GDP (US$ Billion)

42.29 (2018)

World Ranking 91/193

GDP Per Capita (US$)

4,270 (2018)

World Ranking 112/192

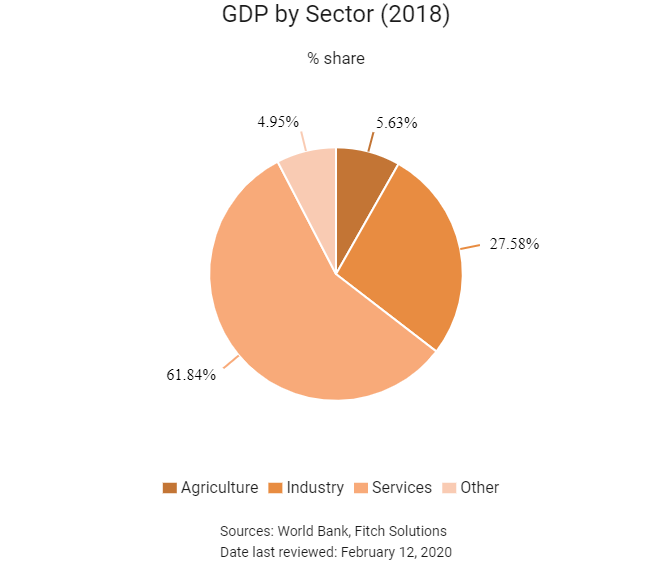

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

87.6 (2019)

Currency (Period Average)

Jordanian Dinar

0.71per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Over the past decade, Jordan has pursued structural reforms in education and health, as well as privatisation and liberalisation. More recently, Jordan has made important reforms to put its economy on the path to long-term prosperity, covering income tax, business regulations, insolvency and the public procurement framework. It has also grown trade with its neighbours, especially Iraq. However, further progress is needed so that reforms aimed at enhancing the investment climate and the ease of doing business can lead to concrete outcomes.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2016

First parliamentary elections were held under proportional representation since 1989.

August 2017

Jordan and Iraq reopened their main border crossing for the first time in two years.

June 2018

Hani Mulki was replaced as prime minister by Omar al Razzaz, economist and the education minister.

November 2018

The International Finance Corporation (IFC) has provided two separate financing packages worth USD151 million for the 51.75MW Abour wind project and the 51MW Daehan wind facility in Jordan. The up to USD80 million financing for the Abour project includes a USD28 million loan from IFC’s own account and parallel from the Islamic Development Bank.

February 2019

Jordan and Iraq signed agreements for various development projects. A key project to be undertaken under the agreements was a joint industrial zone on the border between the two countries. The Jordanian government had donated 2sq km of land for the special economic zone, which would be expandable to 10sq km.

April 2019

AMEA Power and Philadelphia Solar reached financial close on the 50MW al Husainiyah solar photovoltaic power project in Jordan and were set to begin construction.

July 2019

Jordan Free and Development Zones Group (JFDZG) unveiled plans to build a cable car project as part of Al Suwwan Development Zone (SDZ) in Ajloun, Jordan. Phase one of the SDZ would include building the parts of the cable car project on plots 36 and 43. The cost for this phase would be covered by JFDZC. The second phase included building a conference centre, a five-star hotel, lodging and several restaurants at an estimated cost of JOD50 million (USD70.5 million). JFDZC would work in partnership with private sector companies for the second phase. The cable car project was expected to be completed by June 2021.

October 2019

The European Investment Bank (EIB) signed a EUR16.3 million (USD18.16 million) grant agreement with the government of Jordan for a water supply project in Deir Alla and Al-Karamah districts.

January 2020

Iraq's Ministry of Oil opened bids to prequalified firms for a USD5 billion oil pipeline between oil fields in Rumaila in Iraq and Aqaba in Jordan. Phase one involved installing a 700km-long pipeline on the Iraqi side and phase two would see the construction of a 900km pipeline in Jordan. The Jordanian section would be delivered on a build-own-operate-transfer model. Bids were due in May 2020, while the winning bidder was likely to be named by the end of 2020.

Sources: BBC country profile – Timeline, Fitch Solutions

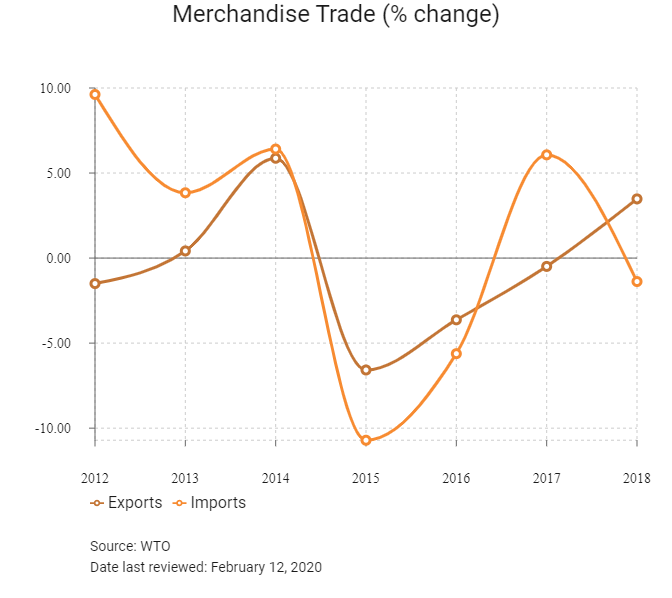

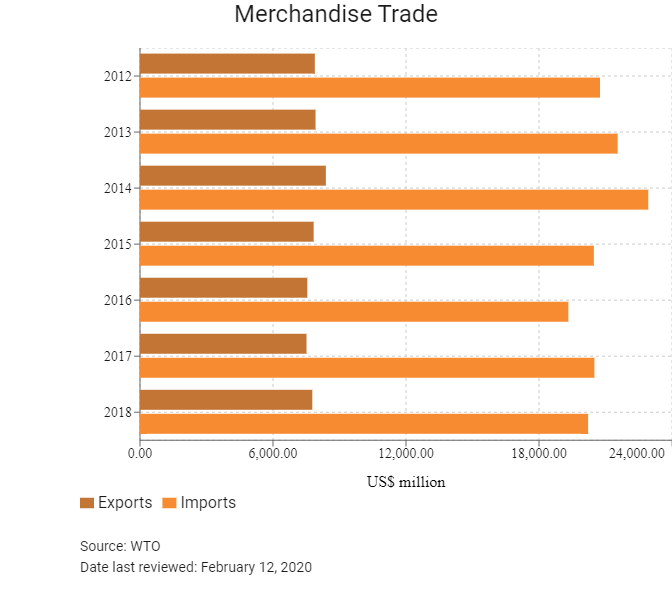

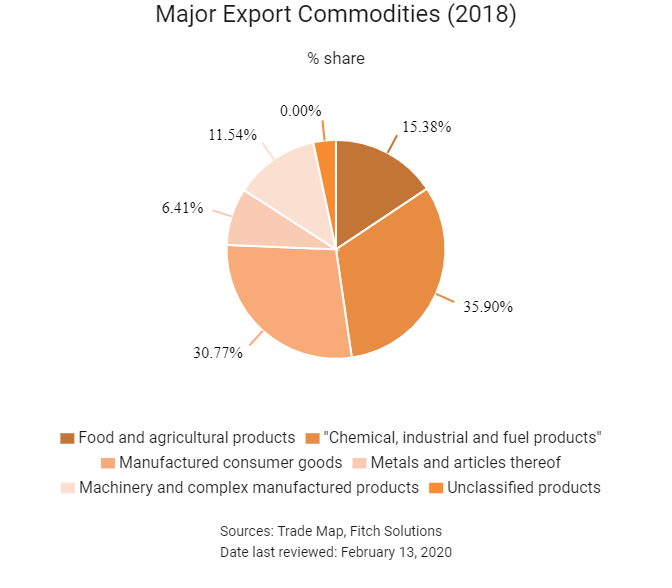

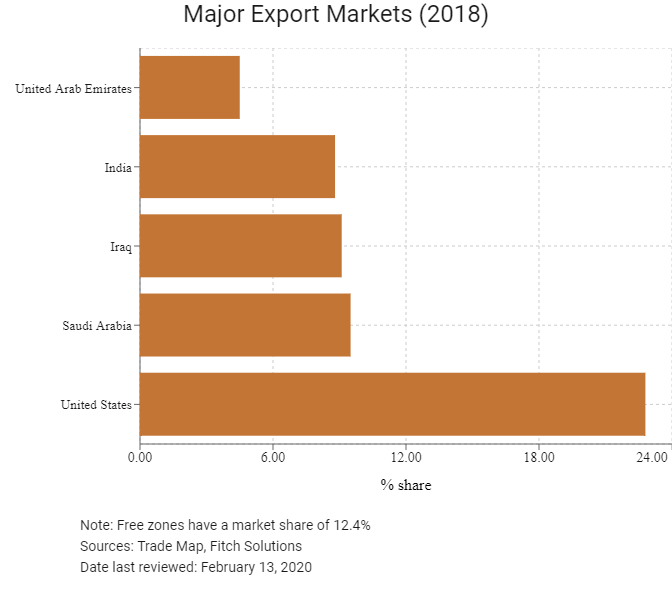

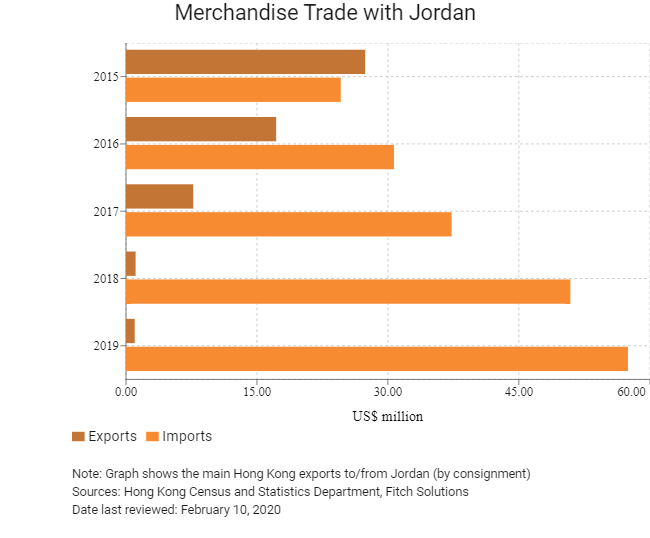

Merchandise Trade

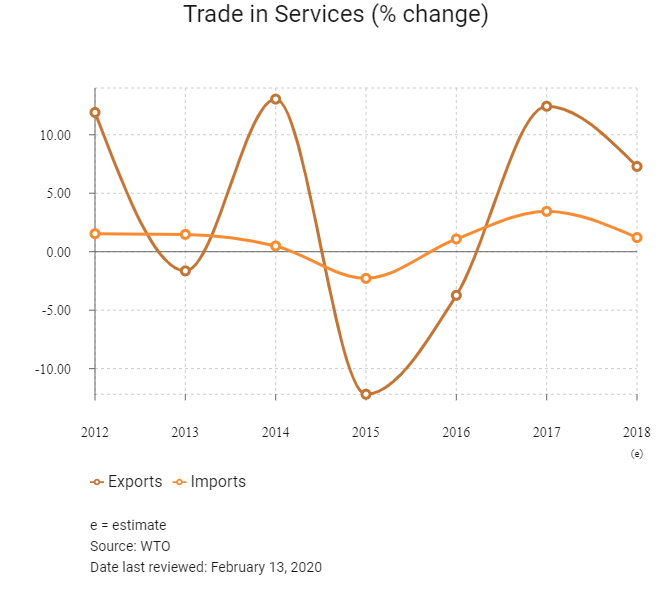

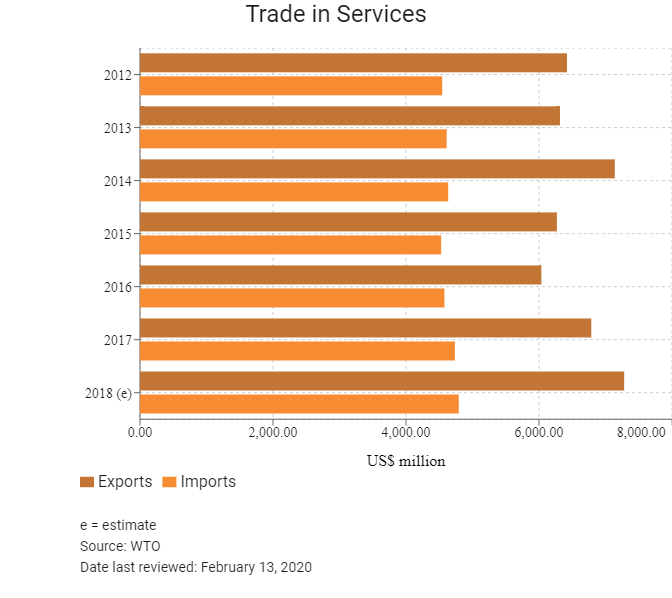

Trade in Services

- The free trade agreements (FTAs) signed by Jordan are slowly reducing the weighted average applied tariff rate, which currently stands at a regionally average 4%. Import tariffs remain considerable for goods arriving from states not covered by FTAs, particularly for foodstuff, clothing and other manufactured products. Beverages and tobacco face the highest tariffs, of up to 81.3%, with the next highest duties dropping to 19.7% for fruits and vegetables.

- Jordan joined the World Trade Organization (WTO) in April 2000 and has been pursuing an open trade regime.

- Jordan has bound its most favoured nation (MFN) tariffs on almost all products, with tariffs levied on an ad valorem basis. The applied MFN tariffs generally range between 0% and 30%, but some products – such as lighters, tobacco products, alcohol and alcoholic beverages – face a tariff up to 200%. Jordan reduced its simple average applied MFN tariff rate from 14.7% in 2000 to 10.2% in 2014, with average rates of 17.4% for agricultural products (WTO definition) and 8.9% for non-agricultural products. Customs duties are assessed on the basis of the cost, insurance and freight (CIF) value of imports on the registration date of the customs valuation form. In 2015 there were 6,767 tariff lines in Jordan's applied MFN tariffs, of which 33.7% of agricultural products and 56.4% of non-agricultural products were duty-free.

- Imports of some agricultural goods remain subject to additional licensing requirements, adding to the bureaucratic burden; however, a number of reforms, including fewer physical inspections of traded goods and the introduction of online customs services, have reduced non-tariff barriers for importers and exporters. This is indicative of continuing improvement to Jordan's operating environment for businesses engaged in international trade. Logistics and security issues will continue to hamper Jordan's cross-border trade in the short term.

- The Jordanian government has worked to reduce the burden of bureaucracy and other non-tariff barriers for importers. Customs regulations have been standardised and streamlined to improve efficiency.

- Companies seeking to import must obtain an importer's card from the Ministry of Industry and Trade in order to clear customs. While import licenses are not required for most goods, there are a few exceptions, including telecommunications equipment and some processed food products. Sanitary requirements and technical inspections can cause delays for food imports.

- With the challenges to Middle East and European countries as a result of the Syrian refugee crisis, the European Union (EU) is engaging in deeper diplomatic and trade cooperation with Jordan. In 2016 the EU committed to increasing aid to Jordan and easing the rules of origin for Jordanian goods emanating from companies located in the country's special industrial estates and development zones that employ Jordanians and a minimum proportion of Syrian refugees. This allows products with a minimum Jordanian content of 30% to enter the EU under the EU-Jordan FTA over the next 10 years. Such change offers positive long-term prospects for Jordan's exports to the European market.

- Jordan has not applied anti-dumping measures or countervailing duties, but safeguard measures are in place.

- Jordan has signed preferential trade treaties, including a number of FTAs, with its major trading partners.

- In 1997 Jordan, the United States and Israel reached an agreement on establishing qualified industrial zones (QIZs) in Jordan. QIZs are designated areas where manufactured products in the zones enjoy duty-free access to the US market with no quota limit, provided that specific requirements on the rule of origins have been satisfied. The importance of QIZs has declined in the wake of the Jordan-United States FTA concluded in 2001, under which qualified Jordanian goods entering the United States market are both duty and quota free.

- In recent years, Jordan has further opened up its economy to attract foreign direct investment. The Investment Promotion Law provides tax exemption on fixed assets from foreign investors for three years and duty-free import of raw materials into Jordan.

- Regional instability, including the civil war in Syria and the expansion of Islamic State (IS) in Iraq, has resulted in border closures which have significantly disrupted international trade. Overland supply chain routes to trade partners in the Middle East have been cut off, and access to the Iraqi market in particular has been restricted since 2014. The border crossing with Iraq reopened in 2017 following the removal of IS militants from the border province of Anbar, which will ease trade flows somewhat.

Sources: WTO – Trade Policy Review, Fitch Solutions, Global Trade Alert

Multinational Trade Agreements

Active

- Greater Arab Free Trade Area (GAFTA): GAFTA comprises Algeria, Bahrain, Egypt, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, the United Arab Emirates (UAE) and Yemen. The GAFTA was declared within the Social and Economic Council of the Arab League as an executive programme to activate the Trade Facilitation and Development Agreement that has been in force since January 1, 1998. Trade liberalisation benefits all member states and reduces the cost of imports to Jordan. However, regional instability and the consequent domestic security concerns have diminished the effect of this agreement and created security-related trade barriers. Bilateral FTAs between Jordan and non-MENA countries have also largely superseded this agreement.

- United States-Jordan FTA and Economic Integration Agreement: Jordan has benefitted considerably from its extensive economic partnership with the United States through a comprehensive FTAs that entered into force on December 17, 2001. The United States is the country's top export partner and the agreement has facilitated significant United States investment in high value-added industries, such as textiles manufacturing.

- Jordan-EU FTA: Jordan and the EU signed an association agreement that came into force in May 2002 as part of the EU's efforts to enhance Mediterranean trade. The FTA covers trade in industrial products, as well as fish and marine products and processed agricultural products. Among the objectives of the agreement is to promote the harmonious development of economic relations through the expansion of reciprocal trade. By 2014 virtually all customs duties on trade in industrial goods and fish and other marine products were eliminated. Medium-term growth is, therefore, expected in trade volumes between Jordan and this important bloc.

- Jordan-European Free Trade Association (EFTA) FTA: The EFTA consists of Switzerland, Norway, Iceland and Liechtenstein, and its FTA with Jordan covers trade in goods and came into force on September 1, 2002.

- Jordan-Turkey FTA: Turkey is an important trade partner for Jordan, providing a key market for phosphate and fertiliser exports, and is also a source of refined fuel. Although trade flows have been disrupted by regional instability, economic ties between the two countries remain strong.

- Jordan also has FTAs and economic integration agreements with Singapore (August 22, 2005) and Canada (October 1, 2012). Although these agreements will assist with trade diversification, overall trade flows with both countries remain low compared with other FTA partners.

- Jordan-Agadir Agreement: The FTA between Egypt, Jordan, Morocco and Tunisia (Agadir Agreement) is an FTA for trade in goods that came into force on March 27, 2007.

- Pan-Arab Free Trade Area (PAFTA): Jordan is a member of the PAFTA Treaty, with members including Egypt, the UAE, Bahrain, Tunisia, Saudi Arabia, Sudan, Syria, Iraq, Oman, Palestine, Qatar, Kuwait, Lebanon, Libya, Morocco and Yemen. The Agreement is an FTA for trade in goods and came into force on January 1, 1998.

Signed But Not Yet In Effect

The Trade Preferential System of the Organization of the Islamic Conference (TPS-OIC): The agreement would see to the promotion of trade between member states by including most-favoured nation principles, harmonising policy on rules of origin, exchanging trade preferences among member states, promoting equal treatment of member states and special treatment for least developed member states and providing for regional economic bodies made up of OIC nations to participate as a bloc. The agreement will cover all commodity groups. The OIC comprises 57 members, making a full realisation of such an agreement highly impactful, encompassing approximately 1.8 billion people. Although the framework agreement, the protocol on preferential tariff scheme and the rules of origin have all been agreed on, a minimum of 10 members are required to update and submit their concessions list for the agreements to come into effect. As of Feburary 2019, only 14 nations have done so.

Sources: WTO Regional Trade Agreements database, Fitch Solutions, Jordan Investment Commission Investors Guide

Foreign Direct Investment

Foreign Direct Investment Policy

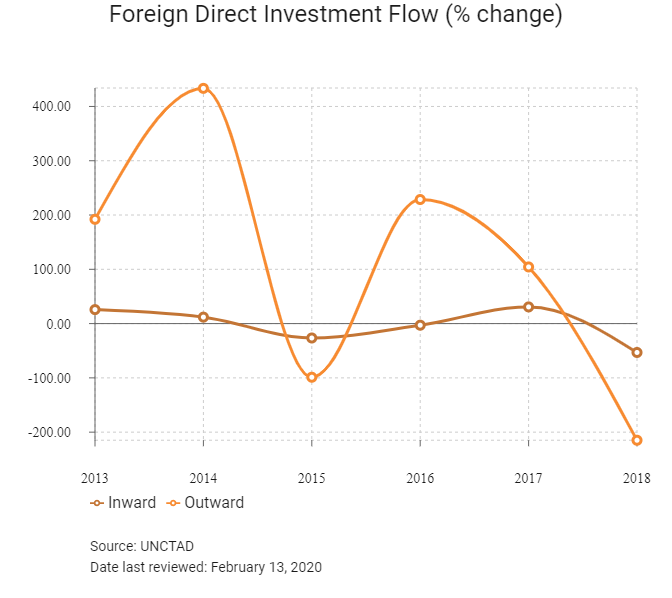

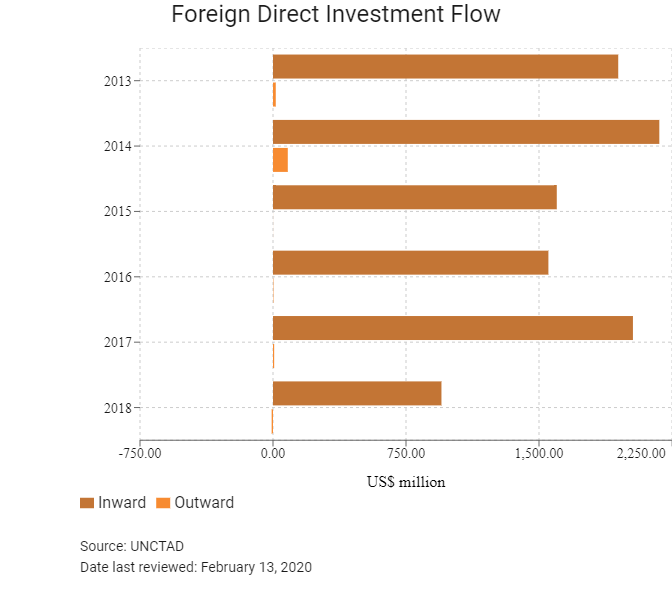

- The Jordanian government has also attempted to channel FDI into certain priority sectors through legislative programmes and the Jordan Investment Commission. Jordan's Investment Promotion Law of 1995 (amended in 2000) and Investment Law No. 30 in 2014 include provisions for attracting FDI as well as domestic investment and covers many sectors, including agriculture, industry, tourism, infrastructure, utilities and R&D. FDI has typically flowed into real estate, the financial sector, tourism and textiles manufacturing, with the main sources being the Gulf Cooperation Council (GCC) states – particularly Kuwait, Qatar, Saudi Arabia and Bahrain – as well as Lebanon and the United States.

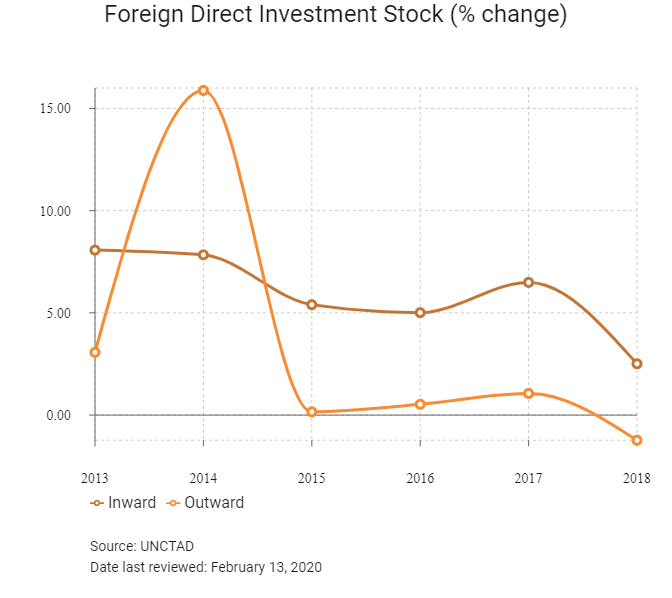

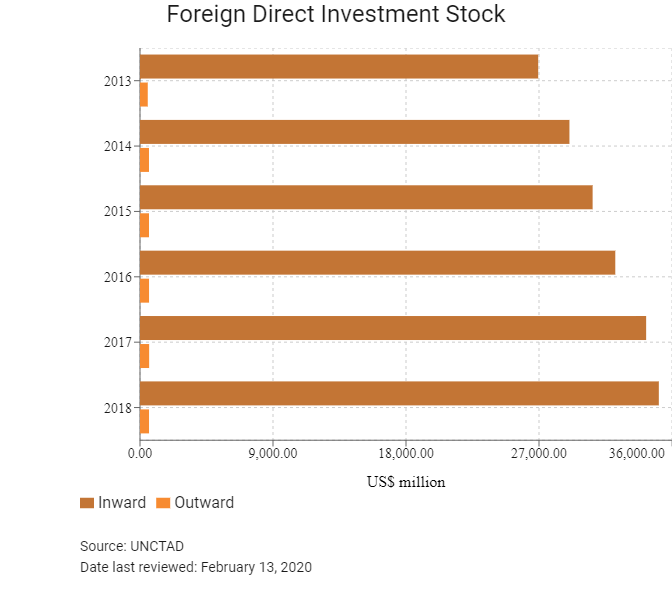

- Inward FDI stock increased considerably over the decade leading up to 2016, from USD19 billion in 2007 to USD32.1 billion, but this remains a moderate amount by regional standards. Nonetheless, FDI represents a considerable 88.6% of GDP, the second highest figure regionally after Lebanon, which indicates the importance of foreign investment for driving economic growth in Jordan.

- Although a minimum non-Jordanian investment requirement of USD70,000 (or JOD50,000) is imposed, foreign investors in these sectors will be eligible for a number of incentives. These may include exemptions from applicable customs duties and taxes on capital goods, imported spare parts, furniture for hotels and hospitals, and salaries paid to non-Jordanian employees. The level of exemption provided depends on the geographic location of the investment, with the country divided into three investment zones: A, B, and C, which represent the most developed (Zone A) to the least developed (Zone C) areas of Jordan. Reductions and exemptions from applicable taxes and duties are available for 10 years at 25% for Zone A, 50% for Zone B and 75% for Zone C.

- The only sector in which foreign participation is entirely banned is newspaper publishing. Foreigners are generally also prohibited from partial or complete ownership of security services, sports clubs, stone quarrying, customs clearance and road-based transport. However, approval for foreign investment in these sectors may be gained on a case-by-case basis, with the requirements that the project contribute significantly to the economy and create a large number of local jobs. Caps on foreign ownership also exist in a number of other sectors, notably transport, retail, engineering, advertising and hospitality.

- A number of restrictions were lifted following the signing of the FTA with the United States in 2000, including in the telecommunications, tourism, health and services sectors. State-owned enterprises maintain a dominant presence in some areas of the economy but do not pose a major barrier to foreign entry, and there are no significant local content requirements that put foreign investors at a disadvantage.

- While FDI is welcomed in most sectors of the economy, there remain some restrictions on foreign ownership in certain industries:

- Foreign ownership is capped at 50% for enterprises in wholesale and retail trade, engineering and construction services, advertising, money exchange, restaurants and cafés, printing and publishing, and auxiliary transport services.

- Foreign ownership is capped at 49% for air transport services, maintenance of road transport and maintenance of broadcasting equipment.

- Foreign participation is not permitted in passenger or freight road services, quarrying for construction materials, security services and real estate services, except in a few cases with government approval.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Jordan Investment Commission Investors Guide

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Aqaba Special Economic Zone Authority (ASEZA) |

- Investors in Jordan benefit from a wide range of development areas, special economic zones (SEZs), industrial zones and free zones, all of which offer a variety of incentives, benefits and tax breaks for both foreign and domestic investors based within them.

|

|

Free Zones located at: Zarqa, Sahab, Queen Alia International Airport, Al-Karama, Al-Karak |

- Free zones offer non-fiscal benefits, such as logistics services, as well as exemption from income tax on profits accrued from exported goods, exemption of employees' salaries from income and social security tax, waived customs duties and lifted property taxes.

|

|

Industrial Parks: Amman, Mafraq, Irbid and Ma'an |

Incentives include: |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 16%

- Corporate Income Tax: 20% (standard)

Sources: Jordan Ministry of Finance, Fitch Solutions

Important Updates to Taxation Information

- According to the World Bank Doing Business 2020 report, in 2019 Jordan made paying taxes easier by introducing electronic filing and payment for labour taxes and other mandatory contributions.

- The Jordanian government has traditionally taken a relaxed attitude towards tax collection, which has contributed to the country's current fiscal issues, and external funding is needed to supplement limited government revenue and shore up public spending. Only a small proportion of Jordan's population pays income tax at present, highlighting the need to significantly broaden the tax base. Consequently, the government has proposed tax reforms in order to tighten fiscal policies as part of its commitment to the IMF's Stand-By Arrangement.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax (CIT) |

- 20% standard rate on operating profits |

|

Capital Gains Tax |

Companies and banks involved in the financial industry are subject to income tax on capital gains made from the sale of shares and bonds in Jordan and on dividends received from companies inside Jordan. |

|

Value Added Tax |

- 16% on value of the products (standard rate) |

|

Social security contributions |

14.25% on salaries up to a maximum amount determined on a yearly basis |

|

Withholding Taxes |

- 0% on dividends |

Sources: National sources, Fitch Solutions

Date last reviewed: February 13, 2020

Foreign Worker Permits

Work permits are valid for up to one year and may be renewed. Foreign workers must apply for a new permit if they wish to change jobs in Jordan.

There are a number of barriers to employing refugees in Jordan, hindering integration into the labour market. The most notable obstacles include the cost of work permits and the difficulty for refugees to obtain the necessary documentation. Jordanian nationals are also favoured for employment by law, owing to high levels of unemployment in the country and the risk of social unrest.

Some measures have been introduced to ease the recruitment of refugees, including waiving permit costs and allowing companies in export zones to employ refugees in their workforce (up to 25% thereof). In addition, the Jordanian government agreed with the EU to open the labour market in Jordan to the massive Syrian refugee population (1.3 million registered but estimated to be more) in exchange for USD2.1 billion in grants and USD1.9 billion additional financing from 2016 to 2018 as part of the Jordan Compact Agreement in February 2016. As a result, issuing work permits for Syrians is being made easier, especially in low-skill sectors, such as construction and agriculture. Consequently, this has widened the pool of labour available for recruitment and has reduced compliance risk associated with employing refugees. The government also opened its first job centre in a refugee camp in August 2017, making it much easier for refugees to register for work permits and to integrate into the labour force.

Localisation Requirements

Under the Jordanian Labour Law, certain professions and occupations may not be filled by non-Jordanians, such as those in the fields of medicine, engineering, teaching, accounting and administration, clerical work (such as data entry and secretarial), warehousing, hairdressing, and mechanical and car repair work. While there is considerable slack in the Jordanian labour market, an absence of vocational or educational skills in these areas means that businesses will face difficulties filling vacancies and will also face higher training costs.

Visa/Travel Restrictions

Individuals of all nationalities must apply for work and residency permits if they want to work in Jordan, with priority given to Arab nationals. Work and residency permits are issued with the approval of the Ministry of Labour and the Ministry of Interior. An applicant may not begin working in Jordan before obtaining work and residency permits. Work and residency permits may not be transferred from one employer to another; therefore, if an employee changes employers, the previous work and residency permits must be cancelled and the employee must apply for new work and residency permits. The work and residency permits are valid for one year and may be renewed on an annual basis.

As a prerequisite to obtaining work and residency permits, the Ministry of Labour requires the employer to submit a bank letter of guarantee to the Ministry of Labour for each expatriate employee seeking work and residency permits in Jordan.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (Stable) |

08/11/2018 |

|

Standard & Poor's |

B+ (Stable) |

20/10/2017 |

|

Fitch Ratings |

BB- (Stable) |

13/06/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

103/190 |

104/190 |

75/190 |

|

Ease of Paying Taxes Index |

97/190 |

95/190 |

62/190 |

|

Logistics Performance Index |

84/160 |

N/A |

N/A |

|

Corruption Perception Index |

58/180 |

60/180 |

N/A |

|

IMD World Competitiveness |

52/63 |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

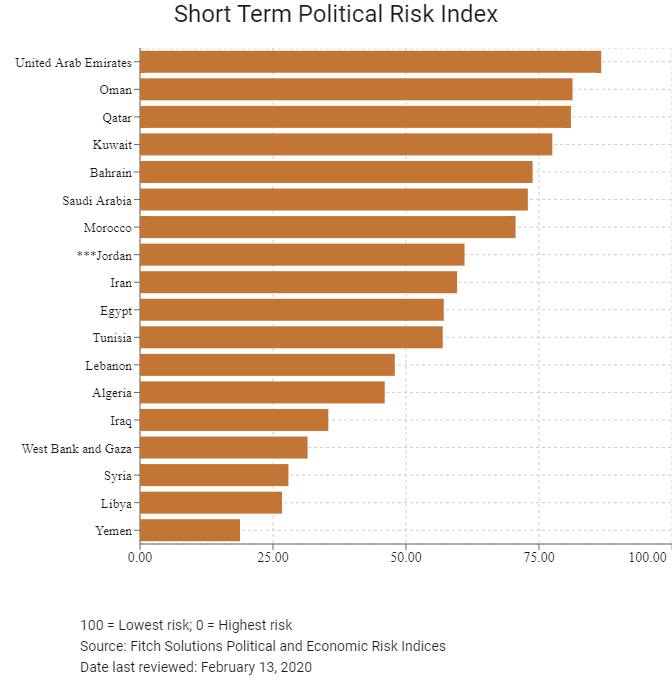

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

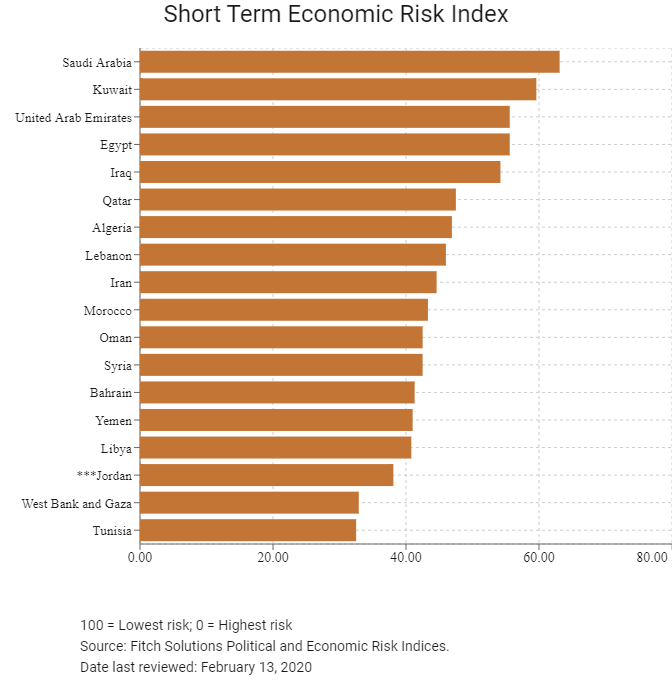

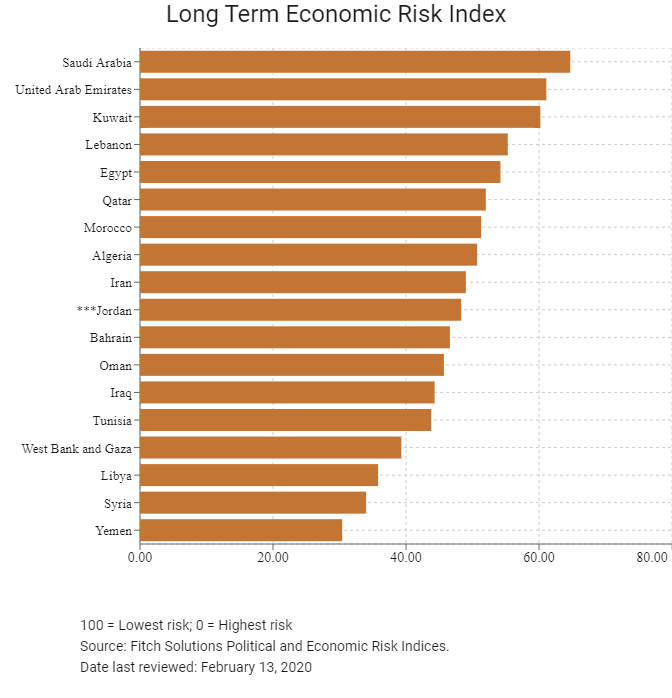

Economic Risk Index |

118/202 |

125/202 |

121/201 |

|

Short-Term Economic Risk Score |

38.1 |

39.2 |

38.1 |

|

Long-Term Economic Risk Score |

49.2 |

48.9 |

48.3 |

|

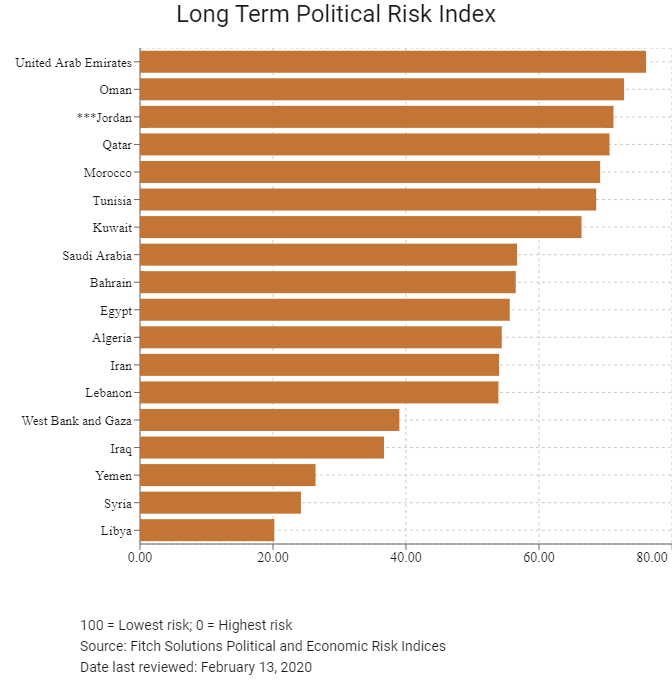

Political Risk Index |

63/202 |

64/202 |

63/201 |

|

Short-Term Political Risk Score |

63.1 |

63.1 |

61 |

|

Long-Term Political Risk Score |

71.2 |

71.2 |

71.2 |

|

Operational Risk Index |

59/201 |

70/201 |

68/201 |

|

Operational Risk Score |

58.2 |

56.1 |

56.5 |

Source: Fitch Solutions

Date last reviewed: February 13, 2020

Fitch Solutions Risk Summary

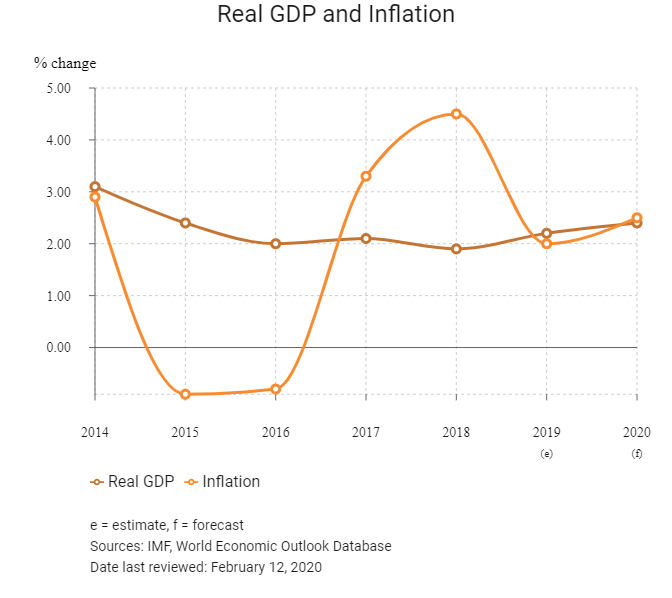

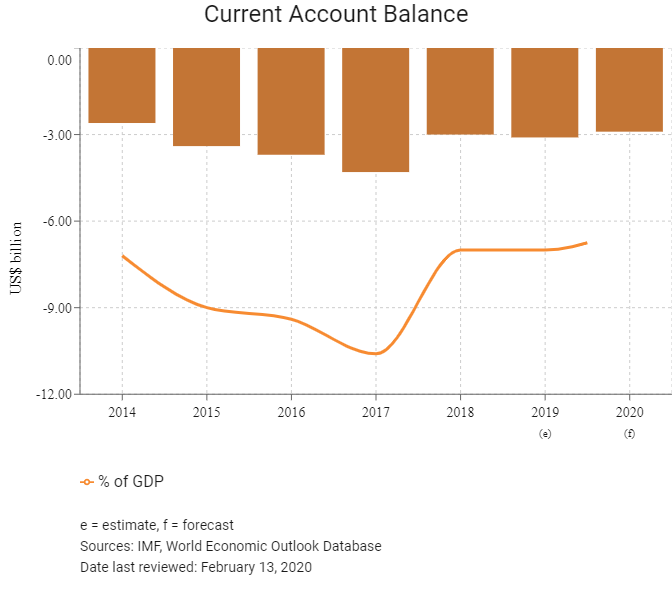

ECONOMIC RISK

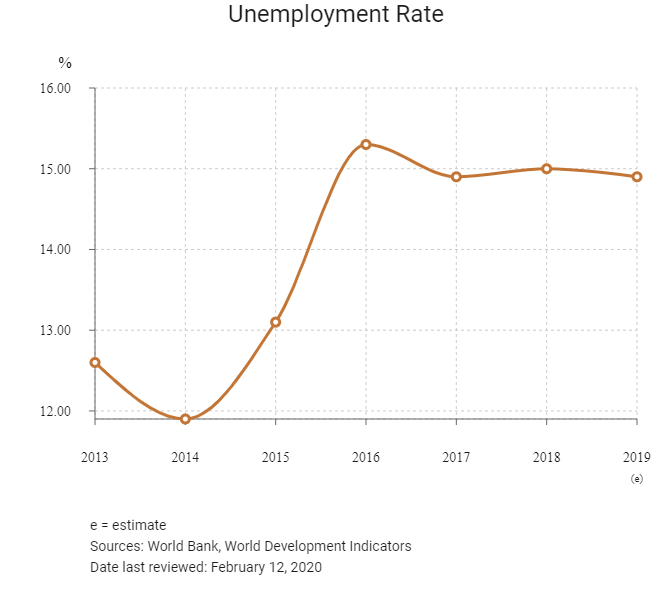

Economic growth should accelerate in 2020 partly driven by expansionary fiscal policy, notably in the form of wage hikes and deferred tax increases. Fiscal consolidation, mainly through higher taxes, will prevent a more substantial acceleration in economic growth. Regional instability has had a detrimental impact on the Jordanian economy. In particular, tourism has suffered heavy losses as the risk of instability has dented the region's image abroad. Instability also led to the export sector being severely hit by trade disruptions in the region. As regional security conditions are now set to improve, tourism and exports are expected to pick up again, although the process will be gradual amid persistent structural challenges.

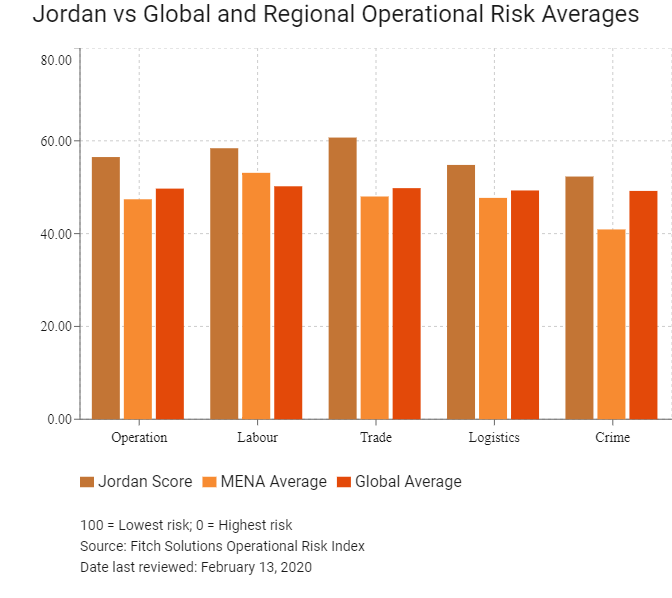

OPERATIONAL RISK

Jordan is one of the lower risk operating environments in the Middle East and North Africa (MENA) region, due to its attractive trade and investment policies and appealing labour market. In addition to presenting an investor-friendly business climate, Jordan has a relatively diversified economy compared to its MENA peers that are heavily dependent on oil and gas, which limits risk of macroeconomic shocks due to slumps in commodity prices. From a labour market perspective, while Jordan has one of the smallest working age populations in the region, the country’s population boasts high levels of educational attainment, which enhances the availability of skills that businesses can benefit from. Weaknesses stem from Jordan's lack of natural resource wealth in relation to crude oil, natural gas, compared to the majority of countries in the MENA region, which leaves the country’s utilities sector vulnerable to external risks. Furthermore, water resources under increased stress and businesses face risk of shortages in the years ahead. We nevertheless note that power shortages are now less common as several new power plants have come online in recent years together with the fact that the country has increased the share of natural gas in electricity generation.

Source: Fitch Solutions

Date last reviewed: February 15, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Jordan Score |

56.5 |

58.4 |

60.7 |

54.8 |

52.3 |

|

MENA Average |

47.4 |

53.1 |

48.0 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

6 |

7 |

7 |

8 |

8 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

68 |

49 |

62 |

75 |

90 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

UAE |

72.0 |

70.6 |

79.1 |

68.0 |

70.5 |

|

Qatar |

65.9 |

66.8 |

61.8 |

73.7 |

61.2 |

|

Bahrain |

65.0 |

65.5 |

69.5 |

71.6 |

53.6 |

|

Oman |

64.5 |

62.7 |

61.9 |

64.2 |

69.2 |

|

Saudi Arabia |

62.6 |

68.3 |

62.1 |

62.5 |

57.7 |

|

Jordan |

56.5 |

58.4 |

60.7 |

54.8 |

52.3 |

|

Kuwait |

54.3 |

58.7 |

51.2 |

50.8 |

56.2 |

|

Morocco |

54.2 |

45.0 |

63.8 |

54.9 |

53.2 |

|

Egypt |

48.7 |

50.7 |

45.7 |

55.2 |

42.9 |

|

Tunisia |

46.5 |

41.0 |

56.2 |

46.7 |

42.3 |

|

Lebanon |

44.1 |

54.0 |

51.9 |

40.9 |

29.7 |

|

Iran |

43.2 |

48.9 |

36.7 |

52.8 |

34.4 |

|

Algeria |

39.2 |

48.7 |

31.1 |

41.0 |

36.2 |

|

West Bank and Gaza |

32.5 |

48.3 |

37.4 |

27.1 |

17.0 |

|

Syria |

27.3 |

42.8 |

23.7 |

27.6 |

15.0 |

|

Libya |

27.3 |

43.3 |

22.1 |

26.6 |

17.1 |

|

Iraq |

26.9 |

43.5 |

24.8 |

26.9 |

12.4 |

|

Yemen |

23.2 |

37.8 |

24.9 |

13.9 |

16.1 |

|

Regional Averages |

47.4 |

53.1 |

48.0 |

47.7 |

40.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 13, 2020

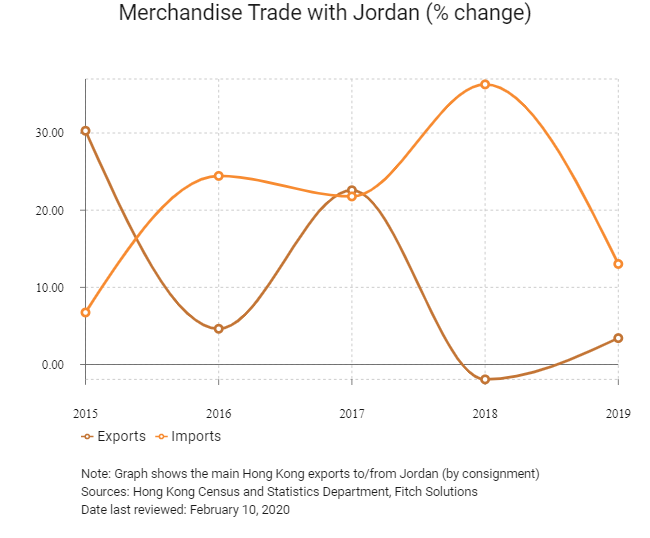

Hong Kong’s Trade with Jordan

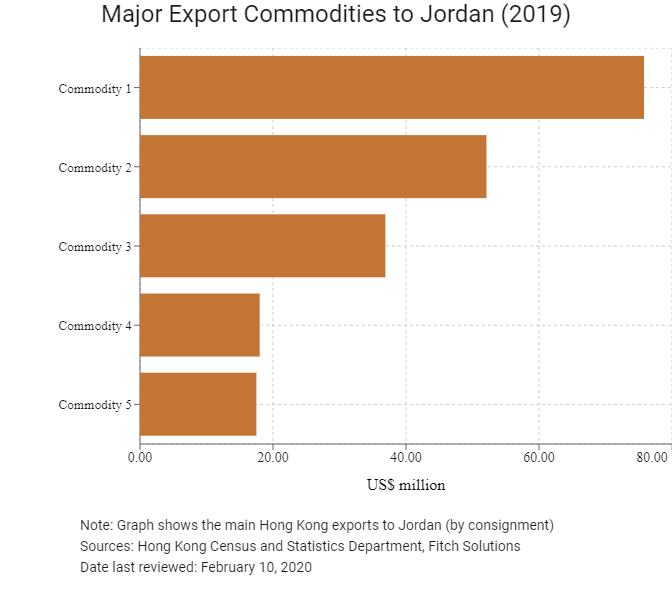

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 75.8 |

| Commodity 2 | Textile yarn, fabrics, made-up articles, and related products | 52.1 |

| Commodity 3 | Miscellaneous manufactured articles | 36.9 |

| Commodity 4 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 18.0 |

| Commodity 5 | Power generating machinery and equipment | 17.5 |

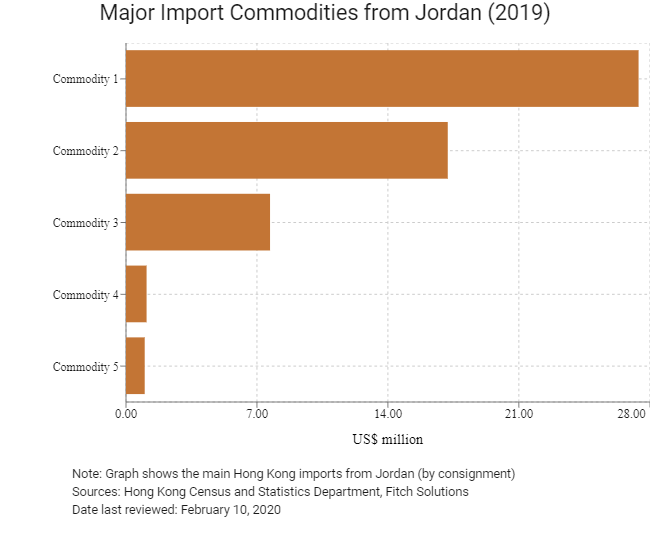

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 27.4 |

| Commodity 2 | Articles of apparel and clothing accessories | 17.2 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 7.7 |

| Commodity 4 | Miscellaneous manufactured articles | 1.1 |

| Commodity 5 | Road vehicles (including air-cushion vehicles) | 1.0 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Jordanian residents visiting Hong Kong |

8,693 |

-16.6 |

|

Number of Middle Eastern residents visiting Hong Kong |

113,849 |

-12.8 |

Source: Hong Kong Tourism Board

Date last reviewed: Febraury 10, 2020

Commercial Presence in Hong Kong

|

2017 |

Growth rate (%) |

|

|

Number of Jordanian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements Between Hong Kong and Jordan

Double taxation agreements that cover airline income only. Hong Kong has concluded airline income treaties with Jordan.

Sources: Hong Kong Inland Revenue Department, Hong Kong Trade and Industry Department, UNCTAD, Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

The Arab Chamber of Commerce & Industry (ARABCCI)

The Arab Chamber of Commerce and Industry (ARABCCI) was established in Hong Kong in 2006 to promote commercial ties between Hong Kong, Mainland China and the Arab world.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org / secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Source: The Arab Chamber of Commerce and Industry, Hong Kong

The Honorary Consulate of The Hashemite Kingdom of Jordan, Hong Kong SAR

Address: Room 606, Tower 1 Admiralty Centre, 18 Harcourt Road, Admiralty, Hong Kong

Tel: (852) 2524 0085

Fax: (852) 2524 6366

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

HKSAR passport holder: 14-day visa-free access

BNO passport holder: visa is granted free of charge on arrival for a stay within 14 days

Source: Visa on Demand

Date last reviewed: February 13, 2020

Jordan

Jordan