Georgia has huge potential as a new trading partner for Hong Kong, with a substantial number of business opportunities arising from its combination of firm support for the Belt and Road Initiative (BRI), its open and business-friendly economy and its strategic location in the central Caucasian region of Eurasia. A country of 3.7 million people, its prime setting at the very crossroads of China and Europe, as well as its extensive array of Free Trade Agreements (FTAs) – including treaties with the Chinese mainland and Hong Kong – sees it offering a host of new trade and investment possibilities.

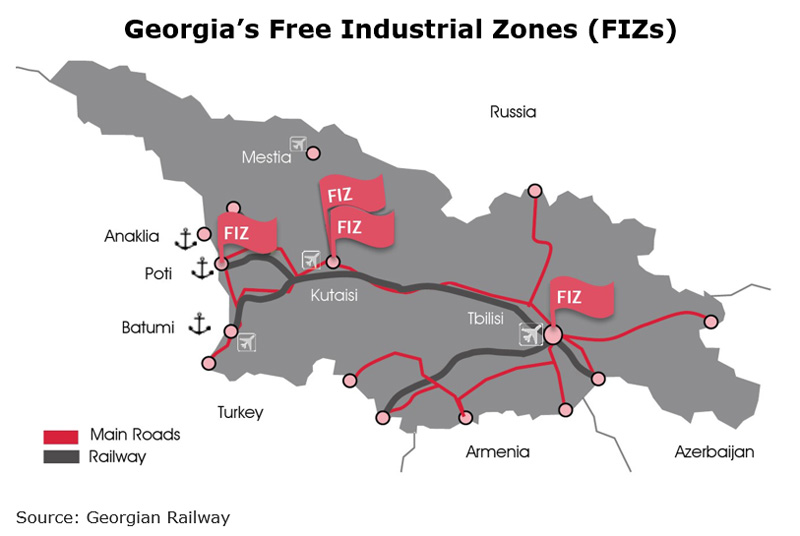

Its appeal has been boosted by a number of ongoing reforms, including a greater emphasis on open governance, improvements to the local business environment and an ambitious infrastructure development programme. In the case of the latter, this has seen a number of landmark investment projects being given the greenlight, including the US$2.5bn Anaklia Deep Sea Port and Special Economic Zone, the Baku-Tbilisi-Kars Railway and ongoing railway track modernisation work. Taken together, these projects are not only seen as representing major steps forward for Georgia’s international connectivity, but also as playing a key role in the country’s evolution from being a simple transit hub to becoming a true regional logistics and industrial centre. Hong Kong investors and professional service providers, of course, could clearly play a huge role in facilitating this ambitious and capital-intensive reinvention process.

A Leading Reformer in Europe and Central Asia

Georgia, which borders Russia to the north, the Black Sea to the west and Turkey, Armenia and Azerbaijan to the South, is a leading reformer and significant emerging Caucasian market. According to the World Bank, it has implemented 47 business-friendly reforms in the past 15 years, topping the ranking of European and Central Asian countries.

Owing to these reforms, all tax procedures and customs clearances in the country are now web-based and unified under one tax code. This has reduced the average number of days and procedures to register a new business greatly, from 25 days and nine procedures in 2003 to just two days and two procedures now.

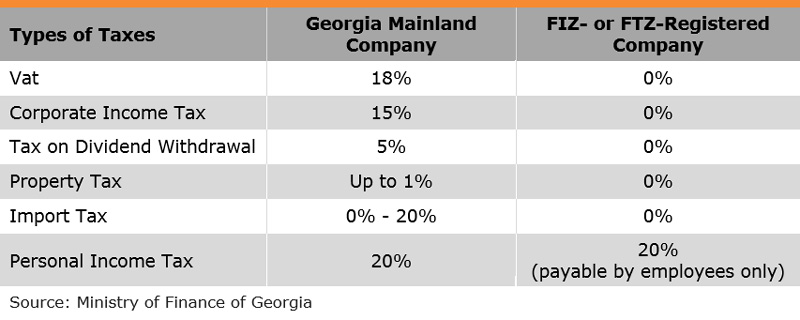

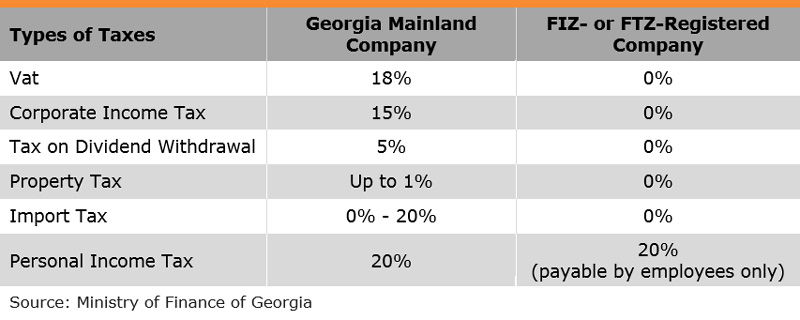

The 2005 tax code changes were especially significant, transforming the country’s fiscal landscape. The types of taxes applicable in Georgia were slashed from 21 in 2004 to six simple, flat taxes with rates so low that the country has once been ranked fourth in the world (after Qatar, the UAE and Hong Kong) in terms of how much it taxes its citizens. Today, to introduce new taxes or increase existing rates, the Georgian government would have to call a national referendum as required by its constitution.

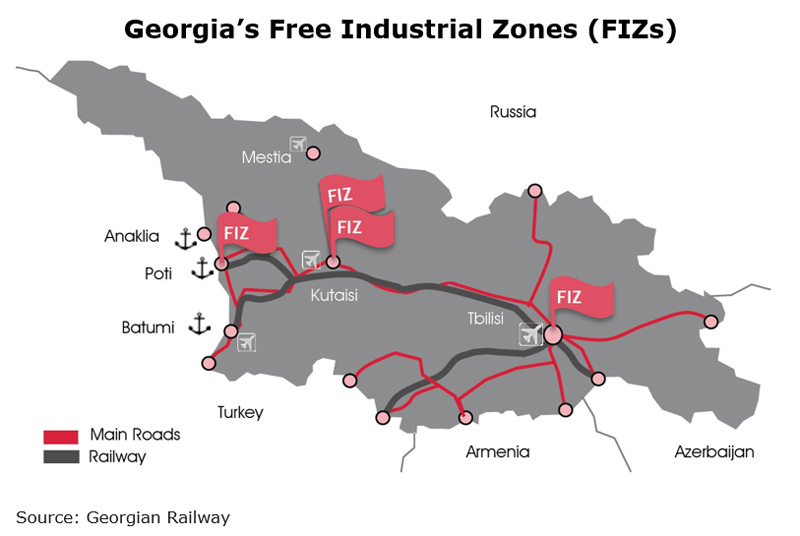

While most of the taxes are already exempted in the country’s four free industrial zones (FIZs) and two free tourism zones (FTZs), the Georgian government also introduced a new growth-oriented model of corporate income tax in 2017. The relevant tax payment is postponed or deferred until actual profit distribution in a bid to promote re-investment of earned profits into existing and/or new business endeavours.

The reform-driven economic success has helped Georgia lay a solid foundation for continued economic progress. In the two decades ending 2017, the country registered an average economic growth of more than 5%, a pace far higher than many of its Commonwealth of Independent States (CIS) peers, such as Russia, Ukraine, Belarus and Kyrgyzstan.

A Staunch Supporter of Free Trade

Georgia, given its strategic geographical location and dearth of natural resources beyond agribusiness, has developed a transit-oriented economy, where up to 60% of the cargo flows the country handles are actually in transit. This is in stark contrast to its Caucasian neighbours, such as Russia and Armenia, which are rich in mineral resources such as oil and gas, iron, copper, molybdenum, lead, zinc, gold, silver, antimony, aluminium, as well as other rare metals.

To facilitate trade and strengthen its role as a transit hub, Georgia supports free trade and has entered into an extensive network of FTAs. Agreements are in place with most, if not all, of its key trading partners, including European Union (EU) and CIS countries, European Free Trade Association (EFTA) members, Turkey, Mainland China and Hong Kong. Apart from the unfettered market access to a 2.3 billion-strong market under this web of FTAs, Georgia also enjoys preferential Generalised System of Preferences (GSP) treatments on some 3,400 products from Canada, Japan and the US.

As a historic step in the continued effort to support the BRI, Georgia signed the FTA with Mainland China in May 2017, coming into force on 1 January 2018. The Sino-Georgia FTA is not only the first FTA China has signed with a Eurasian country, but also the first Chinese-initiated FTA since the BRI was put forward in 2013.

Under the Sino-Georgia FTA since 1 January 2018 Georgia imposes zero tariffs on 96.5% of mainland products, covering 99.6% of the total imports from Mainland China. The mainland imposes zero tariffs on 93.9% of Georgia’s products, covering 93.8% of China's total imports from Georgia, of which 90.9% of product types (taking up 42.7% of imports) will have zero tariffs immediately and the remaining 3% of product types (51.1% of imports) will be phased out within five years.

In a similar vein, Hong Kong and Georgia signed an FTA on 28 June 2018, scheduled to come into effect by the end of the year, after completion of the necessary procedures. The Hong Kong-Georgia FTA is comprehensive in scope; encompassing trade in goods, trade in services, investment, dispute settlement mechanisms and other related areas in 18 chapters. On coming into effect, Georgia will eliminate all import tariffs for products of Hong Kong origin, with the exception of 3.4% of tariffs lines, comprising mainly agricultural products, such as a fruits and nuts and their preparations, as well as beverages and spirits, due to domestic sensitivity.

In addition to merchandise trade, both Sino-Georgia and Hong Kong-Georgia FTAs have chapters for trade in services, under which both sides will further open their markets to each other on the basis of their WTO commitments. Broad consensus has been reached in many fields, such as environment and trade, competition, intellectual property, investment and e-commerce.

These FTAs will bring legal certainty and better access to the Georgian market for Hong Kong and mainland businesses, while offering potential opportunities as a gateway to the Caucasian region of Eurasia covered under the BRI. They will also enhance trade and investment flows between Hong Kong, the Chinese mainland, Georgia and the greater Eurasian region.

Unique Taste and Fashion Ready for Export

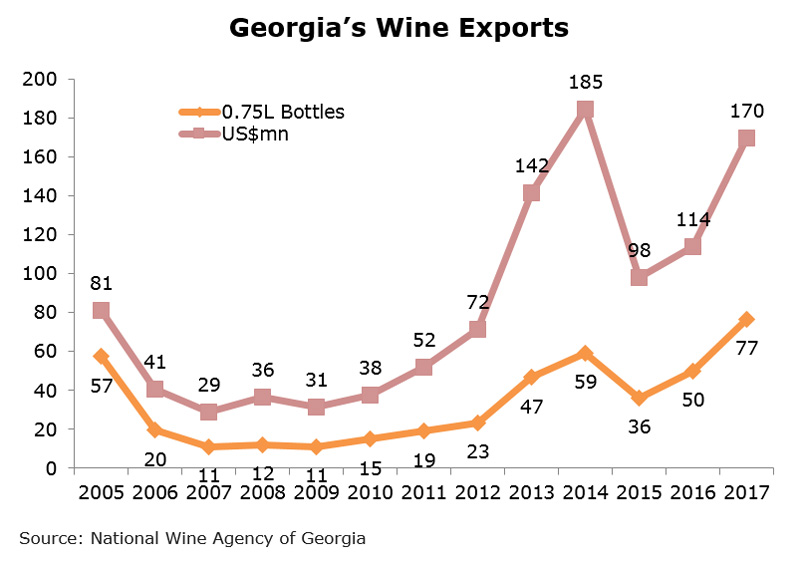

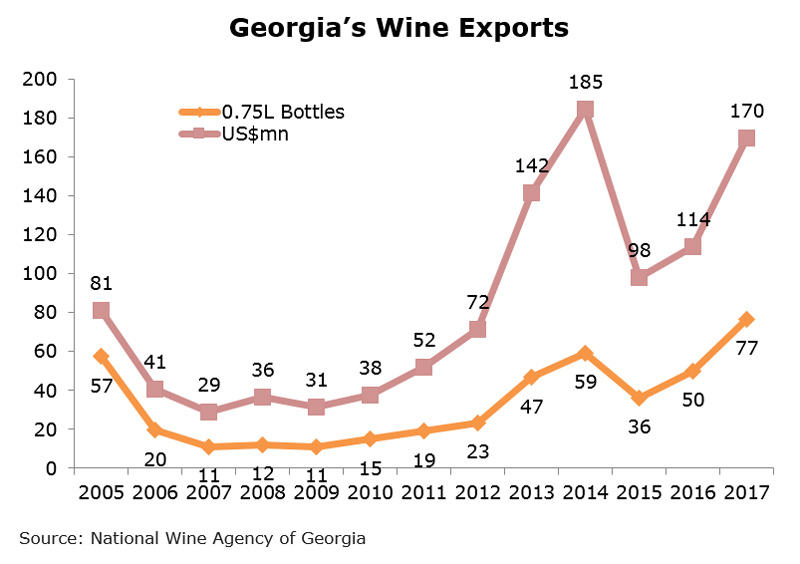

Among the many export sectors likely to benefit from the new FTAs are Georgia’s wine, food and fashion industries. Georgia has an 8,000-year wine-making history and 525 indigenous grape varieties, such as Kristel, Mtsvane and Saperavi highly popular in former soviet republics, but novel to many Asian drinkers. Georgian wine has already become a rising star in the Chinese wine market, with exports increasing exponentially since 2008[1]. Last year, the mainland, buying 7.6 million bottles of Georgian wine, became its third largest wine export market after Russia and Ukraine.

Riding on the success in the mainland, Georgian winemakers are looking for new growth opportunities in the burgeoning Asian market. Some of them, with the state support from the National Wine Agency of Georgia, have been actively exhibiting in wine fairs, organising wine-tasting activities and appointing agents/distributors in the region. Exports aside, the National Wine Agency of Georgia is also keen on promoting wine-related investment opportunities in Georgia to Asian investors.

Irakli Cholobargia, Head of the Marketing and Public Relations Department of the National Wine Agency of Georgia, said: “Although there are more than 500 companies producing wine in Georgia, only about 25 out of the country’s 525 indigenous grape varieties have been widely used in the industry. There is plenty room for growth and foreign investment.”

Hong Kong, with zero duty and duty-related customs/administrative controls for wine as well as widely-recognised neutrality in trading and promoting wine is a ready trading and distribution hub for Georgia wine in Asia. Hong Kong can also offer a good platform for Georgia winemakers to meet prospective Asian investors who are now the prime movers in global wine investment, with a growing appetite not just for fine wines, but vineyards and wineries.

Wine aside, Georgia, with 22 micro-climates varying from cool and dry to warm and humid, was also seen as a quality food supplier during soviet era. Nowadays, Georgian fresh fruits and vegetables are still well-regarded as healthy and of good quality in the CIS region. Also, the country’s traditional delights, such as the sausage-shaped churchkhela[2] confectionary and Borjomi fizzy mineral water, are reportedly gaining more attention from the increasingly health-conscious consumers worldwide.

Long dubbed the culinary capital of Asia, with some 14,000 restaurants serving an array of cuisines from all over China, the rest of Asia and the world, Hong Kong can be a good showroom for Georgian food companies to launch into Asia. In particular, Hong Kong businessmen, who have a good understanding of mainland consumer tastes, can help Georgian food exporters show how their produce can be used with Asian ingredients and culinary skills to complement favours found in Asian cuisines.

In addition to agribusiness, design – including fashion – is booming in Georgia, as the government promotes the use of modern design to convey core values, such as administrative transparency. This goes hand in hand with Georgian consumers, especially the younger generation, becoming more fashion savvy. This demand is driven by increases in income as well as a reaction to the soviet era when outfits tended to be more standardised.

The greater willingness and ability to spend on fashion has also led to the emergence of a number of designer brands such as Avtandil and Rosebud that have built a following in both the domestic and international markets. Given their relatively small production volume, they usually either only sell online or rely on fashion houses and showrooms in West Europe (including Milan and Paris) to reach out to Asian fashion lovers. These budding fashion brands are therefore ready clients for Hong Kong fashion traders able to offer extensive industry knowledge and distribution networks in the Asian region.

Growing Chinese Foothold in Georgian Trade and Investment

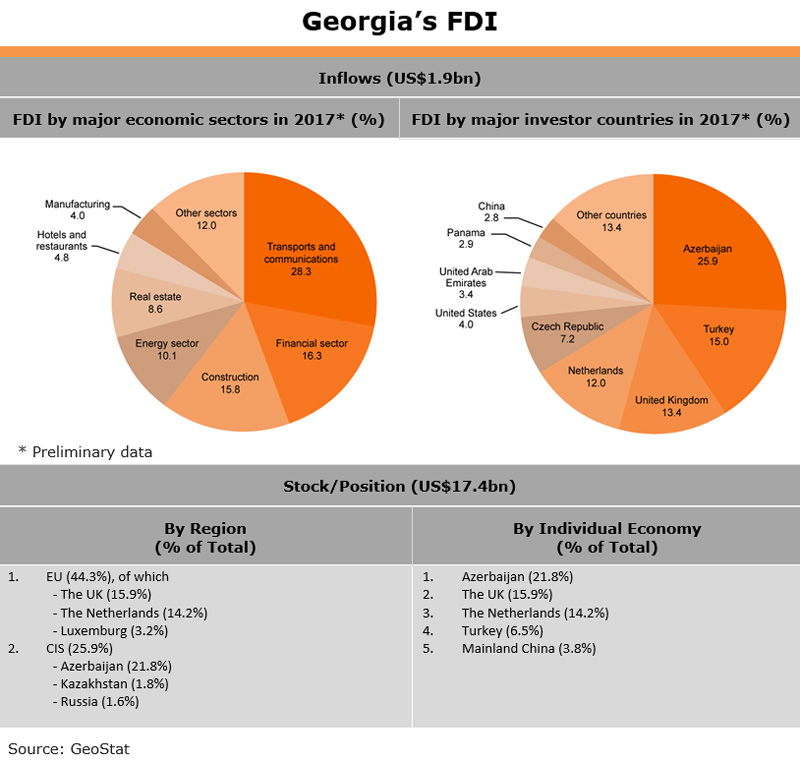

Given the geographical proximity and historic ties, CIS members, EU countries and Turkey are Georgia’s principal trading partners. In 2017, these key partners accounted for 75% of Georgia’s total trade. Thanks to the BRI and wider presence of Chinese enterprises in Georgia, the mainland has fast gained a foothold in Georgia and has become the country’s biggest Asian trading partner.

Last year, Mainland China was Georgia’s fifth-largest export market and third-largest import source, accounting for 7.6% of the country’s total exports and 9.2% of its total imports. Hong Kong sold US$103 million worth of goods to Georgia and bought US$6.3 million in 2017, accounting respectively for 0.2% and 1.3% of Georgia’s total imports and exports.

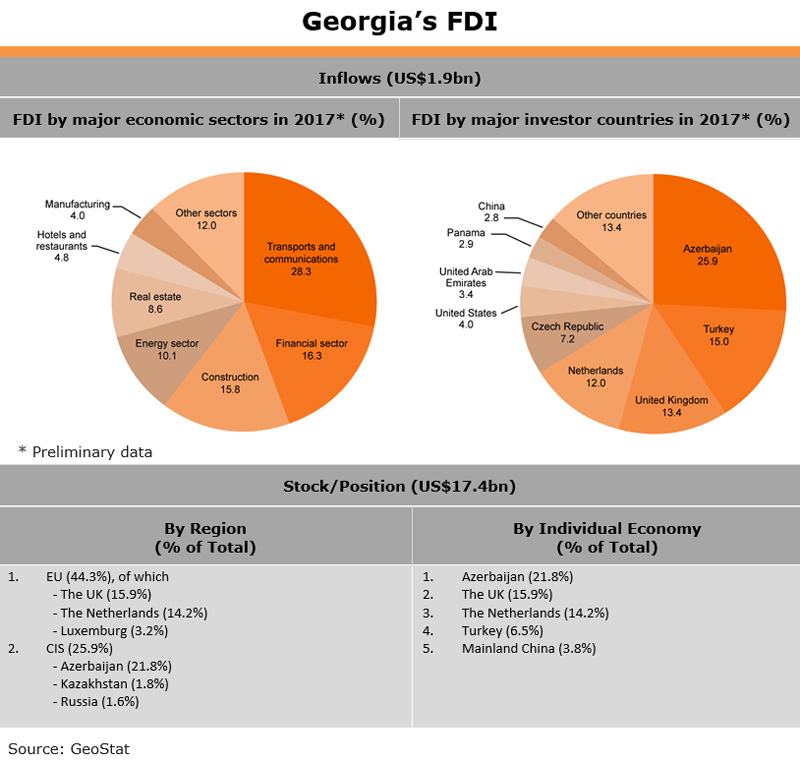

The growing Chinese presence permeates not only in trade, but also investment in Georgia. In spite of a similar EU and CIS dominance, the mainland is estimated to have grown to be the country’s fifth-largest foreign investor, growing from a US$590 million position in 2015 to US$656 million in 2017. An estimated US$51.9 million of the US$1.9 billion annual FDI inflow to Georgia last year came from China, accounting for some 2.8% of the total.

Falling largely in line with Georgia’s economic strengths, Chinese investors have a diversified investment portfolio in the country. Investment span many different sectors such as infrastructure development, engineering contracting, project contracting, trading, banking and finance, hospitality and real estate, telecommunication, forest resources development, building materials processing, manufacturing, renewable energy and mineral exploitation.

Examples of leading Chinese investors in Georgia include Xinjiang Hualing Group Corporation, CEFC China Energy, Sichuan Electric Power Import and Export Company, China State Grid International Development Corporation, Georgia Sinohydro, China 20th Metallurgical Construction Co., Ltd., Huawei Technologies, ZTE Corporation and Manzhouli Heyuan Economic and Trade Co., Ltd.

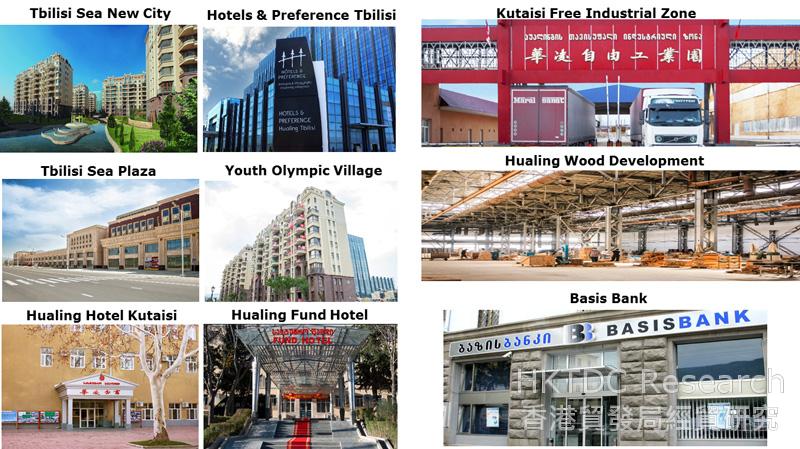

As the largest Chinese investor in Georgia, Xinjiang Hualing Group Corporation, for example, has already realised eight projects, including a landmark real estate development in Tbilisi, the capital. The Youth Olympic Village was converted into a residential and commercial complex, comprising Hualing Tbilisi Sea New City, Hualing Tbilisi Sea Plaza and Hualing Hotels & Preference Tbilisi, with abundant warehousing, retailing, wholesaling and meetings, incentives, conferences and exhibitions (MICE) capacity.

Source: Hualing Group

In consonance with Georgia’s vision to transform itself from a logistic junction into an industrial hub, Hualing has also strengthened its investment in the country’s manufacturing sector by taking a stake in the Kutaisi Free Industrial Zone (FIZ). This, together with CEFC China Energy’s recent investment in Poti FIZ on the eastern Black Sea coast to build an export hub for Chinese goods and services to Europe and Central Asia, has made Chinese investors vital for the future of two of the country’s four FIZs, and important partners in realising Georgia’s industrial potential.

Also worth noting is the growing visibility of Chinese investors in Georgia’s banking and finance sector. A good example is Hualing’s purchase of the Basis Bank in 2012, with an aim to grow RMB cross-border settlement businesses between China and Georgia. This was to facilitate bilateral trade and investment, and became one of the leading cases of Chinese private enterprises purchasing commercial banks abroad.

On a similar note, CEFC China Energy is reportedly planning to work with the Georgian government to set up a Georgian Development Bank. This will bolster RMB-denominated financial services and cross-border RMB settlement, while co-operating with the Georgian National Sovereign Fund to establish a Georgian Construction Fund to invest in financial services for projects such as roads, electric power, telecommunications and other infrastructure.

Also of interest to Chinese investors are the country’s strategic infrastructure projects, including hydropower plants and the ongoing railway modernisation. The recognition gained by a handful of Chinese investors and builders, such as China Railway 23rd Bureau Group, taking part in various signature projects in Georgia, will give Chinese investors a better position in the country’s future infrastructure development.

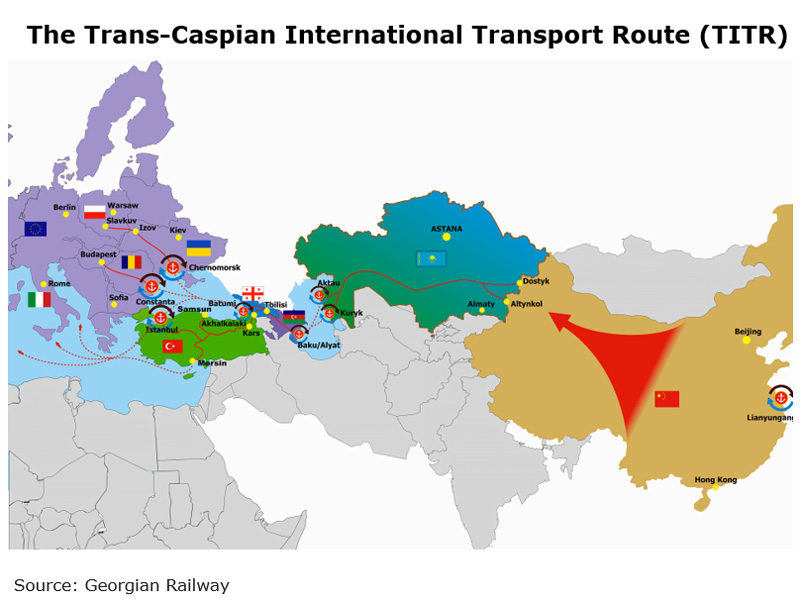

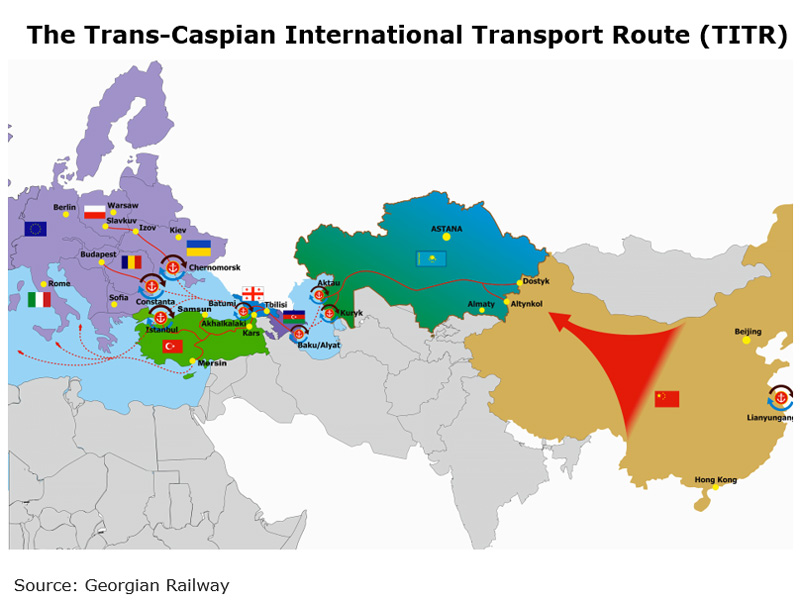

Situated on the shortest land route between China and Europe and being a key component of the Trans-Caspian International Transport Route (TITR) or the Middle Corridor, which stretches from Southeast Asia and China to Europe via Central Asia and the Caspian Sea, Georgia is an important BRI partner. Its strategic role as a logistic hub has been further strengthened with the October 2017 opening of the Baku-Tbilisi-Kars (BTK) railway route, which starts on the Caspian Sea in Azerbaijan and runs through Tbilisi and the eastern part of Turkey before merging with the Turkish and European railway systems.

Cargo trains from North-West China can now take as little as eight days to reach Georgia’s Black Sea coast, compared to sea voyages which can take up to 45 days. But to realise the target of receiving more than 250 cargo trains in 2018 and fully exploit the BTK, further local road and rail infrastructure enhancement work would have to be carried out in order to better connect the domestic rail networks and industrial facilities with the BTK. The route has a current annual capacity of 1 million passengers and 5 million tonnes of freight and the potential to expand to 3 million passengers and 17 million tonnes of freight.

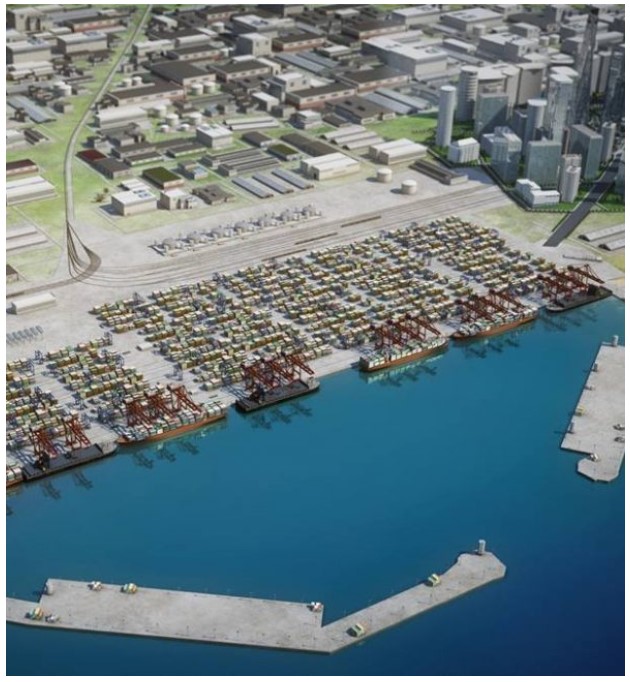

Source: Anaklia Development Consortium

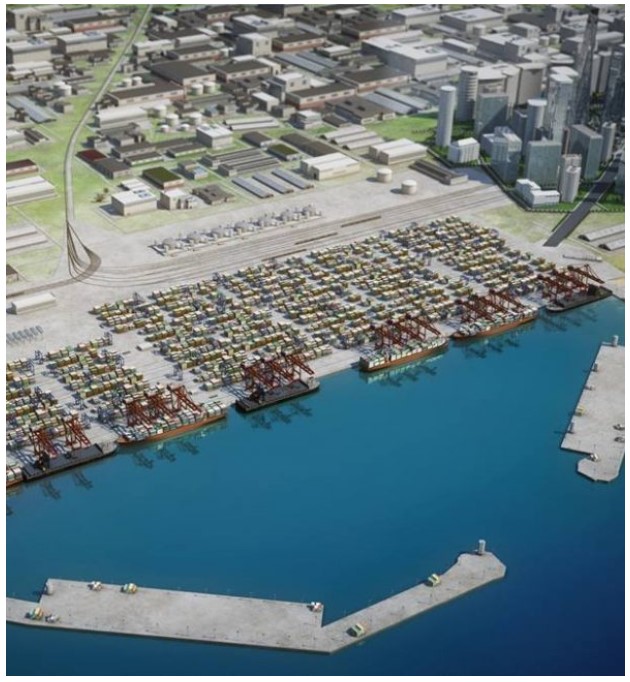

High on the country’s keynote project list is the US$2.5 billion Anaklia Deep Sea Port and Special Economic Zone (SEZ) project. This is the first deep sea port and the largest greenfield maritime infrastructure development in Georgia’s history, marking the beginning of the country’s transformation from a transit economy into a regional logistics and industrial hub capable of attracting Panamax and Post-Panamax vessels from Asia and Europe.

Under the 52-year build-own-transfer (BOT) concession agreement, the Georgian government has committed US$120 million for the construction and development of railway and road transportation links connecting the port to the region to help establish a new maritime trade corridor from Asia to Europe. Expected to receive the first vessels by 2020, the port will open new trade routes to the landlocked Caucasus, Caspian and Central Asian regions and provide badly-needed[3] infrastructure to support regional economic and trade development there.

Anaklia SEZ is close to the port and boasts an initial land plot up to 400ha, with the possibility of expanding to a city-scale project of up to 2,000ha. As a pioneering step to promote the development of light manufacturing and assembly, logistics, warehousing, distribution centres, retail and other service businesses, the SEZ will not only feature a green and smart city concept, but also enjoy a special status to provide a more favourable regulatory environment and tax system (e.g. British Common Law, international arbitration, IP laws, etc.).

Highlights of the Anaklia Deep Sea Port and SEZ Project

| Anaklia Deep Sea Port | Anaklia City and Special Economic Zone |

| Build-own-transfer (BOT) with a 52-year concession | Special Economic Zone (SEZ) adjacent to the deep-sea port site |

| 340ha port development area | Initial project land plot up to 400ha, with expansion to a city-scale project up to 2,000ha |

| Port depth of 16m CD | Focus on light manufacturing, logistics, warehousing, manufacturing and assembly, distribution centres, retail and other essential businesses |

| 14mn tonne capacity by 2030 (Phases 1 & 2) | New legislation to provide regulatory grounds for Anaklia City and Special Economic Zone development |

| Able to accommodate vessels up to 10,000 TEU | Green and Smart City concept with full pledge on urban and spatial planning from the outset |

| Up to 100mn tonne annual capacity following completion of all development phases | |

| Total cost estimated at US$2.5bn in nine development phases |

Source: Anaklia Development Consortium

As a long-term project with nine development phases spanning over more than 50 years, the Anaklia Deep Sea Port and SEZ is set to become a focal point for not only international businesses exploring new manufacturing relocation and regional distribution possibilities, but also investors looking for lucrative investment opportunities and partnerships in Georgia for many years to come.

In order to reach out to prospective investors across Asia and in other Belt and Road- connected regions, the Anaklia Development Consortium participated in the 2018 Belt and Road Summit in Hong Kong. The same event saw the signing of the Hong Kong-Georgia FTA and the promotion of the Anaklia Deep Sea Port and SEZ project to a 5,000-strong audience of investors, project operators and service providers from 55 countries and regions.

[1] According to Meiburg Wine Media, Georgia’s wine exports to China have been growing at an annual rate of more than 100% since 2008.

[2] Churchkhela is made from natural grape juice and different kinds of nuts.

[3] Existing Georgian ports are expected to reach full capacity limit with five years.

Editor's picks

Trending articles

The experience, comprehensive construction and technical know-how accumulated in Hong Kong is key to tapping into Belt and Road opportunities, according to Dominic Pang, Chairman of Asia Allied Infrastructure Holdings Limited (AAIH), whose company has recently secured a major water-supply infrastructure contract in the Philippines.

Having participated in a number of large-scale integrated construction projects in Hong Kong, including the Central-Wan Chai Bypass project, MTR Guangzhou-Shenzhen-Hong Kong Express Rail Link (Hong Kong Section) and Happy Valley Underground Stormwater Storage Scheme, AAIH accumulated extensive experience in the construction sector enabling it to expand business to the Belt and Road countries.

“The Philippines is a starting point to explore other Belt and Road-related construction opportunities around the region. Through this project, we hope to expand our business in the Philippines and find relevant partners. Technology transfer will help the local partners develop and list in Hong Kong, bringing project and investment returns to AAIH,” said Pang, who believed that construction projects, however they are tied to the Belt and Road Initiative, provides the Hong Kong construction industry with an opportunity to export its hard-earned reputation for managing and constructing world-class infrastructure projects. “As more Belt and Road projects are announced, we should be looking at ways to export our Hong Kong premium brand of construction and engineering capabilities and skills of handling complex projects to other regions,” said Pang.

With two independent thirdparty construction contractors, AAIH has entered into a contract with Manila Water Company, Inc to design and construct the Novaliches-Balara Aqueduct 4, water conveying facilities. Due for completion in 2021, the 5.4 billion-Peso (approximately HK$800 million) project will improve the long-term water supply services between Novaliches and Balara in Quezon City, the most populated city in the Metro Manila area. One of the two contractors also worked with AAIH previously on the Sha Tin-Central Rail Link project, constructing the tunnel between the Kai Tak and Diamond Hill MTR Stations.

In addition to the Novaliches-Balara Aqueduct 4 project, Pang said AAIH is exploring collaborative relationships with construction firms in Malaysia, the Philippines and Vietnam. “Other than project management, we are looking at ways to set up material and equipment sourcing collaborations to provide benefits along the construction supply chain,” said Pang. He said establishing connections with local stakeholders and introducing best construction project management practices is a good example of the Belt and Road ethos of promoting cooperation, mutual learning and mutual benefits.

Stephen Lee, Chief Executive Officer of Chun Wo Construction Holdings Limited, said it is noteworthy the Novaliches-Balara Aqueduct 4 project, which features a 7km long and nearly 4m diameter tunnel, will be the first tunnel in the Metro Manila area to be constructed using a tunnel boring machine (TBM). Used as an alternative to drilling and blasting methods, the use of TBMs requires expert planning and operating processes. “Our project management team has worked on challenging tunnelling projects in Hong Kong and will apply their skills and experience on the Philippines tunnelling project,” Lee said. Ahead of the commencement of tunnelling work, currently, geotechnical inspection work is being conducted to evaluate soil conditions and groundwater conditions.

With a wealth of experience in the construction industry, Edward Yeung, Assistant to the Chief Executive Officer of AAIH said by working with Philippine sub-contractors and employing local labour, AAIH can introduce the latest construction techniques and help fast track up-skilling. “The Philippines may lag behind the sophistication of Hong Kong's construction industry, but there is a lot of enthusiasm and commitment to improve,” noted Yeung. Dubbed by the government as the “golden age of infrastructure”, the Philippines has launched a major public spending programme focused on the construction of new roads, bridges, railways, and airports costing some US$167 billion. “As a company that possess extensive experience in project management and construction, AAIH is looking forward to sharing our expertise with suitable partners,” said Yeung.

Hong Kong digital transcription service Scribe Intelligence sees huge opportunities in artificial intelligence under the Belt and Road Initiative. Founder Christopher Choi aspires to dominate the transcription business in Asia – thanks to help from Hong Kong startup incubator, Zeroth.AI. It’s a programme that provides initial investment, help in finding additional financing as well as extensive advice and support, says Zeroth.AI’s Tak Lo.

Speakers:

Tak Lo, Managing Partner, Zeroth.AI

Christopher Choi, Founder, Scribe Intelligence

Sherman Lee, Partner, Zeroth.AI

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

A Hong Kong company billed as Asia’s first Artificial Intelligence (AI) incubator is making waves in the global start-up scene. Zeroth.AI runs an early stage funding programme for various start-up sectors including physical fitness. Managing Partner Tak Lo says he would like to see Hong Kong generated AI solutions tackle health issues in Belt and Road Initiative countries, where healthcare infrastructure may be lacking.

Speakers:

Tak Lo, Managing Partner, Zeroth.AI

Keith Ramjan, CEO, fitoneum.com

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

US$15 billion China-invested refinery and petrochemical complex seen as having essential part to play as Brunei looks to reinvent itself in the face of stubbornly-stalled international oil prices and its own rapidly-dwindling gas and oil reserves.

The news that work on a 2.7km bridge connecting Bandar Seri Begawan, the Brunei capital, with the neighbouring island of Pulau Muara Besar (PMB) had been completed late last month marked the successful conclusion of the country's first Belt and Road Initiative (BRI) project. It is, however, only one small element of the far wider-reaching China-backed development that will transform the island into one of the region's primary refining and petrochemical hubs.

Once completed, the US$15 billion refinery and petrochemical complex is expected to provide up to 10,000 jobs and play a crucial role in weaning the Brunei economy off its traditional dependence on its crude oil and natural gas exports. Although work on the bridge was led by the China Harbour Engineering Company, a Beijing-headquartered subsidiary of the huge China Communications Construction civil engineering conglomerate, the construction of the plant proper is down to the Hangzhou-based Zhejiang Hengyi Group (Hengyi). Under the terms of its agreement with the Brunei government, the company, one of China's largest suppliers of raw materials for the textile industry, funded the $3.4 billion facility and will be responsible for its day-to-day operations once it comes online late next year.

Another Chinese company, Lanzhou LS Heavy Equipment, a specialist in the provision of petrochemical systems, meanwhile, has been contracted to build a number of the refinery's key production units. These include an aromatics facility with a capacity of 1.5 million tonnes per annum and a 2.2 million TPY (throughput yield) hydrocracking unit.

Overall, the refinery is shaping up to be both China's largest, privately-owned facility outside the mainland and, by far, the most expensive overseas-backed project in Brunei's history. Once operational, it will have the capacity to process 160,000 barrels a day, while also providing feedstock for Hengyi's terephthalic acid production, an intermediate material required to make polyester. It is also hoped that, in time, it will produce a sufficient level of fuel to allow Brunei to successfully compete with Singapore, currently the dominant regional oil hub.

Back in March, in order to finance the project, Hengyi Petrochemicals became the first company to issue BRI corporate bonds – a financial instrument newly approved by the China Securities Regulatory Commission – and successfully raised US$79 million on the Shenzhen Stock Exchange. It is money that the company is clearly going to need.

Earlier this year, it was announced that the second phase of the PMB project will cost some $12 billion. This will see the refinery's capacity expanded to 280,000 barrels a day and will also fund units capable of producing an annual TPY of 1.5 million tonnes of ethylene and two million tonnes of paraxylene.

The scale of the project is a sure indication of its importance to Brunei. Although the country is the second-richest per capita in the ASEAN bloc, after Singapore, low oil prices have seen its economy contract significantly over recent years, while also driving up the level of unemployment. Although, after four years of contraction, the country's economy rallied slightly last year with its GDP growth estimated at 1%, it is still being far outstripped by many of its fellow ASEAN states.

As well as the currently stalled oil prices, the country's oil and gas reverses – long its economic lifeline – are expected to be exhausted within 20 years. In anticipation of this, many of the global petrochemical companies have already cancelled plans for further investment in the country.

The PMB facility, then, is therefore clearly a key initiative and will help the country maximise profits from its dwindling reserves. At the same time, it will also nurture the capability and expertise required to service the increasing number of oil and gas fields coming online across the wider region.

Some institutions, however, are not hanging around to see if Brunei can successfully reboot its economy. Back in 2014, Citibank shuttered its branches and pulled out after 41 years in the country. A year later, HSBC followed its example, again ending its ties to the country. Widely seen at the time as swimming against the tide, the Bank of China opened its first Brunei branch in 2016. Given recent events and current forecasts, that might not have been quite the reckless move it seemed at the time.

According to the International Monetary Fund's recently published Regional Economic Outlook for Asia and the Pacific, the country's economy may expand by up to 8% in 2019, maintaining average growth of 5% for several years thereafter. Significantly, one of the cited reasons for this likely resumed growth was the imminent completion of the PMB facility.

While climbing aboard the BRI bandwagon is clearly in Brunei's interest as the country seeks to reinvent itself in economic terms, Beijing's interest in its 3,900km distant trading partner is far from altruistic. Back in 2014, the two countries pledged to work together on the development of the Brunei-Guangxi Economic Corridor (BGEC) as a means of developing mutual trade, particularly with regard to halal products, tourism and shipping. Over recent years, the BGEC has been subsumed into the overall BRI project.

In terms of its BRI significance, Brunei also has the benefit of being set at the very heart of the Brunei-Indonesia-Malaysia-Philippines East-Asian Growth Area (BIMP-EAGA). Given the surging prosperity of this region, the BRI may allow Brunei to resume its classic role as a preeminent trading hub, boosting China's hopes of facilitating international trade to a scale never before seen.

More prosaically, China and Brunei have both staked a claim to the 370km-long Louisa Reef, one of the disputed areas of the South China Sea. It is now hoped that the close co-operation the two countries currently enjoy will allow them to jointly explore the reef's potential economic benefits, rather than remaining a continuing source of tension between the two.

Marilyn Balcita, Special Correspondent, Bandar Seri Begawan

Editor's picks

Trending articles

As well as boosting Pakistan's power generation, deal establishes China as key nuclear technology exporter.

In perhaps one of the more politically sensitive Belt and Road Initiative (BRI) developments, last month saw China and Pakistan agree terms on the installation of an 878-km power transmission line. Once in place, this will link Lahore with southeastern Matiari, a hub city for the electricity generated in many of the China-backed power plants already operational within the China-Pakistan Economic Corridor, the massive infrastructure redevelopment and energy generation programme at the heart of Pakistan's bid to address its acute logistical problems and its vast power undersupply, as well as the BRI, China's own hugely-ambitious infrastructure and trade facilitation programme.

While – aside from a few environmental concerns and suggestions that China's largesse represents a form of financial colonisation – the developments have largely found approval within Pakistan, they have become something a flashpoint with neighbouring India. The relationship between the two countries has long been fraught, with distrust and recriminations dating back to well before 1947, when they emerged as independent states amid the gradual dismantling of the British Empire.

Now, in addition to several territorial issues, India – one of the few major economies not to embrace the benefits of the BRI – is known to be unhappy that China is effectively wooing a number of countries, such as Pakistan and Nepal, that it sees as rightly within its own sphere of influence. Perhaps most gallingly, China is seen as helping Pakistan further develop its nuclear-power sector, a hugely sensitive issue given the long-term nuclear-weapons standoff between the two South Asian countries.

While this latest development does not relate to Pakistan's rapidly expanding nuclear-power sector, with the electricity set to be transmitted via the new power transmission line actually sourced from several China-backed, coal-fired facilities in the west of the country, that is not to say that China's isn't heavily committed to helping Pakistan boost its nuclear-power generation capacity. Indeed, much of the basis of the present and continuing China-Pakistan economic co-operation revolves around power generation – both conventional and nuclear – as the Pakistan government looks to solve its longstanding energy-generation shortfall.

As recently as 2013, with the country's demand topping 15,000 MW, Pakistan only had a total generational capacity of 11,000 MW. With the gap between demand and supply only set to grow, the country has since set about accelerating the expansion of its nuclear-power programme, with China acting as financial backer, technical consultant and lead contractor. Ultimately, it is hoped that this tactical alliance between the two countries will result in Pakistan having a domestic power generation capacity of 40,000 MW by 2050.

That is not to say that China sponsored Pakistan's introduction into the still relatively small number of nations with nuclear-power facilities. Predating China's initial involvement by more than 20 years, 1971 saw Toronto-headquartered GE Canada install and then manage KANUPP1, the Karachi-based facility that produced Pakistan's first nuclear-derived electricity. Although Canada cut all ties to the plant in 1976 after Pakistan refused to sign the Non-Proliferation of Nuclear Weapons Treaty, the plant continued in service until 2002. Following a four-year upgrade, it resumed operation and continues to produce electricity, albeit at a reduced level.

China's involvement with the country's nuclear programme began in August 1993, when the two countries jointly developed the Chashma Nuclear Power Complex in Punjab, Pakistan's most populous province. Marking the first time China had exported its nuclear technology, the installation initially comprised two 300 MW generating units and two subsequent 340 MW units, all of which are now connected to the national grid.

In 2013, China and Pakistan agreed to add a fifth unit to the Chashma facility, which is due to go online in 2020. That same year, construction also began on two state-of-the-art 1,000 MW+ reactors – KANUPP-2 (K-2) and KANUPP-3 (K-3) – close to the original reactor site, with both due to be operational by 2021. Acting under the auspices of the International Atomic Agency, the sector's global regulator, three of the mainland's leading nuclear-power companies – the China General Nuclear Power Group, the China National Nuclear Corporation (CNNC) and the China Atomic Energy Authority – co-operated in the development of the two new facilities, with CNNC covering at least US$6.5 billion of the costs of the $10 billion project through a series of low-cost loans.

At the core of the two new facilities is the third generation HPR1000 Hualong One reactor, the model at the forefront of China's bid to export its nuclear technology. One such model is currently undergoing acceptance tests in the UK, while another has been earmarked as the centrepiece for Argentina's fifth nuclear facility with work on the project scheduled to begin in 2020. In the meantime, as well as helping Pakistan meet the shortfall in its electricity supply, while tying the country into wider goals of the BRI, the Punjab nuclear facility is also acting as China's calling card as it looks to establish itself as a world leader in safe and cost-effective nuclear-power generation.

Geoff de Freitas, Special Correspondent, Lahore

Editor's picks

Trending articles

By Deloitte

China-proposed Belt and Road Initiative (BRI), which has been a large part of the investment landscape across a swathe of the world for four years, will become increasingly important. This paper summarises Deloitte’s key BRI insights for 2018, and also explains how industry players can best position themselves to seize the ever-widening range of BRI investment opportunities...

Winners and global resonance

BRI 2.0

In May 2017 at the BRI Forum in Beijing, President Xi told attendees that the vision underpinning BRI “is becoming a reality and bearing rich fruit,” adding that “a solid first step has been taken.”

Naturally some regions and industries have done better than others. Southeast Asia and South Asia remain key beneficiaries and, our research shows, remain the most favored by SOEs (figure 9). For the former, that is partly due to proximity to China and a higher state of development, and partly due to the demand for better infrastructure. For the latter, the size of their populations and vast market potential are important draw cards.

Europe is also popular, as are Russia and Central Asia. We expect that will remain the case over the coming years, although given that BRI’s sustainability is aligned with China’s economic and political interests, it is likely that the initiative’s priority will continue to be areas that are geographically close to China.

We saw earlier why infrastructure attracted more funding than other sectors, with China’s SOEs the key winners. As BRI’s global ecosystem builds, it will encompass investments in manufacturing and trade, as well as softer investments in tourism and culture. That will create opportunities for MNCs with the technology, skills and connections that Chinese firms, whether SOEs or POEs, often lack.

In addition, we expect increasing numbers of Chinese POEs, many of which view BRI as a venue for SOEs, will become more active in areas such as M&A, which is what Beijing wants. Although some POEs are cautious, others have committed.

Bigger pool of opportunity

This goes to the heart of BRI’s phase 2, which is widening the pool of opportunity. And although many MNCs have yet to reap benefits, some have. Take ABB, for example. The Swiss-based firm has been involved in dozens of EPC deals undertaken by Chinese companies, for which it aims to become “the partner of choice.” In 2016 alone, it helped 400 Chinese firms to resolve inter-country differences in design and industrial standards.

Caterpillar says it regards BRI as a long-term opportunity. For its part, GE recorded orders worth $2.3 billion in 2016, most under BRI projects, up from just $400 million in 2014; over the next year or so, GE will bid for business worth another $7 billion of business. Honeywell and Siemens have also benefited from their technological offerings, while Citibank and Zurich are among others getting more deeply involved.

We believe phase 2 will bring greater global resonance, and that MNCs that position themselves strategically now stand a good chance of benefiting.

Phase 2 is being driven by the ready funding provided by China―and increasingly by others. In May 2017, President Xi announced a further $124 billion for BRI, including $14.5 billion for the Silk Road Fund, and special lending schemes for the China Development Bank and the Export-Import Bank of China, worth around $36 billion and $19 billion, respectively. He also called on financial bodies to establish a BRI fund worth $43 billion.

The involvement of the Asian Infrastructure Investment Bank (AIIB)―which is expanding its influence and in June welcomed its 80th member―in BRI projects will prove increasingly important. As it builds credibility and experience, and enjoys the backing of China and dozens of other governments, it should have little trouble raising funds on global capital markets. This internationalisation of the AIIB should also increase the sensitivity of sponsoring governments, not least China, to perceptions of political influence in BRI.

In short, BRI is benefiting from initiatives that have increased the amount of financing, its sourcing (including from developed nations such as the United Kingdom and Germany) as well as the cofunding of projects between, say, the AIIB and other multilateral organisations.

MNC Opportunities

Not only has MNCs’ opportunity to get involved in BRI never been better, it is likely to keep improving. Why? Not least because Beijing wants to boost BRI’s inclusiveness. China’s leaders describe BRI as an initiative, not a strategy. While that might seem a low-value distinction, it informs an important difference: It means Beijing views BRI as a global program that was initiated by China, and not as a Chinese project.

China stands by its assertion that BRI is for all, and needs to show it means that by keeping BRI open. That will not hold up if MNCs can participate in only a showcase fashion.

Phase 2’s very nature will also afford MNCs greater opportunity, because many enjoy competitive advantages over Chinese firms in areas such as manufacturing, trading and tourism.

There are other pointers too. Firstly, more funding will come from outside China, including from monetary financial institutions (MFIs) such as the World Bank and the ADB; this will bring with it increased transparency as well as rules with which MNCs are more familiar.

Secondly, the AIIB recently brought its decision making more in line with that of the World Bank and the ADB, and said it would take account of issues such as the environment; this should have a similar effect given that MNCs have more experience in meeting such requirements.

And thirdly, richer countries are benefiting from BRI, and are better able to ensure that projects are of the highest standard, and that the companies carrying out such work are the best available. Again, that ought to benefit non-Chinese MNCs...

Conclusion: Three key insights and predictions

Our experience with BRI projects over the years has allowed us to develop three key insights and predictions, all of which have appeared in this report in some form.

Firstly, BRI is much more than a Chinese-funded infrastructure project. And although SOEs have undertaken the bulk of BRI projects to date, we expect many more POEs and MNCs will become involved in the near future. Linked to this, many projects are underpinned by strong bilateral relationships between China and the countries concerned, which makes these investments more secure than outsiders might imagine. And while most participants are developing countries, it is also true that developed nations are increasingly involved.

Secondly, BRI’s opportunities will become increasingly plentiful, but a longer timeframe is needed when measuring returns―10–15 years rather than 3–5. And although many projects involve higher risks than conventional investments, it is important to keep those risks in perspective and deal with them dynamically.

Thirdly, BRI is a collaborative ecosystem that to date has focused on energy and infrastructure, but that over the next five years and beyond will evolve to concentrate on trade, manufacturing, the Internet, tourism and other aspects.

It is worth saying, too, that Beijing’s view of BRI is not well understood abroad: It sees this initiative as comprising a different interpretation of globalisation, one that is about optimising returns, not about maximising them in solely financial or commercial terms. This is encapsulated in the principle underpinning BRI: 共商共建共享, which translates as, “Trade together, build together, enjoy together.”

And so, while BRI is in part an initiative designed to push China’s economy to the next stage, to Beijing it is more too: a way to create a more equitable global economic system. MNCs that manage to position themselves well should find BRI a striking, multiyear opportunity.

Please click to read full report.

Editor's picks

Trending articles

China’s Belt and Road and Guangdong-Hong Kong-Macau Bay Area initiatives enhance Alberta’s international diversification push, says the Canadian province’s trade minister. Speaking at a Hong Kong reception for jewellery firm Korite International, Deron Bilous says Alberta sectors like technology, energy, forestry, tourism – as well as gems and jewellery – regard China as a priority, while Hong Kong is an established hub and gateway for China’s big initiatives.

Speaker:

Deron Bilous, Alberta Minister of Economic Development and Trade

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

Hong Kong has been chosen as the Asian hub for Canadian rare resource and jewellery company Korite International Inc. The Alberta-based company controls nearly all of the world’s resources of ancient Ammonite fossils and the jewellery made from them, Ammolite. Korite’s CEO Martin Bunting said Hong Kong’s world-beating trade shows and location offer huge regional potential, with connections to the Belt and Road and Guangdong-Hong Kong-Macau Bay Area initiatives.

Speaker:

Martin Bunting, CEO, Korite International Inc

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

Blackpanda, a Hong Kong special risks consultancy, draws on the image of the panda to show its community development credentials. But it also aims to show “risk” as an important aspect of the Belt and Road Initiative, with cyber security a major challenge, says CEO Gene Yu. Hong Kong’s connector role is all-important to clients as the firm opens markets in Southeast Asia.

Speaker:

Gene Yu, Co-founder, CEO, Blackpanda

Related Links:

Hong Kong Trade Development Council

http://www.hktdc.com

HKTDC Belt and Road Portal

http://beltandroad.hktdc.com/en/

1512 Views

1512 Views