Africa Set for Major Asian Investment Surge After a Troubled 2017

With political uncertainties and domestic issues undermining growth in several of Africa's larger economies over the last 12 months, would-be Asian investors are looking at options in a number of the continent's less prominent nations.

Last year proved to be a time of change and volatility in many of Africa's business and financial sectors, leaving several countries looking notably vulnerable. Against such a backdrop, then, where should would-be investors look for opportunities in this most contradictory of continents over the next 12 months?

One of the clear themes that dominated coverage of Africa in 2017 was the evident disconnect between politics and business. In other words, the polices that many governments committed to in the political and governance spheres did not necessarily make a material difference to the commercial life of their countries.

One of the many to acknowledge this particular problem is Ronak Gopaldas, an analyst for South Africa's Rand Merchant Bank and the co-author of the influential Where to Invest in Africa annual report. Speaking at the Thomson Reuters annual Africa summit at the end of 2017, he said: "Economics doesn't necessarily follow politics in African markets. There have been countries where their economies have rallied even when political events have been negative. This disconnect is likely to continue in 2018."

One example cited by Gopaldas was Kenya, where 24 people died last year in the violent protests that followed its disputed election result. Despite this, the country's currency strengthened once the results of the vote were announced.

Although other evidence of such a disconnect is easy to find, it is also more than apparent that an uncertain political climate can easily destabilise the local economy, an issue that is often a concern to investors. In 2017, a number of African countries clearly suffered in economic terms as a direct consequence of political manoeuvring.

In Nigeria, for instance, the prolonged absence of its President due to apparent illness caused widespread uncertainty. It was a similar story in Angola, where its President stood down after 38 years in power, with the incoming regime promptly initiating a purge of the country's commercial and political sectors. In South Africa, meanwhile, its increasingly unpopular President clung onto power until earlier this month, before resigning amid numerous accusations of corruption and nepotism. Tellingly, South Africa and Nigeria – Africa's two largest economies – were among the worst performers in terms of 2017 GDP growth.

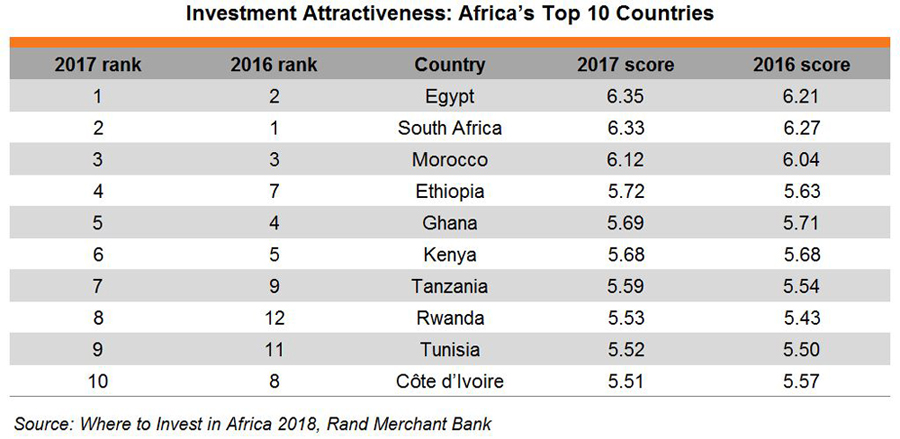

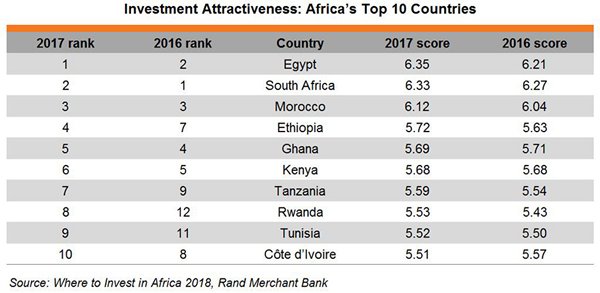

While the downside of Africa's economic development attracted global headlines last year, less coverage was given to many of the continent's success stories. Over in East Africa, Kenya, Tanzania, Rwanda and Ethiopia all attracted substantial overseas investment, as did two of their West Africa counterparts – Côte d'Ivoire and Senegal. In terms of overall investment attractiveness, the top 10 African countries are listed in the table below.

In terms of suitable areas for investment, many African countries are keen to secure backers for their infrastructure development programmes. At the same time, there are considerable opportunities emerging in the rare metals extraction sector.

With regard to so-called 'soft infrastructure', education and healthcare top Africa's priority list. Not only are such sectors attractive investment options, but they are also seen as vital prerequisites if Africa is ever to deliver on its true economic potential.

Another sector seen as having as yet untapped potential is agriculture. With Africa home to 60% of the world's unused arable land, properly managed and funded, its exploitation could prove to be a game-changer for the continent, while also offering considerable returns for overseas investors.

In terms of specific countries and sectors that investors should be considering, Robert Besseling, the Executive Director of Exx Africa, a Johannesburg-based risk consultancy, has conducted an analysis of Africa's most promising prospects for the next 12 months and beyond. Topping his list are Guinea and Zambia, two countries set to boom on the back of their mining industries.

Although both countries are still poorly served on the infrastructure front, they are rich in several of the rare metals essential for the future growth of many of the high-tech sectors, including manganese, niobium and cobalt. In order to deliver on the potential of their mining sectors, both countries will need to upgrade their infrastructure, including transport and hotel facilities, two areas ripe for overseas investment.

Other experts tip Kenya, Nigeria and Zambia as the optimum investment destinations. Explaining their appeal, Gopaldas said: "As well as being regional hubs, all three countries offer mineral commodities and scalability."

In Kenya's case, its fast-growing digital sector has already attracted interest from international investors. So too has its tourism and hospitality industry, a sector that has been boosted by a huge influx of Chinese visitors, many of them lured by its game reserves.

It is not just Africa's most economically successful countries that investors should be considering, with Besseling keen to make the case for a number of the continent's less-prominent nations, saying: "These are countries we forget about, any one of which could turn out to offer the next big opportunity. Many of them are former conflict zones, such as South Sudan or Burundi. Often there is very little existing investment, but a huge need for airports, roads, hotels…"

While Besseling and Gopaldas may disagree over investment priorities, they are pretty much unanimous when it comes to highlighting the most likely source of funding – Asia. Championing the role of mainland investors in particular, Gopaldas said: "We will continue to see a lot of interest in Africa coming from China, with the country already committed to a series of infrastructure developments across the continent as part of the Belt and Road Initiative. Broadly, the Chinese model of investment is likely to continue, with infrastructure funding collateralised against resources."

Besseling, however, sees Asian interest in Africa as extending well beyond China, saying: "India is going to play a huge role in Africa's future development, as are Japan and South Korea. Even in Thailand and Vietnam, banks, corporates and state-owned entities are looking at opportunities in Africa."

Mark Ronan, Special Correspondent, Cape Town