New Belt and Road Index ranking 67 countries along the Belt and Road Initiative

By Knight Frank

“Over the last two generations, we have seen a familiar trend of rising wealth and influence in Asia. It started with the Japanese in the 70s and was followed by the Koreans in 90s and the South East Asian “Tigers” in the early 2000s. For the past decade, China and India have been among the powerhouses of world economic growth. Given their ambitions and scale, they are both likely to be important contributors for a very long time,” says Kevin Coppel, Asia Pacific Regional Head at Knight Frank.

Coppel adds that the Belt and Road Initiative (BRI) is one of clearest manifestations of China’s vision and influence – the infrastructure and investment underpinning the BRI will streamline trade flows and lift economic activity in much of Asia, the Middle East, and North and Eastern Africa. While the vision will bring huge opportunities for investors and developers, the BRI will also change the face of corporate China, which will have an enormous influence in the 21st century as Chinese brands become household names around the world.

In order to help investors better understand the potential opportunities that the BRI could generate beyond their borders, Knight Frank has developed its inaugural Belt and Road report titled New Frontiers: The 2018 Report. It features the Belt and Road Index which assesses 67 countries considered core to China’s initiative.

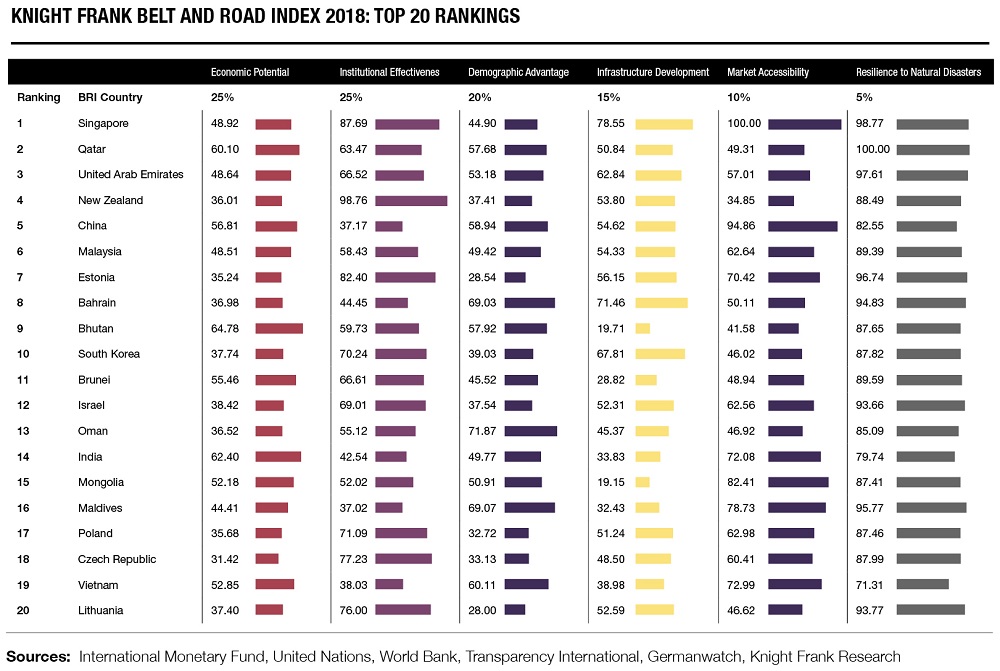

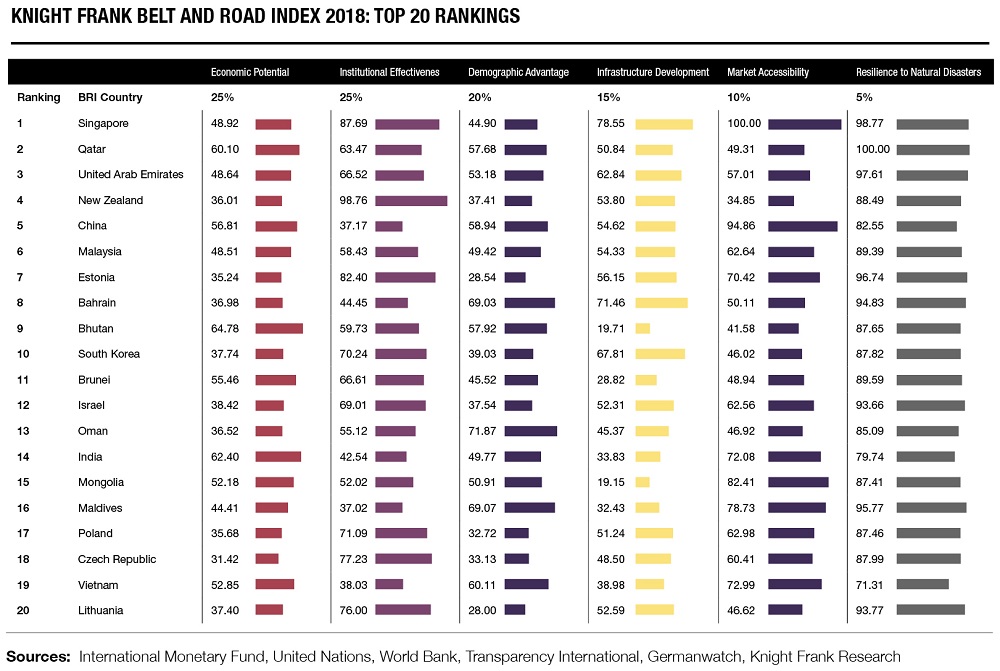

Highlights of Belt and Road Index 2018:

- Singapore, Qatar and United Arab Emirates top the Index.

- Southeast Asian countries rank favourably, especially Malaysia and Vietnam. Apart from Singapore, many Southeast Asian countries are confronted with major infrastructure financing deficits. Chinese companies are well-placed to plug those gaps.

- Middle Eastern countries diverge in their rankings, reflecting the potential and challenges that co-exist in the region. While Qatar, UAE, Bahrain, Oman and Saudi Arabia are in the top half, Iraq and Yemen sit in the bottom half.

The index is classified into six categories: economic potential, demographic advantage, infrastructure development, institutional effectiveness, market accessibility and resilience to natural disasters. Values for these six categories have been normalised from the various data sources and are assigned specific weightage that commensurate with their perceived importance to investment decisions.

Top recipients of Chinese outbound real estate investment

The report also highlights the flow of Chinese outbound investment in real estate along the BRI.

Over the last four years notably along the BRI, Singapore (US$3.87 bn), Malaysia (US$2.37 bn) and South Korea (US$2.74 bn) are the top recipients of Chinese outbound real estate investment which totalled US$10.2 billion. Slightly over half of this total amount (US$5.2 bn) was spent on purchasing development sites, while another third (US$3.1 bn) was spent on office space.

Nicholas Holt, Asia Pacific Head of Research at Knight Frank, explains, “The Belt and Road Initiative is a long-term strategy that will play out over decades, not simply years. Therefore, it will take patient capital that is prepared to look at new frontier markets with greater levels of country risk and at greenfield projects that have a long-term time horizon. For many, this transition away from pure-play, low-risk investment, requires detailed market knowledge and advice in terms of deal sourcing, evaluation, execution and asset management.”

Please click to read the full report on the Knight Frank blog page.