GDP (US$ Billion)

87.93 (2018)

World Ranking 67/193

GDP Per Capita (US$)

1,831 (2018)

World Ranking 148/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

33.4 (2019)

Currency (Period Average)

Kenyan Shilling

101.99per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

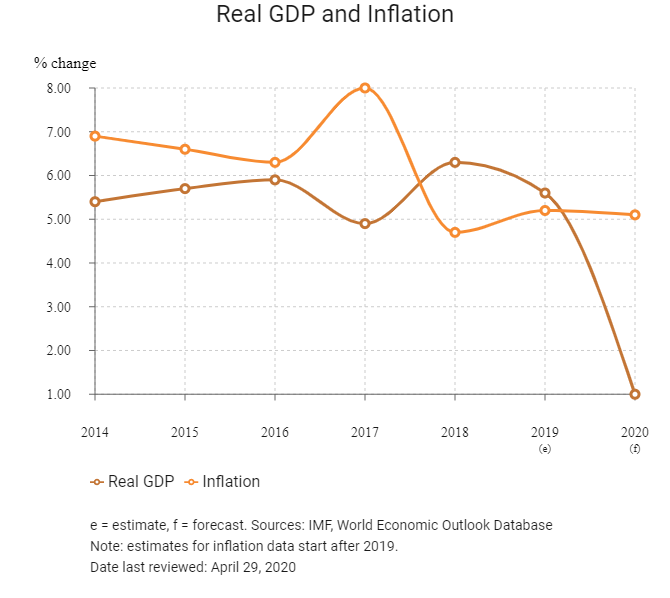

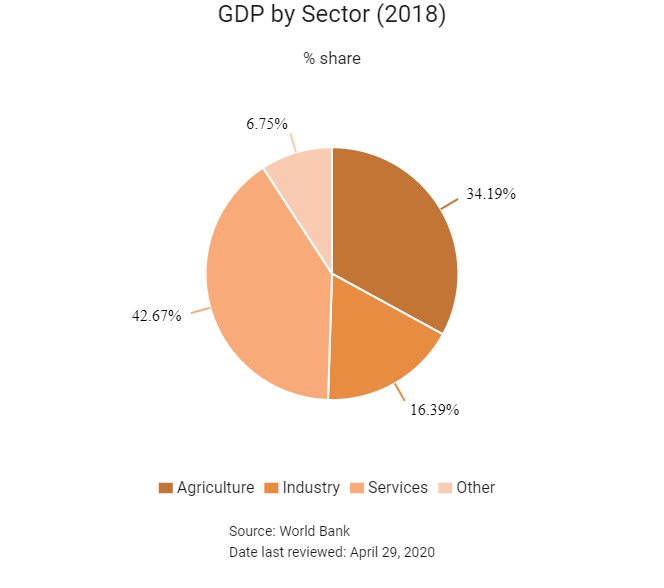

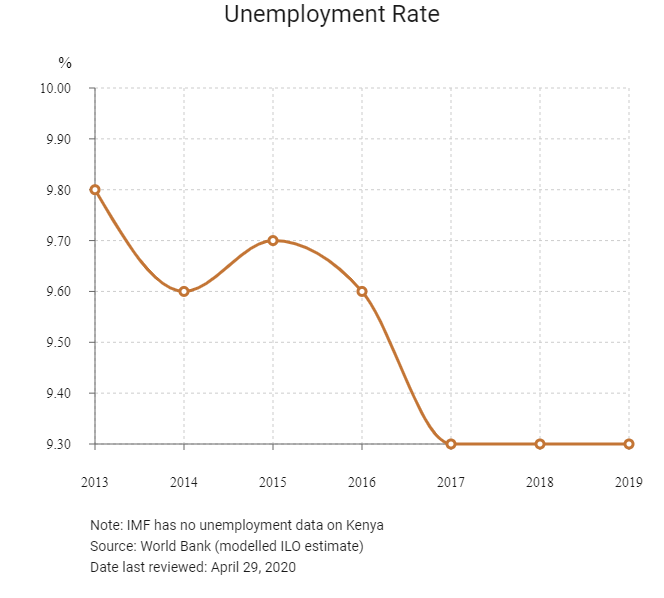

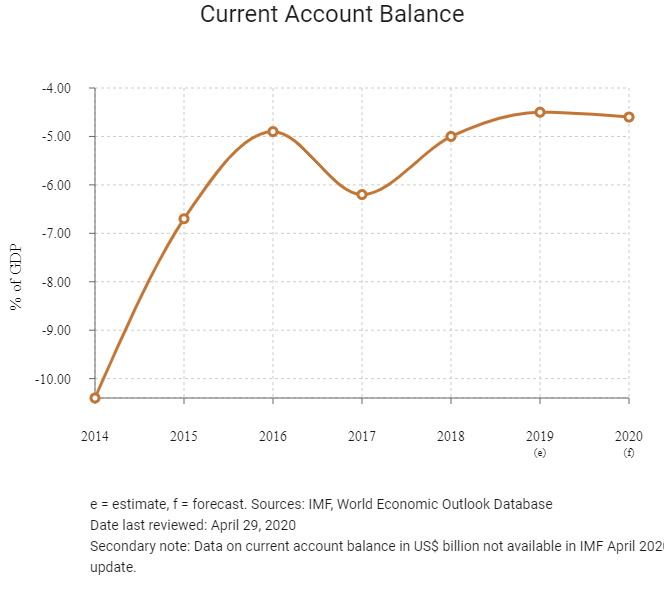

Kenya has made a number of political, structural and economic reforms that have largely driven sustained economic growth, social development and political gains over the past decade. Kenya's recent political reforms are the result of a new constitution, passed in August 2010, which introduced a bicameral legislative house and devolved power to county governments and a constitutionally tenured judiciary and electoral body. Devolution ushered in a new political and economic governance system, giving counties control of their own development agenda, strengthening accountability and public service delivery at local levels. In the medium term, GDP is expected to rise, underpinned by a recovery in agriculture, better business sentiment and easing political uncertainty. However, Kenya’s economy is less competitive on a global scale, largely due to the fragile security landscape, high energy costs and significant water stress, which negatively impact industrial and agricultural activity.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2019

Kenya made plans to build a USD140 million port in Kisian, Kisumu county, on the shores of Lake Victoria, as part of a joint standard gauge railway project. The port would have two multipurpose berths of 3,000 tonnes and one work boat berth.

May 2019

The Kenya Urban Roads Authority signed a USD132 million deal with a consortium consisting of Lee Construction, Cape Construction and Moto Engil Africa for the construction and maintenance of 80km of stalled roads in Western and Central Kenya as part of the Roads Annuity Program. The public-private partnership agreement was for the Riamukurwe-Gatitu road in Nyeri County, the Kanjuki-Mauktano road in Tharaka-Nithi and the Busia-Alupe bypass in Western Kenya. The programme also included making the Nairobi-Mombasa highway a dual road, with the commercial contract already in place; the second Nyali Bridge in Mombasa and the Nairobi-Narok-Mau Summit highway.

July 2019

The government of Kenya signed agreements with joint venture partners Total, Tullow Oil and Africa Oil Corp for the construction of a crude oil processing facility in the country. The facility was expected to produce 60,000-80,000 barrels of oil per day. The agreements cover oil fields discovered in blocks 10 BB and 13 T in the South-Lokichar Basin. The construction of a crude oil export pipeline from Lokichar to Lamu was also planned.

2019

Construction was set to start in 2019 on the special economic zones (SEZs) in Likoni, Kenya. The works would start when residents affected by the project were fully compensated. Kenya Ports Authority had started construction on the second phase of the Dongo-Kundu port in Likoni. The Kenya National Highway Authority would undertake the construction of the road connecting the SEZs to the second phase of the Dongo Kundu bypass.

August 2019

The Kenya Ports Authority (KPA) had launched a KES360 billion (USD3.48 billion) master plan for 30 years. The 2018-2047 Master Plan contained a development strategy for the major ports, lake ports, small coastal ports and the Inland Container Depots. The plan would allow KPA to undertake investments that would position the port of Mombasa among world-leading seaports. The Dongo Kundu SEZ would see additional berths constructed at the port of Mombasa to boost trade.

October 2019

The Kenyan and Russian delegations at the Russia-Africa Summit resolved to establish a Russia-Kenya business council to oversee the implementation of joint trade and investment programmes.

January 2020

A new SEZ was being planned in the Kenyan county of Mombasa, according to county Deputy Governor William K Kingi. The county had collaborated with TradeMark East Africa (TEA), an aid-for-trade organization, for the project. TEA was carrying out a feasibility study for the SEZ, which would come up on an area of 2.43sq km. The study would assess the types of businesses and investments that could be set up in the zone.

March 2020

The government of Kenya approved plans to build a centre for disease research and prevention. Proposed by the African Union and the World Health Organization, the centre is expected to serve the entire continent. The 21-storey centre building would be built at a cost of KES8.3 billion (USD78 million), with financial assistance from Mainland China, according to Construction and Civil Engineering News.

Nairobi City Hall approved the KES28 billion (USD268.6 million) Nairobi Railway City in the Kenyan capital. The scheme, which would cover a 1.72sq km area, would have three components. The first would involve the construction of space for meetings, conferences and exhibitions. The second component would be an economic zone with industries and small and medium enterprises. The final component would include a residential complex. Nairobi County Lands and Urban Planning Executive Charles Kerich has recently gazetted 696,059sq m of land consisting part of the Nairobi Railway Station and its surroundings as a special planning area for the project.

The Japan International Cooperation Agency signed a loan deal with the Kenyan government for providing up to JPY37.09 billion (USD342.54 million) for the Mombasa Economic Zone Development Project (I). The scheme involves the construction of a berth, main road and electric facilities for the Mombasa SEZ in Dongo Kundu. The project, to be executed by Kenya Ports Authority, Kenya National Highways Authority and Kenya Electricity Transmission Company, is slated for completion in December 2024.

On March 24, the central bank lowered its policy rate by 100 basis points (bps) to 7.25%; lowered banks’ cash reserve ratio by 100bps to 4.25%; increased the maximum tenor of repurchase agreements from 28 to 91 days; and announced flexibility for banks regarding loan classification and provisioning for loans that were performing on March 2, 2020, but were restructured due to the pandemic. The central bank had also encouraged banks to extend flexibility to borrowers' loan terms based on pandemic-related circumstances and encouraged the waiving or reduction of charges for mobile money transactions to disincentivise the use of cash.

On March 25 2020, President Uhuru Kenyatta announced various tax and other targeted interventions that the government would implement to help businesses and households cope with the economic fallout from the Covid-19 outbreak, including tax reductions and waivers. Key tax relief measures announced include a 100% tax exemption for individuals earning less than KES24,000 (USD225); a reduction in highest marginal and corporation taxes from 30% to 25%; a reduction in turnover tax rate for micro, small and medium enterprises to 1% from 3%, as well as value-added tax (VAT) to 14% from 16%. The effective date for these measures was April 1, 2020, but there was no indication of their duration.

April 2020

On April 15, the central bank suspended the listing of negative credit information for borrowers whose loans became non-performing after April 1 for six months. A new minimum threshold of USD10 was set for negative credit information submitted to credit reference bureaus. On April 29, the central bank lowered its policy rate by 25bps to 7%.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

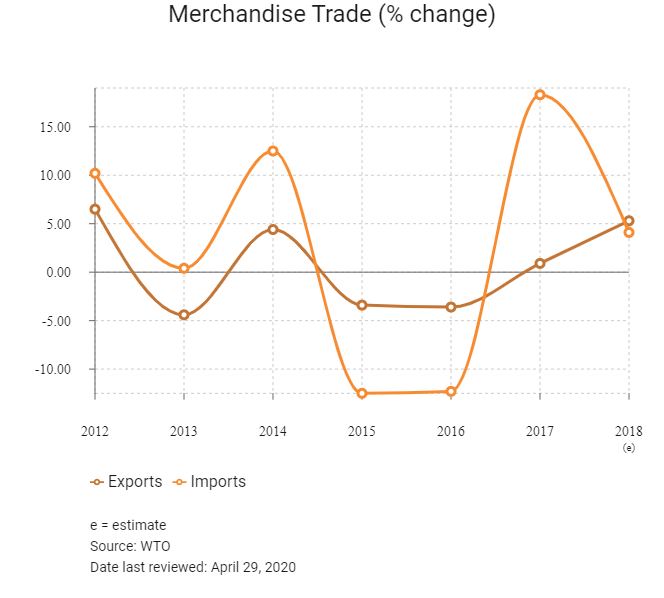

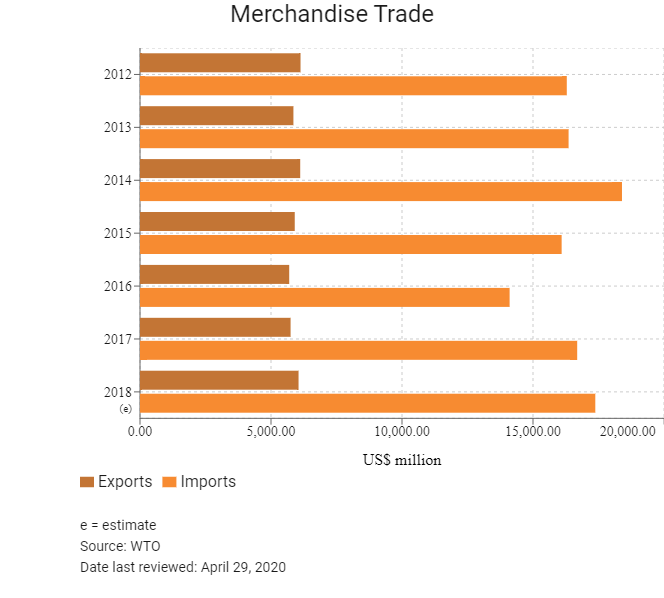

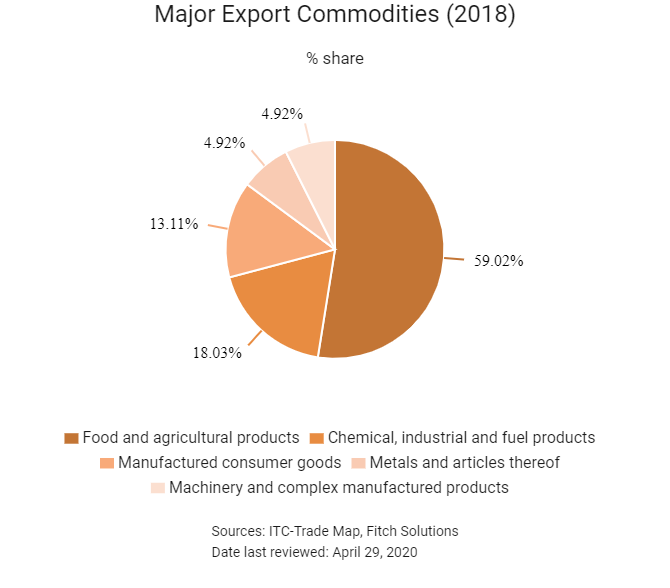

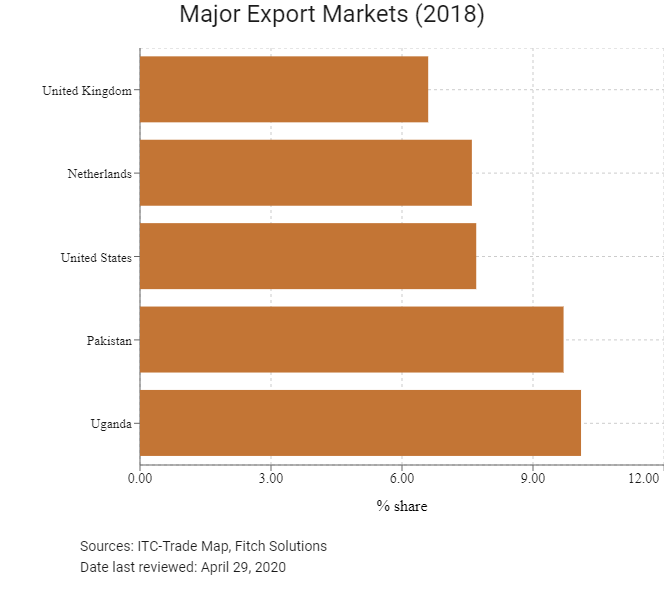

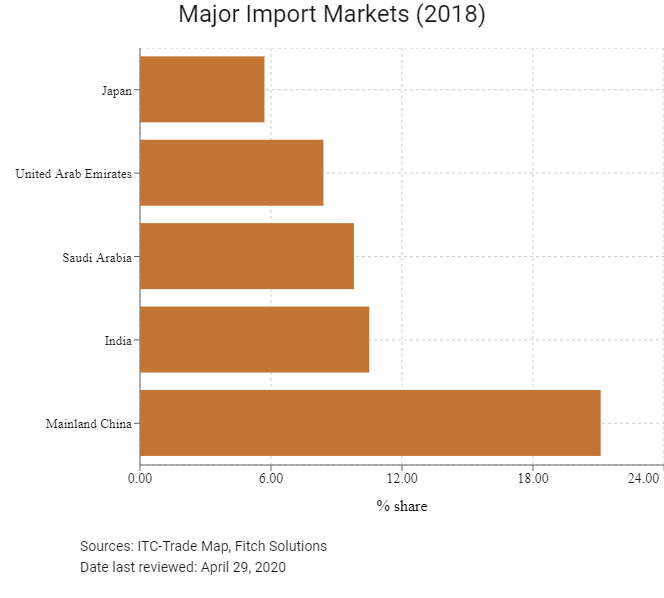

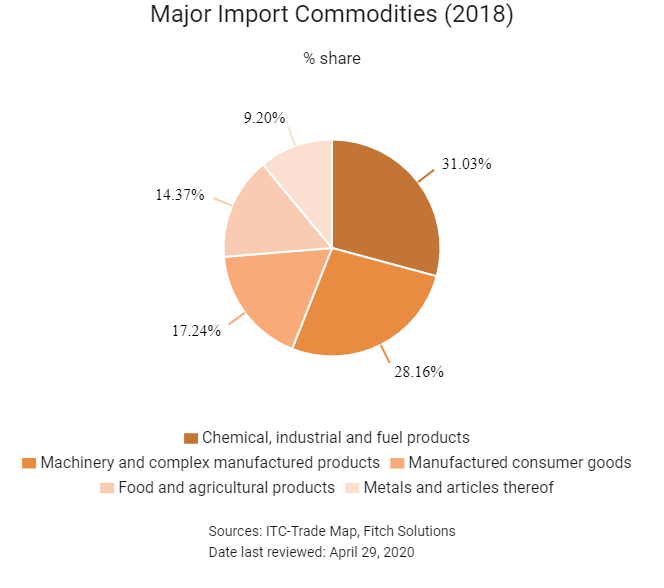

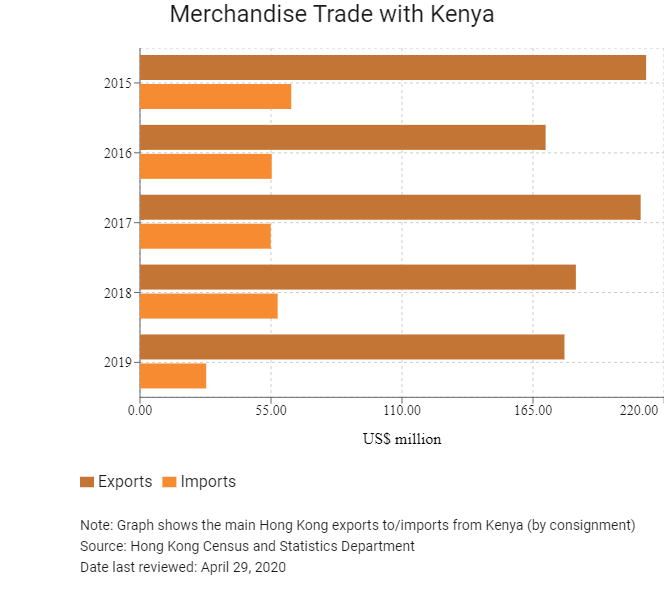

Merchandise Trade

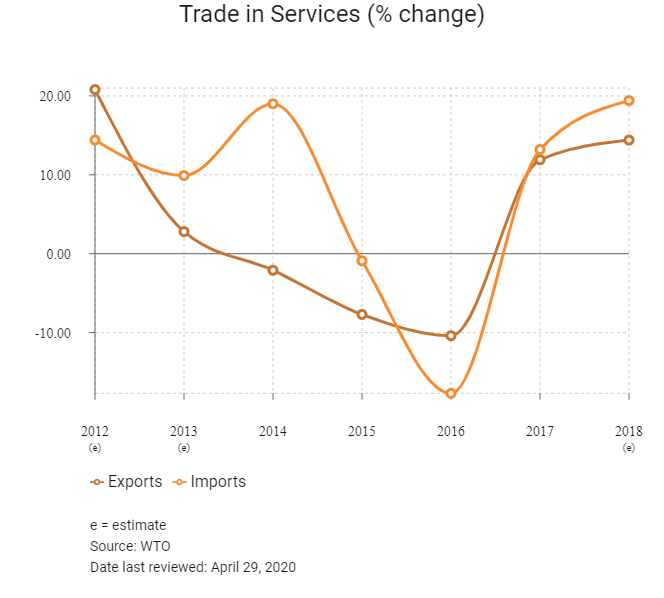

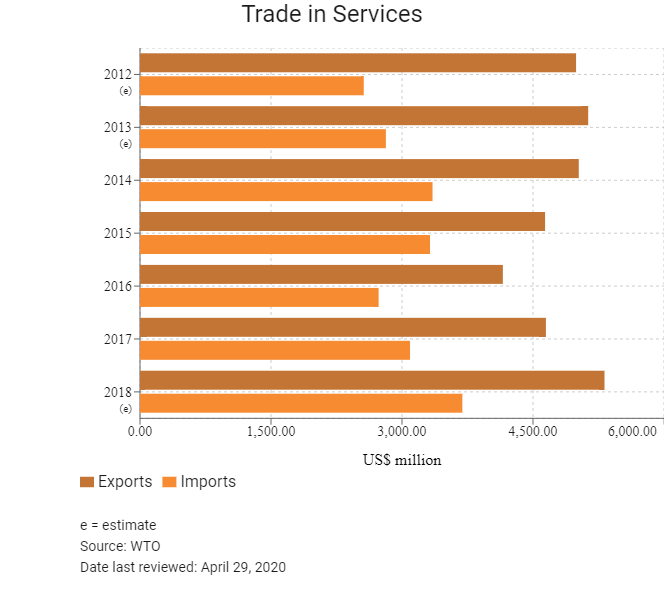

Trade in Services

- Kenya has been a World Trade Organization (WTO) member since January 1, 1995 and a member of the General Agreement on Tariffs and Trade since February 5, 1964.

- Deepening regional integration in the East African Community (EAC), Common Market for Eastern and Southern Africa (COMESA), Tripartite Free Trade Area (TFTA) and the Africa Continental FTA (AfCFTA) is part of the country's long-term goals that will yield benefits for the trading environment.

- Kenya's EAC membership gives businesses in the country access to a large market with reduced trade costs. EAC member states have signed a protocol to establish a common customs union.

- As part of COMESA, most members have an open border for traded goods and services and preferential tariff rates. The final objective of COMESA is to establish a fully integrated, unified economic space.

- Overall tariff barriers to trade in Kenya remain somewhat high, at an average of 8.9%, placing a particular burden on firms reliant on imported inputs.

- There is increasing emphasis on improving intra-regional trade, and the Kenyan government has been at the forefront of major regional infrastructure development to realise this aim. In a fresh bid to open up their borders and facilitate investment and trade, leaders from Kenya and Ethiopia agreed to remove various barriers that impede business development and intra-regional trade. Changes made include relaxed rules on residence for investors, streamlined application procedures for Kenyan companies seeking to invest in Ethiopia and relaxed work permits. Over the medium term, Kenyan investors venturing into Ethiopia should expect fewer restrictions to their businesses once an agreement signed by the two countries is implemented.

- In 2017, Kenya and Tanzania opened the modern Holili/Taveta border post to facilitate regional trade. This marks the first modern border post to be operated among the 13 one-stop border posts in East Africa and South Sudan. Authorities from both countries expect that the facility will reduce the cost of doing business by 40% and accelerate regional integration and economic growth among the East African member states. While non-tariff barriers remain a major challenge across the borders, the facility will enhance integrated border management to increase the free flow of movement and goods. In addition, further changes were implemented, such as opening the port of Mombasa for 24 hours and reducing the frequency of road blocks, which reduce import and export lead times and costs.

- In October 2016, South Africa and Kenya moved to soften trade and visa barriers between the two regional powerhouses as part of ongoing efforts to boost low levels of commerce within Sub-Saharan Africa.

- Kenya has signed bilateral trade agreements with several countries, including Argentina, Bangladesh, Bulgaria, Mainland China, Comoros, the Democratic Republic of the Congo, Djibouti, Egypt, Hungary, India, Iraq, Lesotho, Liberia, Netherlands, Nigeria, Pakistan, Poland, Romania, Russia, Rwanda, Somalia, South Korea, Eswatini, Tanzania, Thailand, Zambia and Zimbabwe.

- A Railway Development Levy has been in place since 2013, imposing a 1.5% tariff on all imported products. Non-tariff barriers to trade, including high levels of bureaucracy, delays at customs clearance and port congestion, add costs to imports for businesses.

- In September 2016, Kenya's parliament ratified the Economic Partnership Agreement with the European Union (EU), allowing Kenya to export its agricultural products to Europe in a move to secure duty-free market access to the EU.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

Bilateral trade agreements are under negotiation with several countries, including Belarus, Czech Republic, Ethiopia, Eritrea, Iran, Kazakhstan, Mauritius, Mozambique and South Africa. Increasing trade partners will provide a solid basis for durable export and import growth in the long term.

Multinational Trade Agreements

Active

- COMESA: Kenya is part of COMESA, a collective of 21 countries under an FTA. Most members have opened their borders for traded goods and services. Notably this group comprises Burundi, Comoros, the Democratic Republic of the Congo, Djibouti, Egypt, Eswatini, Eritrea, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Somalia, Sudan, Tunisia, Uganda, Zambia and Zimbabwe. The agreement entered into force on February 17, 1999 and covers the trade of goods. However, not all members subscribe to the FTA.

- EAC: The EAC comprises Burundi, Kenya, Rwanda, South Sudan, Tanzania and Uganda. The agreement entered into force on July 7, 2000 for goods and July 1, 2010 for services. The customs union aids regional trade flows and allows businesses to use Kenya as an entry point for the East African market. Trade with neighbouring states is substantial.

- EAC-United States: The United States is a major export market and the Trade and Investment Framework Agreement and Africa Growth and Development Act (AGOA) removed tariffs for some product exports to the United States (such as textiles), reducing trade barriers. Under AGOA, Kenya qualifies for duty free-access to the United States market until 2025. Some of Kenya's major products that qualify for export under AGOA include textiles, apparels and handicrafts. Under the Generalised System of Preferences (GSP), a wide range of Kenya's manufactured products are entitled to preferential duty treatment in the United States, Japan, Canada, New Zealand, Australia, Switzerland, Norway, Sweden, Finland, Austria and other European countries. In addition, no quantitative restrictions are applicable to Kenyan exports on any of the 3,000-plus items currently eligible for GSP treatment.

Ratified and Awaiting Implementation

The AfCFTA: The AfCFTA is a trade agreement signed by 54 African Union (AU) member states with the goal of creating a single market followed by free movement and a single currency union. Eritrea is the only country out of the 55 AU member states that is yet to sign the agreement. The AfCFTA was signed in Kigali, Rwanda, on March 21, 2018 and was ratified by the necessary 22 states in April 2019. Since then, a further seven states have ratified the agreement, bringing the total to 29 countries. The implementation of the agreement came into effect on May 30, 2019, 30 days after the documentation regarding the ratification of the agreement was submitted to the AU. Negotiations continued in 2019, including negotiations surrounding the relevant competition policy, investment and intellectual property rights. It has been indicated that the start of trading under AfCFTA will begin on July 1, 2020.

Under Negotiation

EAC-EU EPA: The EAC finalised the negotiations for an EPA with the EU on October 16, 2014. Kenya and Rwanda signed the EPA in September 2016 and Kenya has ratified it. For the EPA to enter into force, the three remaining EAC members need to sign and ratify the agreement. EU states are key trade partners and the EPA facilitates access to this large market. Exports from Kenya entering the EU are entitled to duty reductions and freedom from all quota restrictions. Trade preferences include duty-free entry of all industrial products and a wide range of agricultural products, including beef, fish, dairy products, cereals, fresh and processed fruits and vegetables.

Sources: WTO Regional Trade Agreements database, Government websites, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Foreign ownership is permitted across almost all industries with the exception of some sectors designated as strategic in defence-related industries, minerals and farmland. Foreign ownership caps apply for sectors such as telecommunications (80%), transport (97%), financial services such as life and health insurance (67%) and media (75%).

- The minimum foreign investment to qualify for investment incentives is USD100,000.

- Foreigners cannot own land in Kenya, but they can lease it in 99-year increments.

- Foreign ownership of financial services and telecommunications companies is capped at 78% and 80% respectively, though the state permits telecommunications companies three years in which to find local investors to meet the 20% Kenyan shareholding ownership requirements.

- The Kenya Investment Authority (KenInvest) is a statutory body that was established in 2004 through an Act of Parliament (Investment Promotion Act No. 6 of 2004) with the main objective of promoting investments in Kenya. It is responsible for facilitating the implementation of new investment projects, providing after care services for new and existing investments, as well as organising investment promotion activities both locally and internationally. The core functions of KenInvest include policy advocacy; investment promotion; investment facilitation (which includes investor tracking) and after care services.

- The Mining Act (2016) restricts foreign participation in the mining sector. Among other restrictions, it reserves the acquisition of mineral rights to Kenyan companies and requires 60% Kenyan ownership of mineral dealerships and artisanal mining companies.

- Kenya's export processing zones (EPZs) offer special incentives for firms operating within their boundaries. Businesses in EPZs must be export-focused and pay normal tariffs and duties on goods distributed to the domestic market. The majority of the exports are textiles, Kenya's third largest export area behind tea and horticulture. About 54% of EPZ products are exported to the United States under the AGOA. Around 80% of Kenya's textiles and apparel originate from EPZ-based firms. Approximately 50% of all firms in the zones are fully owned by foreigners, mainly from India, while the rest are locally owned or joint ventures with foreigners.

- Though not yet fully established, SEZs are designed to boost local economies by offering benefits for goods that are consumed both internally and externally. The Second Medium-Term Plan of Kenya's Vision 2030 economic development agenda calls for establishing SEZs in Mombasa, Lamu and Kisumu, and eventually to additional towns throughout the country. A SEZ near Naivasha is also under consideration. The SEZs will allow for a wider range of commercial ventures, including primary activities, such as farming, fishing, and forestry, plus manufacturing, business process outsourcing and resources supporting science and technology.

- Qualifying investments exceeding USD2.2 million incurred outside Nairobi, or the municipalities of Mombasa or Kisumu, are allowed an investment deduction of 150%. All other qualifying investments are allowed a 100% investment deduction in the year the asset is put into use.

- Businesses operating in Kenya stand to benefit from a host of incentivising measures. The Kenyan government provides the right for foreign and domestic private entities to establish and own business enterprises and to engage in all forms of remunerative activity. In an effort to encourage foreign investment, Kenya repealed regulations in 2015 that imposed a 75% foreign ownership limitation for firms listed on the Nairobi Securities Exchange, allowing such firms now to be 100% foreign-owned.

Sources: WTO – Trade Policy Review, the International Trade Administration, US Department of Commerce, Government websites, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Export processing zones (EPZs) – 65 located in various towns and cities including Nairobi, Mombasa, Athi River, Kilifi and Kerio Valley |

Businesses in EPZs must be export focused, but they will benefit from:

|

|

SEZs(proposed) |

|

Sources: US Department of Commerce, government websites, Fitch Solutions

- Value Added Tax: 16%

- Corporate Income Tax: 30%

Source: Kenya Revenue Authority

Important Updates to Taxation Information

- President Uhuru Kenyatta announced various government interventions to help businesses and households cope with the economic fallout from the Covid-19 outbreak, including tax reductions and waivers. Key tax relief measures announced include: a 100% tax exemption for individuals earning less than KES24,000 (USD225); a reduction in highest marginal and corporation taxes from 30% to 25%; a reduction in turnover tax rate for micro, small and medium enterprises to 1% from 3%, as well as in value-added tax to 14% from 16%. The effective date for these measures was April 1, 2020, but there was no indication of their duration.

- As in the 2019 Finance Act, effective January 1, 2020, businesses with an annual turnover not exceeding KES5 million will be subject to pay a monthly turnover tax of 3% on the gross income. Businesses liable to turnover tax will still be liable to presumptive tax. The 2018 Finance Act introduced a 15% presumptive tax of the Single Business Permit fee issued by the County Government. However, any presumptive tax will be claimed as a credit against the monthly turnover tax to be paid.

- The 2019 Finance Act stated that if a company is listed on the Growth Enterprise Market (GEMS) of the NSE and it makes full disclosure of its past income, assets and liabilities for two years immediately preceding the date of listing, the Commissioner will not assess penalties and interest it accrued. The tax amnesty will only apply if the principal tax is paid in full and the listed company has not been assessed tax by the Commissioner or undergoing a tax audit or investigation. The penalties and interest waived on listing will be recovered if the entity delists from the NSE before the expiry of five years.

- The 2019 Finance Act exempted income tax to the investee companies of the Real Estate Investment Trusts. The income of the National Housing Development Fund is also now exempt from tax, while listed bonds, notes or similar securities with a maturity of at least three years, used to raise funds for assets defined under Green Bond standards and guidelines will also be exempt from tax.

- The 2018 Finance Act simplied the computation of compensating tax by taxing any distribution of untaxed gains or profits by a company at the resident corporate tax rate of 30%. Under the new Finance Act, manufacturers are eligible for an additional 30% corporate tax deduction of the total incurred electricity bill. The Act also grants the authorities leeway to negotiate for special tax rates for businesses under a special operating framework agreement. These will come into effect on January 1, 2019.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax (CIT) rate for resident companies |

30% |

|

CIT rate for branches of foreign companies |

37.5% |

|

Capital Gains Tax |

5% of the net gain |

|

Withholding Taxes |

Dividends: |

|

VAT |

- 16% on sale of goods and services |

Source: Kenya Revenue Authority

Date last reviewed: April 29, 2020

Localisation Requirements

Though there are no strict performance requirements (even in SEZs), labour regulations generally continue to restrict the employment of foreign nationals, particularly in low-skilled sectors, despite a large increase in the country's migrant population. The National Construction Authority Act (2011) imposes local content restrictions on foreign contractors, defined as companies incorporated outside Kenya, or with more than 50% ownership by non-Kenyan citizens. The act requires foreign contractors to enter into subcontracts or joint ventures assuring that at least 30% of the contract work is done by local firms.

Obtaining Foreign Worker Permits

Work permits are required for all foreign nationals intending to work in Kenya. Recent policy changes also mandate an assured income of at least USD24,000 annually for the issuance of a work permit. Firms in agriculture, mining, manufacturing, or consulting sectors can avoid this with a special permit. Work permits are classified in different categories that are, in some cases, further subdivided into subcategories. Work permit fees can cost up to USD3,000 and do not distinguish between foreigners and EAC citizens. However, Kenya and Rwanda have exempted EAC citizens from work permit fees. Although businesses may choose to transfer these costs to the employee, other permit costs are less avoidable.

Special Skills

The Kenyan government issues permits for key senior managers and personnel with special skills not available locally. Firms seeking to hire expatriates must demonstrate that the requisite skills are not available locally through an exhaustive search, although the Ministry of Labour plans to replace this requirement with an official inventory of skills that are not available in Kenya. A permit can cost up to KES200,000. Firms must also sign an agreement with the government describing training arrangements to phase out the need for expatriates.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B2 (Negative) |

07/05/2020 |

|

Standard & Poor's |

B+ (Stable) |

14/10/2016 |

|

Fitch Ratings |

B+ (Stable) |

10/12/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

80/190 |

61/190 |

56/190 |

|

Ease of Paying Taxes Index |

92/190 |

91/190 |

94/190 |

|

Logistics Performance Index |

68/160 |

N/A |

N/A |

|

Corruption Perception Index |

144/180 |

137/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

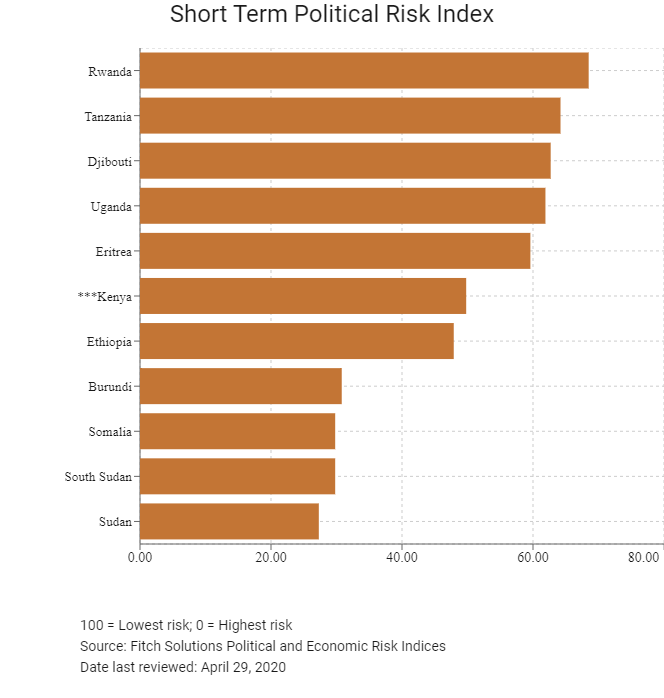

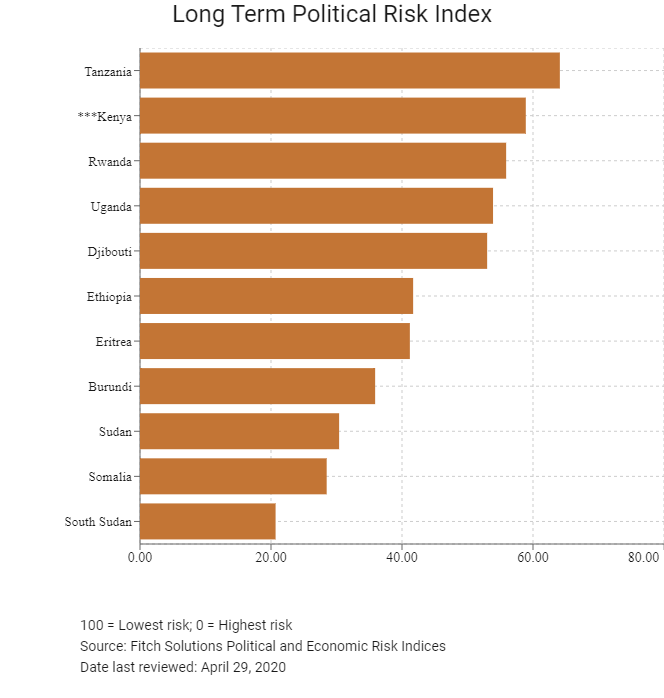

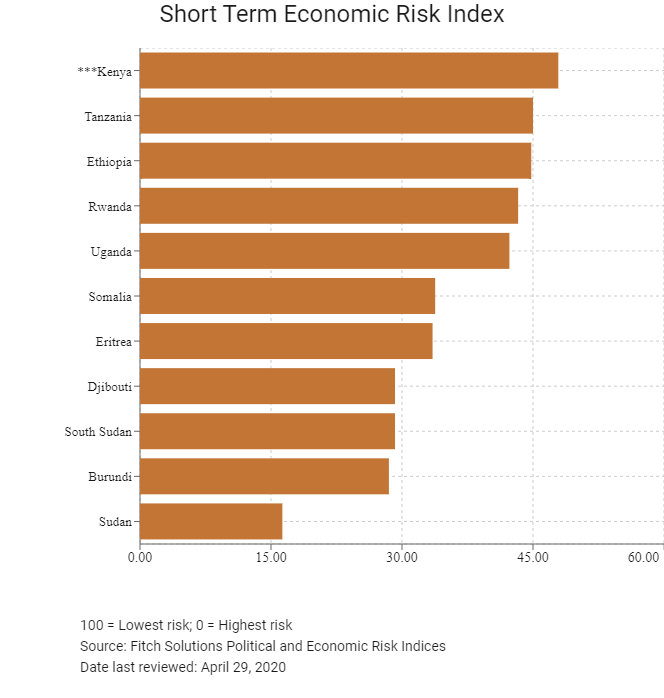

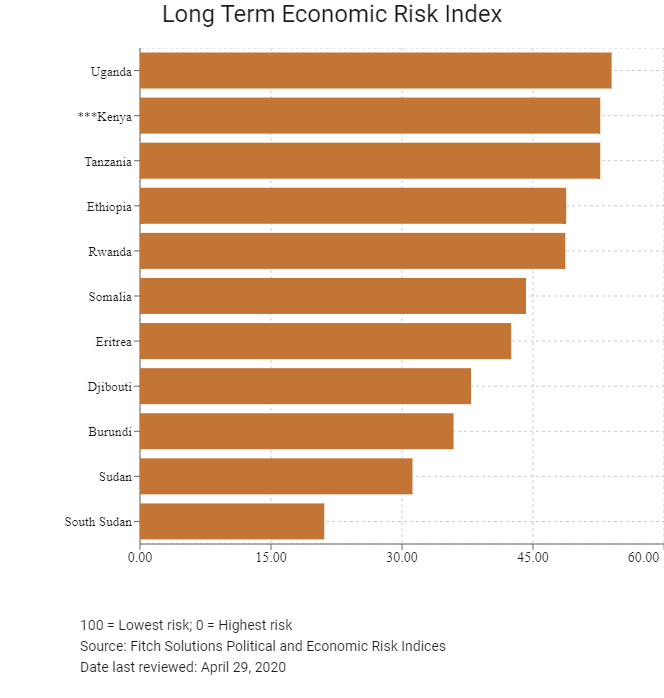

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

99/202 |

102/201 |

95/201 |

|

Short-Term Economic Risk Score |

49.8 |

49.6 |

47.9 |

|

Long-Term Economic Risk Score |

52.3 |

51.9 |

52.7 |

|

Political Risk Index |

115/202 |

113/201 |

112/201 |

|

Short-Term Political Risk Score |

52.9 |

52.9 |

49.8 |

|

Long-Term Political Risk Score |

58.9 |

58.9 |

58.9 |

|

Operational Risk Index |

132/201 |

127/201 |

124/201 |

|

Operational Risk Score |

41.8 |

43.2 |

43.7 |

Source: Fitch Solutions

Date last reviewed: April 29, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The Kenyan economy remains vulnerable to volatility in external financial markets. As 2020 has shown, a substantial downturn in Mainland China, which is a major financier of Kenyan infrastructure projects, poses significant downside risks for investment into the country. In addition, large deficits in its current and fiscal accounts pose risks. The shilling is also susceptible to periods of high volatility that can feed through into inflation and undermine investor sentiment. That said, Kenya dominates the East African Community trade bloc and serves as the region's logistics hub, which will allow it to leverage the region's rising prospects in the coming years.

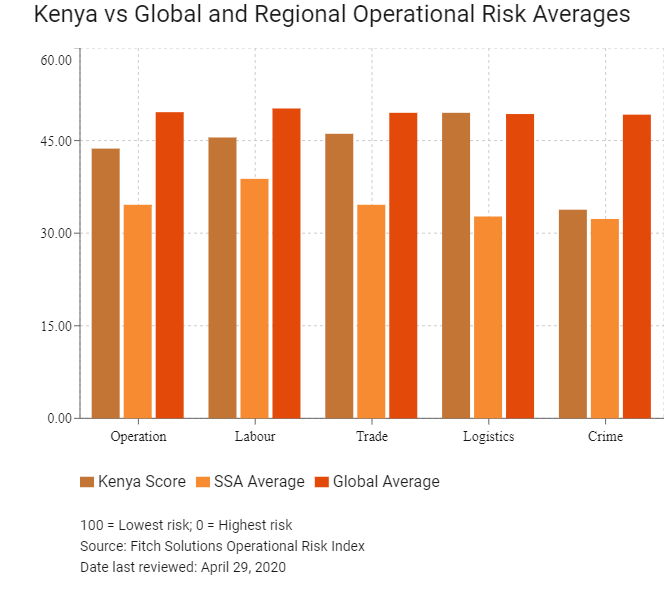

OPERATIONAL RISK

Kenya remains one of the fastest growing economies in Sub-Saharan Africa and the country is a major regional trade hub for East Africa, boasting extensive aviation and maritime connections to major regional and global markets. Though the pace and size of foreign investment inflows remain underwhelming compared to other regional market peers, such as South Africa and Nigeria, Kenya remains attractive to international firms seeking a regional base for their East Africa operations because of its large and diverse population, and strategic position. This is supported by the government's commitment to implementing investor-friendly reforms and driving large-scale infrastructure development projects aimed at boosting regional integration and economic diversification. Furthermore, the recent spate of high court rulings in favour of businesses offers further upside potential to the country's Operational Risk profile. However, Kenya performs less competitively on a global scale, largely due to a tight lending environment, high energy costs and significant water stress, which negatively impact industrial and agricultural activity.

Source: Fitch Solutions

Date last reviewed: May 3, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Kenya Score |

43.7 |

45.5 |

46.1 |

49.5 |

33.8 |

|

East Africa Average |

32.0 |

40.4 |

32.9 |

31.1 |

23.5 |

|

East Africa Position (out of 11) |

2 |

3 |

2 |

1 |

2 |

|

SSA Average |

34.6 |

38.8 |

34.6 |

32.7 |

32.3 |

|

SSA Position (out of 48) |

8 |

10 |

9 |

5 |

21 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

124 |

127 |

117 |

93 |

153 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Rwanda |

49.2 |

49.5 |

52.8 |

44.3 |

50.1 |

|

Kenya |

43.7 |

45.5 |

46.1 |

49.5 |

33.8 |

|

Uganda |

36.7 |

46.9 |

39.2 |

31.1 |

29.7 |

|

Tanzania |

35.5 |

42.3 |

37.2 |

30.2 |

32.4 |

|

Ethiopia |

33.9 |

41.5 |

30.3 |

39.1 |

24.7 |

|

Djibouti |

32.7 |

32.1 |

39.2 |

32.1 |

27.4 |

|

Sudan |

28.8 |

44.4 |

29.3 |

28.7 |

12.8 |

|

Burundi |

27.1 |

39.3 |

27.0 |

24.1 |

18.0 |

|

Eritrea |

23.4 |

36.5 |

14.2 |

24.0 |

18.9 |

|

Somalia |

21.4 |

33.8 |

23.0 |

22.6 |

6.4 |

|

South Sudan |

19.5 |

33.0 |

23.5 |

16.9 |

4.8 |

|

Regional Averages |

32.0 |

40.4 |

32.9 |

31.1 |

23.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 29, 2020

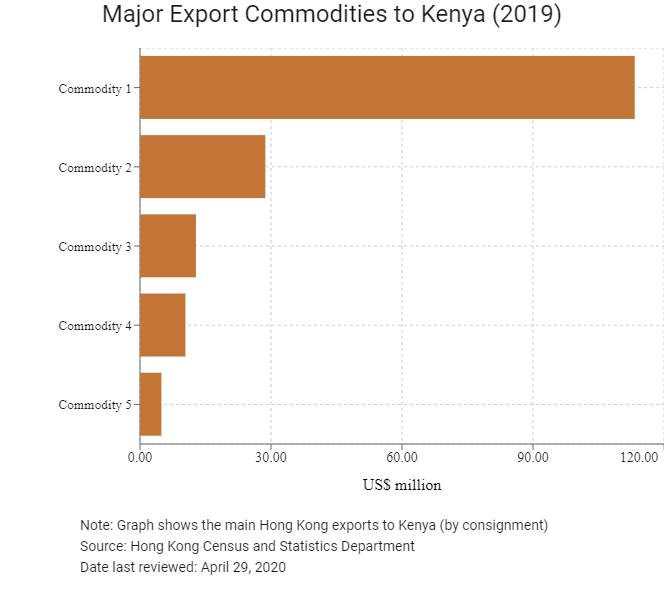

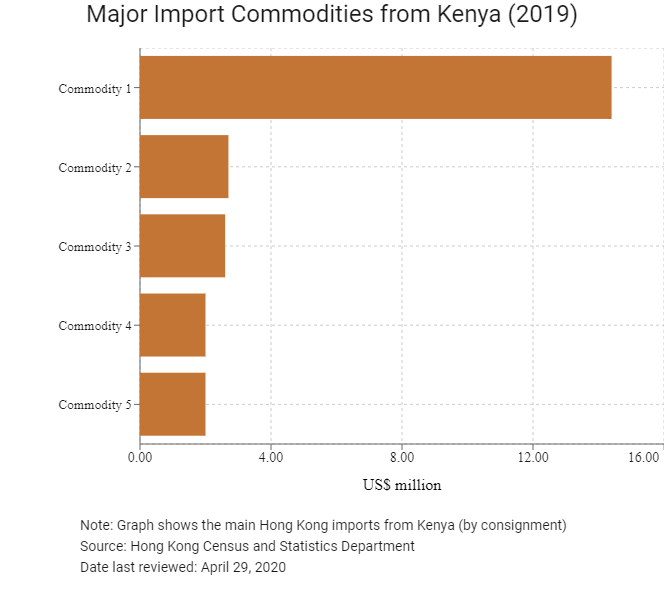

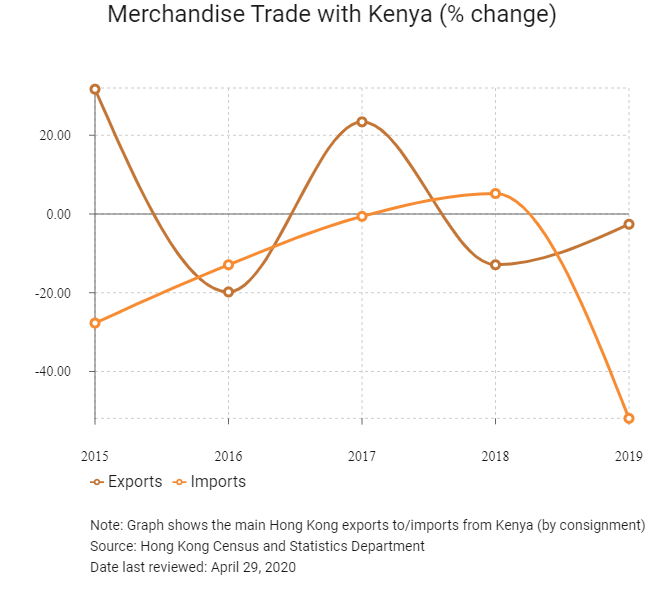

Hong Kong’s Trade with Kenya

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 113.3 |

| Commodity 2 | Office machines and automatic data processing machines | 28.7 |

| Commodity 3 | Textile yarn, fabrics, made-up articles and related products | 12.8 |

| Commodity 4 | Miscellaneous manufactured articles | 10.4 |

| Commodity 5 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 4.9 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 14.4 |

| Commodity 2 | Vegetables and fruit | 2.7 |

| Commodity 3 | Leather, leather manufactures, and dressed furskins | 2.6 |

| Commodity 4 | Hides, skins and furskins, raw | 2.0 |

| Commodity 5 | Non-metallic mineral manufactures | 2.0 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Kenyan residents visiting Hong Kong |

3,140 |

-20.0 |

|

Number of African residents visiting Hong Kong |

123,660 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: April 29, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Kenyan companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Kenya

- Hong Kong has concluded an air services income agreement with Kenya, that entered into force on April 28, 2005.

- Mainland China and Kenya have signed a bilateral investment treaty (BIT) but this has not yet entered into force.

Sources: Inland Revenue Department, Investment Policy Hub, OECD Tax Treaties, Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

Honorary Consulate of the Republic of Kenya in Hong Kong

Address: Flat 1201A, 12/F, Tower 1, Admiralty Centre, 18 Harcourt Road, Admiralty, Hong Kong

Email: wktam@kenyaconsulate.org.hk

Tel: (852) 2520 5000

Fax: (852) 2520 1600

Note: The Consulate is temporarily not issuing visas

Source: Hong Kong Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

A Kenya visa is required for HKSAR passport holders. Visa service at the consulate is temporarily suspended until further notice. Tourists can apply for e-visa through eCitizen and get further information there.

Type of Visa:

- e-Tourist visa 90 days, single entry

- Business visa 90 days, single entry

- Transit visa 72 hours, single entry

Note: HKSAR passport holders can apply for visas via eCitizen.

Source: eCitizen

Date last reviewed: April 29, 2020

Kenya

Kenya