Guangxi: Enhancing ASEAN Supply Chain Connectivity

In its 13th Five-Year Plan, Guangxi has made accelerating the growth of processing trade one main thrust of its outward economic development. It aims to increase the value-added of processing trade by encouraging the diversification of assembly processing into R&D, design as well as upstream and downstream sectors. It also wants to establish a “Nanning-Qinzhou-Beihai Electronic Information Processing Trade Industry Belt” by using processing trade parks and bonded zones as carriers. As Guangxi’s processing trade trends towards mid- to high-end, some of the labour-intensive processes have started to move out and industry chains are being formed with neighbouring ASEAN countries.

Processing Trade Develops in Leaps and Bounds

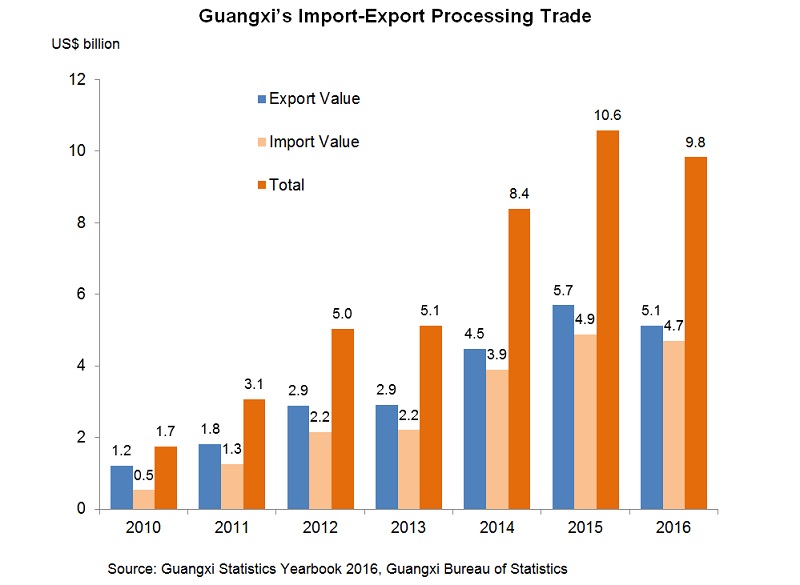

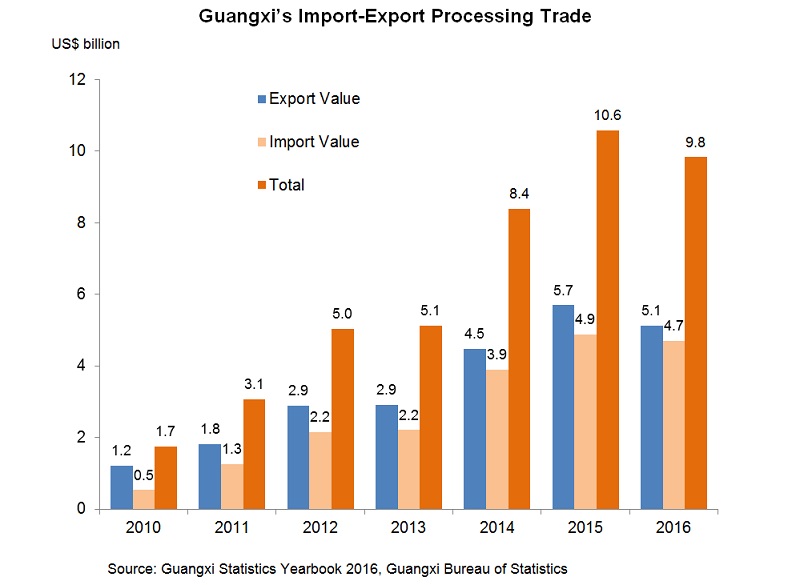

The past few years have seen marked growth in Guangxi’s processing trade. Higher logistics costs notwithstanding, a considerable number of industries in China’s eastern region have moved into the autonomous region. Although in 2016 overall external demand was sluggish and Guangxi’s exports also dropped, from 2010 to 2016 Guangxi’s total import and export value from processing trade still registered a hefty average annual growth rate of 33.3%. In particular, processing trade exports grew at an average annual rate of 27.2%. In 2010, processing trade constituted 9.9% of Guangxi’s overall external trade, but the figure climbed to 20.6% in 2016. Currently, the raw materials, parts and components used in processing trade come from different areas, but exports after assembly mostly transit through Hong Kong.

Further Driving Processing Trade

In a bid to further drive processing trade development, Guangxi proposed a second round of “doubling plan” in 2016. The Implementation Opinions on Promoting the Innovative Development of Processing Trade (the Implementation Opinions) it released in June 2016 proposed that by 2020, the import and export volume of processing trade will double that in 2016 to more than US$20 billion. Meanwhile, there should be further improvements in the structure of export goods from processing trade, with mechanical and electrical products and high-tech products comprising more than 75% and 50%, respectively, of all processing trade exports.

The Implementation Opinions proposed a number of incentive measures to support the development of the processing trade industry, including:

- Processing trade enterprises whose projects fall under the scope of the Catalogue of Encouraged Industries in the Western Region with total investment exceeding RMB50 million will be eligible, up to 31 December 2020, for a reduced enterprise income tax rate of 15% while contribution to local coffers will be exempted.

- In key industrial parks, basic endowment insurance premium will be reduced from 20% to 14% while collection of contributions to the water conservancy fund will be temporarily suspended for processing trade enterprises in these parks.

- For projects in priority development industries with intensive land usage as determined by Guangxi, the minimum land assignment price may be set at no less than 70% of the relevant standards.

- Concerted efforts will be made to give more financial support to processing trade transfer projects. In 2016, a total of more than RMB600 million in specific funds, inclusive of RMB300 million from the Guangxi government and funds from the central government designated for foreign trade and economic development, were allocated for further improving the environment for the development of processing trade industries.

As for labour costs, take the city of Beihai as an example. According to Beihai Industrial Zone (BIZ), the average monthly wage of an ordinary worker is about RMB2,500. It is worth noting that some Guangxi cities along the Sino-Vietnamese border are stepping up labour services co-operation with neighbouring Vietnamese regions. With the signing of a cross-border labour services co-operation agreement in early 2017 between the Guangxi border cities of Chongzuo, Fangchenggang and Baise with the Vietnam border provinces of Quảng Ninh, Lang Son, Cao Bang and Ha Giang, a mechanism for labour services co-operation has been formally set up.

With the sustained development of Guangxi’s economy, labour demand at the autonomous region’s border regions will also grow rapidly. As neighbouring Vietnam has surplus labour, cross-border co-operation in labour services is conducive to Vietnam workers going to work in Guangxi. It has been estimated that the labour cost of each cross-border worker is lower than that of a Guangxi worker by more than RMB10,000 a year.

Processing Trade Trending Towards High Value-added

In recent years, Guangxi’s industrial structure has been turning gradually towards high technologies and electronics, so its processing trade is also advancing in that direction. To promote further processing trade development, the Implementation Opinions suggest that active guidance should be given on bringing in whole chains of supporting industries so that Guangxi’s processing trade can be developed in clusters and its value-added can be increased continually. The autonomous region is now building an electro-plating park in Tieshan port area to provide support for related upstream industries.

Beihai hosts some 600 large and small enterprises in the field of electronics, one of the fastest-growing industries locally. Electronic information is the pillar industry in BIZ, followed by food, pharmaceuticals and equipment manufacturing. According to a BIZ representative, the industry chains there are now extending upstream in the direction of R&D, and BIZ has set up a foundation for supporting this sector. So far, BIZ is host to five state-level high-tech enterprises and eight provincial-level R&D centres and technology centres; it has also set up the first quality inspection centre in Guangxi for electronic information products.

About 20,000 workers are employed in BIZ and the number is expected to hit 30,000 in 2017. Most are local and there is little problem with recruitment. However, one BIZ representative said that labour demands of enterprises now entering the zone are less urgent than before, and they are more concerned with local support in terms of value improvement. BIZ is well aware that, in the long-run, it cannot depend on incentive policies alone. Instead, there is a need to develop support services and upgrade the standards of industrial services including, for example, raising the standards of inspection and testing services, offering certification of standards, and training of personnel, all of which are vital in lending support to R&D. To further enhance the business environment, BIZ will also set up a port joint inspection centre to facilitate customs clearance.

Industry Chain Relationship with ASEAN

For its processing trade, Guangxi uses raw materials, parts and components from different sources, while exports after assembly mostly transit through Hong Kong. Guangxi’s processing trade, however, has ceased to be simple processing with supplied materials: enterprises using Guangxi as a production base make use of labour forces in peripheral areas to carry out and incorporate international co-operation in production capacity. Guangxi figures indicate that some enterprises in the Beibu Gulf area have begun to gradually transfer some low value-added, and very labour-demanding, processes to ASEAN countries.

Although the productivity of Guangxi’s workers is higher than that of their counterparts in some ASEAN countries such as Vietnam, Cambodia and Laos, labour costs in Guangxi are also higher. Consequently, some manufacturers in the Beibu Gulf area have started carrying out industrial division of labour with neighbouring ASEAN countries. This entails outsourcing some simple assembling processes to Vietnam or Cambodia, then shipping back the semi-finished products for further assembly in Guangxi. In this way, a processing trade industry chain involving Guangxi and ASEAN has begun to take shape.

As an example, a Taiwan electronics enterprise has invested in an industrial park in Cambodia through a company it has set up in Beihai. Semi-finished products produced by lower-cost labour in Cambodia are shipped back to Beihai for deep processing or final assembly. Since low-end processes have been transferred to Cambodia while mid- to high-end processes are retained in Beihai, the number of workers the enterprise employs in Beihai has been reducing gradually from 4,000 in 2015 to about 2,000 in 2016. Although there is a reduction in the number of workers, overall output value has not decreased.

From Guangxi’s perspective, this is an inevitable development trend. Even though enterprises are moving out some production processes, Beihai no longer wants to take in low-end, low value-added electronics industries. Industrial parks also want to create a sound operating environment so that enterprises will continue to use Beihai as a management centre while building industry chains with ASEAN countries.

Given the fact that the electronics industry requires specialised services support, BIZ, for example, has established an electronic information product inspection and testing centre so that enterprises do not have to send their products outside Guangxi for inspection and testing. The next step is to provide various types of quality certification locally. A port joint inspection and testing centre will also be set up to allow formalities such as customs declaration and commodity inspection to be carried out within the park premises. A skills training school has also been set up inside the park through the joint efforts of businesses and academic institutions to train related technical staff.

|

China-Malaysia Qinzhou Industrial Park China-Malaysia Qinzhou Industrial Park (CMQIP) has been jointly built by government consortia from Malaysia and China. It is one of the two parks under the “two countries, twin parks” co-operation between China and Malaysia (the other is Malaysia-China Kuantan Industrial Park in Kuantan Port, Malaysia). About 15km from the city of Qinzhou, CMQIP has a planned area of 55 sq km. The first phase will cover 15 sq km, of which 7.8 sq km is designated as a start-up area. It is expected that the whole 15 sq km will be developed in 2017, well ahead of the target date of 2020. By early 2017, 66 enterprises had signed agreements to set up operations in the park or were about to do so. CMQIP is intended as an international park and enterprises from around the world are welcome. Standard factory buildings with worker dormitories are available in its processing trade zone. To the east of CMQIP is Sanniang Bay, a 4A grade tourist district; to the west is Maowei Sea, a national ocean park. CMQIP will therefore make use of tourism resources in its neighbourhood to create an international tourist attraction complete with facilities for leisure, vacationing, business, conventions and exhibitions, culture and sports. CMQIP had its foundation laid in 2012 and, after years of efforts in infrastructure building, it is now ready for enterprises to move in and operate. Six industrial clusters are gradually being built up: medicine and healthcare, information technology, marine industry, equipment manufacturing, materials and new materials, and modern services (including cultural creation and tourism). In addition, talks are also under way to introduce traditional Malaysian priority industries such as bird’s nest processing, halal food and rubber, as well as the deep processing of palm oil imported from Malaysia. In choosing sites for the twin parks, Malaysia and China have decided on a port city with a view to co-operating in the development of both industry chains and logistics chains. Industries now located in Malaysia-China Kuantan Industrial Park include steel and aluminium processing and ceramics, and they have set their sights on the regional market. CMQIP intends to tighten Chinese-Malaysian industrial co-operation. At this stage it is bringing in different types of industries in order to make the park a success. It also has plans to gradually introduce Malaysia’s priority industries such as bird’s nest processing and halal food processing. At the end of 2016, with China and Malaysia signing the Protocol on Inspection, Quarantine and Veterinary Hygiene Requirements for the Exportation of Raw, Uncleaned Edible Bird’s Nest from Malaysia to China, Qinzhou and CMQIP in Guangxi may become the designated port of importation and processing base, respectively, for Malaysian raw bird’s nest. |

Bonded Zones Offer More Value-Added Development

Guangxi’s 13th Five-Year Plan mentions that better use should be made of various bonded port zones and export processing zones to step up the development of processing trade. In fact, its bonded port zones are now promoting the development of more value-added activities in different industries. For example, Nanning Bonded Port Zone not only runs a bonded warehouse, but it is also venturing into the exhibition and maintenance of imported cars, repairing of returned exported equipment, aviation logistics, aeroplane related maintenance and training, as well as the deep processing of imported food and health food.

Qinzhou Bonded Port Zone (QBPZ) is pursuing the processing of imported cotton in its bonded zone. The yarns from spinning can either be imported into mainland China or exported. On the mainland, imported fruits and meat must be imported through designated ports that are equipped with inspection and testing facilities. QBPZ is also qualified in this respect, so it is planning to develop the processing of cold-chain imports, targeting mostly imported fruits and meat where the main processes involved are cutting and repackaging. Another project is wood processing, in which imported bonded wood is processed into boards or wooden components for buildings. QBPZ is also developing cross-border e-commerce, aiming to offer a platform for ASEAN SMEs to enter the China market by helping them handle import formalities. Its position is to focus on specialty products from Southeast Asia, and its target markets are Guangxi and the southwestern region.

It is worthwhile for Hong Kong’s manufacturing industry to pay attention to the progress of Guangxi’s efforts in promoting co-operation in production capacity with ASEAN. Hong Kong can capitalise on the development room available to integrate regional supply chains more effectively. Guangxi’s electronics industry has been growing rapidly in recent years. To support the development of the industry, a modern electro-plating industry park is being planned in Tieshan Port, Beihai. Nevertheless, Guangxi’s manufacturing sector still lacks supportive professional services such as R&D, brand promotion, inspection and testing, etc. These vital aspects in manufacturing can offer opportunities for co-operation between Hong Kong’s related sectors and Guangxi’s manufacturing industry.