GDP (US$ Billion)

60.81 (2018)

World Ranking 77/193

GDP Per Capita (US$)

14,870 (2018)

World Ranking 60/192

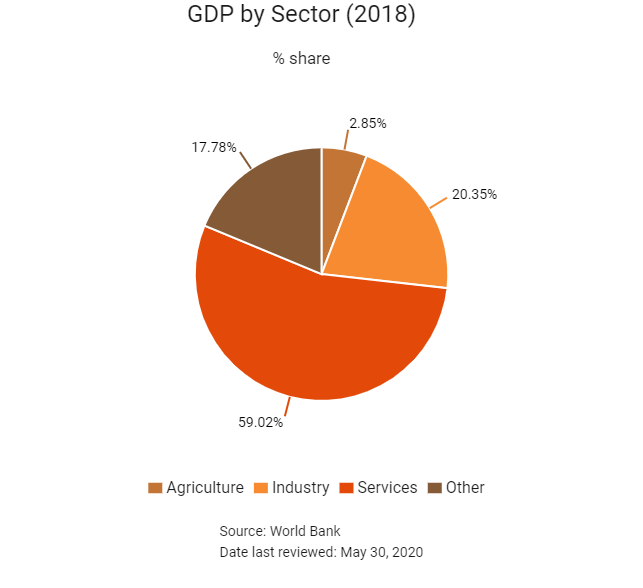

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

101.9 (2018)

Currency (Period Average)

Croatian Kuna

6.62per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

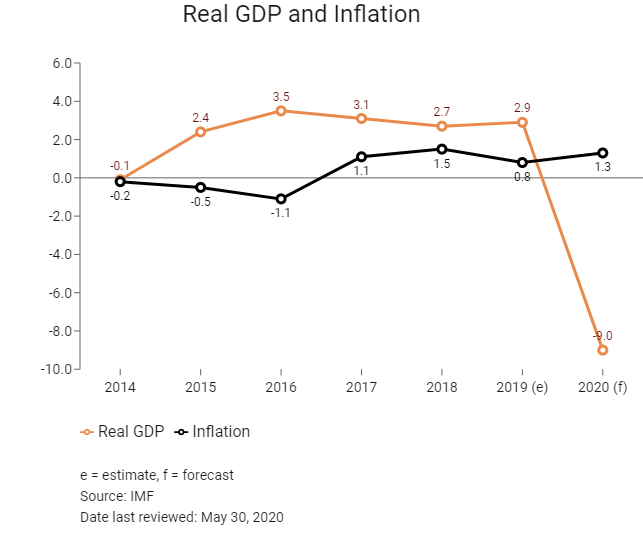

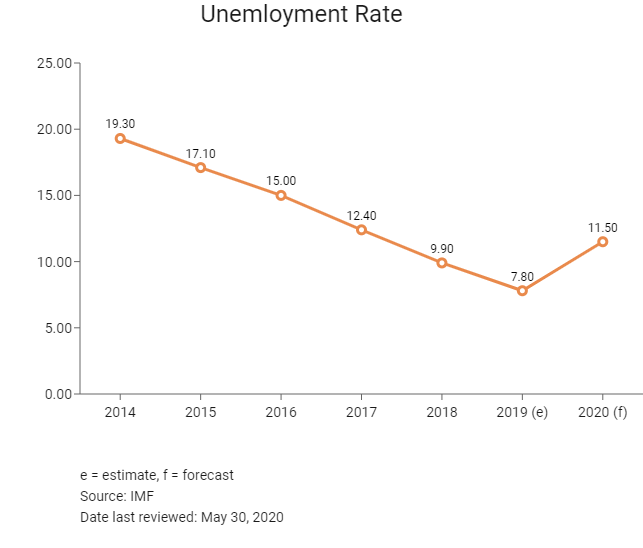

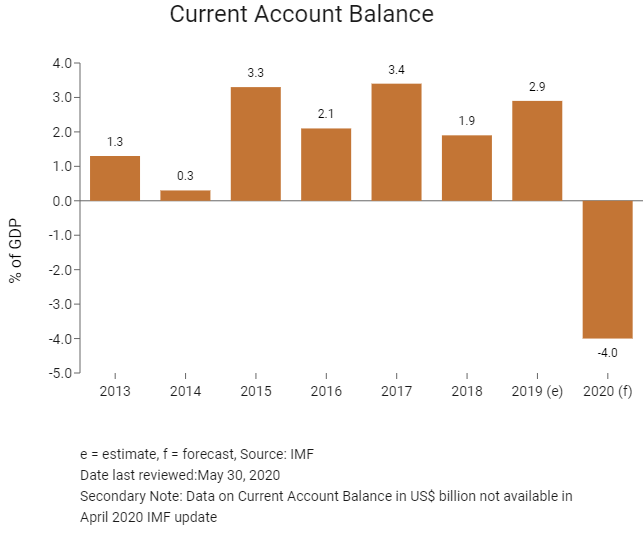

After a six-year recession Croatia returned to growth in 2015 and continued this trend up until 2019. However, Croatia's short-term economic outlook has deteriorated sharply with the onset of the Covid-19 crisis in Q120. Weakened domestic and external demand will see growth contract once again in 2020. This said, we expect to see a notable rebound in growth in 2021 in light of this low base. Long-term growth projections suggest that improvements in Croatia's economy will be gradual rather than spectacular over the next decade. Access to the European Union (EU) internal market helped connect the economy to global value chains, and tourism is experiencing historic highs. However, the uptick in outward migration, the country’s ageing population, the slow pace of structural reform implementation and the high level of public debt risk undermining Croatia's growth opportunities. Lastly, the country's ambition to join the eurozone will likely become feasible in the mid-2020s, although it may be delayed in part due to rising euroscepticism within core countries which will lessen the willingness to absorb new members.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2019

Seven islands of the Cres-Losinj archipelago (Cres, Losinj, Unije, Ilovik, Susak, Vele Srakane and Male Srakane) plus the islands of Brac, Hvar and Korcula launched their clean energy transition programme as part of the European Commission (EC)’s Clean Energy for EU Islands Secretariat.

April 2019

Dubrovnik hosted the 8th Summit of Central and Eastern European Countries and Mainland China.

August 2019

The Croatian government announced that it had awarded licenses for gas and oil exploration on six blocks in its flat north-east region to two local and two foreign companies.

October 2019

Croatia backed down on changes to its pension system as parliament reinstated a retirement age of 65 after leading trade unions staged protests against increasing it to 67.

November 2019

The EC has approved EUR156.6 million financing from the EU Cohesion Fund to support two schemes relating to the modernisation of water and wastewater infrastructure in Croatia. About EUR105.6 million will be directed towards rehabilitating 350km of water supply and wastewater network in Kaštela-Trogir area in the Split-Dalmatia County. The financing will also cover extension of the Divulje wastewater treatment plant and construction of a similar plant on the island of Ciovo. The other scheme in Zapresic area, near Zagreb will receive the remainder of the allocation to improve access to better drinking water in the area. Under the initiative, more than 19,000 people in Zapresic will be connected to the wastewater network via 135km of new pipeline. Both the projects are expected to be completed in 2023.

November 2019

Croatia’s Prime Minister announced that the country plans to join the Exchange Rate Mechanism (ERM II) in the second half of 2020 where they expect to spend two and a half to three years. Euro adoption could follow at the beginning of 2023 at the earliest or at the beginning of 2024.

November 2019

Design works were under way on the 160km gas pipeline connecting Zagvozd in Croatia with Posusje and Travnik in Bosnia and Herzegovina, with a branch to Mostar. The drafting of the project documentation, which is funded by a grant from the EC, is expected to be completed in Q320. The pipeline is likely to be completed by 2023/2024.

December 2019

Valamar Riviera's board approved an investment programme for 2020 with around EUR111 million to be spent on repositioning and upscaling company's portfolio, mainly in Croatia. Under a three-year project, the firm will complete repositioning of Istra Premium Camping Resort in Funtana into a five-star camping resort in 2020. The tourism company also will continue investing in its other Croatian properties including Padova Premium Camping Resort on Rab Island, Valamar Meteor Hotel in Makarska and Valamar staff residence in Dubrovnik.

January 2020

Former Prime Minister Zoran Milanovic from the Social Democratic Party of Croatia (SDP) won the presidential election in Croatia on January 5, defeating the incumbent right-wing President Kolinda Grabar-Kitarović who was backed by the ruling centre-right Croatian Democratic Union (HDZ). The result would raise the profile of the SDP – one of Croatia’s two major political parties next to HDZ – ahead of parliamentary elections, which will take place by December 2020.

January 2020

The EU’s top court ruled that it had no jurisdiction to settle a border dispute between Slovenia and Croatia, complicating Croatia’s accession to the Schengen free-travel area. Slovenia had argued that its fellow EU member could be sued under EU law because it was not implementing a 2017 border ruling by the intergovernmental Permanent Court of Arbitration in The Hague.

May 2020

Prime Minister Andrej Plenkovic said that Croatia has been allocated EUR1 billion by the European Commission to assist its economic recovery after the crisis caused by the Covid-19 pandemic.

May 2020

Croatia’s President Zoran Milanovic called a parliamentary election for July 5, 2020. The election would pit the ruling centre-right Croatian Democratic Union (HDZ) against the top opposition Social Democrats (SDP) party.

Sources: BBC Country Profile – Timeline, Fitch Solutions, Croatia Week, European Commission, The Dubrovnik Times

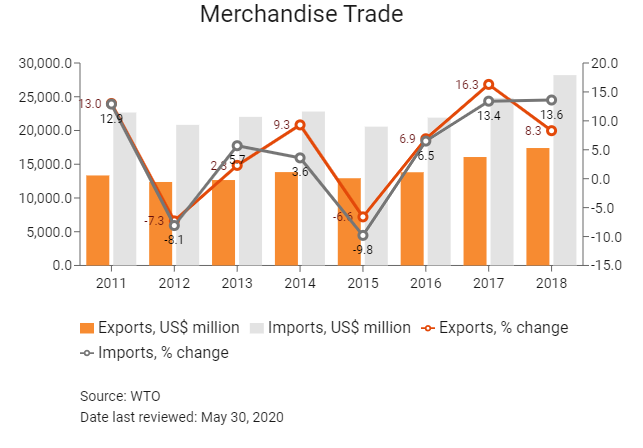

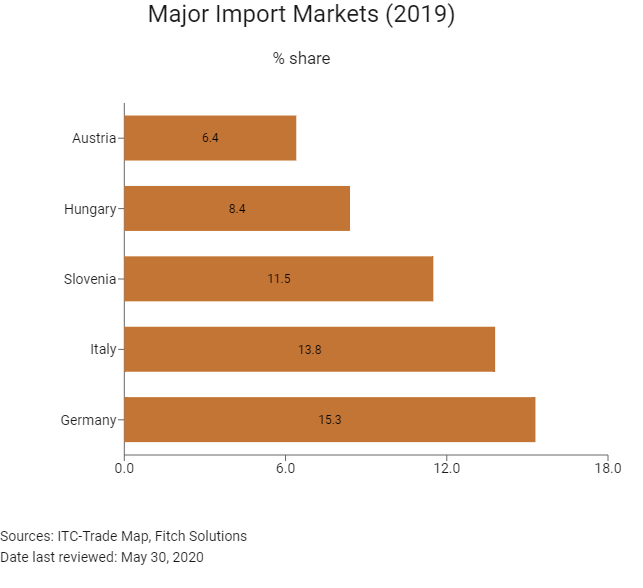

Merchandise Trade

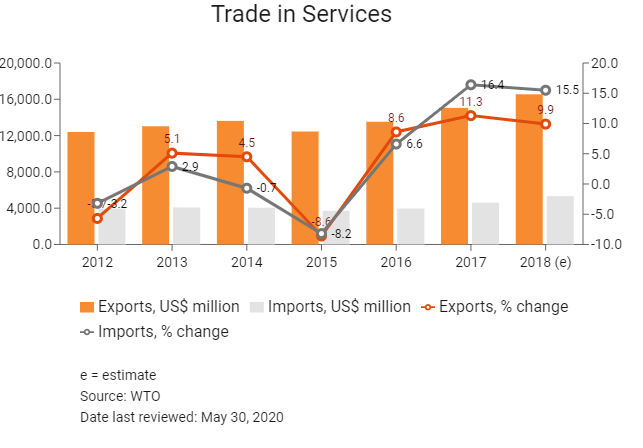

Trade in Services

- Croatia has been a member of the World Trade Organization (WTO) since November 30, 2000. As of July 1, 2013, Croatia became a member state of the EU.

- The EU is party to some 50 free trade agreements (FTAs), and to other markets of the countries concerned is currently mediated through those agreements. The EU's Generalised Scheme of Preferences (GSP) entered into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded USD4,000 for four years in a row. Regarding Hong Kong, the territory has been fully excluded from the EU's GSP scheme since May 1, 1998.

- Prior to Croatia's accession to the EU, the country had signed over 40 international trade or economic cooperation treaties, with further agreements in place regarding investment promotion and protection. As part of EU membership negotiations, these agreements were adjusted to ensure their validity continued once Croatia joined the EU or were voided as the EU agreement took precedence. Once goods are cleared by customs authorities upon entry into any EU member state, they can move freely among EU member states without any additional customs procedures.

- Croatia applies the EU's Common External Tariff (CET), which means goods manufactured and imported from within the EU are not subject to customs charges. The average tariff rate for Croatia is just 1.3%, which is among the lowest globally, although goods imported from outside the EU incur duties of between 0%-48.5%.

- Trade bureaucracy and customs delays are a significant hindrance to foreign investors, particularly those outside the EU. Although there are increasing efforts to reduce trade bureaucracy, paper-based procedures remain cumbersome, and cost and connectivity issues add to market barriers.

- The EU has imposed various anti-dumping measures on a wide range of products - predominantly textiles, parts, steel, iron and machinery - on goods coming from Mainland China and a few other Asian nations to protect domestic industries. On November 13, 2016, the EC imposed a provisional antidumping duty on imports of some primary and semi-processed metals from Mainland China. The rate of duty is between 43.5%-81.1% of the net free-at-union-frontier price before duty, depending on the company. The rate of duty for similar goods from Belarus is 12.5% of the net free-at-union-frontier price before duty. In March 2016, EC imposed a definitive countervailing duty (8.7% or 9%) on imports consisting largely of textiles products originating in India.

- In 2016, the EC introduced an import licensing regime for steel products exceeding 2.5 tonnes. The regulation will be active until May 15, 2020.

- In Q215, the EC issued regulations on trade restrictions with Turkey, regarding cattle, beef, watermelons and prepared tomatoes. This will help to protect domestic agriculture and regional farming businesses.

- In March 2016, the EC announced a new support package for European farmers, which involves mobilising an estimated EUR500 million within the next two years. The intervention ceilings for dairy and other farm products have been nearly doubled. This will limit the ability of foreign businesses to export products, such as milk, fruits and vegetables to Croatia.

- Nine types of goods imported into the EU are subject to licensing. These goods are broadly:

- Textiles

- Various agricultural products

- Iron and steel products

- Ozone-depleting substances

- Rough diamonds

- Waste shipment

- Harvested timber

- Endangered species

- Drug precursors

- At present, no quotas are imposed on textiles and clothing exports or on non-textile product exports from Hong Kong and Mainland China.

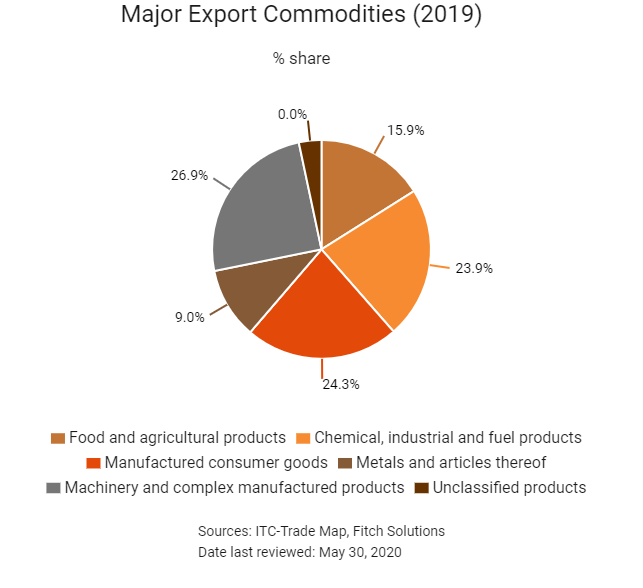

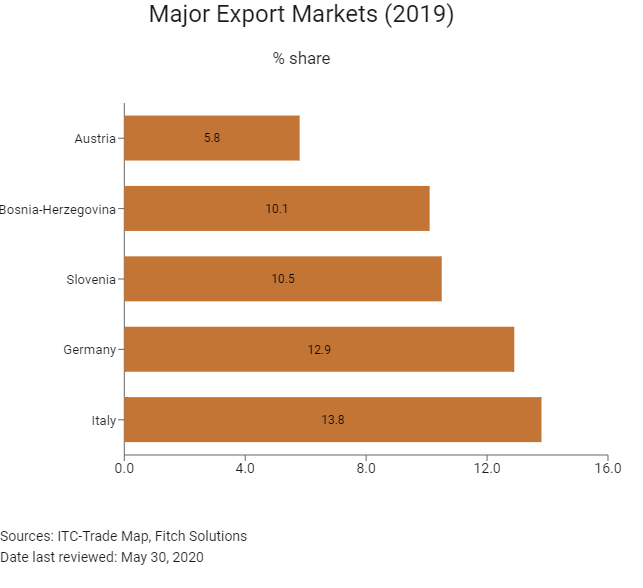

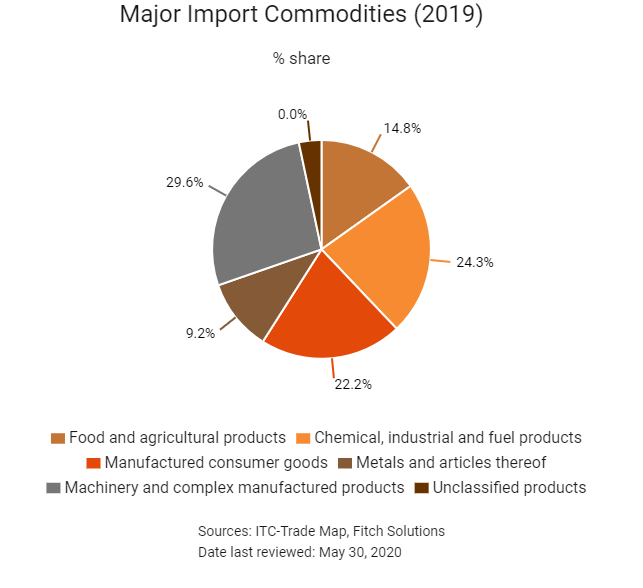

- The Croatian economy is dominated by the services industry (which accounts for almost 70% of GDP), of which tourism is an important element. Tourism accounted for 71% of services exports in 2016. Croatia's most valuable traded products are machines, technical equipment, medicine, and crude and refined petroleum. The country is a major manufacturer of passenger and cargo ships and is developing its automobile manufacturing capacity. It is also a textile manufacturing hub. Croatian product exports stood at USD11.6 billion in 2016, up from USD11.1 billion in 2012. Much of the import sector is dedicated to Croatia's manufacturing sector (for export products), with machinery, chemical products and base metals making up three of the top five imported products.

Sources: WTO – Trade Policy Review, Fitch Solutions

Major Multinational Trade Agreements

Active

- EU Common Market: The transfer of capital, goods, services and labour between member nations enjoy free movement. The common market extends to the 27 member nations of the EU, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

- European Economic Area (EEA)-European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the EU, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers.

- EU- CETA: CETA is expected to strengthen trade ties between the two regions, having come into effect in October 2016. Some 98% of trade between Canada and the EU is duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the EC, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019, after the European Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments, and electrical machinery.

- EU-Southern African Development Community (SADC) EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and Swaziland): An agreement between EU and SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six member of SADC not included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking economic partnership agreements with the EU as part of other trading blocs, such as the East African Community and the Economic Community of Central African States.

- EU-Singapore FTA (EUSFTA): On February 13, 2019, the European Parliament passed the agreement which would see the creation of the EUSFTA. The main aims of the agreement are to eliminate almost all customs duties; enhance the trade of electronic goods, food products and pharmaceuticals and stimulate green growth, remove trade obstacles for green technology and create opportunities for environmental services. All the states involved were required to ratify the agreement through their individual legislatures for it to be implemented. The agreement entered into force on November 21, 2019.

Provisionally Active

CETA: CETA is an agreement between the EU and Canada. CETA was signed in October 2016 and ratified by the Canadian House of Commons and EU Parliament in February 2017. However, the agreement has not been ratified by every European state and has only provisionally entered into force. CETA is expected to strengthen trade ties between the two regions, having come into effect in 2016. Some 98% of trade between Canada and the EU will be duty free under CETA. The agreement is expected to boost trade between partners by more than 20%. CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

Ratification Pending

EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification (29 of the 34 parties have ratified the agreement as of October 2018). The agreement has been provisionally applied since 2013.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017 and bilateral trade in services added an additional EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States Transatlantic Trade and Investment Partnership: This agreement was expected to increase trade and services, but it is unlikely to pass under the administration under United States President Donald Trump in the Untied States against a backdrop of rising global trade tensions.

- EU-Vietnam FTA: In July 2018, the EU and Vietnam agreed on final texts for the EU-Vietnam FTA and the EU-Vietnam Investment Protection Agreement. As of March 2019, the final text of the agreement has been finalised and is awaiting signature and conclusion.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

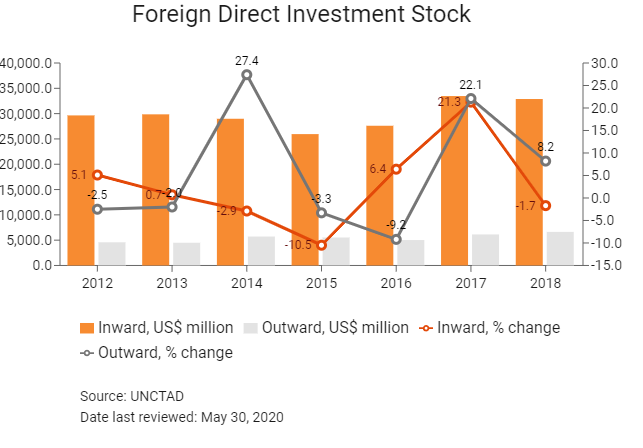

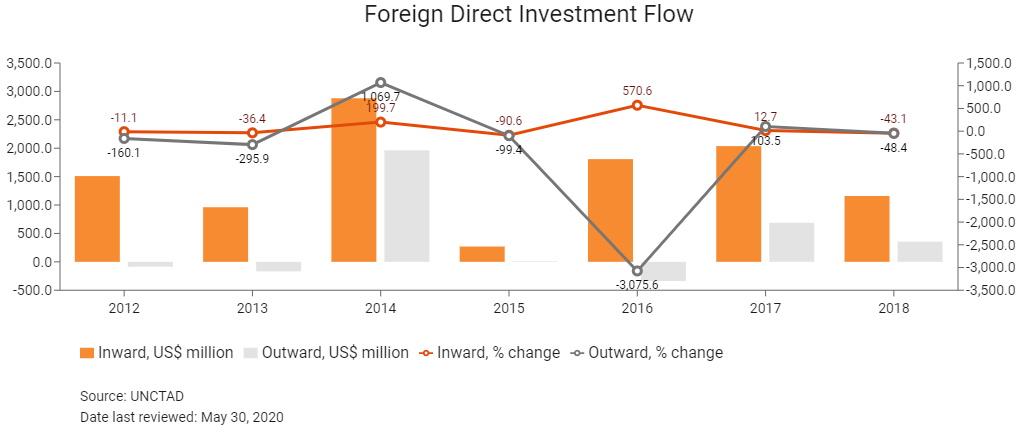

Foreign Direct Investment

Foreign Direct Investment Policy

- The government is supportive of foreign investment and, as well as undertaking regulatory reform, it has established the Investment Promotion and Competition Directorate, based in the Ministry of Economy, which is tasked with providing advice and strategies for investment promotion and the removal of investment barriers. There are no performance requirements for foreign companies, and few restrictions on foreign exchange.

- With a highly supportive government and lack of restrictions on foreign investment, Croatia scores highly in terms of investment freedom. There have been no instances of government appropriation of foreign investment in recent years, and it is highly unlikely Croatia would do anything to jeopardise the flow of foreign direct investment (FDI). The government is working with the European Development Bank to attract further FDI flows.

- Investment opportunities in Croatia were the focus of a United Nations (UN) Organization for Industrial Development International Solar Energy Center for Technology Promotion and Transfer (UNIDI-ISEC) investment forum (which took place on November 3, 2018, in Beijing. During the event, UNIDO-ISEC leaders pledged USD1.2 billion towards the reconstruction of war-torn areas.

- Substantial tax incentives are provided, including up to 100% reduction in corporate profit tax for foreign investors, with the government having introduced real estate incentives to encourage investment in more rural areas of the country.

- Foreign property ownership is restricted. Although EU member states can purchase property on the same basis as Croatian citizens, for those outside of the EU, property rights are based on reciprocity (dependent upon whether Croatian citizens can purchase property in the corresponding country). These restrictions do not apply for foreign investors incorporated as a Croatian legal entity. The Ministry of Economy, Entrepreneurship and Crafts has presented a programme of regional support for capital investment aimed at maintaining or increasing employment figures, valued at HRK90 million. He also pointed to a further HRK250 million which has been earmarked for projects designed to increase value and export shares.

- Croatia is keen to establish itself as a centre for automotive manufacturing and, as such, has been developing the Croatian Automotive Cluster since 2007. The cluster has 50 members and is active in research and development as well as automotive parts production and assembly. Another four clusters have been established in shipbuilding, textile manufacturing, agricultural equipment and interiors, with around 140 member companies in total.

- As of 2015 the Croatian Bank for Reconstruction and Development supports local manufacturers in the construction of ferries and tankers for the Turkmenistan and Norwegian governments. In 2014 the bank also signed a credit agreement worth USD84 million with Russian developers for the construction of a holiday resort in Russia on the condition that construction materials and services are sourced from Croatia, which would benefit more than 50 Croatian companies. This demonstrates that local manufacturers will receive funding priority, which may make it more challenging for foreign companies to receive financial support in certain heavy manufacturing industries.

- There are currently 831 companies in full state ownership, and legislation provides that private entities can compete with state-owned enterprises (SOEs) under the same regarding access to markets, credit and other business operations. In practice, however, there have been instances where political influence in the SOEs had a negative effect on competition, as the supervisory boards of SOEs include political figures that report directly to the government.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Dubrovnik Times, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

There are 13 free trade zones located at the sea ports of Pula, Rijeka, Split and Ploče as well as other strategically located zones in Krapina-Zagorje, Kukuljanovo, Osijek, Ribnik, Slavonski Brod, Split-Dalmacija, Varaždin, Vukovar and Zagreb. |

- Exemption from custom duties and VAT |

|

General incentives |

- An incentive can be granted for the investment project if the minimum investment in fixed assets is EUR5 million and 50 new jobs are created within a three-year period from the start of the project. The percentage of non-refundable subsidies depend on the unemployment rate of the county where investment is located. Those projects can benefit from additional non-refundable subsidies between 10% and 20% of the eligible costs of investments for:

- The non-refundable subsidies could be up to EUR1 million, depending on the applied percentage of the eligible costs, with the condition that the part of investment in the machines/equipment equals at least 40% of the investment and that at least 50% of those machines/equipment are high-tech. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 0%, 5%, 13%, 25% on goods, services and imports

- Corporate Income Tax: 18%

Source: Tax Administration, Republic of Croatia

Important Updates to Taxation Information

The headline corporate tax rate in Croatia is 18%. However, Croatia has so many corporate tax exemption schemes that the majority of businesses do not need to pay any corporate profit tax. Social Democratic Party leader Davor Bernardić has called for VAT rates in the hospitality and hotels sectors to be reduced to 13% and 10% respectively.

Source: Total Croatia News

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: Corporate Tax |

- Standard rate: 18% |

|

Resident company: Capital Gains Tax |

Capital gains tax is due on interest from the disposal of property and intangible assets. The tax is withheld at source and the individual cannot claim expenses or personal allowances. A non-taxable threshold for dividends and profit shares of HKR12,000 per annum can be claimed. |

|

Dividends (Withholding Tax) |

12% |

|

Interest, Royalties (Withholding Tax) |

15% |

|

Branch Tax Rate |

20% on profits |

|

Social Security Contributions (all employers) |

17.2% on gross salaries paid by employer; 20% on gross salaries paid by employee |

|

VAT/GST (standard) |

- 25% |

|

Real Estate Transfer Tax; levied on the acquisition of real estate |

The real estate transfer tax shall be paid at a rate of 3% |

Sources: Tax Administration, Republic of Croatia, Fitch Solutions

Date last reviewed: May 30, 2020

The Ministry of Labour announced in June 2018 that the country required 35,500 foreign workers, up from the 31,000 it had initially anticipated requiring. The workers are necessary to support Croatia's booming tourism industry. In November 2019, the Croatian government laid out a draft of its law on foreigners, which states that an employer from Croatia seeking to hire a foreign – (non-EU – worker will have to contact the Croatian Employment Services’ regional office to verify whether or not there are any unemployed persons in their records who meet the employer’s requirements.

Localisation Requirements

Owing to the high emigration levels of highly qualified individuals from Croatia, the country is flexible when it comes to importing labour to meet its market needs. Although the country is a part of the EU and is open to international migrants, the majority of migrants are unskilled workers from neighbouring countries. This is a cause of domestic tension, considering Croatia's high unemployment rates.

Foreign Worker Permits

In recent years, owing to EU membership, the Croatian government has been under pressure to increase annual work permit quotas by 40% for foreign workers. As an EU member Croatia can easily recruit for its skills shortages from within the union as citizens have freedom of mobility. Work permits for non-EU nationals are issued for a period of up to two years (EU Blue Card) and require the applicant to go through more bureaucratic procedures than citizens of the EU.

Visa/Travel Restrictions

As a member of the EU Croatia does not impose any travel restrictions upon any other European state. Countries such as the United States, Canada, Australia, Japan and South Korea, along with a number of Latin American states do not face any travel restrictions. However, African citizens, along with most Asian and Middle Eastern citizens, may not travel to Croatia without obtaining a visa in advance.

Sources: Government websites, Total Croatia News, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Ba2 (Positive) |

26/04/2019 |

|

Standard & Poor's |

BBB- (Stable) |

22/03/2019 |

|

Fitch Ratings |

BBB- (Stable) |

05/06/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

51/190 |

58/190 |

51/190 |

|

Ease of Paying Taxes Index |

95/190 |

89/190 |

49/190 |

|

Logistics Performance Index |

49/160 |

N/A |

N/A |

|

Corruption Perception Index |

60/180 |

63/180 |

N/A |

|

IMD World Competitiveness |

61/63 |

60/63 |

N/A |

Sources: World Bank, IMD, Transparency International

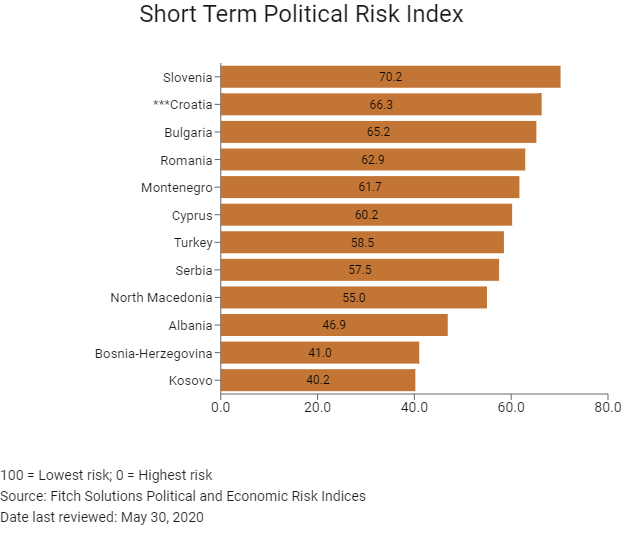

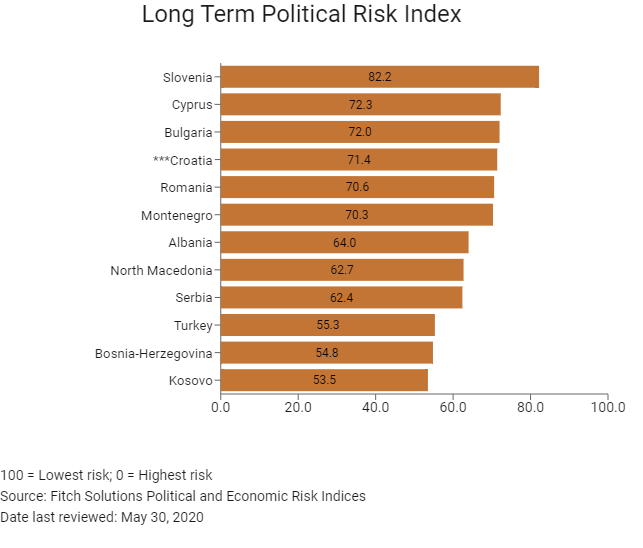

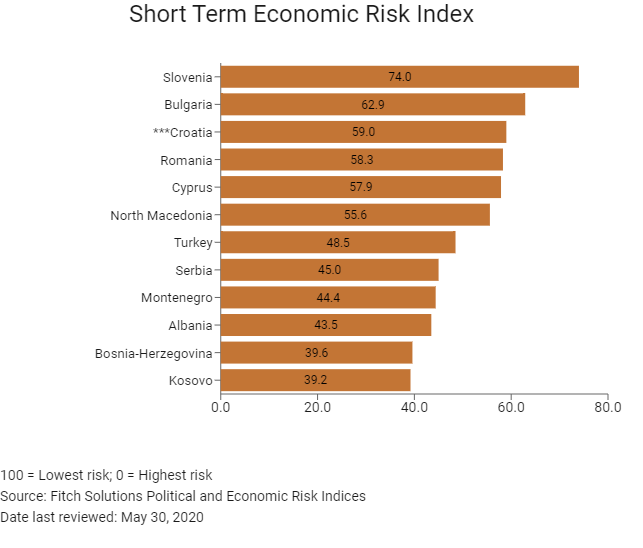

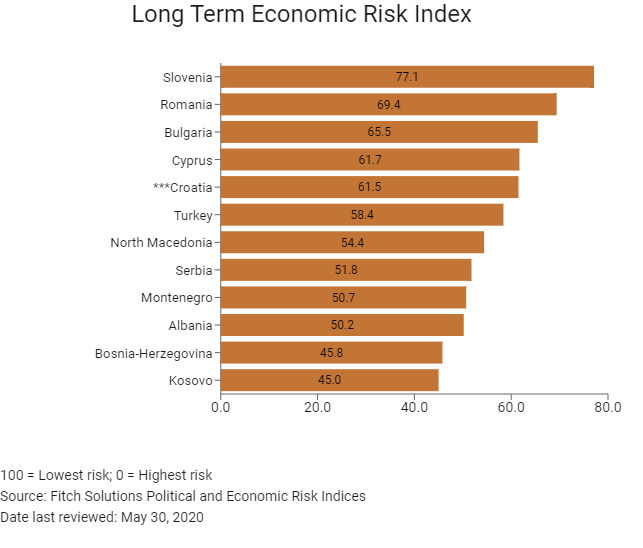

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

62/202 |

65/202 |

68/201 |

|

Short-Term Economic Risk Score |

63.3 |

63.3 |

59.0 |

|

Long-Term Economic Risk Score |

59.2 |

59.2 |

59.8 |

|

Political Risk Index Rank |

60/202 |

60/202 |

60/201 |

|

Short-Term Political Risk Score |

66.3 |

66.3 |

66.3 |

|

Long-Term Political Risk Score |

71.4 |

71.4 |

71.4 |

|

Operational Risk Index Rank |

43/201 |

43/201 |

50/201 |

|

Operational Risk Score |

63.8 |

63.8 |

62.4 |

Source: Fitch Solutions

Date last reviewed: May 30, 2020

Fitch Solutions Risk Summary

ECONOMIC RISKCroatia's short-term economic outlook has worsened precipitously as emergency lockdown measures across the country stifle domestic demand, disrupt supply chains and - crucially - endanger the all-important tourist sector. With services (primarily tourism related) being the dominant sector of the economy, the risk of rising unemployment is high. This will have multiple knock-on effects for private consumption and productivity. The government's carefully observed policy of fiscal consolidation has been blown off course by the Covid-19 induced economic collapse. High budget deficits and growing national debt will follow, despite prior commitments.

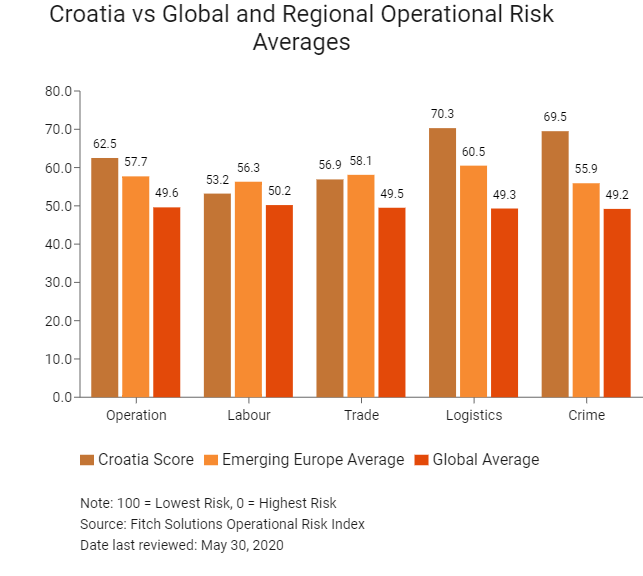

OPERATIONAL RISKCroatia offers a safe operating environment and is one of the most appealing investment destinations in the South East Europe region. Crime and security risks are limited, and the country benefits from having an efficient police force and membership to various regional security organisations. In addition, the country boasts a good transport network with strong regional and internal links that help to facilitate the streamlined movement of freight and labour. Businesses operating in Croatia also benefit from universal access to electricity, water and fuel at competitive prices. However, the Croatian labour market is increasingly tightening, which drives up the cost of labour and will dissuade more labour intensive businesses from setting up operations in the country. The country's overall operational risk is pushed up by its small population size and GDP, as well as its rigid labour market regulations. Operational risks are further being elevated by the Covid-19 pandemic, which is hampering businesses' activity and negatively affecting all sectors of the economy.

Source: Fitch Solutions

Date last reviewed: May 30, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Croatia Score |

62.5 |

53.2 |

56.9 |

70.3 |

69.5 |

|

Southeast Europe Average |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Southeast Europe Position (out of 12) |

4 |

7 |

9 |

2 |

2 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

11 |

23 |

22 |

6 |

7 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

50 |

86 |

77 |

34 |

36 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Slovenia |

69.2 |

57.7 |

63.5 |

74.1 |

81.4 |

|

Romania |

63.7 |

60.0 |

60.8 |

66.1 |

67.8 |

|

Cyprus |

62.7 |

56.0 |

66.0 |

63.0 |

65.8 |

|

Croatia |

62.5 |

53.2 |

56.9 |

70.3 |

69.5 |

|

Bulgaria |

61.7 |

58.2 |

63.6 |

60.9 |

64.1 |

|

Serbia |

58.2 |

59.6 |

60.1 |

60.7 |

52.4 |

|

Montenegro |

58.1 |

56.7 |

59.8 |

57.7 |

58.0 |

|

North Macedonia |

56.3 |

44.9 |

62.7 |

59.8 |

57.8 |

|

Turkey |

56.1 |

53.2 |

59.9 |

65.2 |

46.1 |

|

Albania |

48.3 |

44.2 |

43.3 |

48.3 |

57.4 |

|

Bosnia-Herzegovina |

47.5 |

46.0 |

44.3 |

50.7 |

49.0 |

|

Kosovo |

46.0 |

45.1 |

54.0 |

51.6 |

33.2 |

|

Regional Averages |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

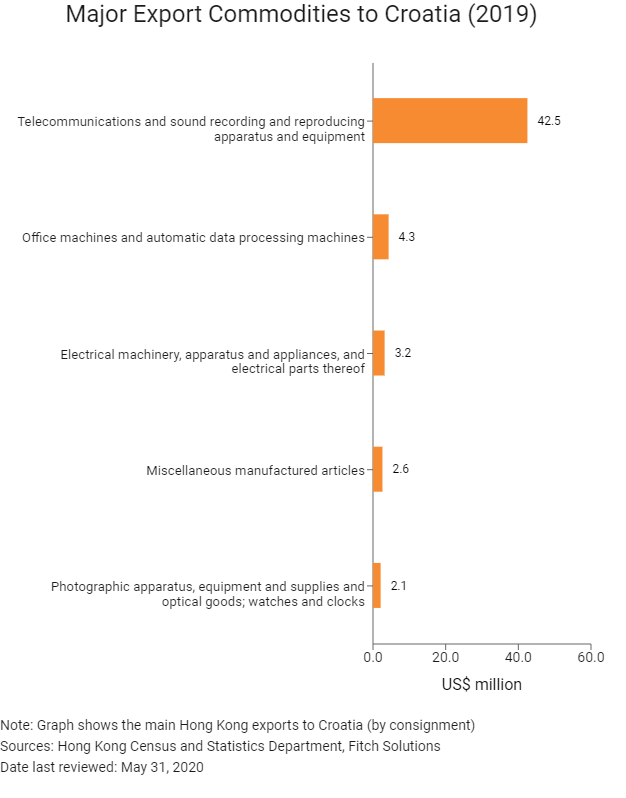

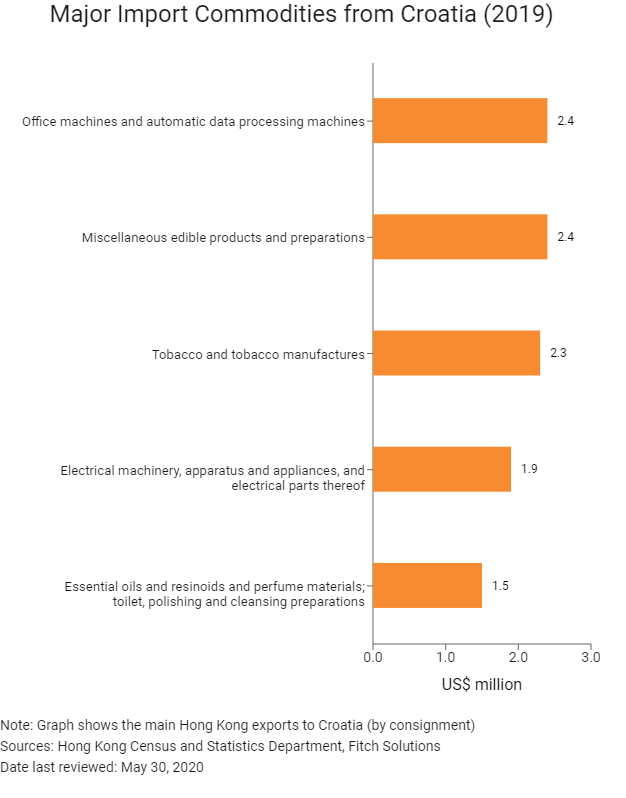

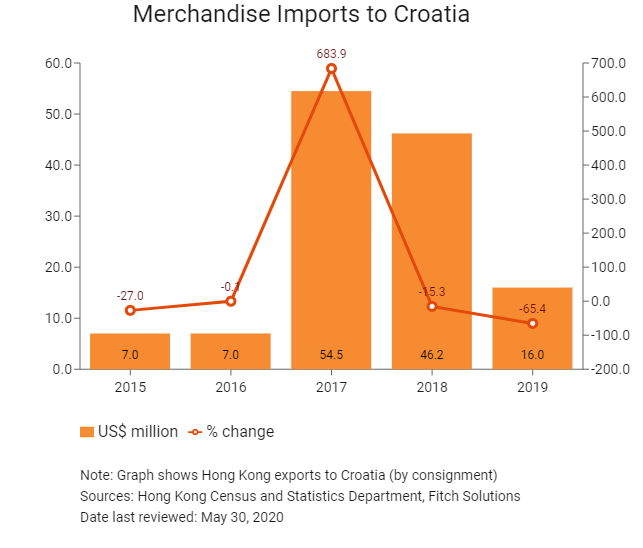

Hong Kong’s Trade with Croatia

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Croatian residents visiting Hong Kong |

3,597 |

-18.6 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: May 30, 2020

Commercial Presence in Hong Kong

|

2017 |

Growth rate (%) |

|

|

Number of Croatian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Croatia

- Mainland China-Croatia Bilateral Investment Treaty; the treaty has been in force since July 1, 1994.

- Mainland China-EC Trade and Cooperation Agreement.

- Mainland China-Croatia Taxation Treaty, signed on September 1, 1995, effective from January 1, 2002.

Sources: UNCTAD, ChinaTax.gov

Chamber of Commerce (or Related Organisations) in Hong Kong

Croatian Consulate in Hong kong

Address: 64/F, Hopewell Centre, 183 Queen's Road East, Wan Chai, Hong Kong

Email: croatia@hhlmail.com, heidiyeung@hhlmail.com

Tel: (852) 2528 4975

Fax: (852) 2865 6276

Source: Protocol Division Government Secretariat – Government of Hong Kong

Visa Requirements for Hong Kong Residents

- HKSAR passport holders are entitled to a visa-free entry to Schengen countries lasting no more than 90 days in any six-month period from the date of first entry in the territory of the member states.

- The Hong Kong Document of Identity is recognised by all Schengen countries. The holders of such documents, however, need to apply for a Schengen visa.

- The Consulate General of Croatia accepts visa applications only if Croatia is the country of your main destination (if you are going for tourism, the main country of your destination is the one where you spend the longest time, not necessarily the country of your first entry).

Source: Hong Kong Immigration Department - Government of Hong Kong

Date last reviewed: May 30, 2020

Croatia

Croatia