GDP (US$ Billion)

154.69 (2019)

World Ranking 58/194

GDP Per Capita (US$)

3,707 (2019)

World Ranking 124/193

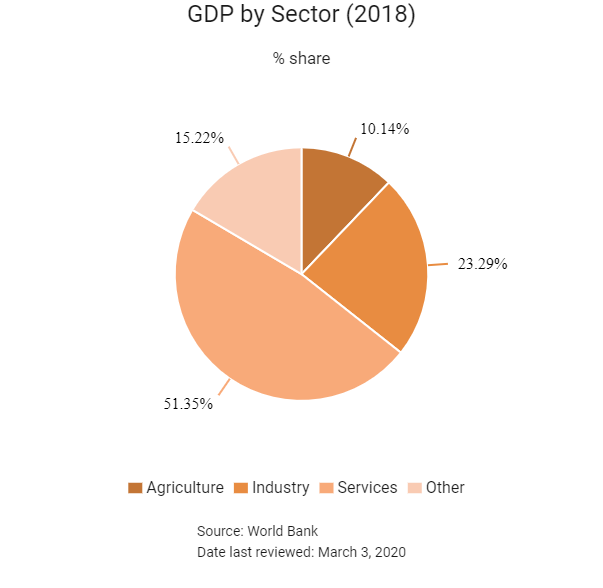

Economic Structure

(in terms of GDP composition, 2019)

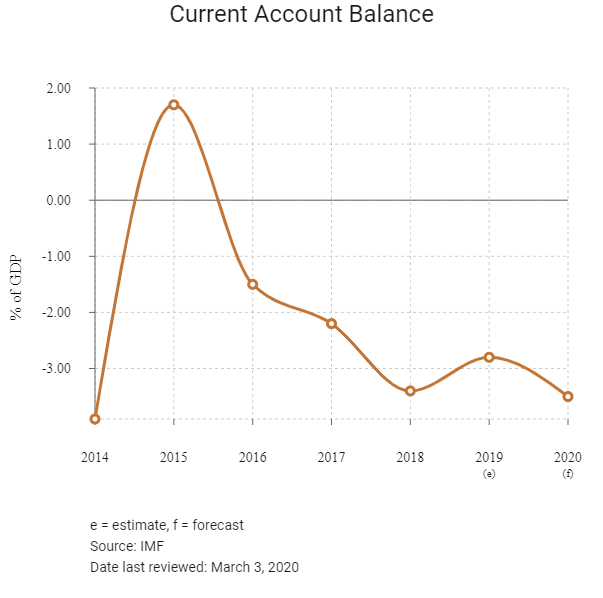

External Trade (% of GDP)

90.2 (2019)

Currency (Period Average)

Ukrainian Hryvnia

25.85per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

The government has committed to an ambitious and wide-ranging reform agenda that has resulted in significant fiscal consolidation, a move to a flexible exchange rate, reformed energy tariffs, more transparent public procurement, simplification of business regulations, stabilising and restructuring the banking sector, a package of health reforms and the establishment of anti-corruption agencies. These reforms will need to be advanced further for Ukraine to achieve a sustainable recovery, a process that the World Bank's 2017-2021 Country Partnership Framework has been established to support. Ukraine needs stronger institutions to bolster the business environment and investment climate. If the country does not lower various barriers to entry and make business-friendly changes, it will continue to lag its international competitors. Institutional weakness also means that Ukraine is recognised as having one of the world's largest shadow economies, and formalising just a portion of that would benefit recorded economic growth. Despite the ongoing security crisis, Ukraine's proximity to the European Union and countries such as Russia and Kazakhstan, its large consumer base and its physical size are key factors that boost its long-term investment attractiveness. The country's main asset is its extensive human capital: a well-educated workforce provides a competitive advantage, producing more than 130,000 new engineers each year. Although poverty remains above pre-crisis levels, it has declined slightly owing to modest economic recovery and wage growth. In November 2019 the World Bank reported on a pick up in economic growth in Ukraine, a strong harvest, consumption growth from higher wages and remittances, and a resumption of consumer lending. But the World Bank argued that to get stronger and more sustained economic growth, which will create jobs and improve living standards, the country needed to deliver on an ambitious reform agenda: demonopolise the energy sector and unbundle Naftogas; increase the efficiency of bank lending to the private sector by reducing non-performing loans in state-owned banks; and establish a transparent and efficient agricultural land market. The World Bank – noting that Ukraine has the largest endowment of arable land in Europe (more than France and Germany combined), but some of the lowest agricultural productivity (less than a fifth that of France) – predicts that reforming agricultural land ownership (and ensuring financing is available for small, credit-constrained farmers to prevent monopolisation) could boost annual economic growth by 1.5% over a five-year period. As with many other European countries, Ukraine is faced with ageing demographics and the emigration of younger, skilled citizens.

Sources: World Bank, UkraineInvest, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

March 2016

Ukraine joined the World Trade Organization (WTO) Agreement on Government Procurement, giving Ukrainian companies the right to participate in public procurement in 45 countries, including (EU) countries, Canada, Hong Kong, Japan, South Korea, Singapore, Taiwan and the United States. The agreement requires that Ukraine follows WTO rules for public procurement.

June 2017

The 2017-2021 Country Partnership Framework between the World Bank and Ukraine began with a focus on creating the conditions for fiscal and financial stability that will enable Ukraine to achieve a lasting economic recovery that benefits the entire population.

July 2017

Ukraine's association agreement with the EU was ratified by all signatories and came into force on September 1, 2017.

May 2018

Ukraine officially withdrew its representatives from all the statutory bodies of the Commonwealth of Independent States (CIS).

July 2018

The Ukraine State Fiscal Service published a guidance letter noting that Ukraine's tax treaty with Mainland China applied to all the territory of Mainland China where its legislation on taxation applies. The treaty did not apply to territories with a separate tax system, including Hong Kong. Based on this, a Hong Kong resident would be taxed in accordance with the Ukraine Tax Code on income sourced from Ukraine, regardless of whether or not residence certification is provided, because the tax treaty did not apply.

Ukraine signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the Multilateral Instrument, or MLI), committing the country to participate in the international tax cooperation network.

Ukraine established, in Kiev, the One Belt One Road Trade and Investment Promotion Centre. The intention was to further boost trade ties between the two countries. In recent years, Ukraine had supplied the majority of Mainland China's corn imports.

September 2018

China Pacific Construction Group and China Railway International were awarded the USD2.7 billion contract to construct Kiev's 18-station fourth metro line.

November 2018

The European Court of Human Rights ruled that Ukraine needed to pay compensation to those whose rights have been violated by the country's moratorium on the sale of farmland. In this month, Germany and Ukraine signed a social security agreement.

December 2018

The International Monetary Fund (IMF) approved a new USD3.9 billion loan agreement for Ukraine.

April 2019

The incumbent Petro Poroshenko was heavily defeated in the presidential election by anti-establishment reformist Volodymyr Zelenskiy.

May 2019

President Zelenskiy called a snap parliamentary election by bringing forward an election originally scheduled for October to July.

June 2019

Ukraine was the target for a large-scale government infrastructure cyberattack that affected the national bank, transport networks and manufacturers.

July 2019

In the Parliamentary election, President Zelenskiy's party Servant of the People won an absolute majority. The victory bolstered Zelenskiy's legislative mandate.

Ukraine began operating a liberalised electricity market, bringing regulation into line with the EU's 'third energy package'.

August 2019

Ukraine reached agreement with Japan over veterinary certificates, allowing Ukraine to export poultry meat to Japan for the first time.

November 2019

The Ukrainian parliament took the first step towards the liberalisation of the country's land market by approving the first draft of a law 'Regarding the Turnover of Agricultural Land'.

At the end of 2019 the European Bank for Reconstruction and Development (EBRD) had more than EUR4.3 billion invested in various sectors of the Ukrainian economy within 454 investment projects throughout the country.

January 2020

Amendments made to the draft land law suggest that certain restrictions would remain in place, placing a limitation on the amount of land any single owner was able to acquire and putting the issue of foreign ownership to a national referendum.

February 2020

The Ukrainian banking sector reported a historic USD2.5 billion in profits, three times higher than in 2018.

Sources: BBC country profile – Timeline, Reuters, Ukraine Government portal, EBRD, Fitch Solutions

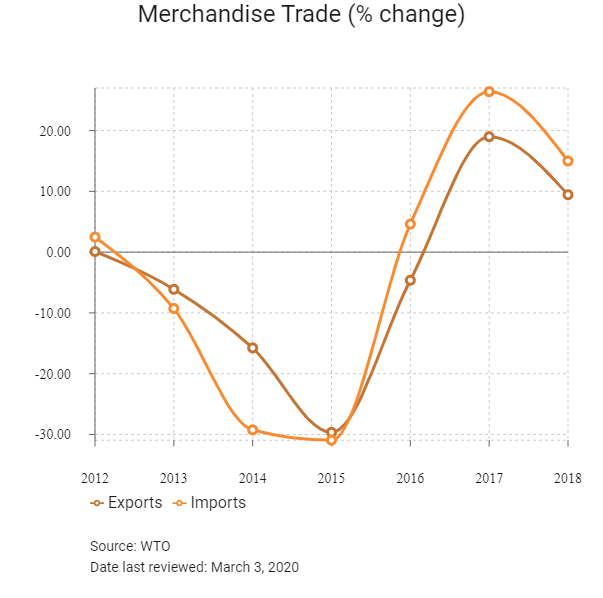

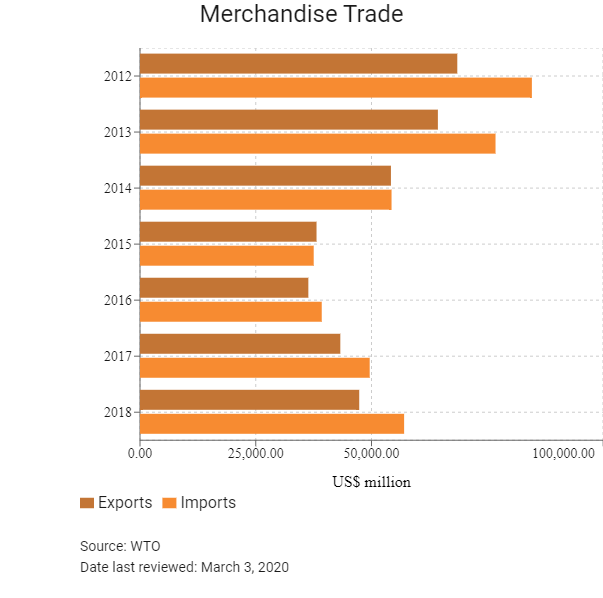

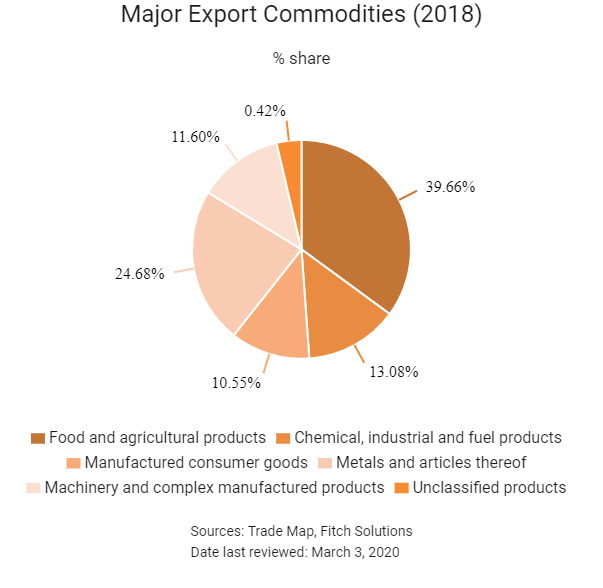

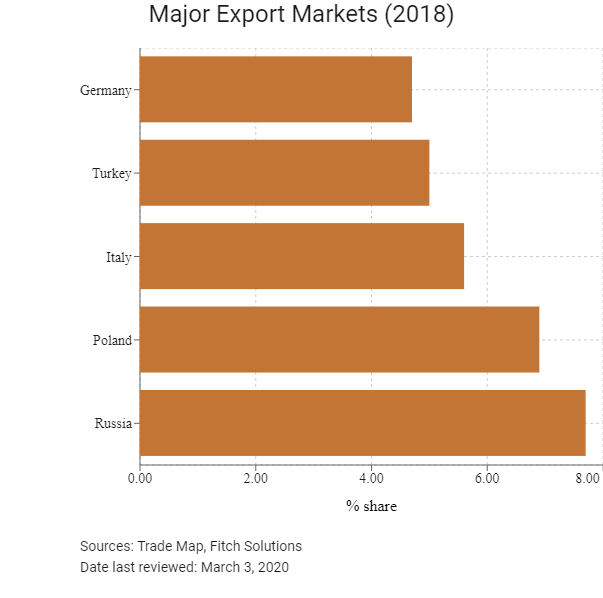

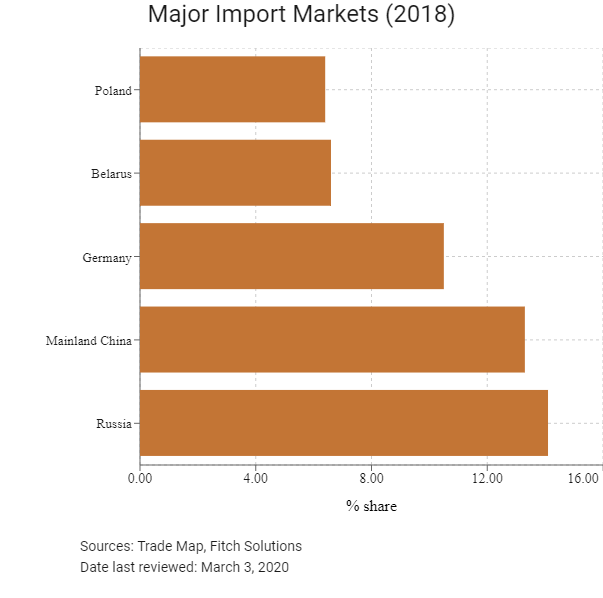

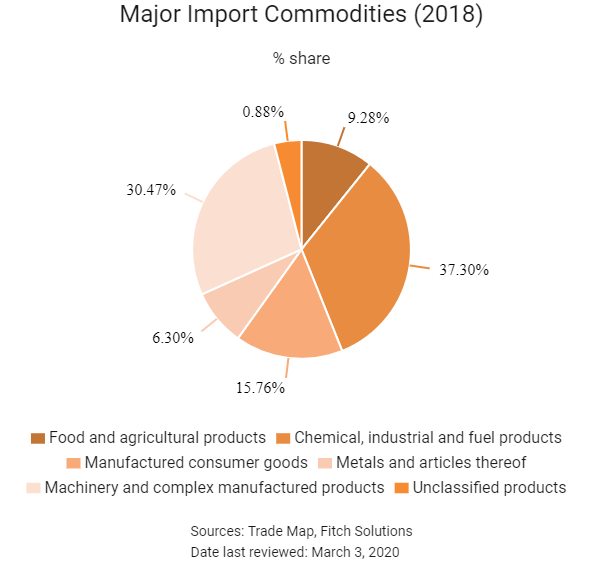

Merchandise Trade

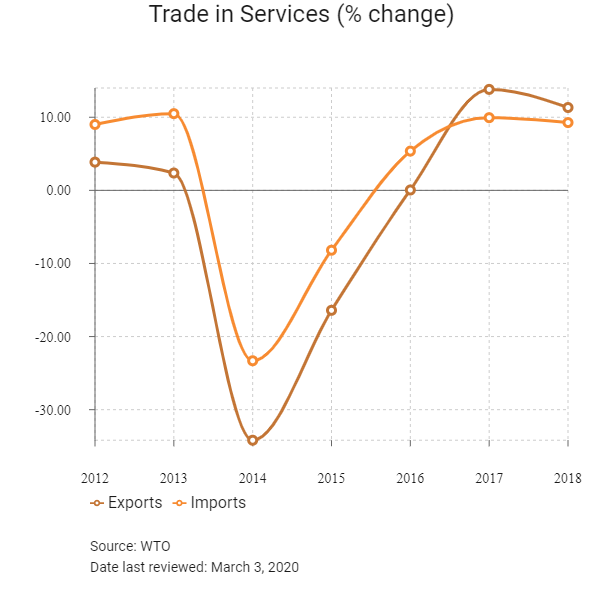

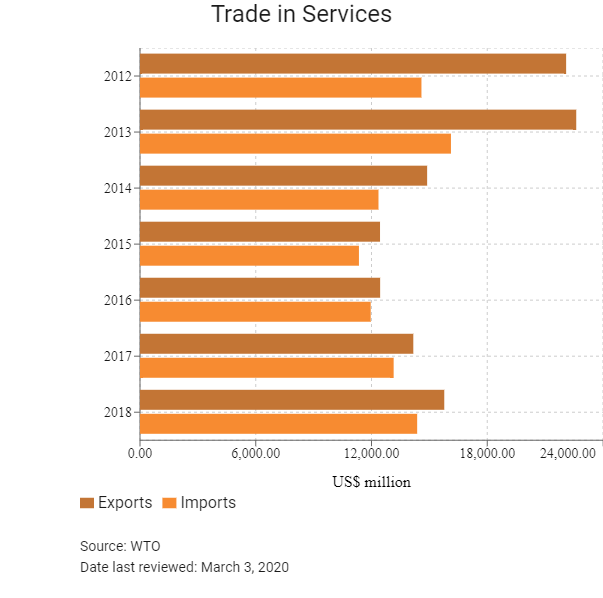

Trade in Services

- Ukraine has been a member of the WTO since May 16, 2008.

- Trade bureaucracy and customs delays are a significant hindrance to foreign investors. In recent years, Ukraine's trade flows have benefitted from low tariffs which have an average rate of 2.1%.

- The size of import duties is variable and often depends on whether the item being imported is similar to a domestically produced item, in which case the duty is usually higher. Import tariffs range from 2% to 50%. Excise taxes can be up to 300%, with alcohol, tobacco, petroleum products and automobiles generally subject to higher excise duty.

- Tariff charges are mostly lifted for trade between members of the Commonwealth of Independent States (Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine and Uzbekistan). A free trade agreement (FTA) is also in place with this group.

- In 2015 Ukraine introduced an export ban on pine and unprocessed timber for a period of 10 years. There are export quotas in place for copper slag, ash and residue (waste) containing primarily zinc and raw minerals. There are also licensing requirements for the exports of certain goods containing alloyed ferrous metals, non-ferrous metals and their alloys.

- Ukraine replaced export quotas on certain agricultural products with export tariffs (9% but not less than EUR17/tonne for wheat, 14% but not less than EUR23/tonne for barley and 12% but not less than EUR20/tonne for maize).

- There are also import licensing requirements with respect to insecticides (except veterinary medicinal products), fungicides, herbicides, means to prevent germination and plant growth regulators, rodenticides (except veterinary drugs) and similar products (except disinfectants).

- Ukraine has imposed various anti-dumping measures on a wide range of products, predominantly in the areas of textiles, vehicles, steel, some electrical goods, galvanised sheets, ammonium nitrate, wood-fibre boards and machinery on goods coming from Russia, Mainland China and a few other Asian nations to protect domestic industries.

- In November 2015, the Ukrainian authorities imposed a definitive countervailing duty on the import of cars from Russia. The rate of duty imposed is between 10.4% and 17.6%, depending on the company. The duty is in force from January 2016 for a period of five years.

- Ukrainian exports have been hurt by Russia's ban on imports of dairy, chocolate, fruits and vegetables, which has contributed to Russia having fallen behind the EU as Ukraine's largest export destination in recent years. However, the ongoing trade dispute between the United States and Mainland China is beneficial for Ukrainian exports of cereals. However, the ongoing trade dispute between the United States and Mainland China is beneficial for Ukrainian exports of cereals.

Sources: WTO – Trade Policy Review, Global Trade Alert, Fitch Solutions

Multinational Trade Agreements

Active

- Ukraine-Israel: Signed in January 2019 during Ukrainian President Petro Poroshenko's state visit to Israel. Israel's import profile of Ukrainian goods is largely made up of agricultural goods such as wheat, corn, soybean and barley, as well as some metal products (such as raw iron bars). Ukraine's biggest import from Israel is pesticides, which is regulated through the need to obtain an import licence.

- Armenia-Ukraine: This agreement became effective in December 1996. Ukraine's exports to Armenia include meat, dairy products, vegetables and cereals. Armenia's exports to Ukraine include electro-technical products, alcoholic beverages and mineral water.

- Azerbaijan-Ukraine: This FTA on goods became effective in September 2006. The goods imported by Azerbaijan from Ukraine are meat, dairy and confectionery products, construction materials and medicines. The main goods exported from Azerbaijan to Ukraine are generally products of the fuel energy industry, chemical industry products and agro-industrial products. The trade turnover between the two countries amounted to more than USD700 million in 2018.

- Georgia-Ukraine: This FTA agreement on goods became effective in June 1996.

- Georgia, Ukraine, Azerbaijan, Moldova (GUAM) FTA: This FTA on goods and services entered into force on December 10, 2003.

- Kazakhstan-Ukraine: This agreement on goods became effective in October 2008. Ukraine's exports to Kazakhstan consist mainly of machinery, mechanical appliances, some cooking products and dairy produce. Kazakhstan's exports to Ukraine consist of mineral fuels, mineral oils and products of their distillation, zinc and articles thereof, iron and steel, and fertilisers.

- Kyrgyzstan-Ukraine: This bilateral agreement on goods became effective in January 1998. Ukraine's exports to Kyrgyzstan include pharmaceutical products, machinery, sugar and sugar confectionery, and cocoa. Kyrgyzstan's exports to Ukraine consist of raw hides and skins, mechanical appliances, electrical machinery and equipment, and glass.

- Tajikistan-Ukraine: This bilateral agreement on goods became effective in July 2002. The main items Ukraine exports to Tajikistan are sugar and sugar confectionery, cocoa and products thereof, paper and cardboard, and pharmaceutical products. Tajikistan's exports to the Ukraine consist mainly of fruits and nuts.

- Turkmenistan-Ukraine: This bilateral FTA on goods was signed on November 5, 1994, and came into force on November 4, 1995. The FTA enables the free flow of goods between the two countries at preferential tariffs and terms and streamlines customs procedures. The main items Ukraine exports to Turkmenistan are sugar, dairy produce, cocoa and cocoa preparations, and articles of iron and steel. Turkmenistan's exports to the Ukraine consist mainly of mineral fuels, mineral oils and products of their distillation, plastics and articles thereof, cotton, and machinery.

- Uzbekistan-Ukraine: This bilateral agreement on goods was signed in December 1994 and became effective in January 2006. Uzbekistan's imports from Ukraine mainly consist of iron and steel, the products of the light and chemical industries, as well as agricultural products. Uzbekistan supplies various types of engineering products, chemical products, pharmaceuticals and agricultural products to Ukraine. Both countries have stressed the importance of expanding bilateral relations between their respective business communities and the implementation of joint projects to enhance economic cooperation.

- CIS Free Trade Area: After it came into effect in September 2012, this agreement created a trade area between eight of the 11 CIS states – Russia, Ukraine, Belarus, Moldova, Armenia, Kyrgyzstan, Tajikistan and Kazakhstan. Uzbekistan became the ninth member to join in April 2014. CIS states remain key trade partners, but Russia has suspended the application of the FTA for bilateral trade with Ukraine, meaning that barriers have been raised with what was the country's largest trade partner.

- European Free Trade Association (EFTA)-Ukraine FTA: Signed in June 2010, this comprehensive FTA with the four member countries (Iceland, Liechtenstein, Norway and Switzerland) of the EFTA came into force in June 2012 and includes trade in goods (industrial and processed agricultural goods, fish and other marine products), trade in services, investment, protection of intellectual property rights, government procurement and provisions on competition. Bilateral arrangements on agricultural products between the individual EFTA states and Ukraine also form part of the instruments establishing the free trade area on both sides.

- Canada-Ukraine: After the agreement's entry into force on August 1, 2017, Ukraine eliminated tariffs on approximately 86% of its recent imports from Canada, with the balance of tariff concessions to be implemented over periods of up to seven years. This includes the elimination of tariffs on all Canadian exports of manufactured goods, fish and seafood, and the elimination of the vast majority of Ukraine's agricultural tariffs. Key product areas benefitting from either immediate or eventual duty-free access include beef, pulses, grains, canola oil, processed foods, animal feed, frozen fish, caviar, certain articles of iron and steel, industrial machinery, plastic products and cosmetics. Tariffs will also be eliminated on fresh and chilled pork, while frozen pork as well as certain pork offal and fat will benefit from an annual duty-free tariff rate quota that exceeds current exports by a large margin. Canada will eliminate tariffs on 99.9% of imports from Ukraine. This includes the elimination of tariffs on all manufactured goods, fish and seafood, and 99.9% of agricultural imports into Canada from Ukraine. Key products from Ukraine that will benefit from this duty-free access include sunflower oil, sugar and chocolate confectionery, baked goods, vodka, iron and steel, apparel, ceramics and minerals. The trade flows currently are not high, but the agreement will facilitate greater trade.

- EU-Ukraine Deep and Comprehensive FTA (DCFTA): This agreement established a free trade area between the EU and Ukraine. A DCFTA is part of each country's EU Association Agreement, and this particular one allows Ukraine access to the European Single Market in selected sectors and grants EU investors in those sectors the same regulatory environment in the associated country as in the EU. The agreement with Ukraine was provisionally applied since January 1, 2016 and formally came into force on September 1, 2017. Ukraine exports raw materials (iron, steel, mining products, agricultural products), chemical products and machinery to the EU. The main EU exports to Ukraine include machinery and transport equipment, chemicals, and manufactured goods. The EU has banned the import of goods originating in (and export of certain goods and technologies to) Crimea and Sevastapol, as well as investments and a number of services (such as tourism) there until at least June 23, 2020.

Under Negotiation

Ukraine is currently discussing potential bilateral FTAs with Turkey, Serbia and Singapore.

Sources: WTO Regional Trade Agreements database, EFTA, Ministry of Foreign Affairs of Ukraine, Fitch Solutions

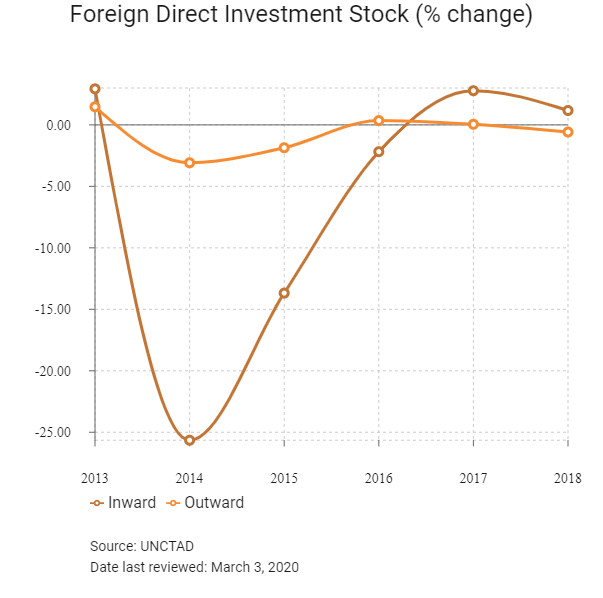

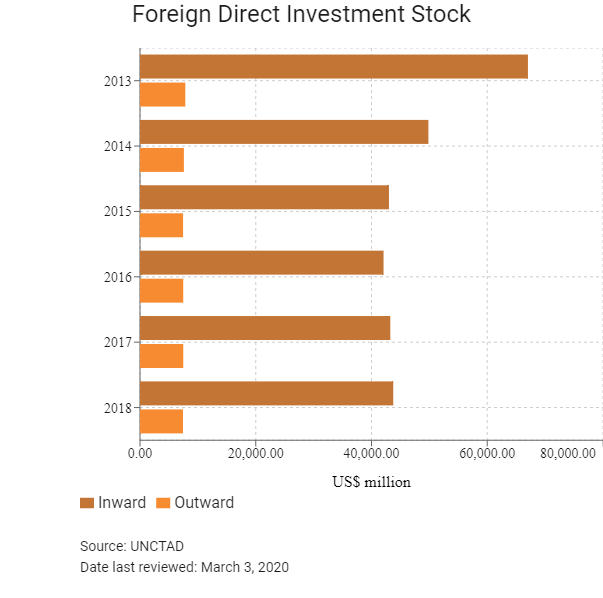

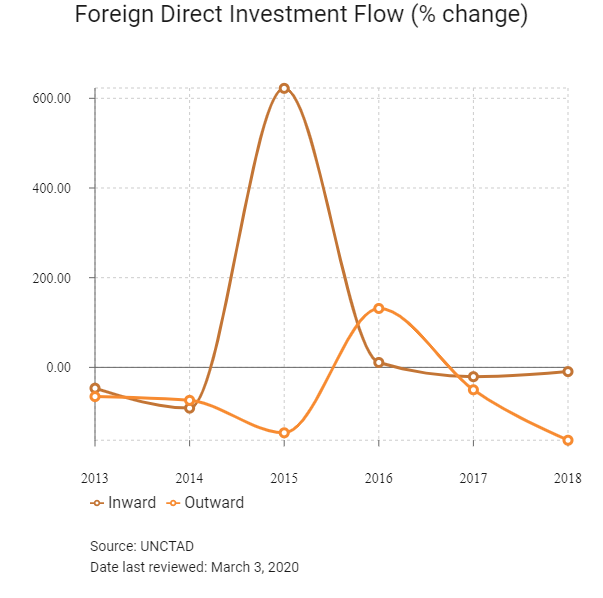

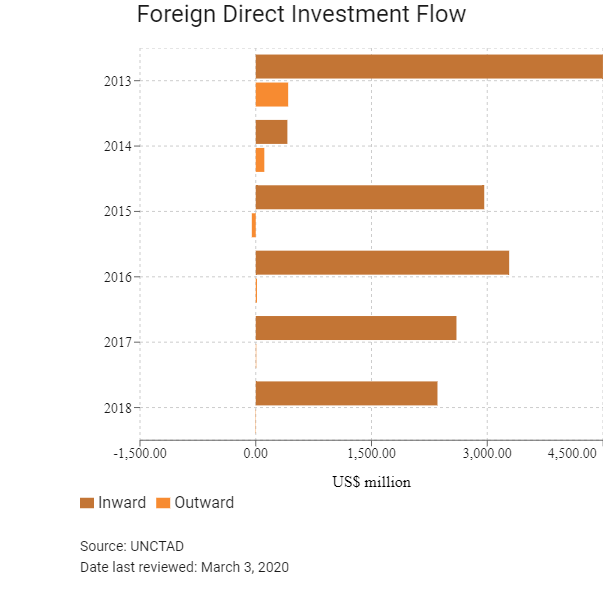

Foreign Direct Investment

Foreign Direct Investment Policy

- Foreign companies are restricted from owning agricultural land, manufacturing rockets, producing bio-ethanol as well as some publishing activities. The presence of state-owned, often heavily subsidised, enterprises in many areas of the economy, particularly energy and mining, is also a deterrent to foreign involvement in those sectors.

- There are local content requirements in wind, solar and biomass power plants, certified as completely built-up and compliant with building regulations after July 1, 2013.

- Ukrainian law authorises the government to set limits on foreign participation in strategically important areas. In 2013 Ukraine prohibited foreign ownership of media. There is also a moratorium on agricultural land sales to foreign investors, which was introduced with the Land Code in 2001. This land moratorium has been temporary since 2002 but repeatedly extended, most recently in February 2019 and to remain until 2020, pending land ownership legislation. The World Bank has stated that Ukraine land values would triple if restrictions on land ownership were cancelled.

- Ukraine has bilateral investment treaties (BITs) in force with 66 countries or economic unions, such as the Belgium-Luxembourg EU. It has signed a further seven BITs that have not yet come into force.

- Ukraine signed a Trade and Investment Cooperation Agreement with the United States in April 2008. The agreement established a joint council on trade and investment which addresses a wide range of related issues, including market access, intellectual property, labour and environmental laws. Ukraine also has treaties with investment provisions in force with Canada, the EU and EFTA and through the Common Economic Zone Agreement with Belarus, Kazakhstan and Russia.

- With effect from September 2019 the National Bank of Ukraine abolished a EUR5 million limit a calendar month on the repatriation of proceeds from foreign investments. The limit used to apply to proceeds from securities and equity rights sales as well as to funds from the capital reduction or a foreign investor's withdrawal from an Ukrainian company or partnership. The relaxation of regulations affecting cross-border payments is intended to improve the climate for foreign investors. Earlier in 2019 the EUR12 million limit on transferring dividends abroad or to non-resident accounts in Ukraine was lifted.

- In November 2019 Ukraine enacted a decree that simplifies the registration procedure for foreign investors, lowers the costs and shortens the timelines from 60 to 20 business days.

Sources: WTO – Trade Policy Review, ITA, United States Department of Commerce, UNCTAD, Kyiv Post, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Ukraine does not maintain special or free economic zones |

- Ukraine offers generous depreciation rates for most fixed assets, including property, plants and equipment for both foreign and domestic investors. |

Sources: United States Department of Commerce, UkraineInvest, UNCTAD, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 18%

Source: State Fiscal Service of Ukraine

Important Updates to Taxation Information

- Transactions performed between a non-resident and its permanent establishment (for example, commercial representative office) in Ukraine are now considered controlled for transfer pricing purposes if their value exceeds UAH10 million (net of indirect taxes) for the corresponding tax (reporting) year.

- On July 23, 2018, Ukraine signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the Multilateral Instrument, or MLI) and this has been ratified by Ukraine's parliament, confirming the country is committed to participation in the international tax cooperation network. MLI came into effect on December 1, 2019. The provisions of the MLI may apply instead of any double taxation treaty currently in effect. In February 2019 Ukraine implemented currency reforms, liberalised cross-border transactions and simplified inward investment rules. The new government of Ukraine has indicated it will make major changes to tax legislation, perhaps by March 2020 in order to have them effective by early 2021.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: Corporate Income Tax (CIT) rates |

18% on profits (insurance companies additionally pay 3% on income from certain insurance premiums and from 2020 lotteries pay 28%) |

|

Resident company: Capital Gains Tax |

Taxed as CIT |

|

VAT |

20% on the sale of most goods and services, but a reduced rate of 7% applies to medicines and specific medical goods, whereas export of goods, the supply of international transport services and the supply of software products are all zero rated. |

|

Withholding Taxes (applied to non-residents unless a double taxation treaty provides otherwise) |

- 15% on dividend income |

|

Social security contributions (all employers) |

Locally paid salaries are subject to the unified social contribution (USC) tax, borne by the employer at a flat rate of 22% (reduced to 8.4% for disabled workers) and capped at 15 times minimum monthly salary. Effective from January 1, 2020, the minimum monthly salary increased to UAH4,723, which in turn increased the monthly employer social security contribution cap to UAH70,845 for 2020. USC is now payable on the salaries of foreign citizens working in the representative offices of foreign companies located in Ukraine. |

|

Special pension fund charge |

A special charge is payable to the state pension fund and levied at a rate of 1% on the acquisition of real estate by individuals and legal entities, 3%-5% on the value of a new car, 7.5% on mobile telecommunications services and 10% on precious metal in jewellery. |

|

Stamp duty |

Stamp duty is levied at a rate of 1% on a variety of things, including filing court documents, notarisation of contracts, operations at commodity exchanges and sales of real estate. |

|

Property Tax |

Real estate tax (RET) rates are set by local governments and cannot exceed 1.5% of the minimum salary per square metre. Based on the example of the USC, the maximum property tax rate for 2020 is UAH71 per square metre. However, many types of properties are exempt from RET, including industrial buildings, agricultural production buildings and non-residential small and medium-sized business premises such as street kiosks, stalls and markets. In addition to RET, when acquiring real estate a 1% special charge is levied that is payable to the state pension fund. |

Source: State Fiscal Service of Ukraine

Date last reviewed: March 3, 2020

Foreign Worker Permits

A work permit is normally issued for the period of employment indicated in the employment contract, but for not more than one year. A work permit can be renewed for the same term for an unlimited number of times and free of charge. The employer secures the work permit and bears the cost, which in 2019 is UAH7,684 for a work permit valid for six months to one year. Regulations on employment conditions and access to basic social services are somewhat discriminative against regular migrant workers, and they are virtually non-existent for undocumented migrant workers. The Labour Code of Ukraine prescribes heavy penalties for employers who fail to comply with the requirements for the employment of foreign nationals.

Localisation Requirements

Foreigners can only be employed in positions for which no suitable candidate can be found domestically or from within the region. Work permits are required for employees of a foreign company performing work or services in Ukraine (provided that not more than 50% of employees engaged in fulfilling this contract are foreign nationals). The salary of a foreign worker cannot be less than 10 times the national minimum wage rate, although this requirement is not applied to preferred categories of foreign employee such as IT professionals.

Visa/Travel Restrictions

Citizens of Mainland China and Hong Kong, Australia and New Zealand require a visa, but citizens from some countries, including Armenia, Azerbaijan, Belarus, Georgia, Moldova, Russia and Uzbekistan, face no travel restrictions at all. EU citizens and those from Canada, the United States, Japan and the EFTA can stay for up to 90 days in any 180-day period.

Sources: Ministry of Foreign Affairs of Ukraine, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Caa1 (Stable) |

22/11/2019 |

|

Standard & Poor's |

B (Stable) |

27/09/2019 |

|

Fitch Ratings |

B (Positive) |

06/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

76/190 |

71/190 |

64/190 |

|

Ease of Paying Taxes Index |

43/190 |

54/190 |

65/190 |

|

Logistics Performance Index |

66/160 |

N/A |

N/A |

|

Corruption Perception Index |

120/180 |

126/180 |

N/A |

|

IMD World Competitiveness |

59/63 |

54/63 |

N/A |

Sources: World Bank, IMD, Transparency International, national sources

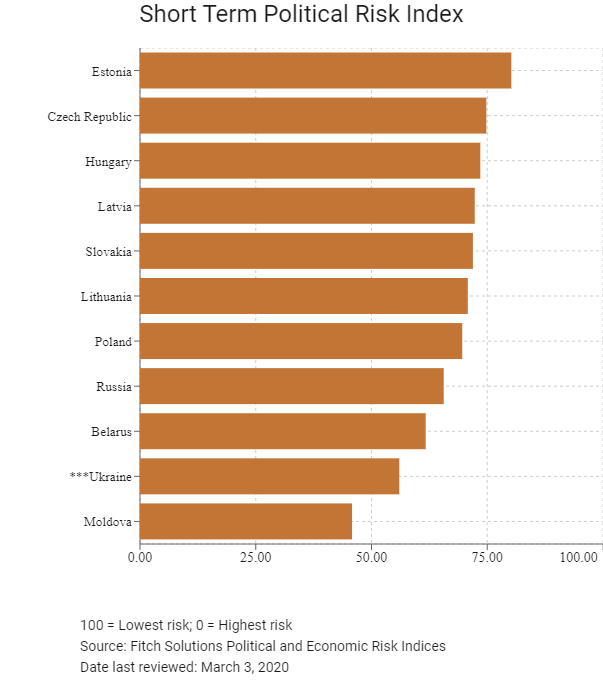

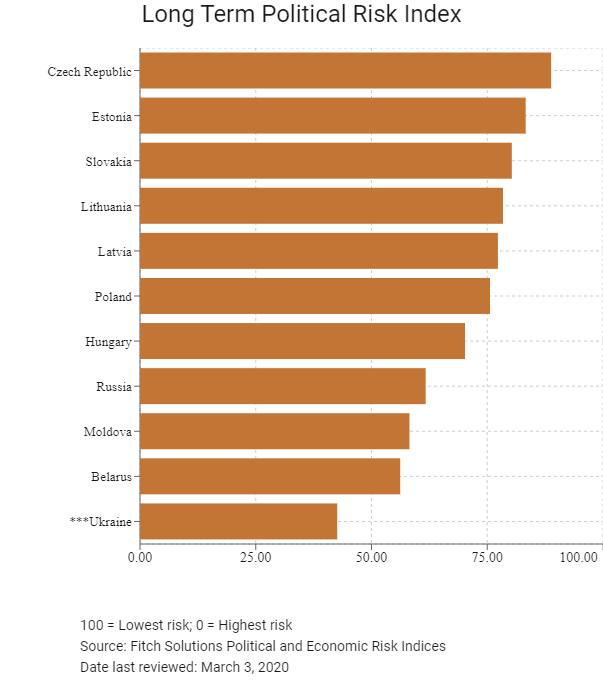

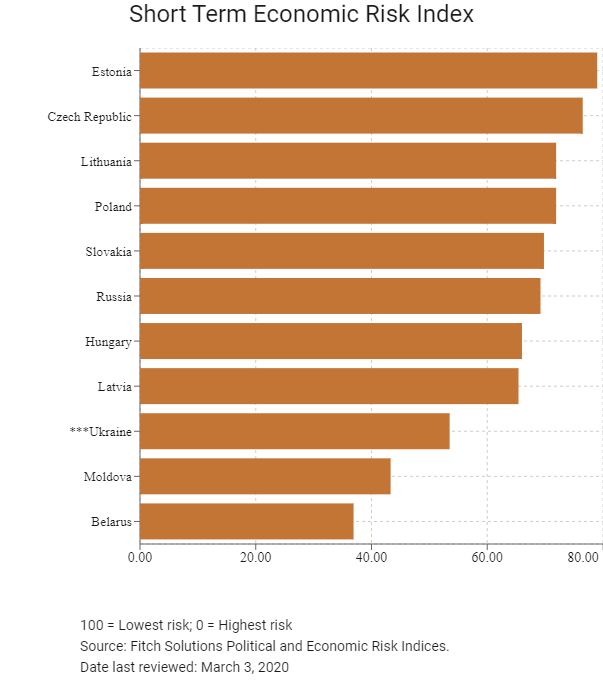

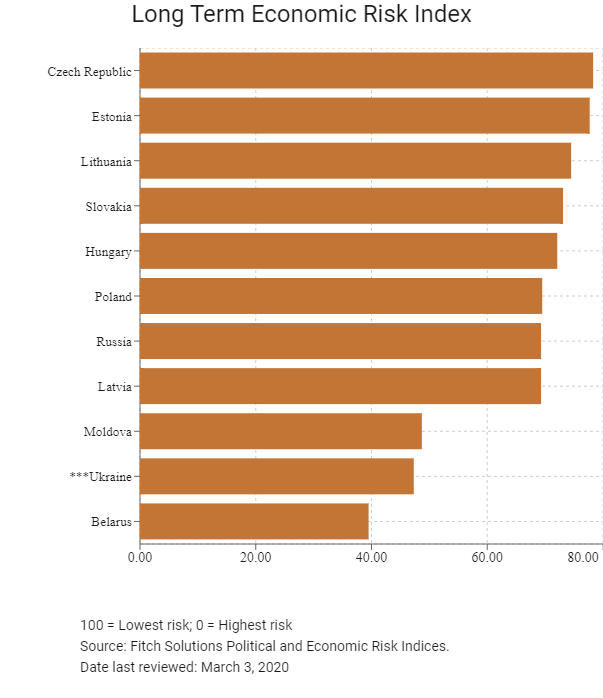

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

144/202 |

136/202 |

129/202 |

|

Short-Term Economic Risk Score |

53.3 |

52.9 |

53.5 |

|

Long-Term Economic Risk Score |

43.9 |

46.4 |

47.3 |

|

Political Risk Index Rank |

179/202 |

178/202 |

178/202 |

|

Short-Term Political Risk Score |

45.6 |

56 |

56.0 |

|

Long-Term Political Risk Score |

42.6 |

42.6 |

42.6 |

|

Operational Risk Index Rank |

117/201 |

105/201 |

105/201 |

|

Operational Risk Score |

45.7 |

48.8 |

48.7 |

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

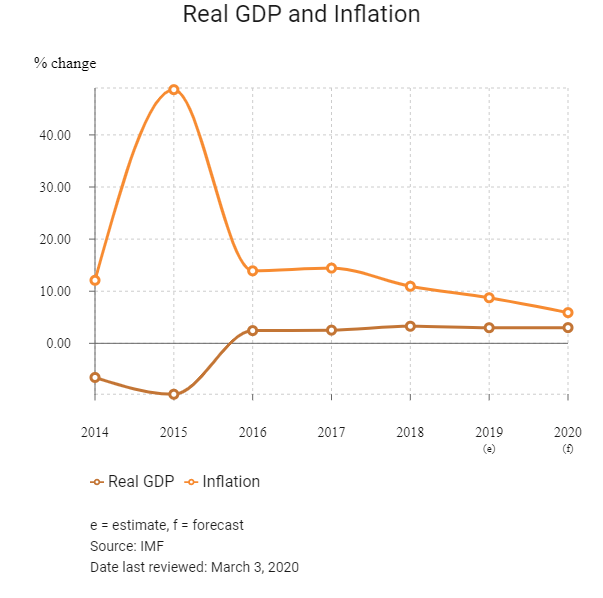

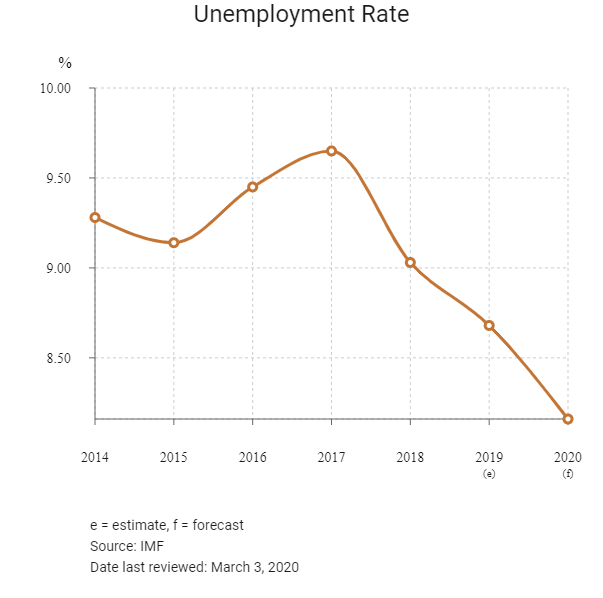

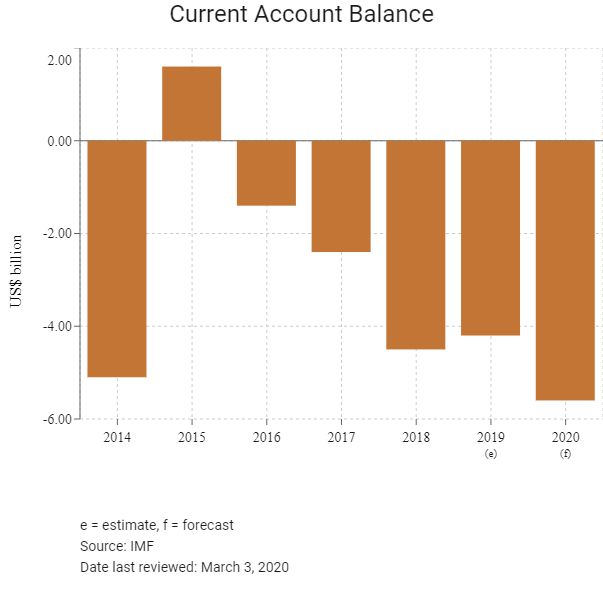

While Ukraine's economy is gradually recovering from the severe economic contraction of 2015, the economic and political situations remain precarious. Reforms are under way to address the fundamental problems in the Ukrainian economy. Although the country has seen inflation gradually cool, the devaluation of the hryvnia has placed severe pressure on households, leaving savings and purchasing power significantly subdued compared with pre-crisis levels. Ukraine also faces high debt-servicing costs and the banking sector has experienced a sharp deterioration in asset quality on its foreign exchange loan books.

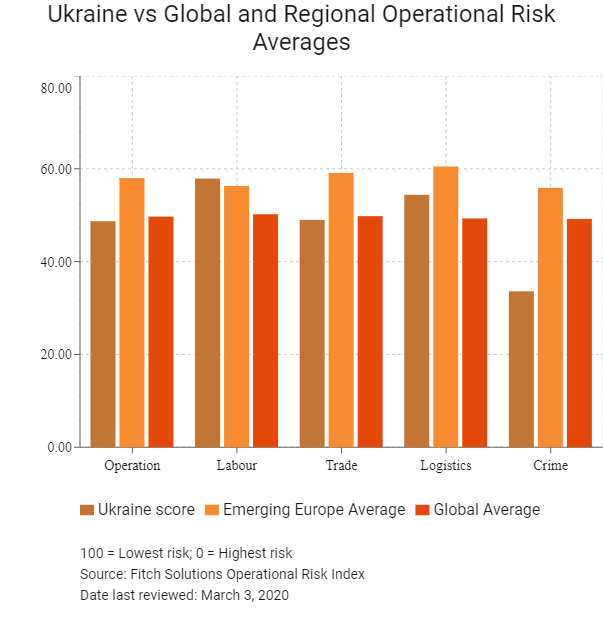

OPERATIONAL RISK

The operating environment in Ukraine has been severely dampened by the weak security situation in the east of the country as well as the accompanying deterioration in trade and diplomatic relations with Russia. However, with the shift in leadership since 2014, some key structural reforms have been undertaken. These reforms include significant fiscal consolidation, moving to a flexible exchange rate, reforming energy tariffs and social assistance packages, making public procurement more transparent, simplifying business regulations and restructuring the banking sector. The country has also moved towards establishing anti-corruption agencies and mandating asset disclosures for public officials. The country's main assets are its strategic location and extensive human capital. Ukraine's well-educated workforce provides a significant competitive advantage for firms, particularly if the risk of conflict eases in the quarters ahead. Ukraine will need to advance reforms on multiple fronts to achieve sustainable recovery and shared prosperity.

Source: Fitch Solutions

Date last reviewed: March 3, 2020

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Ukraine Score |

48.7 |

57.9 |

49.0 |

54.4 |

33.6 |

|

Central and Eastern Europe Average |

62.7 |

58.5 |

63.5 |

67.5 |

61.2 |

|

Central and Europe Position (out of 11) |

11 |

8 |

11 |

1 |

11 |

|

Emerging Europe Average |

58.0 |

56.3 |

59.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

25 |

15 |

26 |

22 |

28 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

105 |

51 |

106 |

76 |

154 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

71.2 |

63.1 |

76.3 |

71.0 |

74.3 |

|

Czech Republic |

69.6 |

60.6 |

67.8 |

73.6 |

76.5 |

|

Lithuania |

69.5 |

61.2 |

71.4 |

74.3 |

71.0 |

|

Poland |

69.2 |

59.2 |

69.3 |

75.5 |

72.8 |

|

Latvia |

66.8 |

63.4 |

67.1 |

69.4 |

67.4 |

|

Slovakia |

63.8 |

52.1 |

66.5 |

66.8 |

69.6 |

|

Hungary |

63.5 |

55.7 |

62.0 |

70.1 |

66.3 |

|

Belarus |

59.1 |

60.1 |

58.6 |

66.6 |

51.3 |

|

Russia |

58.3 |

65.9 |

58.6 |

67.9 |

40.6 |

|

Moldova |

49.8 |

44.7 |

51.7 |

53.4 |

49.3 |

|

Ukraine |

48.7 |

57.9 |

49.0 |

54.4 |

33.6 |

|

Regional Averages |

62.7 |

58.5 |

63.5 |

67.5 |

61.2 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 3, 2020

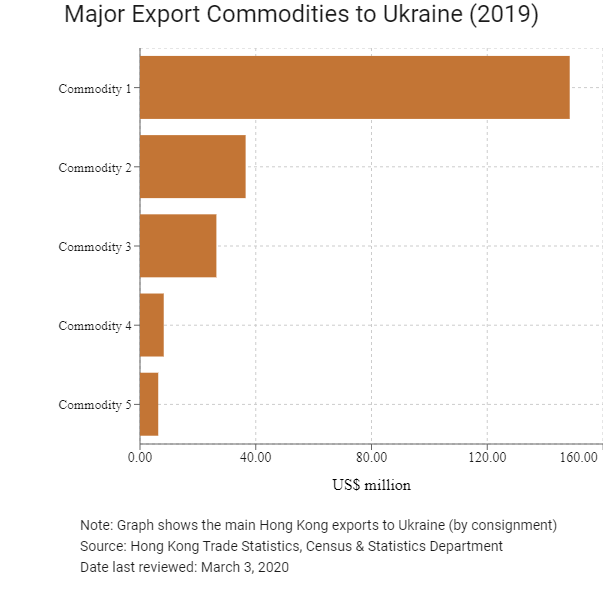

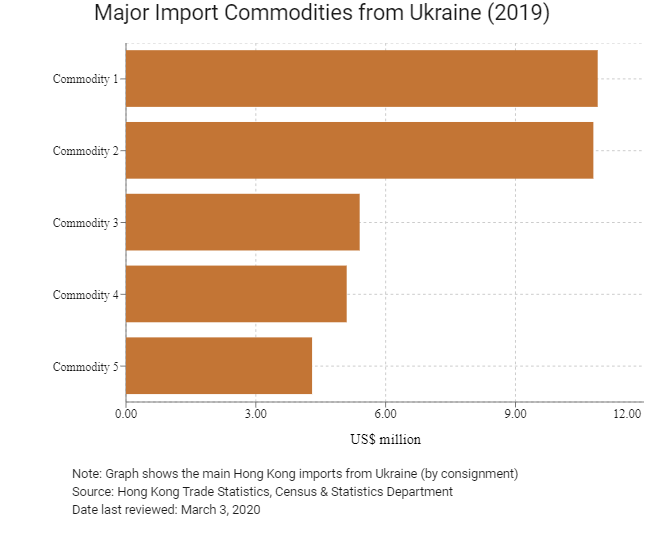

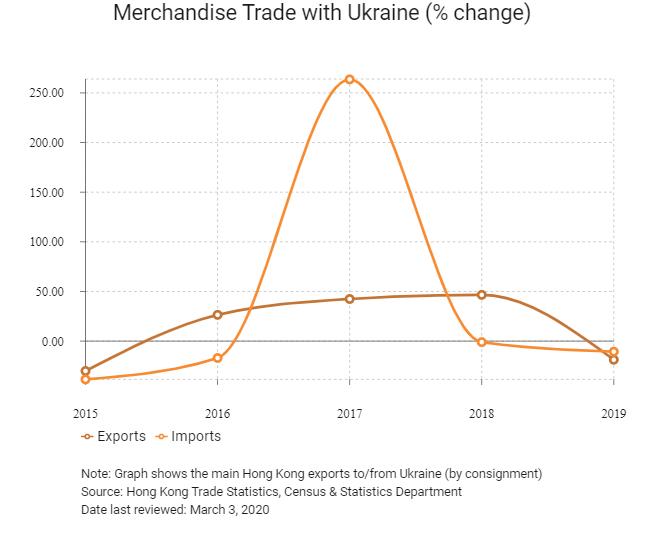

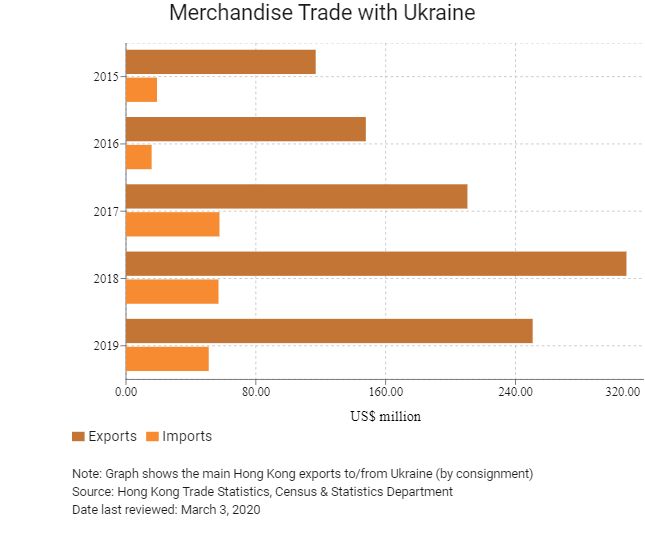

Hong Kong’s Trade with Ukraine

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 148.5 |

| Commodity 2 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 36.5 |

| Commodity 3 | Office machines and automatic data processing machines | 26.4 |

| Commodity 4 | Miscellaneous manufactured articles | 8.2 |

| Commodity 5 | Articles of apparel and clothing accessories | 6.3 |

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Dairy products and birds' eggs | 10.9 |

| Commodity 2 | Meat and meat preparations | 10.8 |

| Commodity 3 | Tobacco and tobacco manufactures | 5.4 |

| Commodity 4 | Power-generating machinery and equipment | 5.1 |

| Commodity 5 | Fixed vegetable fats and oils, crude, refined or fractionated | 4.3 |

Note: Graph shows Hong Kong exports to/imports from Ukraine (by consignment)

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Ukrainian residents visiting Hong Kong |

32,729 |

-35.9 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Sources: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of emerging Europe citizens residing in Hong Kong |

114 |

29.6 |

Note: Growth rate for resident data is from 2015 to 2019, no UN data available for intermediate years

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: March 3, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Ukrainian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Sources: Hong Kong Census and Statistics Department, Fitch Solutions

This document was composed with the free online HTML converter. Click here to give it a try.

Treaties and Agreements between Hong Kong and Ukraine

- Hong Kong and Ukraine do not have a comprehensive double taxation agreement.

- Ukraine does not have a BIT with Hong Kong but does have one with Mainland China that entered into force on May 29, 1993.

- Ukraine has a tax treaty with Mainland China that has been applicable since December 17, 1996, for dividend, interest, royalty payments and individual income tax, and since January 1, 1997 for CIT.

Sources: UNCTAD, State Administration of Taxation of The People's Republic of China

Visa Requirements for Hong Kong Residents

HKSAR passport holders can enter Ukraine without a visa for up to 14 days.

Source: Embassy of Ukraine to Mainland China

Date last reviewed: February 21, 2020

Ukraine

Ukraine