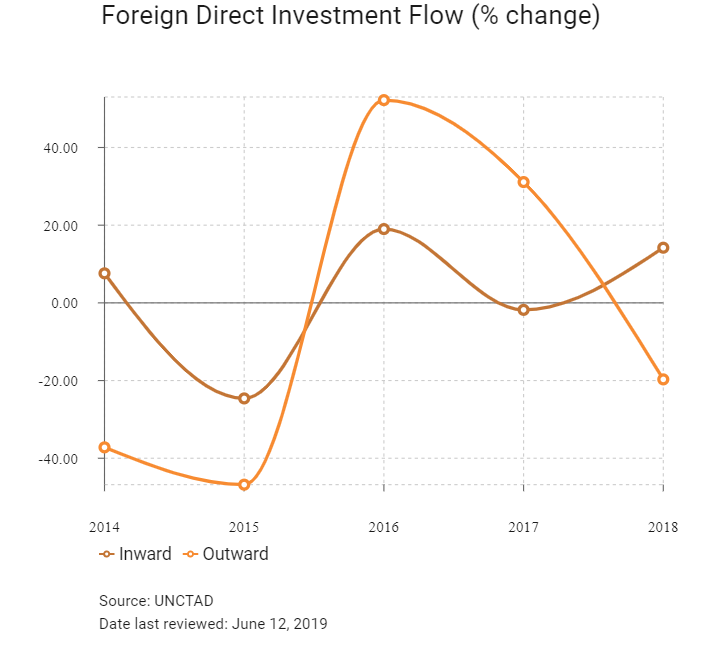

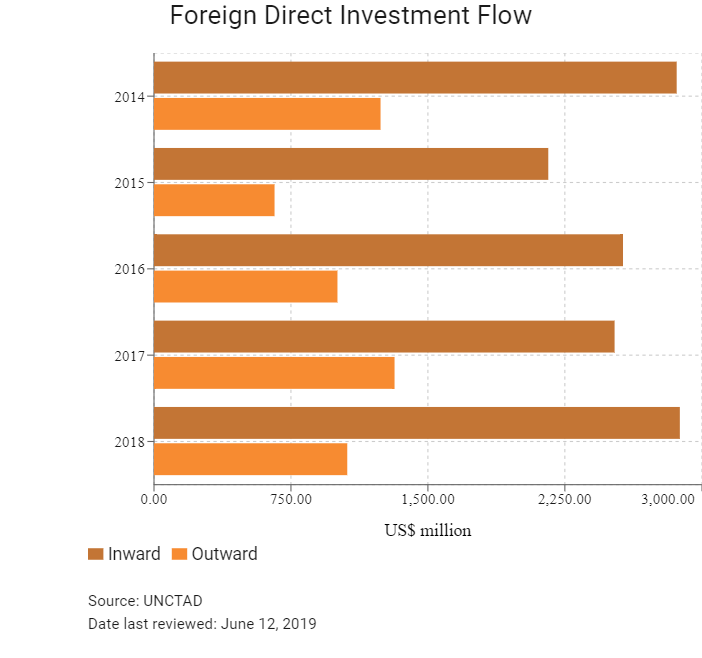

Foreign Direct Investment

Foreign Direct Investment Policy

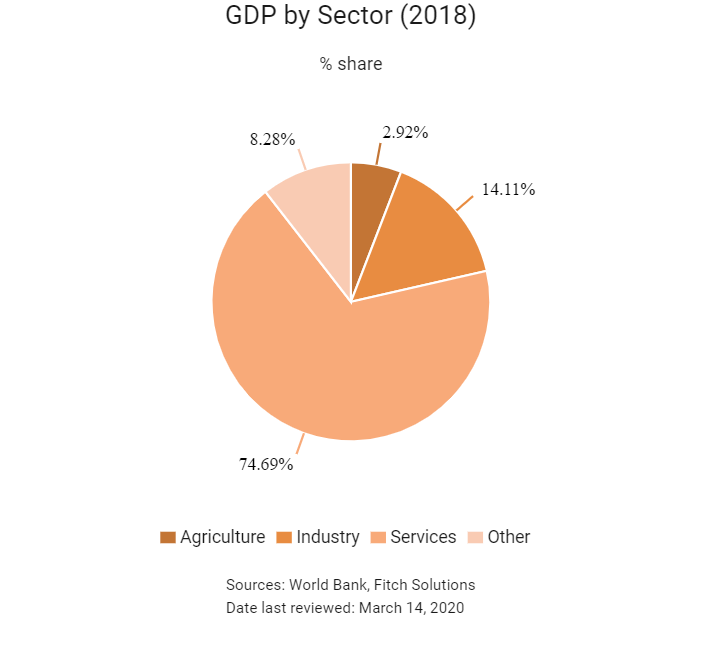

- Lebanon has liberal domestic free trade and investment policies, with free market pricing for most goods and services, an unrestricted exchange and trade system, and extensive links with the developed world in practically all economic activities. The government continues to favour a strong role for the private sector in a liberal policy environment and the economy. The Lebanese economy is service-oriented, and its main growth sectors include banking and tourism.

- There are no general limitations on foreign ownership of Lebanese companies and foreign companies are allowed to remit their finances abroad. Inward foreign direct investment (FDI) stock is consequently relatively high, and a major contributor to economic growth.

- There are relatively few barriers to FDI in Lebanon, as the government actively encourages foreign investment in the majority of industries. The only remaining barriers exist in terms of some localisation and job creation requirements (particularly if businesses wish to benefit from incentive programmes), the dominant presence of state-owned entities (SOEs) in a few sectors, and limited foreign ownership restrictions. In general, the foreign investment regime is one of the most open in the Middle East and North Africa region, making Lebanon an attractive location for businesses.

- Legislative Decree No. 304 of the Commercial Code (1942) governs joint-stock corporations (Société Anonyme Libanaise – SAL), and was amended by Law No. 126 dated March 29, 2019. Limitations related to foreign participation stipulates that: one-third of the board of directors should be Lebanese; board members can be either shareholders or non-shareholders; one-third of capital shares should be held by Lebanese for companies that provide public utility services and capital shares and management in cases of exclusive commercial representation are limited. In November 2016, the Parliament passed Law 75 prohibiting joint stock corporations from issuing bearer shares and required them to replace their existing bearer shares with nominal shares which identify the owner. In the financial sector, including banking and insurance, establishments must take the form of a joint-stock company.

- Lebanon passed the Access to Information Law in January 2017 to promote transparency in the public sector. The law allows anyone, including foreigners, to request information from government agencies. A Whistleblower Protection law also passed in October 2018.

- In January 2017, Lebanon announced its intent to join the Extractive Industries Transparency Initiatives (EITI), a global standard to promote transparency of the extractive sector. In September 2018, Parliament adopted the Transparency in Oil and Gas Law to facilitate the EITI accession process. To complete Lebanon’s candidacy, the Minister of Energy and Water announced that Lebanon would form a Multi-Stakeholder Group (MSG), with representatives from government, private firms operating in Lebanon, and civil society. In March 2019, the Minister of Energy and Water invited civil society to choose independently its representative to the MSG, as per the EITI’s requirements. EITI membership will require annual data disclosures on licenses, contracts, beneficial ownership, payments, revenues, and production.

- FDI in Lebanon is coordinated through the Investment Development Authority of Lebanon (IDAL), which is mandated to grant permits for new investment and provide incentives and exemptions to foreign investors where appropriate.

- The IDAL implements an incentive system for SMEs which divides the country into three zones (A, B and C) in which different incentives and minimum investment requirements are offered in order to stimulate growth in underdeveloped regions away from the coastal strip, which is Zone A. The IDAL also offers incentives for larger projects, under the Package Deal Contract, and has expanded its support to encourage agricultural exports through a new programme, Agri-Plus, and is assisting 13 projects in the tourism, industry, agriculture and technology sectors, with a cumulative value of USD480 million. In February 2020, the government indicated that it will draft guidelines on capital controls imposed informally by banks in recent quarters.

- Lebanon's commercial law provides for a range of business entities available to both local and foreign investors. Legal structures commonly used by foreigners in conducting business in Lebanon are joint-stock companies (SALs), limited liability companies and branch offices. Lebanese SALs are permitted to engage in all kinds of business activity. Shareholders of a SAL have no liability beyond their actual capital subscriptions. With a small number of exceptions (such as real estate companies and banks), there are no limits on the amount of capital that can be held by foreign investors. The management of a SAL is entrusted to a board of directors with a minimum of three and a maximum of 12 members. The majority of board members must be Lebanese, but the chairman may be a foreign national. Certain types of businesses, such as banks and insurance companies, are required to incorporate as SALs. The minimum capital is LBP30 million, and the applicable corporate income tax rate is 17%, in addition to a withholding tax on dividends of 10%.

- The overall estimated cost of establishing a company in Lebanon is around USD7,500. This includes lawyer's fees and registration fees. The registration fees will increase if the company is established with capital exceeding the minimum requirement. However, the registration fees should not normally exceed 1% of the value of capital. For branch offices and representative offices, establishment costs are lower, estimated at USD5,000. When transferring ownership of real estate, registration fees of approximately 6% are applicable.

- Not all businesses are taxed in the same manner. Depending on the relative size and structure of a business, the tax method applied is assessed depending on real (or actual) profits or deemed profits. A deemed profit method is imposed on insurance and savings institutions, taxable transport companies, oil refineries and public work contractors. Taxation is based on deemed profits and is levied at a flat rate of 17%. The rate of deemed profit for public work contractors, as approved by the Ministry of Finance, is currently set at either 10% or 15% of total amounts collected per year, based on the type of activity performed by the contractor. For insurance companies, the deemed profit rate ranges between 5% and 10%, depending on each insurance activity. There are no governorate or local government taxes on income in Lebanon.

- The standard value added tax (VAT) rate in Lebanon increased from 10% to 11%, effective January 1, 2018. Unless specifically exempt, VAT is levied on all commercial transactions undertaken by business entities. Export of goods and services and export-related services, international transport, and some of the intermediate operations are zero-rated. Banking, financial services and insurance operations are exempt from VAT. Investors must note that the recharge of expenses from an entity in Lebanon to another entity abroad is subject to VAT at 11% instead of 10%, effective January 1, 2018.

- Companies and organisations which are granted an indefinite exemption from corporate income tax include the following: educational institutions, hospitals, non-profit organisations and other shelters that admit patients free of charge, shipping, sea and air transport associations (subject to certain restrictions), farmers (subject to some restrictions), syndicates and other types of professional associations, holding companies and offshore companies, and public sector bodies that do not compete with private institutions.

- Localisation Requirements: In order to obtain an employer work permit to run their business, investors must contribute at least USD67,000 of upfront capital and hire three Lebanese workers within the first six months of setting up operations.

- SOEs: SOEs do not have a dominant position across the Lebanese economy, though they do mainly control the power and aviation sectors. While some private power providers have been granted licences to generate and distribute electricity in recent years, the national airline, Middle East Airlines, retains a guaranteed monopoly in air travel until 2024.

- Foreign Ownership Restrictions: There are restrictions on management participation, as Lebanese nationals must comprise the majority of company board members. In addition, the following restrictions apply to foreign ownership of real estate:

- More than 3,000 square metres requires approval from the Council of Ministers

- Exploitation and normal lease right extending for a period of more than 10 years cannot be attained without obtaining approval

- Real estate owned by foreigners, for which approval has been obtained, cannot exceed (over all of Lebanon territory), 3% of the total area of the country. In each province, the total area owned should not exceed 3% of its area. With respect to Beirut, the total area owned should not exceed 10% of its area

- When approval is granted, the building on the real estate should be constructed within a period of five years (renewable once by the Council of Ministers)

- International arbitration is accepted as a means to settle investment disputes between private parties.

- Lebanon is a member of the International Center for the Settlement of Investment Disputes (ICSID Convention). Lebanon ratified the 1958 Recognition and Enforcement of Foreign Arbitral Awards (New York Convention) in 2007. Lebanese law conforms to both conventions.

Lebanon has signed bilateral investment agreements with the following (in alphabetical order, as of January 2012): Armenia, Austria, Azerbaijan, Bahrain, Belarus, Belgium/Luxemburg, Benin, Bulgaria, Canada, Chad, Chile, Mainland China, Cuba, Cyprus, Czech Republic, Egypt, Finland, France, Gabon, Germany, Greece, Guinea, Hungary, Iceland, Iran, Italy, Jordan, Kuwait, Malaysia, Mauritania, Morocco, Netherlands, OPEC Fund, Pakistan, Qatar, Romania, Russia, Slovakia, South Korea, Spain, Sudan, Oman, Sweden, Switzerland, Syria, Tunisia, Turkey, United Arab Emirates, Ukraine, the United Kingdom and Yemen.

Sources: The International Trade Administration (ITA), Ministry of Finance, IDAL, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

IPZ Zone A: Coastal areas including Beirut. Minimum investment of USD200,000 (IT, media, technology, communication); USD1.5 million (agriculture); USD2 million (agribusiness industry); USD5 million (industry); USD10 million (tourism). |

Work permits are available for all categories of employee. Exemption from corporate income tax for two years if 40% of company shares are listed on the Beirut Stock Exchange (BSE). |

|

IPZ Zone B: Central inland areas. Minimum investment of USD200,000 (IT, media, technology, communication); USD1 million (agriculture); USD1.5 million (agribusiness industry); USD3 million (industry); USD4 million (tourism). |

Work permits are available for all categories of employee. 50% reduction of corporate income tax and tax on dividends for a five-year period. Exemption from income tax for a further two years if 40% of company shares are listed on the BSE. |

|

IPZ Zone C: Northern and southern inland areas. Minimum investment of USD200,000 (IT, media, technology, communication); USD500,000 (agriculture); USD1 million (agribusiness industry, industry, tourism). |

Work permits are available for all categories of employee. Exemption from corporate income tax and tax on dividends for 10 years. Exemption from income tax for a further two years if 40% of company shares are listed on the BSE. |

|

Package Deal Contract: Eligible for large projects located anywhere in the country. Minimum requirements: investment of USD400,000 and creation of 25 jobs (IT, media, technology, communication); investment of USD2 million and creation of 50 jobs (agriculture); investment of USD3 million and creation of 60 jobs (agribusiness industry); investment of USD10 million and creation of 100 jobs (industry); investment of USD15 million and creation of 100 jobs (tourism). |

Exemption from corporate income tax and tax on dividends for 10 years. Up to 50% reduction on residence and work permit fees. Up to 50% reduction on construction permit fees. Work permits are available for all categories provided two Lebanese nationals are employed for every one foreign national. Exemption from requirement to include 50% Lebanese nationals on board of directors. Exemption from land registration fees. |

|

Reinvestment incentives |

Industrial companies using operating profit to finance certain capital investments are exempt from up to 50% of their income tax liabilities for a period of up to four years, provided that such exemptions do not exceed the original investments made. In areas designated 'development zones', 75% of a company's tax liabilities may be exempt. |

Sources: US Department of Commerce, national sources, Fitch Solutions

- Value Added Tax: 11%

- Corporate Income Tax: 17%

Sources: IDAL, Lebanon Ministry of Finance

Important Updates to Taxation Information

A new Law no. 64, dated October 20, 2017 (published in the Official Gazette on October 26, 2017) introduced new tax measures and amended several tax articles to fund the increase of the minimum wages and the cost of living for the public sector. The corporate income tax rate increased to 17% and the VAT rate increased to 11%. There are also further taxes on bank deposit interest, financial transactions and real estate sales.The Ministry of Finance issued the 2018 Budget Law no.79, dated April 18, 2018 (published in the Official Gazette no.158, dated April 19, 2018). It is important to note that not all businesses are taxed in the same manner. Depending on the relative size and structure of a business, the tax method applied is assessed depending on real (or actual) profits or deemed profits.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 17% for residient corporate entities based on the taxpayer’s accounting profits after adjustments resulting from tax rules through the schedule of accounting-to-tax calculation. |

|

Income tax on petroleum operations |

20% |

|

The royalties for crude oil and natural gas |

The royalty for crude oil is on sliding scale ranging from 5% to 12%, based on monthly average daily production rate. For natural gas, it is a flat royalty of 4%. |

|

Withholding Tax on interest income |

7% |

|

Dividend Distribution Withholding Tax |

10% |

|

Non-resident Withholding Tax |

- 7.5 % for services |

|

Capital gains on sale of fixed assets and shares |

- 15% |

|

VAT |

11% on sales value of products |

|

Stamp duty |

- 0.4% |

|

Payroll Taxes |

Payroll tax is levied at progressive rates of 2% to 25% instead of 2% to 20% |

|

Social security contributions |

- 8% for the maternity and sickness benefit schemes, on a maximum of LBP2.5 million per month |

|

Built Property Tax |

Raging between 4% and 14% |

Sources: Source: IDAL, Lebanon Ministry of Finance

Date last reviewed: March 14, 2020

Refugee employment restrictions

Lebanon's large refugee population faces structural disadvantages in the job market due to outdated legislation, which makes it difficult for refugees to join the formal labour force. In particular, Lebanese law treats refugees from the West Bank and Gaza as normal foreign workers. This means that in order to gain employment, they are required to meet the condition of reciprocity of treatment for Lebanese workers in their home state - a situation which is impossible to reconcile, given the lack of legal status of the West Bank and Gaza. Applications for work permits must also include copies of a passport, which many refugees do not own, as well as medical reports and formal employment contracts, which are difficult for refugees to obtain.

Foreign worker permits

Foreign workers are required to obtain prior approval from the Ministry of Labour before taking up employment in Lebanon. Foreign workers must have entered into a formal employment contract, and present this along with a medical report, passport, application form, and information about the employer.

Visa/travel restrictions

Israeli citizens are not permitted to travel to Lebanon and any person with an Israeli entry stamp in their passport will be refused entry.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ca (Stable) |

21/02/2020 |

|

Standard & Poor's |

In default with little prospect for recovery |

11/03/2020 |

|

Fitch Ratings |

C |

09/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

133/190 |

142/190 |

143/190 |

|

Ease of Paying Taxes Index |

113/190 |

113/190 |

116/190 |

|

Logistics Performance Index |

79/160 |

N/A |

N/A |

|

Corruption Perception Index |

138/180 |

137/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

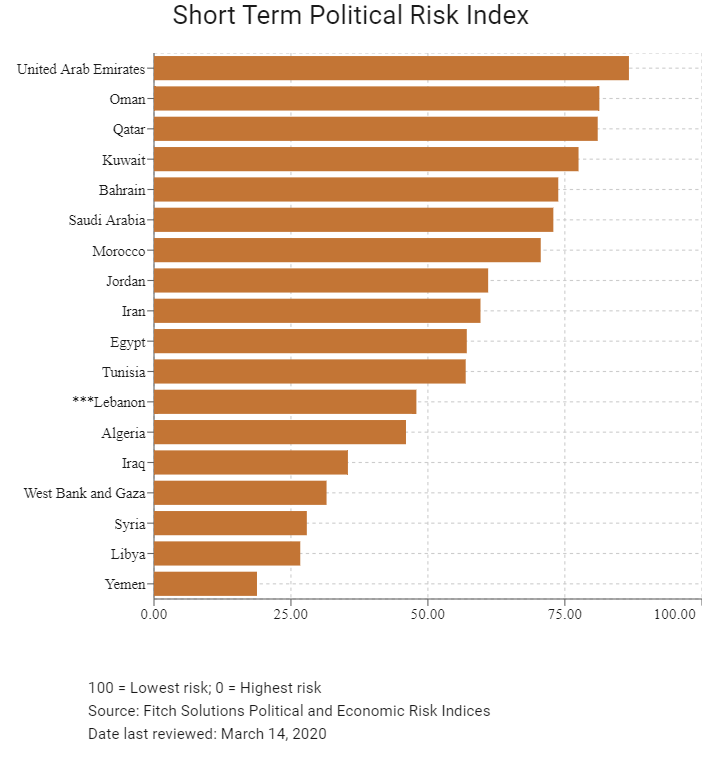

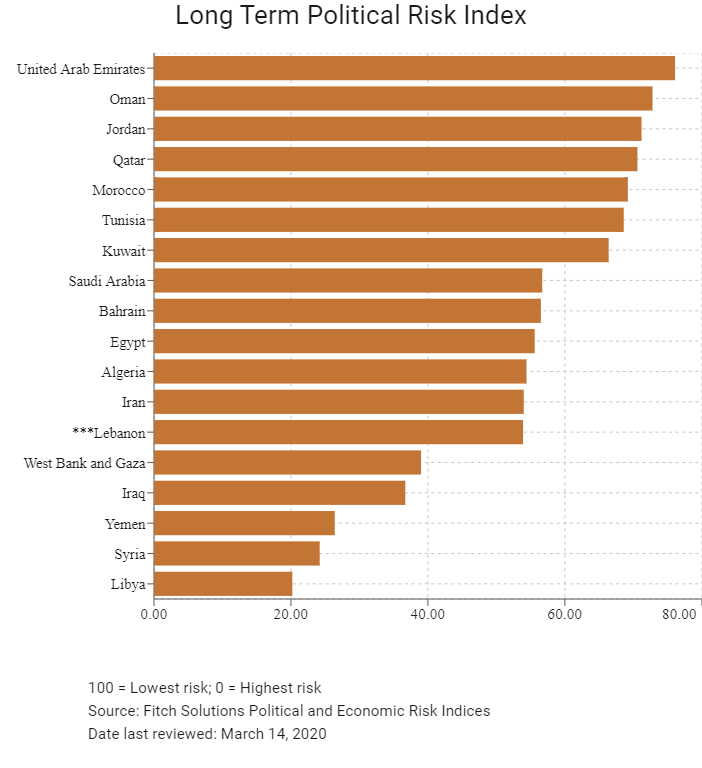

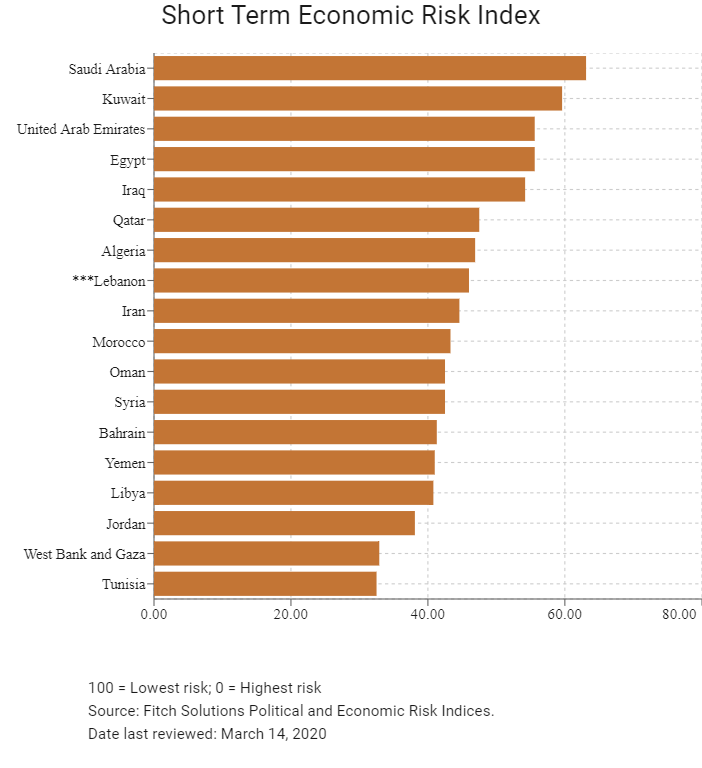

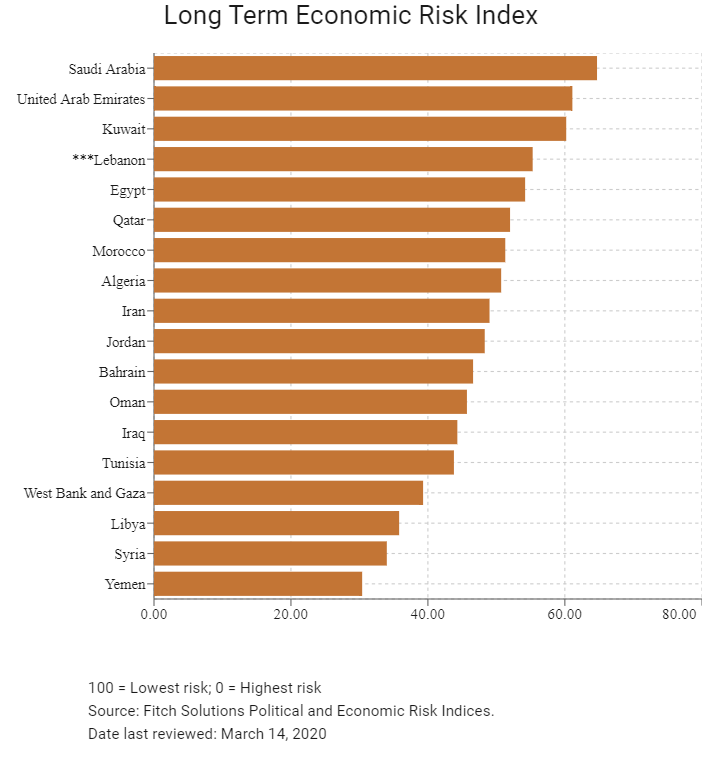

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

75/202 |

87/201 |

77/201 |

|

Short-Term Economic Risk Score |

51.9 |

46.9 |

46.0 |

|

Long-Term Economic Risk Score |

56.5 |

53.8 |

55.3 |

|

Political Risk Index Rank |

140/202 |

140/201 |

140/201 |

|

Short-Term Political Risk Score |

46.7 |

46.7 |

47.9 |

|

Long-Term Political Risk Score |

53.9 |

53.9 |

53.9 |

|

Operational Risk Index Rank |

127/201 |

125/201 |

125/201 |

|

Operational Risk Score |

42.9 |

43.8 |

44.1 |

Source: Fitch Solutions

Date last reviewed: March 14, 2020

Fitch Solutions Risk Summary

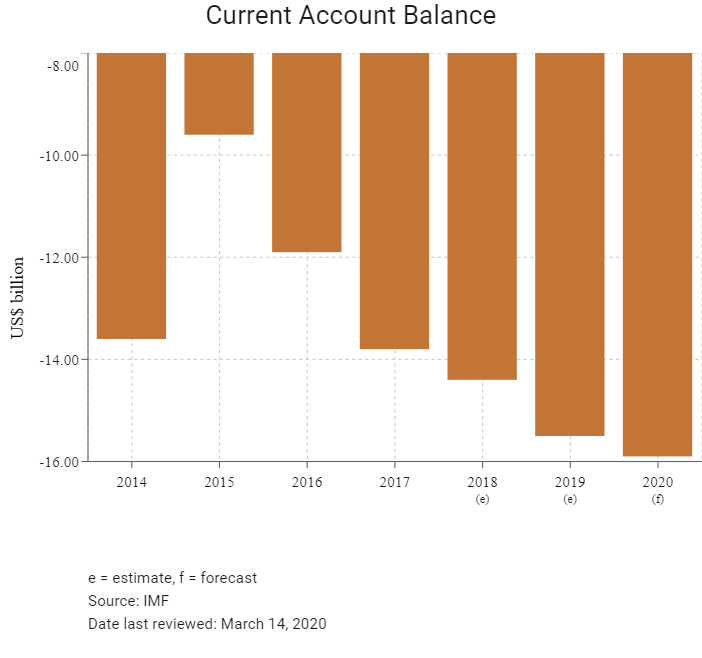

ECONOMIC RISK

Economic conditions in Lebanon are likely to remain extremely challenging in the next two years. Near-depleted central bank reserves and tight commercial bank capital controls are raising the foreign currency liquidity risks, with a strongly inflationary impact. This, combined with low levels of confidence in the government’s ability to resolve the crisis, is generating extremely weak sentiment and demand and weighing on growth. Lebanon’s debt load that stands at roughly 160% of GDP, has severely strained the country’s public finances, and continues to rise with large deficits. Meanwhile key sectors such as tourism, real estate and construction continue to suffer from the impact of regional unrest. With the region's highest debt-to-GDP levels and one of its largest fiscal deficits, Lebanon is one of the economies most at risk from higher levels of global financial volatility. That said, the economy will benefit from its links with the vast Lebanese overseas diaspora through remittances and banking sector deposits, as well as strategic support from both the Gulf Cooperation Council and Western actors.

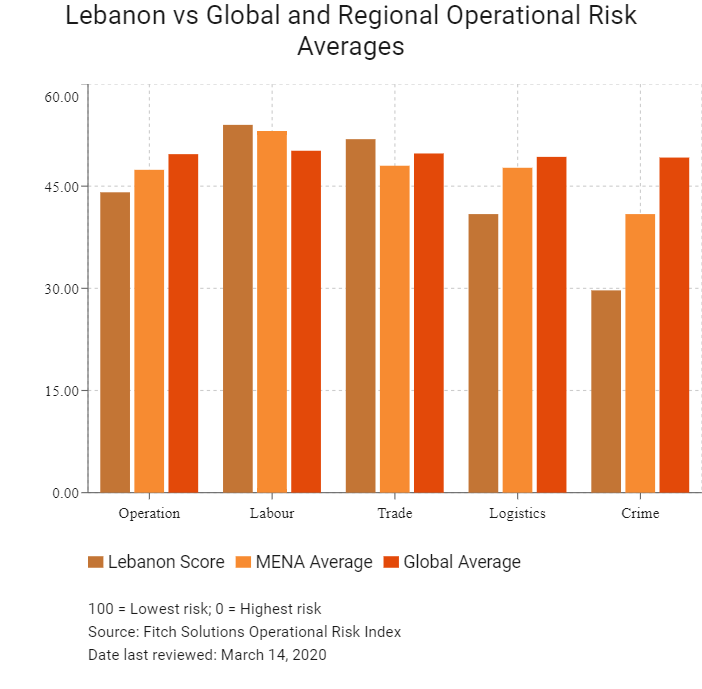

OPERATIONAL RISK

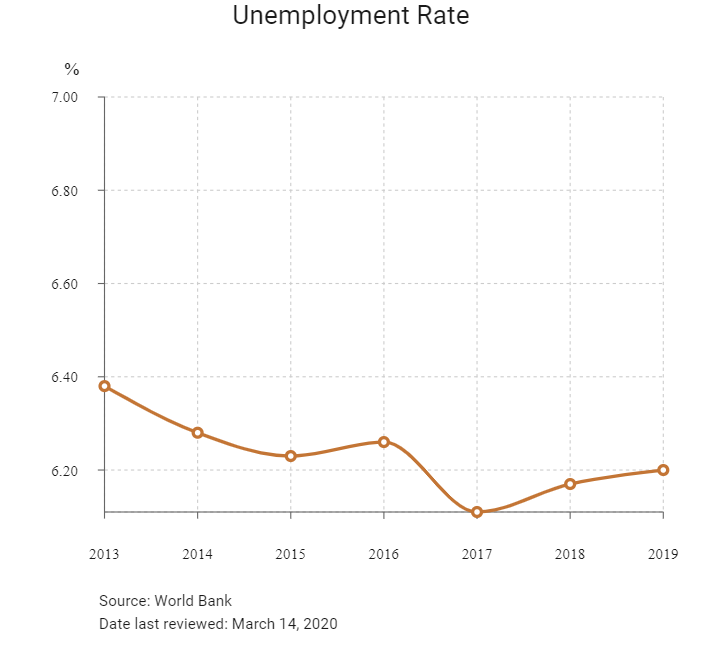

Fiscal constraints, a high debt burden and currency risks are raising risk of regulatory tightening on capital outflows. The Lebanese economy is service-oriented, and its main growth sectors include banking and tourism. Lebanon's appeal to investors is undermined by the country's exposure to a range of wider regional security risks, the most pertinent being the ongoing conflict in neighbouring Syria and long-standing interstate tensions with neighbouring Israel. This has had a negative effect on trade growth as many overland connections are inaccessible due to high risk of clashes occurring in border regions, and military blockades. The influx of Syrian refugees has placed pressure on already struggling logistics networks and social services, elevating the already high unemployment rate and raising social instability risks.

Source: Fitch Solutions

Date last reviewed: March 16, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Lebanon Score |

44.1 |

54.0 |

51.9 |

40.9 |

29.7 |

|

MENA Average |

47.4 |

53.1 |

48.0 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

11 |

8 |

9 |

13 |

13 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

125 |

76 |

94 |

126 |

168 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

UAE |

72.0 |

70.6 |

79.1 |

68.0 |

70.5 |

|

Qatar |

65.9 |

66.8 |

61.8 |

73.7 |

61.2 |

|

Bahrain |

65.0 |

65.5 |

69.5 |

71.6 |

53.6 |

|

Oman |

64.5 |

62.7 |

61.9 |

64.2 |

69.2 |

|

Saudi Arabia |

62.6 |

68.3 |

62.1 |

62.5 |

57.7 |

|

Jordan |

56.5 |

58.4 |

60.7 |

54.8 |

52.3 |

|

Kuwait |

54.3 |

58.7 |

51.2 |

50.8 |

56.2 |

|

Morocco |

54.2 |

45.0 |

63.8 |

54.9 |

53.2 |

|

Egypt |

48.7 |

50.7 |

45.7 |

55.2 |

42.9 |

|

Tunisia |

46.5 |

41.0 |

56.2 |

46.7 |

42.3 |

|

Lebanon |

44.1 |

54.0 |

51.9 |

40.9 |

29.7 |

|

Iran |

43.2 |

48.9 |

36.7 |

52.8 |

34.4 |

|

Algeria |

39.2 |

48.7 |

31.1 |

41.0 |

36.2 |

|

West Bank and Gaza |

32.5 |

48.3 |

37.4 |

27.1 |

17.0 |

|

Syria |

27.3 |

42.8 |

23.7 |

27.6 |

15.0 |

|

Libya |

27.3 |

43.3 |

22.1 |

26.6 |

17.1 |

|

Iraq |

26.9 |

43.5 |

24.8 |

26.9 |

12.4 |

|

Yemen |

23.2 |

37.8 |

24.9 |

13.9 |

16.1 |

|

Regional Averages |

47.4 |

53.1 |

48.0 |

47.7 |

40.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 14, 2020

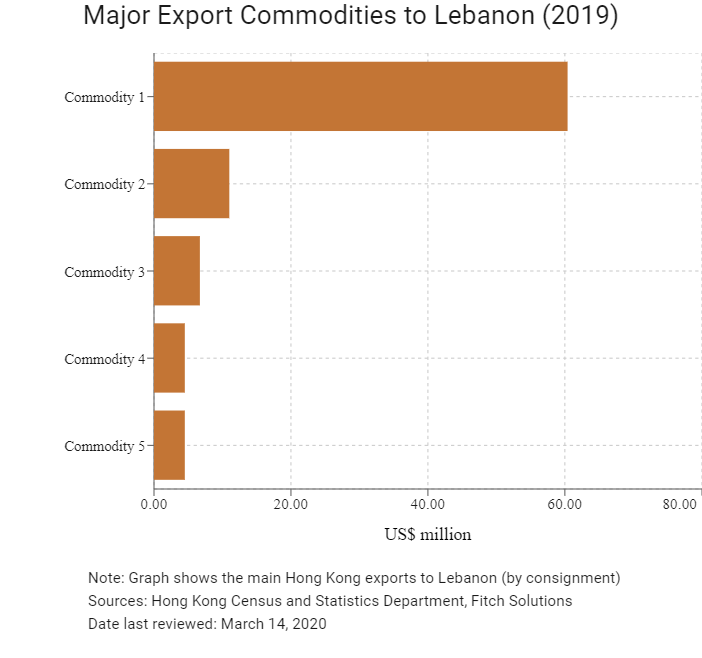

Hong Kong’s Trade with Lebanon

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Power generating machinery and equipment |

60.4 |

|

Commodity 2 |

Articles of apparel and clothing accessories |

11.0 |

|

Commodity 3 |

Office machines and automatic data processing machines |

6.7 |

|

Commodity 4 |

Miscellaneous manufactured articles |

4.5 |

|

Commodity 5 |

Footwear |

4.5 |

|

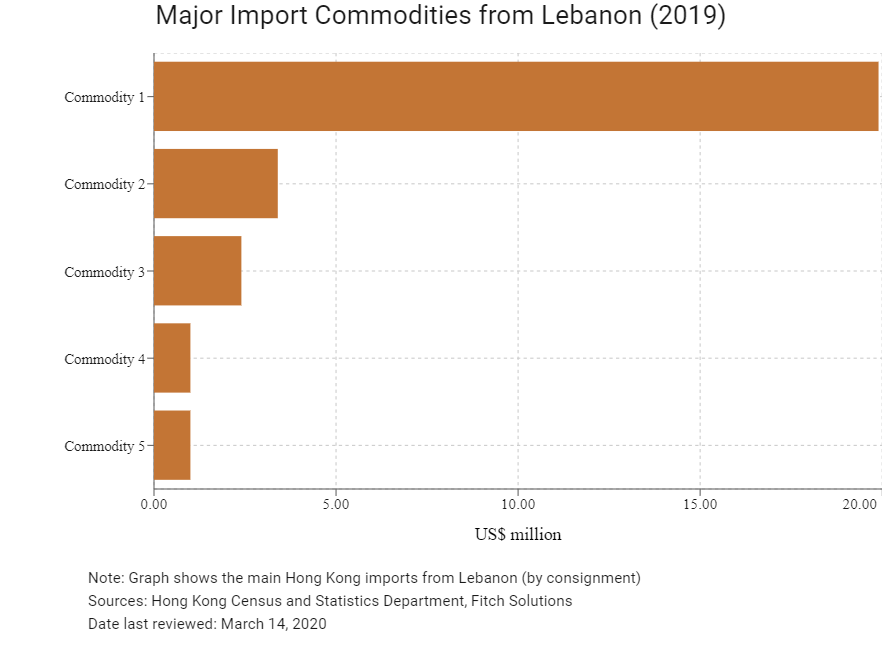

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Power generating machinery and equipment |

19.9 |

|

Commodity 2 |

Metalliferous ores and metal scrap |

3.4 |

|

Commodity 3 |

Miscellaneous manufactured articles. |

2.4 |

|

Commodity 4 |

Professional, scientific and controlling instruments and apparatus. |

1.0 |

|

Commodity 5 |

Articles of apparel and clothing accessories |

1.0 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Lebanese residents visiting Hong Kong |

586 |

-18.6 |

|

Number of Middle East residents visiting Hong Kong |

113,849 |

-12.8 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: July 2, 2019

Commercial Presence in Hong Kong

|

2018 |

Growth rate (%) |

|

|

Number of Lebanese companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Lebanon

Lebanon and Mainland China have a bilateral investment treaty which came into force in July 1997.

Source: UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Arab Chamber of Commerce & Industry

The Arab Chamber of Commerce & Industry (ARABCCI) was established in Hong Kong in 2006 to promote commercial ties between Hong Kong, Mainland China and the Arab World.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Visa Requirements for Hong Kong Residents

A Lebanon tourist visa is required for HKSAR passport holders. Generally, a visa will be granted upon arrival and the maximum duration of stay is three months.

Source: Hong Kong Immigration Department

Date last reviewed: March 14, 2020

Lebanon

Lebanon