GDP (US$ Billion)

118.53 (2018)

World Ranking 60/193

GDP Per Capita (US$)

3,366 (2018)

World Ranking 128/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

87.5 (2019)

Currency (Period Average)

Moroccan Dirham

9.62per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

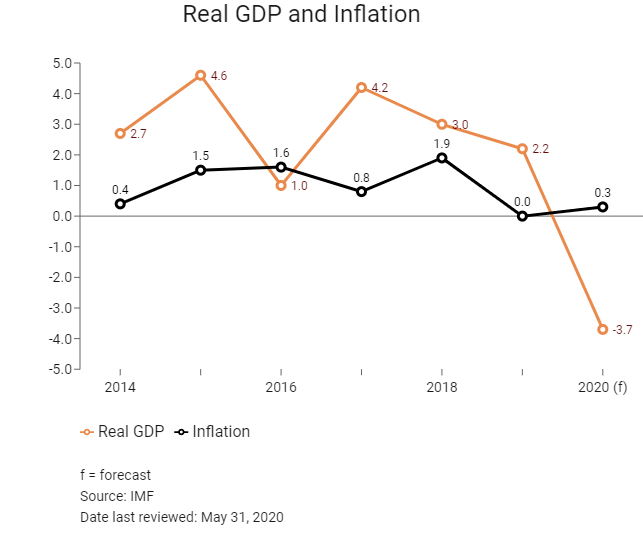

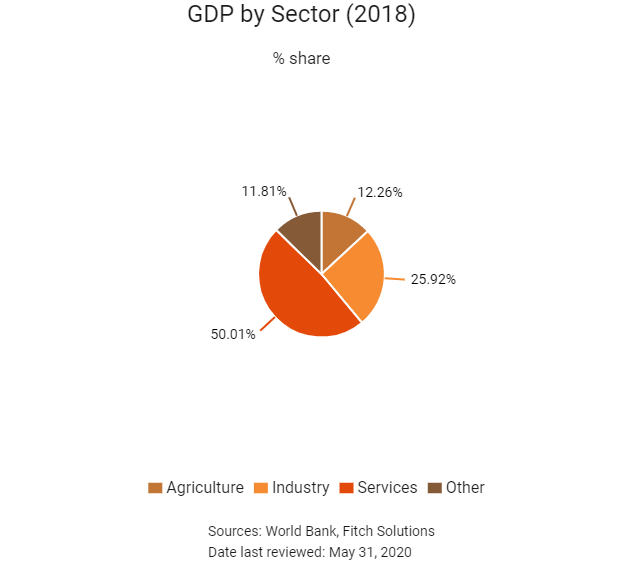

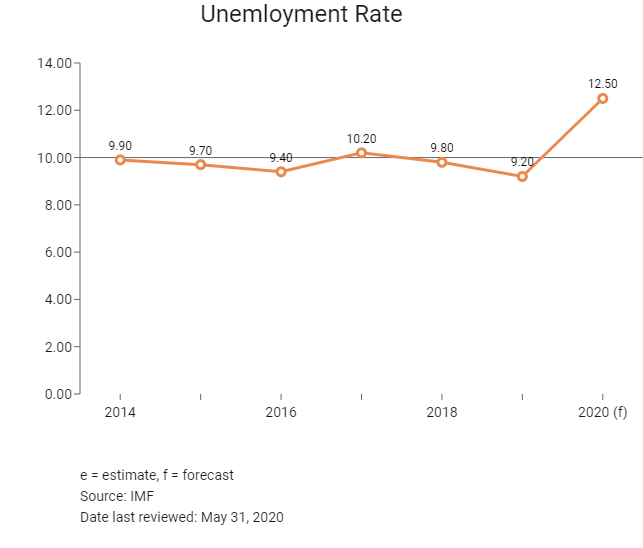

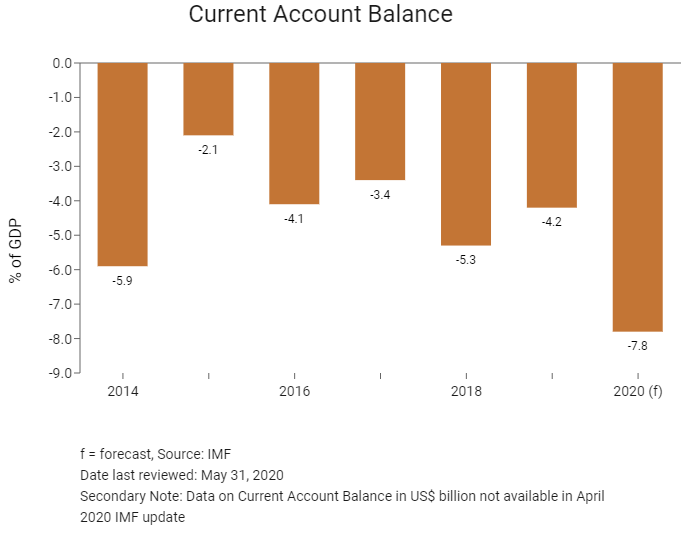

Since the country's privatisation programme, started in 1993 and the liberalisation of its markets, Morocco has increasingly attracted foreign investments. Foreign investments in Morocco have expanded from the traditional domains of textiles, fishing and agriculture to those presenting greater value addition, such as automotive, energy, infrastructure, transport, telecommunications, financial services and others. Over the medium term, Morocco's economic outlook will remain broadly positive, enabled by sound fiscal and monetary policies, a diversified economy and a conducive investment environment supporting competitiveness gains. The current account deficit is set for a pronounced widening in 2020 on the back of deteriorating global economic conditions leading to a drop in goods exports, tourist arrivals and remittance inflows. The government will likely continue to implement deep and comprehensive reforms to boost job creation and skills development.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

November 2018

Africa's fastest train started operating in Morocco, halving the time it takes to travel between Casablanca and Tangier. It took seven years and USD2.4 billion – funded by the governments of Morocco, France, Saudi Arabia, Kuwait and the United Arab Emirates - to build the high-speed railway line.

June 2019

French automotive manufacturer PSA Group inaugurated the new USD630 million Kentira plant in Morocco in June 2019. The plant aims to produce 200,000 vehicles by 2020. Approximately 90% of production will be destined for export markets.

Tanger Med Port opened new terminals in June 2019 following a EUR1.3 billion expansion, increasing capacity to 4.5 million 20-foot equivalent units (TEU) by the end of 2019.

August 2019

BMCE Bank of Africa agreed to co-finance the Cité Mohammed VI Tangier Tech project, which is coming up outside the Moroccan city of Tangier. The bank will help develop the nearly USD 11 billion project in collaboration with China Communications Construction Company and its subsidiary China Road and Bridge Corporation. Tangier Tech Development Company signed a memorandum of understanding with the two Chinese firms for the project in April. The tech city will have an area of more than 20sq km and will be connected to railway and motorway networks. It will house 300,000 people. The first development phase of the project has already been completed and industrial investors are likely to receive the first plots later in 2019. The project is part of Morocco's strategy to boost cooperation with Mainland China and to improve business development in the country. The project, launched in 2017, is due to be completed in 10 years. In addition, phase one of the Zenata ecological city in Morocco is reportedly expected to be completed by 2020.

October 2019

A cabinet reshuffle reduced the number of ministers to 24 from 38 previously.

November 2019

The Moroccan agency for Sustainable Energy and the National Office of Electricity and Drinking Water have signed a contract with a consortium comprising Nareva Holding and Enel Green Power for the construction of a MAD4 billion (USD414.8 million) wind farm in Boujdour province, Morocco. The wind farm will have an installed capacity of 300MW. Construction on the plant is expected to start in 2021. The scheme is part of the 850MW integrated wind energy project, which has a budget of more than USD1.2 billion. Other wind farms under the project are the 180MW Midelt, the 200MW Jbel Lahdid in Essaouira, the 100MW Tiskrad in Tarfaya and the 70MW Tangier II.

May 2020

In light of the Covid-19 pandemic, the authorities declared a state of health emergency, adopted containment measures, including quarantine; suspended all international passenger flights; forbade all public gatherings; and closed mosques, schools, universities, restaurants, cafes and hammams. The authorities have created a special fund dedicated to the management of the pandemic, of about 2.7% of GDP.

2020

Morocco’s expansionary 2020 budget will, to some extent, help boost social welfare. Reports on the 2020 budget indicate a substantial planned increase in government spending, with a focus on boosting households’ welfare. For instance, the authorities envision a MAD6 billion increase in the public sector wage bill – a move consistent with the MAD300-500 raise in monthly public sector wages agreed upon earlier in 2019. The budget also intends to create 20,000 jobs just in the healthcare, education and scientific research sectors while also expanding the health insurance system to cover students. The expansionary nature of budget and the focus on tackling social inequalities and improving living standards.

2021

Legislative elections are scheduled for 2021.

Sources: BBC country profile – Timeline, PSA Group, Reuters, Fitch Solutions

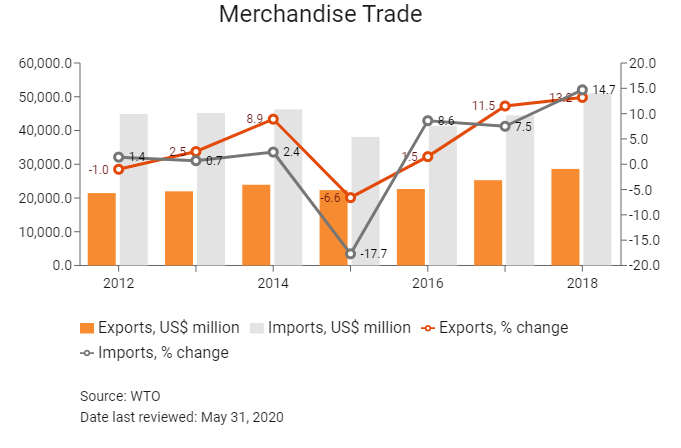

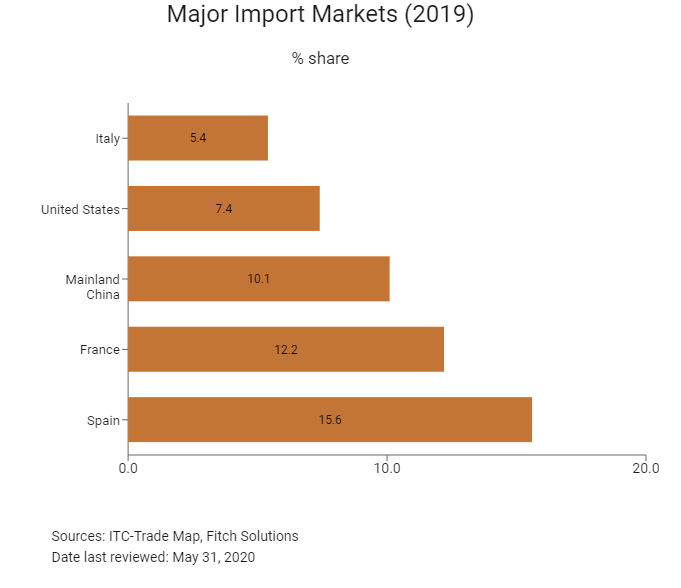

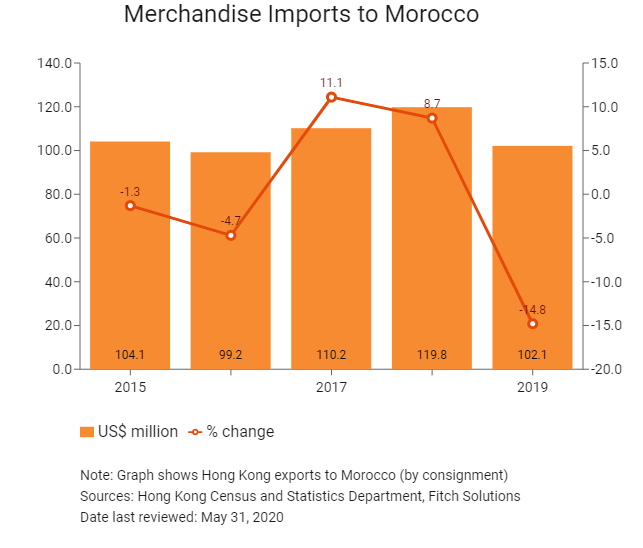

Merchandise Trade

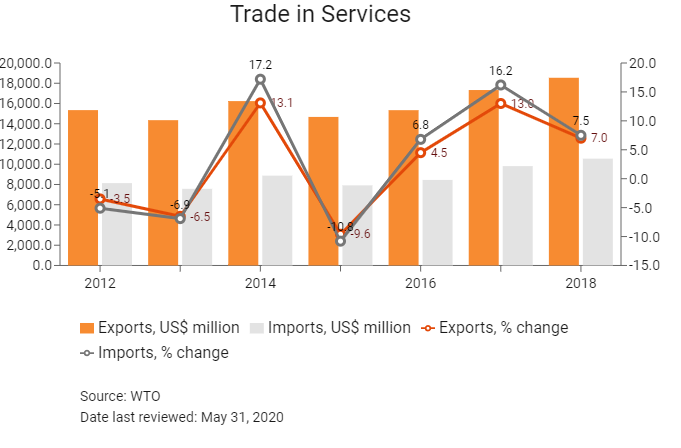

Trade in Services

- The Moroccan government remains committed to turning the country into a manufacturing and exporting hub between Europe and Africa. This is being facilitated through diplomatic actions, investment incentives, macroeconomic policies, trade liberalisation, structural reforms and investments in infrastructure. These efforts have resulted in substantial improvements in the business environment over the past few years, with Morocco climbing from the 129th position globally in 2008 to 53rd out of 190 countries in the latest 2020 edition of the World Bank's Ease of Doing Business Index. The government's commitment to expanding international trade and striking further free trade agreements (FTAs) has also seen a reduction in tariff and non-tariff barriers.

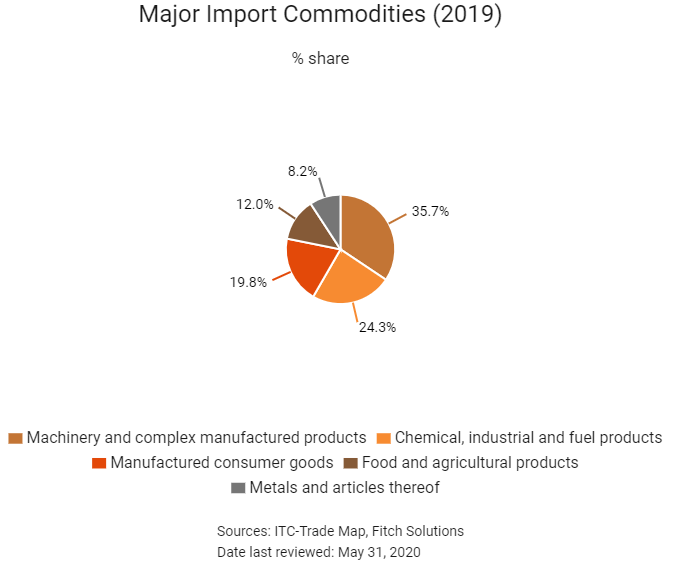

- Morocco has been applying a regionally low weighted average tariff rate on imports of 2.8% as of 2017, significantly reducing the cost of imports in comparison to regional peers. This is among the lowest in the Middle East and North Africa (MENA) region, indicating low-cost imports for both businesses and consumers and boosting the country's appeal as an investment destination. Higher most favoured nation tariffs are applicable to some items, particularly agricultural products and clothing, but generally businesses benefit from competitive trade tariffs.

- The customs process can be somewhat slow and burdensome, with bureaucracy remaining a barrier to trade, but generally documentary and customs compliance is more efficient than in other MENA states. Other non-tariff barriers such as inspections and onerous quality standards pose minimal obstacles.

- The government imposes a restriction on prepayment for import orders at a maximum of 30% of the total cost in order to manage foreign currency outflows. This leaves businesses reliant on trade financing such as letters of credit, which can prove costly and pose a potential barrier to trade.

Sources: WTO - Trade Policy Review, Fitch Solutions

Trade Updates

Morocco re-joined the African Union in January 2017. Its application in June 2017 to join the Economic Community of West African States has also been accepted. Morocco's improving diplomatic relations with a number of Sub-Saharan African states will help diversify its mix of trade partners in the medium-to-long term.

Multinational Trade Agreements

Active

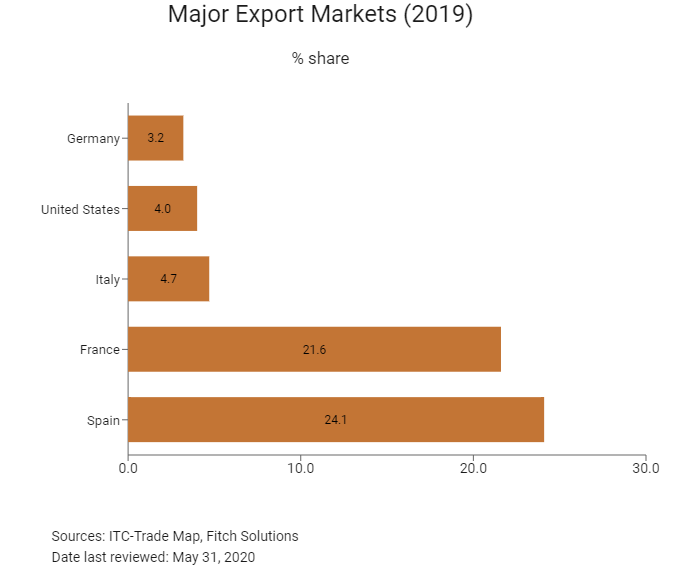

- Morocco-United States: The FTA between Morocco and the United States came into force in January 2006. The United States is a significant trading partner, purchasing 4.7% of exports and supplying 7.9% of imports in 2018. The FTA has resulted in Morocco reducing its tariffs on imports from the United States.

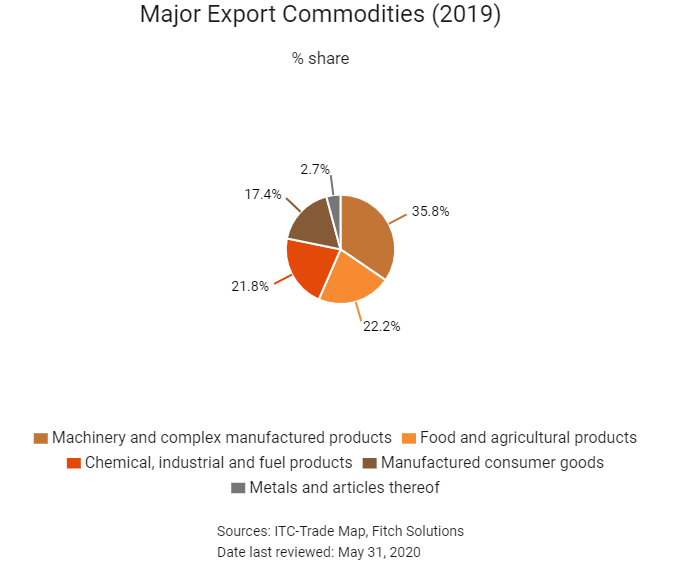

- European Union (EU)-Morocco: The association agreement came into force in March 2000. The EU is Morocco's largest trading partner, accounting for nearly 60% of its trade in 2018. The EU's imports from Morocco are dominated by machinery and transport equipment, agricultural products, and textiles and clothing. The EU's exports to Morocco are dominated by machinery and transport equipment, followed by fuels, metals and minerals, textiles and clothing, and agricultural products. Negotiations for a Deep and Comprehensive Free Trade Area (DCFTA) between the EU and Morocco were launched on March 1, 2013. Four negotiating rounds have taken place so far, with the most recent in April 2014. The overall goal of the negotiations is to create new trade and investment opportunities and to ensure a better integration of Morocco's economy into the EU single market. The DCFTA also aims at supporting ongoing economic reforms in Morocco and at bringing the Moroccan legislation closer to that of the EU in trade-related areas.

- Agadir Agreement: The FTA between Egypt, Jordan, Morocco and Tunisia came into force in March 2007. While none of these countries are within the top five exporting or importing partners of Morocco, this agreement serves to encourage inter-regional trade in the Middle East and North Africa region. The Agadir Agreement is open to further membership by all Arab countries that are members of the Arab League and the Greater Arab Free Trade Area and is linked to the EU through an association agreement.

- Morocco-Turkey: The FTA agreement came into force in January 2006 and serves to encourage greater inter-regional trade.

- European Free Trade Association (FTA)-Morocco: The FTA came into force in December 1999 and includes Iceland, Liechtenstein, Norway, Switzerland and Morocco.

- Global System of Trade Preferences among Developing Countries (GSTP): The partial scope agreement came into force in April 1989.

- Pan-Arab Free Trade Area: The FTA came into force in January 1998.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

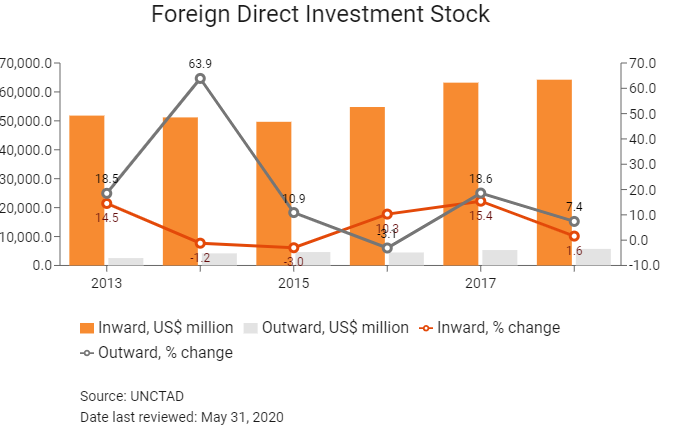

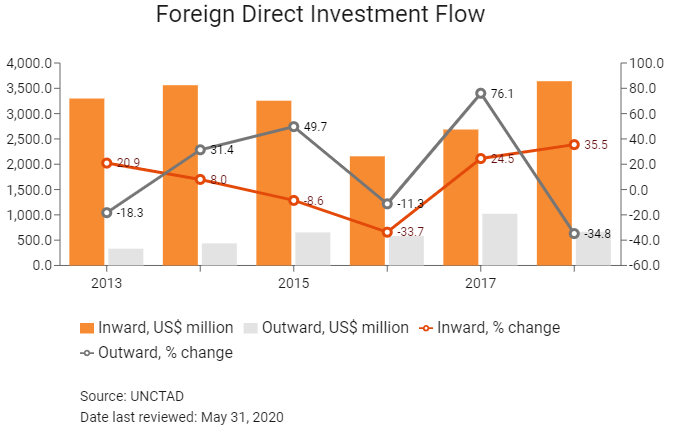

Foreign Direct Investment

Foreign Direct Investment Policy

- Foreign direct investment (FDI) in Morocco is welcomed into a wide range of sectors and has traditionally been channelled into sectors such as textiles manufacturing, autos, real estate, finance and tourism. Recent investment announcements have included renewable energy projects (notably the world's largest concentrated solar power plant), as well as automotive production plants and port expansions.

- Invest in Morocco, the country's investment development agency, was created in 2009 to promote and develop investment in the economy. The agency also proposes legislation and regulations to create an environment conducive to investment.

- Morocco's openness to FDI means that foreign investors face few regulatory or policy obstacles when entering the country's market. The legislative framework for FDI is based on the new investment charter (released in August 2016), which offers considerable updates and improvements on the previous charter from 1995. This provides for equal treatment of domestic and foreign investors, allows the convertibility of foreign currency and the freedom to repatriate profits.

- Most sectors have no restrictions on foreign ownership and there is no mechanism for mandatory government screening of approval of projects. The only meaningful barriers to foreign investment concern caps on foreign involvement in air and maritime transport and fisheries, and the presence of state-owned enterprises (SOEs), which limit private sector activity in some sectors, notably phosphate mining. In general, these barriers do not pose a major concern for foreign investors in Morocco, and the government's favourable attitude towards FDI means that investor sentiment is not affected much by them.

- Foreign participation in companies in the air and maritime transport and maritime fishery sectors is capped at 49%. Foreign ownership of agricultural land is not permitted, though leases of up to 99 years are available. The government has a monopoly on the phosphate mining industry through the 95% state-owned Office Chérifien des Phosphates, restricting foreign participation to downstream industries, such as fertiliser production.

- The government is actively investing in hard infrastructure, particularly transport networks, in line with its commitment to position the country as the leading exporting and manufacturing hub between Europe and Africa.

- SOEs continue to operate in some sectors of the economy, notably phosphate mining. While this precludes foreign involvement in these industries, SOEs do not significantly distort the playing field against foreign or private firms in most sectors.

- Attractive free trade zones (FTZs) exist in a number of locations, offering a range of tax exemptions and incentives as well as logistics connections and access to local suppliers for export-oriented businesses. Foreign investors may also qualify for generous tax breaks and government support for the construction of premises or acquisition of capital goods.

Sources: WTO – Trade Policy Review, Invest in Morocco, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

14 FTZs are available across the country, including Tangier, Fes, Casablanca, Marrakech, Agadir, Laayoune |

- Exemption from customs regulations |

|

Casablanca Finance City |

- Reduced CIT rate of 8.75%, rising to 10% after the first five years |

|

Investment Charter incentives |

- CIT holiday for five years for exporting companies |

Sources: US Department of Commerce, Invest in Morocco, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 10-37%

Source: Direction Générale des Impôts, Fitch Solutions

Important Updates to Taxation Information

- As of January 1, 2018, Moroccan CIT is levied using a progressive rate scale (instead of a proportional rate scale). Credit institutions and insurance companies remain subject to a flat rate of 37%. Furthermore, the capital gains on non-depreciable assets recorded following a merger/demerger operation cannot be offset against available losses.

- Starting January 1, 2019, the CIT rate applicable to the income ranging from MAD300,001 to MAD1,000,000 has been reduced to 17.5%.

- Starting January 1, 2019, a 'social cohesion contribution' is levied at 2.5% on companies with a net taxable income exceeding MAD40 million.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

- 10% on income below MAD300,000 |

|

Branch Tax |

15% on after tax profits of branch offices |

|

Withholding Tax |

- 15% on dividends paid to non-residents |

|

Professional Tax |

10-30% on the rental value of business premises |

|

Value Added Tax |

20% |

Source: Direction Générale des Impôts, Fitch Solutions

Date last reviewed: May 31, 2020

Foreign Worker Permits

Companies wishing to employ foreign workers in Morocco for more skilled positions must apply for work permits (attestation de travail) from the National Agency for the Promotion and Employment of Skills (Agence Nationale de Promotion de l'Emploi et des Compétences). Required documents to obtain a permit are relatively standard: an employment contract, copies of degrees and copies of passport and application forms. The process is free, but can take several weeks and Moroccan bureaucracy can be complicated to navigate for foreigners.

Visa/Travel Restrictions

Citizens from 68 countries (including many European and Middle East and North Africa countries, but not Algeria) do not need visas for stays up to 90 days. Foreigners from countries that require a visa to enter Morocco as visitors must apply in person at the Moroccan consular post where they currently reside. Business visas for 90-day stays cost USD27 for one entry and USD40 for two entries.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ba1 (Stable) |

20/11/2018 |

|

Standard & Poor's |

BBB- (Stable) |

04/10/2019 |

|

Fitch Ratings |

BBB- (Negative) |

28/04/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

69/190 |

60/190 |

53/190 |

|

Ease of Paying Taxes Index |

25/190 |

25/190 |

24/190 |

|

Logistics Performance Index |

109/160 |

N/A |

N/A |

|

Corruption Perception Index |

73/180 |

80/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

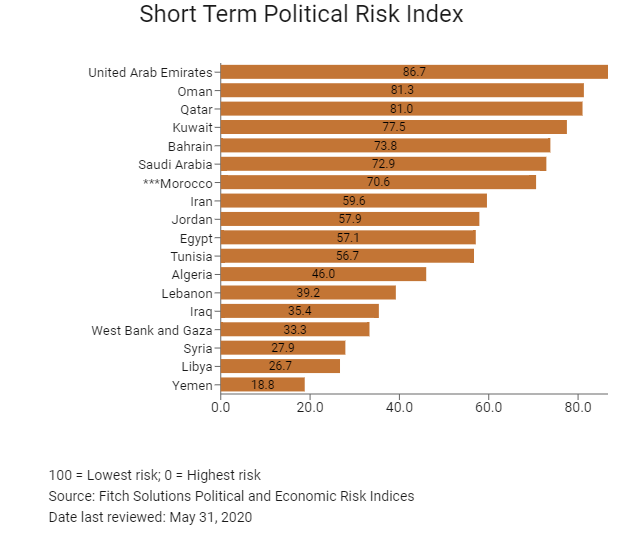

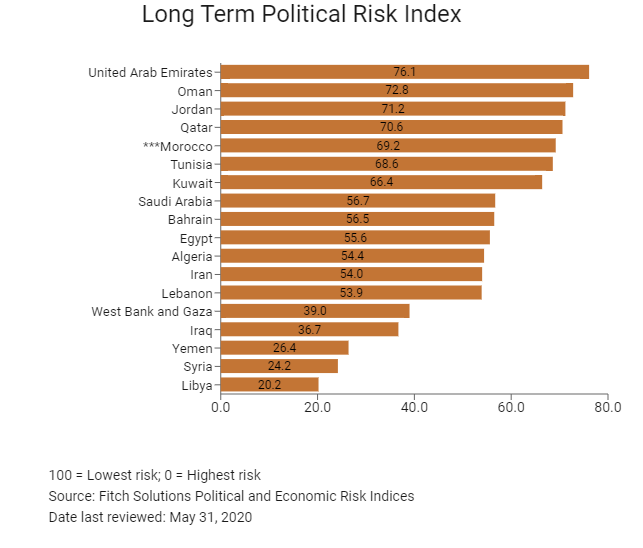

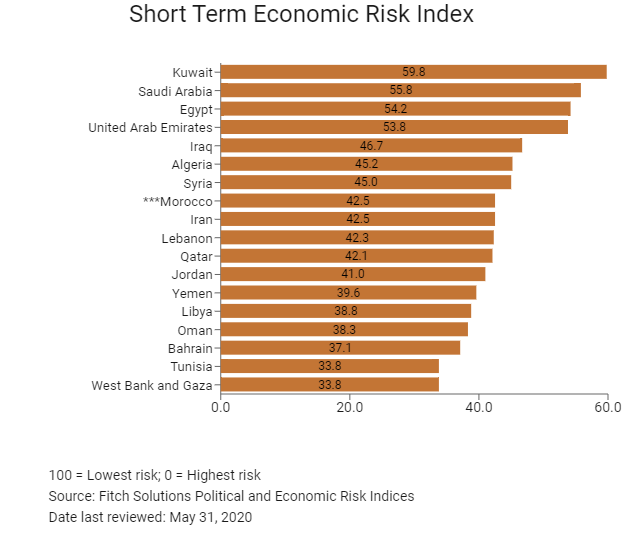

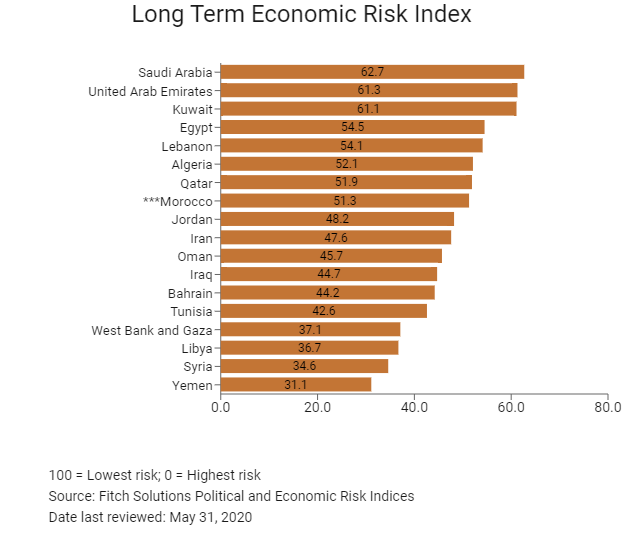

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

95/202 |

116/201 |

107/201 |

|

Short-Term Economic Risk Score |

48.3 |

45.0 |

42.5 |

|

Long-Term Economic Risk Score |

52.4 |

50.1 |

51.3 |

|

Political Risk Index Rank |

70/202 |

76/201 |

73/201 |

|

Short-Term Political Risk Score |

67.9 |

70.6 |

70.6 |

|

Long-Term Political Risk Score |

69.9 |

69.2 |

69.2 |

|

Operational Risk Index Rank |

82/201 |

78/201 |

74/202 |

|

Operational Risk Score |

52.8 |

53.7 |

54.6 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

High trade exposure to the eurozone market poses a medium-term risk to Morocco's growth in the event of a significant drawdown in demand. Approximately two-thirds of the country's goods exports are absorbed by its northern neighbours. As a consequence, the export sector is highly vulnerable to any economic downturn in the eurozone, particularly in light of global trade tensions. The tourism industry also relies extensively on visitors from France, Spain, the Benelux countries and the UK, and any downturn in the security situation would harm growth. Over the long term, the economy will benefit from greater exposure to emerging markets in the Middle East and North Africa and in Sub-Saharan Africa. Weather-induced volatility in agricultural output will continue to constitute a risk to real GDP growth, given that the sector employs over a third of the workforce. Real GDP is expecting to contract on the back of Covid-19-related disruptions to economic activity and the incoming drought in the agricultural sector. Regional political tensions and weak activity in the eurozone pose the main downside risks to the outlook.

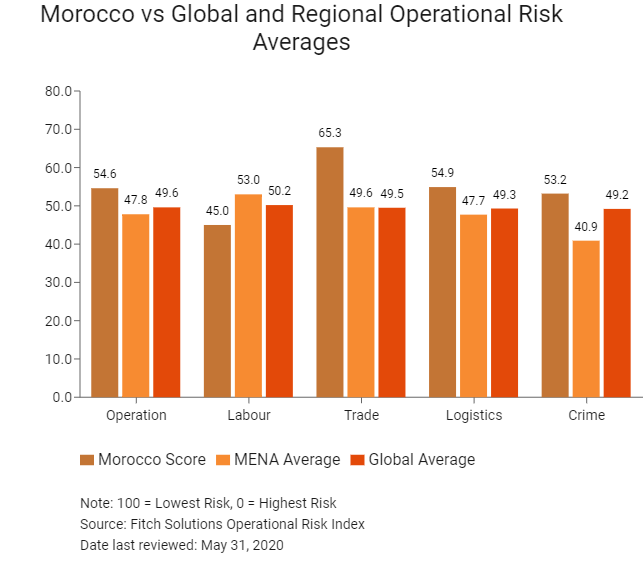

OPERATIONAL RISK

Morocco offers a number of strategic advantages across its operational risk profile which make it a more attractive location for investment than many of its regional peers. In particular, relatively high levels of security, an integrated supply chain network, openness to foreign investment and well developed financial markets contribute to an environment conducive to business. However, key risks are present in the country's labour market, including low levels of educational attainment, which dampen the competitiveness of the workforce. As a result, businesses may face elevated labour costs and limited availability of skilled workers. Morocco also has one of the highest income and personal tax rates in the Middle East and North African region, representing a notable drawback to the country's appeal for businesses. The newly expanded port of Tanger-Med is a global transhipment hub, and consequently export and import supply chains benefit from strong connections to international trade routes. Furthermore, the country is making great strides in terms of e-government readiness, improving the ease with which businesses can complete administrative procedures.

Source: Fitch Solutions

Date last reviewed: May 30, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Morocco Score |

54.6 |

45.0 |

65.3 |

54.9 |

53.2 |

|

MENA Average |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

8 |

13 |

4 |

7 |

7 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

74 |

131 |

45 |

74 |

86 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk |

Crime and Security Risk Index |

|

United Arab Emirates |

71.6 |

70.6 |

77.5 |

68.0 |

70.5 |

|

Bahrain |

66.5 |

65.5 |

75.4 |

71.6 |

53.6 |

|

Qatar |

66.0 |

66.7 |

62.3 |

73.7 |

61.2 |

|

Oman |

64.9 |

62.7 |

63.4 |

64.2 |

69.2 |

|

Saudi Arabia |

63.6 |

68.3 |

65.8 |

62.5 |

57.7 |

|

Jordan |

57.1 |

58.4 |

62.9 |

54.8 |

52.3 |

|

Kuwait |

55.5 |

58.7 |

56.2 |

50.8 |

56.2 |

|

Morocco |

54.6 |

45.0 |

65.3 |

54.9 |

53.2 |

|

Egypt |

49.4 |

50.7 |

48.8 |

55.2 |

42.9 |

|

Tunisia |

47.1 |

41.0 |

58.5 |

46.7 |

42.3 |

|

Lebanon |

43.6 |

54.0 |

49.8 |

40.9 |

29.7 |

|

Iran |

43.1 |

48.7 |

36.4 |

52.8 |

34.4 |

|

Algeria |

39.6 |

48.6 |

32.7 |

41.0 |

36.2 |

|

West Bank and Gaza |

31.6 |

48.3 |

34.1 |

27.1 |

17.0 |

|

Libya |

29.3 |

43.4 |

29.9 |

26.6 |

17.1 |

|

Syria |

28.6 |

42.6 |

29.2 |

27.6 |

15.0 |

|

Iraq |

26.7 |

43.5 |

24.1 |

26.9 |

12.4 |

|

Yemen |

21.8 |

37.8 |

19.6 |

13.9 |

16.1 |

|

Regional Averages |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

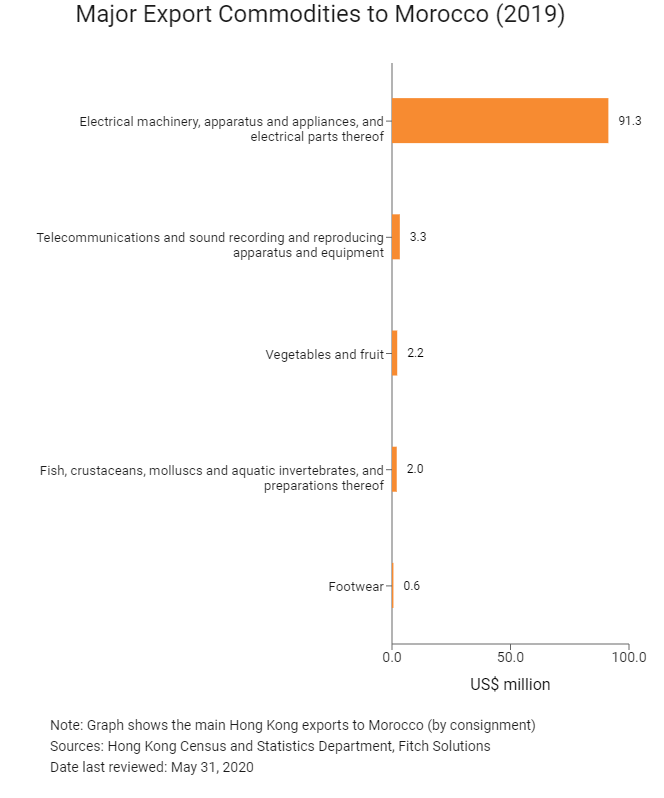

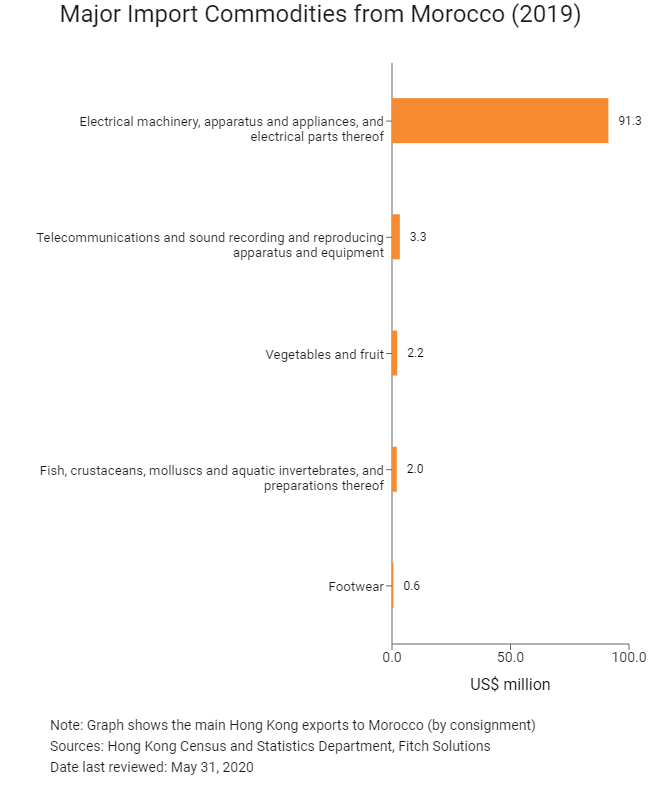

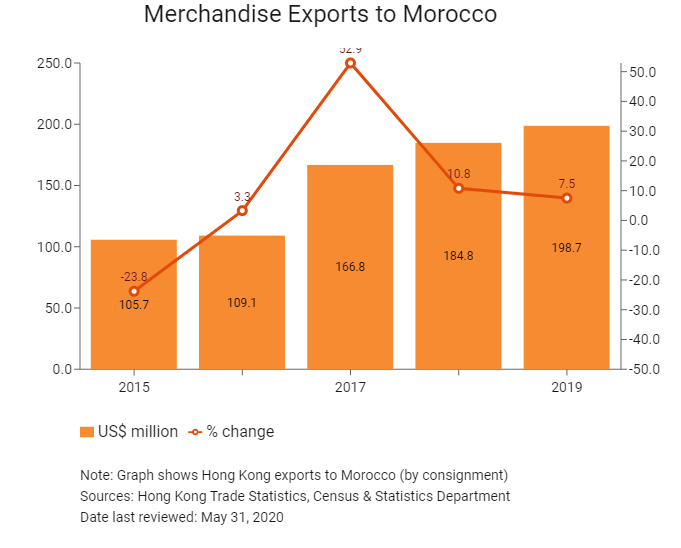

Hong Kong’s Trade with Morocco

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2018 |

Growth rate (%) |

|

|

Number of Moroccan residents visiting Hong Kong |

7,495 |

-6.1 |

|

Number of African residents visiting Hong Kong |

123,656 |

-10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: November 5, 2019

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Moroccan companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Morocco

1. Morocco and Mainland China have a bilateral investment treaty which came into force in November 1999.

2. Morocco and Mainland China signed a Double Taxation Avoidance agreement which entered into force in August 2006.

Chamber of Commerce (or Related Organisations) in Hong Kong

The Arab Chamber of Commerce & Industry (ARABCCI) was established in Hong Kong in 2006 as a leading organisation at promoting commercial tied between Hong Kong/mainland China and the Arab World.

The Arab Chamber of Commerce & Industry

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Source: The Arab Chamber of Commerce & Industry

Honorary Consulate of The Kingdom of Morocco

Address: 60 Peak Road, The Peak, Hong Kong

Liaison Visa Office: Room 3401, New World Tower, 18 Queen's Road Central, Central, Hong Kong

Tel: (852) 2138 3388

Fax: (852) 2868 1988

Source: Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

HKSAR passport holders are granted 30 days visa-free access.

Source: Visa On Demand

Date last reviewed: May 31, 2020

Morocco

Morocco